The return of risky loans: Freddie Mac offering a 3 percent down loan called Home Possible Advantage targeted to cash strapped buyers. FHA loans and interest only loans also permeate market.

I love when mortgage products get creative in their titles. We had those wonderful “option ARMs†that basically gave you the option to not pay your mortgage principal. But what people forget beyond the egregious toxic mortgages, most foreclosures hit people with vanilla 30-year fixed mortgages. That is right, of the 7,000,000+ completed foreclosures most were boring traditional mortgages. Since the stock market has been on a massive run for six years now, people have forgotten that recessions routinely hit our economy. It is part of the economic system. If you can’t pay your mortgage, it doesn’t matter if you have a 30-year fixed, ARM, interest only loan, or other variety of payment you are making to the bank. Now that banks know they can boot you out and sell to an investor, the foreclosure process started humming along. A reader pointed out that Freddie Mac is entering once again into offering low down payment loans to cash strapped borrowers dreaming of their first crap shack. The product is called Home Possible Advantage but in reality, you are making a big bet with little equity.

Home Possible Advantage

For all intents and purposes, Freddie Mac and Fannie Mae were nationalized during the housing crisis. Free market Kool-Aid drinkers conveniently forget that we conducted some massive socialism in bailing out the financial sector. In theory the free market sounds good for housing but the housing market is one heavily subsidized segment of our economy (i.e., government backed loans, mortgage deductions, property taxes, etc).

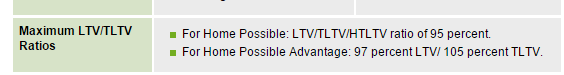

So it was interesting that resurrected and nationalized player Freddie Mac is introducing a very low down payment product:

This is adding a high level of risk for new buyers. Since Americans are tapped out and the banking industry has juiced home values up thanks to investors, it is time to hand this game off to cash strapped Americans. That is, unless you can offer riskier products.

3 percent down immediately puts you in a negative equity position if you need to sell. The standard commission is 5 to 6 percent so right there you are underwater. You are fully betting on home prices going up. But given the dwindling pool of buyers constrained by incomes, Home Possible Advantage is going to target those least able to weather a minor economic setback:

Don’t you think it would serve the community better if home prices weren’t jacked sky high by investors and social welfare benefitting banks? Rents are being pushed up not because incomes are going up but because of insane restrictions and massive speculation brought on by easy Fed money (the bank of all banks). Rental Armageddon is a reality not because people are seeing great jumps in wages. This product is a reflection of simply adding on more debt while trying to keep inflated prices alive.

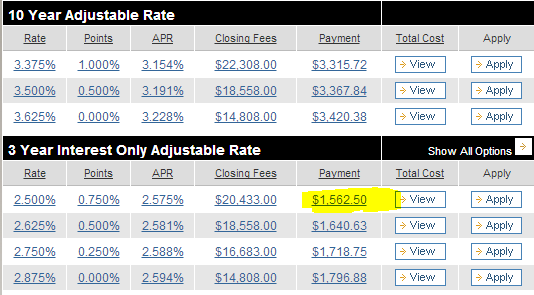

You can add this product to the menu of already risky loans including FHA insured loans. All these loans need is a minor recession to set off another chain of reaction. Then you have ridiculous interest only products that are a massive subsidy to the wealthy, the exact opposite of the Home Possible Advantage product:

Assumptions:Â $1,000,000 home purchase, $250,000 down payment, FICO 740 and higher

If you are a wealthy household, you have every incentive to pay a big portion in interest since you can write this off against your taxes. Why should the government subsidize giant home mortgages? Now, at the very end where momentum is dying, the government is going to extend riskier products to lower income Americans that can’t even scratch up 5 or 10 percent as a down payment. Yet somehow, they are in a position to buy a $500,000 or $700,000 crap shack?

Everything circles back and Home Possible Advantage is a funny name for putting a new batch of Americans at a very big disadvantage should a minor hiccup in the economy occur. But we are in a permanent bull run right? Housing values only go up until they don’t. But that is the mantra.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

119 Responses to “The return of risky loans: Freddie Mac offering a 3 percent down loan called Home Possible Advantage targeted to cash strapped buyers. FHA loans and interest only loans also permeate market.”

Interest only loans = might as well just rent.

Interest only loans can be a savvy choice if the borrower has discipline, particularly if the borrower has at least 30% equity or more. If the 30 year loan payment is $2000 while the IO loan is $1700, the smart borrower can invest the $300 difference each month. The borrower enjoys a mortgage deduction that does not decline because the loan amount isn’t falling; at the same time, principal is being built in the borrower’s own account rather than being sent to the bank.

Where IO loans got a bad name is from unwise borrowers who used the $300/month savings to splurge on a car, boat, cruises, etc.

I’m not sure I understand. I would have to assume most borrowers who get an interest only loan do not have a 20%+ down payment. That being the case, how would the borrower have 30% equity on a new home? I’m confused there.

Also, the only reliable investment currently is a CD at a bank or credit union making a paltry 2% or maybe a little more. If your interest-only mortgage is 4%, then you’re likely effectively losing money each month.

Any other investment is pretty much a gamble, so even if you invest that $300/mo in securities of various sorts, there’s no guarantee that your invested money will be there when you want/need it in the near term.

@Responder: The 30% equity buyers would be existing homeowners or refinancers, not first time buyers. The 30% or 40% equity position is hopefully enough so that during dips in the real estate market the homeowner is always above water and thus can sell at any time if need be.

The 2% CD vs. 4% mortgage: if you send the $300/mo to the bank to reduce loan principle, it is essentially 100% long the R.E. market. It is illiquid and can only be cashed out by selling the home. If instead the $300/mo is kept it can be invested in CD’s, bonds, inverse ETFs if one is bearish… and so the home equity is now diversified, liquid and in the homeowner’s hands. Plus the 4% mortgage is really 2.8% after the mortgage deduction, making it feasible to make a return higher than the after-tax mortgage interest.

The target “end game” is to have perhaps a $350k IO mortgage with a matching $200k of saved monies not sent to the bank plus $150k equity. The home is now “paid off” on paper, yet a mortgage tax deduction continues to be enjoyed.

RSpringbok: Thanks very much for the reply. Interesting food for thought there. If there were a way to make a better guaranteed ROI, I would really like that hedging concept.

Mortgage interest deduction is not as beneficial these days with super low rates making for less potential interest to itemize. The actual benefit is what the deduction nets above the standard deduction assuming that it’s above the standard deduction in the first place and that’s made even less likely if the interest only loan is for 70% LTV.

when gambling on a house with a traditional 30yr mortgage isn’t enough now one can enjoy the IO option and use the $300 monthly savings to gamble in the “casino” on wall-street that used to actually be a market based on fundamentals……as housing once was as well.

facepalm on an epic scale.

$300/mo. Where are you going to put that? The only thing I’m making money off right now is solar stocks.

My wife cried last night. I don’t blame her…we’re in our mid-30s, make $230K/year, worked hard and saved $200K in the bank, yet we still rent a small 2 bed 1 bath (no washer/dryer) in San Diego with our young daughter because housing is simply too expensive.

I could go on a tirade about things like Prop 13 and how I perceive it to be generational warfare, but at this point I just need to figure out what to do for our growing family (we have another baby on the way). Seems like it boils down to a few options for us and others in a similar situation…

1. Rent a bigger place (>$3000/month in SD)

2. Buy a very mediocre (and very expensive house). Be house poor.

3. Move and restart our careers

None of these options sound very appealing.

Then there’s option 4: Suck it up and stay in our small (but relatively cheap) rental, deal with a trip to the laundromat every other day with an infant, and hope that there’s some sort of market correction in the somewhat near future. It’s reassuring to come across this blog and see I’m not the only one that feels this market is unsustainable (unlike the mainstream media), but seeing crap shacks constantly being sold for >$700K quickly erases that. Any thoughts on what direction growing families should take in this uncertain situation would be greatly appreciated!

Agreed that SD RE is very expensive, but it’s not comparable to LA w/ 700k crap shacks. You can buy 3br, 1k+ sqf homes in trendy gentrifying areas like Golden Hill for less than 400k.

You have plenty of good options. You can get nice 3br’s for under 500k in UTC, Clairemont, Sorrento Mesa, etc… If you want to go even cheaper and don’t mind living off the coast, Poway, Sabre Springs, Rancho Penasquitos, and Scripps Ranch are options. If you want something even cheaper, less than 350k, Otay Lakes has plenty available. These are all areas with no crime, decent commutes to Downtown, and are still priced lower than 2006 peak pricing (Otay Lakes is still 100k off peak pricing…).

To some degree you just have to accept that California coastal RE is irrational in that it doesn’t correlate to income growth due to the huge demand from 1% types from all over the world. That’s just how it is and will be.

I too live in San Diego and have posted here several times before about overpriced homes even with large savings and down payments. However, your post seems somewhat ridiculous or at least greatly exaggerated! Just crunching the numbers you’ve provided and assuming a “safe” mortgage amount of 2.5x income, you should be able to easily able to afford a $575,000 home with no downpayment at all. With a 20% downpayment you are now pushing $700,000 for a home. That will get you a nice home in some parts of the city INCLUDING Point Loma, North Park and other trendy areas, and VERY nice homes in outlying areas 15-20 minutes from the city such as Carlsbad, La Mesa, etc.

I easily found 4 bed 3 bath homes with larger lots in under 10 minutes using the above listed parameters. I’m not sure exactly what area you plan on purchasing, but maybe it’s time to rethink your plan. I agree that properties in San Diego County are overvalued and I am hoping they come down at least 15-20% in the next several years so that I can purchase. Best of luck!

I’m in the same boat, but in Orange county. About the same income. But we have a good rental situation. Nice 3 br house in a great neighborhood for $2,400. But I’m itching to buy and own my own place. I’m looking at 600k min for a small house that needs work. I can afford it but I don’t want to spend it. Especially when I compare what home values use to be, or compare it to home values not in the OC. I’m not sure what to do… It’s crazy unfortunate that a good majority of our income has to bd spent on just a simple home.

How about birth control? The feedback loop here is telling you that having more kids is not financially prudent relative to your home ownership goals. You’re competing with more DINKS than ever before. It’s natural population control in action. The crying thing is probably her pregger hormones acting up.

I worked on an SDGE job and lived down there for about 2 month.

Is there pockets of nice neighorhood and are affordable out in La Mesa or El Cajon??..seems no different than parts of the far East Bay or the Inland Empire.

It didn’t seem like that bad of a drive around those parts. When we’d go out for dinner it seemed like normal strip-mall Socal.

You Anglos need to lose your fear of Mexicans. SoCal is our state. Accept it or leave. There are plenty of nice places. The best place is Oxnard, of course. I spend most of my free time at the Marina in my boat. This is the life. Tacos and Corona(forget that Anglo Starbucks coffee). You drop on by and we can have a “Starbucks” style discussion of race with a Mexican beer(I will even throw in a Taco from my cousin Maria).

You Anglos need to lose your fear of Mexicans. SoCal is our state. Accept it or leave. There are plenty of nice places. The best place is Oxnard, of course. I spend most of my free time at the Marina in my boat. This is the life. Tacos and Corona(forget that Anglo Starbucks coffee). You drop on by and we can have a “Starbucks†style discussion of race with a Mexican beer(I will even throw in a Taco from my cousin Maria).

I can’t tell if you’re being sarcastic (a troll) or not. In any case, allow me to offer my sarcastic retort: Mexicans have been such outstanding stewards of Mexico, I’m enthusiastic about more of them coming here (is that even possible!?) to further enhance the quality of living in So Cal!

Btw, careful what you wish for. If all the people with money leave (i.e. take you up on your accept it or leave offer), then where will the moochers get their free stuff?

Really? Mexicans are moochers? They are your gardeners, your nannies, housekeepers, your restaurant cooks, your dishwashers, they paint your house and fix your cars. They spend 15 hours a day in the fields picking the food that you put in your mouth and ingest.

Don’t feel bad, the same crap was said about your Irish, German, Italian, and Scandinavian ancestors.

And yes, there is an ongoing meme/motif that is minority phobic and not afraid to show it.

my sister just had her first baby in december so i know how important it is to have a washer and dryer in the house. she lives in san mateo and her rent on a one bdrm one bth 770 sq ft apt with W/D is $2750 a month

I hear ya. I just have to believe that being purdent will pay off. The patience now will give rewards later. But I get down about it too. Housing to Tank Hard soon! Beware the ides of march.

But Jim, the Ides of March was 5 days ago.

And the Ides of March in 2014 — which you’d initially told us to beware of — was over a year ago.

Just which Ides of March are we to beware?

Haha. You’ve been proven wrong on every count. You could try changing your screen name and taking up where you left off. Your ‘Ides of March’ prediction for last year was especially hilarious.

aaahhh there’s jim. still predicting the downfall 3+ years later. one day it’ll be true – and you’ll be right but only because you “predicted it” every month for 356 months in a row.

I have zero doubts you could buy a decent place for $1M if you looked, throw 20% down, your payment w/ taxes/insurance would be ~4800 but you’d have a nice write off also. maybe 1k/ month. So you’re looking at 4k a month for a place that will be paid down and hopefully at least keep of with inflation in the long run. What’s so hard about that, just suck it up my friend!!! If you’re netting 12k plus a month after tax, ponying up 4k should be doable.

You’re probably kicking yourself for the 100’s of thousands of appreciation you would have had if you would have bought at any point over the past 5 years, right? and think it can’t go on, but sometimes gotta just live in the moment and be content w/ short term fluctuations if your in it for the long term…. that 4k payment will seem even nicer when it’s 10 years down the road and your income is 400k or more.

San Diego has a great climate I think as more boomers retire they may very well retire and provide a bid as well… So maybe think to buy something you like that will be well bid by boomers relocating from other more expensive California cities.

Write off? Mortgage interest deduction? Depends entirely on one’s tax situation and if there is enough interest paid to itemize over the standard deduction. And if it is advantageous to itemize, it’s only worth what is itemized over the standard deduction. It’s not a given as it is all too commonly made out to be. You can’t claim that there’s a big write off if you don’t know the other details of the situation.

You can look at commuting from Temecula. Homes are a lot less expensive for a lot more home. But commuting is no fun.

Move and restart your careers! Your daughter is the most important thing and there are a lot of nicer communities all across the U.S. to raise a child! My Daughter and her Husband took our Granddaughter to a smaller community in another State. They had the professional skills to get jobs, and are in fact starting a business. They are also spending significantly less for housing, but not sacrificing their careers or their income all that much, but are gaining a family oriented community!

If you make a combined 230k a year and have 200k in the bank what exactly are you looking to buy? With that amount of money, you should have no problem buying a 3/2 or 4/3 in the SD area for 700/800k. It won’t be a mansion but do you really need 3000 sqft of house? That’s a lot of money for the pleb class but not for your situation. With your down payment you shouldn’t have any problem finding a mortgage for 3k a month. You may not like the price but you are by no means priced out.

Help!!!

You sound like a logical person and it is true that you have ONLY 4 options. Based on my half a century of experience I can clearly say that option 1 and 2 are really dumb. You are left with 3 and 4. Only you and your wife can decide between the 2 choices left. At a certain stage in life one might work better than the other.

I can tell you what I decided with my wife when I was at your age. Looking back it was a very smart decision which affords us a very good, confortable and happy life. I used to live in San Diego, Aneheim, Bellevue (WA) and now eastern WA. While you are young and the children don’t feel it too much, save everything you can in a major city, earn as much as you can (it looks you did all of this so far), rent, and when you can not take it anymore MOVE.

It is not worth putting your family in bondage and slavery of a major mortgage for a crapshack – there is no fun. There are so many nice places in this big country and yes, there is life outside SoCal. Listen to your wife. She will be much happier to enjoy her children in a place with slower pace of life, clean air and no mortgage. I know that I did and my wife, too.

I hope you are not just inteligent but wise, too. There is a diference between the two.

@Flyover

Though I plan to remain in SoCal, I share your sentiments. If you are a traditional family oriented person who’s not in the 1%, SoCal isn’t the best option. I decided not to have kids a while ago because I knew I wasn’t willing to work the hours to raise them to my standard. I accept that the new SoCal lifestyle “for the rest of us” is roommates and shared financial responsibility. Luckily I’m a people person and when I do buy a house a 4/3 2000 sqft is my minimum. I accept that I’m not gonna have my grandfather’s life in LA County. That said if you manage your $$$ and work with others this can still be a hell of a fun place to live without killing yourself working.

Nihilist,

You may be right for your situation. I was addressing a family man with children. If he has children and how many it is between him and his wife. I was just expressing my opinion of a family man to another family man.

Where I live with 300k you can buy a nice house in a good neighborhood and enjoy those children you decided to have. It is not the SoCal lifestyle but it is a very good family lifestyle. Based on his income and savings habits he can easily buy that house in cash, have wife raise the children and his income will be plenty for vacations and everything else without ever having to be in debt. Based on his income he is a white color profesional.

Even with wife not working, if your housing cost is zero, taxes lower no babysitting expenses, the disposabale net income will probably be higher. In the end that’s what counts – disposabale net income (cost of living). If you are a milionaire and pay one million for a house you are not better off.

@Flyover

Just to be clear I was agreeing with you regarding this fellow.

Bear that I am, I still accept that LA is an international city, more so than it was even 20 years ago. Unless your rich you don’t plan a traditional family life in this metropolis. Even with my life plan/style I wouldn’t want to live in LA proper. i like being just close enough to it to have fun.

As for the family fellow, is he is attached to SoCal he could always wait out Housing Bubble 2.0 and consider the Inland Areas. Close enough to LA/OC to have fun yet with much more affordable housing.

I don’t know what your expenses or debt is like, but I briefly searched Craigslist and there appears to be plenty of 2k-2.5k 3 bedroom rentals even in San Diego proper. Sure I’d agree it’s still very expensive but even in San Diego people making 230K/yr don’t need to live in a place without a washer/dryer in unit. I live in LA and given that I had to do a double take at your post because I found it dubious.

@ Help!!!

You earn $230k a year and you’ve only saved $200k? I have to assume you’ve only been earning that much for a short period. We make much less than that, and we’ve saved nearly that much in less than 5 years with plenty of expenses. It seems like you should have been able to save much more than that if you’ve earned $200k+ for more than a couple of years (i.e. maybe you could have been a bit better prepared for what your goals are). In any case, I’m sure you’ll be fine in the long run in that income bracket.

How about renting a 3-bedroom place for $2,500/mo or less (instead of $3k/mo) in a neighborhood that might not be your ideal? If it were me, I’d keep my rent and other expenses as low as possible and wait for prices to come down a bit (actually, that’s what I am doing).

Although we own a condo that we’re renting out, we also rent ourselves. We are just waiting for prices to come down to reality to buy. It smells a lot like 2005 to me. And if prices keep going up forever, oh well. We’re saving every month anyway (we live in a relatively cheap rental), so we have a larger down payment every month we wait to buy. You can’t wait forever to buy a house, but you can certainly wait five or so years to see what happens.

@Responder – with no real tax deductions and the AMT tax on top of what you are already paying in that bracket is all goes to the state and to the feds. it’s a catch 22. it ain’t as easy as you make it out. especially in LA where housing is 3,500 per month, child care is 2,500 per month, car payments, gas, insurance, groceries… you get the picture. saving in large metro areas with high costo of living and services is rough for some. if it ain’t for you – congrats.

Use Birth Control!

Get yourself a similar unit with an in-house washer/dryer. If you look around you should be able to find one just over 2k. The laundromat is not happening when you have a little one. Sit on your pile of cash and be patient. You’ll get your chance. The ponzi scheme the Fed is playing can’t go on forever and when the dollar/stock market/home prices come crashing down, you’ll be ready to pounce.

I hope you do find a home, you have been responsible in planning for one. However to classify Prop 13 as generational welfare is not correct, Prop 13 keeps taxes at 1% so you can be assured when you do get your home of what the taxes will be. There are only about 5% of the original Prop 13 people still in their homes with the original lower rates as the majority have moved on and into newer homes. Without Prop 13 who knows how high RE taxes might be in the future. Don’t buy into the hype that it is a bad thing but rather the benefits it provides for all of us. I wish you success in finding your home and I believe that you will.

This^. One tiny line against state and local governments to keep their spending in check

Also remember that people were being taxed out of their houses before people voted for Prop 13.

And as well: renters might want to think twice about voting yes for every bond issue that makes the ballot. When you DO buy, you’ll be paying for all that stuff the pro bond promoters claim is just “a dollar”a day.

All those bond issues that the “I’d be willing to pay for that” crowd obligate a homeowner to forever pay for irresponsible public greed and spending. On top of Prop 13 taxation rates.

Prop 13 has numbered days and if you think with what Doc HB has pointed out about a dwindling ownership class constituency that it will be saved by the politicos in Sacramento, your deluding yourself. Don’t count on it sticking around, because it won’t in practice, even if it does in name. It has distorted the taxing scheme so that an inequitable tax and fee burden rests on other areas. Non owners are subsidizing owners to this extent and yes, that’s dovetails with when someone comes of age to afford ownership in CA. All of the housing bubble blog comments in the world won’t save this gravy train from coming to its end.

Dweezi it hasn’t kept any spending in check. Hello this is tax and spend California. All it has done is to increase taxes and fees in other areas to make up for the difference. It failed at that primary objective and ended up contributing to distorted home prices. It is a total fail in terms of aggregate state spending. But hey, if you feel good about your neighbor paying twice as much for the same level of services that you enjoy, that’s your moral burden to carry. I’m 100% in the restricting of spending camp, but treating symptoms don’t fix the cause. I can easily understand why those with the biggest subsidy in the form of Prop 13 are afraid. Who wants to lose a giveaway? Government subsidies are government subsidies regardless of if it’s a welfare check or a tax reduction. The money has to come from somewhere and indeed it does, from everywhere else.

Details: I was responding to the previous post. Prop 13 was enacted to keep the state in check from taxing people out of their homes. Which it does, but still doesn’t keep the owner for being obligated to pay for every bond issue proposal on the ballot that are voted in by the general public. That in itself is a distortion.

As we’ve seen here, people trying to buy are not made of money. And Prop 13 was enacted to keep an insane state government from dumping all it’s fiscal irresponsibility on one segment of the population.

And yes, the state will manage to erase Prop. 13 after some 40 years of trying. You’ll have your “inventory then, that’s for sure.

Please re-read CBs post. Only 5% of the original Prop 13 owners are still in their homes. As for price distortion, there are far more factors than Prop. 13 that have distorted prices. Hello? It’s California.

That the tax burden was spread around to other areas well, then: good. One group of people shouldn’t be able to benefit from all the taxes collected from homeowners while paying nothing.

Water, school, bond, road and anything other “improvements” people decide would be a “good idea” for the state to fund fall on the home debtor’s shoulders, while renters the rest of the public reaps the benefit without paying. Talk about a distortion

A buyer scrapes together the money, obligates themselves to a 30 year mortgage, pays it off, then is still stuck paying the property taxes. Forever. I pay my property taxes. You don’t. I pay for all those bond issues people love to vote for. Who is being subsidized, here ?

Prop 13’s impact on house prices is greatly exaggerated.

Thanks Everyone! I sincerely appreciate all the responses, even the negative ones.

I respectively don’t agree with some of you. There’s a big difference between being approved for a mortgage and being able to truly “afford” it. Yes, we’ve been approved for a $1M place, but is it financially prudent to buy one? That price would make us house poor, making it difficult to save for college and have a life outside of our living room.

Yes, there are houses available for $500-$700. But these are either “crap shacks” as this blogger calls them, or in very poor neighborhoods with very poor school systems. Same is true for the <$3K rentals some have mentioned. Is the new world a place where people in my financial situation can't afford to send their kids to a decent school?

And to those who offered birth control as their advice… I don't want to get into the biology of aging women and birth, but does it sound normal to you that people making almost $0.25M shouldn't bear children in a major US city because it'd be financially irresponsible?

I certainly hope I don't sound like I'm complaining; just trying to make sense of it all. In the end we're all healthy, and these are first world problems. Thanks again for your input!

Generational warfare IS correct. The benefit is TRANSFERABLE not only to your next house but intergenerational as well as between counties who have an agreement like San Diego and Orange, for instance. You can inherit a house in Orange, sell it, and transfer your prop 13 to a house you buy in San Diego. Look it up if you aren’t aware. This goes on all over CA. Yes, the game is rigged.

Also you should be looking at population growth, ie. Jerry Brown’s ‘other Mexico’ as well as the fact that most communities in CA are no growth communities. Look to Ocean Beach for the recent vote they had to make sure no one can ever build anything new or change existing structures. You are rightly fucked if you stay in CA.

It’s amazing to me what people will put up with. Dig deeper ‘Help!!!’, you are only seeing the facade that the status quo has erected for you to see. It’s much nastier than most people realize.

Dear Help!!!

You obviously understand the genesis of this blog and others like it. The value in digging in ones’ heels into SoCal housing at this point in time just isn’t there and has not been for quite some time. You either have to wait around for natural forces to bear their weight on the situation or get the hell out of dodge. There is no present equation that squares with prudence. That so many casino club members comment here in an attempt to promote their club should tell you everything.

there will be a correction, just that no one can call when. Be conservative. I have been involved with housing for 50 yrs +–with all the Fed moves, they are designed to inflate prices–cannot go on forever.

The solution is easy. Go rent a haul truck, tell your landlord to gfy, and move to Arizona, Nevada or Texas like every other ca ex-pat who was in your same situation. Ca does not deserve you

@HoJo I find this upsetting although I understand it’s logical. I was born and raised in CA and it is my home and I love it. to have to move to the middle of the desert for a decent standard of living because I am not a Kardashian, Chinese all-cash investor or movie mogul really disturbs me. But I guess thems the breaks.

For now, hold on for a year or two, save another $50k and have a second child. Yeah your life ain’t perfect but compare it to the poorer half of the world. Then, move to the Netherlands. No worries about “school districts”, because schools are (last time I checked) THE best in the world. Buy for example in a suburb of Amsterdam called Amstelveen. You’ll get a nice rowhouse for about 350k euro, which after dollar/euro parity means a 150k euro or dollar interest-only mortgage and 50k in the bank left. And that interest will be very low, as you own 60%+ of the house. There are plenty of job opportunities in the area, and depending where you find work you might skip buying a car, using just bicycle for short and public transportation for “large” distances. Large between double quotes as we call 30 miles a large distance. Actually you won’t even need two full time jobs, a single part time job is going to be enough. Enjoy a bit of family life, have a holiday in Spain every year and retire wealthy!

I spent about 20 years living in San Diego as a rent payer who never made more than $25k in one year. Got tired of being moved around by landlords every year or two, so I spent 1998 living in a van and did just as well that way as I did renting. The best place for the van was out in the middle of nowhere, and while out there I found a 2 BR duplex in Borrego Springs that my family snagged for $60k in early 1999. The mortgage payment was $338 and we rented the other house out for $450. I had free rent for 6 years and the best part was not having some aggressive jerk in front of me, behind me, on both sides, above and below at home or in the car as I had had for way too many years in San Diego.

But the housing boom hit here in 2005 just as it was topping out elsewhere. People moved in and by now I might as well be living at the beach again, with people everywhere.

Parents paid off the last $40k here from a refi on their main home and gave me the place in 2005. It had never had any improvements to speak of and was in poor shape, so I refied three times between 2005 and 2007 for renovations and bought a 4 acre lot in Julian with cash out as well. Then in 2007 the crash came, so had to rent both houses out and move in to one of the garages, where I still am today over 7 years later.

In 2012-2013 one house sat vacant for 8 months and I fell behind on the mortgage as a result. Spent most of 2013 working on getting a loan mod and finally succeeded in early 2014 after 8 months and about 5 tries. Getting that loan mod was one of the hardest things I have ever accomplished, and I have an advanced degree, plenty of professional experience, and so forth. It required figuring out exactly what the loan servicer needed to be able to get the loan mod approved, and then instructing their workers what to do.

The lead up to getting the loan mod was long and maddening. I had Chase and they would do nothing to help. Nothing one would ever say or write to Chase would ever induce Chase to look at anything on one’s loan mod app in a favorable light. Apparently Chase decided I was dead in the water and sold my loan to DB, thinking they had suckered DB into buying a bad loan. But DB actually helped get the loan mod and came out a winner in spite of Chase’s attempt to screw them via selling them my loan. Like a few others, Chase is definitely a bad egg that should be shut down, with its principals sent to prison forever.

The loan mod from DB reduced my payment from $1592 to $763, and the best part is the reduction is almost as much as each of the many lunatics and wastrels out here on disability get paid as members of the FSA. As a long time self employed person, it is my revenge on the FSA, and I did prove that a loan mod could be gotten–but it was so hard to do that I doubt most people could get through it successfully. In my case, I gave my all to save my home, and I won.

But things are still very tough as I currently have tenants who do not pay. Back when the mortgage was $1592 I had one paying $750 and the other $650 like clockwork for years. But since the loan mod I have one at $500 and the other at $400 and neither one is paying much–am squeezing about $375-$400 per month out of the two of them total and it is just ridiculous to see them sit there in front of me when each one is well over $1000 behind and with no shame at all. No shame, just sociopathic avarice. Evictions are desired for both but at $1295 a pop I have to try everything else first. Things will get better however, and payments are current at least.

Underlying all this in having to have such rotten tenants is a truly rotten economy that just seems to keep getting worse. While rental occupancy rates are no doubt high in most places, I am sure rates of unpaid rent are quite high most places these days as well.

The point here is that the OP needs to start working his considerable pile of money towards his RE goals rather than just expecting to eventually buy a house as if it were an appliance or a box of cereal. He seems to see his pile of savings as rather insignificant when in fact it is quite a lot to work with. In fact if he were to use the very loan product being discussed here at very high LTV, then he and his family could buy just about anywhere in San Diego County including Fairbanks Ranch and Rancho Santa Fe, and with $230k family income there would be no problem at all making those payments. I just don’t see “house poor” ever entering in the equation here in OP’s case with a very high $230k income. I am sure there are homes for less than $2 million each in both of those locations.

OP, if you can’t buy a very nice house in San Diego on $230k income, something is wrong.

Thank you for confirming. If you can’t buy a house in a nice part of socal with a 230K income and 200K down, something is seriously wrong! Maybe the original poster doesn’t have stable income or has lots of debt…if not, it’s time to call the real estate agent.

i don’t understand what you’re crying about $230K !!!! WTF what can you possible do to make that much? You could easily afford a $650K home on that income using the tried and true 3X income method.

I’ve not been able to raise prices in 31 years of self employment so i certainly wouldn’t be “crying” at that income level.

She was using housing as a excuse. You can afford a house. Maybe it’s just you why she was crying.

Bottom line is THIS. California will NEVER have affordable housing, in the AREAS, everyone is talking about.

Let’s say, we get that crash everyone is talking about and the average Home in Irvine, CA is selling for $250,000, Those Homes would be bought up the same HOUR!!! they were listed !!

The California Market will ALWAYS be about SUPPLY and DEMAND.

Bottom Line, California, NY, San Diego, Miami, will always have a HEAVY Dose of DEMAND of people who want to buy there.

You can wait, ALL you want for a crash to happen and you’ll be doing just that WAITING.

CALIFORNIA HOUSING WILL ALWAYS BE EXPENSIVE……PERIOD.

Just did taxes, and it’s depressing. The U.S. government disincentivizes couples who make a decent living ($140K combined income) but whose mortgage debt gets increasingly paid down.

You’re in a no-man’s land, taking a hit from both sides. The Democrats are punishing you with progressive tax rates because you make too much and you need to share your ill-begotten gains with your less fortunate brethren. The Republicans are punishing you because you make too little to be part of the 1%-er Exclusive Tax Shelter Country Club — only the “little people” pay taxes, doncha know?

@NoCommentsYet – that mortgage deduction you are whining about is a hand-out to home-debtors. Keep your mortgage debt high and reap the deductions! Yippee… If you want more giveaways, refinance and take money out of your equity… sure, you’ll never own the house but you will keep getting those mortgage deductions! After all, why should you contribute taxes to keep roads paved? meanwhile, the MAJORITY that rents is getting nothing.

The government acts dumb when they say they don’t understand why America is living in poverty and people here are increasingly becoming poorer and poorer. We should have never left the gold standard. Taxes are wayyyyy too high. I give away 4x the average American salary in taxes every year. Until we have honest money again and significantly lower taxes, this country can never recover.

i don’t know – take a listen to the Planet Money podcast episodes 252 and 253 on the gold standard. seems like it was a wonderful idea to ditch it.

Here’s something even more amazing: the 3% down payment can be borrowed! I didn’t believe it either but I checked out the details. So it’s really a zero down payment. Of course housing prices never go down, right? It’s just like 2005-2006 except now we know how it’s going to end.

For the average college grad “making it” at 100k per year like myself, its not possible to afford a home in Los Angeles unless it is in South LA, East LA, Wilmington etc. In other words, you either putting your life on the line by living in an unsafe gang-infested street or living next to smog and poor air. Either way, life expectancy is probably less than other “desirable” areas of Los Angeles. The commutes, traffic, and politics at work regarding jobs cuts in immense. So having said that, I’d think even if I did make 200k per year, I’m still not sure I’d want to buy a place at these levels. Most peers I know (the ones that went to Univ) still don’t have a stable job; sure, some have PT jobs at coffee shops, banks etc, but its absolutely sad that they can’t even leave their parents house. As for me, I have inquired about jobs in other states, and some of the places actually would match my income of 90-100K, but the Cost of living in most of these other states is half what it is here. As great as the weather is, taco roach trucks, being around “aspiring” writers and actors is, I think I’ve had enough with the BS of overpriced places, overpriced food at places to eat that isn’t even that good. Should I wait another year, or just move now ?

Move now.

I almost forgot. Don’t forget to buy a snow shovel.

Move now! In my opinion this is what will play out:

1.) interest rates creep up in June or September

2.) dollar will rise more (due to 1.) and ECB’s QE program de-valuing the euro, thus pushing the dollar higher

3.) 1.) and 2.) put too much pressure on US company earnings which cause them to miss estimates at an accelerated rate, economic indicators weaken, which triggers companies to implement cost controls (aka job cuts).

Interest rates are very unlikely to rise. The federal gov can not handle rising debt payments and the banksters would prefer to keep their charter so they will see to it that folks like maxine waters can continue to borrow and spend. Watch and see how ‘the market’ miraculously finds a way to keep funding the game.

Most people don’t understand the real estate cycle. It is tightly correlated with population growth. A community that grows at only 5% a year will roughly double in size in just 14 years. Our real estate cycle runs approx 14-16 years from peak to peak. There is a correlation there. CA is an antigrowth state while population growth runs unabated. You are playing a game of monopoly that you are not likely to win.

What happens to most of the players in the game of monopoly? They lose everything. That is what the status quo is setting you up for. You’re just too caught up in the game to see the forest for the trees.

Leave as soon as you can. You’ll realize once you settle in that happiness in life is what you make it. You can be happy anywhere. Hotel California is a roach trap for the unmotivated and uneducated

stop your complaining. Oxnard’s cost of marina housing is much less than Newport. Plus we have tacos(better than the taco truck) and Corona. Just get rid of the Mexiphobia and enjoy life. It appears to me that most of this complaining is unrealistic cultural fears of the Mexican lifestyle. Apparently, some people got low grades in their “multiculturalism” classes in junior college.

The 3% down option fixes NOTHING… Under current lending standards of income verification nobody can qualify at these prices. Last year was the flattening now we’re gonna see price drops as those whose need to sell face a shrinking pool of buyers because the specuvestors are long gone. Last specuvestor free year was 2011 and I’ll bet that’s where prices are headed. It may take us until 2017 to get there though…

With only 3% down and PMI the monthly payments must be ridiculous. Considering current housing prices, who is this program for? I assume they are looking for people who make a very large monthly income but have not managed to save any money. Those people seem like a good risk.

Products like this remind me of the last housing crisis. No doc interest only loans and ARM’s are just around the corner. Anything to keep the dance going.

“CA is an antigrowth state while population growth runs unabated. You are playing a game of monopoly that you are not likely to win.”

Agreed

Interesting point about nobody qualifying. I wonder about the appraisals coming through, especially on the flips. The past year and change has seen a lot of failed escrows and the resultant lowering of asking prices on flips. A look at the details of this program shows that Freddie requires that the lender retains a good portion of skin in the game on these.

@Details

Your thesis supports my own. Which is that just as we had a rapid increase in valuations on miniscule volune, so can we have a decrease on miniscule volume. With no momentum to sell into those that have to sell must price to what people can organically afford. The last time prices were organic was late 2011/ early 2012. If there is no specuvestor activity your left with the few who can qualify for a mortgage. If you have to sell and buyers can only afford 30% less than 2014’s price, well than that’s your market value. I’m not saying every property of every area will have such significant drops. But unless you in Manhattan Beach, Santa Monica or Newport, you are going to have to factor in what the people around you actually make for a living. The boom is over we’ve never had a pullback in sales volume like this that wasn’t followed by rather dramatic price reductions. Then factor in the relative clusterfuck the world economy is (held together by Central Bank scotch tape and hopium) and I expect this correction to be relatively rapid, if not quite the “look out below” event of 2008.

Like 2007 never happened. So quickly people forget and history repeats. If these clowns wake up homeless we have a nice place for them to stay

The doctor says the standard realtor’s commission is 5 to 6%, but I think Redfin charges 4.5%.

And some people have claimed to have negotiated a 2% commission with their realtors. If realtors are desperate enough (i.e., it’s been a while since they’ve sold anything), they might take a 2% commission.

Or you can try and sell your house (or offer to buy) without a realtor. Hire a lawyer for the paperwork. I bought my condo repped by a lawyer. No realtors on either side of the transaction.

Not defending Realtors, but that 5-6% commission is split between the listing agent and selling agent which are usually not the same. Then the agents’ brokers which did none of the work take 10-20% of that. Any seller that doesn’t negotiate a deep discount if their listing agent double ends the sale is foolish.

Just what we need. Financial products that enable more people to buy homes they can not afford to maintain or keep. Like there isn’t enough buying competition already. Like the good Dr. said, anybody using this product will have instant negative equity. Don’t worry bailouts are always around the corner. And remember America can’t have losers and everyone is entitled. Keep the dream alive.

This feels like reading an RE blog for RE agents now, just like before the last crash. People are coming here asking for advice on purchasing extremely overpriced houses with incomes that may not be so recession proof….repeat of 2005. For those asking for advice, this is not the place…if you don’t know then you will never know what is overpriced, you are being driven by emotion, not rationale. Its time to tell youself, put down the wallet and step back and find what is important in life…a cardboard house, or your family and enjoyment of life.

There are MANY beautiful 2000 sq ft 3 or 4 bedroom houses, two lux bathrooms, with two car garages ….even with an inground pool that you could purchase for CASH for $140,000 to $200,000 in Florida…..and many other states besides Cali. Just think! NO MORTGAGE payment to the BANK! LIVE FREE. Contrary to what you think, Florida does have employment in the same industries as CA…..such as financial, schools, technology, medicine, government and hospitality. Yes, we have it all including BEAUTIFUL beaches and affordable houses you can buy for $200,000 cash if you have saved that much. Why use it as a downpayment for a $700,000 crap shack in CA when you can buy a nicer, larger house in Florida and live mortgage FREE?

Are those inexpensive Florida houses in GOOD neighborhoods? Florida has lots of ghetto, barrio, and trailer trash areas. Crazy welfare recipients of all colors. Humidity and tourist traps. Meth and mosquitoes.

SOL wrote “Are those inexpensive Florida houses in GOOD neighborhoods? Florida has lots of ghetto, barrio, and trailer trash areas. Crazy welfare recipients of all colors. Humidity and tourist traps. Meth and mosquitoes”.

None of those problems exist in CA? CA is filled with employed, successful, cultured accepting people of all colors living in well kept, drug/bug free neighborhoods filled with charming, affordable homes with year round perfect weather? Hmmm…

WeDontMakeThoseDrinks, Who said those problems don’t exist in California? You? Certainly not me.

Don’t put words in my mouth. Someone mentioned Florida. I responded about Florida.

Seeing how the original comparison of differences from Florida was made to California, it’s entirely relevant for someone to point out the similarities between the two as well.

Livefree posted about his/her experiences in FL, offering their point of view listing valid reasons why they enjoy living in FL, and how it might be a good choice for others.

“Don’t put words in my mouth. Someone mentioned Florida. I responded about Florida.”

“I responded about Florida”…I think all the negative issues you listed certainly aren’t unique or specific to FL, and likely exist in most US states (gosh, even CA!), but perhaps I’m incorrect; of course, that’s only my humble opinion.

Don’t forget about sinkholes. Hopefully your insurance will cover it.

Southern Florida is nice, but Northern Florida (where cheap houses are) is full of hillbillys and white trash Nascar loving folk.

Too many bugs.

Personally I would wait it out. We are in a stock bubble, bond bubble, dollar bubble, subprime auto loan bubble with dealers offering 84 month loans, and HELOCs from 10 years ago about to reset into regular mortgage rates.

Any one of these that blows will affect the market.

Dr Housing Bubble has provided ample data to see that so much of our economy is over-amped, wages are stagnant yet official massaged numbers are showing a “recovery”.

Do you really want to tether yourselves to payments on an overpriced shack when the economy is so precarious ?

First off, I thought there were loan limits for FHA/Freddie Mac loans … the most you can get in the San Francisco, San Diego, L.A. areas for a single family residence is in the $600k range, and as far as I know, you aren’t getting much of anything for that amount! Second, if you have the means to purchase a $1 million residence and have $250k for a down payment, might I suggest that $250k is a pretty darn good start on a retirement nest egg! It seems insane to risk all that for a chance to jump into lofty real estate that probably has a greater chance of going down than up! And please, please don’t ask me to pay more in taxes to bail you out when your home is underwater or you used poor judgement to purchase that home rather than pay for your future!

There’s no inventory in California where the jobs are or within commuting time to jobs. The inventory is in Fresno and bakersfield overpriced as well. Because of the cheap money.

seriously, this interest rates changes from 3.75 to 4.25 crap is making the market fluctuate on sales… WTF? the difference is like 200 per payment. A lot people pay more for cable.

I just hate it with a passion that I this cheap money has phucked all responsible savers and rational people.

It just burns my butt that not so long ago people were buying via FHA risking it, now they are ballin it and the responsible people are stuck in a rentals. if you want to buy now… you gotta put 20% down bid overt asking and pay 40% more…. all in a period of time in which most people didn’t even get a 5% raise…

What a casino economy BS.

I hear what you’re saying but I don’t think most of those people are balling anything especially when you consider the lowering of standards one must do in order to squeeze into a crap shack. I think they’re stuck. A lot of them can’t sell without a loss or even if there’s a gain to be had, they can only buy back in to the same crappy market. This is why there is hardly any inventory as many are simply treading water with no shore in sight. If missing the boat means not getting stranded at sea, that’s not a boat worth riding. Boats come and go all of the time.

For those who wonder how LA home prices can be so high and stay so high, here are some articles from LA Times today.

‘Silicon Beach causing homes in Westchester to return to prebubble levels’

http://www.latimes.com/business/realestate/la-fi-westchester-housing-20150102-story.html

and

‘tech industry buyers snapping up LA real estate’

http://www.latimes.com/business/la-fi-0321-tech-real-estate-20150321-story.html#page=1

For those of you holding your breath for LA real estate prices to crash, I think you will be holding your breath for a LONG time.

Just bide your time until the next Tech Wreck.

Modern-day tech companies have ridden high on the Fed’s easy money policies that have driven yield-shoppers into anything that looks like it can turn a short swing profit, and have driven the prices of these stocks to nosebleed evaluations that usually have only a tenuous relationship, at best, to the cash flow, profits, or future prospects of these companies.

It’s hard to know when the entire skein of financial fakery will unravel, but when it does, the more dependent on financial engineering and low to non-existent interest rates an industry or entity is, the more devastating it will be.

I agree – I saw professor Richard Wolff in LA recently and he said the main area of economic growth in US has been in financial engineering – nothing else. And financial engineering is wall stree’ts claim to fame.

@Laura, you are correct.

This is the 3rd tech boom (and soon bust) we’ve seen (1999 – Dot Bomb 1.0, 2007 – Dot Bomb 2.0, and now – Dot Bomb 3.0).

@QE Abyss, I have learned to ignore the reporting from the Los Angeles Times. The Times wrote, around 2005/2006, that interest only loans were a wonderful thing, that subprime lending was also a good thing and that no-doc loans (liar loans) were also positive.

Option’s in life run out quickly unless you have a great job waiting with security in it, large cash reserves, very good to excellent credit. Just moving for the sake of a better life or house is something many dream of but few obtain.

This man “Help” a post on a blog tells me nothing about him, some folks make $150k a year provide very well for their families, such as going out less, not leasing a BMW, drive to buy, looking at every home in every area that makes sense in relation to work. Maybe explore moving to a border state if feasible, etc.

Wife crying because this family makes $230k a year 20k a month?, something is wrong with this post friends. You cry when you make $10.00 a hour, lost your home in the sub-prime debacle, live the good life then the doctor tells you bad news, your crying wife leaves you for man that can manage fiancés better.

Everything is relative, at 22 I took a big chance in RE and made nothing like $230k a year believe me. In my days a LA house or Orange county home that was 100k was unattainable also for most, did my wife and I cry, only when I realized my dream of being a ball player was just that a dream.

We look outside the the 100k areas, Ca is a big state always a opportunity you just have to bear down and look every second and pounce on that someone who wants of of their problem house payments. We went to Ventura County back then, might as well been Vegas, long traffic commutes, couple of grocery stores, no mall, police were called community patrols, but it had affordable houses and a possible future of being something other then bedroom communities.

My nephew ask me for help several years ago where do we buy Uncle I work in West Covina but don’t want to live there. willing to drive Steve yes, the I found a great house in VICTORIA in Inland Empire for $230k 3,000 sq. ft. two story, they bought it today worth about $550k. at least. Went to Gibert AZ to visit a old friend haven’t been there in years, great area for the young, beautiful neighborhoods and shopping, thought how happy these young couples look as I drove hundreds of tile roof, very well kept houses.

Wonder why so many cry when opportunities still exist in this country, in spite of the Wash D.C. beltway?

I agree with the first part of your post- crying about a house when your household income is $230k is ridiculous and seriously out of touch with reality of most of the U.S., never mind the world. No matter how much you make (unless you’re Buffet, Gates, Slim et al.), there’s always someone who makes more and can therefore afford more. Boo hoo. Hopefully it’s just because she’s pregnant.

That being said, aren’t you sort of pointing out the obvious with the latter portion of your post? Of course it costs less (i.e. it’s more affordable) to live in the IE or other outlying areas. I don’t think you’ll find many people who disagree with you. What many people are focused on is that most of So Cal appears overpriced relative to the incomes of the residents here, and when prices might adjust to a more historical norm. That some areas of So Cal are more affordable than others is not really the issue here, particularly considering the more affordable areas are probably overpriced, too.

I’m thinking that post was probably troll bait or something. Crying over not having a mortgage is ridiculous.

They caught me.

You sound proud about your ‘sage-wisdom’ buying advice and the rewards of HPI, by pointing out “what it is worth now” (in your opinion) vs buying price.

I can hear your nephew now… “Thanks a lot Uncle-HPI… richy riches”

Robert: My nephew ask me for help several years ago where do we buy Uncle I work in West Covina but don’t want to live there. willing to drive Steve yes, the I found a great house in VICTORIA in Inland Empire for $230k 3,000 sq. ft. two story, they bought it today worth about $550k at least.

The “wealth-building home loan”:

Meet Grace and Armando Ong who recently “lost” their $680,000 house in Pomona and are now buying a $400,000 home, all with no down payment, no closing costs and no mortgage insurance. The Ongs’ real estate agent, Jill Medley, called it “the best loan in the history of real estate.”

http://www.latimes.com/business/realestate/la-fi-equity-building-mortgage-20150103-story.html#page=1

While I don’t see this new Fannie product as being that controversial compared to the stunts pulled last decade, there always seems to be a common thread…

It’s the price, stupid.

If you pay close enough attention, you’ll notice that these creative loan products are symptomatic of unsustainable price levels. Instead of treating the cause, which would be prices that aren’t supported by fundamentals, schemes like this pop up as warning signs along the road to trouble.

Extremely pissed off.

“After five to seven years, their income should grow, and they’ll have enough equity to trade up to a larger house to raise their young families,” he said.

Which under the forever HPI, the larger house will cost even more to upsize to. Extend and pretend economy. Those who ‘lost’ their previous homes, having outbid others 10 years or so ago… invited to the front of the queue again to pay whacky prices and outbid others.

The expectations of Help!!! seem way out of sync. I’m reminded of the proverbial recent college graduate who, now making good money, starts crying when he realizes he can’t quite afford an S Class Mercedes Benz as his first “work” car.

Our first house was 1500 square feet older and in the Palms/Mar Vista area. It needed a bunch of work and we needed to have a Second for a short while as well as take on room mates. It was an effort but when we finally sold and moved up we were in decent shape. Yes, we would have been better to keep it as a rental but that’s a different story. We still didn’t start crying that we couldn’t afford a coastal 2000 square foot plus house. We could have pulled it off but does that leverage make sense for most of us? Not me. It is expectations like this that have gotten so many people in trouble.

Perhaps you were fortunate enough to be able to enter the market at a time where prices were more reasonable as they relate to wages, I don’t know. Point is that it’s easy to say I did things this way so can you when the reality is that timing matters. I think that’s what help is pivoting on. Not that he can’t afford it but that at the present time it doesn’t seem prudent. The whole wife crying thing not withstanding.

Fenster, whats the address on this property? I always like to ask older homeowners if they would purchase their first house again with today’s prices and I always get the same answer “hell no!” Just taking a quick glance on redfin for the Mar Vista area with 1500 square foot houses show 850k+ and all the way into 1.3 million. Is that a starter home for you? Does that make sense with your current income?

Totally agree. Mar Vista has not been a “starter home” neighborhood since the late ’90s. 10 years ago it became a boon for tear-downs and specuvestors like all the other once-affordable pockets of LA.

A lot of people that bought back then are in a fantasy land about LA real estate and like to give out this holier-than-though non-advice.

Yep, refi is payday.

Every 7 years around September a bad financial event happens. Do your research. This is the 7th year.

Year of the Shemitah: Why don’t you do the research and get back to us. I love when people make an assertion and then tell others to “do the research” in order to prove their own assertion. You’re the one who made the assertion- YOU do the research!

2008 – Great Recession

2001 – 9/11

1994 – Mexican Peso crisis

1987 – Asian Currency Crisis

1980 – US Recession, SnL Crisis

1973 – Arab Oil Embargo

1966 – Financial Crisis

1958 – US Recession

1953 – US Recession

1944- WW2

1937- WW2

1930- Great Depression

The Atlanta branch of the Federal Reserve has 1st QTR 2015 GDP tracking in 0.3% using their GDPNow modeling estimates. Any GDP below the official rate of inflation feels like a recession.

https://www.frbatlanta.org/cqer/researchcq/gdpnow.cfm

Sheath – I don’t know if it’s that exact, but economic prairie fires are necessary to keep us grounded in reality. We’re overdue for one now.

As a faithful follower of this blog, I want to say thank you for posting this. As you know, we live in Denver which I know is very different from the L.A. / SoCal market, but nevertheless, we are seeing the hype here too and it’s just disgusting. Found out the owner of our condo is selling, so we’re in need of a new place within 60 days. Everyone keeps saying we should buy, but we’d only be able to put down about 10% and that is not good enough for me. Meanwhile, average rent in Denver for a 1B/1Ba is about 1,600/mo. (again, compared to CA, I can’t whine, but remember that wages here aren’t as high as SoCal and THERE IS NO BEACH.)

Anyway, we’ve come to the conclusion that we’ll live with my parents for 12 months, save up, aggressively pay down debt, invest in my husband’s law practice, and just try to do the best we can until we can come up with a minimum of 20% down. Anything less than that is just a complete joke.

Tired of people waving their “home ownership” in my face when really they just put 3% down and it’s going to take them many more months than it should before they pay it off. Oh, and they’re paying PMI, which is just a joke.

That’s why it’s called “loan ownership.”

Responder …Thanks Responder, I’m just looking at post on this board in relation to my comment. It seemed many are willing to stay in Ca. no matter what, you can stay but sacrifices abound.

Of course CA. as a whole is totally out of touch as always, even during the rush of people moving west in the 1950’s So CA was nothing but poorly built homes, no zoning laws, developers ripping off all who came because of the climate. Many land parcels were bought especially in the SFV for a song in the late to 30’s and to early 50’s. Instead of building homes on at least a 1/2 acre they built houses 8,000 ft lots and the homes were nothing but junk for 15 to 20k. or more. Thousands of them everywhere.

Ca. was the land of promise and a new life, it could have been all that and more, instead it was and today isthe land of opportunist, political football follies, social unrest, and the good life only for the well healed who live behind guard gated compounds in fear of being robbed or worse.

Siggy, I agree these loans (creative financing) are simptoms of bubble prices. I believe real estate prices would correct without all of these interferences.

FNMA offers a similar product called homepath financing. The rates suck. Huge hits for the high LTV and is considered a conventional loan product. Good news is there is no MI. Additionally, since the investor (i.e. FNMA) is essentially holding the note they don’t require an appraisal either. But you can only get it for FNMA owned homes.

On this home possible product which is essentially a variation on freddie mac homesteps program you can use it on most o/o purchases but again the rates suck and there IS mi…BUT you can also go lender paid MI. On the 3% down home possible advantage option you have to go 30 fixed…but hey folks, there is no reserve requirement! http://www.freddiemac.com/learn/pdfs/mp/hp_glance.pdf

This party is just getting started.

They will pump the prices for two years and after the poor are in houses they

will crash the market again and restart the bubble again. The financial system

is addicted to screwing the poor and gov’t bailouts. The public is strangely passive

and the super rich control everything, with the NAS, CIA, FBI, and police ready

to beat up anyone who wants to protest it. There is no hope, the dream is now

a nightmare of cops, prisons and foreclosure oh and fixed elections of paid off

whores to the oligarchs.

You are 100% correct, William.

We now have a 2 class society. One class of people whose excrement does not smell and who are completely insulated from the consequences of their risk-taking, malfeasance, and outright crime, and the rest of us, who can’t win for losing.

to help, don’t worry…

think water first, house second….

man whom buys home in desert with water scarce not thinking wisely…

Leave a Reply to The Ives