The Hollywood real estate connection: 400 square feet for the creative type of buyer that enjoys spending money.

I love the hipster perspective when it comes to selling homes in certain SoCal enclaves. Some areas use subtle language like “creative†or “artsy†location meaning they want you to be the new wave of pioneers that gear up and gentrify a neighborhood. Los Angeles is a massive area where per capita GDP isn’t as high as people like to believe. This reality based on household income has led us into a precarious situation where renter households and owner households are living on the edge when it comes to meeting monthly bills. Renters spend nearly 50 percent of their income on paying for a lease while homeowners are blowing through 40 percent of their income. Most mainstream reports never bother on showing you what you get with the actual money you put down. Today we highlight a wonderful little house in East Hollywood.

The glamour and glitz of East Hollywood

If you are not paying attention, the amount of housing fluff and real estate reality TV is back to peak levels. People are diving back into the housing game and are throwing caution to the wind. Again, if you buy right you are fine but many people (once again) are buying with maximum leverage. There is virtually no cash flow investor deals for the buy and holders. Any investor purchase is largely aiming for continued appreciation gains. In certain prime locations investor and foreign money is dominant crowding out regular households. Bring cash or go home.

It is interesting to see how people are pitching properties in this market especially now that inventory has picked up, prices are stagnant, and the double-digit gains are no longer to be had. Take a look at this place:

706 N Madison Ave,

Los Angeles, CA 90029

1 bed, 1 bath 400 square feet

And let us dive into the ad:

“Great starter home! This is a fixer upper but full of possibilities for the creative type! Close to LA City College, shopping, fwy access and downtown L.A. Property is being sold in its current “As Is” condition. Great opportunity for investors: property is in RD1.51XL zoning!â€

Starter home. Check. Fixer-upper. Check. Creative types. Check. Opportunity for investors. Check. This place is listed at $409,000 but the Zestimate comes in at a whopping $584,000. Great deal right? Take a look:

This place was built in 1921. Here is a Street View of the property:

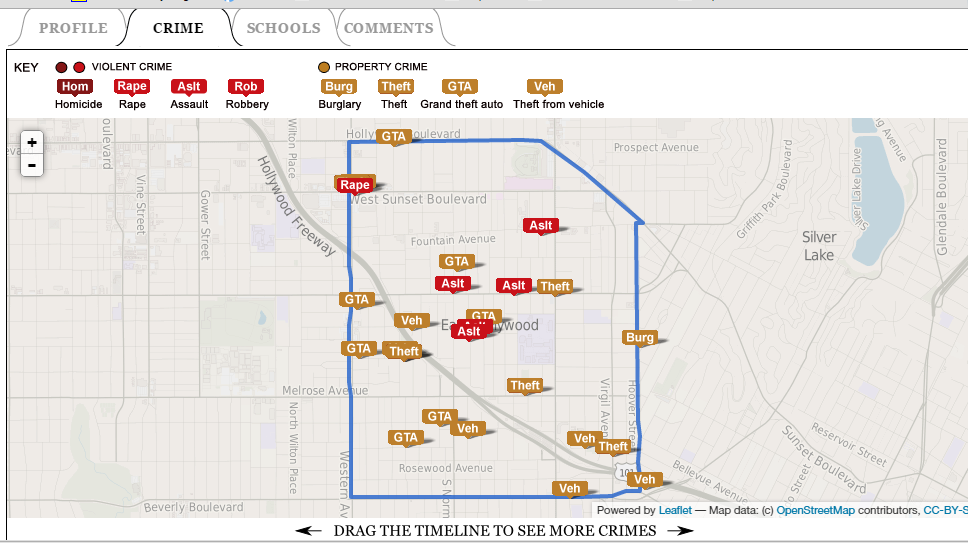

You think this area is great? Here is the crime map for the last week:

Go ahead and pay $1,000 per square feet for this 1921 400 square foot house. And you wonder why people are balking at buying homes and inventory is growing.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

103 Responses to “The Hollywood real estate connection: 400 square feet for the creative type of buyer that enjoys spending money.”

Living in San Diego, I have the option of dumping my entire savings to either buy a run down 600sf shack in the city limits or a 1300sf run down home outside of the city, both for $525,000+. Dumping my entire savings would allow me to have an affordable payment, but then I’d have no money to renovate the run down place. Barring that, I could continue to rent as prices rapidly rise, with 1 bedrooms going for $1500+ on average now.

This whole situation is incredibly depressing to me. Among my late-20’s peers I seem to be doing very well, with a $100k/year career, decent savings, and zero debt. When even I feel squeezed and unable to afford a decent home I can’t see how others would be doing much better. I will continue to save, but don’t see brighter days ahead unless something drastically changes.

For $525,000 you could buy a single family home in Clairemont or Linda Vista. Both places are a little dull for single people, but have a great location.

You got it brother. Our peers are either buying with big parental help or getting something shitty for their incomes. Qualcomm is laying off 3k and the military continues to cut its roster, so I’m guessing people will eventually move out of town when they can’t afford housing.

If I have a substantial amount saved, I would keep as much of it as I can.

I would put most of it in Treasury Direct in the shortest term note offered.

CASH will be king soon enough. Weather the bank will dispense funds is another question. FDIC is now limited to your SS# not to an individual account you have. Treasury Direct is money good. You have to make a deal with the Devil when you play with his toys.

ImnotPOTUS: My understanding is that FDIC coverage is per bank. So one person (one SSN) can have 10 $250k accounts at 10 different banks and be covered for all of them.

Source: https://www.fdic.gov/deposit/deposits/brochures/your_insured_deposits-english.html

Hey Kris,

Doesn’t seem right does it? Were on the same boat saving away without any foreseeable future. This is a constant conversation among my single engineer friends making supposedly reasonable money @ 150k yr with ~300k in the bank. To live near work (West LA) we can only rent, 1m for home cannot be justified.

The only people in our circle going for mortgage are the desperate new families, willing to over leverage themselves in this tech boom area called Silicon Beach. Living month to month with no safety net. Is this putting family first or a selfish dream?

Yes please stack this on top of my our masters/PhD debt. I’ve only been told prices will rise, paying debt with debt = growth. Let ignore the downsizing of the tech sector.

“engineer friends making supposedly reasonable money @ 150k yr with”

i don’t know anyone making $150K a year, not one single person.

“i don’t know anyone making $150K a year, not one single person”

Sorry to break it to you, but Aerospace in LA pays pretty well. I know a bunch of folks in the field and if they have an advanced degree and more than 20 years in the field they ALL make at least $150K. Every one. The parking lots are filled with Beemers, Vettes and Lexuses (and a few minivans for the hardcore breeders).

Most of these engineers also have a working spouse – often with a healthy professional income as well. There are a shocking number of unflashy couples pulling down $250K+ in the LA area. They’re the one’s who can buy those million dollar crap shacks.

Just because you saw a bunch of leased ‘luxury’ cars in a parking lot does not make the drivers wealthy nor does it correlate to 150k+ salaries. Majority of those guys are making far less than 100k

howard –

all my friends in aerospace in their 20’s and 30’s make over $100,000.

i’m sure their supervisors make over $150,000

My daughter’s boyfriend graduated from Purdue with a degree in aeronautical engineering and started off at 82K. Not too bad for a 23 year old kid! Guessing in 10 years he will be making in the 125-140K range….

You’re making good money for your age, but as we know in this economy nothing is a lock 5, 10 or 20 years out. We get another recession within this depression your salary may take a hit. I would bank the money and be patient. I would also look to get a telecommute agreement where you work or look for a job that is ok with that if possible. Offer to take a lower salary so that you can live someplace where the cost of living is much lower but the quality of life is much higher. At least 50-100 miles from any big city. And if you do land something like that, rent first and get a feel for the area before you make a big commitment.

@Jeff, I was going to poke at these numbers also. Taking on a conventional 417K loan in Kristopher’s case is likely not much more than renting a one bedroom apartment when you factor in principal and itemizing mortgage interest and property taxes, it may even be cheaper. I can already hear the AMT police right now. 🙂

If the down payment will deplete all of Kristopher’s savings, he needs to save another year or two to be safe. Buying a house that needs work is normal, especially for first time buyers. The amount of things you learn, doing things yourself is a great life lesson. When you have a family and kids, there is little time to do any of these projects. Good luck with whatever you do.

Kristopher, help me with your math. Do you have the money to put 20% down on a $525k home? If so, then you’re looking at a mortgage of $420k. A 30 yr fixed at 3.7% is $1933/mo. If monthly property tax is about $550, then you’re at just under $2500/mo.

If yearly salary is $110k, that’s $9167/mo gross. Even if you lose 40% of that to taxes and the like, that’s $5500/mo net. Isn’t $3k/mo after paying the mortgage, property tax and income taxes enough? I say this because you said you don’t have any other debt.

If my numbers are off, please feel free to correct them.

To clarify, my down payment would allow me to put down around 30% with closing costs, an emergency fund and furnishing costs as well. That would leave me with a mortgage amount roughly around $350k using a $500k house figure. My income is variable though and could be anywhere from $90k-130k. That would leave me around 4x income being conservative, which seems like a bit of a stretch to me. I currently rent for $1000 a month at the beach in a small cottage, so my housing costs would go up substantially.

I’m open to any advice but the prices seem stratospheric to me at the moment for what you get, so I’d hate to unload my hard earned savings to get into a house that could quickly drop in value.

Plus the property tax is essentially covered by his mortgage interest tax savings.

On a quick back of the napkin I can’t get his $550/mo in property taxes to be “essentially” covered by MI deduction, I’m finding < 50% recovery. This is factoring net of standard deduction @ $100K income 25% marginal rate.

Kristopher, how much was your security deposit on the rental? $2K max? 30% down on $500K vs $2K. That's the difference in exposure. It counts for something. I don't blame you for being skeptical. In a crap shack marketplace I get the low/practically no down scenario but then the monthly costs (all of them, including maintenance, repairs and improvements) compared to rent have to get close to make sense. What's the point in self subsidizing at 3-4% rates

…submitted too soon

I get it if perhaps one expects the real value of the property to increase much greater than interest rates and cashes out at a cycle top or arbs the difference to repurchase in a lower cost area, but then that would be speculating.

i often wonder why kind of job pays $100K a year to a late 20 year old, I’ve been in my career for 30+ years, self employed and netted $70K in 2014……it was a slow year.

i do engineering/design work, my entire industry was gutted and shipped to china in the late 90’s and at $70k a year there is zero hope of ever owning a house in socal ever again.

p.s. my income stopped growing in 1997 and i actually had to lower prices in 2005

Most engineering/software jobs with 3 yr experience and Master/PhD in Silicon Valley and Silicon Beach are well over 100k. Right skill sets and locations are the keys.

Average pay for a software engineer at google. Most tech companies in this location are competitive with this wage.

http://www.glassdoor.com/Salary/Google-Software-Engineer-Los-Angeles-Salaries-EJI_IE9079.0,6_KO7,24_IL.25,36_IM508.htm

Most of us that do live nearby rent here, priced out of owning unless we bunk up. Venice is a crowded beach bum town, it’s hard to see the desirability to raise a family in this place. You have to be insane to pay this prices. http://www.zillow.com/venice-los-angeles-ca/

Law. $160K to a freshly-minted law school grad at the top firms.

Interesting, I think you answered your own question. Even among STEM jobs, the ones that pay are the ones they can’t ship away. Read apolitical’s post above about aerospace. I was going to reply in that post that even “touch labor” hits 100k+ (with constant OT of course). I’m sorry to hear about your job/field. Even at my job, I was trained to do some new stuff, but they brought in H-1 visa folks. Shame really, I know the equipment better than they do.

Interesting – before losing it all in the crash, I was grossing 70k, and netting half of it.

This was in electronic surplus so not engineering but I was doing better than than most techies.

Guy I work for makes 150k but spends it all, his wife often doesn’t have money for laundry soap.

When your wife is pinched for money for laundry soap, Houston, we have a problem.

Most successful guy I know is a huge ugly Irishman who can lift heavy stuff, his wife is working a govt job, and one of his sons is well on the way to playing major league baseball. Guys doing much better than the genius rocket surgeon I work for!

Kristopher, I’m not that experienced but here is my opinion. If you have job security you are in good shape. Keep renting for a couple more years and save as much as you can. The next couple years might bring: a market correction, and rising interest rates. I’m not sure which is better – to buy high with low rates like we have now, or buy “low” with higher rates. If you actually want to be an owner at some point, then you will pay a price. What would you gain? That is for you to decide. Are you comfortable with carrying costs of $1800 month? Just go into knowing your own parameters and if owning is what you want, then at some point you will find the solution.

Lower price at higher rates results in a greater effective MI deduction subsidy… For as long as it remains around either in its current form or at all.

I know someone in LA that lives in a 450 sq ft home. It is just depressing. On top of that, pay 400K+ for the privilege. It is just amazing what people are willing to put up with and become conditioned to.

Hunan that has to be quite depressing. Might be original!y an oil well roughnecks shack. You know many oil wells there are there, originally los Angeles was a grove of oil we!!s. Don’t believe me? Watch some old Little Rascals movies.

I’m getting to like exclamation points for ells.

A preview of the next “Tiny House Hunters” Episode. “Creative types” will definitely bring granite and stainless glamour to the hood.

Zillow says that it is worth $585K, so you can pay $408k and spend another $177k fixing it up. I know the homes in West Hollywood go for similar prices due to being around people with similar values(hint, they are not Texas values). You are not buying

wood and stucco, but an environment.

Ira, that’s brilliant. You must be in marketing “You not buying wood and stucco — your buying into an environment.” It’s just that Melrose and Hoover is just terrible — it’s not WeHo. Just do a street view.

The Google View car probably got jacked as it was snapping pics in that neighborhood! LOL!

The ad makes it sound like it’s in a good neighborhood. I assure you it is not. That part of LA is not what I would call “desirable”. Mostly old run-down apartments with perpetual yard-sales and multi-generations packed in like sardines.

What’s wrong with yard sales?

How are folks supposed to furnish their new shack

affordably without $10 tables and chairs?

How are they supposed to find Englebert Humperdinck records?

How much will it cost in 10 years from today?

It is low rate environment now, but it cannot be like this forever. The debt has to be paid off or inflated away. You have to look at the house price in 1985, 1995, 2005, 2015, and 2025.

“The debt has to be paid off or inflated away”

I’ve always been baffled by that “inflated away” comment in regards to debt and for the life of me i can not understand how that works.

i have never ever in my entire life ever had a raise that was even close to the rate of inflation…..as a matter of fact (this is an old joke BTW) i could give my service away for free and my customer will call and ask “how can we lower prices”? And that has been my entire career, do more for less. So i’d like to see a back of the envelope calculation on how debt gets “inflated away” with stagnant or falling wages. TIA

The only party able to inflate debt away are governments of indisputable (unwarranted) reputations that they can debase their currency with impunity. On the other hand, inflation hurts the ordinary individuals because their salary has kept up with it and, in many cases, has fallen behind it.

Traditionally, real estate prices only kept up with inflation based on wage growth. In a free market system, price trends should track the trajectory of stagnant/declining wages.

Interesting – before I took a swan dive off the grid for a few years, interest rate on my credit card was just under 40%.

Interest rate on savings is around zero, but you owe, you can’t count on inflation to ease your woes.

Low interest rates on debt are black swan rare. I owed the state of California a bit under a grand for a couple of years. After losing it all in the crash, I wanted to button up what I çould before leaving the state, did not think I would be back but wanted to make good on what I could.

So I train and cab up to the tax place in San Francisco, and tell the lady I want to pay up, and the penalty or interest, whatever you would call it, has to have been a per cent or two. It had only increased by what, fifty bucks? Not even that as I remember.

Anyway it was fun watching her eyes get big as saucers as I peeled the cash off of the wad in my pocket. Since I was liquidating everything, I actually had a few thousand on hand.

I also totted up my sales tax and paid that up at the other place in San Jose when I closed up my resale tax number. Thinking about it, I could have left both p!aces high and dry, but I did not.

I’d guess “creative types” is a PC way to fish for hipster or gay buyers (bonus points if both), the most desirable “urban pioneer”. This can’t be marketed to a buyer with 10+ residents, not enough rooms. Bonus points it is located on “Madison Avenue”; maybe someone working in advertising, super fun to say “Greetings from Madison Avenue” on party invites, etc.

Crime stats. This is an interesting website, live audio feeds of various public safety audio streams. See if your hood is there and listen to the daily goings on.

http://www.broadcastify.com/listen/

FYI here is LA South Bay Police & Fire, as its such a “desirable” hood on this site.

http://www.broadcastify.com/listen/feed/1932/web

Seems to me most people buying “hipster” live/work lofts are really mostly lawyers, marketing managers, tech folks with tattoos who would like to picture themselves as “creative types”. Let’s face it, most of those who have this kind of money to burn do boring technical jobs…

agreed

You hit the nail on the head sir. Anyone in the market for a “hipster” house is a yuppie shelling out big money so they can pretend to be hip. Last I checked, bartending while waiting for your band/art project/film career to launch doesn’t make one rich. If you do launch creatively, last thing you want is to be seen with those lawyers/tech types you mentioned.

Realtors love male gsys. Two people making guy money and not having kids.

Guy money is great because larger stronger bodies, trained from toddlerhood to go into tech and mechanical fields, and I don’t see too many women, gay or not, working as steamfitters or even humping tires at the tire place on the corner.

On the other hand, if the hipster is a would-be producer he/she could film a cinema verite crime flick. Perhaps, “Fast & Furious 9: The Real World” …

I follow this blog regularly. I am retired. I retired early because I saved first, made good financial decisions, and lived below my means, including never paying more than $300k for a pretty decent home! Of course that meant getting out of California a long time ago! As a result, I am in an enviable financial position. I say this not to brag, but to make a point! If I paid 50% of my income for rent, or paid 40% of my income for a mortgage, or even if I wrote a check for $1 million for a home, I would consider myself reckless, stupid, and would almost certainly still be ‘scratching my head’ trying to figure out how I might someday retire, have any kind of financial freedom, let alone trying to figure out how to pay next month’s bills! Bottom line, it makes no sense to me!

You almost described my situation and thinking like me. I left CA long time ago for the same reasons you have described. That was the best decision I ever made. Even today, retired way below retirement age, I am thinking that I would never have had the money, the freedom and the financial situation I have if I wouldn’t have left CA.

To become a slave in bondage to the bank for the rest of my life for the so called good weather, to drive in that horrible traffic and spend my life either working or in the car breathing smog is not my ideal of a life worth living. In the winter I can afford every year to go to Hawaii or Caraibean and stay in a resort not bumper to bumper in traffic. Now, this is called life, even if it is not in SoCal.

JNS, how about you just consider yourself lucky and call it a day? If not, please research salaries and home prices around the country and tell all of us where we can replicate your success.

And if you say Iowa, you’ll get laughed out of the room.

If you can’t find a place where your scenario can be done, welcome to the new reality, then just remind yourself that you were lucky.

JNS: where did you move? Many places are not all that much cheaper than So Cal, at least not enough to make a night and day difference in your retirement.

“most places are not much cheaper than socal” – um, where do you get that idea? Take a look at Realtor.com or zillow for ANY other state in the union, for house prices.

Steve:

You misquoted my statement. I said “many”, not “most”. Some examples are Seattle, Portland, Austin, Colorado Springs, Chicago, tri-state area on the east coast, etc. To further clarify my sentiment, one should obviously consider that salaries for professional jobs are a bit higher in So Cal (generally speaking) than in flyover country where one might be able to find a substantially cheaper (not slightly cheaper) place to live.

And you have to compare apples to apples. A place in the middle of Seattle is not going to be substantially cheaper than one in the middle of L.A. Commensurately, a place in Kent, WA might not be substantially cheaper than a place in San Bernardino, CA.

Responder – I have lived in Arizona and Colorado. Neither p!ace has worked as well for myself and people I know as California.

Paradoxically, Hawaii, where I grew up, has been the cheapest (I’m still convinced I could find a room for $300 or less there) but I think California is best.

Just because guys like JNS and Flyover could not figure out how to make it happen in SoCal does not mean it can’t be done. In fact I propose that by sticking it out in SoCal since ’91 I have made substantially more money in RE and have far more net worth than they do – combined. I could not truly afford my first condo in Mission Beach in ’92 but I got in the game a rented a room out to make it happen. Still own it, it’s paid off. Bought another condo in PB 4 years later, same set-up. Still own it, it’s paid off. So about $1.4 mil in equity and grossing close to $5K/mo in rent.

The exact same opportunities are available to people today, it’s just that most do not step up and make it happen. I have no sympathy for anyone who does not suck it up and sacrifice to began building wealth. The big difference is that there is huge upside in coastal SoCal RE over the next 20-30 years, just like over the past 20-30. In flyover country? Uh, not so much.

Falconator you make a good point; one need not move away from Southern California in order to make it big financially. There are advantages and disadvantages of big city living vs. flyover country living. It all depends on what you do with the marbles you have. There is opportunity everywhere if you see it that way. It depends on how you make things work for you. Obviously you took on roommates, paid off a condo and bought another one. Good for you. I know that often times it is fashionable on this blog to always be bearish. But if you are always bearish and that is your lense then you may end up missing up on opportunities that come your way. Have an open mind; don’t be a perma bear or a perma bull.

The last few years I was a perma bear. I admit it. Look where it got me. Nowhere.

Falconator,

You talk about something you do not know. You mention that you have more than me and JNS combined. Then you stated your net worth and income. Based on that alone I can tell you that I have way more than you in both equity and income. Most of it was not made in SoCal.

Yes, I can buy few house cash in SoCal but I don’t have any desire at current prices. Where it is super nice along the ocean, the prices are not justified. Also, I don’t have any desire to live in a thirld world country with astronomical prices. I can do far better than that. Most of SoCal (again with some exceptions) looks and feels like a third world. I can’t call that quality living. If you like, good for you.

I traveled extensively not only in US but throughout the world and I know what is available. I have plenty of reference points.

nah, i’d rather live a life of leisure.

no wife, no kids, easy state job, early retirement, live off my father’s real estate wealth as a rentier

Exact same opportunities? No, Sir. Similar in some ways perhaps. Doc has exhaustively presented the facts over and over that show how different the realities of today are from decades years ago.

Outrageous “I did it, so can you” hubris.

Pacific Beach is not my idea of a nice place to live, it’s ugly and super crowded. So you’re a ‘millionaire’ living in a ghetto beach condo with roommates. Congrats! Here in flyover I have a nice house with sweeping views of the city next to a 1300 acre nature park for a tiny fraction of what you paid for your beach shack that you share with bums. I guess if all that matters is your score in dollars then you win but my quality of life blows yours away. You could have a castle here for a million lol. (I’m not saying where though, I don’t want it to get overrun like San Diego is. Way too many real estate refugees here as it is.)

A friend of mine is an Ivy League-trained doctor with some med school debt but not exorbitant. He’s in his early 30’s and he and his doctor wife are leaving Southern CA for Texas. He says CA doctor pay is the same as it is everywhere else but the lifestyle they can buy in SoCal is nothing compared to Texas. An engineer friend left a year ago too. A PhD academic friend did the same thing. Same issue. Educated people are leaving because they just can’t make it in CA. Even at $300K/year or more gross income they’d have to save $200K for a responsible downpayment on a house plus they’d be looking at an $800K mortgage on a $1 million place. I don’t even think they could qualify for a mortgage that size or save $200K with rents and living costs being so high. To the people that say that you don’t need 20% down I say look at the monthly nut on a place with a low downpayment – it’s an insane amount on any house over $500K.

Yes, I hear this often from my twentysomething kids and their friends; 90% of their peers who have real career jobs have left CA with no plan to return. Their peers still in CA work retail, hospitality, food service jobs, live with parents/relatives with no exit strategy, dream of being DJ’s, fashion bloggers, open a coffee or cupcake shoppe, entertainment industry, etc. or really have no career path and/or attend college PT.

It seems to me California’s best and brightest native sons and daughters are leaving the state in droves, and nobody seems to care.

“It seems to me California’s best and brightest native sons and daughters are leaving the state in droves, and nobody seems to care.”

I’m not surprised. I am one of those. Everything has a price. The prices in CA are for nightmares not dreams; but some like the life of a slave to the bank or they don’t care, or they don’t know what freedom and quality of life really are.

my time is worth more than few extra $10,000

Drinks – the unvarnished truth is, you get born and raised in the Midwest, do your college degree there where its cheaper and affirmative action doesn’t shoot you down, then move out here to California to work, then retire back home in the Midwest.

We’ve become something like London, an expensive place to make money in, or become impoverished, and then move out.

This house is for a developer. I don’t get the map of crime. You’ll see the same symbols in West LA. This property is not the symbol of excess. Its the fixed up properties this size that are going for 600 that caused the zestimate that are the problem.

The size of the lot was not disclosed, but it appears small.

Ok, 1400 sq feet lot. They are insane.

the size of the lot on Trulia says 1,400 sq.ft…. about the size of a typical 3 bedroom home itself…. does not bode well for a developer. Such a smaller lot often times was a large lot then split into 2 or 3 lots each with their own 400 or 5500 sqft home built onto them. Lousy for privacy and your backyard fence, property line is 10 feet from your backdoor.

It is amazing how we live in such a herd mentality type of society. Young people see a certain area is “hot” and they move in right away. People are convinced once again that real estate prices only go up and if they go down, wait enough time and it will recover.

In Chicago we have basements. In advertisements they are called “garden units”. I had a friend and she came from out of state and she went to see a “garden unit” and the minute she got there, she told the owner “but this is a basement”. Also, “vintage” means the apartment or house is super old. A fixer upper means it needs work, lots of it.

Garden apartments are cheaper, so there is a proportional discount. The crap shack flips of L.A. are anything but discounted.

I just want to make the case for young people and their economic situation. When I say young, I mean people from the ages of 22 to 30. Demographically this group is very different from many of their prior peers. They have different outlooks on religion, politics, philosophy, etc. One key difference in beliefs is their belief in marriage. Many of them simply don’t want to get married and have kids. As a result, they feel comfortable spending 40% to 50% of their income on housing. If you don’t have the obligation of marriage plus kids then you can comfortably get away with spending an inordinate amount of money on housing.

http://www.urban.org/sites/default/files/alfresco/publication-pdfs/413110-Fewer-Marriages-More-Divergence-Marriage-Projections-for-Millennials-to-Age-.PDF

Abstract- Declining marriage rates suggest a growing fraction of millennials will remain unmarried through age 40.

In this brief, we use data from the American Community Survey to estimate age-specific marriage rates

and project the percentage of millennials who will marry by age 40 in different scenarios. We find that the

percentage of millennials marrying by age 40 will fall lower than for any previous generation of

Americans, even in a scenario where marriage rates recover considerably. Moreover, marriage patterns

will continue to diverge by education and race, increasing the divides between mostly married “haves†and

increasingly single “have-notsâ€.

What choices do we have to take on 40% to 50% towards a mortgage, its all there is, we were born it this market. Lack of marriage and kids is our inability to provide and take on extra baggage.

We simply can’t keep up with what’s expected of us from our parents. How these two generations will bridge will be interesting.

I’d go a step further and surmise the high living costs are a natural feedback loop from an environment with too many people in a given space.

Life in SoCal for the bottom 99% is the crowded life.

Everyone wants to live here is actually a cost.

The community complex system working at all the levels is very much changed.

1. In connection to your main subject regarding to the style of living of present generation 20-35 years old statistically data showing that their buying power is very much reduced, compared to the generations of their parents. As result two important prob. Have been developed inside of inner society: a. The refusal act to take a big responsibility getting married; b. The refusal act to take the biggest responsibility to having a child.

We are judged our life’s in such a way that the next generation to have at least the same level of standard of living as we do, in particulars periods of time. Because as a theorems next generation must have a better standard of living compared to previously one.

I do not comment any of the causes which determined these phenomenon because of their complexity, interfere wrong or wanted features among gov.,private, justice etc connected to variety interests.

To solve few of the issues, having a globaly correction of present agenda,, on a short, midium and long plans could be:

A. Decreasing the vectors which correspond to rhitm of the implementation of information era, taking in plan the increased elders group of society.

B. Increase the role and available acces to most of the groups part of community to educational processes regarding information era.

C. A rational developing emmigrations and immigration plans, function of variety required issues, at the level of different global areas.

D. Increase by double control the accuracy to international iso requirements to validate almost all the machines and the soft parts integration by using identical informatics supports of data.

E. Increase the education principles regarding the Financial System, much more at the banks “fireworks ” kind of applying the rules and regulations stipulated in different papers and in accordance to the legally ĺaws in force.

F. Medically to be eliminated euthanasia all over the world, in such a way that every person to have the elementary human rights to die in a decent and respectful attitude.

All of the above are a minimum requirements of being knowledgeable regarding of our daily activities.

This place looks more like a one cell prison…. pay em and incarcerate yourself….free meals not included.

More perfect Southern Cal weather brings mudslides so severe a major freeway is closed!

Yes, and next week another heat wave, with Santa Ana winds and increased fire danger. Accessible, well maintained highways provide easy commutes to uncrowded, pristine beaches and mountain resorts where beautiful people surf, ski and relax. Maybe Charlie’s Angels will be surfing in Malibu? LOL.

Fucking santie Annies, man! I lived for a bit in a room in Huntington Beach and rode my motorcycle to Costa Mesa for work, would tuck in like a flat track racer on the straightaway and use trucks for a wind shield and would still get a bunch of sand in my hair.

Tempus fugit! Just a few streets east of Western, this block of Madison features four similar cottages in a row. I visited 700 N. Madison at the corner with Melrose during a crowded open house in 2006 when it had been totally rehabbed with an added loft sleeping area accessible only by ladder. Asking price was $399K; it sold for $400K. By May 2011, it was on the market again and sold for $150K – now I’d say that was a bargain even for this rather sketchy area but one that’s very close to LA City College.

That area was ratty forty years ago when I was going to LACC. Left the area in 82 and moved to West Hollywood before it incorporated and became a mini SF. Then to the Hollywood Hills near Bronson and worked in Silverlake occasionally and the area was even rattier.

An “urban pioneer” will be waiting a long time for gentrification. The ones from the 70s are probably dead by now or in a nursing home.

I have a friend that was born at Hollywood Presbyterian and grew up in the area. He said it was a dump even further back than my experiences with it.

Nice to know some things never change though.

Talk about a Shamelessly Greedy Flip: https://www.redfin.com/CA/Woodland-Hills/22040-De-La-Guerra-St-91364/home/4186400

This Woodland Hills house sold for $350k just ONE year ago. It’s now being offered for TWICE that — nearly $700k.

I know some work was done on it, but really? A $350k — 100% — price increase in one year?

How about 450% for six years in a shitty neighborhood?

https://www.redfin.com/CA/Los-Angeles/1739-W-53rd-St-90062/home/6863198

Even taking the dubious pro forma income in the agent remarks and factoring reasonable assumptions for operating expenses, the cash flow on this thing is a laugh. One would have to bank hard on appreciation to make it work. And the last bag holder took an ugly haircut on this turd. At least the homeless encampment street view shows next door when this place last defaulted appears to have been cleaned up–for now.

It really should be no surprise we keep seeing the same old ugly props brought out for the final act of this show, every time.

It’s not just an outlier or make me move scenario, this insanity is becoming increasingly common and we’ve seen it correlate more than once before with the tides beginning to recede. Might even make it out to that proverbial missed boat.

Another real homes of genius and the photographer could not be bothered to hide the trash cans…

Did anyone notice the big white building across the street from this house? Iglesia Todas Las Naciones. I don’t know about you, but it was always my dream to live next to a big Latino church.

“Si Se Pude!”…. “SI Se Puede!”…. “Si Se Puede!”

Hey they might be bitchin people with bitchin food who will have your back.

Here’s an ad for California livin’ created by some tourism dept: https://www.youtube.com/watch?v=0dIpiOs8bJQ

It promotes California Dreamin’. And I suppose it’s still true, for those who have a ton of money.

If you want to have a good dream about CA you must have at least 5 million net worth and good income (zero debt, too). If not, that dream is not going to be sweet; more like a nightmare.

I said this before and I was “boooed” on this forum, but I will say it again because it is the truth. I lived in SoCal before and I lived in many other places, including for many years overseas. SoCal has some nice areas with relative good weather and cleanER air but the prices are prohibitively expensive. You don’t need money just to buy the house but to maintain it and pay the property taxes for a nice house in a safe area. You don’t want to become a debt slave to the bank for 30 years because it is no fun to live the life a slave. You want to be able to sleep at night regardless of what the crooks on Wall Street are doing.

For those who disagree, please continue to live your slave life of SoCal and hopefully you will enjoy it. I didn’t.

Just arguing details here: The $5M figure Flyover uses seems way more than enough in most parts of SoCal. Maybe that’s the price of admission in a prime coastal enclave with $2M home values, but in other “nice” parts of SoCal it’s not nearly that expensive.

Go up the coast to Ventura County and you can find nice homes and live a comfortable life on something more like $2M (including home equity) – and still be in range to find entertainment in Hollywood or downtown LA if you must. I know because I’m preparing to retire in that area and have run the numbers. I realize that may still seem like an unreachable goal to many, but 20+ years of a good salary, steady investing and responsible spending could get many folks there by their 40s-50s.

Now certainly this number is lower still and more easily attainable in Flyover country, but it’s not yet out of reach for at least 10-20% of households in SoCal (what used to be called the upper middle class).

Flyover, you need to put down the pipe. Even the bears here will agree that living a good life in LA requires much less than a 5M net worth. If you truly have a 5M net worth, you are set for life. You never will have to work another day of your life, you can live wherever and do whatever your heart desires.

Apolitical,

You missed my assumptions. I did not talk strictly about buying a house. I was talking about freedom, safety, financial worries, quality of life and independence from banks, Wall Street crooks, and drive everyday in an horrible trafic and smog. In few words, what SOL was saying in CA DREAM commercial. Therefore, I was talking about a DREAM, a lifestyle which is so much more than buying a house and live the life of a slave to the bank. For me, being a slave is not a DREAM, but a nightmare. Others like to be slaves.

If I wake in the morning to sip a coffee with no debt whatsoever, in a nice new house with low maintenance, with income streams coming from multiple type of investments, to be free to go to the airport and fly where I like without asking a boss for permission, whenever I drive I’m not stuck in traffic breathing all the smog, to be next to outdoor lifestyle, is very important – far more important than living in an unsafe run down house in SoCal, afraid that I might lose a job, with constant stress that I can lose everything because of a mountain of debt.

As you can see, I mentioned lots of things which are hard to put a price on. Don’t read between the lines and don’t oversimplify what I was saying. Son of L. was taking about CA DREAM and I was saying that for most people under 5 mil. wealth, it is not a dream but more of a nightmare. The house is just a part of that dream.

flyover – i think i am a poor single version of you.

i value my time and freedom over a few extra fistful of dollars.

having a family is a full time job and i have none so i tell people i am semi-retired.

my parents are semi-dependent on me but at least i am not of the sandwich generation

my parents and i both have zero debt and we have a house in the ghetto and income property

Anyone in California thinking things are great needs a lobotomy, that would be me included.

My tax bill arrived yesterday to the tune of 10K. So even retired and debt free I would have a $825 tax bill to give the stupid liberals of San Francisco.

Man I wish my wife would move…California is not all that and as a lifelong Californian I can say things are getting worse not better. 6 members of our Southern California raised family are now out of the state…they ran fast as they could….

Signed please wife lets sell and get the hell out of this state…

Flyover – there are p!aces in Costa Mesa and Newport Beach that are in time stasis fie!ds. Years ago I knew there are places on the peninsula that were super cheap to rent because there’s NO NO NO parking. So what? You ride a bike, take the ferry which I have fond memories of, or get a moped. A Yamaha Vino is a sweet little scoot.

I need to age 3 more years and I can get into the cheap so called adult trailer park bonanza. Buy one for ten grand, pay $500 a month space rent in perpetuity, ride my bike out to the Pen and make 100s a day drawing folks

Be a crap hack artist and prosper! It’s worked for Bradford.

I had a tool shed bigger than that in two of my previous homes.

I know a guy in Gilbert, Arizona who has a tool shed bigger than your house.

He pays a high price though, he has to live in Gilbert, Arizona. I was there the day one of his daughters told him the nazi party was trying to recruit her.

http://www.ft.com/intl/cms/s/0/615907fe-6def-11e5-8171-ba1968cf791a.html#axzz3onFSrin3

article about venice beach becoming you know what

A few months I went to the old neighborhood that I onced lived as a child in Hollywood. My father had a low paying job and we lived in a Hollywood apartment complex, area wad, not safe at all. Today, the apartments that my family onced lived are now condos renting for $4000 a month. That was in the mid 90s when theit were “cholos” roaming around that neighborhood. Cities do change.

Better to be homeless in Hawaii then homeless in LA.

http://www.cnn.com/2015/10/17/us/hawaii-homeless-emergency/index.html

Hunan – I grew up in Hawaii. I know me some Hawaii.

The problem is a few thousand miles of ocean.

Repeated studies have shown, if people are going to live in the street, they home in on places they know. Overwhelmingly, homeless people in a given area, the homeless grew up there, spent years there, etc.

But Hawaii is different because people who are losing everything might spend their last bucks on a plane ticket there and then become homeless, lose their papers, can’t save up for a plane ticket home, and there they are.

I grew up there. I know the culture. I know how to fish and forage. I can grow taro and make poi, build a Hawaiian house, the whole schmeer.

But I was born in California, and my first choice to be street homeless would be the Newport Beach area, since I lived there as a toddler, as a teen, as an adult, and then as an o!der adult. I know all the nooks and crannies. I know the p!aces I can sleep undetected. I know where I can rent a cheap p!ace. I know where I can hustle, sell to, or otherwise entertain the tourists. I doubt I’d be on the streets for long.

Second choice is the bay area here. I know people and places.

Hawaii and Santa Cruz are known for transient, stranded homeless. But they are outliers.

Visited New England States a couple weeks ago and loved it. Went all over but I really liked NH, if my wife was willing I would move there. I work in taxes so it is not that easy for me to move and give up clients. If she was willing to carry the load for at least a year and pass the BAR there, I would move there in 2016.

Raised in OC and LA, as much as I love it here, it is becoming too expensive and you are getting a lower quality of life.

Live Free Or Die!

Ha! Yes that is what their Car Plates say

LOLZ. I know a people with Masters degrees in mechanical engineering working 60+ hours per week to barely scrape in 80K/year. A lot of which go to school debt.

Your aerospace fantasies are fun though. And yes, some managers make 150K+ after giving their lives to their jobs for several decades.

BBlaw – this. The guy I work for has no off switch. Day job, contracts, then his surplus biz I work for. Yeah he makes $150k but good god he works long hours.

I grossed $70k as an electronics scavenger requiring no degree, and given how things have changed, can double that at least doing silly comic books.

Leave a Reply to Bob Barb Law