The Heisei boom, financial trickery, and central bank voodoo – Can the U.S. support two lost decades? Japan asset bubble collapse solutions exported to the United States. 9 graphs showing troubling similarities.

The comparisons between the current real estate and debt debacles in Japan and the United States are hard to ignore. Not all horror stories of economic collapse follow the same script but it is hard to deny that we have incredible similarities and more mainstream articles are picking up on this trend. Take for example the current debt ceiling charade. It is amazing that we raised the debt ceiling with no subsequent changes to revenues and yet interest rates fell. Think about this on a more individual level. This is like a household who is spending beyond its means and suddenly raises its spending without any subsequent growth to income. Yet the fear spreading around the financial world still finds safety in the United States. At this point, it is better to store your money in the U.S. instead of Greece, England, Ireland, or Spain for example and the markets reflect this reality. Yet The U.S. is following a remarkably similar path to Japan’s lost two decades. As we approach our first lost decade it is important to examine what is happening on multiple fronts.

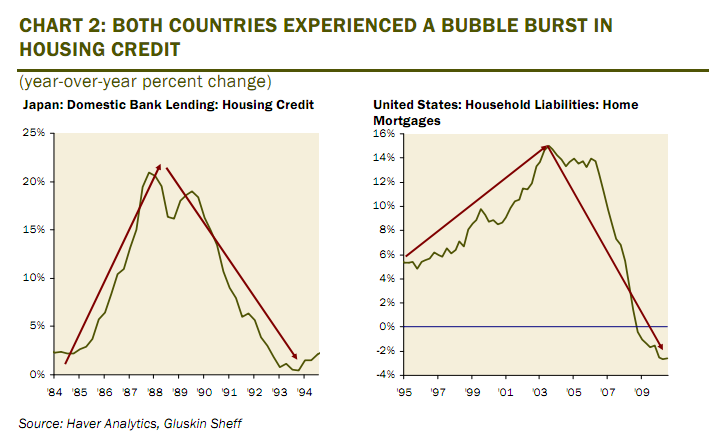

Japan and U.S. experience bubbles in home lending

Source:Â Gluskin Sheff

The U.S. and Japan both experienced unparalleled growth in bank lending to households to purchase real estate. In Japan this started in 1984 and collapsed in the early 1990s. In the U.S. the trend started in 1995 and collapsed in 2007. The collapse in the U.S. was actually more vicious once it hit. The only reason home prices have not contracted as severely in many areas is the emergence of shadow inventory on bank balance sheets. Japan had zombie banks and we have banks with shadow inventory but the comparison to the walking dead is very apt here. Both countries have insolvent banking systems and only through financial trickery and central bank voodoo can both systems pretend to be working. Yet both extract a toll on the productive sectors of the economy.

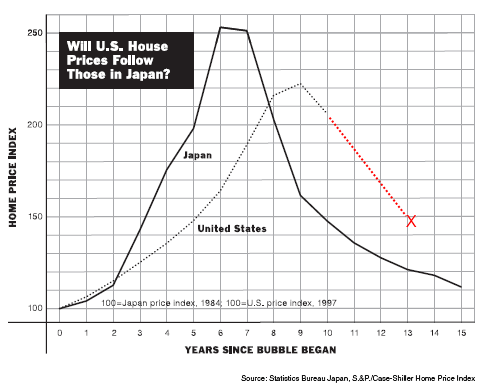

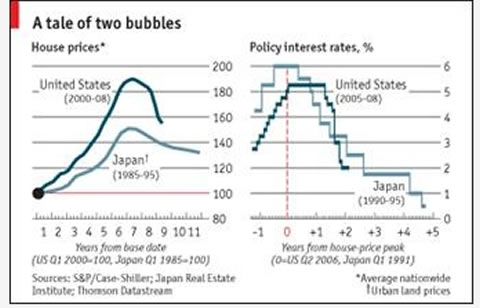

Real estate prices collapse in both countries

The collapse in housing prices has been similar in both countries and the path of each bubble seems extremely similar. For example, the above chart looks at Japan real estate starting in 1984 and aligns U.S. home prices starting in 1997. So a decade sets both bubbles apart but the path is unmistakable. Japan gave up all gains in their housing bubble bust and the U.S. housing market has yet to reach that trough. Does this mean a baseline of 1997 is where a true bottom will be reached? Hard to say yet there is little evidence to show for a rise in home prices. There is still over 6,000,000 homes in the shadow inventory that need to be liquidated at some point and will add pressure to home prices on the downside. In terms of bank housing lending collapsing and real estate values imploding we are two for two between Japan and the United States.

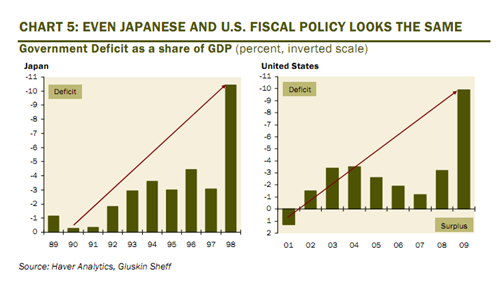

Japan and U.S. fiscal policy looks similar

Source:Â Gluskin Sheff

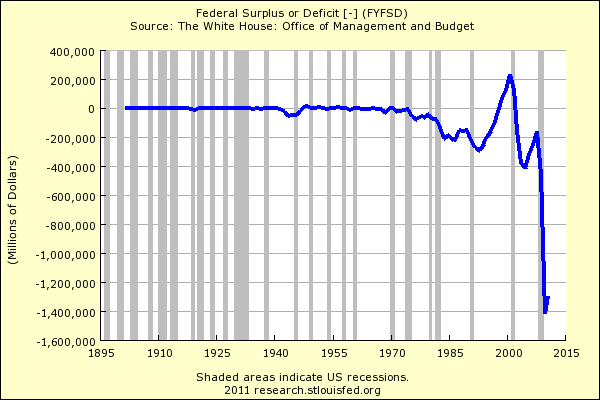

When bubbles burst a wide gap is left in the economy. Both the Bank of Japan and Federal Reserve stepped in and aided the banking systems of both countries but how well did this translate to helping the productive side of the economy? If the ultimate goal is to save the too big to fail banks then both central banks succeeded yet at what costs? Japan has now witnessed two lost decades while the U.S. is entering its first. Take a look at the above data. During the good years Japan was running a deficit of 1 to 3 percent. All of a sudden it was running deficits of 10 percent. The U.S. is running similar deficits and there is little evidence of a reversal here:

With GDP at roughly $14 trillion we are running a deficit of over 10 percent. So far the similarities between Japan’s lost decades and the United States seem to be following a very similar path.

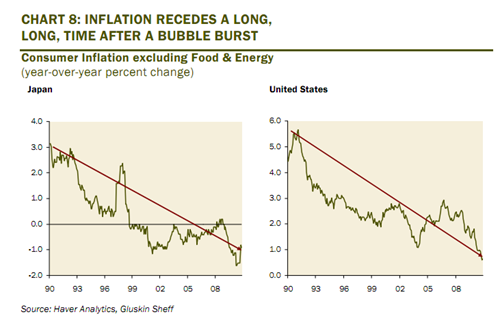

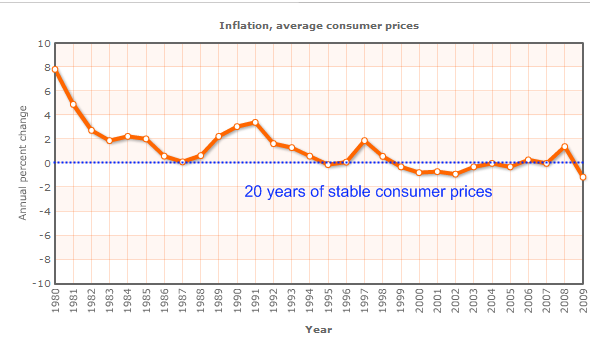

Pushing inflation lower at least as measured by government

This is an interesting pattern that is playing out here in the U.S. The crushing blow to housing has kept a lid on inflation as the economy contracts. The size of the bubble has kept inflation muted at least by how it is measured by the CPI. We’ve argued that the BLS does a very poor job at measuring the cost of housing by using an owner’s equivalent of rent but that is the system that is in place. As measured by both charts above, the bursting of the real estate market allowed each country’s central bank to save the banking system without causing dramatic inflation in the economy. Sure food, education, fuel, and healthcare went up in costs but who uses those things anyway? As measured by each government department, inflation has been contained in each country:

Part of this also has to do with the fear running through the global markets. People want to park their money in stable countries. You don’t see a rush of people buying up Greece or Spanish debt yet people are comfortable in Japanese and American debt. This is why as the debt ceiling “solution†was largely a kick the can down the road response money rushed into the U.S. markets and pushed mortgage rates even lower. Rates are so absurdly low yet this is doing very little to save the market. Why? Well we have 46,000,000 Americans on food stamps which doesn’t exactly seem like a good sign. Many Americans are first trying to deal with the employment market before trying to purchase a home.

The rise of part-time employment is also a very common theme in both countries. In Japan nearly one-third of the work force now works part-time or on a contractual basis yet is counted as fully employed. We have that similar issue here in the U.S. as our “part-time†category has shot through the roof. Headline unemployment is 9 percent but throw in the part-time looking for full work or those who have dropped out of the labor force and we have a figure above 16 percent.

Two decades of collapse

Japan is heading to a third lost decade which is hard to believe. The U.S without a doubt will have a lost decade. Even comparing stock markets we see problems ahead:

Source:Â Dshort.com

Japan’s Nikkei 225 index is down 78 percent from the peak reached 21 years ago! Our S&P 500 index is down 41 percent from where it was in 2000. I know many people discount the similarities between the two countries but you have many comparisons and the path each country is following is very similar:

-Central banks protect banks and turn them into zombies hiding assets in balance sheets

-Incredibly low rates for decades

-Stock market bubble followed by real estate bubble

-Rise of part-time employment workforce

-Drag on GDP

-Massive fiscal deficits

-Artificially low interest rates

-Inflation controlled in government measures

-Large aging populations

-Poorer younger generation

A big difference is the demographic argument and population growth. Yet I would argue that we have a mini-Japan like issue at hand with baby boomers entering into retirement. You have a wealthier previous generation trying to sell stocks and real estate to a poorer younger generation. No doubt, there will be demand for real estate but what we are seeing is demand for affordable housing, not massive debt built mansions. This is being played out here in the U.S. as there is little sign that we have a massive growing middle class emerging that will supplant the baby boomers. And one thing that we even have worse than Japan is our massive burden of student loans on Americans. The student debt market is now larger than the credit card market here in the U.S. Japan does not have a similar massive student loan market. So that is actually a larger negative that we have that Japan doesn’t. Just because you have a growing population means nothing if you can’t bring them into the middle class. Food stamp participation has shot up 70 percent in the last four years and now one out of every six Americans is on this program. Yet what isn’t brought up is that these were folks once not on food stamps. So we are pulling people from the middle class or the working poor deeper into the inequality and this is causing our system to stall and enforces government policy that simply protects the too big to fail banking sector.

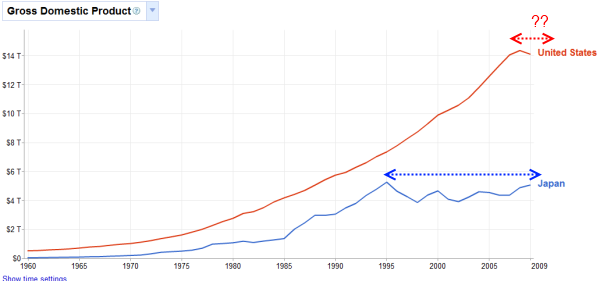

So far we’ve been in this crisis for four solid years and the path seems extremely similar with differences here and there. Japan’s multiple lost decades have hurt its overall economy:

Japan’s GDP growth has stalled since 1995. For the first time since the 1950s has the U.S. had a stall in GPD growth dragging out for four years. How much longer can this go? What similarities or differences do you see between the paths we are following?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

37 Responses to “The Heisei boom, financial trickery, and central bank voodoo – Can the U.S. support two lost decades? Japan asset bubble collapse solutions exported to the United States. 9 graphs showing troubling similarities.”

Doc,

A lot of the big boys think Da Bernank will print out of lack of options. Many of them believe Germany will leave the EU and the world’s Central Banks will be stuck printing in order to save the Euro (It will fail ainyways, too much misallocation of investment coupled with too many unproductive sheeple).

Some of the $%@# I am hearing from investment pros is horrifying.

Eventually confidence in the dollar will be lost (IMO by 2013) and gold/silver will be the one thing left that will hold value all over the world.

The dollar is doomed in Wall Streets’ eyes, as is most of the USofA due to inability to export.

Good luck housing flippers, you’re gonna need it!

This is one of your best posts ever. The comparisons are stunning. Now all we have left to complete the picture is for the U.S. to develop a fixation with high-tech toilets.

Forgive my ignorance, but if the dollar is worthless soon, wouldn’t a mortgage now be a good hedge against the collapsing dollar?

No it would not be a good hedge. Local home prices are based on local income unlike gold, for example, which is not based on local income, but rather global demand. There is no guarantee that your home value will increase when the dollar collapses, meaning weather the dollar collapses or not, your home is still worth the same amount. Therefore you are taking a loss in real terms. Gold, and large cap international stock with good steady dividends are much safer bets and more liquid as well. US treasuries notes used to be a good safe bet, but if we are talking about the collapse of the dollar then maybe that would not be a good idea. Wealth preservation is getting harder in this environment.

“Local home prices are based on local income”

There’s really only one exception to this and that’s for communities where the average homeowner is already wealthy and doesn’t depend upon a job for his sustenance. Thus, certain places like Bel-Air, the Hamptons, etc, will hold onto their value, as the well off need to congregate in safe areas, but for ordinary worker bee suburban sprawls, forget about it. Those will also experience long term deflation and in some overbuilt ex-burbs, even vacant developments with drug dealers moving in.

No, that’s a trap for suckers who only look at things superficially, and don’t see the entire picture of what’s going on.

First, the dollar isn’t going to be worthless any time soon. It will remain the Reserve currency. Yes, it will implode. All fiat currencies destruct. But first, Europe needs to collapse. Then, you’ll have a collapse of credit in the US. And THEN you can start watching for the collapse of the dollar. But that credit collapse is a HUGE hill that you need to surmount, and many will not be able to.

Credit is imploding, and has been for the past 3 years. This is bigger than the dollar. The money supply is almost entirely credit, and not currency (about 95% of it is credit). This has been collapsing since 2008, and no amount of QE has offset this. Nor can it without screwing things up in worse ways.

Having a mortgage during a credit collapse is like having a millstone tied around your feet. Cash is king during this time, and debt becomes extremely expensive. A 3% mortgage, when prices are going down 10% a year means effectively a 13% mortgage. This is during a time when you need cash the most. And prices will continue to collapse, since credit drives everything in our economy, from jobs, housing prices, and even delivering food to the stores where you buy it from.

AFTER all of the bad debts have been wrung out of the system, THEN you should look at getting a mortgage. We’ll be looking at hyperinflation then. But you need to be able to get to that point first. And for most, a mortgage is a trap, not a solution.

“Credit is imploding, and has been for the past 3 years. This is bigger than the dollar. The money supply is almost entirely credit, and not currency (about 95% of it is credit). This has been collapsing since 2008, and no amount of QE has offset this. Nor can it without screwing things up in worse ways.”

I’ll take CON-gress and Chairsatan Bernank continuing to print DEBT via QE and deficit spending for $250K Alex.

Seriously though, we’re drowning in available credit, it’s just the consumer for the most part is tapped-out and detoxing.

Trust me on this, once the tires stop spinning and the rubber hits the road you’re gonna get hyper-inflation in the dollar not seen since ol’ Tricky Dick debased the currency by removing Gold backing.

While it is true that EUROland will preceded us in collapse, it will only be a couple of weeks to months before we’re sucked into the black hole with them…

China now has World#1 GDP, and the extraction of WEALTH from the USofA is fait accompli, and the global banksters/politeers are laughing all the way to Zurich!

Inquistor: The numbers don’t back up the claim that “we’re drowning in available credit”. Not even close. Take a look at Z.1 for the big picture. And, if you break down the segments of credit growth, the only private growth has been in Student Loans. All other segments have been collapsing. The Fed has been trying to offset this, and its segment has of course grown. But the consumer is deleveraging, and credit strapped.

Worldwide, the known numbers in derivatives is over $600 Trillion. There is absolutely no way the Fed can prop up that house of cards when it falls. The Fed had enough trouble propping up the Shadow Banking system, and that was only about $50 Trillion at the time.

The fact remains that the past rounds of QE have been ineffective at stopping the destruction of available Credit. I agree that it will keep doing QE. But you’ll still keep seeing monetary deflation. Don’t confuse that with currency inflation, which is a small part of the money supply.

Questor – this is a great point which is lost on so many people. Monetary base gets borrowed repeatedly as it works its way through the system and this velocity develops into total money supply. Much of that old money supply is burned/burning/on fire/in danger of catching. We increased the monetary base in an effort to keep things constant and fight deflation – we have no remotely offset the capital destruction of 2007-2009. If you look at banks, their excess reserves are a joke – they will not be lent, they can’t be lent as their balance sheets are mismarked and there is no excess. If you look at reserves relative to non-performing loans (which are the mismarked assets) we are at a historically low level. There is no excess, we are still burning down old capital.

The other side of this is that the velocity transmission engine is broken. Consumers have no more capacity of borrow as the US employed this trick too many times and never backed off until it blew up in their faces. They are at debt saturation level and this is why Keynes stressed that it was necessary to pull back government/stimulus after an intervention period. Our government never once gave up the drugs and now we are at saturation at the consumer, federal, state/local levels which is a SUPER MESS. This is why you keep a relatively lean government and keep it to the essentials. They had a huge role in this forcing lending into ghetto areas, removing leverage limits on banks, allowing banks to leverage massively on a ‘securitized asset’ which was the same underlying as any mortgage loan. Stupid.

How long are you estimating for the mortgages to wrung out? And at what inflaiton rate?

Are we, in your opinion, going to hyperinflation, or just into a controlled stagflation?

The Yen isn’t worthless; the dollar definitely won’t be worthless for the next two decades or so. There is no way the Yuan or gold will be able to replace the dollar in the foreseeable future. I’m parking my assets in Agency REITs, cash, dividend-paying and growth stocks for the next two years. I understand gold and silver may still have a long way to go up and may even double in the next few years, but I’d rather be safe than sorry. In 1980, we thought it would be the end of the world and the dollar, and the gold bugs ended up getting crushed.

This isn’t 1980, and interest rates won’t be increasing until a NEW U.S. currency is initiated.

If you think U.S. GDP will be growing again in the next decade or two, you’re in for a rude awaking….

All of the various governments in the USA will be forced to skinny down employment….from Federal to Municipal. In many counties of CA, government is the biggest employment sector by far. These public sector workforce adjustments will be ongoing for the next several years. The only bright side is that some will transition into new jobs as privatization becomes mandatory for some government functions. However, the pay and benefits will not remotely align with the levels these workers have been accustomed to in the public sector. The result may very well be the underemployment ratio we currently see in Japan.

Without ongoing interventions, a prolonged stall in US GDP appears to be baked into the cake. I’ll make a bet that 2-3 successive quarters of flat or negative GDP will force the Fed to move forward with QE 3. That will commence the final death march for the dollar.

“All of the various governments in the USA will be forced to skinny down employment…”

Common sense and honest (pre-scam) accounting say yes, but the Keynesians running our world say NYET! Look at the growth in Federal employment over the last N years–plug in ANY number for N–i.e. it’s NEVER stopped, not even since the wake-up shout of 2007-08! Look for QEn to find its way to state and major metro coffers, and from there to crony hiring. Can’t enact the “Third Way” plan without legions of paid loyalists on the .gov tab. =:O

First I have to recognize this superior summary and effort, it gives the crux of important information but doesn’t bog down. To keep producing such efforts week after week, in such clear and engaging language utterly impresses me.

One thought: if ever your time allows, if multi-year charts are inflation adjusted is most helpful. Since time is short and digging out or making such charts is time intensive, just saying whether each chart is or isn’t adjusted, is usually sufficient (yeah, using the government’s wierd indexes). If you look at total US retail sales, it is a steady up number each year mostly, but when population and inflation indexed, or even better, quintiles adjusted, it shows support for your position AND the spooky difference proper inflation adjustment make (found such a set of charts by dshort for US inflation adjusted retail sales on that blog, for an example).

Mr. Obama appointed all of his economic advisors from Wall St.

Of course, it is no wonder that they could not imagine a world without AIG, Merrill Lynch, etc., and pulled out all the stops to save these firms.

Obama will be re-elected (GOP has no viable candidate that can defeat him), so we can expect much the same until 2016.

Obama re-elected? Ain’t gonna happen.

Perry will win.

~Misstrial

I would like to see the e-mails and phone records of Standard & Poor in the 48 hours prior to the “downgradeÂ.”

Bernanke is stealing from the Japanese Playbook. He wants to keep the zombie banks alive at all costs, in hopes that monetizing the debt will take care of everything…FOR THE BANKS. Meanwhile, Main Street suffers and is left out in the cold. Unfortunately for him, his bag of tricks isn’t working as consumer spending (3/4 of our economy) is in the toilet. His worst fear, deflation is here and will lower prices on everything. Especially real estate.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Bernanke and Krugman advised the Japanese Central Bank.

There is not wonder we will follow their path.

Also just outstanding work on this piece.

Doctor, I didn’t know why, but you didn’t include the fact that the Federal Reserve bought 80% of all treasury bonds. That is pretty scary, talk about a Ponzi scheme! Here is the link:

http://theeconomiccollapseblog.com/archives/ponzi-scheme-the-federal-reserve-bought-approximately-80-percent-of-u-s-treasury-securities-issued-in-2009

*BINGO*

Too late for the USofA, the collapse is already baked in via the Ivy League’s Ponzi scheme based on systemic expansion of credit and DEBT.

Good luck all, you’re gonna need it!

“A system of capitalism presumes sound money, not fiat money manipulated by a central bank. Capitalism cherishes voluntary contracts and interest rates that are determined by savings, not credit creation by a central bank.†– Ron Paul

All fiat currencies fail. Not one has stood the test of time. ALL have failed. Only gold and silver have stood the test of time. Gold has been acting very much like a currency much to the central bankers chagrin.

After gold and silver the best real estate to own in the coming collapse will be farm land with solid water rights. Better to own a 100 acres I can grow food on than a 3000 SF McMansion.

I know this may have been pointed out before and may not be exactly what you are referring to but in a true collapse, rule of law is gone so ownership of said land is going to be questionable and may pass to those who have the will and means to take it. This is how city-states were formed with some laws/agreements and a common army to enforce it. Expansive land is harder to defend so hopefully there’s organized and like-minded neighbors and such in your plan if you truly believe a collapse is coming. And don’t believe this is easy to defend, central keeps and fortifications were a big part of old school defense.

The other side of this is that the US will be last man standing and refuge for the entire free world before it goes. You will see massive negative interest rates if it comes to this because the entire world is going to go down in flames and everyone will rush to store a significant portion of their wealth here. Emerging market balance sheets are not so good unless you have someone to sell stuff too. Take for example the overwhelming majority of wealthy or newly wealthy families in Latin/South America. Many of these are families with ownership in both title and means to defend (just short of private army), and yet the first thing they do is establish a base within the US to store a large portion of their wealth. The reality is that while uncertainty is new to many Americans, they have lived with a measure of realistic uncertainty their whole lives and realize that in times of stress in the global sandbox, getting behind the biggest kid with the biggest stick and letting the rest of the chips fall where they may is a very viable strategy. Treasuries may have an uncertain real return in the future but that’s no different than gold because unless the world ends, you’ll get something back. In that same collapse environment, defending one’s physical gold is not without challenge and potential peril at revealing it to spend.

@constman. That is true. Funny thing is that farmland with water rights may be cheaper than a McMansion-well up until a year or two ago.

Sadly no one on this message board will be any better off than the masses…. Only the top .05% of the elite wealthy will survive. A renter wont be any better off than someone who buys a house now. All the renters money in the bank will be worthless or his atm card will stop working and banks will shut down. Atleast homeowners can squat easier than renters…. We will live in a society of squatters if home prices drop much further…. If the FED defaults on its debts… What will keep American middle class from paying their mortgages… If all homeowners stopped paying their mortgages and taxes and squatted… What would happen then? Do your charts account for that scenario!? Americans are much more rebellious than the meek Japanese culture…

Your scenario is happening right now to a small/unmeasured/ perhaps relevant degree!!

“If all homeowners stopped paying their mortgages and taxes and squatted…”

A giant chunk of the population would be employed by the banks as re-possessers! The banks will not let go of their assets without a fights, and an army of unemployed folk would get licenses, through fly-by-night trades schools in ‘Security” and then get hired by banks to eject the freeloaders. So I see that as the next boom industry. ‘Security” to protect the rich from ….us!

One issue that was not addressed was the job movement, japan outsourced much it’s labor(bought anything made in japan lately) as we did. This has led to the collapse of lower class incomes where the lower middle would move to when things slowed down. No jobs=no money=food stamps. Th idea we can exist without manufacturing jobs is a fools dream, not every one in this country qualifies for a MBA, though i think some of th people driving nails could have done a better job running the country than what we have now.

Sounds gloomy. But cheer up. The Mexicans(e.g. immigrants) are coming. They will flood the country and cause demands for consumer spending, and according to Obama’s economist, Paul Krugman, a lack of consumer spending is a major problem.

Also, Obama will open up that foreclosed home in your neighborhood to rent it out(subsidized rent) to at least 2 families. According to Paul Krugman’s economic world, this would all be good steps to recovery.

“according to Obama’s economist, Paul Krugman”

You’re kidding, right? Obama has never listened to one thing that Krugman has ever said or advised. If Obama had listened to Krugman, or Joseph Stiglitz and NOT Geithner and Summers, we’d be much better off by now.

You are so predictable and boring.

With inflation, or the value of the dollar now plummeting, would make American made products cheaper, and will bring oversea jobs back to the US. Isn’t that a good thing?? Why aren’t people arguing that point?

Dr. HB, thanks yet again for such a great and succinct summary. Someone else already commented on this and I fully agree. It is amazing that you’re able to continually deliver such high quality summaries on such a regular basis, which is clearly a LOT of work. Thanks very much for your efforts.

Stagflation – that’s what we have at the moment from a consumer’s (and investor’s) perspective. It’s very important to understand this concept if you want to understand what we’re going through right now. If this word isn’t familiar to you then I would recommend you take a look at the Wikipedia summary. With true inflation running at around 9% (based on pre-1982 government formulas) and current GDP growth at roughly 0% (and likely in slightly negative territory right now), we’re in the midst of stagflation that can very easily eat away at peoples’ savings. In fact, if you look at Japan for all of those years it was the same phenomenon. Roughly flat GDP growth with inflation at the same time. It’s vital to research and understand this so you can understand how to protect yourself (ie. target investments that are 10%+ post-tax in yield) and how not to protect yourself (leave your cash sitting in a bank account earning roughly 0% while inflation runs at 9%). I’m not going to address different ways to earn 10%+, as it is not on topic for this blog, but there are MANY ways to do so. It’s just a question of education and looking beyond your typical stocks/bonds (ie. how the rich invest). I am sure many of you reading think that it sounds “risky” when, in fact, it’s not – it’s just a question of education, networking, and time – TRUST ME (I have invested in alternative investments with a cash flow focus since 2002 so I know…). And besides, just how do you think the “rich” are getting ahead in these times when the middle and lower class are clearly being eroded. Well, I can tell you that it’s not by being in stocks (down since 2000) and it’s not by leaving money sitting in a savings account!

Back to the topic at hand. It’s VERY important to differentiate between the deflation that everyone is referring to here and inflation that consumers face. For example: In Japan, it is clear that some asset prices (ie. stocks, real estate) dropped over 80% from peak to trough. This is the deflation everyone is mentioning. At the SAME TIME, consumers faced inflation in their every day expenditures (ie. food, clothing, etc). This is EXACTLY what we’re facing here in the US today and will likely be facing for years to come. I find that many people don’t differentiate between these and if you don’t understand this dichotomy then you can really get burned as an investor or as someone who is just trying to get by.

In summary, as an investor and general person trying to get by, I am trying to avoid deflating asset classes (ie. stocks, real estate in general) while I am trying to TAKE ADVANTAGE of inflating or at least non-deflating areas (ie. rising commodities, rising ATM surcharge fees – yes – I own some ATMs, short-term heavily collateralized loans to very successful businesses because the banks won’t lend, etc). Surprisingly, this is possibly one of the best times EVER to be an individual, relatively small investor because we have become the bank for many very good companies and individuals and we can command high rates because of the lack of supply of funding. This is likely going to continue for years and will put those who understand this and act on this will be in a MUCH better position than those who are being eaten away by inflation thanks to their savings accounts and deflating stocks.

I have one more crucial comment: Don’t be fooled by thinking that, as a consumer, you’ll be ok if you maintain your current income and savings during these “deflationary” times. With inflation at 9%, while it helps to sidestep the deflating asset classes (ie. stocks, real estate, etc), you have to be sure to increase your net worth to keep up with true inflation while avoiding the deflating asset classes. If you’re not successful in achieving both of these goals then you will ultimately fall behind.

Good Luck To Everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

Hello Investor J

I am a cash buyer (waiting in the wings) for a house on the Westside and have come to appreciate DrHB such that I am now considering buying a small apt. building to live in AND collect rent on several units. In this way, I am never out of pocket again for utilities, taxes, etc. Isnt this a good hedge against inflation – buying an apt bldg to live in 1 unit (3bd,2ba) myself and rent out the rest. This gives me passive income for the rest of my life and Westside rents aren’t going down anytime soon. The only thing I give up is a yard in return for lifetime financial security. Also, agree with another previous post, if the ‘ship hits the sand’ (ie some kind of ekonomik collapse) it seems I am much better off in a place I own rather than rent….. thanks

Daniel,

I have a couple of quick comments. My comments below are limited without knowing the true numbers:

1) While in theory your idea of buying the building, living in a unit, and renting the others makes sense and is a generally good strategy, it will really depend on the numbers and the cash flow coverage (ie. NOI multiplier or Cap Rate) you achieve when buying the building. In other words, it’s a good idea if you achieve very high levels of cash flow, while it’s not such a good idea if your cash flow levels are relatively low, only because of both the opportunity cost of investing your money other ways and the fact that true inflation is running at 9%, which means that you’ll need to yield 9% post-tax on your entire investment to just keep up with cash flow. I honestly doubt that you’ll hit 9%+ cash flow on anything in your area (more likely 5-7%), which in theory would make it a bad deal in face of inflation and other opportunities out there.

2) Don’t confuse real estate with potential inflation protection right now. It’s extremely clear that real estate is a DEFLATING asset class right now (yes, there are some exceptions but your area is not one of them) and if we have further economic issues then it will continue to DEFLATE. See Japan’s history for a good example of what to expect. So, you might want to reconsider whether real estate is a good hedge against future economic uncertainty, at least as it relates to maintaining your original investment value. While it might be good for cash flow (although probably not good enough in your area), it’s probably not good for maintaining your principal.

3) One other quick note – Even though earning “some yield” might be better than no yield if you consider the argument that buying an individual home won’t yield any cash flow vs an apartment that will, when you look at the true expected yield from the apartment in your area then it’s likely that you’ll earn a BETTER yield and possibly have a higher probability of protecting your principal at the same via other investments. I guess what I’m trying to say here is don’t draw your line at some yield vs no yield. Be sure you consider the OPPORTUNITY COST so you take account other options that might be an even better use for the same level of investment.

I hope this helps.

Good luck to everyone,

Investor J

http://www.meetup.com/FIBICashFlowInvestors/

http://www.meetup.com/investing-363/

Our society de-emphasis in the so-called “hard sciences” has also some bearing on the current situation. We turned away from them too long ago. [Does anyone here remember the GE College Bowl?]

Then the MBA became the ticket to success. More and more went into finance. Pretty bad when even graduates in Physics and Math, from a powerhouse such as MIT, went to Wall Street, to concoct the fantastic tools, such as the sub-prime beauties.

In order to produce top products, the nation needs to have a scientifically literate population. We were tops in that area some time ago. We still have top universities, but they are becoming less and less reachable to much of our population, mainly due to costs.

I look forward to the day when again programs similar to the GE CB will command a respectable audience, a sign of the importance that it should have. But I not holding my breath.

Leave a Reply to surfaddict