The impending slow motion doom for housing – can the United States thrive with another decade long decline in home values?

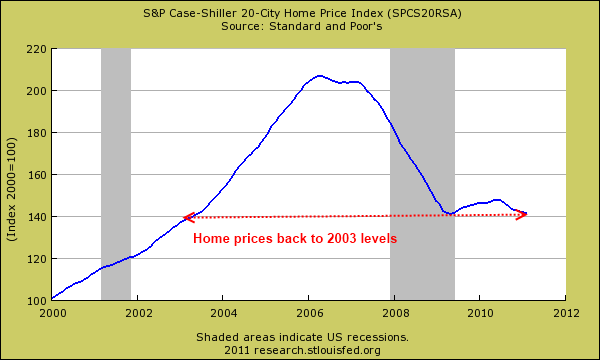

The real estate market is destined for a slow and painful adjustment for the upcoming decade. The demographic shift and also the reality that the current generation will be poorer than the baby boomers will make it difficult to sustain home values even at current levels. Our economy is largely driven by the financial sector and their asset of choice is real estate. Yet we are running out of options when it comes to keeping real estate values inflated. We’ve tried artificially low interest rates with the Federal Reserve buying up mortgage backed securities with no natural market demand. We’ve tried tax credits. We’ve even tried ignoring homeowners who miss mortgage payments as a method of artificially keeping supply low. Yet home prices continue to move lower in tandem with lower household incomes. Home prices in the U.S. are now back to 2003 levels painfully retracing a decade long boom. But as we are now realizing, no amount of financial engineering can come up with a free lunch.

Where the bubble lives

It is hard to believe that many large metro areas in the U.S. still sustain incredible housing bubbles:

Source:Â Department of Numbers

I think one of the largest conscious mistakes committed during the housing bubble was that of decoupling home price gains from real household income gains. Everything was focused on the supply side. If you built enough homes and you provided enough credit people would be willing to buy. This of course played out but was absolutely unsustainable and once the psychological mania ran out of fumes, the market came crumbling down. As the above chart highlights many areas have price-to-income ratios that are much higher than five. Three of the top four most overpriced metro areas are in California.

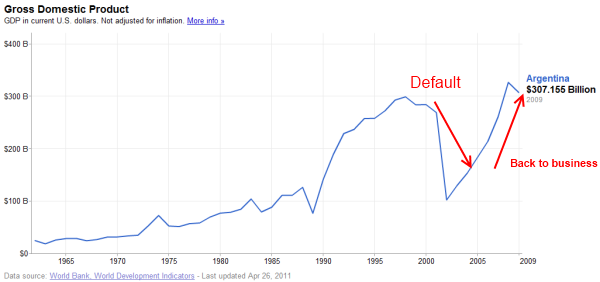

Just because people continue to buy does not mean there is no bubble. Bubbles pop in uncontrollable paths. As we are seeing, Greece is merely the first domino to fall in the perpetual debt machine of modern society. Yet Greece is not alone. Ironically countries that have defaulted on their debt (i.e., strategically default) have seen growth only a few years later:

Take a look at Argentina that defaulted on its commitments at the same time we jumped into our housing bubble. Greece might want to look at South America before making a large commitment to the banks just like Ireland did. The only reason I show the chart of Argentina is that Greece’s best bet may be to default and get their house back in financial order instead of saddling a generation with debts that will only go to payoff large banks. If they get their act together money will flow back in (just look at Iceland as well). The Federal Reserve is ultimately trying to keep housing prices inflated not because of good will to the people but because the banking system would be insolvent if we had to use a basic accounting rule of mark-to-market.

So far the Fed has gotten its way and this is the outcome:

Home prices across the nation are back to 2003 levels. As painful as this is, household incomes are stuck in the late 1990s so why should home prices be any higher? Ultimately people pay for their monthly expenses from a paycheck. To think that the world facing dramatic challenges like European debt issues or a real estate bubble in China that access to capital will remain cheap is somewhat naïve. It is only a matter of time that things adjust. Keep in mind that the only reason mortgage rates are at this level is because the Fed has purchased over one trillion dollars in mortgage backed securities.

People have a hard time visualizing two lost decades in housing values but Japan has been living in this scenario:

Run a quick check list between the two asset bubbles:

-Real estate prices outpacing income gains (check)

-Stock market bubble in connection with housing bubble (check)

-Central bank bailing out too big to fail banks (check)

-Bailouts only create zombie institutions yet prices continue to fall (check)

-Interest rates remain artificially low (check)

-Squeeze on most household incomes (check)

-Quantitative easing (check)

There are a lot of similarities and the paths we are following are similar. Some will point to low interest rates in Japan as a sign that we will have low interest rates moving forward. Not necessarily. The U.S. dollar is the dominant reserve currency. Have you seen what is going on in Washington about the debt ceiling? Both political parties are out to lunch so how does this instill faith around the world? It really doesn’t and our central bank is being looked at more closely by more and more people.

Preconceived notions can and do fall hard. Some of you may know the story of the Salton Sea here in Southern California:

The creation of the Salton Sea as we know it today was created in 1905 when heavy rains and overrun from the Colorado River poured into the Alamo Canal. The sudden influx of water and the inability to drain water caused the sea to form. In the 1950s, there was an attempt to make this area into a resort town and it actually enjoyed relative success during this time. Real estate speculators rushed in. Of course none of this materialized and it largely became an environmental challenge.

On the surface, success did seem possible. After all, Los Angeles and Orange County were being built out so why not go out a few hours more? It made sense on paper but of course that isn’t always how things play out. We are experiencing this with our housing market. An entire generation has never seen year-over-year nationwide home price declines outside of this housing bubble. The mantra “real estate never goes down†did hold some truth before this crisis in the minds of many.

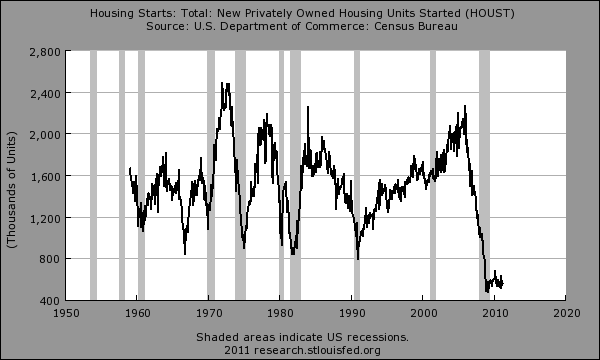

If we look at housing starts, we are still scratching the bottom of the barrel:

Those that are most sensitive to market changes in terms of building houses are seeing no need to build more homes. Given demographic shifts and the 6 million homes in the shadow inventory we are assured plenty of supply for years to come. But the real question centers on the ability of households to increase income which we have no evidence for because this comes from a large growth in good paying jobs and not burger flipping service sector work. We are seeing price increases in food, energy, and other items that have a global market. But real estate has to be consumed locally. When Japan was booming in the 1980s many thought that all of Hawaii and California would end up in the hands of Japanese investors. How did that turn out? Many were only interested in tiny boutique areas and not mid-tier areas like Culver City or Pasadena. Today memory has forgotten that time just like many speculators in the 1950s thought the Salton Sea would be a boom like Palm Springs.

Get comfortable for the next decade because home values will not be going up.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “The impending slow motion doom for housing – can the United States thrive with another decade long decline in home values?”

We became an pretend and extend society. Take more than one decade to change.

Yes, we could thrive with low real estate prices if only we would stop shoveling good money after bad into this black hole ,and let capital find the most productive industries, especially those that will provide us with the goods and services we will need in the era of fossil fuel decline.

Railroads and new power generation technologies such as the Liquid Flouride Thorium Reactor strongly suggest themselves. We will also need to repatriate our manufacturing as upward-ratcheting fuel prices shut down the 12,000 mile shipping lanes, and the “global” economy. Good capitalists will invest their capital in these industries and others that will help us cope with terminal fossil fuel depletion UNLESS we continue , by public policy, to steer available capital into dying industries, like production home building, suburban expansion, and our obsolete auto industry, that have no future in an era of conditions vastly different that those we have known for the past 60 years.

Railroads? You aren’t serious are you?

I am EXTREMELY serious about railroads, mainly because our fossil fuel supplies are in terminal decline,and within 10 years, most Americans will not be able to afford to own and run automobiles, and without railroads we will have no way for most people to get around.

However, as long as we are tossing $14 BILLION in subsidies a year at the fuel-guzzling, rapidly-failing airlines and continuing to promote and subsidize auto travel and the development of auto-centric suburban sprawl, while railroads labor under regulatory strangulation and tax policies designed in the 1950s expressly to destroy them… we will not have passenger railroads. But massive investment is being made in freight railroad already- wonder why Warren Buffet’s Berkshire Hathaway bought Burlington Northern? Because we will need the railroads very badly when over-the-road trucking becomes insupportable due to fuel prices.

The Chinese are extremely serious about railroads. They will have 15,000 miles of high speed rail by 2015. 200 mph rail!

We could do it too if we didn’t pour all our money into subsidies for Wall St. and to support the Natioal Security State to the tune of over $1 trillion/year.

Buffet bought railroads because of the massive tax exemptions and government subsidies that would come with it. Railroads in and of itself was not an enticing enough investment for Mr. Buffet. This also says a lot about the ‘strict’ regulations… there really aren’t any given the right context. Just a few legal loopholes to jump through

Why not? They’re still the most cost effective method of land transport over long distances, for both freight and passengers.

There’s a reason why so many developing countries are pouring money into high speed rail, and why other developed countries are shelling out to upgrade their old rail infrastructure.

Only the US seems to think rail as quaint and outdated. Which is burning irony – seeing as the US as a nation would look very different today without the construction of coast-to-coast rail back in the 19th century.

‘public policy’ is a well positioned (monied) lobby industry – please, don’t foist your disdain onto the public.

Sorry, I have to disagree with you about shipping. Shipping is extremely cost effective; more so than railroads. And the ships are just getting bigger. I agree that fossil fuel depletion and costs will have an impact. But ships will still win over railroads.

But yes, I agree that we need to move from our current financial economic phase back to the manufacturing phase. Produce it and ship it locally is what we need.

Trans-oceanic shipping can be revolutionized by using large air transport to cross roughly 7,000 miles to China from Los Angeles in roughly 25 hrs at low-altitude and 275 mph using “ground effects” to augment aerodynamic lift.

Compare to the average container ship requiring a large crew for about 2-1/2 months to make a round trip with an average of 435,000 tons going 25 mph on a much more larger and indirect route. (15,000 TEU –Twenty foot Equivalent Units)

There’s nothing technically impractical about such a system, but the political issues butt up against some of the oldest, wealthiest owners on the planet who have their hooves firmly planted in shipping and oil industries troughs. Boeing’s “heritage Douglas” engineers have been refining this concept for over 10 years now.

You can Wiki the Boeing Pelican: “…a large-capacity transport craft for military or civilian use, it would have a wingspan of 500 feet, a cargo capacity of 1,400 tons, and a range of about 10,000 nautical miles. Powered by four turboprop engines, its main mode would be to fly 20–50 ft (6–15 m) over water, though it would also be capable of overland flight at an altitude as high as 20,000 ft albeit with a decreased range of about 6,500 nautical miles. It would operate from conventional runways, with its weight distributed over 38 fuselage-mounted landing gears with 76 wheels…â€

–a former Boeing engineer of 16 years with the PhantomWorks

@Dennis: The question is what is the most cost effective transport when oil is at $500+ a barrel?

Just to be clear: W. Buffet bought a FREIGHT railroad.

Laura is advocating PASSENGER rail, incl. metro-area mass transit, in the USA, the one country where–due to our Constitution and customs–it can NEVER work. Why? Because what are the two common denominators that make mass transit work, whether in Mussolini’s Italy, Stalin’s Russia, or present-day Japan, China, and Singapore?

1) Homogeneous population;

and most importantly…

2) Bad Ass Transit Cops! (BATCs)

I’m sorry, but the ACLU (All Criminals Love Us) will not allow BATCops in the ol’ US of A, ergo, no mass transit, zip, nada, zilch. Don’t waste my money even trying. I’m not wearing a spendy Italian suit, or even nice slacks, and commuting to a white collar job, if I have to sit with the filthy and the ill-behaved, and no one else is either.

But hey, you add a few BATCops, with Tasers and truncheons, who will give the miscreants a sound thumping and toss them off like a sack of potatoes, and I’m buying a year-long pass, LOL! You need other BATCops at the stations, who, as in Japan and Singapore, will not let dirty, smelly, unwashed types even board the train in the first place, YAHOO! ;’)

Americans HAVE selected their mass transit–it’s called the automobile–we just have to keep making those autos smaller and cleaner and safer, and tax the hell out of those non-compliant gas hogs.

Every few years since we started to use oil, someone predicts that we have reached peak oil. Every time that happens we find a lot more. It may not be dinosaur goo. It may be the product of heat and pressure in the earth’s interior and being replenished all the time. It has been created that way in the lab.

When prices go up we pump more around here. When prices are down, some wells get capped. Go figure. 🙂

I read that if everyone who could work from home on the internet would, a third of the cars on the road everyday would no longer be necessary. Sounds reasonable.

It worked well in this home for years. Skipping the twice a day commute adds years to your life. Employers don’t need to claim you physically every day. It’s just a stupid habit perpetuated by incompetent, egotistical, power freaks. There are plenty of ways to supervise and monitor output that don’t involve standing over your shoulder. Telecommute. Less road repairs, less infrastructure, less building maintenance, heating and cooling. Less is more.

We built it but they didn’t come. At least not for work.

We haven’t given small diesel vehicles much of a chance yet. There were a few but they never gained acceptance for whatever reason. A combination of bio-diesel, and a 1.8 liter commuter car yielding upwards of 60 mpg could be a game changer. There are promising developments on the way. (They are not electric cars with the remote coal/natural gas/nuclear/wind/solar-fired option. Just my opinion given current battery technology. )

It doesn’t appear that we’ve even begun to conserve. Maybe because we don’t really have to yet?

Laura, don’t understand your love for railroads? Trains are a 18-19 century technology. For freight transportation, I would agree, but trucks are more competitive over the short hall – 500 miles or less. For passenger hauling, in the U.S., not competitive. There is no passenger rail system in the U.S. that is running without subsidies! Those of you who keep citing China, you don’t know the situation. The average Chinese makes a per capita income of under $3,000. Therefore, very few can afford a rail ticket. I’ve taken their super-bullet train and they are 75% empty. No one can afford the hefty prices. Europe is also heavily subsidized. Moreover, the population spread is completely different in Europe and China versus the U.S. The planned bullet train in CA will not be able to compete with Southwest from L.A. to S.F. or other airlines. Heck even bus companies are cheaper than trains.

I can definitely see a reason to love railroads. It is simply a more efficient mode of transportation. Sesame Street was the first place to teach me this. Put 10 people in 10 cars to get to school and you use X amount of gas. Put 10 people on a bus to get to school and use Y amount of gas.

I’m sure many of you live in LA, and you know there are way too many people driving in cars. (Unless you tell them it’s Carmageddon, and they all stay indoors.) Personally, I would love to see more mass transportation in this city. I would also love to “see” the city, but the damn smog gets in the way. Trains are simply a more efficient mode of transportation as compared to smaller (yet more convenient and maneuverable) vehicles.

Yes, the railroads are very efficient. Trucks make for more jobs. Not only the drivers, but also the workers who get to repair all the roads. Trucks cause about 30 times the damage that one car does to the road(we the taxpayers pay for the repairs in so many ways), not to mention all the Mexican truckers on our roads from Mexica(remember NAFTA) with their dangerous ill kept tractors.

Trucks should just be in the city and their trailers should go on RR cars. I don’t want to see them on 99 and 5. Their should also be no trucks on 710 from the harbor. Trucks contribute to air pollution in a big time way. Come to think of it, so does L.A.-Long Beach harbor. Wouldn’t bother me if they went down to Mexico and took the air pollution with them. How about those oil refineries down there?

Participate in local agriculture. No shipping or long distance trucking to bring you commercial foods laced with chemical fertilizer, pesticide, herbicide, antibiotics, steroids, hormones, antibiotic-resistant bacteria, and it pisses off the people we love to hate. Archer-Daniels-Midland, Cargill, Monsanto, oil companies……the food supply sucks. We can make it better, do business with our homies, and become more independent. Do we really need tomatoes that are grown downstream from a sewer plant in South America? Really?

Greece will default on it’s debt, and when other counties in similar condition realize that the sky does not fall in, they will follow suit. It is better to start with a clean slate, as Mish points out in his blog.

In the U.S. virtually no one will be getting real raises for the next 2 or 3 years.

This will have a tremendous effect on people thinking about the future, delaying purchases, driving older cars for a few more years, and avoiding the huge mansions like the plague.

Funny, what is the long term outlook for the Salton Sea? Farm and?

it’s a mess, can’t get funding for environmental assistance, but if it were drained the entire coachella valley would be uninhabitable – the air pollution created from the alkaline flats when the wind blows (and it always blows) would make it a toxic impossibility to breathe – so much for playing golf on all those great courses.

Dr. Bubble, Good article as always. I just have a question for you: Why do you always emphasize your articles in Culver City & Pasadena? I am just curious nothing more! I keep holding back on buying a home but here in the Santa Clarita Valley where I live homes prices just keep going up, Are home owners in denial or what? I check the MLS Almost ever day and homes are selling, lots of them have back offer on them and with all honesty it concern me, Am I making a mistake by waiting for the right time to buy? Sure you can buy a townhome/condo in the mid 200’s but most 3 bedrooms 2 baths homes up in the 400’s. 500’s and plus. My husband makes great money but I refuse to be slave to a mortgage but at the same time I don’t want to buy a condo. Thanks Dr. Keep up the good work!

I think he uses them because they are prime examples of cities still in major bubbles – – but, they are slowly deflating….I think!

yes, I would like to see a report on where Dr. thinks the LEAST risk investment wise is in SoCal, instead of focusing on the west side and Pasadena – we all know these places are ridiculously overpriced.

Overpriced for a reason: Westside JOBs and weather BLOWS away santa clarita etc.

overall santa clarita valley is down year over year. there might be certain pockets that are staying afloat. you’ll have to do your own research. there are resources online to help you break down the data by zip code. i’d tell you to wait too, but personally, if you can afford it and it fits within your financial plans for the future, a home makes a great emotional investment. the question is which will make you happier… owning a home to call your own, or some extra side cash to put towards your other pursuits. you can only pay so much rent before the difference in falling prices become marginal. good luck!

I hear you, Lucy. Dr. HB, I have a similar question about some pretty nice areas but not “super prime” – mainly, mid Wilshire areas like Miracle Mile/Beverly Grove/Carthay. These are communities filled with small old homes (I’m not talking about really prime areas like Beverly Hills/Holmby Hills/Hancock Park but rather areas adjacent to them) – either old 1900-1920 craftsmen and 1920-1940 Spanish, or post war shoe boxes, usually around 1500 square feet to maybe over 2000. If they are fully done up, they are still SELLING for $1.1 million! Junky ones sell for $800,000 plus!

What the hell is going on, where are all these idiots coming up with this sort of money STILL?

Exactly! I’m renting one of those Spanish duplexes for $1550/mo (2br/850 sq ft). It’s not the fanciest duplex and it’s at the Southern edge of Miracle Mile/Mid-City, but it’s a *great* rental in a walkable and transit-friendly neighborhood. I love the neighborhood and would be happy settling here, but down the block a non-duplex Spanish house (2br) is selling for $700K. There’s no way these houses aren’t overpriced, even if we did get a particularly great deal on rent.

The stock market has been doing quite nicely since 2008. There are successful IPOs. Corporate profits are doing great! This is the standard jobless recovery we’ve had over the last few recessions. Employment is doing poorly in part because it is government’s turn to shed a lot of jobs. When the recession hits, government continues on for a few years as if nothing happened, and just borrows money to cover the different. It may even spend more, in the name of stimulus. Eventually, however, reality hits the fan and it has to cut back like the private sector did, because tax receipts are way down. (In the last two years, US tax receipts are currently 14% of GDP, rather than the 18-19% of GDP they almost always have been since the ’50s.)

There is nothing new or spectacularly unusual about the current recession. It is largely unfolding as the others had. The main difference is that financial services bubbles take much longer to recover from because people don’t view bankruptcy as a good solution to the problem, unlike say a .com boom or a S&L crisis.

Lucy SCV home prices have been falling since 2005 and continue to fall. Those homes you talk about were $750k to $1mil, now they are down to what you see. Buy a smaller house than what you want and make it work.

Where are you looking? You can buy a 2500 to 3000 SF house in Castaic or Canyon Country for under 400K. I wouldn’t buy yet, but prices are falling….. everywhere in SC Valley. My next door neighbor hasn’t made a mortgage payment in over 2 years on a 999,000 loan, so prices will continue to fall……. for a long time to come. The shadow inventory in 91381 is HUGE.

Yes, constman, that is what I’m seeing too.

~Misstrial

Hi Lucy,

I don’t know if your post is a faux report or not since I watch the Santa Clarita Valley too (5 years now) and prices have dropped in many cases $100k-200k everywhere including Canyon Country, Valencia, Newhall, Saugus, as well as Santa Clarita.

Just a thought: There are desperate real estate agents who come onto message boards and give an intentionally false report on RE activity in one area or another in order to create false demand.

Just sayin’.

~Misstrial

Relax, be patient, eventually we can all pay off our notes with worthless dollars. It is all part of the master plan. There is no debt ceiling if you keep raising it: The sky is the limit!!

You must belive in the Tooth Fairy too!! lol

BTW- The FBI rates SCV it as the sixth safest city in the United States! Weather is great too, we may get hot days here and there but for the most part is wonderful, today for example low 80’s.

Salton City (the boom area of Salton Sea) was at the tail end of the last housing boom too. Back in 1960, the developers imagined a town of about 50,000 there, and built streets and utilities to serve them. Unfortunately, things didn’t work out, and they ran out of money before they’d built any actual tract houses to fill out their planned city. For 40 years, the area was just a curiosity and a joke, and I often drove around the empty streets for fun.

Then, in about 2005-2006, some new developers saw what was happening in the Palm Springs/Palm Desert area, and thought they’d be able to cash in (housing tracts were going up in a matter of weeks, and were being sold out before they were finished). They built houses in small developments (10-20 homes) on the existing lots. They sold some too.

Of course, when the wheels fell off the housing bubble train, Salton City was one of the first places to feel the pain. A lot of people realized that it was just too far to L.A. or even Riverside, and that living next to a giant cesspool full of agricultural runoff water is not exactly anyone’s vision of paradise. Although most days it isn’t too bad as long as the wind blows from the west, when the wind stops or shifts, you get bombarded by the smell of fertilizer and rotting fish and bird carcasses (there are regular fish and bird die-offs that no one has been fully able to explain).

So last year, a friend of mine who’s on disability bought a house in Salton City. The place was built in 2005, and sold for over $200k. It’s pretty nice by SoCal standards: 3br/2ba, 1500 sq.ft., tile roof, 2 car garage, and a rather large yard. He paid $45,000 in cash. He also established the new comps too (his one nearby neighbor across the street paid $90k the year before). Things have only gone downhill: now, you can pick up an almost identical house for less than $40k.

If you can stand the smell, the heat, the humidity, the remoteness, and the lack of services (it’s about 35 miles to either Brawley or Coachella, the nearest towns with anything in them, and about 50 miles to El Centro, the county seat), then maybe it could be the right place for you. You can use that 401k that used to be worth $100,000 and plunk down the full purchase price for a house in Southern California.

Yikes, and I thought Yuma AZ was bad:)

Unfortunately for you, I travel around the Salton Sea (Hwy 111) to go to Brawley and Yuma on business about once a year.

The Salton Sea (either side) is about 99 percent abandoned and taken over by sand and tumbleweeds.

I rarely use all caps, but in this instance, for consumer protection:

I DO NOT RECOMMEND THAT ANYONE BUY THERE UNDER ANY CIRCUMSTANCES.

THE PLACE IS ABANDONED AND ANYONE CAN BUY PROPERTIES ON EBAY.

SELLERS ARE DESPERATE TO UNLOAD. DO NOT BE VICTIMIZED BY THESE PEOPLE.

Thank you.

~Misstrial

I research the homes for sale in my area every week. The homes that are being sold or put on the market now is people who have lived here over 10 years and raised their kids and now are empty nesters. They are getting out while there is still a market. Hard to believe things could get any worse but the 20% drop is coming. Did anyone see the Shiller guy yesterday on Yahoo finance? If predictions come to roost next year the additional drop will happen and throw this market in yet another tailspin. Any homeowners looking to get out while they can is interesting. Everyone is still so interested on this blog on the right time to buy, what about non-distress sellers, or do you just ride it to the bottom? My guess anyone who owns a home for some time watched with disbelief their equity go down the drain and will not sale because renting is so unsettling. Burn through your equity and hope for better days? LOL, good luck with that one!

That was not Shiller of the Case/Shiller report, but rather Gary Shilling (he was also pimping his new book FWIW), but I believe it.

Yeah, Christie, I saw that interview. Everyone has been saying that Bill Gross, of PIMCO, is a genius for getting out of US Treasuries, but it is Shiller that is right so far. Shiller predicted that US Treasuries would increase in value (with declining yields).

And Shiller has been consistently right about the stock market and housing. It really seems like all the ducks are lined up for another big leg down for housing in the near future.

Oh, I watched in total disbelief as the value of my home went up up up in the middle of the decade. I thought maybe everyone had gone nuts, buying far more than they could afford. Then I thought maybe I was the one who was nuts, for buying only what I could afford. Then it all crashed.

Strangely enough, I was much less surprised by the drop than by the rise that had preceded it. I had experienced the late 1990’s tech boom first-hand, so I knew that things that rise irrationally often fall quite hard.

I haven’t sold yet, and I have no plans to sell anytime soon. If I buy something else, I’ll rent my current place out. I figure another bubble will eventually come along, since the powers that be have not let a decade go by without a bubble. I’ll try to sell into that.

Man I moved to Hawaii guys. The real estate prices are brutal out here. I’m just renting away as long as the job lasts while getting prepared to move on.

What I’ve seen in California is the markets are very polarized. You have areas around high paying govt contractor jobs staying up in stratosphere, while everything on the fringe has crashed to nothing.

Hawaii is going the slow burn route. I suspect as lots of old folks die off that vacancies will increase and eventually crash prices. Will take a long long time though. I doubt we are the retirement destination of choice anymore.

There is always the perpetual cry of the asian’s are going to save the market.

I was recently in Kauai and I couldn’t believe how many for sale signs I saw up on the North shore! All vacation homes, I bet.

Just as examples… Torrance CA… /sarcasm/ Perhaps the true jewel of southern california living with highly rated schools with only 35 students per teacher/sarcasm off/.

Torrance proper, not LA/Torrance P.O. 90501-90503… prices are north of 500k for a 4/3.. a few 3/2 nestled up to Hawthorne in North Torrance (aka the fringe of the hood).. are in the high 300s.

Meanwhile Temecula/Murrieta you can get a large 4/3 for under 200K, perhaps as low as 160K. That is 3x as expensive housing in Torrance.

Torrance’s bread and butter is military spending. If that gets cut, and it should take a major haircut, then all bets are off.

I’d note here that Temecula/Murrieta have decent schools, better class size and decent living conditions but it is far from the beach and cushy quasi-govt jobs at lockmart/TRW/NGC/Boeing/Raytheon…. There is also a lot of studio business over there as well.

Now, the govt could move that work to someplace like Riverside, or places east and new company’s could form and do BETTER work for maybe 50% of the cost. However, I suspect that liberal dems will keep feeding that monster.

Ideological flaming (e.g., “liberal dems”) serves no purpose on informative sites like DHB.

I’ve owned and rented in Torrance for years. Bread and butter industry isn’t military but automotive (Honda, Toyota, auto parts and aftermarket co’s, etc.). The population is 35% Asian (particularly new immigrants) and a growing % of overall pop, which keeps emphasis on education strong (true stereotype). Good SFH:multi-unit ratio. Also, police is uber vigilent and therefore it’s a safe place to live. It’s B-O-R-I-N-G, but a nice place to live and raise a family.

I don’t think Torrance is totally dependent on government contracts. Like was said, Torrance is safe, has good schools, close to job centers, centrally located and a huge Asian population that values education. This is no different than Irvine or Cerritos…all reasons why these cities have such sticky real estate prices.

Most young workers for all the aerospace companies couldn’t afford your standard Torrance 600K house anyway. Salaries in that industry have been stagnant for a long time, new hires get around 65 to 70K/year. That’s a far cry from living the good life in the South Bay.

The GOVT absolutely SHOULD MOVE to riverside (insert cheaper area here) vs south bay. Problem for me is, no surf out there, and its hotter than hell in the summertime…

Why do you have denigrate others who have a different policitical persausion then you on a blog about housing trends? It’s out of place and does nothing to support your argument. I’m a “liberal dem” who is also a “fiscal conservative” neither of which have anything to do with the Southern Cal real estate market. If you want to score political points you should go to a political blog.

“liberal dems?” I resemble that remark!

If you think that this is a Democrat or Republican issue, you really have absolutely no idea whatsoever as to what’s going on. And will be left wondering about why many things are happening. Good luck with that.

As long as we fight each other, they will continue winning. The fight is no longer left versus right but the wealthy elite against the middle class and the poor.

I lived in South Bay (Torrance/Hermosa/Redondo/PV) for most of my life and recently moved to Temecula/Murrieta for a couple years now so here is my opinion on what you’ve said:

– Education in South Bay is overrated. It’s good, but I can’t imagine it being *that* much better than anywhere else. We have had good teachers and bad teachers in that school system. In Murrieta, it’s just as good as far as I can tell.

– in Murrieta, you cannot get a good large 4/3 for under 200k – but you’re not that far off. You’re probably looking at mid 200’s to start but then you’d have a very under average house for the area and you know how it is… you don’t want to ever be under average esp if you’re already moving to an under average area you want to at least be average.

– Don’t get me wrong, the mid 200k’s are a phenomenal deal and I do like living out here more simply because for me the priority is my kids and being in a less stressful environment. However, whenever I am in Temecula, the congestion and poser materialism does make me feel like I’m back in a stressful environment. I don’t recommend moving out to this area unless you’re 1) willing to give up on any sort of bragging rights and accept humility because let’s face it… we’re the IE and will always be looked down on by OC, SD, LA. 2) willing to go through with social suicide 3) in a career situation in which you are not overly ambitious and either have a job near the area or working from home. Commuting will make all not worth while.

– South Bay is *NOT* a military industry area. If anything, Murrieta/Temecula certainly is. It is composed of I’d say MOSTLY military and LOTS of govt workers. Most of them commute to SD OC & LA. I know because when I do have to go into town, I take the Metrolink and the vast majority of the people on there are govt workers. South Bay is certainly a more economically diverse demographic.

– All said, I love it here in Murrieta but if money is no object, I wouldn’t live here. The stress level (in Murrieta and NOT Temecula) makes it all worth it. South Bay, esp Palos Verdes is where I’d aspire to live, if I didn’t have to drive in its traffic yet the stress levels and congestion is extremely high.

New construction in the NYC area seems to be on pace to set new records. In Queens in particular, new construction is increasing at a feverish pace. This all contrary to the national picture.

Well, YEAH, since the NYC Bank$ters are being GIVEN all of OUR cash, it’s going to at least partially sprout in their backyard… GRRRrrrr… 😡

I’d like to point out that if you look at historical rates – there is really no reason rates need to move up. Prior to the 1970s and going back 100 years we were mired in 3% land on long Treasuries (20 year roughly). We dropped below 4% in the mid 1860s and didn’t touch it again until the early 1920s where we hit 5% and promptly dropped below 4% for another 40 years until the late 1960s.

Most 50-60 year olds and certainly younger people only remember the high rates of the 1970s declining through the 80s, 90s and today. But the reality is that since 1865 the average was 4.3% (massively skewed up from the 70s/80s) and the median was 3.4%. Ask those same 50-60 year olds what their father’s mortgage was and you’ll get an answer in the 3% range.

Realize I’m not making a prediction about where rates are headed but a lot of people focus on the 1970s and decline to current levels and assume that rates must go back up to X%. In reality that whole run up/down was the historical anomaly and we’ve spent far more time at levels near current rates than those elevated ones people assume to be the norm. It’s also worth looking at what rates did after the last credit crisis and massive Debt/GDP runup (Depression through WWII) – these are the decades that produced steady 3-4% mortgages.

The interest % rate should be directly related to the relative risk of the instrument, should it not??

Yes, the interest rate should directly reflect the risk, but there are lots of types of risk. Default or risk of principle/equity loss is just one of them. For long term investments affected by inflation and overall interest rate environment, interest rate risk is a significant one. I certainly wouldn’t loan somebody money for 30 years at 5% if I thought there was a reasonable chance that interest rates might go up (substantially) above 5% during the term of the loan, regardless of how “good” of a credit risk they were in terms of default.

Only if you ignore the $300 Trillion in interest rate derivatives that the Exchange Stabilization Fund of the Treasury is backstopping, according to the recent OCC report.

The ESF is heavily manipulating all of the markets, as it sees fit. This is according to law, and also without any Congressional oversight whatsoever.

Rates aren’t going anywhere for a while. But eventually they will. AIG thought they could contain things too. But this time it’s the Treasury that’s put itself at risk of blowing up.

I completely agree that government interest rates were in the 3% range for a long time. But I disagree about the mortgage interest rates. Historically, I believe they were closer to 6% (I looked it up). That’s where the old joke about bankers being 3/6/3 people came from (a banker was supposed to borrow at 3%, lend at 6%, and be at the golf course by 3 PM).

Today’s 4.5% or less mortgage rates are a historical oddity, caused by government manipulation of the bond markets.

Lucy,

You’re doing fine by not buying. Houses are dropping in Santa Clarita like rocks…….thanks to the credit card materialistic culture up there. Everyone is finding out the hard lesson that they’re tapped out. No more toys and starbucks! Time to grow up!

Don’t take Starbucks away from us. You can get a tall drip in a grande cup. That’s what I get everyday. $1.50, and they put more coffee in it cause it’s a grande cup.

IT’s my only pleasure in life and an optional expense.

Those who get the fancy vente mocha cappucino’s and the other high-dollar drinks are suckers.

Yeah, really. Don’t blame the java!

I don’t understand the criticism of going to coffeehouses as a source of pleasure.

Compared to other pleasurable activities, it’s cheap. I used to go to Peet’s regularly…just ordered a regular tea but always had an enjoyable 1 or so reading or talking with others. That’s not very much to go to an uplifting place, I think.

Yes d1, But this happens all over California and other States I am sure! We all are materialistic people just some more than other’s, That’s why I don’t want to be have a big mortgage payment because I like to travel and see the world! Why would I want to have a beautiful home just to sit on it all day and watch the beautiful paint work and nice countertops? In my opinion that’s not the way to live your life!

One of my colleagues is from India and he said that in his home state in India, they have implemented basic healthcare. Many treatments like cancer etc are free for poor people. Middle class and rich still have to pay, but depending on income apparantely.

Maybe these things go in cycles. For centuries, India and China had the largest share of the world GDP and then went into long term decline that lasted centuries. Perhaps it is our turn now???

Those treatments aren’t free. Nothing is. Somebody, somewhere is paying for them.

Once again, the Doctor hits the note that MSM keeps ignoring: income. MSM talks about affordability, interest rates, relative prices, and tax incentives, but they still fail to mention that people can only afford to buy a house if it is no more than three times income.

We had a massive bubble. We now have a smaller bubble.

Prices will return to a level consistent with ability to buy. Additionally, the price-income ratio will mean-revert. This does NOT mean it will return to the mean; it means the mean will be respected by overshooting to the other side to balance out the equation.

Once the government handouts and banking nonsense are finished, we will see the median price to income ratio hit something around 2.75 or lower and stay there for three to four years.

That means a median price of $130 000 compared to about $165 000 today.

And, please, don’t bore me with how great your street, neighborhood, city is. I am talking about the national ratio.

Okay, then, I’ll defer making a purchase of a home until :

a. government has finished making handouts;

b. banks are honest again;

c. price /income ratio has gone down to 3 to 1.

Whichever comes first.

Or when the wifey says, “just do it”.

About a year ago, I thought it was the right time to buy or at least start getting serious about investing in a home of my own. The idea of renting and not getting anything out of it, as far as financial investment, was no longer a good idea for me. The bubble came, prices dropped, and all the “experts” from CNN to McDonalds said, “It’s a good time to buy”. If there was ever a time in my life where I would be given an opportunity to own a home I thought this would be it. It would be my 1st home and I naively thought the same rules applied.. 20% down payment, good credit, and a descent job would get me a loan that I could definitely afford. When I applied, I got turned down from 3 banks and a couple of maybe’s from some others. I thought if I increased the down-payment I would certainly get something. The maybe’s turned into no’s and their excuse was that my job was “unstable” simply because I’m an on-call employee working for a county that was laying off many people due to budget cuts, etc… . I didn’t relent and thought if I put down even more money for a lesser loan amount I could get something. The banks I spoke to told me that a lower amount would fall under the mortgage loan limits of 40k at some banks and 50k at others putting the amount of the loan into the “personal loan” category with higher interest rates. In addition, the same qualifications applied for obtaining the personal loan as for obtaining a mortgage loan. This experience only confirmed my belief that banks are only there to help the rich, not the hard-working tax-payer, who went to college, has good credit, and saved money for the “American dream” or which is, now, the American nightmare for many all because this banking system that i thought would help me. Am I stupid?? Maybe. But, not completely.

I’ve managed to save a little more since then and will be purchasing a condo with cash, using my original down-payment and whatever I can manage to scrape up by the time I’m ready to submit a serious offer. However, people are saying to wait. Mr. Shilling’s article and peoples comments are enforcing my intuition that I should wait and save more. But, the availability or selection seems slim. There’s only 6 or 7 condos to choose from in my price range and half of those have issues. The one or two good ones, that interest me, already have multiple offers on them. I thought there would be way more to choose from. My decision… keep waiting and saving.

I think your patience will be rewarded Mike, instant gratification can come with some serious remorse, as we’ve all seen. Just continue to save, save, save – that is never a bad thing, the peace of mind you derive from money set aside can’t be matched.

I can’t agree one bit with this. As a responsible renter/saver, I have serious remorse about being such. If I had been irresponsible and jumped into the house buying mania, I would’ve 1) lived in a sweet house for the past decade 2) pulled a shitload of $$ out of HELOC or 2nd/3rd mortgages to live like a rockstar 3) stopped paying and lived for 2-3 years (or MORE) without paying a dime in mortgage, all the way shoring up a ton of $$ to save to buy another house 4) as soon as current house price plummeted, took the money from HELOC and plowed into buying the foreclosed house across the street at market value and took a 150 point ding in my credit (big deal). 5) let the first house foreclose, keep ALL of my toys and great memories of being on vacation and the time I lived like a rockstar,

ALL the while, laughing at the responsible renter/savers who kept paying their taxes to bail out my speculation. Now, I have a shit ton of money in the savings from not making mortgage payments in 2 years, as WELL as a house which I bought at market value OR if I didn’t do that, I can wait 3 years and FHA will finance me for a home that IS at market value. All I got was a 150 point ding. BOohoo. Who are the suckers now, right? People who saved and rented.

Condo Mike- sounds like a good plan. I will never buy a condo because of the HOA and heighbors. The HOA just seems like another big tax to me that I have little control over and which will rise every year.

As someone trenchantly pointed out on this blog just a couple weeks ago, if you’re looking at ONE bedroom condos, you’re sinking your money into something with very little resale value down the road. i.e. the only buyers who want them are 20-somethings, and they (like you’re finding out) are the same buyers who have the most trouble getting a loan… result: the market for 1BR condos is even more ILLiquid than the other real estate out there… BEWARE duh 1BR condo… BEWARE duh HOA fees.

PS: Just for laughs, as a Real-Tard if you can deduct HOA fees on your federal income taxes!… you’d be surprised how many LIE and say yes!

I’m going to try that one for fun!

Look at this recent sale in a nice part of Pasadena…almost $2 Million for a 3/3!

http://www.redfin.com/CA/Pasadena/1220-S-Grand-Ave-91105/home/7187866

Are you kidding me with all this?? There’s never been a better time to buy! Interest rates are at historic lows, prices are down. The market is great!!

And I was thinking the term real-tard was disrespectful. ==:-O

I’m hoping it’s sarcasm!

Yes, prices are down! Unfortunately, they keep dropping, too.

This is a historic time though. How often is it that you can lose your down payment and be underwater within a year, if not months?

http://www.zillow.com/homedetails/34032-Winterberry-Ln-Lake-Elsinore-CA-92532/79485823_zpid/#{scid=hdp-site-map-bubble-address}

Foreclosed 2x within a couple years of each other. If you click around in this area its a bit humerus as all these homes sold in 2006. Its a lot more difficult to find a home in this area that didn’t go through foreclosure or some sort of “distressed sale” recently than one that did. House after house sold $370-400k in 2006 and house after house resold $150-180k 2010-2011.

Good and interesting article from the Good Dr. as always. But the Salton Sea as an example? I mean really, as someone who has

driven by there many times, its in the middle of nowhere. Its hot and close to nothing. Hard to believe anyone would have taken that seriously, which I am

aware they did.

I agree with Laura, we should be investing in rail.

@Dennis I don’t see how aircraf would be able to replace cargo ships. As someone who has flown in military aircraft both small and large, flying long distances over water

long distances over water at low attitude is not fun or safe. And cargo ship crews are not large at all.

I am so happy prices are dropping! As a potential homeowner, I am jumping for joy. In 2005, during the bubble, snotty real estate people and holier than though home owners wouldn’t even return my calls. When I managed to put in a bid, they literally laughed at my offer–laughed! They didn’t care that I was a struggling musician who worked as a public school teacher. Now, realtors and homeowners are calling me!

However, I treat them better than I was treated. I know they’re having hard times, and they still deserve compassion.

I hope the Good Doctor’s predictions are right, and prices stay low. When I buy my home, I plan on staying in it for decades. I don’t see buying a house as an investment, I see it as a home. In other words, when I leave, no matter what it sells for, my years in that house would have been worth the price of admission.

I am really glad for you and hope you get the home but let’s be honest shall we? Public school teacher’s in CA are doing well. I rent out apartments…and I have come across two public school teachers. Both of them pulled down close to 7 grand a month and, of course, all the benefits that go with it. They are doing very well, at least better than the most of us. So please, no who is me, “I am a public school teacher” when you make more than double the average wage in CA with great amazing benefits to boot.

You met two public school teachers and you assume we all make that kind of money? Puh-lease. They were probably principles in westside neighborhoods. In good times a public school teachers made nothing compared to a new secretary at a corporation. Those teachers had probably been working for a looooong time.

Did you know most public school teachers PAY OUT OF POCKET for school supplies for their students because state budgets are crunched?

Yup, you sound justr like those snooty homeowners I met during the bubble.

Granting the government a virtual monopoly in education may not turn out to be our brightest idea? Gee…whoda thunk they’d take advantage?

“Doing it for the children.” Many of us are starting on helping to pay for the 2nd, 3rd, 4th, 5th? generation of school kids through our taxes. It’s all for the benefit of society as a whole. More like a black hole for tax dollars. We need to revisit public education and put more of the burden on the people who bring these little snots into the world with little thought to how they are going to raise and educate them.

Oooo. Big news here. Brown signed SB 458. People who do short sales are off the hook now for recourse loans (second mortgages):

http://sacramentoshortsalecenter.housingstorm.com/2011/05/newest-anti-recourse-protection-on-second-mortgages-in-california/

“The bill would prevent holders of second mortgages from pursuing a judgment on a borrower for unpaid debt after a short sale. That prohibition of any deficiency judgment already applies to holders of first mortgages in California.”

Now, they just have to worry about the IRS after next year, or if they used the money for non-house related expenses.

Sorry to pop the “Argentina as model” bubble here but [from a Congressional Research Service study published in 2010] “Ultimately, Argentina’s debt restructuring was costly for all parties, raising a lingering question of whether it represents a new template for debtor countries in the future. For many reasons, it arguably is not. Perhaps the major lesson for Argentina is that a perpetual disregard for fiscal responsibility can have dramatic long-term economic, social, and political consequences. At the financial level, the costs to Argentina have been severe, particularly its inability to access international credit markets. This cost was compounded by Argentina’s resorting to creative, but

unorthodox financing mechanisms that could not adequately replace conventional financial

arrangements. If the new debt restructuring [i.e. dealing with the holdouts to the original take-it-or-leave-it unilateral “restructuring”] allows Argentina access to international credit, the bonds likely will carry higher interest rates than many other countries. This situation does not seem like a desirable model for other countries contemplating a sovereign default.” Let’s repeat that “perpetual disregard for fiscal responsibility.” If that accurately describes Argentina, it goes in spades for Greece.

Leave a Reply