California renters will come out ahead with new tax plan while homeowners will see a higher tax bill under GOP plan.

You constantly hear that owning a home is a no brainer in California because you will always get major tax benefits. Well the new GOP tax plan is actually going to benefit California renters while California homeowners in crap shacks will see higher tax bills. It is an interesting tax proposal because the typical US household owning a typical $200,000 home is going to come out ahead. This is your bread and butter “American†family. However, Taco Tuesday Baby Boomers and Gen X’rs in California have been getting mega subsidies for buying hyper expensive crap shacks. Every tax bill that comes out seems to favor homeowners. In fact, I haven’t seen one that hasn’t favored homeownership. But the way the tax bill is setup, crap shack owners are going to actually have to pay more and renters are going to benefit nicely from the much larger standard deduction. We are now seeing some scenarios where this is playing out.

Crap shacks getting more expensive Â

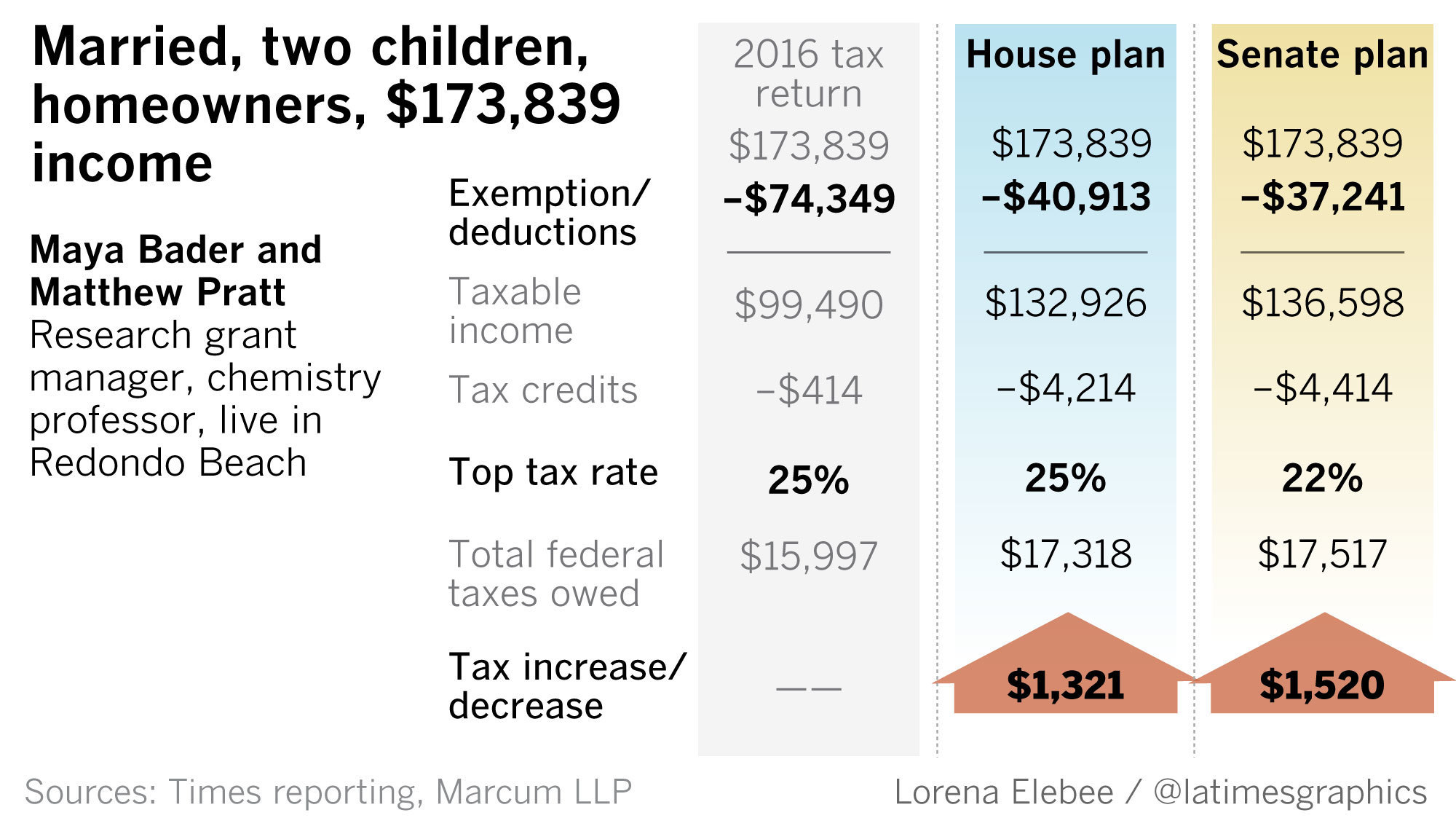

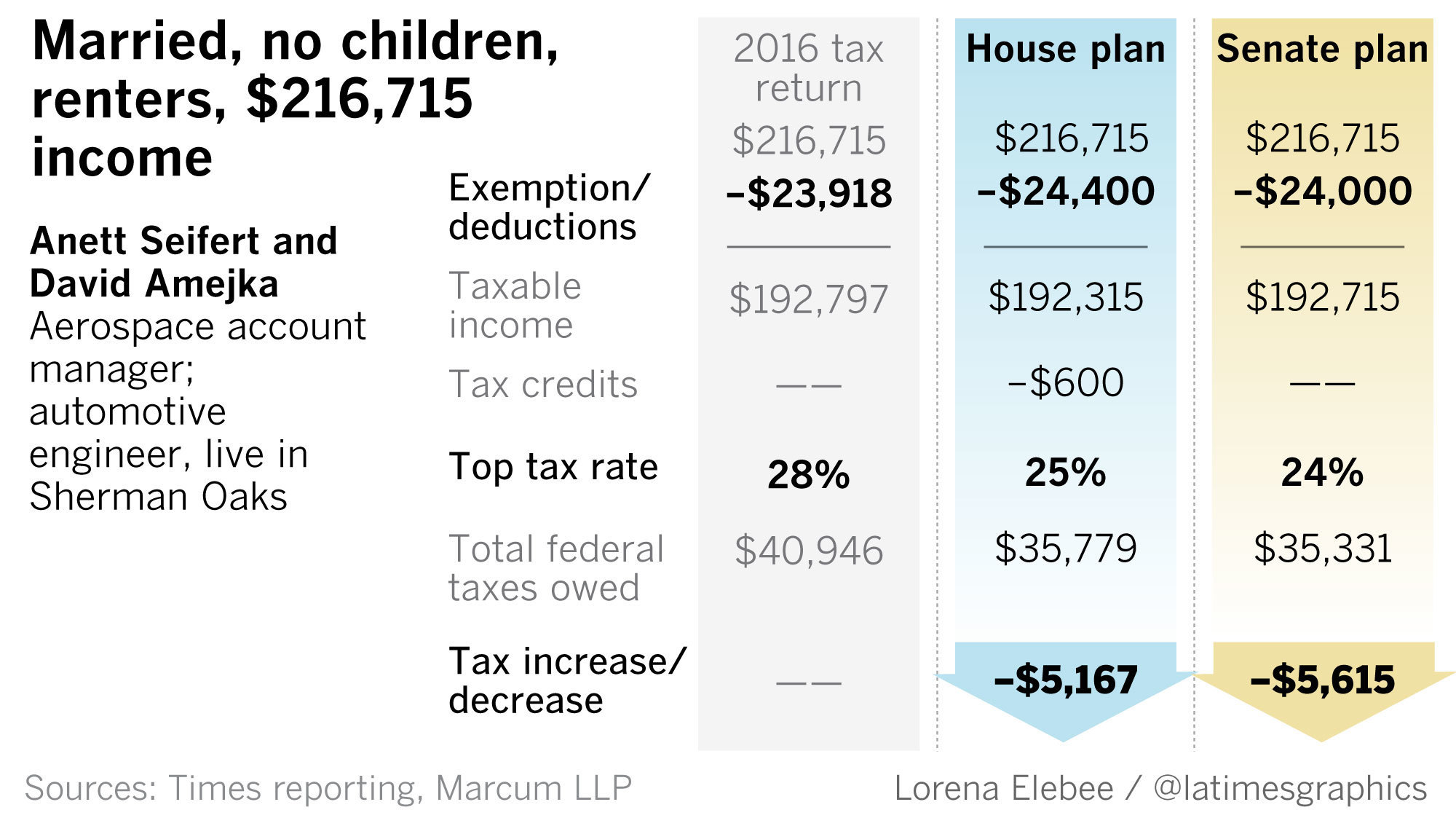

The L.A. Times has a piece where they examine various households in regards to the proposed tax plan. In one example you have a professional couple that bought a crap shack in Redondo Beach (3 bedrooms and 2 bathrooms – your standard million-dollar SoCal home). They paid $915,000 for the place back in 2016. They are going to see an increase in their tax bill:

So there goes the argument that every piece of legislation actually benefits homeowners. Not in this case and in many other cases where people over paid for crap shacks. But what about “poor†renters? There is another scenario presented in the L.A. Times with a professional couple that earns even more than the high income professional homeowner couple:

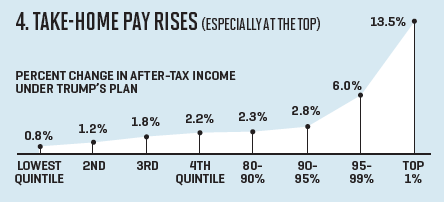

You mean the GOP and Trump are friends of California renters? Not that they care or even spend two seconds thinking about people in SoCal but the way this tax plan is setup, crap shack owners are the folks who will take it in the shorts the most. The top one percent is going to make out like bandits of course:

Welcome to the new world of politics where fake news dominates and the GOP is actually going to help out California renters thanks to their own selfish interest (but both parties are selfish so don’t delude yourself). I think it is ridiculous that people get tribal and think in terms of “blue†and “red†teams because in the end, it is a divide and conquer strategy. A lot of folks in L.A. and O.C. that voted for Trump, those dual income households are going to see their tax bills going up because of their crap shack obsession. Our deficit continues to soar and people are diving deep into crypto-currencies.

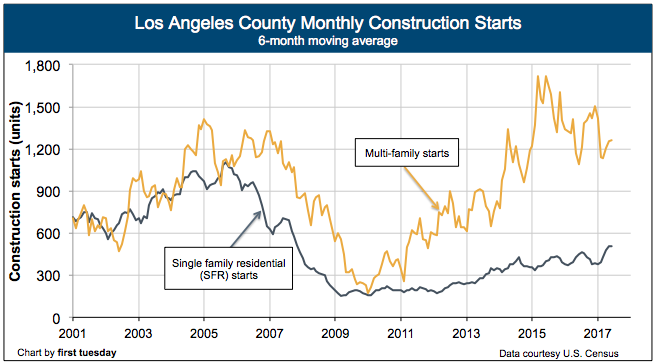

And we are going to add many more renter households in L.A. County. Just look at where all the building permits are going:

But guess what? These are the households that will start benefitting under the new tax plan. Is this a secret ploy to turn California blue? Not a chance. Just like Alabama went blue recently, there is so much at play that things are happening unintentionally here. If you want to think deeper, many dual income professional households would lean “blue†but these aren’t your uber-rich households. So this may be part of the overall strategy.

2018 is going to be an interesting year but what year isn’t? You have rockets flying out of SoCal and people thinking we are being visited by UFOs.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

169 Responses to “California renters will come out ahead with new tax plan while homeowners will see a higher tax bill under GOP plan.”

Figures. On the fence for so many years and finally bought my 1.2 Mill crap shack in the South Bay and now this. I hedged the bet by telling myself that I would live in the house for at least 10 years.

Long before 10 years are up, this nightmare will be over and you will be OK

Buying a $1.2 Mill crap shack in the South Bay near the refineries and the barrios of South Central LA sounds like a nightmare to me.

Well, as long as you didn’t buy all cash and had a small down payment, you can’t get hurt too bad with cali homeownership (that is, as long as it’s not a major part of your net worth – the downpayment). Look up anti-deficiency statutes. Selling your home at a loss, sure you lose the down payment (or portion) and any prior imaginary gains, but it’s not the nightmare of being liable for paying the entire balance as it is in other states.

You shouldn’t have ANY of your own money invested in a million dollar crap shack in a rolleer coaster market. As soon as the value goes up, get a HELOC or refinance to get your down payment back. Keep your savings, investments, and all that separate from the house. If/when the market crashes, just walk. Email the bank and tell them the keys are on the kitchen counter. Just walk. And take your money with you.

roddy6667: “You shouldn’t have ANY of your own money invested in a million dollar crap shack …”

It’s not an investment. It’s a home.

You shouldn’t think of your house as an investment. It’s a place to live and enjoy life. And it’s best to own it completely, debt free.

If you own your house, debt free, then you needn’t worry (as much) about inflation or a financial crisis or job loss.

No money down and your mortgage runs $6000/Month for that $1.2M home plus another $1200/Month in Property tax. I hope you enjoy your place for $7200/Month.

Someone needs a geography lesson

Howz that property tax feel?

that’s $1,250 a month in just property taxes……Jesus!!!!

Try the calculator. You’re probably OK.

http://www.wsj.com/graphics/republican-tax-plan-calculator/

Mr. Landlord askes, “Who are The Powers That Be (TPTB)?”‘

Obviously, Janet Yellen is the most important member of the group. Obama and Hillary Clinton are clearly members. I doubt that Trump is a member because they do not trust him. Probably all of the CEO’s of the largest American banks are also members.

TPTB are bankers, industrialists, the very rich (oligarchs), the Fed, the Deep State and various investment groups. I will never forget the time when President Bush was giving a speech to a group of businessmen and bankers. As he was speaking, one of the hosts (a banker) walked up to him and whispered in his ear, “Shop talking; you are taking too long.†Following orders, President Bush immediately ended his speech. That incident, among others, demonstrates who are really in charge of the government.

TPTB know in advance what the Fed and large banks are going to do so that they can position themselves so as to maximize profits during crashes. One of their goals is gain an ever increasing share of the American single home market so that more and more people are forced to become renters and TPTB can then set monopolistic, high rents.

TPTB have slowly been gaining control the Federal Government as the recent tax law changes demonstrate. That law was largely written by TPTB.

I could go along with the whole TPTB thing, as in it wouldn’t surprise me, but I think it’s more likely that the government is simply too big and has too many tentacles for any one group to control. Everyone just hitches on and takes advantage where they can – from a desk jockey making $150k for a job that would pay half that in the real world, to a banker who is on a board that makes decisions based on whatever their real revenue stream is. Those guys are thinking about their next sailing trip down the east coast, not world domination. What good is having $100b and control of an entire industry or multiple countries, when you already have $2b and a home in all your favorite paradises? Not much, except more stress.

The mention of Hillary and Obama only made me chuckle. Somehow I can’t see either one of them in some secret society meeting giving a toast – “Ladies and gentlemen, to Evil!” Hillary isn’t smart enough and Obama is just too tired.

This article is fake news. The two kids deduction is a major reason the homeowner paid more taxes in the above example. The analysis also paid a numbers game by selecting the worst situation for the homeowner … while the best for the renters. The dependent deduction, as well as the income level was selected to convince people renting is better. The la times will do anything to drive home prices lower.

The LA TIMES will do anything to show Trump is an evil evil man is more like it.

You’re right they found the most extreme example of both renters and home owners and then implied that they are the “typical family”. Which is pure BS. I want to know what couple makes $173K and has $75K deductions?

The typical family in SoCal makes $150K, has 2 kids and a mortgage of about $500K. Plug that into their analysis and they come out paying less federal tax.

Agreed 100%. The example they gave was very misleading. Your typical socal working stiff family does NOT make 200K per year and buy 900K plus houses. These guys cherry picked extreme examples showing how homeowners would be hurt and renters come out ahead. More money in the paychecks of renters is always a good thing…especially if you are a landlord!

More money in the pockets of renters doesn’t mean more demand vs supply.

This type of news feels like it was something the NAR might conjure up to drive sales and I think it was targeted at the six figure income parties. Why would they not bring up lower incomes to show what an average 5 figure income might see from this?

I saw a piece from a wall street firm that indicated high end homes would do well under the tax plan. This is contrary to what we have been told by lefties. Why? Because, a large percentage of high end homes are sold to high income people … and those people tend to be business owners. Business owners will see much larger paychecks after taxes, so more will flow into housing regardless of reduced homeowner deductions. Do you actually think higher income people will mix with the losers in rental housing? Not a chance.

“Business owners will see much larger paychecks after taxes”

how’s that? Many business owners are sole proprietorships as am I. The new corporate tax reduction MAY give me an incentive to incorporate so we’ll see about that but many here sure make a lot of assumptions

Pass through businesses received a 20% reduction.

S-Corp, LLC, LLP

Essentially they pay personal tax rates on the net income of the business as taht income flows through to the personal 1040’s. That income is now subject to a 20% reduction which is pretty huge.

While I would it if every Californian paid $20K more in taxes every year, this analysis is BS. A couple earning $173K does not have $75K of SALT and MID deductions. That’s ridiculous and is LITERALLY fake news.

And why is this analysis using both the house and senate plans? There is no house/senate plan anymore. It’s one passed bill. I guess this “analysis” was done a month or so ago when there were still competing bills? So again, fake news.

The tax code favors renting out your primary to rent someone else’s former primary residence at the very high price points.

“renting out your primary to rent out someone else’s former primary residence” I hadn’t thought of that, but it makes sense. Two households with similar housing expenses could claim to rent from each other (on paper) without actually moving. They would have to declare the fake rent, but could deduct insurance, maintenance, and depreciation.

That’s called fraud

Better hope you don’t get audited.

That’s not hard to pull off actually, only thing that would stop you would be the city, county transfer fees. That’s only a few grand though.

Also, suspect that there will be a cottage business transferring ownership of expensive home to llc and perhaps even offshore corporations.

Yeah, people who can afford higher end properties will really rent our their residence and rent something else to save couple hundred bucks a month. 🙂

Very true. Just like I think people that can afford a million dollar property aint that worried about the MID.

It would be nice to have; but, someone looking at 1mil+ homes are not going to cut their search by a few hundred k; just to sneak that loan in under 750k.

Dan, of course it”s fraud, but don’t think people wont try it.

Surge, it could be more than “a couple hundred bucks a month” for someone with a million dollar mortgage, $12000.00 plus in property taxes, and thousands in state income taxes. Association fees would also be deductible.

Even a grand a month not worth the risk it for people owning such homes.

It is a poor man’s mentality

“In real terms, prices are back to mid 2004 levels, and the price-to-rent ratio is back to 2003 – and the price-to-rent ratio has been increasing slowly”

http://www.calculatedriskblog.com/2017/12/real-house-prices-and-price-to-rent.html

and meanwhile median income just got back to 1999 levels……facepalm.

I’m in hell and have had no way to raise prices for over 20 years so housing needs to get back to 1997 levels on my planet and in my world. Fat chance.

I am a homeowner, I purchased my home in 2012 for $470K. My annnual taxes are about $6K. My annual salary is about $90K. My taxes will go up slightly but me being in about the 88th percentile of income, my taxes will be less. Sounds like for me, there will be slightly higher property taxes but less income taxed. Sounds like a slight gain in income or the two will even each other out??? Thanks.

At $90K income and $6K property tax you will come out well ahead. Remember the standard deduction is doubled, so any limits on your SALT above $10K will be offset by the higher standard. Not only will you pay less in tax, you will spend less time doing your taxes since you no longer have to itemize.

how the hell do you manage $6K in taxes on $90K income?

I was $50K in taxable income in 2016 and paid $14K in federal income taxes…..I have to pay both sides of the SS tax BTW.

pretty sure that 6k figure was referring strictly to annual property tax amount.

California realtors are sponsoring a ballot proposition to expand Prop 13 protections: https://www.ocregister.com/2017/11/27/california-realtors-launch-ballot-drive-to-expand-prop-13-for-senior-homeowners/

An overhaul of Proposition 13, California’s landmark tax-control measure, could go before state voters next year under a plan adopted last month by the California Association of Realtors.

The trade group is launching a signature drive to put a new proposition on the November 2018 ballot that would expand tax breaks for homeowners age 55 and older or those who are disabled.

If passed, the proposition would allow senior and disabled homeowners to transfer their low, existing Prop. 13 tax assessment to a new home anywhere in the state, using the option as often as they choose and paying any price for their new home.

Realtors say the provisions would help older owners “locked in their homes†because they’re reluctant to give up low Prop. 13 tax assessments when buying a new residence. Realtors maintain at least 70 percent of seniors haven’t moved in 17 years.

Wonder if California voters will pass it?

The union goons that retire multi millionaires at 55 will spend the cash to pass it, easy-peasy. People will always make moves to screw over the next generation – sad but true.

Friend of mine’s Dad works as a longshoreman. Dont even need a high school education, making a hefty 6 figures, work a few days a week and if you only work one hour a day you get paid for all 8. He told me the insurance companies love the longshoreman and compete hard for their business – promising health insurance not just for their employees and kids but even their grandchildren!

Wouldn’t surprise me if voters passed it. Nearly everyone is either 55+ or has parents who are, and if there’s one thing the CAR excels at, it’s spin. They’ll advertise it like it’s the cure for cancer.

I can see the commercial now. An 80-year-old widow looks around at her tiny living room. A strained smile crosses her face at the pictures of family and the good memories all the knickknacks bring her, but then she turns toward the window and the smile vanishes. The camera pans to her view, and between the ugly security bars is the sight of a drug deal taking place right outside. Back to the woman’s face now, in time to see a single tear roll down her cheek. Italic text fades in… “Is there no escape?”

Optionally, show her after the law has passed, in her sunny flower garden in a nice neighborhood, birds chirping, group hugging her grandchildren and kissing their infants on the head. The implication being that they couldn’t visit her in the slum.

Very interesting!

We would be in that group (age 55+) that could benefit, BUT it’s more complicated than just the property tax…if you sell and move to a less expensive option, you will get hit with a significant capital gains tax obligation.

SeenItAllBefore,Bob – can you find those calculations again?

It looks like statewide extension of existing prop 60/90

I’m all for it. At this point, anything that will increase inventory is a good thing. I also know a number of people 55+ who live paycheck to paycheck.

Sounds like another form of gentrification. Seniors leave allowing for new development.

L.A. County multi-family construction starts for 2015-2017 is eerily similar to the constructions starts for 2005-2007. The early cycle peaks in both 2005 and 2015 were probably caused by the new homes becoming unaffordable. The chart suggests a major drop in new home sales in L.A. County in 2018

By now, most renters know prices on most items rise every year because we have inflation. Once in a great while, we will see some deflation, but that is rare because central banks stamp inflation out. So, as long as we have central banks, the smart money goes with inflation, and that means buying a well located home. And, if you have one, a second is better. And, a third is even better. Nothing like 3 home benefiting from inflation as a retirement plan. Actually, the more the better. On top of that, rents are also going higher because of inflation.

Once or twice a generation, people get stupid and think the sky is falling. The media was a big part of the 2008 debacle. They brainwashed the dumber people in society to believe home prices were going to zero and that started the panic which caused prices to drop. Of course, central banks ended the panic with money printing and prices jumped back up. The dumb bought the media story and decided to rent because prices where going to continue falling. The dumbest of the dumb walked away from their mortgages. Now, these people are praying for another housing panic. Will it happen again? Possible, but very unlikely in our lifetime. Your young children might see one. But, you may not. So, your best move is to stop planning your life around an unlikely housing collapse. Better to plan against a normal housing pullback, which is more around 10 to 15% and take advantage of that. You will see that. The only issue is how much higher prices rise until we get another housing pullback. That is a tricky guess. But, when the next recession hits, and it will hit within a reasonable time, prices will fall 10 or 15% ish. That will happen. But, the 50% dreamers, which never even happened last time, is so unlikely you are wasting your life planning for it.

“But, the 50% dreamers, which never even happened last time…”

It generally went something like this (nominal median prices): 30% in the actually desirable coastal areas, 40% in the crappy but for some reason still desirable coastal areas (including large metros – for example, SF dropped ~45% and LA dropped 35-40%, SD a little over 40%), 40-50% in the desirable inland areas, and 60% in the undesirable inland areas. So yes, it did drop that much in the last crash. I was there, I watched carefully while it happened, and a few 10-second google searches will show it. 70% only happened with foreclosure sales and the worst properties (e.g., apartment condo conversions). My own condo (I rented at the time) dropped 65%, and that was in a decent inland area.

That said, prices are now dropping in the large coastal metros. Not exactly tanking, but dropping. Nicer inland areas, on the other hand, are still rising – maybe an exodus to more affordable suburbs.

You have correct analysis. It tanked like this because of liquidity crisis. 1) ARM loans triggered much higher payments 2) Crash in derivatives halted/slowed lending enough to make it very difficult to buy 3) Media coverage/panic. 4) People taking out HELOC out of their highly appreciated homes for different investments, then walking from their homes. This was a country wide crash, California has nothing to do with it. I do not think conditions are set for something similar now. In truth, nobody knows what/when will trigger another pricing pull-back, but my belief it will not significantly improve affordability.

@Surge

Many conditions that led to the last crisis are present today: HELOC’s, over-leveraging, exotic loans, and — most importantly — unsustainable speculative prices. This “recovery” is no different than the last — rapid price run ups due to cheap and easy credit. Eventually, credit is tightened because the risk becomes too high for lenders.

jt, like most ;people on this site, I hope you are wrong and that prices drop at least 30% in the next few years. I think it is likely because of the affordability problem and rising interest rates. You are forgetting that eventually inflation means higher interest rates unless the Fed starts buying all the government bonds–which I think is unlikely.

The other factor is that the housing mania this time has spread throughout the world. That should create a tsunami effect in which the real estate crash becomes a worldwide event. That could make it impossible for central banks to prevent.

Finally, I believe that the powers that be (TPTB) have much to gain from another real estate crash. They got rich buying homes during the last crash and would love to see another one in their lifetimes. I am not convinced that the loans being taken out today (to investors and low income persons) are any more sound than the loans of the 2002-2007 time period.

Lower home prices does not mean better affordability

In fact, it is most likely the opposite.

What happens with interest rates will be the key. When we bought our place in ’82, mortgage rates were ~14% and our payment was ~$1100/mo IIRC. Just ran that number through an inflation calculator and the current equivalent is ~$2775 which is not too different from what Zillow estimates (3,362/mo) for the refi payment. I may be missing something here, but the monthly out-of-pocket/income seems critical.

The rate curve has been largely flat, meaning there is little difference between short term and long term rates. Even with the Feds bumping short term rates up steadily over the past year, long term rates affecting new mortgages have hardly budged. A bump in inflation my change this trend. I wouldn’t be surprised to see mortgage rates rise next year but slowly, maybe closer to 5% by year end 2018.

“ I have no doubt that he’ll finally buy a house at a nominal 50% off peak pricesâ€

You got it! 100% agreed. Plus, I will gladly go back and show it to all these people (realtards, RE cheerleaders etc) who told me to buy now (during the peak) and try so hard to make me think that buying high is somehow a good move. Lol

I predict Millennial will buy a house in 2021 after markets correct to 2017 levels and he will have a mortgage rate of 7-8%. He will then return to this blog and proceed to tell all of us, “WINNING!!!! & I TOLD YA SO!!!”

Wheelin,

Wow, your prediction is that RE prices will skyrocket from now until 2021 and than crash hard by 50-70% and go to today’s levels? So within the next three years you predict a 50% + run up? You are full of crap. If you would believe your own bs you would go out and buy now. But of course thats not the case. you are one of these old farts who want millennials to buy high and be the bag holders of this market.

Jt, agree with you

Also

Everyone here seems to be fixated on absolute home prices, which is not as revelant homes being a long term leveraged purchase. That is for long term homeowners that live in their homes.

Price is everything. It’s only a good time to buy when the RE market crashes. People who bought during the peak (like surge) hate this and want to sucker people into buying 50-70% over value.

I am sorry you feel being suckered into something just by seeing a view contrary to yours. Besides I never even rule out possibility of 50% crash, the point is that it will not mean better affordability. Very few can save for cash/very large payment even with you post-crash prices.

Since housing is always(for most people) a leveraged buy, its “price†a more of a function of rates, credit, economy, etc…yes, creates instability. But for vast majority of homeowners (who want to live in decent place), it is always a 15-30 year morgage game. Good or bad, thats the way things are.

Just imagine economy without mortgages.

From the calculated risk link.

[The second graph shows the same two indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.]

So this price adjustment is flat out wrong, meaningless trash. The price of broccoli and beer has nothing to do with housing affordability. The proper crude adjustment would be to adjust by median income.

“Most people†yeah, most Americans are lousy savers and broke. I am not representing most people. I never had issues living a frugal life and saving money. You can easily accumulate wealth by spending less. Since renting is dirt cheap compared to buying I simply wait until we have a crash to purchase my first home. why would you buy during the peak? Only if you are stupid enough to believe in “buy now or be priced out forever BSâ€. Only realtors or people who bought high tell you price doesn’t matter.

Millenial, good luck. There is no such thing as being priced out forever.

Nobody should ever buy if they cannot comfortably afford it.

Buying during higher prices could also be ok and part of personal strategy, personal needs, lifestyle, need, etc – as long as you have it within your means.

Renting is also a valid position.

You are defending and planning for a very narrow outcome (hard crash) and do not want to consider other scenarios (flat prices, 20% drop). It is a sign of amateurism and very self centered viewpoint. I doubt you scooped up any properties in 2009 to have a respected opinion.

Of course I did not buy in 2009. I was still in school by that time. Now, that I advanced in my career I am well prepared to buy. And you are wrong again, I do consider other scenarios. If prices stay overpriced for a while longer renting is the way to go to save more money. I only buy when the market crashes. All you need is patience. Markets always correct and crash after a manipulated run up. So, why throw your money away by buying an overpriced crapshack just to be the bag holder of this market? Realtors and people who bought into a high market cannot admit that California RE is all about timing. You will see them “wishing you luck†as if saving money and maintaining a debt free life has anything to do with luck.

He doesn’t get it, Surge, and he never will. He glances over posts from people who are simply saying that buying a primary residence at the peak is not necessarily a bad thing, and interprets this as advice to “buy now or be priced out forever.” He doesn’t comprehend what he’s reading.

He doesn’t understand the most basic fundamentals that drive the market. He doesn’t understand the difference between buying a home and buying an investment. He has no knowledge of the long-term trend line, inflation, deflation, how interest rates affect affordability, or how demographics (e.g., dying baby boomers) will affect inventory and prices in the next decade. I have no doubt that he’ll finally buy a house at a nominal 50% off peak prices when his spouse demands it, and he even thinks that he’ll be getting an actual 50% discount – but of course he won’t be. Maybe he’s lucky in that sense. If he only compares Price A with Price B, ignoring literally everything else (including the effect of time and government policies on a fiat currency), in his mind he really did get a 50% discount. Ignorance can be bliss.

Had to repost:

John,

“ I have no doubt that he’ll finally buy a house at a nominal 50% off peak pricesâ€

You got it! 100% agreed. Plus, I will gladly go back and show it to all these people (realtards, RE cheerleaders etc) who told me to buy now (during the peak) and try so hard to make me think that buying high is somehow a good move. Lol

Surge bought high (2005)….naturally he has to make up reasons why buying high is somehow still a good investment. Usually, I don’t like to dance on someone’s grave but it just needs to be pointed out why he is trying so hard to convince you to buy now. I’ll guess it makes him feel less shitty if there are other bag holders. Kinda pathetic.

John,

“when his spouse demands it, and he even thinks that he’ll be getting an actual 50% discountâ€

That’s a pretty important point. Your significant other can have a massiv impact when it comes to buying a home. Thank god I did not marry a wife with expensive taste. I learned that from my parents…they have what I call a landlord mindset. On the outside they look like the avg joe. (They buy used cars, don’t waste money on luxury etc). But They retired early and have lots of income just coming from the rentals. When I dated my wife I drove a beater. She knew right away I am not a spender and won’t support it. I saw this too many times how husbands got suckered into buying during the bubble due to their wife’s….don’t do that, you will regret this the rest of your life. Don’t marry a wife with expensive taste unless you are willing to afford it.

Regarding the 50% comment. Yes, when I buy at 50% off the peak I very much see that as a 50% discount. Your Comments won’t change my view. Lol

NO ONE IS TELLING YOU TO BUY NOW. Only that you don’t fully grasp what will be happening while you wait. If I were you, I wouldn’t buy in California now either.

Re 50% discount:

A fiat currency loses value over time.

Higher interest rates mean a higher payment.

Increasing prices leading up to the peak mean a higher “low” when the correction happens. (The long-term trend is up.)

If the government succeeds in keeping this bubble inflated long enough, there will be no discount on today’s prices at all. A + 100% – 50% = A.

That 50% discount is not a 50% discount off TODAY’S prices, no matter how badly you want it to be.

How can anyone say “price is everything”. It is just too funny.

If the market does not crash for another 2 years = 24 months of you not making a mortgage payment and not benefiting from its perks as far as tax returns. You have already lost that saving you may be gaining by waiting for the crash. Not to mention the money you threw away for the previous 2 years hoping that market will crash. The best time to buy a house is when you think you can comfortably afford the mortgage payment. The price of the house will not and should not matter because you have locked in a fixed rate for 30 years. Trust me, with inflation that mortgage payment will feel like a car payment within 10 years (unless you pull money out like an idiot). Remember, you are renting from that guy you think was an idiot for buying before the crash. He or she is collecting rent from you plus any gains on property value + all the tax benefits of owning a house. Don’t worry about speculations people. If everyone knew when or if it will crash, they would keep it to themselves ( like they did last time)

Aaron, what a bunch of terrible advice you have there. Buying now is the dumbest thing one can do. If you think otherwise, be my guest. Go out and buy! Of course price is everything. You want that price to come down so you can buy close to buying in all cash. Only total idiots think that prices don’t matter. Those are the ones who buy everything on monthly payments….cars, cell phones, houses and soon they will start buying groceries on a monthly payment plan. Debt, debt and more debt and tears at the end.

I’m surprised you didn’t mention interest on HELOC’s no longer being deductible. I have no idea how much that will effect people who seek these loans, since I actually live within my means. Any ideas?

Well I’m just going to refinance our small heloc back into our home loan… then voila the interest is deductible again. But then again… might not be worth the trouble since we live within our means and without the full SALT deduction we will probably take the $24k standard deduction anyway.

Unless the law prohibits rolling over a HELOC into an interest deductible loan, in which case, voila! here comes a letter from the IRS. If you go this route, I would definitely do some research first.

You’d better check with your accountant on the indebtedness rules. It might not work the way you think it will.

Anything which discourages debt reduce prices since we have a debt based money supply. The amount of the reduction is impossible to know.

First of all, why would the two graphics start with two couples with $43k in income disparity and have one with 2 kids and one with none. Trying to hide the fact the difference is rather negligible much?

If everything were apples to apples, then this little exercise wouldn’t have turned out the way it did. The LA Times didn’t mention anything on how much the couple put down to buy their house, I wouldn’t be surprised if a no down loan at higher interest rates were used to pump up the deductions. As I have said umpteen times, 20% down payment minimum!!!

All of this will be a boat load of unintended consequences. Should be interesting. On the one hand increased cost of ownership may hurt higher home values. Though it seems there may be ways for multiple property owners to game the new system to decrease taxes. That not 100% clear. If not we could see a sell off of rentals which could increase supply and drop prices.

At the same time we will have renters, especially families with more disposable income. $100’s of dollars more a month. So we could room for rents to bump up more. Which in theory can be good for property values if you can extract more rental income to cover added carrying costs.

It should at least soften the urge to take out a loan over $750k, which is an ungodly amount to power for the vast majority of us even in California.

It does appear that the GOP tax plan favors renters by chance alignment with their other priorities. As someone transitioning to ownership in California this month, it ends up being a wash because the new tax break is a bit larger than I would have gotten for owning. Will kind of sucks if values tank, but California is pretty volatile anyway. And I still get my home equity.

Why in the world would anyone sell a good rental property now? Rentals are even more attractive since tax reform since they retain 100% of their previous deductions compared to principal residences. And with renters having more money in their pockets it’s easy to see rents going up steadily over the next few years. It’s a good time to be a landlord.

More purchasing power alone doesn’t make for more demand by itself. That and the soon to be increased incentives to convert existing homeowner occupied properties into rentals could push up supply.

But Mille said his rent hasn’t increased in the last 10 yrs therefore aggregate rents have not increased at all.

Get outta here with your real world thinking…

“It’s a good time to be a landlord”

AND it’s a great time to have one. I don’t have to worry about anything. I do nothing to this house and love calling him for repairs……chop chop!!! And my weekends are free to do what ever the fuck I want. I made sure that yard maintenance was his fucking problem not mine. The fucker could start a bit later than 9am on Saturday morning but I always smile when woken up knowing i’m not doing it.

I had a house once, and the weekends were chewed up with yard work and all the other little things that having a house requires. I may pull the trigger once again but it’ll never be in California.

@interesting

Gardener $100/mo; problem solved.

For most people in high cost states their principal residence was their primary tax shelter. Trump eliminated or minimized that for most people by doubling the standard deduction and limiting SALT and mortgage deductions. By doing this he made rental property one of the most attractive legal tax shelters available. With mortgage rates still at historic lows, high rents, and low vacancies I can see 2018 being a stellar year for rental property in CA especially if we get a moderate rise in inflation as predicted.

You are mixing financial and lifestyle discussions here

That correct Dan. Rents have barely moved. When I was single I rented a room in 2009 for the same amount you can find it now. Sure, you want to rent from a private landlord not a professional managed company. By renting a cheap apartment you are able to invest all the saved money. Stock market and crypto currency has done extremely well and you can sell anytime without fees. Buying a house ties up your funds (down payment)and buying RE is extremely high in fees, closing costs and maintenance. Any buy versus rent calculater will easily show you how much money you save by renting. However, during a RE crash I would be willing to buy at a 50%-70% discount.

The Tax Reform Bill has passed and was just signed by the President. NAR has produced a comprehensive document that summarizes the changes affecting real estate professionals and homeowners. Here the tax deduction limits and rules for 2018:

·The final bill retains the current-law maximum rates on net capital gains

· Capital gains exclusion remains the same a homeowner must live in their home 2 out of the past 5 years to qualify.Â

· Mortgage Interest Deduction was limited to debt of $750,000 for new loans taken out after 12/14/17. Current loans of up to $1 Million are grandfathered and not subject to the $750,000 cap

· Interest remains deductible on second homes but subject to the $750,000 limit. Â

. If you itemize your deductions they will be limited to $10,000 for the total of state and local property taxes and applies for both single and married filers

· New standard deduction is $12,000 for single and $24,000 for married individuals

· Medical expenses can still be deducted – No change

· Child Tax Credit increased to $2000 – 16 and younger

· Student Loan Interest can still be deducted up to $2500

· Moving Expenses are no longer deductible except for members of the Armed Forces

· Like Kind (1031) Exchanges have NO CHANGE. Â

Gary, the healthcare deduction has been reduced to expenses exceeding 7.5% of AGI down from 10% for 2017-2018. This is a little good news to offset the elimination of the personal exemption for those of us who pay high medical insurance premiums and costs.

Had a chance to escape SoCal hell last year to the Atlantic Coast in Florida and didn’t take it due to not being thrilled with the opportunity, now I have another chance in the coming weeks to go to the East Coast to a very affordable beach city where I can get new construction for under 250 thousand. The same type of house would go for at least 750 in San Diego. Sorry, (not sorry) to leave.

Stoked! I like to hear happy stories, especially when it involves getting out of the hellhole that Clownifornia has become. I had to visit family there earlier this month, I just do not get the appeal and I was born and raised there, lived there for the better part of 35 years and left over 11 years ago to much greener pastures like yourself.

I was reading another message board last night and many of the posters live in cali and normally they talk up how great it is, but no longer. Someone posted an article on homelessness and posters chalked it up to a huge decline in jobs, wages and quality of life thanks to one party rule for decades. Those clowns own it, they were promised unicorns and voted for scumbags.

It’s a good window to buy into a no income tax state. The tides are turning and this thing is happening. I wonder if the cynics who were saying throughout the year that there wouldn’t be a tax overhaul passed realize this or will they double down on the blinders?

Definitely need to find the right state as some of the no income tax states have HIGH property taxes.

See TX

Florida is not my idea since its humid but Arizona is hot where I’am. I recently seen some Ca and Ill liscense plates. Ca could once again see lots of folks moving out of state. The US census shows 138,000 and New York 190,000 but the Salt Deductions may pushed people to move out of state to places like Arizona with lower property and income taxes. New York grew only 13,000. Ca grew 240,000 if you believe the US Census or 300,000 if you believe the state of California Finances. I tend to believe the US census since it shows a lot more growth from international immigration and more people leaving the state of California. Ca could grow less than 200,000 in the next 4 years. There is a good possibly since growth is occurring in Sac and Riverside and less in LA and the Bay Area which is similar to the early Bush years which also shown messed exodus out of the state.

Think I saw you on last weeks episode of Bargain Beach Hunter. Haha. JK. Where are you really moving to that has a nice house on the beach for under 250k?

I love where I live, which is a conservative inland valley in California. Homelessness, crime, and failing infrastructure are frequently issues in predominantly liberal areas (hence most of LA being a disgusting pit). That said, everyone has a breaking point, and I’ve decided that mine is when the state outlaws cars with internal combustion engines. We all know it’s coming.

I kind of chuckle at people in panic over the tax law changes, especially in liberal California! It seems to me that you aspire to the social democratic systems of a Germany, France, or Sweden, yet scream like stuck pigs when you might pay more in taxes! Per the OECD, an ‘all-in’ average tax rates comparison shows corresponding households in Germany, France, and Sweden, pay significantly more in national taxes for the privilege of having nationalized healthcare, an enforced retirement, and other safety nets. And, by-the-way, having lots of European relations, the grass is not greener … they are all unhappy because they are constantly being told they have to pay more to get less and less benefits …

The funny thing is that leftists like to proclaim how they are proud to pay taxes but when push comes to shove you find out they also don’t like paying any more than the next guy! All of the crying over how much this state gets back compared to some other states. I thought they cared about those in need or does that stop at the state line?

The tax cut does benefit renters more than owners, but even most Calif homeowners will benefit.

Mid-to-high income people were already in AMT, making the SALT thing irrelevant.

Check out this calculator, and plug in high income and mortgage and property tax assumptions.

http://www.wsj.com/graphics/republican-tax-plan-calculator/

The LA Times article was based on the earlier House and Senate bills, not the final outcome.

Great article Doc! have been saying the same thing. Renters will continue to save a ton of money by not buying into this bubble. On top of that the tax plan is fAvorabke to renters. Absolutely no reason to overpay massively now. Wait a couple more years and buy half off (or more). It’s all about Cycles and timing.

I have annual prop taxes of $26,000. Should I prepay in 2017 my April 2108 prop taxes? Any ideas on this?

If you’re not in AMT, yes!

Ok…asked my other advisor other than the good Dr. here….my accountant!

I am in AMT…so forget the prepay property taxes thing….

I’ve read that something like 40% of american don’t earn over $20K a year so you pay more in just property taxes than many people make working all year.

found the article.

http://investmentwatchblog.com/40-percent-of-u-s-make-less-than-20000-the-fed-government-considers-a-family-of-4-making-less-than-24250-to-be-impoverished/

-38 percent of all American workers made less than $20,000 last year.

-51 percent of all American workers made less than $30,000 last year.

Sometimes I think this is bull. For example, Margot Roosevelt in the OC Register says there are over 600,000 jobs in OC that pay under 15 an hour and only 1.7 million in LA. Roosevelt is a democratic and doesn’t like the fact that Orange County has a much higher median income than lA. Its more likely its only about 400,000 jobs in Orange County that pay under 15 an horu and LA is near 3 million. Why do I believe this well Orange County has a 78,000 median income while La is around 57,000 even Jon Lanser an Oc real estate writer does mention that Orange County pays higher for construction than LA. I think that LA has only a few good jobs in Silicon Beach and the entertainment industry. Orange County probably has people that make 100,000 more a year from real estate and small business more than LA does. This is why the salary or wage is off because in OC more jobs are commission or small business revenue. I doubt all the bad stuff of OC, sure there are plenty of crappy jobs because of Disneyland but the houses are overprice for other reasons that foreigners. Sure, there are way too many people per household but LA has this too.

Yes, do it. You will save yourself several thousand dollars. You can pay online at the LA Country website 24/7 for free.

If you’re paying $26K in property tax, the correct answer is

c. MOVE

I know. I hate paying that much in property taxes. It all gets spent on the crappy school district and police who never bother to show up. And don’t get me started about the City services. Ugh.

Should I prepay in 2017 my April 2108 prop taxes? Any ideas on this? My annual prop taxes of $26,000.

My CPA said yes for me; so i would check with your CPA or tax attorney.

Yes, prepay your property tax if possible. I am not a lawyer but if the check is dated this year and the letter is postmarked this year, that might be enough to count the payment as being made in this year. Also, you may be able to pay online by making a direct transfer electronically from your checking account.

IRS already issued guidance on this. Payment only counts toward 2017 liabilities if ASSESSED in 2017.

U may save 2-5k on the 16k (26-10)

I would say it’s a no brainer, as long as your talking about the second payment on your 2017 assessment. 2018 property tax assessments will not be deductible in 2017 but if you pay half of your 2017 assessment in 2018, you’ll only get to deduct $10K.

California housing market is done. Crash 2.0 coming your way

http://www.dailymail.co.uk/news/article-5212977/Californias-middle-class-homeless-living-parking-lots.html

Welcome to California where if you work hard & play by the rules, we’ll bring the soup kitchen to your homeless encampment where you sleep in your car!

(picture of Jerry Brown in front of the capital building with a cheesy smile)

bbbut CA is the 5th largest economy in the world and has the best $19 Avocado sandwiches in the world. All those stupid deplorables in flyover country don’t understand the awesomeness of the state.

http://www.sandiegouniontribune.com/opinion/sd-living-in-cars-in-california-20171227-story.html

This is interesting. It says that in the future most middle class and poor Californians will live in vehicles. So auto manufacturers should start making vehicles that are designed to live in. Like a folding bed, kitchenette, etc.

I do agree that the tax bill does make owning less attractive. I don’t know how many times I’ve heard people say “but if you rent you lose out on all the tax savings”. This is idiotic since 70% of people itemize as it is, and so it makes no difference whether they buy or rent. But in high cost areas like SoCal, owning definitely has tax advantages. Now with the doubled standard deduction the chasm between renting and owning has been significantly reduced. It will still be advantageous to own vs rent, but not as much as before.

However, that being said, I also think people don’t make the rent vs. buy decision based on tax savings.

And also, none of these changes apply to landlords, like yours truly. My rental homes are businesses, so there is no limit to how much property tax I can deduct or how much MID I can take. I get to keep all my deductions, but now suddenly my pool of renters is richer thanks to the tax cuts. Which means, in the long run, I can raise my rents since my pool of renters has more money to spend. More income, fixed costs…..BOOM!

So really for renters, you will, in the long run, break even. It’s the same phenomenon when the minimum wage increases. The workers have more money, but in the long run everything is more expensive, and the workers are no better off relatively speaking.

Mr Landlord, you think rents will go up as renters have more money. That may not be true since landlords are down the food chain from Corporate Overlords.

http://www.businessinsider.com/stock-market-today-company-wage-inflation-labor-costs-employee-pay-2017-7

Bob,

It’s not my opinion, it’s simple economic theory. Give buyers of a product more money, the sellers of the product increase prices. In this case the product is rental units.

Bob,

As for the BI article, that was good advice in Obama’s depression of the past 8 years. In Trump’s boom, it’s horrible advice. Companies are now competing for talent. Companies that are unwilling to pay for top talent will be underperforming.

You, like BI, are stuck in the Obama depression era mentality. You need to re-evaluate.

Good post. Just like Prop 13, there could be some unintended consequences down the road. As you mentioned, landlords are the real winners with the passage of the new tax law. This will likely tighten up supply even further in the desirable areas of socal.

The “desirable” areas of socal are absolutely horrible rental markets. There will be no benefit from the new tax law.

The tax law benefits both owners and renters it just doesn’t offer as large as an incentive to own in high cost markets.

Woody,

People tend to conflate high cost and high tax. They aren’t the same thing. For example SoCal is high cost AND high tax. But Seattle on the other hand is low tax and high cost.

The tax bill hurts high tax primarily, but not necessarily high cost. The $10K SALT limit doesn’t really hurt someone in Seattle where the is no state income tax. Even a $1M home there has property taxes under $10K for the most part.

CA, NY, NJ and CT are the 4 states that will feel some pain.

Woody wins this one.

“The “desirable†areas of socal are absolutely horrible rental markets.”

That would be a big N O. Desirable areas of socal (safe, near job centers, good public schools, etc) command quite the premium in rents. To say otherwise would be just plain stupid.

Paying 650k for a property which rents for 2800/mo is a terrible rental market. It would need to rent for 6500/mo just to return what you invested after 12 years (minus costs). You could get there far faster investing in equity index funds (7-9 yrs) with no work and less risk.

And Woody wins again. I am glad there are still people on this blog who can do basic math.

“And also, none of these changes apply to landlords, like yours truly.”

Mr. Landlord, please explain how owning rental property helps with itemizing deductions on your principal residence?

The debate over eliminating the federal tax deduction for state and local taxes has focused on the economic and political effects of the change. But that may be the wrong discussion. The question is whether eliminating the deduction is even constitutional. History suggests that it’s not.

Capping the SALT deduction at $10,000 does not solve the Constitutional problem since inflation will eventually make that deduction meaningless.

The principle of federalism is enshrined in the Constitution. The essence of which is that there are arenas of government that must not be invaded by other governments. The notion that this applied to taxation had been understood dating back to the origins of the federal income tax, enacted in 1962 under Abraham Lincoln to finance the Civil War.

The Revenue Act of 1862 provided that federal tax liability was to be calculated only after state and local taxes were first deducted–and this under the most pressing emergency conditions ever faced by our country. The deduction was enshrined in the Revenue Act of 1913, which created the modern federal income tax.

But eliminating the SALT deduction would be a more far-reaching example of double taxation. The deduction is a fundamental statement of the historical right of state and local governments to raise revenues and of individuals not to be double taxed. As it happens, the Supreme Court has spoken on the issue of double-taxation: It’s wrong. In a 2015 decision written by Justice Samuel Alito, the court ruled that a Maryland provision denying its taxpayers credit for taxes paid to other states was unconstitutional. Expect the states’ challenges to the GOP tax bill to cite that ruling (Comptroller vs. Wynne) prominently.

Precious. Liberals all of a sudden don’t like the idea of double taxation, LOL. OK fine. Then no more tax on dividend income, no more tax on interest and no more death tax. Those are all taxes on money that has already been taxed once (and even twice in some cases).

Here’s a radical idea: you want to pay lower taxes? Get your state liberal Democrats to lower your taxes

Property taxes are also “double taxation”. I already paid taxes on the money I used to buy/build my house.

Due to liberal/collectivists/socialists policies every person is taxed two or three times on the same income in many instances.

How can the city administration in Scottsdale, AZ keep the best schools in the state, perfect infrastructure on half the sales tax of CA, no income tax, less property tax and a mirriad of other taxes practiced in CA? Oh, I forgot – Scottsdale is not a sanctuary city and AZ is not a sanctuary state. All the high taxes and sanctuary cities policies serve only one group – the liberal globalists leaders in Sacramento.

And while we’re at it, why isn’t SS and Medicare tax deductible too? DOUBLE TAXATION!!!!

If you take this to court you will be laughed out of a courtroom pretty quickly.

Mr Landlord, My SS and Medicare and 401K are taken out of my paycheck Pre-tax. My State taxes are not taken out Pre-tax. My Medicare, SS, and 401K benefits should be

taxed when they are withdrawn to avoid double taxation. As noted in a previous post, this issue has already gone to the Supreme Court and they have disallowed sneaky underhanded double taxation schemes like Trump’s plan in the past.

You probably didn’t know this but the State of California taxes you on the money you pay to Federal taxers.

Good luck with that. Double taxation is a weasel phrase. It’s basically a rate increase with another name. Your options are to pay up or move somewhere cheaper.

I noticed a sleazy new “feature” on Redfin.

Some houses are Listed and don’t sell. So the realtor Delists the house, then Relists it, so it appears to be a new listing.

Previously, the old, failed listing remained on the house’s history. Now, no longer. Thus, Redfin is helping realtors and sellers hide a house’s failure to sell.

Zillow house histories still have previous failures to sell.

There’s nothing “new” about relisting an old failed listing as new. It’s always done that way. When the listing expires, it’s up for grabs and the seller frequently relists with another agency. What’s really amusing is, that when the failed listing expires, http://www.realtor.com will mark it SOLD at some ludicrously inflated price, but then you see it listed again for sale a couple of weeks later, for a lower price than previously. Since I’m a picky cheapskate buyer, I took a long time to locate a place I liked for a price I could stand to pay, so I saw many listings in my neighborhood expire and become “new” listings a week or two later.

What’s new is that Redfin previously kept the old, failed listing in the house’s history. Now, no longer. If a listing fails, it disappears from history.

Now you must go to Zillow to discover if a house had any previous failed listings.

Zillow is also better at keeping the previous listing prices available. Even when Redfin maintained the previous listings, it deleted the asking prices.

Housing in the United States for the vast majority,

about 100k to 300,000, maybe stretch to 400,000.

John,

“NO ONE IS TELLING YOU TO BUY NOW. “

Not true at all. Surge for instance repeatedly says we should be buying when we can afford it. Others have said the same on this blog. Every second realtors you talk to says either buy now or priced out forever or says if you don’t buy soon you will never own a home.

Knowing you, you will even deny these statements.

“Only that you don’t fully grasp what will be happening while you wait. If I were you, I wouldn’t buy in California now either.â€

I am pretty sure I know what will happen. While others bought during the bubble and are loaded with debt I maintain a debt free life while investing these savings. I hope I don’t have to explain how well stocks and crypto currency performed the last few years? Besides the cash I am sitting on I have killed it with some of my investments.

“Re 50% discount:

A fiat currency loses value over time.â€

That’s why you invest some of it. BTW the inflation rates are below 2%. Not anything concerning in my mind.

“Higher interest rates mean a higher payment.â€

Wrong when it comes to RE. Higher interest means prices will adjust down.

“Increasing prices leading up to the peak mean a higher “low†when the correction happens. (The long-term trend is up.)†true. Similar with stocks. However, I don’t buy during a run up, I buy when it’s crashing. I don’t care if the next low will be higher than the previous low (of 2008). I only buy low and sell high.

“If the government succeeds in keeping this bubble inflated long enough, there will be no discount on today’s prices at all. A + 100% – 50% = A.

That 50% discount is not a 50% discount off TODAY’S prices, no matter how badly you want it to be.â€

I never said it will be 50% of today’s prices. I said I buy when the market crashes by 50%-70% from the peak. This RE cycle is nearing its end. And even if it doesn’t you can’t lose by saving lots of money as a renter. Having no financial stress , no debt and no liabilities is worth a lot by itself. I can already afford a home now but want to wait for a nice crash so I might be able to pick up a dream home in all cash.

Millie, Good luck. If you can do all cash, all the best. Majority of people will not be able to do so ever.

Btw, you personally should not buy a home. You seem to be able to plan based only on single stretch scenario, which is poor financial strategy. Also, a home that will rxperience a 50% price reduction (if your scenario pans out) will be in not desirable neighborhood. And also I hope you time your stocks well, because you know what will happen to those prices if homes fall by 50%

Surge, you keep wishing me luck. Appreciate it but I don’t think this has anything to do with luck. It’s simply being financially responsible and maintaining a frugal, debt free life combined with some patience. Everybody can do that. House prices collapsed by 50% + during the last bubble. You keep making these wild predictions (e.g a price drop means the house is in an undesirable location). That did not happen in the last crash or ever before. When a crash happens it’s across the board. Timing the RE market is not rocket science. Why try so hard to find reasons against it? Just learn from your mistakes (when you bought in 2094) and buy another house during the next downturn. You will thank me later.

Meant 2005

Surge,

“. And also I hope you time your stocks well, because you know what will happen to those prices if homes fall by 50%â€

Timing the stock market?? Come on now… that’s almost impossible. The stock market can move like a fighter jet while the RE market moves like a cruise ship (that line comes from DR HB). I don’t time the stock market…dollar cost averaging is my friend. If the stock market crashes GREAT, I buy in cheaper, if it goes up a few percent each year that’s fine too. However, I agree you want to unload slowly a few positions in stocks when you expect a crash on the horizon. As long as you get the general trend right you are fine.

Buying when you can comfortably afford it, yes. Not “buy now or be priced out forever.” There is not a single person here who believes prices will never drop. Even what few realtors we get here aren’t dumb enough to say that on a bubble blog.

“Wrong when it comes to RE. Higher interest means prices will adjust down.”

I know you’re not that dense. You knew exactly what I meant. That’s just one of several factors that help to negate that 50% discount you keep hoping for, the one which you’re not going to get.

I’ll also second Surge’s comment about areas you would actually want to live in probably won’t see a 50% drop. If you work in tech, a 50% nominal drop will require an hour+ commute. If you actually checked the history of the areas you will be considering, you would see that, but you won’t, and that’s just keeping your head in the sand.

For example, Carlsbad (nice area, good schools, minor tech hub) only dropped 30% in the last crash. It’s never been Manhattan Beach expensive, but a great place to live, well managed, business friendly. If you want to live in a place like that with a 5-10 minute commute, 30% is all you can hope for. Let’s say you buy now and the correction happens in 2020. You’ll lose out on the savings from a lower down payment and lower property taxes, but there’s also:

Two years of paying down principal.

Two years of property tax deduction.

Two years of mortgage interest deduction.

Savings of a lower interest rate, possibly for the life of the loan if it doesn’t come back down in that time.

The fact that the market will get REALLY hot when people see 30% off previous prices. Bidding well over asking is the only way to win on a normal listing in a market like that, even if you’re paying all cash. I’ve been there and learned the hard way. The “forever homes” (great layout, great school district, decent lot) go pending in 1-2 days at 5%+ over asking. You could try a foreclosure auction, but that will mean a mediocre property and repairs, because the really good properties are bid nearly up to market value anyway.

So, that 30% may be more like 10 or 20, or it may entirely disappear, depending on the property, when the drop happens, and what the interest rate is.

The lesson here is, always be shopping for your dream home, but wait until the correction to buy investment properties.

Yes. Solid zip codes (great schools, affluent) will hold their values much better during RE correction. Nobody will sell you there at 50% discount, there is just no economic base for this. Drop of 10-20% is always feasible of course, but it is not a huge deal over a long run, and to avoid this you really have to time the market

Corrections / price drops are never across the board.

Millenial, the price of my place got reduced by 30% (condo in decent location).

At 30% discount, condos like mine were flying off the market in 2011-12.

See it’s all about timing. 30% is a nice discount. All you had to do is wait a couple years.

“Two years of paying down principal.

Two years of property tax deduction.

Two years of mortgage interest deduction.â€

Renting still wins.

I live close to the beach and close to my tech job. Prices are so inflated that any rent versus buy calculator will show you the savings per month as a renter. These savings are money in the bank plus investments. I am up between 6-12x on different cryptos. That’s not even good but I take out profits and don’t ride the pumps all the way. If I were to buy and hold I could do even better. Ethereum performed 9000% last year for instance.

It’s cute when people tell me about tax savings when it comes to buying an overpriced crapshack. Also care less about paying down principal. My passive income outperforms the RE bubble. I’ll buy when RE crashes. Bubbles are great, millennials just haven’t had a chance to benefit from RE buying opportunities but every generation gets a few chances. Just wait and see.

“Renting still wins.”

It wins big if you’re in a smaller place than what you eventually intend to buy. If you want an equivalent size place, as many families do, it may still be a wash in the short term depending on where you are. I’m seeing 3-bedroom homes in Irvine that are $3,500/month to rent, or $4,500/month to buy the equivalent with 3.5% down (incl PMI). After tax benefits, there is little if any savings vs renting in that comparison. Again, not advising you to do that, just saying it’s not a bad idea either. Those areas saw huge profits even for people who bought at the last two peaks. You would save in the long run by waiting for 20-30% off (which is what you’re most likely to get), but that “buy now” scenario is acceptable to me if I was looking for a forever home in that area and found the perfect place.

Actually 3500 renting vs 4500 favors renting. You do get (reduced) tax benefits for buying but you have to pay property tax and maintenance. And likely HOA fees too.

Even if that 4500 payment includes property tax it is still better to rent financially.

Yes, renting definitely wins. All the successful, wealthy, savvy people I know are renters. Renting is definitely the path to building wealth.

Timing the market is also the way to go. Every successful investor I know perfectly times the market over and over and over. It’s so easy to pick tops and bottoms.

My words! You rent a small place (or live with your parents) save a ton of money, invest some, keep the majority in cash. By living below your means you build wealth, debt free. When the housing market crashes you buy at 50-70% discount. If it does not crash you keep saving by renting. It’s the easiest formula you can think of (riskfree).

Falconator was being sarcastic, Millennial.

At least I hope he was. If not, he lives in a fantasy world. (Referring to picking tops and bottoms as if it’s as simple as tying your shoes. Plenty of wealthy people only rent their primary.)

Lol, no shit. Of course he was….he was right in what he said though. The rich people I know own houses outright. They don’t buy now and are leveraged up to their ears with debt. The rich won’t be the bag holders of this market. It’s the dumb money who rushes in at the peak. Nobody can perfectly time the RE market but nobody has to! 2009-2012 Gave you three years to buy. It’s not a half an hour time window….you don’t have to buy at the very low. As long as it’s inbetween 50-70% down you are fine to buy

Now that we are nearing the end of the RE cycle you don’t see these comments “buy now or be priced out forever†as often anymore. Even real estate agent changed their tone slightly. The theme is now more like the next crash will only be x-x% so basically saying buying now isn’t a terrible idea. Funny huh? Just year ago (or months ago) we were priced out Just to find out we are now debating how big the next crash will be. There are many homes that sold at the peak of 2005 for 50-70% more than what they went for in 2009-2012. Zillow price history is your friend. Now they are close to being back up at what they sold for in 2005/2006. But somehow there will be a soft landing during the next crash. I guess we have to agree to disagree and just wait how big it will be. Interesting times ahead.

Millennial,

Maybe the new tax plan reminded people that things can and do change. Sometimes quickly and significantly.

Exactly!! By doubling the standard deduction even less people will itemize.

“There are many homes that sold at the peak of 2005 for 50-70% more than what they went for in 2009-2012. Zillow price history is your friend.”

A home that sold in 2005 for 50% more than in 2009-2012 would mean it was sold at a 33% discount at the bottom. I know what you meant, but thanks for the chuckle.

“The theme is now more like the next crash will only be x-x% so basically saying buying now isn’t a terrible idea.”

You’re confusing perma-bulls with people like me who have always used logic and data. Look at the past to see just how much the desireable coastal areas dropped the last time. In most it was 30%, not 50-70. Median data is your friend.

You are someone who states that’s it’s always a good time to buy your home and that buying your home is not an investment. To me, that says it all.

John,

“The lesson here is, always be shopping for your dream home, but wait until the correction to buy investment propertiesâ€

Keep telling yourself that. You must have bought high.

I strongly disagree with your statement. “Always be shopping for your dream home†means it’s akways a good time to buy your home. Utter BS. Quite the opposite. The lesson is buy low! The lesson is timing is everything. The lesson is price is everything. The lesson is, save in good times buy assets in bad times. The lesson is to be greedy when others are fearful. The lesson is when the sheeple buy overpriced homes and take out Helocs you wait on the sidelines until people get burnt once again. The lesson is don’t believe a word Real estate agents tell you. Do the opposite.

Millennial,

I really wish we could move towards an age where a house was just a place to live.

Agree ocean breeze. But that’s wishful thinking. Housing has become an investment vehicle where a few win and a lot overpay. But that’s in every market. Look at stocks or cryptos. Remember the dot com bubble where at the end everybody rushed into overvalued market caps and penny stocks? I don’t buy I enjoy reading about it. Same is happening now with cryptos and with overpriced houses. You can profit from these cycles big time if you have a plan, discipline and patience.

“Keep telling yourself that. You must have bought high.”

I’ve bought both low and high, with eyes wide open both times. Hmm, at what point does it change from being a bad purchase to a good one? I bought almost exactly a year ago, and the comps are up 15% since then. What if they go up another 15%? Or 50%? That’s a rhetorical question, because the answer, which you still aren’t getting, is that *IT DOESN’T MATTER TO ME.

“I strongly disagree with your statement. “Always be shopping for your dream home†means it’s akways a good time to buy your home. Utter BS.”

You’re still assuming that everyone thinks of a primary as an investment, or that everyone should think like you. Neither is correct. Some people have families and believe stability and their kids are more important than money, and they can easily afford to buy a home at the peak. I fall into that category.

I fully expect the value to tank in a few years, and I expected it even before I signed the loan docs. *Ask me if I care.

Dan, to each his own. I never said everybody should think like me. Of course a house is an investment. Nothing else. For most people it’s the largest purchase in their life’s. Especially families don’t necessarily have money to burn and should but at a low not at the peak. But who cares what others do? I just strongly disagree with the statement that it’s always a good time to buy your home. However, If people like to that who am I to say otherwise. I see that with crypto as well. People chase the pump and run up and end up being the bag holders and panic sell when prices go down. It would be terrible if most people would trade/think like me or hold out on buying real estate. Every market needs people like you who bought high and are fine with it! What I don’t buy is that you don’t care. I think you care very much about the marketprice otherwise why post on a housing bubble website that it’s always a good time to buy a home? I think it would crush you if a millennial buys next door for 50% less than what you paid….

I meant: I don’t, but enjoy reading about it.

Leave a Reply to interesting