Baby boomers and the golden handcuffs of real estate: Will low inventory be a trend for the next few years?

There is an interesting “wealthy gentrification†of many neighborhoods in California.  I’ve seen prime spots in places like Pasadena slowly evolve into upper-class professional enclaves while “old school†owners live modestly watching their new neighbors pull into their driveways with Range Rovers and BMWs.  They live in million dollar homes but their bank statements would tell you otherwise.  There is a large contingent of California homeowners that have what I call the golden handcuffs of real estate.  They are cash poor and equity rich.  That is, if they are willing to sell and move away from the more expensive market they can cash in their lottery ticket.  Many will not.  This trend is part of the stripping away of the middle class in California.  People seemed shocked by the money flowing in from overseas but just look around your house, car, and other items that you own.  It is very likely that they are global in nature.  So when you have buyers from Asia buying up real estate in San Marino or Irvine with suitcases of money, it is no mystery.  All of this is to say that many baby boomers are likely going to be tied down to their real estate.  Those that want to keep up with their neighbors can simply tap into their property via a reverse mortgage and live up the dream.  Is this smart?  Of course not.  Yet most think they are real estate experts because they’ve watched HGTV or some flipping show.  Is this low inventory environment a temporary situation or is it here to stay?

Real estate prices soaring but very little new building

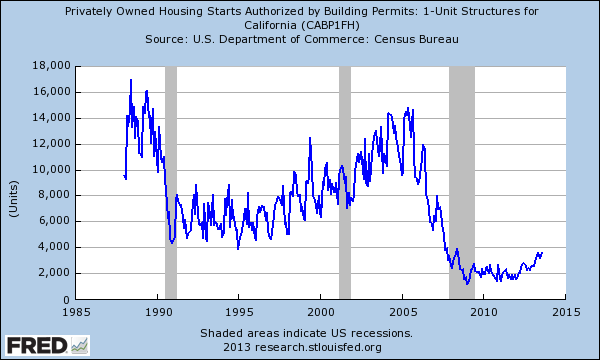

California home prices are up a stunning 28 percent from last year. Â Did incomes boom up? Â Nope. Â Did we have a boom in high paying jobs? Â Not really. Â The flood of investor demand has been the big push. Â If this was a longer term trend we would have seen a big pickup in building which never materialized:

California building permits are down a whopping 78 percent from the peak in 2005.  Yet prices are soaring.  But prices are soaring because the market is controlled similar to a U.S.S.R. project.  The entire mortgage market is government backed.  The Fed is injecting cheap rates into their member banks and this has trickled into real estate via investing.  Many on Wall Street see the devaluation of the dollar and massive QE events and the rush has been to tangible real assets.  Banks rewrote accounting standards to freeze mark-to-market to their favor.  Average Joe’s and Jane’s are basically competing with the big boys and as usual, mistake luck with investing acumen.  We rarely hear about the 5,000,000+ that have lost their homes via foreclosure since the crisis hit, including the hundreds of thousands in “real estate never goes down†California.

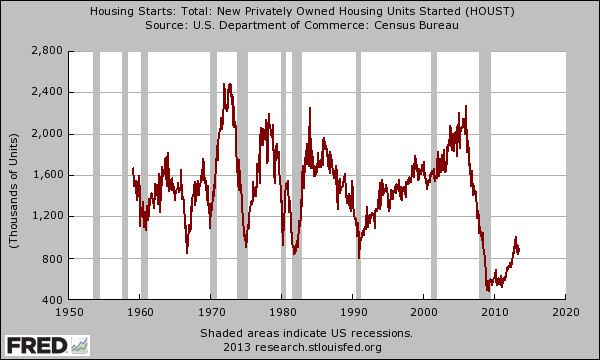

The building permit decline-phase is not only a California trend but is nationwide:

Why is building demand so weak when prices are clearly moving higher?  Well this was a short burst of mania.  Prices are up all across California so the land is short argument is baloney.  Sure, this makes prime coastal areas boom like crazy but for the most part these were wealthy areas to begin with.  Just drive one hour inland and you’ll realize that California has a massive amount of land.  Heck, even the California Association of Realtors doesn’t see this craziness going in 2014:

“(PE) California’s median home price is expected to increase 6 percent to $432,800 in 2014, following a projected 28 percent increase in 2013 to $408,600.â€

Funny how they never predicted the 28 percent increase. Â The CAR in October of 2012 predicted home prices would rise 5.7 percent in 2013 ending at $335,000. Â The point being, the massive rise has come from insatiable investor demand, controlled inventory, and the government owning the mortgage market. Â People are now overplaying this hand which is typical of manias. Â There was an interesting comment regarding inventory in a previous article:

Dfresh said:

“High inventory coming from lack of qualified buyers? Not a strong correlation, IMO. CA is hamstrung with inventory moving forward due to:

1) Prop 13

2) Boomers have paltry retirement and need their house as asset to do a reverse mortgage, rent out rooms, etc

3) Lack of empty dirt to build on (desirable areas)

4) fog-a-mirror types have been wiped out…who remain are stronger hands

5) global economy means lots of demand for so cal, which still is just slightly more desirable than TX

6) LA very hospitable to different races (Middle East, Asian, Latino/Hispanic)

7) etcâ€

This goes back to our baby boomers with golden handcuffs.  Young California home buyers are in a poor position to buy.  They are not the major buyers in this market.  Investors are eating up at least 1 out of every 3 sales.  FHA is still about 20 percent of the market.  The rest is boomers selling or moving up and a mix of everything else.  Yet to think that boomers will all of a sudden sell is mistaken.  People are reluctant to move.  What you do see is “envy†in these areas where people are locked into Prop 13 grandfathered tax rates and have either a very low mortgage payment or a paid off home while new neighbors are truly earning incomes that justify the new housing metrics of the area.  The above comment highlights many of the reasons why inventory although growing, will probably only grow slowly in the next year.

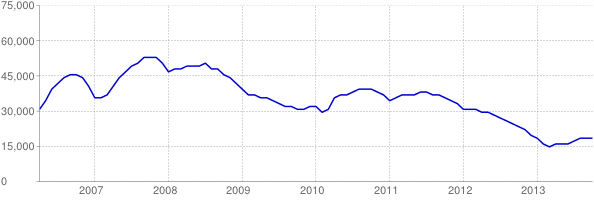

Take a look at the LA area for example (total inventory):

In October of 2007 the LA area had something like 53,000 properties. Â We did hit a low in March of this year of 15,000 but today it is up to 18,000. Â A good jump from the spring lows but a giant distance from the highs of 2007. Â Many of the points given in the above comment highlight why investor demand in California has been nothing short of insane.

What is going on in the current environment is a confirmation bias. Â Everyone is a genius and timed the market correctly. Â Nassim Taleb has a good story about a turkey enjoying every dinner and thinking it hit the jackpot until the day before Thanksgiving when the lights go out. Â A Black Swan event. Â That was 2007. Â All the experts from 1997 to 2007 in real estate suddenly were rushing out the doors. Â Keep in mind that before the last crash, real estate never saw a one year decline going all the way back to the Great Depression.

Of course, many baby boomers that timed a purchase are suddenly market experts.  But I go back to all those cases of failure that now remain silent licking their wounds.  That is how markets work.  The bravado is loudest when you are riding the wave.  Back in 2010 we made a prediction of a California housing bottom hitting in 2012.  At the time shadow inventory was very high but it was clear the government was going to get heavily involved in the game. It is interesting looking back 3 years that we got the overall trend right but some of the reasons for the trend shift wrong. For one, we did not see the massive flood of all cash buyers (not to this level and for such a sustained period). In the context of today’s market, it seems easier to read the trend back then compared to today because it is hard to call this a market. Today however, I have seen few predictions as to how we can sustain this trend.  Plus in a controlled market, the Fed can come out with QE3, QE4, or QE infinity so it is hard to say what impact this will have on prices.  If you think full on government control is good in real estate just look at the empty cities in China and their real estate system.

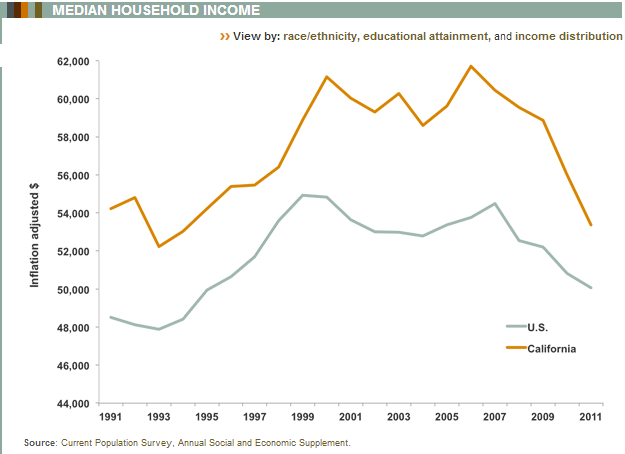

Yet ironically beyond these points, people see the income data and the fact that our government is full on dysfunction but hey, California real estate is like platinum and will never tarnish. Â They look at the below chart and see housing mania 2.0 once again:

So what inventory is out there is being fought over by investors (although this has slowed down recently). Â The few buyers that want some action for a normal home have to compete with this craziness. Â Yet even the CAR is being modest about price gains next year. Â Because of access to information, booms and busts are likely to happen quicker (hence the 28 percent jump in real estate prices last year as incomes remain stagnant).

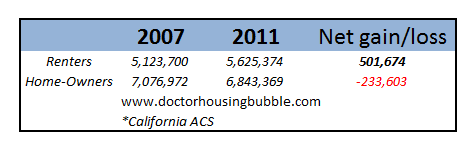

What is interesting though, is that we do have a growing trend of renters:

This is a growing voting bloc here. Â Many people think that Prop 13 is untouchable and maybe it is, but things like Mello-Roos and HOAs are not (neither are local taxes and assessments). Â Just look at the regressive sales tax in California.

With all of this information out there and given the new dynamics, it is unlikely that a flood is going to happen when the market is controlled by the Fed and banks in a U.S.S.R. like fashion.  This is no free market.  It is a game changer however.  The Fed has unlimited digital printing power and they are now the backbone of over 90 percent of all mortgages.  They are willing to keep rates as low as possible until the entire government loses credibility (which sadly, seems to get more and more real every year).  It is clear that this has been a gift to banks, not the middle class in this country.  Baby boomers are likely to ride their golden handcuffs into their graves.  One thing you learn in real estate as an investor is equity is “dreamer’s cash†until you actually sell it and get your cashier’s check minus commissions and other fees once escrow closes.  Then and only then have you cashed in all those golden handcuffs.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

88 Responses to “Baby boomers and the golden handcuffs of real estate: Will low inventory be a trend for the next few years?”

Once re-elected next year, Jerry Brown will make his move on ” modernizing ” Prop 13. He’s never liked it ….but was afraid to touch it in his first term. Now he has a bullet proof Dem majority in the Senate and Assembly and Judiciary. By 2015, the fiscal dysfunction of the State will be much more evident as max pain on payroll and sales taxes is achieved. It is also reasonable to assume the rising minimum wage threshold will feed unemployment and chase a lot of businesses out of the State.

Prop 13 is just another bump in the revenue road for a State that consistently thumbs its nose at its own Constitution year after year.

I agree–but he’s going to be “clever” and come up with some way for the “protected” classes not to be impacted. Look for an exemption if you’re over 65. Maybe a “progressive” re-alignment. All as long as Prop. 13 digs into the job creators and others who are “unfairly” wealthy with real cash.

The tax increases are just starting. Culver City (one of Dr. HB’s favority cities) passed Measure Y in November 2012. This is a 1/2 cent sales tax increase. Culver City’s sales tax at 9.5% is one of highest in California, if not the U.S.

There are many ways around Proposition 13. Mello-Roos is one Prop 13 work-around. There are many others. Cities can charge fees to home owners as a Prop 13 end-around. These fees can be: fire inspection, utility meter inspection, building safety inspection, etc. The cities can conjure up all sorts of special assessments that would circumvent Prop 13 while being in compliance with Prop 13.

When the Great Recession started around 2007/2008, Culver City started nailing local businesses with annual fire inspection fees as a city revenue enhancer. It’s only a matter of time before this gets assessed to residential property owners as well.

Ugh, these never ending taxes and fees are one reason why we are planning to leave the once golden state and retire somewhere else. Leave it to the crazy leftist progressives in California to willingly pay the highest taxes in the country without complaining. Where does all that the tax revenue go? California is perpetually broke! Meanwhile, the state’s infrastructure and government services continue to decline.

Hey all you people looking for help on your underwater mortgage, you’re about to get whacked when you get debt relief starting on January 1, 2014 (from Calculated Risk blog) —

“It appears that the Mortgage Debt Relief Act of 2007 will not be extended again next year. Usually cancelled debt is considered income, but a provision of the 2007 Debt Relief Act allowed borrowers ‘to exclude certain cancelled debt on [a] principal residence from income. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief.’ (excerpt from IRS). This relief expires on Dec 31, 2013. Complete all short sales by the end of this year!”

OK, I see that now is not the time to buy because we are in another bubble. So should a financially well off retired boomer in Burbank sell now and cash out and rent while waiting for a crash to buy at a lower price in Claremont or just give up on the Red Star State(California already has the Red Commie star in its flag) and just move to Santa Fe New Mexico or Sedona AZ.?

If you believe the above argument that Boomers are stuck in place (I do, and not only in California) then this will not bring a “crash” at all. Think of a very slow leak, as the Boomers die off over the next twenty to thirty years, and the homes are sold in estate sales, one by one. You can thank your prop 13 for that one, but, even in the northeast, where i live, rising property taxes still aren’t bad enough to force most of the Boomers into selling. Yet. Beyond a certain age, older people just don’t like to move if they don’t have to, and, really, where will they go? Away from any sort of family contact and social network they have spent decades building? Maybe a few, but, if Florida RE sales are any indication, this isn’t happening. Let’s not even mention the gold mine that the golf course/retirement community developers thought the Boomers would make. That is not materializing at all.

It’s simple. Boomers have no money. Savings are abysmal. Their only large asset, if they didn’t Heloc it in the last decade, is the house, and, they’re finding out it isn’t very liquid at all. You gotta live somewhere, and it might as well be home.

I’d sell and move. Do you realistically expect the California economy to improve on a broad enough scale to make home prices increase under natural conditions? I don’t. We left San Diego last year–yes, missed the March 2013 “peak” by about six months–but c’mon, California’s trajectory for taxes (up) and economic improvement (down) are more or less set in stone since the electorate trusts the wisdom of the super-majority that they send to Sacramento.

I say leave CA. The state will be the last to fall, they will tax everything. There are Colorado mountain towns that have not recovered from 2006-7 and have high quality of life. Pagosa Springs comes to mind. Yes I live there. HK

I am retired and thinking of relocation. Your email interested me. I am a graduate from Northern Colorado Univ. Of course, from Calif. Can you help with gooooood data about Pagosa Springs? Looking for a place in the sun where i have a little money to live out my retirement. Thanks,

Paul, there are many states with lovely flags, many of which don’t have stars at all. AZ flag does have a yellow star, so that might mean a population afflicted by jaundice, so beware. New Mexico seems to have a sun icon, which might mean something weird, too. Please sell ASAP…we could use some of that sweet, sweet Boomer inventory.

Yes please leave. 405 traffic will suck a bit less.

Don’t count on it….If they move, there will always be plenty of undocumented immigrants pouring into LA to take their place on the 405.

Another insightful post on what is happening.

Here is another quick point. Many boomers will leave their overpriced homes to their children. These homes may be worth enough such that they will be over the estate tax exclusion and will have to pay 50% tax which they won’t have, so they will end up selling quickly and at prices lower than “market”

Smaulgld: “These homes may be worth enough such that they will be over the estate tax exclusion”

er… How much is the estate tax exclusion, and what percentage of properties fall into this category?

The federal estate tax exclusion is $5 Million, indexed for inflation. Very few properties fall into that category, and in my experience as a CPA those that have estates that fall outside the estate tax exclusion generally have an estate plan such as a trust in place in order to avoid forcing hasty decisions for their heirs. I do agree with you though, that as boomers pass away, their heirs will likely be forced to sell if the home is under a mortgage, as the next generation won’t be able to keep up with mortgage payments, and likely may not even be living in the same area let alone as the same state as their parents or grandparents.

I am in a situation where to “unlock” the equity in a house that I inherited, I have to keep up with the mortgage payments, ON TOP of my own mortgage and student loan debts. I’m lucky that I have deliberately kept my fixed expenses as low as possible, and am able to do this in the short-term. But due to stagnant wages, and skyrocketing debt, I know many of my generation would not be able to float a second mortgage, and would have to sell in a panic or walk away from the insolvent estate. This is where I see things going with any boomer homes that are not fully paid off.

Are they envious of the old goats like me who are locked into their homes out of inability to move up? (with low income and in some cases supporting out of work kids and grandkids). What do they wish for 3-4% tax on their homes rather than 1% that Prop 13 provides? Remember there are only 7% or so left in that class of homeowners benefiting who did not move up and pay the full 1% on their next home.

Paul, if you are living in CA and not taking advantage of the Mediterranean climate by being coastal, unless you can’t move because of a job, family, medical treatment, etc. (i.e., a really good reason), I don’t see why you aren’t already gone to some beautiful place like Sedona. I know I would be. Landlocked places like Claremont, while nice, aren’t that different from Sedona in terms of weather (they need AC pumping cool air much of the year, then the heater for colder months). Sedona also has a total different feel, etc. and places like Pasadena, Burbank, etc. have access to awesome places like LA for culture, sports, etc. So. Cal. is Disneyland even without Disneyland, whereas Santa Fe and Sedona are not. But if you want to go somewhere much cheaper yet not too different from Claremont weather, like Sedona, I would seriously consider it. I don’t like being land-locked, having been coastal my whole life of 50 years, and my wife doesn’t either, so beautiful places like Sedona are out. Great to visit though. We cashed out on the East Coast in ’07 and have plenty of money to pay for college for the kids, etc. We rent, hoping for another “crash” so we can afford to buy, but as time marches on, I get less and less optimistic that we will be able to pull thatn off in Cali. Maybe Boulder (but hello flooding?), or Seattle (get out the rain slickers, and it’s not as cheap as it used to be). My sister loves the inexpensive lifestyle of Oregon. Good luck to you. You are asking the right questions.

We recently moved to Brentwood, TN. I am back in Beverly to move my daughter and her husband to Nashville also.

California WAS the BEST state to live in, but over 10 years ago things changed drastically. Once pristine neighborhoods are falling apart and the best areas can do is fix up the outside of the retail and business’s but once you walk in everything still smells like must.

We were the same as many of you on this site. We were loud CA cheerleaders. Then after hearing for the 1000th time ‘other’ places are we decided to see for ourselves.

Scottsdale, AZ was great, but too hot in the summer. Portland and Seattle were too cloudy. Dallas, TX was super (and not nearly as republican as I imagined it would be.) and and simply gorgeous and everything was new and shiney and the schools were terrific and almost everyone we talked to was from CA! (Same with Scottsdale)

We decided to move to Nashville after we visited friends and we fell in love with the place. Our school (Brentwood) is one of the nations best, all of our friends are X-Californians also. Our 5000 square foot house is in a wonderful neighborhood called The Governor’s Club. We paid 600K for this brand new home with all the bells and whistles.

Our other children are SO happy and are relieved they don’t have to feel frightened by the ever changing neighborhoods.

I don’t have to tell everyone what is wrong with CA – we ALL know as we have been living with them for years.

We’re done with CA. After this weekend, I hope I never have to come back because I really don’t have the time to always be in fear for my life on the highway, and always have to worry about WHAT ELSE IS GOING TO GO WRONG in CA. Instead, we are now living the type of life we had always wanted. We have NO regrets. NONE.

I recently read that TN has the highest crime rate of all the states, and is one of the states with the most uninsured people, two things that mean something to me anyway.

@ Agree/Disagree – Sounds like it’s been the right move for you. And, for sure, Nashville is an absolutely beautiful place with a reasonable pace of life, cost of living, access to a variety of things, etc.

Don’t know if you’re originally from CA, but one thing I’ll give you a heads-up about related to the South…..the culture may surprise you. If you have enough Cali friends in Nashville it won’t matter as much. But, it is a culture that loves the status quo, they are not open-minded, you will not have discussions…conversations will flip from one topic to another very quickly only to be touched on superficially, if you put forth constructive ideas expect them to be resisted (status quo rules). You will be acquainted with Southerns for years and still barely know them (see lack of discussion comment).

Oh and, passive aggressive behaviors rule here. BIG TIME!

I’ve been in this region a quarter of a century, I know what I’m talking about.

Just letting you know so you can be aware (and not feel like you’re a alien trying to understand the population here).

For me, it seems like a lot of Californians don’t understand TN! It’s a great place to live. (I moved from CA to FL, so I have no vested interest in this disagreement.) Art Laffer moved there to escape Cali about seven years ago…he could live anywhere in the world and picked a Nashville suburb. Another friend of mine just was dissing TN schools…oops, they turn out to be rated higher, on average, than CA. That’s right, I forgot, California is the BEST! Anyone not living there or NY is a Neanderthal.

Prediction Reality Check’s comments sure did give me a chuckle and are just classic!

Status quo conformity, superficiality, and passive aggressive behaviors could just as easily describe the culture in SoCal.

Reminds me of how many folks on the left, right, and in the middle simply define “open minded” to be inclusive of their own point of view.

I can’t even begin to count the number of times I’ve heard comments from people of varying backgrounds in SoCal quick to label fly-over country. Yeah, that’s real open minded and not superficial alright!

@Yeah, and — you do not perceive correctly. It’s all about depth and scale.

No doubt your comments about Calif people are correct related to some of them. I have not experienced those things with the friends/business relationships I’ve had in Calif. Here? It’s beyond belief, the scale of it. Like I said, it’s the culture.

Earlier this year I moved to a small but very interesting city in Western NC that has grown alot in the last dozen years with people from all over the country moving here (incl Calif). Without the significant influx of people from other regions I would have never considered it. I’m liking it and think I’ll stay but this is the last stop in the South for me. If I move on someday, it will be to another region.

Interestingly, I knew 2 Californians while in Atlanta (one from San Fran and one from San Diego). Each of them lasted less than 3 years. They didn’t like it…..difficult to relate to people and understand their coded language.

I’m just providing a heads-up…..not trying to dissuade anyone.

Some of these comments are hilarious. People don’t like things in California(high taxes, high prices, traffic, crumbling infrastructure, deteriorating neighborhoods, poor economy, etc), so they move somewhere else. They then bitch that their new home isn’t more like…..California. They then try to turn that place into…..wait for it…..California. It would be laughable if it weren’t so depressing to watch it happen. It’s like a virus that is infecting the entire country.

What I’m getting from this article is that there will be no crash. All previous crash predictions were based on free market fundamentals, and if free market fundamentals were allowed to come to fruition, there WOULD be a crash.

But DHB said, and I agree, ” it is unlikely that a flood is going to happen when the market is controlled by the Fed and banks in a U.S.S.R. like fashion. This is no free market. It is a game changer however. The Fed has unlimited digital printing power and they are now the backbone of over 90 percent of all mortgages. They are willing to keep rates as low as possible until the entire government loses credibility.”

So the games over for Joe Sixpack. Perhaps life is forever changed and if you don’t have Google founding brains, or a large inheritance, this is the new Amerika.

The Dodd-Frank “Safe Harbor” provision may be a game changer, and the TBTF banks, that have already laid off thousands of their mortgage people this year, are already dumping their mortgage origination businesses in preparation. Along with Basel III, which forces the big banks to have more of their own blood in the lending game, Safe Harbor will force many lenders, including mom and pop owner-carry folks, to damn up the already stagnating mortgage streams. I predict that house prices, even in California, will drop next year.

This is becoming a game of chicken for the government. The big question that should be asked is who the government represents? The citizens or the banks. I smell revolt coming as more people consider both parties useless in bank reform and accepting consequences for their actions. With the Glass Steagall act being thrown out and Banks and investment companies to create the perfect storm for another Depression 2.0 it seems that perhaps the intent of this whole debacle was planned to lead to the next step…New World order. I predict that this maybe the last stages before we lead to another major upheaval for the economy now that it is being handled by the banks and not the government.

Hi Doc, this agrees well with many of my extended family and friends who were or are at the upper end of the boomer age. Not one of them has sold their home or plans to sell their home to downsize. Even for the woman I know who recently retired and owns a 3 bedroom home in Mar Vista… she’d rather eek out her aging years with little income and hold on to her 3bd home than cash out and move into a 1bedroom condo and have cash on hand. Or my mother, who lives in the house that her parents bought North of Montana Ave in 1955. She now lives in the granny flat and rents out the front part of her house for $5K per month (the property taxes are $1800 / yr. Both of these examples are ‘gifts’ of Prop 13. I think Moonbeam Jerry Brown will first hack away at Prop 13 for commercial properties. I think it will be at least half a decade or more before Prop 13 for residential properties will be hit with incremental increases only. Any significant changes to Prop 13 would result in a backlash of protest from those homeowners enjoying it.

I wonder if there are any stats on percent of residences enjoying the benefits of Prop 13?

If you look at where home prices have rebounded back to or very close to 2006 levels, it’s mostly in the very desirable areas of CA. The people with golden hand-cuffs are not selling and the buyers with cash want to purchase highly desirable real estate.

This has nothing to do with jobs or interest rates, it’s all about people taking liquidity out of the market, (their cash), and putting it into something tangible. It’s actually pretty scary and it signals real trouble.

While I think the prop 13 rules should stay in place for owner occupied properties, I do think property used for investment purposes (rentals, commercial, industrial, etc) should not fall under the prop 13 statutes. Sure, I have rentals this would impact, put prop 13 was sold to CA voters as a way to protect older people, on limited incomes, from losing their homes to ever increasing property taxes. That is not the case for properties used for business and prop 13 should not apply IMO.

I hear ya on the Golden Hand Cuffs Dr, as I would love to sell our grossly over valued house, that is a few blocks from the beach, take the money and move on to other investments, but the wife loves it here and that is that.

Excellent article. Golden handcuffs? “Accidental millionaires”? Usually 65+, bought SoCal RE decades ago, many came to CA for weather, jobs, adventure. Hawaiian shirts, hot rods, Beach Boys, RV’s. Comfortably raised their kids in Cali Golden Age w/middle class incomes; great schools, Disneyland, Hollywood. Love CA…its been very good to them. Often retired w pension, or no plan to retire if comfy in long term job. Sometimes majority retirement savings based on house value. May become confused, incredulous when someone departs SoCal; “Who would leave this weather?” Some scoff at disillusioned youth… “When I drove my van to California in ’73 I had $100, rented a room on the beach, put myself through school working as PT bartender, saved down payment for first house after two years at my first job out of college! What’s wrong with these kids? Pshaw!”

Their offspring…middle aged California “Aspirationals”; many cling to Surf in morning Ski at night lifestyle dreams, Disneyland infused childhood fantasies although many have lost jobs, incurred major financial loss/debt, struggle mightily to live on real life income. Social approval often very important; some depend on aging parents for financial help. Adore weather, beach/celebrity culture, perceived multiculti “uniqueness”, California “superiority”. Enjoy discussing “back in the day”, how they went to high school with famous punk rock musician, child star, etc. If family house inherited by this demographic it could perpetuate a new generation of “golden handcuffs”, a massive SoCal pool of owners who couldn’t buy their property at today’s prices; perhaps keeping inventory tight, prices high for years. House poor heirs win a RE lottery. Very possible all equity will eventually be squandered supporting adult kids, keeping up w/Joneses, etc., but it could take awhile.

Millenials? Free to Be Snowflakes Left with Crumbs? Maybe flush parents help them buy SoCal house, or perhaps they’re content living in w/parents/roommates indefinitely with a low wage job. Ambitious Millenials most likely group to leave SoCal seeking lower cost of living/improved quality of life, educational/career opportunities, affordable RE, independence, marriage, kids, etc. Many have seen parents sacrifice greatly to live with a high cost of living, and/or may not want to wait decades to inherit a family house (if there’s anything left to inherit).

“Shirtsleeves to Shirtsleeves in Three Generations”; the culturally universal old proverb that rarely disappoints.

All just my humble opinion.

I wrote, “Enjoy discussing “back in the dayâ€, how they went to high school with famous punk rock musician, child star, etc.”

Let me change that to “famous musician, child star, etc.”, not singling out punk rock, I gotta be fair. Heck, change it to “Enjoy discussing “back in the dayâ€, how they went to high school with any remotely famous person, celebrity, etc.”, call it a day.

Funny I work with someone like that. Always talking about the two or three famous people he grew up with.

And those famous people don’t do a damn thing for this guy, let alone think about him, LOL. But keep livin vicarously bro!

Drinks, 10 plus for you, great post. I think you forgot to mention Trader Joe’s. 🙂

Socal boomers truly lived a charmed life. The vast majority will not sell. Parting with the goose that is still laying golden eggs is a hard thing for most to do!

I got a kick out of your post–really, this whole “golden handcuff” topic, in general. It’s really funny how there tends to be a “bubbled”, herd mentality in So. Cal regarding all of this stuff. Naturally, California is the best. Naturally, 70s/80s California will return if we wait long enough. Naturally, you’d never want to sell and move away.

I’m a Gen-Xer who finally woke up to reality that you “can’t go home again.” Southern California won’t revert back to its former glory. Thankfully, there are other places (really!) in this country that re-capture some of the virtues of So. Cal. in the past. But as for L.A. et al, I think we’ll just see an intensification of the trends of the past five, six years. Pick your social or economic topic–immigration, taxes, etc…–more is better, in California’s eyes.

I always think about those waiting to inherit their parents’ “golden handcuffs.” Typically, as you suggest, they don’t really have the means to afford that property on their own. So what happens when it comes time to consider maintenance, taxes, etc…? I understand that under Prop. 98 or so, there’s some exclusion for properties transferred via inheritance to enjoy the benefits of Prop. 13 exemptions. But still, you’re sitting on a 50- or 60-year-old house and can’t afford to re-build it. You can’t get a loan to do it, either. And what if there’s more than one kid inheriting it? I’m generally in favor of things like Prop. 13 where you’re attempting to cap government spending, but there’s a sheer ugliness in the disparity and motivations it’s creating in the housing market.

@KR Hi KR. I am one of those who stand to partly inherit a 4bd 2ba home in the North end of Santa Monica. The house was purchased by my grandparents in 1955 for $16K. Back then it was a rundown house built in 1923 and my grandfather, the carpenter spent a a long time fixing the house. [imagine back in the 1950’s a blue collar worker could afford a home North of Montana avenue:)]. In any case the house is still in the family and my siblings and I have no intention of selling the house. Taxes (Prop 13) are low and maintenance is low and we can rent it out for $5K per month or more. We have figured even if we need to set aside $500 per month maintenance that it is otherwise free and clear. Perhaps I am naive about maintenance costs but other than a roof every 20 years or new plumbing every 50 years, I dont see what other major maint. costs could be incurred (the house has its original electrical wiring in most of the house with no problems in 80 years)?

Head down to many of the quaint, expensive beach towns on the SoCal coast. Park, walk around. For every massive new construction house resembling a department store, you’ll likely find plenty of old houses in various stages of disrepair (peeling paint, sagging roofs, old windows, termite damage, crumbling steps, overgrown vegetation, etc.) Hmmmm…

Drinks, I have a couple houses like that in my neighborhood. People who bought 40 years ago and would have absolutely ZERO chance of buying said property today if they had to. Can’t afford a new roof, no problem…just put some blue tarps up there. One of my neighbors has a deck over her garage that is literally falling apart. Large amounts of water get in the garage when it rains. No problem, just sweep out the water. I see her adult children stop by and visit, they are frothing at the mouth of eventually owning that shit box and the Prop 13 tax basis. Welcome to California!

QE–good for you! Glad there’s a system that works for your conditions. If I had to guess, though, you might be an exception to the rule. I honestly don’t know–this is all speculation–but it’ll be interesting to see in the years ahead if jobs continue to become more scarce and the taxes/regulations keep growing. We’ll see…hope the very best for your sweet arrangement.

best post here ever!!

American Homes 4 Rent Announces Public Offering of 5% Series A Participating Preferred Shares. The IPO was just completed in August and it may be a bit soon to issue common so soon after?

This scenario is common in northern Calif. too, neighborhoods in my hometown of S.F. that were solidly blue collar when I was a kid now require two BIG incomes to buy as even a small fixer upper is $800K…some of the people that bought back when it was not so tough are dying off and/or moving away, others are stuck due to low property taxes as you said.

I’m a boomer myself and comfortably retired a year ago, sold my last place in 2007 but was unable to buy again in 2011 and 2012 (in Sonoma Co.) thanks to the 100% cash flippers and speculators, am now on the sidelines waiting for Bubble 2.0 to pop…

As a Boomer who lives in the Rust Belt and who’s house has depreciated (a factory town without factories, closed schools, residential neighborhood now filled with rentals and foreclosed properties, etc) I envy the boom induced equity of the SoCal Boomers. I think I’d be tempted to sell my house and move to a small town in the midwest where you could buy a comparable home for $100K or less and pocket the difference. Easy for me to say.

But then you are in a small town in the midwest….no thank you.

Don’t knock the Midwest, it’s better than garbage CA for anyone who’s not making $250k a year.

I wouldn’t trade my childhood or #1 school district for the world.

And that’s how the cycle persists. Because every Southern Californian knows that it’s the very best place on Earth and nothing can possibly compare. Ironically, in the “highly diverse” mentality of Southern Californians, there’s a herd mentality where everyone keeps telling each other that there’s nothing worthwhile outside its own borders. I have my father-in-law to thank for breaking me out of that lie; I now enjoy a better property in sunny and sandy Naples, Fla. at 3/4 the price and 1/2 the property taxes.

Would you care for another cup of snob to go with your platter of condescension, Sir?

Comments such as yours are helping to make us Californians appear ugly to the rest of the nation. The same nation with other states that form our union.

Sell and move to Sedona. Get out while the getting is good so some sucker will over pay you for your home.

Great reporting on this never ending story today. Always enjoy reading this blog and refer people to it regularly. Interesting that if the Fed hadn’t stepped in the price on homes would not have gone up so much and so fast but on the other hand there would have been lots more inventory and regular home buyers with the normal flat wages for the last 30 + years, would have been able to purchase a house to live in, as opposed to someone purchasing a house just to make money off of it. So Thanks to the banks they created and profited by the housing bubble and its crash, then they get to come in like vultures and pick the bones from the carnage they created, then vests bubble 2.0 to continue the predator practice. Now they are supposed to hold these homes as rentals for a minimum of 5 years. Not sure if that’s a guideline or if they really need to follow it but that’s the rule the Fed created for these large investors i. e. JP Morgan, Chase, GS et al. So I wonder what will happen when interest rates rise, investors sell to move money elsewhere, securitizing rent rolls fails, a glut of tentals causes rent to go down, idk. When it’s controlled by a few greedy aholes it’s anyone’s guess what they will do next? its like the stock market its controlled and manipulated so us regular people can only guess when the elevator will stop and when it will go down and when it will go up? real estate no longer follows: any practical free market principles.

You’re absolutely correct; I’ve made a similar point before. Whenever the government “helps” the free market (FHA, Fannie/Freddie, expanded conforming loan limits for “high cost” areas, affordable housing, etc…), the unintended consequences ultimately distort the market even worse than if it had simply been left alone to sort things out under natural supply/demand.

It always amazes me how humans feel compelled to stagnate in one location their entire lives. Uninteresting. Why don’t we just go everywhere and see the world. Life should be fantasy.

@Killerjane – you’ve got it….I’m with you.

Sign me up for that program!

Oh wait, I’m already on it……and it does make for an interesting life.

I think a valid assumption that most all readers will agree with is that investors invest because they want to see a return in real terms on their investment.

So, are these folks investing to get a return from rental income or [future] anticipated price appreciation or both? If its just rental income then it would seem obvious that prices will cap based on what renters ability pay. If it is based on [future] anticipated appreciation then they are speculators not investors.

And what about holding costs such as property taxes, HOA dues, insurance and maintainence? Holding costs are generally paid monthly and the cash to do so doesn’t drop out of the sky [or does it?].

What am I missing?

I want to live in many places, that is my point. What is the purpose of buying a rotting old so-cal fixer. Been there, done that, back hurts. I like nice beaches, Las Vegas edges, desert life, I like lakes in Michigan, snow boarding, scuba diving. Point is, not thinking this is a dating site,,,, But,,,,why pay your whole life for one place to be.

>> why pay your whole life for one place to be. <<

Security. Familiarity. Staying in one place provides the time to build social networks, to build relationships with friends, business colleagues, service providers (e.g., dentists, optometrists, grocers, doctors, churches, favorite coffee shops). One grows comfortable among familiar faces.

In other words, afraid of change.

ive been everywhere and done nearly everything, and i chose to stay in, the best place overall, LA. “how i learned to love LA and forget the bubble”

Duh!

“For the first time in history, a truly global middle class is emerging. By 2030, it will more than double in size, from 2 billion today to 4.9 billion. Brookings Institution scholar Homi Kharas estimates that the European and American middle classes will shrink from 50 percent of the total to just 22 percent. Rapid growth in China, India, Indonesia, Vietnam, Thailand, and Malaysia will cause Asia’s share of the new middle to more than double from its current 30%. By 2030, Asia will host 64% of the global middle class and account for over 40% of global middle-class consumption.”…..

Wake up! Globalization has structurally changed the US and those who don’t like it, there are ways to do even better than before. As for RE, it has always been location, location, location which works in the long run. Sure, picking bottoms is great, but not necessary if picking the right property. Don’t like that cash talks best….sorry, it always does.

Good points, indeed. All the more reason to buy stock in Coke, Walmart, Nike and Apple! But, the middle class is not who is coming from Shanghai to Irvine to buy a $500,000 condo with cash. The ills we feel here in desirable parts of U.S. from wealthy foreigners coming in and swooping up limited RE inventory is being felt across Canada, Europe, in Hong Kong, Japan, Australia…anywhere there is some economic, political and legal stability.

I totally agree. It’s the wealthy who buy second homes abroad, not the middle class. My theory is that the wealthy Chinese (and pick any other cronyistic state) are trying to get their money out before everything collapses, so foreign real estate seems relatively safe. Also, many of those $500k condo purchases in Irvine are for the kids when then go to UC Irvine one day. Again, not too many middle class families can buy Junior half-mil homes overseas for college.

The mania is certainly there in California real estate and even more so in the rigged stock market, bond market and most commodities, bond market in the biggest bubble of all time. If you want to have some fun and educate yourself, read the work below. It is free on the Internet and is the great classic of all time on manias. Believe it or not, they have been around for a very long time and people never learn.

http://www.gutenberg.org/files/24518/24518-h/dvi.html#miss_scheme

@Fulano, it’s not so much that the bond market is rigged. It comes down to investment strategy.

1.) When people are younger, money is invested in the riskier stock market to get the best return.

2.) As people get older, their financial advisers have them move their funds from riskier equities to “safer” bonds.

This is exactly what has happened over the last twenty years as baby boomers have aged are are nearing retirement age.

The bond bubble will pop as more baby boomers hit retirement age and liquidate their bond holdings for cash. The Federal Reserve has rigged the housing market, the stock market and commodities via quantitative easing (QE) and zero interest rate policy (ZIRP). These Federal Reserve assisted bubbles will likely come to an ugly end.

Good stuff, Fulano, thank you for sharing that link. It sure is interesting to witness the “this time is different” self-delusion taking place during our present time.

Question. Does a reverse mortgage count as a ‘sale’ for the purposes of prop 13.? Also the FHA has tightened the rules on reverse mortgages to require the ‘seller’ to have enough income to pay taxes, insurance etc. If a $100,000 1980 house is ‘modernized into its $1 million plus contemporary status a reverse mortgage may not be possible for many retirees.

I don’t think reverse mortgages affect Prop. 13 status. If you renovate your home, technically, it should, since any construction permit is supposed to have feedback to the county tax collector to follow up on the value of the improvement. But reverse mortgages, besides being absolutely terrible financial deals for the home owner, will destroy all forms of equity that Junior was hoping to enjoy. Best not to tell the kids…

The boomers are doing reverse mortgages and staying in their houses and eating up their kids inheritance. On top of this, the boomers are leaving their kids with the national debt to pay. The boomers are having the party and leaving their kids no inheritance and only bills. This is an outrage! We will never be able to buy a house. No grandkids for you dad.

Do you really feel you are OWED an inheritance?? I never have and the total for me so far has been $2000 and I’m fine with that. I’m a boomer and don’t like the national debt at all and vote against people that promote it but do not feel that I or my generation are personally responsible for it either.

You’re absolutely correct. My advise: move. There are plenty of places where the quality of life is better than So. Cal. at a cheaper price. Don’t let the greediness of the previous generation affect your lifestyle choices. If you want to have a family, have a family. Make grandpa have to fly out to you to visit.

Are you so sure it is the “baby boomers” and not the 1% who are screwing future generations?

Blaming the wrong group of individuals for problems fills our history books.

Martin you have to excuse some people who listen too much to MSM. They are totally controlled by the 1% of the 1% who divide and conquer.

I never understand the argument that the 1% are screwing the 99%. How? By selling you Coca-Cola and iPhones? If we’re talking about the Fed (1% of 1%), I’d agree with that to some extent, but I just play along with the game and buy in the stock market while keeping my trailing stops tight. It make more sense to profit from them than complain if nothing’s ever going to change.

KR, you can’t be serious. You really don’t know how the 1% (of the 1%) are screwing the rest? How about insider trading? How about the flow of $ in QE? How about no prosecutions for the whole banking mess? Nobody in the top .01% is getting prosecuted for anything.

and now the financial system is in worse shape than it was 5 years ago. Cumulative family savings are down, median incomes are down. But the top .01% has seen their net work skyrocket. Much of this has been described here on DHB. And you “can’t understand” it? What is it that you don’t understand? It’s lack of prosecution, convincing congress to rewrite laws, convincing justice not to enforce laws…

Jamie Dimon just got an impromptu face-to-face with Eric Holder. How utterly inappropriate is that? Think that you’d get the same treatment if your business had a whistleblower going to the justice department?

Paul, Sell the house, and rent where you think you may want to buy and live out your life. I sold in April and never looked back. No more mortgage, and emergency repairs to fund. The golden hand cuffs are off after 32 years, and damn it feels good.

Sounds good to me. I like the idea of freedom. Equity in a home to me is such a burden. I have more than enough income and assets, I don’t want to be a prisoner to GREED. Time to leave Tune Town.

My Golden Handcuffs is a large rental property that makes over $100K a year. It is paid off and I can live in one of the units. I’ll stay.

home paid off,free and clear.even if one had to pay property taxes of a $1000.00 a month would still be cheaper then renting and on top of that your be living in very nice neighborhoods. those old-timers homes will stay in the family.

I think there are some multi-way gentrification trends going on, and that’s boosting the prices. Also, suburban areas that are feeding into the gentrification don’t see their values drop so fast if there are parents or relatives to move into the house being vacated.

The gentrification pattern of younger people moving into the downtown areas is one pattern. That’s generally not displacing a lot of house-buying people, as most were renters in hotels or apartments. They move on to other apartments.

The gentrification pattern of people with money from China and Korea moving into existing ethnic neighborhoods, or of suburban ethnics moving into lower cost urban areas, is displacing existing residents, and they’re moving to other low income neighborhoods, increasing demand and causing rents to rise. Some are buying, with subsidies as they are moderate income, and that also causes prices to go up. I won’t say who is going where, but it’s happening.

Lastly, we’re still seeing the influence of venture capital money in California. It used to be limited to the Silicon Valley, but some years ago, it went into San Francisco and San Jose, and now it’s coming into Los Angeles. It’s hard to fathom how much capital is involved… but when you hear the reports of 30 years of stagnant wages, while worker productivity increased most years… well. The increase in productivity came from Silicon Valley, and a bit of that wage stagnation was due to the savings going to Silicon Valley rather than to the employees.

We are the 99%.

If you read the comments on this post as well as others, a big chunk of viewpoints seem to be based on age. Millenials as a whole taking it in the rear the most, so they complain the most. gen X watching the american dream slip away too as well so they complain along with a few boomers that didnt win the home lottery. And then a group of CA baby boomers (many of which could have hired monkeys to throw darts at dart boards when buying homes or stocks because of the massive appreciation in almost all of them over the past 40 years) sittin pretty and a tad smugly to boot (sorry to write, but the tone is there fellas). The generational trend is awful. Do future US citizen income and employment fundamentals matter or does world citizen income and (forever? at one point ending?) govt/bank manipulation win in regards to future house prices? Guess we’ll see.

Your observation about generational divides could be the premise for an entire article. The next question is what are these generations doing about their respective RE situations?

Millennials = despite the stereotype of X-Box slackers, they have become the new saver generation. You’re looking at the next generation of first-time 10% down buyer.

GenY/X = lowering their quality of life expectations. The perpetual renter in the new “renting doesn’t make you a loser” meme. Also the generation most likely to leave the state.

BB = Don’t pay attention to “only 7% left” nonsense. In desirable areas, they’re everywhere. Thanks to the Bernanke Bump they’re hunkering down in their Prop 13 lottery win to stay, renting out rooms @ $700 each, inviting their kids to co-habitate, taking out reverse mortgage, etc. Golden handcuffs? How about golden sarcophagus.

As a Gen X/Yer I’m now ok with the idea of renting for a long, long time.

But the next Boomer at the family dinner table to dole out the sage “You two should just find something in the 250-300k range, a fixer-upper to start!” advice is going to get an earful.

Boomers are hitting the retirement age in stride right now. But many don’t have much to show for it. And living is not getting cheaper. Reverse mortgages give them money and a place to live until they die. Very tempting if your only valuable asset is your home and you’d like to stop working or can no longer get a decent paying job.

Both the Bankers and Fox News are touting the hell out of reverse mortgages, they even provide you with a CD to explain how great they are. The only thing better than a reverse mortgage is a 3% annuity.

In the next six months, we are selling our place, becoming trailer trash for 400 bucks a month space rent, and will live off the equity of our sale for the next five years, then gradually file for SS and start tapping our retirement accounts.

Thought long and hard about leaving the area, but friends and family are important, and decided it would be a lot easier to rent a VRBO place in the northwest every summer than buy a second home and have it sit vacant half the year, paying insurance, taxes, and upkeep. This way every summer we can stay in a different area, as well as take that round the world cruise and spend three months in Europe.

If anybody turns up their nose at my mobile home, I couldn’t care less.

@Shellz — are you kidding? I don’t care what you live in….you sound really interesting. Do you need anyone to carry your bags on those journeys?

I took a trip around the world in 2004 for 3 months, visiting 9 countries.

Absolutely incredible and, of course, a life changer. Worth WAY more than any sports car or house remodeling of the latest HGTV-approved accoutrements.

Go for it……you won’t regret it!

I’m boomer offspring that will inherit a nice so cal home at some point, and have no interest in living there. I would either sell it, or my brother could buy out my share if he wanted to live there. I get along fine with no inheritance, and will probably end up donating most of it.

What is going on in the current environment is a confirmation bias. Everyone is a genius and timed the market correctly. Nassim Taleb has a good story about a turkey enjoying every dinner and thinking it hit the jackpot until the day before Thanksgiving when the lights go out. A Black Swan event. That was 2007. All the experts from 1997 to 2007 in real estate suddenly were rushing out the doors. Keep in mind that before the last crash, real estate never saw a one year decline going all the way back to the Great Depression.

Of course, many baby boomers that timed a purchase are suddenly market experts. But I go back to all those cases of failure that now remain silent licking their wounds. That is how markets work. The bravado is loudest when you are riding the wave.

I like this perspective. It’s very loud-busy out there, new paradigm. Always looking to other countries and their new stimulus programs.

Was reading/researching about elderly downsizers last night, and an FT story from November 2014.

Couple of in the comments area got discussing Larchmont.

First guy was saying Larchmont (Westchester County, New York) the county has the highest property taxes in the US, and trying to help downsizers find much cheaper place in the same community. To cut the $60,000 annual property tax he has a business assisting downsizers to find suitable property, so that the annual property tax comes down to a more ‘managable’ $30K a year, or a few miles away in Greenwich Connecticut, around $20,000 a year.

Talking about high income families, who, with their lifestyles and bills, are stretched.

Other guy chips in how he grew up In Larchmont in the 50s and 60s when tax still high but not requiring two working parents. How his parents lived there but moved in mid 1990s due to the painfully high property taxes.

Then he brags how he moved to California in the late 70s and enjoys very low property taxes “thanks to” voters enacting Proposition 13 in 1978. That were it not for Prop 13, taxes would be just as painfully high. I guess it’s all without consequence. Runaway house price inflation to crazy heights, and low property-taxes, and young people who have to go out in to the world to earn a living, shouldering it all.

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights. http://www.ft.com/cms/s/0/7cc9d5f8-10ea-11e4-b116-00144feabdc0.html#ixzz3aoXwZh2H

Were it not for this marvelous piece of legislation, our property taxes would be a bad as Westchester’s… and to pay for what? Enormous pensions and luxurious medical benefits for the burgeoning cadre of government workers. CA bad enough in that regard, with public employee union members treated like royalty and $500,000,000,000 in unfunded promises to public employees, whose representatives in Sacramento are seeking every way possible to skirt Proposition 13 limitations.

(Should open in a Google search, via Chrome browser). The Silver Economy: Downsizers transform US housing landscape

Leave a Reply to Edward