The pioneers of gentrification: home prices are up even in areas with subpar schools and horrible street parking.

Every time a housing bubble forms you get the same typical housing cheerleaders talking about massive gentrification. Many areas have gentrified in dramatic fashion but at the end of a housing bubble, you start seeing wild prices in areas where it is questionable if gentrification will or has occurred. In Southern California, the trend has been unrelenting to adding renter households. Some think that raising the minimum wage to $15 is going to inflate housing prices but this is simply nonsense. All this does is eat into more disposable income – that Big Mac will cost more or Taco Tuesday won’t be such a bargain. As if this new push will allow people to buy $700,000 crap shacks. When you read reports on housing from the media you get a deep sense that they’ve never been out to many of the zip codes in L.A. County. Take a look at an area that is very frothy but rarely talked about. Paramount.

Paramount – the city, not the movie company

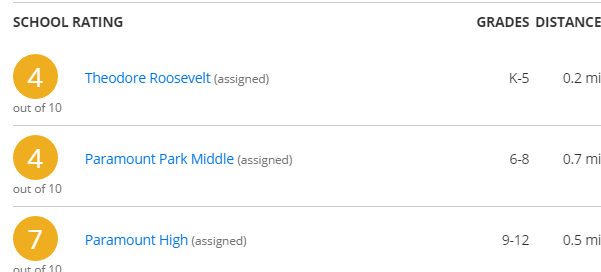

While the house humpers are fixated on tiny markets, they fail to realize that prices are soaring in virtually every area of Los Angeles. Did schools get better? Did incomes go up dramatically? Does Paramount have hot Chinese money flowing in? The answer is no to each of those questions yet prices are very high for this area.

I’ve noticed a few gentrification pushers trying to push cities like Pacoima, Compton, and Paramount as if this was the bargain to be had in L.A. County.

Take a look at one example here:

13440 Jetmore Ave, Paramount, CA 90723

3 beds, 2 baths listed at 1,045 square feet

This place was built in 1924. Street parking seems a bit tight here:

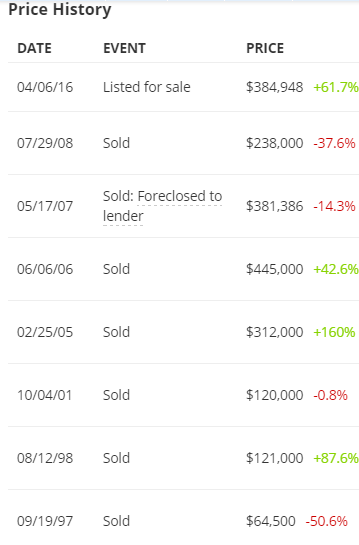

At least you have a gated driveway. People talk about buying a home and holding on for a long duration because otherwise, you are “flushing†money down the drain renting. The majority of people in L.A. County rent because they can’t afford to buy. With that said, buyers of this home never stayed put and some lost money:

Someone bought this home in 1995 and lost the home to foreclosure in 1996 (this was at a purchase price of $66,500). So much for always making money in housing. The home sold in 1997 for $64,500 and then sold in 1998 for $121,000. Someone made money! The next sale took place in 2001 for $120,000 – $1,000 less than the 1998 price (another losing bet). It then sold for $312,000 in 2005 during the mortgage crack days of the bubble. These folks did well. It then sold in 2006 for $445,000 and these folks found no more chairs when the music stopped. Bust and another loser. The home went into foreclosure and then sold in 2008 for $238,000. Now it is back on the market for $384,948.

Yet the line goes, “everyone that buys real estate makes money.â€Â Hell, all you need to do is look at this one property and figure out that is a lie. You make money buying at the right price. Some bought at peaks, some bought at troughs, but in the end some people made and lost big money. Doesn’t sound like a sure bet to me.

The current price is ridiculous. The adjusted gross income for a family in this neighborhood is $32,000. As history shows, California is the land of real estate booms and busts. But believe the hype and be one of the first to gentrify this area. Take a look at school ratings here:

You’ll be spending nearly $400,000 for this. Yes, this market is a bubble. Reporters need to go out to these areas and see what people are actually buying. But they won’t. And the bubble will pop. And on and on will the story go of the booms and bust of California real estate.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

174 Responses to “The pioneers of gentrification: home prices are up even in areas with subpar schools and horrible street parking.”

Housing To Tank Hard Soon!!

Tell ’em Jimmy! Housing to tank hard soon!!

When in your dreams not so soon jim

Gooooooo Jim!

Jim fan 4lyfe here

Jim will be wrong at least for another year or 2.

Oh to only have that crystal ball that Denddandan. I checked ebay and couldn’t find it. Maybe amazon?

Jim your a renter for life!

California bubble has nothing on the housing bubble that formed in Australia. The slums of outer Sydney (full of section 8 / projects) have now become more expensive than New York, Tokyo, and Paris.

http://www.luckyoz.com/new-york-tokyo-homes-cheaper-sydney-slum-mount-druitt/

I lived in Sydney for a few years for work and kept way away from Sydney’s western suburbs.

Slum is an understatement. I’d walk down a dark alley in Compton, Los Angeles, any day before is even drive through Mt. Druitt. IMO any 3 bed house there is worth maximum $5000.

I had a look at those links and yikes.

Even though I grew up a literally persecuted minority for being white/”white”, white trash scare me more than anyone and those people look hard as nails.

Alex, look up crime stats by race and then you won’t feel quite so concerned. Unless of course you don’t believe the crime stats.

Alex, why is it acceptable to say “white trash” when nobody would dare use “the N word.”

For that matter, nobody would dare say “black trash” or “brown trash” or “Jewish trash” or “Asian trash.”

Alex uses this hyperbolic language because many jews hate/fear non-jewish whites. Its quite clear from his postings that this is true in his case. To be fair, they hate and fear all races/ethnicities but non jewish whites are the most difficult to exploit, hence the constant campaign in the media attacking them as the source of all evil.

Jeff: Let me put this right here: I take the report “The color of crime” as Gospel truth.

Junior – Not necessarily. It’s the level of craziness. Trust me, living in Hawaii I was lumped in with them and they were my/my family’s only friends but the craziness is off the scale.

Junior_Bastiet: — I grew up where anyone lighter than a brown paper bag is white == hated. I’m still trying to wrap my head around things like:

Hanging out with fellow “haoles” on the Big Island of Hawaii and having ’em tell me I’m not white because of how brown I am

On my Mom’s side there was her (gone now) and a childless sister (almost certainly gone now) and we were told we’re tan because we’re part Navajo Indian, a cool thing to be in the 1930s/1940s, about 10000X more cool than being Jewish – that was so bad, well, admitting you’re a pedophile was cooler. Verboten subject.

Thus, Dad’s side, the populous one, would have/will have nothing to do with us.

We tried, we really tried, to be good WASPS. Got news for you. being WASP sucks. You’re kicked out of the house at 18, and if you’re not rich by age 30 it’s your fault.

There are whites and there are whites. Although Mom had to keep it on the absolute hush-hush, we had about a million books in the house, of which 300,000 were stuff like “The Joy Of Yiddish” and “Begin The Irgun”. I thought the “irgun” was a dance, seriously.

We also had customs like thinking of whether things were “kosher” where “kosher” meant “ethical”, Mom never ate bacon and come on, that stuff’s awfully tasty, you never crossed a picket line, you’d mention Satan before you’d mention the “M-word” (mafia) and you fed your animals before you fed yourself.

We had halvah!

Apparently, halvah isn’t a normal American thing, and I urge you all to try it, it will change your life.

Joyvah halva is as close as your Amazon account and …. try it, you might like it.

Anyway, diagnosis: Almost certainly spawn of satan Litvak Jew dear St. Hitler tried to to save the world from. And once confirmed, will move to “isn’t-real” and do my part to accurse the world with superior technology, medical research, permaculture, and evil Zionist banking. And halvah.

Junior – But halvah aside, I didn’t get into the subject of whites and whites, did I?

Whites were pretty exotic in Punalu’u and La’ie, so we were all lumped together. We were Mormon, “Born-Again”, etc didn’t matter, we all reflected too much light.

But it turns out there are huge differences. I babysat and never stole or even made myself a sandwich. Houses I babyset in had like 5 books, 4 of which were Harlequin Romances and one of which was the Bible.

Belief in the hay-soos guy seems to have been a granted. Sorry, we never got that memo – we were all reading books “normal” whites were assigned in college.

It seems sports, like football, were a big thing. If you’re white-white, football will make or break you.

We were taught to be painfully honest. Not saying Gentile whites are not but it was at a whole different level.

I’m sorry but the working-class/poor/welfare whites we were around were a real bunch of turds. Their parents drank. They were smoking at age 10.

I have a deep guilt I have not won a Nobel by now that I will never shake. Meanwhile they’re out dousing homeless people with gasoline and setting them on fire.

Same up in Monterey area. Seaside, CA used to be affordable option at $2-300K and now dumpy houses with no parking, no yard, bad schools, 3br/1ba houses squished into 1000sq foot house are over $600K. Would love to own a home, but gotta wait this out. Hope you are right.

Awrite, Hoonan, Yozzi, and awl:

Yezz, I know, Israel’s got programs for poor jooz and all of dat, but if you’re saving me from drowning, I’m still gonna paddle a little.

I have a LONG flowchart to follow, before I set hoof in the Holy Land. I first gotta let 23andme let me know if I’m a joo or maybe an Armenian or something. I’ve been told so many stories – no doubt to protect me from what I’ve sussed out – that I want to let Science tell me wut’s wut.

Then it’s off to the geneologist – a good Kosher one- and to go from there.

What the hell could Israel possibly throw at me? Lack of running water? Substantial chance of getting stabbed? Life-crushing anomie? Seriously, if I’m gonna die in the street in poverty, it might as well be after taking a knife meant for a Sabra.

Ahh yes, back to the previously scheduled program: I’ve never been to Paramout, other than passing though it on “the” 405. A forgettable region of the greater Los Angeles sprawl.

Hot Chinese/Indian/Russian money indeed!

The sad thing is these ‘crap shacks’ go, on a per square foot basis, for damn near what a decent house in a decent neighborhood sells for. Here is a house in the Dominican area of Marin County,

http://www.zillow.com/homes/for_sale/San-Rafael-CA-94901/19247559_zpid/97858_rid/any_days/globalrelevanceex_sort/38.009892,-122.410097,37.940204,-122.562876_rect/12_zm/

Its priced at just over $500/sf by the flipper but it sold for $650,000 in February 12.

The problem, of course, is that those on a budget can’t reach the million dollar and up threshold where properties still have some value. Those on a ‘budget’ must settle for crummy homes for $400/sf that are old, ugly, small and in less desirable neighborhoods.

I am curious why the price of the actual structure is not priced out compared to the land. Maybe that would give people an idea what they really are paying for. When they show price for square foot for old properties next to new ones this should be another item to give us more clarity on what you really are buying.

I remember during the last bubble, $200/sf was considered the demarcation between “real Bay Area” and “not Real Bay Area” now it’s what, $500sf?

Probably closer to $1000/sf for ‘Real San Francisco ( west of Golden Gate Park) and the Golden Ghettos like Atherton, Sausalito etc.

Real Estate is, unfortunately, not like the auto market. If I can’t afford a Jaguar or Mercedes I can buy a perfectly adequate Toyota or Ford that will have 90% of the features of the luxury car. Real Estate is more like the viintage car market in that you are better off owning a ‘cheap’ house in a premier neighbor than a McMansion in a exosuburb in the same way that a vintage 50’s luxury car is worth far more than a 1950’s economy car though both vehicles would be ‘obsolete’.

For this reason if you can’t afford to buy a home in a decent neighborhood you are probably better off renting until you can. Buying property in low income areas in the hope that they will ‘gentrify’ isn’t a good bet as the demographics of the US change and become more ‘Third World’. There just won’t be enough high income people in the coming years to spill out of the existing stock of choice property.

West of GGP? On that car-necessary windy ol’ beach? You can have mine!

Hell man I’d rather live in Chinatown, at least I’ll always be able to get some li hing mui for a sore throat.

Pacoima, Paramount, Compton, all S-Holes with horrible schools and rampant crime. But I for one won’t be surprised when house horny buyers who are priced out of better parts of LA start showing up in these hoods. First Curbed LA will have an article naming Paramount the next Highland Park, or Compton the next Silver Lake then all rational thought goes out the window. It takes more then a few middle-class white families moving in to gentrify a neighborhood, and the hoods mentioned won’t be gentrifying any time soon, if ever. It’s all fun to say that you live in the hood, until you actually experience living “In Da Hood” with cars getting smashed, houses getting robbed, homeless sleeping on the sidewalk in front of your house, neighbors running in the street hopped up on crack in their pajamas in the middle of the day, I can go on and on.

Not only do some areas not gentrify — sometimes the opposite occurs. Nice neighborhoods hoodify.

The crime maps seem to report an awful lot of burglaries in Woodland Hills, so I Googled — and it’s not my imagination: http://patch.com/california/woodlandhills/home-burglaries-on-the-rise-in-the-woodland-hills-area

http://www.trulia.com/voices/Crime_and_Safety/Surprisingly_high_crime_rates_in_Woodland_Hills_-404661

Pasadena is worse. Not only burglaries, but a rise in gang killings: http://www.pasadenastarnews.com/general-news/20151230/spate-of-pasadena-shootings-raise-concern-about-gang-violence

These are mid-tier neighborhoods. Not Santa Monica or Beverly Hills, but still supposedly safe, family areas.

It has me torn — do I opt for a house, or for a larger condo in another Santa Monica security building? (I’m currently in a tiny condo in a SM security building.)

Blame Prop 47 and the “Vibrant Diversity” of the adjacent areas. You’re seeing the same sort of spike in the Beach Cities of Manhattan Beach, Hermosa, Redondo and Palos Verdes, though not to the same degree inasmuch as they have small, locally controlled police departments who know who they work for. Just the same, reading the crime reports in the Breeze give you an impression of a large uptick in sub $1000 thefts as well as break-ins.

Also something to consider is that Woodland Hills and much of the Valley is heavily Jewish. As one demographer pointed out to me once: Jewish today, Black (and Mexican) tomorrow. At the time when he said that I was shocked, but looking at L.A. history and the parts of it that were formerly heavily Jewish, there’s a good deal to truth to that rule of thumb. Not P.C., but there you go.

Just a thought.

VicB3

In regards to the post by ViCB3……I’m at a loss for words. Wow.

I find the historically Jewish neighborhoods of Los Angeles to be some of the most vibrant and usually sought after real estate. Like parts of Fairfax and Pico. I know many Jewish people who live in Brentwood, SM, & Beverly Hills. I know what your saying to some degree. For example, Boil Heights used to have a vibrant Jewish population, and now is a ghetto hood full of chollos. But you have to remember before the Jews lived there someone else did. Thus I have seen many neighborhoods in LA change their demographic, not just the Jewish ones.

Hunan – Jews were “white n—-gers” long ago back in the day. They boxes, shined shoes, all kinds of work no one else wanted to do – no making chorizo though!

My mom’s folks, supposedly, had a small dept. store/stop-n-rob in, probably, “kosher alley” in los angeles.

First I’m letting 23andme tell me the straight poop, then if I’m right I’m tracking down that store. After a childhood being followed around in stores because we might steal something, I wanna see a store one of us owned!

BOXED POW SOCKO BOXING GLOVES.

Los Angeles County in the 1950s was home to hundreds of dairy farms and produced more milk and other dairy products than any other county in the nation:

http://articles.latimes.com/1992-03-05/news/hl-4764_1_dairy-farmer

Before Paramount became a city in 1957, the area was made up of two small communities called Hynes and Clearwater. The towns were home to a number of dairies owned by families of Dutch ancestry. In their heyday, there were 25,000 cows in the area and Hynes once boasted the largest hay market in the world:

http://www.paramountcity.com/ps.cityprofile.cfm?ID=3#anchor33

http://articles.latimes.com/1987-04-26/local/me-1617_1_holland-news

Now Pacoima, Paramount, Compton, and other cities in the area are all chulo barrios.

I truly believe that Mexico is trying to take back CA by shear attrition. One day all of CA will be a barrio with LA being Grande Barrio Uno. Better brush up on your Spanish. The only upside is that everyday will be Taco Tuesday.

Uhm, and what’s wrong with Taco Tuesday?

wait’ll I unleash my awesome Spam(tm) tacos on the world. Pacific Islanders on Welfare meet Mexicanos.

shit, is there Kosher Spam? Pork shoulder and ham. OK ok I can tell y’all how to make ’em.

I looked at Zillow to see their “zestimate” since I am not familiar with the Paramount area. The zestimate values this property at 327K, what’s even more shocking is the estimated rent is $2200/month. This is all you need to know if that rental estimate is anywhere close to reality. Thanks to the Fed induced super cheap money it is likely more expensive to rent this place than to own.

Is the neighborhood unsafe and are the schools awful? Sure. Are there plenty of people who would live in this area knowing that. Sure.

@Lord Blankfein, I lived in Paramount for six years, (while going to college and two years after while paying off my student loans).

Paramount is a barrio/ghetto, just like all those other cities off of the 710 freeway (aka Gateway Cities of Southeastern Los Angeles County).

My pre-winterization routine was to go up on the roof of my home in Paramount in September and patch all the bullet holes in the roof before the rains came in winter. My next door neighbor’s kid almost got hit by a bullet that went through their roof.

The typical weekend activity in many Paramount neighborhoods is for the Cholos to pull out their weapons and fire them vertically into the air. On New Years Eve, LAX reroutes airplane traffic to avoid the vertical gunfire coming from around the Century (105) freeway.

Sheriff’s department helicopters are a nightly event. I was awoken many times by these circling police choppers.

One the other hand, Paramount has lots of really good inexpensive mom and pops restaurants (local incomes really do matter). You just have to go out to eat while it is still daylight. Nights in Paramount belong to the Cholos, gang members and other assorted criminals.

Sounds like bee-yoo-tiful Placentia Avenue in Costy-Mesy, yeah, no treat but the richies over in Newport gotta hire their housekeepers and nannies and gardeners from somewhere.

AKA “ghetto bird”

“Is the neighborhood unsafe and are the schools awful? Sure. Are there plenty of people who would live in this area knowing that. Sure.”

Then you live there you giant pussy. You keep bringing up rents and how everyone is missing the bigger picture aside from you since you know everything but just look at your last statement. These areas are falling into third world status yet all you can focus on is rents? Didn’t you buy some shitty house in the South Bay? Yet somehow, you are an expert on all things real estate including Paramount now. Idiot. Probably bought a home because your wife browbeat you into getting something.

Jay, if anybody ever missed the big picture it is YOU. I’m fully aware that Paramount rivals a third world s-hole. Regardless of how many people they stuff into that tiny crap shack or the number of beater cars parked outside, the landlord collects $2200/month. It’s cheaper to buy this place than rent, what exactly don’t you understand about that?

“It’s cheaper to buy this place than rent” is highly dependent on a lot of factors, so it’s disingenuous to make that claim without the added disclaimer that it probably isn’t cheaper for most situations regarding this particular property at this point in time.

Increase in home renovation plans suggests people aren’t going to sell.

A few years ago, people on this site were ranting and raving that since 10,000 baby boomers were retiring each day that a steady erosion of home prices was about to happen. That was another one of these arm-chair predictions about housing would become oh-so-affordable. That never happened.

On the contrary is it possible that home renovations are a sign of further hunkering down of home owners?

https://confoundedinterest23.wordpress.com/2016/04/06/increase-in-home-renovation-plans-suggests-people-unwilling-to-move-despite-low-mortgage-rates/

It could also be an indicator that houses are old, and need repair.

And … flippers!

Good for owners bad for real estate agents and house sales activity in general.

I’m seeing an increasing number of Flips Gone Bad.

Consider this Woodland Hills house: http://www.zillow.com/homedetails/23221-Califa-St-Woodland-Hills-CA-91367/19878599_zpid/

July 2015 ….. Bought for $825,000

Feb 2016 ….. Upgraded and offered for $890,000

Mar 2016 ….. Reduced to $879,000

Mar 2016 ….. Reduced again to $859,900

April 2016 ….. Reduced again to $839,900

April 2016 ….. Reduced again to $819,000

Listing mentions a “Motivated Seller!” I’ll bet! He’s offering the house for LESS than he paid for it.

Probably a stupid amateur who attended a Flip-To-Get-Rich Seminar and didn’t realize he’d come too late to the party. This house had reached its price ceiling.

Flips Gone Bad is an excellent idea for a TV show.

That is a great idea!

Andrea – I wonder if that could be Kickstarted? I have zero experience in film, check. One-eyed wonder who does not “get” depth perception at the gut level, which I feel actually gives me an advantage, decent speaking voice (have considered getting into voiceover work) check, and who doesn’t love schadenfreude?

TV shows survive on sponsors. Who would sponsor Flips Gone Bad? Mortgage lenders? Realtors? Home re-modelers?

Son – that’s a very good question and one that must be faced.

I’m thinking airBNB, places that make/sell DIY house renovation stuff, and well, TGI Friday’s because if it gets eyeballs, it can be sold.

It is a good idea, but its not like they haven’t thought about it. Think about the premise for the show flip or flop- http://www.hgtv.com/shows/flip-or-flop

They rarely show any flops, if they don’t sell the house during that episode, they just say their same catch phrase “on to the next house to flip” What they dont show is what happened after filming stopped, or what was cut out of the show. Which is what ‘reality’ TV is, a show. Entertainment designed to sell advertising for Home Depot, and the like, and just be an overall schill for the real estate sector.

BTW, the flip or flop people are now doing the same types of seminars that the same type of HGTV reality ‘stars’ did during the last boom. One of the biggest tells to me that we are in the peak of the bubble, is that over half of my coworkers are buying houses. Frickin herd mentality works every time.

Another Flip Gone Bad.

This time in Pasadena: http://www.zillow.com/homedetails/2175-Loma-Vista-St-Pasadena-CA-91104/20873172_zpid/

May 2015 ….. Bought for $840,000

March 2016 ….. Upgraded — including a NEW POOL — and offered for $995,000

March 2016 ….. Reduced to $948,888

April 2016 ….. Reduced again to $899,500

An earlier listing again spoke of a “motivated seller.”

This flipper is offering this house for $60,000 above what he paid for it last year. That won’t even cover the cost of the NEW POOL and other upgrades, much less the holding costs and closing costs.

These Amateur Latecomer Flippers don’t realize the party’s over. The earlier flippers have made their profit and left the Latecomers holding the bag. If prices don’t tank, they’ve at least plateaued for now.

I’m seeing a number of flips and 1 off brand new builds in my area that don’t seem to get the prices they want, so they take them off after 6 months or so and just rent them out.

BTW, when have prices (stocks, RE, etc) ever plateaued, in history? I know of no instance.

Because they havn’t. 2001 was a stock crash, 2008 was a housing crash that took stocks with it, 2016 will be a bond crash that takes stocks, and housing with it.

I’m observing a lot of resales of westside L.A. properties which were bought in 2015, listed for rent, sat vacant with rents reductions for months, now re-listed for sale. So much for the idea that rents are going to the moon.

I ran into my landlord at the supermarket over the weekend, we mostly talked surfboards. Not one rent increase in the 6 years I’ve lived here – 1K for a 2bed, 1bath house with some fruit trees. You step out of the matrix, life doesn’t suck nearly as bad!

Junior_Bastiat — OK then instruct us. Is it just knowing people? Driving/walking/biking around and looking for handwritten signs? Sounds like you lucked out, I was paying that for a 1-bedroom 10 years ago.

Alex, its both simple and hard – simple concepts, hard work. Study stuff that will get you paid – hard sciences, or learn a trade like plumbing, electrician, etc. Move to a place where there aren’t many of similar skills. Be honest in your dealings and work your azz off. Don’t buy what you can’t afford, don’t get caught up trying to live someone else’s dream and dont bother trying to impress people who you don’t really like and who really don’t like you.

I recommend to young types that if they have the intellect and drive to study things related to robotics (computer vision), 3d printing, and drones.

as a retired civil engineer, LA is known as the city that should have never been built due to a lack of water. Check out the 1930’s era news about the major who gangster-ed the water from the central valley to build LA. At any rate why worry about a house when the water runs dry, and can’t even give them away.

Prices sure seem like they are very high and would be lower sometime in the future. In normal times, I would rent and wait for a price drop. However we have money printing central banks pushing rates negative. Who knows what happens? In my opinion, either prices on homes and everything else skyrocket because of runaway inflation, or we see a severe economic problem. So, if you buy now, you will likely see a huge gain or loss. I would guess you are more likely to see a gain, but the possibility of a loss is substantial. I feel sorry for those renting. At this time, buying is a gamble that will make you a big winner or loser. Good luck.

The runaway inflation on house prices and rents has already occurred… hello!?

When you fight deflation with inflation, you end up with net inflation. You’re feeling sorry for the wrong group of people.

Here we go again …. !! Obama’s housing-for-all program. Subprime Implosion II !

‘ FHA Commissioner Carol Galante says people with lower credit scores should be allowed to borrow. “My view is that there are lots of creditworthy borrowers that are below 720 and 700–all the way down the credit-score spectrum. It’s important you look at the totality of that borrower’s ability to pay,†said Galante’ ( April, 2016 )

Good comments, Zig

This is what caused the bubble before. Dumb politicians encouraging lenders to reduce their qualifying criteria to put people in houses they can’t afford.

It is kind of like Charlie Brown, Lucy and the football

doesn’t matter as DTI and PTI against LTV will define underwriting decisions no matter the fica…

Does anyone know if we have this bubble’s equivalent of Linda Green? What are the games being played this go around?

The minimum wage rising absolutely impacts housing prices.

Rents will go up further 100% guaranteed

2 people renting for $20/hr versus $30/hr

or

4 people renting for $40/hr versus $60/hr

That is a huge impact to rents pushing the whole rental market up

I agree Holo. Housing costs and rents are linked. If the minimum wage increase causes rents to increase, then it’s more then likely a increase in housing prices will follow. It’s not like anyone earning $15 an hour can afford a home in S. Cali, but my thinking is that as rents go up it makes rental properties more attractive to investors and lights a fire under potential owner-occupiers who have been sitting on the fence and renting up until now. It’s going to be a few years before we start seeing any impact from the new minimum wage and anything can happen between now and then.

Exactly…. rents go up with incomes… and house prices go up with rent

$60/hr funds expensive rents

Hunan: “I agree Holo. Housing costs and rents are linked. If the minimum wage increase causes rents to increase, then it’s more then likely a increase in housing prices will follow.”

Yes and no. There are far more variables than that. That is a narrow way of looking at things. There are 2 categories of buyers:

1. Buyers who buy to live in it – this group might be affected by the minimum wage increase a lot. Everything they buy on a day to day basis will increase a lot making it very difficult to save anything for a downpayment. Their SS and Medicare taxes will also increase and those are not deductible. The benefit will be negligible comparative with the higher cost of living. It depends on their jobs and the industry they are in – some will lose their jobs to lower cost producing countries and due to globalization those who are not at the minimum wage they might not have too much leverage for a higher pay.

2. The second category is made up by investors – this group invest not only based on rate of return but on the chance of the return of the capital. If the risk on the market is high, they are not going to invest and take the risk for a very small rate of return. Therefore, prices might not increase.

Real life investing is not as simple as picking 2 variables and see the correlation, all other things being equal. In real life “all other things are NEVER equal”. It is a whole dynamic at play and it is hard to predict the consumer and investor psychology in a very complex environment like we have today due to globalization.

Flyover it’s absolutely really simple

increase income

increase rent

It doesn’t get much more elementary than that

job losses from said impact of $15.00 wage which is years away will overwhelm any income gains on state basis…so it will most likely have little impact on rents or homes…

Suddenly incomes do matter.

Holo, ….if only life would be that simple…!!!

It is not. Read my reply again and think on it about all the ramification. I just tried to give you some food (realistically crumbs) for thought…!!!!…

The FED also thought that they just drop the rates to zero and some QE on top of it and they will have economic recovery. Well, the global economy, as any complex system does not work in simple terms like you describe.

I just gave you few leads, if you can continue from there. I can not write here a full dissertation to explain to you in baby steps why your assumption is to simple for the complex system we live in.

Bought 3 years ago because I believed..

(1) the fed will never substantially raise interest rates again in my life.

(2) in search of yield investors will pour into RE driving up rents.

(3) there is no incentive to sell, even if you have equity because property taxes would be higher

(4) mortgages now are legit so if prices do fall, again no one will sell

(5) people have a ton of cash saved waiting for that perfect house and they will jump in the market if there is a little dip.

What you are going to see is a major stagflation in housing. While I think the big house gains are over, it’ll still creep slowly higher with bumps here and there. Rents will continue to disproportionately rise as well. Guys like Jim think they’ll be able to get their perfect craftman house on a quarter acre for like nothing…that won’t happen unless there’s a major political event like war or something to change the current paradigm in housing.

Don’t get me wrong I think housing is absurd, but we now live in a world where housing and healthcare will consume most of a families expenses. Until someone forces the fed to normalize rates, this will not change. And that may take decades….

I agree with most of your assertions regarding housing. Anybody who bet against the Fed got utterly annihilated. Make no mistake, the Fed holds ALL the cards. Here we are in 2016 and mortgage rates are near 3.6%. Raising rates dramatically is not an option.

What we are seeing is the new normal. The population of California has nearly doubled in the past 40 years. Supply and demand forces are at work. Mix in Prop 13, anti growth measures, NIMBYism, Wall St. and DC meddling in the housing market for good measure. The middle class was taken out behind the woodshed. The wealth disparity gap widens every year. Wealthy foreigners have theirs sights set on certain parts of CA. Rents are skyrocketing all over the state. To think things will change and we’ll revert back to normal is foolish. This is the new normal.

I agree with Lord Blankenfein. Until supply increases dramatically (especially in the lower-end starter home segment) these are the new norms for the immediate future. I will go one further and say that if the powers that be push their agendas through, we may go significantly higher in the near future. I assume Hillary will continue Obama’s proposed mortgage for weaker credit policy. This will further push the market to it’s limits with more potential buyers.

I think what’s happening is something like the diamond industry, where something that’s not necessarily the scarce is being made scarce.

Why rent out bedrooms for $200 a month when you can rent them out for $2000 a month?

The New Normal will happen when all the power, water and gasoline are taken away courtesy of a major earthquake plus tidal wave. At that point, all the tribes – that’s what you’re really seeing in California – will turn on each other, and the incompetent State and Federal Governments won’t be able to stop them. Think the L.A. Riots writ very, very large to get an idea of what I’m talking about

Read Tainter’s classic The Collapse Of Complex Societies to get an idea of what I’m talking about and why. Also Bowling Alone on the lack of social cohesion.

Not pretty, but there it is.

Just a thought.

VicB3

ViCB3 – if there’s one thing to understand (and that’s forbidden to talk about) regarding US society it’s that it’s tribal as hell.

In Hawaii where I grew up, it was kind of like the old joke about black people all knowing each other, except it was we whites and we were few enough that we really did all tend to know each other. No one nonwhite ever paid me to do chores, weed their lawn, babysit their kids etc. They’d not hire me at 10c an hour, but I could and did make $1 even $2 an hour working for fellow whites and we were all poor as shit.

You see this in companies – if you want to know the ethnicity of a department, look at the ethnicity of the lowest-ranking member of that department. It will be the same race or ethnicity from the bottom to the top of that pyramid. The lone exception being if the head of the department is white, you’ll see *some *whites in that department.

Even on the mainland US where I am now, things are very tribal. Everyone goes to “their own” Real Estate agent, car dealer, etc sends their kids if they can possibly afford to “their kind of” school etc.

This ideal of family and tribe not mattering is as unrealistic as the ideas of Karl Marx. The “all for one and every man for himself” my Dad’s side of the family believed in, you know, kick the kids out once they’re 18 years and a half-day old, yadda yadda, thing really only worked for the few decades immediately following WWII. Sure, we were the last economy standing and had decades of pent-up consumer demand.

These days you gotta have tribe. Race, religion, maybe some hobby like R/C planes or ham radio, but to get a job and even have a hope of owning a place you’d better have connections.

“Anybody who bet against the Fed got utterly annihilated. Make no mistake, the Fed holds ALL the cards. Here we are in 2016 and mortgage rates are near 3.6%. Raising rates dramatically is not an option.”

Gotta love the self-contradiction. The Fed holds all the cards but yet doesn’t have the option of raising rates. In other words, the Fed doesn’t know what to do. They want to raise rates because they know that the amount of bad debt rivals or even surpasses the last downturn and won’t have any ammo to fight the next recession. However, they’re too afraid to raise because corporations won’t approve.

BTW, have the laws of economics been repealed by ZIRP? Do low rates somehow prevent recessions, which have in the past caused RE prices to fall?

Alex, there is truth to what you’re saying. I had a friend who worked in the IT dept of New York Life, a big NYC insurance company. When he started there in the mid-1980s, there were no Russian Jews. When he left in the late 1990s, it was predominantly Russian Jewish immigrants.

He told me the Russian Jews “stuck together.” Whenever there was a job opening, the company paid a finder’s fee to anyone who recommended a job applicant who ended up being hired.

The Russian Jews were very aggressive about networking and referring their own people. Apparently, whenever there was a job opening, they’d put out the word at their synagogues, Jewish centers, wherever. They’d also prep each other on how to pass the company exams and interviews. As they rose up the ranks, this became easier to do.

They’d also cover for each other. My friend told me that many of these immigrant hires weren’t all that competent, and didn’t know the programs they’d claimed to know. They outright lied on their application forms. But if anyone tried to fire them, their Russian Jewish co-workers defended them, and denied their lack of competence or work ethic. (No, they weren’t all that hard-working.)

It’s harder to fire someone than not hire them in the first place. And if NY Life did try to fire them, there was always the hinted threat of playing the anti-Semitism card.

The fact that they all spoke the same language — Russian — and lived in the same neighborhoods also aided them in sticking together.

Immigrants are more tribal than native-born Americans. Native-born Americans, especially whites, are trained to love diversity, and to bend over backwards to hire those outside of their own ethnicity. That it’s racist to hire your own.

I’ve read that one reason Obama won was because he represented the “cool black friend” that many whites fantasize having. I doubt that many blacks or Mexicans (or Russian Jews) fantasize about having “a cool WASP friend.”

Prince, this was the same commenter who back before the last bubble burst was on the opposite side of the fence. Typical story, someone buys in and now it’s different this time. If these people were truly that confident about the future, they wouldn’t need to be hanging around here trying to convince the rest of us.

Son — Russian Jews, Viets who had to skedaddle when the US pulled out, windward Haoles, Cambodians who were the honored guests of Pol Pot, pretty much everyfuckingbody except WASPS who grew up in a post WWII world where “the best thing you could do for your child is *not* leave them money” – Dad.

Speaking the same language helps, coming from the same place, bunch of things like that.

The whole idea of self-made bootstraps is about as realistic as The Jetsons.

Maybe it’s because so many WASPS came to the US – or what would become the US- as indentured-for-7-years petty thieves that the whole “self-made” myth has any currency.

It’s not how the world works.

@HC

Not surprising. Low self-doubt and insecurity leading to irrational thoughts and fanciful beliefs. If low interest rates was such a good economic policy, why wasn’t it permantenly instituted a long time ago?

PoH,

Who said anything about low interest rates being good or healthy for the economy? It certainly wasn’t me. Low interest rates are here to stay, you and I both know that. I won’t waste anybody’s time explaining why.

As I keep telling people here, don’t swim against the tide. You can hope for your economic normalcy to return, but chances of that seem slim to none. Some people on this blog simply can’t accept that.

As other bloggers have said, California RE is full of booms and busts. We are currently in a boom cycle. There is no question the bust cycle will come in the future (but noboby knows when). It could be 2017 or 2027. Be prepared to act when it does. I have gone on record and claimed some areas of CA are forever changed and I won’t back off from that assertion. There are too many factors that will keep these areas inflated and out of reach for most people (it’s been different for a while in these areas).

Prince, that’s another way of saying it’s different this time, forever!

@LB

My point remains: the Fed doesn’t know what it’s doing and is playing with fire. Low rates (and the Fed) cannot prevent the upcoming recession. And RE prices tend to fall during a recession.

What exactly is swimming against the tide? Not fearing of being priced out? Staying on the sidelines because we don’t believe that the economy can continue a price trend that has been unsustainable in the past?

The Federal Reserve has lost control of monetary policy. That is why the Federal Reserve cannot raise interest rates. Raising interest rates will collapse the banking sector. And since the Federal Reserve is a private banking cartel that is owned by its member banks, there is no way the member banks that belong to the Fed (JP Morgan, Bank of America, Wells Fargo, CitiGroup, US Bank, etc) are going to commit financial suicide by pushing the Federal Reserve to raise interest rates.

I think your scenario is pretty accurate though the Fed may lose control of interest rates once it has to start monetizing the governments fiscal deficit in earnest. Of course hyperinflation or fiat currency collapse only makes real estate a safer, if illiquid, haven. There will be a crash in housing when this happens at first as weak hands are forced to sell but once the system resets good property will retain its value.

I’ve noted before that housing starts peaked around 1970 and only came close to equaling that level again in 2006 despite the US population growing by almost 100 million since. The reality is the US housing stock is shrinking per capita and growing old. There is only so much you can do with postwar tract housing as far as rehabbing goes and few are going to want to try and ‘gentrify’ the Cleveland’s, Buffalo’s and Detroit’s of the rust belt unless it be some enormous wave of Third World migration ( entirely possible ) as areas like Latin America and the Middle East face total collapse and they will not ‘gentrify’ our derelict housing but turn it into Third World style slums.

This brings me to my earlier post. If you are going to buy a home buy in the best neighborhood you can manage and buy as much house as you can. Real estate is not like the auto market where, if you can’t afford a Mercedes or Cadillac you can buy a Toyota or Chevy, and have a perfectly equivalent car without the luxury features. The distinction is more like the vintage car market where a top of the line 50’s Cadillac convertible will retain far more value if not appreciate in real terms as opposed to a similar vintage economy sedan.

People thought that when a barrel of oil hit $147 and gas was over $5 back in 2008 we would be in a new normal. Now oil is back down around $40 and gas prices are half that. When things look like the new normal be cautious.

Aside from that…

I guess by keeping rent high I see it doing the following:

It keeps owners from selling their primary residents and waiting for a crash if they are not under water.

Renters will likely react and buy anything to avoid rent hikes.

It may help reduce the inventory of homes to be sold.

…?

everything has a cycle….the fed initiated a housing cycle to defeat price discovery and save the banks…that is the gist of it….

real risks are adding up across the globe that will pop the QE bubble, hopium does deflate….

Homerun – if there’s one thing I’ve (hopefully) learned, it’s that forecasting is hard, especially about the future.

I’d have predicted my 2005 Prius would have increased 33% over new price, gas (petrol) would be $10 a gallon ($2.50 a litre) and real estate would be Meh to “in the dumps”.

I’m really glad I have essentially no money/power in this world because Oh the waste if I did!

FED TO Tank HArd Soon!

All of these folks who have been the to future and come here to report on it. Makes you wonder why they would even bother coming to a housing skeptic blog if their forecast is so certain.

Notice they have no response. It’s confirmation. Except for that one guy who wrote about how he likes to troll between watching his stocks go up.

Not so sure this house is a good example Doc. The guy who bought in ’97 maybe put 10% down and ended up with close to a 900% return on that in less than a year. Guy who bought in ’98 basically broke even. Guy who bought in ’01 maybe got in with 10% down and made close to a 2,000% return on that in 4 yrs. Willing to bet the guy in ’05 put Zero down and made $130K in a year. Willing to be the guy in ’06 put Zero down liar loan non-recourse, no skin in the game, so what. And the last guy who bought the foreclosure is looking at about $150-175K gain. Looks like a crappy house in a bad neighborhood, but pretty much everyone has made huge returns.

But here’s the problem for the owner occupant. Those huge returns would be net of replacement. If I sell for 100% gain, I’m also paying 100% more for another property of like-kind. After factoring for a 100% increase in transaction costs and a non-subsidized tax assessment, it’s a net loss.

Are you not better off with a 900% or 2,000% return a tiny downpayment? Why even argue that point? Just concede you are better off with a large non-taxable gain than not.

As for replacement cost, so what? With a large gain you have the means to get into another property. You have an large advantage over Renter Jim Taylor who has no equity to roll. Just concede that it is far easier to compete in today’s market if you have a big chunk of profit to play with.

There, wasn’t that easy?

It’s relevant to bring up replacement cost because you’re claiming nearly everyone made out well. The vast majority of people are owner occupants and will sell to buy another.

There is no return on the down payment in their case. The replacement cost eliminates the gain by matching it in kind and the transaction costs of selling are a net negative expense.

The math doesn’t lie, I’m using simple round numbers for example’s sake but no matter what the numbers are, the end result is the same.

Buy 1st property @ $100K with 3% down, $3K out of pocket. 3.5% 30 year mortgage on $97K.

10 years later they have $24,895 of principal paid toward the original cost basis and owe $75,105 in principal.

Sell 1st property @ $200K, pay transaction costs of 3% ($6K), they’re left with $100K profit + $24,895 principal – $6K = $118,895

Buy replacement property @ $200K, less $118,895 they’re left with $81,105 principal to repay.

$81,105 – $75,105 = $6K expense and that’s not even factoring the loss of the original property tax subsidy in CA

Apparently it’s not easy, and that’s the problem for most people.

My friend you still avoid the most important question which is are you better off with or without the large tax free gain to roll into property #2. Just concede that the guy who crushed it with a 2,000% gain is better off than On the Sidelines Renter Boy. I know it is painful to admit but just get it over with. Repeat after me – Guy with Big Roll Over Equity Wins. Have a nice day.

I answered the question which is that you’re not better off because the “large gain” is negated by the increased in kind replacement cost and becomes net negative due to transaction cost.

You’re either deliberately side stepping the truth or incapable of understanding it.

Come up with all of the derogatory phrases and rhetoric you want, but the math doesn’t lie.

Fucking hell Hotel it’s your kind of logic that put Dad and all of us into the poorhouse.

You’re talking coming out ahead $2.5k a year.

I can save that in a year, 2X that if I hustle “awareness” ribbons once a week in Santy Cruz and I only make $10k a year.

Anyone who thinks there’s money to be made in real estate needs to be taken out and shot.

Big surprise, LA streets are dirty. Now you can see just how dirty your LA street is:

http://www.cleanstreetsla.org/cleanstat/

— How I Learned to Love [NorCal] and Forget the Housing Bubble —

If you like the place and can afford it, buy it if you want. Or not. Things are not normal here, we all know that. So what, move on with life we did.

My wife and I bought our first house (December 2004) in Santa Cruz CA with 20% down for 480k. We were 26 at the time. The house was one of eight new construction `smart growth` detached 2 bedroom 2 bath types. Postage-stamp lots. This worked out well, we could afford it and the loan amount was ~1/2 of our income at the time. We had our son in May 2007, wanted more space, tired of close neighbors, and then the bubble popped. Two neighbors did a short sale and everyone here knows the rest of the story…. so we stayed put. Needless to say I was astonished as to how all my neighbors (most older by 5-10 years ) over-leveraged. Crazy.

Busy with life and careers we stayed there until 2014 and just needed to get something bigger so we did. Who cares, we plunked down 20% on a 1 million dollar house at < 4.25% fixed interest rate. The house was custom built in 2002 with a double lot (~1/2 acre) 2400 sq/feet 6 blocks to the ocean. It is a nice place in a nice established neighborhood and most of all we have space (both in and out). Is it a 1 million dollars house, meh? Who cares (We Learned to Love NorCal and Forget the Housing Bubble). Our monthly nut is about what rent is and is actually comparable to our other/first house. After moving into our new primary residence we rented our first place out. The sad thing is we had immediately 15+ qualified renters and ended up renting the place out comparable to our new mortgage.

I am tired of thinking about real estate and I have no desire to be a landlord (granted we had a great tenant, no issues). So now was a good time to sell our smaller first home bought for 480K to the next sucker. We did so for 765k with 1 open house multiple offers (Crazy). I hope the new owners do not want to start a family there.

Moral of the story. Just move on with life, what are our options? We either buy, rent, or move (there are other great places to live) but the most important part is quality of life. We are fine, I do not really care if I over paid. I really don't because we live within our means. We are not complacent. For the people that are waiting thats great. Just don't burn all your cycles on the DHB comments section complaining that things in CA are insane, we all know that. I listened to some of you for close to a decade here. There is nothing you can do about it. Just don't wait two decades hoping for things to become `normal` (your newborn will be in collage then), Learn to Love CA and Forget the Housing Bubble.

As the great Jim Taylor says: "Housing To Tank Hard Soon!!" The reality is either of us don't really care is it does nor do we care if it continues to be inflated. We all know it is not normal. What are you going to do?

MoveOn you played the smart, long game. A house as a place to live.

And if it weren’t raining this weekend, I’d probably have visited and left some money in your fine town. I like Santa Cruz.

+ 1

Truer words were never spoken here

There is one particular blog (wish I could find it) of a woman living in redondo or manhattan beach since the 1990s talking about how bad the bubble is…… over 25 years later she is still renting and complaining. Hell she would have had her house completely paid off… instead she is renting at levels 300%-400% what her mortgage payment would have been.

Yep say what you will but a mortgage locks in your rental rate.

See Senor Cardgage for more!

Don’t really buy it. Anyone who doesn’t care and/or is confident enough that there won’t be a major correction wouldn’t be here in the first place.

There’s always going to be a correction in CA at some point.

His point is that as soon as you can afford to buy and it lines up with rents… buy and don’t wait… don’t try to time the market… otherwise 2010-2012 just passes you by…. or 1994-1997 or 1981-1983 etc etc etc

@Holo

I’m willing to place that bet because the entire global economy, including that of the U.S., is in worse shape than it was in 2010-2012, or 1994-1997, or 1981-1983 etc etc etc

When the next correction happens, what will the Fed do with rates already at or near 0%? Is the American public going to stomach another bailout of Freddie and Fanny? With debt over-saturation, who’s going to have the guts to be the first to jump in and put a bottom in the RE market?

@ Holo,

Good post. Many people are lost in the fog of war when the really good buying opportunities present themselves. Owning RE is long term proposition. Buying when prices are close to rents is likely the most important piece of advice there is. I don’t think there has ever been an instance where this has not worked out.

We never moved on from the last correction. The feds just poured more money on the already bad problem and bought up all the bad stuff. Now they have inflated the market again, forcing investments into real estate which has pushed the market back up to unrealistic numbers. 15 dollar minimum wage just puts a band aid on an open wound. Eventually the market will catch up to whats going on and the cards will start to fall. Another market collapse will cause over leveraged companies to cut back and lay off, a real estate selling frenzy will start which will drop home prices and all those people renting their old overvalued homes will start foreclosing causing another bubble to pop. Like before, its not a matter of it, but when.

Prince of Heck,

When that happens I expect we will see mortgage rates at 1-2% like they are in England, Japan, Netherlands…. Etc

First world problems LoL

They’ll do whatever it takes. But you’ll see the correction for a few years eventually… Just like you have in the past as a slow stagnation for a few years… Just don’t lose your job LoL… And then lift off again.

I personally don’t think the fed will go negative but they have hinted at it already, so I may be wrong.

Prince Of Heck Your Highness: I believe it’s been poorer and poorer every decade since the mid-1970s.

Anyone who really believes it’s as simple as rents lining up wouldn’t be reading this blog.

@Holo

The economy is already stagnating despite near ZIRP rates. I don’t believe that low rates can overcome the economic cycle (especially the bust part) like they couldn’t prevent the fall of oil prices due to over-speculation. Whether or not they resort to NIRP, the Fed will be impotent in fighting the next recession (and falling RE prices). And if the Fed can’t work any magic, what will create a quick economic recovery in the real estate sector?

Same sort of nonsense going on in Auckland, New Zealand.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=11619264

This property has a bit of spare land around it and is in an area that has been zoned for fast-track approvals for redevelopments. This is not because it is in an efficient location where more people should be getting provided housing – actually, it is in an outer suburb that is socio-economically low, has high unemployment and high crime and poor transport connections to anywhere. The reason locations like this have got the fast-track rezoning is because the city Planners are trying to attain housing “supply” targets, they are ideologically opposed to “sprawl”, but residents at the good locations are powerful NIMBYs.

The housing market is in just as insane a bubble as SoCal, with the average house price now nearly a million dollars – and New Zealand has an economy like Kansas, with the disadvantage that it is in the South Pacific.

Even this site in a bad location, surrounded by “social housing” apartments full of unemployed people and drug dealers, is expected to sell for over 1 million dollars! If it gets redeveloped, it will be with apartments, which is why the site is so “valuable”. But the upzoning, and the compact city ideology, is based on the lie that intensification provides affordability, as if sites stay static in value when they are upzoned!

But as the article says, it may simply be “land banked” by whoever buys it. You think SoCal is especially mad?

The low interest rates also make it impossible to get a decent safe return on investment money. The stock market has been extremely volatile, so real estate becomes more attractive in that price swings are not as frequent or severe. Rents keep rising regardless. So people like us, who buy or build a new home, hang on to the old one if we financially can. If other investments were appealing we, and a lot of others like us, would sell. Hate dealing with having rentals, but no place else with stability to go with funds. If we could get a safe 5%+ return in bonds, we would dump a house or two.

you can invest in housing without owning a house while getting yearly income higher than 5%

REITS are paying well over that…

For some the “Bubble” was a good thing, it was all about timing.

Until they hang on too long and continue to lever up. This is going to go from joy to tears for many.

Joy and Bliss.. And Life Happiness… To tank hard soon !!!

Until you realize a gain or loss in a home you are still just an owner.

When my parents generation, the WWII folks, retired in the 1980’s, bank 5 yr CD returns were up over 10%. Sell your $700K house and you would get about $6K/mo to live on. Now you sell your $700K house, you get 1 3/4% on a 5 year CD, about $1000/mo. So if you can get $2500/mo rent on that house, or even $3K in some parts of San Diego, far better to keep it unless you can handle risk. The regular people in the WWII generation rarely invested in real estate. Now most baby-boomers hang on to their homes, and in many cases keep the last ones they lived in as well because there’s no better place to put the cash. Until and unless this situation changes, it’s going to be very tough for younger buyers to get in.

I think we’re seeing the future of real estate here in coastal OC.

Literally every Millennial who purchased a home (condo or otherwise) in Newport had a parental down payment. A friend of mine bought a detached house in Newport Beach because his parents supplied several thousand dollars as a down payment. Another guy had his parents buy the place for cash to get the best price, and now he’s paying his Dad back at a low(er) interest rate.

For people who have lived here for 30+ years, such support is a small percentage of their now $2.5 million house (though several have 3 – 4 such houses.)

Your ability to buy in desirable areas is likely dependent upon your family wealth. Sad, but true.

That’s what mature real estate markets with high demand around the globe look like.

Only the wealthy can afford property.

If you know OC you know the Pen, and yeah, I call ’em “doghouses” but if you don’t mind no parking (get an electric bike or a Honda scooter) you can buy a place out there.

If you *really* know OC/the Pen you miss Gypsy Begging Lady too.

That’s funny, it must also be mature when prices and demand are falling, unless it just become mature a few years back and will cease to be so during the next downturn. Mature, until it’s not.

If they lift the cap on the $250K taxable gain, watch as these old timers crush each other in a melee for the exit.

“Reporters need to go out to these areas and see what people are actually buying. But they won’t.”

This is an excellent point, one that too many people ignore at their peril. The media and the sell-side establishment will continue to push the growth meme until the bubble blows up in their faces. Too many conflicts of interest throughout the system.

Hell, our own paper which serves some 5 million people recently tried to use 2014 Census data to make the slowdown appear more benign than it is. Considering the new fiduciary rule for financial advisors, perhaps we need a new rule for reporters. If a reporter prints something that is obvious horse shit, they should lose their job and be held accountable.

As for Mexico taking back California. Mexico is becoming the capital of car factory jobs. They are opening up a plant by Ford in 2018 that pays 5 yo 6 an hour. In LA in 2018 if you are here illegality, you end up in an 12 hour job part time doing dishes or cooking. Also, LA rent is about 3 times more expensive than mexico. Once the price of oil goes up, Mexico will also take oil jobs from the US since they sold their oil fields to US and foreign companies as a part of the partial denationalization. Oil jobs in Mexico probably pay 8 to 15 an hour much higher than your noramal 1 to 3 per hour job in Mexico.

$12 an hour? For that and leftovers me fucking se habla, at least it isn’t the mess English is.

I find the historically Jewish neighborhoods of Los Angeles to be some of the most vibrant and usually sought after real estate. Like parts of Fairfax and Pico. I know many Jewish people who live in Brentwood, SM, & Beverly Hills. I know what your saying to some degree. For example, Boil Heights used to have a vibrant Jewish population, and now is a ghetto hood full of chollos. But you have to remember before the Jews lived there someone else did. Thus I have seen many neighborhoods in LA change their demographic, not just the Jewish ones.

Waited until oil goes up and Mexican oil fields are more produced since Us and other foreign companies brought them. A lot of whites and Mexicans will want to go to Mexico for the oil jobs. Americans actually get American wages to work in Hotels in Mexico and so do tech people that work in Mexico. Too many people here don’t think that in 1950, everyone thought that New York City would be mainly Irish and Italian. Fast forward to 1975, Ireland and Italy economies took off and a lot less Irish and Italians came over and some went home.

I think Jewish people in Los Angeles tended to live (unless they were the Werner Bros.) where it was cheap, preferably where it was both cheap and zoned to live upstairs and have a shop downstairs.

The older places tend to be small, often have nutty floor plans, and might have an auto body repair shop next door. No self-respecting WASP is gonna live there. The Jews’ kids tended to be successful so they didn’t want to live there either, so what do you get? People willing to get into any place they can, and don’t mind mixed-used zoning. So we’re not talking about people listed in the Social Registry here.

Well the question to ask: Are the price of homes really going up? Or could it be your currency is losing value and it just takes more to buy the same things. Heck… an snicker bar cost 10 cents in the early 1970s and now it is $1.29 (10x price increase). So doesn’t it make sense a $50k socal home in 1970 costs $500k now?

I am not sure how we will have a housing crash when 85% of all mortgages are backed or owned by the GSE’s. I have refinance twice since 2009. Each time the loan has been bought by Fannie Mae one month after the refinance.

Housing has been nationalized. We are essentially renter from the Government because you never really own your home. If you stop paying taxes it will be confiscated. Remember high home prices mans more property tax revenue for the states.

And when all’s said and done, I can still understand you 100X more than I could ever understand one of those damned Katushas near the Korean DMZ.

Actually my currency buys me more energy, commodities, and foriegn experiences these days than it has in years. My house doesn’t transport me anywhere nor does it produce anything.

Hotel – what I fear most is the neighbors from hell(tm) as far as owning a house goes.

Also, if I were raising a brood of 5-7 children a house makes sense.

But as per “the wealthy barber” as a single burying dimes in a coffee can in the backyard makes more sense.

the total population of Paramount is 53,145 people. 78.4% of residents are Hispanic, 28.5% of residents are White, 2.7% are Asian, and 11.8% are Black or African American. In Paramount it is taco Tuesday everyday and no need for the Taco Truck. Eastside Paramount gang-Mexican Mafia connections are bad, stay away from them.

Those numbers don’t add up.

When I’m in South Gilroy I guess I’m Hispanic no one bugs me, I’m A-OK until I open my mouth and even then, census takers in Costa Mesa just thought I was being conceited and refusing to speak Spanish.

Alex said: “This ideal of family and tribe not mattering is as unrealistic as the ideas of Karl Marx. ”

Alex, how can you say that, when you embrace Karl Marx philosophy wholeheartedly? Since you post on this blog, most of your ideas are from Karl Marx. Even voting for Sanders means you embrace Karl Marx philosophy.

Now you have me confused – do you embrace or reject Karl Marx philosophy?

Well, I’m voting Sanders so I guess I embrace Marx.

Where I think Marx does not work in modern society – however much a genius he was – is that people evolved in small tribes, you knew maybe 100 people at most. It tended to be gift societies. I even experienced this in rural Gilroy, CA. You just helped people out and gave stuff, extra eggs, etc without anyone keeping count. That’s Communism. But try to scale it up to a large-scale, mechanized, industrial-farming society and you end up, as a necessity, with 5-year plans, a secret police, yadda yadda.

But yeah, Sanders or if he doesn’t get the nomination I’ll hold my nose and vote for the bitch.

L.A. is Re-segregating and Whites Are to Blame — http://www.latimes.com/opinion/op-ed/la-oe-bader-resegregation-los-angeles-20160401-story.html

I think it’s BS that when immigrants and minorities move into areas with similar kinds of demographics as their own it’s considered ok and expected. But when white people do it it’s called “white flight” and bigotry. If anything the huge influx of Latino’s is what is segregating LA and pushing out other ethnic groups. Take Compton for example. Compton used to be 75% African American, now it’s 66% Latino. So who exactly is causing LA to re-segregate?

Hunan I don’t know how closely you follow the news but a lot of areas have been being “colonized” by various races, blacks vs. hispanics is the biggest story, Long Beach becoming a Cambodian town, etc.

I don’t know how much mainland US’ians know about Koreans, but if they decide they want to dominate a town, they’re *going* to get it.

In the blacks vs. hispanics contest, it’s simple. Hispanics just keep shooting a few blacks at random; it doesn’t even take that many. They keep the shootings few enough to keep it (mostly) out of the news, but just enough that it (rightfully) makes blacks want to live somewhere else. Once in a while it pops up in the news, but the pressure is fairly low, but unrelenting.

Yep if whites did this there’d be federal life sentences, we all know that.

Another comedy article from the LA Times. Blame the White man for everything. Why is it that a large portion of Asians only want to live around other Asians, same goes for Hispanics and Blacks. Isn’t everybody part of this problem? If you are white and English is no longer the language spoken in your city and store fronts do not have signs in English, packing up the tent and moving elsewhere isn’t a bad idea. The is likely another reason some of the more desireable areas have such sticky RE prices.

Son there’s rule no. 1: It’s *always* the fault of whites.

This is a large part of why I hope 23andme tells me my brown paper bag ass is jooish, because then I can move to Israel where there’s no pussyfooting around about whose fault it is and people have some balls about it.

“For a time, places like Covina and Norwalk will remain integrated. But as whites in these areas get older and die, the outcome is clear.” from the LA times article on segregation. The Euro Americans need to stop get older and dying.

I don’t care. The Euro Americans die and that opens up more opportunities for my people. The LA Times is racist and not supporting this. Aztlan is slowly becoming a reality.

Martha read iSteve dot com he’s a racist asshole but he’s a smart racist asshole. Look at his prognostications for the US – same as has been happening through all the Americas, you end up with a white ruling class and a brown working class. Fine if you want that, finer if you “keep pure” and don’t have your family blend into the brown sea.

Essentially, you’re right, but you’re going to end up with a small, pale, ruling class and chances are your family is going to be destined from birth to dig ditches, work in a factory, shine shoes etc.

In other words, pretty much what the USA is anyway, just with a bit more melanin.

In truth, I like HispanoUSA. You guys don’t even get out of the bush leagues for hating whites. Grow up among Pacific Islanders and Asians (Japanese) and you’ll learn how the pro’s do it.

Yes Martha, all the Euro Americans should die and then you can turn the whole southwest into New Tijuana. LA Times is so racist for not supporting this important movement. But I wonder…… when they turn CA into Mexico, won’t they want to leave that too?

Alex, that’s one of the smartest things I’ve seen posted from you. It makes sense considering how it describes the exact situation found in Mexico.

Hotel – all I’m doing is repeating iSteve, I wish I could call the shots like him but … I can’t.

Go to the source.

Interestingly, he started on his racist career by wondering why capable white athletes were not being given a chance because they were not black. He never started out to be a mouthpiece for “scientific racism”.

I am reminded of P.T. Barnum, who said, ‘there is a sucker born every minute’! I think people convince themselves using emotional logic that they will never lose, that this time is different, and that they will always make good choices! My bet, is that those fleeing to cheaper parts of the country who have good job skills, are the ones making the best choices, given the times!

Except there are no jobs out there.

You wanna live in a hole in the ground? Move to flyover country.

Hell I’ve lived in near-flyover and $5 a month? NO thanks.

I feel like California real estate is one big ponzi scheme. If you are the ones who bought on the bottom of the market you will reap some rewards. If you buy at the top you most likely will lose your ass. A home is not an investment unless that is your business. For everyone else its where you live. Here is the best way to deal with the huge fluctuation in real estate prices, pay off your mortgage and never borrow on it. Problem solved.

California is beautiful, weather is great. But all quality people are moving out. California belongs to Mexico, China and India. There is no place for people like us. The only way companies are keeping us here is with supposedly high salaries. Not sure if $200K will keep us here much longer when we can not afford buying a house and sending kids to decent schools with this “high” salary. Actually banks would only give us $800K loan with $200K annual salary and 20% down. In San Jose we could potentially buy a house built in 1940 with roof falling down and neighboring crack heads. Regardless, you have to agree that California is beautiful and weather is great ))

Only moving out if disabled, retired, or have a location-independent biz.

California belongs to Mexico, not China and India.

Southern Caifornia will never become Mexico. Social service safety net keeps people from true deadly poverty, and the government keeps growing itself so code enforcement officers always need something to do. Escondido used to have Hispanic areas with plywood covering broken windows, trash all over, and recent illegal arrivals sleeping on porches. Now they keep it cleaner. Still sounds and smells like Mexico, but there are rules Mexico doesn’t have. We sold an old house in a Hispanic neighborhood, had half a dozen cash offers from flippers in 2014, got all redone and sold for $100K more. Not Mexico.

I’ve not seen real 1970s poverty and hunger since the 1970s ended. Calories are abundant in the USA.

I almost lost a much beloved younger sister to malnutrition in the 70s.

That shit ain’t happening now.

Euphorbia who’s got the money to buy stuff though?

It sure as hell ain’t the Hispanics.

I totally sympathize, but unless your people money-up and arm-up the future does not look very bright.

In my area (out suburbs of Sacramento) I’m seeing the home builders list their model homes at crazy high bubble prices – but contingent on rent back for 2 years. The must be worried they won’t be able to offload the models at an inflated price lol.

Came home to today to find a Notice of Default plastered to the front door of my rental house.

Je&%s H Ch$#st this is the SECOND rental I’ve leased in the past 3 years that has gone into foreclosure. The last one the owner hadn’t paid for 17 months (but kept pocketing my rent that I dutifully paid on the 1st of every month) then refused to give me back my deposit until I threatened to sue because they had “spent it on bills”. This one I’ve lived in since late 2014 and the NOD says they owe $28,350. They bought it new in 2005- height of the bubble…..

I have been putting off buying because I will not buy into this bubble and be underwater before I can retire lol.

Rentals are seriously scarce around here so looks like me, kid and dog will be squeezing into an apartment at $1,600 a month until prices drop. If they ever do.

WTF?

Direstraights, sorry to hear about your situation. Examples like this eventually push many people into buying. There is stability that comes with homeownership…people are willing to pay a premium for this especially if they have a family. Hope everything works out, good luck.

Yeah nothing like ownership stability utilities shut off and cooking using an old tire as a fire ring in the front yard.

YEAH.

Ownership.

“stability that comes with home ownership”

What a laugh! The “owners” this guy rented from don’t seem to have much stability.

The only inherently stable part of ownership is the original principal.

Same message from the sell side for the last 7 years: something will get prospective buyers to get off the sidelines. Actual results: lowest home ownership rate adjusted for population in generations.

Security deposit issues aside, you are still bound by your contractual obligations to pay rent when a landlord fails to perform on their promissory note.

Due diligence, change, and risk applies equally to the renter as it does to a buyer, so it’s incumbent upon you to hedge within your means accordingly. Before signing your next lease, look up the public records to get some information about the purchase history of the property.

Rhetoric about so-called ownership stability from people whose limited “owning” experience exists of the last few years doesn’t provide much to rely upon. People buy houses all of the time and external factors change effecting the property. Take it from someone who has been in this game through a few economic cycles.

I can’t believe this place is pending for 170K in Oceanside:

https://www.redfin.com/CA/Oceanside/403-Fowles-St-92054/home/3200982/sandicor-160016321

Land value only, 9900 sq ft lot. Bring your bulldozer.

I’ve seen similar shacks in Manhattan Beach sell for well over 1M.

$170K == $1700 a month so I could airBNB half of it.

BUT ….

CUT AND PASTE people, and post imaged to IMGUR or something, I’m not gonna pay $20 a minute to get past the paywall and neither is anyone else.

I can’t believe anyone was paying any kind of money to live like that. Is that mold all over every wall?

Makes the old Cabrini Green buildings look like Lake Shore Drive luxury high rises by comparison.

Buy insurance on your down payment what next? Look, just pay folks more money and stop with targeting a zip code as the only place to be ( RE agents love to boost up high locations not worth it) and maybe buyers and sellers can go back to a normal market.

Leave a Reply to Laura Louzader