Foreclosure red carpet style – From $1,350,000 to $576,000 in prime West Hollywood zip code. Real Homes of Genius. West Hollywood real estate enters correction.

You know the housing correction will be with us for a good duration especially when 60 Minutes talks about the double dip in home prices and the fiasco in mortgage documentation. I’m sure some of you caught the fact that one of the people in the story had a mortgage for over $700,000. How much income is needed to support a $700,000 mortgage?  This I believe is the larger problem we will face moving forward especially in California because many bought homes they clearly could not afford and banks simply do not want to accept reality. Even if the home is now listed for sale home prices are reflecting actual borrower incomes. The maximum leverage provided by FHA insured loans needs to be verified with actual income. Home prices continue to correct even in prime Southern California locations. Today we have an example sent in by a reader of a home in West Hollywood. This home last sold in 2005 and the correction is steep for a pricey neighborhood.

The Glamour of West Hollywood

1236 North FAIRFAX Ave, West Hollywood, CA 90046

BEDS:Â Â Â 3

BATHS: 1

SQ. FT.: 1,663

$/SQ. FT.:Â Â Â Â Â Â Â Â Â Â Â $347

LOT SIZE:Â Â Â Â Â Â Â Â Â Â Â Â Â 6,850 Sq. Ft.

PROPERTY TYPE:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Residential, Single Family

STYLE:Â Â Other

YEAR BUILT:Â Â Â Â Â Â Â 1913

COMMUNITY:Â Â West Hollywood Vicinity

COUNTY:Â Â Â Â Â Â Â Â Â Â Â Â Los Angeles

West Hollywood is a unique part of Los Angeles County. The location and proximity to stardom pushes the price of this area upwards. The above zip code has a median price of $872,000. This is a mid-tier area of Los Angeles that is now facing a correction. How deep the correction will go is hard to say. This is a 3 bedroom and 1 bath home and is listed at 1,663 square feet.

This home looks better from the front:

Not sure what they were going for here. This home doesn’t exactly convey a sense of Hollywood red carpet treatment but the sales price in 2005 sure did:

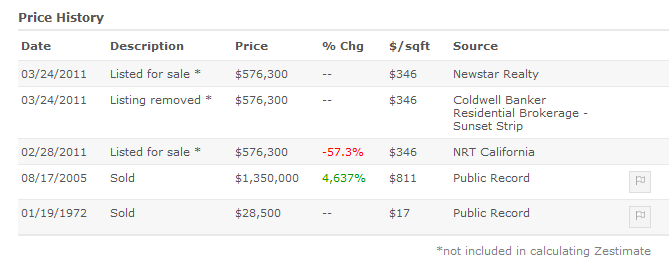

This home sold for $1,350,000 back in August of 2005. Today it is listed for sale at $576,300 and has a sale pending. This is the ad:

“REO-Bank foreclosure. Property condition may restrict FHA/VA financing options. In the heart of West Hollywood, 3 Bedrm + 1 Bath home. Property is Tenant occupied, so please do NOT disturb. Close to shopping and restaurants. Submit all offers BEST & FINAL w/ proof of funds, pre-approval letter & top page of credit report showing fico scores. See pvt remarks for showing instructions. Thank you.â€

The ad mentions it is tenant occupied. I’d be curious to know how much rent is being collected on this place. Even at a purchase price of $576,300 you would need upwards of $3,500 per month to make this even worth your time on the low end (more like $4,000 or $4,500 would be a better starting point).

Either way, we are talking about a 57 percent price cut in a mid-tier West Hollywood zip code. The funny thing when we post items like this or homes in the Beverly Hills area some are quick to comment that it doesn’t pertain to a certain school or niche market even within the city. All of a sudden it is getting harder and harder to hide from the overwhelming momentum of the correction.

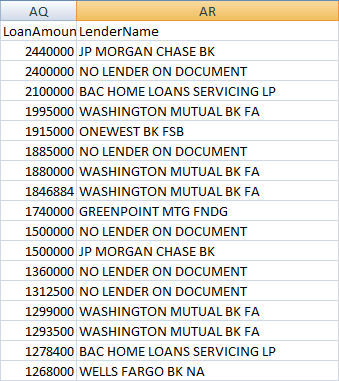

This housing bubble was enormous in California so the correction is expected to be just as big. Many of these areas have yet to face any serious kind of price correction. The 90046 zip code has 149 homes in the shadow inventory. Keep in mind this is in a supposed prime location. Many of the homes have mortgages well above the $1 million threshold. Here is a taste of some of the active shadow inventory properties in the 90046 zip code:

This is going to be a long and drawn out correction but bubbles of this size do not pop overnight or over one year. Ultimately home prices will need to reflect actual incomes of the area. The 90046 had a median price of $597,000 back in January of 2001 with 33 sales. The fact that this home sold within that range might be a sign of where things are heading.

Today we salute you West Hollywood with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

54 Responses to “Foreclosure red carpet style – From $1,350,000 to $576,000 in prime West Hollywood zip code. Real Homes of Genius. West Hollywood real estate enters correction.”

Another dumpy piece of S*** foreclosure with a severe location flaw (just check google streetview).

Makes you wonder how many people aren’t paying their mortgages on the nicer, non arterial streets….eh….actually…it doesn’t make me wonder. There are TONS.

You’d be a sucker if you buy a foreclosure from a bank as they’re playing the buyers for fools and selling the absolute bottom of the barrel homes before they kick Biff and Muffy from their granite encrusted HELOC huts on the nicer streets.

Okay, so it’s more “Hollywood” than “prime” West Hollywood (west of La Cienega, Beverly Hills border, and above Sunset Strip) where all the models, actors, and rich/industry gays live…but it is still WeHo where asking and even selling prices continue to be simply insane (to the tune of $800 to over $1,000 a square foot). The sucker who bought this one at peak for $1.35 mil was probably a developer looking to put up condos/mixed use on the lot but either ran out of money or couldn’t get the permits.

Love the rape shed in the back…looks like it’s straight out of Alabama or Mississippi…

You’re probably right that it was somebody buying it to build condos. I’m not so sure that would work out now. But seriously…it’s on freakin Fairfax! How much worse can it get? Labrea? Oh…wait…there’s a Whole Foods on the corner and more medical marijuana outlets than you can shake a stick at within walking distance. BONUS!

Normally I’m not one to snicker at the words “rape” or “rape shed” but I must admit, I snickered at that comment.

Perhaps that is what is being “occupied” by a …ahem…tenant, and of coruse, their privacy shall be respected.

And as a resident of Georgia, I assure you the rape sheds of Mississippi and Alabama would take offense at being compared to this POS.

Allowing this splendid abode to be valued by the market will reduce the equity of all the homeowners and the health of the community!

Japan Inc. redux:

NY Times editorial calls for more deficit spending to cure the results of excess deficit spending.

Foreclosures reduce the equity of all homeowners and the health of communities, which is bad for business and bad for jobs.

On the federal level, the fixation on the deficit above all else is particularly dangerous.

An economy with significant labor slack requires more — not less — government spending.

Unfortunately, Republicans have successfully framed the debate so that spending cuts are inevitable, and the best one can hope for is that the White House and Congressional Democrats will hold down the size of the cuts.

The recent Republican attack on foreclosure relief efforts, just as house prices are falling anew, is another destructive move.

Foreclosures reduce the equity of all homeowners and the health of communities, which is bad for business and bad for jobs…

Please, please educate me as to how taking on more debt makes a healthier economy and puts more money in my pocket. Debt=Debt. That’s it. If the markets were truly free (not crony socialist/capitalist markets), the housing “crisis” would be over and real job creation on the way.

No thank you.

What about the people who are not yet in houses? At 2007 prices it was impossible for people to get into a home. You had to give up your 401K, any discretionary spending, college funds for your kids etcetera. Is that the American dream? To work for 30 years and all you got to show for it is a piece of land with some bricks on it?

And the mid-tier and high-end levels still have a long way to go. If it remains as is today, the divide between the rich and poor will just have gotten bigger.

Housing prices need to come down. Even if it means pain in the intermediate. Hard work should translate into a nice home, good schools, and setting aside money for retirement and college funds. This can only be the case if your mortgage payment is not some ridiculous percentage of your income.

You can give your children a good education for a few hundred dollars per year if you homeschool. Computers are cheap, electric pianos are cheap, Kindles are cheap, and hundreds of classic works of literature are available for free. The public libraries have turned into daycare centers, with unemployed mommies and their screaming brats taking advantage of government-supplied air conditioning. The public schools are a complete joke — your child spends 30 to 35 hours per week there, you have to organize your whole day around taking him there and picking him up, and when you ask him what he learned today, he can truthfully say, “nothing.” Do not scrimp and save to move into a “good” school district. There aren’t any.

Doug …you must enjoy getting out your credit card when you craps out at the tables.

WTF good is equity and why does it matter if it’s reduced? Do homeowners not want their children to be able to afford houses without selling a kidney in the future?

Equity is a myth. You can’t spend it. We already saw where that got us.

Doug, when I go off on a rant about how the US government is spending us into oblivion she pulls me back to earth by asking, “What can the government do?” That is the crux of the problem. Our government is stuck. They have three options. One, they can stop spending which results in a deep sharp but shorter depression. They can slow spending slowly which results in a long stagnant period of no growth like Japan’s lost decades. Third, they can pretend and extend by borrowing like there is no tomorrow. The last option leads to a sovereign default. This has never happened in the US. Lots of differing opinion about the ramifications of a sovereign default, but you can bet it will be really bad.

This third category is closest to what is happening, although you are correct, the Republicans are forcing some reduction in spending.

I have two comments. One is that the government has almost no wiggle room. Discretionary spending in the federal budget is of the order of 15%. The rest of the money is already spoken for. No room for change without politically impossible bloodletting. Unfortunately the government cannot correct the problems on that 15%.

Second, in 800 years of world history, no country has ever grown its way out of debt. Never. Huge debts have always ended in internal or external default. Doesn’t matter whether we are talking about France, Greece, Argentina, Thailand. No country that runs up massive debt has ever grown its way out debt. See the marvelous work done in the book, “This Time is Different”.

So, your heart is in the right place wishing to avoid the pain that is coming. And indeed our government can delay the eventual correction. But the debt in the system has to be washed out one way or another. It is as inevitable as night follows day.

FYI – US revalued it’s currency against the gold standard in 1933. Roughly a 40% haircut. This is a default – many many countries in some shape or form between the Great Depression and World War II. This event coincides with the US ban on owning physical gold and transacting in gold which was only lifted in the 1970s.

You are correct to point this out. That episode could be viewed as a one time tax rather than default. But, that is semantics. It was in some ways worse than a default. There was a frank gold confiscation. All gold owners were legally required to sell all their gold back to the banks at below market rates.

My point is that this was an internal default. The US government has always honored its external debts. There have been several occasions that could be construed as internal default. Confiscation of 401K funds was openly discussed in 2008. Thankfully that push has receeded, but will resurface when times get worse.

The lack of external default and the sheer size of the US economy have made the dollar the reserve currency of the world. If there is an external default, you can kiss that notion goodbye. A lot of ink out there about losing defacto reserve status, but this blogger thinks the results will be very negative for the US economy.

“This has never happened in the US. Lots of differing opinion about the ramifications of a sovereign default, but you can bet it will be really bad.”

Yes. See what happened to British Empire when sterling pound lost it world currency status: Suddenly British had to pay everything with hard currency and not by funny money they’ve printed themselves. For that you need exports and, unfortunately, that British didn’t have.

Only difference to US is that British weren’t in debt very much: They were left with a currency while US won’t have any: There are more dollars existing than US have or can have any property to back those dollars up. When you already are bankrupt, printing more dollars won’t change a thing. Very clear logic here. 😉

Layoffs from cities are also coming. The treasurer of Alameda, CA has said that the city may be bankrupt within 2 years. The cause- rising cost of retirements and health care packages for city employees.

Not surprising, when you pay janitors and the landscapers $50,000 to $100,000 a year in salary, overtime, and benefits.

And no politician has the backbone to stand up to unions.

Don’t you think it’s time to stop picking on $50K “janitors”, and instead do something about corporations? No-brainer…

You can rail about ‘greedy corporations’ all you want. The cold equations say that taxing active workers to support retired workers is not sustainable. That’s why pensions are defined-contribution for most people, if they exist at all.

The US worker now competes with the entire rest of the planet. I foresee a time when educated immigrants offer tutoring to home-schoolers for $20/hr. Or less. Count on plenty of homegrown Ph.D.’s to join their ranks as the higher education bubble pops.

Increasing numbers of immigrants will start (have started) Catholic schools, Hebrew schools, Muslim schools, Hindu schools, Buddhist schools, etc. to impart their familial values. These new taxpayerswill resist funding a public education system they do not use, much less the lifestyles of its retirees. All of which serves to underscore the point of this blog: current home prices are not sustainable given where median incomes are headed.

It is what it is.

The big difference is this. I can choose not to buy from a corporation if I think the executives are overpaid.

Local government, on the other hand, has a monopoly on all the services in the city. You can not opt out, and must pay taxes to support overpaid workers. In Daly City,CA, nearly half of all city workers make $100,000. in salary and overtime.

I read your link Native P.

The article did not explain to me how the rich soak the middle class.

The end of the article explains how some folks went to work at G.E. for less than what they were worth.

That isn’t G.E.’s fault.

Yes it is the 50K laborer that is the root of this problem, along with all the union enforced overpaid slackers gourging on the dwindling taxpayer, like homes, each job has a value, when unions blackmail the employer for overpayment the short time and political rverberations are all that is considered and now the piper has to be paid. The only govenrment workers who should get big money are those who could command that sort of income in the commercial sector or about 0.5% the rest are parasites and the world has just taken a worming tablet, I for one will laugh at them.

As I was saying…

http://www.alternet.org/economy/150481/greedy_corporations_and_the_wealthy_fatten_themselves_on_the_rest_of_us_–_join_%22we_are_one%22_rallies_to_stop_the_freeloaders/

How many mid-tier markets go down, then there is panic across all markets? I think the correction is gaining steam again after slowing down in 2010.

An Alabama judge has recently found that a homeowner who got a loan she couldn’t afford is a third party beneficiary of the mortgage securitization pooling and service agreement for the trust that was supposed to acquire her loan. She was able to quiet title against the foreclosing entity because it didn’t have title to the promissory note owing to sloppy practices. If the ruling holds, it might blow a big hole in the foreclosure scandal, especially in California, where houses cost a lot more than in Alabama.

On the other hand, the California courts appear to be willing conspirators to the banks’ efforts to paper over their title deficiencies using California’s non-judicial foreclosure process (Gomes v. Countrywide 2/18/11). I do think the Court of Appeal was tacitly inviting the Legislature to do something to make lender fraud more assailable, but I just can’t see that happening anytime soon. Things are going to get more interesting.

Still seems overpriced considering location.

It is just amazing that a 1914 house has a tax assessment of 1 million [source: zilllow.com], and someone is willing to pay 576k for this house.

Is there any wood left in this house or has it already been consumed by termites? Does it even have a foundation? Would this house even stand a 7.0 magnitude earthquake? …?

The lucky person was the person who purchased it in 1972 for $28,500 and sold it for 1.35M in 2005.

Considering appreciation of 6% [being generous] per year since 1972, this house should not be worth for more than 300k; And for estimated medium income:

http://www.city-data.com/city/West-Hollywood-California.html

Even the 300k is too high of a price for this house considering the 3 – 4 times the estimated medium income for this area.

I was thinking the same thing. Some buys it for ~$28k in 1972 and sells it at the peak. That someone is probably enjoying his money in some retirement community in Utah or Arizona. Nicely timed exit.

…..or they are in heaven. Everything dials back to zero for everyone sooner or later.

I’m thinking whoever bought this place is after the lot, not the house.

Termites and foundation are good questions. If it’s that old tho, it has survived several earthquakes hasn’t it?

What I can’t fathom is who would pay even $300K to live in a dump like that? If you have to live near there, rent an apartment or something decent. The only reason to hold title to a shack like that would be for capital appreciation and that ain’t in the cards for the foreseeable future.

Just reading a history of the Roman Republic and empire. For a hundred years towards the end of the Republic, one of the prime public discontents was debt. The many wars had forced small farmers into debt and they clamored for relief from the draconian laws of the time. Your FICO scores weren’t ruined and your house reposessd, you and your family were sold into slavery.

Yet the aristocrats in the Senate faught any corrective measures. Eventually, the exsaperated middle class abandoned restraint and the result was widespread and destructive political violence. Demogogues arose to exploit the passions on both sides culminating in the civil wars of Julius Caesar. Pompey, and Crassis.

The end result was the end of the Roman Republic and autocratic rule.

Let’s hope our system can resolve the wide spread housing debt issue without tearing our civic, economic, and political systems apart.

Very interesting…but this time it’s different. America is immune to any principles we choose not to accept. We are the culmination of aoens of progress…On the other hand, Idocracy may be the rule we succomb to. We are instantly programmable to advertising and peer pressure. Like a bunch of teenagers that have grown old, we still know everything so there is nothing to learn. Economic crisis? We fixed that…just ask Ben and Hank. Hope springs eternal.

Would anyone making over $100,00 per year want to live in this house? Yet you would have to make much more than that to actually afford this POS. Fasten your seatbelts folks, we’re in for a bumpy ride!

A house like this for 576k, even if it is a large drop from the peak, is just depressing. We certainly have a long way to go to any rational pricing. I can’t imagine anyone making ~200k per year, or an investor/cash buyer really wanting to invest in this place.

When was the last time in Southern California that housing prices actually Did correlate with median income? I understand that nationally, historically home prices should be 3 times income

In prime So Cal…. I think a perfect ‘Desirability Metric’ is how many times above median income people are willing to go to own here. Homes in WeHo are 9 times median income… fine.. we are probably 3 times more desirable than Alabama…

What I’m suggesting is that just because it ought to be 3x income…. doesn’t mean it will correct all the way back to that level. If loan regs require a ratio like that, then people will have larger down before they buy.

3x income is derived from experience: anybody spending more than a third of their monthly income on rent/mortgage presents a high risk of default.

“Homes in WeHo are 9 times median income… fine.. we are probably 3 times more desirable than Alabama…”

LOL. That’s ridiculous. Those households are just rolling over credit balances, one week away from financial ruin.

Dasher, the price to income ratio was in line in the vast majority of LA and SoCal up until the housing bubble of the 2000s. Certainly, historically there were other booms and even busts where it was well out of line, but never to the extent that it was in the 2000s, for the most part because of the drive by various powers that be to “get every American into their own home and be a homebuyer” – mostly in order to keep producing collateralized debt obligations/repackaged mortgages, for which investor appetite was near limitless and voracious, and for which the loan repackagers were reaping enormous profits.

Some interesting Google results

Here’s what this house needs………

http://host.trivialbeing.org/up/transformers-20090211-acco-custom-bulldozer.JPG

Would somebody please get that emperor a blanket? He’s been walking around without any clothes for an awfully long time now.

Well, the other problem is that many of the new jobs now being created are low paying jobs with little or no benefits. As for taxes, those still griping about them-we are at decades low tax rates-in other words, taxes haven’t been this low for decades. Lot of good that did.

Millions of manufacturing jobs went to China and millions of service sector jobs to India. The question should be how do we compete with them. Do we lower our wages until we become a thrid world country-we are already heading there with the rich poor divide-which is the greatest since the great depression. Or do we move against free trade and become a protected economy-we have enough/land/resources/people to do that and start drawing individual trade agreements with different countries based on how it would benefit us-as in the country/majority-not just a few executives. But I am sure that will have disadvantages.

I wish our congress critters would at the very least discusss that. One side wants to cut taxes and make us a bare bones third world economy and the other wants to spend , spend and spend and hope this is a regular business cycle. But otherwise nobody even talks about the devastation,the pain, the army of 40/50 somethings who have lost their career/way of life and are faced with hopelessness. Nada.

I just read that China now has surpassed us and become the No1 manufacturing nation in the world.They already have become the No1 auto market in the world. I don’t know-maybe this is a cycle of nature.After all Christopher Columbus found America , because he was looking for an easier route to the riches of India . India fell and came under British rule. China once the hot bed of innovation fell and became all but a vassal state. Perhaps those two nations are arising to their former glories centuries ago ? Who knows how these things work ? But all I can say is it does not look pretty and we probably have the dumbest set of congress critters on both sides in a generation.

Five years ago, when everyone was telling me to buy a house and “get in the game,” I drove around and looked at some houses.

I couldn’t believe the houses in Marina del Rey that were selling for700,000 and 800,000 and 900,000. In fact, just on a laugh, I asked the realtor why so many homes in that area had bars on the windows. He said, “A lot of people in these neighborhoods like this ‘traditional Hispanic style architecture.'” And he didn’t even flinch when he said it.

Every time I went looking, I just couldn’t fathom how, in neighborhoods where all signs pointed to my wife and I having a higher income than our potential neighbors, that we were always invariably looking at the biggest shitbox of a house on the whole street, based on price and what we might be able to afford.

I have to admit, it was pretty confusing for a while. I guess it wouldn’t have been confusing if we’d have stopped into our local Countrywide agent and asked what we could afford.

On the one hand I feel bad for all those people being foreclosed, but, on the other hand, I feel like they chased up all the prices and are part of the reason that I’ve had no real option than to rent a place.

I look forward to those mid-tier prices continuing to drop.

Greg, my wife and I did exactly the same drive to look at shitboxes at exactly the same time in the same place. We laughed and laughed at the idiot who would pay 700k for a dump with bars–or more. We rented instead.

Now these idiots are defaulting and I’m supposed to feel bad for them? This was a multi-tiered scandal. The bankers and lenders are the biggest criminals, but what can I say to the delusional idiot who bought a house that was x9 or x10 what they could actually afford? The fools who drove me to rent (when I had a solid job, a significant down payment, and excellent credit) because they were on a house-flipping bender must go down the economic drain along with the bankers.

DASHER. From the 1989 market top to 1996 market botton the income ratio

for Los Angeles County was 4.6x income at top to 3.2x income at the bottom.

That was a normal market movement. The current 9x income WeHo asking price

is not sustainable even given the traditional SoCal premium. That premium under

normal SoCal loan standards never exceeded 4.6x. So cut your WeHo asking prices in half to be at the high end of sales $$$ possibilities. In fact, we’re probably headed for that low end at 3.2x. Which, by the way, is still far too high for Alabama.

Looking at Google Maps, behind this house at 1236 North FAIRFAX Ave, West Hollywood, CA 90046 is an apartment complex that is has all the windows boarded up with plywood.

Not ALL the windows are boarded up, as you can clearly see a few of them in the background of the lovely back yard picture.

But I guess you have to have some egress point for the pidgeons.

I meant 1201 Hayworth Av sorry.

West Hollywood 90069 has over 28 months of listed inventory. This is without including any shadow inventory. The only other area with more inventory is Malibu with 53 months! Big declines still ahead.

http://www.westsideremeltdown.blogspot.com

It looks like it was for the dirt. From the evidence, the same individual who purchased 1236 N. Fairfax in August 2005 had bought 1244 N. Fairfax two months earlier for $1,200,000, both from the same savvy seller.

Ah, 2005, the boomdiada days when glamorous West Hollywood was descended upon by the lucre lusting locusts. If the two shacks had been demolished and redeveloped, each parcel of land could have sported a 4-story luxury condo building with about 8 units. But then the party stopped…

The original lender for both parcels: Washington Mutual — total $1,860,000 in first mortgages.

The locust — well, we don’t really get into such specifics now, do we? But the same realty company seems to be cropping up in the shenanigans.

Will be interesting to see whether 1244 N. Fairfax becomes a REO/foreclosure. And remember everyone, ultimately it’s we the taxpayers who’ve ended up footing the bill for the debauchery.

I noticed a lot of references to Alabama. As a former resident of Santa Clara, Santa Barbara and Long Beach, California, I bailed and moved to Alabama.

The move was incredible, everyone spoke English (with a southern drawl) homicides were negligible, and the property was so cheap that I had to buy bigger (3,500 sq.ft.) than I wanted to avoid paying capital gains on the 1940’s house I sold in Long Beach. It also didn’t have earth quakes and parking lots called freeways.

Anyone that thinks that California is still the California that I moved to in the late 60’s, probably believes that the home prices are going to rebound soon.

Alabama – don’t knock it if you haven’t tried it.

Howz da surf in Bamma?

“The big difference is this. I can choose not to buy from a corporation if I think the executives are overpaid.”

Unfortunately you can’t. That’s why the executives are overpaid. You have to eat something, live somewhere and go to work with something and (usually) lend or handle money/credit cards to do all these things.

And everytme you do one of these things, one overpaid executive gets richer: He owns his own congressman and there’s nothing you can co about it as long as congressmen are for sale, all of them.

In China they shoot bribed congressmen. That’s a good habit although I in general don’t like shooting people. But the idea is clear: Absolute power means absolute responsibility, personal and very immediate kind. In Western democrasies power and responsibility are inversed: The more power, the less responsibility.

The results of this can be seen in US and EU and most of the other countries too.

“ronnie

April 4, 2011 at 5:38 pm

I read your link Native P.

The article did not explain to me how the rich soak the middle class.

The end of the article explains how some folks went to work at G.E. for less than what they were worth.

That isn’t G.E.’s fault.:

Ronnie: apparently your one of the brainiacs that think teachers are the problem as you flunked reading comprehension. The article is pretty clear in it’s explanation of how the rich got all the gold plus the alleged anecdote about the GE employees is both out of context to the story and non-existent in the article. All of which leads me to the supposition that you are one of the propaganda puppets we have learned are spreading dis-info on the net. Time for you to get actually schooled.

1244 is currently being rented out as a flop house for actors and other individuals. At times, they fit upwards of 20 people in the house, each paying around $500/month. So, yes, they are making more than the minimum $4000 to make this worthwhile….

I spoke with the manager there and he said that he was cleaning up $$$$.

I guess no one wants to buy it from the 2005 buyer and take a gamble. Better to make under the table cash each month

Leave a Reply to BoyWonder