The financial siren call of low mortgage rates – Federal Reserve continues to artificially lower mortgage rates to keep shadow inventory values inflated for banking allies.

The Federal Reserve monetary policy hammer approaches every problem as if it could be solved with its arsenal of interest rate nails. If low rates were the solution to a healthy economy we wouldn’t be in this financial mess. Remember those teaser 1.25 percent mortgage rates? What about our near zero Federal Funds Rate (FFR) that spurred the housing bubble? Repeating history, the Fed is actively trying to make mortgage rates even cheaper as a method to pull us out of this financial crisis. The European debt crisis is causing funds to flow into U.S. markets only adding additional fuel for lower rates. Is this a positive? The only positive item about this is the Fed is protecting banks and allowing them to continue to keep inflated appraisals on their shadow inventory. Some have now fallen in love with the mistress of moral hazard. This financial situation is unsustainable and these low rates are a siren call for our economy. These low rates are not here because things are healthy. Low rates are here because the financial markets are a mess and the Fed only knows how to protect its banking allies. We are the last domino so to speak.

Why low rates will fail the American economy

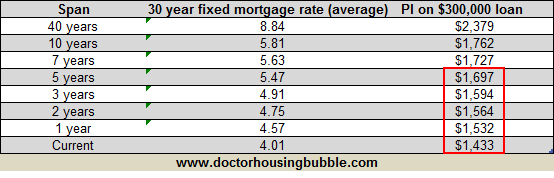

You always get a few comments about how wonderful low mortgage rates have become and how they will save the economy now that we have moved a few basis points down. But mortgage rates for the last decade have been historically low. Let us look at the data very carefully:

We have already had historically low mortgage rates and continue to inch lower now with the Fed embarking on purchasing $400 billion in longer term bonds with maturities that span out to 30 years. Coupled with the European debt crisis and mortgage rates have hit a new historical low. But look at the data above. How big of a difference does this really make? Over the last five years, if you took on a $300,000 mortgage, your principal and interest went from $1,697 to $1,433 (a change of $264 assuming you refinanced and get the current rate right now, which does cost money). What about insurance and taxes? The problem isn’t with homeowners who are current of course and this approach goes after that segment. The issue of course is with the shadow inventory.

By the way, $264 a month is not going to miraculously save the economy especially when these policies attack the U.S. dollar and you now have to pay that much more in food and gas (there goes that savings). This move is really to keep the shadow inventory appraised at high values for as long as possible. The issue you also have is with those that are underwater. As things stand today, your options for refinancing an underwater mortgage are incredibly limited.

Low mortgage rates do not solve the underwater mortgage problem

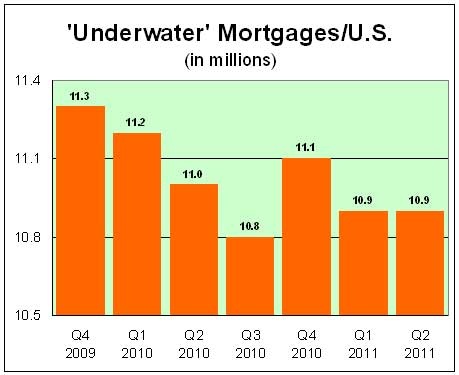

The U.S. is still plagued with homes with negative equity:

Chart:Â OC Register

Of the 10.9 million underwater mortgages in the U.S. over 2 million of those are here in California. How do low rates help those that are underwater? So far it doesn’t but new talks about allowing underwater homeowners to refinance is being mulled around.

“So if you over paid on that $400,000 shack that is now worth $350,000 the government is going to give you the blessing to refinance at the new low rate and reset your 30 year debt slave time clock. I believe current talks are looking at capping the program at a 125 percent LTV ratio. Doesn’t really help the jumbo suckers who bought a one million dollar home now seeing it appraised at $700,000. The big winner? The banks of course because they can still keep the bubble price on their balance sheet.”

I think you are starting to understand what happens when a system is captured by the financial industry. And don’t think it will be a panacea to simply refi each loan. This will only apply to loans backed by Fannie Mae and Freddie Mac and 25 percent already have rates below 5 percent. People are having a tough time paying their mortgage because household income has gone negative for over a decade.

The problem with the low mortgage rate approach is that it is simply an extension of what we have been doing for the past four years to solve this crisis. The Fed and the banking system caused this problem and now we are allowing them to solve it? The action in the housing market is so out of whack because of these horrible policies. It is likely that a large portion of the mortgages underwater are private label mortgages and will not be helped by these future programs. This is why this summer with insanely low mortgage rates and very generous incentives to purchase a home, sales fell in high priced markets like California because the underemployment rate is still above 23 percent.

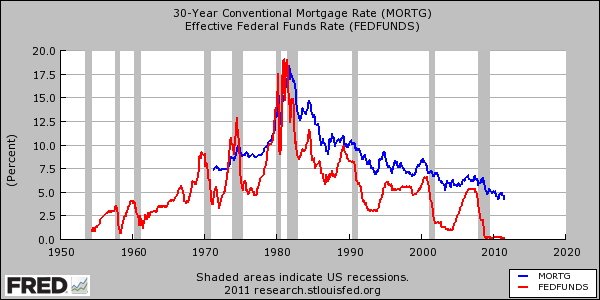

Fed funds and mortgage rates

Low rates are not a new campaign in this market. This is a known to the system. Some now are arguing, “it is now cheaper to buy than rent!†and that may be the case. Yet you will need to get comfortable for a very long time because it is unlikely you will see any appreciation for years to come. These artificially low rates are dangerous and have addicted the country to something unsustainable. This may go on for year or so as Europe battles its debt crisis but don’t think we are out of the water here as well since we also have a debt crisis. As we pointed out, if mortgage rates even trickle up to historical 40 year averages who will purchase your home at your inflated price? There is no sign that household incomes will go up. So you will either need to cut your price or simply continue living in your starter tiny home (this is especially true for California). On the contrary these low rates may stabilize markets where household incomes are more in line with adjusted home prices. A place like California will simply move lower inch by inch as people regain sanity from this bubble.

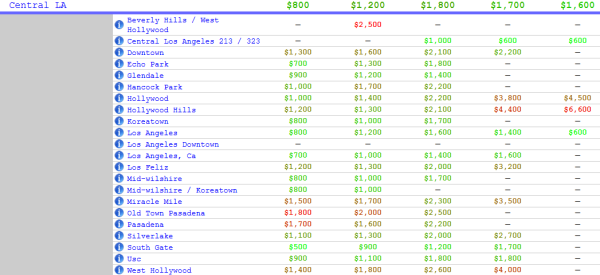

Some keep arguing that rents are growing by leaps and bounds. This is not true. Over the last year rents in Los Angeles have gone up by 1 percent according to the Department of Finance and have actually fallen in the last month. I would assume that given the current problems emerging in the last two months, rents will have more pressure to the downside especially if more shadow inventory is pushed out to the market.

Apartment rents for two bedrooms in Los Angeles seem to hover around $1,800 ($1,200 for one bedrooms):

Source:Â Rentilly, data from Craigslist

I find the above data fascinating because rent needs to be paid from a monthly nut (after taxes) with no subsidized benefits. This is what over half of Californians can truly afford. And given the 2 million underwater California mortgage holders, it would appear that many would probably do better as renters. Nothing wrong with that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

97 Responses to “The financial siren call of low mortgage rates – Federal Reserve continues to artificially lower mortgage rates to keep shadow inventory values inflated for banking allies.”

The ones who really suffer with these low rates are the savers, people who have done everything right, have not taken big risks, and judiciously saved and lived within their means. They get penalized on their CD’s and safe “investments”.

Don’t worry, Ben Shalom Bernanke and Lloyd Blankfein care just as much about the good egg savers as they do about their elite cronies… indeed, every time Congress asks them, they say they “care”… 🙄

I am one of those “savers”, and you are right about the pathetic interest on savings. However, I do still have a mortgage, and I figure I might as well take advantage of the craziness, and refi into a 15y fixed at 3.25%. I’ll make the same $1600 monthly payment, and should have it payed off in 10 years. I didn’t F up this economy, and I have no control over anything but my own finances. I’m just going along for the ride.

“Savings Of Millions Of People Are Going To Vanish”

http://www.youtube.com/watch?v=aC19fEqR5bA&feature=player_embedded

The international bankster community is currently in panic mode as to how to solve a deflationary depression scenario with MONSTEROUS sovereign debt….

Operation twist is the last *gasp* of chairsatan Bernank to reload his QE bazooka, before EURO land collapses.

Accordingly, paper PMs are being revalued to their proper value, while physical PMs are not available at almost any price…

If anyone thinks that a U$D currency devaluation isn’t in the cards for 2013-2015, they better run out and buy RE with all the leverage they can muster.

On the other hand, with job creation negative for at least a generation, how you gonna pay for that RE, especially if you need to relocate ever 3-5 years to regions where ANY jobs are available?

Oh and boomers, thanks for consenting to the Ivy League mafia rule of banksters and their fraternal brethren politeers, your just reward is almost here!

*FLUSH*

The science and statistics and thought put into this post truly astounds me, but it is tight and concise and…wow. Of course, the message is thoroughly scary even if utterly perceptive. Two small points only to add two details. First, the purpose of the refinance plan solves both the equity/bank books values, but more importantly for now, it gives the big five banks a huge and easy surge of mortgage refinance fees! Right now their finance procedure fees are way down; that usual-but-now-missing “easy” river of money drying up is well noted in the present plummeting of bank stocks prices on Wall Street.

On a related topic, look at the disaster that befell the manufactured home industry starting in 2000, every year since then was negative, plants closed, and they had plenty of easy money for buyers and low down payments: but huge problems with creditworthiness of potential buyers (the jobs issue and rising expense and cost of living). Often, that’s where move up buyers started out, maybe still should. Low rates didn’t save the manufactured homes/communities all during the 2000-2011 time frame. California is a large population state, and it may be interesting to find statistics on whether it has more manufactured homes in place than any other, and what happened there during the last ten years (it should have had explosive growth with easy credit, not continual shrinking). I wonder if all those California manufactured home communities are having foreclosureville? Ditto, Nevada and Phoenix; and if so, who holds all that paper? Conseco got into bubble type aggressive overfinancing manufactured homes in the 90’s and ended up totally broke (2002) during one set of down turns; perhaps that served to teach lenders a lesson in that domain of lending?

Just a casual observation from my neck of the woods, which is Castaic. There are three neighborhoods of manufactured homes nearby that have all been slammed with foreclosures. This in turn is really killing the HOAs and threatening the residents who are good on their mortgages with severely higher HOA fees or loss of the HOA entirely. This means a lot of bills and maintenance the HOA handled now must be dealt with individually ay greater expense.

“If the American people ever allow the banks to control the issuance of their currency, first by inflation and then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children will wake up homeless on the continent their fathers occupied. The issuing power of money should be taken from the banks and restored to Congress and the people to whom it belongs. I sincerely believe the banking institutions (having the issuing power of money) are more dangerous to liberty than standing armies. My zeal against these institutions was so warm and open at the establishment of the Bank of the United States (Hamilton’s foreign system), that I was derided as a maniac by the tribe of bank mongers who were seeking to filch from the public.†— Thomas Jefferson

+1. Every American should understand the history of Banks versus the U.S. Government.

Sadly, that subject is not only gone from modern school books, but I’ve heard that they’ve rewritten the history books to portray Andrew Jackson as the worst President of the U.S. now.

Underestimating the Bankers will lead people into the poorhouse, without a clue as to how they got there. And probably under the impression that it was their own fault.

The fed was set up as a cross between government and big banks. It was a compromise between those who saw government as the problem and bankers as the problem. Governments tend to print money like there is no tomorrow. Bankers tend to guide the economy in ways that aggrandize the banks. Neither is a savory solution. The fed was hoped to be a compromise between the two with a balance that would help the American people. Worked pretty well till we got ourselves off of a hard basis for our currency such as silver. Sadly the banks figured out how to co-opt fed policy in a way that seemed like magic to most of the American public. Myself included. I admit that I did not see the basic flaw that Dr. HB has pointed out so many times. Greenspan and easy money worked great for a while. Sooner or later someone has to pay the bill.

The bill has arrived.

It is fascinating that apartment rents for two bedrooms in Los Angeles are around $1,800. The same $1,800 can alternatively cover $1,433 in monthly PI on a $300,000 loan (to buy a 2 BR condo). The difference of $367 (between $1,800 and $1,433), plus another estimated $360/month in tax deduction (for the interest component of mortgage), together yield over $700/mo (not a precise number, but roughly speaking). It seems that $700 (or a similar such amount) is more than sufficient to pay HOA dues, property tax, maintenance, PMI etc. Many vocal readers of this blog are likely to disagree, so the following question is directed at them: How much lower than $1,433 does the PI for a $300K loan need to go, in order to make buying a 2 BR condo more attractive, as compared to paying $1,800 in rent (note: my question is not whether prices will fall further – instead, how much higher do rents have to go and how much lower does PI have to go, to make it worthwhile for you to sign up as a debt slave to the bank rather than continue to slave for your landlord)?

Robin, $1800/month rent can get you a nice 2 bedroom apt in many of the beach communities. Try buying a condo for 300K in those same neighborhoods…ain’t gonna happen. To buy a condo for that price, you need to substitute a less desirable city. And with that comes longer commutes, more crime, worse schools, etc.

Condos are usually just the first wrung of the housing ladder, where people will stay for 5 or so years before upgrading to a house. If there is no appreciation on the horizon (evens the housing bulls will agree on this), it just makes more sense renting. You have flexibility and there is no guarantee that prices won’t continue to go down. If I were to buy something right now, it would be a place I could see myself living in for a LONG time and being happy there.

(note: my question is not whether prices will fall further – instead, how much higher do rents have to go and how much lower does PI have to go, to make it worthwhile for you to sign up as a debt slave to the bank rather than continue to slave for your landlord)?

I think prices will go down in LA area for 5 more years, especially those areas which were slow in declines, so wait 5 years, then jump in. What if you pay 300K on that condo today and can buy with maybe slightly higher interest in 5 years for 225K…I say prices will fall to 96 to 99 prices for sure, and at the rate we are going, after that five year decline, they will stay flat for a good long while, so…all I hope is that your job is a good steady one. I miss the California weather, but that’s about all I miss.

Robin, it looks like you stirred up a bit of a $%&# storm. But I think you raise a very good point. Namely, in some places and at certain price points, it might be cheaper now to buy than to rent. So even if the place goes down for another year or two, all you would have lost by buying now is the opportunity to buy cheaper later.

One potential downside, however, is that jobs are not very secure right now. So if you buy now and then are forced to move to get a job in another city, things could get sticky.

“One potential downside, however, is that jobs are not very secure right now. So if you buy now and then are forced to move to get a job in another city, things could get sticky.”

Yep, says it all….

Sure, there are gonna be trapped debt-owners (and their desperate realturds) trying Jedi mind tricks, lying through their teeth and/or counting on mass bubble inducing insanity to return, but the future is gonna be about INCOME.

And yes, there will be the top 5% that can and will buy “deals” on RE – Jumping the gun on a multi-generational bottom – but as one of those lucky individuals, would it really be a good idea to volunteer to be a tax burro for “The Moonbeam State”?

I think that’s about it, not much more to say, other than good luck all…

Inquisitor out!

Not too sticky, as long as you can rent it out for positive cashflow….if you cant. then you OVERPAID. Yes being a landlord sucks (my Dad and I tried it, the $1300 a month + cashflow wasn’t worth the hassle.)

HenryE:

Agreed, housing is all about job security and unemployment – but it seems to be not a bad time to be looking, for people who have two incomes (husband & wife), and both reasonably comfortable at work. If we miss the seasonal dip this winter, we might have to wait another whole year for the next dip .

And I am not entirely clear how much lower house prices will go if every price drop is counteracted by mortgage rates being slashed via Fed action. In the worst case, assume a double dip recession happens in the next couple of years, is it then too unrealistic for the 30-yr fixed rate to be forced down to 2% (half of today’s rate) by Fed’s actions in future? I don’t understand how house prices can necessarily fall, when mortgage rates are being forced down with every fall in house prices. Isn’t this the point of Dr. HBB’s post above?

There’s no space for rent to go higher for us to jump into this market. We’re planning to move out of state by end of 2012. A slight increase on rent will only speed up our path. We just cannot see in the near future that we can afford a non-distressed house in South Pasadena and Arcadia with our income.

Robin,

Please excuse Mo and the way he repsonded. While I absolutely agree with you on your basis. And Mo does make some points, just a terrible way of protraying them.

I just moved to LA from Philly suburbs 6 months ago, while in the Philly area you can find a place for 300K and have a reasonable commute to work and make things affordable. That just isn’t the case here in LA. Just do a quick zillow search. Then look at the areas where you can get a place for 300K vs the neighborhoods you would prefer to live (based on your desires).

There aren’t even any condos where I live (South Bay/Beach Cities) and if I found a place in a nice neighborhood, I would be 50 miles inland and have a miserable commute.

So, we rent and wait for prices to become back to affordable to the proper income level

No need to appologize on my behalf and I must ask are you dumb as well? Did you just say there are no condos in south bay? I hope not because everything you say after that loses all credability.

Robin,

You realtors in disguise continue to forget one thing. Your mortgages are fixed, while rents are not. We know there is a huge inventory of unsold homes out there, and we know prices are coming down. Our rents are not fixed. Falling home prices will most likely bring rents down as well. Now sure how people continue to compare a 30 year fixed payment to variable rents, especially in a depression.

Spartan, I agree that rents can go down when a market is flooded.

But the point of this post by Dr. HBB is that Fed’s actions are artificially forcing mortgage rates down, to counteract every fall in house prices. What happens to people’s monthly payments, when the 30-yr fixed mortgage rate is forced down to 2% (half of today’s rate) by Fed’s actions in future? Guess what the 5-yr ARM rate would be then? My guess is it could go down to 1%. Will the Fed do it? That’s the 64 million dollar question. You bet they will do it, the alternative is too painful: house prices will get crushed (and so will consumer confidence etc …)

Spartan – I forgot to add, anyone with a 30-yr fixed mortgage will naturally re-finance, when rates go down to 2%, so that’s how the mortgage payments move down too.

Robin:

u should factor in the cost of maintenance–at least 1% per year, and count on the condo dropping 5% a yr–$15K or so.

Changes the appeal a bit.

Robin, I rent my residence at $1,950 a month in Orange County (nice new building, top floor corner unit). I have looked at comparable condos near by for $375k+. So I have thought about your question.

I would need to be able to, with a 3.5% down payment (and shoving closing costs down the sellers throat) save $500 a month on rent to consider moving and owning.

I am not willing to cough up more of a down payment, as I have money working in a more profitable endeavor than housing down payment now.

With our appreciation, I cannot justify the acquisition costs. And I would want to be able to cash flow for my troubles if I had to move and turn it into a rental.

Landlord – seeing how conservative you are, it makes sense to wait for a year or more, until the conditions are just right – wait for the Fed to hit the panic button by next summer – artificially push the 30-year fixed mortgage rates down to 3%, at which time you may the $500/mo savings you are looking for.

Robin

Are you dumb? Do you not understand that that 300k condo is really only worth 150k? Why would any rational investor jump into a market that has the potential to drop another 50%. Do you also not understand that many neighborhoods is LA are totally undesirable due to illegal immigrants, poor schools, and high crime? Further do you not understand that many HOA’s asses significant fees for things the average buyer would never think of like resurfacing the parking lot, ect. and all of a sudden the owner gets hit with 5K bill on top of HOA fees. Condos are the worst possoble way of owning property.

We are living in a world where the gov’t and the banks control the media. Do you not understad that unemployment is really at 50%? Open you eyes and your ears people and stop pretending things are ok. Until everyone accepts thhe fact the paying 2 dollars for a can of coke, 100 dollars to go to a baseball game, and 300k for a crummy condo is totally unsustainable relative to the true income potential of an individual that had no skills other than gardening.

mo – yes, I am as dumb as a doornail. Let’s assume that the gov’t and the banks control the media, and let’s also assume that 300k condo is really only worth 150k. Now, how much would that same condo be worth, when the 30-yr fixed mortgage rate is artificially pushed down by Fed’s actions, to 1%?

Isn’t this the point of Dr. HBB’s post above, that Fed’s actions in pushing down the mortgage rate have artificially inflated house prices? The artificially inflated prices are allowing banks to safely exit from properties they are foreclosing on with smaller losses than if the mortgage rates were set in a free market (without Fed’s actions).

As soon as the banks are done with all foreclosures, the free market will be set free again, and interest rates will naturally rise. Guess what a historically high rate (say a 10% rate) on the 30-yr fixed mortgage will do to house prices … shouldn’t we all be rooting for high rates? Rates high enough to build up savings in our accounts, sufficient to make a 20% down payment … even a broken clock is right, twice a day.

Not dumb, but a realtor shill. The internet is full of them.

Robin, I say if you are real, go ahead and buy. You don’t need anyone’s approval. Come back in 2 years and let us know how much equity you’ve gained or lost. Likely you will lose a lot, but who knows? We promise not to ridicule too much.

I say you are a shill because you are putting out so much effort trying to convince others. Just go away and buy if you are real.

I’m waiting for Europe and China to crash along with the rest of our “recovery”. Then maybe the banks will have to move some nonperforming inventory out of the shadow in order to raise some capital. Oh wait TARP will bail them out again. Thanks US government!

Rather pay landlord than depreciating asset to bank. At least I can move out of California someday.

Bank of America is already moving those little doggies up the shoot to the air hammer, just like in Texas with the beef cattle, cheap prices are coming on beef . The other banks will do the same soon. Monkey see monkey do.

Keep an eye on your retirement funds. That’s the last place around with actual wealth. It will be needed soon to keep the Governments’ derivative bets propped up.

When (not if) they decide to “save” the retirement system, then the end is actually near.

Peggy, and the rest of the (D) & (R) Free Crap Empireâ„¢, have to get “theirs” some way!

http://www.youtube.com/watch?v=P36x8rTb3jI&

Can’t we just vote in da best sugar daddy now, and get it over with already?

That time is already here. Don’t you read the papers how pensions will cause the collapse of the western world? 401k is where EVERYONE will have to go, and my 401k sucks sweaty nutz. Can’t have someone have a pension when the entire nation will be destitute.

I’m getting close to working with all CASH and dropping off the grid. Apply for food stamps, low income housing, and spend my time the way I want, not on a hamster wheel making money for some guy surfing porn and alt-tabbing to his “profits”.

The head of the IMF has warned that its $384bn (£248bn) war chest is inadequate to deliver the scale of the support required by troubled states.

Ms Lagarde said: “The fund’s credibility, and hence effectiveness, rests on its perceived capacity to cope with worst-case scenarios. Our lending capacity of almost $400bn looks comfortable today, but pales in comparison with the potential financing needs of vulnerable countries and crisis bystanders.”

CA real estate is under downward pressure because unemployment is so high. Lower interest rates won’t change this fact. Jobs will. But the jobs are not there, nor are they anywhere on the horizon.

Nationally, in the last 90 days, around 5 million mortgages have gotten into nonpayment status. Unemployment, nonpayment of mortgages and many home being underwater. This is a recipe for lower prices for years to come.

Blah blah blah….. Name a time in history that US housing didnt appreciate for 30 years! Thats what everyone is predicting… We are already at 10 years of no housing appreciation… The govt is gonna keep changing the rules in favor of debtors… Because 90% of Americans are in some form of debt. Pandoring to the 10% that are debt free renters isnt going to garner them any votes. Is it fair!? Hell no… But who said life is fair! Learn to game the system and you will come out ahead!

Kevin

Do you ubderstand that 90% of america doesn’t have the ability to consume. Hence the reason corporations are not hiring and hoarding capital. The know very tough times lie ahead and that we are now living in a time of who can outlast the other guy. The government can do all they want withregard to modify mortgages but short of give every citizen 100k to pump up consumption each day more and more people will be unable to pay their mortgage regardless of how much modification the feds implement

Really Kevin? 90% don’t have the ability to consume? Have you been to Starbucks lately or Olive Garden or on the highway with thousands of other cars – all buying gas at $4 a gallon. The author of “Guerrilla Tactics in the Job Market” wrote that when employment is at 10% then 90% of the people have jobs. So your essentially saying only 10% of people are able to consume. Your making that up plane and simple. Please understand that I am not saying these are not hard times just that your comment is out of your hat.

@ Kevin, I agree that high-FICO renters with good incomes and cash reserves is not a major constituency at either the local, state or national levels of government (or the Fed). We won’t get special treatment in terms of programs or policy.

Now, you seem to be implying that programs and policies will be put in place to raise housing prices. However, the Dr. has been hammering on the notion of jobs = housing market. Without growing #’s of jobs with corresponding growth in wages, housing prices MUST continue to come down. The gvmt programs can only forestall the inevitable.

You’re not really suggesting “gaming the system” = buying into RE now?

More like going on 4 years, and post a 10 year tripling of prices in some areas.

Are you one of those deadbeats squatting in your 750K house who hasn’t made a payment in 2 years who is justifying “gaming the system”? I hold the esteem of those people one step above blood sucking leaches otherwise known as bank executives.

Kevin claims to have just bought a house about 4 months ago, and is going through the buyers’ remorse period which is so common at about this time. It’s starting to dawn on him that he made a mistake, and is grasping at anything right now, except the reality of what’s going on around us.

So do cut him a little slack, please. Except when it comes to the actual facts.

It’s almost 2012… Prices are back to 2002 prices in most major cities..and even lower in some areas. That’s effectively a decade of NO housing appreciation… The tripling of housing between 2000-2006 is OVER… done with.

Let’s say housing should appreciate 1% a year… so we should be approaching 10% above 2002 prices… If we had just NORMAL appreciation since 2002. If we go back to 1996.. when most believe housing was affordable… Housing should have appreciated in the most bearish amount.. 15% appreciation minimum from 1996 prices. Then when you take into account that mortgage rates were closer to 9% back then…

We are already FAST approaching more than a 15 years of paying the same monthly nut to carry a mortgage. We are already at the same home prices as a decade ago… When borrowing money is this cheap… It downside risk of being in debt is minimal if you are confident you can keep your job.

Housing shot the moon until 2007 in many a hood. 4 years down in these parts – longer in ohters.

Hmm. I take it that you’re not familiar with Shiller’s work. How about from 1907 to 1942?

http://www.ritholtz.com/blog/2008/12/classic-case-shiller-hosuing-price-chart-updated/

Or alternatively, from 1907 to about 2015 at the current rate?

Regarding debtor bailouts, there are a number of problems with that. First, the U.S. is broke. Second, I don’t think you realize that about 1/3 of the homeowners out there have no mortgage at all. With the home ownership rate at about 66%, that puts the debtors at a distinct disadvantage, even if we had the money.

And of course it ignores the simple fact that the financial industry doesn’t want you out of debt. That’s the whole name of the game.

Kevin, “Name a time in history that US housing didnt appreciate for 30 years!” You know the old disclaimer…past performance is no indication of future results.

During the bubble, one of the famous matras from the RE industry was that the median American home price went up every year since the Great Depression. Based on that, how could home prices ever go down? We not only saw them go down, but go down in a huge ball of flaming wreckage.

While it is obvious the government is doing everything they can to keep prices elevated, it’s not working. They are only delaying the inevitable and dragging this mess out much longer than required, which actually might be more harmful in the end.

Name a time in history when housing prices tripled within a few years! I’m not saying it’s going to last 30 years (and BTW, we’re nowhere near 2001 prices in the Bay Area, so the “no appreciation in the last 10 years” thing is clearly not statewide if at all), but a lack of historical precedent on the predicted downside corresponds to a clear lack of precedent on the way up.

No where near 2001 prices in the SF Bay Area? Source please; I call BS. Perhaps in some of the high end areas, but not the Bay Area as a whole. I’ve seen houses at the 2000 level, and before.

According to last months’ Case-Shiller data, the HPI was 132.0. In January 01, it was 131.2. Yes, we have had zero appreciation in the SF Bay Area over the last ten years.

Please get your facts straight.

My conscience won’t let me game the system–

10 years of no appreciation?

Everyone exaggerates but you must be a Tea Bagger with an exaggeration that is so outlandish that it is an actual lie!

At the most, we have had 6 years and in most bubble markets, 4 to 5 years of no appreciation to downward pricing.

I just moved from the house that I was renting in a northern suburb of Los Angeles to a different rental house, because the landlord raised the rent from $1850 to $1900. The house was then rented to a new tenent for $2050.

I couldn’t understand how rents could be going up while unemployment was at such historic highs.

I have also been looking to buy a house. The realitor that we were using, told us that rents had gone up because the people getting foreclosed on were flush with cash after going 1 to 2 years with out making any house payments.

That explaines the increasing rent prices.

Unfortunatly those same people who screwed us by overpaying during the bubble years are now screwing us in a new way by raising the rental rates.

I am not too bitter about it though, those same fools are screwing themselves in yet a new way by paying $2400 a year more for the same thing that I had.

Thank you for the explanation of rent increases, however I do find it interesting that the landlord is more interested in chasing after deadbeats for tenants than holding onto a good tenant who obviously can manage his/her finances and pay rent reliably.

This is what I have experienced: Boomer landlords raise rents without thought while WW2 generation landlords put a premium on having good tenants who would rent and care for the property without raising the rent.

~Misstrial

Anecdotal story, I rented from a guy in Philly many years ago. He owned a brownstone in which he lived and another that was subdivided into apartments which he rented. Gorgeous old buildings with old marble foyers, antique elevator, huge antique mirrors. Really a nice place for a rental. Anyway he bought it after WWII and owned it outright for decades. He was probably 20-25% under market at least and knew it as he would laugh at what people paid for properties and what they needed to get in rent just to break even. Most of his tenants were 10+ years and some had over 20 years in his building.

When he/I met, he knew he could rent it to anyone and he made a point that he never rented to students and wanted stable good people because he didn’t want to deal with 1) damage and 2) turnover.

I eventually moved on, he passed away later and his wife sold the building in 2005-6 I think, pretty much the peak. Really nice people and a pleasure to have known – and you are absolutely right, he made his profits over time by minimizing upkeep and turnover by carefully selecting tenants and being a good landlord as opposed to the nickle/dime high velocity turnover business. Good landlords value good renters and good renters value good landlords – both are worth a premium. I think in the whole housing boom/everyone needs to own drama, people forgot that relationship and that it is acceptable to rent and a economic decision rather than a binary sign of life failure.

This Boomer landlord doesn’t do that. I was raised by a WWII gen. dad and landlord. Please don’t lump us all together in a sweeping generalization!

Rhiannon:

Although you are a notable exception to your generation, unfortunately the vast majority of Boomers are the opposite.

Thus I don’t see the generalizations regarding Boomers going away anytime soon.

Please continue to distinguish yourself as an exception.

~Misstrial

Don’t they have to pay the money back? I guess I am very naive.

Not too many folks (outside govt/Wall St) have figured out a way yet, Kevin, given that they’re paying banks to hold their money for them.

Maybe they, like us, don’t regard governments as all-powerful actors at the controls with an unlimited bag of tricks to bring to bear.

Americans Express Historic Negativity Toward US Govt:

Key Findings:

82% of Americans disapprove of the way Congress is handling its job.

69% say they have little or no confidence in the legislative branch of government, an all-time high and up from 63% in 2010.

57% have little or no confidence in the federal government to solve domestic problems, exceeding the previous high of 53% recorded in 2010 and well exceeding the 43% who have little or no confidence in the government to solve international problems.

53% have little or no confidence in the men and women who seek or hold elected office.

Americans believe, on average, that the federal government wastes 51 cents of every tax dollar, similar to a year ago, but up significantly from 46 cents a decade ago and from an average 43 cents three decades ago.

49% of Americans believe the federal government has become so large and powerful that it poses an immediate threat to the rights and freedoms of ordinary citizens. In 2003, less than a third (30%) believed this.

Whoa, something is awakening the sheeple on their pastures of ignorant bliss…

The statistics say we are getting closer every poll they take to revolution (just take a look at those graphs!!!).

The .gov has lost its legitimacy now for all intents and purposes (even though the sheeple voted for the .GOV Ivy League Mob at every election).

The question is will it be peaceful, or violent (and what/how many .gov(s) will emerge?).

Ill leave that for your imagination…

Good luck The Moonbeam State, you’re gonna need it! 😉

Oops! Forgot the link:

http://www.gallup.com/poll/149678/Americans-Express-Historic-Negativity-Toward-Government.aspx

California is very far from armed insurrection. Mostly revolutions happen due to heavy handed government taking away stuff citizens took for granted. California, while potentially heavy handed with business owners is quite soft on it’s citizens. The anger just isn’t there. Business owners never start armed insurrection, because as owners of production capital they have the most to lose in a period of chaos.

I expect armed insurrection in Texas or Alaska or Puerto Rico long before we see it in New York or California.

I’m starting to hear many stories of multiple people living in homes meant for far less people.

There is competition in my back alley for recycled trash digging. These people don’t look homeless. I think they’re cousins and brothers of my neighbors.

As always this is an excellent and thoughtful analysis but maybe I can add some longer timelines for context and some additional thought.

If you are going to look at historic mortgage rates, you should really look at a period other than the last 40 years. That period started with monstrously high rates and took them to today’s very low levels. That in turn increased affordability of financing and led to the largest real estate rally in history (commercial and resi) as pricing moved with that leverage rather than GDP and Incomes to the current peak pricing juiced by rates and irrational speculation we had in 2007.

Take a look at 20-30 year US bond rates back into the 1800s and you’ll find an interesting story. Rates on those bonds rarely exceeded 4% at extreme peaks outside of the 1970s and forward anomaly period (this is just for context, the world changes, we are no longer on gold backed currency but this is useful for a long-term analysis). You can price a mortgage spread off these bonds to back into rates similar to today where we don’t have longer mortgage data.

The other aside is that we are battling financial crisis and deflation for the first time since the 1930s and given budgets we are fighting high debt/GDP for the first time since the 1940s. We have a housing decline in line with and even exceeding great depression measures so it makes good sense to look at this period. Where were rates at this point? Honestly, post 1940/WWII this was an era of prosperity but VERY low rates for a VERY long time (decades). This was the era of Eisenhower mortgages in the 3-4% range – ask a 60 year old what his father’s mortgage rate was and you’ll hear this. Once again, not predicting the future and lots of things are different but useful to consider parallels (and differences, mtgs were standard 20 year for most of this period).

Today we have much higher number of people on the dole. 47M on foodstamps (EBT), 2M in prison, welfare, section8 etc. About 50% of voting population is somehow tied to govt handouts, while the other half pays for it. This is the breaking point. Not enough folks producing to pay for those collecting. Equatre it to a bussiness> your overhead is too high to make a profit< You hear both sides of elected asswipes tout "JOB's" but the reality is working folks vote alongside those collecting handouts. Each side picks the opposing group, and they divy up the votes 50 / 50. so we get stuck with the same scam, year after year. This was NOT the case in prio generation. How do we fix that??

slim-During the 1950’s and 60’s, lenders could safely loan out money for house purchases at 4%, because there was a good possibility that the borrower would repay the loan AND the dollar loan payments would have the same purchasing power at the time of repayment.

Today, that is not the case. Unlike prior to 1971, when President Nixon cut the last remaining tie between the dollar and gold, and they can now create unlimited quantities of dollars, and of course they are doing so.

When the economy eventually turns around, and starts growing again, there is no way that the Federal Reserve Bank will be able to unwind their balance sheet and avoid hyper inflation. Their latest plan is to buy 10-year US treasury bonds that pay 2% interest!!! How will they ever unload those without a substantial loss of value?

Actually, it is probably a moot point, since little or none of this financial house of cards is real anyway. They are just moving around massive sums of electronic, make believe money. They really are at a complete loss as to what to do next and are just grasping at straws.

W-2 wage earners are slaves

I “check” that box! Oh well – not everyone can own their own business successfully. At least I will be in line for what paltry scraps are tossed my way in the form of social security benefits in 30 years after paying into the system steadily and heavily all this time. At least, one can hope.

Go away “Joe”

Please explain. What’s your point?

It is pathetic to see that the Fed is clearly out of options by targeting already record low interest rates in a last-ditch effort to stop housing prices from finding their natural price. Lets think this through…

Housing has shown no appreciation in many states for the last decade.

Income has been stagnant for the last decade.

Inflation has eaten up savings and caused commodity prices to surge.

And the Fed thinks that reducing an interest payment by 1% point will make the consumer more likely to decide that now is the time to take a six-figure gamble on the housing market!? Get real…

http://www.thecashflowisking.com

Speaking of Jobs, California is number one on the jobs lost to China.

. California

> Net job change: -454,600

> Jobs lost: 519,000

> Jobs gained: 64,300

California has lost almost half a million jobs to China, according to EPI. Like Texas, many of these were lost in the computer and electronic parts industry. Additionally, eight of the nation’s 20 hardest hit districts are in the state.

Congress and the Administration are not doing much about this situation. Vote them all out of office.

No doubt we are: TED: Niall Ferguson

This is a long video, so watch it when you’ve got time. It’s a long run to the conclusion, but our technical advantage has one big disadvantage… it’s easily taken.

I sent Zimbabwe Ben a letter about this:

http://www.wcvarones.com/2011/08/benny-and-me.html

I spoke to my realtor today, asking how people are buying the 1.2 and 1.3 million dollar houses in my neighborhood in LA? he said almost always its 25% down followed by a 7 year interest only jumbo loan. As my neighborhood is wealthy, but its not CEO wealthy, its working professional wealthy.

so, it shows you how people are still stretching to get into the house in LA.

I have been looking for investment properties in good neighborhoods of LA, and there are none, you will literally just be pissing your money away. Better off buying the vanguard REIT at this point.

Wow, so this means we’ll continue to have RE problems for years to come. I can’t fathom why people are so crazy to overextend to buy a home.

jason:

Cash rich, status-conscious fools … they are going to get wiped out.

Conditions are extremely competitive at the top ranks of business. Salaries are for the young go-getters. There are thousands of Middle Eastern and Central/East Asian PhD’s who will crunch numbers and do meta analysis for a lot less. These idiots are gambling that if their gravy train dries up in a few years they can just unload the McMansion on somebody else. Ain’t gonna work.

Does anyone have any thoughts on how long the Fed can keep interest rates artificially low? It seems that we have been on this train for many years (2001 – 2011). I would think that people with money would eventually put upward pressure on cost of money. I am sure I am missing something but my econ 101 is failing me at this point…

This ain’t Econ 101 anymore. The Fed and Treasury are using derivatives. Because their economic understanding hasn’t worked, they’ve had to come up with something new. And that is leverage to the max via derivatives. Unfortunately, that has proven, time and again, that it doesn’t work either. But it can buy some time.

There was an article I mentioned recently which pointed out that they are using about $300 Trillion in interest rate derivatives to keep interest rates low. That will work, until it doesn’t, just like how that derivative house-of-cards brought down the shadow banking system back in 2008.

So that’s the secret to how the Fed is so confident that they can keep interest rates low. Add to that a general panic elsewhere leading people to buying up short term Treasuries, and you’ll understand why the Fed is abandoning the short term rates for the longer terms.

If you’ve been paying attention to the news, you’ll have seen Tim Geithner proposing the same thing for Europe last week. The Finance Ministers there ran him out of town on a rail. Then, as the meltdown approached, they paniced, and are doing exactly that right now.

The bankers will tell you that it all nets out to zero, so there’s no risk. Unfortunately, that assumes everyone pays up when they should. In a meltdown, some can’t, and the whole thing starts to collapse. The proof was with how Behr-Sterns failed back in 2008.

Unfortunately, the mainstream economists never, ever pay any attention to actual reality, no badly how far off they are. So they really haven’t got a clue as to what’s going on, or what the impact will be.

As to how long it can go on, no one knows. It could come crashing down tomorrow, or they could kick the can a little longer. My guess is a little over a year, but that’s just a guess.

The key point is that this crisis keeps blowing up in a bigger fashion. 3 years ago, it was the financial systems. Now it’s Sovereign debt. There’s nothing bigger than that, and once that goes, then things will take a serious hit.

I strongly suggest that you use the time wisely. And especially stay out of debt.

Thanks for that Questor. I have a couple of questions. I believe a derivative is no more than a bet on an event that will happen in the future. If this is true, than who is on the other side of this bet with the Fed? The second is how is this bad for a debtor? I would think that only lenders will be hurt by this when interest rates adjust back to the true cost of money (interest rate risk). Am I missing something?

I wonder what would happen if interest rates rose slightly. From the nominal .25% to .5%? This would be higher than most other developed economies’ interest rate and would therefore push down commodity costs in the US. Gas and food would become become more affordable for people, and we might see an increase in consumer spending because of it. Couple this with some good policy, better retraining programs for the jobless, and we could have a recovery. Even better if we accepted reality and said that the new normal will look different than the old, we’d recover even faster – people would have low-paid jobs but cost of living would be in line with those jobs. Of course, life would get tough for some banks, but quick nationalization and spin-off of assets would take care of that. Except Republicans would scream socialism and Democrats are too timid to stand up to them.

@What?

I don’t know. I’m not sure if anyone does, since one of the problems is that this market still isn’t transparent. It could be AIG (as before), or some other Banks, or someone else. The lack of transparency here is part of the problem.

As far the debtor goes, it’s not clear who you mean. In derivatives or housing? In derivatives, it’s real bad. It usually means the institution is insolvent,

For housing, forget about it. There’s no way homeowners are going to get free houses. What will happen is that the mortgages will still be owed, but cash will be far more valuable. So those with mortgages will end up spending precious cash on a depreciating asset.

@LAer:

Yes, it would be better to accept reality. But that is not the stated goal of those in charge. It’s to keep the Banks propped up at literally all costs, regardless of the financial or moral costs to society.

In other words, the goal is explicitly not to create a better society. It’s to create a better Banking system, and the h*ll with the American society.

Since the federal reserve bank can just print money, it can keep interest rates as low as it wants as long as it wants. Interest rates can’t go negative obviously, because then people would be taking out arbitrarily large loans to collect the interest. At some point, so much money could be loaned into the economy that the supply of liquid spendable money is so large that it starts to have less value compared to other things and we experience inflation. However, there is nothing stopping the Fed from loaning money well past that point, as it has done in the past.

How does this all work? One educational perspective is offered by modern monetary theory (MMT), which you can read up on for the full story. (Note that while much of MMT is basic math based on some fairly self evident truths, MMT-ers get into more trouble when they start to use the insight so gained to make policy recommendations.) MMT starts with the fact that our money really is just paper. There is nothing about it that gives it intrinsic value, except that we say it has it. Gold is in some ways similar, in that it’s value is largely based on our perception of golds value, rather than it’s intrinsic value for industrial use. The difference is that while there is a relatively fixed amount of gold in the world, the Fed can print as much paper money as it wants. This is called a fiat currency.

So, given the value of the dollar is essentially arbitrary, and the government can print as little of it or as much of it as it wants, how much should it print? Basically the idea is that the supply of dead money sitting around in piggy banks and unspent in bank accounts is not terribly interesting. That money may still be unspent in 30 years. It may as well not exist. There is a smaller supply of liquid money that people intend to spend soon. The supply of liquid currency needs to be enough so that businesses can get cash when they need it to make payroll or build new factories, but no so much that it drives prices way up. So, government should print enough money to avoid a liquidity crunch.

If you will recall in 2008, we had a liquidity crunch because the holders of most of the liquid money available for lending decided that it was no longer safe to lend. Suddenly, some large otherwise healthy companies like GE and Ford couldn’t raise new capital to service old debts and it looked like a bunch of otherwise healthy companies would go bankrupt unnecessarily due to a cash shortage. The Fed steps in, drops interest rates to near zero, which makes it far less costly for banks to lend money. (Buffet also lent to GE and Ford got some gov’t loan guarantees.) Liquidity is returned to the market. People got paid and a true catastrophe was averted, mostly to the sound of crickets.

We are running into a couple of problems these days:

1) interest rates can’t go any lower, so the Fed is having to turn to ever more exotic methods to add money to the system, such as buying stocks (QE) and buying and selling bonds so as to drive certain bond yields even lower (the twist).

2) the impact of flooding ever more money into the system becomes less as you pump more and more in. It starts to become like “pushing on a string”

3) we have a long term problem right now with money becoming too intrinsically valuable. It is becoming an investment unto itself. People hold it for the opportunity value it represents. It is a hedge against uncertainty. It is a way to build wealth should deflation set in. It is a hedge against another liquidity crisis. So, people won’t spend it. If there was an immediate threat of inflation, people would understand that holding cash was going to cost them, but there doesn’t appear to be. As it is, the Fed pumps liquidity into the system and most of it just freezes.

The problem is that the Fed’s loose money policy is causing a lot of water (slush?) to build up behind the dam. When the trigger finally does come for people to start spending the stuff and the dam breaks, the fed is not going to be able to pull the money back out of the economy fast enough. So it appears that when the recovery does finally come, we are in for some serious inflation. Any timid money still on the sidelines will have to be spent to avoid devaluing rapidly due to inflation.

MMT-ers would tell you that the way to pull money out of the system is to tax it out. This is slow and unpopular. The Fed can also sell it’s QE and twist investments, but there are only so many of those, and unlike our fiat currency, it can’t print more.

Ford had actually already borrowed a lot of money prior to 2008 at substantial expense because they foresaw trouble. This kept them out of bankruptcy. The othe two of the big three went bankrupt that year. I was actually talking about the bilions in loan guarantees they got to build Eco-friendly vehicles that were part of the partisan wrangling this week.

Thanks for that Ian. I am however unclear why interest rates would not go up if we start to have significant inflation.

@ slim, I have a question about your thoughtful analysis. I am under the impression that the rates you are talking about were on mortgages that were a shorter duration and not really fixed rate. I believe I read somewhere that the average mortgage in the pre depreciation era was something like 10 years. I also thought that it was not fixed but every so many years the bank would require a borrower to refinance. They would call the loan and you would have to get a new loan or pay the outstanding amount. This moved the interest rate risk from the banks back to the borrower. I am not positive on this but this is what I remembered. Is this not the case?

Not sure if this will post as there’s another one up already but I’m honestly not sure exactly how mtg financing evolved from 1800s to present. You could probably get this info but it may not be as worthwhile as you think as I was basically quoting long-bond yields as opposed to mortgages outright. This enables you to take the current or historical spread and back into a modern mortgage at various levels throughout the period to see what it would have been (spreads stay fairly constant over time unless there is a direct impact event at a point in time…today and the absence of non-agency subprime or similar private loans against resi real estate). I think the issue is less the ‘type of debt’ than expectation of payment/rate earned. Honestly, I want 8% interest on a 20 year risk free loan and in the 70s-80s I could get it (hell money markets were high teens) – that doesn’t mean it wasn’t a historical anomaly though which is why I think its useful to consider rates over very long-term periods.

A few things that do factor into then vs. now housing: Mortgages were typically 20 years vs. the current 30 years. Houses were family possessions and were handed down generationally. People didn’t want big houses because of the enormous upkeep. A 3 bedroom 2 bath ranch house of today was enough to raise 5-6 kids in during the early through middle part of the last century. Honestly, look at the houses built in the 1940s-1960s – pretty tiny by modern “standards” or better said, expectations/entitlement.

Hey MO:

“credability” is actually spelled credibility. You’d have more if you knew how to use spell check.

Hey Gael

Very insightful comment. That’s for your contribution. Got any other brainbuster you wanna throw out there. I’d love to hear your thought on the current state of te market. I guarantee you are one of the millions who actually bought into the BS economy the american people have he sold. Wake up buddy we got much bigger things to talk about than a misplaced vowel or misspelled word.

Back around the last housing bust in the mid 90’s you could get a nice sized house in the Fairfax District/Miracle mile area- big enough to start a family- in the mid 400’s. Those houses reached 1mil + during the boom. Huge swaths of Metro LA is 500+ for a house, even a 2×1 starter/fixer in decent areas.

If you are 65 yo and up, you are going to retire and probably need to sell your house. At that age, your children are grown with their own children and have probably already purchased a house. If they bought a house around age 25-30 then they bought around the bust early boom of this last cycle. If you need that house for retirement money, you aren’t going to leave it to the grandkids. Are there enough buyers with 100k (+closing costs, +insurance, +property tax) and good jobs to sustain these prices? And most of these houses are old! You also need good amount of savings for repairs or job loss. I can only imagine how many people whose house value tripled or quadrupled took out equity to lead the wealthy life they thought they deserved. They must have thought they won the lottery. This is going to take a while to unfold.

Oh and Kevin, who cares if most major cities are at 2002 level pricing…I think most people here are talking about Los Angeles/OC.

From Trulia:

This Single-Family Home located at 1526 N Evergreen Street, Burbank CA sold for $550,000 on Sep 1, 2011. 1526 N Evergreen St has 2 beds, 1 bath, and approximately 896 square feet. The property was built in 1939. 1526 N Evergreen St previously sold for $550,000 on Sep 1, 2011 and $350,000 on Apr 29, 2011. The average listing price for similar homes for sale is $478,619 and the average sales price for similar recently sold homes is $550,167. 1526 N Evergreen St is in the 91505 ZIP code in Burbank, CA. The average price per square foot for homes for sale in 91505 is $340.

Does this recently sold ad make any sense??? This home went up 200K in 4 months and sold??? WTF, it wasn’t even worth 350K.

1526 N Evergreen St., Burbank

CC, do you know if that street is over the Bob Hope fly zone?

It looks flipped to me. From the pictures it appears to be a fairly decent flip. It’s got a decent size for the area (we’ve looked at about 5 homes on Chandler all under 1100sq ft). I’d say the flip trick is still working on buyers. $550 is steep though.

In our area (Granada Hills) the flip trick is working well. A home near us sold for 240k and was flipped and sold at 356k by a pro flipper (I spoke with two of the agents during the time when it was for sale). The upgrades to me looked to be less than 50k, but I’m not entirely sure. (400 sq feet of new hardwood floor. Tile kitchen. New kitchen cabinets. Tile countertop. No bathroom improvements. Interior wall Paint. Only trim exterior paint. Seed grass back, Sod front.)

10448 Densmore, Granada Hills

@CC: regarding how a home sold for 350k several months ago then resold for $550k, the answer is the house was a foreclosure sold at auction to an all cash investor. Lipstick is then put on this pig in the form of a $50-100k remodel then resold for $550k with the investor pocketing the difference. I’ve seen numerous “nice” looking homes for sale on redfin that fit this mold.

In Burbank, about half the listings expire because the offers are too little(the older folks don’t have to sell . With the other half that are sold, a substantial portion are distressed homes(which are junk that investors like). The sales volume is down substantially from the peak. People change jobs and etc. so homes do sell. Burbank has a great variety of home designs . The homes are not like the typical housing tract cookie cutter homes. Homes built in the late 20’s have real lath and plaster and hardwood floors. The construction is different than these Chinese plaster board built track homes. Many of the Burbank homes are framed with old growth Redwood. They will never build them like this again. For you folks that just want basic housing, try Van Nuys or Canyon Country(and enjoy the commute).

Thanks guys. I hope the buyer has earmuffs, and good air filters this place is right under the runway! Crazy, a half million???

Don’t know if anyone else caught the article two days ago at Yahoo! news titled “How to become a millionaire”…but it was an amusing journey…..seems all one has to do these days to become a millionaire is start saving very early in life…and park it in accounts earning 5% interest.

Really, it is that simple! Of course, there was no reference to specifically where one might find accounts paying 5% interest…but the article did say there will be a “huge increase” of ten million more millionaires by 2030!

Of course, left unsaid is that in a population of maybe 400 million…that works out to @ 2.5% of the total population….and who wants to wager many of those inherit it from their millionaire parents…who make up…wait for it….@ 3% of the total population now….

Real Estate investments? Not a peep. Stocks? Well.. they did try to run that one by the readers…but left unsaid, as usual, was the sad fact the NYSE is @ 20% under the 1999 bubble highmark….and also unmentioned was the huge insider sales happening right now. Seems corporations are sitting on trillions in cash…and unwilling to invest it in what they see as a fading consumer market…burdened with debt and fading assets…much better they just divvy it up between themselves in well-earned bonuses…and park it off-shore…..

This is what happens when we all listened raptly at Greenspanish drivel…and applauded it like it was Gospel. Standing ovations in Congress this conman received.

Those listening carefully, however…pointed out in 2003 that Sir Alan Greenspan stated matter-of-factly that the day would come, soon, when the Fed would “monetize the debt” as a solution. Right on national Sunday television, “Meet The Press.” No one was listening it appears…..well, most weren’t.

Some pointed out in 2001 that the lowering of interest rates, 8 times in 2001, would lead to hyperinflation….this of course, after Greenspan raised interest rates 8 times in 2000 to attempt to thwart the election of the candidate representing a balanced budget and a $150 billion surplus. That strategy failed…and the USSC had to step in and appoint the Chosen Bandit/Criminal…in decision so horrid none of them there “Justices” would sign it. But did state it would not set “precedent” you see…you do see, yes?

It was the opening salvo of the blatant Class Warfare being waged against average Americans…quite successfully, and with many willing victims it appears. The not-so-blatant beginning was when Reagan ran up more debt than all presidents before him…while quadrupling the payroll taxes average Americans were forced to pay…while those making over $80,000 had a cap on how much they paid…and still do.

In other words…this “failure” is exactly what they had planned: to debase our currency, place us in unpayable debt, and making our assets and their sovereign debt to foreign nations debt worth far less.

Happy? Sad? Or Mad?

Here’s hoping you weren’t planning on selling your home and retiring in modest comfort anytime soon: you need to quit being so “selfish” and “lazy” after contributing to FICA for 45-50 years, and get ready to fade away greeting shoppers at a SuperWalmart near you, got it?

By the way…I am being hacked as I write this….just thought you might want to know.

Very nice post. All the things I’ve been reading about the last few years seem to be tying together. It will not be a nice wake-up call for most. I’m adapting my lifestyle as it goes on. No cable TV, no cell phone, no land phone line. Minimimalist lifestyle.

It’s feeeing because when you don’t have alot of things, those FEARS of losing those “things” goes away. In addition, the extra money you can save under your mattress or in your home safe where banksters cannot steal it.

Even with all the crap going down, I’ll stick to my plan to retire at 50/55…and I will. Sure I won’t have insurance, but I’ll get covered anyhow. Sure I won’t have a job, but I’ll get public assistance anyhow. Face it, when you retire whether you are making $1,000,000 a year or $25,000, there are still only 24 hours left in a day. Even rich people cannot buy more than 24 hours, so it all equals out.

Underwater approx. 125% of home value. Bought in 2005 with 10% down and have been paying with due diligence so far. Loan NOT guaranteed by Fannie Mae or Freddie Mac. Is there hope to refi? My current rate is 6%.

Are there any meaningful option other than walking away?

Thx

I don’t know about everybody else, but that $264 a month for me, has been going towards gasoline.

Leave a Reply to mo