Leveraging the Future for a Short-Term Fix. FHA and GSE New Subprime Loan Breeding Ground: The Resurrection of Bad Ideas. Mortgage Markets Recreating Lax Lending Environment with Same Employees from the Previous Boom.

The good old days of the Pay Option ARMs and stated income shenanigans may be fading into the garbage heap of historically bad financial ideas but like many voids that are left open, it has been filled with additional junk ideas. We should remember that during the boom, much of the bubble was fueled by ridiculously easy lending, adjustable rate mortgages, and underwriting so weak Bernie Madoff would look like a modern day financial saint. And many of the grunts who lived in the trenches where feeding at the glorious bubble feast which many of us are now collectively paying for. This casino economic model which probably belongs on the Vegas strip (no offense to Las Vegas), has cost the careers of millions, brought on by an irresponsible banking and real estate sector, a corrupt Wall Street, and a government willing to look the other way.

This economic crisis has been building over 3 decades with the last ten years being the apex of crony capitalism.   You would think that we would learn our lessons and are still rubbing the fresh blue and purple bruises from this given we are still in the path of the economic hurricane. Nope. Instead, we go for the low hanging fruit and pick off the country scapegoat, the American automakers to feed the masses some red meat. What about Ken Lewis of Bank of America or Vikram Pandit of Citigroup? The amount of money they have received from the government would make the loans to the automakers look like a bill from a night out by the firm at a local Manhattan bar.

The double standard is alive and well. Who is going to argue about ousting the CEO of GM? That was an easy call and most would concur with the move. And enough with this “…but the government is getting involved and that is scary!” Yeah, that is what happens when you come begging for government money. You don’t want to be told what to do? Easy. Don’t ask or touch any government (aka taxpayer) funds. My only suggestion is this political capital and energy should be directed at the main culprits of this economic and global calamity, Wall Street and the banking system. Simon Johnson, a former chief economist of the International Monetary Fund gives us a taste of how sausage is made and it confirms much of our beliefs in The Quiet Coup published in The Atlantic. It is a lengthy read but well worth your time.

So back to our topic of the new toxic loan breeding ground. What got us into this mess is an entire system designed to be corrupt and full of short sighted workers only looking out for their own good while putting the majority of the population at risk. Leveraging the future for a short term fix. Finance, at least in an ideal sense should be nothing more than a tool to keep the real economy growing and expanding at a sustainable level. A method of allocating resources to the best uses. In the system that is crashing finance was seen as part of the “real” economy and became much too big where now, the real economy is imploding. Someone once told me, “there are a few rotten apples in the barrel.” I responded, “not only are most of the apples rotten, the barrel itself is being gnawed away by termites.” Most people now see this is the case with the edifice of our financial system crashing and burning in a horrific spectacle. After the subprime and alternative mortgage world imploded, the government has now stepped in to be the uber player in the mortgage markets making up for much of the lost volume from the questionable mortgage sector. The funny thing is many of those toxic mortgage dealers went ahead and got trained in FHA and government loans and now work pumping out government toxic waste:

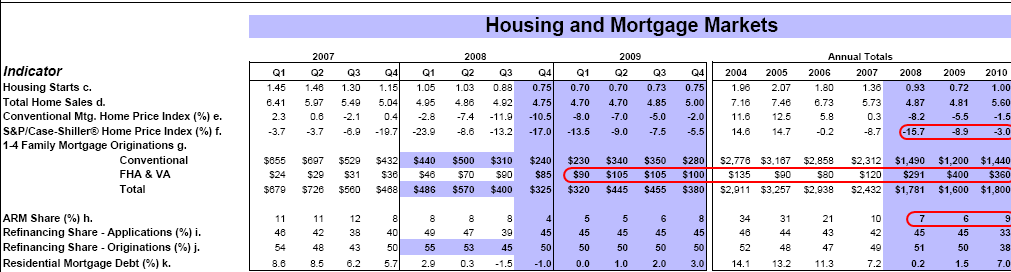

The demand for FHA loan processors has skyrocketed. At least we know someone in the sausage factory is hiring! The reason is that many FHA loans require only 3 to 5 percent down. As I have discussed in a previous article regarding Seller Funded Down payment Assistance Programs, this has taken the place of many of those no money down loans. So yes, maybe adjustable rate mortgages are out and no-doc loans are out but knowing that those with no skin in the game default at higher rates, why in the world would we continue pushing programs like this? The private sector did an abysmal job for a decade with these loans. Why are we now going to take this and apply this to government backed loans? It simply does not make sense. And right on time FHA insured loans are skyrocketing:

“(WSJ) Defaults on home mortgages insured by the Federal Housing Administration in February increased from a year earlier.

A spokesman for the FHA said 7.5% of FHA loans were “seriously delinquent” at the end of February, up from 6.2% a year earlier. Seriously delinquent includes loans that are 90 days or more overdue, in the foreclosure process or in bankruptcy.

Since the collapse of the subprime mortgage market in 2007, most home loans for people who can’t afford a sizable down payment are flowing to the FHA. The agency, which is part of the U.S. Department of Housing and Urban Development, insures mortgage lenders against the risk of defaults on home mortgages that meet its standards. FHA-insured loans are available on loans with down payments as small as 3.5% of the home’s value.

The FHA’s share of the U.S. mortgage market soared to nearly a third of loans originated in last year’s fourth quarter from about 2% in 2006 as a whole, according to Inside Mortgage Finance, a trade publication. That is increasing the risk to taxpayers if the FHA’s reserves prove inadequate to cover default losses.”

This would be funny if it weren’t real. I remember a few months ago when I berated these loans a few comments popped up saying, “well government loans have historically low default rates!” Of course. You should parse that statement with “the government HAD low default rates…” sort of like “housing prices NEVER go down.” Well they didn’t in large moves until this crisis. The rules are now different. Don’t take my word for this. Let us look at the hard facts:

*Click for sharper image

In 2004, FHA and VA insured loans only made up 4.6 percent of the entire mortgage origination market of $2.9 trillion. In 2008? FHA and VA insured loans now make up 16 percent! In 2009 it is expected to make up 25 percent! 1 out of every 4 loans in 2009 will be insured by the FHA or VA. And we are thinking that 3 percent down is sufficient? Didn’t this housing bubble teach us something? The problem once again is this notion that you can somehow go around those boring conventional standards like a 20 percent down payment, modest debt to income ratios, and 30 year fixed mortgages. You can’t! Why? Because we have a bunch of unethical people running the system looking out for number one and would reinflate this bubble again if they had the chance. And guess what? Many are getting this chance. $291 billion in FHA and VA insured loans last year. Default rate now soaring. Didn’t see that coming right?

And if you think the mentality from the industry is any different take a look at the idea of one VP at Union Bank interviewed on 3/30/2009 by the OC Register:

“Q. How does one qualify for the special program?

A. Cole said to be eligible borrowers must have household income that equals up to 80 percent of the median income for their area – that would be in the range of $57,000 to $67,000 for Orange County. Those earning more could also qualify if the property they are buying is in a Census tract with 80 percent median income compared to the county. Also, borrowers must not have a serious delinquency in the past 24 months.

He also said lenders usually only want 38 percent of the borrower’s income going to household payments, including the mortgage, taxes and insurance. But Union Bank will go as high as 42 or 43 percent.

Q. Your company says the lower-income program isn’t a subprime program. What’s the difference?

A. “There are two major differences. First of all, subprime lending by its very nature means people who have established bad credit.”

Cole said subprime borrowers haven’t paid their bills on time nor have a high level of debt to their income, or both. He also said subprime loans have large payment jumps, hefty fees and higher interest rates. None of those factors are true of Union Bank’s loans to lower income borrowers, he said.

Q. With subprime gone have you seen an increase in demand?

A. “We have seen demand increase. I think the biggest increase in the marketplace in general is in FHA and VHA loans. But, yes, we have seen a surge in new applications.”

Q. How about stated income? Do you ever allow borrowers to just say what they earn?

A. “Not currently.”

I love that last statement. “Not currently.” And this is someone who is supposedly arguing that they are careful in their lending practices. It is amazing to me, that many on Wall Street now assume that without those pesky Pay Option ARMs and Alt-A loans that somehow, any 30 year loan is now okay. With the California unemployment rate at 10.5% and growing even a fixed rate is too much for someone without a job. Push their PITI to 43 percent of their income and you are asking for trouble. And that is what we are getting with these higher default rates. Freaking amazing.

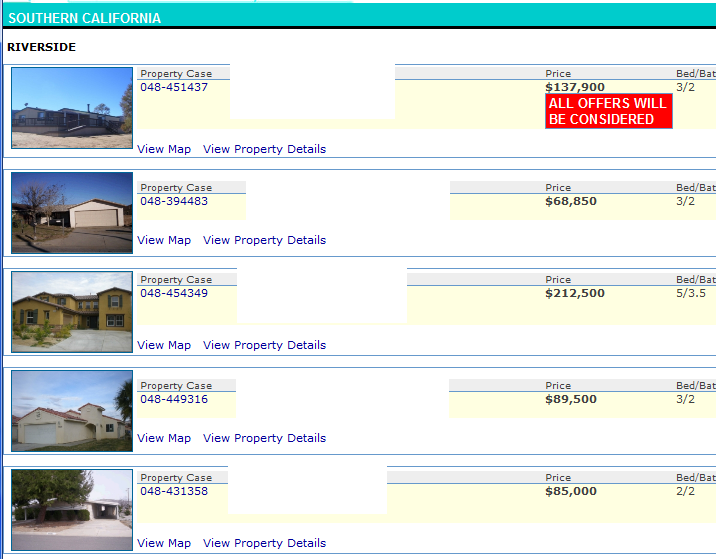

HUD, which is now picking up a growing number of foreclosed FHA and VA insured backed properties is realizing that they are now part of the toxic asset world. Take a look at some of the HUD owned properties in the Inland Empire here in Southern California:

So this is their idea of making the market healthier? Giving loans to people that will default in a few months or a couple of years? Renting is freaking okay! Home ownership isn’t a damn right! What the government needs to focus on if it is intent on pumping trillions into making the economy better is job creation! You know how many jobs you can create with $1 trillion? The infuriating premise goes back to Bear Stearns in the spring of 2008 where we started hearing that glorious mantra, “…we would have systemic failure.” Then we had Fannie Mae and Freddie Mac, Lehman Brothers, AIG, and all the other poor souls that were too big to fail. And here is the main joke of it all. If these “too big” to fail institutions simply made too big of bets, then what do you think happens when the government suddenly backs these up? What we are doing is now putting the risk of our entire country for these companies. There is no assurance the government will be able to back up these loans without decimating our currency with mega-deficits running as far as the eye can see. Just look at the FHA and VA insured loans that are making up a bigger and bigger portion of the mortgage market. Many of the former subprime and toxic lenders now work pumping these loans out. Do you suddenly think they became ethical over night?

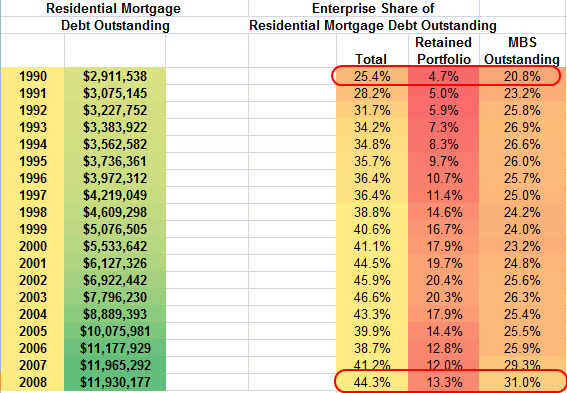

The reason it is so important to be vigilant regarding the mortgage market is its sheer size:

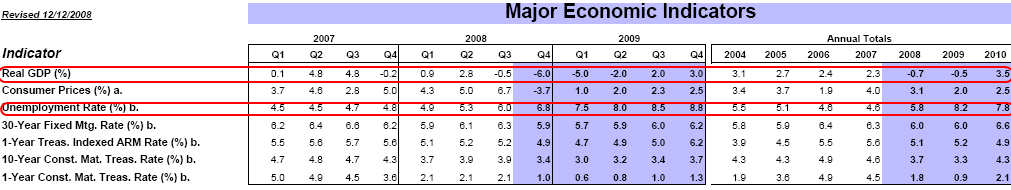

The government is increasingly becoming the only game in town. Unlike some of the PPIP participants that’ll be able unload toxic waste to taxpayers, these government backed loans are already ours since Fannie Mae and Freddie Mac for all purposes are nationalized. What happens when these properties default as we are seeing? And the problem is these agencies are projecting Pollyanna scenarios:

Wrong on GDP and already wrong on unemployment. Those are two gigantic economic indicators and here we are 3 months after this forecast was made and they are off base. And this is the kind of data they are using to project loss ratios for FHA and VA insured loans. These are the new subprime loans. It is no surprise default rates are soaring. You bring in the crew from the previous mortgage disaster, repackage it, and then you assume things will be better just because you aren’t using horrific Pay Option ARMs or other absurd bubble mania products? Glad to know we have learned our lesson well from the biggest economic mess since the Great Depression!

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

11 Responses to “Leveraging the Future for a Short-Term Fix. FHA and GSE New Subprime Loan Breeding Ground: The Resurrection of Bad Ideas. Mortgage Markets Recreating Lax Lending Environment with Same Employees from the Previous Boom.”

Hi DHB, great post.

I agree with what you say about the government offering up punishment to the auto industry, but they do deserve it. Taxing big bonuses is more red meat too. I am fearful of the power these people have to change the law on a whim.

FHA is a good idea when it was started; to help first-time homebuyers. Regulations were strict but fair to both parties and the maximum mortgage amount was quite low. Our legislators have turned what started out to be a helping hand into a feeding frenzy for their banker buddies. And we, thru complacency, allowed them to do it.

Keep up the good work

Great Post, can you be our President?

It is a shame that the people who take out these loans, do so. They are just as much to blame as the government. They know what they can afford, stop adding to the problem. I wish I knew when owning became a right.

The FHA is out there doing everything they can to keep this bubble up. The question is how long can .gov continue doing this until the system can’t take it anymore.

It all has to end sometime.

And another thing…. apparently a lot of loan modifications made by Bank of America are in difficulty several months after the modification. Again, there is no requirement to thoroughly VERIFY the process. This comes from a source doing these loan modifications!!!!

What a mess!!!

WOW! I don’t know where to start.. 1- I will admit I do not have to solution for us regarding the mess we are in. Every corner we come to it seems we are digging ourselves deeper. 2- Govt. getting involved in business at all is a bad idea, simply based on the fact our country was founded on other principles preventing that. With them getting involved in everything is just asking for more problems.. Now that is totally different discussion and I am well aware of that. 3- FHA is the only program out there. I do Real Estate in Salt Lake City, UTAH. And 99% of all of my clients are getting FHA loans. Strictly out of necessity, because they are the only real programs available right now, nobody else is lending money. Is that bad? I can see how this might be leading down another dark road . But what is the alternative. I am all ears on a different route, if there is one?

>But what is the alternative. I am all ears on a different route, if there is one?

Do what Americans did 100 years ago. A family of 5 lives in a 10 x 10 foot cabin with no indoor plumbing or electricity. A home of this size can be put up rather quickly when you have your extended family helping you.

We.Don’t.Deserve.McMansions.

There IS a middle ground between a McMansion most people never did have any business buying, and 10X10 cabin with no electric for a family of five.

It’s called a Rental Apartment, and they come in a huge variety of styles, ages, level of amenity, and neighborhood. You can get a place in a suburban complex with a pool, nice and new with all the gizmos, or you can live in a stately vintage building in the city with oodles of character. You can try out “marginal” neighborhoods to find out how they really are to live in before you commit hundreds of thousands of dollars. You don’t have to worry about maintenance, taxes, hiring contractors. I don’t even have to worry about my heat- that’s included, and when it’s cold I just call and tell them to “get some heat in here”.

It’s cheap, it’s beautiful, it’s comfortable, and, yes, it has heat, electricity, and plumbing as required by city codes.

City Codes? Where we’re going, we don’t need any City Codes.

FHA will be the last refuge of scoundrels for the entire process. Fannie and Freddie are adopting a code of conduct for appraisers while FHA is going to still allow the mortgage brokers and loan officers to shop for value amongst the dishonest and unethical real estate appraiser’s who are still the lap dogs of these hucksters. Sickening.

Well, according to the media today, including meaning CNBC, they have pretty much decided that after today’s rally, the worst is behind us. They then point to the psychology of the market, and how that psychology has supposedly shifted.

The bottom is in – so they say – today.

And then I laugh, as I think of the recent posts from Dr. HB. I

t’s a painful laugh, for all the while I realize that people still don’t have the incomes to support the slightly-less-expensive homes they are buying.

And unemployment is going down anytime soon.

End of story.

Still in denial, and still hoping to re-inflate the bubble so things can go back to the good old days, the media is just tired of the old recession bit. They need a new storyline, and ‘THe Bottom is In’, seems fresh and appealing right about now.. Poor fools.

buzzardology only creates more buzzards!

Leave a Reply