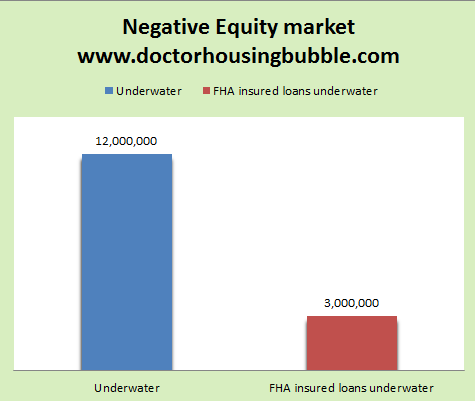

Will the FHA require a bailout? – 12,000,000 underwater mortgages 3,000,000 are FHA insured loans. 1 million underwater mortgages originated in last two years.

FHA insured loans have been a big booster for the current market. Historically FHA insured loans made up roughly 8 to 12 percent of all mortgage originations but in 2009 they hit 30 percent. For first time home buyers it was a stunning 50 percent showing that most people can only purchase a home today with a very small down payment. Yet small down payments create instant negative equity positions if the market moves sideways or pops lower (aka our current market). For example, the 3.5 percent standard FHA down payment is wiped away by the 5 to 6 percent selling costs. What is interesting with this is that the FHA insured loan market is fully backed by the government (i.e., you) so any losses will be completely shouldered by the public. The move to increase premiums recently was no fluke. One piece of data that stood out to me was of the number of homes in negative equity, how large the FHA numbers grew.

FHA insured loans 1 out of 4 underwater mortgages

A very troubling point showing a morphing of the current market is the number of underwater mortgages backed by FHA insured loans. As stated before, many of these loans were originated after the bubble popped in 2006 and 1 million originated only in the last two years:

Source:Â Federal Reserve, 2012 report to Congress

This data is coming straight from a Federal Reserve report given to Congress this year. The issues arise from the overall weak economy and the fact that employment growth has been weak across the nation. Take a look at this example:

“(Business Financial Post) Opalka was refinancing another FHA-backed loan he had obtained in 2008, for $196,000, then at an interest rate of over 6%.

Under the refinancing, he borrowed $192,278 at an interest rate of 4.5%. Opalka, looking at the paperwork, is still surprised at the down payment he had to make in 2010, for a property valued at the time for little more than the loan was worth and in which he had almost no equity.

His down payment was just $3,000 – or about 1.5% of the total loan.

Less than two years later, local real estate estimates now value Opalka’s home at no more than $110,000.â€

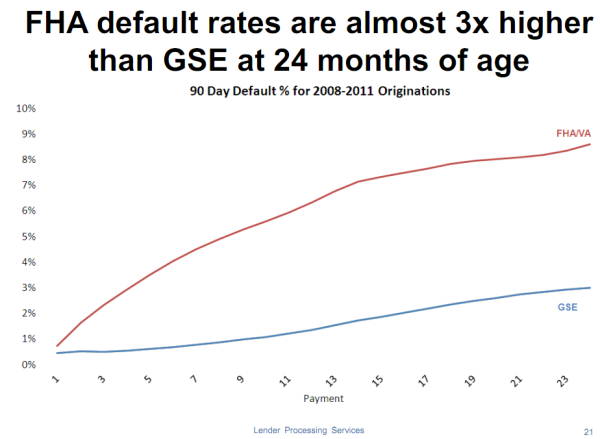

In this case, this borrower only had to go in with $3,000 to refinance his loan (1.5%). The home took on a new $192,278 loan but now two years later is valued at $80,000 less. Just one of the 3,000,000 FHA insured loans underwater. Do you think this borrower is in good shape? How motivated will they be to saddle up and keep making payments on a home that is underwater by $80,000? No wonder why default rates on FHA insured loans are soaring:

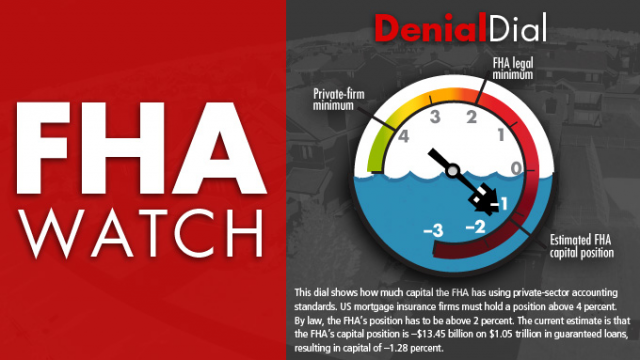

An expert that closely follows this market is Edward Pinto and he has a monthly “FHA Watchâ€:

Some key lending standards are provided:

“1. Step back from markets that can be served by the private sector by taking steps to return to a traditional 10 percent home purchase market share.

2. Stop knowingly lending to people who cannot afford to repay their loans. 9

3. Help homeowners establish meaningful equity in their homes.

4. Concentrate on homebuyers who truly need help purchasing their first home.â€

There is so much nonsense with FHA insured loans. First, most are using these as low down payment entry points. The median down payment is 4 percent contrary to the deception that was being preached years ago that most people were coming in with large money. Next, by rolling in the large insurance premiums you are basically financing the debt into the loan making it more expensive to supposedly “lower income†buyers who need more help. Any doubt why 3,000,000 FHA insured loans now are underwater? This has a little taste of the Alt-A and option ARM variety.

Finally, the average FHA borrower accumulates 7 percent in equity in their home during their first four years of owning the home. In other words they barely break even when they sell and this is assuming the market doesn’t shift even slightly lower which it has over the last few years. Ironically the FHA would be in full bailout mode right now if it weren’t for them squeezing the vice on new borrowers going in with bigger premiums.

The deception is strong in this market. I love the news that one of the GSEs turned a profit although the bailout costs are still in the hundreds of billions! Give me $200 billion and I’ll turn you a $2.7 billion profit tomorrow. With this kind of math, no wonder why we are going to face another bailout with FHA insured loans.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

52 Responses to “Will the FHA require a bailout? – 12,000,000 underwater mortgages 3,000,000 are FHA insured loans. 1 million underwater mortgages originated in last two years.”

Enough is enough. Again the burden is put on prudent citizens. A new movement will be formed.. Collective Default Obligation, CDO (pun intended).. Stick it back to the banks.. No pain, no recovery.

$1.05 trillion in guaranteed loans… is that all you got? Wake me when we hit $1 gazillion…

“Wake me when we hit $1 gazillion…”

Actually, by some estimates we are already pretty close to a gazillion in OTC derivatives, assuming a quadrillion is the same a gazillion, lol.

Actually, once we went from billions to trillions, 10 or 15 years ago, I think most people got lost in the dust. These numbers really don’t mean anything. Like all the debate in Europe about Greece paying back their debts. Sovereign nations never pay back their debts.

The FHA will need a bailout fairly soon. The only question is whether the entire house of cards buckles first, and then we just start over with a clean slate. We’re five years into this bust and there is no growth, just lower unemployment based on people dropping out of the labor force.

Here’s what I don’t get. 46.3 million are on food stamps. That’s 1/7 of the population. Yet, next time you go for a walk, glance into people’s back yards and see if anyone has a vegetable garden. No one, other than me, in my city, as far as I can tell. What are all these people gonna eat when they stop handing out food stamps, or their purchasing power declines. Those are the only two possibilities, deflation (austerity) or inflation (loss of purchasing power). Either way, food stamps will be a thing of the past, in terms of providing nutrition.

“Actually, once we went from billions to trillions, 10 or 15 years ago, I think most people got lost in the dust. These numbers really don’t mean anything…â€

Since a gazillion is a made up number, this was my point exactly!!!

As for food stamps, keep in mind that the food stamp recipients will still have their $750,000 (or a gazillion dollar, because whose counting at this point) 900 square foot 2×1 shack in CC… Maybe they can convert the living room into two more small bedrooms and take in boarders to pay the mortgage. Does anyone know how to amortize a gazillion dollars over say a bazillion years?

What are the 46.3 million going to eat when they stop handing out food stamps? Answer: The vegetables in your back yard.

Itchy-Scratchie1 says that food stamps are a curious historic collectible thing of the past. Now we got mag cards with meals on megabits. Just swipe-em and bingo, it’s party tyme.

Just remember, Jason n campers, that “food stamps” are not welfare for people/eaters.

“Food stamps” are a massive welfare program for agribusiness..

Let’s keep things in perspective here. When fractionated industrial compounds recombined as diabesity bombs is called “food” and marked up for profit to the point where even the eaters of that usual crap cannot afford it, this indicates a Food Bubble of massive proportions.

I agree with Jason–backyard food uber alles. In fact I’ve said since 2007 that if we’re going to shovel godzillions of bucks at anything, it should be local and regional food production. Not mortgage shenanigans.

When I look at your graph of FHA defaults at 24 months, what I find most shocking is that 2% are in default by the third payment, and 3% by the fifth payment.

this due to the fact that loan qualifing system is still broken. FHA and all other loans expect for VA are allowing up to 55-59% of gross income minus housing expense taxes, payments, HOA and melloroos and the debts only on your credit report only. take out taxes, medical, retirement, living cost, fuel, food, utilities, repairs….and misc expenses. booya thier busted. 2-3 months reserves, poof gon. if you took all these expenses, used net income you will see more than 40% not qual for an FHA loan or massive reduction of purchasing power.

The merger of state and corporate powers is, by definition, fascism.

Say, Hail to the Eagle. It shits for……………………….some today (1% or less)

NO, no, that dictionary is out of publication…..In the new dictionary marriage between big business and government is Capitalism as defined by the new Republican Party.

Very true and fascism is a very apt description of what is going on in this country. I forget who it was that said,” When fascism comes to America , it will be wrapped in a flag and carrying a cross.” I think when Sarah Plain posed with her flag based jewellery and her claims that the constitution is based on the God of the bible, I knew this had come to America. I mean can you think of any other time, such a person could have been one step away from the Presidency??

Excellent observation. It is…weird being an American at this point in time.

Of course the FHA will require a bailout.

The interesting question is, as those underwater, delinquent mortgages grow, how much pressure will the FHA be under to forgive principal on those loans? Fannie and Freddie are getting a lot of pressure, but the FHA has nearly as many delinquent loans that are underwater, and will soon surpass Fannie/Freddie combined.

For some reason all that comes to my mind are the lyrics from The Doors song: The End. Fitting that The Doors were a Los Angeles band. Realistically, the world’s gone mad.

4. Concentrate on homebuyers who truly need help purchasing their first home.â€

If you need help purchasing a home maybe you should look at renting.

I’ve found, with today’s prices, a mortgage payment, even with PMI , HOA dues and taxes, can be significantly lower than rent. Having to rent keeps one in a position of having to pay more for housing and that sucks.

I’ve been renting the same place for 12 years now and the rent goes up a little bit every year. If I could buy something with a mortgage payment equivalent to my rent, I’d at least have the benefit of not having my housing cost increase every year. The bank doesn’t see it that way. They figure I can only afford half what I pay for rent, even though I’ve been paying much more every month for twelve years. Landlords, on the other hand, will gladly approve me to pay 50% more than what I now pay because I have good credit. My credit union has offered me a $40,000 auto loan without my asking for it, but they only approved me for a $90,000 loan to buy a house when I applied. The market works against us ever having the capacity to save for a house (if we’re paying so much for rent) and offers us incentive to be in debt to less important things (like a new car).

I am no deadbeat loser and I need FHA loans to get into a house because traditional sources of mortgages (banks) are so stringent that even people with good credit and downpayments don’t qualify – so don’t relegate all of us who need help getting a mortgage to being lifetime renters. And … forget the supposed benefit of renters being able to move whenever they want – my rent is cheap compared to what else is out there. If I moved I’d be paying minimum 25% more for a similar place. That’s exactly why I’ve been here so long and exactly why I want to buy a house so badly.

Being able to buy a house is not a right. If you cannot afford it, you cannot buy it. I am not saying that you are not a good person or that you don’t deserve a house. All that I am saying is that sometimes people cannot afford certain things and that’s life. Using debt leverage to get into something that you cannot afford is way worse than not being able to afford it. In my opinion if you cannot save up 20% down payment and is living pay check to pay check then buying is probably a bad idea and puts you in a worse financial situation.

Let say you buy that house with 3.5% down payment and let’s assume that your mortgage plus FHA insurance premiums, property taxes, and etc is equal to rent, your property taxes will still increase every year. In addition to that, when your roof leaks when you rent the landlord pays for a new roof. When it’s your house, you have to come up with the cash. If you cannot then your standard of living is already lower than before due to the leaky roof.

Heathen — you overlook the fact that rents are doing some strange sh*t right now, too. IMO, comparing the cost or renting to owning is no longer a sound metric, because the rental market is being over-speculated. All of the speculative zeal that went into flipping and all of the attendant “wealth” created from it has found its way back into the market via the ‘investment property’ game. How many landlords do you know today as opposed to, say, five or six years ago? People tend to go with what they know, like how a dog buries it’s bone in the same place over and over. Just like the guy who wins 500 bucks in the State lottery goes and spends it all on more lotto tickets. I am convinced that much the wealth created during the housing bubble will wind back up in housing and will gradually be chewed away at, if it hasn’t already.

The other thing is, all these “genius investors” are enjoying a unique landscape (for now); that is to say, a captive audience of both defaulting home owners-turned-renters with wrecked credit, and first-time buyers who cannot find much thanks to artificially low inventory (thanks to the major banks attenuating the release of foreclosures). There’s also the crowd who have sold and are looking to rent awhile in order to wait out the last few death rattles of a market that has yet to overshoot the mean, which it will — unless Bernanke and Geithner can make world history by defying every other example of a speculative bubble, the housing correction will resume, albeit slowly, and it WILL overshoot.

/rant.

You sound pretty damn spoiled to me! How about SAVING $25K or so and using the credit union $90K loan to BUY IN A TRAILER PARK! How about one where you own the land? With amenities, maybe even gated. Get real!

Itchy-Scratchie1 asks the simple question, why are we under water on loans originated 24 months or less ago? Me itchy for a refi but us loyal loan payin home owners are at the back of the line these daze, especially if itchy wants a little extra $$$ for fix up costs on the homestead.

How bout a little essay by the Dr H.Bubbles on just who is responsible for this mess. FHA used to be a decent alternative in getting a loan. I’m just bubbling with curiousity

“You knew, didn’t you? I’m part of you? Close, close, close! I’m the reason why it’s no go? Why things are what they are?”

Lord of the Flies

Banks are going to start selling off the bad paper in tranches. Chase is starting to do this now. It alleviates them from the processing nightmares. Private equity is buying these and dealing with the mess. Their goal is to be landlords. Decent returns in todays market can be had by positive cash flow rentals.

The one thing that does look like it will create some flow into inventory is that these guys will probably not sit on foreclosure processing like the banks have been doing since 2008. They cannot keep them all as rentals, so some houses should start to hit the market as they work through their inventory.

…and these REITs will gradually undercut the earlier investors who daisy-chained HELOCs on their primaries in order to be a small time Warren Buffet.

This whole country is stinking drunk with the fear of poverty, and it makes it a real ugly to be any more these days.

CAE

Good point about some homes will go from the Bulk Sales on REO Rentas back into inventory, but with the deep discounts they bought the bulk inventory, I assume the total losers will be returned to the market for a SFH sale. The nicer, better condition homes will become the REO rental ones. Just my 2C’s. The $450M deals are behind closed doors. I’ve noticed tight lips until they brag in the press release.

From what I can gather, it sounds like many of these private equity groups will become very large landlords of SFRs. At least that’s what they’re saying. Yes, they’ll probably sell-off the dog properties asap. But, if they buy these mortgages at enough of a discount from the banks, they may start dumping them on the markets in a methodical way as they work through their inventory.

Bruce Norris just talked about this. There’s going to be 2,500 to 10,000 notes sold in a group. Most must be held for 5 years. But if the holder is a REIT, they will be owned by shareholders. So although the REIT may not sell the individual homes, the REIT itself can be bought and sold via shares. And the REIT may get the notes so cheap that they’ll drop the rents in order to make sure they have 100% occupancy of their homes. Getting these notes away from the banks may have a concerted downward effect on rents and property prices as the new owners will not be burdened with the balance sheet losses that these notes have represented to their original holders. This may prove very interesting action in the housing market for 2013 and 2014.

CAE

I listen to Bruce Noris on his internet radio show as well, although I don’t follow him religiously. He is a flipper and flipper trainer, so I have a bad taste in my mouth for him. Some of his radio guests are interesting, especially foreclosure website CEOs and data cruncher types.Thanks for reminding me to check up to see who has been on. Much appreicated.

I am soooo sick of all the rigging. All I want is a place to call home. Some of the price point of the marginal neighborhoods in east Ventura County is just laughable. Some of the dumps and noise machine areas (oy vey), they’d have to pay me to live there.

I find it infuriating that the FHA was doling out loans with 3.5% down FOLLOWING the crisis. Not learning from mistakes is one definition of stupidity. Anyone that has been paying attention could have predicted that doling out gov’t guaranteed mortgages to people with little-to-no skin in the game during a downdrafted market would result in losses. What kind of @#$#@ buffoons are creating policy in this country?

Anyone up for a game of kick the can?

They’re not stupid, it was planned. By allowing those loans, they increase the pool of buyers, thus driving up the prices. If the market was left to the standard 20% down and 28/36 DTI ratio, the pool would dwindle, the prices would plummet until ACTUAL demand matched supply, and the banks’ massive balance sheets full of foreclosed homes from the crisis would lose insane amounts of value. Tax revenues would drop from the resulting drop in values…so the government is doing everything in its power to LET people with no money buy homes, because that’s what keeps the artificial demand UP and props up the market.

The 3.5% down loans would not be so horrible in themselves if they were underwritten decently. That’s not the main problem I have with FHA loans post-2008.

What stupefies and infuriates me is that the FHA started writing not only loans for 4X the borrower’s income, which is insane for moderate income people who moreover usually have car loans and cc debt as well, but worst of all, the FHA was writing ARM loans for horrifically overpriced properties.

I know because I was offered one. Was strolling through my own nabe here in Chicago, a “marginal” area that had an excessive number of hasty, badly done condo conversions during the bubble and post-bubble periods. I saw an open house on one of these conversions, a rather ugly old building that really was a teardown. I wandered in, and viewed a few tiny, laughably overpriced 4 room 2 bed apartments with the requisite granite and SS kitchens, priced about 60% higher than substantially superior and larger units a few blocks away. The agent attempted to sell me on the units by telling me to “forget about the price and think about the payment” which was way too low for the size of the mortgage. You could see that payment would not pay back a loan of that size.

“What happens when this reaches the end of the introductory period and adjusts up?” I asked. “Will there be a balloon payment due at that time?”

“Well…. yes,” he answered hesitantly.”But you can refinance.”

“What if this apartment is only worth half this price, like better units I just looked at 6 blocks from here?” I asked.

He had no answer for that.

There were tens of thousands of loans written just like this one during this period. The FHA was even giving people ARMs that were cash out Refis, if you can believe. I noticed that most of the residents of the building I looked at that day looked poor, and seemed not too bright. I thought, OMG, this whole building is going to go into default in 3 years because these people will no way no how be able to come up with the balloon payment amount if even they want to when they see the places are worth half what they paid for them.

This is going to get very ugly, people. I just wonder when the millions of low-end and middle-market condos and houses financed just in the past five years are going to hit the market.

To put Laura’s point another way, a conservative metric for buying a house is 2.8-3.x times the buyer’s income. But if the buyer has an income one or more standard deviations below the mean (so to speak), a more conservative one is needed.

FHA should have applied that lending conservatism. They did not, for very obvious reasons (softening the sector’s landing by lending to more people who couldn’t afford houses *and* who will have very little recourse once this latest pile of manure hits the latest big combine).

Another bailout, no problem. Ben will “ease”, implement QE3, QE4, QE100, whatever it takes. Doves fly, Cramer pumps fist. Losses are “contained”. Buying opportunity?

See stock market action today; JPM $2B (?) loss, market UP, nobody cares, too big to fail. Gotta keep it green, it’s Friday…people read the internet, check 401K balances on the weekend, more time to ask questions, start thinking. Not good. Ben’s got it covered…folks need to refocus on what’s really important, is Brangelina adopting?Kardiashians? Dancing with Stars?

“JPM $2B (?) loss” is that two billion or two bazillion? Please tell me it is only two billion…

Two godzillion.

Spelled with a B.

ha!

+1

It’s only 2 bazillion for the time being, but, as Obama’s second favourite banker ( after Jon Corzine) Jamie Dimon put it…“It could get worse, and it’s going to go on for a little bit unfortunatelyâ€.

So the lowball figure is 2, but watch as that gets increased in increments on friday afternoons and when the media is fixated on something. The day one of the kardashians gets her kit off on Youtube is the day we find out it’s really 8 bazillion.

The fly in the ointment is that the US “Housing Bubble” very likely has another 20 years of unwinding to go before a bottom in prices is established. The ultimate bottom will be UNBELIEVABLE to most. We’re at the beginning of the West’s biggest depression ever, but very few are behaving as though that is the case.

Colin — I think you’re going to be accused of hyping things in a negative fashion with that observation, though I think you’re generally on the mark. I’d be interested to see you expound upon your thesis.

The unwinding of Westside Real Estate may have already begun. West Hollywood Condominiums are selling for up to 60% off.

http://Www.westsideremeltdown.blogspot.com

It is required to keep up an illusion of propriety when you create money out of nothing and give it to your friends. When they kick some back to you as contributions or bonuses or salaries making it look like you’re running a business, bank, or helping ‘the people’ is very important.

I just testified in House Financial Services on the FHA and their instant negative equity policies and de-facto insolvency. And I mentioned that there is NO employment recovery to help. The number of people going on disability since July 2007 is 100,000 greater than the decline in unemployment!!!! http://confoundedinterest.wordpress.com/2012/05/12/something-wicked-this-way-comes-disability-and-average-weeks-unemployed-skyrocketed-since-mid-2010/

Right on, Mr. Sanders. Keep an eye on the labor force participation rate (LFPR). The unemployment stats are meaningless without the LFPR metric. Imagine if there were no jobs, and 90% of the labor force went back to school, collected SSDI, or just dropped out entirely and became homeless and collected food stamps. If all of the remaining 10% of the labor force were unemployed, we’d have a 0% unemployment rate. Great, right?

So for the Obama goons to crow about a stable unemployment rate without acknowledging that it may be stable because people are exiting and collecting SSDI out of desperation as there are no jobs, is just absurd.

And the declining labor force participation rate cannot be blamed on the retiring boomers, as the labro force is defined to be workers between the ages of 16-65. If you retire at 65, that does not impact at all the LFPR.

Obama gets a Big Fail on mishandling the economy. Geithner and Summers – what can you expect with appointments like these?

Oops. I meant to say: If all of the remaining 10% of the labor force were employed, we’d have a 0% unemployment rate.

Wall St. owns and runs our “government.” The country is lost. Nobody really knows what’s out there in terms of derivatives and there’s no way to predict or control the mess if it unwinds. The Fed can’t print that much money without hyperinflation. They don’t care about this country and I believe that the money has already run to Asia and developing economies. The only money that stays here is used to rip us off by flipping homes and reinflating the bubble.

Hate to say it, but given what we have seen in the past, if real estate started another dip, the FED would step in in a yet unseen way. I wouldn’t put it past them to start buying properties themselves, especially since they can create money out of thin air. What would their risk be to do the next stupid thing?

As far as the FHA, if Romney wins, a bailout will come. If Obama should win, which I now doubt , FHA will limp along, maybe the FED will rescue the FHA if Obam wins, Congress if Romney wins.. A FED based bailout certainly would not be legal but many things the FED currently does used to be illegal.

It is what it is, it will never be what it should be.

While visiting a new housing tract of modestly priced homes in my area I overheard a young man ask the sales representative how much time he would have save for his down payment. The rep told him about 5 months because it would take that long to build the model he wanted. He replied that he would need that amount of time to raise the mony which would have been around $8000.00. This was for an FHA 3.5% down loan. While listening to this conversation I got the impression that he had little if anything saved already. Which implies that he probably has little money saved and lives from paycheck to paycheck. So any unforseen emergencies or job loss and you have a struggling homeowner who will find it easy to walk away since he has so little invested. This is whats wrong with the current FHA program Their letting to many people like this into homes that will be go with any significant financial setback.

Geez, where do I start? First, if your not part of the solution, your part of the problem. Meaning if people want low priced homes, very simple, don’t buy (supply and demand) If you have to rent, do so, but with others (roomates, family, etc) it won’t last forvever! Save for a down payment, and be sure your income is stable. Of course the banks are manipulating the home prices! Why, because they can. The only thing the individual can do is not play ball with them, simple. Actions get results. If you hit them were it hurts (wallet) that will result in action, lower home prices. The investors that are buying now, well some will fair well, most won’t. Renting is a risky business, if you rent to a family with kids, and they cannot pay the rent, you have to take legal action (atty fees, filing fees, etc) and that is not even considering the time it takes (courts are backed up due to cuts) So the family that is renting from the investor is living there rent free, believe me I have been there, and that was when the economy was GOOD. Then you also have the damage and clean up after it is vacant (can be expensive!) and who are the investors renting to? the people that lost their home? Most landlords run a credit check before renting to someone. Most people are living on their credit cards right now, but the ones that ran out of credit are now black-listed (not credit worthy) NO RENTAL FOR THEM! Oh and what abot all the people that are unemployed and soon to lose their UI money? Don’t get mad, get even, beat them at their own game, don’t play by their rules.

Westside, means, strictly speaking, West of Lincoln. In generous terms, west of the 405. geez!

To top it off, FHA is collecting the mortgage insurance payments from borrowers to protect against defaults. However, instead of saving that money for a rainy day, HUD is immediately spending it on other programs, like rental assistance. Surprised? Another Ponzi scheme in the making.

Leave a Reply to A