FHA insured loans dominate top 20 metro areas – The near nothing down mentality is the new rage in the housing market. FHA loans showing massive delinquency rates and have the potential of costing the taxpayer $100 billion in another bailout.

The Federal Housing Administration (FHA) has stepped into the housing market in a too big to fail way. Their involvement in the mortgage market is not necessarily a good thing in the long-term. The reason for the FHA popularity is the incredibly low down payment requirement of 3.5 percent. Couple this with the Federal Reserve subsidizing lower mortgage rates and you have a recipe for a nation simply pushing debt off to the future. The FHA is now a mess since it is picking up the slack of defunct toxic mortgage lenders. In 2008 HUD went to Congress for a $143,000,000 subsidy, the first in three decades. More troubling is the projected losses that could amount to $100 billion over time. The rising delinquency rates and the market share of FHA insured loans assure us problems ahead. Let us look at the proliferation of this product since the housing market bubble burst in 2007.

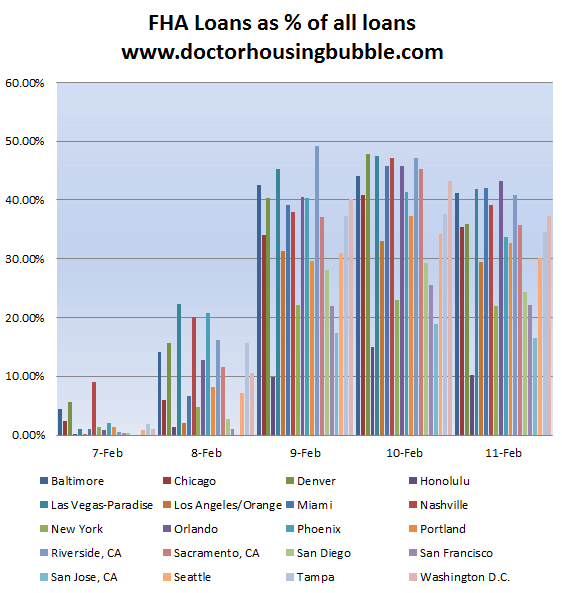

FHA market share of homes purchased with loans

Source:Â DataQuick

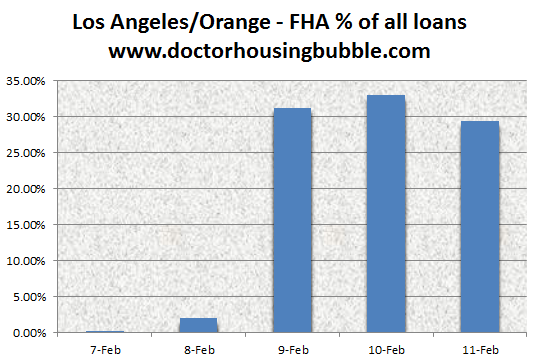

This is a disturbing chart for a variety of reasons. First, FHA insured loans were never meant to be a large part of the market. They were intended to help lower income Americans purchase homes yet many of the larger and more expensive markets are using FHA insured loans as their primary purchase loan product. For example, in 2007 FHA loans were 0.20 of all loans in the Los Angeles and Orange County markets. Today they represent nearly 30 percent of all loans. This is how the growth for the LA/OC area looks like:

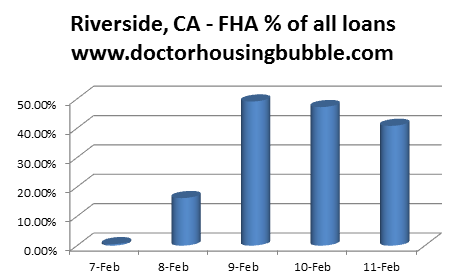

Even more problematic is the dominance of this loan in places like the Inland Empire:

Currently 41 percent of all sales with loans originate with FHA insured loans in Riverside County, an area of California with a notoriously high unemployment rate. Keep in mind these markets have 25 to 35 percent of purchases coming from all cash investors! In other words you are putting people into homes that can barely muster a 3.5 percent down payment and selling homes to investors who want to flip or rent the places out. The normal market buyers of those selling their home to move are virtually a footnote since the bubble burst in 2007. This market dynamic shows no signs of stopping especially given the current shadow inventory. I found it fascinating that the median price for a FHA insured loan is slightly higher than the price paid by all cash investors. It seems like a large pipeline has developed for investors to purchase homes and sell them to first time buyers via FHA insured loans.

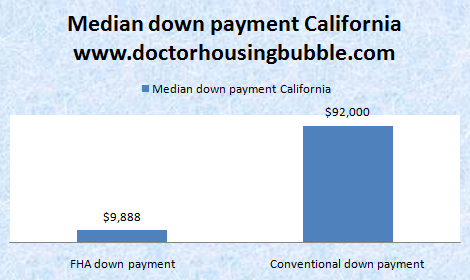

Almost no down payment loans

I was having a conversation with a few colleagues and their perceptions simply do not coincide with the data. They believe that most buyers with mortgages are putting substantial down payments into their purchases. That is not the case especially for non-cash investors. In fact, the majority of FHA insured buyers are doing the absolute minimum:

This amount coincides with the actual median price of a California home ($244,000). So basically people are putting 3.5 percent down on most of these purchases. These loans have now taken up the slack that was lost form the toxic mortgages of the bubble years.

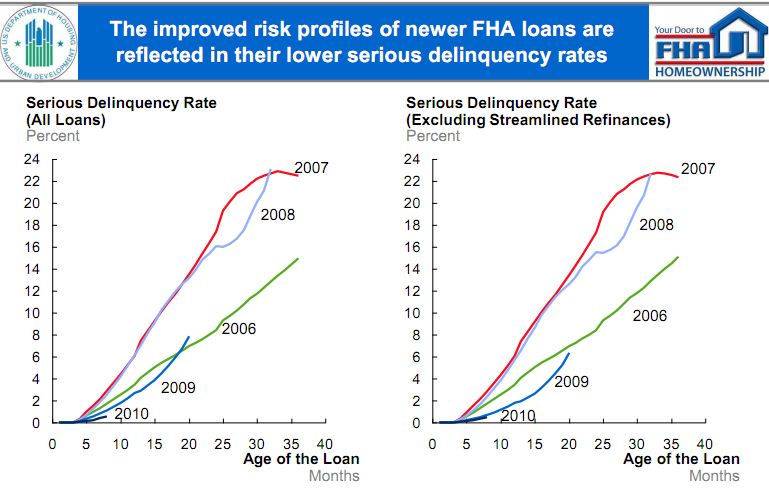

HUD gave a presentation to Congress regarding FHA loans late last year. The report is comical in nature. First, they try to show how FHA insured loans are performing better with newer loans:

Source:Â HUD

Note how 2008-vintage FHA loans are suddenly deteriorating at an accelerating rate. This was the last year FHA allowed the illegal no-money-down SFDPA loans. Coincidence?

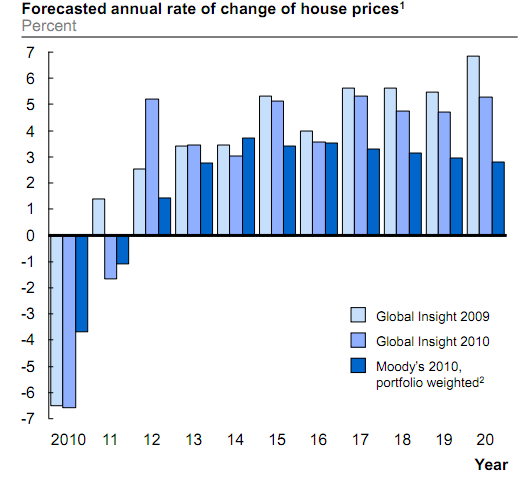

In this presentation they actually prove the opposite! Loans originated in 2007 and 2008 actually are performing worse than those originated in 2006 before the FHA started aggressively entering the market. Next, look at the loans in 2009 and how badly they are now starting to perform. This is not good. Are they trying to use the limited data in 2010 as things begin strong only after 6 months of data? Heck, most option ARMs were performing fantastic if we only looked at one year of data. Wait until mid-2012 and you’ll see these loans crapping out as well. Why? These geniuses in their same presentation have projections for the housing market that already four months into 2011 have failed to materialize:

Source:Â HUD

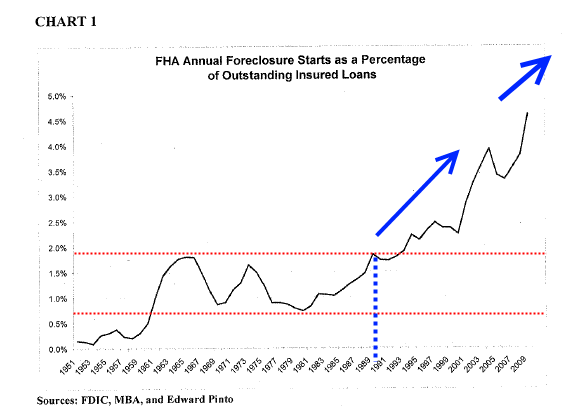

Non-stop perma growth once we are out of 2011 and home prices going up every single year into infinity. By the way, where is the chart for income growth? That might help especially since people pay their mortgage with a W-2 job. One thing we have learned about housing prices is that they do not simply go up. The housing bubble fiasco has taught us that and also Wall Street investment banks have done nothing to reform so the same system that led us to this mess is largely in place. FHA insured loans are the new toxic mortgage but with a touch of down payment spice. Only enough to claim they are not nothing down like adding salt to a soup. Until the down payment requirement is pushed to a minimum of 10 percent we will see problems cropping up:

Many in the mortgage industry love these loans since it allows them to squeeze people into homes they cannot afford. If you can’t save 10 percent for a down payment you shouldn’t buy a home. I would argue it should be 20 percent but the fact that we are still pumping out 3.5 percent down loans is maddening. Plenty of nice rental homes so this isn’t like a choice between living under the riverbed and owning a palace. Those in the housing industry argue this is good for homeownership and to that I say then you fund the loans. If you are so up on these loans you use your own money and not government backed subsidized programs that blast off economic rents to the toxic financial industry while the costs will hit the taxpayer years down the road. Enough of this toxic financial industry.

These kind of loans also force home prices to stay inflated above real market levels. If people were required to save for a down payment home prices would need to adjust lower to reflect what people can afford. Plus it shows a discipline to save and restraint in not buying every new iPhone that pops out or every new plasma TV that hits the market. In California in 1997 the median price was in the high $100k range because that was all people could afford with their incomes. Incomes have not changed over that time to reflect current home prices. The only reason prices remain at current levels is because of maximum leverage loans. FHA insured loans are the new stop-gap measure. Expect future losses here. What do banks care since this is all explicitly backed by the government (aka you)? If banks had faith in the borrowing public they would put their money out in mortgages and hold onto them. Of course they rather borrow your money and speculate in global stock markets since the return is higher.

Do you think a 10 percent down payment on any government backed loan is too high or too low?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

73 Responses to “FHA insured loans dominate top 20 metro areas – The near nothing down mentality is the new rage in the housing market. FHA loans showing massive delinquency rates and have the potential of costing the taxpayer $100 billion in another bailout.”

You can tell how bad the economy really is by this measure- 10 years ago, when mortgages were 8%, and CD’s paid 5%, sales were robust. If mortgages had dropped to 4%, houses would be flying off the sales chart- couldn’t build them fast enough.

Today, at 4% mortgages, and 2% cd’s, sales are tepid at best. What does this tell you about the REAL situation??

YEPper… cogent perspective there. Wait, are YOU, perchance, DrHB? ;’)

Another fantastic report, DR. HB.

A 10% down payment would be fine for cheaper homes and condos as long as the DTI ration is low, no more than 2.5 to 1.

For homes over $150K, a 20% downpayment is appropriate, and the DTI ration should be no more than 2.5.

If the borrower has other debt, such as car or student loans (especially the latter) or other consumer debt, the debt to income ratio for the mortgage should be 2:1 or less.

FHA’s 3.5% down payments worked with little trouble for decades, because these loans were underwritten properly and borrowers thoroughly vetted, and buyers were limited to DTI rations of 2.5 or less. But in the 80s, the allowable DTI ratio was raised to 4, which is really unworkable, especially when you consider that borrowers since the 80s are far more likely to be burdened with 5 year car loans and 6-digit college loans. These days, perhaps the limit for most people should be a DTI of 2: 1, given the large student loan burdens and 7-year car loans so many people now have.

You are correct. I would add that financing a motor vehicle, ANY motor vehicle, for a term longer than 3 years is folly, and a red light to any thinking person who has their insecurities fairly well in check.

I only finance a car if its 0 interest, I buy the lost leader for cash, they hate guys like me. I even have gotten them to change the car to the color I want, saves about all of the dealer add on fees.

A bigger part of why FHA loans worked before is that prices were rising faster than the fundamentals that supported them. E.g. who cares is your 5 year interest only period ends if you can just sell for a massive profit to spend as a down payment elsewhere or if you can simply refi and reset the clock? (and yes, this is the slippery slope that brought many people into the fold of liar loans and options arms.

As far as the D-to-I ratios, I do agree with you but I’m not confident we’ll see anything like that for years, or rather, that by the time it happens, the economic landscape will be a charred no-mans-land of death and destruction visited upon the middle class. Simple reason being, if you look around at the lower middle class areas of orange county where 3-5 years ago, houses were trading between about 450000-600000, and they’re now around 300000-400000, looking at the wages in and around those neighborhoods would require either that prices continue to fall all the down to the 180000-220000 range or that wages rise to the six-figure level. For that to happen through normal inflationary means will take at least a decade, perhaps more. In that time, the CPI might go up 2-3%/year but the real cost of living will continue on a much more strident march regardless of the lies and vagueries propagated to goad us into spending all we earn and then some. Going the other way, then, seeing prices continuing to fall, would doubtless spark more fervent action to toward market “recovery” which will put us in the same pen as the EU’s PIGS.

And the sad part is, many of our compatriots will welcome the notion of the bourgeoisie being compressed into the ranks of the proletarians. Afterall, we *did* elect “change” and especially here in California, can’t seem to let go of myriad social programs that we really don’t have the wealth to support nor the strength to terminate.

No downpayment and 3.5% downpayment… virtually there is no difference between them as far as the danger of mortgages becoming underwater is concerned in today’s housing market with falling prices. It’s apparent that no lesson is learned from the recent big financial/mortgage mess.

“It’s apparent that no lesson is learned from the recent big financial/mortgage mess.”

I’d say a lesson _is_ learned: The banks (i.e. ruling class) are not putting a cent of their own money in this game, this time. There’s no way a bank can lose money in FHA loans, but the taxpayer pays everything, eventually.

This is just another back door bailout of the banks by propping up whatever dismal values the market has sunk to, therefore making the junk on their books they don’t have to mark to market somewhat more valuable. Maybe this game can continue through 11-02, and Obama and his pack of thieves can stick around for four more years. That, sir, is all they care about.

Just imagine what the market would be without this support. We can dream, can’t we?

I meant 11-12. You know, election day.

Yeah. Then those honest Republicans like W and Hank Paulson can come back and restore the “ownership society”. BWAHAHAHA

Vote for Crime Syndicate A or B….that will fix everything. We are on the debt autoban. We can’t go back, we can’t slow down, we can’t stand still. We can only play out this Ponzi scheme until it crashes and burns. There will be wailing and gnashing of teeth.

Oh, please. Wake up. The only choice for a Presidential candidate that you will be offered will be what the Bankers offer you. You’ll get to vote for a Red candidate of the Bankers, or a Blue candidate of the Bankers. No other one will have a serious chance.

How many times does this pattern have to repeat itself before you get a clue?

Squabbling over the two just serves to distract people from the real issues.

exactly…Meet the new boss, same as the old boss.

WATCH THE SOCK PUPPETS

pay no attention to the man behind the curtain…

DrHB writes: “It seems like a large pipeline has developed for investors to purchase homes and sell them to first time buyers via FHA insured loans.”… and HE IS ABSOLUTELY SPOT ON!

In my Bubble-icious Zone (Fort Lauderdale/Broward County, FL), last month a whopping 69% of all residential RE sales were ALL CASH buyers! These REITs and hedge funds (with their bags of cash) get such a significantly lower price than an FHA (or ANY mortgaged buyer), that they are then able to INSTANTLY FLIP them to said FHA sheeple, w/ a hefty markup! Pure ARBITRAGE!

I should add that courthouse foreclosures in Broward are 5% DOWN on deposit just to bid, then the remaining 95% due IN CASH within 24 hours… good luck getting a mortgage on that action. So there’s that huge slant in the market. But even with MLS listings, the all-cash boys are at a huge advantage, due to rapid closing periods, the absolute certainty that deal is NOT contingent on ever-stricter lenders not coming through, lender changing mind over ever-falling appraisals, etc.

From Bloomberg:

http://www.bloomberg.com/news/2011-03-29/cash-paying-vultures-feast-on-u-s-housing-as-mortgages-dry-up.html

Rather than play this hardball game myself, house by house, condo-by-condo, I think I’ll just invest in one of these (shady, unregulated) funds, and get back to my day job.

Enzo, I’m seeing quite a bit of this in my so cal area. House purchase last year at 240K or below, and on the market now at 380K or above. These flips are great competition to regular sales that have no upgrades (since 1970), or Short Sale half-arsed HELOC’s. I’m not going to be going for them. The upgrades are cheap and quick… door, tile, carpet, pergo, paint.

My wife and I are currently looking for our first place in the Granada Hills, North Hills, Burbank, Sherman Oaks area. We thought we would not be able to secure a loan for awhile, but I had found out that I can get a VA loan and have since been pre-approved for 0% down, no PMI etc… This was back in December. (I’m glad I’ve discovered your blog and now read it religiously). I can tell you that the emotional pull to buy our first place was quite strong. In December, I did not want to agree with what my smart friends and family were advising, but rather take the plunge. We are currently able to save quite a bit of cash (~3K/month), and I am also watching our choice neighborhoods decline into our price range (<400k). (In December, Burbank and Sherman Oaks were not a choice). We're into our 4th month of saving and have learned a lot about our cash flow during this time. We have also learned quite a bit about the housing market, loans, investment, real estate terminology, loan terminology, and other important factors I had never considered had I not the time to digest it. Since it will take us ~11 months to save 10%, I will have definitely learned what I think should be necessary to make this largest investment. In October we'll be more serious about actually buying a home, but if the market is diving still then, 2012 may be our year. I'm happy we did not buy back in December and have learned to curb our emotions.

I’ve been doing the same thing in San Diego. Waiting, waiting, waiting, and in the meantime improving my financial situation. Meanwhile, home prices have come down in some of the areas I’m looking at, and interest rates are pretty steady. I actually own a small condo that I’m living in, and which I’ll rent out once I buy a house.

H

Smart move. Why would anyone buy today with 0-3% down, when they’ll be underwater in less than a year?

Save for 20 more months, and you’ll be stylin!! Saving is “paying yourself” Keep up the good work!!

I am a bit new to this and curious how the FHA loans can be compared to ARMs. I was always under the impression that the problem with the ARMs is that people could afford the monthly payments in the beginning, but once it started to adjust higher, it became too expensive. With the FHA, isn’t it just a lower down payment with fixed monthly payment? If you are young and haven’t had the time to save up 20% but have a good job that allows you to afford the monthly payments what is the issue with having a lower down payment? (I understand that a larger down payment will lead to lower monthly payments less interest paid overall.)

Yes, you are right. But it assumes a lot of things: The person is young, has a good stable job, etc.

The problem is that this is often not the case. Quite often, the reason people are paying only 3.5% down is because they’ve spent the last decade wasting their income and not saving and so can’t afford a higher down payment. And probably can’t actually afford the home and might default the first time they run into a financial hiccup.

H

Sort of agree with the gist of your post….I live in the North Bay and make enough money (mid 50’s – college grad in 2004) to afford the monthly payment on a place around the area (Petaluma/Santa Rosa) but the rents have not come down at all!!!! Even gone up a bit in the last 2-3 years.

It is brutal trying to save up when rent eats away 1200/month….and yes, I’ve already cut back….I use a company cellphone, no TV, only internet, no kids, and I’m generally cheap. But I refuse to live in the SW Santa Rosa barrio. The landlords are forcing our hand into these low down payment FHA loans. In all reality, 1200-1500/month would be a mortgage payment on a nice house in Santa Rosa.

http://www.sonoma-county-realestate.com/home-sales.php

There are 117 homes in Sonoma county between 100K and 200K…..so the homes are there, the down payment isn’t.

Sorry to be blunt, but landlords these days goals are these:

1. To make their properties “cash-flo” positive, and

2. To make the “bleed factor” so much so that you *cannot* save for a down payment for a home of your own, thus making you a “perma-renter” perforce.

That is their goal.

Your strategy is to defeat this by one way and one way only:

Under rent, even if that means renting in a mobile home park.

I understand you not wanting to rent in a barrio, OK, understandable from the crime perspective.

But mobile home parks should be safer and residents tend to watch out for each other.

And for you, there are options along this line in Santa Rosa/Petaluma/Sonoma.

True example: we are tenants renting out in the high desert. Because we wanted a garage, our rent is a bit higher, but way under what we’d be paying in the Valley.

Result after 5 years: we are approaching lower 6 figures in savings and will most likely pay all cash. We are wise to what’s going on in the housing market and will hold off buying for about 5 years.

You too can do this. DO NOT tell your LL what you are doing or your savings successes. They tend to think that what’s yours is actually theirs and you never know what sleeping monster of greed you’ll awaken by saying anything about your financials.

Surprise them instead at move-out.

~Misstrial

jymalchi, I’m in the market now and was put off when I showed my numbers to my investor friend who scoffed when I said I was to put 0% down with a VA loan. What he taught me was that over a course of 5 years, my “investment” didn’t amount to much with nothing down as compared to other investments. I think what everyone is saying here is with low or no down loans are just exacerbating the problem of new home owners by fooling them into larger loans quickly. People don’t stop to think about the actual cost of home ownership, rather they buy with emotion… Down the road, any slight trouble forces them into selling, or foreclosing with all investment lost. Saving 20% really gives one the discipline really needed for this kind of investment. Unfortunately, enforcing this kind of 20% down would have an impact on the market that would probably get the market back down to mark. I’ve spoken to a few different lenders while out looking in the market, and they’re quick to reveal quick approval tricks to me to “help” me get into the home. (Special conditions to wave bad credit, low income, etc…) It kind of makes me sick. Seems like not much has changed really, and I still feel like some banks are operating under the old bubble ways just to keep the market up. I don’t blame them. They’ll do whatever they can to protect themselves and stockholders.

I have news for you. The FHA is indeed writing ARMs and has been since at least 2009, when I found a scan of one such loan, a cash out refi no less, on line and posted it on my own blog.

I was strolling through my own nabe here in Chicago last summer and walked into an open house for a horrible condo conversion of a fugly, ordinary old building that had been converted to miserably small 4 room 2 bed 2 bath condos, for $199K. That might sound cheap to Los Angelinos, but it is now far above the current market for such a place in Rogers Park or Edgewater, Chicago these days. There are many beautiful rehabs with 5 rooms, nice finishes, and in beautiful buildings with great architecture available for $100K or less around here, and they are languishing on the market.

Well, how were these buyers getting financed, I wondered. Sure enough, the agent showed me how I could buy this wonderful apt. with its granite and steel and the rest, for only $695 a month, on an ARM loan issued by FHA. The downpayment was 3.5%, and the payment was locked for 3 years, after which it would reset to a much higher payment, at whatever the prevailing interest would be, to make up for deferred principal and interest. I didn’t examine it any further as I was only curious to begin with, but I figure that the break-in “teaser” interest was about 1%. I also figured that every buyer in the building had financed with this loan, and that the whole building will be in default in another couple of years, adding to Chicago’s huge inventory of failed condominiums……. and that we will be looking at a massive FHA bailout at about that time.

where is your blog Laura?

To pbamma: to find Laura Louzada’s website, click on her underlined name.

HMOG! ARMs from FHA! I had NO idea! I too ASS-u-ME-d the “conservative” FHA was a fixed-rate-only originator! Laura, thanks for pounding the pavement, and nosing around.

Bottom Line: props with TOXIC financing are still the only things moving to non-cash (regular, middle class) buyers. D’OH!

Also, the main problem with these 3.5% loans is that a major impetus for staying in your home is your equity. When you have only 3.5% equity and the lender (here FHA) has a security of only 3.5%, as soon as the market drops—which many say it could—Case Schiller is saying 15-25%.. well you see the problem. You have a situation where a person who has only put down 3.5% has lost 10-20% on the value of his home. You set up a classic repeat of our current situation….people walking away from thier homes in droves.

Oh, it’s worse than that. As patrick.net points out, RealTards have their tentacles in most every FHA deal, i.e. 4-6% dead money, err, I mean “commisions”, right off the top, SOOOoooo… Duh Buyer is ALREADY UNDERWATER THE DAY THEY CLOSE! D’OH!

Couple of months ago there was an article that Federal Reserve Chairman (Sheila Bair) was in favor of 20% minimum down payment. What happened?

With 3.5% down payment, the doc is right. We are just delaying and pushing the problem down the road.

Sheila runs the FDIC and is inconsequential . It’s the real Fed Reserve Chair who calls the shots…..and he dreams of recovery, whatever that means. Too bad all the central planning scheming has painted them all into a corner. This time really is different. They’ll be the last to acknowledge it, though.

“We are just delaying and pushing the problem down the road.”

Indeed, which just happens to be the main overarching strategy of the PTBs… you see, the ultimate goal is to keep the sheeple from rioting, a la Cairo, and that means GRADUALISM… SLO-O-O-O-OW-ly drip the feelgood-disinfo-heroin out over the cable and sattelite info-tain-ment channels, SLOW-ly let the banksters’ froth out of Duh Bubble, SLOWly let the price of gold, oil, and food reach the moon… and of course fleece the sheeple on various debt instruments, coming and going, nach. ;’)

The good news is that prices should turn positive next year, the election year. I hear that the Federal Reserve is putting pressure on the banks to get rid of their REO property, so that in the election year things will be getting better for Obama.

As for the 3.5% low down payments and FHA loans, that is for the low end of the market. Not for Santa Monica and Irvine. Banks are happy to make loans if the credit score is good, 20% down and a good W-2 income. As for the bank rejects, let the taxpayers handle that. They pay for everything else.

Sorry, you are dreaming. You sound like the Federal Reserve Chairman who claimed that “there is no housing bubble” back in 2006. Or “the subprime mess is contained” in 2007.

You’ve got absolutely no data or economics to back up that claim other than sheer hopium. Personally, I prefer to deal with reality, and all the indicators are pointing very strongly downwards.

See the above chart: Forecasted annual rate of change of housing prices

, Global Insight and Moody’s.

“Non-stop perma growth once we are out of 2011 and home prices going up every single year into infinity.”

The above is the general consensus of our rulers. Of course, the above chart applies to the US as a whole. As you know, California does have its exceptions. I know that now things are discouraging. But cheer up, the future is full of possibilities.

John CPA JD said:

“See the above chart: Forecasted annual rate of change of housing prices”

So John, did you read the words above it? Let me repeat them:

“These geniuses in their same presentation have projections for the housing market that already four months into 2011 have failed to materialize”

And then there were these words below it:

“where is the chart for income growth?”

I would suggest reconsidering your optimism based upon those charts.

Prices turning positive next year? I wouldn’t bet on it…

12 months ago everyone said that too…

From what I can tell we have almost 11 months of shadow inventory off market in addition to official 8 month inventory levels on the MLS. These alone are well over a year of inventory. Now figure that we are adding to the shadow inventory faster than we are disposing of it. Let’s just forget about everyone who would like to see but is holding off until prices recovery (lots). And you expect that this all goes away to normal supply/demand in 1 year and that prices will actually increase?

I hope you are right and it would be nice to see real market fundamentals return again and some stabilization, but those numbers don’t come close to working and this looks like a 3-5 year proposition.

Wow – sorry for all that sentence and typos, worst ever…”like to sell but are holding off until prices recover”

So your conspiracy theory says that a magic obama wand will be waved over the banks making them give away millions of distressed properties to insure a re-elected Obama, hmm, are you Glenn Beck in disguise???

if the banks got rid of all of their REO property, prices would plummet. They would not go up next year.

I agree, you don’t seem to understand the numbers at all. FHA goes up to 729,000 in California, who do you think is getting a loan for 729,000, the low end rejects? No, Santa Monica CPA and Lawyers who want to live in Irvine or other overpriced areas where they can’t afford to live unless the down payment is 3.5%. When the market drops and takes a dump on all of us again, which homewners are more likely to walk away? The 3 1/2 percenters buying in Santa Monica and Irvine, that’s who.

74 billion dollars in possible cuts at the Federal level, and the realturd told me it’s a great time to buy a house. 26 billion in possible cuts at the state level in California, but they say home prices are going to go up. 8.8% unemployment rate and Joe Realturd told me it’s a great time to buy. 12.4% unemployment rate in California, and they say prices will be drastically rising any day now. Mr. Realturd say it isn’t so. Just be honest and tell me that you are full of sh*t or very misinformed.

$74 billion in cuts to a budget of something like $3,900 billion (3.9 Trillion) that’s around $1,700 billion in the red (only 2.2 Trillion is actually coming in) is laughably insignificant.

The fight in D.C. is nothing more than kabuki theater for idiots.

I put an offer on a house and lost to a FHA bidder. My offer was 6% higher than the listing price.

I call BULLSHIT that you got beat out by an FHA loan…. We put in an offer LOWER than an FHA loan and the SELLER chose us because they didn’t want to deal with the FHA buyer. Most sellers and realtors prefer 10-20% downers… Banks will approve you for 10% down with a slightly higher interest rate too.. but not that much higher if you have an 800 credit score.

Another informative, well-written, very timely essay. Thank you.

I think people misunderstand the inflation issue. They think a house is a real asset better than cash in an inflation environment. However, the inflation is primarily coming from the emerging markets, and involves things commonly needed, and globally marketed, such as food, oil and metals. Housing is local, not globally traded, and this type of asset tend to go lower in an inflationary environment. Plus the interest rate will be higher, further pushing down the home prices. the wages will not go up. Its inflation, but not hyperinflation. I guess if you have a $1m home loan debt from a bank waiting to be inflated away, you might be disappointed.

Right Pete–Another way to look at is this: with commodity inflation, the costs of nails, glass, copper, etc. are mainly going up. If we weren’t in a globalized economy , wages would be going up too, and so would houses. But obviously, wages can’t go up much, if at all, due to outsourcing. So this is horrible for builders. Their costs are going up for materials, but the price they can charge for finished homes is not.

Regarding the FHA 3.5% down payment, here’s another way to look at that. Let’s say someone is buying a home and they have to put 3.5% down, so they are borrowing the remaining 96.5%. So their tiny pile of invested capital is leveraged 28:1!!! (96.5 divided by 3.5).

Where else can a little guy get 28 to 1 leverage? No where. Imagine going to a casino and saying, “I have a $10,000 in cash. Will you please give me a $280,000 line of credit. I make $35,000 a year, so I’m good for it, lol.”

I’m not concerned about inflation. Especially with housing prices. You might remember that Housing prices were actually a part of the inflation numbers until 1983, when they created a bogus statistic that they could use to manipulate the data (and keep SS payments down, among other things).

Ever wonder what the real inflation numbers would look like, if they used the more honest way of accounting? Check out this article: “If Home Prices Counted in Inflation”

http://www.nytimes.com/2011/04/02/business/02charts.html?_r=1

In particular, note the charts. Had the Fed used this in the past, they wouldn’t have screwed up so badly in 00’s.

The only way the U.S. economy is going to respond to the enormous mess we’re in is to do the same thing it has done several times in our country’s history, i.e., we are going to engage in massive monetary inflation which will wipe out much of the debt load which can never realistically be serviced; and then the country will suffer from some version of ‘staglation’ with no economic growth and high unemployment; and then, very slowly, monetary sanity will return, with lower inflation and gradually rising employment and the return of relatively normal economic growth. It has happened before (think 1877, 1929, 1949, 1980, among others.) None are perfect analogs but all involved flat-lined/negative growth and other dire conditions.

Meanwhile, for the next few years (maybe quite a few years), unemployment is going to be in double digits (despite the phony Bureau of Labor numbers) and real wage growth will be near zero. Millions of families who thought they were comfortably middle class, or would become comfortably middle class after graduating college with their $200K degrees, are actually going to be uncomfortably lower middle class, if not worse.

Our federal govt. is now a wholly owned subsidiary of Wall Street and their man, be he democrat or republican, will act so as to not materially displease them, nor will they permit the emergence of a truly independant 3rd party. The net effect of all this for housing is catastrophic for anyone who thought he had, or would have, a nest egg consisting of home equity. There is absolutely no rational reason to expect anything but further, and possibly faster, decreases in home sales prices for the next few years, possibly for the entire decade of the 2010’s. The FHA is like the Dutch boy with his thumb in the dam. They just don’t matter.

Joe, This time it’s different. Bazooka Hank skipped town and we’re all out of ammo. As General Custer said at the Alamo, “Davy, damn the torpedoes. We’re going down”

I agree with you, but one difference that the banks managed to push is that you can’t ever get out of student loan debt. When you can’t pay you get all kinds of late fees and higher interest rates which then pushes your debt to something you would never be able to pay. We are essentially going to have an entire generation of college graduates that live in debt slavery that will probably stay with them until the day they die. How much of their future earning will be eaten away by banks because of the education bubble.

Down payments that are less than transaction costs put buyers into negative equity…instantly.

Excellent obvious point, frequently overlooked and forgotten!!

FHA is causing a new bubble. I saw a transaction that just closed where the buyer put 3.5% total down on a $450K purchase with ZERO reserves. Another with exactly 3.5% down on a $270K purchase with no reserves as well. (Sellers paid all closing costs) I am in the industry and believe FHA is causing so much long term harm. Yes, everyone wants it as it creates sales, but it is terrible for us as a country. And the FHA loan criteria is laughable.

Theres a further problem with the FHA loans. People will bid up to their approval levels with wanton disregard. In other words, if it was their own money needed to cover that extra 25 or 30K, they would think twice. But because its funny money, its *ONLY* $25 or 30K more.

Now that you mention it, the $450K buyer was the winning bidder of 5 bidders and made an offer $50K over asking. It was cut back to $30K over asking when the FHA appraisal came in low, but you are exactly correct. These 3.5% down buyers are more concerned about getting the seller to pay their closing costs than an extra $20K+ on the sales price.

The Doctor has been on target with every post regarding this housing market. The fundamentals of home ownership are undergoing structural changes not seen in our lifetimes. I used to own, sold for a profit due to a job relocation and will not buy for the time being.

I’m happy being a renter, and will continue at least for the next couple of years. Why put even 20% down when prices will drop by another 20-25% in the next 2 years.

Regardless of what the gov’t does, the key thing is jobs. People need to earn decent income to sustain current prices, and that ain’t gonna happen, since the recent job growth reports are all in low-paying service areas .

So the realtors, banks, and gov’t want to keep prices inflated with cheap, low down payment FHA loans in a last ditch attempt to keep the bubble inflated.

I ain’t fallin’ for it. If you can pay all in cash, go ahead.

Otherwise, rent and wait it out, especially you first-time buyers.

Help me understand.

I have an acquaintance who had 1.2M in loans on his 5 acre Sacramento area spread. Main house, stable, pond, you get the picture. Can’t meet the mortgage. Tried to rengotiate the loan downward but bank forecloses, friend makes a last ditch payment to stave off the forclosure. 2 months later a short sale is arranged for 530,000 to an “investor”.

Here are my questions:

1. Why did the bank allow the investor to do the short sale but not my acquaintance

2. What is the bank’s angle if they have to write down 670,000?

3. Is the investor tied to the bank in some way?

4. It feels like this is going to end badly for my acquaintance, what do you see as the end game here?

Thanks!

It’s possible the bank was more willing to negotiate with an investor who could pay out in full with cash (as opposed to downgrading a loan to a lesser amount, which is at risk to default yet again). Although the bank writes off half the loan, they will eliminate the loan as well as receive an injection of cash. this will keep the banks fractional reserve ratio happy and allow them to create more loans and get the machine pumping once again. Was it worth taking a half a million dollar hit? In the short run, yes. You’re taking one step back to make 2 steps forward (on the balance sheet at least). In the long run, I think it’s the same old story. Take on too much risk and see the house of cards crumble

the end game is the bank gets to patch up its leak with yet another bandaid, the investor gets cheap property to sell at a profit, and your friend is left to take the hit in all of this. one possible way that your friend can recover (if there is still time that is) is if your friend competes with the investor as another investor. assuming the investor doesn’t have any personal/business relations with people at the bank, the bank will do whatever is more financially reasonable.

My guesses/answers:

1. Banks have done loan mods, but these are rare. They’ve only done them when the government has paid them to do so. My guess is that the investor is bringing cash to the table, which the bank needs. Plus he probably has a higher credit rating. And the main reason is probably because the bank gets additional money here (see below).

2. The bank probably doesn’t care about the loss. They may well have sold off the mortgage already, so some other idiot (like your pension manager) is stuck with the loss.

As part of this situation, the banks get a higher cut of any money recovered. 10-20% IIRC. The rest goes to whoever bought the mortgage. And this is why banks have been kicking people out after starting to do a loan mod. The gov’t gave them money to start the mod. After that ran out, they kick the “owners” out, and take the bounty.

3. Not necessarily. But a lot of crooked dealings are going on. The Real Estate brokers for the banks seem to be screwing over the banks big time, and the banks don’t care.

4. As for the end game, it really depends. But your friend can look forward to debt collectors, both private and from the IRS (if they spent *any* money from a 2nd mortgage on non-housing things – like vacations). After next year, the IRS will be going after the full amount. They might want to look at moving to another Country.

Thanks to all for the excellent responses. Questor especially for #4. I will question my acquaintance very carefully on that issue.

“they might want to look to moving to another country” , like returning to Mexico. This only works for non citizens, like Mexicans. Citizens are taxed on their world wide income. For U.S. citizens to leave, the IRS will follow you where ever you go(such as attaching a lien on your Social Security and other pensions and etc.

John said:

“the IRS will follow you where ever you go”

Not whereever you go. It depends on how you do it, and where you go. People go the ex-pat route all the time. You can indeed give up your citizenship, and if you declare that you’re doing so for non-tax reasons, you can even return to the U.S. without problems. Sure, they can put a lien on your SS, but they’ll be doing that anyway.

For the debt collectors, you just have to avoid their reach for a certain period of time. You might be able to do that in the US, or not.

The basic point is that you don’t have to be a debt slave the rest of your life. You do have options, and everyone’s options are different. It’s not nearly as cut-and-dried as you are painting it.

Bet you didn’t know that 99.5% (rather than 96.5%) have never gone away. CALFHA and others have been doing 3% 2nds all along. Every time you hear about a new Obama initiative for the “hardest hit” areas, there’s more funds for those 3% 2nds. So, you can purchase a $250,000 home with $1250 down. You don’t even need really good credit, just income. How’s that gonna work out with a slight dip in values?

Re:

“In California in 1997 the median price was in the high $100k range because that was all people could afford with their incomes. Incomes have not changed over that time to reflect current home prices.”

Doctor, this is most always the best of the arguments, but you’ve left out a crucial fact: Interest rates were about double back then. So, boost the back-then price by about 40% (some cost elements staying the same) and there you have the “correct” price today. Easy as pie.

I agree Dave… No one looks back and compares MONTHLY cost of 1999 with 8-9% interest rates vs. now. In reality I would say we are fast approaching 10 year lows in monthly cost of owning real estate…

Just do the math! Do i think real estate will take off into another bubble from here? Nope.. But there’s less risk investing in real estate now than the stock market.. that is for sure… Might even be less risk than keeping your money in a savings account… if inflation kicks in.

Leave a Reply to Mike M