How much control does the Fed have on the housing market? The current state of housing and the Federal Reserve. Fed now owns roughly 12 percent of home mortgages.

The Fed is the housing market. That sentence is often thrown around but there is little hyperbole here. Since September of 2012, the Fed has essentially purchased all mortgage backed securities (MBS) issued. This is a massive deal for the biggest household debt market on the planet. The Fed started QE1 memorably on December of 2008 and this phase ended in March of 2010. QE2 started in November of 2010 and ended in June 2011. QE3 started in September and 2012 and has been dubbed “QE infinity†since the Fed is now essentially purchasing all MBS issuances with no stop date planned. The perception is that the Fed can fully control interest rates and to a certain degree this is true (or was true). But why did rates rise more than 100 basis points this year at the apex of Fed MBS buying? First, QE has been going on for nearly five years now. The “market†is fully manipulated. Looking back at the last half decade of data, we find that current Fed policy has been a boon for investors and has priced out many American households.

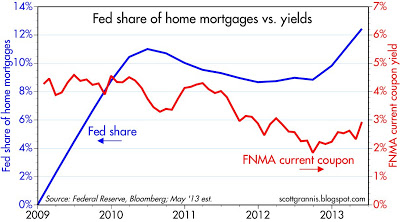

Share of mortgages owned by the Fed

The Fed has taken a full dive into the pool of housing. Â The Fed now owns roughly 12 percent of home mortgages (up from 0 before QE):

Source:Â Scott Grannis Blog Â

“If the Fed bought three quarters of the new issuance of Treasury securities over an 8-month period, with a focus on longer maturities, the 10-yr Treasury yield would almost certainly fall, right? And if the Fed bought all the new issuance of MBS over an 8-month period, increasing its share of home mortgages by over 40% in the process, yields on MBS would almost certainly fall, right?

Wrong. The Fed has indeed been a huge buyer of Treasuries and MBS since last September, but Treasury yields and MBS yields have moved significantly higher, not lower.

What we’ve witnessed over the past 8 months—the duration so far of the Fed’s Quantitative Easing Part 3—is almost a laboratory experiment designed to discover which is the more important determinant of longer-term interest rates: the market’s willingness to hold the existing stock of bonds, or the actions of a very large purchaser of bonds on the margin (i.e., the stock vs. flow argument).â€

This is an interesting argument. How much power does the Fed have on interest rates? The 100 basis point jump in mortgage rates this year tells you that the market is more concerned over the perception of health in the economy rather than the Fed. The amount of MBS purchases is extreme. The Fed is increasing its balance sheet to nearly $4 trillion. There is no exit to this game and the market is starting to understand this. So far, the market has been consumed by investor buying to a level never seen. Last month it was still over 30 percent nationwide. Yet is this truly beneficial when all you do is create asset inflation without any subsequent rise in household incomes? It is no surprise then that over this QE experiment the actual homeownership rate has declined steadily.

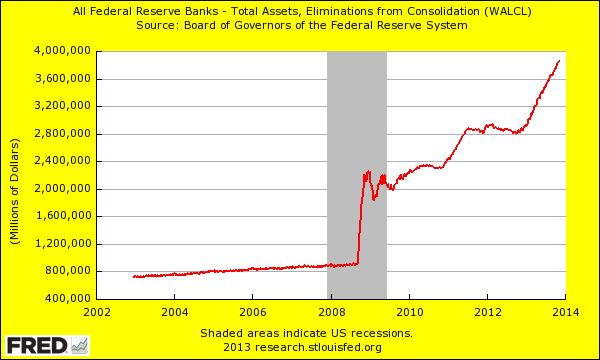

Fed balance sheet

The fact that the Fed now owns roughly 12 percent of the mortgage market does not come cheap:

The Fed’s balance sheet is quickly approaching $4 trillion largely because of the actions of QE. Yet the recent rise in interest rates reflects an uncertain market. Investors are already showing some signs of exhaustion in certain markets. In places like Nevada or Arizona you have something like 50 percent of all sales going to investors and many are simply selling them to one another for higher prices (i.e., speculation). As prices soften how big will this market be? Since 2008 many investors ate up rock bottom prices and sold into a crazy low-supply housing market. It has been a winning recipe for investors.

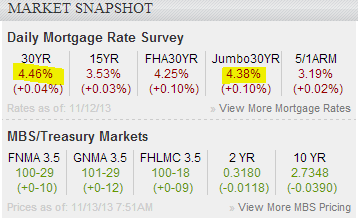

Today, you now have markets once again becoming unaffordable primarily because of market manipulation. This is exactly what is going on. The market was aiming for higher rates to account for added risk yet the Fed wanted to assist member banks in offloading millions of underwater properties. Slowly, this plan has worked like a charm. Yet this was one hundred percent a centrally planned idea. Let us call it like it is. It is ironic to hear these “capitalist†talk about the free market for some industries but then start going into U.S.S.R. talk when it comes to housing as if investors and homeowners “needed†major subsidies for home buying. They like having it both ways. Free market for my gains, corporate welfare for my losses. What is ironic as well is that for a few months, jumbo loans are cheaper than conventional loans showing how the benefits of all these actions are really going to those that least need it.

Yes, a working class family is really in the market for a jumbo loan. What is different this year with QE3 is the sizable move in interest rates in spite of record breaking MBS purchases per month (this is the first sizable counter-move in rates against QE since it started in 2008). If QE3 isn’t keeping rates down anymore, then what is the real purpose?

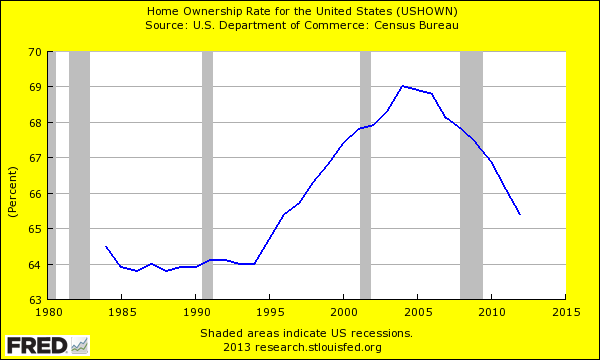

US homeownership

In spite of all this market intervention the regular American household has not benefitted. The homeowernship rate is now heading to multi-decade lows:

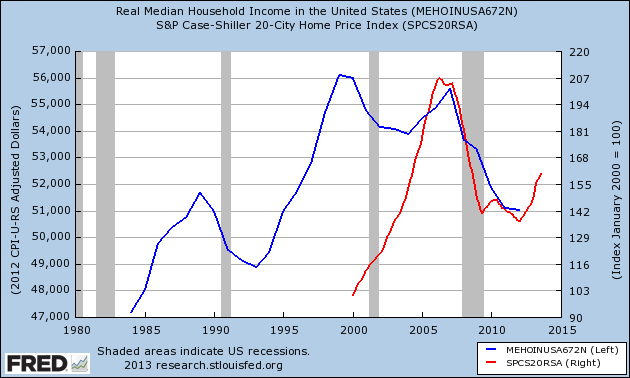

The US homeownership rate is now back to where it was in 1995 (you know, nearly two decades ago). Here is a good chart showing household incomes and US home prices:

So while US home prices are rising strongly because of this intervention and massive investor buying US household incomes are back to where they were a generation ago. For the millions of new renter households, rents are also up but on a stagnant stream of income, a larger portion of disposable income goes into housing. Not exactly the best use of money. This is the impact of Fed intervention in the current market. Investors love a riskless trade and easy debt. Since the Fed looks out for member banks, they were the first and largest party to benefit. However, many are realizing there is no exit planned for that $4 trillion in the Fed’s balance sheet. A 100 basis point jump in mortgage rates is not a small move especially when the Fed is the housing market.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

84 Responses to “How much control does the Fed have on the housing market? The current state of housing and the Federal Reserve. Fed now owns roughly 12 percent of home mortgages.”

Not to worry. We have a community organizer from Chicago running the Oval Office and a liberal economics professor from Berkeley running the Fed. What can possibly go wrong as we go FORWARD ??

Um. The supposedly “free market” Republicans would do it differently how?

The most important–maybe the only–bipartisan agreement in American government is to make sure that current home “owners” (especially pending retirees) are secure in the belief that the value of their home will only go up. Their entire economic future depends on this one assumption. If either party drops the ball on this, it will be obliterated at the polls.

^ times 10!

Please. Bernanke is a Republican.

“Please. Bernanke is a Republican.”

And, he was educated Harvard/MIT, and taught at Stanford/NYU/Princeton. No Berkeley in that resume.

They are talking about Janet Yellen, Bernank’s replacement.

I think zigzag was referring to Yellen who is a professor emeritus at Berkeley. Not that it matters, anyone appointed to the Fed chairmanship will follow the same insane policies, regardless of party affiliation.

You guys are all hilarious. Thanks for the laughs.

I’ve got to hand it to “man of the people” Obama…he got elected not once, but twice primarily by large groups who have seen their economic lot in life improve little, not at all, or even worsen during his administration. The rich, bankers, Wall Street have benefited enormously. Stocks up, RE up, QE forever, stay the course, keep counting the money. Joe/Jane Sixpack takes another hit for the team. But Obama’s cool, feels good to vote for him, so do your part.

I’m sure another Dem will be elected in 2016, again voted in by the same groups whose lives continue on living with parents, stuck in low wage jobs, stuck on govt bennies. Can’t move out, can’t buy a house, can’t find a good job, can’t do much but post another Selfie.

Meanwhile Repubs will likely run another grey faced, grey haired guy in an expensive suit who will be about as appealing as a cold meat sandwich served buffet style at a low end real estate seminar. Perhaps his handlers might come up with a game changer that twerking during the Repub Convention wearing an provocative Uncle Sam costume could be a brilliant way appeal to youth demographic. The crowd, primarily aged 50+, goes crazy! Hilarity ensues!

There will be independent types on both sides of the political spectrum who will speak truths, offer potential plans to responsibly move forward…likely they’ll be mocked, discredited, dismissed. The media will label them radicals; news anchors will roll their eyes, sigh when discussing them. The public, more interested in celebrity sex tapes or athlete behaving badly, loses interest.

It’s a joke. But if you want to believe either party cares about you, and Dems or Repubs are somehow superior/different than the other, knock yourself out.

True

Drinks, great post. Both these parties are nothing but snakes with different name tags on. Everybody needs to look out for themselves in this world, that means following the money!

I’ve heard the “Dems and Repubs are all the same” argument before. They serve the same corporate masters, we’ll get screwed regardless, so why even bother voting, blah, blah…

If they’re so similar then just look back to the recent history of 2001 – 2008 and ask yourself if you think events would have played out in substantially the same way and the USA would be in substantially the same place if a few Floridians had had their votes counted differently. If you think so, then by all means continue to rail against all and vote for none.

“It’s a joke. But if you want to believe either party cares about you, and Dems or Repubs are somehow superior/different than the other, knock yourself out.”

Increasing parties won’t help at all: Here (small EU country) we have six party- government at this moment and all of them are as bad as Dems or Repubs in US: Big money has thoroughly corrupted everyone involved and bought puppets do as the money tells them to do.

At that point the party these people belong to is totally irrelevant: Everyone is in “money rules”-party.

Painfully obvious in EU-level too, to the level that bribing a commissar to introduce a directive for you direcly isn’t even illegal. Direct pledge from commissars to companies: Give us money, get a directive.

And companies do as directive-enforced mono- or oligopoly is a huge money maker for them, millions and billions every year.

to apoloticalscientist, YES, I do think that things would have played out the same way had Gore won in 2000. Why would you think different?

The Clinton/Gore gang was as pro-war as Bush. Clinton/Gore bombed the hell out of the former Yugoslavia during the Balkan War. Remember Madeline Albright’s comment, “What’s the point of having this superb military that you’re always talking about if we can’t use it?”

Clinton/Gore also enforced the no-fly zone over Iraq — with military force. And they enforced the economic sanctions, which some estimate cost the lives a million Iraqi children.

Clinton/Gore also eased many of the regulations on Wall Street, allowing for the real estate misdeeds which bore bitter fruit in Bush’s term.

Considering the war fever after 9/11, and Gore’s long history of being part of a very pro-war, pro-Wall Street administration, I think a Gore presidency would have played out EXACTLY as did the Bush presidency. The rhetoric regrading gays and abortion may have differed, but not big ticket policy items such as foreign policy, national security, and the economy.

Dems & Repubs the same? Wrong!

The Romneycare website would have performed much better than the Obamacare site! 🙂

Also as if UC Berkeley was still somehow filled with 60’s era hippies

UC Berkeley is still filled with 60′s era hippies along with far left radical communists and anarchists who are now professors and administrators at the university. It’s become nothing more than an indoctrination camp for the far left.

@MaximumImpact

I studied at Berkeley. It is not what you say.

I live near UC Berkeley and there is a reason why it’s nicknamed “Berserkeley.”

The California Association of Scholars, a division of the National Association of Scholars, have just released an incendiary report showing that all nine of the University of California’s campuses have been compromised by too many politicized courses and radical faculty members. There has been a sharp increase in faculty members who self-identify as radicals. This has led to “one party†academic departments, such as at Berkeley, where left-of-center faculty members outnumber their right-of-center colleagues in Political Science by a ratio of 28:2, in English 29:1 and in History 31:1. A number of these professors are openly avowed Marxists!

http://www.breitbart.com/Big-Government/2012/04/09/new-study-of-uc-system-proves-radical-professors-rule

U.K. looking to tighten rates soon, look for U.S. to follow soon:

http://www.marketwatch.com/story/pound-falls-ahead-of-quarterly-inflation-report-2013-11-13

Meanwhile, the rich still get better rates that we do:

http://money.cnn.com/2013/11/12/real_estate/jumbo-mortgages/index.html

One way to look at the cost of the $4 trillion bet (long only, 20 to 30 yr UST and Agency, extremely long duration) of the Fed is to look at what the market has done to some players in a similar area.

Mortgage REITs essentially play in the same sandbox that the Fed has decided to take over. One of the consequences (probably intended) is to ruin a sector of the financial markets that provided some market based discipline and independent price signals. Unlike the Fed, MREITs have to get funding, they have to deal with limits on capital and have to report transparently what they are doing.

The largest of these entities is Annaly. It has lost over 40% of its share value in the last couple years. This is an entity that buys the same paper as the Fed has been buying for the last two years BUT it must fund, hedge and remain capitalized. Unlike the Fed, it leverages about 4X and has a pretty matched book after hedging leaving a 1% ROA. Yet, the market has said this is way too much risk for too little reward and has cut nearly half the market cap.

My contention is that the Fed would lose over $1 trillion shareholder value if required to mark to market and report as do market participants. Beyond the paper losses (NB: Fed shows a massive profit based on arguably fraudulent accounting and then dividends out profits to bank shareholders), the amount of downside risk if rates were to increase even 3%-5% is massive. This is an institution that is totally out of control and incapable to reversing course without exposing that it has cost us trillions while extinguishing accurate price signaling and encouraging misallocation of capital to things like stock buybacks

Except that since the Fed can PRINT MONEY AT WILL, the rules don’t apply. Loss? What loss? Here is a handful of $1 billion platinum coins that we made in the back room. All legal. No loss.

The Fed exists to help buffer market liquidity by taking money out of the system and destroying it or printing more and pouring it in. We have a fiat currency. They are not making value. They are simply increasing or decreasing fantasy numbers and making sure that there is enough currency going around that the wheels don’t lock up. The market without the Fed is like your toilet without the ballcock valve.

What a great analogy! So bankster Bennie boy Bernanke is like the Tidy bowl man floating above the shi* it’s a great deal. Gamble w OPM if they win they keep the profits. If they lose, then it’s gee sorry that was your loss. This QE to infinity is nuts and the money has not made it into mainstream. There is no money flowing into mainstreet. Once that happens interest will skyrocket. The banks are just making interest on the free money more than they would make lending it out. Its so bad. We should have a class action lawsuit against the Federal Reserve for the harm they have caused and continue to cause the American people and our country.

“dividends out the profits to banks”…

That’s economically inverted. Those dividends — at a statutory 6% — which was the 19th Century norm for Preferred Stocks — represent a pitiful return on the mandatory capital — preferred stock — that has to be provided by the commercial banks.

For those banks the 6% is a terrible return on their capital — it’s worse than what they get on their other assets — they CAN’T use leverage (deposits) to fund it.

The REAL payoffs come byway of CONTROL of policy — of which we all see. So forget the silly dividends, they’re not the issue, not at all.

As for the Fed being a Private Bank — give us all a break — it’s a Federally chartered institution which is functionally controlled by the government and Wall Street. That is, it’s a FUSION OF INTERESTS. It straddles the priorities of BIG Commercial Banks, Wall Street, Main Street, and the National Government.

At this time the top interests are those of the Politicians and BIG Commercial Banks — which now have been folded on top of Wall Street — or vice versa.

Main Street has been kicked to the curb.

The REAL profits of the Fed are kicked back to the US Government in toto. These figures are so vast as to make the 6% dividends a JOKE.

Of course, at this time, those profits are imaginary… so a new law was enacted such that the US Government would eat ALL of the losses incurred by the Federal Reserve!

This detail seems to elude most. It was not given much publicity — even in the financial press — for it exposes just how perilous the Fed’s exposure is — and consequently the national liability!

So, hush, hush….

The full force of the Fed (unlimited money) has been applied to rescuing the financial sector and the 1%. Comparatively speaking, nothing has gone to the 99%. Obama had the choice of either saving the banks or saving Main St. He chose the former, something that’s giving Hillary fits…and Chelsea married a banker to boot. (look for a replay of Obama’s lies in 2016… Hillary will be all sympathetic to the 99%, but boot them out as soon as she wins…not that winning isn’t in doubt too)

Meanwhile, all you “monetarists” need to read this:

http://neweconomicperspectives.org/2013/11/talking-points-99-part-1.html

what happens to house prices when the Fed can no longer carry this burden? You know that someday this will happen.

Because… uh… they run out of money?

Because… uh… they print money and no one wants it?

I guess when that happens we end up with the greenback version of the Real, which guess who will be busy printing.

To the Federal Reserve, quantitative easing is a pair of journal entries on the balance sheet. i.e. debit the liability account, credit the equity account. Press a button, and “Proof!!!” 85 billion created out of thin air by mere debits and credits on a balance sheet.

This is all made possibly by:

1.) petrodollars

2.) The U.S. dollar is the world’s reserve currency

3.) The retirement funds of baby boomers

The BRICs (Brazil, Russian, India, China) are trying to do away with #1 and #2. #3 will work its way out via the aging process. When this happens, interest rates on the 30 year mortgage go back to their historic levels of around 9%, and home prices plunge by 50%, although the monthly mortgage will remain the same since home selling prices and mortgage interest rates move in opposite directions.

You left out the 4th reason, which should be number one, a worldwide military force at the ready.

Yes@Fulano! BRICS want to mess with the petrol Dollar? They will get the wrath of the full US industrial military complex. Why do you think Obama was trying to get something going in Syria? Because he cares about the children being gassed? Why do you think tptb used HARRP to increase the typhoon to wipe the Philippines off the map? So they will have to be indebted to the IMF . My prediction, world war 3 to keep the petrol dollar as the reserve currency.

Wrong, wrong, at every level. Petrodollars are more myth than reality.

The Fed is creating fiat money the EXACT same way as the other fiats: Euro, Yen, Pound.

So, being International Money has absolutely NOTHING to do with their money engine.

Zimbabwe made money the same way, too. Look what happened.

Americans, on the whole, just don’t save. So, forget about the Boomers. What ever funds they’ve set aside are more than balanced by other Americans. There have been years on end when the (back-calculated) national savings rate was below 3%.

Such a low figure means that savings — by Americans — across the national economy are not only astoundingly low — they can’t factor into the issue at hand.

The sole and only reason that the US Dollar hasn’t already fallen out of bed is because EVERY other fiat power is printing like mad — it’s a mercantilist-currency war.

Instead of a Liars Contest — it’s a Manipulator’s Contest.

And the players get together at least four times a year to talk shop!

The Fed is buying garbage MBS’s and long treasuries. This is because their masters require this. The big banks want to get rid of the garbage on their books and the Federal govt needs rates to stay low. The Fed having just 12% of the mortgage market tells me they’ve got a ways to go yet. As rates rise, they may even try buying more treasuries.

When you’re a hammer, everything starts looking like a nail.

“The Fed having just 12% of the mortgage market tells me they’ve got a ways to go yet. As rates rise, they may even try buying more treasuries.”

This is a catch 22 of epic proportions. If the FED gets even more aggressive you have even more inflation. This will kill CAP rates for the Blackstones and AHRs as well as crushing retail as the consumer is already tapped out. So you have a fire sale by the investment buyers of the last few years as well as crushed consumer sentiment.

Housing to Tank hard in 2014. Buyers beware!!

“However, many are realizing there is no exit planned for that $4 trillion in the Fed’s balance sheet.”

Sure there is. If there is nothing now stopping the Fed from creating $85 billion, per month, out of thin air, in order to buy Treasuries on the secondary market and impaired MBS directly from the TBTF banks, then what’s to stop the Fed, in the future, from destroying $85 billion in “assets”, per month, and shrinking its $4 trillion dollar “asset” pool by that same amount? After all, $29 billion in distressed Bear Stearns, toxic waste CMBS (Maiden Lane 1) pretty much disappeared. We were even told that those defaulted Extended Stay mortgages actually made money? And, without an audit of the Fed, who can argue that point?

However, before we see the Fed pull it’s toxic waste disappearing act, we will probably see the BOJ do that first. After all, how much longer can Japan run a domestic debt that is equal to 200% of its GDP? It’s hard to tell. Remember the Fed only started monetizing Treasury debt in 2008, while the BOJ has been doing so since 1999, and yet the yen has become even more resilient.

As far as the TBTF banks go, having purged themselves of most of their impaired MBS, at full face value (thanks to the Fed), they are pretty much getting out of the home mortgage origination business, as well as out of the business of the buying of other originators’ mortgages on the secondary market. This will not bode well for non-cash real estate buyers. Additionally, the Qualifed Mortgage rule, that goes into effect in January 10th, will make it very tough for potential borrowers to obtain home mortgages. That, alone, could drive mortgage rates down. Remember, if rates increase, CAP rates decrease, and hedge fund investors, that are currently creating rent-backed securities, would suffer. But as we all know, the FED, and the TPTB that own and control the Fed, are hellbent on protecting the elite investors and their SIVs.

The recent foray into RMBS and such is interesting because they are self-liquidating — and have a duration of much less than ten years.

The exact duration whips all over as interest rates swing round. Plunging rates trigger a collapse in duration — every note gets refied. Rising rates draw duration out.

So the Fed’s books can shrink just by backing away from the market — and standing pat.

Likewise, a staggering fraction of its Treasury exposure is rather short in duration. If the Fed merely stopped buying every dang note at the auctions ( with delay ) then it’s pile would shrink so fast you’d be astounded.

As a practical matter, such paydowns shrink the global money supply. This terrifies the expansionist big-spenders… Congress and the President.

QE exists to save their spending mania. At the end, we’ll all be Zimbabwe. Terrific.

“If the Fed merely stopped buying every dang note at the auctions ( with delay ) then it’s pile would shrink so fast you’d be astounded.”

The Fed is forbidden by law from buying Treasuries at auction. All the Fed’s buying is done on the secondary market. The FRBNY’s Primary Dealers do all the Fed’s buying, and much of the Treasuries they buy are from their own banks. The Primary Dealers make their banks money, coming and going.

As the article clearly points out, the Fed has lost control. It can no longer control interest rates, in fact, they are going up. To reverse the momentum would require even more massive QE. And, guess who is on deck, nothing but the most dovish of them all Old Yellen. She is fully geared to blow QE out of the water and let all hell break loose. They are totally boxed in until the whole thing blows up. Take your pick, catastrophic deflation triggered by higher rates that Old Yellen will not let happen, or total debasement of the currency. Just a matter of how long it will take. The really crazy thing is that there are people who actually think there is a way to “grow” out of the impasse. There is, however, a third option, the nuclear option, savings confiscation which would be deflationary as well. This could take awhile but one mistake and there she goes in a heartbeat.

Calm down and get used to low interest rates for, maybe, decades. Study Japan. The “catastrophe” that you so worry about has happened, five years ago. This is it. Get used to the slow grind of a credit crisis aftermath. You saw what happened last spring when even a hit of “tapering” went out, and, no, interest rates aren’t going up, they’re actually settling back down right now to post crisis levels after that scar dissolved. Imagine a world without QE. It would be very ugly. I’ll take this, thank you. I don’t own guns and have no well stocked bunker to run to.

Mike,

You are going to need the guns and bunkers because of QE not because of its removal because it is creating the groundwork for chaos. There is no exit strategy. And, comparing the US economy to Japan’s economy is nonsensical.

Chaos? Doubtful. Not in your or my lifetime. America didn’t devolve into chaos in the thirties, when our financial system was serverely damaged, and many were hurting. Is Southern Europe engulfed in chaos? Ireland? Those countries have been living with Double digit UE for years now. Greece and Spain above 20%. Sure, there’s some goose steppers and head bashers trolling about, but, most are resigned to their fates, just as most Americans will just turn on the TV and drink more.

You’re letting the gold bugs idiotic talk get to you. They’re just profiting from gold sales, in one form or another. So, you can’r make any money in your baking account. Big deal. Never could, anyway. If that’s where you expect to grow your retirement account, start developing a taste for Alpo products. There’s plenty of places to make 5-8% on your money, and it can be done with a few clicks on your computer. If that doesn’t appeal to you, buy a house or two and rent them out. That’s a little more work and hassle. But, don’t hide in a hole fearful of “chaos” or whatever. That’s no way to live.

Remember. Millions lived in poverty during the Depression. But, many many others made millions. Who do you want to be?

Large capital is now flowing away from govt debt. Notice that Vanguard is now bigger than Pimco. Govt debt is at risky levels, but more importantly, it does not pay enough return for all the big institutions that need 8% to stay solvent. Look for large cap, dividend paying equities to be the next big winners on Wall Street as lots of capital looks for a better home. This will force the Fed to buy more treasuries. But like Japan, it may not reduce the value of the USD as much as many think.

“Look for large cap, dividend paying equities to be the next big winners on Wall Street as lots of capital looks for a better home.”

You missed most of it since March of ’09. But, I’ll bet there’s more upside.

Mr. Yellen scares the sht out of me. She argued that we should all get a negative savings rates at banks. In her world, you capiatlize a bank with say 100k in depsoits so they can do what they want with it (with the fdic insuarnce of course to cover the bank losses) and at the end of the year you have 95k. Sounds great! Watch home safe sales take off then ya big dumb academic idiot. At some point it feels like taxes will go up and savings haircuts may happen a la Cyprus, but agreed that savings would have to be nuclear as its hard to disguise a savings haircut like you can a currency devaluation, especially when the govt has taken housing, gas, etc out of inflation and its now chained (aka not a real measure of continued standard of living). I also love how the fed wants inflation so bad, but without rising/inflated wages to go along with inflation in home/rent, medical costs, gas, etc, how is that good again? Wages will never go up with the ‘true costs of American life’ (not a govt measure of ‘inflation’ again for most folks. Too much global labor supply.

Unrelated interesting article in LA times on home equit line resets from bubble 1.0 coming up:

http://www.latimes.com/business/realestate/la-fi-harney-20131110,0,6997479.story#axzz2kNgJik5m

They have already instituted negative savings rates across the pond. Yup. Pay to save is the new upcoming model. Oh and securitizing rent rolls? I can see that doing extremely well and is a completely safe investment, said no one ever. . . . Unless they are lying. But that never happens on Wall Street. lol

We are already getting negative return on having our money sit in the Bank account. We “earn” about .1% interest while that very money is devauled by at least 5% per year due to QE to infinity.

All will carry on as before until the perhaps a day arrives that we all wake up to discover the US dollar is no longer the world reserve currency. That could indeed be an interesting day.

If the US dollar is no longer the world’s currency reserve we in big trouble. However, we’re already not in good shape. Costs are going up and wages arent and the divide between rich and the rest is getting borderline dangerous. I dont care what the govt tells me about “inflation,” just look around and you’ll see it. Look at how McDonalds 99 cent menu is changing or at other fast food places. Or this is my favorite sneaky inflation in diapers and in toilet paper/paper towels:

Sept, 2013: “Procter & Gamble Co. PG +0.82% next week will start using an old trick to boost the bottom line for its Pampers and Luvs diapers.

The company will raise prices an average of 5% to 7%, but that won’t be visible on the receipt. Instead, the pricing will become clear when the diapers run out sooner than usual.

P&G is using the time-honored practice of downsizing, putting fewer diapers in each box so the retail price holds steady. In some cases the retail price could fall as the price per diaper rises to make P&G diapers more competitive.

The extent of the downsizing will vary. For size-five Pampers Cruisers, P&G is cutting eight diapers from the 140-pack box, but a listing on Amazon.com shows the price is holding steady at $45.99. That raises the price of each diaper 6%, to 35 cents from 33 cents.

The paper industry uses the term “desheeting,” effectively raising prices by cutting the number of sheets per roll for toilet paper and paper towels. Kimberly-Clark Corp. KMB +0.75% recently used desheeting to boost unit prices for its Kleenex products by cutting the number of tissues in each box by 13% while saying each sheet was bulkier.”

And guess who the FED will turn these mortgages over to….

The Fed Blows Bubbles

If any of you gentlemen have the time I would advise watching the movie

“Money for Nothing” A historical look at the Federal Reserve with Fed Members being interviewed.

Remember in March of 2013 on CNBC. Ivy Zellmen said Housing was in Nirvana..

Does the mortgage purchase applications decline, and the decline in SAARS from the peak in 2013, with a slowdown in new home sales sound like Nirvana

http://loganmohtashami.com/2013/08/26/housing-nirvana-gets-slapped-by-higher-rates/

The feds ability to push housing prices is now limited

We are now reaching the limit on higher home prices because the real economy can’t support them. Indeed, according to the California Association of Realtors, less than one in three Californians can afford a home in that state.

There is a limit to what QE can do for the housing market once home prices reach levels of unaffordability. Fewer people working, making less money, when home prices and interest rates are rising means fewer people can qualify for mortgages and afford to buy homes at higher prices. End of housing price appreciation.

As long as QE continues, however, money will continue to flow into the stock market as rising stock prices may make prices too expensive, but not unaffordable.

http://smaulgld.com/five-long-years-in-the-feds-potemkin-qe-village/

@Smaulgld, you are right QE3 does have a limit on the housing market. I did an estimate and came to the conclusion that 2 years of QE3 would enable the Fed to transfer most of the bad garbage MBS’s from the Fed’s member banks to the balance sheet of the Fed. The Fed is 1/2 the way there. That’s why the Fed most likely pulls the plug on QE3 by the end of 2014.

RE will NOT crash, at least for the next 3.5 years, because of two reasons.

1. RE will only crash if interest rates go up. Fed will absolutely not allow that as we’re not close to hyperinflation, so printing will continue, which is essentially Fed telling investors they will subsidize RE, and therefore RE is a safe asset, backed by US. And the Fed need these investors to prop up RE, and pay property taxes to keep municipals afloat, banks’ balance sheet float (this is partially solved already), minimizing risk of bank runs.

2. Think about it, for housing to “crash”, owners, collectively, would have to sell below what they bought it for. In 2008, subprime owners didn’t put any money down and did not care for their credit score, which is why many mailed keys to the bank and just walked, even if they can afford the mortgage payments. Those that bought RE after 2008, were approved under stringent loan qualifications, why would anyone sell a house and lose 10-15 years worth of savings? I’ll guarantee you, anyone that puts 20% down or more will not mail keys to the bank and walk. They would fight like hell and not lose their money. Unlike in 2008, housing now is owned by the financially responsible.

As cruel as this sounds, Fed is not going to allow housing to crash just so the middle can buy a home. RE crash leads to Municipal bankrupties, pension funds default, etc. So the latter is much worse.

Fed is now raising/reducing interest rates to stablize RE prices now, to prevent 10% YOY gains and 10% YOY losses. This stability will continue to lure investors.

What IS inevitable is “The Great Default” of 2017. That will be the headlines 3.5 years from now.

“Those that bought RE after 2008, were approved under stringent loan qualifications”

Oh, so wrong. Your new subprime lender is, well, you, paying your taxes to support the FHA, which stepped in to fill the vacuum the banks and private lenders left after the bubble popped. You can still obtain a very cheap low interest loans with just 3.5% down backed by this agency, and they are practically bankrupt because of that. Just another component of the back door bank bailout that Geithner managed so well for his buddies.

I’m old school. I remember a time not so long ago when a 20% down mortgage was standard, acquired at a local bank. How quaint. There is a whole generation today who would consider that unfair. The 20%, I mean.

I do agree that RE won’t crash, because we, just like Japan for two decades plus now, will experience extremely low interest rates for years and years.

“…Fed is not going to allow housing to crash just so the middle can buy a home…”

And your Omnipotent Fed allowed the 2007/8 crash why??? And the godlike minds at the FED have exactly what new policy tools to use now that they are in a liquidity trap??? This central planner worship sickens me. If pulling a few levers and controlling our economy was so easy why have ANY downturns happened in the FED era??? The FEd couldn’t even protect home values after the Savings and Loan Crisis. To believe they have everything “Under Control” is the height of stupidity.

+1 NihilistZero for pretty much all your comments the past few months. People think just bc the Fed has control over things for a while, control can’t slip away at any moment and chaos can ensue. You’d think anyone on this board who studied the last crashes of dot com, long term capital, housing bubble 1.0, s&l crises, etc would remember the Fed existed then also. Also any parent with a kid should know how quickly control can turn to chaos. Control is there, until its not. castles made of sand fall in the sea, eventually.

Also +1 for “drinks” comments as of late too.

“You’d think anyone on this board who studied the last crashes of dot com, long term capital, housing bubble 1.0, s&l crises, etc would remember the Fed existed then also.”

Where and what is this “chaos” you speak of after these events? We survived these downturns, just as we will survive this one. I guess one’s little life is in “chaos” if they invested stupidly in overprice assets while using way too much leverage. If not, and you had your defenses well placed, life goes on, and it can still be lucrative and profitable, too. Don’t bang that Fox news/goldbug drum. It’s tiresome, and increasingly the voice of losing.

Read a little history. Study the financial history of America without the Fed, especially the second half of the 19th century until 1913. It wasn’t pretty. Be happy you live in the modern world. Imagine life right now without a little QE, bank deposits insured, no work rules or consumer protection, etc.. Not me.

Mike m.-if you dont think there has been massive financial chaos than why have the number of people on food stamps gone nuts as well as disability (basically the new unemployment when benefits run out)? I wasnt talking chaos on the streets with clubs n baseball bats. You realize the only thing that held up bubble 1.0 was by destroying the middle class in ways it will never recover. Its cool all is well with you are well diversified. Im a homeowner so QE benefits me. At the same time, unlike you i can see how, and i actually care that, it benefits the minority over the majority. Go look at this weeks op-ed pages from former fed folks coming out against the fed now saying QE was a lie. Most importantly, we were talking about the fed being able to always maintain control, which i believe it loses. You went off on a tangent about political beliefs and taking a myopic view of the world. PS: Im not a republican. Also being against the fed would not be a republican position; did u hear mitt romney speak against the fed? Wouldnt anti-fed be independent?

“we were talking about the fed being able to always maintain control”

Oh, that’s your problem. Here’s something you should know. The “Fed” is an easy target. It’s a council of really smart nerds (man, I thought Ben was bad, but Yellin is a caricature of a nerd) that lives in a world of high statistics and math, and can determine the price and flow of money throughout the world. That’s the extent of their “control”. They’ve had their cards on the table for five years, and are still waiting for our elected representatives to raise and, dammit, DO SOMETHING!, and raise the bet. Anything. But, and I’m convinced of this, and Ben has heavily hinted at it more than once in his “new transparency”, that congress and the executive branch has to get their s**t together and decide which direction they want to take the economy. They can only do so much. They provide fake money, and Congress can put some of it to work making jobs. A few jobs. That’s all they can do. Then, finally, the private market may revive. So far, we’re just stuck. And it ain’t the Fed’s fault. They’re doing as much as they can.

Oh, and, if you think Americans have experienced anything newer “chaos” within the last five years, move to Zimbabwe, and get back to us.

Mike, on this one I agree with FTB. Like him, I am not a republican. And I am not a looser either. I have millions in real estate and no loans. Therefore, I am on the receiving end of the FED printing. However, my financial position, which is excellent and thrives in this environment, is not changing the fact that FED policies are hurting the middle class a lot. Their policies, indirectly, cause the biggest transfer of wealth in the history of the US from the middle class to the wealthy – or I should say to the supper wealthy.

You might do well and I do excellent, too. But the fact remains – the middle class is getting poor and disappearing because of the FED policies. Their policies are for the benefit of their shareholders – the big banks. If others can benefit, then they will. However, they benefit as a byproduct – that is not the goal.

It is a long talk we can have which explains why what I am saying is true. I don’t see the point. It looks that you understand the money system as well as I do. If you really think about you’ll agree with what I am saying. I am not saying that is good or bad. What I am saying is that is good for few and very bad for most.

“the middle class is getting poor and disappearing because of the FED policies.”

NO NO NO NO……NO!

Listen, here’s why the middle class is dissolving before your eyes. Technology. And, three major developments of modern technology: Contanerized shipping, which allows the massive world trade that didn’t exist forty years ago, the internet, of course, and robots in factories. The Fed has nothing to do with that, and those developments will still destroy jobs in the developed world for decades, no matter how much the central banks flood the world with fake money. They are just urinating into the wind.

If it wasn’t for the Fed, we would be much much worse off after ’08. I’m not happy with the situation, and, I’m sure glad I have no kids to leave all of this to, but, that’s the way it is.

most homes are being bought all cash by investors….but if you have good credit, low dti and pti along with reliable income 5% down is more the norm….

Housing will suffer soon, you can’t outrun a train by putting more gas in the car…

OK, back in 1979 there was a comedy called “The In-Laws.” The story was about an undercover CIA agent trying to prevent a third world dictator (who stole currency printing plates from the US mint) from crashing the US economy (thus eliminating his own country’s debt) by printing and circulating unlimited amounts of cash and making the dollar worthless. Does this sound familiar? Seems like what the Fed is doing here.

Sad, our leaders have become comedians and our government the stage for a bad comedy. There is no happy ending in this one…

The housing market is in BIG trouble:

http://www.truthingold.blogspot.com/2013/11/unfortunately-im-going-to-right-about.html

The Fed wants a bubble, that’s why they created it…

A bubble changes how most people feel about everything.

-What you study at college.

-How much you think you will earn in the future.

-It changes how much you spend on things, how much you come to believe they are worth.

This thinking is the most difficult to overcome in a bubble. People want to feel rich again. as soon as their house value goes up, most people star spending more, consume more, vacation more… it creates an illusion of richness for those who have assets tangible and intangible

off topic, but in North San Diego County I’m again seeing “seller never occupied property” for four (4!) new listings, two obviously from the same flipper (identical tile, bathroom sinks, kitchen granite, paint color etc). All have come on the market since Nov 1. These are the same places I watched go off the market over the past two years. I’ve decided not to move to this particular community because the market is obviously very manipulated (few new houses coming on the listings, year-old listing the only ones showing, no price drops on those old listings, etc), probably because it’s closer to the coast than the other community I’m tracking. When I see price drops in this area, I’ll let you know because I think it will mark something significant, tho I’m not sure what except maybe flippers who are playing musical chairs with the market have been left with no place to plop their asses. (Another “bottom” for the market?)

this bubble will end like the others….count on it…the only thing that can save housing from imploding is hyperinflation….which might just be around the corner based on the cash fleeing into housing….if that happens.. who cares if you have a house..you better be prepared for chaos….

Hyperinflation DESTROYS real estate values — for they are directly connected to the leverage available from mortgages.

Weimar Germany and recent Argentina both saw apartment block CRASH in value. The tenants couldn’t pay, absolutely NO ONE would extend out a mortgage. Every property had to trade all cash — typically in an alien currency, to boot. (US Dollars in both cases.)

There are survivor accounts of 16 apartments TRADED for a used BMW! (Argentina)

Real Estate does well under slow, persistent, inflation. It dies under hyperinflation.

Beware.

in reply to Lord Blankfien, please go back and calculate, your math skills are not good…

Your basing the home payment on DTI when it’s PTI, any PTI over 29% is recipe for disaster. All debts paid by borrower are DTI, your example is a DTI of over 48%…dead in the water…some of us here have worked in mortgage industry..Please refrain from being obtuse…

QE is all about profit without production. QE treats wall Street as if it is the government, buying bonds it manufactures.

Raise and prop up the cost of housing. “Seek lower cost centers.” So production is moved overseas where labor’s housing, thus labor, costs less. The government has decided production (export income and jobs) are not needed. Cronies can make money and be political kingmakers without productio

cd, thanks for the reply. I especially love the “some of us here have worked in the mortgage industry.” What kind of advanced degree did that require? 🙂

The DTI for the previous example is very simple to calculate. I see you like mixing gross and net number, can’t do that. DTI is usually based on gross numbers.

Debt: $2400/month total gross monthly house expenses

Income: $89000/12 = $7400 total gross monthly income

DTI = 2400/7400 = roughly 33%

A housing DTI ratio of 33% is nothing to be alarmed about. There are some math classes available at the local junior college, sign up for next semester is soon!

Lord Blankfein

Since we are around Thanksgiving time, I will use an appropriate analogy. Your comment on the 33% DTI as nothing to be alarmed about is as full of shit as a Thanksgiving Day turkey.

Lenders today will NOT approve a loan at 33%. Even FHA requires 29%. And, this is using your dubious $2,400 number.

As you smart ass comment about “advanced degree requirement”, I have a PhD.

@Fulano:

“Lenders today will NOT approve a loan at 33%. Even FHA requires 29%. And, this is using your dubious $2,400 number.”

Lenders will not approve a loan at 33%. Do you have any evidence to support this? Housing DTI of 33% is totally normal in Socal. Maybe not Iowa, but in Socal that is just the way the game is played. Get used to it.

DR. HB used a PITI number of $2230. This is the number lenders will use. I threw on the additional $200/month for maintenane and upkeep just to be realistic. Using Dr. HB’s number, the housing DTI ratio comes to 2230/7400 = 30%. There are you happy?

If a couple/person can’t live on nearly $3000/month after paying for housing, they have serious SPENDING problems. Fulano, I don’t have a bone to pick with you and I’m certainly not a shill for the housing industry. I’m stating facts that you simply can’t or are unwilling to accept. Sorry about that!

@Fulano and @Lord Blankfein

Just wanted to clarify your comments. I am in the mortgage industry (and yes I do have a Bachelors from a UC) and would like to offer my input on the DTI mentioned here.

DTI or Debt To Income ratio is an extremely important function of qualifying for a mortgaqe. This takes gross income divided by all monthly obligations (from credit report) including the new proposed mortgage payment with taxes and insurance.

For conventional loans, 45-50% is the max. Usually it is 45%, however I have seen 50% fly with compensating factors (tons of assets and perfect credit).

FHA, will go to 56.99% DTI. That does not mean all lenders offering FHA will as they will have their own internal overlays (loss mitigation factors), however, that is what the FHA Mortgagee Letter defines as maximum acceptable debt to income ratio.

Now I could discuss other facets of the FHA program that exudes sub-prime characteristics, but for now, I just want to inject some facts regarding the present DTI situation in the mortgage industry.

Hope that has helped.

bmd, thanks for the reply. I just couldn’t help myself from responding to cd above. My little joke of the mortgage industry goes back to the bubble days. Trust me, I saw them all…former bartenders, auto mechanics, even porn stars who wanted a piece of the mortgage industry pie.

Thanks for the DTI info. I assume you work locally in Socal? Could you please comment on what type of housing DTI is commonplace here in Socal (just PITI). I mentioned low 30% was very common and I nearly got run off the blog.

I keep preaching about the desirable areas of Socal. With limited supply and much demand, people will lever themselves up substantially to own in these areas (and that will definitely run up the housing DTI number). It’s been like that for a long time and I imagine it will only get worse as time moves along.

Thanks in advance. I’m sure the blog would love to hear the inside scoop from someone in the local mortgage industry.

Just to keep things civil bc I’m bored and can’t sleep, I think you can all possibly be right depending on the situation maybe. When I was looking to buy in prime LA with 20% down, I was offered WAY too much money by two banks, Citi and Prospect, to purchase a home based on my income and what I personally thought was safe for me. I settled for a home in hill country, tx instead for just a tad over a 1/3 of what I was ultimately right for me. I really want to boost my annual savings rate AND I’m my salary may not go up with true inflation going forward or may go down. But that’s me. Some people make good money, don’t want to save cash and want more risk and feel CA real estate is where they want to put their money. You would assign a greater rate of default for these folks risk but some thrive and get rich….and others fail. Basically there are lots of hidden factors that could make something a better or worse decision. true honest assessment of one’s future income and additional expenses being the key bc that makes or break your ability to extend your hold time if need be. also, understanding best you can if your job will remain in that area and if you can lose a grand or two a month if need be if you lose money renting it out. then there’s good ol individual risk appetite.

From my personal experience, with 20% down at least (makes banks feel a lot more comfortable in a rising market that they at protected), the banks are willing to basically overlend if you pass all their other million questions. I still think part of the reason they offered me so much money was the hoped I defaulted and they could take the house and my 20%. However, that could me just being a wus maybe. Others may have went balls to the balls and got rich. Who knows. All I know is I personally felt the market was too frothy and the risk too much. So far at least I’m wrong and my friend who levered himself to the hilt is sht eating grinning on a 2.5mil place that is up approx 20%. Time will tell.

Please forgive all my typos. Balls to the balls is not a new phrase amongst the younger generations. Its still balls to the wall. Also meant to say “1/3 of what I was ultimately offered”. Also “I’m afraid my salary.”

FTB, it is amazing what lenders will to let qualified buyers borrow. Very true that a rising market and Fed/government protection definitely help. Your friend did well levering himself to the hilt. I honestly don’t think any reasonable buyer today sees huge future appreciation. Housing is being viewed as a safe place to park your money as it is close to rental parity in many places.

Regarding the DTI discussion, like you mentioned every situation is different. We were discussing housing related DTI. Obviously all debts need to be taken into account for the final equation. The amount of other non housing related debt is likely what separates the pretenders from the contenders. The ideal situation would be to have ZERO debt when applying for a home loan. It definitely can be done with some discipline and sacrifice. Those 33% housing DTI numbers are then a walk in the park.

@Lord Blankfein

Didnt take offense and I do agree with you. There were so many unqualified and shaddy people in the business the last time around. There have been new restrictions/qualifications that are required now to be a loan originator and I think that has thinned out the riff raff quite a bit.

That being said, it is a dramatically different lending world today than 5 yrs ago. As far as the “common” DTI for socal (which is where I am), that is hard to say. There are good buyers that have low DTI ~25-30% DTI and there are ones that push it to 50% and up. As stated earlier, FHA can go above 50% and be only 3.5% down. There is also a down payment assistance program funded by the State of CA that allows a 3% 2nd behind that FHA 1st (if you qualify based on income restrictions) which would make the total % down on the purchase at only .5%

THe VA program allows for 100% financing (I am not making this up). And, there is NO PMI on that program.

Bottom line is that there are programs available for those that are marginal buyers; bad credit, little to no liquidity, and borderline income. The trick is to finding a property that does not have a cash offer, and is willing to accept an offer from a marginal buyer. Lot’s of demand, little supply (due to market manipulation).

Let me know if you have any other financing questions, happy to offer the perspective of someone on the “inside” (who also rents due to market conditions).

Reuters) – World shares climbed back towards five-year highs on Friday as markets cheered a robust defense of the Federal Reserve’s money printing by Janet Yellen,The Fed finally seems to be convincing markets that even if it does taper, an actual increase in interest rates will still be distant. The Fed explicitly links its monetary policy to U.S. employment, 6%.

Big money is starting to flow into the DOW. There may be a stall for a month or two, but over the next couple of years the DOW will probably rise quite a bit more. As Kyle Bass stated a couple of weeks ago, “Equities are now the only game in town”.

“Big money is starting to flow into the DOW.”

No, Big Money has been in the Dow since March of ’09, and done very well, thank you. If “little money” starts flowing into the market, that’s the time to get out. I wouldn’t worry too much about that, because, bottom line, most little people have no money. Americans are still addicted to debt, and have paltry savings. it’s all institutions, pension funds, and sovereign playing this game

Dr. Housing Bubble

I see you did not post my comment. I find that unfortunate because “Lord Blankfein” needs to be put in his place. Not only is he a shill for the NAR but he is insulting and condescending in his comments. Additionally, he gives out erroneous information that the novice might take at face value to their extreme detriment. This type of behavior does not enhance the quality of your blog. I have nothing against contrary opinions but this guy goes beyond professional discourse.

California is getting so weird that we may see bridge financing: where an all cash bid can be made as an investor pool funds it — followed by putting a mortgage on the property. The mortgage would then re-flush the investors.

This seems to be needed if one has any chance at nailing down a property in the hotter markets. The bridge team would have to be bought out entirely — with a commission, so the true buyer would still need to have the balance — the down payment plus the spiff.

What cannot be denied is that America is seeing the leading edge of hyperinflation. That’s when foreigners reject currency holding — the fiat emitted by the sinning nation — and trade it in for real goods. In this case, real estate.

This phase occurred in Weimar Germany, as elsewhere. During this phase, the locals normally remained oblivious to the significance — like a deer in the headlights.

During the following phase, the price movement in real goods of all kinds begins to simply take off. The overseas money comes back in an absolute flood — to by everything not nailed down — and the land it sits on!

With Yellen at the wheel, we should expect rapid price increases: stocks in particular. Remember, the debts of the corporates are being destroyed in real terms! This is why even plain old utilities — especially power companies survive the travails. They walk through the storm, ending up owing nothing!

It’s amazing how many people don’t understand basic economic principles.

We need both Inflation and Deflation but our goverment, the banksters, and the rich are afraid of DEFLATION and are trying with all those programs (QE1,QE2,QE3, ZIRP and etc) to prevent deflation from happening.

Now let me tell you this…….no matter what we do, no matter what gimmicks we try deflationary forces will win a the end.

We are past due for deflation…..deflation that many Americans desperately need.

Bring the home prices down back to earth. It’s a shame when majority of our own citizens can’t afford to buy a house in its own country.

Remember, no matter what those clowns in Washington do to fight agains deflation, they can’t win. Deflation and Chaos is comming.

We need to destroy all bad debt that we have accumulated during the last 30+ years. We need to take a medicine of Deflation and Chaos.

Raise the interest rates to 20% and allow the bankruptcies and defaults to run wild. At the end that is exactly what we will end up doing, so do it now.

Leave a Reply to cd