How Federal Reserve and banking policy is accelerating income disparity: Financial obligations ratio soars for renters while declining for homeowners. Problem is, we have less homeowners.

Current housing policy has been a major windfall for large institutions and investors. Banks enjoyed a continuous stream of good years as rates slowly dragged down and people became serial refinancers. Good way for banks to earn fees courtesy of the Fed’s QE maneuvering. However the results have been negative for the large number of working and middle class Americans. Many of you have encountered investors bidding prices up on properties here in your own backyard but this trend is nationwide. In some areas the bidding has been more aggressive (i.e., San Francisco) but overall, the nation has seen a big jump in home values. However new data continues to highlight how this current policy is really benefitting a small group of Americans. While rental vacancy rates reach decade lows, homeownership rates are also reaching multi-decade lows. Not hard to do when a large portion of the market is coming from the investor crowd.

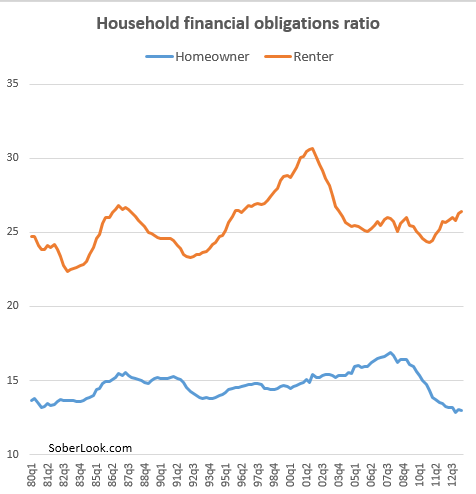

Financial obligations ratio

The Fed has an interesting ratio on household financial obligations. They break this data out between homeowners and also renters:

This is an interesting chart. Since the recession ended, financial obligations for renter households have only increased while those of homeowners are now down to generational lows. Low supply and new building moving along at a snail’s pace combined with rents increasing. What this means is that for renter households more money is now flowing to housing. The problem is household incomes have been stagnant.

Of course for homeowners current banking policy has allowed many to refinance and lower rates into the abyss. Yet there is a cost. You are seeing it here. There is no free lunch.

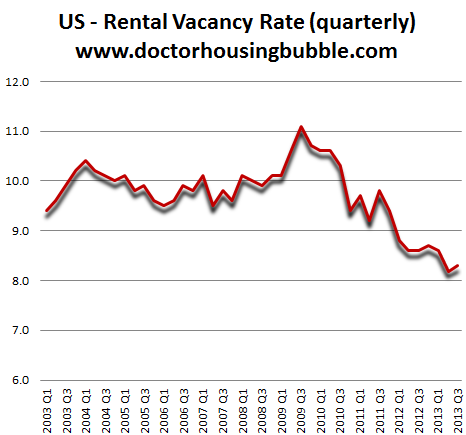

Rental vacancy at decade lows

Part of the very hot housing market stems from lack of supply. The rental vacancy rate is at decade lows. So rents have been pushed up. Yet there is a ceiling as to how much this can go up. Investors are already finding it tougher to get solid cap rates on their investments. Also, many of the new permits issued for new housing have gone to multi-unit developments which should ease some of the pressure later on.

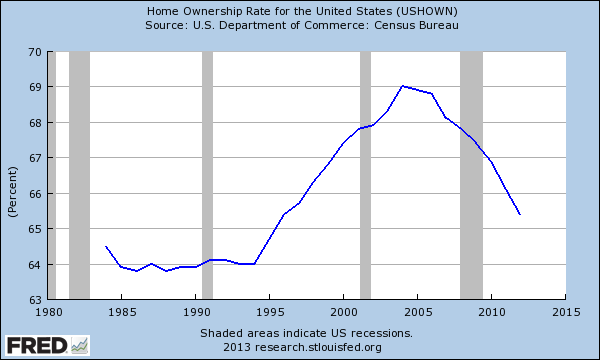

Homeownership rates decline however

This would be great if homeownership was increasing so more households could enjoy in the spoils of this banking policy. Yet homeownership is clearly moving in one direction:

The homeownership rate in the US is heading back to where it was 20 years ago. The big difference in this drop is that over the last few years many single family homes have been put into the “investor†category.

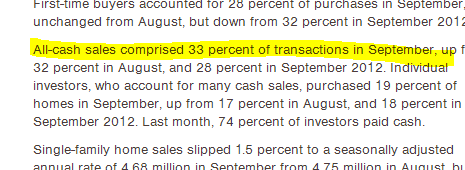

I’m not sure why people are so doubtful about this even today. Some analysts are so wedded to the “housing is moving up sustainably with investors only being a tiny portion†meme that they don’t even bother gathering data. Heck, even the NAR acknowledges the massive amount of investor buying:

Last month 33 percent of all existing home sales went to “all-cash†sales. 33 percent across the country! That is a big freaking deal and a massive part of the market. Since Americans don’t have too much in terms of savings, these are not your typical first-time home buyers.

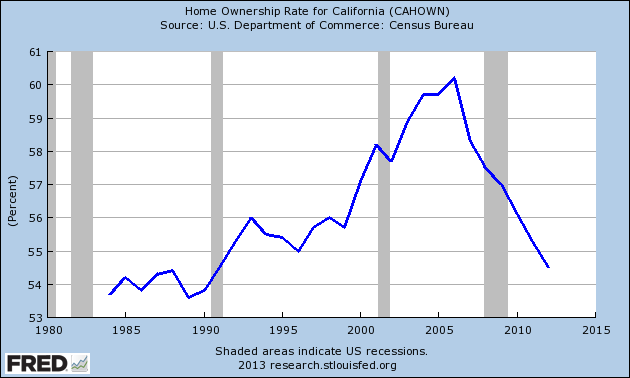

Then we have states like California where the homeownership rate is approaching 50 percent:

Cash sales are dramatic in the state. In the Bay Area, 32 percent of all sales earlier in the year went to “all-cash†buyers. Take a look at home prices there and ask yourself if even a young working professional couple can afford a home, let alone pay for a place with non-traditional financing. The bottom line is that the costs of QE and freezing accounting standards do have an impact on the larger economy. The working and middle class in the US are taking it on the chin for those that can play the easy money financing game. Yet make no mistake, this is no free market and housing has only become even more subsidized. You would think with home prices rising so quickly that most Americans would be jumping up and down but too bad the costs are being siphoned from those least likely to afford this financial magic. The current meme is that you can’t go wrong with buying a home especially right now.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

44 Responses to “How Federal Reserve and banking policy is accelerating income disparity: Financial obligations ratio soars for renters while declining for homeowners. Problem is, we have less homeowners.”

Don’t worry, we can just pretend that the problem is simply due to a lack of financing and in turn we’ll extend more credit. There, I fixed it.

The artificially created housing price appreciation is done by the same sleight of hand as the rise in stocks

Manipulate supply lower (stock buybacks/inventory hold backs) and boost demand with low rates that institutional investors have access

Create asset bubbles, tell the world printing money works

Some good stuff in this article on the housing bubble (seems like more and more agree its a bubble, but the timing thing is the real issue as always)

http://www.zerohedge.com/news/2013-11-06/fitch-warns-housing-bubble-says-unsustainable-jump-leaves-home-prices-17-overvalued

And another one on our “can-do-no-wrong” Chinese overlords (who last time I checked survive based on their ability to provide corporations with relatively low wages (which is slowly changing):

http://www.zerohedge.com/news/2013-11-06/china-admits-it-has-overcapacity-bubble

It’s so obvious to anyone with a pulse.

My uncle, a mortgage broker, called the bubble last time at 40% overvalued. Earlier this year it was, again, in a bubble this time at 10%. So by now it’s a hair more, and that awfully close to the 17% number this article is calling out.

I say after a 10 to 15% drop from current levels, housing is about right in MOST areas, not all. The more suburban and flyover, the better prediction. After that, the MONTHLY PAYMENTS should remain the same but prices will move inversely to interest rates.

Obamacare does throw a monkey in the wrench though, soaking up discretionary income. No bueno.

Folks need some advice, my family combined income is 135K and I am thinking to purchase second rental house in Fresno 93722 in very good area.

Price 225 k for 2212 sq feet built in 2004 (425K in Peak in 2006-7)

Down 20% with 4.75% fixed 30 year loan and my payment is 950+propoerty tax etc.

Rent is approximatley $1500-1600

I am planning to retire in Fresno in next 15-20 year as my family lives there and I love this area. Is it smart move ? I am not sure how much I will get back in tax ride off with my income bracket.

With those #’s looks like you will probably be close to breaking even.

Need to factor other costs in: vacancy, maintenance, repairs, turnover, etc……

I would say there are better RE investments around, however, if you plan on moving there eventually it may be worth it.

93722,93720 and 93730 are about the only zip codes in Fresno I would live in. A new shopping center is being built off Herndon and Golden State blvd which should increase the value of the 93722 area. I too live in Fresno and anything south of Shaw ave. is undesirable area to live in even within the 93722 zip code.

Looks like homeownership rate has finally started to turn

http://www.bloomberg.com/news/2013-11-05/homeownership-rate-climbs-from-lowest-level-since-1995.html

The share of Americans who own their homes was 65.3 percent in the third quarter, up from 65 percent in the previous three months, the Census Bureau reported today. The prior level was the lowest since the third quarter of 1995.

As investors are stepping away from buying at great discounts families are less hesitant to buy homes. Looks like the economy is slowly turning up, and with foreclosure log clearing I would expect the rate to drift up to at least stay flat. I believe historical averages are around 65-66%. There is always a fraction of population who should not be owners.

The problem is the foreclosure log is not clearing! That’s a lie too! I lost three homes in the housing crash that are still underwater and the bank still have not foreclosed on them and they’ve had five years to do so I want nothing more for them to take the houses back so I can move on with my life! They won’t do it! Offered Deeds in lieu, went through mediations, all that crap. Banks are sitting on the houses period. There is no shortage and the foreclosure log is not diminishing. It’s ALL BS.

Lynn,

“I lost three homes in the housing crash”

“the bank still have not foreclosed on them”

I may be confused here, how did you “lose” them if they have not foreclosed on them? Did you just forget where they are? 🙂

Shadow inventory stats are public, they include all homes that are 60+ DPD. And that number has been coming down quick, and investors stepped in.

Even DHB has not published any shadow stats in a while, because he knows they are way down.

Sounds like Lynn was part of the problem. I feel sorry for people who purchased ONE home during the height of the bubble only to see its value plummet. Looks like Lynn wanted to be a RE baron and got a little greedy. These are all homes deserving people would love to own.

My advice to you Lynn: rent these properties out and collect the rent. Rent skimming is/was going on big time. 3 properties * several years of rent = lots of money in Lynn’s pocket. The bank can take their house back whenever they want to. If you can’t beat em, join em! Isn’t capitalism great. 🙂

And you have been collecting rent from tenants in them for the past 5 yrs, correct?

Cmon, don’t lie.

My guess is that the % of households in America that should be eligible to buy a home is no greater than 40-45% as the market is currently conceived. If mortgage-originating banks had to carry 100% of the risk for the life of the loan, I think that’s where the level would fall fairly rapidly.

Don’t get me wrong. This is not a moral judgement, only a financial one. Until the government gets out of the housing market, we will see no innovation in domiciles. We will see only innovation (aka “chicanery”) in financing.

The one-third of current home buyers who should not be in the market today, would not disappear into rentals forever. The middle class “dream” of home ownership would not be dead. They would drive up demand for smaller starter housing, multi-unit housing, energy-efficient housing, and manufactured housing assembled on site (rather than stick-built). Builders would meet buyer demand instead of financier demand.

Instead, we simply look for ways to shoe-horn them into overpriced vinyl villages that provide little more than the social status that comes from being able to say you don’t live in a trailer park (not that there’s anything wrong with that).

As it stands now, the government is simply propping up one of the most hidebound and lazy industries (i.e., home builders) in the country, which exists as nothing more than the front door to a financial slaughter house run by the banks.

A good case that the NAR-inspired “dream” of home ownership is bad for America. Maybe a better “dream” would be to “be competitive in the world economy”:

“The US has prioritized housing ownership, promoted by preferential tax treatment of mortgages and home ownership, subsidizing quasi-public institutions designed to deepen the ownership of real estate. In the US, there is a lower and declining public commitment towards subsidizing quality education (pre-school, primary, secondary, vocational, and tertiary levels). In contrast, Germany (42% ownership rate) does not provide public subsidies for home ownership, and has a much deeper residential rental market. Germany is also committed towards deeper support of low-cost quality education, including a well-resourced vocational education and training system, combining public and private funding, aiming at preparing blue collar workers for the challenges facing labor in the modern economy.”

I hope there’s a steady supply of cash buyers at the ready. Looks like mortgage applications are going into the cellar.

http://www.zerohedge.com/news/2013-11-06/october-mortgage-purchase-applications-collapse-decade-lows

CAE,

Looks like you’re predicting at least a couple of more years of cash buyers…

“Real estate and equities are headed higher for the next couple of years. There’s no other game in town and the banks are sounding sketchy. Might as well sink your dough into something valuable or at least paying a return. Govt debt is now in scary land and pays nothing anyway. So it’s off to the races. Only problem is that this too will run out of gas….and when it does…..BOOM BOOM, OUT GO THE LIGHTS.”

Yes, in the desirable areas, I think the cash buyer will still be showing up to buy. It’s global money that’s looking for a home. But in the less desirable areas, I think we’ll start to see the market head south within the next 12 months as those homes represent the “real economy” and are homes purchased with a mortgage, not cash.

Housing to Tank hard in 2014!!! Incomes are falling and families relying on government assistance is rising. Young people leaving college with massive debt and no jobs. Demographics of young people delaying marriage and household formation.

Jim, what are you basing your prediction on? Incomes have been falling for years, tens of millions have been on govt assistance for years now, college debt is a problem but it’s been a problem for years now, etc etc

there’s still a lack of supply, houses in the IE in CA are still 30-40% below rental parity. You can buy a 4 bed/2 bath 1300 SF for $125,000 (under $100/SF!) you cant even build homes for $100/SF and you’d have to buy the land cash…..basically what I’m saying is you can buy a house for less than the cost to build it! how can prices go any lower on the low low end of the spectrum?? I paid $125,000 for the hemet house….it’s rented for $1250/month and I got the insurance quote they put the insurance value at $180,000….I’d say that’s a good deal, and I bought it as a standard sale, not a short sale or REO. I’ve seen short sales selling for $60/SF when you cant even build for less than $140/SF

There will be 3-4 more years of increasing prices before we are in a bubble in the Inland Empire, Orange county is pretty much at rental parity right now

Yeah but there isn’t REALLY a lack of supply. In reality if all the homes in some stage of foreclosure or already foreclose,psed were suddenly on the market, they would cost fat less than cost to build based solely on the abundance of supply. That’s the reality. What we have is a fake created market and are simply stuck at the whims of the ones controlling it. We can only guess what they will do to us next. So you can still get a house for under 100.00 per sq. ft. In the IE? That is non distressed? That’s great. Here in Las Vegas we are back into the bubble land. My distressed property has an all cash offer for over 100.00 per sq. ft. And the bank turned it down, even though I already filed chap 7 BK and don’t owe them a dime. They still turned it down and sold the Note (which I owe nothing on) and now the new debt buyer Ocwen is playing games. Current offer on the table 340k for a 2900 sq ft house w roof leak and slab leak and the bank is sitting there with a Note already discharged in BK and they still haven’t grabbed this deal, ok? You tell me wtf? Lol

@CA Appraiser

I just took a stroll through Craig’s List for the Inland Empire rental offers just today Nov. 7th and, guess what, there were ONLY 2,800 properties available for a single day. You are either very lucky to have found a renter, and if they are not an imbecile, will be gone because with that kind of offer they can certainly do better. Or, you are a shill. I am betting on the latter.

OK lets get real here, and put what’s right out there. There are THREE I.E.’s that need to be differentiated.

1) Western IE (Rancho, Upland, Ontario, Claremont, Corona, Riverside). These are desirable suburban areas. Some areas have million and multi-million dollar homes, like Alta Loma and Hawarden Hills.

2) Eastern IE (San Berdoo, Hemet, Banning, Redlands, Loma Linda, Highland). Less desirable, even less jobs, but pockets of nice housing. Super commuter dependent.

3) High Desert (Victorville, et all). Nuff said.

I guarantee you all your $125k homes are not lived in by the gainfully employed or super commuters. No one wants to live in Hemet. No one with a good job wants to drive, let alone to Hemet or Banning, (although I know some do) but many prefer the nice newer and bigger homes north of the 210 for example in Rancho or Upland.

If it “costs so much to build”, than why are they still building homes for $150k in every state but CA?

The builders are saying that still cannot build and make a profit because the ‘areas’ where they can now build housing tracts are not selling for enough for them to break even.

This is the bifurcation of the US economy. There’s the very wealthy from around the world and locally wanting top real estate, and then there’s the average US employee. Notice how many coastal areas and highly desirable areas are now back at or very close to 2005 prices!

And the 800 pound guerrilla in the room is forced healthcare insurance and disposable income tanking. Most of the non-insured will just pay the penalty the first year but the second year the penalties go up.

Less Disposable income means less money for everybody on Main St.

As for the Household Financial Obligations Chart – Renters vs. Homeowners: Renters tend to live for today and not tomorrow. All of my friends that are renters are driving Beamers/Mercedes and Caddies… while those of us that own drive POS old cars that are paid for. After such a great opportunity to buy just passed, if you didn’t buy it’s because you couldn’t qualify for a loan or had no cash — signs of carrying too much debt and crappy credit scores. (Live for today, take government assistance tomorrow.)

INO — It’s a lot more complicated then just saying the cost of living is going up for renters. Where I live, there is a rental glut from all of the investors buying up everything and turning them into rentals. No shortage of rentals available and the cost to lease something has only gone down. Mo’ money for new Beamers… which is why the car dealers are having a banner year and back to pre great recession levels.

Fed poor QE velocity … and they blame it on tight lending standards

Fed’s Pianalto: Tight mortgage credit standards will continue to hold back the housing sector and broader economy

http://www.clevelandfed.org/For_the_Public/News_and_Media/Speeches/2013/Pianalto_20131106b.cfm

My counter to the Federal Reserve thesis on tight lending standards on Bloomberg Financial … tight lending is a myth

http://loganmohtashami.com/2013/03/27/will-be-on-bloomberg-financial-talking-about-bernankes-myth-on-tight-lending-standards-the-real-housing-story/

QE is all about saving the owners of long term treasuries and MBS’s. It does not do anything for the real economy. It rescues the bond market and institutions/banks holding all that crap MBS’s. So, as always, the Fed is the enabler of it’s masters…the banks and the Federal govt. That’s it. Full stop.

Who are the “investors” going to sell to when there is no income? Actually it’s not even about income as much as it is about the number of jobs. If that number drops, look out!

How can there be a housing shortage? That would mean there would be a lot of people walking the streets needing a home. There’s no shortage. It’s just shuffling the same homes among the haves and have-nots. What the haves don’t realize is that when the have-nots quit paying or can’t pay that the Haves won’t have a supply of people to rent to.

I do believe much of Southern California could stand being torn down and rebuilt to better neighborhoods. We don’t have a shortage of land here. But we really have a shortage safe areas and that’s what drives safe areas prices up.

forced health care i believe will make home buying a little less stressful for some.the fear of losing one’s home by illness is eliminated.

Wow that is one of the dumbest statements ever. You are one of the true believers which means you are to stupid to understand what is going on in the world. So STFU the adults are having a conversation.

This is a good example of the kinds of comments that lead me not to even bother coming here much anymore.

Do respectable adults attack and post nasty anonymous comments to other people using internet abbreviated swear words? I mean really?

Obamacare will just significantly decrease the disposal income and savings rate of the middle class. The effect will be less housing affordability for the middle class.

That is 100% FACT – it does not matter if you believe it or not.

The most desirable places will not be affected because the middle class could not buy anything there for the last 2 decades. With or without middle class savings nothing is going to change.

Obamacare + the revamping of Fed Flood Ins. Program means I get to sell a little property I have on the east coast which I bought around 2001, which means I’ll be taking a 40% haircut presently. Then I get to reinvest that money in dividend growth junk that I’m stuck buying at a premium in order to get enough dividend money coming in to cover my new Obama health tax. I’ll probably deploy over a 12 month period hoping the QE pull in March will push some stuff out of premium land. This then means I can’t reinvest those dividends and gain any compounding over the next 30 years which then screws me out of a few hundred thousand at retirement.

I still don’t get health insurance, but I end up paying a tax to subsidize some other low income family’s insurance who decided to have two kids they couldn’t afford, or some 50 year old secretary who hasn’t exercised or eaten healthy a day in their life and has been overtaken with high blood pressure and diabetes because of it.

I’d be willing to commit to a single payer system like Canada or Europe where the cost of healthcare per GDP is lower. But this Obamacare thing is not good for me at all.

Who knows, maybe the market will crash and I can get in cheap enough that my dividends will allow me to afford the actual bronze plan….

ha! We’re aiming high with the bronze too. Lived in Australia and Canada and trust me, everyone is missing out here. We’re lucky to have a retired FIL who is cashed up and will subsidize the increase in our health insurance costs. Won’t help us buy a house though. Frustrating hearing about rich parents helping kids buy. We got one of those tea party types who ‘has his’ and worked damn hard for it and so should everyone else. Lucky us.

My eyes see this story. Housing prices increased due to the Fed easy money and fannie and freddy 3 1/2% intererst. The game is this, as housing prices rise so does property tax. This benefits local governments. They will do almost anything to keep this game going, again i say anything. The money being pumped out will barely keep pace with the money being pumped in due to the rise in property tax increases. Does the right hand give to the left?

At some point this will collapse, but who know when. I have sat on the sidelines with about 500k drawing .08 for too long.

You should have just bought a house 2 or 3 years ago people.

Glad I got mine last year at 4% interest rate. I’m even one of those dirty lazy millineals everyone is talking about that’s not supposed to be able to buy a house, but I did anyway.

Next try defying the stereotypes of being smug and self-centered.

Agreed. Longcat is one of those types of people I avoid. Seriously, how old is he/she, six? And I say that without any trace of envy – we own a house. We certainly don’t rub it in the faces of those who were not in a position three years ago to buy.

Great! Where?

To give some perspective to how crazy the US is in terms of regional disparity:

Nice, ten year old house in planned community in very good condition for $54 dollars a foot, not REO or short sale. But, in the poorest city in the country. If this does not fit a third world profile, I don’t know what does.

http://www.trulia.com/property/1081327442-2784-Woodside-Brownsville-TX-78526#photo-19

What do you mean by “does not fit a third world profile”?

Please read the second clause of the sentence. “If this does not” followed by “I don’t know what does” indicates affirmation.

>>> Not hard to do when a large portion of the market is coming from the investor crowd. <<<

All these cash purchases, including Asian money; isn't there going to come a time when the banks, in healthier financial positions, are going to want to lend. Houses owned outright, at toppy values like $750,000 are little use to the banks overall. It's an asset they're not getting any return on. Someone's 100% equity in a house, denying the banks their right to lend on these owned outright houses. The banks want to drive the market down, and sellers will sell for lower prices at the margin, driving down the values for everyone who owns outright. Then banks provide mortgages to millions millions of people wanting to borrow to buy houses at say 40-50% of what they're currently valued on the back of QE ect. 30 year mortgages on a house that's halved in value, over 30 years at 5%+ mortgage rate, is a fat return for the lending bank.

the home ownership rate is RETURNING to historical levels where only responsible people were home owners. This is all good. Someday, the investor bought homes for rental, will go onto the housing market when they find out that being a landlord is not a good experience, especially for the small time landlord that has a personality that wants to be loved. Nobody likes landlords anymore than bankers. Be a pastor, if you want to be loved.

Leave a Reply