Fannie Mae and Wells Fargo Announce Creative Mortgage Solutions: A New Thing Called Renting. Option ARM Scenarios, Lease for Deed, and Delaying the Financial Future.

Last week, foreclosure Hall of Fame member and government stepchild Fannie Mae announced a stunning $18.9 billion loss. Remember last year when we were told that bailing out the enormous Government Sponsored Entities that we would be turning a profit? Well that didn’t exactly pan out and both Fannie Mae and Freddie Mac have been a vortex for taxpayer money. With that said, Fannie Mae announced a “lease for deed†program that will essentially convert struggling homeowners to that feared word, renters. In the same week after Attorney General Jerry Brown sent his letter to the top option ARM wheelers and dealers in California, Wells Fargo came out with its ingenious solution. Wells Fargo has decided, at least as it stands, to convert their Pick-A-Pay option ARMs into glorious interest only loans for periods of six to ten years.

The fascinating thing about the Fannie Mae initiative and the Wells Fargo program is that homeowners are converted to renters. Think about it. In the case of Fannie Mae, you explicitly sign over the deed to the organization and sign onto a yearly lease like 50 percent of California renters. Not uncommon but will people be able to cover the monthly rental rate? They are planning on going with a market rental rate but as we all know, rents are going lower in a financial limbo. Any short fall is going to be covered by the taxpayer (yet again). Why not take back the home, sell it for market value and allow the current borrowers to find a rental that is more affordable? With the Fannie Mae plan, I’m not sure how many people will take this up.

Wells Fargo – From Option ARM to Interest Only

The Wells Fargo plan is another beast altogether:

“(WSJ) Wells Fargo & Co.’s strategy for modifying troubled Pick-A-Pay mortgages looks like a game of kick-the-can-down-the-road.

The fourth-largest U.S. bank by assets holds about $107 billion in debt tied to option adjustable-rate mortgages, a relic of the U.S. housing boom that allowed borrowers to make small monthly payments in return for increasing their mortgage balance. Many such borrowers now own homes worth far less than they owe in mortgage debt, and most can’t afford a full monthly payment that pays down the loan’s principal.

To solve that conundrum, Wells Fargo is taking a gamble: The San Francisco company is issuing thousands of interest-only loans that will defer borrowers’ balances for as long as six to 10 years.â€

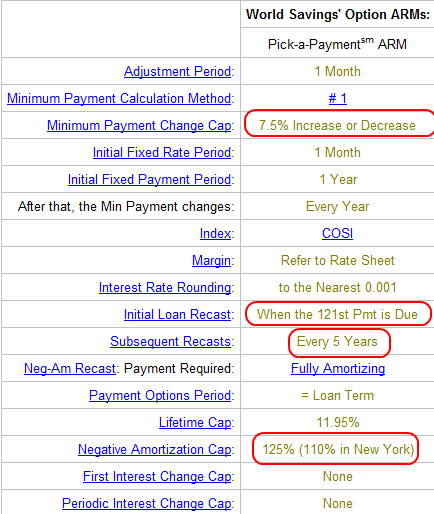

Now let us run a scenario on why this won’t work. First we need to look at how the Pick-A-Pay mortgages acquired from World Savings are structured:

Source:Â Mortgage-X

Wells Fargo didn’t make these loans. These were acquired when genius Wachovia decided to purchase toxic lender Golden West at the height of the financial speculation orgy. That doomed Wachovia. But here we are nearing 2010 and the option ARMs are still sitting there exploding because of the above worst case scenarios. Wells Fargo is jumping ahead of this because many of these loans are hitting negative recast ceilings. That is, 80 to 90 percent of option ARM borrowers went with the minimum payment option that didn’t even cover interest. Each month, additional principal was added to the overall balance. That is why even when people talked about “well that is different for Wells Fargo, they have the Pick-a-Pay based on a 10 year model†it didn’t really matter because of the recast ceiling. Like I have said with option ARMs, no one really cares about the time because the negative recast window was going to hit much quicker than the actual 10 year mark. In fact, 45 percent of the option ARMs are now 30+ days late.

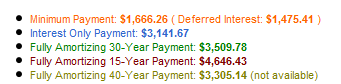

Take a look at a $500,000 option ARM example:

Here is where it becomes obvious why these mortgages were going to fail. Borrowers had four payment options:

-1.       30 year fixed payment (principal and interest)

-2.      15 year fixed payment (principal and interest)

-3.       Interest only payment (aka renting)

-4.       Minimum payment (negative amortization – 80 to 90 percent of borrowers went with this option)

So most of these loans are doomed. But look at by how much the loan was growing each month with the minimum payment:

Interest only ($3,141) – Minimum Payment ($1,666) = $1,475 tacked on to the balance each month (at least)

That is why I wouldn’t jump on the bandwagon that this is a success already. That minimum payment was so low, that it may be less than the current market rental rate. And as you can see, the difference between the minimum payment and interest only payment is enormous. And look at it this way. Say you bought a home with an option ARM for $500,000. You were making that minimum $1,666 payment each month. Since you paid the minimum your balance might be at $550,000 to $575,000 depending on the index being used to calculate your loan. Yet your home is now worth only $250,000 or $300,000. What is the interest only portion of a $500,000 mortgage?

$500,000 30 year interest only portion @ 5.5% = Â Â Â Â Â Â Â $2,291

$500,000 30 year interest only portion @ 4% =Â Â Â Â Â Â Â Â Â Â Â $1,666

Now that is a familiar number. Keep in mind Wells Fargo would have to write-down that additional balance growth because they have been calculating that into their revenue thus far. Even with this move on these option ARMs, major losses will be taken in. The question is, will people want to be renters for six to ten years in these homes? I doubt this will be a major success for three primary reasons:

-1. Strategic defaulters – many bought these places as step-up homes in California. They never intended on living here for 5, 10, or 15 years. It was merely a way to get equity to buy that other McMansion. Since 58% of option ARMs are here in California, this is largely a bubble state phenomenon. For someone to sign onto this, they will basically become renters since they are not building equity and the only real winner is Wells Fargo because they can still claim that the home is worth $500,000 even though the reality is much different.

-2. Rents are dropping – Keep in mind that many of the minimum payments were lower than rents. So even with the interest only loan, many will opt not to stay in their place because they can find a cheaper rental. We know that 80+ percent of these mortgages were stated income. Many are defaulting because people didn’t have the money to begin with. Many won’t be able to prove that they can even afford the interest only payment without a writedown to market value. But at that point, Wells Fargo can just foreclose and sell the home and be done with it.

-3. High Unemployment – California now has an unemployment rate of 12.2. percent and an underemployment rate of 22 percent. Many people will lose their home no matter what is done because of the economy. In fact, we are hearing stories of people moving back home with parents, doubling up, or other novel ways to make ends meet. It is much too optimistic that Wells Fargo believes a large portion of their Pick-a-Pay borrowers will stay just because they are now on an interest only schedule.

Fannie Mae Solution – Become a Renter

Fannie Mae is losing money like a drunken gambler in Vegas. The best analogy I can think of for the current bailout structure is this. You have a gambler that is told, if you win you get to keep all the winnings but if you lose, the house will cover you completely. So if this gambler hits a losing streak, wouldn’t they just double down to recoup losses quicker to make up for the past? After all, the house is assuring that they won’t lose. Welcome to modern day Wall Street.

Fannie Mae after reporting a quarterly loss of $18.9 billion has the chutzpah to ask the government for $15 billion in additional funds. We already own Fannie Mae, so this is like having a schizophrenic talk with yourself and answering your own question. There is madness in the current government structure.

The new “idea†for Fannie Mae is a Lease-for-Deed program. In other words, after two years of trillion dollar bailouts and failed plan after failed plan, Fannie Mae has come up with a wonderful plan. “Hey, since these homeowners can’t afford to own these homes because our underwriting is less than Kosher, how about we do something that is completely unheard of in the modern era. Let us do this thing called renting!â€Â This is basically the plan:

“WASHINGTON – Can’t pay the mortgage? You still might be able to stay in your home. Government-controlled mortgage company Fannie Mae is going to give borrowers on the verge of foreclosure the option of renting their homes for a year.

The change announced Thursday could give a temporary break to thousands of homeowners, but critics question whether it will only add to the mushrooming losses at the company, which has received billions in taxpayer money.

The new “Deed for Lease” program will allow homeowners to transfer title to Fannie Mae and sign a one-year lease, with potential month-to-month extensions after that. It also helps save money because the lender does not need to complete the often lengthy and time-consuming foreclosure process.â€

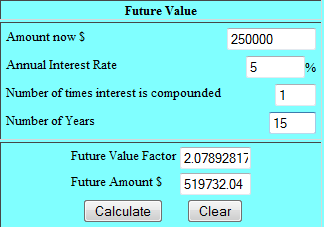

What does the Fannie Mae and Wells Fargo plans have in common? They are both methods to fluff the foreclosure numbers temporarily. Think about this. Each plan is temporary and both are betting on a quick housing recovery. Let us use that $500,000 option ARM mortgage on a home valued at $250,000. How long will it take to reach $500,000 assuming a 5% annual appreciation rate?

15 full years at 5 percent annual appreciation! Keep in mind that since the recession started, the CPI is running at negative or close to zero. So the borrower that elects to do this after 15 years, might be lucky enough to walk away from their home with no equity. The only winner is really Wells Fargo. There are plenty of rentals on the market right now for excellent prices. It will be interesting to see what other lenders do here in California.

Yet the Fannie Mae plan converts homeowners to renters. The deed is given over to Fannie Mae. Will people want to do this? Hard to say. The data so far isn’t encouraging:

“In the first nine months of the year, Fannie Mae took ownership of nearly 2,000 properties through a process known as a deed-in-lieu of foreclosure. That pales in comparison to the 90,000 foreclosed properties the company repossessed in the period.â€

Now these are actual foreclosures. That is a “deed-in-lieu†is essentially handing over your rights to the property to the lender. If stats like this go with the lease for deed program, it will be another failure.

Glad our bailout money is being used for creative and innovative ideas. After all the talk and trillions funneled into the abyss, the answer now looks to boil down to renting.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

28 Responses to “Fannie Mae and Wells Fargo Announce Creative Mortgage Solutions: A New Thing Called Renting. Option ARM Scenarios, Lease for Deed, and Delaying the Financial Future.”

OK, 2 things on the lease for deed B.S.

1) After the year is up and the pervious owner/current renter is now free and clear – no credit dings I assume? The renter can now go out and buy a new house – better house for less money and Auntie Fannie is still stuck with the house. What do they do now? Keep holding it? Find another renter? Put it on the market like an every day shmo?

2) Let’s suppose the previous owner/current renter, for whatever reason, just decides to keep renting *forever*, let’s face it time gets away from us. Anyway so the renter stay there for years – 5 – 10… who knows, and the market by them has (at least started) to correct and Auntie Fannie wants to sell? At least in L.A. we have laws that protect renters from just being evicted (unless the don’t pay rent or break the law in some way, drugs, etc). My point is, how is Anutie going to get these people out?

what a fricken mess, huh?

IS THEIR ANYTHING THE GOVERNMT. WONT DO TO KEEP THESE HOUSE PRICES UP? WHAT ABOUT CONCENTRATING STRICTLY ON CREATING JOBS. THATS WHAT DRIVES THE MARKET…RIGHT? WITH UNEMPLOYMENT AT 12% IN CALIFORNIA, WHO HAS MONEY TO BUY A HOME? OR KEEP A HOME.

1) “The fascinating thing about the Fannie Mae initiative and the Wells Fargo program is that homeowners are converted to renters.” Hey, my garbage disposal just broke. Somebody please call Fannie and have them fix it. They are the landlords, aren’t they?

2) If they will not evict people for not paying their mortgage, are they going to evict people for not paying their rent? Good luck!

3) The 2010 elections will be over in one year, and the lease is one year. Am I being too cynical?

I tend to agree with the Dr. that the Fannie Mae rental solution won’t work out, at least in CA.

On the other hand I think the Wells Fargo trick will appeal directly to the speculator in all our Option Arm gamblers. Currently none of them believe they will be able to make a payment once their old loan recasts and they have to pay principle and interest, but a new “interest only” loan? Sure lots of people are losing their jobs but there are still a lot of people holding those ARM’s that can hold on and make the interest only payment. Most of those people knew they wouldn’t be able to hold on until the market comes back making their former full payments. Now they will be paying a larger full interest payment but that will still let them live in a house much nicer, (we hope) then a rental and it gives them a chance to wait for the market to come back.

I agree with the Dr. that kicking the can down the road 1-2 years is pointless, but how about 6-10 years? If the housing roller coaster in CA keeps rolling then prices just might be back into the stratosphere by then. At least that’s what the banks would hope.

The FM program has two kickers:

>>

(1) The rent (set by reference to the ‘Fair Market Rental’ schedules of HUD) can not be more than 31% of the household’s gross income. If the FMR is more than 31% of the household’s gross income, no deal and the house goes through foreclosures.

>>

(2) After 1 year of renting it back to the former owner/defaulting borrower, FM puts it on the market. That is why after 1 year it goes to a month-y-month lease.

The funny thing is that at the same time these “owners” are being turned to renters. People like my self who want to become home owners are being forced to continue renting, because the all knowing all caring Gov. wants to keep housing prices in California high.

The crazy disconnected state we are in, here in So Cal home prices are going up almost as fast as unemployment is. Wall St. and NAR have called the bottom on real estate yet congress voted in and expanded the stimulus to real estate. Dead beat borrowers allowed to live 6 -12 months with out making any payments. then allowed to become renters.

I am truely almost beside myself, having to compete with these people for housing, then when they default, they still get the upper hand. God bless the politicians and the banks for shafting truely responsible who refuse to live beyond their means.

Long live over priced housing, and the dead beats who defaulted.

I have been out looking at houses and my opinion is changing. Prices in many san Diego zip codes are rising quickly and approching price peak, except perhaps in the “barrios”.

All of the programs cumulatively seem to be making Real Estate Speculators quite rich.

Dumps picked up last fall for 325K are now going for 600K all over central San Diego.

“The data so far isn’t encouraging”

I would have to imagine it’s because not many know about this program. I am in the property management industry and just heard about this program the other day so I doubt homeowners in the foreclosure process are aware of it.

With the word getting out on this program, I would imagine the data would change.

Government doesn’t create jobs. The private sector creates jobs. The fake government jobs are simply shrinking the private sector, thus increasing the unemployment rate all while claiming they are ‘creating’ jobs. Notice that most of the claimed jobs are govt jobs or temporary construction work. This will not bring the housing market back. Wishful thinking does not make wishes come true. The govt bureaucrats should get real and stop the fantasies.

What is going on? Home prices in North Orange County are increasing, so-so homes are getting bought out by corporations who then re-model the home and turnaround to sell if for more than $80K. I’ve seen this 7 times already. An offer of $320 was not accepted however the house sold for $285K. 2 months later it’s back on the market for $420K?! Unemployment is high, the economy is stagnant, and yet a home for $320K is wishful thinking? Geez….

The only possible response to this proposal to repossess the home and then rent it back to the ex-homeowner is……

Huh??

In the San Francisco area, ANY house under $500,000. will have a bidding war.

Houses in the $500,000 to $700,000. range usually sell in 2 weeks or less.

It is only above $700K that you see homes sitting on the market.

The tax credit, loans from local government, and “down payment assistance” means you can still buy a house with zero down.

No wonder the last few months have been a feeding frenzy.

Most of us who read this site are cursed with common sense. Due to our common sense we are now in a position where we can only hope the latest massive bubble that began building 10 months ago collapses all the way down to last falls prices.

It is looking less and less likely.

The Government is working tirelessly against us. They can mint money without limit to fight the Prudent, to screw the Prudent.

This is really making me sick.

I looked at a house in February that I could have paid cash for in that was a Cream Puff, now my cash can only buy a Dump I wouldn’t be caught dead in. The area I am looking at has jumped 20% since Feb.

“I closed on a home last week and it’s already appreciated over 70,000.00.” -overheard in LA.

????

Unquestionably, those “homeowners” who are now allowed to become renters, will be paying lower rents on their house than those of us who might want to rent a house now would pay. Almost incredibly, the people who run our country have found another way to punish the people who didn’t buy into the housing bubble. And yet, rest assured, we are the citizens whom the government is relying on to bring the country out of the recession. How will we do this? By paying the inevitably higher taxes which will be necessary to pay for all these bailouts and programs. By being stupid enough to finally enter the rigged housing market, paying the inflated house prices, buying them from the banks which will have been allowed to overstate the real value of the home through these insidious schemes. By taking our money out of the banks, since it earns nothing there anyway, and contributing to the last stock market bubble. And by not getting too upset at the bubble sharks who were after all only trying to get rich without risking anything, and who now need our help to be able to stay in the nice houses that they could not afford in the first place.

Besides being furious about all this, along with the rest of you, I am trying to think of a proper response. I guess I will not buy a house for a while. Not that I could not afford one, but I absolutely refuse to bail out the banks and the people who thought it was so clever and wonderful that they had found a neverending cash machine, while the rest of us were just too cautious to get in on the fun. So these people can sit in their houses as renters, and let’s see if they put one cent into refurbishing or upgrading their houses, or even keeping them up. And let’s see whole blocks become rundown and zombified, as the “renters” can’t sell, and the rest of us refuse to buy at inflated prices. And just maybe the current group of responsible owners, who are so thrilled that the government will be keeping their house prices up, will find that not many are interested in buying at those prices, particularly when adjoining houses are falling into disrepair, because they are being rented by people who do not have the money or the interest in keeping up someone else’s house, and yet who are fixed there like ghosts. I can wait another three years to watch all of this. I refuse to be the sucker in the ponzi scheme that they are continuing to play.

If none of this interference had occurred, housing prices would have inevitably retreated to reasonable, maybe even pre-bubble levels, as they should have. Responsible people who were saving for just that to occur, would then come in to replace the wave of quick-profit, scamming bubble buyers, and the responsible people would have paid 20% down, and would have honored their mortgages. But that would have cost the banks a lot of money; and making sure that the banks are immensely profitable seems to be the number one goal of both political parties. None of us even get to vote on these inane measures, the government just does them, “for the good of us (the banks) all.” Well, for whatever it is worth, I will make sure that any holiday shopping I do this year is only going to be for the very important people in my life. It may be spiteful, it may even be short-sighted, but I am looking forward to a very bad holiday retail season.

Prop 13, ladies and gents. I’m not absolutely sure, but it seems like CA’s housing costs disconnected from the rest of the country’s median trend back when this Prop hit the books. The premium will always be there. But there is still a price trend within So Cal that you can see on many of the Dr’s. graphs. And prices will correct back down to that trend line at some point, down to the 1999’sh number + inflation at about 3%. His point is that the longer the prices are artificially inflated, the bigger the correction will probably dip below the trend line for longer period because no matter what is done to prop up prices, without paying jobs, people can’t pay rent or mortgage. And those people will not be finding jobs anytime soon. I have many lawyer friends who were making well into six figures that have not worked in a year and have no prospects. It is going to get very ugly next year. And winter of 2011, for sale signs will be everywhere. There will be three banks, and they won’t be giving money to anyone with a credit score under 760. Look for foreign investments and stay there for the next year or so. Smart companies are going to invest in places where they can exploit the labor force/resources to maximize profits (basically steal from them). Those companies will make big profits. Ride their stock price up, then sell and buy a nice house cheap.

Is Fannie going to be paying property taxes? There may be hope for that municipal budget after all…

Fannie Mae – will they really kick anyone out – ever?

Wells Fargo – Put the loan in place on the promise of the housing gambler living there and then sell the note to the FED. Has the FED foreclosed on anyone? Do they know what’s happening to their collateral? Do they care?

Prices in SOCA up 20%? Are you shitting me? Really?

You can’t tell me that this bubble is going to reinflate….

A lot of commenters are talking about CA home prices rocketing back up. Sounds like a market head fake to me. Not that it’s not happening -just that it can’t be sustained. They key word is “speculation”. When owning is so much more expensive than renting (and it still is), the main rationale for buying is appreciation. But appreciation isn’t assured merely by people hoping for appreciation. In 2000, after the Nasdaq dropped from 5,000 to 3,000 it rallied back to almost 4,400 just because people assumed it would “go back up”. A lot of people still assume home values will “go back up”. A few more waves of home depreciation will disabuse them of that assuredness. Only when the common expectation has changed from “it’ll go back up” to “it’s not going to go to back up” will it be a good time to buy. Keep renting for a few more years. You won’t be sorry.

Brian T. —- Prop 13 was a result of the ability of California housing to ramp up. The re-assessing of homes was literally forcing owners out of them due to rising prices. Not as you might have suggested. Out of state residents just don’t understand why we have that on our books. Face it …. it’s the best weather in the country by far. It attracts lots of people and always has. The competition for homes in good areas is unlike any other state. If you don’t learn that you will never know when it is a good time to buy. That, unfortunately, has already passed. Start chasing the market from here and learn this simple lesson for your future investing strategies.

Looking back—I concur with your statements. Hard as it is to believe, one will find brutal competition to purchase a house in a quality neighborhood in California. Many of those competitors come from China or India where a 1200 sq. ft. townhouse in one of their good areas will cost 700K and higher and will have hundreds, sometimes thousands of perspective buyers look at a listing in one week in those countries. Just bullshitting around the campfire waiting for a great house for a song drop in your lap isn’t going to happen.

I am a Realtor and sold a fixer REO to young man in 2008 for $155K. He referred a friend to me who wants to get be ahomeowner,too and get out of the renter rat race. Another REO came up for sale for $215K about 8 doors down the street last week. It was in a little nicer condition and had an added family room. We went to see it and there were 2 cars of buyers leaving when we pulled up, one unloading and before we walked to the front door, another pulled up and came up to see it. As we left, another agent with clients came in to see it. Demand for homes is high – inventory is artificially low. That is why a home is 40% higher this year over last on the same street. This “deed for lease” idiocy spits in the face of the American dream of home ownership. We have people ready and willing to buy who have jobs and were smart to sit it out when the houses were twice as much. Let’s stop bailing out the banks so they lower their non-performing inventories like any businessman would. They should take the losses now and get back to reality.

What if we understood that foreclosure is more about the recovery process than destruction? If the banks were allowed to process the foreclosures there would be a true floor established. Do you realize that over 40% of modified mortgages from the first Qtr 09 have already suffered late payments? How about the idea that by the time a foreclosure is completed, there hasn’t been a payment made in over a year. Now somebody sitting at a desk thinks that GSEs playing landlord looks good on paper. These are the same guys who said that housing will have a smooth landing.

Will the banks include in the amount of monthly rent, the HOA monthly fees, property taxes on appraised value at time of purchase which happens to be 50% higher than today’s appraised value, and PMI? All of this added up is more than some folks today can afford, especially if they are now unemployed, and not receiving any unemployment monthly benefits. I think this is just another government stall act, as they don’t want the real numbers out there for the public to see how many folks are reallly in deep, deep waters on their mortgages. And who are the banks that are doing this, the big ones that gobbled up all the smaller banks, along with that came the toxic loans.

I have been in the industry for over 35 years, and the banks brought this on themselves with their creative ideas of liar loans, no income verify, no job verify, no asset verify, in other words, if you could fog a mirror you got the loan. By the way, I am no longer doing mortgages as all the wholesale lenders pulled out of the market, as if it was our fault. I never once did a loan that I personally did not verify the assets and income, that was an old habit I never dropped, and to this day all my clients are still in their homes making their payments as they could really afford it!!!

Waaaaahhhh!!!! Waaaaaaahhhh!!!! All I hear is crying how people who defaulted are “deadbeats” and how they get such wonderful terms and rates on housing.

There is *NOTHING* holding all you whiners back from purchasing a new, over-priced home. You too can get in, lose your 10-20% down, be upside down, and then default…ruin your credit, risk losing the home you bought….BUT, hey man, you will get the deal bro……those deadbeats have life sooo good.

If it’s all that, then everyone here should be doing the same thing.

Banksters started this bubble fraud, and the government just keeps giving them OUR money to subsidize. Everyone takes it in the arse on this one, EXCEPT the banksters, they get paid on both sides. It’s time for a revolution.

6-12 months? Where have you been, Greg in LA? It’s now at least 12-18 months. I read several “sob” stories where the poor, downtrodden, victim of a homedebtor hasn’t paid a cent since early ’08, like Jan or Feb.

Jo, true that gov’t doesn’t create jobs, but it can *help* create jobs by reducing red tape and lowering taxes and minimum wages.

Not that it will, but it can.

Leave a Reply to looking back