Exporting the U.S. housing bubble – Japan and China real estate bubbles provide a fascinating example of what occurs with currency intervention and quantitative easing. If Ireland implodes with a similar U.S. housing market what does that mean domestically?

One of the arguments made about quantitative easing is that it will somehow cause strong inflation and thus cause home prices to move up. Why? The argument follows the logic that the roundabout way the Federal Reserve is printing money will somehow result in consumer inflation and thus push home values up as well. To that, we can point to quantitative easing part one (QEI) and see that U.S. property values clearly did not appreciate with $1.75 trillion of Fed intervention. Why are we to believe another $600 billion will do anything different from the first round? People will say that all this money had to go somewhere and that is true. Much of it went to repair the balance sheet of insolvent banks but has also become hot money around the world. Just because the housing bubble has popped here doesn’t mean it isn’t raging elsewhere in the world. The housing bubbles of Japan in the 1980s and the current China housing bubble give us an interesting look at the aftermath of bursting bubbles, currency intervention, and quantitative easing.

Japan real estate bubble

For those of you who remember Japan was offering stiff competition on a global scale in the 1980s and many pundits in the U.S. would make frequent statements that Japan would soon eclipse the U.S. as the biggest economy. The U.S. argued that the Yen was too strong and that Japan had to appreciate their currency. Here is how things played out:

“(Vox) The Japanese property price started to increase with strong fundamentals and financial deregulation in the mid-1980s. In the beginning (say, 1984 to mid-1987), property price increases seemed reasonable and well-justified with strong macro fundamentals. Real demand came from a few booming sectors, like newly deregulated financial services. Foreign investors were interested in Japanese assets including stocks and real estate. Monetary policy remained very lax (i.e., the official discount rate being 2.5%, a record low at the time) from mid-1987 to mid-1989. Both stock prices and land prices kept rising, partly helped by the low interest rate. However, some time later (mid-1987 to end-89), the process became a bubble – that is, people invest in the property only to aim at capital gains. A leverage ratio became higher in pursuit of higher yields and as banks became more confident that the value of collateral would continue rising.â€

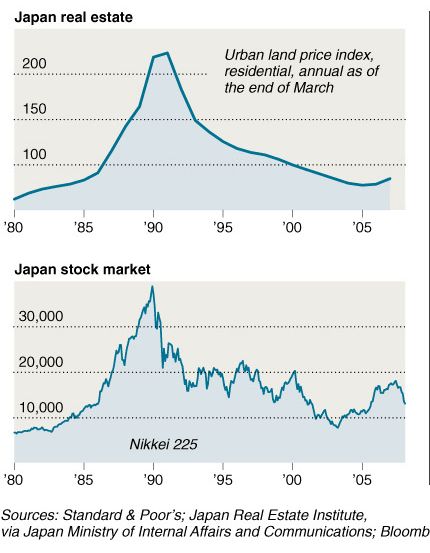

Here is the housing bubble expanding and bursting in Japan:

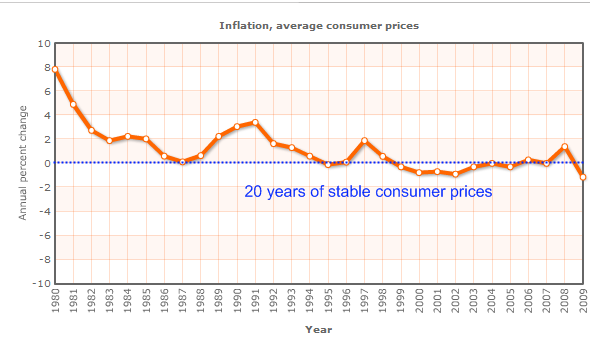

The bubble eventually burst and the Bank of Japan went into their own quantitative easing similar in scope to what the Federal Reserve is currently undergoing. Japan protected its banks and many became “zombies†just like many of our large banks. Few of the big banks were allowed to fail and were propped up by the central bank. An inordinate amount of money was pumped into the banking system and clearly property prices did not rise as the chart above will show. In fact, overall inflation moved sideways:

How can this be? With global currency markets banks can use certain currencies (i.e., the Yen) to speculate in other markets (i.e., U.S. tech bubble in the 1990s). So inflation doesn’t necessarily mean it will be domestic. Are we seeing wages surge up? And with Japan, wages at the time were more in line with those in the U.S. but how do you compete with a country where workers make one tenth of what they would in the U.S.? No amount of quantitative easing can fix that imbalance without serious pain somewhere. That is why when we look at the China housing bubble there is a good sense of where the U.S. quantitative easing is heading:

“Many of our Chinese friends who live in Shanghai and Beijing are telling us that the property inflation rate exceeds 50% – and 100% in some areas. Available housing for a young couple is far from downtown, closer to one-hour commuting distance, and still more than ten times the average salary. There are also reports that the state government is borrowing with “protected†forest land as collateral (Dyer 2010). However, these stories do not match the Chinese official data (National Bureau of Statistics of China 2010a). The Chinese official statistics say that the average increase (year-on-year) in property prices was 10.7% in February. The increase is accelerating from a year-on-year rise of 9.5% in January.â€

There is no doubt that China is experiencing a housing bubble. The question of course is how badly will it end when it bursts? It seems however that China is looking to Japan’s experiencing as a way of moving forward:

“Many Chinese officials tell us that they believe the origin of Japan’s 20-year stagnation after its housing bubble burst lies in its failure to stand up to US pressure for the yen to appreciate. They cite this presumption as one of the reasons why they resist US pressure to allow the renminbi to appreciate. What is the logic behind this?

* The US pressure to appreciate the yen made the bubble size bigger;

* The US pressure to appreciate the yen made economic slump from bursting bubble worse; and

* The US pressure to appreciate the yen made the Japanese export sector to lose competitiveness that caused the 20-year decline.â€

Now this seems to be the arguments put on China at the moment by the U.S. Treasury and Federal Reserve. There is no doubt that the first and ultimate goal of the Federal Reserve is to smack the dollar lower. In other words, your standard of living will fall. Each dollar you are paid with is going to be worth less and less if the Fed gets its way. As Japan realized, quantitative easing did not revive their national economy and it definitely did not bring their housing bubble back. Just look around your own home and see where most of the items you buy come from. If your dollar has less purchasing power abroad, what will that do? It would seem that inflation will happen but what if other countries also devalue their currencies at the same time? At the moment, that seems to be the path many countries are going.

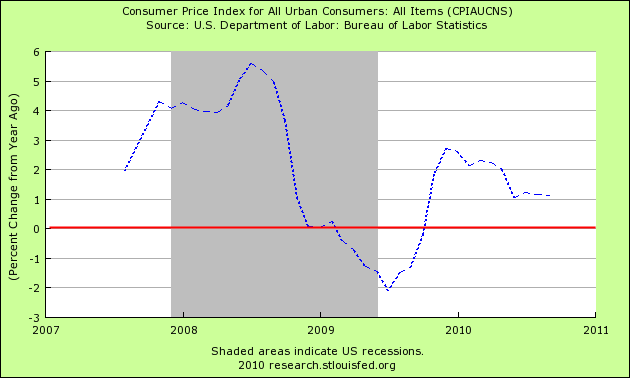

Now the Fed has already embarked on nearly $2 trillion of quantitative easing. What has this done to inflation since the recession hit in 2007?

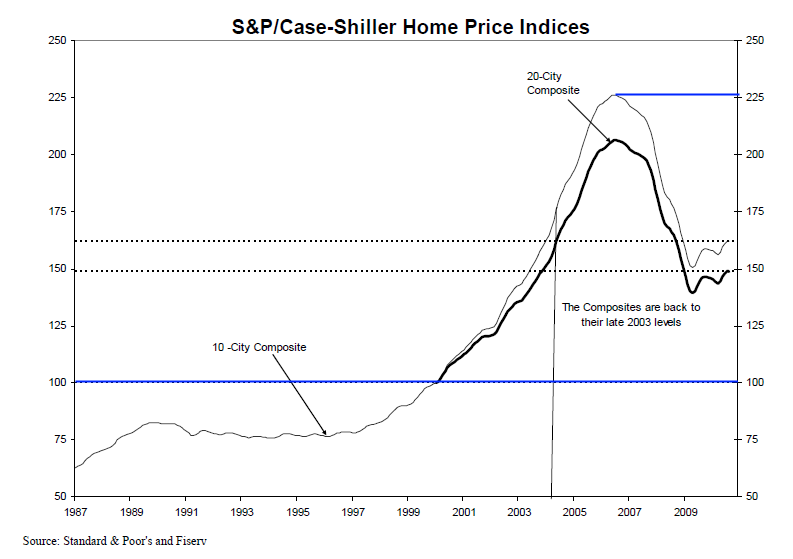

It looks like the Fed intervention has taken some of the edge off of the deflation caused by asset price destruction. But where is the massive spike up in inflation because of QEI and QEII? The issue of course is that people are looking domestically while all these funds have shifted into the hands of big banks that are now chasing hot money around the world. One location is in China real estate. I’m sure there are many markets like this but they are not here domestically. Why? Well how are Americans who are paid in U.S. dollars (a currency being pushed lower by our own central bank) going to pay for homes with a depreciating currency? The logical thing would be to expect that home prices would move lower as the standard of living in the U.S. falls. This is actually the case when we look at U.S. housing values:

Doesn’t seem like QEI did much to getting us close to peak prices. In fact, the moderation that we recently saw was fueled by loan modification programs, forced low interest rates, ignoring delinquent borrowers, and additional tax breaks. But now that the market has priced that in, home values are moving lower again although not as quickly to reflect the weak buying power that many are now feeling.

Game theory offers a few good explanations as to why things are not going to get easier any time soon. China is overheating and housing bubbles are a manifestation of this just like Japan experienced. Yet China at the moment has very little reason to allow its currency to appreciate. Why? This would make their products less competitive in the global marketplace and will cause domestic instability with rising unemployment (not exactly a good political move). The Federal Reserve is calling this bluff and moving forward with QEI which has clearly not pleased Chinese policy makers:

“(MarketWatch) People like Geithner would argue that China should raise the currency to force American companies to move production back to the U.S. I suppose that that is how the whole yuan-appreciation idea may work. But, at what exchange rate would the American companies want to do it? American wages are 10 times China’s. Should China increase its currency value 10 times?

Of course, the American pundits wouldn’t put it that way. They would talk about China’s trade or current-account surplus and the rising forex reserves, the prima facie evidence of currency manipulation. I don’t want to deny that the rising forex reserves are a problem that China must tackle with. But, it is a separate issue from the U.S. economy. The solution isn’t yuan appreciation either.

Everybody knows China has a massive savings rate of around half of its GDP. It’s a simple equation that the current-account surplus is equal to savings minus investment. If the current-account surplus is a problem, it is either insufficient investment or excessive frugality. China’s investment is over 40% of GDP. Even casual observers would find China’s investment too much. Are Chinese people too frugal? The household income is probably under 40% of GDP. How could they be the source of the gigantic savings?â€

It is a challenging situation for many nations. Yet when I see what is going on currently (i.e., low inflation in the U.S. while real estate bubbles rage in China) you can see clearly where the hot money is going. The money is certainly not flowing into U.S. real estate. Ultimately people in the immediate markets need to be able to afford their local housing and rents are always a good indicator regarding the actual monthly amount people can carry (rents have been falling or stagnant over the last few years). The global contagion is hitting again and Ireland is at the center for the past few weeks but an interesting article sheds a little light on the uniformity of how real estate bubbles burst:

“(Irish Times) Banks have been relying on two dams to block the torrent of defaults – house prices and social stigma – but both have started to crumble alarmingly.

People are going to extraordinary lengths – not paying other bills and borrowing heavily from their parents – to meet mortgage repayments, both out of fear of losing their homes and to avoid the stigma of admitting that they are broke. In a society like ours, where a person’s moral worth is judged – by themselves as much as by others – by the car they drive and the house they own, the idea of admitting that you cannot afford your mortgage is unspeakably shameful.

That will change. The perception growing among borrowers is that while they played by the rules, the banks certainly did not, cynically persuading them into mortgages that they had no hope of affording. Facing a choice between obligations to the banks and to their families – mortgage or food – growing numbers are choosing the latter.

In the last year, America has seen a rising number of “strategic defaultsâ€. People choose to stop repaying their mortgages, realising they can live rent-free in their house for several years before eviction, and then rent a better house for less than the interest on their current mortgage. The prospect of being sued by banks is not credible – the State of Florida allows banks full recourse to the assets of delinquent borrowers just like here, but it has the highest default rate in the US – because there is no point pursuing someone who has no assets.

If one family defaults on its mortgage, they are pariahs: if 200,000 default they are a powerful political constituency. There is no shame in admitting that you too were mauled by the Celtic Tiger after being conned into taking out an unaffordable mortgage, when everyone around you is admitting the same.â€

This kind of brinkmanship always ends badly. So where are things heading? It is Japan redux except with China. The early 1980s saw the U.S. in another bad recession. This time however, countries are more tuned into what happened and many are racing to the bottom. This puts bigger issues for the global economy on the table but with a nearly 10 percent unemployment rate (17 if we combine underemployment and unemployment), a declining currency, and the Fed exporting bubbles how housing values blast upwards in the U.S. is a mystery and clearly not reflected in the data. Housing is the least of the worries for the economy and future job growth as usual is issue number one.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

49 Responses to “Exporting the U.S. housing bubble – Japan and China real estate bubbles provide a fascinating example of what occurs with currency intervention and quantitative easing. If Ireland implodes with a similar U.S. housing market what does that mean domestically?”

WELL WHERE DO WE GO FROM HERE. BUY SILVER AND GOLD FOR THE LONG TERM. HOUSING STILL HAS 20 PERCENT MORE TO FALL, AT LEAST. COMMODS LOOK GOOD. ALL COUNTRIES MUST NOW DO WHAT THE FED IS DOING TO OFFSET THE DEBT LIABILITIES.

US housing prices are highly correlated to employment. QE wont solve this. But QE seems to be having an effect in the commodity and stock markets. So there’s your wealth effect. Trouble with high commodity prices is that it hits emerging economies right in the gut. Not great for those who are un/under-employed, either.

A couple of points.

The “inflation” may not be coming tomorrow or next year but the longer it remains at bay, the bigger the future burst of inflation will be.

People assume that they are comparing apples to apples when it comes to inflation, couldn’t be further from the truth. The CPIndex is rigged!!!

Just one of the games they play with the CPI is the “basket of goods” they use. If in the basket steak becomes too expensive people switch from steak to hamburger so they take the steak out of the basket and put hamburger in. If hamburger becomes too expensive and people switch to Tuna Fish, they toss out hamburger and put in Tuna. When tuna becomes too expensive, if people were to switch to Dog Food they would take tuna out of the basket and replace it with Dog Food!

In plain terms they remove the items that reflect the inflation the most.

And you don’t even want to know about “hedonics”.

Inflation can occur without wages rising too, that is what turning into a third rate country is all about. I will agree it is tame at the moment but the best analogy I can think of is some idiot trying to start a fire and dumps gallon after gallon of lighter fluid on the wood but nothing happens, so they throw even more. At some point a spark will ignite that fire into an unintended fire ball.

Good input Martin.

i always have the same question for the inflationist:

who can afford higher prices in a falling income environment? AND higher prices will be followed by falling sales. what happens when demand falls further off the cliff caused by higher prices?

i agree with your hedonics argument though, no matter what the inflation rate is the government will massage it to make the number lower.

The simplest answer to this is take a good hard look at Zimbabwe, and not just Zimbabwe, history has a multitude of examples of declining economic activity, stagnant wages and rising prices.

We are a sheltered bunch, we grew up in a land of plenty and know to our very core, “it can’t happen to us”. Well, when you turn into a third rate country the very definition is rising prices, stagnant wages and a lethargic economy..

It can happen here, is happening here.

Expenses are rising for many small businesses, but high unemployment rates and falling incomes are forcing a squeeze on businesses where they cannot pass on the premium to the consumer. For instance, my folks run a restaurant, and food prices have noticeably gone up. However, charging an extra 50 cents to a dollar per meal will drive customers away. They eat up the loss until the business can no longer support them, or until the business environment gets better.

On the flip side, Martin, I don’t see an eventual explosion just yet. QE1 and perhaps another trillion in QE2 will not induce an inflationary burst. A few more planets need to be aligned for that, but I do agree that this is a very real possibility. We haven’t reached our threshold for printing more money before inflation becomes that scary reality that some people are preaching about. This is not to say I’m in support of the Fed’s easing policies, or that America in itself is too big to fail. I just think that there’s still ample room for damage control in preventing that bigger, massive fire.

Ah men… LET IT BE!

Dear Dr. Housing Bubble,

Perhaps it would be wise to specify what you mean by “lowered standard of living.” That’s a scary phrase, but if it means that the average household would own 2 TVs instead of 3, I have no problem with it. How much of our standard of living is measured by the purchase of worthless or frivolous junk – largely from China, as you observe? If our currency depreciates until we can only afford 32″ TVs instead of 42″, is that a bad thing? It makes our real estate less attractive to Chinese investors, which would push prices down – again, a good thing if you want to achieve affordable price-to-income ratios in SoCal.

norcal – excellent point.

Lower standard of living would be a good thing for most as we live excessively. We live in a disposable society and generate an excessive amount of trash. But with that said every year our standard of living gets better.

I can’t think of any time in History I would rather live.

1900 – you die young and there are very few antibiotics and almost no advanced medicine

1950 – things are a little better, but not very safe, life in fear of the a-bomb, cars are unsafe, few homes have A/C, but things are picking up

2000 – things are good, but the internet still sucks

2010 – new medicines, fast internet, reasonable products, as a common middle income person I can afford a safe car, good food I don’t need to grow, and a fast computer that is lightweight

So I think the standard of living is relative. If I need to spend 3% more on bread and food next year, fine. This is an excellent time to be alive.

A a slightly solopsistic view, but okay.

You’ve got the fifties really wrong, however: medicine was actually pretty well advanced by the fifties; cars were less safe, but automobile fatalities were lower than today and, besides, a 1956 Belvedere was a good-looking death cab to check-out in; America made some of the best quality and most highly collectible wares it would ever be known for; films were great and Hi-Fi was the order of the day!

Best of all, the boomers weren’t in power.

Not too sure about that. You can contract a fatal illness from casual sex today, after you’ve finished an education that has you starting adult life with a mortgage sized debt.

Bob, not that I was alive in the 50’s (wouldn’t be for another couple of decades), but the 50’s were a mixed bag. Great improvements in standards of living, and what many look back at as a “golden age” for America.

However, as far as medicine is concerned, you have to remember that in the 1950s advertisers were using “doctors” as recommendations for various brands of smokes. Whether truly endorsed, or simply twisted endoresments from “doctor X stated Y brand of smokes is the least harmful, however they are all harmful” which the ad execs spun into “9 out of 10 doctors recommend Lucky Strikes” etc. advanced medicine was hardly where it is today.

I measure my standard of living in available leisure time. What do i like to do with my time? SURF. Race my car. Ride dirtbike with my kids. Play with my dog. Go Camping with my wife. The high price of fuel SEVERELY cuts into my ability to enjoy these things. MORE time has to be spent WORKING a JOB to get the DEVALUED currency to pay the mortgage, food, taxes, etc. Dont focus so much on the material things that dont matter to me. My material things are merely expensive TOYS so i can PLAY!!

We can only hope it’s the people with three large televisions who will suffer a decline in the standard of living.

Those of us watching old 20″ televisions… we can’t take a drop in the standard of living, thanks very much.

Maybe not, but you are obviously posting on the Internet so your standard of living must be pretty good; unless homeless shelters now offer free Internet access with their meals and beds.

“It’s all about choices” some conservatives say. I’ve chosen to use a prepaid cell phone, and skype is my “budget” phone. I use a dry-line DSL shared with two others. This is the bare minimum an employed person needs – internet is a necessary part of staying employed at a “desk job” type of job, and a phone is needed for communication.

I won’t deny that I’m making a middle class salary – statistically speaking right in the middle. My household, however, is not so wealthy. My housemate was laid off, but she found a job, so she’s fortunate. But we’re lucky. I’ve got a college degree. For my local community, a working class neighborhood, I’m doing well. We have enough space, and enough food, and I’ve got savings. Life could be better, but, these days it could be a lot worse.

BTW – we have a 20″ television, no cable tv.

I keep reading how Bernanke is trying to inflate a new housing bubble or a commodity bubble to inflate the economy back to health. Actually, I think he’s trying to break China’s currency peg and force the Yuan upwards. The real question is at what point will China’s leaders be forced to let their currency appreciate?

I think they will hold on for dear life because they would rather almost die than let the US get it’s way by currency printing brute force. They’ll hold on to their currency peg with a death-grip. The hot money in-flows will continue.

How much hot money has to flow into China before the bubbles now being blown would burst so hard that even the authoritarian Chinese government can’t contain them? I think that’s when QE will be stopped and the hot money in-flows will stop. It seems a very good possibility that Bernanke is trying to play crack the whip with the Chinese economy. Hopefully the oscillations here in the U.S. won’t get too bad before the Chinese leadership breaks or Helicopter Ben finds it impossible to continue.

Hmm, the dollar index chart shows the dollar stronger now than it was 3 years ago. I remember the yen at 75 in the mid 90’s…yet the yen was appreciating at this time when 5 years later the yen was well over 100? When I studied in England in 1990 the pound was well over 1.8 and now it’s 1.6. In the fifties the it cost 5 dollars to buy 1 pound.

I know you’re thinking we are exporting inflation, but sooner or later it will be exported back to us.

The dollar index is a rather worthless measuring stick. An unbacked fiat currency measured against other unbacked fiat currencies. Measured against a hard asset, Gold for example, the dollar has lost 40% of it’s value in the last 3 years alone!

Isn’t Japan more costly then the SoCal market? (Even after 10 years of falling prices?) I don’t think we can easily compare Japan to the US. It’s still more expensive, so the bubble in Japan must have been a huge spike.

It was ridiculous. At one point, I remember reading that the land immediately surrounding the emperor’s residence had a supposed value as high as all of California. All of it. It was nuts.

I am an engineer. For years now, my engineering friends have gone to lunch, and we laugh at how economist, even ones with Nobels, Rhoads, Ivy, etc are dummer than a first year engineering student. All the economist have done is make shadier and shadier securities, making bubbles, by creating unpragmatic decisions on how to create distortions. Bernanke, Greenspan, Frank, and Waters did not understand economics then, and dont understand it now.

The only thing we should know is that we dont have many science majors, we have the most bean counters and talkers of any modern society.

I’m an engineer, too.

Everytime I read a Nobel-winning economist named “Paul Krugman” I am reminded at how smart he is.

And then I listen to an engineer down the hall, listening to Rush and repeating the lies, cliches and out-and-out propaganda of the GOP, like it was the honest truth.

And this engineer, while being somewhat of an idiot-savant, is really dumber than I was back in 7th grade–long before I got an engineering degree.

My how things change, right?

I too am an engineer and the problem with most engineers is that they think they are smarter than everyone else or have a better understanding of the problem domain than the “experts” in that field. This is a weakness of in engineer training.

While engineering tends to be more black and white and the discussion is about trade-offs, most other fields of study think and process discussions differently. Whether your talking scientists, economists, doctors or lawyers, there are always a multitude of ways to discuss a problem set and there is usually not just one best answer; this is not how engineers are trained to think.

I’ve been interested in world financial markets since I was a kid.

I think I was 15 when I realized that the majority of economists are normally wrong, the minority right.

Who knew there were so many engineers out there?

John – Although I agree with the sentiment of your last statement, two things: 1) when you want to denigrate someone for being less intelligent than you, it looks better when you spell “dumber” correctly, and 2) the people coming up with “shadier and shadier securities” aren’t economists – they’re finance guys working behind the scenes at places like Goldman Sachs, dreaming up new ways of increasing their already obscene bonuses.

BCumbers – You mean we’re not smarter than everyone else? 🙂 We may speak a different language than other professions, but it seems to be working out pretty well for China (their political elite is populated primarily by engineers instead of lawyers).

Japan is a lot like California as a whole and Tokyo RE prices are more like Manhattan then LA or SF.

Though, still in Tokyo prices are still ridiculous. I’ve lived in Tokyo on and off since 1997 and it seems that buying a house 10-12 times your income is normal and that is what is keeping prices ‘high’ in the Tokyo metro area. The way you can afford that is the crazy low interest rates there.

I looked at a the equivalent of a 1M dollar house at a new development in suburban Tokyo, it was an actual four bedroom house about 1600 square feet on a piece of dirt about 1800-1900 square feet. This was in Machida City area. Tokyo is more of a ‘County’ or ‘State’ even though it has a mayor and each ward, village, town, city under ‘Tokyo’ has a mayor too.

At any rate, I could get a 1.1% loan for the first 10 years and then a 2.2-2.8 % loan for the remaining 30 years if I put at least a 20% downpayment. This was through my lender Tokyo Mitsubishi UFJ.

So in some ways, Tokyo is actually more affordable then SoCal, as someone making as little as 50k/year can afford a place of their own (as small as it could be) in a nice neighborhood with convenient access to transportation. 400-500k/year can get a nice 2-3 bedroom condo in the outer wards or suburban villages/cities outside of central Tokyo. Though it is very small by US standards and you are still a debt slave to the banks.

Someone making 50k/year in LA, SF or SD cannot even hope to afford anything half way decent that is not in a crime ridden ghetto.

Compared to where my wife is from, Nara City Japan, you can get a brand new house for under 300k, somewhat smallish by US standards, but affordable, new with gigabit ethernet, near good mass transit, good schools and lots of recreational activities.

Thanks for that, Agent. I have heard that middle class life isn’t the disaster in Japan that some of our pundits want to convince us. “Twenty Years of Deflation” has made housing, and, I’m guessing, other requirements of life much more affordable. Some think that living in a society with million dollar closet sized Tokyo apartments is a healthier economy, and the same people want our housing market to return to absurd pricing levels. I say, let deflation run. Nothing wrong with cheap houses.

Thanks for the Tokyo/Japan comps, AgentDent. R.E. Prices in Tokyo are generally still about what, 50% of what they were at peak (1990/1991 or so)? Is that correct?

And yeah, 40, 50, or even 100 year multi-generational loans…yikes!

The thing I would stress is although they have had 20 years of deflation and on paper its a train wreck, Tokyo is a much much much nicer place to live now than 20 years ago , the quality of life for most citizens is actually much higher in terms of what you can enjoy now, it used to be unthinkable for ordinary people to play a round of golf, it would be a weeks earnings and a massive day out, now hop in your car and drive out and the courses are full of people enjoying a leisure time they never could before, food is of the highest quality of any city in the world period ! you average Tokyo citizen will brobably eat out, excellent food 3-4 times a week . I bought a nice 200 sqm unit in one of the most upmarket parts of tokyo 1.75 m us , yes a lot of money but when mortgages are 1.25% its affordable to many couples on ok salary, when built in 1988 the unit was over 10 million usd and interest rates were 6% , impossible to own by anyone but the most elite …. education and civic services provided in tokyo are also excellent and no crime there is no price for the personal safety that one can always enjoy !

How much is the property tax in Tokyo area? How good is the quality of air (better than LA or Orange County, CA)?

thanks for your info

Japanese style scenario seems to be our future. Government wants to keep bailing out the banks as long as possible, until they finally become solvent again. Banks realize the US economy is comatose and are either hoarding cash or investing it overseas. With the FIRE economy exposed for what it WAS, there doesn’t seem to be anything to replace it. Unfortunately, that means job loss, wage cuts, furloughs and textbook deflation. Housing will continue to tank until we have some sort of fundamental changes in our economy.

http://www.westsideremeltdown.blogspot.com

Only the boomers are so obsessed with hyperinflation. Japan has been fighting deflation for the last 20 years. When will their inflation come? I’ll believe that inflation is coming here as soon as it happens in Japan.

Aside from that, I don’t know what else you expect the Fed to do. We already have two examples of what deflation does to economies, we need only look at the Great Depression and Japan’s current situation to see that. So the Fed rightly fears deflation, and they only have a limited tool set to address the problem. It may actually work IF the banks in turn lower their interest rates for something other than mortgages. The problem is that while the banks are borrowing money at .25%, they are loaning that money back to small businesses at outrageously high markup. So they money gets stuck, perpetuating deflation.

The banks are recalcitrant, we know this. They are also easy to get around: The government can simply take advantage of these historically low interest rates, borrow the money and invest it in infrastructure.

Agent Dent: Thank you for your post, very informative!

I’d like to comment that I was in Peru two months ago and there is a HUGE property and building boom going on there… so maybe the big banks’ “hot money” is in part going there? I can only speak about places I’ve seen first hand, have talked to locals about, etc.

Cheers.

For the last 10 years, I’ve been buying mutual funds that invest in foreign countries. Nordic funds, Latin funds, Canada funds, Australia funds.

All are willing sellers of their commodities and there is the benefit of trading a falling currency for a rising currency.

If I am any example then, the infusion of cash by the Fed is heading overseas, and not increasing the rate of inflation in the USA. Deflation is a real consequence.

Others are buying homes and income properties on foreign soil; again taking out of our economy and pumping up another economy.

Capital flows to where it does the most good for the capitalist.

You have to get used to competing in a global market. All the G20 protesters, and SEIU Union Organizers in the world can’t stop the flow of capital from low return investments to high return investments.

General question: when people say you shouldn’t purchase property that is more than X times your income, how is that calculated? Is that gross annual household income or after-tax income? And is that based on purchase price or loan balance? The numbers can differ quite a bit depending on how you calculate this. Can anyone clarify?

@all: interesting replies.

@DHB: Nice article keep it up.

QE1 didn’t increase real estate prices, but it and other measures taken did a pretty good job in stopping the real estate roller coaster from its death spiral (Or from reaching their fundamental values). The rate at which real estate was decreasing was more than twice the rate experience in the 1990s. Maybe that is what they meant by “soft landingâ€.

It looks like QE1 and all the levers that they pulled did a good job from preventing us from going into an abyss, but did we really fix the root cause? Were any actions takes to hold people/businesses accountable for their actions? Did we restructure our economy so that it is resilient enough to not have any “Too big to fail†businesses? Privatizing the profits and socializing the losses is NOT capitalism.

João P. Bragança makes some excellent points, and despite all the resources on the internet, I simply cannot determine why every civil engineer, surveyor, and proven construction company in CONUS is not working at full-throttle on NECESSARY infrastructure buildout and repair. No make-work required; dams, canals, reservoirs and related water projects alone would probably make-up for the collapse in residential bubble building. In the Obama Admin, malice and incompetence become indistinguishable.

RE the 1950s: Peeps were MUCH better behaved (except for the smoking everywhere), cars were more dangerous, but, OTOH, drivers were better trained and more careful (plus no “smart” phone, DVD, or GPS distractions). As for medicine, there is STILL, today, a tremendous amount of ignorance and misinformation being promulgated by the BiMIC (Bio-Medical-Industrial-Complex, aka Big Pharma).

As for housing in the 50s era, Real-tards were MUCH less slimy, mortgage lending was MUCH more strict, and the best residential architecture (and construction quality) ever erected in this country was arguably 1947-1958… at least in So-Cal and So-Fla. Check it out.

Like your post and agree with it except for just one little thing… I believe the best construction ever erected in this country was between 1900 and 1930. There is nothing that surpasses the fine homes and apartment buildings built from 1910-1932, during the City Beautiful and Art Deco eras, in beauty, comfort, and quality of construction. The old Eastern cities are stuffed with magnificent homes and buildings from these eras, and even the little cottages and courtyard buildings are exquisite and worth rehabbing.

Take a look at the older sections of your own Los Angeles. L. A. is stuffed with gorgeous little bungalows and apartment courts from those eras, and you won’t find higher quality in anything built since. Time to start restoring your old neighhorhoods.

The old stuff doesnt comply with earthquake codes and needs retrofitting. I enjoyed the sway offered by my old building during some of our quakes, but i prefer the safety of my double shearwalled, concrete on slab, freshly constructed by ME house. It is all a matter of tase too, Im weird in that i like flush doors, white walls, & no detailed mouldings to collect dust.

The answer is simple: we have become fat, lazy and compliant. We would rather complain on the internet about how things should be instead of actually doing it: writing our congressmen, volunteering on political campaigns or running for office. America won’t change until her people do.

Hilarious Video on QE2

QE for you and me.

The one thing the government knows for sure when they take your money:

They’ve got your money.

QE I/II were just a fraud on the American taxpayer. The world would not have ended if all the insolvent banks/banksters had met their deserved end. Housing would have been able to be purchased for a fraction of what you are being ripped off for today. It’s only really worth the infrastructure and construction cost…all the rest is theft.

When a loan is made, it should be for the money it takes to by the house. The actual cash is what is owed…too many people think they are borrowing a house.

I have to say that I agree completely. The state budget of California will collapse and housing prices will fall further. It couldn’t happen to a more deserving group of people. the voters of San Francisco and Los Angeles have consistently voted for budget busting “sanctuary city” policies. The cost to provide free education and medical car for the undocumented has of course bankrupted the state. Just this week the decision was made to have undocumented people get in state tuition at state universities.

Indeed, voters were warned repeatedly, over the course of years and years that such policies would bankrupt the state but they voted for it all anyway. So the collapse of California couldn’t happen to a more deserving set of people

Wow. You’re an asshole.

But we have to keep the shell game going, because there is no way to justify a baggage handler at the airport making 90k–all wages in US have been insluated from world equivalent wages, but there is no way to maintain that differential over the long run. All we have are financial shenanagins and a powerful military to enforce the Feral Perverse Note as the world’s reserve currency. We’re two generations past the gold standard, so let’s blame Obama and feel justified–bet that will work…not. Housing is the main bubble business to keep our oppulent living standard eleveated from where it would stand on otherwise, so if you think normal supply and demand rule the day in housing you will be continually wrong.

Construction is picking up again in Moskva after the 2008-2009 halt. Booting Luzhkov out was part of that, as it wouldn’t do to try and attract foreign investment to Skolkovo and have it turn into a real estate project managed solely by Mayor Luzhkov’s wife and her firm Inteko. Though Yelena Baturena isn’t going anywhere even her husband is out and makes the Daleys look like small fries in comparison. FYI, Moscow City budget is THREE times the size of London for a city only 30% larger.

Russia is definitely one of the recipients of the ‘hot money flows’. Goldman called the BRICs and then rode all that cheap money in emergings and the AIG bailout which was really a bailout of Goldman drove more into the emergings even after the Russian market tanked (then rebounded) — conflict of interest anyone?

Leave a Reply to threadkilla