Shopping for Earthquake Shacks in San Francisco: Homes housing the homeless after the 1906 earthquake now up for sale at ridiculous prices.

We have now gone full circle when it comes to California real estate. The San Francisco housing market is blistering hot with all common sense being flushed down the Twitter tubes. While the idea of “tiny houses†seems like a new thing, this already happened over 100 years ago although by a force more powerful than the financial market. After the 1906 earthquake and fire people sought shelter in tented communities and city parks. Of course this was not a long-term solution so union carpenters in combination with the San Francisco Relief Corp., San Francisco Parks Commission, and the U.S. Army got busy on building the original earthquake shack. These tiny cottages were built quickly and fast. These places simply provided a roof over the heads of families after the devastation of the quake. Today, they are being sold to future tech hipsters and investors for ridiculous prices. The earthquake shack mania is now here!

Earthquake shacks with startling prices

The earthquake shacks were built fast and with simplistic utility. These were not developed as a housing option for a modern day tech elite or investor crowd. Yet here we are, recycling the old into a modern day mania.

Take a look at the original shacks built in 1906:

“Future million dollar pad”

Over 5,000 of these places were built. This was the original “pre-fab†construction. But when you look at the history here, these shacks were built to replace tents and shoddy shelters built by many displaced residents.

Back in the 1980s there was a push to save these earthquake shacks for historical purposes. Many of these are now HGTV upgraded and available for sale in posh neighborhoods (with inflated prices). Take a look at one of these “official†earthquake shacks:

451 Anderson St,

San Francisco, CA 94110

2 beds, 1 bath, 1,100 square feet

Let us look at the description:

“Originally 2 earthquake shacks from 1906, they were combined to create this charming 2 level home which features 2 bedrooms (master bedroom with faux brick wall), one remodeled bathroom with skylight, wood floors, kitchen with breakfast bar and stainless appliances. The landscaped yard has 2 decks and private hot tub. 1 car garage parking, laundry room and storage. Perfectly situated just 1.5 blocks from the Cortland Street corridor, aka Cortlandia, with its myriad of neighborhood shops, cafes, bakeries and restaurants. The home has easy access to freeways, Muni and BART.â€

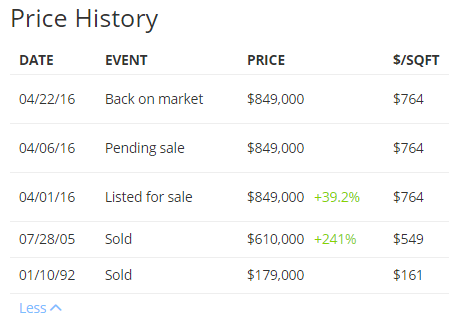

What a steal. you get 2 earthquake shacks for the price of one. This is a 2 bedroom and 1 bath home listed at 1,110 square feet. The ad copy reads like it is targeting tech hipsters. Get it, “Cortlandia†– so bust out those nerd glasses and rock that flannel out while eating organic beans. It’ll probably be all you can afford after you pay the mortgage. Let us look at price history here:

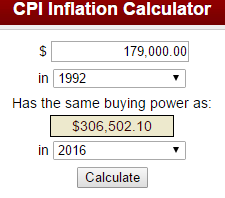

The 1992 price of $179,000 seems reasonable for two earthquake shacks. It sold again in 2005 for $610,000 and then was listed in April for $849,000. And it actually almost sold. But take the 1992 price which was during another California housing bubble. What if the property merely tracked the overall inflation rate since that time?

Source:Â BLS

“But interest rates. The Fed is like God. Yadda yadda yadda!â€Â Sure, knock yourself out and buy this place. Go ahead and pay $849,000 for 2 earthquake shacks that originally were probably hauled in by horses.  Maybe in 50 years they’ll take 4 earthquake shacks and turn it into a Voltron like house for $3 million.

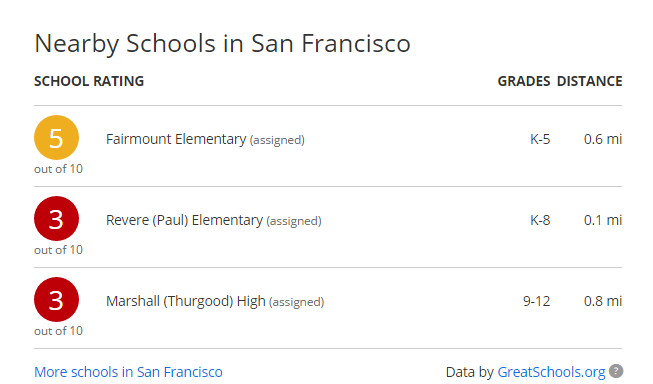

The schools in the area aren’t even rated highly:

Next thing you’ll have is people renting out vans for ridiculous prices. Oh wait, we are already there.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

100 Responses to “Shopping for Earthquake Shacks in San Francisco: Homes housing the homeless after the 1906 earthquake now up for sale at ridiculous prices.”

Just another example of our national decline. Here ‘temporary emergency housing’ built with no help from the Federal Government is not only still with us more than a century later its serviceable housing. Compare that to the FEMA trailers that had to be screpped a year or two after Hurricane Katrina.

Now Bernal Heights,where this example is, is about as far from San Francisco as you can be and still be in the city limits so paying over $800,000 just to have a city address seems stupid to me. You can buy a lot more house and have better weather if you cross the Bay.

Bernal Heights is not “as far from San Francisco as you can be and still be in the city limits.” It’s one of the hottest hoods in SF, south of the Mission, and has been for 10+ years. I agree better value can be had across the bay, but don’t just spout off nonsense like that. Either way the prices in Bernal are insane, the schools aren’t great, and the lot sizes tend to be tiny.

When you describe Bernal Heights as ‘one of the hottest hoods’ that says it all to me. That is realtor talk to make a shabby neighborhood sound promising. No one describes Pacific Heights, Sea Cliff or Telegraph Hill as ‘hot’ neighborhoods’. They are what they are expensive and always fashionable places to live.

I’m not sure across the Bay is any better….I rent in Alameda…this is down the street from me.

Built in 1910!! 840 Sq. ft 2bd 1bath….for $750K!!!

https://www.redfin.com/CA/Alameda/1719-Bay-St-94501/home/1811287

I’m renting a bigger place a few blocks away for $2300 a month.

Seems like a “hot” neighborhood now means that it is simply the least insanely overpriced area. Still stupidly priced, just not quite as much as the next neighborhood over. Yet.

Sangell – the state I grew up in is sufficiently Socialist that RVs/trailers are banned. Flat. Out. Banned. Needless to say, no one stays in the shoddy things. Back in 1906, trailers and RVs were effectively unknown, plus there was lots of high-quality wood for the taking. Add in a certain recently-developed phobia regarding flimsy structures… It worked out the same as a trailer/RV ban.

Plus, a lot of these “earthquake shacks” are probably like certain old violins, that are 100% original except for the replaced fingerboard, soundboard, bridge, sound post, tailpiece, scroll … you get the idea.

These days I see new buildings being built of oriented strand board, the worst crap you can possibly get away with building something out of. I’m amazed it’s legal. I blame capitalism.

First you blame “socialism” for banning flimsy RVs, but I’m not sure if you mean in California or not. Last I checked this state was an RVer’s heaven. Anyway, I’m not sure what “socialism” has to do with it, however you define it.

Then, two paragraphs later, you blame capitalism for stuff being built out of OSB. So whose fault is it? Because generally, socialism and capitalism are two pretty different things.

Or rather, what are you actually trying to say? Both socialism and capitalism are bad? What should we do instead?

Housing To Tank Hard Soon!

Absolutely!

Absolutely Not. Yellen already said it yesterday, no rate hike until indefinitely.

There may be a small percentage decline, 5% to 20% at most, but there won’t be any good neighborhood homes in good condition for $99,000 anymore or even $199,000. Everything will still be $500,000 and up, even for bad areas in bad condition. That will still be the going price for things all over California, north and south, especially in the coastal and urban areas. Affordable housing is a thing of the past except for those double income earners at $125,000 each.

Sounds like real estate pundits who claimed slowing appreciation and then finally pullbacks were “healthy” during the previous downturn. The reflation of prices to bubble proportions must really be different this time.

i always ask my homeowner friends “which one of your kids can afford to buy the house you live in” and i always get the same answer “i couldn’t afford to buy the house i live in on my current income”

please explain who’s going to buy all these overpriced assets in the future of decline populations (or are the third world peasants we import going to pony up and buy with 3-4 generations all living together) and declining incomes (I’ve not had a pay raise since 1997)? please post using pretty picture and graphs if you have to but i’d like to know how this is going to play out. TIA.

Dream hard Jim you will tank hard too

Tough on the phone huh. My wifes tough on the phone.

Jim’s predictions have been tanking hard for years. He is a visionary.

My magic 8-ball says that housing will tank in 2024 and housing prices will decrease to 2019 levels.

Jim, Yellen just speaks, and basically FED will not raise rate soon, housing market will not tank soon.

That’s your dollar ranking not housing. Just start adding up the cost of everything since gasoline was 79 cents a gallon in 1998 and that should answer everyones questions. The only question remains “how long before truly unaffordable becomes truly unaffordable?” It’s when interest rates soar as the dollar collapses that folks will understand…when an ounce of silver goes for 15,000 dollars an ounce. That’s when folks will go “aha! I get it now!” not when their Home is suddenly worth 39,000 dollars after having been told it was worth 3 million dollars just a week prior….

Officials admit that current extraordinary efforts to levitate asset prices renders the Fed and the government relatively weak against dealing with the next recession. Way too much future demand, in the form of record debt, pulled forward just to juice up a weak recovery. This is why I’m skeptical that current asset prices can be sustained (through additional credit expansion) when the current debt levels are historically high. Should they attempt to further inflate debt away, real estate will be least of our concerns.

http://www.wsj.com/articles/u-s-lacks-ammo-for-next-economic-crisis-1439865442

One of these down the street from me sold for over asking and broke $1 million. There wasn’t a thing worth saving. It reeked of mold, the yard was so dark nothing would grow, a bus ran past the house every few minutes and was no more than ten feet from the living room. The houses on either side were also earthquake shacks so you can’t build a second story and the lot is small so you can’t build back. I wonder what they have in mind? So far nothing has been done and it’s been at least a year.

Doc, nice story as usual. Yesterday I saw an article in the San Jose Mercury news where the subject was essentially “welcome to the new normal” with respect to silicon valley employment and housing trends.

I know the general sentiment on the board here is that a crash will happen, but I’m pretty skeptical that it’s going to be significant in magnitude. Sure, we could lose 20%, but that takes us back to prices of what, 2 – 4 years ago. Seems like it’s going to take a global depression to see something more significant than that. Of course that’s possible, but isn’t something that I would wish for when one thinks about the hardships that many people will face if that comes to pass.

I sure am happy to be out of the bay area now. On top of that, I’m fortunate to be able to say that I’m in a home that I worked with an architect and contractor to build. I saw every step of the build and have a good idea of what was done well and what wasn’t.

Well thought out response Jeff, and I agree completely. Crashes happen for a reason, not because a bunch of people like us think prices are ridiculous. Well you could think of house prices in reverse… the worth of the dollar is ridiculous. The value has been decimated, mostly since going off the gold standard. Now it’s backed by “faith and credit”… lol. I guess there isn’t much faith, and the credit… well that’s even iffy.

Where did you move to (that is so much better)?

Also can you provide a link to the SJ Mercury News story? Thanks!

Have you by any chance been paying attention to the worldwide economic events of the past few years? There’s a reason why worldwide bond yields are at 0 or less: very few people have any confidence in the future of developed economies. Any growth has been mostly due to inflationary policies (massive debt assumptions) rather than economic fundamentals. What does history tell us about over-gorging on debt?

Mercury News story: http://www.mercurynews.com/michelle-quinn/ci_30028800/quinn-high-tide-tech-economy

I’m in MT. Lots can still be bought for ~100k and construction costs will be in the neighborhood of $150/sf for something decent but not full of custom/luxury touches. Just know that it can hit 30 below on the worst days of the winter. I used to live in Santa Clara – the positives in MT vastly outweigh the negatives for me personally.

One thing that makes me smile about the move is that the square footage of my new garage is exactly the same as the sq ft of my prior home: 1650.

I have to fly back to San Jose for work next week – 2 days of that traffic and congestion is plenty for me now.

” Of course that’s possible, but isn’t something that I would wish for when one thinks about the hardships that many people will face if that comes to pass.”

Don’t worry people on this blog hope for Ebola, earthquakes, nuclear radiation, gas leaks. All so they can save a few bucks. Pretty sad.

That was pretty funny. I remember reading on the bubble blogs back in 1998 that the big crash was coming. It did come, but after almost 8 plus years of crying out doom and gloom. Is a correction coming? Who knows. I bought in 2013 and for me it was looking at the cost of rent versus ownership. Current mortgage total is $3100 and rent would be between 2800-3200, so for me buying made sense. Most recent sale in my neighborhood for the same model I have, was about 130K over what I paid 3 years ago…..

If there’s nothing to worry about, then what would be the point in visiting this blog, much less taking the time to inform us? The rhetoric doesn’t match the action.

I’m sure that Rob left out crucial details such as saving for a down payment, monthly maintenance costs, insurance, property taxes, etc. Based on his monthly mortgage payment and assuming a 30 year mortgage, his 20% down payment was well over 100K.

Otherwise, mortgage payments are “equivalent” to rent in his locale.

The “new normal” is another way of stating that this time is different. It’s the same disease of mistaking input attributes as fundamental outcome. Saturated calls for the new normal tend to mark an inflection point. In the last cycle’s topping we were reassured that there had never been a nationwide housing price dump. Everyone knows how that turned out, but notice how it isn’t considered the new normal. For all we know there could be a global housing price bust coming next.

I remember skeptics warning against “wishing” for an economic downturn prior to the last recession. The “new normal” was first used at the height of the tech bubble.

Do you think that people are so well off now that the predominant economic policies based on ZIRP and currency debasement can forever be sustained? If that was possible, then Zinbadwe would be a global power. Look at Japan’s multi-decade long economic stagnation. Then consider China’s train wreck of an economy.

I think what we are seeing is the globalization of West Coast real estate.

The globalization in the Bay area is mostly coming from East Asia. Maybe we should look at what happened to a real estate investment bubble in Asia? How about the bubble in Japanese real estate in the 1980s that collapsed in the 1990s. The Tech industry is not immune to game changing events, so we cannot say that it will be able to support such prices without a major decline in the Dollar’s value. The Yen deflated for a number of demographic reasons. Some think the Dollar will also, some think not.

I must have missed the Japanese takeover 30 years ago. The Chinese do love to copy things, whether or not the business model is successful.

Yes, “Globalization” of west coast real estate… which means a crash in Asia might crash our Real Estate. The Good doctor has documented the high percentage of Chinese money buying houses in certain cities. When the Chinese take away the punchbowl, what happens? Party over?

I was less concerned with any imminent market crash in Asia than with a overall structural change in the tech industry that affects the number of local people who can afford these prices. The changes in Japan that caused the steady decline in real estate were internal and had nothing to do with foreign investment. There are also a lot of Asian immigrants working in the tech industry aren’t there?

The other thing that drives real estate bubbles is the fear of inflation. During our deflationary Great Depression, California real estate, which had been flying high, went into a deep tank. Upscale houses dropped from $20000 to $3000 (those are 1930s dollars). If we fail to generate the inflation the Fed seems to crave, we could have a rough landing with more debt deflation.

Chinese Won’t Take away the PunchBowl, when we buy we pay all cash or high down payment, because we never intend to use the House in US as an investment, but as fallout shelter. When the shit hit fan in China, we stay here just in case the Party going communist again.

So to all the China Crash will bring down coastal price believer, when China Crash rest assured there won’t be panic selling. When Chinsee invest in US asset, they really do not care about return, because the return suck compare to invest in China, Chinese invest in US asset for safety. So sorry no sale from the chinese landlord.

@Chinese immigrant

It doesn’t if “you” won’t sell you over-priced properties. Those who sell will set the price for you. In the long run, you should be concerned whether the source of these “all cash” foreign offers will still be available over the long run when their domestic economies and currencies continue to weaken and capital controls become more stringent.

I don’t know why people fail to realize that there are billions of people in China….

yes when we talk about California Real Estate… we are only talking about Tens of Thousands of Chinese sheltering their money

These are the wealthy elite

They seek to escape the pollution and corruption of China

They are not going away, and there are 10 more waiting to take your place

@holo

If it’s too good to be true, then it isn’t. Just as money doesn’t grow on trees, China’s recent wealth gain is built on historically unprecedented debt. Good luck thinking that another Asian takeover is in the works.

Overpaying != value

Look to articles on Vancouver re: their bubble and Chinese investors driving up prices there on Zero Hedge. Australia just enacted a tax on foreign housing “buyers” as well.

Not surprising at all that these crap shacks sell for close to 1M. I don’t need to tell anybody here that the Bay Area has changed dramatically in the last 24 years…1992 is a distant memory. We now have 3.X interest rates, a booming tech industry, massive housing shortages, international money flowing here non stop and this is the end result. We’ll have our housing correction one of these days, but much of coastal California has a floor when it comes price declines. Don’t expect 50% off prices like Riverside, Phoenix or Vegas. Looking to add a rental, but not at these prices.

One of my fondest memories in life is driving into Los Angeles in 2009 as a Truck Driver and encountering zero traffic. Why do Americans love bubbles? Because they burst every time. Forget California and just be amazed by Manhattan…or Panama…or London.

And that’s just the real estate part.

Commodotities including gold collapsed years ago…and still folks are plunking down a million US for 500 sq feet…of property. Does that even include the house? Indoor plumbing? A roof? A doll house? Who knows, right? Who even cares?

Globalization already happening in California. I know a friend that bought around twenty houses during the downturn. Do you think he bought those house last by himself, no there are multiple investors and they chip in their money to buy those houses.

He even lend me some money to buy an investment for myself.

Now they’re investing in multi family housing.

I think until now they are buying houses in auction. imagine all other investors from China that we don’t know are operating to manipulate the housing prices here in California. I think that’s globalization are already happening because of greediness in this country a law that favor rich people. Guck the fed

Looks like your friend is on the path of becoming very wealthy by buying those West Coast properties. Good luck. I know lots of people who have done just that. Where else can you see that kind housing appreciation growth. Just don’t buy property in the Midwest. Those properties do not appreciate hardly at all.

It will crash at some point after the election. And if it doesn’t we will keep renting. Love seeing my downpayment funds grow. Fools keep buying means less competition when it crashes. From my perspective, this bubble can go on for the next ten years. I will probably have enough money to buy in cash. Keep the bubble going and let the idiots get screwed once again!

You’d better hope the growth of your funds outpace the growth of inflation. Although my funds too are growing, I feeling like I’m running in place. The more money I save, the higher the price of RE.

Then there’s always the threat of hyperinflation. It that gets bad enough, the value of your nest egg will shrink or even collapse.

I don’t need to outpace inflation. I just need patience until it crashes once again. You do understand Crash=deflation & bubble=inflation….

Hyper inflation is already here in speculative assets such as coastal CA housing. On the flip side, USD is up 100% in two years priced in the commodity which backs it (oil).

Just make sure you buy next time… 10 years from now

And don’t get caught in the Bear Trap like you did last time

Not sure what makes you think I got caught in a bear trap last time but okay…. Yes, I will buy during the next crash.

How many RE purchases can we put you down at this time?

Brian! You da man!

They already sell most of the properties. They earned around 100k to 200k each houses depend on the location to dumb buyer out there, they are not idiot like you think they know when the time to sell as. When is the time to rent out those properties,

This racist troll schtick is getting pretty old, man.

Wang Bu admitted to being a Chinese businessman who bought US real estate specifically to rent it back to US citizens. Yet Wang Bu constantly rails on this blog against US government allowing foreigners to own US property. This is a new kind of NIMBY’ism I have never seen before. So congrats Wang Bu for being a hypocrite, a troll, and a major douchebag.

I don’t think you can compare current Chinese buyers of California real estate with Japanese buyers back in the day. Japanese-Americans are estimated at 1.3 million. Chinese-Americans are already at 3.8 million. Japanese people are by now all legally here and counted. A lot of Chinese people are here illegally so its probably more than 3.8 and 10 times more will be coming over in the future (legally and illegally). China has 1.4 billion people while Japan had population crisis for decades. Japan even at the time was a developed country so not that many wanted to leave anyway. China is a developing country so pretty much all of them want to leave.

The underlying factors of recent bubbles: rapid acceleration of asset prices due to uncontrolled money supply and credit expansion. That happened to tiny Japan from the mid 80s to the early 90s. The far larger U.S. recently experienced 2 within a decade, with a 3rd one well on its way. China is well known for its ghost cities and roller coaster stock market. It’s economy is in crisis mode from all the debt that fueled its rapid expansion.

In other words, population size matters not when it comes to economic mania

Everybody already knows there are a lot of people in China.

The argument being made is that this time is different because more.

Volume can amplify both gains and losses. The comparisons often made to Japan is about the binary events which led to the buildup and end of a speculative mania.

A storm is brewing in the real-estate market, Pimco warns:

http://www.marketwatch.com/story/a-storm-is-brewing-in-the-real-estate-market-pimco-warns-2016-06-20

There aren’t enough people with the financial wherewithal to support every single house in L.A., S.F., San Diego, San Jose, etc. commanding a $1 million price tag! An even bigger question is who will be standing in line to buy those homes in the future? It would take a miracle to reverse the general economic trends, a decline in widespread prosperity and continued concentration of wealth in the hands of fewer and fewer individuals!

“There aren’t enough people with the financial wherewithal to support every single house in L.A., S.F., San Diego, San Jose, etc. commanding a $1 million price tag!”

These expensive properties that are for sale are selling like hotcakes, why is that? There is little supply and much demand. You may have to rethink your statement.

“It would take a miracle to reverse the general economic trends, a decline in widespread prosperity and continued concentration of wealth in the hands of fewer and fewer individuals!”

Agree 100%. Anybody who thinks the middle class will make a roaring comeback (especially in uber expensive CA) just doesn’t get it. The divide between the haves and have nots grows every day in this country. Do everything you can to get into the “have” camp.

“These expensive properties that are for sale are selling like hotcakes, why is that? There is little supply and much demand. You may have to rethink your statement.”

Artificial demand pulled forward due to rapid credit expansion and low rates. Sounds like a typical economic mania.

“Agree 100%. Anybody who thinks the middle class will make a roaring comeback (especially in uber expensive CA) just doesn’t get it. The divide between the haves and have nots grows every day in this country. Do everything you can to get into the ‘have’ camp.”

I think that Buffett’s quote is more appropriate: be fearful when others are greedy and greedy when others are fearful. As far I can see, greed is driving people into overpriced assets. Now, I might change my mind if you can convince us that the economic cycle has been repealed.

I agree that the low inventory is keeping prices up, but are those homes selling really worth the prices they are commanding? I say NO WAY. Location, location, location, is and always will be the rule. The property two-blocks to the beach is valuable, but those crap shacks not in that perfect location are and always will be crap shacks … they aren’t worth the prices being paid, and no one will be standing in line to buy those properties at those prices … 5 years from now!

There IS money out there for nice properties.

This Santa Monica townhouse was listed for $1,048,000. It held on Open House this Sunday. It was Pending by Monday: https://www.redfin.com/CA/Santa-Monica/2311-Schader-Dr-90404/unit-107/home/6767538

Yes, it’s nice. But it’s a townhouse, not a house. It’s mid-city (not even north of Wilshire), and it’s 23 blocks from the beach.

Yet the offer must have been so good, the seller didn’t even bother with a bidding war.

Actually, it’s not even a townhouse. These so-called “townhouses” in California are really “townhouse style” condos.

A true townhouse, as the term is understood back East, is when you OWN THE LAND under your townhouse. There are no HOA fees or CC&Rs, and you can tear down your townhouse and build something new on it whenever you want. The only requirement is that you don’t destroy the shared wall.

You all vote for Democrats, they appointed money printing central bankers in the Fed, which caused price jumps in homes. As long as you keep voting Democratic, they will keep printing money, and home prices will just keep creeping up forever. That is econ 101.

JT,

I agree with the underlying idea of money printing and what causes in the economy. However, I don’t believe the politicians appoint the FED chiefs in the true sense of the word. I’ll try to explain below:

The FED is a private corporation which “prints” money and collects interest from the taxpayers for the money it created out of thin air. For that reason, they can pretty much buy the best politicians representing their interests. It happens that the Democrats serve their interests better. The democratic base is by and large clueless about economy, and those who understand it stand to benefit from it one way or another (they have a vested interest to keep the game going). The republicans have a faction of the conservative base very much against the FED as an institution and for that reason the FED owners don’t like the constitutionalists too much and spend considerable amounts to demonize them. However, a faction of GOP (RINOs) like wars a lot which serve the interests of the FED. Now, if the FED owners lend the money for welfare or wars does not matter too much to them. The point is to increase the amount lent so they collect more interest.

They lower the interest because they have a very lucrative gig and they didn’t want the system to go up in smoke. So far the game is to transfer the money from the producers to the cartel.

If you have a republican or democrat in the White House makes no difference in who leads the FED. They always chose one of them (from a certain tribe) and the president is just giving his blessings for legitimacy to make people confuse the private cartel to a branch of the government. It is all a show.

I hope now things are clear for you. Disclaimer: Ideologically I am a “realist” and enjoy the US Constitution very much. It is a big asset of US. I hope the new generation will continue to preserve this document which made the US the envy of the World. As a hobby I like everything related to economics and wealth creation.

Doesn’t matter whether it’s a Republican or Democrat government. They represent 2 sides of the same bad corporatism coin. Bush 2 was a primary cheerleader of the previous bubble fueled by when excessively low rates and incredible credit expansion (just like now). The corporate bailouts began at the tail end of his presidency and persist to this day under Obama.

This article reminds me of an episode of “Tiny House Hunting” where a hipster couple was looking at Craftsman shanties built for shipping industry workers in Long Beach.

Three houses around 600-650 sq feet. The shack they chose was 50,000 more than they had budgeted because hipster hubby thought it had “a certain je ne sais quoi”.

My jaw dropped. Did the douchebag just say that? Then the gag reflex started.

People really are delusional out there. $450,000 for 650 sq feet for an ex dock worker’s shack ? Just to have “own” some “je ne sais quoi” ??

It’s the glamorization of reduced expectations and living standards and the sheep are buying into it.

LOL. Can’t stand those types. They’re usually completely full of themselves too.

Real Homes of Genius near real homies…

Almost $900K for an old house, probably with lots of Homey Depot upgrades. This Mid City part of LA is not terrible but definitely iffy…

http://www.trulia.com/property/3121817398-2116-S-Dunsmuir-Ave-Los-Angeles-CA-90016

Check out that price history

Even more fun, check out the crimes report for this piece of heaven.

Not a particularly welcoming neighborhood if you happen to own a car, or enjoy walking down the street.

Your auto insurance might be more than you mortgage in this neck of the woods!

Not the worst neighborhood, but definitely not Bel-Air. That particular area is very close to Culver City and more desirable then the area to the East of La Brea which is even more ghetto. I wouldn’t be surprised if this whole area gentrified in a number of years if current market conditions continue.

At least that Dunsmuir Ave house IS cute, and the landscaping is nice.

But, dammit, why no rail on the stairs?

@ LA’r

the price on that home was ridiculous, but Yes, now that people are getting priced out of WLA, Culver City, Palms, Mar Vista, Venice, they will start to purchase in these lower tier areas between La Cienega and La Brea. From Olympic Blvd down South till you hit Kenneth Hahn Park. This area is not too far from the coast AND although sketchy, nothing near as bad as East of La Brea.

QE, I absolutely agree. 850K+ to live in the hood off Washington Blvd. is complete insanity. But I think we can all agree that someone will overpay and buy this piece of crap. It will probably be a 1st time buyer who succumbed to a bad case of housing-fever and tossed all common sense out the window. This is the market we are currently in.

From the OC Register: OC median home price reaches all time high of 651K. Surpassing previous bubble peak back in 2007.

http://www.ocregister.com/articles/median-720069-home-price.html

“It’s totally meaningless,†economist Chris Thornberg of Beacon Economics said of May’s price record. “First of all, it’s not inflation-adjusted. And if you look at it from an affordability standpoint, homes are far more affordable now than they were in 2007.†Once inflation is taken into account, May’s median was almost $96,000 below the June 2007 high.

There we have it, when accounting for inflation and today’s much lower rates…housing is definitely cheaper than the peak bubble highs of a decade ago.

You know, after years of lurking and looking I pretty much ended up finally biting the bullet and moving to a house. Westside rents for 2 bed apts, I couldn’t get below $3,000 for something semi nice with parking and pets allowed. It’s just gotten too crazy, and due to tech moving in I don’t think it’ll go away.

Instead for $2,500 PITI including $100 in PMI I got a small 2/1 in Lakewood with good schools and no crime. I did have to spend about $40k in remodeling as it was a light fixer, but now I have all custom flooring, bath, kitchen and if reappraised it paid for itself in equity plus some.

After tax deductions for property tax, and mortgage insurance my effective payment will be $1,950 plus maintenance. And some of that is principal, too.

I figure if I’m in for 10 years, I can ride out a drop. I don’t see a huge 25%+ drop happening. Maybe a slight one but not like before. I feel like LA is now “discovered” as a good alternative to SF for industry and once that happens it’ll just have more demand always. SF keeps recovering and going higher and higher after every bust…

I would have waited if I could as it’s obviously a market high right now, but sometimes life pushes you. Pets, girlfriend, life situation, I just couldn’t justify renting for $2,500 anymore and not even having everything I want.

Downside: commute went from 20 minutes to 70 minutes. Luckily my job is strictly 9-5 and so a 11-12 hour workday with drive included is not too bad. Some people work 12 hours PLUS commute, so I’m lucky in that respect. Had this not been the case I may have just moved out of LA altogether and switched jobs.

I used to be on the “renting is OK in LA” side but rents have gotten so crazy that it required a re-evaluation, and your rental parity argument just makes more sense now than it did back in 2007 when prices were high but rents were not as high…

If the median home price sales in LA went from $350K to $675K in only 5 years, a 25%+ decrease in home prices sounds very likely to me. When the tech bubble pops, it’ll ripple through the whole west coast.

Wow man you’re spending an extra two hours each workday sitting in the car and that’s pretty much an entire additional workweek each month staring at bumpers all for a 2/1 in Lakewood?!?!

@whoa,

Yep, a 2/1 from the 50’s within 20 minutes of work is around $4,500 in rent, maybe $5k in mortgage, and costs $800-900k. I don’t have that money, so to make up for the $2000/month I don’t have I am spending an extra 2 hours a day out of the house. Like I said that’s the downside. To make the $2,000 post tax required to have the house I want I’d have to make around $2,800 pre-tax, for that one week of “work” looking at bumpers. That’s pretty good pay for just driving and talking on the phone!

Like I said it only works for me because I can work 7.5-8 hr days at work with no problem. If I had to put in overtime like many people I know, it wouldn’t work. If I ever switch jobs it’ll just be in OC or closer to home, I’d only stay on the westside for my current one as it works well for now.

What’s Lakewood like? I never been there. I hope it’s better then nearby Hawaiian Gardens.

@LA’r

Lakewood is great as long as you’re in Lakewood proper. Go too far west/north and you’re in bad north LB areas. Go too far east and Hawaiian Gardens is no bueno. But just north of HG there’s Cerritos/Artesia which are great areas. The best way I can describe it is like living in Cerritos at 75% the cost because there’s no Asian premium.

We really liked Lakewood and decided for that over other areas. The GF is picky and she loves Irvine and has a place there with her family but it’s not an option for me and she approved of Lakewood.

It’s clean, low crime, good schools, and 7 miles to the coast. On the weekends I can hit downtown in 20 minutes or go to Venice in 35-40 or South OC in 30. The people are nice and down to earth, not stuck up like on the westside or too hipster-y like in places like Silverlake, all of which I’ve grown tired of.

The only negative is my hour long commute. Then again I have co-workers commuting an hour from WeHo or K-Town and living in apartments there – which I would never do. Then there’s people who commute an hour from the valley. Why one would choose the hot muggy ugly valley over a more coastal area like Lakewood/LB I am not sure.

It’s all about one’s lifestyle, priorities, but I just wanted to point out that LB’s correct in that rent has gotten so high, the equation changes. If there’s a place that can be bought for close to the rent cost, and you can hunker down for 10 years, and your life is at a point that you might want to settle down, it’s not a terrible idea.

Look at Yellen…she just said interest rates are not going to rise now. I saw that one coming…once I saw delay after delay in the raise, I figured they are not going to raise it. Too many people have skin in the game for them to raise rates and lower everyone’s home value. So the only way to get the big drop is a huge job loss recession…then there are two options – ride it out (CA seems to always recover in 10 years or less, in fact in ALL of the previous drops it has recovered and gained more)…or just play their game and do a strategic default and get a free place to live until they kick you out. Playing by the rules just gets you screwed with the current leadership, so you might as well just join the club…

I also think the migration of tech into LA can’t be discounted, that can be a factor that keeps price up too. The biggest factor I think will be if Chinese money dries up – but they are so picky and buy in herds that it would affect certain areas the most (we all know where). I specifically avoided places with high numbers of Chinese for that reason.

With rents the way they are now, I’m joining LB’s camp – look at rental parity, hunker down for 10 years, and go as close to the ocean as possible.

ha guy good luck with all of that been there done that more than once and it sounds like you don’t know what you’ve talked yourself into! I swear two hours a day stuck in traffic takes a huge toll on health and sanity plus the freeway you never know what to expect and there are always those days where some bullshit just makes it grueling but you get what you pay for! yeah they always say well I’ll just get a job closer by but that’s the catch the best jobs aren’t close enough by.

@A: “With rents the way they are now, I’m joining LB’s camp – look at rental parity, hunker down for 10 years, and go as close to the ocean as possible.”

You are putting a tear to my eye. Congratulations on your purchase. Skyrocketing rent is a major factor in today’s rent vs. buy equation. A decade ago, all signs pointed to renting. The same is not true today. Unlike home price in socal, rents generally do not fluctuate much. The long term trend is up, that simply can’t be refuted. Those 3%/year rent increases may not seem bad in the short term, but are absolute killers in the long term. Good luck.

@whoa,

I didn’t have to talk myself into anything. The rent situation just forced my hand. I had two choices: live in a small apartment without laundry, that is probably from the 60’s and not that nice (trust me I looked a LOT – pet restrictions make this difficult), hearing my neighbors all the time and dealing with silly rules all the time…or just spend an extra 40 minutes each way in the car (commute 20min>60min) and enjoy a 2-bed house with yard and garage that is MINE.

I decided that living in a crappy apartment was more depressing than driving those extra 40 minutes each way, that’s all. Either one is not ideal. but the skyrocketing rents due to the Silicon Valley migration to west LA just left me with those two choices. I do think tech will bust and things will change, but I feel that LA has now been “discovered” as an alternative to Silicon Valley and it will just end up recovering like it always does, like SF always does.

I bought even thinking, that LIKELY it will stagnate and possibly drop 10-15% in my opinion during the next downturn. But my life situation and needs at the moment just made waiting more difficult. So I told myself since my job is stable during recessions I just would have to ride it out. And I was very strategic in where I went.

I do agree it’s not a good time to buy IN GENERAL, but with Yellen saying interest will stay low (remember when the increases were just “delayed”?), and considering that the house I ended up in costs $2400 in mortgage and rents for around $2200, when I account for tax deductions and principal reductions the rents have just gotten so outrageous they changed the tipping point with these low interest rates.

Again, not always, not everywhere, but it’s not correct to compare to 10 years ago without accounting for inflation, rate drops, AND the fact that LA is just booming more than it used to.

dude do what you like but you’re only kidding yourself about the commute!

Sometimes we forget, overpriced housing has long-term social implications. As we create a generation of poor renters, we are also building a generation that will never have money for a downpayment or to start a business or RETIRE. We need to remember there are people affected by this and the manipulated market is swamping them. The implications of expensive housing are HUGE

http://gawker.com/the-affordable-housing-shortage-is-very-fucking-severe-1782428438

Both the short and long term implications are huge. Short term, high housing costs decreases mobility in that people commute farther distances – more time in traffic, less with family or other pursuits, lower quality of life. Long term, I see no middle class or affordable housing being built that isn’t rental and part of a side agreement when builders put up so called luxury homes/condos – which are a sick joke themselves. So the affordable rentals give those in them little opportunity to move up the economic ladder (aside from buying overvalued junk stocks). Many in previous generations were able to have a good nest egg thanks to housing, that is going away. The tribe in charge is in overdrive trying to create a slave class with their constant attack on our freedoms.

Not really. Incomes are down and cost of ownership has increased. Easy creative financing in the 2007 era such as option arms and interest only schedules allowed for lower monthly carrying costs compared to now. OER has been one of the larger components of CPI in terms of positive change over the past several years and essentials such as food and energy have seen a lot of deflationary action in the same period.

Thornberg must have meant that real estate is more affordable to investors this time as they’re the primary recipients of easy financing. Inflation has nothing to do with real estate when prices have far outstripped an inflationary numbers.

Thornberg somehow changed his stripes after the last downturn. He was a realist back then but now has turned into a real estte shill.

The future may lie in plug-n-play lego style roof housing.

http://www.cnn.com/2016/06/20/europe/stephane-malka-paris-architecture/index.html

Don’t you love it when the financial media translate higher prices as a sign of a stronger economy? To me, it just means people tired of house hunting bit the bullet and decided to settle on an overpriced crap shack and taking on more debt than they were willing to take on. Unbelievable!

http://finance.yahoo.com/news/u-home-prices-rose-5-131040773.html

By 2012 housing dropped 77% in my county. Homes that once sold for $238k were now 43k. Many people in my gated townhome community were doing all kinds of stuff to try and save their homes: hamp 1 and 2, negotiating with the bank, refinancing, strategic defaults, etc… Now prices have tripled and were basically in another bubble. I cant imagine someone paying 1m+ for this glorified tool shed only to see it going back to its normal price of 179k. Very risky.

PBS,

Very risky indeed. There will be a rerun of 2012 only it will be worse.

Here’s a different story from the Mercury News: http://www.mercurynews.com/business/ci_30037774/greener-pastures-beckon-some-beleaguered-residents

It’s about the exodus from California. Rising home prices, rising taxes, rising population with its over-crowding and traffic jams, are forcing Californians to move to cheaper states.

Article also says that California has a declining middle class, and growing income inequality between the very successful and very poor.

Smart guys by doing the sensible thing to move to a lower cost of leaving. All socialists paradises (CA is one of them) end the same – all equally poor with few overlords at the top (0.0001%).

Everything the governor promises to the poor is not giving from him or his rich buddies. He takes from whatever is left from the middle class, enriches himself and his cabal and give few crumbs to the poor for their votes. This is the essence of socialism – it works till you run out of middle class to steal from. Just like Maduro and Chavez did in Venezuela. A very rich country in natural resources has children starving and morgues overflowing.

Housing would tank for sure.. no one knows when..

Housing have crashed in CA many times. .the reasons were all different every time but the effect was same.

I saw it firsthand in 2009..

In 2006 everyone was saying housing would never crash…..

Okay, Brexit is now fact. Friday will be brutal for banks in GB.. How will this affect world currency and how will it affect the housing market in say,.. Socal? Only the Shadow knows.

This one is easy, HOUSING WILL START TANKING NOW!

The U.K. is going Bye-Bye–“See you later E.U.!” Watch the markets unwind like magic.

Gee, where did all that wealth go?

Leave a Reply to Wang bu