Doubling down on rentals – Las Vegas market dominated by investors but is the market saturated? 50 percent of all purchases last month came from cash buyers with the median price of $82,000. Over 1,000 postings on Craigslist showing free rent for rentals.

Managing properties is a hard business. The days of flipping properties and television promoting this bubble exploitation are gone here in California but do seem to have an audience in Canada’s ridiculous real estate bubble. Here in the states however most investors have shifted their focus to buying properties to rent out. Now this at least is more stable overall and many have to come in with large amounts of money to purchase. Yet places like Las Vegas may be reaching a saturation point. After all it is hard to determine the pool of renters especially in a contracting economic region. I think the data on Las Vegas is fascinating and wanted to examine the current trends playing out in the market.

The massive amount of rentals on the market

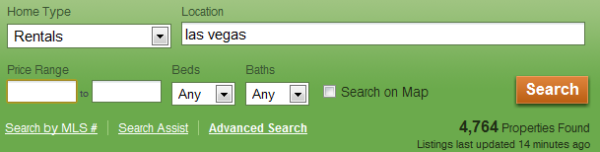

I did a search on Craigslist for the Las Vegas market and found over 50,000 entries for rentals. These are posts only going back to January but Craigslist has many multiple postings for the same property. This might be considered the “desperation†postings where people keep trying to get their place rented out and higher up on the list. So you can only use this as a gauge and not a raw figure. If we look at another place with MLS data we find the following which doesn’t cover the entire market:

4,700 rentals is a good amount but what I search for when looking at rental market health is how many places are offering free rent?

Over 1,000 recent postings on Craigslist for the Las Vegas market are offering free rent. This ranges from two weeks to the entire first month off. You don’t need to have an MBA to realize that giving out something for free isn’t exactly good business especially when you have expenses on the property. Now look at the prices above. There seems to be this misconception that people will dive in, buy an $80,000 to $100,000 property and have the best renter ever for years on end churning out $1,000 a month. That is not the case and most who have been in the property management business for years understand this. Also, if these people had a stable job don’t you think they would buy themselves? The fact that people aren’t buying to live in these places in larger numbers should tell you something.

For perspective, over 50 percent of all purchases last month in Las Vegas have come from all cash buyers. The median price paid was $80,000. And many of these hit the market as rentals. The number of people doing property management in Las Vegas is astounding. What prompted this analysis was a post over at Patrick.net from a Las Vegas investor who has a property manager:

“(Patrick.net) I bought a 3br/2ba/pool home in the Summerlin area of Las Vegas in Feb of 2011 for $134k, as an investment/rental. The first tenant skipped out after 2 months, stiffing me for $800. Next tenant only wanted a six month lease, but did pay their rent on time. They vacated on Dec. 31, and since then the home has been on the market—over one month at this point—without even ONE rental applicant. I just got the following bad news info from my property manager:

“We know you are concerned about how long it is taking to rent your property. We are very concerned as well because we do not want our customers unhappy and just like you we do not make any money on a vacant property…the single family home market has drastically slowed down because of the influx of all the new properties put on by the investors. I have been tracking this for some time now. Listed below are the records showing this trend.

Currently there are 6,614 properties on the market for rent.â€

Sales have perked up but most of this is from investor demand. At one point nearly 70 percent of all monthly purchases came from investors. I don’t think we have any historical precedent for something like this especially for an area with millions of people. Investors rushing in aren’t something new and what has told me something was suspicious with the market was the fact that prices continued to make new lows. Think about it, the median price of all cash buyers paid was $82,000 which is down from $89,000 last year. If rentals were doing so well, don’t you think prices would be going up?

The economy of Las Vegas

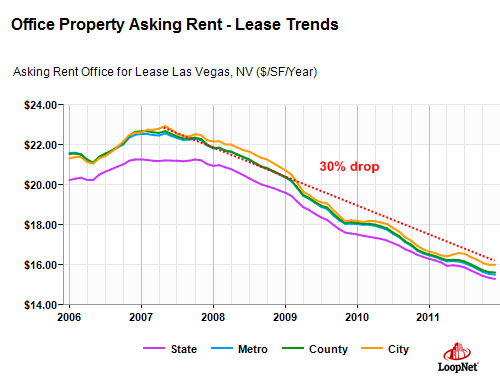

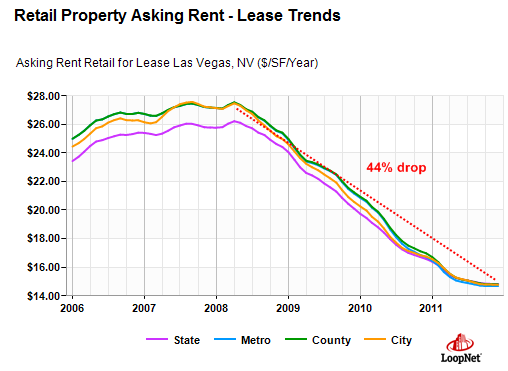

I’ve followed Las Vegas closely because at these prices, it is hard not to consider the area for investments. Yet the macro trends still don’t seem favorable. Obviously you need people with jobs from businesses and commercial property isn’t doing well either:

Keep in mind the above charts are looking at Las Vegas from a business perspective. Lease rates are at post-bubble lows. If jobs were flooding in and business was doing well you would see these rates go up because of demand. This is usually the case for any turnaround. But look at the above trend.

I know it is alluring to see homes for $80,000 and hearing sales pitches that you will be cash-flowing like Niagara Falls with $1,000 rental checks coming in until the cows come home. Apparently this is the mini-trend in Las Vegas and has been going on for years now and tens of thousands believe this. But rents are falling and when you start seeing massive amounts of “free†this or that you know there might be a problem. Obviously Las Vegas is a big market with prime locations as well but I can tell you many of those $80,000 properties are not in solid locations and this is where investor money is flowing.

I’d be curious to hear about anyone investing or living out in the area. Does the above data match with your own experience?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

78 Responses to “Doubling down on rentals – Las Vegas market dominated by investors but is the market saturated? 50 percent of all purchases last month came from cash buyers with the median price of $82,000. Over 1,000 postings on Craigslist showing free rent for rentals.”

I have thought about this topic a bit.

From what I have seen, the banks have held off on selling their *better* REO properties. When they finally sell them in bulk to their hedge fund cronies, the hedges will be able to rent them out for lower prices that will compress the margins of the 2010-2011 individual investors.

For example, if an investor purchased a home for $100,000 and currently rents it out for $800, the hedge funds will soon buy blocks of nicer houses that were previously priced at $150,000 for $100,000 and rent them out for $800. The small investor will then potentially only get $600. Not only will the return on capital be less but the homes will also be worth less. The hedge funds will also have lower overhead as they realize economies of scale with much larger rental portfolios.

Just my 2c fwiw.

If true, this trend is so discouraging for a small-time-investor-wanna-be like me and makes me sick to my stomach. Both spouses working, we live within our means, have no debt, and trying to save some down payment money for an investment property we hope to use for our retirement & for kids college fund. We were thinking owning a couple of properties will be our safety net for layoffs and save our kids from having monster student loans. How am I supposed to compete with hedge funds that eat people like me as their breakfast? Not only am I at a huge disadvantage when purchasing these stressed properties, but I’ll be at a disadvantage when renting them out! I’m sure managing properties is no picnic but we were willing to do it for the sake of financial security. I’m grateful that we are both working but seems like we’ll never get out of this wage slavery situation. We were hoping to own maybe 2-3 properties and retire early by 60 yrs of age but now I just don’t see the light at the end of the tunnel. Sigh….

I am sooo sorry that you will have to work for a living…

Just wait for the hedge funds to buy and for the market to truly bottom before you buy. Simple. Also, be satisfied with a lower rate of return than a bigger, more sophisticated play MIGHT make.

You have the ability to be far pickier with the tennants that you select than they will, so there is a certain edge . . . but only if you are local and are williing to put in physical labor.

I’d look for an investment property in a niche market. Stay away from where the hedge funds will go.

The hedge funds will buy and manage in bulk will want their homes in fairly close proximity to each other to get managment economies of scale. Stay away from the LVs, PHX, Miami’s and Socals.

Go find something off the beaten path or in a smaller vacation area where the hedge funds will avoid.

If you believe that hedge funds have a market edge over everyone else, and this is a market that you want to invest in, then you buy shares in the hedge fund / REIT. There are plenty of REITs for sale through Vanguard, Fidelity, etc.

We did it; it takes a lot of saving (primarily from relocating out of CA to work for several years, living in a cheap rental, lower cost of living makes it much easier to save…can be challenging with two parents, two kids, three cats). Buying at garage sales, driving old cars, cooking at home. Our well paying jobs eventually vaporized…we bought a few modest multi families between late 2008-mid 2010 with the money we saved; the properties are not in CA. Did much of the work ourselves, fun sleeping on air mattresses in vacant units with no electricity or hot water while working. Love discount mismatched paint, tile sales, scoring near new draperies/rods at a thrift store for $10. It’s no fun, nothing like a TV show, but it’s what we do, so far, it’s okay. We don’t own a home, we’re still renters ourselves. Plan is to move into one of the places in a few years…staying put until youngest graduates local HS in two years, then we’re gone. Not what I thought my middle aged lifestyle would be, but we’re still alive and kicking. Don’t give up. With long term sacrifice, it can be done.

I don’t recommend borrowing money to invest with, this is no different than buying stocks on margin. There are many cash flow investors out there, they buy rental homes with cash, and get about 8% return on investment. Not too many investments give this type of return today. The down side is that it is not liquid, you can sell stocks in .3 seconds, but not a house.

You can do it, do not get descouraged. I started as a small time investor and now have over 30 units. Stay focused, look outside the big cities. Small towns were people know there neigbors are best. The best returns are in the “c” properties, the higher return is worth the work. You will succeed if you are determined.

Why in the world are some convinced that the “hedge funds” will be jumping into this market feet first and affecting pricing with volume. Do you even know what a hedge fund is? They are no property management companies, which is what you are proposing. I’m pretty sure that the Harvard MBAs that run those funds will just do a cursory look at the incredibly tight margins getting tighter by the day as more “investors” jump into the market, and laugh it off as a money losing bet. Well, the more dishonest funds will try to convince some with money burning through their pockets at zero interest rates of 10-15% returns over five to ten years, all the while taking their 2% fees. That, I wouldn’t be too surprised to see happen. But, even then, they have to promise amazing appreciation of the value of these homes over that time period – like, maybe, doubling or tripling. I can’t see that happening in a place like Vegas.

Me, I’ll take my nice 6% in dividend stocks and quality bonds, and not worry about the type of tenant one would expect in a place like Vegas ruining my life. If they don’t burn the place down making meth, they’ll just get up and leave if the cops are on their trail for whatever.

yeah everyone in las vegas is a looser to u what a upstanding guy you are wish we could all be like u lol what a self absorbed idiot

I really doubt that hedgies will want to be landlords. They’re in the quick return business and being a landlord is almost the antithesis of getting a quick return. I think it’s more likely that they will get the great deal on bulk RE purchases and then just tirn around and flip them to the onesy-twosy investors.

Maybe the landlords could get some section 8 tenants? That’s a growing trend here in CA.

CAE,

A few observations…

1. In North Las Vegas headed towards the airforce base, there were several master planned communities built with homes in the $400,000 range. Those homes are now worth some place near $80,000. Most of them are either abandond, drug dens or rented to section 8 tennents.

2. I recently looked at the MLS to see what was avaleable in the LV area & was surprised to only find 10-listings. I new something was a miss & this may explane things a bit.

We know about the best places to live servay that comes out each year, but there’s also a worst places list as well & Las Vegas/ Henderson is on it. Factors included weather, housing prices, ecconomic stability & others that I cant remember at the moment. Also there are areas of the city that were a bit weird but otherwise safe to travel through a few years ago, but today I wouldn’t go near them. The area near the Boulevard Mall on Maryland Parkway South as an example.

Sean – I really can’t stand when locals start bashing “areas they wouldn’t drive through”. Until you’ve lived in the south side of Chicago where people were getting shot almost on a daily basis and the police would take their time to show up (if they even showed up)…don’t talk to me about an area you wouldn’t drive through. What is wrong with Maryland Pkwy? I’m a female and I work down there – daily – at night. Las Vegas is in a serious housing market slump – granted. But we have A LOT of wonderful things about living out here. Yeah, I’m upside down in my house about $230k….it’s depressing. But the people out here are great, the weather (despite being on a list as a bad thing??) is fabulous out here (you can have a garden year around out here and never have to shovel snow). We have beautiful natural areas like Red Rock Canyon and Mt. Charleston. Date night is never a boring movie & dinner Friday night ritual…there’s ALWAYS something fun, exciting & new to do out here. Where sin abounds, grace abounds even more. God is a HUGE presence in our valley. Our police department is top notch – I would argue one of the best in the nation. The officers that I always come across are friendly, interested, listen and are caring. I feel very safe in Las Vegas. Las Vegas is my home and I love it here – despite the crappy economic housing issue we’re having right now.

“I new something was a miss & this may explane things a bit. ”

Too funny. And even a “spellcheck” will only find one error…..

Great post Sandy. And an even greater attitude about life. Truly, home is where the heart is. No neighborhood bashing, no condescending digs at so-called non-prime areas, just plain “counting my blessings”. Bravo!

@Sean, right on. @Sandy, there are only 3 zip codes I will buy in. 89128 (west of Buffalo, south of Cheyenne), 89134, and 89144. It is 10 degrees cooler in this area compared to the east side and Henderson. The water district is forcing people to convert to desert landscaping. Talk about ugly. Metro is a murderous bunch of ex security guards. Top notch myass. Most of metro is worse than the criminal population.

Currently there is some sort of shortage of foreclosures because our Nevada politicians decided they knew the best way to help the housing market. It will take some time for the foreclosures to process, but they are still there.

Real estate agents blame everyone else for the mess. If you really look at it hard more than 80% of the problems were the blame of the agents. These people are illiterate scumbags. They could not get a real job where a brain was required.

section 8 doesn’t only pay rent, they pay mortgages as well. i have a friend who is a realtor in the sf bay area. he had a foreclosure listing that received an offer from section 8 recipients. he was shocked to receive the offer, and even more shocked when it closed. thankfully section 8 doesn’t make all 360 payments, only the first 240. so get back to work! no slacking! those people are counting on your hard work to make their mortgage payments!

Glad to see you mentioned commercial real estate. It is the same underlying problem. The cost to borrow money was under priced, so it was borrowed for marginal projects. This is quite apparent when you see an office building or strip mall being built near a half full one a block away.

Eventually, the vacant office, retail, warehouse, and factory space will be leased, and then new construction will resume in earnest, providing hundreds of thousands of construction jobs, not to mention the jobs of the workers inside the new digs. Seems like that will be many years in the future, though.

I new it was only a matter ot time, Vegas was the first with the foreclosure problem, people lost their homes, forecloseures flood market with cheap houses, investors rush in for next “pot of gold”, to many investors, rents drop or houses can’t be rented at all. Investors stuck with a crappy pain it the A## investment and wish they never bought.

I thought the Patrick.net article was very interesting on many levels. It is very funny how the same folks that tout “what the market will bear†when their house/rental/investment is going up and then state with a straight face “the government needs to fix housing†when the market corrects.

So many have commented how rent is not at par with owning in either direction and surmised that it was or was not a good time to buy based on which way the wind was blowing. The facts as I see it are that there is a surplus of housing and wages are not strong enough to support the current cost/price of housing.

The current situation in Las Vegas is interesting from an economic perspective. A surplus of houses was built during the boom because the market was signaling builders to build and they did. Then the market collapsed when there were no more “greater fools†left. The market signaled “investors†to buy the relatively cheap homes to rent out and they did. This created a surplus of rentals which lead to rent reductions. This is a simple exercise in supply and demand. This is a very important lesson because I believe that this is our future…

Hey Doc – how do your numbers look for South Florida which is a comparable market to Las Vegas. I own 3 section 8 properties which results in a Healthy ROI. I would like to buy 2 more but after reading your story about Las Vegas my fear is that the South Florida Market may be similar. Great article and thank you for any advice or stats available.

As a Realtor in LV and a researcher into the biggest bank ponzi scheme ever perpetrated in world history I have an opinion on this topic. I completely agree w Dr Housing Bubble! The rents will have to come down. I have been advising my cash buyers to wait a little because the 80 k house of today will be the 65 k house this year. I also am not trying to get 1000 a month for a rental. don’t chase the market down and pay on the way. The school of thought is everyone will pay 1000 a month. Not anymore, they don’t have it. Incomes have been slashed and the dollar buys less so 800 is much more realistic and if our corrupt bank owned Obummer has his way there will be a new manipulated market of bulk sales to rental properties and so rents will have to go down and price to own will go up as supply diminishes but who will want to buy if rents will be dirt cheap and the home value is only based on government sachs/ banksters manipulations of the markets! This is not a free market, this is a corrupt manipulated market. The banksters already stole the future equity for generations to come and the Atty general Erik holder worked for the banks and helped them create MERS and represented them and now is in charge of prosecuting them hence no banksters have been arrested. We were robbed and no one us protecting Americans from this theft. Until we clean out the wolves guarding the hen house we really are simply at the mercy of our masters. Revolution!

Wow! I actually agree with something you said!!! I’ll be right back, I need to check and see if hell just froze over…

Wow my mind just exploded from a hypocrisy overdose.

Be honest. Leading up to 2008, you were telling everyone “it’s a good time to buy”, right?

“I have been advising my cash buyers to wait a little because the 80 k house of today will be the 65 k house this year.” Aside from being an illogical sentence, if that is truly what you are telling your clients then I want to buried with my ice skates on, in case I go to hell…

“The banksters already stole the future equity for generations to come ”

Complete B.S. Much and for many ALL of this equity was an illussion from the credit mania. It only existed because of the credit mania and was only made possible because of the absurdly low credit standards which enabled millions who had (and still have) no business buying any home to do so. If credit standards had remotely resembled what should exist in a non-distorted mortgage market (they STILL do not), there would have been no credit bubble, no real estate price bubble and therefore, no “equity” for these people to “lose”.

Lynn Chase: ““The banksters already stole the future equity for generations to come â€

EM: “Complete B.S. Much and for many ALL of this equity was an illussion (sic) from the credit mania. It only existed because of the credit mania and was only made possible because of the absurdly low credit standards which enabled millions who had (and still have) no business buying any home to do so.”

I see…..sooooo EM, if it wasn’t the banksters that pushed to approve these liar loans to buyers incapable of repaying, then packaged up these turds and selling them as AAA-rated investment vehicles…then who was it? Give it a sec to sink in….

Hey Doc: where is that woman that commented a few days ago about how she and her husband were thinking of buying the rental in Vegas they were living in, because she was “paying double for rent what it would cost to buy it”…and that is “wasn’t in a good neighborhood” and “had 70’s style kitchen”…etc? I told her to go look for cheaper rental or better place for same money…..and to be cautious…..that I expected the market to drop more soon.

I had no idea she had almost 7,000 rentals to choose from….sheesh. I’d be hating life if I had plunked down $82,000 cash for a place, and had 7,000 competitors….in declining market..for rentals and jobs. Didn’t I read just a few days ago that the unemployment rate in Las Vegas was a staggering 50%???

Again, the US economy is showing NO SIGNS of improvement, there is NO CHANGE in monetary policy, NO CHANGE is budget outlays…and wise investors know what asset class has shown a 10 year bull market in these conditions. And if the conditions aren’t changing, in fact, are still degrading…where does one place one’s assets?

I won’t say if those without ears don’t hear what I just said.

If you MUST buy housing R.E., then use the old logic: location, location, location…or buy agricultural land producing cash crops….look at inflation, and the Total on receipt at checkout at your grocery store. Food prices are rocketing upward….because the dollar is getting debased.

Back in 1990, at the very peak of the California real estate boom of 1985-1990, I sold a place in Fremont for more than triple what I paid in 1985 (bubblicious!)…and bought a 10 acre place in Mendocino county…with old farmhouse fixer-upper. I paid $82,000. Put down $12,000, owner carried a 15 year note, $700/month.

It had over three acres of very mature fruit trees, pears, apples, cherries, berries and walnuts…the valley did not allow chemical spraying….(Gerber bought all the pears for baby food from a local orchard near me), and on 6 acres I planted oats & peas for hay to sell.

The pear trees alone produced fresh and dried fruit to feed me and family for months. The apples, cherries, blackberries….we canned, we cooked, ate fresh…..and probably saved enough that it paid for 4 or 5 months of mortgage. Had veggie garden, tomatos, corn, squash, melons….had an old chicken coop: we kept chickens, had eggs too…they mostly fed themselves, lost a few to chicken hawks…heck, everyone got fed.

Both of us kept part-time jobs to pay the bills, medical insurance, fuel for vehicles, utilities, kid’s recreation, etc.

No traffic lights or jams. 5 minute drive to work. Fresh air, take a 15 minute stroll…and stay on own property.

People, I am saying this…because unless Americans stand up, and toss off the yoke of “Globalization”…and re-erect tariffs, resist this urge to roam SuperWalmart to buy imported Chinese goods, manufacturing is a lost cause in America. And so are the resulting jobs…including the R&D engineers, the waitresses and cooks at local eateries feeding the middle managers, the tire store guy selling to commuters…..all the way down the food chain…including the tax base that builds schools, pays for fire protection services, parks and road crews, etc.

If we do not change direction…..then please consider: during the last Great Depression, when @ 25% of Americans were unemployed*(included/includes those working part-time but needing full-time employment)…there were @ 185 million Americans back then…and almost half of them lived in rural areas and had agricultural jobs. They left seeking JOBS in the cities. Almost 42 million Americans seeking work. Now less than 2% of Americans live on farms….this won’t end well. Why?

Because NOW, there are 330 million+ Americans…22.5% of which are unemployed.*

That is 74 million needing work.

You tell me: which was the GREATER DEPRESSION?

WHERE WILL THEY GO TO FIND JOBS?

They won’t…they will learn to grow food, or starve. Or they will revolt, however that must be done, and throw off the yoke described above.

There is no MAGIC involved…and no OVERNIGHT CURE for what ails America. No “painless remedies” exist. NONE. The sooner “privileged, entitled” Americans grasp this basic premise…the sooner the bitter pill can be taken, and the healing begin.

Jobs that produce domestically needed goods, and exportable goods are the Cure.

The Ailment is Globalization/Imperialism.

theyre doing the same thing with the stock market!! watch out below

Yea it was all the bankers. There weren’t any individuals standing in line to buy and flip properties. They were all innocent bystanders who were forced into the housing market, by Bush, Holder, Obama, Barney Frank and the Gubberment,

There also weren’t any home ownere who took out HELOC’s so they live and drive cars like the “rich and famous”. Of course, every US home buyer was responsible and lived within their means, the whole problem must have been caused by them terrorists. Best solution to the US housing problem – Lets invade Somalia.

I will not argue a single thing you said in the post. But let me ask you about this: why would you expect a $80k house will get you a rent of $1000 a month? $800 is not enough? Even with 800, you are getting 12%? Today’s 10 year T note is 2%. I don’t know about Vegas, but in anywhere, if you look at the rental, it’s hard to get a decent place at bargain price. If you are a realtor, is today not a much better time to buy than 2005? I said before that people are interesting creature. They don’t buy when the price goes down, they buy when it goes up.

I will let you catch the falling knife…

You hit the nail on the head, and heads should roll. The american people have been scammed, by fraudsters both big and small.

Lynn,

What a delight to run into a broker who has their clients financial interests firmly in the forefront. I have been planning to invest in US real estate, but everyone up here in Canada says to stay away from this meatgrinder. I keep telling them that if I can build a team, investing in the sunbelt is smart business. I invite you to email me. I would appreciate the opportunity to communicate with you.

Sincerely,

Ed Rempel

Jared Farms Ltd. Starbuck, Manitoba Canada

Great rant!

One comment about the price of housing coming down hard this year is correct. Not sure we will see 20%, but may. When the foreclosures start coming on the market again there will be fewer buyers. The investors are using hindsight to compare prices and over paying. We will never get back to the previous economic high for 20 years because of the construction trades. We have too many houses and commercial properties and casinos! Look at the vacancy rates.

Now, I have to take you to task. I absolutely HATE real estate agents. These people taken as a group are the most dishonest I have ever stumbled across. When I look at the real estate bubble I see real estate agents at the center of it. They were the ones that told buyers the market was always going higher and it was a can’t miss investment for the long term.

They got people to over bid and stretch themselves way beyond their capability to afford the house the agent pushed. They helped the buyer by pushing them towards the mortgage broker that was the most “flexible” and got the buyer to take on a gimmick mortgage they could never pay off. If the price was a bit too high for the current market the agent found an appraiser that would come up with the right numbers.

The banks are only to blame for not doing the oversight needed to make sure the property was worth the price and the buyer could actually pay it off. The agents saying the bankers are at fault is like the shoplifter saying the store owner is at fault because they did not catch them.

Scumbags!

I just checked Palmdale / Lancaster Craigslist homes for rent . Both cities are in the Amtelope Valley here in Southern California, and are considered to be the bargain basement of residential real estate. The appear to be pages and pages of properties for rent. Looks pretty saturated to me. Thank you for the reminder to check. Does this mean even more price drops in the area?

Looks like it

Jason Clark

Santa Monica

Looks like a buying opportunity in 2013-2014, perhaps. But at a certain point, who cares if the mortgage is 300 and the rental income is 600? That $300 delta is going to get eaten alive by basic repairs. There become a “chump change” factor at a certain point where none of these lower lier houses are worth the time and engergy to invest in. I wanted to own in the high desert for a long time because of the “attractive valuations” (Yucca Valley Joshua Tree, etc) but came to the conclusion that a house that rents out for 500 a month isnt going to help my situation much regardless of how much cheaper the mortgage is and regardless of how goo d the tennant is. But it could be a major time suck.

I’m getting 400 a month in various dividends, 80% of which is tax free becasue of the nature of the account, and 20% of which is taxed at 15%. I can handle that, and you know what? I never have to lift a finger to get it. Better to be in sold blue chip stocks for the long haul than messing around with far flong, low rent real estate holdings. . . .

There are a lot of foreign investors flooding the market right now, I have been monitoring International new channels from Asia (primarily chinese) and there are a ton of interest from China, Taiwan, other asian countries in US real estate. Of course, a lot of chinese realtors here in the US are also pushing the stuff out there. Foreign investors have no clue which part of LV is bad, ok or good, to them, LV is just one big city, and of course buy into the sugar coated claims.

In any purchase, you need a system to put value on the item. US is in general the cheapest place among places you mentioned. You will not get a house for free, let me remind you that. People from other countries have a little better sense of comparative value.

I am not saying everything is rosy. But if you have a stable job and you want to buy instead of rent, I think this is the best time. I also think buy is better bang of buck than rent. We have not built many new houses for almost 6 years, and we have population growth in this country.

One of the beauties of the residential rea lestate rental market is that it has about the least amount of govt intervention of any market. Section 8 is pretty much it. So everything else about it is very much a supply/demand relationship in the open market. An area like LV is in deep trouble because the unemployment level is so bad. As more homes hit the rental market and jobs remain scarce, the prices will be coming down.

A significant portion of the local residential rental property business is also done in cash.

My family owns 9 properties in Las Vegas. I operate a fund which acquires properties, fixes them up, rents them out, and sells them to cashflow investors. I know this market very well.

Rents did see a normal season drop this winter, but there has been no epic collapse of rent rates. I only buy properties that rent for more than $800 per month, so I don’t feel the pain of the low end of the rental market. Perhaps things are still really bad there. Condos which compete with apartment complexes at the bottom of the rental market have a lot of vacancy, but single-family detached homes rent fairly easily. As always, it’s a matter of price.

How many people do you think can afford to rent those properties. If they are making that much in Vegas then most of them would buy. There are very few in Vegas who can afford such properties.

There are very few in Vegas that can qualify for a loan of any kind. 85% of the houses are under water. Unemployment is high. Most jobs are low paying.

It’s been obvious for quite some time that single family homes, do not make for good rentals. Even if they do cash flow! Savvy Investors went Multi-Family a long time ago. The other alternative for single family investors is to think – Lease Option sale. That way at least you have a fighting chance to make some money. Combine that with Seller Financing when option exercised and you have a strong case for long term cash flow and equity appreciation. And! You can also sell the note if so desired!! Win-Win!

Hey Dr.

I follow ur blog and http://ochousingnews.com/

Over there Irvine renter is holding seminars to buy cash flow properties in Irvine. Some people still think that they can make money. I always use to wonder how can somebody get renters in vegas where jobs are so unstable. Me and my wife had discussions about buying rental property in vegas and we always concluded with a question – where to find credible renters??

sorry meant vegas and not irvine

I would like to see an analysis of the East Bay Castro Valley area in Northern California.

At some point the middle to high end REOs and those forced to/able to sell come forward and this market takes a hit. I’m not talking the A++++ beachfront home in Malibu but I am talking the very nice communities where people are sitting in what they think are $800-$2m homes but everyone makes $100-200K yearly.

Those are good jobs and incomes but those incomes don’t get one to those house prices. Those house prices are debt/leverage/speculation driven along with a history of several equity out sales for which the mechanism to realize no longer exists (no bottom feeders paying up driving the market and interest rates already at the bottom so affordability is purely income/cash flow rather than past appreciation). Eventually these come to market and market price is going to get crushed to real income levels which is going to put more pain on the lower end.

You see it in Florida where one community built in 2004-5 had $700K houses now priced at $200K but right up the street is a 1990 community with more seasoned mortgages and everyone still wants $600-700K. No real difference outside of forced selling and distress, but guess what – there are far, far more psuedo $700K houses than there are large income earners (250K minimum) able to carry them and that isn’t going to change for a very long time. Supply/demand sets price and you can’t rig this on hope forever.

Today on CNN the talking heads were chit-chattering about how Americans took out record debt in December, most of it was student loans, and that was a good thing. Not with the current wages college students (can’t) find upon graduation. So as Dr. HB has pointed out these folks will be debt slaves to their loans for years, if not life, and never able to buy their own place. But no worries, with the Fed and the banks handing all the REOs over to their landlord buddies, instead of letting ordinary people buy them at sane prices, the mega-landlords will turn these places around and rent them right out to the poor debt slave college graduates!

It’s all being driven to an end goal of turning us all into debt/rent serfs. Once again, California is leading the trend on this.

Lynn, it was marvelous to read your comment, and from a realtor yet! Way to “cut to the Chase” (sorry, couldn’t resist).

Yes, “Obummer” is obviously beholden to the Four Banks of the Apocalypse… but listen to the other alternatives. Mitt “corporations are people” Romney??? They’re ALL sold out, with the possible exception of Ron Paul.

It will indeed take a revolution to clean this rats’ nest out.

I’ve been looking around Vegas for about 2 weeks and have just put in an application to rent. A good house in a decent area is hard to find, and they seem to go quickly. But there are tons of houses built during the bubble that are in crappy locations. Furthermore, even in the good locations, most of the houses are poorly maintained. The better houses have had applications come in as I was looking at them. Talking to other new-to-Vegas renters, they echo my feelings that most houses are junk and that the good ones go fast. One guy I was talking to yesterday talked about looking at 30 houses to find one in decent shape (he was in the $1000/month range).

We were looking in the 1500-1800 range and didn’t like the quality and/or neighborhoods. We then started to look in the 1800-2300 range and found a few houses that were in good neighborhoods, were well maintained, and had good layouts (it is amazing how hard it is to find something here that meets all 3; some of these architects and developers should be ashamed but I guess it it sold during the bubble…). Also, I will admit that I am more picky than most!

So, based upon our search criteria and looking at 30-40 houses, we found 4 houses that were acceptable. Here are the asking rent and the home values (using Zillow):

$1800/month versus $216K in Henderson South of 215

$2395/month versus $310K in Henderson North of 215

$2250/month versus $303K in Rhodes Ranch (they have HOA fees of around $165/month)

$1995/month versus $208K in Summerlin

If we decide that we like Vegas, we’ll buy something to live in. Prices could drop more, but based upon monthly payments and quality of life, we’d rather own.

For investment property, I think it can work for us IF we choose wisely and really fix it up first. I don’t think that most people are as picky as me, and there are better returns at the properties more lower end than what we wanted. But, if you just plan at buying something and throwing it on the market, I don’t think it is as good as a lot of people think.

I think this is the most informative post of all. To make money is to buy low and sell high. It sounds really easy, but people always do the opposite.

Great article. Up until recently, Las Vegas was really a question mark for many investors. Yes the rent to price ratios would make sense form a cash flow perspective ( if you could keep them rented), but it has been so unclear as to the city’s future.

Historically, rent rent prices are much more sticky than home values. During the housing collapse, while national housing prices fell by more than 33%, rents only fell 3.5%. However, this is what happens when investors come with cash to pick up the unbelievably high volume of inventory as underwater houses get pushed the foreclosure process. Eventually, rents have to correct because vacancies shoot through the roof. I was expecting 12-15% drops in rent, but these numbers are actually unbelievable.

There is no reason to be messing with these markets. Don’t listen to the realtors that are claiming to be excited that “we haven’t seen prices like this since 1989.†This goes for commercial properties as well. Because the rents are dropping in single family, it has a direct connection to the rents in multi-family apartment complexes. SCARY STUFF.

I have one *major* problem with this analysis…

“If rentals were doing so well, don’t you think prices would be going up?”

The deals that are closing *today* are short-sales are just now being approved by the banks, for offers written 6-12 months ago.

I’m in Phoenix, we’re in much the same shape as Vegas is * but * there is no inventory here.

If you look at under $100k, not *pending*, and not *short-sales*, you get about 1,000 homes to look at.

This isn’t Iowa, this is *Phoenix*. So prices *are* going up.

No inventory in Phoenix? Is that Phoenix, AZ or Phoenix, Beverly Hills? Redfin can’t even show all the listings on their map because there are over 10,000 listings. So I narrowed my search to under $100k, and I get 4700 listings.

hmm,low rents,looks like a soon to be ghetto.

— I’d be curious to hear about anyone investing or living out in the area. Does the above data match with your own experience? —

Okay, I’ll testify (I posted at Patrick, too.) I live not too far from Boulevard Mall (Maryland Pkwy. area.) I am not happy paying $1,400 for a SFH (est. $120K, peaked at over $300K, 1,999 sq. ft, ranch, 3 car garage, rock front yard, grass backyard, no PITA pool) – but I like the house, despite its old kitchen (our microwave goes ding) and it is close to UNLV and the Strip.

What I don’t like is the feeling I get that the area could turn into a REAL slum overnight. I see people packing up the stuff in their garages everyday. About half of the owners’ house values are back to what they paid for them long ago; the rest are really underwater. It’s good to be a renter; we’ll just move if things go bad (but I am getting tired of moving.)

I agree with Sandy – the people are very nice, pretty friendly, almost all in their late 50’s – 60’s.

a microwave that dings ..ohhhh the suffering

Ha!

Hey, I’m hardly a spoiled b*tch; I don’t have to have the latest and greatest. I just hope it’s not leaking. I only mentioned it because my 19 yo kid’s friends had never seen a microwave that old.

I rent in the Pueblo section of Summerlin. 3 bd 2 full ba, about 1400+ SF. Condos, gated, (Red Hills if curious), nice grounds and they are putting money into the complex. $1,025/month. Saw a 2 bd 2 ba 1200+ SF next door go for $800. I will be looking around in a couple months to see if I buy or rent again.

After looking at everything for a few months I figured the rental market was not that good, and decided to put off investing. I may still buy just to get a house I like for long term. Got a feeling the market here (and in other areas) may implode in 2013 and 2014 before we recover (yet again).

Dr. HB:

I don’t understand the hue-and-cry. One month free equals an 8.3% discount, two weeks free equals less than a 4% discount. If anyone expects greater than an 75% paid occupancy rate for their property then they are smokin’ crack.

For a purchase price of 100K, renting at 800/mo will give you a break even at ~ 65%; so what’s the big deal?

The comments on this blog are assuring me that we have not hit a bottom and we are nowhere near a bottom. Why you ask? Because I am not seeing any capitulation in the housing market based on all the greater fools who still talk of buying a house as an investment/cash flow generator/etc. I consider this site more of a housing bear site or at least the average reader is more educated on the housing market than most and we still hear arguments that buying a house is a good investment? One important sign of a bottom is capitulation and I am not seeing any…

Exactly.

When we still have posters such as Pete trying to convince people that now is the time to buy and using statements such as ” I also think buy is better bang of buck than rent.” all I see are 1st generation foreign (r)ealtors who don’t have the best grasp of English idioms.

It is obvious that housing is still being “sold”. If people need to be convinced to BUY, then it probably isn’t such a great deal. We bears don’t make a dime from convincing people to wait.

I am just gonna let you have it.

Any generalization about any investment is just bad advice. The right property in the right area at the right price and you can still make money. In fact RE is the one area where you can make a huge amount of money in very little time–even in this market.

E.g., condo purchased for 125, put 25 into it, sold for 175. Outlay: 60, Profit: 20, Time Frame 6 mos, Return: 33%/annualized 66%. SFR purchased for 130, put 50 into it, sold for 275. Outlay 80, Profit 120, Time Frame 4 mos, Return: 150%. Annualized 450%.

Wah, wah, wah–stop peddling this pessimistic despair as wisdom. Because RE is highly leveraged, lots of money can still be made.

Yes, gone are the days that any moron can buy for $250, sell for $550 within a year, giving the moron a 1000% profit. Those days are gone (thankfully), but there are always opportunities to make money.

What are you going to do, but it in a Jumbo CD at 0.3% ? (Yes, the real rate). The S&P at 5% ? (Again, the real rate).

Just STFU, and get out a drive around and find a property that you can make money on.

You are just another one of the greater fools…

How come when it comes to Las Vegas nobody talks about the dwindling water supply? If no action is taken Las Vegas will run out of clean drinking water within the next decade. The Las Vegas Sun has done extensive reporting on this. http://www.lasvegassun.com/news/topics/water/

I wonder if this is a consideration to investors looking to purchase real estate in Vegas?

The sky is falling!!! Lemme know when lake powell dries-up, Ill give you million bucks.

I’m not saying the sky is falling. I am pointing out a consideration that should be made when buying in a desert community. Will they actually run out of water? Probably not. Will the lack of supply cause water prices to significantly increase? Probably. Not to mention a tax increase to pay for better infrastructure to import more water. It’s not fun to live in a place that reaches 100 plus degrees during the summer, and not be able to afford to fill up that nice pool you over paid for.

Oh, it is late in the post to be putting this out there but CH Smith over at oftwominds blog had a great comment way back in 07-08…

He said “I’m not going to mess around with namby pamby predictions of 10-20 or 50% drops in price. A lot of housing is going to drop 100%.”.

Excess housing in an unattractive area, like crime ridden Vegas, has a negative value. You have to pay taxes, possibly a lot, for all the associated infrastructure and maintenance. People are leaving the area as construction and gambling employment declines. So, a lot of houses are just going to rot or turn into ghost neighborhoods. Perhaps some squatters and meth heads will stay there for a while but there isn’t any water or services.

Basically we are seeing the end game there. I think a lot of the Inland Empire will go into a similar vein as well. Central Valley has more water resources so not quite as big of a mess.

This area seems to lose all touch with reality.

On the Patrick list…never have such hopelessly incorrect numbers been publishied. Las Vegas has rented over 2000 single family rentals each month for the last couple of years. And that is only the MLS…the less formal channel should be even larger.

The ratio of rented to listed was greater than 1 in 2010 and 2011.

Rents have been stable for at least 18 months.

As is almost always the case it is the cheap slumish houses that offer the best return…though always with the price that you really need to be local and hands on manage.

Section 8 is fine but understand that there have been no new section 8s in Las Vegas in some years and are unlikely to be any in the next years.

The renters are of course those who have had to let go of their homes due to the crash. And many are quite well employed and quite reasonable tenants who will buy again once their credit recovers.

Las Vegas is an artificial market. There is a $20 per SF differential between REOs and non-distressed. Such a thing cannot exist in an unmanipulated market. At the moment the foreclosure inventory available on the MLS has dropped below a month…though prices have continued a gentle slide.

Our clients have made well over 30 offers in the last few months with about a 15% hit ratio. Sure there were some low balls…but most were reasonable offers. It is a very competitive market.

A cherry condo at a rational price has a half life of about three days. A similar SFR may not last that long.

Las Vegas unemployment has been improving for some months. If you eliminate the totalled residental construction industry it is about on national norms.

I would personally prefer that the rental market not grow…it is a bad thing for lower end housing and ends up with slummier neighborhoods. But I don’t get a vote.

I lived in Vegas for well over 20 yrs and feel as a landlord an once a tenant I prefer living in a nice decent home rather then a slum. It is sad commentary that generally properties are quite often neglected due to high cost of maintenance. During my youth, I lived in New Orleans an experience the landlords who did very little to care for their homes. With those memories behind, I swore I would refrain from becoming like them. It is very challenging at times since occasionally you will encounter a very small % of tenants who appreciate the deplorable conditions I once disliked as a child. In order to keep cost down, I have sacrificed my time and energy to do most the work myself in order to rent properties which look like homes that are well care for as if lived in by an owner.for the shear love of my community and respect of my neighbors.

Where do we park our money while waiting for real estate to come down to reality? It seems to me everything else (stock, bond, gold) are currently overpriced, probably due to high inflation, high amount money injected, but low interest rate – lower than inflation.

It is really interesting to see the ratios of rent to home prices out west. Here in NYC a two-bedroom apartment that would sell for $2 million would rent for about $5,000 per month and the owner would have to pay about $2,000 in maintenance (which includes real estate taxes). $800 per month is what we call a slightly expensive parking space in a garage.

I still think investment property is a good investment and great way to get extra money for your retirement years. We have investment properties in north Myrtle beach SC and surside beach SC. And one in Maryland. All properties are rented some have lost value. But you only loose if you sell them. We have worked very hard too pay them off. Our rents vary from $775.00 to 1,000. Being a landlord has its challenges but with retirement plans and social security going away. We also keep all the properties nice maintenance free. In a few years we will retire and the extra income from these properties will really help. Don’t buy real estate in areas you know nothing about. But where you are familiar with good deals ,locations, schools etc.

Leave a Reply to Jason Emery