Debt built society – Last decade saw negative real household income gains yet the sharpest rise in home values ever. Household debt and dual incomes hid the collapse of real per capita wage growth. Home values destined for a stagnant decade ahead.

U.S. housing values will continue to decline largely because of weak income growth, a massive amount of distressed properties still stagnant in the pipeline, and the end of the great debt bubble of the last few decades. American housing values rose to stratospheric levels only because of a comically unchecked mortgage market and not because of sustainable income gains. This seemed to be lost on many and a large number of Americans battling with stagnant incomes could not resist the siren call of easy money in real estate. Instead of confronting the reality that incomes were shrinking because of global economic shifts and the pollution brought on by the unregulated financial sector many decided to jump into the mania and spend today what would be earned (hopefully) tomorrow. Instead of one income being able to afford a home with a reasonable 30 year fixed mortgage it was now necessary for two incomes and a toxic mortgage simply for a basic home. Home values will continue to go lower even below early bubble price levels because not only are we erasing the bubble era gains, we now have to contend with the lost decade of income gains.

Without rising incomes home prices cannot rise

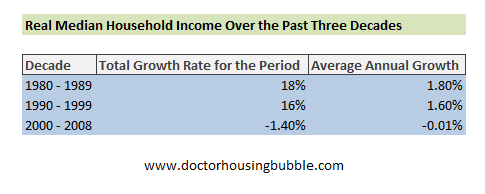

The above is a fascinating chart because it shows the stalling out of real household income gains. What it also reflects is the illusion of wealth in the last decade. From 1980 to 1989 real household income growth measured 18 percent. From 1990 to 1999 real household income growth came in at 16 percent. This is 20 years of real income gains although we’ll point out a caveat on this later. But from 2000 to 2008 real household income actually shrank by 1.4 percent (even more if we can include data from 2009 and 2010 which isn’t available). Now think about the implications of this. Home prices rose to the highest levels during the weakest ten years of the last three decades. How can that be? The reason this happened was because of the casino like nature of Wall Street and the desire to turn housing into a speculative casino like investment that could be churned and sold around the world like any other pump and dump stock.

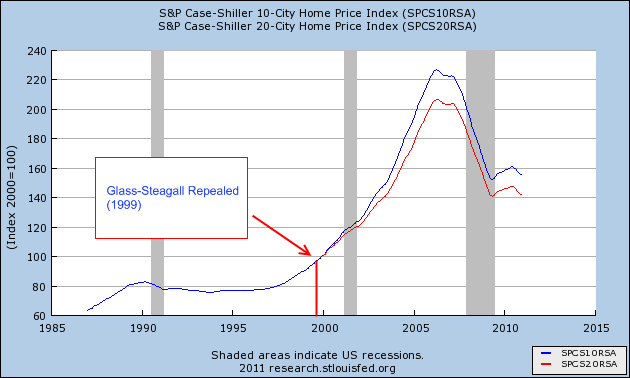

Some try to blame the government for the entire mess as if they forgot that the government had been involved in the housing market heavily since the Great Depression (1930s). Yet over time, the government and Wall Street became more and more joined at the hip. Eventually after Glass-Steagall was repealed (a law specifically designed to curb banking speculation) in the late 1990s did we finally see the housing bubble take off:

This was completely a Wall Street push. It wasn’t like some Republican or Democrat sat behind their crony desk and conjured up the ideas for collateralized debt obligations. They got this idea from their overlords of banking lobbyists. Both are guilty but do not mistake where this idea originated. For nearly half a century of government backed mortgages with a boring sizeable down payment and of the 30 year variety, housing was rather stable. During that time we never had one nationwide housing bubble. But of course now Wall Street banks had nearly half a century of data on “stable housing†to start creating toxic mortgages that were to be packaged and sold to pension funds, foreign investors, and any other fool willing to hand over their money to a charlatan.

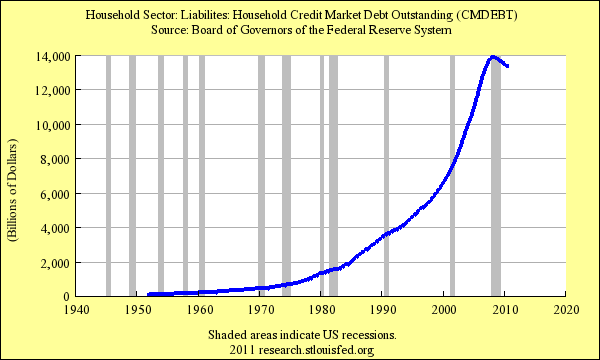

The above chart shows the magnitude of the housing bubble. Keep in mind the massive run from 1999 to 2006 largely occurred at a time when real household incomes were falling. So you ask again, how was this possible? Pure and simple it was built on debt:

We reached the apex of debt overload when household debt aligned with annual GDP. The credit markets made up for the faltering income gains during the last decade. No need to check for income because this lost decade of real income gains didn’t matter when you had mortgage brokers selling option ARMs to people fabricating incomes to purchase homes. Brokers got their cut, the borrower got their home, and Wall Street investment banks now had more junk to speculate on and sell to unsuspecting investors. Again, this happened because housing had been such a stable investment for half a century. During the bubble I would constantly hear people say “well nationwide we have never seen home prices go down.â€Â That was true before Glass-Steagall was repealed but with housing and mortgages now part of the global casino all bets were off and home values did a rendition of Tulip mania.

Spending more than you earn

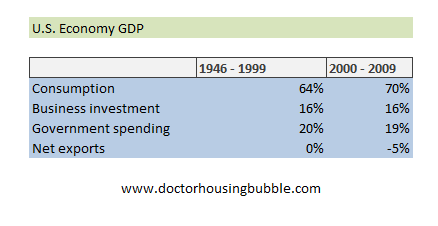

The above chart break down of GDP shows the unsustainable spending habits of our country. From 1946 to 1999 consumption made up roughly 64 percent of GDP. During our last decade it was up to 70 percent. You also see our negative net export column reflecting our spending beyond our means ability. This financial crisis is largely one of too much debt. Debt isn’t necessarily bad if you have the income to back it up. If you make $1 million a year then a $1 million mortgage isn’t so bad. But if you only make $100,000 a year then there is no way a $1 million mortgage is going to work. Yet that is exactly what happened over and over during the last decade. Many of those mortgages are still out in the market.

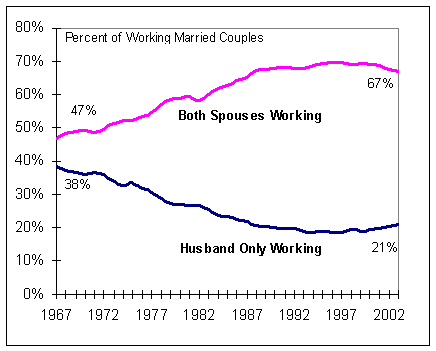

Part of the financial pain now being felt in our economy is because of this unsustainable pattern we took on. What is also hidden in the data however, is that during the decades when household income was rising much of this was largely due to having more workers per household:

Source:Â Tax Foundation

The dual income household trend moved steadily from the 1960s to the late 1990s where it seemed to peak. So of course during this time real household income would go up since you are adding another bread winner. But even with that, per capita income gains were muted and only access to more and more debt masked this shrinking access to capital. Many Americans confused access to debt as access to wealth. A perfect example was treating your home like an equity piñata when people would tap into it each year like a birthday celebration. Debt is not wealth. Clearly many bought into this model as demonstrated by the willingness to tap into housing equity and spend it like it was actual money saved.

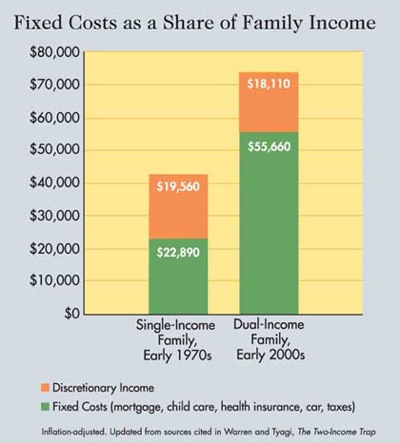

More people are working under the same household yet fixed costs kept going up and up:

In the early 1970s a single earner household had more discretionary income than a dual income family in the early 2000s. The only reason this was not apparent in say 2001 through 2006 was the easy access to debt. Take away this easy access to debt and you have to confront the grim reality of a decade of stagnant income growth. You also have to factor in that with an incredibly high unemployment rate of 9 percent and the underemployment rate close to 17 percent that many of these dual income households have now shifted to one income. Where is the additional money going to come from to keep home prices inflated?

The housing industry is obsessed with keeping mortgage rates low because that seems to be the only tool in their belt in terms of keeping home prices inflated. Yet rates can’t go any lower. In the early part of the decade keeping home prices inflated was simple; you gave loans to anyone and everyone and didn’t even bother to check income. If income was being checked many would have realized a stagnant economy. Yet the appetite for mortgage backed securities seemed reasonable since for half a century home prices were stable so what could possibly go wrong? After all, it was the sophisticated Wall Street investment banks now with the repeal of Glass-Steagall fully in charge and with absolutely no regulation or oversight. It should be no surprise that in the end, it was the American people that got the bill and all those housing gains and benefits that were supposed to come simply went to a small group that actually served as the architects of this financial destruction.

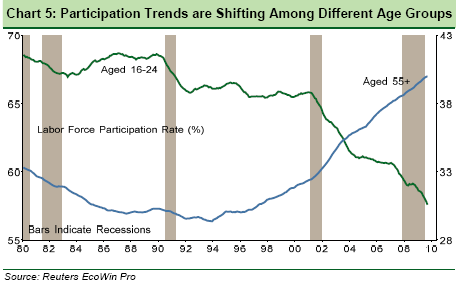

The baby boomers are coming

Most Americans derive their net worth from their housing equity. With over $6 trillion of housing equity evaporating into thin air, many are now having to work into the later years of their lives. The above chart shows this trend. What is more troubling is the crowding out of younger workers. You have more and more people having to hold off retirement while younger workers have fewer jobs to gain early experience. I’m sure some of you have seen older workers at Wal-Mart which usually would have been a young person’s job. Do you really think someone working at Wal-Mart at 65 or 70 years of age is doing it because they want to? The above chart shows this crowding out.

Now many baby boomers had a structured plan for retirement. The stock market from 2000 to 2010 was going to return 10 percent per year and then they would sell their home that also increased by 10 percent per year to a young couple and all the money would then be spent sipping margaritas by a pool in some sunny retirement location. None of that panned out. The stock market is basically back to even for the decade and home prices are going in the wrong direction. So now the 50 year old baby boomer in 2000 is 61 today and they don’t have time for more stock market rallies or another housing bubble. Many will have to sell but with lowered expected gains. The stock market is rigged for short-term gains, not long term prosperity. This is why you have investors like John Paulson who can make over a billion dollars in one year by betting on the failure of Americans and the housing market. No value is added here and as we are finding out many of these investors had incentives to drum up support and push for demand in the market which led to more predatory lending in the market just to create a pool large enough for more Wall Street speculation. In other words the incentives were designed for graft and exploitation of the market. That is why we are left with this current financial mess except Wall Street banks received trillions of dollars in bailouts through TARP, PPIP, TALF, QE1, QE2, HAMP, HAFA, HARP, FASB mark to market suspensions, FDIC intervention, and yet home prices go down while banking profits soar.

Home price implications?

In the next one or two years I see home prices falling. Much of this fall will come from the 7 million homes that are labeled as distressed. The market right now is largely driven by these lower priced homes. Bank of America recently hinted at working through a legacy loan portfolio of $1 trillion over the next three years (which puts us into 2014 or 2015 depending on when the program launches). After that however, we have the built in issue of baby boomers retiring. This is another group that is likely to be selling and downsizing homes. Even though many may not have the equity they once thought they would have many will still go on with their retirement plans. This group has no choice. Time is not on their side and unless the stock market goes up another 100 percent and home values double a new reality is here. Global competition is pushing wages lower and high unemployment will keep wage growth capped. We have bigger issues than housing values but without income growth it is absurd to think home values will go up.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

97 Responses to “Debt built society – Last decade saw negative real household income gains yet the sharpest rise in home values ever. Household debt and dual incomes hid the collapse of real per capita wage growth. Home values destined for a stagnant decade ahead.”

This is a fantastic article and very relevant to me as I am at the trailing edge of the Baby Boomers (born in 63).

True Doc,

The Charlie-Sheen household is next. One man, two women. Man and woman#1 work outside home, woman #2 is ‘wife’ to both, homemaker, mom, etc. This is already happening more than we know. Sometimes it’s a divorcee coming to live with sister or brother and never leaving. Until people realize that their lifestyles have been dictated to them by Madison Avenue via Hollywood, they will never get it. We cannot sustain our oppulence via imports only. At some point, virtual wealth will not satisfy our trading partners. The foundation of housing is still levitating on a mirage of debt–nothing got fixed at all. Fannie and Freddy didn’t go away. Goldman is still doing God’s work (destroying the middle class, evidently). AIG is still 90B down. GM will flounder again. Wiping away their debt will not fix an unsustainable business model. We’ll see.

I’ve been telling my husband for years we need a wife!

You are kidding…Just make sure she is not an attractive newer model otherwise he might “trade up” and “trade you in”. (Humorous Intent)

Seriously I believe in the sanctity of the Sacrament of Marriage. May the Good Lord forbid that it happens.

You are forgetting something. Asians (Indians, Chinese, Koreans) are upsetting the male/female ratios by aborting females. Many of these male children are now reaching marriage age. Two women in a relationship, unless the man is very rich, will be very difficult, since women will have more options.

The new motto for men in China is that they need to make good money and take care of the household chores, while their wives spend all their money. The direct translation of the new slogan is “new good man”. Well, it actually has been this way for several years. It looks like it will get worse for the Chinese men.

Yes! Two men one woman households. Let one be a handyman and the other have a high paying job.

Excellent presentation of facts on the real estate world of today versus the unreal world of yesterday. I’m constantly amazed by friends, family and colleagues who deny the cold hard facts based on DATA even to this day. They are addicted to NAR/ government-managed propaganda on the sell side. I guess many have no choice but to keep their heads in the sand.

It should not at all surprise those who get the data. We live in a society that is literally ignorant of realities and such inconvenient things like proof or evidence or the lack thereof in support of their delusional fantasies of a fabulous lifestyle. I feel sorry for @Trail Rider as he is at the “tail end of the baby boom” and will most likely suffer the consequences of his generational peers the most as there is backlash against the crushing burden parents and grandparents put on their children with their decades long celebration of anti-intellectual fantastic pursuits. I have a strong feeling that as and if the world becomes more financially savvy as the world changes while we sit stagnant, markets will increasingly realize that our sham economy cannot sustain the debts we have and are expected to be taken on to take care of those baby boomers who have dreams of riding a harpy into the sunset while listening to rock and roll hopped up on Viagra.

Nice rant.

Marc

I find myself amused by your description of baby boomers since I am one. Given you did not live through our generations history there is room to forgive you but it is actually a surprise to hear you describe our society as ignorant of realities and delusional and then seque into marking boomers with “decades long celebration of anti-intellectual fantastic pursuits”. Hello? It was our generation that put a stop to the Viet Nam war with millions protesting from Frisco to DC. It was Gen X that was tagged with selfishness and it is the current generation that thrives on reality TV and celebrity gossip sites while Fux News spews toxins into anything smelling of truth and social responsibility. Granted boomer Bush created our debt with his wars to get Bin Laden no matter what and his lies to go after the man “who would kill his father”. Nice distraction from his corporate bankster buddies rippin’ us all off in housing and energy (Ken Lay at Enron). These are the criminals of our generation but don’t go slandering boomers because we are the age we are.

It is by the way delusional to think the debt was taken on for the care and feeding of the boomers. It was a matter of incompetence, ideology and greed.

A trend you mentioned in your article is the number of Baby Boomers who need to retire and will end up selling their house. So far a lot of Boomers are still hoping that housing values come back up with a vengeance and then they will sell. So far they are resisting and won’t sell. How long will this trend hold on?

Also, in 2011 is the first year in which the first set of Boomers turn 65. So this trend of Boomers selling their home is in it’s infancy.

That will also be the year when they start trying to sell their 401k holdings. And I don’t think the student loan-ravaged, perennially under-employed, out-sourced generation behind them will be buying.

Interesting times.

How long will the baby boomers hold out? Many will be forced to live within their means and lower their expectations – expect sales of Purina cat food and Alpo to go up as a result. Many will die in their homes, or not downsize until they are forced into convalescent homes by their children/grandchildren.

At that point, their children/grandchildren will be selling, and more than likely more willing to accept the realities of the market and cut their losses.

Agree with Foolio on this one. I have seen old people around me stay in their house as long as their health allows them to keep up with the cleaning and maintenance. Most of them don’t sell just because they turn 65, especially if they have it paid off already. Many of them live in their house until in their 80s, when the health issue finally kicks in. They have to downsize and move closer to their kids or a care place. I think the housing will be stagnant for the next 10 to 15 years for the inflation to catch up.

Established neighborhoods are full of boomers attempting to sell their overpriced and outdated home with$ 8,000 a year in taxes upon my generation (30’s). My household grosses between 10,000 and 12,000 a month; but after taxes, student loans; daycare and living expenses and savings; there’s not the $3,000 a month leftover some boomer wants so I can pay for retirement. My housing situation cannt be someone else’s retirement plan! Eat cat food boomers!

Since you think you are personally paying for a boomers retirement please send whatever is left over to me at: Stop making sense your out of your mind. It is your retirement that is at risk. Boomers are not at fault for how you handle your finances.

Dr. HB, what level of home price drop do you foresee in Southern California during the next couple of years, particularly in the more desirable west side locations (the $550K to $850K price range)?

I’d just triple the local income, maybe quadruple it for the nicer areas. Some liek to say, 2000 prices are about the “right” amount of correction over then next few years. $500-850K, those are beverly hills prices, not suburbia anymore.

1980’s was a financial bubble.

When that bubble popped the tech bubble took over.

When that bubble popped the housing bubble took over.

One mans debt was another mans income.

It has been fake for decades.

We found a house we really liked. We will try to low-ball the offer to protect ourselves, because we believe the mid-tier market is still too high. Our agent drafted up an offer per our request. But she put in a $250 transaction coordinator fee for us to pay, so that the coordinator can help her coordinate the paperwork. That is just too funny. Last offer we put in, she did not have such term. This is an agent from ZipRealty. On their website, it says to give us up to 20% of their commission if we buy from their agent. So, we wrote her back and asked for a written agreement for this cash back promised if the deal goes through. We backed out of our last offer (approved short sale) because of the roof and termites problems. She said at the time our lender had to agree and it needs to show on HUD. We did not have an agreement on the amount. So it was just up in the air. I asked the lender and escrow company. Either knows anything about it. I think we will change our agent. It is not about we cannot pay a $250 transaction coordination fee, or we have to get the thousands in the cash back. We don’t like people sneaking fees. If she could just hang in there and finally help us get a house, I was going to let it be up in the air and forget about it. It is no point to take a chunk of someone’s earning, if he/she spent a lot of time to help you. Well, since she wants a fee from us to pay her helper, then we want the promised cash rebate.

Amazing. Now did the website say that there was a coordinator fee? Did you meet this coordinator? Pure junk fee. I imagine that money is going in her pocket. I sure would never pay it and I would still expect them to honor the 20% back. Not that an agent should not make a living but not off of unethical practices. Are not unethical practices what got us the bubble in the first place?

What has your situation got to do with the Doc’s article?

Why do comments have to have anything to do with the actual written article? Perhaps here, readers can feel welcome to find a group of like-minded individuals to assist with issues?

Tell that agent to take a hike. If you can be a bit self sufficient, go to someone like Redfin where you get around 1.5% back (half their commission). They have a great website but you need to be a bit self sufficient looking for a home you want to tour and purchase. There is nothing sneaky about their business model that I have found.

YEP. Can’t readily poke any holes in this thesis. Given how flat housing prices were during the 1990s, within a MUCH better economic environment, I too see nothing but more decline, followed by a looooong low bouncy-bounce along the “new normal”, aka bottom/post-Bankster Baseline.

Back to the article, I think it is spot on. I read something today to back this article.

Shrinking Labor Pool Means Shrinking Demand For Housing

http://globaleconomicanalysis.blogspot.com/2011/03/shrinking-labor-pool-means-shrinking.html?source=patrick.net

Why inflation hurts more than it did 30 years ago

http://finance.yahoo.com/news/Why-inflation-hurts-more-than-apf-916813098.html?x=0&sec=topStories&pos=6&asset=&ccode=

If Bernake announces another QE, we need to gather together for a tarring and feathering. What is happening in this country is very similar to the French revolution, when the peasants came and said they were hungry and did not have bread to eat and the Queen purportdetly told them to go eat cake.

That didn’t end too well for the royalty and if the current “royalty” of the corporatists and the wall street bankers who seem to have a chokehold on both countries don’t change, they may face an angry mob.

Sorry caboy, it won’t happen. I used to think the same thing; how much can the average American take before people get sick and tired and start making real, meaningful change (not the fake Obama type of change).

Unfortunately, the response is to continue to more of the same. Extend and pretend, hope for yet another bubble to bail out the previous bubble, continue to live beyond one’s means, continue the same old Keyenesian economic principles, bail out the insiders, etc….

Now I surmise when people do get tired, it will be too late. The Republic will already be bankrupt.

The Republic has been bankrupt for a very long time. The Republic went bankrupt in August, 1971 when Richard M. Nixon default on U.S. Dollar to Gold controvertiblity. When he decoupled the U.S. Dollar from Gold that was a technical default on the U.S. Debt. Most people do not understand what problem is the root cause of all of this. It is called “INFLATION”. All bubbles inflate before the bubbles burst. Do you know which is the biggest bubble market now? Read on…

The reported inflation rate of the past 30 years has been a fictitious number. The true inflation rate is equal to the sum of (the total amount of money which was added to the previous year’s Total Money Supply, hereforafter known as the “New Total Money Supply”.) added to (the amount of money that the U.S. Government borrowed to maintain its spending, hereforafter known as the “Annual Deficit”.) added to (the amount of Annual Interest charged on the servicing on the National Debt), heretoafter known as the “Sum”. Then you divide the “Sum” by the amount of the “New Total Money Supply”, heretoafter known as the Quotient. Then multiply that Quotient by 100. This is the Actual Rate of Inflation for any given fiscal year.

Thus the official inflation rate reported was much, much lower than it actually was. The actual rate of inflation would have been reported if the US Government had not borrowed any money, but actually had printed the money that it needed to finance itself. This is an accounting scam of epic proportions pulled off over the myopic eyes of the American Public for over THIRTY YEARS. No one understands this.

So I believe that CURRENTLY the U.S. Dollar is EXTREMELY OVERVALUED and in a bubble market of epic proportions. It is poised to extremely devalue because Bernarnke is printing Dollars as if there is no tomorrow because, the truth be told. there IS NO TOMORROW FOR THE DOLLAR.

Well now the Day of Reckoning is approaching like an out of control frieght train. Do you think September, 2008 was a major event? It was a minor hiccough compared to what is going to happen when the currency defaults IN THE VERY NEAR FUTURE. All of the inflationary effects that we should have experienced over the past THIRTY YEARS have all ADDED UP. In short we are going to experience ALL OF THAT PAIN in a very short time frame as a HYPERINFLATIONARY event. IT WILL BE A SHOCK!!! If the pain had been spread out over those THIRTY YEARS it would not be anywhere near as painful as it is going to be. So to alleviate the pain I have two major suggestions. Get out of the Bond Markets. Get into Gold and Silver…Especially Silver. Silver has great upside potential as it is more undervalued than Gold. The Precious Metals are a bargain right now…AT ANY PRICE.

I am not a Financial Advisor. I am not a Professional Trader. All market investments are risky, especially at this time. This is merely a statement of my own personal beliefs. Do not risk what you cannot afford to lose. This is a belief of mine from the data that I have available.

I’m curious. Do you really think the Fed is about to stop “printing”? Do you have any idea of what will happen if they do? What, in your view, would happen if the Fed actually stopped printing? From what I see, the entire Ponzi scheme in structured finance comes crashing down. What happened last week in the Yen carry trade was small pototoes.

That said, I’m of the opinion that no QE3 will be announced. A stealth QE will be implemented, now that the Fed is receiving payments on all the toxic debt that we will be paying for.

That is the same argument they used for the bailouts.That is the same argument they used for refusing to break up the too big to fail. How long do you think we can continue toprint, without ending up like Zimbabwe? The world cares about our dolalr because of our markets. China and India may exceed that in the near future-then what. best to back away now and find a new model than be forced into it like the Weimar republic found itself in the 30s.

@Caboy: You are correct, but if you had read some of my previous posts, you would know that I am in no way, shape or form in favor of the continued propping up of the Ponzi scheme in the F.I.R.E. economy. We’d have been much better off nationalizing the Banks a couple of years ago. But the Banks control the White House and Congress, not the people, and so that didn’t happen.

My point was to get the original poster to think what would happen; not argue in favor of it. I.e. the Fed has absolutely no choice in this matter, in their opinion. So yes, printing will continue. The only question is whether it will be by stealth or not.

It’s pretty clear we’re in the end-game for this fraud now. When you have hedge fund managers working at odds with the G7, the writing is on the wall. The Central Bankers never win in those situations over the long term.

What this means for housing is pretty grim.

Let them eat Ipods!

Oops I menat to say both parties, not countries.

Great article doc… I can’t imagine that the baby boomers will just sit and take the diminished expectations. Whatever else you say about the boomers, they have never been shy about demanding what they see as “theirs” – I’m a trailing boomer (born ’62) so I’m kinda hoping for it.

As someone, probably part of a minority in my generation, who pays attention to the types of things this wonderfully refreshing blog discovers; I can’t avoid feeling somewhat “disturbed” by what @ChrisSoCali expressed. I understand his/her position about hoping that baby boomers demand what they think is “their’s” as their entitlement impulses kick in that would make any decent person cower with shame. From my perspective, I hope that my and younger generations can find the courage to make baby boomers suffer the consequences for their delusional and borderline mentally ill mindsets and subsequent effects. I realize that it’s rather unlikely for many reasons that will ultimately end in that courage not coming in time for baby boomers to have bled the country dry and brought the country to it’s knees.

On the other hand though, the single thing that has perpetuated america’s perceived wealth, our natural resources we viciously and irrationally plunder like the trust fund they essentially are, might be further tapped to cover up and bandage the failure for a couple mode decades or a generation or two. Our whole country functions like a stereotype of an American consumer; maxed out credit cards as far as the eye can see out of reckless behavior with nothing to show for it, now living with children and grandchildren and a burden on their lives, yet still making demands and showing no willingness to change their behavior or attitude, or even the slightest admission of responsibility or being gracious for being supported at the end of their squandered lives.

Totally agree with you Marc. The Woodstock generation is not going to let a little thing like the future of this country kill the party. They will demand their pound of flesh from the younger folks to ensure that their credit funded consumption lifestyle remains intact. They are too big a voting bloc to be ignored.

One thing in favor of lower prices for CA that is often ignored is that only a fool would retire in this state. If you’re well off enough to maintain a house in a coastal city, the state of CA will plunder your 401k and other retirement investments. Around 65 or so, the smart money should leave the state, or at least maintain a residence in another state for most of year. Theoretically, these boomers should sell and move out of state.

Then the developers can subdivide the properties and replace them with mass produced town homes as far as the eye can see.

Wonderfull analysis. Thanks.

Great article. We are nowhere near the bottom in still inflated parts of LA and OC. I lunch with a buddy today I haven’t seen in a while. He and his wife both got big cuts in pay and they stopped paying their mortage 6 months ago in hopes of getting a loan mod. This is the new reality!

The younger generation is at a breaking point where they simply can’t afford expensive housing. When you factor in school loans, credit card debt, car payments, car insurance, rising gas prices, rising food prices, rising health insurance costs, planning for retirement, kids (god forbid you have several)…there really isn’t a that much money left to feed the house monster. The boomers that will be downsizing will be forced to lower their asking prices plain and simple!

“The boomers that will be downsizing will be forced to lower their asking prices plain and simple!”

…. or this reality check will be delivered via Executor of the boomer’s estate.

Thanks for that, Unde- employment and wage caps are the new norm, when you have an army of hungry people outside the door looking for work you can really keep your staff quiet and willing. I think that housing is being seen more and more for the brick and mortar handcuff that it currently is. Prices will have to drop to a decent level, and employment will have to stabilize, period. Best case for this to play out on a time line? Hard to say, but it aint today.

Many of the homes on zillow in my area when you search for sold in the last 90 days, have sold for what seems to me to be rather high prices. They are then relisted 20k higher about 14 days later. What does this indicate? These seem to be mid-tier homes not the real low end but not luxury properties either.

What’s your specific area?

If the “rather high prices” are also very specific — sometimes even down to single dollar and/or cent values — that would usually mean that an auction was held without finding a buyer, and that the loan was “bought” by the bank and the subsequent lower listing days later is as an REO.

Impressive work. I’ve had the same broad ideas but not the aptitude to put the pencil on it like that. Good job. Needless to say, no disagreement with the conclusions.

Doc, with all due respect, your headline above says “Home values destined for a stagnant decade ahead.” I strongly disagree.

I think housing is going to TANK, as in plummet, crash. Jobs are disappearing. Incomes and benefits are being reduced on a massive scale. Food, energy and consumer goods are increasing in price. Taxes are and will increase in a nightmarish fashion. Housing is going to rightly find its true value, which is much lower than where it is right now.

AHH! The Sky is Falling! The planet is warming! The Chinese are coming!

I might just move in to my boomer-parents home and put them in an assisted living facility when the time comes. The house doesn’t need to be sold. Inflation (surely coming !) will eventually turn the price of housing around. And California is still a pretty nice place to live/retire. The US has decades of reserves of Nat gas and coal, and thats without any energy tech advances.

Relax! Rent, save…

For me, the proof that Boomers are in horrible shape is the fact that Florida, Arizona, and Vegas (all traditional sunny retirement destinations, especially Florida) are still seeing home values drop and inventory climb, after, what, five years of this great crash? Amazing. You would think that, with the Boomers now turning 65 at the pace of 10,000 a DAY, therefore, 3.65 million a YEAR, they would be flooding into Miami or Tampa or Tucson snapping up the incredible bargains. Look at, say, Cape Coral, Fl. on Zillow. You can grab a nice little three bedroom that is practically brand new for less than 100 grand. Wait on the courthouse steps with some cash in your hand, and that price could be 25 – 40% less! We’re talking a nice little home here, not a trailer that would get blown away in the first tropical storm. And yet, they aren’t moving. All the Boomers are stuck up north with a ton of debt, still working, and can’t sell the MacMansion. And, the last Boomer will turn 65 in TWENTY years! This housing depression will take a very long time to work itself back to sanity.

Excellent perspective on the Florida-retiree angle. While the mythical wealthy South American investors have not arrived to save the day (LOL), we are seeing a mini-support floor formed by CANADIANS, who suddenly find their dollar on par with the US greenback, FOR THE FIRST TIME EVER (in memory), vs. it’s historical FX in the range of 65-70 US cents.

I would have to subscribe to some “insider” sources to gauge the depth and breadth of the Canuck demographics factor for So-Fla. (CoreLogic covers Canada, maybe?)

Of the few actual properties I’ve seen bought by Canadians, they seem to be imitating the Japanese in 1989, i.e. doing inadequate due-diligence, and then paying too much (e.g. GRM > 16, based on current and foreseeable rents, D’OH!).

Um, the Canadian dollar has been gaining value versus the dollar since 2002. It’s been at (relative) parity with the USD for at least 2 years now. Before that it was actually worth MORE than the USD for about a year and at par a year before that. I have no idea if Canadians are buying US real estate or not but if they are, it’s certainly not because their dollar is “suddenly” worth more… That “historical FX” of 65-70 hasn’t existed for almost a decade.

http://www.indexmundi.com/xrates/graph.aspx?c1=CAD&c2=USD&days=3650&lastday=20110321

Um, Chris, dude, you’re reading the INVERTED chart, lol. Go here instead, or click the “Invert” button on your page:

http://www.indexmundi.com/xrates/graph.aspx?c1=USD&c2=CAD&days=3650&lastday=20110321

As you can see, just 2 years ago the CAD was back down to 75 cents-US, and except for a short-lived spike during the beginnings of the Banking Collapse in Fall of 2007, it’s historically been well BELOW the USD.

Anyway, I’m tellin’ ya, I’m always swamped with Canadian tourists this time of year (in So-Fla), but THIS year they’re all puffed up and arrogant–especially the faux-French-speaking “Quebecois”–because of their dollar’s strength, and every merchant, inn keeper, and restaurant owner is ready to strangle the lot of them, LOL! (OTOH, the Real-tards are worshipping the ground they walk on…)

Looks like we’re in for less than flat

Okay, now I see I can post. It appears to me, from your charts that the way over pumped real estate market prices have not yet come home to roost. Govn’mt is still messing around with the cruel reality that we were in big trouble, even from W’s reign and maybe earlier to Clinton. Clinton got sucked, W fiddled, Bam Bamstimulated the walking dead in the water and America is burning up in debt in order to keep conspicious consumption alive. When I look at the U’s in Calif, I see that most of the slots go to over seas types and our kids are left to work at Petsmart or sell their soles for a $.05 at Walmert. We got some fundamental problems in this country, mostly centering around the slide into decline.

The baby boomers have been given another out with this current stock market being supported by government interventions. The market is going to correct and go into a period of no gains for appox. the next 20 years. Cash out Boomers while you can. I was born in 66 and my retirement horizon sucks. My house has gone down in value and the stock market gains will be non-existent. Every dime I have today, I have to save without the benefit of Boomer economics. I don’t even want to plot out my kids depressing path. Boomers have made out again like bandits, their social security is safe, they can still sell their homes for a profit and have benefitted more than any other generation from the stock market. I agree with the comment above. It is time for someone to take back from the boomers for their greed and sense of entitlement that has left the rest of us with few options. No they should not receive social security benefits if their income is over a certain amount. Boomers have lobbyist on their side to further their greed. Boomers had the ability to retire with so much more than any other generation. They created it most of the problems we face today. We all have to suffer the consequences of Boomer greed. All this is was created by Boomers for Boomers. It used to be the little guy was getting the squeeze but now it’s everyone. Boomers will survive quite well while they leave the rest of us with a declining housing market, flat stock market, no social security, stagnant wages and inflation. They successfully pillaged and raped us financially. We are on the Titanic and the Boomers are safe in their boats.

Jeez, lighten up. If it wasn’t for us Boomers, there wouldn’t be any Classic Rock and socially acceptable casual drug use and sex. Think how miserable your life would be without that.

So…. The legacy of the Boomers is: Sex and drugs and Rock-n-roll!!!

You betcha. And, Christie is mistaken that Boomers are benefitting from the stock market these days – most don’t have a penny in the market. Hell, average retirement savings are something like 50,000. Big Whoop. All the spare change went into the MacMansion pyramid scheme.

That the Boomers (the original “Me” generation) are responsible for the nation’s mess is an unspoken truth. Having spent their lives being pandered to by their Greatest Generation parents, the media, and the government, they only know how to have their needs anticipated and acted upon.

Is it their fault? No, but they have always reaped the rewards of being the Elephant in the Room – and no one has being willing to find out what happens when that elephant is aroused.

It’s time. My Boomer father has a great pension, I won’t – period. As for my children, who knows?

Christie, your anger is absolutely understandable. I too share your frustration. Born in 56 I guess I am a boomer. But, I know that I will not get any social security. The 401K that I have worked so hard to build up is in jeopardy. Who knows where the stock market will go.

What I do know is that avoiding debt at every turn will allow you to build your own financial lifeboat. If you owe nothing, then the banks/government will find it much more difficult to take away what you have worked for. And, you will sleep like a baby.

Will you get to drive around in flash cars and eat at overpriced restaurants? No. But the boomers I know who did all that are now facing reposession of their houses. They have no cash reserves. They have no prospects for re-employment if they lose their jobs. These acquaintances are not sleeping well.

Don’t be a boomer-hater!!

Thank you. I find it ironic that Marc starts out with comments about our society (current) “…inconvenient things like proof or evidence or the lack thereof in support of their delusional fantasies of a fabulous lifestyle” and then goes on to bash boomers without any evidence or proof and then the rest of these folks jump on the band wagon. Boomers were fortunate to live in times when the economy grew because of innovation and exploding population. But if you check the numbers the average retiring person does not have pockets lined with gold. We need I think instead to be looking at the power brokers. When I was a kid the country was rife with Mom and Pop businesses. Today Mom and Pop only thrive if they can pay thousands up to a million to get a lucrative franchise from a corporation or are able to rise to the top of one of America’s corporations. It is not our generation that is at fault but those of it, of the one before and of the current one that seek wealth and power at the cost of their fellows. Buffet has it right “It is warfare and our class is winning” (paraphrased).

Man, I thought this blog was about real estate, not “boomer-bashing”, sorry some of you are so bitter, but can we keep on topic here?

Will you morons do some research before you spout off about boomers? They just became eligible for SS about 38 months ago, Medicare less than 90 days ago. After doing nothing but PAYING IN for 40+ years. And no, they aren’t making money on real estate, theirs went south along with everybody else’s. The ones in the private sector watched their pensions disappear years ago. Just how have they destroyed anything? By going to work everyday and paying their bills just like anyone else? You act like the boomers meet up at noon every Thursday to plot out their next move against a younger generation. Please, they are just individuals like EVERYONE else who were told to grow up, go to college, get a job, pay their way etc. My kids are in their late 20’s. They hate it when they hear about the endless stream of useless 20-somethings that employers say cannot carry on an intelligent conversation or even spell. They are articulate and responsible but tell me they feel like they have to prove that they aren’t lazy and undependable when dealing with some new clients. Lumping groups of people together and blaming them for society’s problems just because they were born within a few years of each other is as stupid as it comes….

Hear. Hear. Enough of those Scott Walker mentality moorons.

DH — Might millions of citizens of Japan flee radiation and relocate in California and other parts of the US, raising demand for housing and thus stabilize prices to some degree? In Japan real estate is measured to the square inch it is so expensive. US real estate prices are, in comparison, a bargain.

So far, there is no lasting radiation from which to flee. While Japan, as a whole, is “densely populated”, there’s still vast agricultural areas, and small fishing villages, and these stricken nuke plants fall into just such a lower density zone in the far North of Japan. (I would also note that these plants PERFORMED SUPERBLY IN SEISMIC TERMS, and were not crippled AT ALL by the quake–which was 7 TIMES STRONGER than their upper design limits! It was only the tsunami which did them in. Better future siting would obviously mitigate this… i.e. Sharks can’t attack you in Kansas, lol.)

Also, I have not heard anyone in Congress sponsor the “Allow huge numbers of immigrants from one particular country to enter the USA in a short period of time” Bill, lol… though I’m sure the NAR lobbyists ARE PUSHING FOR IT! ;’)

Also, I’m thinking the daily commute back to their jobs in Japan would eat up their “wise investment gains” in US real estate… ;’)

Enzo, I noticed that too. Massive devastation of houses but all from the Tsunami. No a single building collapse from a 9! earthquake. I was at the Series for the Loma Prieta quake. That was a piddly 6.9 lasting 15 secs. It broke the major bridge across the bay, and cut a major east bay artery with many lives lost.

The japanese really do build magnificently. It will take years to get the final word on how the nukes really fared, but my crystal ball says that the root cause will be the tsunami and resulting power outage, not any direct effect of the quake.

LOL. Yeah…because we all know that every Japanese person is just made of money. That’s what all the overly indebted realtors say so it must be true.

There is also that little problem of immigration.

Illegal immigration is no problem, whatsoever, apparently. But I’d take the Japanese over the current illegals any day.

Where are they gonna find jobs! Oh that’s right you don’t need a job to buy a house!

Calfornia real estate is only for the cash rich who are gaming with each other to see who outbids and “wins” while hopefully paying well under the appraised/asking/norm housing price. (whatever that means right?)

California already a primarily renter’s paradise will continue to be just that… and the numbers doing so will rise.

Then yes, you have the sector of people who were stuck in the middle: can’t pay the mortgage or having a morality crisis in deciding if they should continue paying their $400k mortgage tab on their new $200k valued house…

That decision making, along with the deterioration of inland communities where businesses and services grew DUE TO the increase in home developments and buyers (and have since been batted down by economic woes) will guarantee that no prudent buyer will miss ANY opportunity – because simply, there aren’t many in terms of those looking for “primary residence home ownership”

Our 15 second attention spans are preventing a lot of people from grasping this. Of course the boob tube real estate propaganda helps to jam their good senses and cognitive reasoning…

The lay of the land in this part of the US is DIFFERENT than other states. Someone in the midwest and other regions may certainly want to buy — HOWEVER — they certainly won’t miss out by waiting longer, and they may even save a few more dollars if they do. If anything, nationwide buyers should stick to their guns and grind, grind, grind down those offers they put out there — on both the seller and real estate agent commission side of things…

Out in california where the acknowledged “preferred” areas of residence are, the renter’s paradise continues…

While it would be prying, I would love to walk up and down my block and see the true financial picture the mortgage holders inside these homes face…. a clean yard, modern looking home and fresh paint hide the true pain ( and it just got started remember! 08 is a BLINK of an eye in relation to trends, markets, etc). We know the media is never going to give us the big picture, they only cheer lead for the monied interests and status quo: real estate – great. stock market – great….

Like others here – the HARD thing for me to grasp is not what is happening, but how many friends and family had no idea and got stuck in the middle…. They rolled their eyes at info like this because they live under the mantra of “They (govt, boobtube, mainstream media) will tell me when things are changing/bad”.

Those of us who read news with alternative or competing views have a hard time in understanding the psychosis (an understatement) of these people… It’s not that they need to be real estate sleuths — but rather: when are they going to wake up and start being critical about where they get their “world views” on subjects from – and how many times they will continue to listen to the center source that lies to them over and over again. People’s short memories is one factor, but their unwillingness to admit things are VERY wrong yields a truer picture. (for most moral people, if they admit something is wrong, they have to do something about it)

Whether it’s world events or real estate markets – it’s time for those people to admit to themselves they’ve been had… we all have.

ps – NO radiation in Japan OFFtheBooks – all fear mongering, that’s all the military media does now… the herd/hive belief system is a strange thing – Japan and Libya are our latest distractions from subjects like the one we are discussing: the predatory financial complex of the US and to a greater extend, private world banking cartels. The issues that affect each and every one of us in our pocketbooks, ie: standard of living / quality of life.

Ahey-I agree most people are busy living their life and trying to make it through another day. I don’t blame people for not understanding how complex this whole housing/banking/Wall Street situation is. Wall Street, banking and the housing sectors took advantage of regular hard working people and made life a Rubics cube. Most anyone on this site I would say is above average in the savvy dept. but don’t put middle America down for just trying to live their life and not think about money every second of the day. Check out the t.v. guru of stocks, Jim Cramer what he really thinks(great you tube interview ) about long term investors and how he manipulated us dummies when he wanted to buy, sell and dump stocks when he was in charge of a hedge fund. It’s tough out there, it’s hard know who to listen to and who to ignore. Banks and hedge funds could not do what they do if they did not have all our 401k dummy money sitting there so earnestly. They do donuts in parking lots around long term, dollar cost averaging investors. Banks don’t buy and hold why should you? I don’t think people should day trade but there is a lot that the average investor has no idea how Wall Street really makes their money. Do I think it’s fair no-but I would never put someone down for not knowing. How many out there know that anyone in the real money trading world think Jim Cramer and CNBC are the biggest propaganda machines. The behind the scenes rules put common beliefs on their ass.

Incredible post.

It’s almost like you crawled into my brain, unjumbled my thoughts, and put words to them.

I suspect that if you were able to see all your neighbors financial pictures, laid out in plain view, you still wouldn’t be able to convince them of their reality. They have been living a lie for so long that not only do they believe the lie, they’ll fight tooth and nail to hold onto it.

Too many dishonest people in this world.

Sadly, in the end, one by one, they’ll see the truth…and they’ll hate you for it. They’ll start blaming you for all their misery and lash out at you for reasons that have nothing to do with you.

“Sadly, in the end, one by one, they’ll see the truth…and they’ll hate you for it. They’ll start blaming you for all their misery and lash out at you for reasons that have nothing to do with you.”

That’s more true than you know. That’s why I never share my opinions about investing with anyone I know. I get it all out of my system on my anonymous blog. Great therapy.

To Christie S. – I recommend following the advice and comments of some of the posters on this blog, esp. SomisGuy at 3:15 pm. Also, if you invest in companies run by honest and competent managers and stick with them, while keeping a close eye on them, you won’t go wrong. As for your 401(k) – avoid mutual funds and have it be self-directed (you might have to fight for that) you should be o.k. It takes a long time for a portfolio to grow and an individual investor to learn.

BTW, on March 16, 2001 (ten years ago) the Dow was at 9,823. Today’s 12,000+ does not include dividends reinvested over that period, it’s just the prices. And the DOW 30 ten years ago was quite different from the DOW 30 today.

Yes, how despicable of the financial industrial complex to have engineered that tsunami in Japan to distract us.

Dpes anyone ever think before posting here or is a venting site for uncontrollable mental diarrhea/whining?

This just in !

http://news.yahoo.com/s/nm/20110321/ts_nm/us_usa_economy_housing

I am still dumbfounded at how sky-high prices in some places of California are. Greed takes a long way to work out of peoples’ system and psyche.

I live on the California coast. There is a small housing development which was built about 6-8 years ago (at the peak). Houses started selling there in the upper $600’s I believe. Quickly homes were selling from the upper $700’s to $1.2 million big ones! It was insanity at its very finest.

I have told my daughter that I believe that close to 75% to maybe 100% of the people who originally bought in this small development will end up losing their homes. Many of these homes are being offered in the mid 500’s to upper 600’s now. ( How’s that for return on investment?). Many of the homes are now sitting vacant, a victim this Great Depression 2 and the Housing Bubble.

Don’t forget to live while your waiting for your chance to live better. Lots going on in the world today, it’s allways been this way… Every generation. So who’s in charge of you? Can you decide at this moment to be Happy or Angry? Are you rich with much to lose if you make a poor choice? Are you poor, with little to lose if you take the Educated Risk? Is it beneath you to serve others? Do you feel guilt when others serve you? If tomarro your world was rocked by a 9.0 earthquake, would you regret anything… ? Just a few Thoughts…

Sorry for sounding so Serious, I have to get out more! Please excuse my lack of “Spell Check” on my previous post…

Semper Fi

Great post Doc! This one hit the nail on the head. I’ve said it before, numbers don’t lie, people do.

I worked in a corporate environment before, with several people in their late 50’s early 60’s. I can tell you, these boomers don’t understand the concept of sustainability. Its really not wired into their thought processes. As best I can tell, they never had to deal with any scarcity of anything, so they don’t think in those terms.

Whatever the cause, I will tell you the consequences. They will try to sell their homes at inflated prices, which won’t work. Wages, as we’ve seen are too low to support that. Then to prevent their finances from collapsing, they will attempt to work longer than planned.

That won’t work either, since as the Doc kindly illustrated, unemployment is high amongst the young. That means Joe Boomer is now competing with 50 millenials who are hungry, energetic, less costly in terms of benefits, computer savvy, and willing to work for less. That doesn’t count foreigners, in this increasingly globalized marketplace.

Its only a matter of time before the economics demand that the boomers are forced out of the labor pool. When that happens, they will have to sell their properties at whatever price the market will support. Given the housing projections for the next 10 years, I wouldn’t want to be a boomer right no.

Numbers don’t lie and people do get delusional generally based on tunnel vision. Please don’t paint boomers as ‘blind to sustainability based on the one or two people you work with. Many many boomers get sustainability and many many x, y and new gen folks do not. Smart boomers will be fine in retirement, just as those in your generation who understand how to handle their finances will.

I’m going to make a few generalizations that are certainly not meant to apply to each and every individual.

1) The boomers came from parents that saw multiple world wars and a Depression. The ‘greatest generation’ was well known for frugality, never taking on debt, not trusting banks, hoarding cash, turning off lights, and reusing aluminum foil from taking sandwiches to work for lunch all week. How we went in one generation from ultimate frugality to massive over consumption and living on credit has always mystified me. In general boomers don’t have enough to retire and even making good on all the entitlements won’t save them. Many will experience very low standards of living in their old age and it will be a major drain on society.

2) The newest generation in the US work force (under 28 from what I gather) is a major disappointment and I hear this everywhere. Huge sense of entitlement, desire for all the pay/responsibility as well as super great convenient quality of life. This probably comes from being coddled as 20 years ago the whole psychological baby/kid programming thing started (some good point though). They experienced rampant grade inflation and many have never known failure or having to truly suck it up and work hard. They are in for a rude awakening when and if they ever wake up. Hell a lot of kids today don’t even have summer jobs or work after school as the soccer moms cart them from activity to activity. Bottom line – it’s okay to fail, builds character and makes for a stronger person that won’t be easily shaken and has confidence that they can work and fight to achieve something.

3) It will likely be the kids growing up now that will achieve a bit of balance. They’ll know and see scarcity. They’ll appreciate material things as well as the most important things in life which are non-material (which many seem to have forgotten in the drunken debt stupor).

Bottom line is that America has gotten too soft. You even see it in Hollywood with this self loathing societal guilt crap overlaid on many movies – like Avatar (which I’m fine with as long as they donate the majority of profit to worthy causes and aren’t banking major dollars living in some multi-million dollar house while preaching the non-material/selfish world to others). We need a society of independent critical thinkers with strong wills and work ethic who are not content to be manipulated and marketed to by the press, corporations, and politicians. Wake up America and demand better of your leaders, communities and yourselves.

That is a quite plausible scenario, the thing I think will be a bit of a lose variable is how the “millenials” behave in the face pf the reality you outlined. I am not quite certain that your dread for being a boomer is not at least partially unwarranted as the politicians who are boomers themselves and always horny for such a ravenously selfish and homogenous voting block, will not put the screws to gen x and younger as much as they can get away with it. Our younger generation is sadly quite ignorant of their reality, having been coddled in a world of debt and undeserved expectations and demands by their boomer parents. Our whole social and political structure is essentially built on a methodology focused on fooling people just enough to extract as much as possible without causing explosive breach of negative sentiment, similar to that which the Middle East and Maghreb are demonstrating so finely. I am not quite certain how long it will take for post boomers to wake up and realize “hey, they totally screwed us”, and then build up the resistance and maturity to refuse grand ma and grandpa their long dreamed of, yet undeserved, retirement in comfort…all billed to the national credit card junior is holding in his hands. It will be quite an interesting thing to behold. I have an extremely high probability on the post-boomers suffering, because over our whole history the people/individual that should be held accountable and suffer the consequences never do.

What people and most economists don’t realize and wholly underestimate is 1. The significance America’s “Trust Fund” in the form of our unusually abundant natural resources has played in the “success” of our economy and 2. how much the absolute destruction, paralyzation, subsequent societal trauma, and follow-on century long catharsis of the Cold War significantly eased the playing field for us. Europe is trying to get it’s economic act together, India and China and all the other outlying beneficiary countries are powering ahead like at breakneck pace, South America is waking from it’s slumber (or USA facilitated coma. Whatever), and North Africa and the Middle East are casting off the horrible VD they caught while being raped every which way by us, the soviets, and Europe to a lesser extent.

Every Boomer I know has 2.1 children. Most own their houses outright by now, and can reverse mortgage or somethign similar to generate cash flow if their kids can’t help them.

The upcoming generation in California is non-white and works in low-paying jobs. Few of them will be capable of saving up any sort of down payment. If the government makes it more difficult to get a mortgage without putting down 20%, house prices at the lower end in California will nosedive.

A lot of whites are moving out of California, some when they graduate from college, some when they get married/have kids and want to own a nice single family house in a decent school district, and some when they retire. There are wealthy whites and Asians willing to buy at the high end, but what happens to California real estate prices if the middle class leaves?

That writing has been on the wall for over a decade…perhaps it got covered up with gang graffiti?

One of the truly sad outcomes of the financial mess we’re in is the fact that being prudent with real estate and investment endeavors didn’t offer much protection from the stupid and irresponsible actions of so many millions of other people. Plummeting house prices take down everyone, no matter if the house is paid off or financed by some irresponsible no-documentation negative amortization variable rate funny money mortgage. Ditto for investments in the stock market, where blatant manipulation of stock prices trumps careful and conservative approaches every time. And then add to these insults and scars the fact that our political leaders and their minions (e.g. the Greenspans, Bernankes and their enablers) have acted so irresponsibly for so long that wrecking the economy and keeping it wrecked seems to be what they are best at doing.

The only bright spot might be that there are a lot of places that are not in such dire straits as California, Florida, Nevada and Arizona, the ground-zeros of the housing bust. Indeed, there are still places where a couple earning under $100K household income can still purchase a nice 3-4 bdrom/2 bath home and still have money left at the end of the month. Most of these places are, of course, located in what is derisively termed ‘flyover’ areas and populated, if you watch TV and movies, with knuckle-dragging primitives who don’t know a computer chip from a chocolate chip.

Fortunately, there’s a lot of data (with more emerging all the time) that population growth (including a lot of inter-state migration) and economic growth are starting to occur in these supposedly undesirable places and, hopefully, it is only a matter of time until they become the desperately needed engines of growth that will pull us all out of the economic pit we’re in now.

Cheers,

Fast Eddie

(happily living in the boondocks)

Gary Shilling Predicts Home Prices Will Fall Another 20%

A. Gary Shilling, who predicted the U.S. housing collapse and the Greek crisis of 2010, says house prices will fall another 20% before the market hits bottom. With excess inventory of unsold homes in the millions he sees no other way for house prices but down.

Massive Deleveraging

Shilling, who is president of the investment research firm A. Gary Shilling & Co. in Springfield, New Jersey, believes the Fed’s efforts in stimulating the economy will fail. He says that this recession is unlike the others: This time around, massive deleveraging is under way.

Savings rates will keep climbing as consumers realize they have not retained enough resources to retire on. Home equity withdrawals have already ceased as a result of falling house prices.

A Stock Market Sell Off Will Decimate Retirement Savings

Shilling also thinks the stock market is overvalued and we are in for a “significant†sell off within a year as the Federal Reserve fails in its efforts to stimulate economic growth. This will further decimate many Americans’ retirement savings.

No matter how hard the Fed tries, Shilling believes overall borrowing will continue to decrease.

Given his recent track record, you can’t dismiss him out of hand. He predicted the housing collapse. He foresaw the Greek crisis of 2010 and called for investors to short the euro only days before its spectacular collapse in early May.

Boomer bashing? Â Please. Â After a lifetime of GenX bashing it’s about time.

You can pop off all you want about “my generation.”  The fact is Boomers,

specifically Republican Boomers have made a mess of our country and its

finances. Â And while Boomers were quick to rally against the Viet Nam war

they were even quicker to send GenX and Millennial kids to die in the sand

for oil, or face, or whatever the occupations in Iraq etc. are actually

about.

GenX is not about to sit by and allow Boomer thieves to maintain their

lifestyle at the younger generations’ expense. Â This thread is about real

estate but more and more I am seeing generational politics emerge in all

discourse – especially in regards to economic issues.

Baby Boomers have created a monster. Â They have held down Generation X,

belittled us, stolen from us, told us we’re spoiled, etc. Â We have endured

your assault and what’s left is the strength we acquired to withstand it.

Now GenX as a single unified thick skinned beast will wield its power

without remorse. Â None given, and now none granted.

America’s greediest generation (Baby Boomer) being lorded over by their

punky junior sibling (Generation X) who happens to be smarter, meaner,

better. Â Deal.

And then I’ll buy one of your foreclosures.

I can’t wait.

Remember only half of LAUSD kids are graduating HS. What kind of future does that generation face. Only so many can flip burgers, we have no real manufacturing base so where are they going to work? How many households are they going to create? The future for the uneducated is scary because the safety net is gone. They’ll be living with mom forever.

Secret confession: I cant wait for the baby boomers to die.

Karma!

Enough Said?

Patience, schoolboy. That’s going to take about thirty years. And then you’ll have a bunch of spoiled brats waiting for your demise.

Don’t be in too big a hurry, Matt. There is a good chance that what comes after us will be much, much worse. Are you prepared for that?

doc i agree with most points, however i have to disagree with your assertion that the housing bubble started in 1999. i believe it started in 1997 when clinton started enforcing jimmy carter’s community reinvestment act. by 1999 when glass-steagall was repealed, the housing bubble was already being inflated as shown in your first graph. while repealing glass-steagall likely contributed to the housing bubble, cra got the ball rolling initially.

Leave a Reply to EconE