Creating a Central Foreclosure and Mortgage Database: The Urgent Need to Centralize Housing Data.

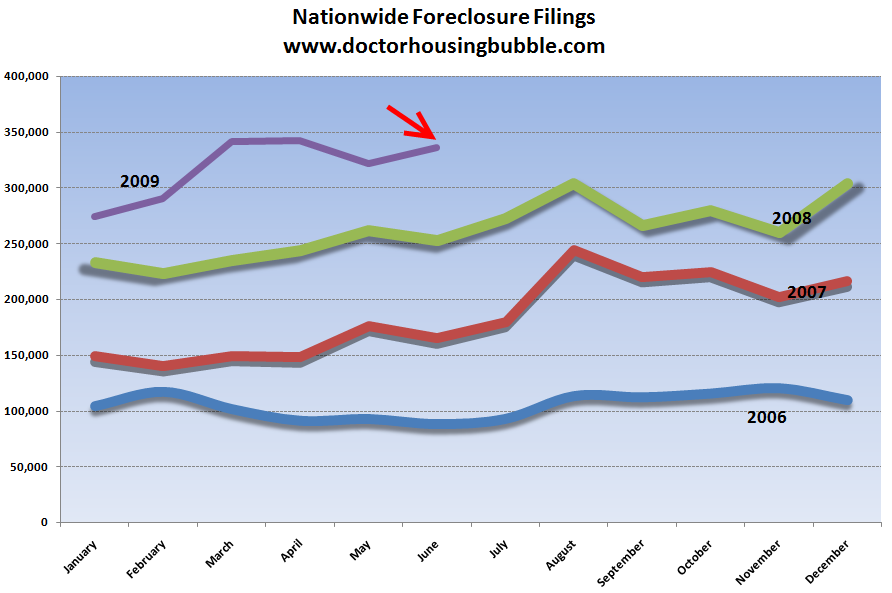

There is an urgent need to centralize important pieces of housing data. I view this on the level of employment data or even calculating GDP. Housing has become such a crucial component of our nation’s economy that I am stunned, nearly two years into this crisis that we have not spent any money in a concerted effort to bring housing data under one umbrella. We spend trillions in bailouts yet will not allocate what, a few million to create a central hub of this information? When we investigated Southern California we used three different sources to come up with our estimate that 40,000 homes are lurking as shadow inventory. Some argue that this issue is minor and will have a minor impact on the overall market. Others argue that shadow inventory is much larger than many would expect and this will have an effect on the overall market.

In searching for Alt-A and option ARM data for example, we have to rely on multiple sources of data including the Federal Reserve and independent studies. We have a raw number of loans and average balances yet this data is not connected in any easy format to foreclosures:

I view this as an urgent need. If we are to conduct any thorough analysis it would be useful to have the multiple data providers under one central hub. Take for example California and two large data providers in RealtyTrac and DataQuick. Let us look at distress property data for Q2 of 2009:

DataQuick (Q2 2009):

Notice of Defaults:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 124,562

Trustee Deeds Recorded:Â Â Â Â Â Â Â 45,667

RealtyTrac (Q2 2009):

Notice of Defaults:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 124,275

Notice of Trustee Sale:Â Â Â Â Â Â Â Â Â Â Â 45,419

At least with these two data points, we realize that both sources are nearly on the same page. Yet this is where a lot of darkness begins to emerge. We know that many banks are taking properties back as REOs. How many? To figure this out we would first need to have banks reporting to one central hub and ideally providing data on the properties they have on their books. Some would argue that this data is proprietary. I would argue that since banks are using trillions in taxpayer bailouts they really don’t have any say at this point especially with their sad attempts at loan modifications.

Now assuming we have banks reporting to a national hub of REO data including loan stats, we can better assess the potential damage. For example, let us assume the 40,000 REO homes in Southern California are clustered in certain counties. With access to this information, we can better assess the market. Not understanding the overall market is what led to our moment of Niagara with housing. Knowing where and what the loan is attached to is half the battle. The other battle is access to local MLS data. The MLS data isn’t such a big deal anymore with sites like Redfin and Zillow making housing information accessible to all. Yet there are still hurdles. In order to have a more accurate figure on housing data, wouldn’t it make sense to have a centralized hub of how many homes are currently for sale on the market? Wouldn’t it be useful for example to know at any given moment how many homes are for sale in the U.S. and be certain of that number? It would also be easy to run a monthly analysis on the data. Instead, we are battling it out again in terms of housing bottoms and everyone is looking at various data points supporting various perspectives.

This transparency is absolutely useful and critical. When you have $13.8 trillion in household wealth disappearing and millions of foreclosures, I think it is time we rethink how we look at housing and housing data. Just imagine if you knew that in Los Angeles County there were 26,000 homes currently on the market with 10,000 homes as shadow inventory. In order to calculate a holistic market perspective of housing we need to search through a multitude of sources including the Census Bureau, Federal Reserve, MLS, foreclosure records, and other sources of public information. Otherwise, we are missing the bigger issue.

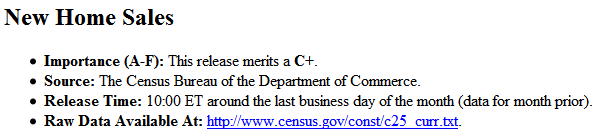

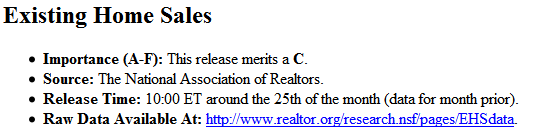

Take for example new home sales and existing home sales:

New home sales are reported by the Census Bureau and existing home sale are reported by the National Association of Realtors. Why not streamline the data into one spot? I’m sure there are many legal hurdles here but the data for the most part is already being collected. The question is whether it is useful to have all these sources reporting to one spot. What should they report? At the very least, I think disclosing foreclosure and REO data is important. In that case, we can have someone pull up a bank REO in say the Inland Empire and see that XYZ bank is valuing it at $400,000 when in reality we know comparable homes are selling for $200,000. Otherwise, we are making billion dollar policy decisions by estimating when there really is no need for it. The data is already there. That is why I am not surprised that so few people actually consider the Alt-A and option ARM problems as even an issue at all. According to government data, there are still some $1.1 trillion in subprime and Alt-A loans in the market. Yet if we selectively look at home sales that are picking up, we can conveniently ignore the toxic waste on the balance sheet of many banks.

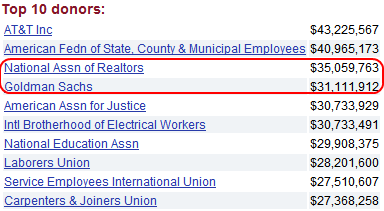

So why isn’t there a concerted move to do this? As in many things, politics trumps good public policy. Just take a look at the 10 largest donors to Washington D.C.:

What a coincidence that in a crisis caused by crony Wall Street and inflated housing values that a Wall Street firm and those benefiting from the inflated housing values are actually doing well with current legislation. I’m sure that they being 2 of the top 3 donors to Washington is merely a coincidence. Just to show you how important information is, take a look at what happened back in 2006 when Zillow was taking off:

“Zillow is placing the American dream of homeownership at risk for countless working families,” says John Taylor, president and chief executive of the NCRC President in a prepared statement (PDF). “For a company that represents to consumers that they are the ‘Kelley Blue Book of Homes,’ this is a very dangerous situation. We call upon the FTC to intervene and ensure that Americans receive accurate appraisals and valuation information to protect the single most important investment of their lives: their home.”

Ironically, this came out when accurate appraisals meant absolutely nothing and everyone was inflating the bubble to its sad conclusion. The more data that is hidden the more speculation will be embedded in the real estate market. An appraisal is useful in getting an accurate figure on your home based on construction, modifications, and more specific changes. But if you want to get a quick sense of sanity, you can use Zillow to see why a home on one side of the street is selling for $500,000 while another home is going for $400,000. How is this bad? Of course, we have many industries that survive by hiding data from the American public and obscuring facts with noise and distractions.

We already have many analyst including myself that piece together this information. But the question is whether we want to keep the massive speculative element in housing or make it a more bland industry as it was for multiple decades? Without Alt-A and option ARM loans the bubble in states like California would not have ballooned to epic levels. Alt-A allowed for those no-doc and no-income loans to those supposedly quality borrowers. Diana Olick had this estimate a few weeks back:

“So what exactly is the size of this shadow inventory?

Hard to say, but estimates are that it could be around 700,000.”

That sounds about right but who really knows. At this point, we can only offer our best estimates with the resources available.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

14 Responses to “Creating a Central Foreclosure and Mortgage Database: The Urgent Need to Centralize Housing Data.”

The old saying goes: “Knowledge is Power”; the government does not want people to be empowered. Much of the statistics reported by the government are flat out inaccurate (ie. unemployment, job loses, etc.). Why would we believe their foreclosure numbers? The banks obviously would not want the public to know the numbers of the “shadow inventory” and foreclosure rates. If the public knew this, we would stop by houses.

Well here’s some good news:

http://voxday.blogspot.com/2009/08/seriously-below-surface.html

Stunned? Truly Doc you can’t be asking this with a straight face. You have a better chance of getting David Copperfield to reveal his magic tricks than to get the crony capitalist to reveal theirs.

Taking the logic to another level, where is the so-called financial reform that we were promised? Elizabeth Warren of the Congressional Oversight Panel testified again this week that her committee is getting practically stonewalled.

David Copperfield is a sideshow magic act compared to the gov over how they made $700B in TARP money disappear without a trace!

A Central Foreclosure and Mortagage Database is urgently in need.

The scenario so far look retty grim.

“The number of U.S. households on the verge of losing their homes soared by nearly 15 percent in the first half of the year as more people lost their jobs and were unable to pay their monthly mortgage bills.”

The mushrooming foreclosure crisis affected more than 1.5 million homes in the first six months of the year, according to a report released by foreclosure listing service RealtyTrac.

On a state-by-state basis, Nevada had the nation’s highest foreclosure rate in the first half of the year, with more than 6 percent of all households receiving a filing. Arizona was No. 2, followed by Florida, California and Utah. Rounding out the top 10 were Georgia, Michigan, Illinois, Idaho and Colorado.

Read More: http://www.housingnewslive.com

Every aspect of the American Empire is inflated so far past reality that the only way this thing keeps going is blind Ponzi and the assurance that enough Americans are alpha-ignorant and rectify all data to absolute positive. The perma-bulls have their minds made up: It’s only a matter of time before the American juggernaut rights itself and green shoots and rainbows are everywhere. Don’t forget, Gen-X grew up with Barney and Wallstreet. We grew up with that Drug Smuggler Captain Kangaroo and his sidekick, Mr. Greenspan, and the movies were like The Towering Inferno of Housing and the Inland Empire Strikes Out. We’ve seen this movie a few times already. Maybe the special effects are better but Planet of the Alt-Apes has the same plot every time…just a remake of The S&L Crisis, only this time it might be more like the Omega Man. “If you knew the future, you wouldn’t go there.”

You’re dreaming. Ain’t gonna happen. Live with it.

It would be like asking OPEC to provide independently validated production and resource data.

HaHaHaHaHa.

Great suggestion Doc, but believe that a .gov entitiy will simply create rules to hide information from the public, like the data .gov releases for unemployment and inflation. It will be a bureaucratic failure at the expense of the tax payer.

Sabian,

I’m a Gen Xer and I definitely did not grow up with Barney. I think he was there for Gen Y, maybe. Mr Dressup, Care Bears and Smurfs. I’m only ashamed of the Care Bears.

You’d have to kill them, which is what I’ve been advocating for the last two years.

You’re dreaming, DHB (with all due respect – you do GREAT work). Look at unemployment statistics. They FIND ways to obfuscate (birth-death, people no longer collecting UI or not looking, so they don’t count, etc.). The DOL keeps track of labor and unemployment data, right? It’s “centralized.” Yet we get completely bogus numbers (U6 versus U3, etc.) in the MSM. You think the banks and Wall Street won’t figure out how to game the numbers? Forget about it. Just keep doing what you’re doing – -revealing the truth.

Dr. HB:

Couldn’t disagree with you more on this one… More government intervention and control is what got us into this mess in the first place. It was the Fed, through their pricing of money below the risk free rate, that got us into this mess. If the government had stayed out of pricing money in the first place, the banks and brokerages would never had the incentives to lend this money out and would not have. Consolidation of too much power at the federal level is the problem we’ve faced in this country since our founding. If only we would follow the constitution…

Plus, a more pragmatic argument is, that when you start aggregating data at the federal level, you lose sight of all of the micro-markets, of which housing is a prime example. If you are looking at LA county data in aggregate, you lose sight of the fact that $2mm properties on the westside are just languishing, etc.

Sorry Al,

Maybe I was thinking about Barney Frank…they both have equivalent plans for solving this mess.

Doc,

Agree w/your thesis that there should be a single repository for this info but what bounced my jaw off the floor was your “10 largest donors to Washington D.C.” chart. Will you please supply a source for that info? It’s not that I’m disputing it, it’s that I really want to see & research this data as it’s stunning that 6/10 supposedly represent workers. If true it shows some amazing reality.

The NAR is a bunch of lying crooks run mainly by people who can’t get a real job!

Leave a Reply