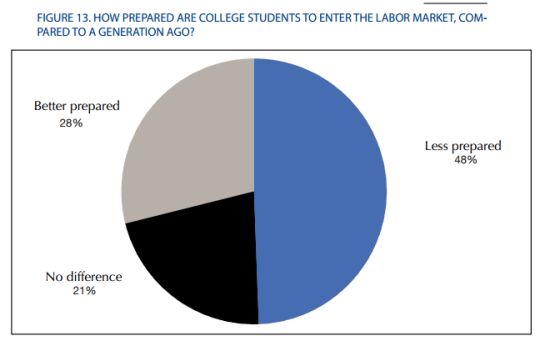

The kids are not looking for more debt – 40 percent have delayed making a major purchase in a home or car because of student debt.

Part of the long-term sustainability of the housing market will come from future young home buyers. There has been a massive boom for current homeowners who have refinanced and have subsequently had an increase to their own disposable income. The economy has really benefitted from the low interest rate environment but how much monetary bang do we have left? Those that place all their faith in the Fed forget that Alan Greenspan laid the foundation for the greatest housing bubble known to humankind. Younger Americans are facing dramatic challenges not faced in previous generation and are coming out with incredible levels of debt, many with student loan debt. It is important to examine the perceptions of this group since in many parts of the country it actually would make sense for younger families to purchase but many are not. So what gives?

The young and debt saddled

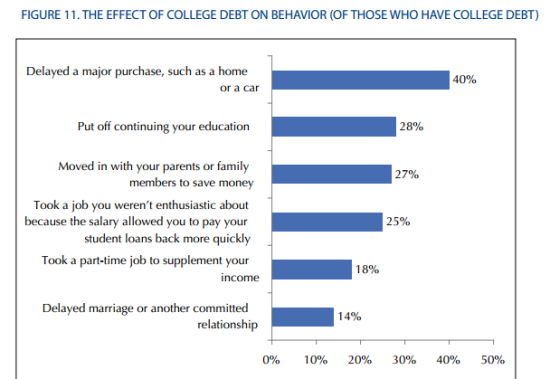

Rutgers University did a really interesting study with their recent graduates. Some of the perceptions shared in the research are enlightening:

Source:Â Rutgers University

The item that stands out the most is the delay of making a major purchase. 40 percent stated they have put off buying a major item like a home or a car due to their college debt. This is a new phenomenon. Never had we had such an indebted young population with student debt now towering over $1 trillion. It is impossible to suggest that this level of debt is going to have little impact on people and how they view future purchases. Also in the above chart, you see that 27 percent indicated that they will move back home to save money. This data coincides with Census figures showing millions of young Americans have moved back home during this recession instead of going out there and starting a new household via renting or buying.

Perceptions are important in the economy especially for buying a home. The baby boomer generation really blossomed in line with the apex of middle class America. The two were intertwined. After World War II the US was left with a dramatic competitive advantage globally and this setup the largest middle class the world has ever witnessed. It was common for a one-income blue collar family to purchase a home, find secure employment, and essentially live in a low unemployment environment. This kind of environment created a boom and laid the foundation to the massive consumer driven economy that we now have. The culmination of all this peaked with the housing bubble where people bought into the perpetual bubble machine and had no problem yanking out, $50,000, $100,000, or even $200,000 of equity from their home to fund car purchases, vacations, or expansions to their money machine. None of this was sustainable and we are now seeing a shift. Those that think youth are out of touch really need to look at the research more carefully:

Almost half of recent college graduates felt they were less prepared to enter the labor force compared to previous generations. This is stunning. Keep in mind we now have the most college educated population in the US yet the economy is still mired in long-term problems. The underemployment rate is incredibly high and many younger Americans are facing the brunt of this economic drag. Salaries are lower and long-term security is virtually non-existent. The long-term security that was available for many boomers setup a perfect environment to purchase a home and set roots in one specific location for decades. As you can see from the above figures, many do not feel that.

The connection between high student debt and the economy is now being explored much more carefully:

“(FT) Proponents of such schemes say high student loan burdens are hindering the US recovery. Studies show that recent graduates from US universities are delaying purchases of cars and homes, inhibiting near-term economic growth.

Rohit Chopra, the official responsible for student loans at the Consumer Financial Protection Bureau, added his voice to the debate last week, telling the FT that the student debt problem was hurting the US economy. “Student debt may be more intertwined with the housing market than we realise,†he warned.â€

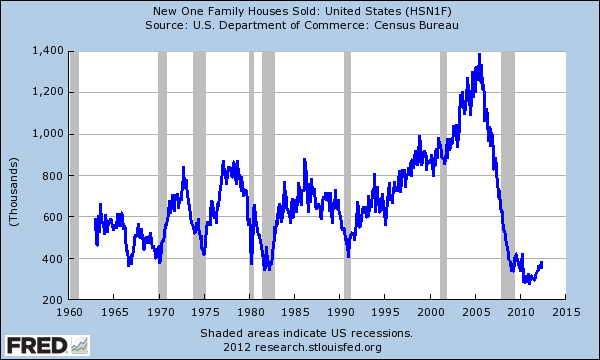

Agreed. Student debt is going to be a major impact on the economy for years to come. The short-term burst of lower interest rates has helped current home owners and those underwater that qualify for refinances (many do not). These two groups are the largest beneficiaries. The large pool of Americans on fixed incomes, not so much. You would think given the 3.6 percent 30-year fixed mortgage interest rate that many would be diving in and buying homes. New home sales are picking up:

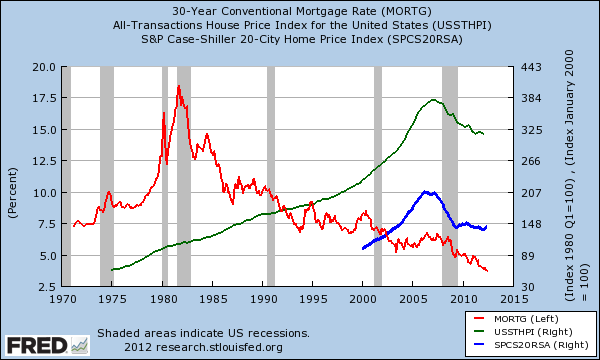

We are barely inching back to more normal levels. More of the buying is still with more affordable homes. Home prices are leveling off but much of this is because of the dramatic decline in interest rates:

From 1970 to 2000 the 30-year conventional mortgage was above 7.5 percent most of the time. Even until 2010 anything below 6 percent was rare. Only since the recession hit and the Fed massively restructured the system have rates gone ultra-low. The juice is running out and young Americans already have big levels of debt for their college endeavors. Many are not willing to dive into another big debt commitment and we are seeing this with homeownership rates for younger age groups. You need to have a healthy market for younger buyers to have a sustainable system. So far, we are simply dealing with problems as they crop up like pulling weeds and long-term planning is crucial for a sustainable system. Many of the younger buyers jump in with low down payment FHA insured loans and default rates are soaring for these loans. Too much debt with a weaker economy is not a recipe for good times ahead and the young seem more in tune to this reality.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

55 Responses to “The kids are not looking for more debt – 40 percent have delayed making a major purchase in a home or car because of student debt.”

Well, of 40% of the young and indebted aren’t falling for the trap of debt servitude for a home, than, I guess, 60% still are, right? Old habits die hard. There’s probably millions of older relatives who haven’t been burned yet in this crash (in other words, they haven’t tried to sell the house, yet) who are still advising the young ones to buy buy buy, there’s no better investment than a home! Worked for me! Hey, here’s 25 grand towards that down payment. shhhhh…….don’t tell the IRS, because it’s over the limit. It’s our little secret.

Kids are stupid. But I don’t tell them, let them figure it out on their own.

On another note, well, it looks more and more like I’ll be the average statistic, buying my first home at 35 yrs. old. This milestone will be in a couple years if I’m lucky…

the story is incredible.

http://thoughtcatalog.com/2012/get-a-job-the-craigslist-experiment/

Thanks for that link. Being in that boat for the past 4 years, it was not at all surprising to me.

What’s crazy is thinking that someone with boatloads of student loan debt would be working in NYC for $12/hr. What would they do, 2 hour commute from a rented camper closet?

I am the biggest bear on this board. In other words, If you ask every person on this board where they think prices will be in ten years, I will predict a lower price in ten years than anyone else.

There are quite a few demographic factors that make me feel highly confident that prices will be way down in ten years

That being said, the honest truth is that over the past 12 months prices have been in an upward trend. I watch my micro market (the Franklin 90402) very very closely and what I see is prices going up. Not going up quickly, not creating a frenzy, but on balance prices are inching up rather than inching down.

The people that deny that prices are heading up are just not telling the truth.

I completely agree that housing prices will most likely be down in real terms 10 years from now and that we are currently seeing a small bump in prices. My take is that this is that it is very similar to other collapsing markets (NASDAQ in the 1999 – 2001 and the Dow 1929 – 1935). One thing to keep in mind is that there is a lot of “friction” in the housing market. Most home purchases are leveraged which makes it harder to buy and sell. Transaction costs are very high (over 6% in some cases) and it takes quite some time to sell/buy a house. Compared to other markets (stocks, commodities, bonds, etc.) which change hands in fractions of seconds, this market can take a long time to correct.

That’s the reason you can’t get too caught-up in forecasting prices. If you can mortgage < 2.5x your household income and your total housing costs will be < equivalent rent, then consider buying. Or just rent and maintain freedom. No biggie.

I think what we may be seeing is a mini-trend based on investment properties and low interest rates, i.e. overbuy a bit, pay less over the long term and get more (in terms of rental income over decades).

But yes, it will trend down over a decade. As this article suggests, the drop-off in new buyers is pretty drastic, and they have something hanging over their heads that we haven’t seen before.

I’m usually somewhat bearish. However, I personally think that housing will track inflation over the long run. There may be a slight upside because I think the US population is a little more (well a lot more) panicky about the economy than is really justified, so prices might be a tad low. However there seems to be a bit of bubblicious foreign money coming in to prop up prices, so maybe not true. All and all, I don’t think your home is the right place to make a buck these days. Buy a house if you need one, I say, but don’t assume more risk than necessary doing so. Its a big liability.

Point me to one “bearish” comment that you have posted…

“The people that deny that prices are heading up are just not telling the truth.”

Ahh, “the prices”, yes.

So it doesn’t matter that the houses sold are bigger/in better areas than earlier?

If you don’t define what price you are talking about, that statement is more or less meaningless. Inflation corrected, $/sq. ft., total price regardless of size/location or something else?

Total price is pretty much meaningless indicator when houses sold are not uniformly distributed against location or size, so claiming that prices are going up based on just that is so small part of the whole truth that it’s really a lie.

Cheap houses are now sold and the selling is moving to middle range, of course the nominal price will go up. But only that: statistical trickery. Not an accident either.

http://finance.yahoo.com/blogs/daily-ticker/u-totally-broke-federal-govt-fiscal-gap-222-135416602.html

I understand where this post is comeing from, but let me give another perspective.

If you read recent research on those twenty somethings who are buying or renting for the first time, they DON’T want to end up in the car dependent suburbs they grew up in since a fair perportion of them don’t have a drivers licence. Infact a growing number of teens are forgoing licences as well. One of the factors of this trend relates to the ever increasing restrictions tied to the graduaded licence statutes in many states.

Mobility is a key factor today in choosing where to live, work & other life choices. Being trapped in car dependent suburbia doesn’t help current & future home buyers.

I agree with what you’re saying, but the fact is that suburbia home prices (the same areas that these kids grew up in) aren’t reaching anywhere near accessible for recent college grads. Hell, they aren’t even in my ballpark (and I’m 34).

Are they trading commutes + car payments + insurance for the city life? You betcha. I did the same. We are a one-car household now.

We’d all love to move out to suburbia again (and deal with the commute) but it’s impossible to pull off. It’s not like LA’s great public transportation system is leading a wave of change here. It’s the economy that is forcing us to rethink our expenditures.

Chris,

The MTA may not be the greatest transit system in the world, but based on what I have read recently they are in the process of rapid expantion. This will keep value in properties that are near those transit lines. Also ridership will continue to increase as gas prices rise & as the Transit Access Pass or TAP card coverage widens throughout Los Angeles County.

I definitely agree with the mobility factor. I have little interest in buying a house that doesn’t make fiscal sense unless I live in it for 7+ years.

Also, working from home is becoming more and more common (I do it), which gives people less incentive to stay in a single location for an extended period of time. Knowing I can move around without changing jobs is great, and makes me less motivated to buy something.

That said – if it makes sense that I can buy something, and then rent it out for profit should I decide to move, I would do that.

Big money is everywhere.

If you’re in the market today, you’re also competing with that 20-30 trillion dollars lying fallow in tax-avoidance money laundries, such as Bermuda and the Cayman Islands. This money, much of it from illegal sources, can afford to take losses of 50% or more (money laundering schemes often take even bigger bites), so investing in a real estate investment trust or an LLC (“entity,” in Rmoneyese) helps turn dirty vapor money into clean hard assets that actually offer cash returns. This makes buying up properties wholesale a very attractive proposition. It also prevents the market from reaching bottom.

EXCELLENT point! Dirty money has ALWAYS been a factor in RE here in So-Fla. It only slowed down temporarily following the Roaring Twenties.

Think about it: you can “gather” a private pool of $750MIL to erect a beachfront condo, without a single gov’t “oversight” agency caring where Duh Cash B From–not the SEC, not the OCC, not the FTC, nada. Even the IRS only cares about salaries and bonuses paid from the faux-corporation–and that would be the only fraction that comes directly ashore from The Caymans. GenCon and other first-tier “entities” have their own Cayman accounts… paying the subs is their problem… yet another layer of laundering.

No need to mention the age-old linkage ‘twixt organized crime and concrete production.

I know this is not the point of the article, but want to take issue with the following assertion: “The economy has really benefitted from the low interest rate environment….”

I fail to see a NET benefit of the ZIRP (policy). It has mostly been a devious method to transfer massive amounts of wealth from savers to borrowers (i.e banks). If savers were receiveing the traditional 10 year TR yield (2-3 points above inflation-5%), savers would have much more disposable income to stimulate the economy. This would have a much larger positive net effect on the economy than lowering the monthly payments for home owners or allowing a few more people to buy their first or a bigger home.

Intervention in the housing market with low loan rates is keeping house prices artifically high and is further protracting the duration of the current housing crises. It is way past time to return yields back to traditional levels.

I believe this policy is specifically engineered by the Fed to prop banks up and make them very profitable until they can unload / unwind the bad debts and avoid a jarring resolution to the financial crisis. I bet they believe that the quality unearned income of people with little to no debts is not really our problem right now.

That is exactly right. The big lie was that banks only had a liquidity problem, not an insolvency problem. All the banks needed was a payday loan (TARP) to provide a little cushion. We have had 4 years of ZIRP, assets parked at full value in Maiden Lane, recision of mark to market on Tier 2 and 3 assets, QE 1,2 and soon 3 and other similar policies so banks could repair their balance sheets. Problem is even after these massive taxpayer handouts the banks are still insolvent zombie institutions sucking what little life there is in the economy.

In retirement, Bernanke, like Greenspan and Clinton will eventually get tens of millions in honorariums (bribes) to make boring inconsequental speeches. Gotta love this system if you are an insider.

I think the real problem is that the artificially low interest rate is forcing retirement funds and retirees to put their money in more risky investments. This is part of the reason the stock market rebounded while the economy has been pretty much flat. We will see a lot of bankrupt retirement funds and retirees if we see any significant market correction. Also, there is the issue with all the mal-investment that artificially pricing money causes…

DHB: “Part of the long-term sustainability of the housing market will come from future young home buyers.”

Maybe, but not entirely. For the same reason why the workers of tomorrow will have trouble paying for the retirement of boomers, it is unreasonable to expect them to soak up all the housing too. There just aren’t enough young people to pay for the demographic bulge.

DHB: “Keep in mind we now have the most college educated population in the US yet the economy is still mired in long-term problems. The underemployment rate is incredibly high and many younger Americans are facing the brunt of this economic drag. Salaries are lower and long-term security is virtually non-existent. The long-term security that was available for many boomers setup a perfect environment to purchase a home and set roots in one specific location for decades.”

The article would be better without this sort of hyperbole. These statements are largely untrue, due to their overreaching claims. The economic problems we face aren’t structural. We don’t have epidemic graft, corruption, hyper inflation, failure of rule of law, etc. common to most other countries. What we have is some failure to act for the greater good from our political parties, and a lot of squirming and inability to address long term problems, but they are far from insurmountable. If we had the will, we’d legislate our way out of the mess in 6 months, take our medicine and move on.

Unemployment is not that high. It isn’t like spain or greece or Ireland. We still have the largest economy in the world. Even if we are surpassed by China, it won’t be because we are diminished. Most in the world would love to have our problems.

“long-term security is virtually non-existent”

Give. Me. A. Break. Do we worry about bread lines? Are there even gas lines like the ’70s? Is inflation out of control? Is government seizure of private assets likely? Is a secret police going to come in the night and take everything you have? Long term security is what we have in the United States in SPADES. Look no further than the yield on the T-Bill for your proof. Trillions of dollars worldwide flock to our shores to buy US government debt, precisely because we have long term security.

“The long-term security that was available for many boomers setup a perfect environment to purchase a home and set roots in one specific location for decades.”

I think you mean the Boomer’s parents. The notion of working for one company for 30 years, getting your gold watch and retiring on a nice pension died in the 80s. We’ve been on a tear of union busting, downsizing, offshoring, etc. since the Reagan Revolution. That was 32 years ago.

I think “security” was in reference to job security for today’s younger generation. I would agree with Dr. HB that these kids can’t count on working for one company their whole career, or even stay in the same career field…those days are over!

Say what you will, the younger generation has it much worse than the previous few generations. This country will likely become a two or three tier system. It all depends when you were born…

I’m curious about your position here.. my guess is 45+ with a mortgaged home in a nice area, with employment in a field that probably has a government contract attached.

My Boomer parents had five homes (four rentals) at my age, 34. We’re not in any debt, and I made some good money for quite a few years. Noses clean, but not stupid. What now?

“If we had the will, we’d legislate our way out of the mess in 6 months”

Just curious – what laws would accomplish that?

Ian, So what you are saying is, people who acted prudently and didn’t run out and buy 5 houses on liar loans, or had the good sense to see the bubble should be punished? So that the banks and lending institutions should survive.

I have most recently been planning as trip to reno, I would like to use your money, if i win i will keep the winnings but if i lose well you can suffer the loss. Sounds fair to me!

Till, Check out the RE market in Reno instead of wasting your money in one of those casinos. Sick cheap, with very low taxes. Unfortunately, I couldn’t stand living there, even though it’s an hour to Tahoe.

“The economic problems we face aren’t structural”

This is a blatant lie: They are.

There is no production based economy and money is floating freely around the globe. That is as structural as it gets.

“Trillions of dollars worldwide flock to our shores to buy US government debt, precisely because we have long term security. ”

No, wrong chain of logic.

Dollar (based debt) is bought because dollars and only dollars can buy oil. That is only reason anyone needs dollars for anything. And that is not very secure in the long term. Very unsecure, actually.

Of course euro and other currencies are even more insecure, at least for now.

If you really think that US government is the backstop for dollar, you’d really should think it over: In reality it is the oil. And only that: Government has no power at all.

Well I am looking at my subscription foreclosure website, and low and behold, our former residence (our 1st purchase in 1984) is up for auction this morning for $280K. We sunk a boatload of dough in that new construction home (would list now in the low $400’s). When we sold it, it was a beauty and the yard was really pretty. Weird to see what happened to our “love-nest”.

If it wasn’t a two-story stucco jungle HOA home, we would buy it again. BTW, we sold it for $225K in 1997 an bought the “big house” McMansion. We are a cash & close for a single story plain jane final place, currently renters.

I can’t believe the balances on some of these auction home. For instance, a $400K estimated value home has $1.2M in debt behind it. I mean, some of these stats are mind blowing.

I hope the lessons of debt with the newly minted degree folks make better decisions than all these homemoaners.They had a refi orgy, and had fun, but their later years will not be easy. They planned piss poor.

We are looking at a short sale we didn’t get last time it was on the market. We are doing both wholesale and retail shopping, as we have more options than most.

The housing cycle is broken for good, imho.

Everybody have a great day.

…someone has been drinking the Kool-Aid.

yes,but who is making it?

Walt

We have been shopping for 4 years, and NO, I didn’t drink the KOOL-AID. We are probably older than you, and have lived the S&L housing cycle. Homes prices came down fast back then, while this historic bubble isn’t letting housing come back to a normal cycle. The former VP of Morgan Stanley in the REIC sector says we’re headed into a rental housing market. I believe it. He and others started a SFR REIT LLC to rent out REO Bulk Sales and so has Rick Sharga, the former VP of RealtyTrac.

They have primed the pumps to keep this monster alive.

You must be younger. We can agree to disagree.

I smell Japan… only I think our housing market is in worse shape.

Maybe it’s because I’m in a position to buy, although extremely skittish. Maybe it’s just ignorance, but a couple of “what if’s” are bugging me.

1. What if there is some sort of student loan forgiveness eventually?

Also, even with all its flaws I cannot see that the US is going to be a terrible place, relative to the rest of the world, in 10-20 years. I am inclined to think that on a global economic scale that we will be a desirable place to live…with increasing populations, climate change, religious freedom etc,

2. What if we are one of the top countries in which to live when everything shakes out globally? Wouldn’t it follow that our housing would remain high relative to the global marketplace? Is that higher or lower than what it is now?

The thing that bugs me the most is comparing fundamentals without considering what everyone pays for rent…for instance I pay $2200 for a crappy 3bed house, this same house is priced at $450,000. So with the amount I have to put down I’m looking at a similar payment…this is in Redondo Beach. Doesn’t it make sense to buy fundamentally or are rents going to decrease? Ugh I’m so confused!

I follow housing very closely, even on a daily basis. A huge major factor is how demographics will impact the market in the next 10-15 years. Long story short: There will be 3 houses for every one buyer. So there goes your price.

And speculators will scoop up the other two, hoping to make $$$ on renting them out.

Bill

Interesting stats, but with all the REOs and workout deals, I see a broken market with an engineered shortage. And who has a decade plus to wait around. We’re older, and our quality of life is important to us. Since we are cash, paying multiple rents, and are dealing w/Glaucoma, etc…I think our “T Acct” looks different than some here.

We are going to overpay, no doubt. Our equation is give it to the LLs, or throw it at a SFH.Someone is going to get our dough.

Yeah but that requires waiting 10 to 15 years. That’s a long time, and dont forget about death.

I watched a lecture on future city planning on fora.tv a long time ago. It was saying that as energy prices rise, and the need to meet CO2 reduction goals by mid century looms, planners are shifting away from suburb planning, to more energy efficient, multi-floor condo/apartment planning, centered around walkable neighborhoods, with emphasis on public transport.

That kinda goes along with your oversupply idea.

Those townhomes and condos, (and homes) around LA that are already near the grocery, the drugstore, dinning, etc. could perhaps have a little upward pressure attached to them, because of the rising costs of energy and anticipated regulations regarding energy efficiency, over the long run. Someone already mentioned kids getting less enthusiastic about driving recently, on this comment section.

Hi, I was the one who pointed out the younger generation passing on driving above.

Good observation on the condos & townhouses, since the production home builders are moving in that direction. This is do to an oversupply of single family homes that are just sitting there or becomeing rentals by investor groups. One of those developments is http://www.navalsquare.com in Philadelphia PA. It is located a few minutes from center city & has several bus routes ajacent to it or a few blocks away.

What is most interesting is the increasing bifurcation between the “Professional/Design/Consulting/IT/non-profits/Gov’t lobbyists/” and the rest of us that support them. This is reflected in the increasing differences in home values (I infer this from the fact that the coastal zone has not fallen as much the rest of California.) If you look at the Washington DC Metro area and the Portland Oregon area one sees the same pattern. The returns to this highly educated population (growing rapidly) is what the young are aiming for. It is similar to the young that go to Hollywood and work as waiters, trying to hit it big in movies. We won’t know whether or not the young are foolish to take on this college debt for a chance at this cornucopia until we look at their lifetime earnings. It may be that the lifetime earnings profile is shifting dramatically and they will be the beneficiaries.

Doc, there’s another possibility here.

The life spans of people in the US have increased dramatically over the past 50-70 years. Baby Boomers were born at a time when life expectancies were some 10-15 years less than now. And in my parents’ generation (Depression/WWII), lifespans were 20+ years shorter.

Wouldn’t it make sense that expectations about piloting one’s education, household formation, and major purchases would change as well? Meaning that decisions such as buying a house SHOULD be deferred from my parents’ to my generation to that of young people today.

While I understand your position completely in that our economy is engineered around certain expectations about consumer behavior, many of those expectations were based on the experiences of people from the 1940s to the 1980s. I never expected to buy a house before age 50; actually purchasing in my 40s (in 2001) was a pleasant surprise, and the fact that I had deferred this purchase has meant that I had more choices, and over the course of my life, much less of my wages has been handed over to banksters in the form of interest. That meant bucking a lot of pressure in my 20s and 30s.

I consider young people’s willingness to defer gratifications such as marriage, breeding, graduate degrees, and house-buying to be a ray of sunlight in a bleak global economy. I know that the prevailing attitude is that if everyone just keeps partying like it’s 2006, everything will be better… but that just ain’t so.

The question of young people being saddled by schooling debt–that is something I feel strongly about, and it was one reason I left the Ed Biz after 30 years in it. In fact I’d venture to say that totemistic belief in schooling and degrees will also fall by the wayside in the present generation. That’s not unhealthy…even though it will mean huge dislocation in a lot of expectations about how to live life. A lot of people who parasitized other people in the debt-serf economy are going to be disappointed.

This will come across as more glib than I intend–sorry, I’m listening to Rory Gallagher and taking a break from fieldwork, with little keyboard time and too much sun. I’m simply suggesting that delaying gratification is part of what we need to relearn as a culture/society. Yes, that has certain impacts on a consumerist and debt-based society where going into hock for big-ticket unaffordables is the norm. But that system should and must change. It won’t be easy. I think it’s going to be downright grueling. And yes, it means that I have had to adjust my own expectations somewhat. Though not nearly as much as those a few years older than I (Boomers) who thought that cashing out their house, rather than gradually saving from their wages, would be their retirement plan.

PS–Forgot to mention that young people have all the time in the world to delay rushing into big ticket life choices. They have plenty of time to bounce back from even a global depression. It’s older folks who have much bigger, and more immediate, deadlines.

A few years ago, folks were talking about the bottom and I suggested we were entering a new reality of the next Dark Age–a downturn so long that instead a bump in the road, this would be a continual decline of living standards and of expectations. With the unbelievable stimulus that has been thrown at this mess, the falsification of inflation and employment statistics, mark-to-liar banking accounting, Fed accounting tricks and low-interest-rate scam, we are in a steady decay. Anyone still think we are almost ready for another major bull run? Euro-bail and QE3 and then we’re good?

Agree 100% that we are heading downward in a sawtooth pattern. Housing is currrently at the top of it’s cyclical “tooth” due to all the shenanigans thrown at it (lowest interest rates ever, no inventory, every program known to man to help troubled bowwers, etc).

I was thinking about buying early this year and am glad I did not. The economic storm clouds get darker everyday. To fix the structural problems that exist will require MAJOR PAIN from everyone. Buying an overpriced house right now could make for some sleepless nights…

You can consider me one of these “kids” not looking for more debt. At 30 yrs old with a PhD I would hardly consider myself a “kid”, but together my wife (masters grad) and I have accumulated 100K in student debt over our educational careers. However, we have been fortunate enough to use our education to launch us into successful careers, and we now generate a fairly large income stream, which is something I cannot say for many of our friends our age who are also saddled with debt levels similar to ours.

To be honest, I don’t know anyone under the age of 30 is capable of buying a house in southern California for any reasonable price (400k+) without significant financial help from their parents.

What is most frustrating to us is that fact that we feel we are significantly better off financially than the homeowners of the houses we are touring to potentially buy. For many of the houses we feel we must be making 50%-100% more in income from wages than the current homeowner, continuously questioning to ourselves how is all we can afford?

What are the main reasons we have not purchased?

1) The value just does not compute: With inventory dripping out like sticky molasses it feels as though are only two styles of houses coming on the market. The first group are old run down shacks which haven’t been touched in 30 years+, although priced at a reasonable level. With the second group being remodels which are 100K overpriced. Both options feel like we are lining the pockets of others and getting stuck with the bill.

2) Student Debt. The monthly payments on our 100K in student debt basically removes 100K of purchasing power off our potential housing purchase.

3) We feel we must be in this house for at least 5+ years, and more likely 10 years. Being in a home this long requires planning for kids etc, requiring more space. This in turn requires more money, and hence more saving more for our down payment, leading to further delays.

Summing up, we are highly frustrated.

“Summing up, we are highly frustrated.”

I can believe that.

But as a single person, buying _anything_, even a small condo, is out of the question: Rent is already taking major part of my income so there’s no way to accumulate wealth for downpayment.

Even when paying my “own” condo would be cheaper than renting. You need to be at least well-to-do in order to save money.

Anyone have experience with short sale offers?

Did you get a highest and best round during multiple offers?

Did the bank come back after comps with their counter?

Does cash and a quick close upon approval help?

Any feedback would help. This is our second try on this home.

The bidding war buyer walked due to the repair needs. Or at least,

that’s the story.

Would love some insight.

I heard a portion of a long story on public radio the other day. There was a lot of discussion about the trend by major universities to have a portion of classwork online. Obviously, there is significant cost savings to be gleaned from this format. But in that case, why do we need this ongoing campus expansion that you see in towns hosting large universities?

I am a very strong advocate of higher education, including liberal arts, in order that America keep its place in the global market. I guess what really surprises me is the apparent inability of institutions of higher learning to reign in costs. The problem with the ‘online’ is that it begs the question of whether we need all these expensive buildings and high priced faculty and staff.

With regard to the housing market, one may wish to look at the current and future macro economic picture. The US is going into debt each month to the tune of 100 billion dollars on average, over a tillion for the year. This is with Ben’s complete and total batshit printing spree. What do you think will happen after the election when Obama does not have to worry about re-election? By the way, he is a two to one favorite with real money on the line, not Fed funny digits. The US/World cannot “grow”, wink, wink, inflate its way out of the debt spiral. So, guess what? How about cuts in spending. Do you really think California can grow its way out of this? What happened to all those billions from Facebook stock price inflation the Jerry was going to use? You have to be out of your mind to buy a house before the real adjustments take place. On the down side, you may “loose” a few points on the selling price but interest rates cannot go up as it would bankrupt the system even more. Hang in there, the downside is tremendous if you act now.

Just another report from the trenches. A colleague of mine just put his small “starter” home in Sherman Oaks on the market for $400K. Five offers in the first day – all over asking price. The house sold for $450K in 5 days. Madness.

Where in Alan Sherman Oaks. Hello Mudda hello Fodda!

result of unhappy people in jobs they dislike- decreased productivity, negative attitude, loss of faith/confidence in financial system/economy

problem is fiat currency requires confidence, capitalism requires confidence. What happens when the next generation and the tail end of the prior all lack confidence. The impacts are far greater than any chart could explain.

Like housing inventory, sure numbers can say it would only take 6 months to clear out but based on what. People are not buying/selling homes which loops back around to all the pieces that existed in the previous puzzle not fitting the new one.

Kids who used to buy houses, consumables all taking a hit on all levels, not just consumer goods but housing. They can’t borrow everything, they move back home. There was a period when families had equity and would use it to help fund the next generations future. Problem is that without the appreciation that was tied to borrowing 100+ percent in value there won’t be a can to kick down the road.

people simply had an expectation of 6-10% return, sure they can buy at X then sell at X + y% over a certain number of years. That was the thinking, it will just go up. Well that wasn’t reality. Equity was just a hedge for most. Follow the leader type of game.

A recovery is not based on sales of housing, it is based on savings/equity. People with no money can’t buy anything.

Values need to be reset, if we fixate on prices we are not seeing the whole picture. Just because it was X before and it is X-10% doesn’t mean the value has shifted. If you view things in terms of intrinsic or actual value most of this still seems overly inflated.

Jobs help but how many jobs were covered by the inflation of housing. Even if they were all employed today they would be working for less, thus less consumption.

Create a rent bubble and watch what happens. Nobody can rent and nobody can afford to buy. The older generations used all their equity to bail out their kids thus the kids don’t get much when the parents pass if the parents weren’t forced to use it all just to sustain loses in retirement. These are the exponential issues that people aren’t really dealing with.

We can break it apart but the whole uses more energy than the parts. This is the problem, automation and technology decrease the need for human labor. Simple reality. Now what to do with the existing backlog of indebted, under educated or mis-educated students searching for jobs. What to do with the backlog of foreclosures etc…without people borrowing it all falls apart whether it be colleges not earning or homes not being built/sold. It all comes back to some miserable gov’t. borrowing 3x as much to try and sustain its populus.

Much of it has to do with expectations. If you lived 30 yrs in periods of hyperinflation and excessive credit/debt then your expectations will be different than someone who has lived 30 years and the last 10 were bumpy at best. It isn’t about recession/depressions, recoveries etc…reality is what it is. A recovery based on what, YOY numbers that is amusing. Recovery back to the point if unsustainability when everyone just expects to earn 3% every year on everything they touch just because inflation has been steady.

Ponzi away.

Leave a Reply to Chris