All cash buyers dominate Florida and Midwest: The significant number of all cash buyers continues to add strain to families looking to buy.

There has been little discussion in 2016 regarding the volume of all cash buyers. We have grown accustomed to anomalies in the housing market. Rapid dips and jumps in prices are now assumed to be a part of the system. Massive numbers of investors buying single family homes are now assumed to be status quo. And the number of all cash transactions is seen as normal when in fact, all cash buyers were usually a small part of the market. All of this is abnormal in the housing market pre-2000s but we are now living in a very different world. Yet people still have a hard time understanding the volume of all cash buyers in certain markets. Clearly most of these buyers are investors. Even a home costing $200,000 is out of reach for the regular family living paycheck to paycheck without a mortgage. And mortgage rates just increased at their fasted clip in many years thus making it more expensive to buy a home. In some markets, cash buyers dominate sales volume.

The all cash buyer is still out in force

All cash buyers represent a clear sign that investors are still buying. However, it should be noted that volume in many markets is low. All cash buyers are out in full force in Florida and the Midwest. These investors are largely buying up single family homes and looking to capitalize on two trends:

-1. The rental Armageddon trend

-2. Trying to buy and sell into this wild uptrend in the market

Real estate values have soared in many markets across the US. So investors are trying to maximize their return and are jumping into markets where home values are more affordable:

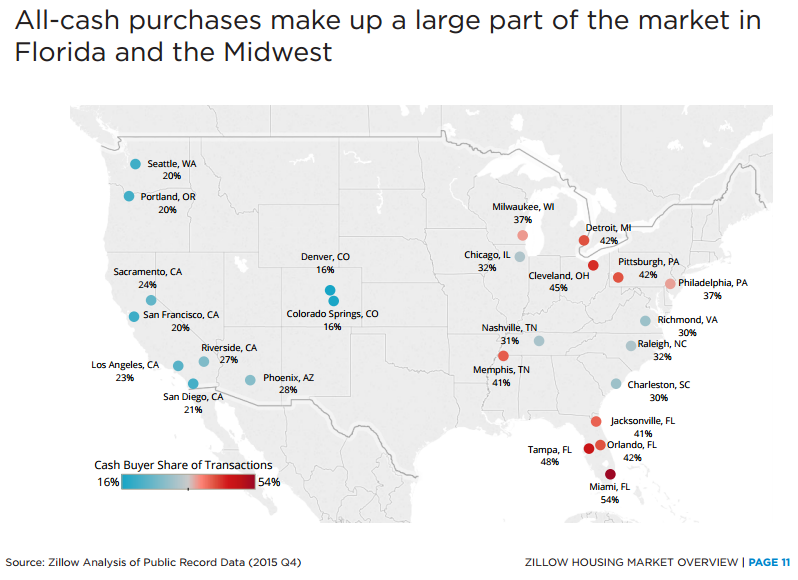

This is an interesting chart because it shows that most of the all cash buying action is taking place in the East Coast. In Miami, 54% of all sales are going to cash buyers. In Tampa, Orlando, and Jacksonville the rate is in the 40% range. Cash buyers rule the market in these locations.

You see all cash buying also making up a big part of the market in the following locations:

-Memphis (41%)

-Cleveland (45%)

-Detroit (42%)

-Pittsburg (42%)

The West is already hyper inflated so all cash buying has subsided. In a place like California, pre-2000s all cash buyers made up about 10 to 15 percent of all purchases. Things are still somewhat higher but with prices being so high at this point, investors are chasing value in other markets.

For most people, buying a home with all cash seems like a dream. But there are markets for example in San Francisco and Irvine where money from abroad, in particular China is flooding the real estate industry. In Florida I would imagine money is flowing in from Latin America and Canada too.

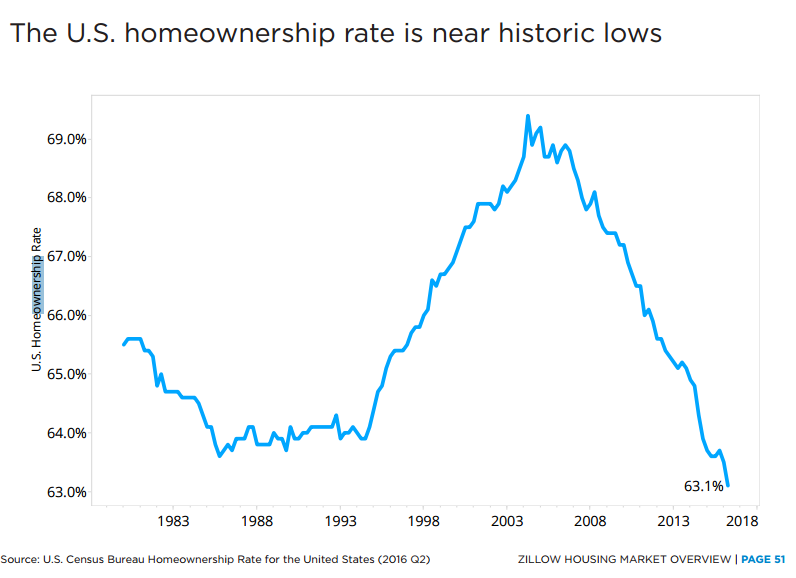

The bottom line is that the homeownership rate has continued to bounce off a multi-generational low:

This drives home the point; if home prices are soaring and fewer Americans as a percentage are owning homes, who is benefitting here? Rents are definitely up and home prices are up but the number of Americans owning homes is definitely down. A few reasons for this:

–Millennials are largely broke and don’t view home buying as urgent as their Taco Tuesday Jimmy Buffet loving Baby Boomer parents.

-Long-term employment is rarer today.

-Who wants a McMansion when you are going to have a small family (or no kids at all?). This goes against the house horny buyers of a previous generation.

-Lower incomes and higher student debt. Student debt outstanding is now $1.4 trillion. Many already carry tiny mortgages.

-Many young adults continue to live at home, unable to afford high rents let alone high home prices.

The all cash buying trend continues to signify that investors are a big part of the market. But all of this is contingent on the massive Bull Run we have had since 2009. Of course, some now believe this is a “new normal†and we have reached permanently new plateaus. Many said rates wouldn’t go up and just look what happened – rates went up and the Fed increased rates.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

141 Responses to “All cash buyers dominate Florida and Midwest: The significant number of all cash buyers continues to add strain to families looking to buy.”

http://www.latimes.com/politics/la-pol-ca-mortgage-vacation-home-affordable-20161219-story.html

Get ready….

70% chance bubble pops in 2017

90% chance in 2018

I saw that too! The dems have run out of middle class tax money and are moving on to the wealthy. It needs 2/3 to pass so I think its unlikely that it will.

California is becoming a Socialist state. Proposition HHH was just passed last election. Too many Social Programs out of tax payer’s money. In addition, I read somewhere that the Mayor of LA is planning to use tax money to fund legal aid for illegal immigrants.

The Red states are the most socialist, everyone’s on welfare and food stamps in flyover country. California should shut off the money-spigot since like any Blue state, we pay more out in taxes than we take in, by far.

That new immigration lawyer slush fund LA passed makes me so angry. Why make taxpayers pay to keep criminals around? Go ask the non-profits to pay. I used to live in a part of Pasadena that aggressively ticketed the residential street parking but they never bothered to go south of California where all the rich people live. It was basically a renter tax and was a big hardship for some people. Later I find out that the city didn’t notice an employee embezzling millions of dollars for years. Now they want to tax Netflix and streaming services. The schools are terrible, the roads are terrible, but somehow there is money for these stupid bleeding heart causes and the voters keep approving new taxes. The only benefit to being a renter is that I can just leave if California tries to raise income tax to pay for expanded medi-cal coverage after Trump repeals Obamacare.

alex in San Jose: California should shut off the money-spigot since like any Blue state, we pay more out in taxes than we take in, by far.

What do you mean “we,” kemosabe? From the way you describe your life, I doubt that you are any kind of “money-spigot.”

Alex in San Josy , you are a low income person that doesn’t even pay $4000 in federal income tax. Alex, you are not a player. You are like the hungry person with his face against the window at the restaurant.

Billybob, Goober, Jeeter, Jim-Bob, Kneel N.Bob, all of you. I am low income now but unlike a red state paying my end, I pay into social security and medicare, plus also pay all the usual federal taxes on things like cell phone etc.

Plus, I have worked many years in California and paid plenty of taxes. So don’t worry, I paid into the special-ed for that “unusual” kid your cousins had together.

And lastly, I am not “in a restaurant window looking in” because fried possum, washed down with moonshine “with just a lil’ lighter flooid” doesn’t sound too appetizing!

If I wanted to live in flyover country, I’d just work more and save up for a few years, and buy a house in flyover. All paid for, I’d just have to worry about things like utilities, insurance, and property tax. Things a minimum-wage job would cover because unless you’re related to Boss Hogg the po-lice chief, you’re not gonna make more than that.

re: molo

What?! Tax breaks for 2nd homes was a wealth giveaway to the rich. There is no good reason at all to give them a tax break. Especially for the sort of person who can own a 2nd home given today’s, or even last decade’s, prices.

And progressive taxation isn’t even a Left or Socialist concept. Its just plain common sense. Especially when its the wealthy that have most of the money and wealth in the country.

More now than ever given the extreme wealth disparity that exists between the poor and rich today.

tts – we need a real Rebublican like Ike Eisenhower back – progressive taxation, looking at social benefit first (just listen to his “military-industrial complex” speech, how many hospitals he’d rather build than battleships etc) again.

Eisenhower knew that things like progressive taxation, taxes on 2nd homes etc, plowed back into the good of society, just make sense.

And he was no pushover! As soon as he heard about the possibility of satellites for surveillance, he wanted one and said so in so many words. He loved it when the USSR sent Sputnik up, because it gave us carte blanche to send up snoopy birds.

He was strong on defense, I believe presided during a time a sensible agricultural worker program, the bracero program, was in place, and well, everyone but everyone looks back on the Eisenhower years with fondness, they just forget that there was an awful lot of “socialism” that made them so good.

Instead, the party of Eisenhower and Lincoln has elected not a Republican but a “Cashpublican” who’s basically Al Bundy from Married With Children’s idea of what a rich guy would act like as president.

The next four years are gonna be interesting.

got to keep those pensions alive some how…

“That new immigration lawyer slush fund LA passed makes me so angry. Why make taxpayers pay to keep criminals around?”

Dems need the illegals for votes of course…

AB 71 and a 15% foreign buyer tax would also help reduce inflated home prices in California!

I’ve met several people who have retired on a generous CA public pension and have moved to CO. They are living like royalty here. CA should put a requirement that if you are collecting a full CA pension, that you are still living in CA contributing to the local tax base. Otherwise, the pension amount should be reduced.

Horrible idea. A good solution addresses the problem, not the symptoms. Pensions should be reduced to more reasonable amounts. I know, I have one coming to me and I did the math 20 years ago and figured it was too generous. Reduce those, or better yet eliminate them completely so they have 403b/401k/IRA like everyone else and then without those obligations the state and local governments can operate on much lower budgets, helping to bring down the cost of living. Then those retirees wont have to move out of state to stretch their dollars. Of course it will never happen, CA is just too corrupt. Glad I left years ago, and I cant wait to get my lump sum soon and tell them to FO!

re: junior_kai

“Pensions should be reduced to more reasonable amounts.”

The pension amounts are perfectly reasonable. Reducing payments to employees would be in effect stealing from retired workers who paid into the system all their lives.

Issues with pension funds have to do with how they were managed not how much individuals get back from them.

“eliminate them completely so they have 403b/401k/IRA like everyone else”

None of those are effective means of retirement in general.

http://www.thefiscaltimes.com/Columns/2016/03/04/Retirement-Revolution-Failed-Why-401k-Isn-t-Working

And virtually no one who works for a living can afford to put money into a IRA BTW. The idea of a “free market” retirement savings plan is effectively dead.

“obligations the state and local governments can operate on much lower budgets, helping to bring down the cost of living.”

State/local govt. operating costs having nothing to do with the cost of living. Stuff like housing costs, food costs, etc. dominate over things like local and state taxes. You could cut my state income tax in half (which gutting pensions wouldn’t accomplish) and it would hardly make a difference in my spending money on a monthly basis. I think it comes out to well under $100/mo.

“Then those retirees wont have to move out of state to stretch their dollars.”

Housing costs haven’t had anything to do with any sort of sensible market forces for going on 15yr now in CA and in much of the rest of the country. Cutting the spending money of retirees will not do a thing to improve the CoL in CA for anyone. It’ll just make a bunch of old people poorer. Which is quite awful of you to suggest BTW. Especially since they paid into the system.

re: Seen this all before, Bob

Without some sort of price control in the market for the retired or for the general population on high cost necessities like housing forcing people to stay in state would be a catastrophe.

We have Prop 13 of course. But that has been a complete failure and has in fact helped to keep prices in CA higher than elsewhere in much of the country.

I’d be fine with forcing increases in home values to never exceed the rate of inflation + tie min. wage an inflation adjusted amount similar to what min. wage earners made back in the 60’s but I don’t think it’d get passed. Too many see their home as a means of retirement and too many don’t properly understand what the effect of 40yr+ of persistent small wages cuts have done to people’s income.

Youre beyond retarded TTS. Basic maths – if you could do it – would tell you the management of these pensions has little to do with the issues. You probably think in your twisted mind that an 8% low beta return in a near-ZIRP environment is doable.

No one does IRAs? Are you that dumb, or are you channeling Alex in San Jose? Seriously, projecting your miserable situation unto the rest of the world does no one any favors, but most of all ruins YOUR life. Pensions are nearly extinct in the private sector, and they will go the same way in the government sector as well as they are untenable. People working high five figures for 20-30 years can not generate enough economic production to qualify for 75% or more of that salary for another 20-30 years. Just cant be done. Thats why we have all these ponzi schemes – pensions, stocks, housing, etc. – to cover up the big lie. A lie that you want to perpetuate.

That *is* a horrible idea. You mean you don’t want those California dollars, or less of them, spent in CO?

You really don’t want those rich Californios putting their kids into CO private schools, buying cars from CO dealerships, eating so much in CO restaurants, having their kids getting into potentially lucrative things like horseback riding and 4H programs?

Re: tts

“The pension amounts are perfectly reasonable.”

1) Work 10-20 years at a public job requiring few skills and little work ethic

2) Pay minuscule amount of salary into a pot

3) Retire at 55-65

4) Collect full salary plus benefits, adjusted for inflation, for the next 30+ years

Gee, seems “perfectly reasonable”. Nothing fundamentally unsustainable here.

Housing To Tank Hard Soon!

Preach it Jim!!!

Many, many homes can be purchased in those red cities for $75k to $150k

Tons of places for under $50k, no wonder there are cash buyers. No jobs out there, but if you can work online or something, or are living on retirement money, you can get by in bumfuctnowhere.

No jobs/income in those areas.

Certainly not “near” (ie. 20-30min drive) to home. Weather is usually much worse than CA too. And the schools tend to suck as well.

Telecommuting isn’t really a general solution either. Not a lot of jobs will offer that option.

The people do tend to be friendlier though.

tts – best is to make a living in a way that’s location-independent. Mail-order sales of some type, phone sex talk, whatever works.

Home-educate your kids, expose them to the writings, works, and general feeling of being around people with 3-digit IQs which they won’t get locally so you have to add that.

In a flyover town long ago far far away (OK not all that long ago) there is a temple to a non-caveman religion, that you’d mistake for a structure meant to house a utility transformer or something. 99% of the structure is underneath. Smart people go there. Smart people network with smart people. If you’re gonna be smart in flyover country, you have to find the other smart people and network with them, and teach your kids to not show how smart they are, put up a good front of being an inbred nose-picking hick like the rest of the local population.

Really, if I could find any good argument for living in flyover country I’d be doing it by now. People think you need a bunch of savings, need a job arranged beforehand, etc. Not so. Just go. Just go and find a job washing dishes or something, work up from there. The problem is, moving to flyover country is a classic case of “play stupid games, win stupid prizes”. But if you think thinking is the tool of the Devil, by all means go ahead.

Alex, you’re giving advice on how to make a living? Seriously?

And you’re telling folks how to raise their kids in the flyover states? Get over yourself.

Jeff – Considering the people I know who make 10X what I do and their wives don’t have laundry soap and they’re shopping at Grocery Outlet, and the guy’s happy if he’s got money for the cheap meal at Wendy’s, yeah.

Considering the cousin-cousin marriages and rampant mental retardation (if the cousin-kissin’ don’t get ya, the meth will) in flyover country, yeah.

Just say “yee-haw” if I’m hitting too close to home.

I see a lot of cash buyers in FL, but many are

1. Canadians buying “century village” type places for less than 75k. Older condos that will make a nice place to shoot down for a break from the weather. Also many health care procedures that have long wait lists in CA can be done in FL right away.

2. The Lat Am group is buying as a doomsday bunker. If you buy a 1 million condo and it goes down 50% you still have $500k and a ticket to get out of dodge with some money in the USA. Plenty of former fortune 500 types who used to work in VZ floating around Florida now.

My question is this, is any of this money flowing into commercial RE? Vacant Land? Strip Malls?

I was going to make a similar comment from here in Naples–it’s a different kind of buyer. In California, you have a bunch of folks who read “Rich Dad, Poor Dad” and think that they’re going to become some SFH rental magnate. Here, all-cash buyers typically are picking up their second/third/fourth home and are coming from Europe, Canada, etc…–it’s more of a safety asset than an income generation tool.

http://johntreed.com/blogs/john-t-reed-s-real-estate-investment-blog/61651011-john-t-reeds-analysis-of-robert-t-kiyosakis-book-rich-dad-poor-dad-part-1

read and laugh!

Housing to Tank Hard Q2 2017!

I can see 30 year mortgage hitting 5% within 2 year. From 4% ($2,300/month) to 5% ($2,577) mortgage, the payment is $270 higher for a 600k shack with 20% down ($420 if from 3.5% to 5%). Well, the monthly payment will be at least 10% more expensive so that would about to wipe at least 2 year worth of appreciation just in time for the next depression. Rents will go up as well due to [perception] of inflation. Wages do not gain anywhere close to 5% (more like 2-3%) so something has to give.

My nick is a tribute to Mr. zero % rate Ben Shalom Bernanke. Is he who said “rates will never normalize in his life time”. Well it didn’t take long. It is he who reflate this bubble only to see it burst again (to lesser degree). But then bubbles come and goes on their own, but it is people like Bernokio who is making them more extreme. I love how all the e-con-nomists is talking BS. The ez money experience is about to be over so it will be a rough ride from here.

I’m actually hoping he’s right and he’ll die soon! FU Bernanke and the QE you rode in on!

Millennials are largely broke? As I travel the road to housing developments who are the lookers by far the Millennials. Who are in the offices signing papers the Millennials. Who lives in the new homes with crossover’s in the driveway and when the garage door is opening the German cars, I see only Millennials.

The last investment home I have for sell only sees Millennials looking and giving offers that I can afford to say no to (thank goodness).

Millennials who by the way are really tough folks to convince that a buy is buy, they don’t trust anybody including their parents, but where are the 45 and up crowd, and the baby boomers they are the broke folks, they are the scared buyers who have short memories of sub-prime and who can blame them?

The over all housing market is not near as robust as the liars at the NAR want you to believe, it is a unbalance as I have ever seen and yes rates are going over 5%.

I dont think Millenials are doing as bad as some say….

after all, who the heck are buying all those $600K+ condos and $1M + homes in Playa Vista?

http://www.pewresearch.org/fact-tank/2016/04/25/millennials-overtake-baby-boomers/

http://playavistarealestate.com/playa-vista-condos/

A friends nephew just bought a $600K house and when i asked how they fuck he could do that at 28 i got the “got the DP from parents and works for the city” reply

I have another good friend that works for the city in socal and she gets a raise every 6 months…..i shit you not. A once a year actual raise and then a once a year COLA raise each coming 6 months apart.

No wonder cities are broke.

And some one replied about taxes, well looks like the state is going to add $10 to every vehicle registration so some state worker can retire at 50 and have his gold plated pension….for life…..i was reading a article about pensions and there’s 10’s of 1000’s of retired cops/fire/teachers making well over $100K in retirement some even over $200K.

while i can afford the dollar menu.

re: QE Abyss

Its exactly as bad as they say. The millenial home ownership rate has consistently declined every quarter since the bubble popped and is now at historic lows:

https://www.census.gov/housing/hvs/data/charts/fig07.pdf

mean while college debt continues to skyrocket:

http://financeography.com/millennial-home-ownership-shrinks-as-student-debt-grows/

Perhaps you’re seeing nothing but millenials buying but perhaps also you’re seeing what you want to see.

This situation will not improve as long as millenials continue to have their wages and compensation driven down:

https://www.americanprogress.org/issues/economy/reports/2016/03/03/131627/when-i-was-your-age/

Fact is millenials are the first generation to be poorer than the last in the US post WWII period. If you can’t see this then you’re in denial.

re: mumbo jumbo

“A friends nephew just bought a $600K house and when i asked how they fuck he could do that at 28 i got the “got the DP from parents and works for the city†reply”

Most parents don’t have north of $100K lying around for a down payment. By default they’d have to be rich which means a tiny minority of the population. And govt. jobs normally pay less than private sector still.

“I have another good friend that works for the city in socal and she gets a raise every 6 months…..i shit you not. A once a year actual raise and then a once a year COLA raise each coming 6 months apart.”

Not doing a COLA would mean they’d be cutting her wage and the raises they tend to do are more like McRaises from what I’ve seen.

“No wonder cities are broke.”

Cities are broke because the wealthy properties and businesses aren’t being taxed properly. It has nothing to do with civil servant’s wages or retirement. That is just some nonsense propaganda to get you to vote against your own best interests.

Mumbo-Jumbo – Seriously, that’s the way to fly. Pick parents who are wealthy enough to give you one of those “small loans” and go work for something non-sexy but necessary like the water processing plant.

If you can’t get the first part right, doing the 2nd will still get you there with a delay of maybe 5 years.

‘The over all housing market is not near as robust as the liars at the NAR want you to believe’ very true…the realtors are the worst at lying about where the market is…everything is peachy and listings are flying out the door…until they are not.

Maybe the small percentage of home-owning millenials are in debt up to their eyeballs? They have student debt, expensive have-to-have-that-car payments and have stretched their dual incomes to buy these very expensive homes, assuming that they will always be earning those incomes + yearly raises. If one gets laid off, they are in trouble. For some, when housing goes down, they will be upside down and will sell their home. It happened a lot after 2008. It can happen again.

Lots of Millenial couples are dual-income no kids and there are a lot of younger women in Cali that are pulling in 6 figure paychecks. I don’t believe that was as prevalent in previous generations.

I agree 100%. Where I work, almost all of the millenials are dual income no kids. Add kids to the equation, with student loans, and housing in CA becomes unaffordable.

‘If one gets laid off, they are in trouble.’

Not exactly. There is a program called “Keep your home California” that pays your mortgage up to $3000 per month if you get laid off. Certain restrictions apply, but they’re not as bad as you think – if your current household income is less than 90K/yr, you qualify. And even once you get another job, they will pay that for 3 additional months. Of course, there is no such handout to renters with families, like me.

re: molo

“Lots of Millenial couples are dual-income no kids”

If both of them have min. wage jobs or a job that doesn’t pay much better than this doesn’t matter as much as you think. Plenty of DINK’s (Dual Income No Kids) are effectively working poor. Fact is most are that way.

“and there are a lot of younger women in Cali that are pulling in 6 figure paychecks.”

Nope.

Median net worth for people 35yr old and under for 2016 is just $14,200. There are a relative HANDFUL of millennials (less than 1 million of them nationwide earn more than $100K: http://www.refinery29.com/2015/03/81765/millennial-top-one-percent-calculator) of any sex making 6 figures.

Only 28% of millennials making 6 figures are female as of 2015.

Over a third of millennials work a 2nd job just to make ends meet and the vast overwhelming majority of them make McWages or near to it.

re: Jackofalltrades

“Not exactly.”

Actually yes exactly.

That program isn’t giving away free money (they put a lien on your property and if you sell they get to recoup costs, typically for 5y but can be for up to 30yr) and its only for a very short duration.

Qualifying for the program isn’t easy and they do a lot of screening which is why their retention stats look so good but in reality you can still easily lose your home.

Interest rates MUST rise so as to drive the cost of a home back down to earth.

They must rise to repel investors.

We do NOT want a nation of landlords.

We want a nation of family-forming home owners.

The staggering reason for the screwy politics of the entire old world: landlord-tenant.

Yup.

It really is that simple.

Tenancy ruins the middle class.

This is papered over in Europe via even MORE government meddling.

The result is that the average English Joe is living in half the square footage of the average American Joe. ( But he does have an out house. ) Yes, you’d be STUNNED as to how many First World Europeans have to use an out house. Then, think about their winters.

Investors have less incentive to chase housing yields as rates move upward.

And RE hedge funds will have to respond with better returns to compete against those safer and slightly more appealing investments.

What the hell are you talking about.

In 99% of the country houses are “down to earth”

Don’t worry, when Trump puts the squeeze on the Chinese commies(Chicom) and they respond, I think that the commies money will dry up and the homes prices will not be going up. Things will change under Trump.

I see. So the man who made his living in real estate is going to take decisive action that results in declining real estate values? Brilliant.

You mean the man who (we think) kept some money after losing a ton in real estate?

yes, you got it right. Real estate is going to tank. http://www.cnbc.com/2016/12/21/tax-changes-taxing-imports-plan-has-chance-of-passing.html

60 miles east of SF, between Stockton and Modesto, Manteca is seeing a housing boom.

Builders are gobbling up the farmland south of Hwy 120 with those close together 2 story boxes. I hate em, but big famlies with adult kids love them. Then for the oldies like myself, there is the Del Webb community which is building like mad, drove around looking, last Saturday. Looks like military base housing, nice neat houses all in a row. Don’t dare hang a flower pot from the eves or the Del Webb rules officer will pay you a visit. There is a big push out of the bay area to Modesto and Sacramento where you can afford a place. but the commute to the Bay is a killer. Probably no different in So. Cal. – Inland Empire to OC & LA. It’s only gonna get worse.

Greater Sac area is going gangbusters, anything listed sells immediately even though the peanut gallery has been saying for years, months, days, that the market is crashing.

As a form So. Californian, I can say the traffic in the Sac area is just as bad now. It is atrocious.

I’m all for a crash, believe me, but chanting ‘it’s happening now!!!!!!’ will not be the impetus. Or making creative names for our central bankers. There has been so much inaccurate and premature bubble calling that I am starting to think this market might have legs. The contrarian play seems to be bullishness in housing now. Everyone and their mother is calling it a bubble.

Any RE bubble will take four years ceiling to floor. Rome wasn’t built in a day, and real estate doesn’t fall in a day, but the market is turning cold. SacTown is a capital city market, and therefore a lagging one. Things should be fine there for the time being (two years or so).

The old saying comes to mind, “When your barber starts talking about puts and options it’s time to sell.”

That saying can be adjusted for this site. “When your local school teacher, or the angry grown many who complains about living in his crappy studio apartment and or panel van starts calling real estate bubbles, then they aren’t really there.”

JR….. I could easily see 4-8 year run up… as the contrarian bet.

… and Myagi… absolutely… when everyone is calling for a bubble… you are no where near bubble territory…. it’s when everyone is bullish that you are at the top…. that is far FAR from current pessimism.

The number of all cash buyers is astounding. If the big TANK really does come (25% plus declines), rest assured that every single home sold will likely be bought by investors flush with cash. How the average Joe can compete with this is beyond me.

Oh yes, the constant hope is that once the big players are forced to liquidate, even bigger players will come off the sidelines to take their place. This despite higher rates (big investors don’t risk their own money) and record levels of debt.

Manteca, a poor man’s Castroville. Let’s buy the models. Roll dem bones!

Remember that Stockton was the Ground Zero/Poster Child for the subprime crash in 2008- the city government actually went bankrupt. I hope it’s not a bubble for these towns, because it will be a disaster for their residents (again). Keep watching places in Cali like Stockton and Modesto, they may very well be the proverbial “Canary In A Coalmine”…

“Cali” gives me douche chills

Use warm water, not cold.

Rising interest rates mean one thing. The markets think inflation is nearly here. Both home prices and rents will rise strongly during inflation.

And if the market is wrong, meaning no inflation, then mortgage rates crash right back down, and home prices go up anyway.

Either home prices rise from inflation with higher rates, or home prices rise with no inflation and lower rates In this environment it is hard to lose on quality real estate.

So under no situation prices can go down?

+1 Jim Taylor, LOL

but actually home prices have a much stronger correlation going down when interest rates go down, that is the historic trend.

Hauntingly familiar, very 2006 like analysis. Except that incomes are lagging and a recession will kick the stool out from under the McJob needed to make the minimum mortgage payment (plus selling blood at the blood bank). Plus this is another bubble market similar to the current stock market.

The luxury markets in New York and San Francisco are saying otherwise.

jt

Help us out.

From which source(s) is all the cash going to come from to service the debt created by these forever rising prices?

Hint: It *won’t* come from wage growth because there isn’t any. (except for the 1%).

OR

Are we all entering the new normal La-La-Land where the world is always in Technicolor and the women smoking hot?

More like entering Rotoscope land (think the Lucy In the Sky With Diamonds animation in Yellow Submarine) and the women are smoking pot.

Housing prices historically rise with inflation as long as businesses are doing well and wages also rise with inflation. McDonalds is hiring here in Colorado at $10-$12 per hour (min wage is $7.35) so I believe the economy is still growing under Obamanomics. Forced min wage hikes in 2017 will also drive inflation. When the floor rises with a good economy, the rest of wages above also rise. If interest rates rise due to inflation and wages also rise, then housing prices will also rise. If the economy is not doing well, ie the stock market crashes, then housing prices will follow due to the lack of down payments. This has been a historical trend.

Trump has declared himself to be pro-business with promised tax cuts to business and individuals so I see business and individuals with more money to spend on housing.

no way is McDonalds paying that much. I would have to see a paycheck to believe it.

It’s entirely possible. Some business owners get smart and actually do the math on turnover, training, and low-efficiency costs. Pay someone $7.35/hour, and finding another job – ANY other job – becomes their number one priority. In-N-Out figured this out long ago.

Of course there’s a point of diminishing and then negative returns, but $10/hour ain’t it.

Day shifts when they can’t get HS students.

So instead of a HS age shithead who can’t speak English and makes it clear they don’t want to be there, you get a 40-something shithead who can’t speak English and makes it clear they don’t want to be there. This is why I swore off of McWorm’s long ago.

I’ve noticed here at the local McDonalds that people’s outlook on life improves proportional to how much more they are making compared to poverty wages.

WTF

“McDonalds is hiring here in Colorado at $10-$12 per hour”

are you trying to justify insane price levels on houses based on McDonald’s jobs paying $12 an hour? I hear CO is going insane with prices as well but in socal $12 an hour is enough to afford the rent on a room rental…….forget EVER buying a house, well, unless you and 5 friends buy it together.

Correct, but when the bottom is up 50% in wages, it raises all levels above. That is driving housing growth and rent increases.

“Correct, but when the bottom is up 50% in wages, it raises all levels above.”

Over what time frame is that wage growth being measured? And no, higher wage at the bottom doesn’t guarantee real growth at the middle tiers — not with outsourcing and offshoring of blue and white collar jobs in full force. Real income growth has been stagnant over the past few decades.

“That is driving housing growth and rent increases.”

Nope. Over-speculation through cheap and easy credit has primarily driven housing inflation. Since real income growth has been stagnant for the middle class, borrowing has been the primary way of keeping up with runaway prices.

LOL…..i love these “top” indicators.

what you said there is almost word for word what a realtor told me in 2006….AND I’m not kidding you.

We’ve seen this before. I distinctly remember 2006. A very short lived time period when the bubble had already popped, but the market was walking on thin air like Wile-E-Coyote with Acme roller skates. I remember certain investors, knowing that the run-up in CA was pretty much done, thinking that a similar run-up in prices would happen in the Carolinas, Georgia, Kansas, Phoenix and other places, started buying spec homes in those areas. I distinctly remember saying “please don’t do this.” Of course, they didn’t listen to me.

Pigs get fat, hogs get slaughtered.

Dude, people were buying homes with negative amortization, no income proof, zero down loans then….

… not 30-50% cash buyers.

Reminder:

The bubble is in high prices, not in borrowing qualifications. The majority of defaults or foreclosures during the last downturn were prime loans. Many chose to strategically default rather than to remain underwater. This wasn’t a unique situation nor will it be the last.

If you think it’s the same Prince… you are going to miss the boat…

AGAIN

@NTS

Do tell me how economic fundamentals have changed. What new economic paradigm shift has RE experienced in the last 8 years?

As a cash buyer myself, I am chasing a lot of deals but don’t perform on any of them because they are all way too rich and don’t pencil at all. I am constantly getting deals from agents and every time they are trading they are selling to other cash buyers. I don’t have specific stats on this, because frankly I don’t give a shit what they are and it makes no difference to me proving myself with stats on an online forum. I just know that I talk to 20 different agents a week and deals they show me that I pass on all end up selling to all cash buyers right now. Unless they’re all lying to me, then this is the most cash I’ve ever seen in a marketplace buying deals.

Mr. Miyagi:

That’s the classic sign of a bubble: when the good is just traded from investor to investor, and never consumed. Its no different than trading tulips around and around and around, never planting them.

Son of Jim,

On one level I agree with you. To your point, I am not touching these deals because they make zero economic sense. As soon as I as pass on them (which has been every one shown to me for 12 months plus) a cash buyer is right behind me buying it.

You and I can agree that these prices are insane and most people are foolish to be paying them. No question. Where I disagree with most of you though is that a massive crash is coming tomorrow. Well, in the case of your father Jim Sr., and many others on this site, the crash is coming yesterday, a month ago, a year ago, etc.

A big real estate correction at best is not coming until there is a recession. It is going to be a macroeconomic issue. This is not the same bubble as 2007. It is wildly different. We will see prices walk back within 12-18 months in most markets is my guess as I’ve said many times. It will not be a total collapse though. I hope to Thor I am wrong though so that I can deploy my greenbacks in viking like fashion and my sword will drink till it is no longer thirsty.

I have to agree with Mr. Miyagi about this being a very different bubble. I could see the top of the last one before it happened – it was very clear. The visibility is near zero with this one. I have no idea when it will pop or how bad it will be. As of yet there isn’t a good enough reason for it to pop, and the reasons for the pop (or slow deflation) will be different. People buying now are well-qualified and willing. There will be strategic defaults, but no forced-foreclosure tsunami. All that said, I’m confident enough that we’re close that I’m half cash and have dipped a little into shorting the housing market – for the winter at least.

“all cash buyers”

how do we know where all this “cash” is coming from? How do we know the intentions of all these cash buyers? What if…..yes IF……many if not most of these cash buyers are really just borrowing the money elsewhere to show up with cash but yet still have a loan and are buying to rent for a while and then cash out?

once prices start dropping in earnest we will finally see all the skeletons in the closet and we might be shocked to find out how many of these cash buyers were really just gamblers betting on the hot “investment” of the day and then they all try and hit the exits at the same time.

paying cash is all the rage now, I have a friend who’s done it…….by getting a 2nd on his current home…..see where this is going?

Agree with MJ. The Fed unleashed a tsunami of cheap, easy IOU’s, not helicopter money. The underlying causes of the current RE bubble and previous ones is same: too much bad debt. Somebody’s going to go belly up for issuing too many bad loans.

Unemployment numbers aren’t there yet to justify another recession. Wait for the official unemployment rate to rise above its 12 month moving average for 5 straight months. Then you know it’s coming.

In the meantime it’s just usual market hi-jinks…

I think people who pine for California real estate are naive! The hidden and much larger problem isn’t low inventory which is driving current prices and creating low affordability. It’s the dangerous liabilities and unsustainable nature of the State and most government entities. Pensions, infrastructure problems, service delivery problems, welfare, and the corresponding increasing pressure to continuously raise taxes and fees of all kinds, will increasingly stymy California’s economic vitality!

Everyone waits for crash to buy, as they screwed up last time and did not do it,but it may or may not.

The problem last time was the notion of the dead cat bounce. In 2011, 2012, people kept saying buyers were ‘knife catchers’ and the dead-cat bounce was on its way. WRONG.

What people were wrong about back then was the extent through which the government and Fed would be willing to go to reflate the RE bubble. Over-speculation through funny money is not sustainable. Otherwise, the Fed would have kept rates at 0.

Cue resentful comments about entitled, snowflake, loser Millennials putting off careers, children and home purchases due to Pokemon Go.

donpelon: Cue resentful comments about entitled, snowflake, loser Millennials putting off careers, children and home purchases due to Pokemon Go.

Amid resentful comments about entitled, greedy, lucky Boomers who lived extravagant lives while passing the bill to future generations.

History rhymes. Twenty years from now, the millennials will be sitting in homes mostly paid off that are worth five time w who lived extravagant lives while passing the bill to future generations.” And, twenty years from now, a small percentage of Millennials will be total failures living in giant dreary 1000 unit apartment complexes wishing they would have bought while warning the next generation not to repeat their mistake.

History rhymes. Twenty years from now, the millennials will be sitting in homes mostly paid off that are worth five time what they paid for them The next generation will be saying “resentful comments about entitled, greedy, lucky Millennials who lived extravagant lives while passing the bill to future generations.”. And, twenty years from now, a small percentage of Millennials will be total failures living in giant dreary 1000 unit apartment complexes wishing they would have bought while warning the next generation not to repeat their mistake.

“the millennials will be sitting in homes mostly paid off that are worth five time what they paid for them”

i think you are a troll……5 x $600K = $3,000,000….you think crap shack houses are going to be worth/selling for $3,000,000?? 30 year loan, 10% down (that’s $300K HAHAHAHAHA) at .5% = $8,000/mo

look into your crystal ball and tell me where income and the price of a loaf of bread will be then too. I’d be interested into seeing how and why you can justify all this as well.

TIA.

5x today’s value does seem a bit spendy.

I am just extrapolating. For some homes, Zillow has history way back. I saw a handful homes not to far from the beach in Laguna. They were selling for less than $50,000 around 76, They were selling for $300,000 in the middle 1990s. Now, they are selling for around $1,600,000. That means every 20 years or so, the go up 5 times or more. If they just go up 5 times again, in 2036, they will be worth about $8,000,000. Even if they only go up 3 times, that makes the worth $4,800,000. I am not a troll. I am just looking at history.

I bought my Santa Monica condo nearly 30 years ago for $139k. Today, identically sized condos in my building are selling for over $750k. That’s an over 5X appreciation.

Yeah, it took nearly 30 years rather than 20. Condos don’t appreciate as fast.

Federal government is increasingly garnishing social security to pay student loan debt. My parents borrowed somewhere close to $20k in parent PLUS loans to help pay for my school in the early 2000s. CA tuition is much higher now than when I was in school. http://www.wsj.com/articles/social-security-checks-are-being-reduced-for-unpaid-student-debt-1482253337

College is going back to what it historically always was: a money pit. Like a yacht or a string of polo ponies.

If you were rich, you could splurge on college because it was fun, and made you able to get into a more profitable marriage. If you were non-rich but really really wanted to go to college, you’d find a way to do it, knowing you’d make less than the brick layer or rag-and-bottle collector, but be happy.

JNS,

Well said. The state and local governments love the housing bubble reflation. Not too many people remember that the state was paying income tax refunds with IOUs. Taxes are only going to get worse.

If you sell your house or condo in CA for upwards of $1M, you can move and buy almost anywhere in the rest of the US for cash and still have a tidy sum left over. If you are also collecting a 100K+/year public pension from CA, then you are living like royalty. Living like royalty somewhere else, may be driving the 5M people to leave CA over the last 10 years despite the good weather and beach. They are cashing in their winnings, retiring, and living well.

The question I have is, if you have the cash and have to choose between a 4% mortgage or paying it off with cash, will bank interest rates rise above 4% making a cash buy a very bad choice? A future government insured 5-6% bank account Trumps a cash buy when you can get a mortgage rate now for 4%. This is what happened to my parents in the 80’s. Banks were paying 9%, their mortgage was at <6%. The choice on whether to pay off your mortgage is obvious. The question is whether we will get there again.

Do you think anybody can predict where interest rates will go?

Keep in mind that there is more to consider than what you’ve posted. Personally, I’d take a max mortgage so that I had the cash to invest elsewhere. Also – if house prices collapse, a person can just walk away from the house and stick the bank with it. So folks will say that’s a crappy way to do things, but if that’s how the rules are setup, then one should hedge appropriately.

Think again Bob, 1 million dollar home depends where you want to settle, in ARK maybe you can bank some money but do most folks want to wake up in ARK?

A place like Denver where a home in a nice neighbor hood can cost you upwards of 900k with high taxes and you can shake hands with the neighbor( lots are small there) than where is the trade off, maybe in the end you bank 40k was it worth the move?

$500K buys a lot in the nicest neighborhoods of Indianapolis.

People look at their local conditions and extrapolate that to the rest of the country/world, but that’s a huge mistake. If you travel a lot you get a much better perspective, and I believe the bubble has already burst, but like a tidal wave the effects haven’t washed over much of the US – yet. What caused the bust? China and the commodity story. That sent shock waves through the first tier markets – Australia, Canada, etc. and many people from those markets bought around the US and are feeling the pain now. Dollar strength is the driver that no one (or few) are talking about but pretty much the entire world changed (economically and politically) when the trend reversed.

That is an interesting point. Although it is hard to truly have a pulse on a market outside of where you live. One might think they do but in reality market expertise is very localized. Even traveling extensively does not give you the same detailed insight into a given submarket as someone who lives there and studies it.

What areas are you referencing when you say that bubble has already popped? Give me specific places because honestly I am not seeing it, and I don’t live in a cave. The entire western US where I spend a lot of time, CA/Eastern Wa./Eastern Or/and Idaho are all ‘booming’ (it makes me throw up in my mouth too but I’m sorry that’s what I’d call it.)

If I am ignorant to these collapsing real estate markets then I am open to being enlightened, they just don’t exist in my mind’s eye right now. Sure, Vancouver has issues, and maybe China sure, and SF is sort of softening, sort of. And rents in NY have gone down a hair from oversupply. Ok, now beyond that, please tell me where these places are. I’ll listen and admit I’m wrong if you reference places that I am ignorant to.

Parents sold their house in Stockton about a year ago and we saw the market change pretty quickly during that. I dont follow that area at all though, instead focusing on San Diego, Hawaii and Australia as a former and sometimes current resident and have spent a lot of time in all of those places in the past couple of decades. Australia was particularly insane this past spring, with the signs of pending doom everywhere. I follow other countries too, Thailand, Japan, Bali, etc. but to a lesser degree. Seeing money flows all over the planet gives a better indication of the big picture than what some yuppies up the street or at work are thinking, theyre just caught in the herd and trying not to get trampled.

Junior Kai, you’re a man (or woman) after my own heart. You must surf if you like Oz and Bali. I lived in Oz too and surfed Mourubra every day. When I was there houses on the ocean were cheap. If I only had money at the time…ahhh.

Add another international darling of the RE world to the list: London.

The strength of the dollar versus foreign currencies is certainly something to watch, but I’d say the media has been over-hyping that recently. The amount of ‘strength’ the dollar has gained has been trivial, at least for the foreign currencies that I watch.

Euro, yen, aussie and canadian dollar moves have been bigly over the past year and a half. Euro most recently has been interesting, nearing parity as predicted.

Hear it all the time ‘THE HOUSE OWNS YOU” Well you play your music nobody bangs on your wall telling you to quiet down, when your car gets ding because no garage to park it in, when you just want to go in the back yard and there is no backyard in a rental, when you have the landlord send you a notice to vacate let alone reducing the landlords equity not yours.

Than be glad your house owns you, better than a landlord named Fred who owns you lock, stock and barrel, because as a renter you own nothing?

That’s why I rent SFRs, and, if my landlord isn’t great, I simply move. I’m the customer and I expect good customer service, because I know I’m an ideal tenant. We’ve had landlords practically beg us to stay in the past.

How cute, more recycled real estate sales talk. Too bad it didn’t help those who were foreclosed on or those who chose to strategically default because financial reality couldn’t overcome emotional attachments.

Baby Boomers downsizing are often all cash buyers. Nothing evil or abnormal about this. They sell the paid-off 4 BR 2.5 BT Colonial that is now an empty nest, often at a lower price than they had planned. They still have enough to buy a retirement home in a warmer climate with low taxes that is easy to maintain and heat and cool.

My exact thought. Lots of all cash buyers in my area doing what we did. Selling the house in the high priced area (Seattle) and retiring to a low price area. (Coeur d’Alene) We paid cash for our new home and paid cash for an apartment building in our new area, so we have another income stream for our retirement.

RathdrumGal: We paid cash for our new home and paid cash for an apartment building in our new area, so we have another income stream for our retirement.

You can’t really “retire” if you own an apartment building. Managing an apartment building requires time and effort.

* Finding tenants.

* Dealing with tenant complaints.

* Dealing with late-paying/non-paying tenants.

* Dealing with building repairs and maintenance — both normal wear & tear and damaged caused by bad tenants.

* Hiring and managing employees and/or vendors.

* Dealing with government regulatory agencies, lawyers, accountants, and the IRS.

* Dealing with illegal sublets (and today that would include tenants secretly using their apartments for AirBnb rentals) and other illegal activities (e.g., running illegal washing machines as a business, that then flood the apartment, etc. — I speak from experience)

* Going to court to sue or evict bad tenants, or defend against lawsuits from bad tenants (or vendors, or govt regulatory agencies).

I could go on. One does not “retire” as a landlord, then kick back while rent money is direct deposited into your account by unseen tenants.

Son – now don’t make it out to be all bad. Now that we’re in the winter months, I’ll spend just a day or two a month dealing with my rentals. I spend a lot more time on them in the summer, but even then it’s still nowhere near the time commitment that a full-time job would be.

“Semi-retired” would be accurate, “retired” is what I say in casual conversation (I’m in the same scenario as Rathdrum)

Some people see landlording as a lot of hassle, but others see it as a form of social life that pays well. When I was a landlord, I was in the latter category. One of the biggest mistakes landlords make is trying to be perfect. The shortest vacancies, the ideal tenant, the never-late payments, etc. If you let a few things slide just a little you make about 5% less money but it’s not a huge problem. When you die, you don’t want to look back and see that you were too demanding of yourself and others for just a few shekels more.

Well, it looks as though I will become one of those all cash buyers. Location: Denver area.

My company is pulling programs out of the SF bay area. Paid to move to Denver!! And I’m 5-10 years from retirement. Perfect timing!! Thank you very fucking much, company!!

However, looking at the prices in the Denver area, while much, much cheaper, I believe they are obscene. I’m find a lot of houses on the market that were purchased a year ago for $100K less.

I can think of worse fates than Denver. List most of the US, if you don’t have a car you might as well be a quadroplegic. But you can get any old cheap car and buzz around. There’s all kinds of wilderness within even as little as an hour’s drive, the air’s clean, high altitude is healthy, and there are neat places to go like Manitou Springs, Colorado Springs, Boulder, etc. Apparently there’s a lot of neat fly-fishing there, there are the shooting sports, icy-snowy stuff, etc.

Consider yourself lucky instead of peeved! Denver prices are high, but sounds like you are getting rid of something in the Bay area so will come out ahead … be happy you’re not getting transferred from someplace like Des Moines to Denver … you’d be in a house price deficit! Heck, with only 10 years ’till retirement, any excess cash that you don’t spend on a home in Denver, is retirement nest egg gravy! And, besides, when those faults all along the west coast finally let go, real estate in places like Denver will double overnight!

JNS, my comment may have come across poorly. I am actually ECSTATIC!!

I will pay cash for a house if I choose to buy. Cost of living is lower. My company will keep my salary unchanged from Bay area rates. I had no intention on retiring in the Bay area. I love the mountains, road cycling, mountain biking, backpacking, hiking, and skiing. Now read the following comment knowing all this…

Perfect timing!! Thank you very fucking much, company!!

Cheers!

.

Well, folks, I just herd the official policy here for the Bay Area on the radio, and anything on the radio has 10X the weight of anything on line* and the Official Policy is build, build, build, get those projects started so WHEN the economy turns down, the projects will be ongoing and must be finished. There’s a push to put tall apartment buildings in San Jose, for instance. But on the radio they really said it, in so many words, that the push right now is to get building so they can keep building through the next crash.

*the 10X ratio holds for AM radio, about 7.5X for FM.

Earlier I made a comment about the plethora of 75k to $150k homes available in the Midwest. I think I need to elaborate on that as people jumped to conclusions that are hubris.

While it’s true that there are a lot of low-paying jobs in the Midwest, that’s honestly true anywhere. Even in Southern California, there are plenty of 10 to $15 an hour jobs that people slave away at. I don’t think that’s the sole justification for lower prices in the Midwest.

Now, people tend to be much more financially conservative and less of gamblers in the Midwest. They don’t see their home as a stock. My brother just bought a 1000 square foot home, with an 850 square foot garage that’s wired for 220V, and he paid $96,000.

Let’s not be mistaken, there are also neighborhoods to go from 250k to 450k. These tend to be 2000 square foot to 4000 square foot homes. Somebody commented that there’s no jobs in the midwest, that’s not necessarily true. Companies have Engineers, managers, there are lawyers and doctors over there, and successful business owners. There are University faculty, there are people in the financial and insurance Industries, there is a sizable population with good income.

If I had millions of dollars cash, I would try to buy any physical assets including houses and land. That explains the RE bubble even in this depressed economic environment.

If you consider the 6 or 7 trillions in QE that explains a lot of cash buyers.

If I had millions of dollars cash, I’d get my ass over to Israel, make sure I’ll always be housed, then put the rest into buying land from the Palahooptians and getting it into Israeli hands. And take trumpet lessons.

That actual makes sense Alex.

Leave a Reply to robert