This time it is not different – Canadian housing prices reach apex and set for deep fall. Foreign money speculation and crowding out local Canadian families. Canadian household debt at record levels.

Being inside a bubble creates an interesting atmosphere. To a certain degree logical voices from outside of the bubble need to speak up to recognize what is rather obvious yet lost for many within the bubble. There is no bigger housing bubble than the one currently happening in Canadian real estate. Not only is the bubble raging it has far surpassed what the US housing bubble reached at its pinnacle. Those in the housing bubble of course are intoxicated by the elixir of easy money. After all, simply sitting in your condo and having it go up $50,000 or $100,000 in a year for not lifting a finger sounds like a good investment. This happened all across the US from condo happy Miami, Boston, and Chicago to housing crazy California and Nevada. Yet the echoes are the same when one points this out. It is truly different here. The only true thing is that human psychology driven by unfettered greed creates bubbles over and over like the sun rising. Taking a look at the Canadian housing market, you realize that not only is a nationwide bubble in full force but some cities like Vancouver and Toronto are extraordinarily overpriced.

Comparing the Canadian and US Housing Markets

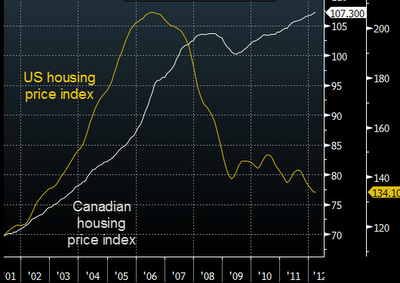

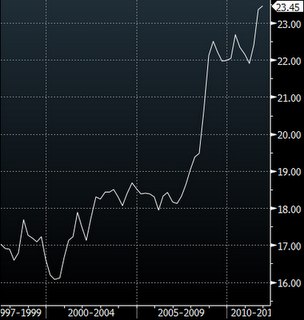

While the US housing market peaked in 2006 (six years ago and prices are now hitting lost decade territory) Canadian home values are now at their apex:

Source:Â SoberLook, Bloomberg

The source of this bubble is hot money from foreign markets and local buyers being caught up in the frenzy. Yet as we are now witnessing in this globally connected system, a bubble bursting in one market (i.e., Spain) will have ramifications all across the world. So paying attention to the Canadian housing bubble is obviously important for those in Canada but very important for people here in the US.

The above chart highlights a big bubble that simply rolled right through the US housing correction. Yet keep in mind that Canada has a large flow of money coming in from foreign markets. Places like Australia and ironically, China have restrictions on foreign funds even though most investors into the Canadian housing market are coming from Asia. Some interesting dynamics for Canada:

“(Financial Post) Conventional wisdom is that this is the market at work. This is not the market at work. This is manipulation of a government system of open-ended mortgage insurance that is poorly supervised. What is going on here is a deluge of hot money from abroad that is creating an artificial and potentially dangerous real estate bubble. This mania happened in several other countries — where it was shut down — and has spread to Canada. Officials here have been urging restraint but that is not the solution. A ban on foreign buying of residences is the only solution.â€

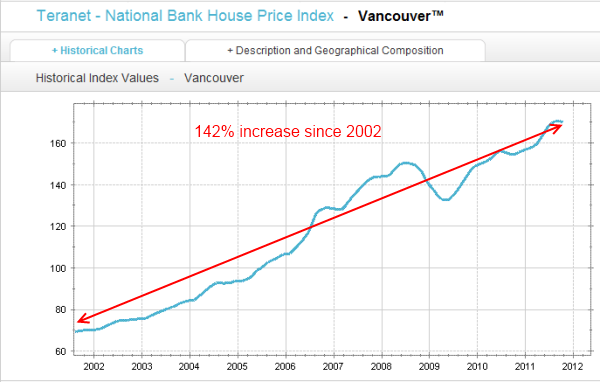

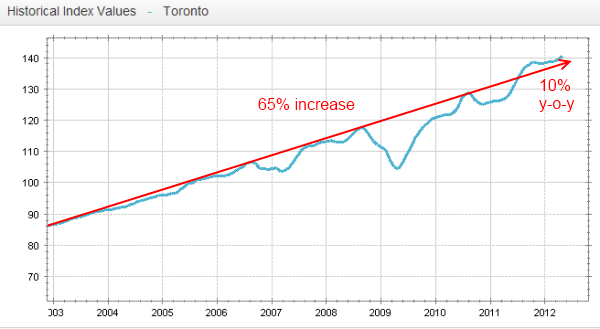

Just take a look at home prices in Vancouver and Toronto:

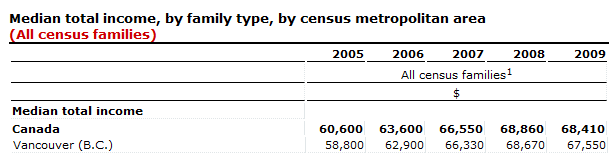

You might be thinking that household incomes can certainly afford those prices:

The above is median household income for more prosperous Vancouver. The bottom line is that this is a bubble and has many aspects of a mania:

“This is what is happening. For example, a modest bungalow in Toronto sold last month for $1,180,800, $400,000 more than the asking price of $759,000. Canadian bidders were furious and deserved to be. The winning bid was made by a university student whose parents have a business in the United States but who live in China. I don’t know if there was a mortgage involved, but student housing — even for foreign students — is now liberally insured by CMHC, in other words, by the Canadian taxpayer.â€

A bungalow selling for $400,000 above asking price? That is simply insanity and of course, it is harming local buyers. The anger is obviously there as some in Canada are pushing for Australian like remedies where foreign money is heavily restricted. Yet there are many winners right now so why stop the Canadian housing bubble party?

The coming hit to the economy

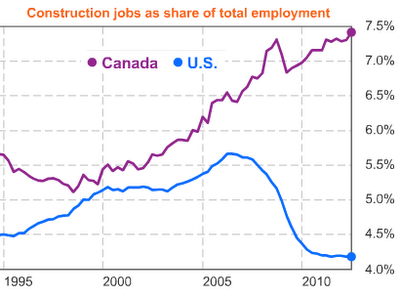

As occurred in the US, at the height of the bubble a big jump in construction jobs occurred. Canada was tracking with the US but now has entered into a new realm:

The above is not occurring because of massive population growth. This is happening because of big real estate speculation and largely in condos:

“Nearly three times’ more condo high-rises are being built in Toronto than are being built in New York City and nearly seven times’ more than in Chicago, according to Bloomberg News.

This development boom, and accompanying price increases, is not about housing to meet a sudden surge in population. It is not about an economic boom. If it was, Calgary and Edmonton would have 128 cranes, like Toronto does, building housing and pushing up all prices. Instead, this is taking place in Toronto and Vancouver where economies are moribund.â€

Many different dynamics yet a bubble is definitely there. You even have people flipping rights to properties skipping out on paying taxes to the Canadian government:

“(Financial Post) 3. Some developers, and intermediaries, are in the business of helping speculators flip their rights and pocket a fee for doing so. For instance, Mr. X from Asia pays $15,000 for the right to buy a $300,000 condo, then, when the price of similar units rise to $400,000, he can assign the right, get his deposit back and make the $100,000 difference. There is a frenzy of this speculation going on which makes prices escalate so rights can be bought and resold over and over again before a building is completed.â€

This reminds me of all the buyers purchasing places without even viewing the property here in Southern California. Yet this is even worse because at least here, each transaction generated state and federal revenues. In Canada with the large foreign buyer market, some are actually gimmicking the system:

“Under CRA rules, foreigners making Canadian-sourced income are fully taxable by the federal and provincial governments. In Ontario or BC, the total tax bill would be 46% or $46,000 in tax for $100,000 profit.

The unpaid taxes could be staggering, said a real estate agent. In Toronto, 20,000 condo units have been sold each year for the past five years. Let’s assume one-quarter were sold to foreign speculators who flipped the assignment and made $100,000 profit without paying taxes. Their Canadian-sourced income would total $500 million a year, and they would owe 46% of that in taxes or $230 million.

Most condo developers may not be involved in this game, but a few – notably developers with Asian and Middle East owners or backers and buildings located in downtown areas – certainly are.â€

Ironically in Canada foreign buyers are in a much better position given the high tax structures in place for locals. Some will argue that this is carefully managed but of course it is not. This is like the Alt-A and option ARM pushers that claimed they were verifying all other data carefully and most taking on these loans were doctors and actors not looking to document high income. Since other countries around the world have stifled this kind of nonsense, more and more money is flowing into a market that is very favorable to the foreign investor. Yet Canadians looking to buy will have to contend with these mania forces and many are doing the exact thing that Americans did. Many Canadians are simply loading up on debt since incomes do not support current prices without leverage:

The above chart looks even more problematic than what occurred in the US. Not only is the Canadian economy heavily dependent on construction now but households are more and more in debt. Even US debt rescue shows bring out Canadian families as their examples (although the shows do their best not to explain that we are looking at a modern day Canadian household). It is only a matter of time that the bubble will pop.  Bubbles last longer than most will expect (in the US home prices went on a tear for well over a decade even though household incomes were not keeping up before it popped). As the global economy slows including China, hot money will likely slow down. Legislation comes late so if they implement similar rules like Australia or China for foreign money, it will likely push prices lower since much of the price movement is coming from hot money. People forget that California was one big beneficiary of the Japanese stock and real estate bubbles and when the market contracted, California took a hit in the early 1990s. But of course, this time it is different.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

59 Responses to “This time it is not different – Canadian housing prices reach apex and set for deep fall. Foreign money speculation and crowding out local Canadian families. Canadian household debt at record levels.”

Those super bubble Canadian cities are going to crash and burn. We’ve heard all the stupid crap before…it really is different this time. No it’s not different, you have cultures known for gambling who have made easy money in the casino to date. And then you have people rushing in near the end game because they don’t want to miss out on their share of easy money. When it comes to gambling, the house NEVER loses.

This is actually going to be fun to watch in a strange way, similar to the demolition of an old building.

I live in Vancouver. I owned a house for 12 years but sold in 2011 after it appreciated from 400k to 1.6m in 12 years. I am not a speculator by nature, at least not where my home is concerned, but I decided to sell because I saw the writing on the wall, as reflected in fundamentals such as price to income ratios of 11, price to rent ratios as high as 29, and a home ownership rate nationally of 70%. A dozen or so other indicators completes the speculative mania picture. The Vancouver market is currently showing clear signs of topping. Every day since the beginning of 2012 inventory has increased and sales have dropped. May, traditionally one of the strongest months of the year for sales has been abysmal, and clearly one third of new listings are now re-pricings (reductions), as sellers realize the game is coming to an end and are rushing for the exits. Hot Asian Money (HAM), was expected to arrive again earlier this year to keep upward pressure on prices but this has not materialized. Main stream media continues to pump the RE myth but it’s becoming clearer every day the end is near, and the pool of greater fools grows smaller daily. I believe I am probably one of the lucky one for getting out when I did. This is not going to end well for a lot of Canadians, especially those who took on record debt in order to “own” at the very top of the market.

Eric, congratulations on your bubble sale and good for you for realizing that this party is coming to a bad end very soon for a bunch of people. We’ve seen this before in coastal California where all fundamentals and numbers simply did not justify home values. I’m sure Vancouver is great place to live with lots to offer; however, when someone is going to plunk down 1.5M for a bungalow knowing there will either be price declines or at best no appreciation for a decade or more…that really doesn’t seem like a smart thing to do financially. Sounds like the hot Asian money has already found the next best thing…and it sure as hell isn’t buying in overpriced Vancouver!

Eric,

I think you made the right decision. Many areas in Southern California went through the same bubble when house/income ratios were about 9-10. I think selling at 11 is pretty good. You might have been able to hold out for another 20-25%, but pigs get slaughtered. It is almost impossible to sell at the exact top and buy at the exact bottom anyway. Good trade. You can probably buy back in 2-3 years for 70% off. People forget…paying interest, taxes, hoa, insurance and additional maintenance cost is like renting anyway.

Send the foreign money injectors back down to California, after the deflation, so that i can cash out and get out-a here!

Canada is the United States number one trading partner. When this bubble pops, the consequence will be felt. My guess is a 6 to 9 month recession.

On the upside, the Canadian government will be able to draw on the experience of 20 other nations when developing a policy response. Since Canada has its own currency, it won’t suffer as badly as Europe. And since it has a growing population, it won’t be stuck in neutral for 20 years as Japan has.

I don’t think there is any upside. The Canadian government has had more than 5 years to learn from the US experience, to set policy to avoid exactly the problem that the Canadian RE market it is now facing, which is a massive speculative overvaluation fueled by debt; therefore, I have little confidence that they will learn or implement anything useful on the way down.

Dollars to donuts they will not learn a thing and go straight to austerity to attempt to fix the problem. The US will quite possibly do the same in November, having also not learned a thing.

Except where you print more, money is a zero sum game. If you have a trade deficit (money leaving the country), you can’t have both the government and the private sector trying to save money to pay off debts at the same time. Every dollar the private sector keeps is one less dollar the government to can use to pay off its debts and vice versa. All austerity will do is cause severe economic contraction as both sides try to out cut (and thus reduce economic activity) the other side to save more cash. This leads to reduced income on both sides, more cuts and more economic contraction.

You nailed it. When the government has been transformed to an orchestrated, stalemated puppet show the real rulers are the money printers/lenders. And all they need is the next generation of servants who are waiting in the wings already indebted up to their eyeballs. All that remains is to create the script for a re neigh on the old promises and they jettison the boomers.

I live in Winnipeg and while the market is not as hot as Calgary, Vancouver, Toronto the houses are selling for crazy prices. It seems that when a house goes on sale there is automatically a bidding war. Houses are selling for $20, $30, $40 thousand over asking price. While I don’t know if the bubble is ready to burst yet, I think that an increase in interest rates could well supply the pin. I do know that there is a tremendous demand for housing, partly due to the fairly large number of immigrants that come to Canada each year.

What we need is less regulation. If people have incentives they will always do the right thing…we are such a flawed species. Thousands of years ago we (maybe) built pyramids–now we build pyramid schemes. Last cannibal standing wins…

Hey Dark Ages, was that sarcasm in regards to ” less regulation?”

If you watch HGTV enough, pay close atention to the number of shows that either originate from Canada like Holmes Inspection or have canadian participince such as House Hunters International. The former actually contains educational value in several ways.

On the other hand, HHI often features Canadians who are either moving from their home country do to the cold winters or sometimes on a more perminent basis. They usually end up on one of the Caribian islands where direct AC flights to & from Toronto can be found.

Speaking of HGTV…”HGTV’s totally fake House Hunters is still totally fake.”

http://www.avclub.com/articles/hgtvs-totally-fake-house-hunters-is-still-totally,81121/

You want to devote 25% of GDP to building an oversized tomb for your political elite? Are you nuts? What exactly is the economic return on investment for mausoleums?

What’s that you say? Well okay, fine, you got me there. It is better than fighting a war. You win! Scrap the DoD and reinvest the money in pyramids.

The pesky thing is that the DoD budget is about half the amount of money we borrow each year, so if we wanted to avoid running up deficits, we should can the DoD and simply fail to spend the money anywhere.

Ian Ollmann: “You want to devote 25% of GDP to building an oversized tomb for your political elite? ”

The amount might be excessive, but the concept does have its attraction …

But how does the normal Joe investor short this stuff? Is there a way to buy credit default swaps on some security linked to this junk, then sell the rights to them when the bubble looks sharp for bursting? Shorting REIT’s with lots of Canadian exposure?

Anybody? If only I was a banker, and knew how to scam the system in detail….

http://sandiego.backpage.com/RealEstateWanted/all-cash-buyer-seeks-30m-per-month-of-san-diego-bulk-sfrs/9210498

So……this is what I have been up against this spring! From my calculation, this guy alone would be soaking up between 300 and 700 houses, depending upon the price.

OOPS. For some reason I thought I read in there he was looking to buy a total of 150 million in housing so that is why I came up with the 300 to 700 houses. Still, 30 million a month is a quite a bit.

At least Canada’s immigrants are generally legal, educated people with money, unlike California where the immigrants are frequently illegal, uneducated and a big drain on social services. Canada may have a bigger real estate bubble, but it has a more cohesive society with a fundamentally more sound economy.

Yeah, but they got rhythm, right?

Actually, those illegals work crap jobs for not much pay and the money that gets deducted from their paychecks for UI and Social Security they never see again.

You know who is a big drain on social services? Old folks!

So, given your tone I imagine you are planning on not becoming an old folk. Well, good on you then.

“Actually, those illegals work crap jobs for not much pay and the money that gets deducted from their paychecks for UI and Social Security they never see again.” Actually few of them work in the fields, mostly they have construction and service jobs legal workers would love to have. Most of the “amnesty” proposals include allowing them to collect Social Security. Obama’s aunt lives in section 8 housing, and did even before she was legalized because of her famous nephew. Illegals clog up emergency rooms, their anchor babies clog up the schools. Through their anchor babies, they draw welfare.

I think 90% of the home-buying and renovating shows on HGTV are Canadian productions and filmed in Canada. It’s easy to think they are in the US, but you look at the credits at the end, you see that all these shows are Canadian in origin, dealing with the Canadian housing market, with Canadian stars of the show.

You are so right, Polo, and watching those programs arouses deja vu. It’s almost heartbreaking seeing young couples purchasing overpriced houses and condos as first time buyers or participants in a renovation project. We saw it all play out on HGTV in the US housing market and it’s been playing out in the Canadian market in exactly the same way. A shame. I really like Canada and hoped they would learn from the US debacle.

Maybe if you spent less time watching morons on the boob tube & more working, you could afford to buy a home instead of always complaining!

Lots of HGTV Flip-that-B*tch types shows filmed in Austin TX, too.

Not so. I just channel surfed and happened upon an HDTV show about a couple buying in Palo Alto. That’s not in Canada. They looked at a couple of Eichlers and a house in Mountain View – a much less desireable location. They ended up buying an Eicher in Palo Alto that was a bit above their desired amount. I couldn’t believe the price. It was something like 1.4 million and the place was smaller and not as nice as the Eichler where I lived in Pale Alto and my parents only paid 36K for the place. That’s craxy! The one they bought looked to me like it would have sold for about 27k back then. Yes. It was a long time ago, but a friend of mine pointed out to me recently that her parents’ house in Cleveland is only worth about 65k now and they purchased around the same time frame my parents bought our house in Palo Alto. Location trumps all. DHB has addressed the high end. I’m curious to see what happens with it.

No one said ALL of them are Canadian, but it appears the majority of them are.

It’s so obvious! Just listen for the pernounciation on perticular words, “house” amung them. We say house, in Canada they say “houwse. Not sure if my spelling reflects that variation.

…also ‘Molsen’, ‘Kreugan Blouney’ and ‘kurd cheese’. All dead giveaways…

House should be pronounced to rhyme with moose, eh?

dude get a spell checker, each post contains 4 or 5 errors, I hope English is not your first language

One thing that no one ever seems to note in these Cda/US housing bubble comparisons is the vast difference in mortgage laws between the 2 countries. The US law is much much more borrower-friendly, while Canadian law is much much more lender-friendly. Avg time to foreclose in Cda is 6-9 months versus 2yrs plus in the US. Also in Cda, if the foreclosure sells for less than you owe, you are still on the hook for the difference and the bank will garnishee your wages for years to get the remainder. Plus, mortgage interest is not deductible (though capital gains on a principal residence sale are tax-free). Otherwise, i have no disagreemenst with Dr. B’s conclusions. I note that the domestic banks (if they are dumb enough to make mortgages loans to foreign speculators) will have diffciculty trying to collect. Many of those Asian speculators are buying properties for cash, and not with local mortgages, so if (when) housing turns, it won’t have quite the same iimpact on the local market. Still, I want to sell my house and rent a double-wide somewhere until things get back to reality.

FYI:

A) 2006 timeline for foreclosure in the US was about what Canada is now. We are only at multi-year levels due to the distress in the US. “Where will Canada get to as their bubble pops” is the question as this isn’t contemporaneous.

B) Many states allow the lender to go after any deficiency post-foreclosure (judgement, legal steps etc…). California does not, and logically should have always paid higher mortgage rates to compensate the lender for the decreased protection (but didn’t because lenders were making money hand over fist for so many years and didn’t want to irritate almighty CA). Either way, this is a state policy and not in any way homogenous across the US.

C) At some point foreign money stops or goes looking elsewhere (i.e. nothing goes to the moon and if it tries it eventually it gets unaffordable even for foreigners). The US and other countries have been down this road MANY times and it always happens with locals holding the bag (and foreign money momentum ending also hurts local economy for a double shot). To say otherwise is a “this time is different” statement. It may be…but realize the track record here.

I’m just a worker-dawg bloak, however, I am left to wonder if there is a dotted line connection between the Corn-Servative Canadian Govmnt and BIG BUBBLE. Back here in the ole U.S. Of A. we had our very own BUSH BUBBLE! Remember that? Deregs galore, Wild West Cow Boy Capitalizum or waz that cannibalism (certainly wasn’t the cannabus talkng waz it?) and then……………………………….MELT DOWN. I personally feel that the Neo Con philosophy is morally and ethically severely lacking and should not be allowed to Govern. It’s just plain harmful to yours and my well being.

you got it bass-ackwards. Delete govt and we’d all live like kings instead of the other way around. Both majority parties are big govt proponents and the deregulation myth you repeat is a farce, and exposes your ignorance.

You are the LAST person who should accuse another of ignorance as your years of posts show.

Thank.You.Gael!

I am the first to admit i dont know jack.

I would say when the Conservative Gov’t introduced 40 year, zero down mortgages (before changing the policy 2 years later) led to many people borrowing more than they could afford…

Canadians should have learned from our mistakes here in California, Florida, and Nevada. I believe in the next few months we will see some signs of a declining Canadian economy much like the US. Over valuation of real estate will effect, housing, banks, corporations and the Canadian taxpayers.

1) Canada is putting the brakes on this boom by capping the growth of mortgage insurance available by CMCH. In 1989 CMCH had $50 billion in MI in force. It is now $550 billion but is capped at $600 billion, so growth there is stopped cold. Private MI companies have also been restricted.

2) Stated Income programs by the 5 major banks have been curtailed

3) New proposals by OSFI will force HELOC’s to be amortized. No more Interest Only and they will be capped at 65% CLTV. In addition the banks paying your down payment nonsense is also on the way out.There are many other sensible proposals about to be implemented.

4) In many provinces, unlike most US states, you can’t just put the keys to the house in the mailbox and send them to your lender and think it is now over. There is recourse in all but AB and SK I believe unless you also declare bankruptcy. This will make a bad situation worse when the bubble finally pops.

5) A catalyst is now necessary to unwind this bubble, but as yet it has not appeared. The question is when.

You want a catalyst?

How about all-time record levels of inventory in Vancouver at the moment? Sales have completely collapsed and prices have cratered 10-12% in the last six months.

The bubble has already begun to rapidly deflate in Vancouver. Toronto is on deck.

Enjoy the show

Clueless,

Totally agree Vancouver is ridiculous. Same goes for Toronto. I go to Calgary a lot. They are not seeing any decline whatsoever. In fact sales are up, inventory down and prices are still rising. Perhaps it starts/started in Vancouver, migrates to Toronto with Alberta, Canada’s strongest economy going last. A drop to $60 a barrel or less in oil would do the trick. But right now Calgary was just named the best commercial real estate market in the world and there is a shortage of office space.

I believe that Canada sold off all her sovereign gold about 10 years ago. Right now it is the Euro that is under pressure, for obvious reasons. But as all the world’s pure fiat currencies get marked down in the coming year, the Loonie (as they call the Canadian dollar) will get whacked too. This will put a serious strain on Canadian household budgets, just like it is doing in Greece and Spain now.

As long as prices are rising, borrowers that are in trouble can sell, and there is an illusion of manageability. But it is not different this time, and once the top is in, the psychology changes rather quickly.

Nothing like front row seats to a train wreck… I enjoyed the USA in the first release, but being able to watch from an uninterested position could be fun?

Where will HGTV find another bubble to film their junk programming?

I recently spoke to two Canadians, one thinking of buying a house, and is pre-approved, but has reservations about whether it’s going to fall, so clearly some there are talking about it. The other one is generally unwilling to entertain the thought that anything beyond a couple of hot markets (Toronto and Vancouver) are over-priced.

From my perspective even fairly secluded areas seem worth more than they ought to be. Eastern Canada has a lot of expensive housing and not just in the heart of healthy cities.

All I could think about while reading this article was how to capitalize on the trainwreck. Perhaps open a short position against publically owned canadian real estate developers? Does anyone know any names that have big exposure in Vancouver? In other news, check out this LA times article that confirms what people have been saying with regard to limited hgher quality housing inventory in LA: http://www.latimes.com/business/la-fi-inventory-20120610,0,1637144.story?track=lanowpicks

But it’s Canada…

On the other hand, in 100 years, they will have all the oil, and water they need, and while the rest of the world bakes in a furnace of global warming hell, they might still have a hospitable home. Then maybe the property will command it’s current market value.

“…On the other hand, in 100 years, they will have all the oil, and water they need, ”

Maybe not, China and India have been buying more than residential real estate as they have been buying resource rich assets directly through land purchase deals or part ownership of corporations that are involved in such to the extent that canadian law allows.

Hope the Doc will explain this:

Shortage of homes for sale creates fierce competition

This shouldn’t be too hard to explain if you have paid any attention to what has happened over the past five years.

The housing market is not a market. The housing market is a Soviet style centralized command economy. The Fed/US Treasury is doing everything imaginable to control the housing market.

The suspension of mark to market allows banks/Fund Managers/GSE’s to hold worthless assets on their balance sheet which gives the impression that the banks/Funds/GSE’s are still solvent. The banks/Fund Managers/GSE’s have a financial incentive to not foreclose on non-performing loans as the loss would have to be booked and the asset marked down on final sale.

The Fed has created the lowest artificial interest rates in history by being the number one holder of US treasuries and MBS’s. Throw in a little operation twist into the mix and our finance market is no longer a market, rather it is a Soviet style centralized command economy as well…

Now, who here is old enough to remember what happens in a Soviet style centralized command economy? That’s right! Surpluses and shortages.

It is BS. LA Times has always pushed real estate. Read the comments section.

I have $100,000 cash, I would like to SHORT THE CANADIAN HOUSING MARKET, I COULD MAKE A FEW MILLION IN A YEAR OR TWO, HOW SHOULD I GO ABOUT DOING THIS???

Perhaps some mortgage company but If you short Real estate Investment Trust take note that you will have to pay the often high monthly dividend.

Our essay explains why this is not a bubble, for residential real estate in Toronto and Vancouver .. but it also explains how the Toronto market peaked in 2005 – in real terms and has been already falling in prices since. You can read the essay here:

http://www.cliffkule.com/2012/05/is-there-housing-bubble-in-canada-or.html

The worse the financial crisis gets, the more Toronto and Vancouver housing prices will go higher likely.

I was in Toronto two years ago, watching the news. A government official suggested raising interest rates to cool down the speculative housing market. Young couples who were interviewed about the proposed policy expressed alarm that they would be closed out of the housing market. So there you go.

I’m Canadian and will admit we’re sitting at some high prices …. but don’t even try to compare us to the US “housing market”, which was completely fabricated by sub-prime / NINJA loans for the purposes of filling Wall Street pockets.

Canadian housing has been fueled by low interest rates – no doubt – but our buyers are real and our mortgage lending rules are stringent.

Could we cool off? Absolutely. Crash USA style? Not a chance. Canadian economy is healthy and will continue to be so thanks to plethora of resources to feed the world. Moreover, many of our immigrants are educated and/or wealthy.

Apples and oranges my fine friends south of the border.

Regards,

George … The Greek …. From Canada

The only sustainable reason for booming construction and rising prices is increased population and wages. Neither are occurring in Canada in proportion to the market and therefore they are in a bubble. That which is unsustainable will stop. The argument about the major banks curtailing no doc loans is true but ignores the explosion of private label vendors offering this same toxic money. The fact that Canada is a recourse country will cause much pain when the bubble pops but has no relevance as to bubble formation.

Leave a Reply