Canada went full USA with their housing bubble:Â Their bubble is just starting to burst with home values dropping for the first time since Q1 2009.

The Canadian housing market is entering into a “housing correction†courtesy of the mega debt our neighbors to the north have taken on. The bubble grew and grew and like most real estate bubbles, they can go on for years beyond what most would expect. Canada’s housing market is deep in a bubble. You have households deeply in debt and many taking on wild loans secured to the value of their real estate. It has been a few months but key markets are now seeing noticeable changes. The online news feed no longer reads like a cryptocurrency surge where everyone has to get in before missing the party. Canadians went full USA in their housing bubble. Should you expect a different outcome?

Canada did it bigger than the USA

The Canadian housing bubble is massive because when US real estate values were correcting and the market was being flushed, prices in Canada simply kept on climbing higher oblivious to what was going on in the south. The excuse was “hey, we didn’t have NINJA loans so we are good!†but this is nonsense. As we noted, out of the over 7 million US foreclosures most happened on plain vanilla 30-year fixed rate mortgages. The wild loans were simply the tip of the iceberg.

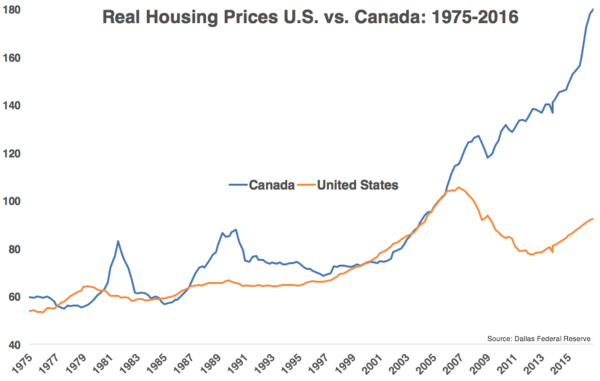

Take a look at Canadian home values relative to US home values:

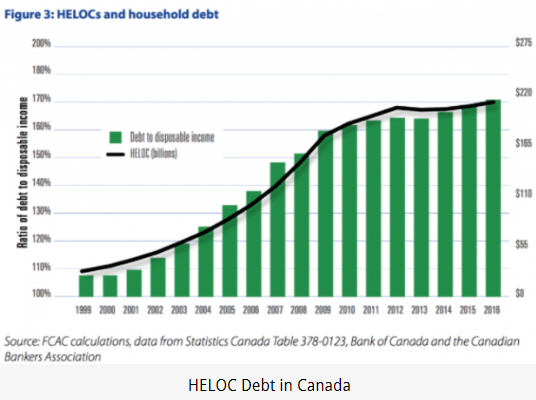

The market has been out of control for a few years now. And of course, Canadian households drank their own Kool-Aid and have tapped out equity from their homes:

Reminds you of the US when homes were being used like ATMs.

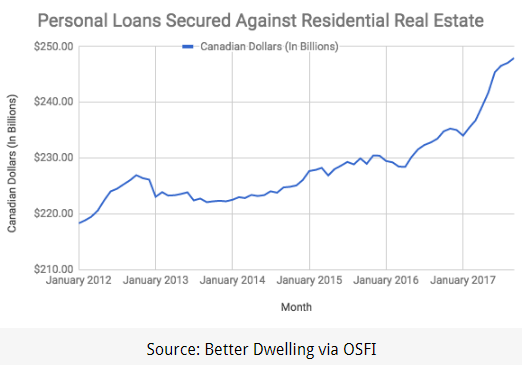

Canadians are securing debt to their homes as if prices were never going to go down ever:

The end result is that you have a nation with massively indebted people. The entire pyramid is built on ever growing housing values. And values are so out of sync that even a minor correction is set to topple this weak foundation.

Are prices falling? Oh yes they are:

“OTTAWA, Dec 13 (Reuters) – Canadian home prices fell again in November, the third straight monthly decline and the largest November drop outside of a recession, as Toronto prices fell for the fourth month and Vancouver prices were flat, data showed on Wednesday.

The Teranet-National Bank Composite House Price Index, which measures changes for repeat sales of single-family homes, showed national prices declined 0.5 percent in November from the month before as four of the 11 cities surveyed weakened.â€

While these are only the first cracks these are rare headlines for the Canadian housing market. Yet confidence is a big part of the current widespread bull market. Canada’s housing bubble is a symptom of a nation in too much debt (where the debt-to-disposable-income ratio is now over 170%). The strains were already there and 2018 is only going to push on this bubble more deeply.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

153 Responses to “Canada went full USA with their housing bubble:Â Their bubble is just starting to burst with home values dropping for the first time since Q1 2009.”

Steve Keen argues that debt to ratios can survive at 1 to 170, which is the tipping point. But much of the housing increase is the CAD to USD rate which was at parity for much of the last decade before settling back at a historical norm. Two years ago, Vancouver properties climbed around 30%, but the currency also dropped 25%. So, as JT and others always say, this is just reflecting massive money creation by central bankers that you cannot fight. Immigration there is steady and solid and supply is low. It doesn’t seem to be a bubble.

“Canadian home prices fell again in November, the third straight monthly decline and the largest November drop outside of a recession”

Yes, but according to our RE gurus on this blog, “over a long time it really doesn’t matter”.

Over a long time, I am a bull, but ONLY when I buy low. Like any market, RE goes up and down. I don’t know ahead of time when is the bottom and the top; I am just happy when I get the direction right.

In high cost markets there is a lot of leveraging. Because of that, when financial crises occur, the swings are higher.

+1

If you “don’t know ahead of time when is the bottom or the top” then how do you know when you are “buying low”?

One could say they bought a property for 700k today and it has gone up to 1mil in the next 3 yrs; they technically bought it low.

Dan, you are right. Nobody has a crystal ball to say ahead of time when is the top and when is the bottom and it is not an exact science. However, with education, age and experience I get a good enough “gut feeling” for the direction ONLY. As “accurate” as it is, it served me well so far. Sorry, I can not give you a math formula, because I don’t have one.

You may call my “gut feeling” LUCK but I’ve got the direction right most of the time. Those “coincidences” helped me to become a millionaire. Don’t get me wrong; I am not a perma bear. I’ve been bullish most of my life on RE. I’ve made most of my money in RE not stocks. At the present time, I still have most of the money in RE and trying to pay off completely (a little bit extra to go). If I would have cash laying around in the bank, I would invest it because the danger of inflation is high. However, leveraging at current prices would give me insomnia. Out of all investments out there, if I would have to invest my own cash, I would still buy RE instead of stocks, bonds or cryptos. I know that lots of people would disagree with me, but that is my preference; maybe I am old fashion. If someone likes stocks and cryptos, who am I to tell them what to do with their money?

Please take this as from an investor. That is the ONLY angle I am talking from. I am not talking about buying a house for me, because I have one that I like.

Flyover, you have a very honest and mature opinion.

Yes, it does make a difference whether purchasing a home to live in (which depends highly on personal situation) vs investment properties

In my opinion, correction (10-15%) in absolute prices is very real

For investment properties, it matters. For forevero long-term home – not so much.

A lot of people on this board are tuned into very narrow possible scenario.

You’re correct you will never know until hindsight when the top or the bottom was. I bought a house five years ago (we bought a Fannie Mae foreclosure and only put 3% down but also received 3% towards closing costs, basically 0% down).

https://www.redfin.com/CA/Los-Angeles/4546-Verdugo-Rd-90065/home/7177420?utm_source=myredfin&utm_medium=referral&utm_campaign=ios_share&utm_nooverride=1&utm_content=link

prices went up so high so fast I sold less than two years knowing I was gonna have to pay capital gains thinking that there is no way prices weren’t going to crash down. I rented for six months and the next-door neighbor would call my landlord for ridiculous things and my landlord would bother me. So I went house hunting again. That was three years ago. We just sold last week.

https://www.redfin.com/CA/Los-Angeles/4041-West-Avenue-42-90065/home/23151470?utm_source=myredfin&utm_medium=referral&utm_campaign=ios_share&utm_nooverride=1&utm_content=link

Stick to the US market…. you don’t know enough to about the CDN market to have a credible opinion. Dig into Canadian banking (which supplies the money) and you will see that this is a tempest in a teapot.

Plus we do NOT do fraudulent mortgages in Canada

Really get informed.

Oh yes Canada does do fraudulent mortgages. You should do some research before shooting your mouth off like you know something.

The epidemic is so bad, fraudulent mortgages have been nicknamed ‘Brampton Mortgages’. Look it up.

I suspect you are a realtor. Keep telling yourself it’s different in Canada. You will be looking for a new career soon enough.

Here’s some info on that.

https://www.reddit.com/r/Brampton/comments/5zzswx/til_a_brampton_loan_is_a_term_for_mortgages_where/

I visit Canada and plenty of Canadian investment firms and economists are acutely focused on this issue and have been for years. Granted a full blown financial crisis taking out their entire system is mitigated relative to the US 2007 episode for reasons you allude to as well as others (i.e. size of the asset class in general) but consumer balance sheet, debt/income, etc…impacts are VERY real and it bears close watching.

Comparing US vs Canadian prices is apples vs oranges since it’s two currencies that vary wildly. In the mid 2000s the Canadian dollar was at 65 cents. Today it’s at 80 cents. In the 90s, for a brief time it was actually stronger than the USD. So a chart like you posted is meaningless.

That being said, the Canadian real estate market has been driven up by the Chinese. Every since the 80s, literally millions of Chinese have moved to Canada, specifically Vancouver and Toronto. It started with residents of Hong Kong who were scared of the Chinese takeover in 1997. And then it continued as mainland China boomed and created a lot of rich people that wanted to invest outside China. So these people bought property in Toronto and Vancouver. And they’ve kept doing it for 30 years.

Bubbles go until you can’t find a sucker anymore paying for these highly inflated prices. It’s the sheeple who are the bag holders of these bubbles. Pure Stupidity. People buy at these insane prices, are loaded up to their ears with debt and take out helocs on top of it to buy more useless stuff. During the next job loss recession you will see many in tears again. Can’t feel sorry for them. Living a frugal life is out dated. Being debt addicted is in trend.

Based on the initial assessment from those on both the right and reluctantly on the left; it looks like de-regulation in industries and this huge tax overhaul plan will stimulate the economy for the next 4 (or maybe 8) years; so, that timeline may work for you Mille; but, not those with families who have held out a long time and are dying to pull the trigger.

Dan, families should not throw their money away buy buying overpriced houses either. I would even argue that especially families should buy during the dip and not the peak. But that’s up to you. I also understand that some couples run into the issue were you have a partner with expensive taste who demands to buy an overpriced crapshack to keep up with the Joneses.

There may be cases of keeping up with the Jones’ but I would think the majority are life decisions.

Renting condo/apt vs owning home with yard for kids.

That is probably the big driver; as people can only burn so much time waiting…..

Time? Millennials got plenty of time to save and wait for a crash. What’s s few years when you get a 50% discount? A mega steal! By saving that much money you have to ultimately work less and might retire early!

From the Housing Bubble Blog:

A clutch of real-estate industry and government officials in Canada still want the public to believe foreign capital and immigration policy have little to do with the sky-high housing markets in Vancouver and Toronto. But the evidence is pushing their vested voices to the fringe of the affordability debate.â€

“UBC geographer David Ley, author of Millionaire Migrants, joins SFU’s Qiyan Wu in maintaining Chinese investment has become ‘a fundamental’ of Metro Vancouver’s real estate market, up there with interest rates. National Bank of Canada economists estimate ‘almost $13 billion was spent by Chinese investors in Vancouver’ in one year alone.â€

“Indeed, this year’s move by China’s authoritarian leaders to severely restrict how much money they will allow to leave their populous country appears to be a key reason prices on high-end detached houses in Metro have this fall been dropping by 15 to 20 per cent, even if most of the public hasn’t noticed.â€

http://thehousingbubbleblog.com/index.html

The debt-to-disposable-income ratio is 170% in Canada. What was our ratio in the last bubble and what is it now?

Getting back to US RE.

Here is Realturds.com comment on the Drump tax plan

http://snip.ly/d4ay5#https://www.realtor.com/news/real-estate-news/is-the-mortgage-interest-deduction-really-a-big-deal-after-all/

excerpt

The new tax plan has been framed as a deathblow to the American dream by some real estate professionals and groups, who warn of falling home prices, a new generation trapped in renting, and an exodus of residents from the highest-cost cities and states.

But are these fears surrounding the new, lower cap on mortgage interest deduction—and the incentive for taxpayers not to use it—overblown? Or are there indeed big repercussions to come? That all depends on whom you ask—and where they live.

Never fear, California and New York are scheming to get around the system by deducing as charitable or payroll taxes. Personality, I thought it was a good thing for Californians to moved out to Arizona or Oregon. As for New York, people have left it in droves to the point that it grew less people than Idaho. California is heading in that direction since all the east coast states are now in slow growth and international immigration doesn’t help you much when the population is older like the East Coast states are.

A prediction. If California et al go down the workaround path of charitable deductions, the IRS will decree any taxpayers doing it as evasion. The payroll thing isn’t going to work either, no business is going to want that. This tax thing is really happening and California will eventually have to take its medicine. A massive migratory shift has already been underway and this adds more fuel. Although the productive class is emigrating for far more than just financial reasons, just behold the significant amount of people attempting tax avoidance by jamming assessors offices around the country last week. Then there’s the suggestion that wealthy people don’t care about avoiding spending a few extra bucks in taxes. That’s a good laugh!

What does this mean? “by deducing as charitable and payroll”

How is it evasion? CA will construct a non-profit to hold its own property tax claims. A

State can leverage no property taxes on its residents if they choose. The Feds can’t force a state to collect property taxes. They are coming up with a way in which it can still collect revenue, but construct it in a way in which it is deductible to the payer.

Remember when all the smart liberals laughed when Trump said he was bringing manufacturing back to America? Who’s laughing now?

“U.S. manufacturing expanded in December at the fastest pace in three months, as gains in orders and production capped the strongest year for factories since 2004, the Institute for Supply Management said Wednesday.”

Trump has done the impossible. In less than 1 year he has reversed the destruction of Obama’s 8 years. And that was all pre tax cuts. 2018 is going to be mid 80s style economically. Get ready for GDP growth in the 5% range.

#MAGA

https://www.bloomberg.com/news/articles/2018-01-03/manufacturing-in-u-s-accelerates-to-cap-best-year-since-2004

Could be, a lot of the manufacturing growth is related to the oil industry if the price continues to go up, more people will moved to Texas or North Dakota again.

Keep picking factoids that make you feel righteous.

Randy and the loony left prefer fake news coming from the LGBTQRST clowns on propaganda outlets like CNN who endlessly regurgitate that Russian collusion hoax manufactured by Hillary and the DNC.

Sorry, “landlord”, you are not correct.

“The economy has added jobs for 85 consecutive months, the longest streak in recorded U.S. history. A healthy economy increases demand for manufactured goods in America, from cars to solar panels.”

I think that is, what, 7 years?

Hmmmm, who was president during that timeframe? A strong, well-educated, sincere and well spoken black man. I know, it hurts, doesn’t it?

http://money.cnn.com/2017/12/04/news/economy/manufacturing-jobs-trump-2017/index.html

Also, if you support Trump, then you also support pedophiles, misogynists, and racists, so please kindly crawl back into your cave you ignorant fool.

You can thank Obama for the thriving economy. Let’s see who you blame when the market collapses. Keep grasping at straws buddy. Your ignorance and arrogance is on full display.

if you support Trump, then you also support pedophiles, misogynists, and racists,

Tons of pedophiles, misogynists (and misandrists), and (anti-white) racists among the Democrats.

Obama was the only president since Herbert Hoover to not have guided the US economy to 3 percent growth in any year he was in office.

The race-baiting Marxist did nothing for the US economy other than to stifle it.

His regime increased the national debt more than ALL presidents combined to over $20 trillion dollars. His regime stifled job growth with draconian governmental regulations and Obamacare which was disastrous for business owners.

https://nypost.com/2017/03/30/gdp-growth-under-obama-was-worst-in-decades/

Obama was strictly about income redistribution and not about wealth creation or economic growth. Letting people become wealthier was strictly against his collectivist/communist mindset. Socialism has never worked.

LOL at the left. Every economic metric is off the charts in 2017 after barely budging for Obama’s 8 years. But 2017 is all because of Obama? God you people are idiots.

Hey by the way, did you hear about the Gorilla Channel? LOL

The stock market actually grew more in Obama’s first year than in Chump’s first year. I’m guessing you watch Fox News though, which is pretty much the equivalent of Russian propaganda in the U.S. I bet you use the term “fake news” a lot too.

Also, all growth is based on Obama budget so Trump is just taking credit for the hard work of his much more accomplished and intelligent predecessor.

You are also probably completely oblivious to the fact that Chump is a complete and utter moron who has gone bankrupt multiple times, has multiple rape and sexual assault charges against him, and is just the worst possible human being to ever hold the office of the President of the United State of America.

How many indictments/guilty pleas did Obama’s campaign have against him for colluding with a foreign government and lying to the FBI? ZERO. Trump? 4 and the list will continue to grow while you shout MAGA into the void and deny any substantive reality.

Just because I know you are racist and a bigot, just know that I married an immigrant that speaks 6 languages, 4 fluently, went to university in the U.S., was on the Dean’s List every single quarter and now has one of those precious jobs that you stupidly think are being stolen by foreigners. She is making 6 figures in the financial industry with a hedge fund. Paid off her student loans in a single year. Also, she looks like a supermodel, but her heart and her brain are more beautiful than any physical qualities.

You think she (and others) are stealing jobs from you, but you could never qualify for such a position since you lack basic intelligence and self-awareness to see that you are a failure. You are, apparently, a “landlord”, which, honestly, is nothing to be proud of. When Trump is removed from office, just know that all the people on the left will be laughing at you. Loud and with big smiles on our faces. :))))

God…the right is full of such idiots! See how easy that is. I hope it feels good to insult people, because it is all you have going for you.

Also, never forget you support a man who openly and actively campaigned for a man is credibly accused of sexually assaulting underage girls. What a leader! I hope you don’t have children!

@Dumptrump,

Dude, you have your panties in a wad. Relax and enjoy life, you have seven more years with Commander and Chief Trump.

Not defending Sr Landlord, but the classist name calling makes your arguments look weak and petty. I’ve known a few people that don’t otherwise impress me much who can also speak multiple languages. Same goes for establishment institutional credentials, big deal, those are about a dime a dozen anymore, whereas some really impressive people without a dean’s listing have made truly world changing accomplishments.

Why are all the people running away from liberal cities and move to the red states?

Here are the stats:

https://www.zerohedge.com/news/2018-01-05/americans-are-ditching-these-five-states-record-numbers

The numbers on the tables speak for themselves. Apparently surging violent crime, massive tax hikes and insolvent public pensions are bad for attracting new residents…who knew?

Based on these migration patterns, it looks like people like how the conservative states are managed better than the liberal states.

DumpTrump,

What is your current occupation and educational background?

Dearest Dumpy –

Just because we know you are race bating and a marxist, just know that the rest of us elected a man who accomplished the biggest tax overhaul in a generation, graduated from an Ivy League business school and now has arguably the most prestigious job in the world that you stupidly think was stolen by foreigners. He has made billions in a diverse set of industries and is married to an actual supermodel, also with a kind heart and a mind every bit as beautiful.

You think he (and others) stole the election from you, but you could never qualify for such a position since you lack the basic acumen and self-awareness necessary to see that your approach has failed. You are, apparently, a “Internet pundit”, which, honestly, is nothing to be proud of. When Trump finishes his second term, just know that all the people to the right of the extreme left will be laughing with us.

He also has kids and they appear far better adjusted than most, not to mention a couple of them are quite accomplished.

P.S. The incredible amount of bonuses companies large and small are now giving their employees as a thank you to our President also are laughing with us. No reports of any employees refusing the money.

Libtard Dumbacrat Alert- Obuma was nothing more then a filthy smelly muslim, better known as Bathhouse Berry in boys town chicago. So take that smell POS and ur opinion, and F off.

“Your ignorance and arrogance is on full display”

WOW, that’s odd seeing how hateful and arrogant your post was. But Trump was right on the campaign trail, this is one big fat bubble and this is all we got for 8 years of spend spend spend…..$4 Trillion in bailouts to rich people and bankers and $10 trillion in new debt…..what a legacy

This economy is poised for collapse and Trump is going to get all the blame but in reality has little to do with him OR the last 8 years. To say one thing about Obama, he ran on a platform of the “most transparent administration in history” and did nothing of the sort, he was basically Bush 3.0. Not only are we still in Afghanistan (withdraw was a MAJOR part of his campaign) and Iraq HE EXPANDED THE WARS IN THE MIDDLE EAST.

He dropped 26,171 bombs in his last year in office and killed thousands and yet some still think he’s the 2nd coming. There is no estimating the stupidity of humans.

hey dump……you’re a left wing nutcase dude. Not much else to add but when I read something that insanely left wing all I can feel is pity.

You are literally insane with hate, the left has become the “hate party”

Interesting – I call them AMPs. Angry Modern Progressives. Even if you’re a “classic liberal” and agree with them on 90% of issues, they will DESPISE you for that 10%. Nothing but hatred and venom. God help you if you lean conservative.

Wow, I love the Laurent comment. You think just because you don’t have sketchy mortgages there is no way it is a bubble or will pop? Ever heard the phrase “this time is different”. Look at the chart. You think that is normal or sustainable? That chart has rampant speculation written all over it. You think the average family in Canada can afford to buy at those prices? If I’m a betting man my money says it will fall hard at some point, but maybe your government will do more to prop it up than the US system did.

DG is spot on. Liar loans were just one symptom of the housing bubble, and not even that important in popping the bubble. When the easy money suddenly stopped, that not only killed the bubble, it exposed everyone who was swimming naked. And in Canada, almost everyone is naked. The fact that Canada is a recourse country only means that its citizens are going to be even more screwed. It doesn’t mean that all Canadian housing is “worth” its bubble price. The fact that Canadian banks are even dumber than American banks (and German too, if you count the huge role that Deutsche Bank played in America’s housing bubble) should give no comfort to anyone who thinks the government will take care of everything.

We haven’t heard “this is the year when millennials buy in droves†yet? Too early in the year? For the last three years we heard it….wondering when it will come back again?!

It’s already happening Millie….your peeps are buying homes.

http://popdynamics.usc.edu/pdf/2016_Myers_Peak-Millennials.pdf

Cities hit “peak millenial renter” in 2015. And since then millenials have been moving to the ‘burbs and buying houses. The period of 2010-2015 was an aberration. All the talk of millenials being different was nonsense. Millenials just postponed doing what every other generation had done (get married, have kids, buy a home) because of the bad economy of the later 2000s and early 2010s. But once the economy improved, that delay ended.

Today’s 35 year olds are no different than 35 year olds in the 90s or 70s or 50s.

“It’s already happening†nice! And I thought this year was different. For the last few years we heard millennials will go out and buy (in droves!!) Just like this year! It’s already happening!! So we will see homeownership rates improve dramatically right? Especially for the millennial bracket? Any day now!

Millie Vanilie,

Did you actually read what I posted? It’s not some op-ed. It’s an academic research paper from USC. But they must be lying and part of the grand conspiracy to keep home prices expensive in Los Angeles, right?

Landlord, wake me up when homeownership rates increased. Until then, keep posting this is the year when millennials go out and buy (in droves). I believe it when I see it.

Millennials with a good career and a good down payment are looking to buy a home or have already bought a home. The remaining millennials are either working on a career, or working on saving a down payment.

Of course JT. Why would it be any different than the last years? THIS is the year! Glad it’s resolved and millennials are no longer blamed for declining homeownership rates. You heard it here first, per the RE expert JT: millennials have already bought and the few remaining ones are basically ready. The remaining ones are sooo close to get the last bucks in for that downpayment. Before you know it these millennials stopped buying avocado toasts and Starbucks coffee! And almost magically the downpayment appeared!

“Millennials with a good career and a good down payment are looking to buy a home or have already bought a home. ”

I.e. those people who have rich parents. Not many and definitely not most. Even “good career” for a 30-year-old isn’t paying six-digits income for two people needed to buy a house nowadays.

Also millenials (most of them) realize that putting 90% of your personal wealth into walls isn’t a winning combination in long term. Walls are not only cost, they are a taxed cost, not source of income. Owning stock or almost anything else is not taxed.

Unless of course you are renting out but then it’s not your own home.

jt is right about Millenials not in the high cost areas of outbound states like California.

If 30% live at home and another large percentage live 2-3 to a 1 bedroom. I don’t even see it in a decade. Due to economic and personal confidence conditions the opportunity for upward mobility is slim. They are stuck in whatever stalled living situation they are in. Parents do need to stop enabling there kids to be unproductive. What happened to tough love?

How and why would a millennial come out of its protective shell? Adulthood is scary, Snapchat is a cozy blanket. The individual millennials that break out of this norm can live whatever dream they choose, while the rest slow it down.

Gen X,

I agree with you. I’m a millennial and see so many of my peers in those situations. They could unstuck themselves if they wanted to. They live in soCal not being able to buy a house, but they could move to nearby states and still come visit family. It’s a compromise, but becoming an adult requires some compromise.

And there are also the ones like Millennial posting here. For the past few years, he has been waiting around for a crash. I do think the crash will happen and probably in the last half of 2018 (people who predicted 2008 are saying this now), but while he was waiting around, my husband and I bought a house, sold it at more of a profit than we could have saved in many years, and are moving out of state. We got lucky and know it. Now we are gonna move out of this always-worsening state and take our kid to a place that offers better quality of life. We probably fall into some statistic. The thing we are proud of is that we didn’t get any help with downpayment and we always knew we wanted to leave this state, even before having a kid.

California is bad for your wallet and your freedoms. Why would anyone wanna stay here forever?!

Gen-x,

Do you mind explaining what living at home as an adult has to do with productivity?

Unproductive means to me that the adult would not work. Do you think that adults living at home don’t work?

Hi Glaba, thanks for sharing. Hope it works out for you. to which state did you move to? You bought and sold a house within a relative short time frame? Do you mind telling us when you bought and sold?

For me, I like living here. No intentions to move. I wouldn’t know why I should or where to.

Gen X,

See my post above and read that study. What you’re describing was exactly the case 2010-2015. That trend has reversed. Not every millennial will go buy house overnight. But the momentum has definitely shifted away from living with mom and dad or with 3 bros in an apartment, to buying a home.

GenX, genY – these are all marketing terms practically. People are people.

At some point in their life stability becomes more valuable

Everyone should buy or rent based on their own circumstances and goals

All this “buying in droves†or “all renting†is utter BS.

Hope you get to buy here in soCal soon. Patience or delayed satisfaction are hard and not characteristics of most millennials I know. I do believe that the sooner people get into something (like real estate), the better off they are. Just from observing the lives of people in their 60’s. If we hadn’t bought the house and just stayed at the rented apartment, we would not have even half as much today. Also, we learned so much about maintenance.

We bought early 2015 but at a 2013 price, comparing the smaller comparable houses (with smaller lots) across the street that went for the same price in 2013. We just sold it a few months ago, since we didn’t want to rent it out. We did get lucky a lot though.

We are in the process of moving, either to Lake Tahoe area driving distance to all family in CA (my idea) or northern Alabama (my husband’s). Huntsville, Alabama has many jobs, is cheap to live and a very nice place. My husband thinks we’d have a great life there. I think being away from family (all in California) would be terrible for so many reasons. Maybe it’s not good that we don’t know where we are going to yet, even though we sold the house. But, I truly believe this is the best thing we did. We have money to really start investing in rentals. Also, it happened before the tax plan. Sometimes you have to get rid of the clutter to really look at the possibilities.

Any comments would be appreciated. Thanks in advance.

Glaba,

There is so much wrong with your post.

“Hope you get to buy here in soCal soon. Patience or delayed satisfaction are hard and not characteristics of most millennials I know.â€

Buying during the peak of the bubble is financial suicide.

“I do believe that the sooner people get into something (like real estate), the better off they are. Just from observing the lives of people in their 60’s.â€

Muhahaha, people in their 60’s??? So these people bought around 30 years ago in the 80’s. Are you seriously comparing the 80’s to 2017? It was dirt cheap in the 80’s compared to now. Nowadays the median house price is like 10-12 the median household income. In the 80’s you could easily afford a home with just one salary.

“If we hadn’t bought the house and just stayed at the rented apartment, we would not have even half as much today. Also, we learned so much about maintenance.â€

I challenge that but without you providing some actual numbers it’s not possible for me to prove. In general you don’t make money buying a financed home and selling it within just two years! Have you considered closing costs, realtor fees, maintenance, hoa’s, taxes?

What about opportunity costs? What if you would have rented a small apartment and invested the savings from renting versus buying? Stock market? Crypto? Even bonds?

Millennial,

You are so quick to form your conclusions.

I meant comparing people in their 60’s who mostly rented their whole lives or the ones who bought houses, maybe even moved a few times. Still, the ones who bought seem to be ahead. It’s maybe the responsibility part. When you take on a house, you take on responsibility. It makes you more free too, I believe.

Generally, yes, people lose money on selling in 2 years. I am considering all costs. We did get so very lucky and believe me, not the stock market or anything could have given us that much of a return. It’s a lot of luck though. Most people would need to live in a house way longer.

This is getting better and better. Keep it coming.

“Still, the ones who bought seem to be ahead. It’s maybe the responsibility part. When you take on a house, you take on responsibility. It makes you more free too, I believe.â€

Seem to be ahead? Just like the ones who drives beamers and buy the iPhone X seem to be wealthy? Never mind that most of them are piled up with debt and buy everything on monthly payments.

Let me help you out with the responsibility part. Most Americans have never learned what it means to be responsible in a financial sense. That’s by design. Our economy cannot function anymore without people taking on more and more debt. And that’s exactly what you are saying. When you take on a house you take on a massiv load of debt

(What you call Responsibility). And no, taking on a house does not make you more free. It makes you a debt slave in most cases. Quite the opposite of freedom.

Millennials are indeed buying in droves in the inbound states (OR, WA, NV, ID, AZ, TX, CO). In fact, the homebuilders have significantly adapted many of their products to suit Millennials. I feel your pain, but you’re your own worst enemy on this issue. While you’re waiting around for a worsening situation to get worse in California, others are GTFO and MTFO with their lives, man.

Avi, if I would live in OR or WA I would probably buy a house too. If it were close to my job and in a rental parity situation. But I don’t live there….I am enjoying sunny California. 10-13 min from the beach depending on traffic. I feel like I move on with my life (just by looking at my finances). Not sure why so many people think waiting is somehow a bad thing. It’s not like I am sitting in a waiting room bored to death or stuck in traffic. I live a normal life, playing sports, investing money, hanging out with friends, going out on dates with my wife etc. all that debt free…plus I get some additional entertainment here from realtards and people who bought high telling us how buying now is the only option to ever own a home. Lol…. what’s not to like?

Millenial, there is no such thing as being priced out forever. You can buy now or in 10 years or never. Whatever works.

Horrendous traffic in LA can make what should be a 15 minute commute to the beach take an hour or more. Once you get to the beach, it’s often so crowded that there are no places to park. The beaches and water are often filthy. The sun is often obscured by pollution and fog cover from offshore flows.

Ugh. Why wait to move?

Sam, I totally agree. LA is the arm pit. There are def. lots of parts in California where I would not wanna live.

Oh come on man, if you have moved on with your life, what are you doing here? The beach is calling, after all it’s only a few minutes away depending on traffic.

We’re not the ones needing convincing, by the way.

Avi, I am not following. What’s your indication that I havent moved on with my life? If it’s because I have not bought an overpriced crapshack than we simply have a different def of moving on. Moving on to me personally means finding a situations that reduces stress, finding an environment that makes you happy, getting married and improving your finances. It’s a journey. I enjoy writing and reading on this blog. Btw I don’t use my home pc. It’s all done via my phone from anywhere. (That’s the reason why I write fast and have tons of errors and typos). I also feel like I learn a ton here from reading DR HB and from other posters. E.g. seeking reasons why buying now would be a good idea. Reading stuff like, “buy now or be priced out forever, the market is going to skyrocket because trump is a real estate guy, the market is going sky high because of the upcoming pot boom or my favorite: it’s always a good time to buy your first home .it just proves that there is absolute no reason to buy at these ridiculous price levels. So basically, I am thankful for this blog and hope it continues for the next few years.

I would love to GTFO, but my husband works in the entertainment industry. So we are pretty much stuck in SoCal. Owning a house in another state is appealing, but the job prospects in his field are limited.

Clearly, a large portion of the Canadian economy is energy or natural resource driven, and that portion of their economy has been hurting for a while. That is why the Canadian housing market has hit a soft patch Remember, economic slowdown = home price drop.

In the US, no signs of weakness, so home prices are humming. Eventually, we will have our economic problems and housing prices will slip. At this time, no slowdown is in sight. When the slowdown hits, prices will fall, and there will be a few deals. However, the deals will not be what people on this board dream of … unless you are dreaming of a 15% price drop.

I heard exactly the same predictions in 2006. Until the Black Swan collided with our windshields. Where or what is the current Black Swan? N. Korea(Trump has challenged the crazy person in charge to push launch button)? The overbloated stock market that has never seen highs as highs as these, ever? Bitcoin?

Who knows?

There is def. a bubble forming in crypto. Market cap is now over 770Billion. Given the fact that institutional money has still not fully entered and your Uber driver has not started giving you crypto tips I still think that bubble has legs.

Can agree with you on that, Mil. One of the features I remember quite clearly about the dot com and housing bubbles was the dearth of everyday cynics. The blockchain trend has tons of expert clairvoyant naysayers. I’ll know we’ve reached an inflection point once they begin capitulating en masse.

Totally agree jt. CA is an amazing place – people with skills and/or resources will always be drawn here. Coastal areas will only drop so far as there are many folks itching to get into the prime real estate. I left CA and spent 10 years in FL. Finally made it back a few months ago and have been wondering why I (we) ever left. Complain about real estate prices all you want, it’s the price you pay to live here. Home price affordability drives the market and there are tons of folks with $150-$200k household incomes that can swing $1M homes. Gotta pay to play…complain all you want but there are plenty of people that can and will spend $1M to live here.

I lining up my ducks, will make the move in 2019 from Altanta. You only live once, i’ve always wanted to live the CA lifestyle, surf, ski, beach, and yes, pay thru the nose for housing and taxes. I’m in my mid 50’s, zero debt and worth maybe 2.2M with the wifes assets and all. A correction is coming, housing, stocks, PM’s, all markets will be affected, adjust accordingly and continue to live/play life to it’s fullest. We will retire in Charleston SC, but before I do, I wanna live in SoCal, Laguan, Irvine (wife works for company there, im SE) Caralsbad, who know, but im coming.

It’s more than just high house prices. The congestion is terrible as one example. A line for everything. This is a multi-dimensional issue that makes for a lifestyle not easily described on a brochure.

“In the US, no signs of weakness, so home prices are humming”

As long as free debt is available and FED generates money from thin air by shiploads.

If and when that stop you start to realize that US is running solely on debt and is basically bankrupt. Not technically as country can’t do that but the idea still applies.

Not only income doesn’t cover expenses, but it hasn’t done that since 1970s. That’s an unstable status in the long term. And “long term” doesn’t mean years, it means decades or centuries.

https://www.cnbc.com/2018/01/02/manhattan-real-estate-prices-and-sales-fell-ahead-of-tax-changes.html

NY RE prices and sales are falling.

From the article:

New York real estate has its worst quarter in 6 years

Manhattan real estate sales and prices took a fall in the fourth quarter, according to a new report from Douglas Elliman Real Estate and Miller Samuel.

Total sales volume fell 12 percent compared with the fourth quarter of last year.

The average sales price in Manhattan fell below $2 million for the first time in nearly two years

Weird huh? Our RE experts on this blog were predicting RE prices will skyrocket this year.

CNBC must be reporting fake news.

Millie, stock market hitting new all-time highs, unemployment lowest it’s been in years, strong GDP growth, low inflation, tax reform set to push economy into hyper-drive, new millionaires emerging from bitcoin & crypto, etc. etc., where’s the catalyst for a housing crash?

Don’t get me wrong, I just as much as anyone would like to see a correction so I could snap up more rental property on the cheap but I fail to see a catalyst for such an event at this point in time.

Wheeli,

Yep sounds a lot like 2007. While RE prices are going down already some perms bulls think this is the year of hyper drive. Dude, if the economy is about to skyrocket whats stopping you from investing in real estate more? Buy all the houses you can! Don’t waste you time here trying so hard to convince me. I will wait on the sidelines for a crash in the meantime.

The Dow just hit another record high of 25K. As long as the stock market is roaring and the economy is strong, there will be NO TANKING IN SIGHT.

I’d think people who see that housing doesn’t bring profits invest in stocks. Of course that’s also a bubble and will collapse eventually.

But later than housing.

Thomas, in a perfect world that would be true. As it has been posted umpteen times on this blog, most Americans live paycheck to paycheck and the majority don’t have enough money to cover any unexpected expenses. These same people aren’t investing in the stock market. The rich are killing it, these are same people who will be adding more rentals to their portfolio at the next downturn.

I have a friend who just relocated to OC from Canada several months ago. He said jobs were dying, and he had an opportunity to move when his employer offered him an opportunity in OC. So, he said he was lucky to get out and come to Cali. He bought in Newport Beach. He painted a really depressing picture of where the Canadian economy is headed. I know nothing about it, I am only repeating what he had to say.

Employers will continue to flee SoCal and the rest of California as long as communist Democrats in Sacramento continue to penalize employers with burdensome regulations and taxes which make it impossible for employers to successfully do business in the state.

Red states are welfare states. We have to many con artists and pervs in this thread. You keep on trashing blue states like WA, NY, CA, etc. These states create jobs versus red states with trickle down economics like Kansas (remember that failed Sam Brownback trickle down little Kansas experiment?) and Kentucky. People in those states are so poor and ignorant. Had they voted for Democrats, they would have real jobs already. It’s no wonder US has to import immigrants to work high skilled jobs. We have too many stupid people in America. That’s how a con artist and his treasonous family got into our government. Sad!

Red states are welfare states. We have to many con artists and pervs in this thread. You keep on trashing blue states like WA, NY, CA, etc. These states create jobs versus red states with trickle down economics like Kansas (remember that failed Sam Brownback trickle down little Kansas experiment?) and Kentucky. People in those states are so poor and ignorant. Had they voted for Democrats, they would have real jobs already. It’s no wonder US has to import immigrants to work high skilled jobs. We have too many stupid people in America. That’s how a con artist and his treasonous family got into our government. Sad!

Hopefully your friend bought a home in Newport Beach that is in a gated compound with security since things could get really ugly in the next few years with California becoming a sanctuary state open to any criminal that crosses the border and where the middle class is being replaced with low income residents thanks to the policies of communist Democrats in Sacramento.

Samantha,

I don’t know where exactly his house is, but I agree with you about the sad affairs of California. I work near Angels stadium and drive past the homeless encampments in the Santa Ana River every day. As bad as it is, I know it is only the beginning.

I kind of admire CA. The sixth largest economy in the world. While those poor red states who wallow under extreme poverty and unemployment, CA has the highest wages in the US and fast job growth. I used to think those Republicans had the workers best interest at heart but after the Yuge disaster in Kansas where they implemented Republican policies and the ENTIRE state’s economy crashed so hard that they have the most people fleeing the state( likely to CA). Now Trump is trying to repeat the failed Kansas experiment and only people like Samantha think this is a great idea. Mid Boggling.

CA has the highest poverty rate in the country Danny Boy. Sure it has the highest wages. But the cost of living is also high. And accounting for the cost of living, CA’s residents live in poverty.

http://www.politifact.com/california/statements/2017/jan/20/chad-mayes/true-california-has-nations-highest-poverty-rate-w/

“During the same period, California had the highest poverty rate, 20.6 percent, according to the census’ Supplemental Poverty Measure. That study does account for cost-of-living, including taxes, housing and medical costs, and is considered by researchers a more accurate reflection of poverty. For a two-adult, two-child family in California, the poverty threshold was an average of $30,000, depending on the region in the state, according to a 2014 analysis by Public Policy Institute of California.”

It’s funny how leftists whine about Kansas. Let’s compare unemployment rate in Kansas vs CA….hmmm…what do you know?

KS: 3.5%

CA: 4.6%

And did you know that CA has the highest debt per person? Bet you didn’t. Did you also know that Kansas isn’t even in the top 10? Of course you didn’t. You only parrot MSNBC talking points. CA is awash in debt, both personal and govt. And if you look at the top 10 states, 9 of them are deep blue states.

“California has the highest debt-to-income ratio in the country. Residents of the Golden State make about $28,000 annually on average, according to U.S. Census Bureau data. The New York Federal Reserve Bank shows that Californians have a per resident debt balance of $65,740. This gives Californians a debt-to-income ratio of 2.34 on average. Like many other states, most of Californians’ debt is held up in their mortgages. Californians owe about $51,190 on their mortgages on a per capita basis.”

https://smartasset.com/credit-cards/states-with-the-most-debt

The largest economy in the world elected Trump. Admire that.

“Let’s compare unemployment rate in Kansas vs CA”

Irrelevant when the number of “unemployed” is counted totally different way. Also, while you can live as unemployed in CA, you can’t do that in Kansas, so either you have work or you move away. I’m not having an opinion which way it should be, but this is comparing apples to screwdrivers.

Cherrypicking statistics is the way to prove anything you want: Only the whole matters and that’s much harder to show as a single number.

WTF? Unemployment is counted exactly the same way in every state. Kansas has a better economy than CA. CA has the highest poverty rate in the country. Yet liberals whine about Kansas, lol.

Landlord just hates CA, doesn’t live here and trashes it every second he can with stats and articles he googles all day.

So how’s Spokane? Cold and shitty as usual?

http://www.krem.com/mobile/article/news/local/verify/verify-are-spokanes-crime-rates-the-worst-in-the-nation/494087652

Spokane has the worst crime rates in the nation. Here’s some stats for you.

Sorry Perma Bears…..

“U.S. employers announced plans to cut 32,423 jobs in December, bringing the year’s total to a **** low not seen since 1990****, global outplacement consultancy Challenger, Gray & Christmas reported Thursday. Cuts in 2017 totaled 418,770, 20 percent below 2016’s number. In 1990, companies announced plans to cut 316,047 jobs.”

And keep in mind in 1990 the population was much lower than today. Which means relatively speaking the number, adjusted for population, is way lower than 1990. And 20% lower than 2016. Incredible what a pro-American, pro-Business president can do, huh?

#MAGA

https://www.cnbc.com/2018/01/04/job-cut-announcements-in-2017-see-lowest-level-since-1990-challenger.html

De-regulation, more disposable money via tax cuts, and strong consumer confidence make for a strong economy.

Tax cuts for the rich doesn’t help economy at all: None of them is investing in US and cutting income tax with 17 dollars yearly isn’t helping me at all when other taxes increase by 170 dollars at the same time.

So how ‘tax cut’ is ‘improving economy’, to be precise?

Also “stong consumer confidence” on what? Trump? I’d laugh at that, but it’s so delusional it’s not even funny.

Tax cuts for the rich? Yawn. I ran about 20 different scenarios in the new tax calculator; and essentially the only ones not getting a tax cut are the single people w/ no kids who make 6 figures+ in high SALT states.

Kinda hard to get a tax cut when you are a worker ALREADY not paying ANY fed income taxes b/c of your income bracket.

And; if you are self employed with a small business (which is the backbone of america), you got a fat tax cut of 20%. So; even if you are in the aforementioned class taxpayer in SALT state, but you have a small business the 20% deduction off sets any SALT loss so you either break even or come out ahead.

It’s pretty simple; if you pay fed income taxes the chances of a tax cut are very very high.

Lastly, you can laugh about Trump and consumer confidence but it is legit and even the left anti-trump media is having to admit it’s true. When you start seeing positive economics pieces come out in the Wash Post and NY Times; both of which recently gave more rosy pictures of con conf and economic outlook you know the economy is ready for lift off.

I dont care if Trump has a D, R, or I next to his name; and sometimes he flies off the handle and says things he shouldn’t, the fact remains that his presence in the white house and his policies are having a positive effect on the economy. I guess we’ll just have to wait and see in the next 12-36 mos.

Poor Thomas. He believes the MSM lies about tax cuts for the rich. Let me guess Tommy, you also believe that Obamacare made health care cheaper, right? Democrats can keep counting on your vote.

as i was flying out of SFO the other night i noticed that San Fran glows orange from all the hps lights on their streets ,(((at approximately 60 dollars a bulb per night)))),do we still we have a mint in S/F ? it must be operational still cause they have to be printing money to not have replaced their streetlights with LED’s,,,, of course with a crapshack at a million$ usd i guess they have all the money in the world to waste with the Tax income generated on all those over valued home sales?? six months ago my entire city was relamped with cheaper brighter lights=Led,,, such a progressive waste,,,energy wise clowniforku,,,,oh and honestly, are they stoned or just stupid? its going to get worse folks,,already experienced in local paint store,,still waiting on my part because stoner did not order it over a week ago when i called, manager says that employee transposed the numbers,so part was not ordered,,, renting sprayer today to paint home in time frame will cost me extra money ,,,so i lose because of dyslexic worker,i get punished for his handicap,,,in other countries they have personal accountability,, not here,,,,, almost out of this country as fast as i can go

“mately 60 dollars a bulb per nigh”

Where does this number come from? Because it’s absolute bonkers.

I pay 5 cents per kWh and 60 dollars is 1200 kWh, meaning 120 kW bulb burning 10 hours per night. Small thousand-fold error as bulbs aren’t more than 120 watts while similar led bulbs would be 20 watts, at least. But replacing millions of bulbs would cost tens of millions as work alone and then you realize that both the bulb itself and the electricity it uses are irrelevant compared to cost of changing them, i.e. salary.

And no, LED-bulbs don’t last longer except on paper as they lose brightness right from the start and at some point it needs to be replaced even it still is ‘not broken’.

Replacing bulbs with LEDs when they burn and need to be replaced anyway causes variable lightning, not good.

Of course it’s a political issue too: Bulb makers pay city officials and they choose ‘correct’ brand of bulb.

Canada does not have 30 year mortgages. If you get a mortgage in Canada, typically it is a 5-year loan amortized over 25 years, meaning you have to re-fi every 5 years. In Canada, creditors have rights … they can go after just about everything you own for default! California has added protections that only make consumers more reckless and ‘entitled’! Canada has sailed along just fine with expensive real estate prices for a long time! The big difference is that a bursting bubble in Canada doesn’t let people off the hook! Here in America a bursting bubble, simply allows a lot of people to walk away and place the burden on the lender and the government to take the loss.

Canada also doesn’t allow mortgage interest or property tax as an income tax deduction. It’s funny how libs in CA and NY always whine that we should be more like Canada. OK, you got your wish. We’re more like Canada now. LOL!

Excellent point.

Landlord, ease up on the political rhetoric. This forum use to be interesting and informative about RE. Either your a Russian troll or just a fucking moron.

Funny how con freaks like you once hated liberal Canada. Now you and treasonous Trump want to model after it. How about universal healthcare? Putin got what he wanted. Trump will destroy USA along with the GOPutin party.

” In Canada, creditors have rights … they can go after just about everything you own for default!”

meaning the persons taking the loan has no rights at all: They’ll lose everything if they fold, not only the house.

Absolute and blatant robbery by banks.

I can absolutely agree with this.

Bank makes loan to buyer after running a full income, asset, credit assessment. Buyer puts down payment and balance held by bank and secured by the collateral.

Bank accepts the risk in return for rate of interest and collateral securing the loan.

If buyer defaults they lose their down payment and bank repossesses/foreclosed on the collateral. In this case the bank did not assess the risk properly and any loss arising from legal costs should be born by bank.

Going after someone or recourse after the collateral is seized is kinda ridiculous. Risk vs reward.

In theory the bank/lender would hold the risk on their books and the interest rate would reflect the risk. In the US there is no need for the bank/lender to keep the risk. They simply sell it to Freddie and Fannie. Basically, the taxpayer backs up

These loans sold to Fannie and Freddie. The banks can care less if foreclosures increase. They made their money giving out the loan initially and then again when selling the loan to Freddie and Fannie. Therefore, pretty much everybody can buy an overpriced crapshack they can’t afford and interest rates can remain low because there is little to no risk. A system based on debt that works until it doesn’t.

Lot’s of Canadians have used that equity to buy property around the Phoenix metro area where I live and I assume that it is also happening in other southern parts of the US. If in fact there is a bubble and margins are called, there will have to be a cascading effect into these US markets as well. Interesting times.

In Canada the lenders can chase a defaulted mortgage holder for additional assets.

Have the lender prepared to chase assets out of the country?

What is to stop a Canadian home owner from Helocing and buying a duplex in FL? If that Canadian walks away from his Heloc in CA, can the Canadian courts follow him to the states? Are the lenders prepared for this sort of situation?

Yep; crash right around the corner:

http://www.foxbusiness.com/markets/2018/01/05/six-figure-construction-jobs-are-going-unfilled.html

And-

https://www.cnbc.com/2018/01/05/black-unemployment-rate-falls-to-record-low.html

And-

https://www.cnsnews.com/news/article/terence-p-jeffrey/196000-jobs-added-manufacturing-2017

After tax cuts put more money into workers pockets; can’t see the economy not roar.

Yes yes we know Millie; you are ok waiting 100 yrs, but, for others sitting on the fence; it really may be awhile before a major pull back occurs.

If it’s affordable and fits your lifestyle and family; may want to think twice about passing on it just b/c you think a pull back is around the corner. All signs point to a strong next 3 yrs.

In my opinion if you build in hurricane/tornado locations homes need to be built to handle f5 conditions. otherwise it is just wasting money.

“After tax cuts put more money into workers pockets; can’t see the economy not roar.”

Less money you mean. Take a small slice of income tax away and tax everything else double. Also lose deductions for schooling except private schools: That will hit families with kids hard.

Varies of course a lot but as a general rule worker will lose. Only those who have income in millions will benefit.

Tommy, Tommy, Tommy. Turn off MSNC buddy. It’s rotting your brain.

“Analysis from Left-Leaning Tax Policy Center: Actually, 80 Percent of Americans Get a Tax Cut Under GOP Plan”

https://townhall.com/tipsheet/guybenson/2017/12/19/leftleaning-scorekeeper-so-the-gop-tax-bill-cuts-taxes-for80-percent-of-americans-n2424201

Dan, We are long due for a recession. I don’t have to wait 100 years for that. Recessions happen every ten years (average). It’s healthy, it’s normal, it’s economic cycles. It’s the first thing you learn in eco101. House prices are completely disconnected from fundamentals. If the economy is soooo booming right now and everything is awesome why haven’t Americans gotten a pay raise? If the economy is skyrocketing as you say how come this is not passed on to the average joe? What’s wrong with renting and savings a couple years and buying at an incredible discount when the Housing market crashes again?

I actually don’t disagree with your line of thinking if it works for, you what I mean is if you are willing to wait for quite a while and your family is willing to do so it does show discipline so if you’re comfortable with your current lifestyle then good for you.

I do however disagree with the notion that a crash worse than 2008 will be upcoming especially when I read articles like this:

http://www.businessinsider.com/small-business-optimism-tax-reform-record-level-2018-1

Optimism The last time we had such sky high optimism was in 2006….

I’m very glad I bought in 2014, at least right now. I made 30% on my home on paper and in monthly expenses since I didn’t experience rent increases. People are fools if they think a crash is coming due to some unforeseen economic event. The catalyst will be a natural disaster, war, some type of commmodity shortage or geopolitical event you can’t predict with certainty.

The US is experiencing a boom as TRUMP has slowed the pace of new regulations to a trickle, google it. He’s defunded agencies by freezing hiring and not appointing directors. The economy is booming like never before and if you’re not in business you’re failing.

Thank you Erik. That made laugh out loud:

“The economy is booming like never beforeâ€.

Yes folks the economy has NEVER been better! The time to buy that overpriced crap shack is now!!

2014 was a good year to buy.

Figure in your principal paid down and tax savings and you’re obviously way ahead of renting (at the current point)

So was 2015 and 2016 and 2017 and so will 2018.

Dan, You are off by a few years. 2009-2012 was a good time to buy. 2013 prices started going up significantly and wages remained stagnant. In 2014 rental parity was long gone. Now, that prices hit the peak you just wait for the next crash.

Lol landlord. I kinda wish you would put your money where your mouth is. I don’t think there has ever been a worst time to buy than now.

Not California but just for fun check out this Chicago listing I’ve been following for over a year. Check out the price and tax history! https://www.zillow.com/homedetails/1370-S-Fairfield-Ave-Chicago-IL-60608/3825232_zpid/

Hee hee. I wouldn’t even pay money for that fugly little dump in that crappy, ugly neighborhood. I don’t care how “trendy” or “gentrifying” it is. I wouldn’t walk around there at night, for sure. However, the neighborhood IS rapidly developing increasing in value because it is close to downtown. All the old inner-city Chicago neighborhoods are being redeveloped into luxury zones, so the property itself is probably worth the price, depending on the zoning, or the possibility of up-zoning.

That’s Douglas Park. I know that neighborhood and it’s not a good one.

The house faces a busy hospital located across the street. The park down the block to the west has constant gang and drug activity, along with a few music festivals that take the whole thing over during the summer. The area is a shithole and the only redeeming thing around there is the Lagunitas brewery that opened up a couple blocks away.

Nice little house if it was in a better area, but this area will not be desirable for quite a long time, since other neighborhoods in near better areas are still turning over.

Buying this place for even $160k is a huge risk. You get a nice, updated little house – but with all the issues go on around it.

Typical posters on this website: Those who recently bought an expensive crap shack in Cali who continue to post here seeking validation that they did the “right” thing buying at the peak. They also try to convince others to do the same. Then, there are also those waiting for a crash that may or not happen.

Crash will definitely going to happen. It’s a matter of when. Stock market will burst. If all investors are pulling out of the market, there isn’t enough money available to pay these folks. The system is rigged. The stock market is a casino where investors (gamblers) go to gamble.

Where’s Jim Taylor? I guess he’s given up on housing tanking soon.

I cant imagine any tank happening UNTIL there is a job-loss recession OR derivative crash. As much as I detest Trump policy, I cant imagine a recession with him in office.

As far as these theories of a crash due to war or earthquake, it wont happen.

Nah, he is just taking a break. He’ll be back before you know it. Pretty clear we are close to the end of the RE cycle in California. Add tax reform, increasing interest rates and an overdue recession and Jim Taylor’s prediction of a hard tanking is right on the money.

A crash could start because of a black swan event, but it also can be started–on purpose or by accident–by the FED at any time. I believe that the FED wants a recession to start later this year but become obvious only after the midterm election, so that the Republicans can retain control of Congress. The real estate top will likely occur in the Spring of this year and will one of the causes of the next recession.

SELL NOW OR BE WORRY!

China and other developing countries are advancing while Trumerica is regressing..back to oil, coal and gas era. We need progressive and liberal ideas to advance this country. We don’t need Putin to turn America into a corrupt kleptocracy state where greedy conservative billionaires control this country by brain washing our children with religious propaganda where conservative freaks prey on our children. Enough is enough. Take back America from conservative traitors.

Trump is not conservative. He is definitely not a social conservative.

That being said, he has far more business sense than Obama, Bush and Clinton; way more common sense!

Yes, he will make the top 20% richer and that is better than Obama making only the top 0.0001% richer and all others EQUALLY poor.

I guess you need to define “richer” because if that means ending the Trump term with more money in your pocket and making more money than when it began I think the vast majority of America will be richer. I guess it comes down to how much richer.

Any small business will reap huge rewards on this 20% deduction for pass-through entities. Also for the Trump will make the rich richer argument that 20% deduction is phased out for a married couple Above 315000 So it seems to me that the lower end of the small business income scale is receiving the large deduction.

As I stated in an earlier post I believe the only category that will not see a nice reduction in taxes is the single person with no kids that makes 6 figures and lives in a high tax state.

http://www.scmp.com/business/companies/article/2127233/chinese-backed-start-byton-wows-las-vegas-electric-car-40pc

TROLL allert!!!…

A troll came here posting under different handles – “Dump”, “Pussy4grabbs”, etc….same s–t under different labels. He thinks that with the label changed the s–t will smell better. He employs the same strategy like Clinton hoping that some stupid voter will buy their nicer packaged s–t. Like with Clinton, it never occurs to him that he is a loser.

Since he has zero understanding of economics, business and housing, he can not post anything intelligent. Therefore, like a true “With Her” wearing a pussyhat, he is bashing the president, thinking that that will inform the rest of the people about housing in SoCal in particular and housing in US in general.

Just another junior commie eunuch, unemployed with nothing better to do. The prospect of welfare reform probably has “it” worried. Nutbag libs have little self control on forums. Pots shots at the President fill their empty days in mom’s basement. An annoyance at best. Laughable at worst.

It’s obvious who is a troll. The sociopath has the nerve to call itself a troll yet playing Trump. The Trump troll is so Trump. Stop being so paranoid. Go prey at your church already.

The socialists here are in pure panic mode. The economy is booming, home prices are still climbing, stocks are at all time highs. Their worst nightmares are coming true.

Don’t worry though, President Oprah will turn it all around for you, LOL.

They’re not just socialists, they’re racist white haters. Most of the white haters are not persons of color either, they’re disgusting self-loathing white people. There isn’t a sentient human being on earth who peddles the fiction of ‘white privilege’ but can simultaneously acknowledging that Trump’s economy is actually working.

I am not a huge Trump fan either and have criticized him, but the data stands alone–his policies are actually working.

Let’s the blue 🌊 roll. We need to take back Congress so it works for us not serve that Putin’s Puppet. Why did Trump fire that treasonous General Flynn? Tell me the real answer not that he lied to VP 💩. Americans know better. At least 3 millions more of us who aren’t suckers.

The economy is not booming yet however confidence about the upcoming year is Sky High and once wage-earners start to see more of their paycheck stay with them instead of going to the federal government that will instill more confidence and small businesses once they realize they get to keep more of their earnings that is when the economy will start to Boom.

Increasing wages? Lol, not in this lifetime. Thank globalism and the vast numbers of visa holders who work here for pennies without paying into the social security system. I work in the tech industry and every year our company increases the numbers of Asians who are here on visas who work for much less than Americans. Plus they pay less taxes. Wake me up when we hire Americans and pay them more than 2% each year. Btw, all the administrative work is being outsourced like never before. Google shared service centers in Costa Rica….. they literally build cities of offices down there for American companies….all the big ones have already outsourced their accounting, IT support, customer service down there. Sure Dan the us economy is about to boom and we all get a 10% percent pay raise #keepdreaming #Magainyourdreams

http://www.businessinsider.com/small-business-optimism-tax-reform-record-level-2018-1

Small business world abuzz.

I think this will be the opposite of what Mille first thought would happen with the Trump tax cut.

More disposable income and a robust economy is a bad recipe for a housing crash.

The tax plan was a pleasant surprise. Trump is targeting blue states (NY is seeing already massiv price reductions). California is next. There are probably a thousand articles who calculate and forecast a housing dip in California just from the tax plan. The tax plan is not the biggie though. Add increasing interest rates and the overdue job-loss recession and you get your crash. Save your money in good times and buy your house when the market crashes by 50-70%. Easy recipe to fincancial success. But now and regret it for the rest of your life. Easy, no?

Tell it like it is DumpTrump. In the future, people will be embarrassed to have supported the clown dictator Trump the trumpleclown. When the economy tanks hard, they will go back and blame Obama and Hillary (she did everything). Those in love with the executive clown will give the clown emperor love no matter what he does. Even Trump said we were in an asset bubble before he became chief clown. He now is pushing for blowing it up higher. What a great thinker. Just like so many Americans.

Leave a Reply to Mr, Landlord