You can’t afford to live in California: It would take the typical family 35 years just to save for a 20 percent down payment in San Francisco.

One of the biggest reasons why people “need†to buy a home is to expand their family. And when I say expand, I mean having a baby. It is always interesting to see the carefully planned budgets but in many cases, daycare costs are not factored in or how much additional costs a new mouth to feed will be. And one baby is just the start. Why is this important? Because people choose to enter into major life changing events simultaneously. That is, taking on the purchase of a home and starting a family. I bring this up because I get many e-mails from people saying “my spouse wants a baby and our apartment/rental is too small so we need to buy.â€Â Yet for the most part, we get calculations based on two incomes and these don’t factor in the big cost of daycare for many. For example, in a place like Pasadena daycare can cost you $1,400 a month. That is a nice chunk of change. The LA/OC market is already incredibly unaffordable. In San Francisco it would take the typical family 35 years just to save for a 20 percent down payment. That is why the typical family is getting pushed out of these markets.

You really can’t afford to buy

It is very clear that most families are unable to buy in expensive states like California. This is simply a fact with current price levels. How much are you willing to sacrifice for that $700,000 crap shack? A large portion of buying over the last few years has come from investors and foreign buyers. Those able to buy have had to take on much larger mortgages with historically low rates to squeeze in.

The numbers seem clear when people get real estate obsessed. It doesn’t help that the HGTV “success†stories convert everyone into the next millionaire property flipper. So buying seems like a simple move. You don’t have shows highlighting complicated option trades, hedges, dollar cost averaging, or building a small business from the ground up. That is too boring and too slow. Better to buy a beat down place and pay others to fix it up and then sell it for a big profit. Work is for suckers right?

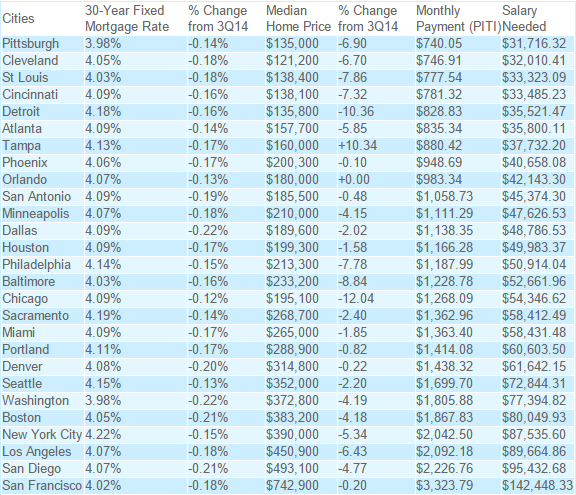

Here is an interesting chart looking at income levels required to buy a modest home in each area:

Source:Â Hsh.com

And at those price levels, you are getting crap shack central in Los Angeles, San Diego, and San Francisco. Even the example of the $742,900 home in San Francisco, you would need a household income of $142,448 to avoid eating Fancy Feast to pay the mortgage.

People always talk about diving in with low down payments. What is interesting in places like San Francisco, a big down payment is common. Shouldn’t be a surprise given the number of investors and foreign buyers. They aren’t like your typical family trying to go in with 5 percent down and trying to work magic with their mortgage broker to fluff up their income statements.

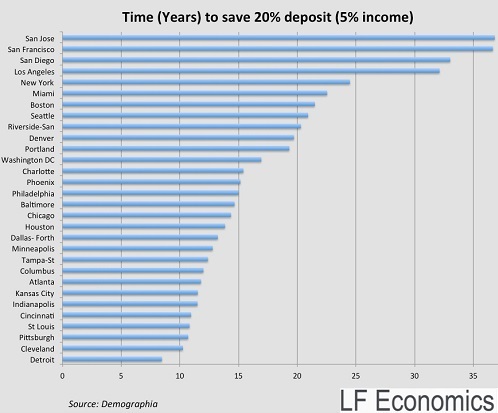

The reason low down payment structures are popular is because people are too broke to even save a modest amount. Take a look at how long it will take the typical family to save a 20 percent down payment in various markets:

The above is based on data on how much Americans save, not your anecdotal case study of how you saved a massive amount or know of a neighbor that did it. I’m sure you will have the person saying “move in with mom and dad and squirrel away for 10 years and then you can buy your crap shack in Pasadena.â€Â If you think daycare is a non-issue, take a look at this:

“Hello mommy’s! I am four months pregnant and starting to look for an infant day care in Pasadena, CA. I work in Pasadena and will need to put my baby in day care at four months old. All I can find so far are day cares that are $1400 to $1800 a month. Are there any Mommy’s here that have a child in a day care in Pasadena? If so, do u like the day care and how much do they charge for infants. Please don’t judge. I am the main bread winner and have to work. This is not an easy choice. I have had a point in my life were I could barely pay the bills and I don’t want to go through that as a parent if I don’t have too. Thank u for any info u can provide.â€

First of all, it is unfortunate that this person feels bad about having to go back to work. But this is the reality in high priced areas. Sure, you earn more income but more is eaten up on the cost of living, largely on housing. Instead your baby becomes another line item to squeeze into the compressed budget.

One thing that I truly agree on with the real estate pumping side is that people buy on emotional decisions more than rational behavior. After all, this is the home where your child is going to grow up in right? You don’t want to buy a more modest home and have your kid coming back to you when they are 25 saying “I never succeeded in college or life because you bought a crap shack in Highland Park instead of Santa Monica just because you wanted to be near a Trader Joe’s!â€Â Should have bought in prime Santa Monica. The nice thing for many parents is that adult “kids†in their late 20s, 30s, and even 40s are moving back home so you have plenty of time to talk it out over Taco Tuesday lunches.

From the contact I have from readers looking to buy, many are wanting to buy because of adding a new family member. Yet the math is nearly always lacking on costs that will happen. The focus is merely on getting to pay for that monthly mortgage nut. Everything is based on their two-income household without the added mouth. Everything else will miraculously fall into place and many don’t even bother saving for retirement. Just wait for college costs down the road. This is why we have a ton of baby boomers living in a million dollar home eating Purina Dog Chow while seeing their kids moving back into their rooms and partying it up in the LA scene.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

90 Responses to “You can’t afford to live in California: It would take the typical family 35 years just to save for a 20 percent down payment in San Francisco.”

How much of this problem is due to excess liquidity/low yield/low interest environment?

Slightly off topic, but I get RE investment emails everyday and all of these deals brag about CAP rates of 3.5 to 6.5%. IE today got one for the Breckenridge Ale House in CO, they are asking 3.5 million for a building that will pay 6.5% or $228000 per year.

This is not a corporate grade tenant, just an individual business. Over time things change, the current fad of brewery/restaurant can come to an end one day just like Cigar bars did a few years back. There is a good chance you could own a building with no income but still have to pay property tax etc. (assuming you buy cash, if you financed…;)

If interest rates went up to a point where putting this money in the bank or bonds, or T bills would yield roughly the same (remember when $100.00 in a savings account at the bank earned 5%? Was only five or so years ago…. When people with money to invest can make 5% at the savings bank, much of this RE investment will look like crap.

Or are we in a low rate environment forever?

The answer is “forever”. Or using Bernake’s language, his “lifetime”.

THIS IS A DEFLATIONARY CYCLE

======================

We are in a Deflationary event except for the price of gasoline which is a manipulated supply/demand which cannot be mitigated by anti-trust laws.

Housing and Real Estate are deflated except for major employment areas like So.California and major cities like New York, Jersey area, Chicago, etc -where the prices are inflated by the Real Estate Brokers/agents who are forcing prices up to “SQUEEZE COMMISSION” out of every Property Deal … because very few people can afford to SELL where they live .. Where would they move to??? There is no selection or supply in many neighborhoods – so the R.E. Agents/Brokers forces prices UP … and that vicious cycle continues..Choking off the R.E. Market in major employment areas.

Almost all of other consumer goods and services are CHEAPER today than before,

most of our goods are being imported from Asia (China), Mexico and So.America.

Automobiles, appliances, clothing and food have seen a DECREASE IN DEMAND, and consumers keep waiting for a better price cut .. and this decreases Demand further and forces Suppliers to lower prices and consumers wait longer to buy … and so forth.

Sort of. It’s really the story of financialization of the economy. Oil prices did not drop due to a drop in demand or greater supply – it was the end of QE3 and the resulting drop in money creation that pulled that extra money out of oil futures. Consider the timing of the drop. It’s asset management 101 – when the economy is bad, asset managers put money in oil, utilities and food. That’s why energy and food always increase when people can least afford it.

Reason people aren’t selling houses is because they’re in way over their heads with the mortgages and HELOC’s – they have to bring money to the table that they don’t have. Add in the fact that cheaper housing doesn’t exist, people waiting to sell for even greater profits down the road, foreclosure moratoriums, and cheap money and you have a situation where these assets remain permanently high with few buyers. Of course there are bidding wars when there is 1 house for sale and 2 buyers. There are 250,000 HELOC resets coming in LA county this year though so we’ll see what happens. There are also Alt-A resets, loan modification resets, and mass investors exiting the biz so we might see some more inventory this year.

It’s not just California where this is happening. Around the world the cost of housing is insanely high. There isn’t a place that is affordable for regular people. In the old days if you couldn’t afford San Francisco, you’d move to Livermore. Even Livermore, 45 miles away from San Francisco, is out of reach now. Hell, even highly-paid tech workers can’t afford SF anymore.

LAer, you claim “there isn’t a place that is affordable for regular people.” Look at the table above provided by the doctor. Housing looks very affordable in places like Detroit, Cleveland, Tampa, San Antonio, Atlanta, Dallas, Houston, etc. A sub 200K median home price should be affordable for the average Joe. And remember home prices in urban centers are always higher than small towns. Homes are very affordable in the US as a whole. They only become unaffordable to the average Joe in certain select areas (Bay Area, LA/OC, SD, northeast Metro, etc).

Paul this is a excellent post, as many know I do make a study of markets. Many RE agents in the big towns especially push for the big get and drive prices so they can sell two houses a year and take off the rest of the time. The are wrecking many sells by this practice by steering buyers into high priced homes once they qualify them.

I tested this practice, and called three agents in a location of homes from 650k to 1.2m. I acted like I didn’t know the local market and told them I could qualify up to about 1.2m.

All directed me to 4 house in this general neighborhood all from 1 to 1.2m. When I ask maybe I could save some money and look at 650 to 1m dollar homes they made excuses such as distress homes, bad lots, not worth the effort. They want to keep this area high and if I buy for 650k it ruins the median price, and comps?

@LAer, there are lots of sub-$100K houses in the U.S. The problem is these are non-hipster areas. Des Moines Iowa, Louisville Kentucky, Lawrence Kansas, Omaha Nebraska, Boise Idaho or Indianapolis Indiana are places with crap shacks in the $75K range. Both investors and hipsters have largely stayed away from these areas.

I live outside SF, but I renovate and rent out homes in Rockford IL. I’m telling you, if I took one of my houses that I rent for $775 and put it in my neighborhood I live, they would charge $3500 or more, and I am not lying. Four and 1/2 times as much. I’ll tell you now, you don’t make 4 and 1/2 times your salary in SF than in Rockford. At some point, you have to decide whether it’s worth it. (BTW, I rent in the Bay Area no way would I buy and try to compete with Chinese and American IT people ready to pay cash for bungalows.

Go to demographia.com to figure out where to own and where to rent.

Hello:

I saw all the comments about what constitutes “Major Employment Areas” and where Home prices are being “forced up” by R.E.Brokers/Agents or NOT.

In So.Calif – you can STILL buy alot of house if you are in EAST part of the State – i.e. San Bernardino, Riverside and East San Diego County – but commuting to a Major Employment Area is almost IMPOSSIBLE — SO those home prices are SURPRISINGLY CHEAPER .. WHY ??

BECAUSE THE R.E. AGENTS/Brokers just can’t find BUYERS who can AFFORD TO PAY THE HIGH PRICES in those areas and THEY CAN’T GET THAT COMMISSION INCOME there.

** I know I called those areas and getting Discounted Home Prices were EASY !!!

…… HAPPY HOUSE HUNTING.

The US needs to stop exporting Real Estate. Why should we let foreign investors buy residential property when they don’t live here, and have no interest in the good of the country? Australia requires people to live there for 5 years before buying Real Estate.

The lack of financial literacy and spending/saving discipline in our society is just stunning.

From high school kids who have no concept of “percent” to highly educated adults who will argue that getting a gigantic mortgage is really free money because of the “tax write-off”.

Suppose that explains why all the payday loan centers in practically every town and radio ads for legal services pushing bankruptcy or how to deal with the IRS.

I was listening to the radio this morning and heard a Wells Fargo commercial…it’s a great time to buy a house with record low interest rates. I have preached many times on here, most Americans can only do elementary school math. The financial sector preys on people like this. Start thinking like the financial sector…

I think the FED is conditioning Joe6Pac that the economy will likely be in perpetual limbo with a potential chance of interest rates staying low and perhaps popping up from time-to-time. Maybe more in mortgage rates than savings/borrowing rates.

Last i heard from someone in the real estate industry that it could take 40 years to clear out all the inventory depending if banks or cities declare these properties for tear down sooner like what is happening in other states. – all imo

“First of all, it is unfortunate that this person feels bad about having to go back to work.”

One of the few times I disagree with you, Doc. The first years are key in a child’s life. Love, bonding, stimulation are very important, especially for infants.

Although there are good daycares/nannies, sadly some daycares are crowded, can’t/don’t provide the stimulation/love/care a parent or loved one can, which may affect a child for a lifetime. How many awful “nanny cam” situations have we seen where the “wonderful” nanny neglects, ignores or abuses a child when loved ones aren’t around? It is something all parents should think long and hard about before everyone quickly heads back to work 40+ hours/week to make payments on all the “stuff”.

@WeDontMakeThoseDrinksNoMore: You make it sound like a child can’t experience love, bonding, stimulation and other necessities if they are in day care. Perhaps this is true to a small extent, particularly in the first year of life; however, this can be effectively remedied by selecting a quality facility, and providing for any lack thereof at home. I’m not going to bother to search for all of the studies that have been conducted (refer to Google) that I have read previously, but there are plenty of scientific studies that seem to indicate a child is no better or worse off in day care than they are with a stay-at-home parent in the long term (such as educational achievement, financial well-being, criminal activity, etc).

So far so good with our kid in day care. Most days, we drop him off and he runs off to play, do activities etc. Most days, he doesn’t even want to come home! And he has a nice life at home (two interactive parents that love him, plenty of toys and stuff to do, etc). Like I mentioned, selecting a decent facility is important.

One last thing I wanted to mention is that not everyone (maybe even most people) has the financial security to have one parent stay at home. For instance, if both parents make, say, $75k or so, it would be tough to have one parent stay at home and have the other one support the family on $75k. Maybe this can be done somewhere in the Midwest, but good luck with that in So Cal. Maybe an acceptable game plan would be to have one parent stay at home for a year, and then find a decent day care facility after that.

You pay for quality

Hopefully in the inner city you have free childcare with family members

Agreed. Having only one person in the family making $75k will be difficult in Los Angeles given today’s real estate climate. No only is your income halved in your scenario, you’ll also have to pay extra for health care for the significant other and child. I still don’t understand why our developed nation cannot offer universal health care.

Thank you for a thoughtful and intelligent response.

I’m glad your child is doing well in daycare…there are good daycares, but I still believe a loving and involved Mom/Dad/relative has far more invested in a young child than a person who receives a paycheck to care. But that’s just my opinion!

We all make choices in life. Too many times I’ve known people who complain they “can’t afford to start a family”, or “have” to put their kids with a nanny or in daycare because “we have no choice”, then in the next conversation are eager to talk about real estate they own, their pricey home filled with beautiful things, new car, latest electronic gadgets, vacation they just took, etc. Umm, no.

There is nothing wrong with not having kids. However, if a person feels badly about going back to work after having a child, or “can’t” start a family because it’s too expensive where/how they live, maybe hard choices need to be made. One might not be able to live in their “world class” city of choice with access to 24 hour pho and tacos; one might have to relocate to a less glamorous place, take a different job, learn to make their own pho and tacos (we did), etc. Time stops for no one. Nobody “has it all”; life is filled with trade offs. Make them, live with them, don’t make excuses for them.

$75k is enough even in Orange County, but you have to make a few sacrifices. Spend 40% of your pre-tax income on housing, send your kids to public school, and live in a ‘detached condominium’ rather than a SFH. You share a driveway with your neighbors, but otherwise it feels like a small tract house. You have a 2 car garage on the first level.

A lot of women would rather stay home, and this is how they do it in my neighborhood.

Plus your child in daycare is going to catch every germ from all the other munchkins and pass it on to you. You will not remember what it is like to live in a family where everyone is well and low-grade fevers and runny noses will become the norm.

Helps build up their immune system.

If your kid is in school (daycare/preschool, grade school, high school or otherwise), you’re obviously going to get sick more often than if you didn’t have a kid. As far as the frequency with which you get sick, it probably doesn’t matter if you have a stay-at-home parent or not once the kid(s) starts kindergarten.

That said, I’ve been pleasantly surprised at how infrequently I’ve gotten sick with a kid in day care (3-4 times per year versus once or twice per year pre-kid). Of course, we only have one kid (one and done) and maybe we’re just lucky; who knows. From what I’ve noticed (anecdotally), families with multiple kids are sick much more often than those with one kid (day care or not), and families with a parent who is a teacher are virtually always sick.

You rock! 🙂

$450k to $752k median price SF to San Diego, most folks would say wow make $89k to $142k a year and get a house for $450k. Those of us who know CA. what you get for the median price. Lets say all homes in that price range need automatic dialing system for 911, and if you can even get a attached garage make sure your car is inside it,never leave it parked on the driveway overnight?

You can’t afford to live in California, but you can afford to pay record high rents? Who’s paying for these high rents? If the argument is people are doubling up, doubling up further increases supply, which would drive rents down. Any other reasons?

Limited number of places where high income people can live among their own kind.

95% of LA is ghetto

Ben, what you say is true. SoCal is not for families with children if you care for the well being of the child. Nobody can provide for a child what his/her mom can provide.

If you don’t want children, I understand. But don’t say we have to spend a million on a decent house in a decent school district and then forget about children because we need 2 incomes.

If you don’t buy a house what the doc says is true; the cost of living plus taxes makes it almost impossible for most young couples to save money for a 20% downpayment (except those with inheritance). If you have a high income to buy a house you pay massive income taxes to both the FED and the state, on top of myriad other smaller taxes.

Therefore, if you want children and enjoy them (not just to throw them in a daycare), move out of state. If both parents have higher education (to earn enough to buy a house), one can decide to stay home and educate the child and the other go to work. Any parent with education can do a better job of educating his/her child than the public school at least based on the student/teacher ratio.

If you don’t want or can’t have children, who cares about the school district? If you think about resale, the next couple will be as broke as you. The vast majority of young couples in SoCal can not buy homes in good school districts.

Flyover….thank you for your thoughtful response.

I have a niece now so I have somewhere to spend my money on. Rent a kid I call it. Borrow for a day then return.

There is a movement called MGTOW or men going their own way. Look it up on wiki

I live in the nicest ghetto area in LA. Gardena, where the neighborhood is middle class but the high school is ghetto, 50% black and 50% mexican

https://youtu.be/GOIduTY0mHY … this is a youtube video about MGTOW

@Jason, many of the new apartments coming on to the market are priced waaaay outside the pocketbooks of people in the area. In the strange bizarro universe that is SoCal, these owners would rather charge rents of $2500 and have a 50% vacancy rate rather than charge rents of $1250 and have a 100% occupancy rate.

Of course, they’ll assume 100% occupancy rate with any rent: Reality doesn’t exist.

Pure, concentrated greed.

EB,

Greed isn’t the only reason landlords charge high rents, and there is nothing “strange or bizarre” about it. People that can afford higher rents typically have higher credit scores and take better care of things in general. To address your statement about charging double the amount and keeping half of the inventory vacant, those vacant units aren’t experiencing any wear and tear by lower income renters.

Maybe the landlord doesn’t want riff raff in their complex?

We are going to be Rich and Homerun,

Both are very good intelligent replies – thinking like true businessmen!. All landlords are in the business to generate profit (6-8% after all expenses in SoCal is considered excellent).

Only socialists think that businesses are there to provide a social good and politicians are there to serve the society. Everyone is there for themselves. It shouldn’t be that way in an ideal world with ideal people who don’t exists, but that is the reality. With human nature there are always only 2 forces: greed and fear. When fear dominates you have Depression. With no greed you have zero investment; all investors will look for capital preservation.

Those landlords are not stupid, or they wouldn’t have any money. The take a calculated, intelligent approach to generate an income without too much risk. For all investors, the offensive is as important as the defense or the fools would be separated by their money really fast. Therefore, I believe the landlord is smart.

Socialists are out for themselves too.

I’ve never met a socialist (or progressive) who didn’t expect to be a net beneficiary of any regulation, or on the receiving end of any entitlement program.

re: We’re gonna be rich

You are correlating credit scores to cleanliness? You are arguing that higher rents = less wear-and-tear?

IMHO, there’s NO correlation. I have people in my family who earned over six figures to the point where they came to rely on house-keepers. For the life of them, they can’t keep their home clean without them. They destroyed a $60K kitchen remodel in under five years by gumming up their nice white cabinets with their sticky fingers (paint literally flaking off, looks 100 years old). Their bars of soap collect dust because they don’t wash their hands even after using the bathroom (their own germs no need of it?). They were wealthy. And educated. It didn’t make them less likely to make a mess of their home.

I would argue that when you can’t afford to just go out and replace things or remodel at a whim, you might take BETTER care of your home/belongings because it has to last longer.

A lot of people who pay high rents are transplants who don’t really know how to value the area properly. My brother’s apartment building in Oakland got bought by investors who raised everyone’s rent by over 50%. The people who rented those units after them were all techies who lived in SF who had never even been over the Bay Bridge in years of living in SF. It’s easy to put one over on these types.

The reason why “investors” are interested in buying up rental units, whether single-family home or multi-family dwelling, is because just a few short years after all those faulty Mortgage-Backed Securities went bust — leading to the credit crisis or “Great Recession” — Wall Street hatched the “Rental Backed Security”. Google the paper on the “Rentership Society”. They pushed people out of their homes during the foreclosure/subprime crisis and into the rental markets. In time, the rental markets will be “pumped and dumped” just like the housing markets were. In areas of the country where the jobs are, like Los Angeles and Orange County, we’re already seeing a RENTAL BUBBLE.

They will keep squeezing people until more and more people are literally homeless. And our Wall-Street financed politicians will gladly look the other way. Talk has been, for years, the idea that home ownership can be “irresponsible”. Well, you read it here first: Renting in high-cost areas of the country is the new “irresponsible”. Brace yourself for the next attack, “How dare you want a ONE bedroom when you can only afford a studio!”

I wish the people who like personalizing these things into “greed” would realize that the greed is being pushed through by the financial sector, and the “irresponsibility” on the part of renters, let alone homeowners, is symptomatic of the Economic Hijacking that’s being handed down from places so high up on the economic food chain that, if anything, the REAL problem is failure to connect the dots between Wall Street and Main Street. The financialization of the RENTAL market, let alone the housing market, is just one of the manifestations of GREED not by people who just want to live a humble life but by those who would seek to make even unavoidable expenses like housing, food and energy into “cash cows” for hungry investors. Globalization has produced the condition of all the “real economy” offshored. That leaves mundane economic activity, like food and shelter, as the new “investment” aim of the craven Wall Street set.

There are a lot of costs that come with children, and childcare is only one of the most obvious.

You also have to consider foregone income as a real risk. Even if mom is only planning to take 2 weeks FMLA, pre-eclampsia or complications or any number of things can turn that into longer unpaid leave (if you’re lucky) and potentially needing to look for reduced employment after the child is born.

And depending on your employer, you’ll want to plan for the out-of-pocket premium cost for moving to a family plan. At my work that’s like $600/mo, so we instead had to look at buying a separate plan through the state exchange, which is less but still an additional $180/mo or so.

Plus there’s all the small things – just cheap disposable diapers will run you $50/mo. And even clothes/books/toys from Goodwill aren’t free. The small things add up if your budget is already stretched to the limit going in.

Thank god I dodged the bullet of parenthood.

More money to spend on myself.

Independent thinking and going against the herd

Here are my experiences in raising a child. The first years are very expensive, you need special equipment like cribs and strollers etc. and then you need special food, diapers, and expensive infant care. Then you hit a sweet spot when they are housebroken, start eating regular food, and go to group care/school. Your expenses here are limited to extracurricular activities like sports, and if you choose carefully, this is not that expensive. THEN the biggest expense is college….some consider this optional, but this will consume more money that all of the previous years combined. This is where I am now…..thank god we only have one child, a degree at an out of state public university will cost 100K when you include room board, books, and tuition.

GO JAYHAWKS

GO JAYHAWKS

Lived in Kansas a few years. Kids enjoyed sports, open space, history, many cemeteries with gravestones going back before the Civil War. Nice folks, great food (check out Jack Stack BBQ in OP). It was cool that employees at the local bank greeted me by name when I came in. Miss those amazing thunderstorms. Only thing I don’t miss is driving on black ice, haha! Rock, Chalk, Jayhawk! 🙂

Couldn’t you buy really cheap cribs and strollers, providing they’re used?

I assume that, since children are always outgrowing cribs and strollers, there must be many used ones available on Craigslist, Ebay, Goodwill, etc.

And it’s not like electronic gear, which breaks down. A crib is furniture, and thus should last for decades.

Or is there a status thing, with wanting the latest design in cribs and strollers? Are white parents ashamed to be seen with an outdated stroller? (I assume Mexican immigrant mothers don’t care.)

I did a quick check on the Los Angeles Craigslist. I didn’t check all the crib listings — TOO MANY. But here are the cheapest cribs I found:

Here’s a solid crib, MATTRESS included, for $40 – http://losangeles.craigslist.org/sgv/bab/5028524848.html

For the trendy baby, here’s an Ikea crib for $40 – http://losangeles.craigslist.org/sfv/fuo/5009311795.html

If you’re really on a budget, here’s a foldaway crib for $15 – http://losangeles.craigslist.org/sfv/bab/5028417583.html

You’ll have to find your own strollers.

There are close to 8 billion people on the planet. It’s going to be problem eventually.

SHHHHHH….iksnay on the law of exponentsay.

As Rose said, “There aren’t enough life boats for everyone, not enough by half.”

Upward mobility is dead. If you’re born a prole continue to rent and be thankful you have a job

The daycare dilemma is real for families everywhere. We’ve done the math and it’d be costlier to put our child in daycare than it would be for me to work less and stay home part time. But the truth is that it’s already difficult to get by with 2 incomes, no child, no daycare…much less a mortgage. Combine that with record high rents in Denver and it paints a pretty discouraging picture for people wanting to start a family.

Every family should do what’s right for them and what is best for them. But the reality is that choices are becoming more limited, IMO. We’ve put off having kids for the last 5 years of being married, but I can’t wait forever. Even if we rent, our monthly living expenses will be pretty astronomical if we add a kiddo into the mix.

Behold the results of a grossly overpopulated planet. California has too many people chasing too few resources and too little land. Major cities, way too many people. And China, India, and most of the African continent, grossly, disgustingly overpopulated.

Part of me is relieved people are foregoing children. And if the way to achieve less births is pricing people out of birthing, so be it. The simple facts are there are way too few resources to support 8 billion, 9 billion, 10 billion people on this planet, and it is getting much worse, and rapidly.

What’s more, the tax code should be totally revamped to make parents pay *far more* in costs and taxes, because it is these families that are sucking down all the resources — which we can no longer afford. And before anyone tells me we need more kids because “the future,” spare me — rapidly advancing technology is zeroing out the need for billions upon billions of humans. This will greatly accelerate once self-driving vehicles are a reality and additional AI improvements come at breakneck pace.

The simple facts are, this planet is full. Technology is superior to humans at a great many tasks. The future? It doesn’t need your children.

IMO Technology will ultimately change the population growth going forward. I foresee where ag companies will likely morph into labs producing food from vats or something else other than using ag land. No need for cheap labor to farm.

Robots will likely take over remedial work.

These two alone would likely kill off a large portion of cheap labor and government subsidies and/or section 8.

>> The simple facts are there are way too few resources to support 8 billion, 9 billion, 10 billion people on this planet … The simple facts are, this planet is full. <<

No, those are not the "simple facts."

In terms of land, the planet is vastly underpopulated. In terms of resources — water, etc. — it's an allocation problem. Plenty of water in the oceans, all we need to do is desalinate more.

I know lots of New Agey types (e.g., The Celestine Prophecy) claim the ideal human population for Earth is around 100 million or so. But that's just their Malthusian opinion. And the Malthusians have been proven wrong, again and again, for a couple of centuries now.

Not that I like over-crowding. But there are plenty of open spaces I can find on this planet if I ever chose to leave L.A.

>> In terms of land, the planet is vastly underpopulated. In terms of resources — water, etc. — it’s an allocation problem. Plenty of water in the oceans, all we need to do is desalinate more. . . . Not that I like over-crowding. But there are plenty of open spaces I can find on this planet if I ever chose to leave L.A.

Respectfully, this analysis is way off base. Those “open spaces” you refer to? That land is needed to feed us, and feed the species we need to survive. A whopping 51% of land in the United States is used for agriculture, including cropping, grazing and farmsteading. Let that number sink in: half the land in the U.S. is used to feed us, clothe us, shelter us.

So it is dead-wrong to say, lots of open space. Demonstrably untrue. Because these open spaces are needed to sustain the stunning 7+ billion people already on the planet.

Concerning desalination, there is going to be a major, major cost: the dumping of all that extracted salt into the ocean. Build a few plants, and you are going to greatly increase salinity, which will kill anything and everything within the vacinity. You can already see the effects in the Dead Sea, which is used for industry and drinking water. It’s a catastrophe. And if we continue at this pace, this disaster will leave no shore untouched.

Then, why is Obama puting tens of millions more illegals on the path to citizenship and by his reward encouraging even more to come here to the US???

Why aren’t the liberal constituents write to their liberal politicians to stop this madness???

Where is Siera Club (who supported Obama to get elected) when they have to lobby Obama against more US citizens???? Where you frustrated with Obama when his ecouraging more and more imigration legal and illegal????

The planet would probably be best with zero people. Over the past 400 years or less, it’s amazing how much humans have managed to screw up the planet. It would probably a great thing for all involved (except for the money changers) if a few generations had one child or less.

Read about John B. Calhoun and his Mouse Experiments:

http://en.wikipedia.org/wiki/J…

Thumbnail: Despite abundant resources, crowding lead to a breakdown in social structure, with females refusing to reproduce and the males withdrawing to solitary pursuits. The population declined towards extinction. “The conclusions drawn from this experiment were that when all available space is taken and all social roles filled, competition and the stresses experienced by the individuals will result in a total breakdown in complex social behaviors, ultimately resulting in the demise of the population.”

More here: https://www.google.com/?gws_rd…

You’re already seeing hints of this with females claiming *rape* with any sort of perceived slight or “trigger warning,”and correspondingly and increasingly males opting out of having anything to do with the opposite sex, becoming the “Beautiful Ones” of the experiment.

(The book ‘Shutting Out The Sun’ by Michael Zielenziger – http://shuttingoutthesun.com – essentially touches upon the same thing.)

Something to ponder as you sit alone in the dark playing videogames.

Just a thought.

VicB3

@Jack wrote: “…California has too many people chasing too few resources and too little land. Major cities, way too many people…”

You are sort of on the right track. Most of the people in California live in Los Angeles, Orange County, San Diego or the Bay Area. So that means that California is mostly unpopulated.

Basically California has 3 megalopolises: LA-OC-IE, SD and SF. the rest of the state is barren.

Drive up California highway 99 or I-15 through Barstow and you’ll see massive pockets of nothingness.

The only thing your “plan” would accomplish is to drive out the “aspirational class” (middle) and leave the super rich and the super poor to “evolve” in even greater opposition to one another.

In broad generalities, it breaks down like this from a SOCIAL ORDER perspective (which is arguably more significant than population concern, alone): The poor tend to stay poor (poverty becomes generational), whereas the rich will remain rich (wealth is also generational).

The middle class is unique because it represents the bridge between the two classes, a bridge that has allowed for the rise of democracy itself.

The risk one runs of being super wealthy is the loss of touch with day-to-day trade-offs and character-shaping struggles. This tendency to under-appreciate what life is like for others is a risk one runs for belonging to the “entitled class”. As an example of this phenomena, one need only look back at First Lady Barbara Bush’s comment after Hurricane Katrina that for the poor, an over-crowded evacuation center would be akin to a step up.

YOU NEED to keep middle class birthrates up, particularly in First World countries, because the middle class are not so poor as to have lost hope and not so rich so as to have lost touch (flaccid in character).

Again, these are generalities, but they hold TRUTH: The very wealthy grow bored with their toys and their globe-trotting ways — there’s only so many diamonds, furs and exotic vacations before they’re hungry again — and that “hunger” often translates to influence trading (the pursuit of power).

The very poor, on the other hand, may grow disenfranchised and rise up and revolt. This is why so many POOR countries in South America, Africa and elsewhere are in constant political and social turmoil. Extreme poverty, like extreme wealth, breeds a sort of restlessness. For the rich, it’s power. For the poor, it’s revolution.

Here, again, YOU NEED the middle class because middle class families are, in every respect, the middle ground. The middle class are not so rich that they’re going to abuse their power/influence and not so poor they are going to be easy targets for sectarian strife, crime (warlords) and political rabble-rousers (dictatorships).

Once the middle class stops having babies, you’re left with the very rich having kids and the very poor having kids. Their offspring will have no common life experience and little common ground. The poor will despise the rich, the rich will despise the poor. All manner of racism, terrorism and instability will be on the RISE in direct proportion with the demise of the middle class.

The creation of middle class FAMILIES is the key to social, economic and political stability. It’s no good if the world is only X-number of “sustainable population”. We need to also ask ourselves what comprises a sustainable socioeconomic mix. A wholly stratified and bifurcated world of “haves” and “have nots”, is not the kind of world any of them — or us — will wish to live in.

Good graph. And quite depressing, really.

I calculated that for me with current salary and current (local) price rising speed I’ll never be able to save even down payment (with 5% of income like in example): Prices rise faster than I can save.

And still I’m are considered a ‘well-to-do’ based on salary alone. Absurd.

“And still I’m are considered a ‘well-to-do’ based on salary alone.”

No. YOU, consider yourself well to do.

Those in Zimbabwe get paid millions per month and they are not well to do. Money is not wealth since they are no longer gold or covered by gold. They are just a medium of exchange. If what you make from work can be exchaged for a crappy standard of living, that means you have a crappy income in terms of purchasing power.

If you earn more you pay more in taxes. After you factor the cost of living, you realize that your well to do income is a fraction of someone else who lives in a different state with a lower pay per month. You can’t eat money, and they can’t keep you warm. Remember, your income is well-to-do if you have purchasing power. If you compare your income with those LA illegals, that is your business – you live with it.

That’s why you don’t save 5%. You save 40%+, if possible.

I feel badly for people with children who are chained by jobs or family ties to high-priced areas where you have to make $200K a year to afford a shack in a decent nabe, because the quality of the neighborhood becomes a much larger issue when you have children. Were I similarly placed, I would take a 3-room apt in Santa Monica over a mansion in a “gentrifying” half-ghetto neighborhood, while I would, and do, make the opposite choice as a childless singleton.

The reasons for the concern are not superficial. The main worry, of course, is safety. The world around you starts to look very threatening when you have the responsibility for a small, totally helpless human who you love madly, and the presence of thugs, gangbangers, and child molesters is suddenly a much larger threat.

Then, there are the neighborhood influences and quality of the schools. This becomes really important as the child progresses to his teen years, when he is very susceptible to the influence of teen “peers” in the area, and is socializing a lot. You want your kids surrounded by high achievers in the classroom, and decent influences outside it- not the boyz in the gang and the girls who are having their 3rd out-of-wedlock baby at the age of 16.

You can pick where you want to live, but you can’t pick your neighbors.

@Laura Louzader, the rent vs. ownership costs (i.e. rent equivalent) are completely out of whack in SoCal.

I live in one of the nicer neighborhoods in LA, walking distance to the beach, no graffiti, no police activity, no homeless. I rent for less than $1500 per month including all utilities. If I were to get a mortgage, FHA @3.5% down payment, in my neighborhood, my monthly living expenses would go from less than $1500 per month to about $3500 per month (PITI).

Ernst, I don’t think you are comparing apples to apples. You are saying the rent vs. buy equivalent for the EXACT SAME unit is $1500 vs $3500 per month. I find this hard to believe. $3500 PITI after factoring in a down payment is likely a ~650K plus house/townhouse/condo. Renting a beach close 650K unit for less than 1500 per month is unheard of.

A friend rents a one brm on Catalina and H in south redondo for $1600/month

I think the math is even fuzzier. Your charts refer to median prices which is great to compare relative prices between major cities, but is not a good indicator of what is really happening in a place like L.A. I’m not sure anyone wants to live in Compton. The actual median price of a home or for rent in a better neighborhood is significantly higher. And, if you are starting a family, there is a significant cost premium for those communities with decent school districts! Factor a decent neighborhood in, and those prices, monthly mortgages, incomes, and rents, increase significantly!

yup – true. I doubt the author would argue that median’s and averages can be misleading. Reality is skewed toward the more expensive quartile. First – it’s better not to even raise kids in many parts of SF. Many households choose to live in the burbs with their greater amount of green space, safer streets and lack of school lotteries etc. If you move to a leafy suburb current prices for a single family residence are over a million – for 750k u will be living close to something undesirable like a gas station or a freeway – or you’ll be living in a townhouse. If good public schools are important then be prepared to pay closer to 1.5m for your typical 3 bdrm rancher.

Unless you have a lot of cash you most likely will not be living in a leafy suburb with good schools. You can wait and hope prices go down – but I doubt that will happen until the tech sector craters at which point will you still have a job? 🙂 But all is not lost – if your an executive, an ipo millionaire or a highly paid engineer married to an other highly paid engineer life is pretty good in Elysium.

But the problem with tech sector employment is that it is brutal in terms of hours and pressure. Sure you might make good money, but it’s so easy to get burnt out or thrown away – tech companies are not sentimental at all about their workforces no matter how they purport themselves. What do you do if you’re burnt out from 90 hour workweeks or if your company purposely creates workforce churn so no ones stock options can vest or be exercised (Netflix, Amazon, Tesla to name a few)? How do you support your $6000/month mortgage if you decide to quit or get fired? You could get another job but then the same problem presents itself just a few years later. Add to this now you have kids and a house payment, you’re settled, but in an industry where you’re considered an old fogey at 35 and have decreased employment outlook.

I have many friends in this situation I described above except that none of the couples I know can afford kids. They have super demanding jobs, hellish commutes, tiny houses, and are one job loss away cat food dinners.

If you’re cool collecting $3 rent on Baltic Ave. Then yeah, it’s a good place to start. 4 green houses, one red hotel

Thousands of Immigrants Pushing Baby Carriages All Over the Southland – Their Just Not Trendy !

And their smart kids work where I work in technical jobs. And contrary to stereotype, they aren’t all Asian.

Joe

I also agree that the median/average home prices are misleading. In the area where we rent a median home is either a tear down or super fixer for 600K. If you want to find something for under 500K you have to buy in East Oakland which safety-wise is a no go for my family. Not to mention the public schools are a disaster!

The childcare piece is HUGE! We pay $2300 a month for preschool for our 2 and our 3 year old. I could see how people without kids might not even research this cost before jumping in and having a family. I’m sure it is a big surprise for a lot of people, especially the ones mortgaged to the hilt already.

I’m pretty ready to jump ship on the Bay Area even though I love it and my husband and I both have good and stable jobs.

Quite a few people commute from Sacramento to the San Francisco Bay Area. The median home in Sacramento is $245K but unfortunately many of the school districts in Sacramento are a disaster. The City of Roseville which is northeast of Sacramento off I-80 might be a better option than Sacramento. The median home price in Roseville is $374K and the schools are generally good to excellent. You could ride the Capital Corridor train from Roseville to the Bay Area but the downside is that it would take 2.5 to 3 hours one way. Here’s a typical tract home in Roseville with 3 bedrooms and 3 bathrooms priced at $369K:

http://www.zillow.com/homes/233-Amatrene-Ct,-Roseville,-CA-95747_rb/

Information on commuting from Roseville to the Bay Area:

http://www.city-data.com/forum/sacramento/254494-commuting-san-fransisco-roseville.html

I grew up in So. California, but lived my working life in the Denver area. I owned a home in the L.A. area which I sold last year … the price was right. I always wondered what drove Californians to drive those long distances in all that traffic? Was it the job … is your job that unique and pays that well, then I guess that is a reason. But, if it is the weather, or some notion that that is the place to be, seems like a huge downside considering the time spent in the car, the housing prices, the gasoline prices, and on and on! I spent over 30 years driving 15 miles to work on a back road, from the northwest suburbs of Denver to Boulder … little traffic, great view of the Rockies, some mornings deer on the adjacent hillsides, a nice town to work in. Just saying, there are many other places that make daily life much more pleasant!

“…but the downside is that it would take 2.5 to 3 hours one way”

5-6 hour daily commute for a job? Sounds to me like a fast track to an early grave. The Twilight Zone…where’s Willoughby? If I had to spend that much time on a train daily the life of a crustypunk sounds more appealing.

http://crustypunks.blogspot.com/

Or maybe your kids will become disillusioned crustypunks because Mom/Dad are strangers; always working or commuting, racing faster to keep up with the Joneses.

Yes, Roseville is nice, but commuting costs for driving (since trains only limit your work hours) is 200 a week with a small car, plus quality of life is a concern as you are driving almost 5 hours a day. Not that people are not doing this, they are. Or else housing rents and homes would be going up as much as it is. Median price for home rentals is probally around 1500 a month. Apartments are going up too.

No one has been blunt and honest enough to say that it is DUMB to have a child, or God forbid, children,in this Economic climate without a strong career and high earning power and or a partner who can equally support that decision. I’m tired of hearing young people make up excuses “I’m getting older and it’s just that time!” No it isn’t, don’t bring a child into this world and then treat it like its a burden and neglect it because you could never afford having one. Just don’t have kids!

And to add, don’t have kids with the intention of having your hand out demanding that me, the hefty tax payer, pay you to take care of your damn kids. I want to take care of myself first!

The exploding population, cost externalities, and rapidly advancing technology are a trifecta which strongly militates against having human offspring in this century. The harsh facts are this: your future children are going to be thrown into an unrelenting meatgrinder of exploding governmental debt, increased financialization (as DrHousingBubble oft shows in the housing market), land, water, and resource wars, and increasingly limited job/income opportunities. Every child you have will be fodder for the machine, a pawn to be used by the global conglomerates to crush wages because of the billions of unemployed people, all of whom are excess labor.

There is one — and only one — way to win this game: don’t play. Don’t birth offspring. Don’t allow your DNA to become yet another unit in the minimum-wage meatgrinder, fighting for scraps from the king’s table. Instead, conserve your time, energy, and resources; invest in only those things that pay you a healthy monetary return (which children do not), and exclude everything else. This is our present and our future, a world dominated by financialization, technology, and redundancy of human labor.

Jack,

Like all people, I’m sure at one time or another you asked yourself the meaning of life. Based on your comment, you gave yourself the wrong answer. With that type of outlook in life you must live a lonely, sad and depressing life.

I feel sorry for you. Be honest with yourself and I am sure you can change your outlook to something more positive.

We could be building entirely new cities in this country if we wanted to. Necessity is supposed to breed innovation. Why not innovate new cities with ten thousand dollar houses with permaculture yards where everyone can just chill out? Instead you’d rather beat yourself to death for a crap shack in the ghetto. It’s madness. I guess people can be conditioned to put up with just about anything.

Jack, have you considered that you ARE playing into the game? If you’re going to argue that adding children into such a world is a BAD idea, one can only conclude that doing as you advise would hasten that end, not slow it. Such a future will be a parasitical one in which the restless wealthy seek to control the restless poor. The power-seeker will offer big political promises and the revolution-seeker, in search of a savior, will be the target of the power play (social engineering).

The middle class ARE the “salt of the earth” — the barrier to your predicted dystopia. Instead of “raising all boats”, you propose we make way for a Dickensonian future. What a long, long way to come in Western Civilizaiton only to revert soooo far BACK. I question the intelligence, emotional and otherwise, of anyone who would give in to a world without a middle. It’s the middle that keeps the peace. The middle that can advance the reforms without toppling the society. And the middle that can sustain an economy. Our whole PROBLEM these past 40 years is that we’ve climbed aboard the globalization bandwagon without enough critical thought. If globalization raises all living standards, we will over-strain the earth and its resources — we’re already seeing that. But if it gives away to the “haves” and the “have nots”, it’s a world in which a very small elite consume more than the rest of us put together — the “same difference”, just that a lot fewer people, as a percentage of the population, who will partake in the benefits. Just how long do our elite think THAT scam will last before the “savages” come for them? Gates, guards or weapons of war — they’ll still be outnumbered by the “have nots”!

The hubris never ceases to amaze…

And maybe your parents were dumb enough to have children too. Why talk down on people who are trying to do the best they can and raise kids? Having children is a blessing and one of the best jobs in the world. Yes it means you think of someone besides yourself which a lot of you have a problem with on here. But I have not felt it to be a burden, and I spend half my paycheck a month on child support. I feel lucky. And if you cannot afford to raise a child where you live, move. Pretty simple.

No need to talk down to parents, but recognize that it is a choice – and one that has consequences for the rest of us on the planet. If you have the resources and character to raise a child then more power to you, but don’t expect anyone else to shoulder the burden you CHOSE to bear.

Look at those dumb breeders, acting like their brats are the most precious thing in the world….guess what? No one wants them around! Stop popping out your worthless offspring filling already overpopulated and resource-straved world with another leech. And just look these SOBs who threw their life away (haha, paying half of pay check to child support!) try to make it look good to themselves…you must be really sorry for your poot choices in the past. Best job in the worl? Wow…having screaming, stinking, annoying brats around? You threw your life in the garbage when you had them and you did disservice to the world. Jack, you’re right! The breeders just making some meat for the machine, to drain Earth’s resources to the last. The best payback is that their ‘children’ will live like Slaves — but I guess their parents being slaves already this might be OK. Keep driving 3 hours from Sacramento (“armpit of California”, to put it mildly) to work for your master…sheeple

it is dumb to willingly be a slave to the brain that’s between your legs

Smells like the late bubble 1.0 to me. Geez even RealtyTrac is sending me emails proclaiming “Foreclosure Investing WITHOUT Banks, Money, Credit, or Private Lenders— and “A NEW PROGRAM REVEALS HOW YOU CAN LEGALLY BYPASS THE BANKS AND MAKE HUGE PROFITS IN REAL ESTATE”.

It tells me I can:

•Access Unlimited, Low Interesting Funding For Real Estate

•Legally Securing Credit in YOUR name with a Bad FICO Score.

•Get a Mortgage Without A Credit Check, Banks or Lenders.

•Be Able to Invest in Real Estate without Having to Risk Your Savings

•Buy Homes With Down Payments as low as 1% Using the ‘UFP’ Method

•Acquire Properties at Huge Discounts and Flip them for Huge Returns

•Generate Streams of Income Using Cash Flow From Your Properties

•Extract Huge Amounts of Wealth from Real Estate

And the best part is you don’t have to quit your full-time job, since there are no employees to manage or rehabs to fix up. Thats right! No Rehabs – No Employees.

Remember all these ads and seminars in 2006-2007??? The end is near lol

Used cribs are not an option if you do a little research. Japan has negative population growth. They are at the forefront of robotics out of sheer need. Who will take care of their elderly? We have lots of not-so-smart people having babies. We will need a few children of somewhat smart responsible parents to help balance it. Societies we consider backward because their tech is behind us understand a simple truth most Americans don’t seem to acknowledge: children are the responsibility of everyone, not just the breeders that inflicted breeder bashes with their existence.

So many people think that computers etc. make it different. The collapses from past generations simply cannot happen. Balderdash. Our tech has allowed us to cock the slingshot farther than ever before. When that pebble flies it will do some serious damage.

Love reading blert’s posts.

If we want responsible people to have children, we need to stop punishing them for it, specifically responsible men.

We pay the irresponsible monthly by the child, while responsible fathers are faced with rapacious taxes and even more rapacious divorce laws which incentivize their wives to eject them from their own home, take a minimum of half of what they own, and demand 30% of their paychecks for 20 years to support a child they’re not allowed to parent. The wives are rational actors, and these policies have resulted in women initiating between 70 and 90% of divorces.

So long as the responsible are forced to pay for the irresponsible, for people who are incapable of keeping even their basic word let alone capable of fiscal responsibility, the west will continue its steep decline.

Phase two of the high-housing cost fallout is a completely altered course of life, different from that of your parents — and that’s precisely because you CAN come up with a budget and the math of bringing children into the mix, when you can barely make your mortgage-size rent, doesn’t add up. So the rational part of you says, “hold offf” — because the promise is that you’ll hit your prime earning years and some of it will begin to be an option. BUT because of recession, layoff, personal misfortune and whatnot the “right time” never comes.

I grew up in a high cost area in Southern California, in a family of four with one primary breadwinner (blue collar no less). My mom, who is a widow now, lives in a paid-for house. Now try to live that American Dream in SoCal even with TWO incomes and even after starting one’s adult life relatively late due to earning additional college degrees, marrying later and just not gaining enough of an economic toehold to justify “the next step”.

I can tell you that out of all the friends and friends-of-a-friend who I went to high school with and still interact with, some 25 years later, only three of them have children. The ones who DO have kids were the ones who got pregnant either in high school or right afterward (didn’t complete college). They went through some rough times, with one having lived in a hotel at various points (with her husband and three kids), the other with her parents right up till her kids graduated high school.

ALL of my college grad friends whom I went to high school with, on the other hand, are still living without children, and we’re all in our 40s now. I have three sisters, two older, one younger. Only one had children.

When people bemoan the fact that you shouldn’t really want/need a house, they forget that the ability to AFFORD a home may signal a “delayed” life progression. From Gen-X on down, those of us who live in high-cost areas of the country are significantly older before we do the things our parents did — if ever.

The irony is, while you may appreciate that a new home is not a wise financial decision, many who try to make a go of it in these high-cost areas still need to be married or “shack up” to make rent or mortgage payments.

In areas like this, even a college degree is no guarantee you will have the income to keep up. I always marvel at the number of young minorities with kids who don’t even HAVE a college education. How do they do it with even LESS earning potential? It is because they’re living with relatives? Is it because they’re working three or four jobs? Is it because they’ve figured out how to game welfare entitlements, as the conservatives always assume? The contrast is ironic: The wealthy have the kids and the homes and the poor have the kids. All of us who played by the rules and landed somewhere in the low end of middle have almost nothing to show for it.

For those of us with enough education to factor in childcare costs in a budget BEFORE having kids, the reaction is “No way, no how” — childcare alone is a RENT CHECK! And then you have to ask, after childcare, wardrobe, additional cost to have a car (or public transit) and gasoline to get to/from work, might that mother’s income be almost TOTALLY wiped out? She’d have to live incredibly close to work, have a casual wardrobe requirement, be paid above average (to afford the childcare). After the extra cost of the car, the insurance, the gas, the childcare, the wardrobe expenses does she even come out ahead or are some of these women on the low-end of the income spectrum actually PAYING for the privileged to work (more going out than coming in)?

Leave a Reply to Thomas