California shacking – three trends crushing the California housing market. Young workers moving back home, household incomes back to 1990s levels, and lack of an entry level market.

The recent data released by the Census does not bode well for the U.S. housing market but especially for the California housing market. We’ll go into the data later in this article but suffice it to say that household incomes continue to fall while poverty continues to increase. The data reflects the aggregate 2010 situation, a year when some were claiming that California was seeing an upsurge in the economy; therefore absurd home prices were justified. What we now realize is that it was nothing more than a gimmick induced spending spree brought on by the artificially low rates produced by the Federal Reserve and absurd tax cuts in the midst of massive budget deficits. All this action on the surface was to keep home prices inflated, at least that is how it was pitched to the public, yet in reality it is merely a ploy to keep troubled banks walking further down their zombie like path. Other data released shows that many younger workers, those 25 to 34 are moving back home and “doubling-up†instead of buying a starter home or even renting for that matter. The starter side of the market is practically fried.

California household incomes now back to 1990s levels

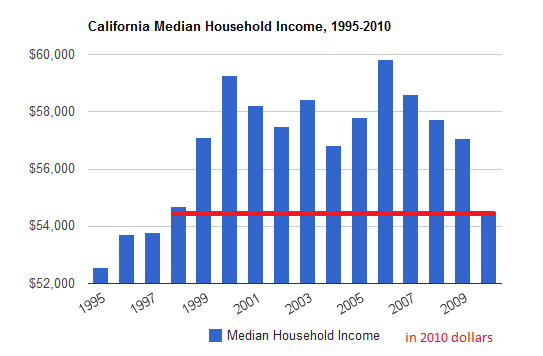

One of the most troubling data points released in the Census for 2010 is the crushing blow household income is taking:

Source:Â Sacramento Bee, Census

“(SacBee) Median household income – the middle number in a list of incomes ranked from lowest to highest – in California fell from $57,061 to $54,459. Median household income has fallen 9 percent since 2006, before the economic downturn.

California household income dropped about twice as quickly last year as household income nationwide.â€

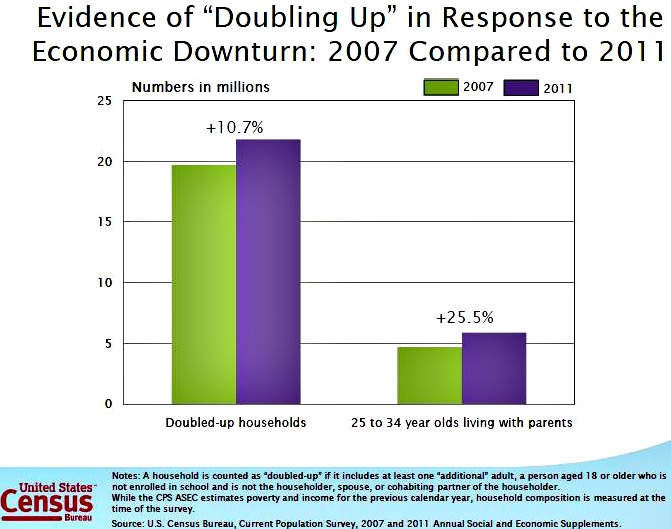

This is data for 2010 so why would home prices go up when the median household income is actually going down? We also find out that household incomes in California are contracting at a higher pace than those on a nationwide level. The shadow inventory in California is enormous and now we have another piece to add. I’ve talked to contacts in the lending industry and they are stating that even with low rates, the bulk of traffic is coming from current owners refinancing. Those looking to buy simply do not have the household income or down payment for the best rates. Many older owners, the bulk still are delusional and want high prices. So most sales action occurs with those few REOs that hit the market and make more sense for tight budgets. Many are simply going for barebones FHA insured loans that require nothing more than a 3.5 percent down payment. These are all multi-year trends. However one national trend that is picking up steam is with households doubling-up:

Source:Â Census

Before the recession officially began, you had 4.7 million adults between the ages of 25 to 34 living with their parents. In the spring of 2011 that figure shot up to 5.9 million. These are important years for household formation. Presumably these 1.2 million young adults are not saving money for a down payment. If they are, they are doing it through unconventional methods. This is a new trend in the U.S. housing market. The trend is abundantly clear and what it shows is that the weak economy is taking a larger toll on younger households. You have older more established households watching their faux-equity evaporate and stock portfolios incinerate and many are hunkering down in jobs and prolonging retirement. This keeps a lid on employment openings that would otherwise go to the 25 to 34 year old age group. However this also keeps a lid on the starter home market.

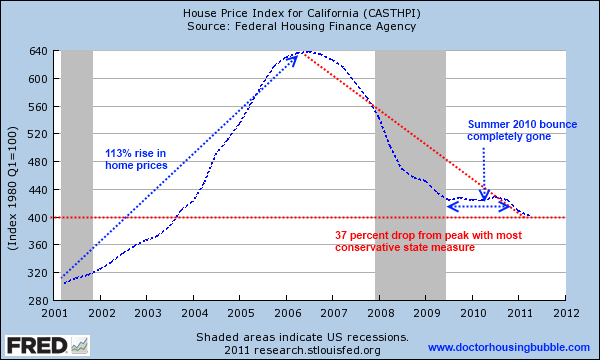

California home prices continue to make new price lows

While we have been following the data from multiple sources, the Census data simply reflects our deeper assumptions. There was no recovery in 2010 in California, to the contrary household incomes were tanking. The summer bump was merely an adrenaline induced boost that evaporated just as quickly as it came on. The price information is rather clear:

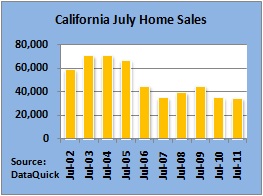

What can we gather from all of this? The economy is incredibly weak and the best predictor of any sort of bottom is going to come from household income data and a boost in employment.  It may be useful to have a California home warranty.  This is why with record low mortgage rates July had one of its weakest months even with home prices down close to 40 percent statewide from their peak:

Source:Â DataQuick

When you have 23 percent of the workforce underemployed, budget deficits for years to come, cities still in bubbles, and household incomes contracting there is little fuel to boost prices upwards.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

81 Responses to “California shacking – three trends crushing the California housing market. Young workers moving back home, household incomes back to 1990s levels, and lack of an entry level market.”

Yup, it’s a depression and it’s a structural change in the global economy. NOT a cyclical recession. Most of the new jobs and growing industries are in the developing economies, not the developed economies.

Yes it is cyclical. It’ll just be a longer cycle this time, like about a hundred years.

Not to get to Keynsian but in the long run we’re all dead. 🙂

Not to get existential, but we’re all dead already. 🙂

The drop is actually 71% and not 37% because you are taking 640 index to 0 instead of to 340 index which is your starting point in the graph.

Google is your friend:

http://www.percent-change.com/index.php?y1=640&y2=400

I can see where you’re coming from, but the starting value for the graph is implicitly 0 since it’s an overall measure of HPI, therefore 37% from peak is correct.

If we used the beginning of the graph as base (index 2001 Q1 = 0), peak would be ~330 and current would be ~90, and the drop would be calculated around ~73% (not much off your calculation).

I’m still not clear. According to you the implicit starting value is 0, but your starting value to reach the 117% increase is around 300 since 640 is 117% increase from the existing home prices at the time. But your % drop is being measured from $640 to $0, not from 640 to 300, where 300 = 0% increase in prices.

@Vic: i understood the graph to be measurements of two different contexts, the former being relative and the latter being absolute.

let’s say the price of the home was $100. from 2001~2007, we got an increase of 113%, which makes the value of our home @ $213 (our peak value). if the home price decreased by 37% (from peak), home price would now be ~$134, which is still above our starting point and consistent with the graph.

71% is the drop in the delta that occurred in the HPI, which is a valid measurement, but it’s just comparing apples to oranges. they’re just measuring different things.

I meant starting point index of 300.

Bank of American is pushing homes to foreclosure now. If other banks see Bank of America pushing more loans to foreclosure, which will inevitably mean more properties heading out for sale, they may want to get in before that glut of properties pushes prices down even further. Folks, the stampede is starting. CA is a non judicial state and my friend, Bank of America, needs to raise cash fast, so they will unload at bargain prices, prices never seen for many years. Time to round up the cash for the bargains.

Clearing shadow inventory should be good for another 10-25% off, depending on the insanity entrenched in each specific area, but the final bottom won’t happen until a couple of years post foreclosure RE dump…

When investors finally grasp the TRUTH that this is the Greater Depression, and that JOB CREATION will be negative due to a myriad of factors in CA, then you’ll see an additional 10-15% shaved off in under a season as investors run for the exits (2014-2015).

Honestly, with all the .GOV meddling, not the least of which is aiding/abetting TBTF balance sheet fraud, I don’t see things in recovery before 2018-2020 short of divine intervention!

Hope is not a business model…

!0-25% decrease seems too conservative. At least in Sacreamento county, I see prices dropping at least another 25% in the next 2-3 years. I’m thinking it will drop another 30+ easy in certaing neighborhoods that have already lost maybe 55-60% and others that have lost onlsy 40% but have still tons of shadow inventory as banks are holding these properties back. This will get a lot worse before it gets better, at least in Sacramento.

Bank of America is finally realizing that if they DO NOT start the fire sale process, they are going to get burned and burned badly. It will be interesting to see where prices will be 6 months to one year from now. My guess is at least another 10% lower, maybe even 20% depending on one locale.

@J

BofA might be foreclosing but they can hold onto the REO for a long time too, so don’t expect anything to happen too quickly. The buying process is still crazy for foreclosures.

Do banks even care now if pricies fall further? The huge hit the banks will take dumping their REO homes has already happened what is another 5-20% btw, Valencia home prices are dropping fast, where’s the poster complaining about stable prices in Awesometown?

The short answer is no, banks don’t care. They’d much rather slow up the foreclosure process and hold everything in shadow inventory for as long as possible. Several banks have moved to ignore delinquent payments and/or make it easier for delinquent homeowners to pay SOMETHING. Expect this to continue as banks continue to keep these loans on their books as their original purchase value while they use the bailout money to try to make enough money speculating on the market to avoid bankruptcy when they finally have to markdown the massive depreciation in the houses they now essentially own outright.

Union membership is at the lowest since WWII, taxes on the uber wealthy are at one of the lowest point in histories…why aren’t the jobs here? The high paying jobs should be falling out the posteriors of the rich, but they’re not. Yet people believe the same old lies.

America *will not* recover until the people figure out they are being lied too. Personally, I hope they bust all the unions and pretty soon no one, not even a cop will be paid a “living wage”. Mayeb THEN we shall see riots in the streets, I’m looking forward to it.

A riot is what it will take. But as for cutting union jobs, that can only help to create more jobs.

Union jobs have already been cut: no “new jobs” were created, only lower paying ones. Which hurt the economy, not help it.

Nice try though…if we were all tea bagger level idiots.

Did Unions bail the banks out? I think you have confused the Union with the Fed.

re: “Maybe then there will be riots in the streets, I’m looking forward to it”

Careful what you wish for…

It’ll happen: but like an alcoholic, we haven’t hit rock bottom yet.

But when we do…events will occur that will set your hair on fire…

I get angry sometimes as I (at 32) am realizing I’ll never have the housing opportunity my parent’s generation did (and squandered.) But I refuse to buy at these prices, bailing them out for retirement, validating their excess and greed.

I’m focusing on saving for my kids, the next generation, and passing on the lessons of this mess to them. Hopefully our generation and the generation just after will resemble that my grandparents – work, save, rinse, repeat. Get rich slowly.

You may want to look into relocating to another state, if you have the chance. The numbers simply do not make sense out here, and haven’t for a long time. There are actually a number of markets (primarily in the South) where job growth is much stronger. These same markets weren’t subject to the same boom and bust cycles as CA, and have median prices that are much more in line with median incomes, meaning just about everyone can afford the average house, unlike out here.

Brian is right. I left CA after 12 years and relocated north of Atlanta. Bought a gorgeous house on 3/4 acre, 3400 sq/ft for $164k. Great public schools, no crime, low taxes, fantastic neighbors. Plenty to do here and the airport gets me a direct flight to anywhere fast. I save so much on CA taxes and rent I can go to Europe for a long vacation, or NYC for a weekend out.

My income is the same but my housing overhead just collapsed. I don’t really care if the house depreciates; it’s a place to live, not a short-term investment. Besides, not much bottom left on 164k–I’ll have the place paid off in under 10 years.

I loved CA but it made zero financial sense to live there; my wife and I clear 100k and couldn’t afford to own anything worth having. Best decision I made was to walk away. CA housing priced us right out of the state.

Sounds right to me. (a late 40-something) What’s happened is a tragedy, and it’s lining pockets of those pulling strings. Speaking of, call your state attorney general and tell them to go prosecute. This mess isn’t going to end until we get less moral hazard and lots more accountability.

I read something like the following in the bsphere recently. Probably here or on oftwominds.com:

I tell my children “My parents rode the wave of post-WW2 growth, I got the foam, and you’ll get the rip-tide. Travel light (no debt).”

Many pardons to the author for my mangled version.

My oldest son is 30. I worked two 8 hour jobs, paid Reagan’s quadrupled payroll taxes…that paid the SS your grandparents never contributed to, saved my money, my wife worked too..and “we” squandered what?

You’re a jackass, Child.

I was responding to this comment, but for some reason, it didn’t go to appropriate area:OcBystander

September 14, 2011 at 3:08 pm

I get angry sometimes as I (at 32) am realizing I’ll never have the housing opportunity my parent’s generation did (and squandered.) But I refuse to buy at these prices, bailing them out for retirement, validating their excess and greed.

I’m focusing on saving for my kids, the next generation, and passing on the lessons of this mess to them. Hopefully our generation and the generation just after will resemble that my grandparents – work, save, rinse, repeat. Get rich slowly.

I am sorry, English is my second language.

What is “doubling up” ? Thanks

“Doubling up” is when two families move into a house which was normally used by one family. Such as children moving back in with their parents.

“Doubling down” is when you place twice as much money on a bet that you just lost in gambling.

So, one could say that people are now doubling up, because the bankers had to double down.

English is a fun language. 🙂 And welcome.

In this article it means that 24-35 year old sons and daughter are moving back in with their parents. They can’t afford to live anywhere else. Dr. has pointed out numerous reasons why. For instance, huge student loans, lack of high paying jobs, artificially elevated housing prices.

Also, they can continue living in the pleasant suburban neighborhood they grew up in, enjoying a lifestyle that is comfortable and familiar, plus they can still afford all the expensive toys they like to buy. Something like childhood, infinitely extended. Perhaps a reason Apple stock performs consistently. Maybe this generation will be the first in large numbers to never leave home, staying on until the parents pass away.

children moving back home with their parents, or people sharing the same apartment or house. flatmates or roomates in other words.

Literally it would mean double the number of persons in a given dwelling. For example, a house or apartment where normally a couple a perhaps a few kids would live is now occupied by those same people, plus cousin Ed, Ed’s girlfriend, and the girlfriend’s mother, lol.

Or a 1-bedroom apartment that normally would house one person, or a couple, now has two couples, with the living room converted to a second bedroom.

In my own case, we would love to sell our house and buy a bigger one, but there are no buyers and we are underwater, even though we put 20% down. Se we are converting our concrete basement to finished rooms for my in-laws that stay with us 6 months out of the year.

Anyone that bought a house in the past 2-3 years bought only 3-4 times their income or less… They won’t be foreclosing. Everyone that foreclosed in 2007-2009 will be able to buy again in 2012-2014. (When home prices will be discounted 40-60% off 2006 levels).

Sorry, there’s a hard bottom coming and it’s coming soon… Sure some on this board will get a “steal”.. but most will hold out so long they miss the next bubble… Probably when inflation hits and all your money in the bank will be worthless. Or the government starts bulldozing all vacant homes and your landlord raising your rent 30%…

Have fun…

Kevin, can you you please share with the class when you bought your overpriced house? If there was ever a guy defending his purchase, you just did it in spades. Also, I like scare tactics…better buy soon before you miss the next bubble. I’ll stop right here!

If anyone is waiting for the “next bubble”, they are sadly, and stupidly I might add, mistaken…

Over the last 20 years the politeers and their fraternal brethren banksters have looted so much from the future, probably up to at least 2030, that even a bubble based on herd emotions is absolutely impossible.

Until then, all the US economy will be is a scavenger operation picking over the carcass of a dead industrial giant…

Good luck Klownfornia sheeple, couldn’t happen to a nicer bunch of suckers!

Bought this summer.. mortgage is 3x income.. in good school district… I might add 3x my income alone, not counting wife’s potential future income…(currently she’s in nursing school). I don’t see prices going back to 2006 highs for maybe 30 years worst case scenario.

More likely something in between the pessimist predictions and optimist predictions will occur…. But the dooms day predictions won’t be good for ANYONE.. The LEAST.. and i do mean least of your worries will be buying a home vs. renting in 2011-2012 if everyone’s predictions on this board come true.

The downside risk is very minimal… if you buy at 3x your income… Rents are STICKY as hell in L.A. and just aren’t dropping even in this crappy economy. Rent to buy ratios with 4% interest rates are pretty equal on middle class homes now…

Kevin, thanks for answering my question. Where to start?

I know several people who bought last year to get that magic homebuyer tax credit and use the 3.5% FHA down. Guess what, they’re upsidedown already. If we see another 10-15% decline…things could get real interesting for them. Throw in a job loss, divorce, etc and it’s foreclosure time.

Many of the people who got foreclosed on during 2007-09 had NO business ever owning a house. What makes you think they do now in a world of much higher required down payments, credit scores and financial health.

In your case, taking a mortgage out at 3x your income to live in an area with great schools. One of the following must be true then: you make much more than the average person, you had a much higher down compared to the average person or you didn’t buy in a prime area. How’s this for a hypothetical example: You earn 100K/year, use a 100K down and take a loan for 300K (3x income). So buy a place for 400K…unfortunately that isn’t going to get you far at all in this city. And the person in the example is financially better off than most people without a doubt.

Rampant inflation and 30% rent increases? Cmon man, seriously. The only way that is going to happen is if you have massive wage inflation. There is currently ZERO chance of that. It comes down to affordability. When local wages support local RE prices (not including the Malibus, Bel Airs of the world), that will be the time to buy. Until then, sign a lease, save money and enjoy life. Trust me, you won’t be “priced out” anytime soon!

It is possible that the government could touch off hyperinflation. My crystal ball says they will pull back from that brink. Inflation is here as many on this blog have noted.Just not hyperinflation. Housing prices have to fall or inflation has to overtake housing prices. IMHO that is inevitable. But, I don’t think the people on the sidelines will “miss their chance”. If there is a takehome message from this blog, it is that a house is in general a stable investment. Over the long haul it will neither gain enormous value or lose it. Sure if you bought in 2000 and sold in 2007 you did great. You were also very lucky. In general a house is a place to sock money away for stability, not growth. In a normal market, any appreciation will be eaten in taxes, maintenance, transaction costs, and inflation.

Whenever this market returns to sanity that principle will come back into force. When that happens anyone buying a house will get stability. I just don’t see another bubble allowing homeowners to use their house as an ATM. Delaying a decision to buy a house is therefore not a huge economic mistake.

Hyperinflation only happens when a government prints like crazy, in comparison to other similarly tiered nations, or when the currency loses all confidence.

The USofA is dangerously close to the “prints like crazy” line, which is why QE3 was held back and most probably won’t happen in the near future…

Luckily for the US Government/FED, the U$D is currently the World’s reserve currency based on the petro trade and int’l banking, and Europe is ahead of us on the unsustainable curve, for now.

With that said, given the duplicitous, pandering nature of professional (D) & (R) politicos, and the uneducated, disloyal and gullible nature of We the Sheeple, it’s only a matter of time, perhaps months, before the digital printing press is cranked up to redline and we collapse the U$D, post haste…

If anyone thinks that this is an optimum scenario for debt-owners, I suggest they read books on collapse of the Roman Empire, with a helping of “Grapes of Wrath” thrown in.

There is no way out of this systemic fraud, other than reset and PAIN!

@Inquisitor

Granted that hyper-inflationary events are more political in nature (than economical), still, what motivation is there to collapse a currency that keeps the wealthy, wealthy? Overprinting and hyperinflation will destroy the banks, wealthy people (including the political elite) and their corporate bond holdings as well as destroy the Fed itself. Would the Fed commit suicide for the sake of bailing out an upper echelon of the upper echelon before all things break loose? That’s a lot to lose… especially considering they will be losing the system that has sucked the financial life out of American citizens for decades. I think they’d rather pull back to live another day than to die in a blaze of glory and try to re-instate a new era of financial slavery from the ground up.

In the end, this is still a numbers game, and the numbers need to add up. Not saying it’s guaranteed, but I’m from the camp that hyperinflation is not an option by virtue of the wealthy elite not wanting to shoot themselves in the head (although, shooting in the foot is just fine).

“Sure some on this board will get a “stealâ€.. but most will hold out so long they miss the next bubble… Probably when inflation hits and all your money in the bank will be worthless”

Now, stop and think about that one. If everyone’s money is going to be “worthless” (and, we’re supposing that a lot of people have a lot of money in the bank – not really), then how will the “Next Bubble” take off and sustain itself? Are you imaging a world where one can walk into a mortgage broker and get a no money down/no doc half million dollar loan as long as you can scrawl an “X” on the dotted line? That happened a few years ago, and those times ain’t coming back, unless some fool country in the third world gets so rich that they buy up all the MBS based on those loans, sight unseen. I suppose that’s possible. About as possible as my pet unicorn giving birth to twins.

The last time this country experienced a period of wage and price inflation was in the 70s, when unions were much stronger and did their part to drive wages up in that spiral. How would wages even budge today with nearly 10% official UE and the only unions with any power are in the public sector, and they’re on the defense as we speak, just trying to survive? Nope, you should do a 180 and prepare for deflation in most of your lifetime. Don’t worry, cheaper stuff is good. If you have a lot of money in the bank.

“Methinks the lady doth protest too much…”

Tell you what Kevin, wake me up when housing prices start rising 20% annually. I’ll be sure to kick myself if that happens again, in my lifetime.

I have to mirror other posters and ask – what set of circumstances do you imagine will happen in order to make property values inflate to nosebleed highs – in the next, say, decade?

I notice that a lot more folks are realizing things would get better in 2012. I truly feel that like climate change we just have to prepare ourselves for a new normal. It won’t be fixed and it will continue to decline in general indefinitely.

I’m truly sorry @OcBy. A lot of us Boomers missed the party too, trying to life an honest life and follow the rules, while the foolish had a season of false opulence leaving the world a much worse place than they inherited. I just hope when we are forced out we won’t be turned into pillars of salt…

correction: “would not”

Well, I wouldn’t say “a lot” – I would say “a few of us Boomers.”

Generally, those Boomers born prior to 1955 cashed in and to hell with everyone else.

Those looking for relief from the Boomer damage should start to see some improvement in about 5 years due to death rates.

~Misstrial

“Generally, those Boomers born prior to 1955 cashed in and to hell with everyone else.”

You seem to be mistaking Boomers for Republicans. The official Republican motto is, “screw you, I’ve got mine.”

The official Democrat motto is, “screw you, I’m taking yours.â€

Somehow, as much as I despise the (D) & (R) duopoly, I think straight kleptocracy is worse…

I’m with Polo. You are way off, Miss whatever.

OT: Citibank just dropped a ton of their student loans on Sallie Mae.

The shadow supply increases as the price of homes decreases while debt doesn’t decline, thus the shadow is almost infinitely larger than the potential buyer pool x years out as to city/neighborhood z. We can chart when price collapse will hit most areas based on trend projection (the time shown by trend lines when you simply run out of buyers v. sellers and seasonality doesn’t save the market). Finding an area or city that won’t continue to head for the collapse point, is very hard right now for California.

As for the young person saving their money: just how does one do that, truthfully and not being snide here. Where shall you put that money to “save” for your future, in 2% five year CD’s, which after tax is about 1.5% per annum and inflation is at 3-5%. The stock market, yeah, that’s gone down lately again (and look to the Japanese example over the last thirty years). Only for the richest are there real money making opportunities, and even a lot of them are now scrambling. In case no one noticed, the banks used to invest in real estate loans, and the banks have a teensy problem with collapsing collateral values and uncollectible development loans.

Do what all smart investors do ever since the stock market was founded: invest in large cap that pays a dividend. There are companies out there paying 4-9% dividends (not REIT) and are super solid. AT&T are paying close to 6% and Verizon is paying 4.5%. Those two companies are not going anywhere soon.

And who knows, you might get capital appreciation, too. Now is probably the best time to look at the equity market. You have to have courage while everyone else is scrambling.

Good luck!

“Do what all smart investors do ever since the stock market was founded: invest in large cap that pays a dividend. There are companies out there paying 4-9% dividends (not REIT) and are super solid. AT&T are paying close to 6% and Verizon is paying 4.5%. Those two companies are not going anywhere soon.”

Wise thinking. I even heard Jim Cramer (JIM CRAMER!) talking up dividend stocks the other day. Booyah!

Research some funds that invest in high quality corporate bonds and dividend paying stocks. Vanguard has a few by the name of Wellington Income and Wellesley Income. Both have a good history, are low cost, and didn’t get hit too hard in ’08.

I share your concern. Where does one turn? All the options are fraught. My advice would be to avoid debt like the plague, pay your credit card off completely every month, keep working, look for inflation protected investments. They are out there, just hard to find. Finally understand that owning a Malibu house or a Lamborghini does not create happiness. Relationships do. Work on friends and family.

I apologize for sounding like Wilford Brimley.

A few centuries back, China and India accounted for more than half the world’s GDP. Then they fell and the west rose. Now it looks like they are rising again and it seems like it is the west’s turn to go down. One wonders how long will the fall of the west last -a few years, a few decades or a few centuries???

I am purchasing condominiums in two neighborhoods in Los Angeles at the courthouse steps for approximately 20% below current market prices (60%+ off of peak prices). I am renting them out and recieving a 7%+ return on my money ( with no loan).

In many zipcodes in Los Angeles, the cost of renting is substantially higher than the cost of owning. I view this to be an indication of a floor in housing prices. Sure, there are many houses particularly in the mid to high price range that have a ways to go before hitting bottom, but I do not believe real estate can be generalized. You have to look at it zip code to zip code.

Without knowing the age of these condos, number of REOs/vacancies in development, HOA fees, HOA governance, history of special assessments, etc… I gotta say, that seems like a rather thin operating margin, and determined on a rather short timeline.

But congrats on having a big pair, and jumping in. Poised for same in So-Fla.

Hey Enzo, remember this one? Looks like one of P.T. Barnum’s suckers took the bait. It will be interesting to see the final selling price..

http://www.redfin.com/CA/South-Pasadena/1928-Fletcher-Ave-91030/home/7009350

Has it dawned on any of the “experts” that 9-10% unemployment could now be the norm?

More bad economic data today, another big rally on Wall Street. Some days seems like we’re being shuffled off to some Financial Super Dome, “wise minds” assuring the masses that there is no need for panic, the situation is under control, all is well. Please follow all instructions carefully as they are given. Continue moving ahead in an orderly fashion to ensure safety, a Category 5 financial Katrina is bearing down, but Suzanne researched this, and there’s nothing to fear, stay calm, hot lunches will be provided shortly…

Unfortunately the picture of CA as a whole is mixing areas of the state with huge variations in pricing and incomes – in the Inland Empire, prices came crashing down and it may now make sense to buy on a rent comparative basis. In much of the Bay Area on the other hand, prices have barely budged and buying is still a huge net month to month loss versus renting and saving unless you assume plainly unrealistic future appreciation levels.

That Sac Bee article was grim. I’ve been watching homes in the Sacramento area for a few years now, as we wait on the sidelines. Just looked at the list of homes I’m watchin on trulia. (A lot of homes in the $500k range) Many of them are still sitting there unsold 180+ days or have been taken off the market. Thank goodness we’ve waited to buy –because now we’re considering moving out of state.

I have told my children that they can live with me for as long as they like. They’re both young professionals and have very good jobs and I have the room. I live in a city where they can take the bus to work so they don’t need the expense of a car. The money they’re able to save is amazing. They work such long hours that they would only be sleeping in their apartments anyway. When they decide it’s time to move they’ll have their 20% to put down and prices will have fallen further. It seems like the only way to get ahead in this economy.

You sound like a good mom (:

My mom charged my “boomerang” brother rent when he moved back home. She cleverly opened a savings account & a separate brokerage account with him as the beneficiary, so as to guarantee his “permanent departure” from the nest. She then deposited all the monthly rent for about 4 1/2 years into both accounts. My mom surprised him when she revealed these secret accounts on the day that he proudly announced his engagement, and that he was finally going to move out! This painless “forced-savings” allowed him and his fiance to buy an upgraded house in a brand new neighborhood. My mom really only needed the rent money to actively secure her empty-nester “dream retirement” which definitely didn’t include my brother living at home forever! She certainly controlled her situation by covertly manipulating his spending & savings habits with out him ever knowing it.

Mom may know best, but her son didn’t. So long term she never taught him how to fish. The son went from the care of Mom to the care of his new wife. Hope he enjoys the upgraded house, because if that doesn’t work out his ex-wife will be living there and he will be back home with mom.

She taught him to fish by making him pay rent. While he got back on his feet, and figured his sh!t out, his mother taught him a lesson of the power of saving.

It’s up to the kid to realize all of this, but that mom rules.

You are doing a great disservice to your children. If your children are professionals then then have enough money to rent. Then staying at home deprives them of their full potential and is A LOT of what is wrong with kids these days.

There is something to be said about struggling in life, getting buy, spending on an apartment, meeting the love of your life, building a new family, building new relationships, etc. It builds character!

By keeping kids at home NONE of this is happening; if they are men (yes men, not boys after 18) they are not going to attract good women by living at home. Women don’t want little men who live at home with mommy.

Sure they may get ahead financially by $1000-2000 month, but that extra savings is not what life is about. It’s about finding out how to make it on your own.

I say this because I live in an area where there are a lot of 25-40 year old men living with family. They may be saving but they are losers in many other respects of life. They don’t take relationships seriously, the have mom cook, clean and do laundry, and in a nutshell they have the mentality of high school kid.

I am not saying these are your children as I don’t know you. But I have seen the results of children living at home beyond college age and it’s not healthy.

Oh sod off. Mr. know-it-all annoying pain in the ass.

Sean, I couldn’t have said it better myself………….the entitled generation did not get that way without a lot of encouragement and enabling.

@ Sean. I am one of those that you decry above. I lived at home until I was 30. Met the love of my life when I was 26, got married when I was 30, moved out and have been happily married ever since. I’m now 32.

And guess what………….I lived at home during undergrad, medical school, internship, and residency because that’s how long it takes to become a trained physician these days. In addition to working 70-80 hours a week for 5 years after medical school, and “paying to get worked” during medical school. My parents couldn’t be more proud, and my wife and I couldn’t be happier.

From all my friends who were taking out an extra $15,000/year in living expenses during medical school, and living hand to mouth during residency in California, they all thought I was the luckiest, smartest kid around. And I think I turned out just fine. I’ve had great life experience through my professional travails, made amazing friendships at each level of my education, and training, am well versed in building engines, working on cars, working on houses, building things, etc. This all because my parents never gave me a thing and told me I had to sort things out myself. I bought my own car at 17 with money I had been saving from birthday presents since I was 5 years old. I paid $1750 for a 1971 VW beetle in 1996 and drove that thing through each level of training I listed above, for a total of 15 years. During that time I rebuilt the engine 4 times, put 2 new transmissions in, changed the clutch as many times, restored the interior and pretty much every other part of the car because I lived on essentially no money and had to do it myself.

Now I make a pretty good living, and am still living frugally every month. We rent a 950 sq ft apartment and are happy as clams, content, and debt free (except my $350/month student loans that, mind you, are only so low because I DID live at home all that time). We pay our credit cards off every month, and save a decent amount of cash to buy a house some day. Probably not any time soon. Now if I could only find an inflation hedged investment…… another argument for another day.

Anywho, I wanted to shed some light on the situation you so sadly demeaned above, because if the kids are brought up right, there’s no reason to think that her children will not turn out just as well, and be successes at life just like someone who didn’t live at home for an extended period of time.

There are surely situations when continued living at home can be unhealthy, but clearly there are situations when it is not.

Marcia’s story sounds like she’s got good kids, “Mom knows best” is a dumb-ass comes home and reforms (only to have a super smart and kind mother… nice story end), and Common Sense Renter clearly has an example of a smart way to put yourself through school (while sacrificing your private life wishes of living on your own).

I’ve got a complete f-up cousin who is riding his well-off parents. His lesson is basically this: fail up. He knows that if he messes up, there is no consequence. I think this is the story that Sean knows and speaks of, which is quite valid story too. I would have to agree with Sean’s 25-40 year old story as well. This sort of behavior is incredibly lame… But it’s not the only story.

I think you summed it up perfectly, and in two words the entire real estate/financial debacle can be summed up. Personal Responsibility. Period.

And how many of the Depression/War Generation, the Generation who built America and, according to you, didn’t have everything handed to them like the “kids these days,” lived at home EVEN AFTER THEY GOT MARRIED? How many of them continued to double and even triple up well into adulthood, with grandparents living in the house or the newlyweds in the basement?

It’s unclear how a generation facing youth unemployment rates well over 20% and saddled with inescapeable and record levels of student debt (while their parents walk away from obscene mortgages and cling to their under-funded SS benefits) somehow continue to be coddled into adulthood. The kids inheriting the world screwed by the financial mess created by the boomer generation need to save, because they can’t ride the magic inflating home carpet, and are facing years of stagnant growth and horizontal wage growth.

I agree with you 100%, most young people can find a job, it may not give them enough of money to drive a bemmer or benz or pop bottles in the champagne room. I see no reason with them having to work long days and weeks.

Speaking of bubbles, I watched a video by Casey Research with John Mauldin and he says there will be another bubble – it is Biotech. 5-10 yrs from now Biotech will be what the dotcom was… I can see this happening esp. with so many stocks in the few-dollar-a-share range right now and people migrating away from RE, hi-tec, etc.

Hey Enzo,

What kind of cap rates can you get in S. Florida? I’m interested because out here in LA, 7%+ is phenomenal. I wouldnt be surprised if its much higher in other parts of the country though.

i find it funny that most of you can see where real estate is going but didn’t see it 10 years ago.frankly don’t care what most off you got to say about it now.just like owning a car we all drive what we can afford,same goes for homes,you buy what you can afford the only differences is the banks are given cheap tax money to maintain them through this “readjustment” so they got the time to do as they please.need to realize wall street calls the shots and if your going to get ahead of the (8) ball you need to think like wall street,what is their next move to profit from this? the way i see it you need to lock in on some of this cheap money for as much and as long as you can and save as much cash.profiting on saved money while paying for cheap money.

Sounds like Realtor logic. That only works if the inevitable rise in interest rates doesn’t drive prices through the floor (they won’t stay zero forever, and when they rise, home prices must fall to compensate or no one will be able to afford the payments), along with the also inevitable retirement/downsizing/die-off of the baby boomers which will increase supply and reduce demand of housing space.

Leave a Reply to Brian