California rental rates based on counties and a trip into Huntington Park for real estate deals: When will the renting trend reverse?

The financial system is gearing up for providing maximum leverage to those willing to take the dive and purchase a crap shack. Low down payment loans are now making their way back into the system and the machinery of credit is flowing nicely. I’m sure many of you are in the same boat and if you happen to have decent credit (meaning no bankruptcy or foreclosure since the bar is low), then your mailbox is being flooded with credit card offers and advertisements to buy a new car or to take on another credit card. The last time volume was this high was back in 2005 and 2006. Now I’m seeing ads coming in regarding low down payment products and also interest only loans. Yet when we look at the actual details, the trend has been dramatic in leaning in favor of renting. But not because this is some trending sensation. No. Household incomes simply do not justify current prices. However, inject risky loans again and the game can go on further. We are seeing weakness in the market in the form of low sales volume. Virtually all major counties in California have seen a dramatic drop in homeownership in favor of renting. We’ll look at the county level data but also take a stroll down to Huntington Park for some real estate deals.

Renting in various California counties

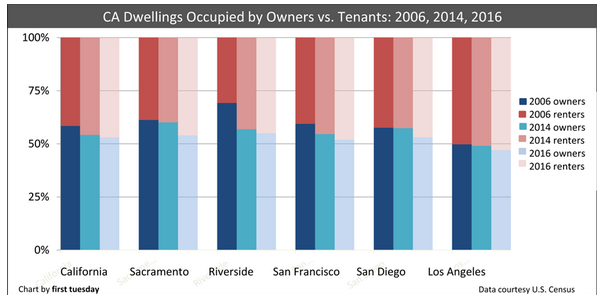

The homeownership rate across various California counties has taken a major hit since 2006. This rate differential has not recovered almost 10 years later. The stock market is near a peak. The unemployment rate looks good on the surface. So why is the homeownership rate not recovering? Because incomes have not kept up with price changes. Investors have been a dominant force since 2008. Low interest rates hide the underlying disconnect because they allow for people to borrow more while still paying an inflate price to the secured asset. Take a look at the trend for various California counties:

San Francisco and Riverside took massive hits to their homeownership rates. Los Angeles and San Diego not so much because these counties were already rent heavy areas. Los Angeles is a renting majority county (and the most populated county in the state). The LA/OC market is the most unaffordable housing market in the entire country because of household incomes and current prices. We have many readers from California but also from other states. In the vast majority of the country $200,000 or $250,000 buys you a very nice home. But this is California baby! Where that price gets you crappy schools and high crime areas and then you get the pleasure of living in a crap shack.

Today we take a trip down to Huntington Park:

2565 Broadway, Huntington Park, CA 90255

2 beds, 1.25 baths, 1,241 square feet

This place was built in 1922. Yes, nearly 100 years ago. It is also close to a very high traffic boulevard, Pacific with a strip mall right on the corner. Here is the ad:

“Sharp Remodeled Home used as 3 bedrooms (actually 2 bedroom & den) with 1.25 baths plus large individual inside laundry room. more info. & pics to come. Home located in “Walnut Park” 90255 Area. Updated kitchen with new cabinets & granite counter tops, New ceramic & Laminate tile flooring throughout interior, Remodeled bathrooms, New Fixtures, Mirror closet doors & much moreâ€

And here is the corner view:

You will be dealing with massive traffic in this area. Here are your assigned schools:

Now I know you are just itching to buy this place and want to know the price:

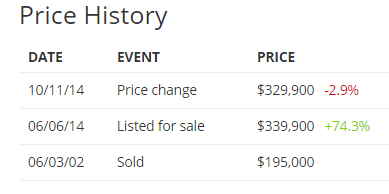

This place was listed for sale back in June of 2014 for $339,900. No one took that deal. They dropped the price by $10,000 in October of 2014. So I decided to get the average adjusted gross income for households in the area and for 2011, it was $26,779. So in other words, this home is priced more than 12 times the typical household income. Now imagine someone buys with a low down payment loan and the economy encounters another inevitable recession. Then what? As I mentioned before, most of the foreclosures in the last crash came in the form of vanilla 30-year fixed rate mortgages. If you can’t pay, you can’t pay. But then again, the Taco Tuesday gentrification crowd doesn’t mind sending their kids to poor performing schools just so they can wear a pin saying “I own in SoCal!â€

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

67 Responses to “California rental rates based on counties and a trip into Huntington Park for real estate deals: When will the renting trend reverse?”

I can demonstrate the insanity in only 520 Sq.Ft.

feast your eyes on this gem.

https://www.redfin.com/CA/Los-Angeles/1376-Echo-Park-Ave-90026/home/7055969

1376 Echo Park Avenue, Los Angeles, CA 90026

1 Bed 1 Bath for $349,999

Ladies and gentlemen we have officially Jumped the Shark!!!!!

This place allegedly had a former glory. I think he left of the hole part.

In a sane economy that place would be listed for less than half that price as the value would be in demolishing it and building a modern condo sized place. But instead of new construction and an ultimately reasonably priced place to live for someone, we get a dead listing until they lower the price enough where some knife catcher will think “It’s better than renting” until they realize the money pit renovations will be. 7 years of the FED not allowing the creative destruction we need to un-seize the economy gives us this.

That’s the problem in LA. Historic preservation BS, complicated & expensive building codes & zoning. All this has done is prevent rejuvenation, modernization and kept many parts of LA ghetto. For example. most all of West Adams Ghetto is considered historic buildings and protected, even though majority of buildings there have suffered years of neglect that can’t be reversed and should be torn down at this point. Like someone else said, the majority of LA was built on the cheap in the 1920’s & 30’s and it’s showing it’s age. Now it’s cheaper and easier to put lipstick and bandaids on these crappy buildings then fight with city ordinances, inspectors, and neighborhood councils to build something new and progressive.

I doubt that parcel is worth anything in a sane universe. No car access, You have to leave your trash can down at the bottom of a flight of stairs that are equivalent to about 7 stories at least. I am shocked that the mail boxes get deliveries up those steps. Absolutely useless parcel for development FYI it has an Open House this weekend!!!!! Who wants to go with me?

Hunan, in Woody Allen’s 1977 film — “Annie Hall” — Allen mocked what passes for historical landmark in L.A., as compared to cities like New York or Paris. I think he referenced a 1940s or 1950s hot dog stand, which had been declared a landmark building in L.A.

Here in Santa Monica, there was controversy in 2011 when people tried to save a “historical” Arby’s Burger sign on Lincoln Blvd. The Arby’s was replaced by a Wendy’s, but the sign was saved and moved to a museum for preservation and display: http://smdp.com/arbys-sign-finds-a-new-home/79817

Here’s another example of preservation BS:

http://la.curbed.com/archives/2015/03/sunset_gordon_eviction.php

God forbid we lose the facade of The Old Spaghetti Co. restaurant. I’ve been to that restaurant years ago and it sucked anyway. Made Olive Garden seem like a 5-star restaurant.

I don’t think you can even access that sh*thole in EchoPark with a car. It looks like you have to park a block away at the bottom of the hill and then take a path & walk up all those stairs just to get to the house. That is ridiculous for $673 sq. ft. Is this some kind of joke?

I know 3 people who moved to this part of Echo Park within the past few years. All of them without fail have been robbed shortly after moving in.

They were robbed before even moving in

Way too many crap traps up in the NELA area are like this with street only parking and you have to walk up and down a million steep stairs coming to and fro. I guess the silver lining for the hipster crowd is that they can get their crossfit WOD done while leaving the house. Some of my favorites from that part of town are the ones where you have a crumbling half dirt/half paved street with cars parked haphazardly off to the sides. Pride of ownership!

This is my favorite example of a fine City of Los Angeles third world street scene:

https://www.redfin.com/CA/Los-Angeles/4129-Turquoise-St-90031/home/6947389

The street view says it all: https://goo.gl/maps/rzSRj

Siggy,

If you buy that property you will be the proud owner of a SoCal estate, in the premier world class city, the same as Paris and London, the entertainment capital of the world with the weather that the whole world will envy you.

Don’t miss the opportunity! Buy now or this “boat” will leave. All your friends in US will envy you and wished they could afford to buy in SoCal like you. Who cares about the mansions in the flyover country when you live in the weather and entertainment capital of the world???!!!…Isn’t this what you hear from our felow bloggers all the time??!!!… see I learned all the comments…:-)))…did I miss any????

Siggy,

I thought I didn’t miss any, but I was wrong; one more – it’s “trending”.

Notice how the selling points include three food establishments. None of which have been around longer than a year or so. Yeah, go ahead and mortgage up with max leverage because being served food outside of the home is revolutionary. It would be interesting to see which lasts longer, the name on the front of the aforementioned fad eateries or the timely mortgage payments from the buyer of this crap trap.

Need to add “tree house” to the Realtor lexicon to reality dictionary.

Food outside the home. So hot right now.

Given the proximity to Dodgers Stadium (riff-raff central) I bet if I threw a beer bottle from the top of thebleachers, it would land in the backyard : )

Is that a meth lab or a real estate listing?

Redfin now considers this a “Hot Home”, perhaps a frenzy of multiple bids. Unreal?

Hot Home: Redfin predicts that this home will sell within 12 days — go tour it soon.

See everything is fine, Unicorns will shite skittles forever in the sky!!!!!!!!!!!!!

No doubt about it imnotPOTUS. You have won the crap shack of the week raffle with your example.

NO WAY! THE CRAP SHACK OF THE WEEK GOES TO THE ONE NEXT DOOR. YOU GUYS DIDN’T FINISH THE TOUR. If you continue down the street you will see the neighbor has a t-shirt on that says “Free Chorizo” with an arrow that points down. IT MIGHT BE THE PERFECT ZEN MOMENT!!

https://www.google.com/maps/@34.082278,-118.197902,3a,75y,14.16h,39.84t/data=!3m4!1e1!3m2!1syQ5-l_Vphmx3HJmX_VQtsg!2e0

IPFreely, you win hands down. Unfortunately your prize is a free chorizo. Best go get it from the guy before they are all gone!

That is too funny. I thought that was a street view from a shanty town in Tijuana or Nogales. What have I been saying about the divide between rich and poor in this city.

Hey, the view is nice! Never mind the tarp on the roof and the dead cars. I wonder if the Google Car driver made it out that neighborhood ok?

All time winner. This is amazing. I’ve seen some shitty neighborhoods in LA, but this all comes into focus. It really looks like it must have in 1938 when dust bowl Okies were streaming into LA.

Here’s an eye opener crap shack from San Francisco .. just sold for $1.2 million.

‘ Contractor’s special … needs everything … not for the novice ‘

https://www.redfin.com/CA/San-Francisco/1644-Great-Hwy-94122/home/635970

wow. that one may take the cake.

No worries on that Huntington Park dream home because when you’re trying to catch some peace and quiet at home but the intermittent encroachment of thumping bass and fart can mufflers invades your space, just remind yourself that it’s world class international global weather capital everyone wants to live here noise and air pollution. After all, you’d probably be spending so much time in traffic between all of that surfing and skiing during the day, you’ll only have time to enjoy the ghetto birds at night. All this and leverage too!

Thank God this time is different…

Yes it is. History repeats itself but not ever in the same way. What we’re seeing now is urbanization, economic globalization and bifurcation (just for you, What?) like the earth has never seen.

You could take a lesson from The Realist.

I read an article that says Fannie and Freddie are now losing money and this time the government is not taking steps to fix them — the policy is to let them go broke. Is this true? If Fannie and Freddie go away, you can forget about 30 year mortgages. Prices will fall off a cliff faster than you can say, “Hey, we have socialism in the U.S., of course the government is going to bail out Fannie and Freddie.” Does anyone know about this?

Not true – the government hasn’t made any decisions to fix them or not fix them. It’s in limbo. See some of the limbo-status in this article:

http://www.bloomberg.com/news/articles/2015-03-25/senate-s-shelby-signals-fannie-freddie-fix-unlikely-this-year

Yep…thats a winner for sure, if you look at the picture closley on bottom left hand side you can see the shadow of the chain link fence!

Check this house out in Echo Park. Over $1,000 per square foot in this 600 square foot 2-1 mini-mcmansion. Hurry this one will go fast.

https://www.redfin.com/CA/Los-Angeles/1947-Delta-St-90026/home/7055439?from_mobile_app=true

The taxes are listed at $430 something…

I like how the realtor says the house includes “peek-a-boo views of the Echo Park Lake.”

I guess “peek-a-boo view” is realtor spin for “you can just barely see it.”

dude, this is listed at over $1200/ SF that’s just beyond nuts…..$1,209 / Sq. Ft. holy moly that’s like Newport Beach price per foot with all the added charm of meth heads sleeping on your front stoop and gang bangers robbing you day and night! yippee! Whoever buys this house (dumb hipster?) needs a swift kick in the head

Echo Park reminds me of Mexico, but with more Mexicans.

I’m gonna borrow that Hunan. LOL

Ken, this listing is priced at $1209/SF that’s the same per foot as Laguna Beach, Pacific Palisades (559 BIENVENEDA AV, Pacific Palisades 90272) …… but with Echo Park you get that cozy feeling when crackheads sleep on your front stoop. Maybe the crackheads will scare off the gangbangers! Every cloud has a silver lining….

I’ll say this much, you gotta have balls to list that place at 800k. God damn I miss the 90’s… Relatively affordable RE. Savers and labor weren’t enemy #1 of the FED. seems like a long lost golden era. Maybe I’m just getting old…

It’s all cyclical. Up here in N. CA Bay Area people are buying houses like crazy. Last time after the crash it was a ghost town up here. This time is really not different. Rise in interest rates will flush out all the excesses soon enough. If interest rates don’t go lower, anywhere within 50 miles of a major city will be too expensive for employers to pay workers so companies will move to cheaper locations.

118 Magnolia ST, Costa Mesa 92627 – for sale for a little over $1000/SF but hey you are less than 8 minutes to the ocean….

As if the math of income vs home prices isn’t a big enough issue, there is so much more to the story in California and the Los Angeles area that ultimately will impact housing! According to Forbes, California is 48th in terms of business tax climate, 50th in income tax structure, DWP just said it would cost $15 billion to upgrade water lines for earthquake safety, L.A. is toying with mandatory retrofitting for earthquake, L.A. wants $1 billion to fix roads, 2/3 of the states budget goes to pay ‘services rendered’ such as bonds and pensions, not for services to citizens, and almost every local jurisdiction is fighting similar liability vs services problems. Meanwhile, that realtor will tell you that $1,000/ square foot, is a bargain!

Zestimate®: $339,618 . Look at Zillow, this is the going rate for this Mexican neighborhood. The bigger homes go for $400-500k. Regarding the 26K income for the area, that is only the income reported. Low reported income qualifies for Medicaid, food stamps, and so forth. Self employed people (e.g. gardener, construction worker) get to manage how much they report. http://www.mcclatchydc.com/static/features/Contract-to-cheat/Labor-law-dodge-hurts-taxpayers-and-workers.html?brand=slo

“1.25 baths”. What does 1/4 of a bath consist of? One drain for all waste elimination? A sink? A toilet? A pipe hole in the floor connected to the sewer? Is a gallon of hand sanitizer included?

Serious question, what is the .25 bath in the 1.25 baths? Just a urinal? A toilet with no sink?

.25 is a sink only. .50 is a sink and a toilet. A sink, a toilet and a shower with no tub would be .75 bath.

A bathroom is broken down as .25 for each fixture; .25 for shower, .25 for tub, .25 for toilet, .25 for sink.

Thanks for the information would think just a sink makes it a wet bar..

the market is weird, I have my beach house 17 lots to the sand in Mandalay bay at Oxnard shores, it’s 2000 built and on my street which a block to the waves,there are homes that sold for 1.5 million and at the end of my street 3million dollar homes, so I gave tenants notice to move, very little is for sale , it’s 1503 sq feet, nice place at 548k and I have had 2 calls in 3 weeks and I’m the cheapest, beach just a tiny over 300 a sq ft,and lowest HOA 198 a month, wow,,,, and it’s just a 3 unit townhome complex……. what is really going on, some say there no supply so I began tracking it and simi valley and Oxnard has held nearly same number in inventory V a month ago, thousand oaks has added nearly 200 to their inventory. I feel the market is at a stand still??? any agents want to chime in,, is society standing still or what 🙁

Yes, on many posts here, I have sang the wonderful points of Oxnard, the Newport Beach, with Tacos better than the Taco truck. I spend much time in my boat at the Marina(I never pilot it out since the Coast Guard suspended(1yr) my Charter Boat Captain license due to the Corona) with my friends and clients. You come on over and have some Tacos and Corona with me.

I love the way Mexicans do stuff. Pave the front yard to park more cars. No steps to get up to the front door. So there is a two foot step up to get to the front door. All completely against the building code. Code enforcement much? Crap schools, crime up the ying yang. Go back to that same corner in 1950 I’m sure it was nice. It’s like in back to the future. Marty Mcfly goes to the future and has town is a $hit hole. Too bad I live in the future.

Don’t forget the weekly fiestas consisting of bounce houses and screaming kids during the day and obscenely loud polka music at night. Some of them even raise chickens/roosters!

I grew up in Walnut Park and and still lived in Huntington Park until 2010. The city is insanely crowded. Too many people! When the carnival shows up twice a year traffic is even worse. It’s the city’s way of making money.

On weekends, there are loud parties and some residents even have roosters. It’s hell on earth. OK, I exaggerate. It’s pretty bad.

Andy and Gerardo, you just have a problem with Mexican culture. Anglo culture is just different. You apparently did not get good grades at your multi-culturalism classes at Jr. College. Regardless, there is little doubt that SoCal is Mexican with pockets of remaining Anglos. This is just ethnic relocation. Learn to love the Mexican culture and integrate into it, or live in your expensive ghettos, pockets of expensive homes and send your kids to private schools(e.g. Marlborough girls school in Hancock Park tuition for the 2015-2016 school year is $36,365. )

Gerardo, you just made me laugh.

A previous Mexican American manager/company owner I worked for always said that Mexico is slowly taking back what was stolen during the Mexican-American War. Mexicans are nothing if not patient.

Yes, Mexican culture is different. They brought their gang infested, run down barrios with them when they moved up from Mexico along with their corrupt government. Most of LA is just another run down barrio of Mexico.

You’re right, Carlos. The problem is that it’s so expensive. It’s one thing to live in these areas for cheap, but for even $300K it seems crazy to me. $600K+ is outrageous, and, while I’ve spent time and lived in Central/South America, I wouldn’t pay that to live there, either. That’s why we finally got out of LA a few months back. As my close friend, who’s of Mexican decent, says, “We don’t know how to have nice things.”

Sure, Mexicans want L.A. to be just like Mexico so they can work for $2 a day and have 20 families own everything.

Whoever said SoCal is La La land? Welcome to real estate fantasy land. For anyone even faintly connected to reality, use it only as your breakfast entertainment. It beats the news any day.

The average salaries for most of CA don’t support renting or buying. California wages support moving in with relatives, renting a room, or finding a bunch of roommates to cram into a one bedroom apartment.

Both retirees and college educated adults have been fleeing the state for years. I don’t know a single Boomer who is planning on staying in the state once they retire and this includes MANY lifelong Californians.

The CA housing market is in for an absolute collapse in home values.

My wife and I are boomers (I am 69, so maybe slightly pre-boomer) and are planning to stay here in Westchester, 90045. But then, we bought in 1980 and our house is paid for and we have moderate savings and other resources. It’s depressing to realize that we are the exception.

Marty, yes, financially you are set, but how do you like the changes of culture and neighborhoods. Do you still feel comfortable in walking to shul?

Why don’t you think there will be enough demand from new home buyers to offset those who sell and leave CA? New jobs being created and the city is becoming a more international destination, not to mention discount to NorCal…

Home prices outpace wage growth 13:1 nationwide…

LA not in the top 5 worst cities.

http://www.zerohedge.com/news/2015-03-26/us-housing-bubble-one-chart-home-prices-outpace-wage-growth-131

“…The math is well known to frequent readers. Nationwide, median wages have increased 1.3 percent between the second quarter of 2012 –when home prices bottomed out and started rising again — and the second quarter of 2014. Meanwhile home prices have increased 17 percent in the two years ending in December 2014, outpacing wage growth by a 13:1 ratio.

excerpts

Among the 184 metro areas analyzed, the average wage growth over the two years ending Q2 2014 was 3.7 percent while the average home price appreciation in the two years ending in December 2014 was 13.4 percent….”

So it’s sixth, and some of those areas such as Detroit had nominal prices on the floor due to overcorrection so of course a return there to something more realistic would be expected to outpace wages over the same time period. A similar yet not as extreme case could probably be made for Atlanta and Houston as well.

Prices in SF and LA never fully corrected when compared to wages so those two markets (#2 and #6 on that) list would be at the top in real terms of scope.

If anything, this provides further ammunition to the idea that SoCal is overpriced relative to its worth.

When Bert said that Obamacare will take money out of RE many bloggers laught at him and dismissed his remark. Although it was logical to make that assumption, here are the official numbers and graphs showing massive increase on Obamacare and decrease in RE. This happened in a background of lower gasoline prices.

http://www.zerohedge.com/news/2015-03-27/its-official-americans-spent-all-their-gas-savings-obamacare

As gasoline prices will increase over the Summer under pretty constant wages, Obamacare will impact budgets even more. Most of the GDP increase was due to Obamacare and how GDP is calculated. Given the globalization and flat wages, Obamacare will become the straw on the camel’s back. And wait! Not all Obamacare provisions were implemented yet. Some were postponed by Obama for the next president to make the economy even more miserable.

In conclusion, people didn’t save the money they did not spend on gas (as the offical narrative says), they spent them on Obamacare. Wholesale and retail plunged while people supposedly have more money from gas savings. Oh, I forgot!…it was too cold!

We’re commenters, not bloggers. Dr Housing Bubble is a blogger. You and I are commenters.

As a rule, when the System looks stupid/illogical, it means that there is a deeper dynamic that has so far escaped the observer. You note the increase in renting, ergo, more renters and relatively fewer owners, indicating an increasing concentration of property ownership. Pushing cheap credit on the remaining owners allows the winners to pick up more chips when those players fall, which is almost predictable. We are gradually converting back to a neo-Feudalist ownership structure, where the Big Money, which also writes the rules (such as bankruptcy laws) ends up owning pretty much everything worth owning. The pattern is too consistent for it to be coincidence.

Leave a Reply to Siggy