A history of a turning housing market in Southern California: Does the contraction in sales necessarily mean a fall in home prices?

Housing markets have a very slow inflection point compared to say the stock market. When the stock market corrects, the reaction is nearly instantaneously and the visual cues are so apparent by thousands of flashing red signs. In housing however corrections happen in a multi-step process yet will feel like watching grass to those viewing the spectacle. With a couple of decades of watching SoCal housing, the turn in the market has followed a very similar pattern. This applies to the dip in the early 1990s to the epic crash of the 2000s. Sales tend to be the leading indicator of future change. Seeing a jump in sales volume usually will indicate price changes ahead. A sustained drop in sales usually means price adjustments ahead. Of course, this is not your typical housing market because of low inventory, investor demand, and stagnant incomes but even with these new paradigms the slow turn is appearing again. For example, we are already witnessing a ceiling on what some sellers can charge. Some are full on delusional and inventory is building back up. There are still plenty of house horny buyers but the larger trend is unmistakable. Let us look at some real estate history for SoCal to see what is in store for the market.

Price changes and sales volume

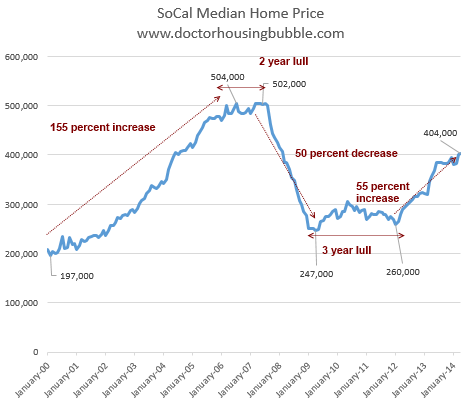

The median price for a SoCal home went from $197,000 to start off 2000 to a peak of $505,000. This amounted to a 155 percent increase over a six year window. What is interesting is that once at the peak, the median price stayed put for nearly two full years (from 2006 to 2007). Sales volume on the other hand started tanking in 2005, 2006, and hit a big dip in 2007.

Once the apex was reached, momentum grew on the opposite end and the median sales price plunged 50 percent from 2008 to 2009. So what took six years to build up, was pushed over the cliff within one year. It can be argued that when markets correct they fall faster than the speed in which they moved up.

It might be helpful to look at the SoCal median price history going back to 2000:

When the market hit a bottom in 2009, it bounced around the trough for nearly three years. Starting in 2012 prices have gone up 55 percent. Looking at the current median price and what is going on in the current market, we are going to see a stalling out in year-over-year increases. This is important. The upward volume and price movement in 2012 set the stage for the full-on house horny narrative that permeated the market in 2013. That narrative is only going to get weaker and weaker. Even investors are starting to pullback because current prices make absolutely no sense in relation to overall economic fundamentals.

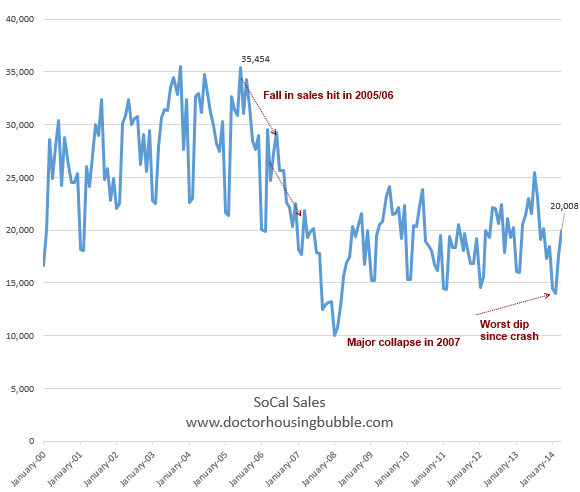

It is useful to look at overall sales volume to illustrate the leading nature of home sales:

This latest winter sales volume was pathetic ushering in the lowest volume outside of the full on market panic of 2007 and 2008 when sales completed stalled out. Sales volume continues to be weak and at least in the 2000 to 2005 run-up, sales volume was truly in a manic stage. Today, very low inventory and investors have created a razor thin market where a few properties are setting prices on the margin. Given how appraisals are done, this can turn a market quicker since a few sales to the downside will set a new trend for the correction especially in thinly traded markets.

The narrative today is odd. You have some saying that they bought in 2010 – 2012 and how great a deal it was. I fully understand that argument but what about buying today at current prices? Are potential buyers seeing something different from what we are looking at? You have house horny flippers and investors starting to think twice. Who will they sell to? Baby boomers might be locked in for the duration given that many of their adult kids are now living at home probably permanently.

There is also this notion that somehow making big bucks in real estate is all about intelligence versus blind dumb luck. These folks should read the Black Swan and understand the larger economic trends here but this would cut into their misguided narrative. Beach property by itself is not a precursor to success (i.e., Baja California has plenty of beach front property and so does Florida). I’m sure all those mortgage brokers during the 2000s also thought themselves geniuses big of what they were earning. I agree that fortune favors the prepared but the stock market is up something like 180 percent from 2009! So does that mean stock investors are bigger geniuses than real estate investors? I’m fascinated by the elementary like view of success/failure and good/evil by some of the people in the industry.

The charts and trends above should be clear. We are facing an inflection point. Big money investors are slowing down given the lack of deals in the market. What comes next? The lull. This likely results in a “come to religion†moment for sellers when their properties languish on the market for months. We are still not there yet. However, gear up for hearing more and more about those weak year-over-year price increases. Investors are already pulling back and if we use the logic of some real estate folks, since they are tied to the stock market (bigger gains), they are smarter so the fact that they are pulling back means they are shrewder than the regular run of the mill flipper that is still in it to win it and is misjudging a short-term trend versus larger macro changes. But if you are going to forget about financial history, SoCal is the place to do it. Just look at the charts above and you realize some people in SoCal underwent some epic financial carnage. Let us just not talk about that as we enter a new paradigm.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

90 Responses to “A history of a turning housing market in Southern California: Does the contraction in sales necessarily mean a fall in home prices?”

Are you saying we are basically at the price peak and no more increases until the next housing drop?

Only a fool would buy at these prices.

Except when we have Red Chinese and fund managers waiting in the wings…

We have MILLIONS of greater fools!!! MILLIONS!!!

More like billions of greater fools, the rise in housing is far from over, even if we are in the ‘lull’, we will be there for 24 more months. Don’t count your chickens before they are hatched, predictions are cheap and easy to make, only time will give you the correct answer.

I suspect the Doc’s answer is that it depends on what you mean, in no small part because the market (whether dropping, climbing, or lulling) tends to remain seasonal.

If you’re measuring month-over-month, we still may see some slight increases since summer is almost always higher than spring as spring is higher than winter. But as a longer term measure (even YoY) my interpretation is that he’s saying YoY gains in the near term will be slim, if not zero or negative.

Good post Dr. Bubble, your take on the stock market is so right, almost instantly it is gauged and a reaction happens overnight or no later than 48 hrs.

Housing is a emotion such as buy now or forever be left out, which I as you know I profess. The reality is nobody can really make a distinct call because the fundamentals and rules of the game of buying and selling anything is a constant turmoil in real estate.

I made very well over the last several years, I did a exhausted search, timing, and planning of each property which most can’t or didn’t do.

The result, so many got burned, the game was rigged by the your gov’t, banks, loan companies, builders, and the trustworthy RE agent who couldn’t resist getting their piece of the American way, make all you can now, because if you don’t the next person will leave you in the dust.

Housing To Tank Hard in 2014!!!

GDP corrected print for Q1 -1%. Once Q2 comes in we will have 2 consecutive negative growth quarters = Recession. TANKING TO BEGIN SOON!

Although I believe the housing market is heading for trouble, I would not count on negative second quarter GDP this year. Right now, the numbers just don’t support that theory. Just like last time, housing will get into trouble first and the rest of the economy follow in six to twelve months.

Housing to go up 30% in 2014 and GDP to go up 7% in Q2. Remember all the pent up demand on the side line. How about those GM (Government Motors) sales? Take that gold hording gloom and doomers!!! We are back!

Jim, you’re backpedaling. You previously called for the tanking to begin “the Ides of March” Please explain.

He’s not back pedaling. He’s giving an educated guess on what should happen to the housing market based on news from the Fed about the QE taper. The Fed has postponed their taper plans, it was supposed to more significant in March but it was just a trivial taper (relatively speaking).

Given that supposition then high interest rates and high principals don’t mix so when the taper is complete housing purchases will dwindle at current prices. Right now rates have dropped another 1/4 point (I’m looking at Jumbo mortgage rates at 3.75%) and housing purchases will still occur but they are not as frequent compared to 2013 so when rates do go back up prices *will* have to come down and the market will implode*.

*NOTE: Assuming the QE taper does happen in a timely fashion but it’s anyone’s guess whether that will happen.

@ Polo

DHB has a chart that states “Worst Dip since Crash”.

He writes a entire article saying sales is precursor to prices coming off.

Price action will trade sideways for awhile., then after escalator up, it’s elevator down.

Are you not paying attention?

If anyone dares whisper the R-word whilst QE continues to fade, I’m pulling out Hard!!@ It used to be you could ride the waves knowing that the tide would still be rising. Ain’t like that no more.

Also, I find the solution to overpriced homes is to knock them all down and put up energy efficient town homes a la Edinburgh, Paris, London, &c.

@Jim Taylor, home price declines normally occur quite a bit *after* a recession has concluded. That is what happened in NYC 1987, SoCal 1980, 1982, 1990 and 2009. If history repeats, then winter 2014 or 2015 is when this happens. And the big declines are 2 to 4 years after the recession is over, unless the Federal Reserve starts messing with the markets.

“unless federal reserve starts messing with the markets?” When did they ever NOT mess and meddle with the markets??? Shouldn’t your question be until they stop meddling with the markets?

Whether we are in a “recession” as defined by bullshit .gov stats is immaterial. The FED is going to let interest rates rise and will manipulate the data however nevessary to justify this. The QE experiment is over. They could not get the wage inflation they wanted. All they got was the mother of all speculative bubbles and across the board inflation in food and energy. The FED’s mouthpiece at the WaPo is already signaling higher rates to the markets. All you bulls who think they can manage a soft landing are drinking hopium.

And as for Jim, housimg IS tanking as we speak. A cratering of volume to levels not seen in 20 years is tanking by any definition. The price crash will come next year. 6.5% mortgages in late 2015 according to CAR and 2.5% FED rate in 2016 according to the FED itself. Tell me again why I should be in a rush to buy?

Good point, however home buyers are screwed either way. You can buy now at ridiculous prices with low interest loan, or buy at cheaper prices later with high interest when rates are up. The math will probably translate into equivalent poison.

@ Winnie

“Good point, however home buyers are screwed either way. You can buy now at ridiculous prices with low interest loan, or buy at cheaper prices later with high interest when rates are up. The math will probably translate into equivalent poison.”

Nope. Give me low prices and high rates any day. My CC rate is 15% (I think). I wouldn’t know, I’ve never carried a balance.

http://www.investopedia.com/articles/realestate/12/monthly-payment-trap.asp

Agree – Winnie’s position is overly simplistic. If you’re only looking at PI, high principal/low rate may mathematically equal low principal/high rate but the last one can be, by far, the more advantageous in many ways.

For one, it leaves the door open wider to refi in the future at a lower rate (basically impossible if your initial finance is at a historical low to start with). And any add’l monthly/annual payments you can make towards principal will go farther towards actually paying off the loan.

But more importantly it saves you money by:

1) reducing the amount you have to put in as down payment to avoid mortgage insurance

2) reducing insurance costs

3) reducing tax assessment and thus tax

4) reducing what you pay on closing costs and origination fees (which are calculated as a percent of the transaction)

And then the same damn thing will happen as in 2008-2012. Folks with cash reserves will just sit on their houses rather than “giving them away at these ridiculous prices”. Inventory will vanish (except for the occasional deal wired to insiders) and decent houses for decent prices will remain unavailable for years. Just watch.

I don’t see how we can ever have a recession again as long as the federal government is buying all of its debt via the Fed or through Belgium and as long as corporations can borrow at a negative real interest rate and buy back their own stock. The federal government can change the definition of GDP if it starts to look a little sluggish. The federal government can change the definition of unemployment if it starts to go up. I think we need to get accustomed to centrally planned economies because it will be around for a very long time. The good news is that we will never have an economic down turn again. NEVER!!!

“Housing To Tank Hard in 2014!!!

GDP corrected print for Q1 -1%. Once Q2 comes in we will have 2 consecutive negative growth quarters = Recession. TANKING TO BEGIN SOON!” JT

Not holding my breath on that one JT. I think the big YOY increases will moderate and hopefully average about a 3% YOY increase down the road. It takes a huge economic event to make prices go down 40%-50%. What is going to cause that to happen?

Hey there Jim Housing to tank hard in 2014! and just think, the Federal Reserve had projected a first Qtr. GDP of 3% and the reality was minus .5 percent so that means q2 needs to be 4.5 percent gdp to average the projected 3%. Lol Fed must be on Prozac. . Thought you’d like a little comedy this morning, there’s truth in jest.

“Housing markets have a very slow inflection point compared to say the stock market.”

Yes, but in the past the housing market was dominated by people intending to live in the houses they were buying. The current housing market is dependent on investors (you know, the same people who are known to react quickly to “inflection points” in the stock market). When trouble comes in the future, I don’t think investors will act the same way home buyers have acted in the past. Institutional investors are already largely out of the market and I don’t see mom and pop investors using their life savings to buy into a falling market. When the market starts to look a little dicey, investors will head for the exits. Also, just because everyone has memories of the recent housing deflation, the signs of trouble will be recognized more quickly and believed more readily than in the past.

One final point, as we should have learned from the last go around, median house prices become an unreliable guide to the housing market just at the point when the market runs into trouble. Housing markets fail at the bottom first. Failure then propogates upward as each level of “move up” buyers are unable to sell. For this reason, median prices will actually go up when the market is heading down the toilet. Sales disappear at the low end first causing the median to rise. To see early signs of a deterioration in prices, you need to look at sales and per square foot prices for property at the bottom end of the local range.

Here is some recent data from Conn. on price per square foot in that area and what appear to me to be some reasonable conclusions regarding same. http://www.advisorperspectives.com/dshort/guest/Keith-Jurow-140603-Housing-Market-Recovery-Is-Over.php

Keith Jurow is a person who told everyone to sell at the bottom, Now, he is pointing to middle of nowhere places in CT as a warning. Meanwhile, in Boston and New York City, where dozens of homes are sold for every sale in Jurow’s nowhere CT, the market is on fire. He seem to leave that little detail out …

Worse than that, Jurow told people to sell in 2011 because prices (in places like NYC mind you) would be down ANOTHER 50% by 2013. When the story of the bubble is told, this will be the most horrifically bad call ever recorded.

jt and Golo,

Rather than simply assert the ad hom fallacy, you should address the underlying facts and reasoning. I don’t know what is happening with sales and price per square foot for lower end homes in SoCal. If they are going up, the market may have more room to run. If they are going down (as I suspect they are) I think we are starting to see a second housing bubble burst. If you think the reasoning or the factual premise are wrong, come with facts and/or analysis.

Aside to Golo: I don’t know anything about the prediction you mentioned and if your reference to NYC housing means just the high end properties in Manhattan, I agree it would take a lot to see those prices go down much (the .1% have done very, very well under Obama/Bernanke/Yellen). For the rest of the market, however, its still early days yet. Just this morning, the Mortgage Bankers Association said purchase apps were down 3% week on week and are now down 17% year on year.

“I don’t know what is happening with sales and price per square foot for lower end homes in SoCal.”

@ BMC Burney-

Exactly. You don’t know. In the markets I frequent, $/SF is moving up.

It sure looks similar to this.

Keith Jurow Publishes

Free Excerpt Access.

Issue -23-

“Why The Housing Recovery

Is Dead In Its Tracks”

–Inventory Rising Rapidly,

Actual Price Declines,

Reflected In Raw Data

Drawn Mostly From

Connecticut And

Westchester Co., NY

If it looks like a duck, swims like a duck, and quacks like a duck.

Those who sold the bubble have for 6 years

been getting no safe investment return

on the proceeds so the banks could have

a cash folio alternate to their collateral.

Also,

http://www.forbes.com/sites/erincarlyle/2014/05/20/9-7-million-americans-still-have-underwater-homes-zillow-says/

http://pages.citebite.com/d1i8e3n1t3rpv

http://pages.citebite.com/o2c0d2e1j0mlb

(Not intended as personal forecasting:)

http://finance.yahoo.com/blogs/daily-ticker/bond-bubble-bigger-catastrophe-real-estate-bust-casey-161402082.html

https://duckduckgo.com/?q=richard+koo+qe

http://blogs.marketwatch.com/thetell/2013/09/26/richard-koo-says-vicious-cycle-taking-hold-as-fed-faces-qe-trap/

http://www.zerohedge.com/news/2014-03-06/feds-fisher-admits-stocks-are-eye-popping-levels

Even investors are starting to pullback because current prices make absolutely no sense in relation to overall economic fundamentals.

When has it ever been the case that investors follow economic fundamentals? The greater fool is older than man himself.

You have house horny flippers and investors starting to think twice. Who will they sell to?

To each other! We know that houses are just the latest baseball card craze. No need for fundamentals or occupants…

Whoops! Forgot the quotes around the fist statement and the third statement…

Hi, I’ve been a long time reader but haven’t had time to post

for a long, long time. Anyway, check out VictoryIndependece on YouTube “Housing Doomed.” This guy is brilliant and has been right on the economy all along. Also check out the interview on Financial Sense News Hour “Major Headwinds for Real Estate 2014”.

i think i heard that 35% of working age people between 18-65 are either unemployed or working part time but wish to work full time. shadowstats john williams. that’s depression numbers. 1 in 5 children in us live in poverty. if it wasn’t for welfare and snap it would be worse.

Sorry ben,

The OFFICIAL unemployment rate FELL to 6.3 percent. That is the only number that the MSM reports and that is all the people need to know…

http://www.bls.gov/news.release/empsit.nr0.htm

The official numbers are the only thing the proles need to know except most on this blog are not proles judging by the wealth income and intelligence

Home prices in mid and upper tier SoCal usually fall in the aftermath of a recession. Prices in mid and upper tier areas fell in the early 80’s, early 90’s and 2009 after those respective recessions. The only exception was the recession of 2000 where the Federal Reserve began their whole scale market manipulations.

What is misleading about the early 90’s home prices is that home prices in low end areas did not go up in the late 1980’s. The late 80’s was a mid and upper tier bubble that exploded with price declines of up to 50% by 1996 in those same areas. However since most of SoCal is low end (i.e. ghetto / barrio / white trash) the median home prices registered a modest decline while the mid and upper tier areas (perhaps 10% to 25% of the market) were decimated.

So the decline in home sales does not necessarily serve as an indicator of future price declines. Future price declines are usually indexed to recessions and the depth of the recession unless the Federal Reserve does their full scale market manipulation, ala early 2000’s or 2012.

Wrong, The high end beach communities fell far less than anywhere else, and because of that, they have surged to new highs, and sales remain brisk. Meanwhile, the less desirable areas are still a long way off from their peak. You sound like you are wishing a high end area collapses and you get a shot of buying. Don’t hold your breath.

This guy sounds like he’s been reading Dr. Housing Bubble’s blog…

http://www.advisorperspectives.com/dshort/guest/Keith-Jurow-140603-Housing-Market-Recovery-Is-Over.php

The Obama administration can see the finish line and Congressional GOP are looking to make a comeback. Neither will allow for a significant drop in nominal housing prices this year. The GOP probably wouldn’t mind pinning a housing crisis on Obama after November, but the White House controls all of the levers. They will do whatever it takes to prop up housing for another two years. The last six months of Obama’s term will be the best window for someone to drop the ball when everyone is fixated on the election and administration officials are transitioning to their cozy private sector jobs to cash in on their connections.

“The last six months of Obama’s term will be the best window for someone to drop the ball…”

This is true. The real estate bubble was bursting in the last six months of the Bush Administration. By the time Obama came in, the economy was being held together by duct tape.

GM can now get you financed for 7 years on a $ 40,000 vehicle with a minimally qualifying credit score !! The 50 year fixed subprime government-backed NINJA mortgage up to $ 1 million is coming soon !! …all of it bundled into AAA mortgage backed securities marketed by Wall Street. I know it sounds preposterous , but there’s just waaay too much fiat floating around the world anxious to accept high risk based yields.

Bankrupt European bond yields haven’t been this low since the days of Napoleon. The junkiest of high yield corporate junk bonds trade under 5% ! No way the oligarchs will accept uber-leveraged real asset deflation again without a fight to skinny down monthly payments and lending standards. Remember … these Wall Street gangsters do their payday looting from quarter to quarter. They have NO longer term vision.

Before the final Big Crash, all of the past mistakes will be repeated with vigor . The Final Act must be played before the show is over.

Not a chance, because they know from recent experience that once those loans go bad, they will be buying them back at par. They can float as many junk bonds and CDOs as they want, but private label RMBS is dead for at least a generation.

1988 top, 1993 bottom, 2006 top, 2011 bottom 2019-2023 Top(sell early).

Bought sold 25,000 acres. Avg. 1167%/acre. Avg IRR Land 27.16%/month/nnn

Bought sold 36 commercial buildings, max IRR was 38% NNN per year/not month.

Bought sold 100+ homes/condos, max IRR was 45% NNN Waikiki Beach Repos

California has same Real Estate Cycle since 1942=7-12 years up, 7-12 years down

Start selling 2018 to 2023!!!

Is that you What? Sounds like your type of gross sarcastic hyperbole – at least the projected IRR and time frame.

No F’ing way! Way too much math for me!!! We all know that math has been scientifically proven false so why waste your time doing math? Actually, I think this guy used to post comments some time ago and they made no more sense then do they do now…

That theory falls apart though when you look at the market since the last crash. It’s been completely manipulated with the low rates and investor purchases. What makes you think the top is still 5 years away? As the good Dr. shows, it looks like we’re reaching the top now…not later.

“1988 top, 1993 bottom, 2006 top, 2011 bottom”

1988 to 1993 = five years

1993 to 2006 = 13 years

2006 to 2011 = five years

“California has same Real Estate Cycle since 1942=7-12 years up, 7-12 years down”

Except from 1988 to 2011?

Really anon? Et tu brute? What is up with all the F’ing numbers? What are numbers in a world of unicorns farting rainbow flavored Kool-Aid currency? Numbers… Huh.

No sense trying to time this. The 1% own 95% of everything, they don’t care how big the bubble gets. When it all comes crashing down they still get to keep 95% or even more. Remember they are hording cash. They will just buy it all at pennies to the dollar at the bottom. Just keep your powder dry to pick up the scraps they leave behind.

Sadly… Yup!!!

“Remember they are hording cash.”

Why would anyone do this? You are losing all those opportunity costs! You can double your cash in the stock market and housing market. ALL of the SMART monies are in the stock market and housing market!!! Like they say a fool and his money…

Prices are set by what you have “cash on hand” or what you can borrow. When the SHTF no lending happens and PRESTO CHANGEO everyone has to sell to the guy with a big pile of cash for the price he sets.

Corps/1% are holding cash. Easy to do. FED pays the 1% to store the $$$.

All of that money is borrowed at stupid low rates. When it tanks, big fnn deal, they just file the losses and are free and clear and entitled to tax refunds, no less. They hired fancy suits to shield the cash pile.

Because of deflation oozing around the world, imo. Who cares about yield at these toppy prices? Well the buyers who think it’s forever house price inflation care, as they set ever higher prices. Savings rates are low because risk out there, in nearly all other asset and investment classes, is so high – in my view.

______________

5 November 2013

…Further to Sternlicht’s point that “you’re gonna hold cash”,

A new survey of family offices by Citi finds that the wealthy are cash heavy—meaning they may fall short of the investment returns they’re expecting. Wealthy families have about 39 percent of their assets in cash, according to a recent poll of more than 50 large family office representatives from 20 countries conducted by Citi Private Bank

Wow! I never would suspect that POTUS or Brain would take my bait.

But what about all the inflation eating away all the savings? Have you bought a bag of groceries lately??? Housing is a hedge against inflation!!! Look how high the stock market has gone up. We need to tell the rich that they better get on this train before we see them in the soup line…

What? hehe, but I just took it as an opportunity to post up Citbank Wealth report of a few months ago.

I enjoy your Socratic irony. It works to your advantage and helps highlight shocking inconsistencies of the vested-interests. Although it’s draining that those who really believe do have total belief in forever house price inflation and ‘everything is fine’, continually keep being proven correct in the housing market.

Not much escapes you either….hehe – example on the Doc’s last article to a comment.

________

What?

June 3, 2014 at 12:48 pm

“I just had a very good friend phone me this morning about his recent trip to Vegas for a class on real estate investment.â€

“He’s a pretty smart guy, so i’m hoping he heeds my advice.â€

How can you rationalize these two sentences? I am willing to bet that this “pretty smart guy†will NOT heed your advice…

____

“Although it’s draining that those who really believe do have total belief in forever house price inflation and ‘everything is fine’, continually keep being proven correct in the housing market.”

I believe this is the oldest con game in the books. Let the “target” think they have the upper hand in a fixed game, then when the “fix is in”, take the target for all they got. For example, imagine a fixed gambling game where you let the the guy win a few games and get the emotions rising, then you “turn the tables” and your victim will “lose his shirt”…

A bit like that episode/movie Battlestar Galactica (1978) – on the casino planet – where they’re all having a great time party, wine, music, and every bet in the casino is a winner; patting themselves on the back. The fun continues each evening until the group notice more and more of their friends missing. The winners leaving in the elevators which instead of taking them to their rooms, instead basement where they are seized by the insectzoid Ovions aliens, paralyzed, and stored for use as food, for Ovion baby hatchlings. Then when the main group sufficiently weakened, the Cylons attack. Yes – something like that would be cool. In fact it would be too good for many of them.

Housing and the stock market are going up dramatically until 2017. Then prepare for the next great depression.

Scary prediction – but in the realm of possibility.

If that occurs, recovery will be on a Great Depression timeline.

“Housing and the stock market are going up dramatically until 2017.”

Completely agree!!!

“Then prepare for the next great depression.”

Physically impossible. Depressions NEVER happen in a centrally planned economy!!! NEVER!!!

We’ve been in a Great Depression since 2008. There has not been any recovery. Just a bubble.

As stated many times, buy a $500k house now at 4.25 or wait and “maybe” buy the same house $400k at 6.5% You decide?

While the latter scenario is uncertain, it’s otherwise better in every conceivable way.

Monthly PITI is lower, down payment is lower, tax assessment is lower. And despite the higher interest rate you at least have some prospect of refi to a lower rate if they ever drop again in the future. Alas, you cannot refi away principal.

That is an impossibility! I told you housing will go up 30% per year forever! It will NEVER go down! NEVER!!!

well at least i got more money down and pay less interest

Um, Yeah. Scenario 2 much more desirable, because if you find yourself underwater or close to underwater after rates go up, you are stuck unable to move up. And what about property tax? It is 20% lower in scenario 2.

If the scenario becomes “$500k two years ago, now you can buy it at $275k / 3.85%” and people still aren’t biting, we’re in big trouble. This seems to be where it’s headed.

Doctor – I would like to bring back your favorite topic that ZigZag’s comment got me thinking about. You always talk about the ARM as a toxic loan, why not include the 30 fixed as a toxic loan as well. Why not say house horny horndogs are humping their way into new houses by using 30 year fixed rate mortgages. It was not that long ago that most mortgages were between 10 and 20 years. A 30 year was considered crazy. Many years ago in an accounting class we were using spreadsheets to calculate loan payments and interest cost and the class was stunned to see how much interest you payed over the loan if you increased the periods. I would argue that an ARM that is payed off over 20 years is WAY less toxic than a 30 year fixed.

Don’t think the prices will lower at all, even tho my mortgage broker is telling me mortgage apps are down 17% this year over last. Plus, interest rates just went up (briefly?) because Italy is screwed or something. 30 year fixed with 20% down at 4.625 today, but might be better tomorrow. People who have the money and credit are snapping up the good stuff within a week in north san diego county where I’m looking and when I look I’m being followed by at least two other couples. The good buys (3/2, 1/4 acre under 500K) are off the market in minutes. Even in the small town I’m looking at about 10-12 miles to nearest places of good employment.

30 fixed @ 4.625 today??? Your broker is raping you. I’m @ 4.375 on a 30 day lock.

Also should mention in north san diego county, houses are just not coming on the market like they used to last year. I found the average to be about 3 new places a week a year ago, now maybe one a week.

Anecdotes aside, your indicators are off.

http://www.nakedcapitalism.com/wp-content/uploads/2014/05/US-Home-Sales-Inventories-by-Metro_Redfin.png

Yeah,

I am finding 7,200 houses on the market vs 5,900 same week last year for the whole county. In fact, it is the highest inventory in the last two years.

Note again though, inventory is like the water in a tub. The level can increase by either turning on the faucet or plugging the drain.

Wow with meat and coffee prices up again, just wonder how long small and chain restaurants can hold out, they are operating razor thin now.

With Seattle at a min wage of $15 next year, I’m all for better wages but it looks like mom and pops many franchisee will fold, this is not good kids.

The Seattle $15 minimum phases in, and I believe it’s over a 7 year span to reach the full $15 It won’t be $15 a year from now.

Thanks bler, good to know it phases in, that helps for business to get a plan together.

wtf,do all you smart people believe what you preach? money is coming in to buy REAL estsate,land,real assests. no bank or stock is going to give you real returns that won’t be taxed in its real income. but as a little guy maybe if i wait a little longer i’ll be able to play with the big boys…not.save and scrape every penny buy that home and at the end its yours and no one can say”your a fool” why? cause its your home and you got a roof over your head.

“wtf,do all you smart people believe what you preach?”

Not really…

http://www.zerohedge.com/news/2014-06-05/nirp-has-arrived-europe-officially-enters-monetary-twilight-zone

It is kinda sad when my sarcastic over the top “predictions” start to look like they might actually happen. My prediction was to pay lenders to borrow money. Well, NIRP is the first step in that direction. Charge depositors interest and pay interest to borrowers. Why not? My F’ing God!

This kind of crap is the x factor what. We have no idea of what insanity TPTB will actually pull. Savers will never be rewarded again. .gov will be forever rewarding risk on behavior. Rational folks with savings get scared and start dumping stupid $ on real estate, like those red Chinese pulling their cash out of their own currency into hard assets in the US.

I am actually rooting for a drop in prices even though you like to say anyone who works in real estate is a shill. If prices actually drop, I just move back to buyer representation. I do not think you will see a drop in nominal prices until late 16 or early 17.

Frogs at a slow boil and all that…. Hope everybody has a safe in their basement.

Actually, it’s all ok. It’s deflation locking in. I suggest you look out for similar signals in the US market, and read them appropriately. In UK we’ve just got MMR in place, where lenders are scrutinizing mortgages, and finances of applicant, much more intensively… including stress testing to see if applicant can afford something like a 7% rate.

1) Nirp: “This means Euro weakens against other currencies.”

No – Deflation means it strengthens, -ve deposit rate offsets that, but probably not enough. All else equal over the medium term would imply strengthening euro

2) “European banks lend more because of the negative interest rate and 0.1% charge on deposits with central bank.”

No – instead of lending more they’ll lend less because few will borrow to by assets and property under deflation or threat of deflation. And be more fearful of lending.

3) Europeans withdraw their savings because banks ultimately pass on the negative interest rates.

In the UK at least, savings rate has plummeted this year as people chase higher yield. (less in savings is deflationary already). They’re even withdrawing from Cash ISA savings account, which offer long term tax-advantage savings (eg you don’t pay income tax on the interest, so even through savings rates are low, you get the full compounding over time)

See “…Sky News revealed that the overall outflow of savings deposits from all long-term accounts was the greatest and fastest in recent economic history.”

http://news.sky.com/story/1274709/isa-deposits-suffer-unprecedented-fall

And importantly, rather than being a yield chaser, think about protecting what capital you already have, as low rates of interest on your savings still might be advantageous in this market = mild or significant deflation is going to cause the euro to strengthen so while they may face a -ve nominal or just a big fat zero on their savings, in real terms they could be getting a +ve return.

I would be wary about reading too many easy conclusions from the MSM… this is what I believe is the real issue. Even with the push to lend, aggregate demand is weak and weakening. Would you want to put your savings in, and borrow from the banks, to compete with a new business venture in some of these markets – especially when so many competitors are zombies, and you can pick up their business assets at a cheaper price in the future?

_____

December 2013: Reuters

There are limits as to what monetary policy can still do to stimulate demand for credit to fund investments, European Central Bank Governing Council member Ewald Nowotny said.

“Credit availability is not a problem now but what we see is that demand is very low,” Nowotny, who is also governor of the Austrian Central Bank, told a news conference on Austrian bank stability on Wednesday.

“The possibilities of monetary policy are more or less limited,” he added. “It is the demand side that decides investments.”

http://uk.reuters.com/article/2013/12/11/uk-europe-ecb-policy-idUKBRE9BA0AJ20131211

_____

Shop prices fall 1.4% to record thirteenth month of deflation

4 June, 2014

Shop prices deflated 1.4% year-on-year, the same rate as recorded in April, making May the thirteenth consecutive month of deflation. May’s British Retail Consortium (BRC) Nielson Shop Price Index said that prices have been kept low as food retailers compete in the price war and non-food retailers keep value-for-money at the forefront. Food inflation was unchanged at 0.7% from April, the lowest ever recorded. Non-food recorded 2.8% deflation in May from 2.7% deflation in April. The category has reported deflation for the fourteenth consecutive month.

_____

Also ECB has stress tests coming in later this year on the Euro banks. Many weaker lenders expected to fail. The market apparently expect 30% failure of banks in the stress test, rather than fudges of before where just all banks cruised through. If they do a proper stress test – it’s an unknown how robust they’ll be – some banks may have to find €billions to recapitalize. Many other larger lenders have been taking measures to improve their capital position recently. Stress tests on how banks cope with contraction in their own economies, and other economies within Euroland. All in, I see signals of deflationary tightening.

There is no magic cure. I’m looking for the Vested Interests of assets valued up at incredible heights, to have to start selling then at lower prices in the future. Expect denial and scapegoating and confusion throughout the process. Too many VIs just believe central bank is there to cuddle them…..

Draghi and the ECB may be clever operators. Allowing some market participants to believe their own hype, and seeing loads of credit able to lend. However, smaller pool of participants who want to borrow. Aggregate demand is what matters.

This article author seems to want easy liquidity to magic things to paradise on a river of red ink, but one thing he may be correct about, is Draghi’s willingness for economies to rebalance (although it’s not quickly enough for my liking)… with some measures already taken just cushioning the process.

________

4/2/2014

Dr. Draghi Prescribes a Dose of Deflation for Spain as his latest Quack Cure

.. Here are the two extraordinary aspects of Draghi’s praise for deflation as the solution to Spain’s Great Depression level of unemployment. One, Draghi’s pro-deflation policy contradicts the ECB’s anti-deflation policy. That explains the strangest puzzle economists have had about the troika.

The troika’s practices are insane under their own written policies. Under their stated policies they should have — over a year ago — adopted maximum monetary stimulus. Instead, they have been claiming that they are waiting to intervene until the eurozone is minutes from sinking into deflation. The troika has also been claiming that if this intervention comes a minute too late the results will be disastrous because the intervention will likely fail.

Quote

“Mr. Draghi has said low inflation is concentrated in crisis countries where falling prices are welcome and necessary to regain competitiveness on world export markets.”

_____

Chart shows % of homes paid all cash by city state and price range

For example in Los Angeles 32% of all homes bought over $900,000 were paid in cash

http://www.advisorperspectives.com/dshort/charts/guest/2014/Keith-Jurow-140603-Fig-1.jpg

Interesting chart, looks like folks have some nice 401k dollars and used it along with sale of house for the cash purchase, especially over 900k.

Dr. Housing Bubble: Who will they sell to? …The charts and trends above should be clear. …We are facing an inflection point. Big money investors are slowing down given the lack of deals in the market. What comes next? The lull. This likely results in a “come to religion†moment for sellers when their properties languish on the market for months. We are still not there yet.

______

Who will they sell to? That’s what I can’t work out – so many tapped out and skint younger people? I can hope for when the standoff when that moment arrives, we get no languish, with some smart sellers more readily accepting lower prices.

Given the valuations reached. Prices have reinflated so hard in so many global cities past few years. You’d have to almost be Midas to keep pace with the increases in value as a non-owner. Even in the UK, from London-to-Manchester, often really crummy housing stock, thought to be worth mega fortunes. Weakness in just one market could feed through to others. Including perhaps tighter money, or margin calls, on Europeans owning or invested in US housing stock. There are more signs of monetary tightening or slowing in China, going from an aviation profits forecast I’ve just read.

Want to hold on to something – feeling of constant vertigo at current asset valuations, with my personal view of deflation creeping over everything. I’m not even exposed to the market; liquid, patient, cautious, non-yield chaser.

I’m wary about extrapolating too much from the past, but getting feelings we’re approaching this sort of stage… even with the slight bounce from the latest winter sales volume, which scraped near a crisis low.

1989: Prices are very expensive; affordability an issue. Sales slow and prices drop.

January 16, 2007: La Jolla,CA—-Southern California’s housing market continued to send mixed signals last month as prices reached a new peak while sales volume remained at a ten-year low, a real estate information service reported. DQNews.comâ€

NIRP is the new ZIRP. I really don’t see any tightening. I think this will go on FOREVER!!!

Can anyone comment on the BB communities outside of SAC?

Hi, could you please update this article on the charts for 2018? That would be really helpful. Thanks!

Leave a Reply to KR