Where did the real estate agents go? California has lost nearly 90,000 active real estate agents since 2008. New licenses are picking up even though sales volume is not.

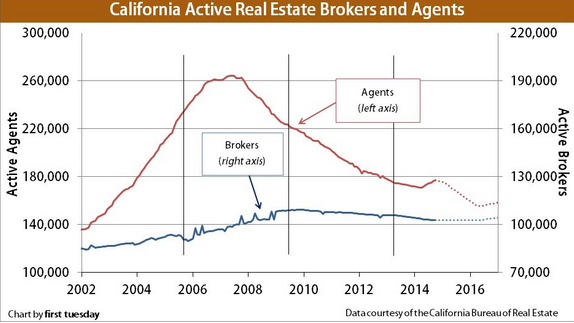

Real estate agents and brokers make a large portion of their income once a sale is completed. Escrow closes and the nice healthy commission is dished out. During the heyday of the housing bubble we had over 260,000 active real estate agents in California. Today it is down to 170,000 as licenses expire. The drop in the number of agents corresponds to the big drop in sales volume. California home sales are a shadow of what they were during the boom. So it makes complete sense that real estate agents have pulled back in conjunction with the drop in sales volume. From the perspective of an agent, you would rather sell two $500,000 properties instead of one $700,000 home. Inventory is still low so for those looking to buy, you have slim pickings and crap shacks still permeate the landscape. So where did all the real estate agents go?

The drop in real estate agents

During the peak of the housing bubble there were over 260,000 active real estate agents in the state. Today we have 172,930. This is a rather dramatic drop since entry into the profession is rather low. Sales is a hard gig. Most of those that came in during the easy money days simply did not realize that circumstances were completely unique. It was a one off situation. I’m sure many of you experienced this but it felt that everyone was moonlighting as an agent at one point.

Take a look at the drop in real estate agents:

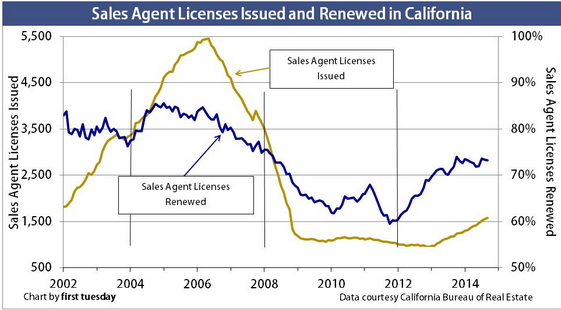

Of course many left the industry before their license expired. What is telling however is we are seeing more agents jumping into the game which tells us the masses are now getting into the party late:

Sales volume is still incredibly low so you have to wonder what is driving the numbers back into the game. Is it the quick rise in values brought on by investors, foreign buyers, and flippers? That has to be it because volume is still anemic and there isn’t much inventory to move around. Then again, the desire to make a healthy percentage off a $700,000 crap shack is probably very enticing as well. Sell a few crap shacks a year and you are living California large. Sure beats flipping burgers.

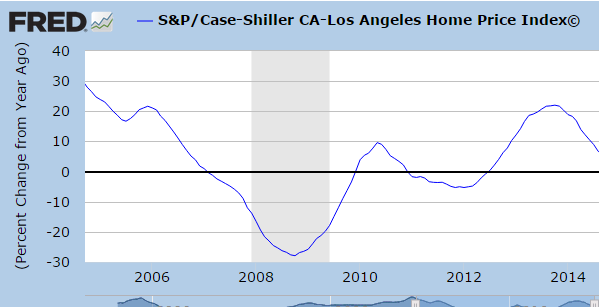

The momentum is showing up in price gains as well:

2015 will put the stalemate to the test. With the fever of 2013 washing away will people buy merely to keep pace with inflation? Or is this simply going to be another iteration of the boom and bust mentality of California where slow gains are too boring so people will run at the first sign of a fracture?

The fact that we are seeing a bump in new real estate agents tells me that the frothy mentality of 2013 is permeating into the minds of the general public. This year already I have heard people at the grocery store talking about real estate and how “they know someone making tons of money†from being in the industry. I always wonder if it were so easy, why not go out there and give it a whirl? Just like those trying to justify the price of these crap shacks. If they believed their own hype why don’t they put the money down on this obviously screaming deal? Nope. They just assume more lemmings will line up to keep the party going. That is how bubbles form and pop by the way. At this point in the game it is speculation. Those crying that they missed out are really stomping their feet that they are not good market timers. If you are buying for 30 years, what does the current fluctuation matter? This is the mentality that harms people when they try to time the stock market as well instead of planning long-term and dollar cost averaging into a broad base of the market. Instead, they want to chase the next Tesla, Twitter, Google, or whatever is trending at the moment.

Seeing more agents dive in when sales volume doesn’t warrant it is interesting. You can see from the earlier chart that from 2008 to 2013 new licenses remained fairly steady. Yet in 2013, the pickup started just in line with a number of investors pulling back. Apparently many new real estate agents are coming back into the game to play.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

62 Responses to “Where did the real estate agents go? California has lost nearly 90,000 active real estate agents since 2008. New licenses are picking up even though sales volume is not.”

With looser lending standards this year, 2015 looks bullish for housing. Expect Yellen to enact QE4 and fuel the fire further.

Just like I said on many occasions, no Housing Tank on the horizon, at least till 2016. The inventories at all time lows, the mortgage rates are at the new lows, the Fanny and Freddy just introduced new sub-prime with no money down (3%) + Nobama is talking the mortgage fee reductions, etc. QE4 is coming, no rate hikes in 2015. As soon as stawks start to go down (along with the howzing), moar QE will be unleashed upon us. Beware of the Felon Yellen Ideas of March 🙂 🙂 🙂

“moar QE”

You give yourself away, Mr. “A Guy From Seattle.” Learn to spell ‘more’ correctly than come back with new name and try again. 🙂 🙂

Now, try to prove me wrong… :p

/btw, i have never tried to hide my name :p

welcome back …. you always amuse me

Commodities started crashing last year. This is usually signals recession. Once the effect of cheap oil (i.e. massive job losses in Texas, North Dakota, Pennsylvania, Alaska, Louisiana) kicks in, the Fed can’t QE4 until long after this happens.

Also real wages increased by less than the official rate of inflation, so the real estate boom is over.

Never mind the stealth QE. Like the FED doesn’t do the currencies swaps with ECB and BOJ. The currency swamps do not show up as the excessive reserves on the FED’s balance shit because the US$ outflows and the euro, yen inflows. Now, the very same monies come back and buy moar treasures. Keep in mind, the QE has never ended. QE4 is coming any time now. So, basically, the FED does QE via its subsidiaries such as ECB and BOJ, which are just other branches of the FED.

Sleepless in Seattle,

I agree with your statement about the FED. You are right on that one.

i haven’t had a raise in 20 years.

Doc,

Some comments.

1. In CA, a Real Estate Agent license allows a person to act as either a licensed loan officer or realtor. A few agents act as both loan officer and realtor but most pick on or the other, so the drop in licenses issued and now the bump up does not necessarily coincide with realtor positions. Any evaluation of agent activity must take this into consideration.

2. Licensing requirements under Dodd Frank may mean that the non licensed loan officer allowed in CA prior to the crash is now getting licensed so as to return to the business in the future. This could also distort actual agent numbers.

3. Previously, large numbers of agents in CA were part time housewives, etc. With the crash, they bailed out like loan officers did. With the economic conditions, could this mean that they are returning to the RE field, along with loan officers?

3. A study in CA was done in about 2000 regarding sales among agents. Less than 10% of the agents sold 10 or more homes per year. I would imagine that this remains the same. Will this practice be the same with the new licensees?

You may very well be right that the perception of a recovering housing market is causing the uptick in licenses. However, due to demographic and economic considerations as you so often point out, any faux recovery will not last.

Every time I see people getting into the game late, it reminds me I should be getting out.

With the top 10% of all agents making 90% of the income, being a RE Agent isn’t a sure thing for anyone but those who work damn hard, have the patience of a Saint, to deal with the unrealistic consumer and a huge referral network or farming campaign.

As a lender, I don’t like working with most of the agents I run into, as they can be pretty harsh to deal with, but I do respect the ones that do it well and greatly appreciate the referrals from agents that trusted me over the years.

I also think that peak in licensing may have been greatly driven by people getting into lending, during the Liar Loan Years. Once we went back to full doc loans, at least half of the brokers got out of the business and hence a non renewal of their RE license.

@Hello:

re: “Every time I see people getting into the game late, it reminds me I should be getting out”

I forget who said that the secret to making money was “Be bold when others are fearful, and fearful when others are bold” or something to that effect.

Warren Buffet

Buffet I think

Artie Lange

I saw several open houses in Woodland Hills this past weekend. None of the houses (save one) looked like their Redfin photos. They all looked pristine and gleaming in the photos. Up close, they looked … lived in. Dirty walls, stained carpets. One house in particular I’d want to fumigate before living in it. Lots of kids stuff, and pet bowls.

One house was empty, the owner having moved out. Balconies overlooked a steep drop (Woodland Hills has many houses built into hills or overhanging canyons). The metal railings were wobbly. I thought if I’d leaned on them, they’d break.

I was the only one at that open house. I told the realtor about the wobbly railings. She thanked me and said she’d inform the owner. (Do realtors ever inspect the houses they’re selling?)

Only one house looked as pristine as in the photos. It had been completely refurbished with new floors, paint, stainless steel etc., and was staged with nice furniture. So that was to be expected. But it was overpriced. The house next door — same lot and house size — had just sold on Dec 31 for $165k less than the pristine house was listed for. And I doubt the pristine house’s refurbishing cost anywhere near $165k.

I think I may have been at that exact same house this weekend, the pristine one. There was one couple there when we arrived and our agent told us the house next door sold for much less recently…and it had a pool. Although the house was nice inside, it looked like the owners had cut corners on updating it and the back retaining wall was cracked and leaning forwards. Looked like a money pit.

We are also looking in Woodland hills and saw 4 houses last week. None looked as nice as in their pics. Very old and lived in and priced much too high.

People are jumping in despite low volume because there are not very many other jobs for Barbies with a high school education and skill set. It’s either sell houses or cosmetics (vitamins whatever). Industry has gone lean and secretarial positions are now rare.

??

… the Barbie’s ran out of ‘sugar daddies’ ; So, sell property .. at least it’s something

I have a workmate who’s husband is a RE agent. He hasn’t had a sale in 21 months.

But he’s made no effort to get another job, or retrain into a new field. She told me he will start making money “when it picks up again in a few months”.

The business model of real estate brokerages is good for one thing: To make people work like dogs and provide little benefit to society in the process. In Las Vegas, if you become a real estate salesperson (agent) and you manage to sell a typical single family house for $175,000 and get your 3% commission, it probably isn’t enough to break even. The MLS membership fee is in the thousands (not hundreds), and by the time you pay for the business license, the monthly fee to your brokerage (e.g. Re/Max, Century 21, Coldwell Banker, etc), and gasoline, $5000 may be what you need to break even, assuming your time and the wear and tear on your car is free. So to survive, you probably will be forced to put in crazy hours. The incentive for the brokerage is to hire the maximum number of salespersons / agents possible because even if an agent sells nothing, the brokerage still makes money on the monthly fee collected. In a world where everyone walks around with a smartphone, technology has essentially made this occupation obsolete, as everyone could theoretically access all the information they need wherever they happen to be. Given the popularity of Airbnb and Uber, I am surprised that the MLS maintains something close to a monopoly on the market. There is a lot of money at stake, and selling properties directly from person to person would benefit both buyer and seller.

Las Vegas is known as one of the few cities where Uber is banned. While self-driving cars will make cab drivers obsolete soon anyway, in the meantime, the taxi cab companies have a business model that is very similar to real estate brokerages. Drivers usually rent the cab for a daily or weekly fee, so the incentive for the cab company is to hire the maximum number of drivers possible. The more drivers, the more revenues. From the perspective of health and quality of life, a 5-6 hour shift is probably enough, but that earns a driver barely enough money to pay for the lease, nevermind the gasoline. The result is a workforce that is severely overworked, while another 40 million sit idle and wait for their EBT cards to be recharged.

The best thing going on in the economy right now is the trend towards more part-time jobs and contractors rather than permanent employees. But the progress being made is painstakingly slow.

Please explain “The best thing going on in the economy right now is the trend towards more part-time jobs and contractors rather than permanent employees?”

That would seem to be a bad thing to me… as it would result in a poverty-stricken underclass. I’m quite curious why you consider it a positive.

I thought I read in an online article that Uber was allowed in Las Vegas?

I grew up in Illinois, moved out here @ 25, and that was over 15 years ago. I’m entrenched in the daily grind and rat race that is L.A., I honestly don’t even remember what it’s like to live anywhere else.

“I honestly don’t even remember what it’s like to live anywhere else.”

The answer is: much better than living in the rat race. Actually I wouldn’t call that living; it looks more like surviving. I left the rat race more that a decade ago and I never missed it for a second. The best decision I ever made.

All the RE agents left cuz they were mostly ex-strippers turned agents, and now there’s more money in the Porn Industry in the San Fernando Valley than selling crap shacks on the Westside.

The L.A. Weekly had an article a few years ago, about how the internet is killing the porn industry. There’s so much piracy, plus tons of free porn (amateurs uploading their own home-made videos), that consumers no longer feel obligated to pay for porn.

So while porn is prevalent, the porn industry is suffering the same problems as the film, music, and book industry. Piracy and a consumer expectation of free stuff.

The San Fernando porn industry’s gross revenues have apparently dropped in the billions of dollars over the years.

You’re way behind on the news–the porn industry in the San Fernando Valley has left. A recent article in the L.A. Times (or somewhere) noted that filming permits in the Valley have dwindled to almost zero.

Why? The new condom law passed by L.A. City which mandates the use of condoms on porn sets. Well, it seems that production companies can’t live with that so just like with the “regular” film industry, the porn film industry has moved production to locations without restrictive regulations and business busting costs.

And they passed the law for “the children”, or someone….When will governments ever learn?

I know all about the new condom law’s effect. I’d heard the porn industry didn’t move all that far — just into Ventura County.

Many agents have no idea how to represent buyers or sellers. They think price = sale = commission they don’t know all things involved in a sale and how it can go South very easy.Very few do homework, and will take any listing, which does a huge dis service when the listing lingers with no showings.

Like my top sales people would say, “I don’t train green-peas let them learn their techniqesc

TO continue, and learn how to build a customer base. Most RE agents think they earn a 3% spilt because they passed a test?

I know a local broker and she explained to me once the 3% is split 50% – 1.5% to the agent and 1.5% to his brokerage/office.

Yes that is true Calgirl most split. Look, I believe the avg. agent makes maybe 30-40k a year so it is not rich time. all I ask no matter what you make, if you are working at your job or profession be professional most agents I come across don’t.

Many RE transactions are like being a lawyer these folks go to school for six weeks take a test and all of a sudden they think they know what you should sell for and buy for without any logic, just sell and buy, get quick 3%, and move on to the next unsuspecting buyer and seller?

We tried buying at the end of summer 2014. We have looked for 6 months and we have stopped looking. There are bidding wars on homes that look great in photos (my favorite phrase is “gleaming hardwood floors,”) but in person the homes are beat up and in need of serious rehab. I don’t meant they’re outdated (that I can live with) The sellers have the audacity to say that the home is for sale “as-is.” We toured one such home and there was ACTUAL ANIMAL URINE on the carpet in the basement, and the “gleaming hardwood floors” had been stained a horrid color because I suspect the urine problem was not limited to just the carpet.

I still have real estate people (lenders, agents) calling me every day to see if I am still interested in buying a home. After 6 months and seeing what people are willing to pay for absolute s*** that was selling for 50k less only one year ago, I say no. We’re not looking anymore. I’ll rent forever if I have to…because buying in this market means a 10-12 year commitment, minimum. (Seems to be the case, at least in Denver, where we live.)

Bye.

Most of the foreclosures in SoCal happened from 2007 to 2010. Federal banking laws allow banks to keep foreclosures off of the market for up to 10 years. So we are 3 to 5 years away from having a normal (not artificially low inventory) real estate market.

My thoughts exactly.

Interesting. Do you have a link to this? That would indicate a coming wave of foreclosures should be hitting the market in the next year.

For all the crowing about how badly the rich want to house-up in L.A., sure seems like they aren’t exactly tripping over themselves to pay just anything…

Palisades: https://www.redfin.com/CA/Pacific-Palisades/580-Chautauqua-Blvd-90272/home/6841015

Calling all freshly minted Chinese millionaires to Arcadia: https://www.redfin.com/CA/Arcadia/445-Walnut-Ave-91007/home/7238376

Hollywood sign adjacent rich: https://www.redfin.com/CA/Los-Angeles/3321-Lugano-Pl-90068/home/7129842

RPV “Cartier” prestige: https://www.redfin.com/CA/Rancho-Palos-Verdes/30095-Cartier-Dr-90275/home/7744069

Holmby Hilltopper: https://www.redfin.com/CA/Los-Angeles/438-N-Faring-Rd-90077/home/55582478

Uber coastal prime, new burger joints on Sepulveda adjacent, South Bay price appreciation factory: https://www.redfin.com/CA/Hermosa-Beach/3224-Hermosa-Ave-90254/home/6713449

The hills of Beverly Hills: https://www.redfin.com/CA/Beverly-Hills/9610-Oak-Pass-Rd-90210/home/6833417

People’s republic: https://www.redfin.com/CA/Santa-Monica/1107-Carlyle-Ave-90402/home/6771468

Those are fabulous properties that are going to make some very successful people, very happy. Great for entertaining and hanging out in these 74 degree January days.

I have notice more “Get rich quick” ads on radio recently. The guys (and gals 🙂 ) offer their “how to become millionaire flipping homes” programs. Is it just me or it is 2007 dejavu all over again…

I heard a radio ad for a flipping seminar today. The guy said he’ll show you how to make $20,000 a month with no money down, risk free.

imfromcolorado …good news for you, Co. like Texas are seeing storm clouds on the horizon, low oil prices will really hurt those two states. As usual Denver is a boom bust all the time. Live by this, never ever overpay in Denver for property, it will break your heart and pocket book in a NY minute.

California is just as much a boom and bust real estate market! The real problem is anyone who chases the real estate market after such meteoric rises, either by becoming an agent or buying ‘high’ is probably going to lose, or be stuck for years before there is positive equity! People get caught up in the emotion, rather than take a step back and objectively make their decision. It gets worse for those that will grab anything and the L.A. area is a perfect example. My opinion is that roughly 80% of the L.A. area is undesirable as a place to live, and the 20% that is desirable, is priced accordingly, sky high!

But your argument is self destructive, and you admit it by saying “takes years for positive equity”. True, but do you think the worry-warts that bought in the 60’s, 70’s, 80’s, 90’s, or 2000’s are worries about that now? Don’t you think in the 2020’s and 2030’s these current issues will all be history?

RE always goes up.

Great point, JN! About 80% of the L.A. area is largely about lowered expectations being backstopped by the mirage of the sunshine speculators brigade rhetoric we like to poke fun at. Being stuck in a mortgage and unable to make a non-destructive move due to it doesn’t sound very appealing, for any amount of time.

Some unrealistic folks who have obviously little experience with the turning of events over time take the simple minded path of pointing to mostly nominal gains made by others over the decades, conveniently ignoring the plight of those significant masses throughout the decades who played the game and got burned or have net zero gains.

Good thing they are the ones who are worried, as is made clearly obvious by their very presence on a blog raising skepticism of the always goes up marketing message. If they were confident enough in their positions, there wouldn’t even be a desire to read blogs such as this, much less comment.

@The Realist

i bought inland in 1991, was upside down until 2000, then the price exploded during the bubble years to more than double what i paid. When i sold in 2005, after the bust that same area was back in price to the 1991 level (some even less) now that area has recovered but only to about half what i sold for in 2005. after the sale my X went and re-bought a newer home in a nicer, area she IS STILL UPSIDE DOWN DOWN.

so in my 24 years of California real estate experience I’ve only seen 5 years WHERE THE PRICE TO LOAN WAS “NOT” UPSIDE DOWN. this is a fact jack, if you don’t time the market in California YOU. WILL. LOSE.

@JN, you are correct. 80% of Los Angeles and the Inland Empire are garbage dumps. When family and acquaintances from out of the state visit this area, they are shocked at what a filthy rat’s net SoCal is.

Now, Orange County is (mostly) nice, and San Diego is gorgeous.

Interesting,

If you would have just kept that 1991 house like a normal person, it would have tons of equity now and you would be 24 years into your 30 year mortgage. Almost done. It’s not societies fault you are playing mortgage games.

Buy, pay 30 years, retire. ITS SIMPLE

80%? Give it a break hater.

You mean the 80% NOT including San Dimas, Claremont, Chino Hills, Upland, Rancho, North/South Fontana, Eastvale, Norco, Corona, and the Tyler, Hawarden, Woodcrest and Mission Inn areas of Riverside? Oh and Elsinore and Temecula. So basically that leaves the area in between the 10 and the 60. I’ll give you that but that is not 80%.

Thanks. I’m relatively young (29) and grew up in Denver. My parents said they’d help my husband and I purchase a home but I’m too scared to commit right now, oil prices being what they are. I just don’t understand how others my age are able to buy when they have a ton of debt. I feel left out but I can’t justify buying in this environment. Seems very frothy. Thanks for your insights.

I’ve just read on the Seattle housing bubble blog that the east side (the king county area between lake WA and lake sammamish, east of the city of Seattle) http://seattlebubble.com/blog/2015/01/12/eastside-prices-hit-another-time-high-december. I know, Seattle is different from So Cal… is it, though?

Sorry, I missed at all time high in my post…

Doc: The fact that we are seeing a bump in new real estate agents tells me that the frothy mentality of 2013 is permeating into the minds of the general public. This year already I have heard people at the grocery store talking about real estate and how “they know someone making tons of money†from being in the industry. I always wonder if it were so easy, why not go out there and give it a whirl? …Seeing more agents dive in when sales volume doesn’t warrant it is interesting.

_____

And ‘This is how bubbles pop’.

Fully agree Doc. Great entry; good reading.

Seeing yet another example of that pop it in oil sector, as more and more market participants have piled in wanting a slice of projected long range higher profits. Causing excess, overcapacity, malinvestment, super-bubbles.. all those projections based on $100 barrel oil being the minimum base for the future. Attracted furious competition wanting a slice of the action. Now recoiling energy sector, especially from those most exposed, such as companies who were exploring for new oil field supplies, as the competition created a world glut of oil. A lot of malinvestment being exposed, and it will continue to play out.

It’s natural for the expectation of larger gains/profits to bring in more competition wanting a slice of the party easy money – but cautious market participants will be careful about getting pulled into the fantasy, putting big hard money down to try and stake a claim to it, with debt and at higher prices, as others also pile in. For soon after it is likely to pop!

_____

“Profit margins are probably the most mean-reverting series in finance, and if profit margins do not mean-revert, then something has gone badly wrong with capitalism. If high profits do not attract competition, there is something wrong with the system and it is not functioning properly.†– Jeremy Grantham, Barron’s. (His main view seems to be a ‘fully fledged bubble’ with S&P 500 hitting and passing 2250 – but he is open to possibility of market cascade before that – then a hard reversion to mean).

ECB is about to announce QE for the EU on January, 22nd. Watch it closely, as it is a good news and the markets (the DJI) should rally at least 500 points.

I feel the real estate flux is in part to people that have exhausted their unemployment benefits and a hope of a new growing industry. It doesn’t matter how may of these people make sales in the new economy every dollar helps. Recently I went to an open house and the agent was flipping through his smart phone and I saw him looking at an ultrasound. The guy had a very abrasive personality and a pair of Versace shoes. He was trying to look the part but clinging to an appearance might be his only solace. By the way the house was overpriced by LA standards.

Most agents like most employees today just read from a script. They are programed to answer questions in narrow window. Try throwing them a question not scripted they look like deer in headlights. I had one the other day and she said, “obviously you are well verse in RE so I don’t care to research your questions nor do I know how to reply please call someone else?”

Sleepless,

It looks like the market did not read your blog post.

michael ..What’s the old saying, by the time the street hears it to late to make or lose money. I have learned one thing ,when ever I hear good news is coming I do the opposite, it is called putting it out there to get the non players involved.

sleepless… Just my likes and dislikes but I have been to Seattle many a times ((business), you couldn’t get me to live there no matter what kind of deal I got, it is place when I get off the plane I ask myself, when and how soon can I GET A RETURN FLIGHT.

Again just me, I’m not a Northwest guy, hope I didn’t offend the folks who enjoy it, but as a former Ca. resident the place gets ripped so many a times maybe I take a deep hard look in my travels. I find many a town has issues in this country, just that Ca. is ten times bigger, so everything is magnified X 10?

Having lived in both Seattle and LA, both are uninhabitable messes and I’m glad I no longer live in either place.

Leave a Reply