The inventory is coming back just not in manic areas – at least not today: Some markets reaching new peak prices but competition is fierce because of lack of inventory.

The good news for our inventory starved nation is that supply is indeed increasing. The trend is positive this year and it is starting to look like we reached a bottom when it comes to the lack of inventory. The only caveat in this is that it is unlikely to be in an area where you are looking to buy. Now we have readers from all across the country and the positive news is that the pressure valve might be opening up this year when it comes to the selection of homes. Yet we also have a large contingent of California buyers looking to buy in very select markets. There is little indication that inventory is coming back here and some of these markets are actually making new or close to new record highs when it comes to prices. Let us first look at the change in nationwide inventory and then target a few prime SoCal markets.

Nationwide inventory coming back

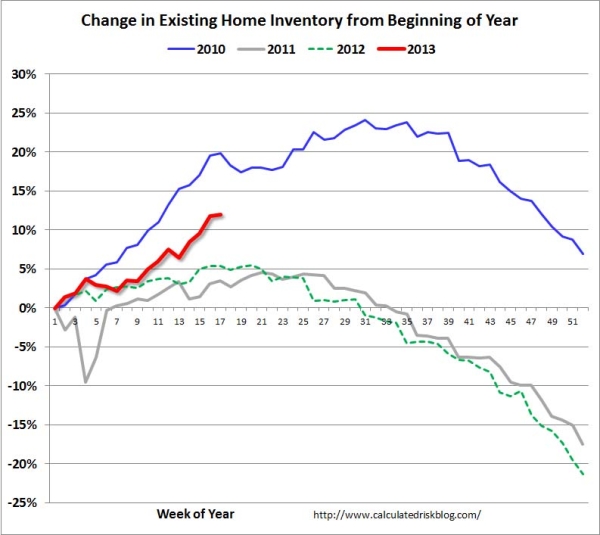

Overall it does look like inventory is starting to come back:

You can see that inventory is now up by double-digits from the start of the year. Part of this is seasonal but you can see that in 2011 and 2012 this seasonal pattern got smashed. This year it looks like the trend is starting to get back to more normal levels. Now this will help since one of the major reasons prices are screaming higher is because inventory is so incredibly low. You hear nonsense that investors are a small part of the market but that is baloney. In SoCal we have something like 34 percent of all homes being purchased by investors with all cash. This has been the trend since the bubble popped. It makes a giant difference when you are battling it out for a tiny number of available properties. We can also see the lack of normal buying by taking a look at purchase applications for mortgages:

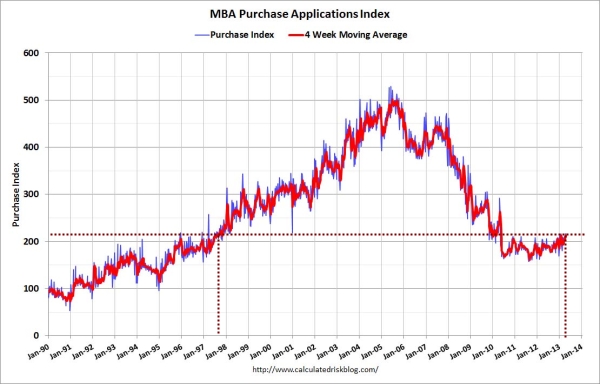

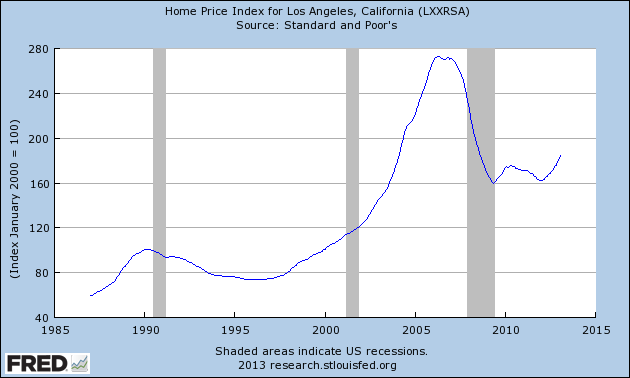

The volume of purchase applications is at levels last seen in 1998. Yeah, the market is booming because of demand right? So it is clear that inventory across the country is starting to ease up a bit. Yet in prime markets, this is not the case. First, I wanted to do a price check on a few areas from peak, to trough, to where we stand today based on the Case Shiller LA-OC index:

So we’ll use this as a measure for prices during snapshots in time:

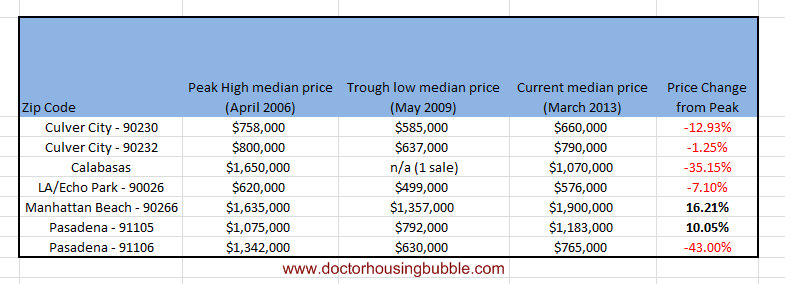

Now remember that in 2006 we were in a delusional mania. If you look at the above chart, you’ll see that some places like Manhattan Beach are now up over 16 percent from the crazy peak in 2006. The 91105 zip code in Pasadena is seeing similar changes. Other areas are off from their peak but some not by much. What is interesting is the inventory in these markets. Take a look:

Simple supply and demand. With such a limited amount of supply and added leverage from low interest rates, if you are looking to buy in these markets you are going to confront manic like scenarios including bidding wars and having to write a Jane Eyre like letter to the seller begging them to allow you to spend $1,000,000 for a Great Depression construction home.

I think most reasonable people can see that the very little supply is causing some odd market behavior. Yet this also highlights the regional nature of real estate. While the Case Shiller shows home prices in the LA-OC region being down by 32 percent even after the recent rise, it is obvious that some areas are not down, but to the contrary are hitting prices that are higher than the manic 2006 era.

Nationwide inventory is picking up and so are prices. Yet in some areas it is as if the bubble never happened and now you have the added benefit of record low inventory coupled with investors, low rates, and the momentum that comes from the media cycle constantly talking real estate up.

Â

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “The inventory is coming back just not in manic areas – at least not today: Some markets reaching new peak prices but competition is fierce because of lack of inventory.”

Charles Hugh Smith has an interesting take on this.

http://www.oftwominds.com/blogapr13/bubble-symmetry4-13.html

But, you know, it’s always different this time.

Shoot, pull the inventory graph for Corona 92880 zip. 350 homes down to less than 50! Approaching a 90% inventory drop.

If the last 6 months have been fun, how’s the next 6 months going to go?

The prevailing views I’ve been reading on this blog are:

1. Banks are holding back inventory and are the primary cause of low inventories

2. Investors are outbidding prospective homeowners and are the primary cause of rising prices

It’s commonly accepted that:

A. Foreclosures were less common in affluent areas (such as Manhattan Beach) and banks hold fewer properties in those areas in comparison to the IE or Phoenix.

B. Investors will rarely buy-to-let in affluent areas since the price/rent ratio doesn’t work out for them.

Therefore, if inventories in affluent areas are down and yet prices have risen quicker than other areas, doesn’t it reason that banks aren’t the ones holding down inventories in those areas and investors aren’t the ones bidding prices up in those areas? That the low inventories and rising prices in those areas are “organic”?

By the way, Dr. HB. The snapshot is a horrible way to look at prices since the dataset is so small. A rolling 12 month average

Looks like this might be hitting close to home MB. I don’t agree with the premise that banks are holding inventory down more than the reality that we have all these other programs that are dragging out foreclosures. Also, from the data we have seen, foreclosures take longer in wealthier areas simply because people have more resources to draw out the process. You make a good point on the renting argument but has this always been the case in these markets? Even during the last price spike people were buying in affluent areas for the mere sport of appreciation. I doubt people bought in Manhattan Beach for rental gains in 2006. Yet many bought to flip for quick appreciation gains.

What you call organic might also be called speculation. To each their own I suppose.

I’d be curious on the 12 month average as well. Do you have a link to this MB?

In MB, 4 foreclosures sold in 2008, 13 in 2009 and 6 in 2010. I don’t have 2011 or 2012 data unfortunately. While it’s true that lenders will give more leeway toward affluent owners and affluent owners are more likely to know the ins/outs of the system to fight foreclosure.

RealtyTrac currently shows 6 bank owned residential properties and 8 preforeclosures.

My point wasn’t that distress sales don’t occur in affluent areas, of course they do. They generally occur in lower rates than less-affluent areas, especially areas where there has been a lot of new construction.

Flipping has been around pre-bubble years, that’s nothing new. If I saw an influx of flipping where the same home was getting flipped multiple times in a short span, I’d be weary but I don’t see that happening much anywhere in Greater LA.

DQnews.com would have data for a rolling average, but I do not. From other blogs it looks like MB is at 2004/2005 levels, maybe 15% off peak pricing overall.

It’s easy to blame banks for low inventory in South Florida where there are a lot of bank owned properties and they can affect the entire market. And it’s easy to blame investors/institutional investors in markets where the cap rates are low like Phoenix.

But if those elements are missing/less relevant in Manhattan Beach, what’s causing prices in areas like Manhattan Beach to jump upward as well? Might those same other elements have a greater correlation to areas like Santa Monica, WestLA, Pasadena as well? It’s pretty hard to find a SFH that pencils out for investors in those areas too.

I don’t think people said it was only banks holding inventory for the lack of supply. I think its just easier to blame banks because they are greedy short sighted fcktards Its also underwater folks, folks that can’t find or dont want to find decent replacement costs for housing once they sell, etc.

My personal new ridiculous recent attempted fix/flip is below. A whopping 1380 sq ft for 1.1 million after buying it for 600k in August. At least you’re next to a bunch of big buildings and on a corner for double traffic….but Runyon is close so you’re all set….

http://www.redfin.com/CA/Los-Angeles/1604-N-Vista-St-90046/home/7115606

I think some of the biggest appreciation in all of LA and where prices are now new records is the prime area between 3rd street north to melrose and then a little east of la cienega to a little west of larchmont.

One of my favs is this “well maintained” gem for $1.15mil (cue ‘if you want to view paradise, simply look around and view it’ from the original Charlie and the chocolate factory):

http://www.californiamoves.com/property/details/2827954/MLS-12-638207/658-N-Edinburgh-Ave-Los-Angeles-CA-90048.aspx

Sorry, meant west of larchmont to around Bronson Ave-ish/paramount studios.

“for 1.1 million after buying it for 600k in August”

what kind of idiot would pay $1,100,000 for a house that someone just paid $600,000 for? that is beyond moronic…..IMHO

that is Korean money coming in at that location. They don’t think that their money is safe with the fat man threatening.

Could be that the more affluent places are perceived by buyers as lower risk regarding depreciation. Kinda similar concept to people putting their money into blue chip stocks.

The Federal Reserve has pointed out that for every house available in “inventory”, there are 2.5 that are being held off-inventory for non-economic reasons. This 2.5 does not include 2nd homes, vacation homes, rental homes between renters, etc. These are houses that should be on the MLS listings and are simply being held off market. So far it is working well.

Speculation? In Manhattan Beach? Never!

http://www.redfin.com/CA/Manhattan-Beach/2904-Pacific-Ave-90266/home/6708222

200K markup for a new range.

That’s a pretty sweet place if you are into cars and basketball. The sale price last year for 873K was a good buy. With this crazy market, I wouldn’t be surprised if they get close to their asking price.

I don’t think another place on this planet exists where 1100 sq ft old shitboxes close to a giant refinery sell for over 1M. I guess Manhattan Beach really is different. 🙂

Probably sell within days…bidding war between investor group, wealthy cash buyer from Asia, or a couple of retired CA firefighters who need a place for their sons to live while they attend college. Maybe new owner flip in a few years to another cash buyer from Asia, HB-1 IT rockstar, trust fund baby, celebrity, etc. for sweet profit. Opportunity?

Take a lot at the wealth gap in the US. And then factor in the highly desirable areas. It stands to reason that these areas never saw much of a sell-off, nor do they lack any demand from buyers.

Everyone else fights for the scraps in the IE.

I was in our local real estate brokers office today. The biggest one in town. They were telling me that they’ve never had so few homes to sell by May. They also do property management and they said they’ve also never had so few homes for rent.

Somethings aint right here. Thanks Fed.

You should thank all the well-to-do homeowners rather than the Fed. While Fed policy and accommodative US laws have allowed banks to delay foreclosures for extended periods the elephant in the room here is the ordinary homeowners who have just chosen not to sell. I know these people. I’m one of them. I work with thousands of others and my town in upper middle class eastern Ventura County is filled with them.

This is a two tiered recession. Working class folks are getting the shaft while home owning professionals are, by and large, doing just fine. Still making good money, Prop 13ed into a nice low tax payment – why shouldn’t we all just sit on our fat happy asses and wait for prices to recover?

Whatever the Fed does, whatever the banks do, you won’t see inventory recover until either the bubble is re-inflated so far that home owning class feels they can once again make a tidy profit – or else the economic pain spreads up the food chain far enough so that the rich are forced to sell. Unfortunately, I’m betting on option A.

I couldn’t agree more, I hit on the ever growing divide between the haves and have nots in Dr. HB’s last post. The top 20% of society got off real easy during the Great Recession. Like you said, they have their high paying jobs, are locked into Prop 13 tax rates and likely have refied into super low rates. I wouldn’t be surprised if many of their mortgage payments are lower than apartment rentals in their town. These people are NOT going to sell anytime soon. When looking at Redfin, I noticed many of the recent homes for sale were bought during the bubble years (04-07). I could understand these people wanting to cut the anchor free after being upsidedown for many years. The renting alternative won’t be fun though.

I personally think we will have unusually low inventory for quite some time (probably not as bad as it is now). The younger generation for the most part don’t have the means (jobs) to buy. The recession also kept people put in their current house much longer than historic norms (move up buyer ladder is broken). Add in all the shenanigans with banks, investors and squatters and you simply don’t have much to choose from. Rental prices have also creeped up to the point where “renting and saving money for a few years” isn’t an attractive option for most.

Where will the impetus come from to drive prices higher?

Readers of the Doc know the story: 1) household incomes are not rising, 2) the real unemployment rate is kept in the closet (no coming out date set), 3) student loan debt is crushing the new wanna-be loan owners, 4) low down / no income doc loans are not on the horizon, 5) investors are satiated as the cap rates are turning putrid and will stop fencing with first-time homebuyers over the slim-pickens, 6) there’s no more room to lower interest rates and 7) gov’t budget deficits are coming after our wallets. So what now?

There could not be a more compelling argument for an imminent collapse. You’ve seen the froth as the collective demand of the investors and first-time homebuyers has overwhelmed the micro-supply of homes causing prices to shock upward but remember that the transaction volume is pathetically low. Stock market investors know that a wicked rise in a stock price on low volume is highly suspect and subject to collapse.

You could not create a more absurd distortion of a market if you tried. This will fail with new lows ahead. Can you imagine the carnage when those hedge funds run for the door at the same time? The budget already anticipates HUD reaching into the Treasury for $900+ million this year due to claim losses, the next leg down will see HUD in need of billion$$$$$$$$$$$$$$.

BRACE FOR IMPACT!

Given that the global economic picture is looking pretty bleak, I’d go one step further and bet that mortgage interest rates go down and qualifications get less stringent. Perhaps from the govt directly.

I am choosing Option B sir. Just wait for ACA to kick in with other taxes to be added. We will all feel the pain come 2014 and moving forward in time.

Same old song and dance that many thought would have ended in 2007.

The market inefficiencies are anything but organic. They are federally aided and bank controlled in favor of the investor class. The working class family in the $60-100k income range has no chance in decent areas of SoCal. Those in that income bracket who chase this bubble are indenturing themselves to a lifetime of serfdom to their mortgage.

No chance of change without some systemic shock to pull down prices or with real economic growth (wages, jobs, etc.) – huge inflation to push up the rates.

Without either of those scenarios it will be more the same rate adjustment market shenanigans we have been watching for a decade. As we keep watching a slow low-inventory leak of properties to the owner/occupant market and bundled purchases to the all cash investors for rent or flip housing, so it shall continue. No paradigm change on the horizon for SoCal.

I bet they’re coming for more property taxes. No free ride.

Mortgage rates could be headed lower.

http://www.foxbusiness.com/personal-finance/2013/05/02/mortgage-rates-fall-to-just-above-record-low/

Market can stay irrational longer then one can stay solvent. It will collapse all right, but one can waste many years of one’s life waiting for it. It’s a casino with a quirk: you cannot choose not to participate. One way or another you are making a high stakes bet.

So what happened to the upgrade buyer who is doing so well in your scenario? Even if you are slightly underwater, if you moved to a bigger house in the same neighborhood it also would be priced similarly ‘below market’. With low interest rates all your richie riches would upgrade, leaving smaller houses in the market for others.

From my readings, almost all of the recent recovery has gone to those with 500k in net Assets (minus liabilities). That is nowhere near the top 20% of folks. I think you and your friends may be doing well (lord b’s too), so you are viewing things from slightly biased eyes imo (which we all tend to do at times).

Also, every stat says wages are barely going up or are flat for almost the entire nation, yet fuel, college, etc is up/purchasing power down. Once again, some wages are up, but its more like select folks and the top 2%, not just the top 20% across the board.

Its almost as if you hear a million negative stats but focus on the one that says 1% are doing great and thats who buys in LA, so its good in the hood for homes in prime locations forever. Personally i think thats a tad simplistic. Its a sunny spot with limited decent jobs with hot money flowing in due to unprecedented actions by central banks. The only reason LA has more legs to move up is because QE will continue until the houses throughout the country Are off banks books and that takes a while. Then rates get raised. Study your history and not the bs stuff you read on cnbc, bloomberg,etc

LOL, that’s like asking a realtor “when’s the best time to buy”…and the answer is always????

We are definitely in a low inventory induced bubble.

I’ve posted here before chronicling my short sale home purchase back in April 2012.

It’s been a year since I closed on our home in Santa Clarita. I purchased it cash for $250,000.

Zillow now estimates it at $344,000. I feel that I could conservatively sell it for $380, maybe be even a bit more.

I’m not trying to brag, but $100K-$130K in just a year is ridiculous. We’ve put 5K into the house and we’re seeing a 50% increase from the purchase price.

There is currently virtually nothing for sale and it has been slim pickings (record low inventory for over a year.

Home buyers I am sorry to tell you this but, you have no other choice but to stay put in your rental for as long as it takes until the inventory is released. Buying at current prices is setting yourself up for financial loss.

I believe that the inventory will be released, and prices will fall, but we just don’t know when that will happen.

SELL! SELL! SELL! SELL!

Believe me the thought has crossed my mind.

If I was hard core about it I would sell and re buy once prices fall again.

What if that is two years away?

This is our first stable home in California since we moved here almost 8 years ago.

The thought of uprooting my kids and putting them in another rental is not very appealing.

The thought of dealing with another landlord or management company is very unappealing also.

I bought exactly a year ago in Belmont shore, LB. agreed price was 280k apprasal came in at 273k so I got it for that. The Neigbor just put thier 2 bedroom on a SS for 350k, three days later the unit went pending at 395k They are a 2bed but only 50 sf larger?

Wow, so how will they finance, it can’t appraise right and ” loan to value?

@ Rudy

I purchased a home in December 2012 in Baldwin Hills for $470K and from then to now, the inventory is half what it was in December. And 2 realturds have asked me if I want to re-sell, saying that home prices have shot up in the past 5 months and I could make a profit of about $40K. Anyway, I am not impressed by this surge in prices, rather I purchased the home for the long-haul, intending to live in it the rest of my life, so that sinusoidal fluctuations in home prices would not cause me problems.

I’m with you, I’m in an area with a walk score of 92, about 12 minutes to work and happy. But pulling 50k out represents some buying power if in fact the premise of this site and general thought is true. That being there is still mountains of shadow inventory out there and in a pipeline moving at about the speed of grandpas pipes. Buy eventually it must be resolved. For now I’m parked.

Real-time update: A friend just listed a completely remodeled home in a very nice area of the SF Bay Area. Asking price on the low-end, $1.1M, hoping for a bidding war.

Had over 100 couples come through the open house last Sunday. As of today, he’s gotten one offer. At his listed price.

Where are the Real Homes of Genius?

Just about anything on the market these days, based on the data points in the responses to the above article.

You don’t mean to say that you actually believe that there is very little inventory available?

The banks are holding back all the foreclosures to dribble out as they please, and so manage the market prices.

This would be wonderful if they were going to manage prices conservatively until all the inventory was used up, but they can only manage this as long as QE3/4/5 goes on.

When the inflation begins, and the currencies begin to feel pressure from the debt markets world wide, the market crashes again.

You do recall the old selling point back in the 70’s and 80’s don’t you? “All these higher interest rates are offset by these wonderful low prices!”

It’s the same as now, just phased a little differently than ‘Gee, prices have gotten high, you know…so much demand, but look at the low, low interest rates!

Q

Questor, I don’t think QE is going to be ending anytime soon. The Fed has made it very clear that low rates are here to stay until unemployment reaches below 6.5%. Yes, the numbers are all bogus. But what are we to do? Low rates are likely to stay for a very long time…I noticed 30yr fixed is at 3.35% today. That is ridiculous I wouldn’t be surprised if they went lower.

If interest rates shot up and home prices plummeted, I honestly think the .gov would come up with yet another scheme to help homeowners (principal reduction, loan mods, etc). There is no guess work involved regarding government/Fed policies toward housing based on behavior from the past 5 years. Everybody needs to take this into account.

Just bc the govt is telling you their goal is home ownership for all and they want to help distressed homeowners, is that what you believe? our banks are insolvent so mark to market on properties was suspended. No one was gonna buy a house so they had to drop rates to unprecedented levels AND turn cash savings into crap via QE to even get anyone off the housing fence. Once the banks get this crap off their books, and they mow have 10 and 20% down payments (plus new laws in some states that can make foreclosures easier) you still think uncle sam is going to protect you as much?!

@Lord Blankfein wrote: “…QE is going to be ending anytime soon. The Fed has made it very clear that low rates are here to stay until unemployment reaches below 6.5%…”

Hint: QE3 has nothing to do with unemployment. The “real” purpose of QE3 is for the Federal Reserve to function as the “bad bank” by taking all these garbage mortgage backed securities and transfer them from member banks to the balance sheet of the Federal Reserve.

Clue: Most of the toxic MBS’ are for mortgages originated in 2004, 2005, 2006, 2007, and 2008. Since MBS’ are usually chopped up into 10 year securities that are sold to investors, the first of these toxic securities are due to mature in 2014 (next year). Is it a coincidence that QE3 started in September of 2012?

If the principal on these MBS’ are not returned to the bond holders, this would roil the mortgage market causing interest rates to explode and housing prices to plummet. The monthly mortgage payment would not change but the comps would fall through the floor. The Federal Reserve knows this. That is why there is QE3.

The Fed will continue QE3 until they have transferred as much radioactive mortgages from member banks to the Fed as they deem necessary. Again, this has nothing to do with unemployment. That is their cover story not their reason.

FTB and ernst, I agree with both of you that Fed induced low rates are primarily there to help banks. However, I think both of you underestimate the role government/politicians/lobbyists play in keeping home prices inflated. If rates shot up and home prices plummeted, we would have economic chaos similar to 2008. Tens of millions would be upsidedown, another foreclosure crisis would start, massive job losses, another recession, wealth effect would evaporate, etc. No politician in his/her right mind would want that on their watch. Politicians ultimate goal is to get re-elected, for that you need accomodative measures for the majority (homeowners).

I think this whole situation sucks and it certainly isn’t fair to many. Home prices (especially in certain areas of Socal) are massively manipulated by external factors. Renters, especially those holding cash have got the double whammy. As one of the posters said above, this is a casino where you are forced to participate. The alternative of doing nothing might be worse.

Here is one for insanity and greed.

http://www.redfin.com/CA/Hermosa-Beach/2666-The-Strand-90254/home/6713558

You realize that the home was just built. The owner bought the existing and tore it down and built a brand new home. not saying I don’t believe he isn’t making anything on it, but he isn’t trying to flip it for $9M profit.

Just check Google maps and hover above and you will see the previous home and also during construction.

Check the purchase price in the history and the amount the seller tried to get.

Prices in my neighborhood (Studio City) are up to pre 2008 highs. I’m actually kind of stunned. And there seem to definitely be more houses for sale. This is my question for all you smart people out there- my dream is a casita in Santa Barbara. I obviously should have made a move a year or so ago. Do we think prices will be rising there or ?? I don’t think I’ll be able to make my move for another ten ten months….

Hi Julie, I currently rent in Santa Barbara, and the market here is even more insane than Los Angeles. Every place I’ve looked at has had multiple bids (about 20 or so), and has gone for way over asking.

Check out the piece of crap a million buck will buy you in Santa Barbara today:

http://www.zillow.com/homedetails/400-E-Pedregosa-St-APT-C-Santa-Barbara-CA-93103/15887952_zpid/

100% agree that Santa Barbara RE is a whole different complete universe. At least with prime LA locations, you get proximity to lots of high paying jobs. The same can’t be said for SB. If you weren’t one of the lucky few who bought ages ago, you better brings suitcases full of money if you plan on buying today. SB is “old money central.” Good luck breaking into that market!

I rent in Santa Barbara. Inventory is very low as it is most places, but prices are still off 30-40% from the peak. In a desirable neighborhood, a small, crappy 50 year old house costs 750K – 1.2M.

That should say- ten months or so…

anybody else notice that Multi-family development is blowing away single family and a major kind of way?

“For the first time, multiple-family housing units surpassed single-family hom

es in new construction throughout the state. In 2012, local jurisdictions reported 23,801 multiple-family housing units and only 20,883 single-family homes statewide. In addition, 625 mobile homes were added.”

http://www.dof.ca.gov/research/demographic/reports/estimates/e-1/documents/E-1_2013_Press_Release.pdf

I typed that on my phone. sorry.

Point being that, in California currently, multifamily development (apartments and condos) is exceeding single family development currently. If that isn’t a statement on the banks lending practices and the availability of capital I don’t what is.

Seems like it’s possible that the trend to multi-family is due to the cost per unit for a SFH just being above what many potential customers can bear. We’re just running out of places to put people, so they’re going to be closer together…

@Hank wrote: “…anybody else notice that Multi-family development is blowing away single family…”

Why yes, I have. Here in my Culver City neighborhood (a city frequently cited by Dr. HB), over the past 5 years, the following has happened:

1 single family residence torn down and replaced with a 4 unit condominium consisting of 4 2-bedroom townhouses.

1 SFR torn down and replaced with a 4 unit condo complex consisting of 4 3-bedroom townhouses.

A duplex (twin 2-bedrooms on a single lot) torn down and replaced with an apartment building consisting of 4 2-bedrooms and 2 1-bedroom apartments.

Will The New Housing Bubble That Bernanke Is Creating End As Badly As The Last One Did?

http://silverdoctors.com/will-the-new-housing-bubble-that-bernanke-is-creating-end-as-badly-as-the-last-one-did/

its totally different this time. we promise!

Here’s a fresh new article from RealtyTrac…”25 MARKETS WHERE FLIPPING HOMES IS MOST PROFITABLE”.

http://www.realtytrac.com/content/news-and-opinion/25-markets-where-flipping-homes-is-most-profitable-7706?a=b&utm_medium=3&utm_source=1022811&utm_campaign=3411&accnt=1022811

Comparing Manhattan Beach is silly. The name might as well put the case to rest, Manhattan Beach was named after Manhattan NYC after all. Just look at all the rich and famous that live there.

http://en.wikipedia.org/wiki/Manhattan_Beach,_California

It’s not an “average” market, some places on earth can be safely considered a little more special than others.

Santa Barbara and it’s old money is a good point too. At one time in America, it was “westward ho” and “stake your claim”. That works with a population in the 6 or 7 digit range for an entire REGION. Now there’s almost 9 digits in L.A. County alone, let alone west of the Rockies. A few lucky plunked their money down and not 25 to 100 years later, the sign reads “No Vacancy”.

It’s not just the US and/or Europe, it’s history and humanity. Look at the rise and fall of empires, the trend of democracy and capitalism toward socialism, etc etc over periods of history. The other thing that “helps” too is getting rid of large amounts of population. Not a question of ‘if’, it’s a question of ‘when’.

Population control is coming via diet. Rich eating at wholefoods and drinking bottled water while poor people eating gmos, shtburgers, drinking crappy water filled with cracking chemicals, etc

Leave a Reply