California Housing Prices Then and Now: Foreclosures, Fast Money, and Deflating Economic Bubbles. Comparing 15 Counties with Household Income to Home Price Ratios from 1999 to 2009. Many Counties Still Over Priced.

People have a hard time understanding that many counties in California are still overpriced. Massively overpriced. Now this is hard to reconcile for many because we hear about the 50 percent price drop for the entire state so many simply assume that this applies to each area. In many ways that is deceptive. This is similar to those using the median home price on the way up in the bubble to justify prices. Isn’t it fascinating that after one decade, you will hardly hear any real estate industry proponent talk about area incomes in relation to current home prices? Why would they? This would poke holes in their Swiss cheese theory of housing. Of course what blasted home prices upwards were toxic products like Alt-A and option ARM products. People would like to forget about this data like a wayward family member but the fact of the matter is many of these loans are going to haunt banks for the next few years.

Option ARMs are largely a California problem but also to drill down further, a problem attached to many of the overpriced counties. Many of the lower priced counties (the bulk of current sales) have washed out a tremendous amount of subprime mortgages. Yet these financially engineered housing products, the Alt-A and option ARMs, are linked to higher priced homes and carry higher average balances.

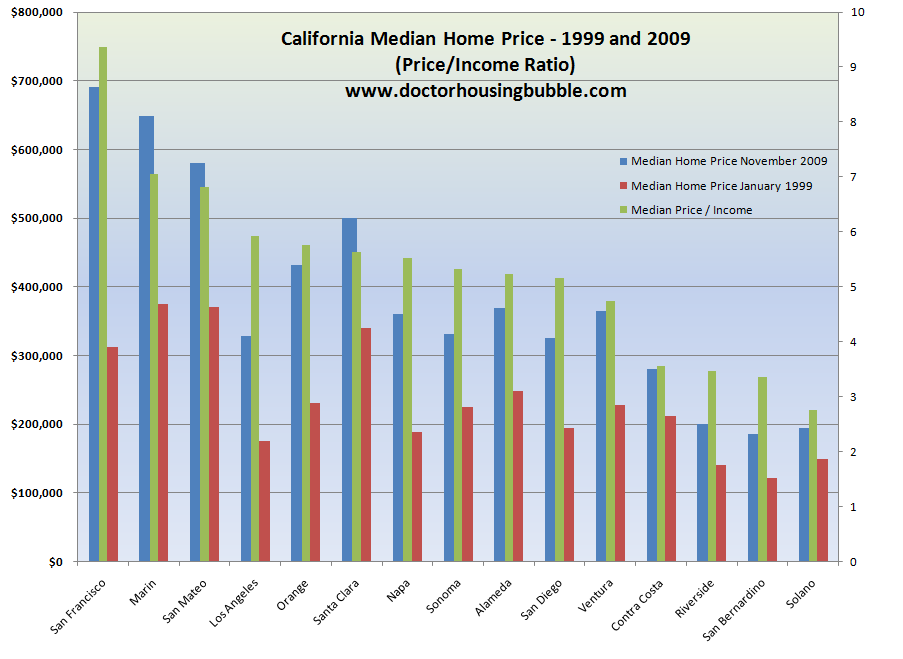

To say something is expensive we need to measure it with metrics. If you were looking at a stock to see if it were expensive, you would look at price to earnings ratios. In other words, how much are you willing to pay for a certain amount of earnings? With a home, you can look at local area lease rates but also look at local area household incomes. Some would like to argue against this metric but these people are usually the folks who say, “well that’s not what I’m seeing. I’m seeing plenty of people with money†as they stick around their one block radius in Santa Monica. Yet the bigger picture is vastly more important. I’ve put together 15 large California counties and gathered 1999 home price data and measured it up to 2009 data. I’ve also included a price/income category to see how expensive an area is:

This chart should tell you the entire story of what is happening. In counties like Solano, Riverside, and San Bernardino prices have been slammed yet these areas have seen tremendous amounts of sales. Why? The price/income ratio seems to be within a fair level. Some may argue and say that these areas have always been cheap. Really? Riverside County had a median price at the peak of $432,000 (a ratio of 7.4 in 2007 but now it is down to 3.4). Solano and San Bernardino have price/income metrics of 2.7 and 3.3 respectively. I have argued for years that a good rule of thumb for housing prices is 3 to 3.5 times your annual gross income. So in these counties, prices may start making more sense. So why aren’t more buyers buying? Because unemployment in these areas is through the roof! The government and Wall Street would like to ignore income and jobs because this is really the driving force of any economy. Yet in this past decade our economy has become housing obsessed to the point that we are now dealing with the biggest economic crisis since the Great Depression.

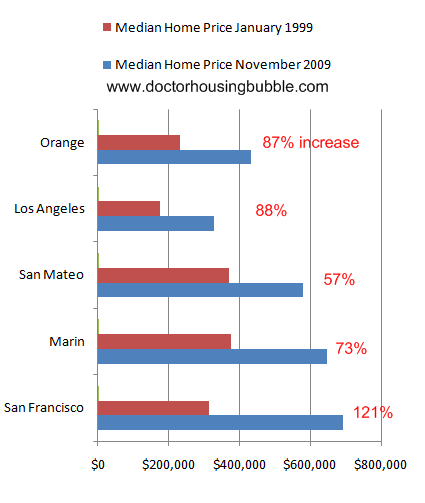

So that covers the lower priced counties. But what about the more expensive areas? Ah yes. This is where the next round is bound to go off. The most expensive county based on local area household incomes is hands down San Francisco. With a price/income number of 9.3 there is no justifying the current price. This area is flooded with Alt-A loans and will have much explaining to do in the next few years. The next 4 counties are Marin, San Mateo, Los Angeles, and Orange. These areas will be the next rung on the housing correction. They all have price/income metrics that are above 5.5. This is incredibly unhealthy.

Let us graph these 5 counties:

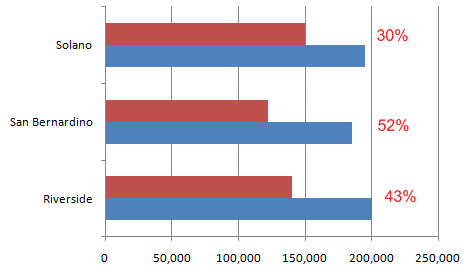

Keep in mind that the nationwide inflation rate over this past decade (1999 to 2009) was roughly 29 percent. So some of these counties outpaced inflation by leaps and bounds. Historically housing prices have tracked the inflation rate. Yet a curious thing also happened this decade and that is income growth hit a wall. Keeping that 29 percent rate in mind, let us look at the three cheapest priced counties:

I find it fascinating that the areas that have seen the most sales activity are now reverting to the nationwide inflation rate and carried home prices with them. This only makes sense. Even as an investor, if you purchase a home to rent out you want to ensure that the local market demographics can ensure some form of cash flow. Otherwise you are making a bad investment. In the higher priced markets good luck finding cash flow properties. People buying in these areas to fix and flip are playing the same card as all the people that got stuck back at the peak of the bubble. In fact, the metrics tell us these areas are still in major bubbles.

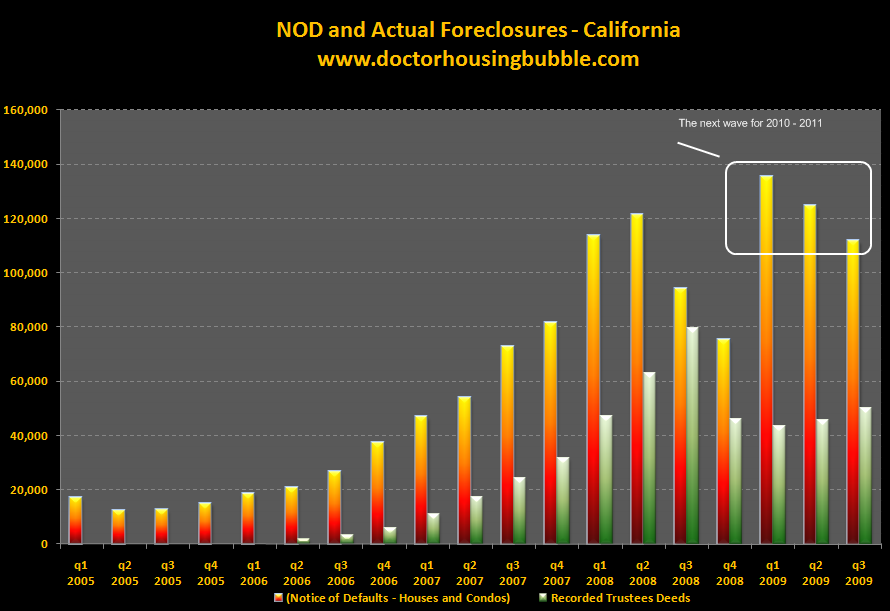

What this data should tell you is that we have much correcting to do in California. The Alt-A and option ARM wave is coming even though banks and real estate cheerleaders would like to say otherwise. Take a look at the notice of default wave:

And make no mistake about this, the wave is going to hit and is hitting. HAMP is a major failure and banks are starting to lose their opportunities to keep these properties off the books with the shadow inventory. The current yield rate with HAMP for loans to go from trial to permanent modification is 4%. Since 140,000 or so loans have entered trial mod phases in California, we can expect approximately 5,600 loans to be modified. Great. We are on pace for 475,000 notice of defaults for 2009. The moratoriums and can kicking at a certain point will need to stop. It will start becoming clearer to the public (if it isn’t already) that the Wall Street bailout is merely for the crony Wall Street bankers. After all, even counties like Riverside and San Bernardino with FHA insured loans are now affordable for many families. Do you think that San Francisco, L.A., and Orange County will have a helping hand when those mega toxic loans come due for adjustments?

And keep in mind the above ratios take into consideration incomes. So prices will never be equal simply because of the market trends but they have to reflect local area economies. Even if we strip out the bubble decade and look at San Francisco, using 1999 household income and median home prices the price/income metric comes in at 5.6. That is a far cry from the 9.3 number today. Los Angeles County has a price/income number of 4.7 in 1999 and Orange County had it at 3.9. In other words, prices need to come down further or incomes need to rise sharply. With unemployment and underemployment at 23 percent there is little pressure for incomes to rise. So that leaves one option.

And let us put recent home sales in context. All you hear about is the massive jump in home sales for 2009. Yes, it has jumped but as we have discussed it is because of lower priced areas making big moves. Plus, do people suddenly think that we went from a decade of speculators and charlatans to overnight becoming a disciplined and prudent economy? In Southern California, 1 out of 4 loans is now FHA insured. 19 percent of November buyers were absentee purchases meaning investors. In other words, half the market is lower end to investors. How long can this go on?

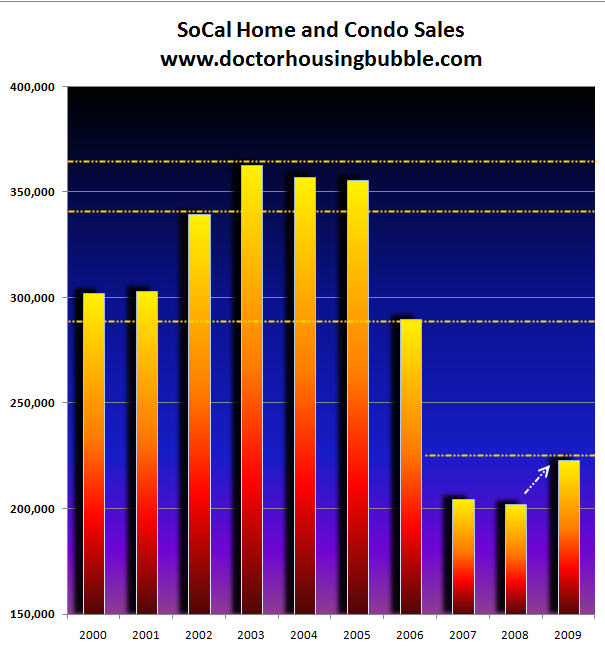

Let us look at Southern California’s recent sales in context to bubble year sales:

That jump you see there is thanks to massive bailouts, FHA insured loans, the Fed buying down mortgage backed securities to keep rates low, and the lower end selling like pancakes. It is all artificial and we are not even close to pre-bubble annual sales figures.

Many counties are clearly overpriced. If the past is any predictor of the future then there will need to be a correction. The lower priced counties have already shown the way to increased sales. Lower prices. Yet the stubborn mentality of banks and those in mid to upper tier markets will be put to the test in 2010 to 2012. The data isn’t pretty but what would you expect with toxic uglified mortgages like Alt-A and option ARMs? When you party hard sometimes you don’t realize the extent of the damage until you sober up.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

29 Responses to “California Housing Prices Then and Now: Foreclosures, Fast Money, and Deflating Economic Bubbles. Comparing 15 Counties with Household Income to Home Price Ratios from 1999 to 2009. Many Counties Still Over Priced.”

People have a misconception about the role of real estate agents. They are there for one purpose- to MOVE PRODUCT. They have no legal obligation to look out for your interest. If you can qualify for a mortgage, by hook or crook, their job is to PUT YOU IN A HOUSE.

Many commenters here verbally assault real estate sales people. They have a child-like concept of what sales people do.

It will be amazing to see what unfolds next year when the other shoe drops. The government has already spent it’s ammunition. We will see a massive correction in the stock market and real estate will continue to get battered. I think once the second shoe drops, it will be “lights out”, a “knockout blow” to the psyche and pocketbooks of our fellow Americans. Get your popcorn ready folks. It will be ugly (but not for us who were wise enough to save our money).

To Robert Cramer. Maybe real estate agents do not have any legal obligations, but they sell their services by claiming that you will get a better deal with them then without them. False advertising?

Yes RE agents have one purpose is to move Product. But at what cost to families livelyhoods? Moving product is one thing, potentially ruining lives is another.

I am in sales as well, I still believe in moving product, but also having integrity and honesty in what I sell. Bottom line don’t screw your clients over. Everything will bite you in the end.

I would appreciate it if the Doctor could confirm the math for where I live. In Studio City the median household income is $65,192.

The median home value in Studio City (zip 91604), CA, is $799,670.

This gives a multiple of 12.27.

Is this the correct way to measure this stat?

I am bearish on housing but after watching what is going on I am no longer so certain about the “other shoe” dropping this year.

By all metrics, prices should continue to drop, but there is massive manipulation going on that far exceeds anything anyone could have expected:

1) The banks have a vested interest in not releasing a flood of inventory and continuing to carry their properties on their books for as long as possible to prevent writedowns of their assets. With TARP and loans from the fed window, they no longer need to create quick liquidity and cash flow by selling their foreclosure inventory quickly. In fact, the big banks are reporting record profits. Insolvent, but making profits. Strange but true. Their strategy is to drag this on for as long as possible to let their executive collect another paycheck and another bonus for as long as they can stay in business. They have no reason to quickly unload foreclosures. They all saw what the subprime unloading did to that market.

2) the larger the loans, the larger the losses. Even more reason to delay delay delay the foreclosures, keep the bad loans on the books, and avoid the day the FDIC comes knocking.

3) the gov has a vested interest in propping up this house of cards, at any cost. They don’t care about the economy except as a function of how they can use it to get re-elected. No one wants to be the guy that let the big banks fail. In fact, if even one big bank is allowed to fail and it becomes widely known that the Federal Deposit Insurance is broke and worthless, there could be another run on the banks. This would be bad for re-election and at this point both parties are heavily implicated in the housing mess. They would rather print money and shove it at the problem in the form of tax incentives first time buyer credits, etc. and devalue the dollar further, than the alternative. They have already quietly changed the law to allow the GSE’s to become landlords and to rent the houses back to the defaulting owners rather than taking it back as inventory. This is to keep more inventory off the market. There will continue to be all kinds of meddling to keep this gravy train going until the next election… and the next election… and the next election, and to hell with the long term effects of this “monetary policy” — who cares, when that can be a problem for some future administration?

4) Gov now guarantees explicitly or implicitly every bad loan out there, and they are buying huge quantities of the loans being made today. Further drops in prices will hurt them too much. Pretty much all the big banks and the government are fully invested and in on the scheme to prop prices up. They will print money until they run out of paper and ink if that’s what it takes. The only thing that could stop them is inflation. Inflation hits and guess what? Maybe the asset prices eventually re-inflate to the carrying value, THEN they can sell without “loss.” If the print dollars until the cows come home, who is to stop them? On a comparative currency level, they will bet that the dollar will still be worth something, even in China.

Printing money is just the tip of the iceberg. There is no telling to what lengths they will go. FHA is already making 0 down, low down loans after blasting subprime lenders for doing the same thing. They raised the conforming limits to allow people to BORROW MORE. Could stated income be that far behind? What about stated income loan modifications? The main problem with the loan modifications not being completed is the borrower’s inability to document income. “If they can keep making the modified payments, that is enough proof that they have the income to do so.” What about modifying payments, even for a few years, for the defaulter, to make staying in the house as attractive, or perhaps even cheaper, than renting? At least that way they can carry the entire mortgage on their books as a productive asset…

In a free market, it is easy to see that prices are hugely over inflated in many areas. But this market has not been running on “free” market principles for a very long time. When you have a government that almost has no choice but to keep meddling in the market, coupled with greed and financial incentives to do so, no one can say when, or whether, the assets will ever return to “normal” values.

The fact that they are throwing massive amounts of money at propping up housing prices and banks, many times more than they ever threw at the jobs problem, even though we are approaching depression-era unemployment (no new jobs being created, people out of work for going on years now, not months) indicates to me that the powers that be do not care about the economy, free markets, or really anything at all except gov and banks keeping each other in business for as long as possible.

If the day ever comes when they really do have to unload the shadow inventory quickly, I fear we will have arrived at a situation where it won’t matter who was right, whether housing is more affordable or in line with “fundamentals,” etc., because the fact that they finally give up tall he propping up efforts will signal a kind of desperation that will be truly frightening and have massive negative implications for the rest of us that I don’t want to try to imagine. In other words, what could happen that would be so bad that the big bankers will no longer care about the FDIC coming knocking to close them down, and make the elected officers no longer care about re-election? Thinking about such a scenario, makes me want to load up on guns, ammo, water, and food. Gold, too.

When an executive recruiter places a person in a job, do you think they lie awake at night, wondering if the person is happy?

Again, considerations such as ” at what cost to families?”, does not enter the equation.

People who buy houses are adults, and are expected to make adult decisions. And gain from the good decisions, and suffer the consequences of bad decisons.

We do not live in a “Nanny Nation”, where everyone is taken care of from birth to death.

People make bad decisions all the time- who to marry, smoking or chewing tobacco, driving after too many drinks. (And no, I do not make my living with anything to do with real estate.)

Robert Cramer,

Thank you for substantiating what we already knew; that real estate people have no integrity whatsoever and just want a COMMISSION.

Cramer go back to school or read a book. Sales is about service. Any monkey can move product.

Robert Cramer, according to the National Association of Realtors, you are the one who is misunderstanding the role of a realtor. Here are some excerpts from the NAR’s Code of Ethics and Standards of Practice:

–

“REALTORS®, in attempting to secure a listing, shall not deliberately mislead the owner as to market value.”

–

“REALTORS®, when seeking to become a buyer/tenant representative, shall not mislead buyers or tenants as to savings or other benefits that might be realized through use of the REALTOR®’s services.”

–

“REALTORS® shall avoid exaggeration, misrepresentation, or concealment of pertinent facts relating to the property or the transaction.”

–

“REALTORS® shall make reasonable efforts to explain the nature and disclose the specific terms of the contractual relationship being established prior to it being agreed to by a contracting party.”

–

“REALTORS® shall be honest and truthful in their real estate communications and shall present a true picture in their advertising, marketing, and other representations.”

–

“REALTORS®’ obligation to present a true picture in their advertising and representations to the public includes the URLs and domain names they use, and prohibits REALTORS® from:

1. Engaging in deceptive or unauthorized framing of real estate brokerage websites;

2. Manipulating (e.g., presenting content developed by others) listing content in any way that produces a deceptive or misleading result; or

3. Deceptively using metatags, keywords or other devices/methods to direct, drive, or divert Internet traffic, or to otherwise mislead consumers.”

–

“When representing a buyer, seller, landlord, tenant, or other client as an agent…REALTORS® remain obligated to treat all parties honestly.”

–

–

These are direct quotes from the NAR itself, so it seems reasonable that people would expect these standards to be held true by a realtor. So again, it seems as though you may be the one who needs to be realigned. If these expectations are child-like, perhaps the NAR should create a new Code of Ethics and Standards of Conduct to accurately represent the purpose of realtors.

Are the investors in the lower priced areas getting deals somehow…maybe buying at auction before the home hits MLS?

Otherwise I think these guys are gonna bail on their “investments” in a few years. Renting is hard to do right now. I know some people in what should be prime area sitting on SFR empty for quite a while. Present a good profile on Westside Rentals and landlords will cold call you. This is on places on the Westside at $2-2.5K/month(around a 25-30% drop in rents from 2 years ago).

I wonder if these investors know what happened to the rental market in LA County in the early-mid 90’s when unemployment was at 8-9%, not 12%+ that it is now?

Bunning Statement on Bernanke: ‘You Are the Definition of a Moral Hazard’

Instead of taking that money and lending to consumers and cleaning up their balance sheets, the banks started to pocket record profits and pay out billions of dollars in bonuses. Because you bowed to pressure from the banks and refused to resolve them or force them to clean up their balance sheets and clean out the management, you have created zombie banks that are only enriching their traders and executives.

You are repeating the mistakes of Japan in the 1990s on a much larger scale, while sowing the seeds for the next bubble.

In the same letter where you refused to admit any responsibility for inflating the housing bubble, you also admitted that you do not have an exit strategy for all the money you have printed and securities you have bought.

That sounds to me like you intend to keep propping up the banks for as long as they want.

Even if all that were not true, the A.I.G. bailout alone is reason enough to send you back to Princeton. First you told us A.I.G. and its creditors had to be bailed out because they posed a systemic risk, largely because of the credit default swaps portfolio.

Those credit default swaps, by the way, are over the counter derivatives that the Fed did not want regulated. Well, according to the TARP Inspector General, it turns out the Fed was not concerned about the financial condition of the credit default swaps partners when you decided to pay them off at par.

In fact, the Inspector General makes it clear that no serious efforts were made to get the partners to take haircuts, and one bank’s offer to take a haircut was declined.

I can only think of two possible reasons you would not make then-New York Fed President Geithner try to save the taxpayers some money by seriously negotiating or at least take up U.B.S. on their offer of a haircut.

Sadly, those two reasons are incompetence or a desire to secretly funnel more money to a few select firms, most notably Goldman Sachs, Merrill Lynch, and a handful of large European banks. I also cannot understand why you did not seek European government contributions to this bailout of their banking system.

Bunning To Bernanke: You Are A Systemic Risk

Jul 15, 2008

Your article is good overall but perhaps needs some clarifications.

“I have argued for years that a good rule of thumb for housing prices is 3 to 3.5 times your annual gross income.â€

1) You seem to ignore demand for a given area.

2) You are not focusing on the importance of interest rates. People buy a home based on their monthly income. This is a fundamental fact being missed.

Using a historical norm of 30% monthly income towards home costs.

$60,000 annual income ($5,000. Monthly) would allocate 1,500 towards housing costs (PITI)

For simplicity let’s say $1,500 is the amount you will pay for housing (30 year fully amortized loan).

During the early 80’s when interest rates were 17% you would qualify for a loan of $106,704.

Today’s rate of 5% (using same 1,500.) would service a loan in the amount of $280,587 (hence home prices rose).

Using the often touted 3 times annual gross of 60,000 means you are waiting for a house to buy at $180,000. Therefore your rule applies when interest rates approximately 9.49% if you got in with 0 down. You can adjust for your down payment.)

Back to Demand, obviously when you live next to the ocean and your communities are reaching build out, supply/demand favors higher prices than the wide open areas in Texas for example. Interest rates would have to be much higher than they have EVER been to cause homes in SF to go to 3x gross!

Unless we have big time inflation, do not expect rates to scream higher.

By the way Swiller, agree with your term childish. Most real estate agents are not financial advisors. It would be wise for adults to understand the way the world works with regards to human nature when it comes to trusting each other (buyer beware). However some agents are unethical.

Moving on.

hlowe

Not happening yet, here in the South OC. Homes are still priced at $400-$600K. And I don’t want to hear about families earning $100K in this eCONomy. That usually means dad is working 20 hours of OT and mom has a gig or is running a giant gargage sale on eBay/CraigsList site, neither of which can keep you making payments.

Besides, if dad is working 20 hours of OT as a cop or fireman of is traveling all the time, what cost is that to a family. Nice Christmas! Dad buys us a truckload of presents, but he is stuck in Chicago on bidness during the holidays!

Eventually, what will do in South OC, LA, and SF counties is the 20 and 30 somethings, who see this nonsense and realize there is more to life than overpriced McMansions that come with faaaaaaar more cost than a high price tag. IN fact, I am seeing it more and more every day. I work with a young lady, who is ready to give up the whole ghost and move to a farm with friends in Oregon. They have the whole schebang up and running now for a few years and are making a real go of it. I have told here to get out while there is still time, before the whole flywheel lets go and everyone is running around looking for canned food and water. She is close.

Anyway, enough ranting.

The bottom line is that homes are not only overpriced in lines with income, but with all the associated costs: taxes, mello roos (don’t tell me you don’t have one), HOAs, maintenance, keeping up with the Jonses’, and the emotional strain.

Look this isn’t your grandad’s 1950s anymore where you did the lawn on Saturday after coming home from Little League. Sure, a few still do. But generally, dad is off working OT or a second job and mom is busy with the other siblings’ needs.

And I haven’t even mentioned commuting yet!!!

You see, the TOTAL COST is eventually going to take its toll.

People will learn what is valuable and what the value of something is.

As someone once said: “Everyone knows the price of everything, but few know the value of anything!”

I agree with ‘househunting’.

The problem is the low interest rate & low home inventory on the market keeping current home price sustained. I read on the web that it is Ben Burnanke who prefers inflation rather than depression at any cost since he studied the devastating effects of the Great Depression too much. He may drag the low interest well beyond he is supposed to raise to tame the inflation, opposite to his recent public announcement. Before we get the normal interest rate with reasonable home price, we may encounter inflation caused by the massive bailout & low interest rate now. I think that is what Bernanke and bankers want.

I agree that 3 to 3.5 ratio of home price over the income in case of normal mortgage rate but I think the mortgage rate also significantly affect the sustainable home price even though one pays more property tax and insurance premium. I think one should look at the ratio of home price over monthly payment including mortgage plus property tax plus insurance premium.

If government/FDIC keeps low interest rate and banks maintain low house inventory on the market by trickling their inventory only in the spring, I think chances of home price drop in the next few years may not be what we expect to be.

Typical price pre bubble 1997 $250K for 2000 sq ft home

Doubled to $500K by 2000, than up 750-800K by peak year.

some went past $1M .. Half mill homes went to 2+ mil.

Pretty nuts! Right ?

so now we are down to $500-600K from $750K..

Bargin ?

Not a chance!

I think our chances of a zoombie market are quite good. And why the japanese experienced this in the 1990’s. Our govt will do everything to support the banks and the banks dont want to recognize devalued assets nor do they want to flood the market with product. So we should continue to see low inventory and prices sliding….and this will keep people coming in to the market. But for the lower tiered ranges. Houses overy $600K will probably not be selling.

Just some points to ponder.

“Banks are holding inventory, only trickling them out”. My question then is why do you have places like Phoenix where the prices are tumbling at 2% a month in the nicer areas? Foreclosures in Prime Areas are all over the place…. Why don’t the banks “trickle” those out?

I too am perplexed by the current situation. I am/was looking to buy but gave up in North Park (san Diego) because in the course of 10 months houses are now back near the Peak Price.

I remember back in 2004ish tens of thousands of Californians were moving to places like Az and Nv. for their cheap living. Well the price difference between those two places have never been greater from what I can see. Will the stubbornly high prices in Ca reignite the exodus?

I find myself SKITZO when it comes to my thoughts on the housing market, and why not? The FED has made the market SKITZO and it doesn’t make any sense any more. Common sense is out the window.

Don,

It appears that you have not seen the best return yet. One of my babysitters bought a duplex in LA for $110k about 10 years ago and sold the house for $750k in 2007. More than 600% return in 10 years. Can anybody beat that?

Househunting,

BOTTOM LINE: prices are tethered to incomes. Any shuffling of inventory, interest rate, down $, or DTI designed to obfuscate this truth is a ‘fraudulent incentive’, not ‘financial innovation’. The shoe may not ‘fall’ next year, but prices will continue their decline, or reversion, to trend, in ‘real’ terms (i.e. the ratios).

Consider for a moment that the Banks, Congress, Treasury, and Fed have already, in concert, pulled nearly every rabbit out of the hat, only by the grace of being able to skate on unprecedented 0% ice for more than a year, and all they have managed to do is create a bump on the downward slope of the mountain, or flatline it in their wildest of wet dreams.

What do you think will happen to prices when rates rise, as they must? Remember that the treasury markets set the rates, ‘Wizard of Oz’ Bernanke just follows them.

A rhetorical question re: San Francisco: do you think that there is some skewing of the data going on here? San Francisco typically has a higher percentage of renters than, say, Orange County. Under the assumption that renters typically earn less than homebuyers, then wouldn’t the price/income ratio be skewed because you are incorporating median prices (which apply more to the weathlier citizens) with income (which incorporates the lower incomes of renters)? It’s not a complete apples to oranges comparison, but there is appears to be some skewing (in theory).

Anyway, I can’t prove it, unless anyone else has some better data or information. Anyone care to help?

After all I’ve read on this issue, it’s refreshing to find information that looks precisely at the income to house price ratio. I still believe that the whole crisis in a nutshell, is largely due to the fact that earnings never did reflect the ability of consumers to afford the product. Plain and simple.

My gut instinct says that any spike in sales now comes from two primary sources. Homeowners who have “traded in” the house they couldn’t afford, for one much cheaper. And secondly…people out there with a lot of money who are gambling that the investment properties they’re grabbing up will pay off eventually, when prices turn around.

The pattern makes sense to me, and reflects accurately the market trends that continue to aggravate the problem, not fix it.

One thing I completely agree with….is the thinking that this problem will never be solved until homes everywhere reflect the average earnings of the communities they’re in. That well-healed 5% of the population can’t fuel the market by itself.

Plain and simple, average income earners have to be able to afford homes where they live. If they can’t, then home ownership becomes an elitist privilege (something that kicks the American “dream” in the pants, eh?)

And on that subject….income flattening out, and income imperiled by the threat of percieved job insecurity does not bode well for future home ownership risk.

I agree with almost everything you said, but keep in mind that only small, relatively underrepresented portions of the country are in serious trouble vis a vis real estate, i.e., California, New York, Florida, Arizona and Nevada. Of these, California and New York don’t count politically, as both are solidly democratic, have only 4 senators combined and are hated by the rest of the country (never mind that we contribute more in federal tax money than vast swaths of the rest of the country). RE markets in the other three have already capitulated and have stabilized or will do soon. That means, basically, we are using Federal money and policy to support California house prices and the NY banks on the risk for those loans. As this dynamic becomes more apparent, the anti-California rhetoric will heat up and nationwide appetite for the asset price life support will wane (remember during the CA energy crisis, Oregon didn’t want to share its energy with us so we could “heat our hot tubs”). The shift is already happening — look at who and from where are the most vocal critics of Bernanke. My point — support for the current policies will end, until then the smart will continue to be patient.

I have noticed a recent trend in the Inland Empire business journal. Prices for late November REOS that were purchased at the court are starting to come in substantially lower than minimum bid.

Anyone out there know anything about this?

ex. 5504 greenbrier dr. 92504 ask : $289,413 sold : $132,000

ex. 7330 amanda ct. 92504 ask : $292,847 sold : $ 85,501

ex 4660 emerson 92506 ask : $ 267,734 sold : $124,000

ex 13664 crape myrtle dr. 92553 ask : $ 247,725 sold $ 70,600

There are many more like this, maybe a signal for upcoming 2010 in the Inland Empire!

Prices will contine to come down in the crap areas. Here in Newport, inventory is falling. Prices will not come down. I agree with the long post. TOO MUCH GOV MANIPULATION. All the old metrics do not apply.

Robert Cramer – your comment is accurate and entirely misses the point. Yes, we are “adults,” and need to be responsible for ourselves. But, the main point – which you missed – is that Realtors are LICENSED to PROTECT THE PUBLIC. Implicit in your comment is that we are on our own. Realtards are supposed to be licensed professionals who can give you ADVICE about the merits of a purchase. So, yes, they SHOULD be awake at night if they put you in an overpriced home because they told you to buy, and “not to worry,” because real estate prices always goes up, etc. Or, that you could simply “refi” if the loan is unaffordable. They are licensed for our benefit, not theirs. You are quite correct above when you said they are paid to “move product.”

It’s amazing that through such a crisis, your first instinct is to defend real estate agents. While I understand verbal abuse is a reality for sales people in general, this situation is about the over-indulgence of all parties involved including the buyers that ignored the fact that good deals and bad deals existed long before real estate people did. Respectfully, I hope you are not a real estate agent and if you are, I hope you can change the need to defend yourself and instead thrive on streamlining your brutal honestly with something productive. Like teaming up with an honest banker and saying no to ones that are not. While I realize there is no legal obligation, I believe it is our lack of inter-personal moral obligations that got us in this mess. We all take the blame here and hope this can be a reason for you to improve. Sincerely. -MD

“It will be amazing to see what unfolds next year when the other shoe drops”

You talk as if you are a mind reader and KNOW this is going to happen. If that’s true, you must be VERY VERY rich! No one knows, and the vast majority of predictions (like yours) don’t come true. Any time someone talks like they KNOW the future, run!

Iceman,

I’ve noticed this in the IE also…It looks to me that after the short sale fails, the home goes into pre-foreclosure where it goes up for auction. The price set at the auction seems to reflect the default amount on the loan, so if the home was purchased in ’07 the auction price looks way out of line. Typically the house will not sell at auction, so the home becomes an REO and a real estate agent is assigned to sell the house, and this is when a more realistic price is set on the house.

Leave a Reply to JP Merzetti