California housing leaving the middle class behind in the dust: Prime real estate markets close to previous peaks while areas inhabited by working class families fall further behind.

California is a land of booms and busts. Generations ago gold rush fever brought many to speculate and gamble for future glory. In the 1900s the promise of uninterrupted sun and great weather lured families to the area. This trend has only magnified with global forces becoming so dominant and people fully connecting and thinking alike on the technological hive mind. In other words, people are seeking the same goals and dreams. People also love speculating on real estate. Language is hardly a barrier when documents can be translated in the click of a mouse button. California housing is leaving many middle class families behind as the state gentrifies dramatically. Reports are very clear, and that is only one out of three California families can actually afford to purchase a home at today’s prices. Yet the market is attracting investors from all across the country and world. People are willing to leverage their income with low interest rates and funnel upwards of 50 percent (or more) of their household income into real estate. What is interesting is that in many “prime†areas housing prices are inching back close to their former peaks. Yet working class areas, only a few miles away from these markets are still years away from reaching their former peaks. California is a magnifying glass to the slow erosion of the American middle class.

Prime areas reaching peaks while other areas crawl out of recession trough

As mentioned in a previous article, housing is an odd industry where prices are set at the margins. In the US, we have 81 million single family homes. From the latest figures we have something like 2.2 to 2.5 million homes available for sale (existing and new homes). What this means is that at any given point we have roughly 3 percent of all existing inventory on the market for sale. This is nationwide. In some prime markets, you have even lower percentages and this drives up prices especially if speculation is running wild.

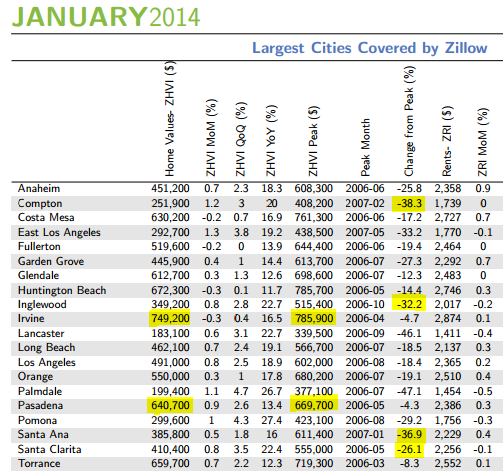

Zillow has some great reports on markets across the US. Let us look at a few Southern California cities in terms of the latest housing figures:

Source:Â Zillow

This chart is very telling. First, you’ll notice that places like Irvine and Pasadena are only 4 percentage points away from reaching their previous peaks hit in 2006-07. These markets pull from local investors, global investors, flippers, Wall Street, and of course professional families. But take a look at areas like Compton (still off by 38 percent from the peak), Inglewood (off by 32 percent), Santa Ana (off by 36 percent), and Santa Clarita (off by 26 percent). Santa Ana is only a few minutes away from Irvine but this is like comparing two different worlds. Of course the majority of people by definition live somewhere in the middle and that is why looking at household incomes is important. Yet these are unlikely to be the current buyers. Over 30 percent of California buyers for close to half a decade are coming from big money investors. Many are stretching out with FHA insured loans but this is likely to be in more working and middle class neighborhoods. Talking with colleagues in the industry they mention that FHA in prime areas is virtually a no-go for buying with sellers.

People might look at a home value of $749,200 in a place like Irvine and scratch their heads. But with ARMs, interest only loans, and dual income families people are willing to stretch to buy. Investors of course are willing to go deep into the game.

Yet we may be seeing a slowdown here, even in prime areas. For example, in Irvine inventory hit a low of 400 late in the fall and is now at 620 (up 55 percent). You’ll also notice that month-over-month prices dipped which is telling but then again, your typical California family is not going to swing a $750,000 home. Which is really the big divide happening across the US, a gutting of the middle class.

Homeownership not available to everyone

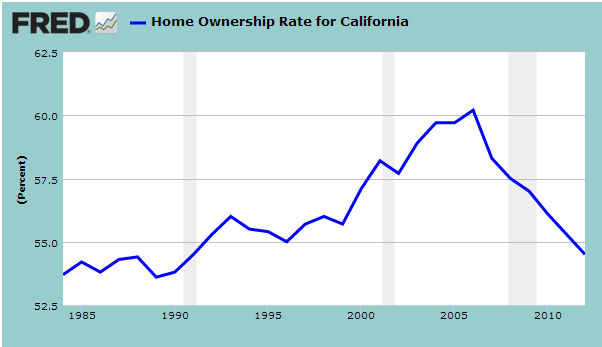

I made the argument close to a decade ago that homeownership was not always the best option. For most parts of the US, owning may be a good option (when the median home price is $190,000) but in high cost areas the math isn’t so simple. Renting may make a lot more sense for those starting a career and looking for mobility for work. Yet young Americans are facing a very tough economic climate. Beyond the economics, the homeownership rate has fallen dramatically in California:

Even before the bust, the homeownership rate was already trending back to where it was in the late 1980s. Not much has changed since. In fact, with high levels of investors buying properties and lower sales figures, this trend is likely to continue.

For many families, the quick run-up in prices in 2013 has completely shut them out. We are now seeing investors slowing down given that good deals are harder to find. Some are venturing into lower priced areas but you also deal with lower incomes. This may matter if you are looking at hiking rents or trying to flip to an actual potential long-term homeowner.

Housing starts and future trends

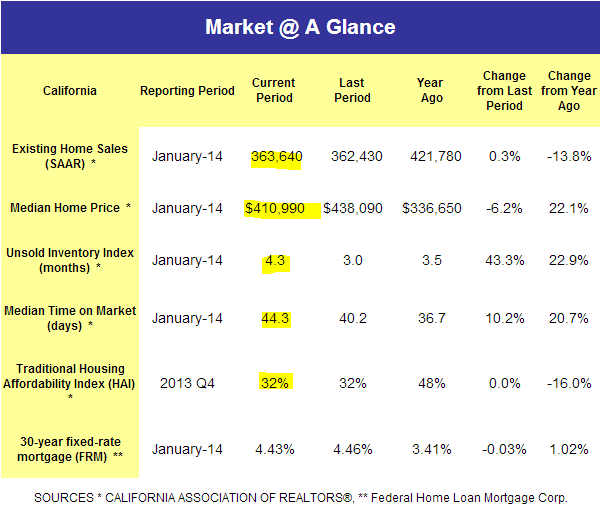

Even if housing were to erase the gains of 2013, California has essentially shut out a good number of middle class families from owning. The market has hit a turning point recently:

You’ll see that across the state, year-over-year prices went up 22.1 percent but fell 6.2 percent over one month. Inventory is up 22 percent from last year and time on the market is up 20 percent as well. More to the point, sales volume has fallen by 13 percent even in the face of rising prices. At current price levels in more selective markets, you really have to be upper middle class to wealthy to own a home. In fact, you will likely need to be in the top 15 to 10 percent of household income (meaning a household income of $150,000 a year is the minimum to play the game without leveraging your entire future on real estate).

California is largely leaving a good portion of the middle class out of the homeownership race. This trend looks to be the case for years to come.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

104 Responses to “California housing leaving the middle class behind in the dust: Prime real estate markets close to previous peaks while areas inhabited by working class families fall further behind.”

Robert Shiller not predicting a steep rise in home prices for 2014 but not predicting a crash either….

http://www.youtube.com/watch?v=y0XgHZ4a28s

…Prices likely to continue increasing but not in the spectacular fashion they did last year…

Shill ER said some similar similar things in 2007 if I remember he was off who’ll Roubini was spot on. Either way 2014 is 2007 Deja Vu. Jim Taylor is right as the crash in SoCal is happening as we speak. Volume is zero and what’s going through is in the upper end so the median is going to skew upward, but that stat is worthless. Mortgage originations down. Sales volume BELOW 90’s recession levels. Same thing with rentals. Rents skewing upward in SOME areas doesn’t mask incredible vacancies. Foreclosure filings had their big spike for one reason, the banks see the last group of Greater fools for this cycle lining up to throw away $$$. I’m sure when low double digit sales drive the median up in a few areas the bulls will give us their last, best troll before the 2015 collapse.

No housing bubble in the Midwest. I see homes at prices still at there early 2000 prices

If you want low income rental property there are plenty of home priced at mid 1990 prices

“Rents skewing upward in SOME areas doesn’t mask incredible vacancies.”

Can you elaborate on this statement? I think you mentioned in the last post that you had a property manager friend exiting the business after 20 years. Would love to know more, if it’s truly due to compressed cap rates, which areas, etc…

RE: Anon

It’s not just the Cap Rates squeezing profitability the property owners are asking the managers to assume TONS of liabilities as far as keeping the vacancies down AS WELL as up keep and damage liabilities. In other words, they want you to fill their properties, but only eith good tenants who pay on time and don’t mess shit up or demand upgrades. It’s ludicrous. My client’s description of the run up since early ’12: “It’s an illusion”

That’s why when posters like BenShalom describe rent as one of the most stable sources of revenue their is I know he’s a full of shit troll. Sure there’s always somebody to rent someplace at some price, but does that equal PROFITABLE revenue??? Not unless the cap rate works and for most recent sales it’s razor thin. All it takes is a small amount of inventory to start the avalanche. People buying houses leave rentals. More vacancies drive down rents. Cheaper mortgage nut for J6pack drives down rents. Driven down rents create that much more competition between landlords, which drives down rents. Take away the FED’s Monetary Meth and the whole thing falls into a deflationary spiral. Probably protracted and slow like Japan’s (though not as steep) but a deflationary spiral non the less. We’ve been pulling demand forward for 30 YEARS! The run up had it’s peaks and valleys and so will the run down, but down it will go none the less.

It seems odd that your friend’s property management business would fall on hard times now, as opposed to in 2009, when LA rental rates actually dipped.

1 bedroom rents in LA have increased substantially since 2000, almost doubling depending on what service is doing the reporting.

If he’s been in business for over 20 years, his long-time clients should be making money hand over fist, and probably wouldn’t be pushing top-market rents at the expense of vacancies or marginal tenants.

If his biggest stress is what you term ‘liability’: “fill their properties, but only eith good tenants who pay on time and don’t mess shit up or demand upgrades” It sounds like his problem is competition from other management companies that are over-promising rents vs vacancies. Perhaps with RE investment getting into the recent limelight there’s a glut of new property management companies that are cutting into the profits of the middlemen?

Undoubtedly recent RE sales will result in narrow cap rates, but anybody getting into the rental game, should understand it’s a long-term investment and if a few years of 1-2% returns causes financial difficulties that investor should have stuck to a savings account.

For a good perspective on LA’s rental market and trends, check out the USC Casden MultifFamily report. They have good stats on not only rental rates and vacancies, but long term indicators such as pending MF units being built and net absorption rates.

“Shill ER said some similar similar things in 2007 if I remember he was off who’ll Roubini was spot on”

I had to laugh at this. Are you saying Robert Shiller is a RE shill because he doesn’t forecast a RE crash in 2014? His predictions haven’t been spot on, but he’s probably the furthest thing from a RE shill. Look up his past predictions. Perhaps you’re thinking of Karl Case who’s a little more bullish?

Even Roubini (Dr. Doom) hasn’t been his usual negative self as of late.

Yeah, there will be another crash. I agree that the flaws are systemic and that there is no entity with the clout, intelligence, or guts to stand up and fight the TBTF FIRE behemoth and the sycophantic politicos whose bread they butter.

But I think the Dr. is right in saying the trend will continue (as it has since 07) with some yet to be designed SFH buyer tax incentive, credit, fed rebate coupon, or back to the dead end of monetarist rate manipulation and money printing when they realize what they already know that pumping the rates drive money from all equities besides bonds.

Same old song as what was once an affordable 30 year fixed property for a family becomes an asset to be securitized and turned over to some city who doesn’t know if there buying rental or mortgage cash flows.

I’m on the side of the perma-bear for SFH RE as long as the middle class is gutted by homes in the $550-750k range. A mortgage 4x annual home income is a dumb stretch, over that is stupid.

Like the Dr. has pounded in print, outside of these California Dreamin’ enclaves of the wealthy and privileged, a $150K household income is a far cry from the American idea of middle class.

RE:MB

Shill ER was an auto correct on my keyboard, DHB could use an edit button.

As for investors thinking long term on rentals, we’re talking about the specuvestors here, they aren’t playing with a savings account when they have OPM to speculate with. I’ll say it again, we are at the end of a 30 year inflationary pulling of demand forward. The BEST you’ll see going forward is disinflation. But housing as a percentage of income HAS to come down or the economy is toast. It’s all about the values in big metros because that’s where the jobs and consumers are. I’ll give you that the days of a working class person owning anything more than a condo in LA County beach areas is over. But Bubble 2.0 has brought back $600,000 track home values in the 909. It’s insane and the math is all based on exponential QE just as the FED is turning off the water. CA outside of Malibu, Manhattan Beach, etc is completely Bubbleicious. Even those prime areas are 15% or more over because the people buying them make their money in bubble industries and they also get the sweetest interest only bubble financing. The FED economic Meth binge is almost over and EVERY asset will be affected by the repricing of credit.

They predicted the same thing in 2006. A “Leveling off” or a “slight decline”, or at worst a “soft landing”.

All of these predictions were 100% true until they weren’t.

The peculiar events elevating transaction prices, financing and sales at that time are not operative.

CRA Policy is, more or less, dead. Hence the dreary stats out of Compton, etc.

The insanity pricing in Palo Alto is directed at raw land. The ‘offending properties’ are complete tear-downs.

http://sanfrancisco.cbslocal.com/2014/02/19/palo-alto-home-sells-for-1-6-million-despite-cracked-foundation-nearby-train/

(Being so close to the tracks, one might suspect that the property is going to be converted to commercial or high density. Yet, for statistical purposes, that deal must count as a SFH sale.)

California may well be devolving into a Castles and Hovels market.

I’d bet that whatever real estate equity Black Americans had in Compton has been zapped by the real estate drop.

The US Census indicates that Compton and Watts have been emptying out of American Blacks for the last forty-years. The Latinos purportedly have displaced them. Such a shift may have national impact. The CBC may evaporate like a Cheshire cat.

These massive shifts in demographics are hard to link to real estate price moves, least of all in the aggregate.

What history does show is that unlimited immigration — even when legal — triggers the formative economics for new age slums. The mega-slums of New York City were directly consequential to the wide open immigration — from Europe to America — at that time.

Once the door was shut, by WWI, the slums gradually emptied out. The ability of American employers to wage arbitrage against current Americans with ‘fresh ones’ had been halted.

It can be no surprise that the American labor movement of the 19th Century was entirely oriented towards stopping further inroads by immigrants. This, even when such immigrants were entirely legal — and from Europe, too.

Permitting the elites to under-cut wages across the breadth of the economy (H1b) cripples the ability of the wage earning sector to sustain a mortgage. Everything else flows from that reality.

With all that said, blert, you’ve previously stated you’ve made incredibly prescient ‘predictions’ numerous times that, while seeming outlandish at the time to those you conveyed them to, would have brought untold wealth to these people had they listened to you.

So, WHAT IS/ARE THE NEXT BIG BOOMS GOING FORWARD? I’ll put some money where your mouth is and wager a bit

150K to afford a house on the pennisula, no way! The average house price on the penninsula is about 1.5 to 2million. Using the 3x rule, you need a yearly income of at least 600K per year. Don’t forget, at that level your getting taxed to death, where nearly 45% of your income goes to taxes. So, you’ll probably need more than 600K per year.

As usual, a great post and nice summary of where things stand in the CA housing bubble….oh sorry, I mean housing market (wink, wink).

Homeownership rates are going down. We are more the renting class now. Time to erase prop 13 as a relic from the historic past. Move onto the future. Apartment living is more environmentally friendly than single family housing. Agenda 21 and sustainability requires us to move towards apartment living along public transportation corridors. SFH can be converted to apartments where feasible(such as the Westside, Santa Monica).

Prop 13 protection is self erasing… to a very large degree.

This reality was covered some time past by the Doctor.

The ONLY significant segment to benefit is the elderly. Leave them to God.

Prop 13 is a distraction — to throw the proles off the trail.

The big story is that the PTB have reversed national housing policy. As it stands, big government is favoring big money.

A new peerage is being established.

BTW, how do you think the ancient peerage was established? … Just so: the big money bought the government/ became the government.

Prop 13 is self erasing? Only for the lower classes who have don’t know how to properly plan financially (or who can’t afford or are too ignorant to hire those that can properly plan for them).

Prop 13 covers ALL property, as we know, including all commercial property. The smart and big players have already put their properties into LLCs, S Corps, Corps, etc. in order to keep their properties from being reassessed FOREVER, or at least until if/when Prop 13 is repealed. I’m talking the absolute most prime, A+++ commercial real estate in the region, still assessed at the late 1970’s/early 80’s values (+ 2% of that assessment, per year, at best give or take).

Just as many SFR/residential properties are also never going to reassess as long as Prop 13 stands, as they are also held by various corporate entities and have been structured so that they will never trigger reassessment.

The rest of your schtick is pure collectivism.

A slum for every prole.

To see how that worked out in Wales: “How Green Was My Valley.”

That’s what you’re advocating.

Got it.

Agreed. Repeal prop 13.

Repeal Prop. 13 and everyone will pay more you idiot. So what if am and Pa Kettle pay less? Someday will too if you stick around and build a community as they did. Do you really want California local governments setting your property tax rates? Every time they think they need something they will raise your rates. Those of us who lived in California before Prop. 13 remember what it was like.

The economy has become a fantasy; an amusement park ride of pastel smoke, mirrors, fairies “flying” on invisible wires, well dressed handsome princes and beautiful princesses living happily ever after. The line wraps ’round the building, velvet ropes and well dressed staff reigning in a hopeful populace, their eyes shining with excitement; grasping tickets hoping for their chance to enter the Magic Castle.

I suppose, just believe; carry on! That’s all that matters at stage of the game. Grandpa Warren says America’s best days lie ahead. Bless his heart.

….while at the same time increasing his cash positions and decreasing the stock position. He is saying one thing and doing exactly the opposite. Is he feeling something?

Time out. You mean to tell me that smart savvy capitalist billionaire investors use the media to get into and out of stock positions at a good price? I thought Warren, et al were patriotic, altruistic gentlemen doing gds work with tons of free time to go to television studios and do media appearances spouting off advice that we could all just follow and get rich off of?

And Karl, if you want to live in an apt, go for it. Lots of pluses. However, in America it’s probably better if we don’t tell individuals or families with children that they should live in an apt (or a house for that matter). This country is built on freedom and your comment, although perhaps coming from a good place, is one of the most worst ideas I have ever heard. You don’t want to give local officials that much power, let alone “elected” (aka bribed) federal “representatives” control over citizens of 50 states with differing cultures. I mean another way to control sustainability is population control. Maybe everyone gets 1/2 of one kid, so couples get one and two single people can share one if they like. Maybe we’ll make an exception to that rule where rich people (lets set an arbitrary number of $250k per year in salary) get 2 kids bc they can pay for sustainability offset credits that those that want no kids can sell. Or why not start setting how many calories each person gets per day. Or maybe servings of meat per week because that’s in limited supply. Now we’re saving food and fuel to bring the food. Once again, we’ll have our exceptions bc rich people like to eat. We can all think of ideas in theory that could help a lot of bad hings in this world, but trust me, central control (which, btw, will not be in your best interests no matter how many times you click your heels and pray) is not what you want even if you think you do. Live your life and let others live there’s. We only get one ride on the roller coaster it seems.

Uncle Warren is a prick who uses his influence in government to enrich himself. His insurance companies are the kings of claim denials. He has used the interest free loans from his insurance clients to enrich himself through deals that have fucked working class people. All while playing the “aw shucks” grandpa. Fuck Warren Buffet.

You forgot the magical unicorns!!! I saw the brink of our insanity a few days ago. I know I know I am slow. But the Dow/S&P at all-time highs and there was absolutely no good news to support it? Maybe in the land of make believe the Dow/S&P are “safe” havens/heavens…

What’s your favorite flavor of Kooooool-Aid?

We have Red China Cherry

We have Ben Bernanke Blue Berry

We have Goldman Grape Sachs

We have Tropical Fed Fruit Punch

We have Lehmann Lemon Lime

We have Zero Rate Raspberry

We have Sideline Strawberry Cash

We have Pink Putin Lemonade

Plenty of flavors for everyone…

Lehman Lemon Lime was discontinued back in ’08 due to being too sour to swallow. Same with Very Berry Bear Stearns and Angelo Mozilo Contrywide Country Style Lemonaide

Can’t resist putting some reverb on Nihilist’s pot shot towards the Sage from Omaha and What’s ice cream man cool aide call.

“What’s your favorite flavor of Kooooool-Aid?

We have Red China Cherry

We have Ben Bernanke Blue Berry

We have Goldman Grape Sachs

We have Tropical Fed Fruit Punch

We have Lehmann Lemon Lime

We have Zero Rate Raspberry

We have Sideline Strawberry Cash

We have Pink Putin Lemonade”

We have Romney Rum Raider

We have Warren’s Watermelon Whizz

don’t forget the Tea Baggers Favorite

We have Patrick’s (Dan) Pumpkin Spice

Plenty of flavors for everyone…

…even when they deserve a big FU in front of their first name. (No offense intended towards Patrick Henry)

F’n A

Just like all real estate is local, so is the concept of middle class. Since there’s no “official” definition of what constitutes middle class income, I’ll through out there for SoCal we’re talking about HH incomes from $60-$100k.

Wrong…. Try again!

BTW what really is your favorite flavor of Kooooooool-Aid?

Lehman Lemon is is the bomb

But it’s been discontinued since ’08, DFresh! You have that big a leftover stash from the sugar crash 6 years ago?

Thanks, Craigs…I thought “bomb” was enough of a tell, but apparently not.

@DFresh, if you use normal distribution (aka Bell Curve) to define the middle class then SoCal incomes look like this:

32% of the SoCal population has a household income of less than $30,000 per year.

21% of the SoCal population has a household income of greater than $100,000 per year.

47% of the SoCal households earn between $30 and $100K with the median income of around $55K per year.

Your estimates of $60K to $100K would be the top 35% to 40%.

Sorry EB… Wrong…. Try again!

I’ll give a hint. Income is a result of the real measure not the measure. In other words, you’ll need to back into income once you determine the definition of middle class. There was a time, not so long ago, where executives made $100,000. I remember when my dream was to make six figures, now I pay six figure taxes each year and I am barely middle class. Quantifying by dollars or population will give you the wrong answer…

What is your favorite flavor of Kooooooool-Aid?

Yes, and then we parse down into lower-middle and upper-middle. Wouldn’t those break-downs look much different in SoCal than nation-wide?

Regardless, I was trying to address the irrelevance of continuing to use the term “middle-class” re: SoCal HH housing purchasing power with median prices as they’ve been for 15 years and wages as they’ve been for 30 years.

Maybe the better metric isn’t HH income, but disposable wealth.

Maybe this lower/middle/upper income vernacular is obsolete for SoCal. Seems 1%/9%/90% wealth is more germane to issues such housing affordability for the “organic” market (i.e., non-Wall Street, non-Chinese national, etc.).

Like Papa has pointed out, households in the $60-100k HH income range have a very difficult time saving $40-80k for a $400k crapshack. So, they might be “upper middle class” but they have no wealth. They might as well be making $30k when it comes to buying in gentrified SoCal.

If you went 6:1 leverage on your SoCal crapshack, then you have no wealth either, because you’re not a move-up buyer.

Who has the wealth? Only the 10%. Which 1040 HH can buy today in gentrified SoCal? Only the 10%.

But how many of those households are under-reporting or outright not reporting income? No doubt at every level there are individuals that under-report, whether minute amounts or vast amounts of income, but in particular at the lower levels where people receive all sorts of welfare “income” but are bringing in cash via one or more methods, whether collecting recyclables, panhandling, slangin’ rocks and dope etc., prostituting themselves, working jobs for cash etc.

CL – that is why the new 1040 forms include revenue from ill-gotten gains…

Maybe if the IRS spelled it out, cash money for pimpin, ho’in, slangen, bummin, recyclin, we would see more of this income reported…

Craig and What, you mentioned under reporting or non reporting of income. Now, this is an art in of itself. I am not just talking about the little ma and pa businesses where one can make 100k tax free and drive the BMW’s and MB’s, but when you add up all the taxpayer benefits, California is truly the “Red State” and “uncle Karl” would shout with joy.

Beware the Ides of March …………………..

et tu brute?

Since you’re James Taylor, why not make a song out of it.

“Housing to tank in 2014, beware the Ides of March…

My shirts and pants have all gone stiff – cause I used too much starch.”

“For most parts of the US, owning may be a good option (when the median home price is $190,000)”

‘May’ is the right qualifier. By standard metrics even a 190k home is only affordable with a household income above 60k (about $1300 for PITI on a 30 yr. mortgage or 16k per year). There are only 7 states where the median household income tops 60k, and they’re all states (MD, NJ, CT, AK, HI, MA, NH) where the median home price is above that price point – NH being the only one even close.

I just find statistics like that to be B.S.

In realityville…

Think of it this way. Most people worth a buck in this country are making $15 to $30/hr doing something. It could be an insurance representative, a CNC machinist, aerospace worker, car dealer mechanic, etc. Normal, average people. So lets call it $20/hr average. Marry a chick who makes $17/hr doing her thing.

$20 x 2080 hrs = 41600

$17 X 2080 hrs = 35360

That’s $76960 of household income per year. Take that X 2.5 and you get $192400. Voila! Maybe that’s where the median comes from? Not from places like CA and NY.

Most of my friends homes in the Midwest are worth $125k to $225k depending on size and neighborhood. And there are even options beyond those if desired.

It’s worth digging into the underlying data. For example, your statement supposes the two-income family (both with solid if not spectacular earnings) is typical and constant.

And, reverse engineering, in that income range the median number of earners per HH is 1.7. So you ‘tend’ to be more or less right if looking at that 5.9% of HH earning between 70-79k.

But drop down to 50k, and it’s 1.3. Jump up to 105k and it’s 2.0.

So certainly HH formation is a key issue. But remember the split isn’t just single/married, it’s that having children often influences workforce participation. For example, if you imagine the income split was $25/$12, aside from the emotional push to stay home, in many cases it costs more to work and put children in care than just to stay home.

And as the economy changes, the consensus is that we’re currently generating fewer $25/hr jobs, and more $8-15/hr jobs.

It is sad that a market has moved away from the middle class, but we have to go back and figure out what is middle class in California. Basically my observations since I moved here seven years ago is a family must make $100,000- 300,000 to have a lifestyle equal to the middle class (50,000-100,000) in the fly-over states. The current problem might not be that “middle class” Southern Californians can’t afford the houses, but 1) throngs of low wage workers with dubious credit have increased as a proportion, thus the middle class is not as numerous on a proportional basis and median income isn’t what it used to be if you properly account for inflation; 2) the recent crash illustrates the risk of a house as an investment; and 3) the housing stock is from a different era and is completely out of line with current valuations.

Simply, demand is evaporating because the market is over-valued. The Fed can do what the Fed can do, but they can’t make people any younger. They have been passing money in the form of housing support to a population of higher age and thus lower spending habits. Most current homeowners (the 80% with significant equity) are very concerned with their retirement. They will not spend like drunken sailors. The Fed has started to tighten and will continue to tighten since QE has not worked. We are still stuck where we were, but now the Feds options are diminished. The Fed is scared and still hoping we believe their bluff.

If the house sucks don’t buy it. Don’t be a patriot. You are a critical part of the market.

“The Fed is scared and still hoping we believe their bluff. ”

Correct!

But now we have to define “bluff”…

Hint – “…QE has not worked” Maybe yes maybe no. What was the real reason for QEInfinity? We have been scared into becoming specuvesters with every average Joe financial transaction. Average Joe will soon be speculating on fuel and food… Housing, education, transportation and retirement, Check!

There was no QEInfinity nor a plan for it. Eventually they would loose control of long term rates. It sounds better if rates begin to rise because of tightening versus loosing control. The Fed would be happier to keep up their purchases but they are not. It looks like they did not anticipate the loss in the workforce to happen as fast as it did or they wouldn’t of made as many projections on interest rate rises based on the unemployment rate. They made a mistake.

See estimates in

http://www.washingtonpost.com/blogs/wonkblog/wp/2014/01/10/the-biggest-question-facing-the-u-s-economy-why-are-people-dropping-out-of-the-workforce/

QE did help in buttressing household wealth.

http://www.bloomberg.com/news/2014-03-06/household-worth-in-u-s-rose-by-2-95-trillion-in-fourth-quarter.html

Wealth unlike energy can be destroyed. People have not saved for retirement and even with the wealth boost they must deleverage. Disinflation and lower prices will continue. Though in select markets where money is flowing in (social media anyone) like Silicon Beach, the mania will continue and I don’t anticipate buying a beach home at $500,000.

LC what flavor is your Kool-Aid? I think you missed the real purpose of the whole exercise. Put the fear of hyperinflation in all of us and we will stop saving and start “investing”. Remember the Bernanke stating that we had too much savings?

The other reason would be to get the toxic ass-ets (MBS) off of member bank balance sheets. The plan to lower worker participation has been in effect since 2008. This is the only mathematical way the Fed can meet the double mandate…

“The Fed has started to tighten and will continue to tighten since QE has not worked…”

What do you mean QE has not worked?!? It, along with various financial “reforms” most importantly the change from mark to market to “mark to myth”, worked EXACTLY to the TBTF PTB’s liking – it allowed them to launder the bad debt and keep these powerful financial entities liquid and from becoming insolvent overnight, as well as allowed them to (re)inflate multiple bubbles for them to make money off of at every step, every transaction, every contract, and every penalty – from loan and lending rate margins, to servicing credit, debt, securities, etc. etc. contracts, to acquiring assets on the cheap and flipping them.

QE certainly did not work to help our broader economy or the “little guy” at all, but that was never the plan.

QE for all intents and purposes made the FED into the current “bad debt public private resolution trust corp”. Get those bad loans off the member banks’ balance sheets and books, repackage them at the FED and sell them for pennies on the dollar as yet another method of acquiring more properties below market price.

Property prices run up too much, causing profit margin squeezes for the big investors? Easy, just go after the bad, nonperforming loans now that the corporate attorneys have figured out the loopholes to the new “homeowners protection” legislation, and viola! Foreclose, rent ’em out, and keep pushing those RBSes (rent backed securities)! Continue on with the Reverse RTO business plan – Own to Rent.

http://www.dailyfinance.com/2014/03/01/investors-delinquent-mortgages-foreclose-rental/

http://www.businessweek.com/articles/2014-02-27/delinquent-mortgages-draw-investors-seeking-cheap-properties

QE has not worked as intended since as Craig states “it has not helped our broader economy”. The FED ultimately is not interested in holding so much of the housing market, but can make mistakes. As for bankers, they are in the business of making as much money as possible. They want the real economy to grow as much as everyone else. Remember in the USA they get a cut of everything. Can you imagine their take on 3% GDP growth.

Personally in many ways (wealth) I benefited from QE quite a bit as have many stockholders and homeowners in the short term. However after they noticed that the real economy wasn’t getting a bump they should of stopped after QE1. I don’t see a flood of mortgages passing on the benefits to the broader economy. Maybe this year…. maybe next year…. maybe not at all.

In the meantime we have stock evaluations based on stock repurchases with limited expansion. Retail is not looking so good. A housing market that soon will have trouble finding buyers (Investors try not to loose their shirts and they have limits). Now if you mix in a little increased cost inflation from increased minimum wages, stir in deflationary expectations and tech wonders that enhance substitution that keep a lock on price increases, and gut some people with high energy prices. I doubt you will see people speculate on food, gold, or paperclips. They will cook it themselves, hunker down, and deleverage though. When will their houses be on the market? Low demand, low supply.

CraigLister…

“QE for all intents and purposes made the FED into the current “bad debt public private resolution trust corpâ€.

This is a fundamentally incorrect analysis of how the Fed bails out commercial bankers. The Fed simpley does NOT accept rotten collateral. Period, end of story. For a solid century, the Fed has a firm policy of only accepting the good stuff. Wrapping up loose ends, resolving REOs and all the rest – that’s exactly what the Fed is not staffed to do. Indeed, its charter prohibits that function.

“Get those bad loans off the member banks’ balance sheets and books, repackage them at the FED and sell them for pennies on the dollar as yet another method of acquiring more properties below market price.â€

The Fed does not, will not, has not, repackaged any crippled securities. It’s against its charter. The cripples are shunted off to every other Government Sponsored Enterprises – but never the Fed.

Overwhelmingly, the beat-downs have been absorbed by the commercial banks – and Freddie and Fannie – and mortgage investors. Quite recently, Freddie and Fannie forced major loses back on to the commercial banks. Remember the news?

â€Property prices run up too much, causing profit margin squeezes for the big investors?â€

This is a total misunderstanding of how property owners win. NOTHING could make them happier THAN rising property prices. “Profit Margins†are of concern to businesses, not landlords. Rents, finance, taxation and cash flow are the metrics that matter. In all by days, I’ve NEVER heard of a property owner even using the term “profit margin.†You must be very, very, young, perhaps an economics professor.

“Easy, just go after the bad, nonperforming loans now that the corporate attorneys have figured out the loopholes to the new “homeowners protection†legislation, and viola! Foreclose, rent ‘em out, and keep pushing those RBSes (rent backed securities)! Continue on with the Reverse RTO business plan – Own to Rent.â€

You are utterly lost. No-one uses corporate attorneys to pursue these matters. Everyone uses attorneys specializing in real estate. It’s a different sector of the profession. Most would be considered ‘bottom feeders’ – the catfish of the profession. They’re only one-step away from bankruptcy attorneys and divorce lawyers. Players like attorney Ken Bowden (Bill Murray) in “Wild Things.â€

New legislation will not affect old, broken contracts. It’s irrelevant, completely so.

The rental stream backed securities have absolutely nothing to do with the CRA Policy and resultant national real estate bubble. They’re pretty much brand new, and only exist because the Fed has ginned up ZIRP. They represent an attack upon the pension funds and other tax qualified monies. (Retirement accounts far and wide.)

Bringing back feudal economics turns on the macro-attack upon earned incomes by way of importing waves of immigrant labor – some legal – some illegal, but tolerated by TPTB.

&&&

Read the previous entries of this blog, and get up to speed. You have your work cut-out. The somnolent propaganda of the financial channels is no help, nor is the screeching over at ZeroHedge. (Too much heat, not enough light.)

Again, LeafCrusher, you state QE didn’t work as intended. I disagree. It was never meant to help the broader economy; never meant to help main street. Its primary purpose regardless of what other BS propaganda was spouted, was to save the too big to fail banks, trading houses, financial institutions et al aka the banking cartel which were collapsing, result of their own doing, in the (il)liquidity crisis. First and foremost it was to be a method of putting the taxpayer collectively on the hook for any and all losses of the entire banking cartel, while consolidating any and all profits to said same banking cartel. Socialize liability, privatize profit.

The banks don’t give a flying fuck about 3% GDP growth YoY or 10% GDP growth YoY, real or imaginary, when their corporate existence i.e. their asses, are on the line. It always has been, and always will be, a matter of self preservation of the banking cartel. They will continue to make their transactional cuts and find more and more new revenue streams and profit vectors i.e. ways to nickel and dime even more, but they can’t make that the priority when they are too busy collapsing one by one.

If it was actually about the broader economy, the FED would have stepped in far earlier than it did and in far different methods than it ultimately did, and attempt to prevent the RE meltdown and financial and credit/liquidity freeze via a much more proactive and rapid bubble stabilization/reflation, as well as via helping actual individual homeowners with at the very least their primary residences directly.

blert –

“The Fed simply does NOT accept rotten collateral. Period, end of story. For a solid century, the Fed has a firm policy of only accepting the good stuff.â€

I’ve got one word answer for you! WRONG!!!

My ADD makes it too painful for me to finish reading the rest of the rambling babble so I will ASS-U-ME that you put your thesis at the top and the rest is just supporting evidence. Given that your thesis is incorrect there is no reason to read further…

I read that Kool-Aid is putting out a new flavor blert berry… Not sure how well it will sell in these economic times… What exactly is a blert berry?

a Blert Berry is similar to a dingleberry but of a blueberry color. Closely related to a doodoo bubble.

Blert, do you really think TPTB used plain old RE attorneys to find the holes to exploit in the Dodd–Frank Wall Street Reform and Consumer Protection Act? As you stated, your run of the mill RE attorney is one step above BK, divorce, and personal injury attorneys etc. No, there were MUCH brighter legal minds in the FIRE industry, lobbyists, and government working hand in hand to write that piece of legislation, as there always is. And they left plenty of loopholes and backdoors in it for their benefit.

As for the comment regarding landlords and RE investors never using the term profit margin, I wasn’t talking about landlords or RE investors – these are Wall Street beancounters and speculators who in real life know fuckall about the realities of RE investment. All they give a fuck about is their fees and earnings on transactions and margins on the spread between the free or nigh-free money they are being handed and what they are getting in return from the investment vehicles they dump it into i.e. profit margins.

I’ve asked repeatedly, blert, with your incredible financial brilliance and perfect score on the trader test, calling the bear market bottom of the early 80s and subsequent super bull rally, PUT YOUR MONEY WHERE YOUR MOUTH IS! What are going to be the biggest profit and moneymakers this year???

It really depends. Prices aren’t even close to their peak in the IE and are still 1/3 lower in most areas. Its not a bargain anymore by any means, but I would be surprised if there was a big crash coming. Most of what you see happening in CA is just related to what is happening with incomes in general. Incomes are becoming more concentrated at the top and home values are just following that same path. I wouldn’t be surprised if the rich areas keep going up as the rich continue to get much richer and the middle income areas continue to stagnate and decline as middle incomes go flat or even lower. I don’t expect to see this trend reverse anytime soon especially with Republicans looking poised to control both the senate and house. If anything this will get much much worse before it gets better.

Median household income in 1990 was $35,978.00 which equates to $64,390.43 in 2014 dollars using an inflation calculator. Today according for the census it is only $61,400. The trend is declining income.

The population of California grew only 10% from 2000-2010. The lowest decade of growth since statistics were taken. In the same period LA grew 2.6%. So with modest growth in housing these people can easily be housed.

Stagnant growth in people and incomes doesn’t make for a robust housing market. It can in the short term if you market to people from other regions ie. Spain, but it increases volatility and that can be a recipe for disaster.

Costco and Staples both miss earnings, worse than expected sales and margins. Staples closing 225 US stores. Market rallies 86 points.

http://finance.yahoo.com/blogs/breakout/today-s-trending-ticker–costco-stumbles-but-staples-goes-splat-155128868.html

Los Angeles worst city in America for finding a job…

http://www.laweekly.com/informer/2014/03/05/la-is-the-worst-city-in-america-for-finding-a-job

Maybe that news could spark another 10% bump in 2014 LA home prices? Perhaps a steady stream of moving trucks are heading toward LA from flyover country, filled with dreamers who quit stable jobs, sold their $200K, 2000 sq. ft homes on an acre of land to try their luck spinning the Cali Dream Wheel! Perhaps a cash filled plane loaded with Chinese RE investors just landed at LAX? Bike to beach!

Hahah, But there’s plenty of Girls having 3, 4 kids out of wedlock from certain ethnic groups which will be going on SECTION 8 and renting all those houses bought by investors and subsidized with money out of your pocket, for this generous program…;) yahoooo!!!!

Thanks for stopping by, Jose/Armen/Lee/HomeSugar!

You may want to re-boot your bigotry, whoever you are. Childless rates are rising more rapidly for black and Hispanic women over white women. It’s an economic issue, not an “ethnic” one. Correlation, not causation. May want to stop by West Virginia and see some other “ethnic group” leading the pack in cooking meth, going to prison, children out of wedlock, .gov dole, etc. etc. etc.

Pardon me, though my great-grandmother was born in Los Angeles area in 1875 when LA was mostly Mexican, I also was raised in Fresno, where many of my childhood friends were farmers and staunch Conservatives who all to gladly looked the other way allowing illegals to come work their crops while their offspring played football and drove 320i’s. F’ing hypocrites to the core.

I know some married couple immigrants from the middle east area who come to America and then claim not to be married so that the mother can be a single mother with children and get all of the taxpayer benefits while they live in a million dollar home on the hillside and drive a BMW. Of course the husband has an off the books business and pays little to no taxes. Their excuse is that everybody is doing it. They believe that they are doing what is right because everybody is doing it.

DFresh – 320i BMW??? You are older than I thought. I was still a German car mechanic when the 320i was out. That is the wayback machine!!! Yup my family was in LA in the 1800’s and surprise, surprise there were Mexicans there! And my family had large tracks of land in Nor-Cal as well and… wait for it… there were Chinese and Mexicans up there! Not sure where the idea came from that a place named Los Angeles (Spanish for the angles) or San Francisco were started by English settlers and invaded by Mexicans…

LA never was a good place to find a job. It’s amazing that it’s somehow even worse now. I read that LA Weekly article – so depressing. I do know a lot of people with huge parental support that live there. What happens when that well runs dry though?

“Perhaps a steady stream of moving trucks are heading toward LA from flyover country, filled with dreamers who quit stable jobs, sold their $200K, 2000 sq. ft homes on an acre of land to try their luck spinning the Cali Dream Wheel! Perhaps a cash filled plane loaded with Chinese RE investors just landed at LAX?â€

Perhaps, a steady stream of Unicorns is heading toward LA from flyover country, filled with sparkly shit to try their luck spinning the Cali Dream Wheel! Perhaps a plane loaded with cash just landed at an empty field in the high desert now being trucked to LAX?

There, I fixed it for you…

so, what you’re saying is it’s a bad time to buy? I’ve been waiting for five years now, and am about to inherit about $600,000….and I already had $100,000 for a down payment. Should I wait? how long? looking in Sierra Madre. HELP!!!

I don’t think trying to time the market is the best idea for a person who has the money and has to live somewhere. As long as your horizon is long you will typically be OK. If the market tanks, everything will tank (stocks, bonds, and gold) and at least your house will be worth something. If this is a pure investment take into account all possible investments and your risk tolerance. Diversify as much as possible and plan for retirement. Some rental properties can be really fun to. Whatever decision you make enjoy it!

Get yourself a small fixer house in a decent SoCal beach city. With 600K down, Hunington Beach or Dana Point are excellent picks. Forget all the negative spin in this blog. Fact is, over the long term, beach close homes appreciate wildly. Remember this … if you purchased a home in a better SoCal beach city, you are up, no matter when you purchased. Even those that purchased at the 2007 peak are doing well.

See Newport RI…

Just keep your eyes closed really really tight and jump, pammy. Uncle jt will be there to catch you.

Thank goodness jt is here to save you from your instincts.

Housing to tank hard in 2014!!!

You’re doing the Lord’s work, Jim.

Thanks for checking in hard Jim.

Hi Jim! My husband and I are traditionally home buyers with 2 children and looking to buy since Nov 2013. The San Gabriel valley (SG, Temple City, Alhambra, Pasadena) area is getting insane, in terms of pricing. Should I wait until the end of 2014 or 2015 to buy? It’s for house we intend to live in for a long time. Price range up to 650k for a 3/2 with some yards. We’re getting outbidded and outpriced here… It’s so depressing. Cash offers are winning over our 20% down of course!

Whether or not to purchase is based on your own financial situation and rent v. buy metrics. Run those numbers and make the call. If you are going to buy and stay put for the next 30 years (i.e. purchasing a place to live, not buying as a short term investment) whether prices go up or down in the short term shouldn’t matter.

In the cities you are looking at we are nowhere near rent parity nor do I think you will see rent parity in those cities any time soon; not likely that there will be a large price drop (10% or greater) in those markets within the next 12-24 months.

Look elsewhere. Mainland , HK, and Taiwan/Taiwanese Chinese are dumping all those dollars in a location they feel is safe and undervalued. Even though there are signs the Chinese economy is even more smoke and mirrors than previously estimated and it’s indeed looking like a monstrous financial collapse could occur with their house of cards, until that happens the SGV will be full blown insane price wise. Hell, if the Chinese economy does collapse it might even push the SGV higher with a surge in demand from fleeing Chinese pulling everything they can out of country.

The Fed and Janet Yellen will be crushed by a deflation soon. Everything will crash!

I am waiting for the pension bomb to blow up, even Warren Buffet said so!

http://www.bloomberg.com/news/2014-03-03/buffett-says-pension-tapeworm-means-decade-of-bad-news.html

The stock market will dive 50-60%, Obomba care will take every penny the common man has, then Calpers will blow up and take down California pensioners and whatever housing market with it. Then all the Mexicans will vote to end Prop 13, in accordance to the Communist manifesto that our President has written!

It’s time to panic, people! I am with Jim Taylor, the Fed crashes the economy in 2014.

Alert someone has hijacked my handle. The post I am replying to I did not post. It of course appears to mimic what I usually post, but if you look back I generally capitalize the words Housing and Tank.

Also notice I posted “Beware the Ides of March ………….” in the last blog post and higher up on this one. My plan was to use this catchphrase for the entire month and give the tanking hard a rest for the month and bring it back strong in April.

None of this is very important, but I want to let everyone know that it is possible that future Jim Taylor posts may not be indicative to the real Jim Taylor.

So just to set the record straight ahead of time. Stocks are going to sell off this year. I expect in the next 6 weeks. Housing always lags, but we will see heavy selling at the end of the year. 2014 will be the first big downleg in housing. Then int will accelerate in 2015 and 2016 we should see the final move down completed with a 50% or greater drop from peak prices.

Will the real Jim Taylor please stand up please stand up…

Well I’m Tim Jaylor, and I disagree 100% with Jim Taylor’s assessment. Stocks will continue to rally well beyond their current levels, fundamental continue to be damned. Dow should end up above 20000 by the end of the year. 25000 by end of 2015, and 30000 by end of 2016.

RE will re-surge and increase by 50% by the end of 2016. 5-10% increase by end of the year in most zip codes, followed by gains of 10-15% per year for the next 2 years.

Housing to NOT Tank Hard

Tim Jaylor – You know I am probably the only bear left on this site and I actually read your ridiculous (most likely not serious) comment and thought to myself that’s actually possible…

This is why I fear that the exact opposite will happen. We know that the bubble is probably in its final days when there are no bears left. We have run out of greater fools. It is true that fund managers buy to out perform their peers but this is just a game of chicken and we all know the outcome of that game. Someone has to capitulate. I think that this capitulation might be the domino. Also, the bond market could be the domino as blert pontificates. I am not clear how the bond market collapses before the stock market but either way we are set up for an epic correction.

At this point I will sit back, sip on my blue bear berry Kool-Aid and watch from the sidelines as events unfold…

I prefer red Kool-Aid What?

I know why the FED did QE but I can have my criticisms.

1) Mainly mentioning a tie of interest rate policy to an unemployment rate of 6.5 was a big mistake. Why a mistake? Credibility. Remember this is all ultimately a psychological project.

I don’t think everyone really thinks 6.5 is the magic number for full employment. The number is debated and probably higher after the loss of skills in the recession. We may be at 6.5% tomorrow and still be over the natural rate of unemployment with a declining workforce.

2) Tightening needed to happen earlier. 2013 would have been preferable. S and P at 1600 not enough for you?

3) Interest rates might be fodder for discussion on a housing blog. However the intense focus on Fed policy on every aspect on the US economy is not a positive development. $5 trillion dollars later and they are sole focus.

I’ll be watching Japan and let you know how that experiment works.

Red is a color not a flavor!!! Now is it Red China Cherry Red? Or maybe Robert Rubin Red Raspberry? Tropical Fedberry Punch is also red in color… Take your pick!

Well if I have to drink the Kool-Aid I don’t want to be picky about flavor. Just give me the red, I won’t be able to tell the difference anyway. Just make sure it is laced with Soma.

Red is the Red Star in the California flag. That is what draws so many people to California and not to the Rebel state of Rick Perry. The Bay area just needs to accept that their taxes support the rest of us. Property taxes goes to Sacramento, then they give a cut of it back to the locale. California has generous benefits for our parents that come here and for us as well when we take care of them as “care givers”. California is truly the golden state. There are so many government benefits that we could only dream about in China. Thank you Google and Apple.

Lower worker participation rate and you can have any unemployment rate you want. It is like share price and volume. Lower the volume and you can get any share price you want…

“I got everything on my own. It’s made me immune to those who complain and cry because they can’t.”

Yea, but your daughter is an ex-con ho…

Try granddaughter…

Let’s keep up to speed.

Let me give you some advice. I have made millions in real estate. The trick? Start in your 20s … early 20s if possible. Be careful what you buy. Pick up small fixer homes in the best beach city you can afford … but avoid cities like Long Beach. That is what I did. I started picking up small beach fixers 20 years ago when I graduated from college. 5% down worked then, and if you contact a mortgage broker, it will work now. Live in that home until rents rise enough to cover the mortgage and taxes. Then, rent it out and get another with 5% down. Just keep doing that and in 20 years you will be a multi-millionaire. Just make sure you only stick to beach cities. And, forget the real estate doom and gloomers. Prices rise a lot, then fall some, before rising even more. That is the cycle.

http://www.youtube.com/watch?v=5ysMt_9JnyI

You smell that smell? That gasoline smell? I love the smell of RE shills in the morning. It smells like vacancy…

“Let me give you some advice. I have made millions in real estate. The trick? Start in your 20s … early 20s if possible. Be careful what you buy. Pick up small fixer homes in the best beach city you can afford …”

Twenty somethings picking up small fixer homes in the best beach cities? How many twenty somethings in SoCal have the income or savings to do this, unless they have a big inheritance or generous parents? I’ll guess many don’t have the savings or income to rent a SoCal apartment on their own.

1970’s-80’s SoCal is gone. A twentysomething Midwest transplant can no longer rent a room in a beach town for $100 month, surf in am attend UCLA get a business degree, all expenses paid with income from a PT bartending job. A fresh new episode of Magnum PI won’t be airing this week. Sorry.

Well, Arsenio is back. Maybe acid washed jeans, neon parachute pants are next?

Do you know that you are living an illusion, jt?

All those increases are not real – they are funded by the debt and deficits! When will you learn, the right sustainable price for your area is probably 4x of median income in the area, which is probably around $300k, not 900k-1.5m.

Eventually the debt and deficit will come home to roost, the Fed will collapse, and your house will go down 50,60, maybe 70%. Thank you though, for the time being you are enabling the oligarch to steal from the middle class.

I am with Jim Taylor, housing will tank hard in 2014! (or any other year!)

Can’t wait until your beach shacks are washed away and the foundations are sitting under water. Oh and your insurance companies will say fuck off rising ocean levels aren’t covered.

What a load of HORSE SHIT! Sure it was easy as pie 20 years ago, hmm I wonder why?!?

Let’s see, there was the bursting of the late 80’s RE bubble and S&L crisis and subsequent ’91-92 recession which was really a depression in SoCal due to the defense and aerospace job losses which in turn HEAVILY and disproportionately hit many of the beach cities particularly Manhattan Beach and other south bay beach cities, RPV and PVP, north O.C. beach cities, coupled with the rampant crime and general ghetto shithole view of LA which was also exacerbated by the ’92 riots, and top it off with the Northridge quake of ’94. Oh and of course, the global cache, desire, and demand of the beach cities was a mere fraction of what it is today.

You think your plan is all that simple and easy to pull of now – ALL YOU REALLY DID WAS GET LUCKY WITH YOUR TIMING. Just a matter of when you were born/graduated from college and started buying, no more no less. Sure you picked the right location, but again that’s only the right location because of your timing. You weren’t smart money by any stretch of the imagination, just benefited tremendously from the built up and now built in demand.

At this point you have to start out a millionaire to be buying even the crappiest shitholes in the beach communities.

California should build low price housing so the so called middle class can afford a home?

folks this is a capitalistic nation and California is the Ultimate in a lifestyle of the rich and famous, and the poor and nobody. It is America at it’s best and worse.This is 2014, gas is almost $4 a gallon, $20 bill is lke $1 bill 20years ago. You people are still believing that 90k housing is coming back, $2 gas, and you can stretch a $1 bill.

Please understand if you didn’t save when you were younger, if you didn’t get a degree that means something, if you didn’t own a business that kept up with technology, if you don ‘t inherit at least $250k or more then you are going to be in for a tough go in America, going you forward in your life.

Reminds me of my native India. This is the way God made things. Accept it. The Vaishyas, and the Kshatriyas rule over the the varna of Shudras, the servile laborers. Of course, the East India Company and the British gave us guidance. The British understood, they had their own class system. In Hindu thought, life runs in cycles. Now California is going into the Indian cycle. Accept it, don’t fight it.

Follow the flip!

http://www.redfin.com/CA/Los-Angeles/2125-Vallejo-St-90031/home/6945511

How low can this 134 year old girl go?

Going on five months and a $100K discount from beginning ask. We’ll see how that open house goes this weekend. Maybe turning up the color saturation on those photos will do the trick.

That 134 year old girl is in the barrio AND no extra charge for the constant buzz of the 5 freeway traffic!

Yikes! There is much more than noise involved living that close to the freeway…lived a few blocks from 101 for several months back in the ’90’s and it was nasty, a thin layer of black grit covered everything outside…diesel soot, tire rubber, brake lining material, etc. Would not do it again at any price.

Shame. That house looks great. The upgrades are beautiful, and in keeping with the character of the house, which is charming.

OK…so there’s a cry-me a river story about some guy fighting foreclosure for 5 years and about to lose his house. I keep reading and I see that this family has :

” including 6 horses, 5 dogs, and 3 cats in Ridgely, Maryland”

WTF, unless you’re making money off the horses and dogs… There’s no Reason to have them when your broke. A hourse EATS a lot… even a single dog can cost you alot…imagine 6 horses, 5 Dogs, 3 Cats… only in AMERICA these saps cry about losing their home… in other countries people would’ve already made fillets or steaks off these animals to stay alive.

This is an interesting website describing life in mainland China. They often have discussions regarding the high price of empty housing in China. It’s scary and I believe if Jim Taylor is correct the problem will start here rolling west to the U.S.

http://www.bon.tv/China-Price-Watch/

My daughter has an attractive job in San Diego. She bought in late 2013. The house she bought was purchased for $400,000 in 2006. She purchased it on a “short sell” for $240,000 in late 2013. That was a drop of 40% in eight years. I think economic reality is coming slowly to California.

Leave a Reply to QE abyss