Rethinking California homeownership – Why 2011 is not the time to buy a home in California. FHA domination of mortgage market, price to rent variables out of sync, and unstable economy.

As we near the end of 2010 many will recall the late 2009 and early 2010 housing cheerleaders talking about the resurgence of real estate in California for the current year. These people have an uncanny ability to ignore macro trends and simply focus with tunnel vision like accuracy on housing with gimmicks like tax breaks and artificially low interest rates. Last week incoming Governor Jerry Brown said that California’s “day of reckoning†has arrived as he held a forum to discuss the $28 billion budget deficit. And for those of you who didn’t notice, the California unemployment rate held steady at 12.4 percent with an underemployment rate at a stunning 23 percent. In other words the California economy faces dramatic challenges in 2011 yet somehow there is a shrinking group of people who are still wedded to the idea that somehow real estate will go up in the face of all this economic news. At the very least if you have examined historical precedents and have read some history of economic challenges globally you can understand that the odds are very likely that housing values will fall in California. There are some key statistics that should put a pause to anyone thinking of buying in 2011.

Home Prices Flat and Sales Falling

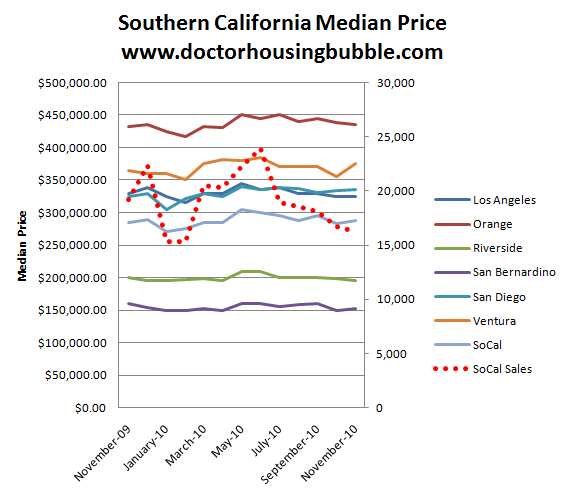

Notice how all the lines above move sideways? The chart looks that way because prices went nowhere in the last year contrary to all those housing cheerleaders one year ago who were trying to get people to rush into the market. The only reason that prices remained flat is because of the massive amount of gimmicks including the tax credit and the Federal Reserve artificially keeping interest rates low. But now that the fumes have run out, you can see that sales have collapsed:

Source:Â Data Quick

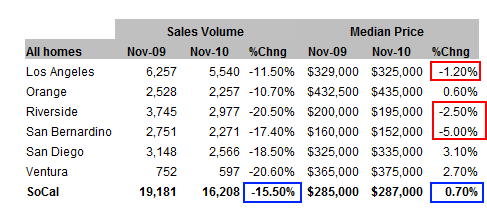

Collapsing sales are a leading indicator of where home prices will be heading. This significant contraction signifies price weakness in the months ahead. If you look above, 3 counties have already gone negative year-over-year in price. All counties will go negative in 2011 at some point. The housing market is extremely weak and if you can still believe it, we are starring at an enormous amount of shadow inventory even after the bubble burst in 2007. Another factor that many pundits don’t want to examine is the massive amount of FHA insured loans flooding the market:

Source:Â Real Estate Channel

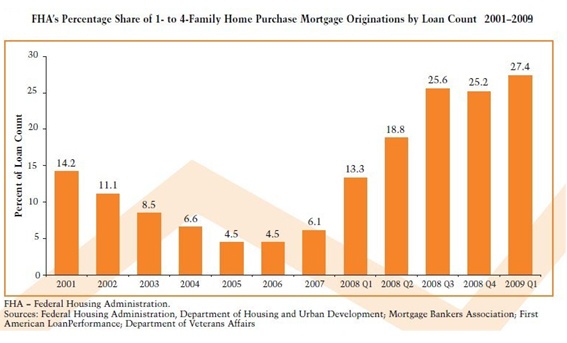

Some see this as a good thing since it isn’t their money that is at risk here. After all according to some, people use FHA insured loans because they want flexibility. This kind of logic is the same thing I heard when people defended option ARM loans as being for doctors, lawyers, and aspiring entrepreneurs that just didn’t want the hassle of documenting their income. I mean who can be bothered proving their income when asking for a $750,000 loan right? As it turned out option ARMs were going to Wal-Mart employees buying up $500,000 homes with no income documentation and padding a mortgage broker’s wallet with a nice juicy commission. So instead of listening to the false conjectures of the housing industry, let us see why people are drawn to FHA insured loans:

Source:Â Home Buying Institute

53 percent will go with FHA because of the smaller down payment (aka they are too broke to go with a more conventional loan product). Another 19 percent enjoy the “easier†qualification process. Another 13 percent simply can’t qualify for a regular loan (a good reason to give loans right?). 7 percent have bad credit (hey, giving loans to people with bad credit never ended badly has it?). And another 5 percent have low income. Sounds like all the FHA insured borrowers have so much money that they simply don’t want to tie it up in the process of getting a conventional loan. Of course that is nonsense and anyone with a thinking mind can see that people are using FHA insured loans as a substitute for low down payment mortgages that are now gone. In fact, last month 36 percent of all Southern California homes were purchased with FHA insured loans. FHA was never intended to be this big in the market and it certainly wasn’t designed for $300,000 to $500,000 mortgages.

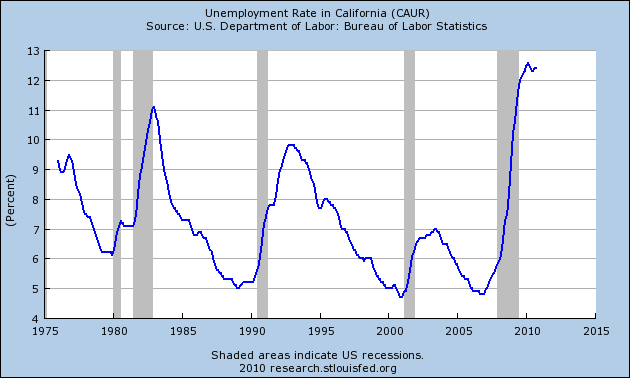

California Economy

Part of the reason folks have gravitated to loans with smaller down payments is because the economy is still in a mess:

One year ago in November of 2009 the unemployment rate was at 12.3 percent. The November 2010 data was just released and the unemployment rate is now at 12.4 percent. Sounds like we made some serious progress in the year.   Housing cannot recover without solid job growth! The reason folks are so drawn to FHA insured loans is because the income they bring in does not provide enough additional income for even a 10 percent down payment. Yet simply getting someone into a home is a horrible policy especially when it is with government backed money. FHA loan defaults are now at record levels. Why? Because lenders unwilling to lend their own money are pumping out government backed loans and squeezing people into homes they still cannot afford. Just because you can qualify for a loan doesn’t mean you can afford to buy a home.

I think many are starting to get this even at a gut level. The recent Governor’s forum should tell you many things. The Governor is setting the table for tax hikes or spending cuts. He understands that Californians want it all; they want the service without paying for it. So now many are going to have to make the choice. Either way, tax hikes or spending cuts do not bode well for housing.

Home prices still out of sync

A fellow California housing blogger Patrick who runs Patrick.net talks about housing values in relation to local rental rates. We’ve used this metric many times as well especially when investing in properties. He has put together a useful tool that measures home prices to local area rents:

Source:Â Patrick.net

For example, I pulled up a home in Los Angeles selling for $320,000 that would fetch $1,200 in rent. The red home icon means it is a no go on purchasing here. You can see SoCal is flooded with red. Ultimately putting a debt albatross around your neck is going to result in a foreclosure down the road or you being owned by your mortgage. If that sounds good to you then go for it. Yet the recent trends are showing that people are more reluctant on paying current prices and are more cautious about jumping into a home. This idea that people “love†their homes hasn’t really held here in California with the rise of strategic defaults. A large portion of the buying public has turned into mini real estate speculators.

California home prices are falling, have fallen, and will continue to fall in 2011. Those that claim otherwise have no solid argument except to say “well you just don’t understand and those that buy get it just like me†since they just don’t have any solid market analysis to refute the market trend. I’d be the first person to say things are changing if over the last year unemployment dropped to 6 percent and all of a sudden good paying jobs were hiring people and home prices stabilized because of this. But early in 2010 the only stabilization came from tax gimmicks, foreclosure moratoriums, and housing psycho-babble. Even the incoming Governor realizes a day of reckoning is on hand and this is a good time to buy?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

78 Responses to “Rethinking California homeownership – Why 2011 is not the time to buy a home in California. FHA domination of mortgage market, price to rent variables out of sync, and unstable economy.”

Thanks for another excellent article. We sold our house 6 months ago and decided to rent to take advantage of the market. We are taking our time looking for a home and like many advise on this site we will get a great deal or continue to wait.

For those of you with experience dealing with foreclosures, I am interested in your opinions regarding the market. There is a foreclosure in Long Beach close to Cal State LB that is worth about 850K (according to web appraisals) that is bank owned. We like the area and it is close to my work. For those of you with experience with buying these types of houses or possibly work with banks what would you start your offer at? Do you think they will try and get full retail or be open to negotiate? Thanks.

It depends on how long the bank has had the property on the market. The longer they hold on to it and they see the market deteriorate, the more willing they will be to take a lower price. However, if you’re thinking of a price w/in 20% of what they’re asking now, you should take a shot at it and let them know you’re not budging from that #. Lenders will sometimes take less than 80% retail value, but it’s usually for all-cash buyers that are purchasing homes that are not normally financeable. Good luck on your home pursuit!

I would not be buying anything in this market, especially a foreclosure with the huge robo-signing mess going on. Will your title be challenged later on by a previous owner? I would expect S. Cal real estate values to plummet back to late ’70s, early ’80s prices before the bleeding is done and I’m currently a homeowner, looking to do the same thing you did and rent instead for the time being. I believe it’s way too early to jump back in as the dollar is wheezing badly and on life support. It’s only a matter of time before the plug is pulled. Just too much inventory flooding the market.

Los Angeles is even worse than the rest of California. Record unemployment will not re-inflate the housing bubble any time soon. Here’s a quote from the Mercury News:

“Los Angeles County’s seasonally adjusted unemployment rate increased to 12.9 percent in November – its highest rate in modern history – as job growth gained little traction. California’s rate as a whole held steady at 12.4 percent in November, with the state showing a net gain of 1,600 nonfarm jobs following a revised gain of 43,200 jobs in October.”

You would have to be a complete idiot to buy a house now, in CA. or elsewhere.

Economy is sliding back into recession, massive cuts are coming to state and local budgets, with a tidal wave of government employess being laid off.

There are no easy solutions left- only painful choices.

http://www.cbsnews.com/stories/2010/12/19/60minutes/main7166220.shtml?tag=contentMain;cbsCarousel

Saw that segment on 60 minutes about how the state and local governments are like a car heading over a cliff. It’s going to turn into a crisis within the next twelve months, I think is what the analyst said. So we’ve got that, billions of student loans that can’t be repaid, and another guy is predicting that corporations purchased by private equity firms during the housing bubble are on the verge of bankrupcy which would lead to a million more layoffs.

We’d like to invest our money in rentals at some point –because .02 percent interest for CDs is meaningless. But we’re still waiting it out. My aim is to buy a rental at the lowest price so that I can afford to be competative with the falling rents and still make a profit. 2011 should be an interesting year.

Right and when Bernanke announces QE3, we won’t be looking at recession, but rather the beginnings of hyper-inflation.

I think you’re spot on Walter.

Just a small quibble with your rent to purchase comparison. In Southern California, as we all know, there are a significant number of empty housing units across all price ranges, the result of foreclosures. The fact that so many homes remain unused puts upward pressure on rental prices for those relatively few that are available to rent. I would suggest that perhaps a more realistic estimate of value might be found by comparing incomes to prices since over time we must assume that mortgages will tend to revert to the traditional model of twenty percent down, and not more than perhaps thirty five percent of gross household income being devoted to PITI. Not a novel concept by any means but that might be worth revisiting.

The price-to-income is a valuable metric for predicting housing prices. However, one adjustment to that is foreign capital. I’ve seen it several times in the past in California where wealthy people from a foreign country will flock to an area to buy homes without an income source in the local economy.

As examples, I offer Marin County in the 1970’s following the fall of the Shah of Iran and currently in Silicon Valley where Asian money is keeping prices high.

This effect is generally second order and has chronological limits but it still can offer significant market distortion while it lasts.

Thanks for the commentary Doctor. But have no worries. All of the FHA homes that are underwater and foreclosed are going to be given to rich investors and hedge funds. Diana Olick suggested this in a report a few weeks ago and we all know that she is a mouthpeice for the deep pockets.

I believe John Burns is one of the masterminds of this theft. He mentioned it last year. His good friend John Maldin mentioned it in his newsletter a few weeks ago.

The way that this con works is that the government with the help of deep pocket investors is going to set up big REIT’s to hold all the foreclosed homes that are currently held by the FHA, Fannie Mae and Freddie Mac.

These homes will be rented out by the big REIT’s. Huge profits to the deep pockets. Large commissions to guys like John Burns. The destruction of the lower end of the housing market and a monstrous bill to the taxpayer. What’s not to like?

Tax, sadly, you are likely right. I lived near one of the worst bubbles of the 1989 S&L crisis (Colorado Springs, CO), and the RTC liquidation game was definitely skewed towards “bulk” purchases and BIG investors. Being the pre-internet era, “transparency” (in real-time) was almost nil… GRRRrrr…

Anyone who would buy in this environment is what I would term ‘low hanging fruit’, and not a particular asset to the human gene-pool.

With all due respect Polo I disagree with you “low hanging fruit” comment. Many people are getting big discounts on foreclosures. In our situation, if we could get the supposed $850K bank owned house for $625K I would buy it. We have plenty of cash, excellent credit, and will be approved by the bank that owns the property.

I agree that paying “full retail” right now would be insane but by being patient in the rental situation one could find the right deal and offset the projected price declines. I was hoping somebody had some added perspective on dealing with foreclosures as the tenants are going to be gone the first part of January. I still believe the best advice is to stay emotionally detached, offer way low, and if the deal gets rejected walk and wait for the next one.

Retail price for housing is what a willing seller and a willing buyer agree on. It sounds to me that you have already made your mind up about this home. As a lister of 100’s of REO’s over the past years, the advice i would give you is do you homework, check all the neighborhood comps to determine a fair price for the home. Banks will start at an opening price and adjust as needed each 30 days. A lowball bid will be looked at as meaningless in the beginning. You will receive a counteroffer that will be full price. The banks beleive they know the fair price, its up to you and your agent to show them otherwise. Have you even been inside this home? Renters in Foreclosed properties tend to tear them up out of anger. When you pay your rent and the landlord pockets the cash and doesn’t pay the mortgage, then he walks away and the tenat has to move, it has the same effect as kicking a hornets nest, you get stung big time. They will find a way to extract their pound of flesh.

Renter, normally, FORECLOSURES go to auction–highest bid wins, and bank can set the minimum acceptable bid. If you’re able to deal directly with the bank, that’s great, and usually known as a short-sale. Best done with a lawyer in your court, but yeah, low-ball away… you can always counter-offer later… but it’s even better to walk away, and let the bank come chasing after you a week or three later, as they realize they are stuck in the nightmare world of NO (qualified) BIDS! Treasure these rare reversals of power, where finally YOU can make the bank squirm! ;’)

It must be nice to make $206,000 per year for 30 years. We all wish we were you. If i made that kind of cabbage, and the confidence that I could sustain it for 30 yrs, i wouldn’t be spending $625,000 on an LBC house, but that’s just me. I bet your realtard is stoked to be “friends” with you.

Sigh. I’ve been waiting Since 2005 to buy my first home! WTF is wrong with this state? Just let the collapse finish up and I’ll buy my first home.

I’m in the same boat as you, only I’ve been waiting a few years less. My wife and I just want to buy a home and get comfortable. We’re not looking to flip and “move up,” or anything of the crazy schemes people around us tell us are necessary here.

We’ve decided to give it another 2 years while we save for a down payment. If things are reasonable by then we’re moving out of the state.

I’m in the same boat with the waiting to buy thing. When I was making decent money, I waited for home prices to adjust back to realistic numbers, because I didn’t want to pay half a million dollars for a 600 s.f. home. Now I am under-employed and making less so I don’t qualify for anything, loan-wise. Prices have come down a bit, but I will continue to wait.

Same here. Totally agree.

Have you considered moving to a place with rationally priced real estate, lower unemployment, better job opportunities, and getting on with life? The world does not begin and end in California. Oh, I forgot, the weather and restaurants…never mind!

I think about it all the time, but like you said, you just can’t beat the weather here, and that’s pretty huge. I grew up in Toronto, and I’d rather not go somewhere that has cold winters or hot/humid summers. I prefer to be close to a city with more of a multi-cultural thing going on too, but you don’t find a lot of that in this country outside of LA or NY.

I’m in San Diego and have been waiting to buy for 3 years. I do get concerned when I see prices rise and am hoping I’ve made the right decision about waiting. I should rephrase that, I know I’ve made the right decision for me but I do sometimes wonder if San Diego will be the exception is Socal falling house prices. The good news is that we’ve saved up a massive down payment in the meantime and love our rental house.

And as for moving from San Diego, people rarely mention this, but we love our family and friends! We have a nice life, the only difference is owning a house or not. So, just like I refuse to be house poor, I refuse to leave my loved ones soley for the purpose of buying a house.

As bad as the unemployment situation is in California, it’s still the prime employer for those in the Tech and entertainment fields. People move away all the time and find employers don’t need the tech backgrounds, and then they pay half California salaries. Many couples have one employed, and one not, or underemployed. They’d be taking a huge risk to give up one job with benefits for the remote possibility of 1-2 jobs paying much less in a dif state. People have built their careers and skills around the jobs California has… not easily transferrable.

I think a lot of us who read this page are in the same boat. I’ve been looking for a home for about as long as you have. There are a few bargains out there but it is frustrating dealing with banks and agents. I usually get beat out by investors/flippers and within a couple of months I see the same house on the market with a real cheap cosmetic fix job for a lot more. The whole industry seems to be filled with shyters and shady characters. I am disgusted and I am no longer looking for a house. I have started to put my money in a diversified stock portfolio. I figure I get a better return in stocks versus buying an overpriced home.

Ditto. I’ve been wanting to buy for about 5-6 years now, but I’ve come to a different conclusion:

Prices are NEVER going to revert to “historic norms” in SoCal.

Here it is, years now after “the crash”, and people in my neighborhood still want $600K for a <1000sqft shoebox built in 1950.

And some people are actually buying.

From what I've seen the last few years, the government will literally destroy the dollar and/or every other aspect of the economy before they allow actual market forces to determine the price of a house.

3X median income?

Good luck.

What are your thoughts about the Shadow Inventory?

What is the possible reasons they are not being released? What possible plan do the bank/lenders have? Why are letting people live in their homes for almost 2 years without making payments, without foreclosure. Why not make the Short Sale with the owner already in the house instead of paying commission, their own labor staff, transaction fees, etc.?

Is there a big, smart plan out there? Do adjustment rates reset at these historic low interest rates?

Also, the media is clueless. Who writes their stuff?!

I’m just say’in……………

Because if banks do that, they have to admit the loss on the loan. As long as homes remain delinquent and not foreclosed, they retain the value of the loan they made. This keeps their balance sheets happy and investors even happier.

Renter: my experience with REO’s is that the distress sales process of short sales/auction then REO tends to filter out the better homes relative to location and physical condition so that an actual REO is usually in poor locations even in better zips codes such as being on busy streets or sitting on weird lots, has structural issues either the house or lot or needs considerable up grading such as homes that had been long term rentals that need just about everything. You should not pay more then a inflation adjusted price based on early 90’s price.

Tax Home: Of course at some point in time the government will need to dispose of a large number of housing units and as you suggest it will go to deep pocket individuals but these properties will probably not be the bargain many expect as the years of maintenance neglect quickly reduces modern built homes into giant cash sucking pits very quickly. At some point in time the large number of over sized homes built throughout the urban landscape comes back to haunt the owners from a maintenance perspective. Urban Homeownership requires deep pocket homeowners as the modern home is nothing like your built to last small home of the past.

23% real unemployment is the real story. This will continue to put downward pressure on the real estate market. State and local govt’s are in real trouble now. Raising taxes and/or laying off people will put even more downward pressure on the market. 2011 is indeed going to be a very rough year.

Shadow inventory is still a wild card that will either be neutral because the homes stay off the market or bad because they go on the market.

Most of the activity I see at the low-end of the market looks like investors that are turning the homes into rentals. This could put downward pressure in the rental prices as they’re all rushing into the market with the same strategy.

The only thing I disagree with here is the data that says you can rent a house in Culver City for $1200/mo. I doubt this is true. I pay $1220/mo. for a rent-controlled apartment in the valley, and that’s low because I’ve lived there for 10 years. $1200 will get you a bachelor pad in Culver City these days.

So true. I was renting a two bedroom apt in Los Angeles, not far from Culver City, and it was $1,600/month a year ago! A house for less than $2,500 a month? No way.

Heathen is right. Do a quick search on “Craigslist – Housing” and you’ll see that houses rent for much more than $1200 in Culver City (except for spam/scam “Rent To Own” listings, though even these are higher than $1200). In fact, you’d be hard-pressed to find ANY house for rent in Los Angeles county for $1200. They start at $1500 – and there are very few of those – then go up quickly.

How many different ways can you say our economy (or what’s left of it ) sucks! extend and pretend, deep pockets, foriegn investors, gov’t gimmicks etc.. etc.. will not keep the market from correcting back to historical norms of housing purchases. Without GOOD paying jobs to support current home prices on the Westside, the trend has been and will continue to be DOWN.

With the Patrick.net calculator, it is obvious to anyone, that renting right now is the choice for 95% of those living on the Westside.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Renting right now “will be” the choice of 95% of those living on the Westside.

Dr. HB,

You should have waited for the L.A. Times article “Mortgage deduction on the line”

to include as icing on your current article. Can’t wait for the next comments for this one. The “Housing Chearleaders” and Realters Ass. will need to come up with a good excuse to buy buy buy now!!! LMAO!!!

Anyhoot, Does anyone know how these “dead beat homeowners” are getting buy without paying property taxes and all the other realestate perks that come with buying a home of their own or are they? I know of a couple who are playing the game of “owning their American Dream” But little do they know we have them all figured out. I dont wish them bad, but to ask them about how they manage to avoid property, City, taxes and other obligations would be an insult to their great intelligence. So I avoid the subjects. Does anyone know if these obligations are being met???

Its no wonder the govt. is doing away with the “Mortgage deduction”. Thanks to our entitled “dead beat squatter” neighbors!!!

Taxes aren’t due until it sells / changes hands again. The responsibility is that of the owner (the bank) not the Squatters. Squatters can’t take the tax deduction, because they havent been paying the interest on the loan, so argument against tax deduction makes no sense.

Alright Doctor:

You keep quoting the high unemployment rate as evidence that California is not nearing an economic recovery, yet you don’t take into account the fact that the unemployment data is skewed by the large number of farmers in the San Joaquin valley that are out of work due water restrictions. Many communities in the central valley have 30% unemployment rates.

How about this: what is the unemployment rate excluding communities where farming is the main industry? That will be a better reflection of the state of California’s economy.

I would argue against the impact of those jobs:

http://articles.latimes.com/2010/feb/22/local/la-me-water-jobs22-2010feb22

http://www.contracostatimes.com/top-stories/ci_16208283

If anything, there are less non-farm jobs today than back in 07 (1.3 million less jobs in non-farm). Given today’s labor force (as presented by the BLS), those 1.3 lost jobs make up 7.3% of unemployment. Given that unemployment was at 5% (adjusted to 4.9% based on # of unemployed people in 07), we’ve covered 12.2% of the 12.4% mark. This seems pretty consistent with the articles above that claim job losses weren’t all that dire.

The LA times article shows Fresno County (the largest agriculture producing county in CA) having an increase in farm employment, as well as overall agriculture employment being positive since 06 (as of Feb, 2011). Furthermore, the 2nd article shows that a larger chunk of lost jobs in those central valleys are construction related (non-farm payrolls).

Say we include those lost non-farm jobs anyways and cut out all the high unemployment communities. I doubt that removing them would put our unemployment rate below 10%, or even 11%. It would require 300K jobs to decrease the unemployment rate to 11%. A loss of 300K farming jobs is a large number if you consider the exclusion of fresno county and some of it’s neighboring counties in central and south-central california.

Case in point, bad is bad, with or without farm payrolls.

Brandon, this was posted by Nickhandle above.

Los Angeles is even worse than the rest of California. Record unemployment will not re-inflate the housing bubble any time soon. Here’s a quote from the Mercury News:

“Los Angeles County’s seasonally adjusted unemployment rate increased to 12.9 percent in November – its highest rate in modern history – as job growth gained little traction. California’s rate as a whole held steady at 12.4 percent in November, with the state showing a net gain of 1,600 nonfarm jobs following a revised gain of 43,200 jobs in October.â€

LA county just reached its highest unemployment rate in modern history. There’s not a whole lot of farming going on there either. The laws of numbers come into play to answer your question. The majority of people in California live in a narrow corridor: LA, OC, SD, IE, Bay area. The region you are referring to won’t impact state unemployment much, there’s just not enough people to make a difference.

Yep, and the newspaper Saturday was reporting a double digit rate here in the Bay Area as well. For those who say unemployment is not pervasive all over CA, you are deluding yourselves – it may be lower in some places than others, but is still WAY higher than it’s been in decades even here in the Silicon Valley.

You sure about that, Brandon? I’m pretty sure the “official” unemployment numbers are NONFARM employment, considering the “jobs added/lost” numbers are for NONFARM payrolls.

Besides, how many of those unemployed farmworkers are here legally? Illegals don’t count in the numbers!

Think of an FHA loan as an arbitrage trade for the average Joe.

No one has any clue how long this false plateau of prices will last.

Most buyers now in the market are married with kids who need loans to buy a house.

Renting sucks when you have little kids.

Most spouses won’t find well researched and thoughtful arguments to holding out on a home purchase of any merit in a situation like that.

Sinking only 3.5% of your own cash is better alternative to a divorce. Thats’ about 9,000 to 16,000 grand for a mostly decent house in almost all of the Lower 48 States. You would be most fortunate to only have to shell out that much in alimony much less child support for even the 1st year of the divorce.

I think that is the strongest selling point of an FHA right now.

Just get a house that will keep the peace between the spouses at a monthly nut equal to equivalent rent.

Ride out the time it takes for prices to find the markets true value if ever.

If the idiotic government succeeds in inflation your OK as far as housing goes, but there will be bigger problems to deal with and the capital you did not waste on the house can be used to pick up other more tangible assets that preserve purchasing power.

If the idiotic government fails to hold deflation ( a more likely scenario), you have only suffered an equity loss of 3.5%, the rest of the monthly nut was what you would have had to spend on equivalent rent (does it really matter to you, if it went to a landlord instead of the FHA). It was mostly interest payments anyway, heck FHA’s sugar daddy gave you a tax credit for it (for the time being anyway).

If you lose your job, default, divorce, move, etc… you have managed to lose the absolute minimum amount of skin in the game. You in a lot better position than those “all cash” investors or the greater fools that ponied up a huge down-payment.

If deflation takes hold, you can be better positioned to take other opportunities since you have tied up only 3.5% down instead of as much as 20%. Now the cash you saved on the DP can be used in an environment where cash has significant purchasing power. If credit disappears in a significant fashion your idle cash could buy a much better house.

The false positives that the FHA product offers will, I think, limit home transactions to a range bound area of the PITI equal to $1,000-$2,000 plus the 3.5% down for a protracted amount of time. If reality sets in after that, look for housing to fall to 1 times annual income. If reality does not rear it’s ugly head, you will have bigger problems to worry about other than housing valuations. You’ll be more preoccupied with personal safety at that point.

So unless you reside in an unencumbered, rent controlled Soviet Monica flat, I suggest you ride the bull that gives you the most options and that steer is the FHA 3.5% program.

You forgot that if you do default, you get to live rent free for several years…

Yes, you really have nailed a lot of the reasoning here. We are one such family with small kids. We’ve been renting the same Irvine Company sh**box townhome now for 4 years, heading into year #5. And it does suck.

I am one of those spouses who has been so miserable and is so ready to be a homeowner again (as I was before I got married and had kids!) that is *has* been really tough on our marriage. We’ve been tempted to just jump into something decent to have it “done”. We were even in escrow once, and backed out when we realized that we were completely unenthusiastic about the place.

But I’m also not unreasonable. We will probably move into a rented house in Jan/Feb and hope to stay for a year or two. We’ll do our best to find a place we can tolerate at the price we want to pay, that isn’t in danger of being foreclosed upon any time soon. (That $50/month to Foreclosure Radar is worth it during the search.)

It’s a huge drag. We don’t even WANT to be in Orange County. I’d move back to Toronto in a heartbeat if we could, but my husband is in an extremely specialized industry and he’s currently in literally one of the best (and best-paying) jobs in the world in his field.

It’s hard not to feel completely trapped as we gaze out to our freeway-and-high-tension-wires view, singing the song from “Lowered Expectations”. Our consolation is to remind ourselves that we could be much more trapped than we are right now, with our 20% down sitting in the bank. We could be locked into some stucco piece of crap with no hope that we’ll ever get back above water.

If you don’t mind me asking how has being a ‘renter’ been “tough on your marriage”?

If you say that being a homeowner makes me feel better about myself and myself image – I’d say that’s an honest answer – and all too common. Ironic how the largest financial decision of one’s life is ruled by emotions.

BTW – you not missing anything back in the GTA. Unless you’re planning on moving to a nice place on Lakeshore in Oakville TO is just about on the verge of falling in on itself.

“The Governor is setting the table for tax hikes or spending cuts. He understands that Californians want it all; they want the service without paying for it. So now many are going to have to make the choice. Either way, tax hikes or spending cuts do not bode well for housing.”.

This statement is a bit misleading. 1/3 of the state’s costs have to do solely with employee pension liability. If state employees received pension benefits at par with social security, we would have more money than we would know what to do with. Retiring at 52 with 80% of your pay is too expensive. It will bankrupt the state.

I’ve been waiting and watching and reading Dr. H for about two years now. My 10 year old loves her school in South Pasadena (I do too) so I am trying to find a way to stay in this very expensive community. Finally found a short sale on a 930 sq ft loft on the edge of town for $315. Am I crazy??? Seriously, I’d love some help thinking about this.

I bet you mean the Ostrich Farm lofts, right? I live in So. Pas. too 🙂 I would be very careful of that place, I believe there is a lawsuit now against the builder. Many of the tenants have had problems with the sewer system and leaking roofs. Bottom line, they just weren’t built well. I have several artist friends here in town and they have found nice apts. to raise their kids in….you really don’t have to follow the herd and be a home owner. Check out the nice big units up on the Raymond Hill, I have an artist/teacher friend up there with a young daughter and he loves it!

I used to live in an apartment in that area. I lived on the outer edge on state street. It’s a nice little area. I wouldn’t mind living there again, but one part I didn’t like too much was that living in front of the freeway causes everything to pick up lots of dust. Otherwise, great area and a quick bus/car ride to old town, or a short walk to the little village shopping area on mission.

There are a gazzilion empty condos in So. Pas. right now, I think I’d hold off and wait for prices to come down more. Three hundred K is a lot of clams for a condo!

I guess it depends why you’re buying. We’re not in Southern California but I think we’re still in a bit of a bubble over here–though perhaps slightly less of one. Nonetheless, we’re not really buying because we want to live in a house and then sell it in 7-10 years. We are buying because we want a home. We fell in love with the community where we will (hopefully) be moving into and then found a really nice and happy house and well… if all goes well, that’s where we would like to put down roots. And I think we should be OK with the financial end of things. We’re putting down 1/3 of the price of the house and hopefully (we are at the beginning stages of this) the mortgage will either be equal to or slightly below our rent. Of course we still have property taxes, water and sewage to pay but I think our total housing will be within 25% of income. (After we’re done buying washer & dryer, refrigerator and furniture). So maybe it depends on WHY you want to buy a house and whether you are buying a house or a home?

@ Artist Single Mom

There’s a few things you should take into consideration before you think about buying. First, do your research and find out the historical values of properties in the neighborhood you are looking to buy. You may be able to find out the sales history of the property you are interested in buying as well. You don’t want to pay much or any attention to the

Wow! Wow ! This just in…. (sorry if sombody else brought this up already). I found the link to this on Patrick.Net. This guy (Richard Suttmeier) says home prices to fall 15 to 30% more in 2011. I believe him. Housing is a disaster waiting to happen. But it’s reaffirming to hear someone say this in the mainstream media.

http://finance.yahoo.com/tech-ticker/richard-suttmeier%27s-2011-outlook-pain-in-the-banks-as-housing-falls-another-15-30-535736.html?

Think about this: you buy a $500,000 house today. It falls 30% next year. Guess what? Your “$500,000 house” is now a $350,000 house!!! What an investment!

And who’s to say that 2011 is the end of it? I doubt it will be. D-W-T-H (Disaster Waiting To Happen).

@ Artist Single Mom- continued

You shouldn’t pay too much or any attention to the values of homes in South Pasadena during the 2001 to 2010 timeframe. Those values are based on unrealistic unsustainable bubble fundamentals. You should be looking at values during the mid to late 1990s to get a better idea of how much the property you are interested in should be priced at. Second, you should think about the possibility of you having to relocate. If you need to relocate do you think you will be able to sell your home without taking a loss? Remember, with our current bad economy, it is most likely that home prices are going to decline further in Los Angeles County (including South Pasadena). Do you want to take that kind of risk? I know people who bought during 2006 and would like to sell know, but they cannot because their properties are worth much less than what they paid for them.

Another question I have is, are you a multi-millionaire who can easily afford to buy a $315,000 dollar home? If you are, this possible purchase may not be an issue for you. If you are like most of the population in this country, then you probably don’t fall into this category. If you saw a reduction in your pay, would paying your mortgage be an issue?

What is the median income level of the area you are looking to buy in? What is the median price of homes? Is there a large disparity between the two? Is the median price of homes far more than 3 to 4 times the annual household income levels?

What if interest rates increase drastically? Historically, higher interest rates equals lower home prices.

Can you currently rent for much less in the South Pasadena area?

Does this property border the Pasadena, San Marino, Alhambra, or Los Angeles borderline of South Pasadena? I know that the areas bordering Pasadena and San Marino are probably going to be more expensive than the others.

The state of California is facing record budget deficits and unemployment. The federal government is broke. The economy is in shambles. Furthermore, the federal mortgage tax deduction may possibly be eliminated next year.

Do your research before you buy. Don’t overextend yourself. Follow the 3X rule.

Personally, I would not buy anytime soon in South Pasadena. But that’s just my opinion. Some of what I have said in this response is just my opinion that I based on logic and what I have read over the years.

Use logic not emotion when deciding to purchase your home. Good luck.

@ Artist Single Mom

There are a few things I forgot to mention. When you do your research, you are going to find that there were condos in Pasadena and South Pasadena that were selling for around $90,000 during the late 1990s. You have got to ask yourself if you think prices can go that low again. I believe they can and will. I’m almost betting that they will. Why wouldn’t they? Have wages increased dramatically during the last 10 years to warrant higher home prices? No. So take these things into consideration as well. Good luck.

Informed sideliner, as much as I want to see prices crash, I doubt you’ll see Pasadena condos go for 90K again in our lifetime. Wages haven’t went up much since 1999, but almost everything else has. As much as the government claims there is little inflation, we all know otherwise (food, gas, commodities, healthcare, education, etc). If we see real estate prices go down another 50%, the Great Depression won’t seem that bad afterall. I see a drop of ~15% in desirable areas and this will be devasting, anyone who bought in the last few years (think 8K tax credit, 3.5% FHA down) will be underwater in a big way.

Unless all the stars align for someone, it would be smarter to remain a renter during 2011. There is no upside and unlimited downside. The days of remaining on the fence and getting priced out of the market won’t be back for a long, long time. Sign a lease for 2011, save money and enjoy life!

The fatal flaw in your argument of growing inflation is that commodity prices are inflating on most of the things we import from other countries. Remember, 70% of our GDP is consumer spending for products we purchase from other countries. The US produces very little and is primarily a service-oriented economy which services its own consumers. How sustainable is that economic model? Now that China has pulled the plug by turning their back on propping up our out of control consumer credit purchases and are going to a gold and silver backed monetary standard, we are done.

Just listen to the propaganda the media is pumping regarding Black Friday and consumer confidence rising. Those out there shopping over the holidays are buying on credit, unemployment, welfare and social security checks. People aren’t spending their savings for these things because they have none, nor do they intend to pay for them when the bill comes due. Just look at retailer margins, they are declining sharply due to the higher cost of imports. These costs will be transferred to the consumers in 2011

Those stuck with US dollar-backed assets, stocks, savings, bonds, CDs, etc. will continue to really feel the pain. Real estate will not inflate because there is way more inventory than potential buyers out there and inventory numbers will continue to skyrocket as the dollar crumbles. Look at Las Vegas’ real estate bubble, up to 80% declines with at least a 20 year inventory of unsold homes with more on the way. Hey, at least they have gambling, prostitution and organized crime keeping their economy afloat. What do we have in California?

Smart money is transitioning quickly out of investments tied to the US and fleeing to foreign commodity producers and precious metals, the very things the Wall Street media propagandists warn Americans not to do.

Thanks to those that answered with some good advice. Also thanks to Surfaddict who offered up his complex linear affordability equation. Maybe too much time surfing and not enough time thinking.

Thanks for the laugh, that was hilarous!! Yes, too busy surifng and working to pay the mortgage to think, but stoked!!

it seems as if areas in los angeles, specifically areas such as hancock park, santa monica, brentwood, westwood are still very overpriced in the 1.5 – 3 million dollar range. yet homes are still selling. they are taking a little longer to sell but the good homes are eventually selling. who is buying these homes at these crazy prices?

Robin-

I totally agree!!!! I have been looking in Santa Monica and Brentwood and the prices are insane. Even rental prices are crazy. You would be hard pressed to find a decent 2br condo for $3000, let alone a house. I would like to rent and save money but finding something decent is really hard

@Brian, I’m curious what sources and where are you looking that you can’t find a decent 2br for less than 3k? It has been my recent West Los Angeles & South-end-of-the-San-Fernando-Valley experience that there are plenty of rentals available now –at least to those with good credit and verifiable income– & management companies are even willing to negotiate with renters anxious to fill their vacancies.

Managing dozens of properties in San Diego County – my sense is that while the housing market as a whole remains poised to take further hits – the lower-end of the market has taken most of its lumps and has in fact rebounded since early 2009 (around here). Because of stable rents and continued high demand for rental properties, investors standing at the ready just don’t let livable 3 bedroom, 2 bath homes get much lower than the $225k mark in North County (Escondido probably has the most of these).

I agree with DHBB – with current economic indicators no one should be buying a home (at any price) thinking that they are going to see equity build in the next 2-5 years. However, at certain price ranges (the lower range) – the major declines have run their course. This is not a matter of unemployment, available credit, willing home-owners, etc. – it is a matter of investors understanding they can pick up a property for $200k – $250k and rent it out for a 5%-6% return – a real asset that, if held for 10 years will appreciate (hopefully keeping up with future inflation). The same is not true of a home at $350k+

I tend to notice the same thing. Homes close to 200k are being grabbed and rented out. However, I think that ultimately, the landlords will not only have a tough time finding a renter, but with increased globalization we will start to see more wage deflation and rents on that end will start to dip further.

Most require 10-15% cap rate. Prop tax, insurance, R&M, ads, opportunity loss on the 50k down payment – adds up to 5% right there. Then you also have huge risk when you let strangers rent your home. Apartments are better way to go for rentals you’re buying less land and a lot more income producing units on that land. Houses have unproductive land you pay a premium for – front yards, drives, back yards, side yards, dog runs, etc. Just my thoughts…

Well, here is my two cents.

The problem is that stock market is directly proportional to real estate right now. Some of us recall that mortgages were being bundled up and were sold in the stock market few years ago (it was not like this prior to 2000 and they were kind of inversely proportional to each other).

Some local and state governments started to purchase real estate at the end of dot com era. and some of us followed the same path. Bankers were much smarter and started to tie the stock market and real estate together. Whom ever thought of this was a genius!

If stock market or real estate collapses, then the other one would follow, and what are the state and local governments going to do with all their obligations? As long as federal reserve is printing money and keeping the stock market between 10,200-11,700 not much will change in the price of real estate and five or seven or ten percent drop in the coming year will be a drop in the pocket.

We have created and allowed this economical mess (in some part because economy is much more complicated) and human nature tends to blame the others (government, banks.) Our parents worked very hard and they lived within their means and were not as greedy as we are. Some of us want to get rich and get rich soon and that can be true only for a few and not for all.

I have been to looking to buy (first timer) in Valley Village (91607) for over a year now. Inventory was on the high-side until recently when about 30 houses/apts. disappeared. I know a lot of people de-list if it’s sitting around too long and I figured people de-listed this week so no potential buyers would discover all the leaks (crazy rain out there). Anyway –

I just checked sales history using Refin and 20 houses/apts have sold in the last month and all at greatly reduced prices from the asking. Of the twenty, 5 were over 500K and the rest were under. The 500K and over houses sold for 50K less than asking and I saw a 1790 sq ft condo in a nice building sell for 295K from an asking price 0f 429K. If you put 10% down, with HOA fees it would be under 1600.00. this is not a good deal?

In 1995 it sold for $142,50. In 1988 it sold for $163,500. I think some pricing adjustments are happening right now.

I’m Not POTUS

December 20, 2010 at 2:41 pm’s comments sums it up for a lot of us. Wife threatens divorce if the husband does not buy. I am kinda of in this situation. Thanks for the empathy.

If that’s all it takes for your wife to threaten you with divorce than you should probably beat her to the punch and file first. Your relationship sounds really sad.

My wife always asks me when we’re going to buy a home. She hates the fact that I keep asking her to wait a little longer. I do search around here and there to see what’s available, but I tell her like it is. I show her the homes we can afford, the things we can or cannot do if we decide to buy and the bigger picture. In the end, she feels disappointed about the whole situation, but she eases off on her nesting instincts.

I think the best thing you can do is to lay out all your options and work with her on it. This doesn’t put her on the same rational level as you, but it does help her get a glimpse of the other side of things. She may still decide it’s worth giving up her arms for a home, only to bark back at you a few years from now because she finally realizes what your family has to give up for a home that’s slowly losing it’s appeal. But hey, that’s how they can be at times.

Be open and honest about it. Fight it out if you have to. You’re fighting for the well being of your family too. Hire an agent to keep tabs on the market for you and keep your wife in the loop. A good one will keep you on his/her list and contact you every now and then. And try to hold off for one more year. She won’t leave you if at least she knows you’re trying to find a resolution. She’ll be upset, but it is what it is. Good luck to you

Fred let me remind you of an important eternal truth.

“If your wife ‘aint happy….you ‘aint happy”

’nuff said.

A majority of the amicable divorces are precipitated by financial distress. Contested ones, more often than not, should have avoided matrimony in the first place.

Ed has got it right, and in this clustermuck of a situation that passes for an economy and governance we have right now, the only people who should even contemplate purchasing a house is a family with kids to raise. The reason they should be the only ones crazy enough to buy is because they pretty much have no other choices.

I’m just saying everyone has their limits and if reason fails to win out, you have an option in the FHA 3.5% program to hedge you risk that home buying implies right now.

As the tax code stands right now, that mortgage payment is all interest for the average 7 years that you own a home for the typical “married with childrens”. That is deductible, your renters credit is a joke and it will fall to the budget axe quicker than the Federal interest credit. When that tax break for the middle class is taken away for the greater good of the banksters, rent v buy is a wash from a cash preservation point of view. But by then it won’t matter if your a renter or buyer, you’ll just not be filthy rich enough to be of concern to your elected officials. OPPS to late that already happened.

Everyone else is a greater fool and one heck of a knife catcher if they are buying now. If strategic defaults make economic sense right now for those that own already, the same facts make it clear that no one should be buying a house now because they can.

Just want to put in a plug here for the reasonable, patient wives with small kids to raise. We ARE out there! Our only other close friends on OC are also originally from the East Coast, and have their 20% down sitting in the bank. My friend and I have both struggled pretty mightily with being crammed into tiny rentals for *years*, but we both know that whatever distress that has caused in our marriages, it’s nothing compared to the distress we would feel watching our equity vanish over the course of– a year? six months? It looks like it’s going to get a lot uglier before it gets better.

It was the sale of MY home (in a non-distressed, non US market) that brought us the money we have now sitting in the bank. Believe me, I’m the one doing all the research and presenting the sad facts to my husband. I’ve tried my best to make those damned rent vs. buy calculators come out in favor of buying, but the numbers just do not add up. The only way it would make sense for us to buy is if we were planning to stay here for more than 25 years. God forbid. We can’t stand OC and we’re only here for the job.

My friend does like it here, and they do intend to stay. They will buy this year if the REO property they bid on when it was a short sale ever comes back on the market. And that will be the right choice for them. At $220/sq ft., they might see loss in equity for a few years, but they’re in for the long haul so they should be ok.

I’m in the position of being able to pick between an FHA and a 20% downpayment, so I computed the costs on a spreadsheet.

The FHA isn’t the magic band-aid you make it out to be. Buying FHA could be compared to buying a stock call option: you pay a fixed premium to get unlimited upside and limited downside, since the downpayment is reduced.

The “protection” of the FHA loan is somewhat reduced by the high interest cost as well as upfront frees. Moreover, since the loan amount is larger (since the downpayment % is lower), you’ll be forced pad your payments with a larger principal payment.

In my scenario, the worst case loss in going for a conventional 20% downpayment was 24% loss (relative to house price) after five years (full payment lost + equity payments over five years).

After five years you are GUARANTEED to pay at least 7% of the house price in extra FHA and interest costs. With a fixed rate loans you will have built up around 12% of equity in the house with an FHA after five years. So with FHA the maximum loss for a similar downturn is 19% of house price (smaller downpayment + FHA premiums + extra interest costs + equity payments over five years). You only get “protected” for an extra 5%.

In fact to come out ahead with the FHA you’d be better darn sure house prices will come down not 5% or 10% but AT LEAST 15% within five years to get any advantage. Anything less and your equity payments over five years will make sure you take up most of the losses anyway. And if house prices are somehow higher in five years the FHA will cost you substantially more.

So the FHA is not a cheap price risk protection umbrella, at all.

Now if you’re willing to play the deadbeat game and plan in advance to not pay your mortgage if house prices go lower than you like, that’s a different ball game, and you’ll likely to come out ahead. Cheat a little, not worth it, cheat a lot, you win big. That’s really more of a gamble really.

Dudes, don’t fret. I am doing my MBA right now and we went over this in macroeconomics just the other day. Y’see, the long term aggregate output of the US has been dropping but was covered up by all the debt and hijinx over the last few decades. In fact, the long term aggregate output has shifted to a level below the level we should be at because wealth has been destroyed. With all the outsourcing, lack of wage growth, debt and on and on house prices are going to drop. I mean, for God’s sake, we are at 12.9% unemployment in LA and somehow prices are not budging! There’s a lot of rich folks who rode the wave of LA’s economic boom from the late 70’s till 2000 or so. These people bought real estate because that’s what they always did. Now, they don’t want to sell because in their experience, holding on has always gotten them rich. Sadly for them, not this time.

Anyway, I have been living in Europe as an exchange student for the last term and yeah buying a house is crazy over here but rents are not bad at all. I live a 10 min tram ride from the center of town in a nice 1 bdrm apt. and pay 1000 USD month. I could not get this place in LA, SF, NYC or any other major US city at this price. The cost of living in the US is waaaaaay high mostly accounted for by housing, renting and buying included. Some things cost more here, non prescription meds cost a fortune but prescription meds cost a tenth of what they do in the states. Transportation is pricey here if you go city to city, but within the city it’s cheap. Cel phone service costs around 20 usd a month. Once you get out of the usa, you realize there’s other, better places than the westside of la. I actually came back to LA from the city where I have been studying in the US earlier this year and couldn’t believe how dumpy it looked.

I came to LA and I also couldn’t believe how dumpy it looked.

Then I went to some OC coastal cities and couldn’t believe how beautiful some of these places were.

Yet I don’t think either of these pieces of information will help me figure out which way their house prices are supposed to go.

Good to know your MBA profs are way ahead of the curve as always 😉 I wonder what that class was like in 2005-2006?

I POSTED THIS IN AN EARLIER OC REAL ESTATE DISCUSSION, BUT IT MAY BE OF INTEREST TO THIS ONE AS WELL.

About real estate and hyperinflation: Weimar Germany issued a currency called the rentenmark, which was backed by real estate. It effectively ended the hyperinflation. During a hyperinflation, you’d be crazy to sell real estate; only exchanges for goods or other real estate would take place.

T-bill interest is going up now. Look at what has happened to the ETF TBT in the last couple of months. We don’t have high inflation, but the bond bubble seems to be winding down just like the housing bubble before it. With QE going on, the big players want more interest for holding US debt. The Government cannot set the rate on a T-bill. They can loan out money to others at any rate they choose, and if the rate is below the market rate, they will have PLENTY of takers. But they have to take what the auction price is for their own debt.

The N vs S OC argument seems to forget that there are plenty of nice N OC areas like Villa Park. And they’re a lot closer to LA County where there are JOBS. S OC is full of service jobs, but what else?

The bloggers who point out that income alone doesn’t predict ability to buy are absolutely correct. Plenty of late middle agers have had parents die and leave them a lot of cash or property. And many of us have been saving quite a bit, too. If there is any whiff of high inflation, getting out of cash and into real estate will make a lot of sense. (Remember the rentenmark?)

I think that when interest rates rise, the market will have another correction. That will be the time for people with cash to start looking again at real estate. Don’t even think about RE as long as fixed rates are around 5% or less. Even though there are a lot of cash buyers, they are greatly outnumbered by non-cash buyers. This applies to working class and middle class areas (including upper middle class). Truly rich areas are different, because the cash buyer is much more common at that level. But if foreign interest in premium real estate in Socal wanes, there will be bargains to be had there too.

Leave a Reply to I'm Not POTUS