California Financial Dreaming: 5 Exhibits Showing Why California will be in a recession until 2011: Revenue Projections, Housing Inventory, Unemployment, Toxic Mortgages, and Consumer Psychology.

It took California only three weeks after passing a $41.6 billion budget deal to fall back into the financial rabbit hole. How much did analyst miss? Try $8 billion. You need to remember that the budget battle started back in fall of 2008 and lingered for months so when the budget passed, it had rosy assumptions from a few months ago. Of course, things since then have deteriorated even further. More and more toxic mortgages in California are imploding and people are walking away from their homes. The California median home price is now off by over 50 percent and much of this occurred in one devastating year. Unemployment now stands at 10.1 percent and nearly 2 million people are out of work in the state. What the $8 billion short fall tells us is people are still too optimistic in their economic projections of our present predicament.

California benefited the most from the housing bubble. Sales on the most expensive homes, mortgage equity withdrawals from these inflated homes spurred sales on other items, and employment directly linked to the debt bubble expanded. So it would follow that the bursting of the housing bubble is hitting the state harder than any other state especially in industries directly related to the housing market. We also had state revenue projections that are directly tied like a scout knot to massive consumption which of course, are contracting as we speak.

In this article, we are going to dig deeper why California is going to have structural problems for years to come. We’ll examine revenue projections, the housing market, rising unemployment, and the change in consumer psychology. Michael Jackson is coming back on tour just in time to see fans moonwalk away from their mortgages.

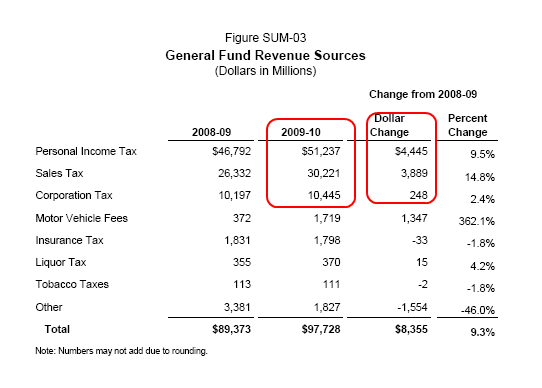

Exhibit #1 – Revenue Projections

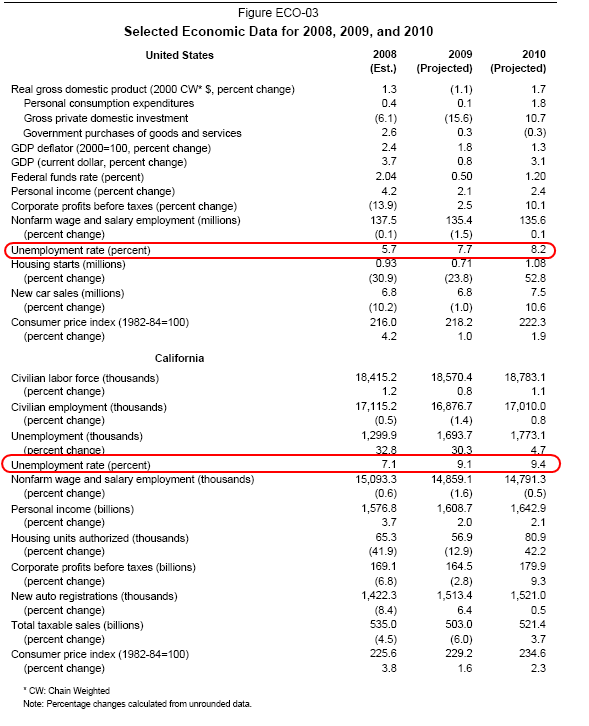

The above chart comes from the budget agreement reached in February of 2009. The problem for California is that it draws an unusually high percentage of its revenue from the personal income tax and sales tax. Of course, after the massive wealth destruction last year and rapidly changing employment climate, you can see why the number one source of revenue has fallen off dramatically. In fact, they have massively miscalculated the employment situation. Let us go back to the initial budget projections back in the fall:

That is a major miscalculation. They were projecting a high unemployment rate nationwide of 8.2 percent being reached in 2010 and statewide of 9.4 percent being reached at the same time. Well as you all know, the unemployment rate as of February of 2009 is now 8.1 percent nationwide and 10.1 percent statewide. That is a massive understatement especially when you consider that personal income tax is your number one source of income. So it isn’t any surprise that the projections are off and we now face a $8 billion short fall.

Yet look at the initial chart once again. The state is projecting that we will have a $4.4 billion increase in personal income tax collections and $3.8 billion in sales tax collections. Keep in mind this is for the fiscal year that begins on July 1st. Are you telling me the state is still buying that second half recovery notion? Personally, I think these projections are still much too optimistic. Yet the reason why this is occurring is the experts in the field are failing to look at unprecedented changes:

“(SignOnSanDiego) As an example of how bad it is, Taylor said his office projects a slight decline – one-tenth of 1 percent – in personal income this year. Although not much, Taylor said he looked back as far as 1950 and could find no prior year in which personal income declined in California.”

They’re projecting a slight decline in personal income tax? There is the problem. What do you think people are going to be doing with the massive losses of 2008? Many of the wealthy California contingent lost money in the stock market in 2008. In fact, many of these people are going to be able to write off a sizable portion of losses and will cut their tax liability lower and lower. Those that are unemployed aren’t paying taxes but instead are drawing on unemployment insurance. So this is a cash flow problem.

Yet even the new proposals are betting on high time again:

“This assumes not only a turnaround that doesn’t begin until (the first quarter of) 2010, but very modest growth thereafter,” Taylor said. “We don’t see anything like the kind of recovery we’ve had in past recessions, where we can bounce back with 8 percent, 10 percent growth.”

Interesting that they now have modest projections yet the revenue in the budget still reflects a rosier picture. These projections are still betting on some sort of new industry rescue. In the 1980s we re-emerged and had the technology bubble in the 1990s. California took in massive amounts of money but developed a structural budget deficit that bet on these high times. When things were settling out in the early 2000s, we get another whiff of a bubble with housing and we were riding high again. I think many of these people think some other bubble is going to save us but we may be reaching a bubble fatigue point.

My colleague John Rubino over at DollarCollapse put out an excellent book called Clean Money examining the new technologies that will emerge from green technologies. I correspond with John on a weekly basis and he was spot on regarding the housing bubble so I tend to listen to people that have been right for many years. Reading the book, you realize that many of these technologies will require massive government spending which I’m not sure is priority number one at this time. In addition, the drop in oil has pulled back that vigor that we had when oil was at $147 a barrel.

In the moment, I think some of our politicians are clinging for a third bubble but I just don’t see it happening. The wizard behind the curtain of our economic system has been shown and I think most Americans will now have a hard time believing in the way things once were. If we want something, we will need to pay for it out of more immediate financing.

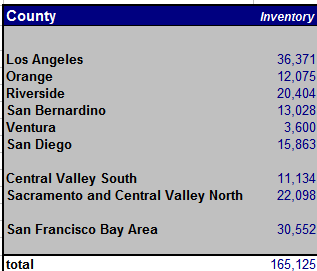

Exhibit #2 – Housing Inventory and Sales

California still has a glut of homes. In fact, more homes are coming onto the market that will keep us from reaching a bottom for many years. The 10 reasons for a California housing bottom in 2011 still hold true, especially given these budget deficits. Why? The only way to fix the problem is with job cuts or tax hikes. Most likely we’ll have a painful combination of both. What that means is we will have more tax hikes and job cuts in the upcoming years. How does this bode well for housing, which we have just pointed out, was part of the reason California gained so much wealth this past decade? Much of that bubble wealth is now gone.

In January of 2009 29,458 new and resale homes and condos were sold in the state. The median price for the state has now fallen to a stunning $224,000. This is a far cry from the peak reached in May of 2007 of $484,000. That is a $260,000 drop or a 53.72 percent decline. We’ve been in this decline for close to 21 months now. Keep in mind the above data is from DataQuick. If we look at the California Association of Realtors (CAR) data we find that the peak was reached in April of 2007 at $597,640 and their current median price is $253,350; that amounts to a drop of 57.44 percent. Either way, the housing market is falling across the state faster than most would have imagined.

So let us try to figure out how much inventory is in the state. First, there is some suspect business going on because banks are not putting up all their REOs for sale at least in places where the public can see it. In fact, many are selling them to private investors in bundles and never listing them on the MLS. How so? Let us do a bit of investigative reporting here:

February 2009 California Data

Notice of Defaults filed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 43,072

Notice of Trustee Sale:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 18,831

Real Estate Owned:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 18,872

Total distressed for Feb 2009:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 80,775

Total Sales for January of 2009:Â Â Â Â Â Â Â Â 29,458*

*60.4 percent of all the January 2009 sales were foreclosure re-sales.

What this means is 17,793 homes sold were once foreclosed homes. Meaning, only 11,665 homes sold were naturally done. That is, a seller puts the home up for sale and a buyer purchases it. No bad history. So even looking at this, we realize that only with the February distress data, we have 4.5 months of inventory with one month of distress properties! So let us now look at what is currently on the MLS:

Keep in mind this data is not complete. We are missing parts of northern-northern California but this is only to give you a sense of the inventory in the larger areas. With this data, we see that a total of 165,000 homes are on the market not including many of the distressed homes. So assuming only 11,665 home are selling naturally each month, we have 7 months of this natural inventory. But that isn’t the entire picture. Most of the distress homes do end up REOs so let us aggregate the data:

165,000 + 80,775 = 245,775

Sales for January of 2009:Â Â Â Â Â 29,458

Total months of inventory:Â Â Â Â 8.3 months

Keep in mind that we are uncertain how big the REO portfolios of many of these banks are. We are simply using a lower rung estimate here and we have already found 8.3 months of inventory. I would venture to estimate that we have anywhere from 12 months to 14 months of inventory if we had a clearer way of gathering all the data.

Bottom line? Until we start seeing 4 to 6 months of true inventory, we are not anywhere close to a bottom. Prepare yourself to hear many people start quoting this but beware of the shadow inventory.

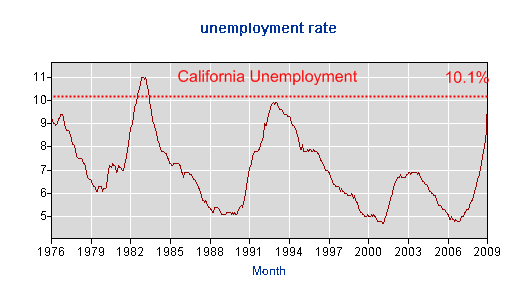

Exhibit #3 – Employment

California now has one of the highest unemployment rates in the country. The current unemployment rate is 10.1 percent and 1,863,000 Californians are out of work. This is up by 754,000 since last January. How big of a jump is this? That means in raw numbers, there are now 67 percent more unemployed Californians in one year. Stunning numbers. Of the unemployed 990,600 were laid off, 126,700 left voluntarily, and the rest were new entrants into the job market or were on temporary assignments. However you slice it, the unemployment situation is dire:

We are now back to the early 1980s level of unemployment. In fact, the highest unemployment on record with the BLS is 11 percent reached in November of 1982. We will breach that. Some are calling for massive cuts and that will only flood the market with more unemployed. We already have 1,863,000 people without work in the state. Those on unemployment insurance reached a record 717,525, a jump from 480,858 from only one year ago. It is harder and harder to find work for many. And of course, those 1.8 million are people that are not paying personal income taxes at normal levels or are probably buying stuff and consuming thus lowering the sales tax the state collects. All in all it is a difficult situation.

As I have argued before, the only way to solve this mess is with a combination of cuts but also tax hikes. This is the worst of both worlds and we shouldn’t be here in the first place but we are. Those calling for no spending cuts are simply living in a different planet. We are in a deep hole and many will need to cooperate to help. Those calling for no tax hikes fail to examine the depth of our problem and don’t bother to examine that we already have nearly 2 million people unemployed. Adding more people to the unemployment lines is not cost effective either. There has be a balanced approach but seeing how the state has failed to see this $8 billion short fall tells me that they are too optimistic with their projections. While millions suffer in a silent depression many are looking for that next perma-growth model.

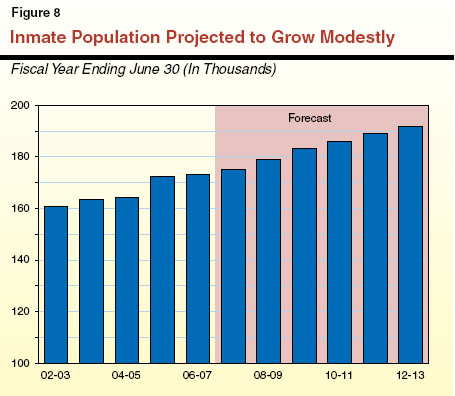

There is one growth area for California housing. Housing for prisoners:

One thing that we know how to do as a nation is provide housing for prisoners:

I think at this point we as a society need to examine where we want our money to be spent. We need to strategically think of what to cut and be smart about it. Instead, we have ideologues on both sides saying “no cuts” or “no taxes” yet fail to miss the nuisances of this problem. Given how things are moving, I have little hope that we will come up with smart solution and instead will continue on this path of measured resistance that will keep our economy depressed for years to come.

Exhibit #4 – Alt-A and Option ARMs

The sliver of good news with the new mortgage and housing plan is that most Californians in toxic option ARMs or exotic mortgages will receive little help. And before thinking this is callous, just realize that many of these people went with zero down or very little down so they technically will lose nothing except their credit scores. Of course, there are exceptions but the data doesn’t support this view. So what will occur is they can stay in their place until they are evicted or move, and then they will become renters. California has one of the lowest homeownership rates and this bubble bursting will bring us back to the lows again.

These toxic mortgages are the worst of the worst and the irony is after all the shenanigans in the global markets, we have yet to decide how we will deal with them. The problem is that the only way to deal with theses mortgages in a morally fair way is to have them go back to the bank and have them sell it off. Yet that is the issue. With the flood of these mortgages coming back to the banks books, we are going to see numerous bank failures (of course those too big to fail will get unlimited lifelines which is even worse than nationalization which I have been calling for). Banks are running on razor thin margins so further write-downs will be enough to sink many.

And we still have people saying “no nationalization” failing to realize that we have some quasi-form of nationalization where the taxpayer is subsidizing the losses and allowing the banks to keep the profits. Awesome! Great thinking. The fact that Citigroup and Bank of America claimed they have a profit is laughable. Assuming what? Zero write-downs? We’ll find out soon enough once the Q1 earnings start rolling out. Remember BofA is now owner of Countrywide, the uber-perveyor of toxic mortgages especially here in California. What is going to happen when all those mortgages recast?

There is still an enormous amount of toxic loans in California:

January 2009:

Subprime loans in California:Â Â Â Â Â Â Â Â Â Â Â Â Â 391,959

Average balance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $323,117

Total outstanding:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $126,648,616,203

Alt-A loans in California:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 666,386

Average balance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $441,909

Total outstanding:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $294,481,970,874

So combining Alt-A loans and subprime loans, we still have over $420 billion in toxic mortgages residing in the state from the January 2009 data. Many of those option ARMs are in the Alt-A category. Many banks used optimistic models since Alt-A borrowers had “better” credit and therefore their loss ratios are just as optimistic as the state’s models on the economy of California.

Now do the quick math. If the median price of a home in the state is now $224,000 and the average balance of a subprime loan is $323,000 and for Alt-A loans it is $441,000, do you think we have a tiny problem? The new mortgage program only goes up to 105 percent of the home’s market value. So most of these loans are not going to qualify, as they should not. If we help these mortgages out, it is bailing out bubble priced homes. This is like bailing out Pets.com during the tech bust at a high share value.

The irony here is the average Alt-A credit score is 709. Bwahahahaha! Now that is a good one. It doesn’t matter, 50 percent will be recasting in the next year or so.

Exhibit #5 – Consumer Psychology

Finally, we come back full circle to consumer psychology. We have heard many pundits claiming that our political leaders should be “optimistic” and more “positive” regarding our economy. I agree that our politicians should not be downers but I rather have someone be honest and straightforward than a Pollyanna ideologue who is preaching the gospel of infinite prosperity. It is hard to believe someone when they are so wrong and frankly, many Americans I think simply want someone that can be upfront about the facts. Look, we have a major crisis on our hands and I think most do not expect miracles. Just don’t tell us to go out shopping because it is patriotic.

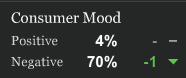

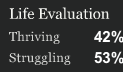

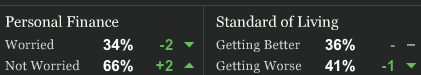

The thing is, most Americans have an accurate assessment of reality:

*Source:Â Gallup

Most Americans are having a hard time economically but also, this has filtered down to their quality of life. Consumer mood is at a record low. This does not bode well for a country where approximately 70 percent of our GDP depends on consumers running a non-stop marathon of consumption. Yet another disturbing number is that 53 percent of Americans now say they are struggling. This again highlights the reality of the silent depression that many are dealing with. The silent depression is a more accurate test of the state of our country because many people are living paycheck to paycheck and realize they are only one missed check from eviction. Many realize that they are simply moving along because of access to credit. Yet as we know, many credit card companies are now cutting back.

The truth of the matter is many Americans are now shifting into an austerity mindset. And make no mistake about it, many baby boomers (those with wealth to spend) are now more reluctant to save or invest because of very public cases like that of Bernard Madoff. I’m sure many of you saw the public smack down of Jim Cramer by Jon Stewart this past week. If you haven’t seen the clip, you can watch it here but it strikes once again at what is happening with consumer psychology. I have talked about Jim Cramer and Ben Stein many times and how they ridiculed those that saw a housing bubble or saw things in a different light from them. Now, it is very easy to be apologetic. I know one of the internet memes going around is “but they are entertainers!” Of course they are. But keep in mind that we are bailing out many companies that they were pumping up and using for “entertainment.” There were consequences. If you invested following their advice, the market has punished you enough. Yet it is another thing when they are advocates for the same institutions that ALL of us are now bailing out (i.e., Bear Stearns).

One clip found in the interview is the notion of pumping and moving stocks through hedge funds. The clip is simply reminiscent of the crony capitalism that has been pervading our system for too many years. Ultimately, the show was one of the most watched shows on The Daily Show in its 12-year history. Why? People are flipping angry and want to see some sort of justice even if it comes in the form of a comedy show. Many of our politicians are bought. I am stunned that we have yet to see any CEOs going to jail. In fact, instead of claw-backs we are still giving bonuses out! AIG just announced they will be paying out $165 million in bonuses after receiving $170 billion in taxpayer money! You can’t make this stuff up. The fact that we now have a realistic push for legislation forcing the Fed to disclose amounts given out to institutions is a step in the right direction. It is starting to look like the oligarchs in power are facing populist resistance.

Just look at the consumer sentiment indicators above. People are struggling. They don’t trust the markets anymore. So the markets had a technical rally last week. Does that mean the housing market problems are gone? Does that mean banks are now coming clean? Does that mean we stop bailing out the toxic institutions? I doubt it. Either way, consumers on the ground are pulling back and I see this as a permanent change in the psychology of many. People won’t forget this crisis that easily. Sure, we’ll go back and do crazy things because that is human nature. But people act as if we are out of this mess already. I don’t see a recovery until 2011. And after that, it will be moderate growth.

Here in California, I have seen people pulling up in Escalades full of aluminum cans and plastic at recycling centers. Something I have never seen. In fact, this weekend I saw a middle-aged couple pulling up in their Mercedes with Hefty bags full of crushed aluminum cans at the recycling center. And I think things like this is what will make this recession different from those in the past. You see many people in leased or newer cars driving around but they are flat broke and in debt. That is something you would have never seen in the Great Depression. Pain was very apparent then with people losing farms and soup lines everywhere. Now, we have people with a negative net worth driving around in $75,000 cars. It just doesn’t compute but the outcome is the same. Many people are broke especially here in California. The fact that we are now $8 billion in the hole after a $41.6 billion budget passed three weeks ago tells you a lot.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

38 Responses to “California Financial Dreaming: 5 Exhibits Showing Why California will be in a recession until 2011: Revenue Projections, Housing Inventory, Unemployment, Toxic Mortgages, and Consumer Psychology.”

So it would follow that the bursting of the housing bubble is hitting the state harder than any other state especially in industries directly related to the housing market. We also had state revenue projections that are directly tied like a scout knot to massive consumption which of course, are contracting as we speak.

Thanks for another good post Doctor.

We all must do our best to try and keep these people in the light.

Barney Franks is now crying about bonuses paid to AIG although he was one that was pushing the fed to bail them out carte blanche.

Nancy Pelosi crys about corporate jets and spends $400,000 a trip to get back to CA.

Republicans won’t approve spending that is all pork after supporting the same under George Bush for 8 years.

Bernankie won’t release the details of bailout funds.

A recent article on Patrick.net says the banks are lending but not to the toxic derivatives schemes that brought the system down. The Fed wants these re-floated; buisness as usuall! That is their plann… to reinflate the system.

American’s won’t buy American-made cars but the fed will bail out the car companies then buy their cars to boot!

Total madness!

Dr HB, Your California stories are all to real. People here, have the illusion they are rich, when in reality they are in a world of debt. This has come as a sudden realization, now that the debt game is in its final stages. Credit is being choked off and the emperor has no clothes. Everywhere, are signs of people retrenching and trying to eliminate what debt they have. Business, which survived on credit are going out faster than could be imagined. On the Westside, high end sales of real estate, cars etc… are at a standstill, just about dead in the water. Driving around Montana Avenue in Santa Monica, I counted 15 commercial businesses in a 1/4 mile that have gone out of business and the rest seem to be barely hanging on. People on the Westside are submerged in debt and now worried about their jobs. The downturn is surely picking up more steam.

It doesn’t help, that the Fed Chairman has resorted to making pleas on 60 minutes, trying to sell the American public, that everything is OK.

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Help accelerate the downfall — do your own personal tax revolt.

Alt-A Borrowers that lied about their income on the loan application should receive NO government assistance or bank loan modification! Let these properties foreclosure and let responsible buyers buy them at current market prices [although I will be waiting until 2011-2013 for more affordable prices near the bottom in the bay area].

So when are people going to start talking about a systemic debt write-down? Is it just too big-picture for anyone to see?

Very interesting to see the table “USA is the world leading Jailer.”

It refreshes my memory. When I was stationed in Seattle, WA as a foreign service officer. There is a report that a street people breaking a shop window and what he does next? He did nothing else, just sitting on the curb of street and waiting. Waiting? For what? He is welcoming a police to arrest him? Why? Because it is so cold and he is hungry in the cold weather; he wants to get into jail for free “social security benefits.”

Well, it also remind me of another report. “Of course, with 2.2 million people in US prisons, that means there is about 1 lawyer for every inmate.” http://en.wikipedia.org/wiki/Prisons_in_the_United_States#Population_statistics

I am with you wondering what kind of country we have building so far after our ancestors voted by their foots and moved into this NEW WORLD.

Reading and watching what Fed head Ben Bernanke said last sunday, I run into a comment made in MarketWatch.com as follows:

If your neighbor is out of work it is a recession. If you are out of work it is a depression. If Bernanke is out of work it is a recovery.

What A Nice and Neat Comment by ereilad! I love it!

Great article Dr. HB. Your statistics and data are always spot on and I learn more and more everyday about the state of our economy through this website.

Do you think it would be possible to write up a post discussing several strategies for getting through these tough times? e.g. Investment strategies, buying gold or silver, international real estate… The thing I like most about your site is that you present all the facts with a twist of humor but you don’t pander or use overly sensationalistic fear mongering to try to get people on your side.

Your help would be much appreciated. Thanks Doc.

DHB-

Very informative research and info… as usual.

Keep up the great work!!

We appreciate all your insight.

Very informative as always. But I would offer a few points.

You’re comments on what Jim Cramer said are incomplete. He was not talking about Bear Stearns’ stock, but if you had shares invested in the market through a Bear Stearns brokerage account. Those are two different things. As for the stock, which was then trading about 30-times what it is now, he didn’t offer a direct opinion, although I would have expected that he wouldn’t have predicted what did happen. However about the safety of the brokerage accounts invested through Bear Stearns, he was and is correct.

I also take issue with what you say about the necessity of California tax increases. California can’t get out of this through an increase in taxes. Technology makes moving companies increasingly easy. Living in Tennessee, I’ve been the benficiary of that as Nissan, Assurion, and countless other corporations have already walked away from the Golden State and relocated here. The tax increase, which you rightly point out is at least $8 billion too small to cover the gap, was still enough to saddle a California family of four with over $1,500 in additional tax burden. Those who can relocate will; those who can’t won’t. The former group are disproportionately wealth producers, the second group isn’t. California is already seeing a massive out-migration of high-income jobs, at the same time that there is an influx of low wage earners increasingly dependent on government support. It is a recipe for disaster as tax receipts will continue to fall short of estimates while government expenditures escalate.

Worse even than the housing crisis is the ticking time bomb called CALPERS. It is severely underfunded and will eventually require more state and federal tax dollars to shore it up. CALPERS is the largest, but it is just one of many private, public, and quasi-public pension funds whose disbursements are guaranteed by future taxpayers. Most of them assume unreasonably high market returns. Add to the pension problems,the FDIC bailout that will come when finally the banks bare their balance sheets (the sooner the better), and the amount of taxpayer dollars that is going to be spent bailing out bad obligations is going to be staggering.

You say that we have bubble fatigue, but the next bubble has already begun and it’s the most explosive of all. It’s the dollar bubble.

There is an upside, however. When the dollar bubble does burst, the California housing problem will no longer seem so problematic by comparison.

HI, DHB,

I am a renter and hope the house price go all the way down.

I read two blog post, which suggest that the low end house in SD might hit/will hit soon bottom.

What do you think? A “bull trap”, or some real sign.

http://www.californiahousingforecast.com/commentary/2009/3/15/16-offers-sent-to-seller-no-further-offers-accepted.html

http://www.californiahousingforecast.com/commentary/2009/3/15/crazed-san-diego-market-thousands-of-buyers-out-there.html

Thanks

Norman

This is just another typical white male – Republican hate attack against the Obama Administration.

You people just can’t get used to the fact that Obama won and won on a real platform of CHANGE. He has been President for only 2 months and you want to bring him down since you can’t stand it that a Black Man is President.

Within 2 months he has encacted bold and precise and real action to move us forward. Did BUSH come out with energetic and real stimulus legislation? No. Did BUSH have the political will and drive and intelligence to work a Trillion Dollar stimulus bill through Congress to get us back to work? Did BUSH come up with a bold and courages plan to get 2 to 4 MILLION jobs back? Nope.

Obama has promised change and the MAJORITY of voters voted for him since they know he can do it. We believe. Your problem, white man, is your hate.

What is the source for Alt-A / subprime loan numbers and amounts?

It makes alot of sense that California will more than likely be in a worser recession than some of the other states. Especialy considering the hard cold facts that you have outlined here.

Chubbini,

I did a few posts on that a while back: Navigating the Depression, What Comes Next and Navigating the Depression: Investor Edition.

I’d be interested to hear your thoughts.

W.C.

Norman,

We are far from a bottom as the good doctor points out. Don’t let anecdotal accounts by REALTORs lead you to believe otherwise. The data doesn’t lie and points to much lower prices. On our way to the bottom, there has to be buyers and we may see a “bull trap”; however, inventory and “shadow inventory” is and will be rising.

Take a look at this graph, San Diego is far from bottom:

http://www.housingbubblebust.com/OFHEO/Major/SoCal.html

Patience future buyers! 😀

RE: BobK “You’re comments on what Jim Cramer said are incomplete. He was not talking about Bear Stearns’ stock, but if you had shares invested in the market through a Bear Stearns brokerage account. Those are two different things.”

Yes they are 2 different things.. but, Cramer did tout BS stock itself 5 days before the comment about not pulling investments out, and again a bit earlier. See thedailyshow.com March 9th episode, first 3 minutes for the Cramer clips.

@jubilee Jujubee:

Not that simple any more. It is now a world that runs on debt, and we are the largest debtor nation. Most of the world’s investments are actually debt vehicles–highly leveraged. So I pay off my house, Joe is $300,000 underwater in a RHG with a shopping cart and trash can decor and suddenly we’re equal?? NFW! That boat don’t float…

No doubt about it–the prison system, health-care system and insurance industries are nothing but organized crime syndicates…(like that’s news). Who said crime doesn’t pay?

@Observer

Didn’t see that coming. Sure you got the right blog?

I remember when a billion dollars seemed like a lot of money. And that was only two years ago.

What I haven’t heard yet is the idea of people with trucks with campers, and living in them. Wouldn’t be so bad, would it? Find a nice street with plenty of trees, join a gym to take showers. Travel around, place to place, and live in a nice camper shell. It would beat living in a tent city, in my opinion.

I would definitely recommend it for that middle aged couple with the Mercedes with Hefty bags full of crushed aluminum cans at the recycling center.

Trade down, and then live it up…

Love the blog!

Observer, that was the most bizarre, off-the-wall post I’ve ever seen on this site, in the two years I’ve been coming here. It has nothing to do with anything the Dr, has ever written, let alone this most recent post.

“This is just another typical white male – Republican hate attack against the Obama Administration”

What kind of a whacky statement is that???

As an Obama guy, I can tell you, the Dr, if anything, is apolitical. He just looks at the facts, Jack!

Good on you for letting the post appear, Dr. H.B.

Shows you’re not afraid of letting whackos post weird shit – on your site. (haha)

And just to complicate matters…:

http://cbs13.com/local/foreclosures.real.estate.2.638417.html

Comrades,

I have bad news for California. Two basic ingredients that created the boom in the State, cheap water and oil, will cease to sustain the unsustainable. Those two things led to massive sprawl and the degradation of prime agricultural lands. So what if you solve the financial crisis? Will there be water to drink or raise crops? Will there be oil to support the beloved fleet of SUVs, run factories or power tractors? What of the parched breadbasket of the World?

Some posters ask the good Doctor what the next bubble to burst is. In my humble opinion, the next next bubble will not be one of over-consumption but of under-supply of basic human needs. The State must deal with the financial crisis but must also be making provisions for future decades through a paradigm shift in land use, housing and transportation policy, conservation, green technologies and basically living within the environmental realities of the 21st Century. As I am fond of saying, the 21st Century will look as different from the 20th Century as the 20th did from the 19th. Whether you want change or not, you’re going to get it.

Be brave Comrades!

I do not recall anyone saying anything about the current presidents race and I’m pretty sure the purpose of this blog is to share an educated opinion about the state of the economy. Not to discuss how certain minority groups may still be feeling repressed 55 years after the civil rights movement. Every political leader since the formation of society has been criticized, why should President Obama be treated any differently just because he’s black. There is a black man in the presidential office, grow up and stop complaining about inequity.

regarding “Observer’s” comment….

I love this website AND I am a huge supporter of Obama. This website, more than most is really not endorsing one political party over the other. What does happen is honest critique…. I know, it’s completely fresh, given the last eight years.

An especially absurd comment by Observer because Obama isn’t really black, by most common definitions. He has 8 great-grandparents (like all of us) and four were white European, three were ethnic Arabs (Luo tribe) and one was African. That puts him at about 12.5% black. Not that this means anything, except to racially obsessed idiots like him, but I thought I’d point it out for accuracy and clarity. I had a great-grandparent who was Native American, but I don’t identify myself as one because to do so would be ridiculous. A great site, btw. When you see the numbers relentlessly laid out like this, it is really scary.

Great post. I contend that there is another issue that isn’t being discussed much which will make the housing crisis even worse in California – Total Cost of Ownership (TOC). Thousands of 5000+ sq ft McMansions were built over the past decade in CA. Who is going to buy them, even at a deep discount? TOC will eat many people alive even if they buy a $1.5 million McMansion for $300K. Utilities, maintenance (pools, jacuzzi’s, huge kitchens, etc.), insurance, landscaping, HVAC units, roofing, cleaning, etc. will put a lot of financial stress on the new owners – especially over time.

I read stories that some new developments are being completely abandoned and people go in at night and gut the houses. I contend that many of these McMansions will never be sold, and many that are will end up in foreclosure once again once they have become delapitated. There just isn’t going to be a new market for these huge houses – too much wealth has been destroyed. And does anyone really think wages are going to increase anytime soon will such high unemployment?

As a hypothetical – suppose everyone decided to buy stretch limousines over the past 10 years because they were cool (like big houses) and they were appreciating quickly in value. Then the bottom falls out. Now there are 20 million surplus limousines. What do you do with them? They aren’t good commuter cars. They’re expensive to maintain. They just aren’t designed to be used for much of anything useful.

That is how I see the housing in CA. Why would a family of 2 or 3 or 4 need a 6000 sq ft house? These houses just aren’t designed well for living in long-term – they are too big and expensive and there just aren’t enough “rich” people to buy them and live in them long-term. As I’ve read – a house is a place to live, not a speculative investment.

There are areas in CA that have become ghost towns. Ghost towns usually don’t make strong comebacks – they die. I think we are going to see a lot of these McMansions bulldozed down at the end.

On another issue – how are reverse mortgages going to affect the CA housing crises? Didn’t a lot of people cash in with a reverse mortgage near the height of the housing bubble? How will this affect the financial institutions that took on these reverse mortgages?

Joe,

“should receive NO goverment assistance” or “will receive NO”? I guess they will.

Alt-A Borrowers that lied about their income on the loan application should receive NO government assistance or bank loan modification! Let these properties foreclosure and let responsible buyers buy them at current market prices [although I will be waiting until 2011-2013 for more affordable prices near the bottom in the bay area].

thank you Joe,

Are you also live in bay area?

@markytom

That has been something I’ve been discussing with post-status-quos, longing for some penicillin-type remedy to make the infection go away. The entire structure of our society is unsustainable. Scores of books, papers and articles have observed how all of our economic algorithms end at the same node: collapse. We have ignored obvious principles, axioms, postulates, realities; and instead fallen for the rush of the Ponzi-scheme bubbles and supply-side suicide.

Instead of picking the bottom as When?, we need answers to the questions:

What?

How?

Who?

What is going to fix this?

How is this going to work?

Who has the courage and political capital to make the tough choices?

The jig is up. China knows they are not going to get their money back and are voicing that. Venezuela president said “They print paper money and the get our oil” and the press calls him a nut. Saddam takes only Euro’s for his oil and…well, you know what happened there…

I still hear people say “buy land” or “get repo’s on the cheap”. Our general ignorance is still intact. Gotta go, time for “Fast Money”…right.

Observer,

“This is just another typical white male – Republican hate attack against the Obama Administrationâ€

Seriously?!?!!

C’mon, Dr HB doesn’t play the ‘Repuglicans vs Demoncrats’ blame game. Go back and read his blogs during W’s presidency.

He’s all about the facts and btw would probably do a better job than W and Obama managing (and I use that term loosely) this country!

Everyone seems to be pretty sensitive to the idea of Republican hate attacks – given good ole Limbaugh’s continual insanity on everything Obama. Let’s just hope the housing stimulus bill leads to some recovery in the housing markets. One of the key points of that bill that I think will help is bumping the number of mortgages for qualified investors from 4 to 10. Investors have been held back from buying bargain houses till now. Hopefully this should clean up some of the REO inventory.

I wanted to pop in and point out one area that seems to have slipped by, as it usually does. The unemployment rate is actually far higher than 10.1% if using the exact same method as was used during the Great Depression. Why should that method be used now? In short, because of all the finance talking heads and politicians who use the unemployment rate figures from then, as some sort of ‘proof’ that this isn’t so bad at all. U3 is the only data currently being used, when U6 was what gave the famous 25% from the thirties. U6 places the nation just under 15% right now, revised downward on the 6th of March from just above 20%. Even still, it isn’t accurate. The figures are reached by conducting telephone surveys and unemployment filing, and reporting from large companies. Smaller companies are not required to report, and a great many laid off folks never file for unemployment. Using my own friends and family as example, of the 25 persons I personally know who have lost their jobs in the past 3 months, not a single one has filed for unemployment, and only one worked for a large corporation.

This isn’t a partisan issue. That sort of specious trolling and pot-stirring has no place here, or anywhere. It was not solely one party that brought down the economy; greed and lack of accountability did, and there’s enough of that to go around on all sides.

Mortgage rates likely to sink on Fed actions

http://news.yahoo.com/s/ap/20090318/ap_on_bi_ge/mortgage_rates_consumers;_ylt=AldXSr6hM9WNsxUUMy4IEx.yBhIF

WASHINGTON – If you’ve got a good job, solid credit and your home’s value hasn’t fallen dramatically, you’re likely to benefit from the Federal Reserve’s extraordinary action Wednesday to help drive mortgage rates to historic lows and revive the U.S. housing market.

——————————————————————————————————————

That’s awesome, isn’t it? With the highest unemployment rate and falling home prices this should really help out CA….

Another note on the budget/tax/employment theme. As better-paying jobs are being replaced with lower-paying ones (where they’re being replaced at all), the tax base will further shrink, as will these wage-earners’ expectations, sense of confidence, and willingness to spend money/pay sales taxes. We saw this in the Bay Area during the tech bubble burst.

~

But Comrade Blutown has it right. California is the Bubble State, actually more like the Froth ‘n’ Foam State, with bubbles upon bubbles upon bubbles. And it all comes back to simple things like wind and weather.

~

I was watching the local University of Washington public TV station the other day while doing some little chore or other. A climate change researcher from I think it was U of Arizona was showing data trends for drought in the western US.

~

To put it simply, the last worst drought prior to the current one all over the SW, including the Imperial Valley and Central Valley (agriculture cornucopias), was several orders of magnitude less severe than the current one. And projected drought conditions by 2030 are expected to be exponentially worse, year after year after year, between now and then. WA State is open minded about climate change research, and watching the numbers and trends carefully, because of the likelihood that even with the western North American mega-drought spreading up here over the next two decades, we’re going to get a couple zillion bubble-headed Californians up here…still unable to understand the concept of living within one’s means.

~

We’ve already got plenty of these Ex-CA Lifestyle Nomads in our ‘hood, though they’re not nearly as vocal as they were this time last year about their megamillion-dollar state of CA pension fortunes…nor the upscale consumerist culture they transplanted to this poorer enclave so they could live out their retirement dream of lording their lifestyle over others.

~

rose

@ rose – you certainly have a way with words!

Awesome post. I got to it late.

One frequent refrain from the California real estate industry is how “everyone wants to live here”. Given what we know about the future economic, housing and job outlook in the state, do we also see the possibility of a “state exodus” in the future to more affordable areas of the country where there are jobs, better schools (California’s elementary schools are already ranked 46th in the union and the budget crisis and teacher firings will only make this worse), and perhaps a less consumption-based, “millionaire poser” way of life?

Leave a Reply to Sabin Figaro