California Budget and HAMP: Is the Home Affordable Modification Program Helping? California Tax Revenues Falter and Employment Breaks Historical Record.

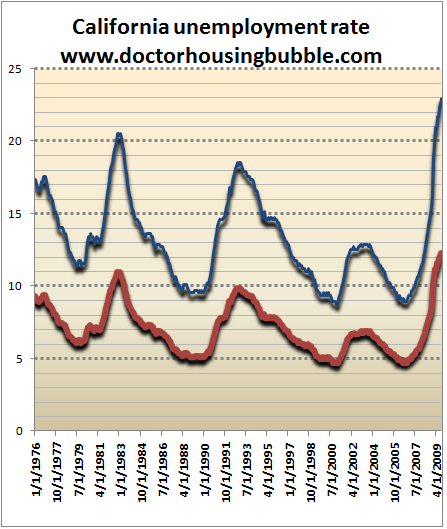

California is still unable to find the key to job growth. Last Friday new data showed that the California unemployment rate broke through another record coming in at 12.2 percent. Data for August was revised upward to 12.3 percent. Good news right? Well the reason the unemployment rate fell in September was because thousands of Californians gave up looking for work. In fact, employers ended up cutting 39,300 jobs in September alone. The California budget situation is still in a fragile situation. The state has had to contend with $60 billion in budget short falls and already preliminary data shows the state is $1.1 billion behind on recent estimates. These estimates were done with pessimistic expectations and even then, they over estimated the amount of tax revenues they would be collecting.

Source: BLS, EDD

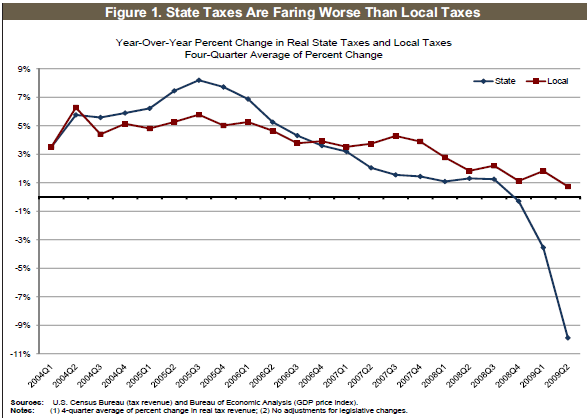

I’ve compiled the U-6 rate for the state and it is over 23 percent. That is why most people either know of someone that has been let go, has seen their hours cut back, or is one of the over 2 million unemployed in the state. With the state hiking taxes, this impact has been felt by all. Yet California isn’t alone. Many other states have seen their tax revenues decline. Unlike the federal government with access to the U.S. Treasury and Federal Reserve printing presses, most states have balanced budget requirements. A recent study shows the massive decline in state tax revenue:

Source:Â Rockefeller Institute of Government

The reason overall state taxes are falling much harder and faster than local taxes is many states take in a big chunk of money from personal income and sales taxes. California in fact brings in over 50 percent of their revenue from personal income tax. In recessions, the amount collected falls. Combine this with another fluctuating revenue source like sales tax that also declines in recessions and you can understand why the state has had to deal with $60 billion in budget gaps. We are already expecting a budget deficit of $5 to $8 billion depending on what analysis we look at.

Local taxes have faired better simply because of more stable income streams. But even this hasn’t protected them completely. Here in California the state has gone to battle with local municipalities in terms of paying on obligations. This is not the way to handle major budget deficits.

For the second quarter of 2009, state tax revenues across all states saw a 16.6 percent revenue decline. This is the largest decline on record dating back to the early 1960s. This is not a typical recession. This is the deepest protraction since the Great Depression. This only adds fuel and a reason to be cautious and suspect of the California housing rebound. The state is going to be left with two options to balance future deficits. Either raise taxes further or cut spending (more job layoffs). Both cases do not bode well for housing.

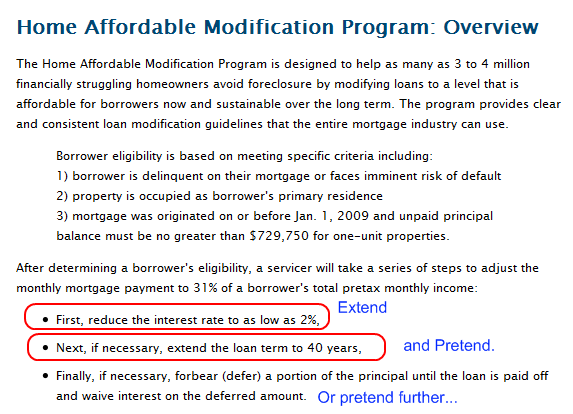

Let us now shift gears to the Home Affordable Mortgage Program (HAMP). Much is now being made about the “success†of the HAMP program with nearly 500,000 mortgages now in the trial modification period. We have major reasons to doubt this premature success. Let us go into detail why the HAMP program is largely a smoke and mirrors exercise in trying to stem foreclosures.

Let us Smoke some HAMP

On the surface the HAMP seems like a good initiative. Let us try to keep borrowers in distress in their homes. After all, a major reason for our current problems are due to housing so why not work with borrowers? Yet the problem is in the way the program is structured. The way HAMP has been carried out is largely a big extend and pretend program. In fact, HAMP is another reason adding to shadow inventory. Instead of going to another source for data, let us go directly to the HAMP website and get some documents:

Source:Â HAMP

I always took issue how the program was structured. The essence of the program is the belief that the problem is the interest rate and terms of the mortgage. Yet the real issue is something we all know. The banking industry is the main culprit in setting up this housing bubble and gave loans to people it shouldn’t have. Wall Street and banks made billions in profits and when things went bad, they took the taxpayer for trillions. HAMP is actually designed to help the banks, not the borrower.

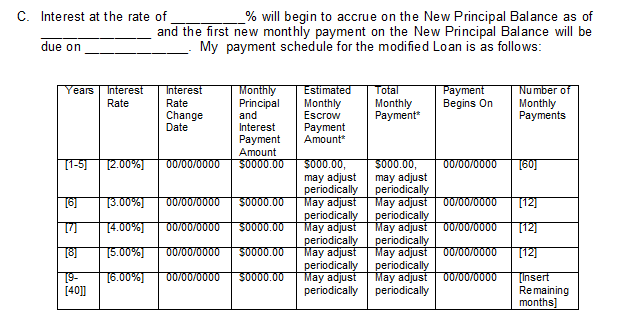

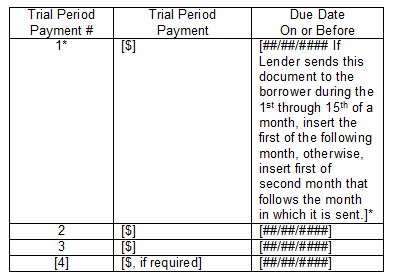

Look at the guidelines from the site above. First, the borrower needs to be delinquent or face imminent risk of default. That is easy to establish. So what is the solution? Look at the three steps given to us above. Drop rates to as low as 2% and if necessary, extend the term of the note to 40 years. They even give us the option of capitalizing principal to the note. In other words, these are option ARM-lites. This is straight from the program’s site. We are even given a document that resembles option ARM terms:

This is provided to us as a sample modification agreement boilerplate. Let us go back to those 500,000 trial modifications. Keep in mind these are trials, the program is too early to show whether this is permanent. JP Morgan announced a $3.6 billion profit last week based on their investment banking and private equity divisions. Losses are still growing in their mortgage holdings and also with their credit cards. In other words, JP Morgan is basically using taxpayer money to play the stock market casino. Forget about traditional commercial banking profits. It is now operating like an investment bank.

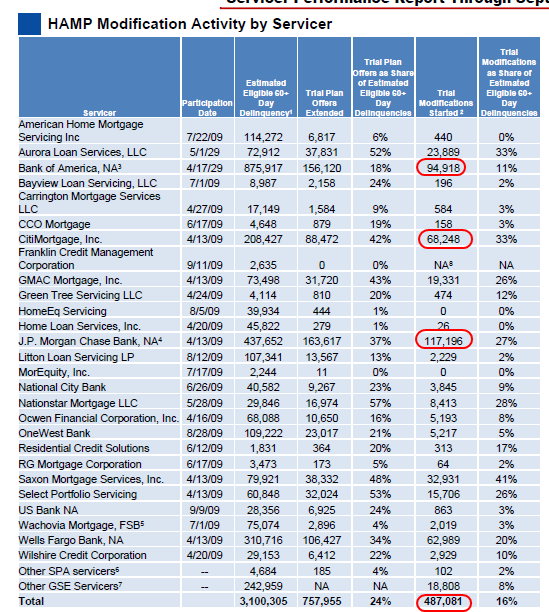

It is important to look at JP Morgan because they swallowed up toxic mortgage All-Star Washington Mutual who by the way, made billions in toxic option ARMs here in California. JP Morgan by sheer size has entered into the most HAMP trials by any bank in the country:

This data goes up to the end of September. So 3 million mortgages are estimated to be eligible for HAMP and nearly 500,000 are now in the trial phase. Keep in mind 757,955 offers were sent out. Another brainy move by the U.S. Treasury was allowing servicers to use stated income in allowing for the trial program. That is correct, the same style underwriting for Alt-A and option ARMs is being allowed for entrance into the trial period.

Initially the trial period went for 3 months but is now up to 5 months. I am not making this up:

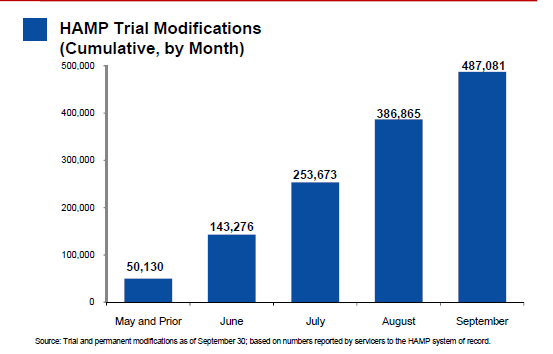

The announcement of 5 months was recent so it may not show up in some of these boilerplate documents. So what does this mean? We will know success in mid to late Q4 or early 2010. Most of the trial modifications have occurred in the last few months:

So I would imagine that once we move from trial to permanent, many of these will re-default or will not qualify. To move from trial to full mod there is a requirement to vet income. Why not do that now? Good question. It is always good to put quick gimmicks in front of good public policy. A good example of horrible public policy is the $8,000 tax credit. A waste of time brought on by the lobbying arm of the housing industry and politicians with no backbone.

There is also interesting data out on the first trial modifications. Look at the chart above again. 50,130 trial modification were entered into in May of 2009. Even with the 5 month extension, we can now see how many entered the full modification phase. How many went into a permanent modification? 1,711 or roughly 3 percent. Some interesting data on this:

“(HuffPo) Here’s why: Permanent modifications under Obama’s Home Affordable Modification Program (HAMP) first go through a three-month trial period. Since the COP and Ocwen figures are as of Sept. 1, that means that those permanent modifications entered the trial phase back in April and May. As of the end of May, 50,130 borrowers were in trial plans (there are now 500,000). The low number of permanent modifications is partly due to the fact that “the initial volume of HAMP trial modifications was quite low,” the COP noted in its report.

Even at this preliminary stage, the low number of permanent modifications is still shockingly low. Warren’s panel said it is “concerned about the low rate of conversion from trial to permanent modifications.” Unless the rate increases “substantially… HAMP will come nowhere close to keeping up with foreclosures.”

The panel’s report discusses possible reasons behind the low conversion rate, including data reporting issues and the failure of borrowers to comply with the program, like making timely payments. One issue stands out: “the difficulties servicers have in assembling completed documentation on modifications commenced on a ‘verbal’ or ‘no-doc’ basis.”

Yes, not making a payment would somehow be a problem. So let us assume a rate that is nearly twice (5%) that of the early trial modifications dating back to May. This would mean that out of the 500,000 trial modifications some 25,000 mortgages will be helped! $75 billion to help 25,000 mortgages? This is insane! This is like the $40,000 per house that taxpayers ended up footing because of the $8,000 tax credit. In fact, let us be generous here. Let us assume all the 3 million loans in the target range get a trial modification and 5 percent go into the permanent phase at the higher rate. We are talking about 150,000 mortgages. So do the math:

$75 billion / 25,000 Â Â Â Â =Â Â Â Â Â Â Â Â Â $3,000,000 / for each fix

$75 billion / 150,000Â Â Â =Â Â Â Â Â Â Â Â Â $500,000Â Â / for each fix

Dr. HB back of the napkin solution

$75 billion / 500,000 = Â Â Â Â Â Â Â Â Â Â Â $150,000 / for each fix

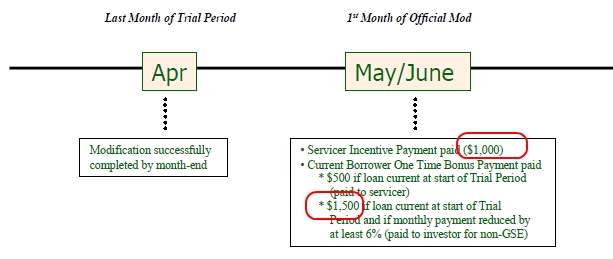

This is nuts. I even ran a back of the napkin scenario that does better. It is simple. The median home price in the U.S. is $170,000. How about we pick all loans that fall under this number, see if they are delinquent, and then flat out pay off 500,000 of these mortgages via a lottery system. I’m not even sure where all this money is going. If we only have 1,711 loan mods and basically all they are doing is lowering the interest rate and extending the terms, something has to give. Oh yes my friends! It is another crony handout to the banks. Let us look at some documentation provided to banks/investors to entice them to enter this program:

What an absolute waste to basically extend and pretend. Keep in mind that principal reduction is basically absent in any of these loan modifications. Yet right off the bat, even when a borrower can “make things up†to enter the trial period the servicer is paid! Paid for what? We already know the current success rate is only 3 percent. Are we to expect a sudden jump over the months? Even at 10 percent we are wasting money at the front end. We would have better success just doing a lottery of delinquent loans and paying off 500,000. I assure you we are not going to have 500,000 permanent loan mods given these current measures unless something drastically changes. Also, you can modify all you want but unless we start seeing some job growth, what are people going to pay their mortgage with?

Now keep in mind I’m not advocating for the lottery option. This is an extreme example to show where the money is being wasted. But also, big banks love this. Why? Because these loans are still held on the books at full face value. That is right, banks can extend and pretend and buy some time, another 5 months by simply extending the trial period to a large number of loans – they don’t even have to check for income. Think that JP Morgan profit would be so huge if it had to deal with those 437,000 mortgages that are 60+ days late? You can bet that with WaMu and California lending, they probably have a ton of $500,000+ mortgages that are going to go bad when the option ARMs recast next year.

Either way, HAMP is simply another handout to banks. So far we only have 1,711 permanent modifications. Banks are laughing at Washington D.C. They did with the last administration and the current one. Why not just go in and claw back those profits and clean house? Why not tax bonuses on Wall Street up to 90 percent?  After all, they should be thankful because they would be gone without the taxpayer. And who really knows if the loan mods won’t re-default since we don’t have that data. But data from the OCC and OTS shows re-default rates of 50, 60, or even 70 percent depending on the loan category. Even if all these mods go permanent, all you are doing is extending the problem. The rate eventually will go up. But they are betting on what, another housing bubble?

Policy has gotten so bad that we might as well do a lottery. Seriously. A random Vegas style lottery would have better results. What a joke. Banks are controlling this country and policy. HAMP is $75 billion in the scheme of trillion dollar bailouts but the amount of loans that are now being shelved for another 5 months is a lot larger. In other words, it is another way for banks to hide losses.

After seeing things like this you might need to role one and smoke some HAMP.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

42 Responses to “California Budget and HAMP: Is the Home Affordable Modification Program Helping? California Tax Revenues Falter and Employment Breaks Historical Record.”

I know of three people who had their loans modified. These people will not default on their mortgage because even though they had some financial hardships, they all still had enough money even before their interest was reduced to pay their mortgage. The data will show that HEMP saved them from defaulting when in fact HEMP just saved them money. I think that it is getting pretty easy for people to qualify for HEMP. Just like there are many people who strategically default on their loans, there will be many people who strategically get HEMP. If you can get your interest reduced to 2% why not do it? You can get more than 2% if you invest your money in a CD, and most people had some kind of financial setback this past year, so they can qualify for HEMP.

thanks Doc. wow, this is food for thought. This turns out to be yet one more government program which I learn enough detail on to see that it really benefits the big business (in this case, the banks) over the people.

I know of three people who had their loans modified. These people will not default on their mortgage because even though they had some financial hardships, they all still had enough money even before their interest was reduced to pay their mortgage. The data will show that HEMP saved them from defaulting when in fact HEMP just saved them money. I think that it is getting pretty easy for people to qualify for HEMP. Just like there are many people who strategically default on their loans, there will be many people who strategically get HEMP. If you can get your interest reduced to 2% why not do it? You can get more than 2% if you invest your money in a CD, and most people had some kind of financial setback this past year, so they can qualify for HEMP.

Sorry… forgot to say great post – can’t wait to read your next one!

Nice is absolutely right.

Beware of the law of unintended consequences.

The message to responisible mortgage holders is “See, you fools, if you’d over-extended yourselves like these clowns, you’d be looking at a 2% mortgage right now.”

The responsible ones are being punished. Along with all other taxpayers who aren’t benefiting from this program.

Who’s going to rise up & say, “I’m mad as hell, and I’m not going to take it anymore?”

Also, don’t forget, Mr. and Mrs. Taxpayer, that the reason your investments are in the toilet is because these mortgages that are supposed to be yielding some good margins are being re-spun into below-CD rate mortgages. Your 401K won’t come out of the gutter as long as those mortgages are being knocked down to 2%.

Oh – what if they don’t modify the toxic mortgages – won’t there be a ton of defaults? Don’t worry. The homes will go on the market again (for a lower price), be bought by responsible people at a reasonable mortgage rate, and the income will flow again.

I don’t argue with DHB’s facts – or even with his assessment of the problems with HAMP and other government policies propping up the housing market. But I think that simply ranting about the injustice ignores the facts on the ground. This IS the government’s policy and all evidence suggests that similar moves to support house prices will continue for the forseeable future.

The patient potential homebuyers who read this blog may never see the “Alt-A Option Arm Tsunami” we’ve all been hoping for. I am not happy about it, but to come up with successful strategies we have to face the facts.

Nick,

I agree that if the program is available and people can lower their interest rate to 2%, they should take advantage of that. But the only way that someone can get a 2% rate is if their income is low enough to justify it. For example, if household gross income is $5000 a month, the HAMP program sets a mortgage payment of $1550. If an interest rate of 5% makes the mortgage payment $1550, 5% would be the rate of the loan, not 2%.

Regardless, their take home pay would be ~ $3000-3500 so they will be quite strapped after paying almost half of their net income on their mortgage. IMO, if the HAMP program actually lowers someone’s payment, they should walk away and start over. The only way the HAMP program makes sense to me is if the modified payment is a less expensive option than renting would be or they have equity in their house. I doubt this is the case in very many situations.

On another note, does anyone know if this 31% payment includes taxes, insurance and HOA? If so, then it has a chance of helping some people. If not, it will simply delay the inevitable. And why is gross income being used as the measuring stick instead of net income? If taxes increase (likely) gross income will be unaffected but net will go down. This makes the home less affordable in an actual sense but equally affordable according to the HAMP guidelines. Can anyone explain this? And finally, does accepting a modification under the HAMP program cause the loan (assuming a purchase money loan) to change from non-recourse to recourse? I know this is not applicable in all states but it could have a big impact in the future if the loan ended up in default.

If the entire basis for this program is to ensure all modified loans are paying 31% of gross income towards their mortgage, does anyone think this will be a long-term success? I know that I am more pessimistic than optimistic, but 31% of gross seems to be an outdated number to me.

I have absolutely no data to back this up, but it seems that monthly expenses outside of housing are much higher now than they used to be several decades ago when this idea of ~30% of gross income was a safe amount to spend on a house. Cable, internet, cell phones, longer work commutes, many more dual-working parent families which require some amount of childcare, etc., all contribute to the monthly costs of a family. Assuming the relative cost of gas, utilities, insurance, taxes, etc. are the same, wouldn’t the “safe” percentage of gross income used on housing need to be lower? Say 20% or so. I just don’t see how HAMP or any other program like it has a chance for long-term success.

Partyboy,

Here is what I have experienced. This did come from a debt collector but he said they would ONLY use the first mortgage to qualify me for the program. So at 5650 gross they wouldn’t qualify me because my first is $1750. This is almost exactly 31%. Now never mind that I have a $550 2nd (with a balloon), $80 for insurance, $125 for HOA, and $500 for property taxes. So my real payment is $3000 a month on $5650 which is 54% but they won’t qualify me based on the 1st being $1750. I don’t care a ton as I’m much better off with a foreclosure since my loan balance is $390,000 and my property is worth $150,000. Given that I can’t qualify with those numbers I’d think most people would have a hard time qualifying unless their incomes is really low and they only have a first mortgage. If they did reduce my whole payment to $1750 though I’d stay as that is only a couple hundred a month more than renting.

I see a lot of discussion that paying 31% of gross is too much. Well, why not just lower home payments to 0% of gross? I’ll bet that would have a very good success rate!

A couple of problems with this program:

1. Many people will qualify that would not have been foreclosed on. People who earn cash side income, or have a temporarily reduced family income due to one layoff, etc.

2. Many who qualify will either hit typical problems later (death/divorce/jobloss/illness) and still default, or just default again with no real excuse.

So, even 500,000 modifications (trial so far) lest assume Assume that p1 is the probability of moving to permanent modification, p2 is the probability the homeowner would have defaulted in the first place, p3 is the probability of no future default after loan modification ever.

what do we have? 500000*p1*p2*p3 saved foreclosures… I’m going to just guess p1 = .5, p2= .9, p3 = .7[being remarkably generous on all fronts I’ll bet] and we get 157,500. The rest are merely delayed foreclosures.

These are stall tactics by the banks & washington cronies to keep the debtslaves shackled until hyperinflation kicks-in and saves us all!!

Your line of thinking tugs at many of us apolitical scientist – will the government’s attempt to devalue the dollar and engineer a wholesale transfer of our collective national wealth to the banks be successful and leave especially those of us who tried to be responsible the most screwed of all.

from Partyboy “And finally, does accepting a modification under the HAMP program cause the loan (assuming a purchase money loan) to change from non-recourse to recourse?”

I’d like to know the answer to that as well. I don’t know what current stats on banks going after recourse loans are in the current climate. I think the temporary act Congress passed to not pursue tax collections via 1099s on debt forgiveness is still in force, but for how long? Borrowers should be wary of any modification that changes the recourse terms of a mortgage.

Great post!

Here’s a link to “The Mortgage Debt Relief Act of 2007” IRS page. If I understand it correctly, foreclosures (now including non-recourse loans), short-sales, refinances (within limitations), and modifications, which involve debt forgiveness on part of the lender will not result in taxable income for the borrower.

Interesting – on the one hand govt is doing everything it can to keep people in their homes (not walking) yet on the other hand it is making it much easier to just walk away.

http://www.irs.gov/individuals/article/0,,id=179414,00.html

BP,

I believe that most people who are in danger of losing their home or are walking away because the are so far underwater could avoid tax implications via the insolvency clause. There are thousands of families where I live who bought for $400-600k a few years ago and are now $200-300k underwater. I would imagine most of them are insolvent.

The concern I have about recourse vs. non-recourse is whether or not the lender can come after someone for the balance of the loan if the home sells at auction for less than is owed on the house. This is quite different than the forgiven debt tax implications.

My understanding is that if someone owes $500k on a home with a non-recourse loan and gets foreclosed on, the lender cannot come after the owner for any difference if the home sells for less than $500k at auction (or whatever method is used to sell the home). In the case of a recourse loan however, if the home sells for $250k, the lender can still pursue the borrower for the difference. Potentially, a lender could garnish wages, seize personal property, etc. until the full $500k was recouped.

Someone in the know about this please clarify if I am incorrect. In California, I believe that any money used to purchase a home is non-recourse. However, if the loan is refinanced (even if no money is taken out of the home) the loan becomes recourse. This is why I would be extremely hesitant to accept any sort of modification if the loan in place was a purchase money loan. HAMP may not change a loan from non-recourse to recourse but it is certainly something that should be found out before accepting any modification.

BP,

In regards to the law look at the IRS web site this law change never mattered if your loan was non-recourse. The way I understand it legally is that if your loan is non-recourse when it is sold it is treated as if you sold your house and made money. Thus if it is a primary residence and you are married(my situation) the bank can lose up to $500,000 before you would have to pay taxes with or without the law. Under this event the bank is not forgiving debt because legally you don’t owe it, but you did have a capital gain when this house was sold so it falls under capitol gains tax for primary residence. This is also the reason that in CA if you have a non-recourse loan you don’t have to worry whether or not the state complies with the federal guidelines. It is possible that I am misunderstanding something(as I am obviously not financially very smart given the mistakes I’ve made), but from what I read on the IRS web site this is how they make it sound. I would estimate that if you do a loan modification that it would be technically considered a “refinance” and would convert your loan from non-recourse to fully recourse. Lets be realistic though, how often are the banks going after people? In 99% of cases it is cost prohibitive and rarely happens.

Just thought I’d add why I think what I am saying is correct. Straight from the IRS web site:

“Non-recourse loans: A non-recourse loan is a loan for which the lender’s only remedy in case of default is to repossess the property being financed or used as collateral. That is, the lender cannot pursue you personally in case of default. Forgiveness of a non-recourse loan resulting from a foreclosure does not result in cancellation of debt income. However, it may result in other tax consequences.”

And

Step 2 – Figuring Gain from Foreclosure

4. Enter the fair market value of the property foreclosed.For non-recourse loans, enter the amount of the debt immediately prior to the foreclosure ________

5. Enter your adjusted basis in the property.(Usually your purchase price plus the cost of any major improvements.) ____________

6. Subtract line 5 from line 4. If less than zero, enter zero.

The amount on line 6 is your gain from the foreclosure of your home. If you have owned and used the home as your principal residence for periods totaling at least two years during the five year period ending on the date of the foreclosure, you may exclude up to $250,000 (up to $500,000 for married couples filing a joint return) from income. If you do not qualify for this exclusion, or your gain exceeds $250,000 ($500,000 for married couples filing a joint return), report the taxable amount on Schedule D, Capital Gains and Losses.

Pretty sure the debt relief act is only for those with recourse loans and it never pertained to those with non-recourse. I am assuming this part works the same way at the state level, but that may be incorrect? I am banking that it does worth the same way otherwise I’m going to owe $250,000 * .099 or roughly $25,000 to the state when my house gets foreclosed. Another interesting point is that if you are single and your gain is over $250,000 you’d owe taxes. I can see this happening with some Neg-Am loans and other toxic products. Interestingly if you were non-recourse you might actually end up owing taxes if you were over this amount whereas someone with a recourse loan would not owe federal taxes.

Sorry for the triple post, but in response to Partyboy:

Even in the event that the bank did come after you for the difference there is always bankruptcy. Mortgage debt is not like student loan debt. One bankruptcy filing and you can be free and clear. I don’t know if I would say all those people are insolvent especially the middle aged ones. You said yourself you were able to save $30,000 in the foreclosure process and I’ve been able to do something similar. Obviously most don’t have assets worth $500k, but maybe $100k? Especially if you factor in retirement accounts and pensions. I really haven’t heard of the banks going after people as the legal costs to do so usually outweigh the possible benefit. In most cases if the banks try to chase these people down they just end up filing bankruptcy. At that point the bank might incur another $20,000 in legal fees and get nothing out of it. My understanding is that they almost always write the debt off and 1099 you.

Oh boy. Here we go again.

How is that possible? I thought FHA was pretty strict about checking these things.

http://www.businessinsider.com/20-year-old-buys-home-with-183000-fha-loan-and-just-35-down-2009-10

The monthly payments on her debt amount to $1328. Her income is $2470, leaving her with just $285 a week to live on. She’s paying 54% of her income to make the mortgage payments. She earns that income by holding down one full time and two part time jobs.

Oh simple explanation. She was just hiding her income. According to Myspace, she makes “$100k-$150k”.

http://www.myspace.com/denise2688

Typical full-of-sh1t $30k millionaire. Spin Spin!

I know this has been demonstrated before so I apologize if I should have gotten it earlier, but can anyone list simple step-by-step instruction for how Dr. HB and others are able to show a map of shadow inventory via google maps and whatnot?

DG,

It may be cost prohibitive to go after the homeowners who default, espcially since many of them don’t have any assets to take. But it would be interesting to know what the statute of limitation is for collecting on the remaining balance of a recourse loan. If 10,000 people default on recourse loans, and each of those homes is sold for $100,000 less than the balance of the loan, then you have money worth going after. Especially if the statute of limitation is long enough to allow people to save something worth taking.

Some of you are mixing apples with oranges here. There are two issues here the sale of your house and debt relief. Everyone, no matter if the house loan was recourse or non-recourse has a $500,000 (married) exemption from the gain on the sale or $250,000 if single. Any gain above that amount is subject to tax, no matter what.

Second, if the mortgage is foreclosed upon the owner may be subject to debt relief. All California loans are non-recourse if they are purchase price loans. Another words, the original loan amount on the purchase. If they refinance the loan, it becomes recourse. A second on a house is recourse. Recourse loans are the ones the banks can go after you. However, added to one of those debt relief acts signed by the President was if the loan was the orignial purchase price loan the debt would not be subject to income tax no matter if recourse. Again, only the original loan amount reduced by any payments on it. If you used your house like a piggy bank and went out and bought a car or went on vacation, the amount of the loan is debt foregiveness and is subject to income tax. But, there is always ways out of it including bankruptcy or insolvency. File for bankruptcy, get it forgiven and no income taxes. Insolvency is simply more debt than assets immediately before the debt is forgiven. Sometimes, the banks forecloses on the house and doesn’t relief the debt for some time so there may be tax due if your assets have increased during that time but, usually that is not the case. Hope this helps….

Partyboy “And finally, does accepting a modification under the HAMP program cause the loan (assuming a purchase money loan) to change from non-recourse to recourse?â€

___

That recourse-non-recourse thing is peculiar ONLY unto California. Never heard of ANY other state where it makes a difference whether it was a purchase money mortgage or a refir to buy toys. (Recourse-non-recourse only comes up in states that allow a judicial forclosure or trustee sale – lender’s choice. The only wya a lender in one of those states can not go back and collect from the borrower is if they don’t have an order from the court foreclosing on the property, approving the sale and then setting the amount still owed by the borrower. In those states it is called a ‘deficiency judgement’ and the lender has to get it from a court. Just selling the property at auction won’t do it because (1) it is not a court ordered sale and the lender could rig the bidding and (2) the lender usually bids it in for the amount owed and then tries to get rid of it. In the latter case it is tough toenails if they can’t sell it for what they paid for it at auction. The auction discharged the mortgage to the extent of the auction price.)

>>

Now you need to take yourself off to an attorney in California who specializes in rela estate law. (And that ain’t the guy who advertises ‘If you don’t win, you don’t pay any fee’ on TV.)

>>

I would speculate that a HAMP mod doesn’t change a CA non-recourse into a recourse because the loan is not being discharged (paid off by another loan) and then a new loan taken out. It is still the same loan – the parties to the loan are just tinkering with the terms of the loan. But GET THEE TO A COMPETENT LAWYER.

>>

DG – IRS rules regs or any federal law have NOTHING TO DO WITH whether a mortgage is recourse or non-recourse. Zip, Zero, Nada, NOTHING!

>>

It is two different jurisdictions (Federal vs state) and two different issues (tax liability vs paying back the lender.)

>>

Save yourself a whole lot of misinformation and major legal mistakes by NOT doing your own legal research.

Wow, a lot of good information. “…roll one and smoke some HAMP”: classic!

Can someone please explain to me that if the economic condition in California is so bad, then why haven’t housing prices collapsed? For example, in Pasadena, people are still buying a modest 1300 square foot home for $400,000 to $550,000.

I am a Midwestern Boy and I dream of moving to sunny California. I want to move to California once the dust settles from this economic storm.

I just want to point out that if we were to pay off anyone’s mortgage on a lottery system, those people would probably just go back into debt and lose it all, a la how most lottery winners fare.

They’d likely be preyed upon by banks offering them home equity loans.

Partyboy,

Your take on this is accurate – unless the rules have changed in the last few years. I’m not a lawyer, but a friend who is researched this a few years ago.

A non-recourse loan means that the house is the only recourse available to the bank. Should the borrower default, all the bank can do is foreclose on the house and your credit gets dinged for a few years.

A recourse loan allows the bank to go after you for any difference between what is owed on the house and what it eventually sells for. Should the bank decide to not pursue the borrower for this difference, it would issue a 1099 forgiving the debt – this debt then becomes income to the borrower and is taxed at the borrower’s marginal tax rate. Essentially, in a recourse situation, the borrower either gets pursued by the bank for the shortage or has to pay income taxes on it. With the passage of the debt relief act by Congress, if the lender decides not to pursue the shortage and forgives the debt, the borrower doesn’t owe anything.

My understanding is that in California the original-purchase loan is a non-recourse loan. Once it’s refinanced it becomes a recourse loan.

Thus, your original question about whether modifications change the terms from non-recourse to recourse is a valid one and if anyone out there can answer it, I’d appreciate it.

Randolf,

Go to foreclosureradar.com You don’t even have to have a membership to try a free foreclosure search. Type in a zip code and voila. Though in fairness I have found that some of the foreclosures are outdated. I know, I bought a rental at the end of Aug. and it’s still showing as a bank REO. I suppose that works on the flip side too where some shadow inventory that becomes available is not recorded in there yet. Either way the shadow inventory is huge.

I’m not sure what DR.HB subscribes too to get the details on the loans and the HELOC abuse he has provided but it sure is interesting.

DG –

It seems to me there are two separate issues here, (1) debt forgiveness in the event of a shortage between what’s owed and what the bank subsequently sells the house for, and (2) any gain or loss on the sale or foreclosure of the house.

(1) you’re right – debt forgiveness applies only to a recourse loan and with the Debt Relief Act of 2007, there would be no income tax on any forgiven shortage. (Bank could choose not to forgive & instead pursue, but again I think you’re right in that they do not seem to be doing that).

(2) Married, filing joint are allowed a $500,000 tax-free gain on the sale of their primary residence (single filers are allowed $250,000). Any gain beyond that is taxed at capital gains rates as opposed to the higher income tax rates.

Per the worksheet on page 11 of IRS publication 4681 (previous link), the gain or loss is: Amount of outstanding debt immediately prior to foreclosure, less your adjusted basis (what you paid +/- additions). So if the outstanding debt is more than the adjusted basis there would be a gain. But, based on the tax-free exemption, that gain would have to exceed $500,000 to be taxable.

Again, I’m no expert, I’m just trying to figure out all the nuances and consequences facing people caught up in this mess. That’s why I read this blog & I appreciate ALL the information, anecdotes and comments.

Partyboy,

Regarding your reply to my post: I know what HAMP is supposed to be, but based on anecdotal information, people who are not supposed to qualify under the parameters you mention are given interest reduction anyway. Think about it. The banks are pressured to modify loans. They do not want the modified loans to foreclose. So they modify mortgages which would not have defaulted anyway. This way Obama looks good. The banks look good. The people who got their interest knocked down are happy. It’s a win, win, win situation. Of course, this will not stop the foreclosure tsunami.

NickHandle, PLEASE do not post information like this it is catagorially untrue!!!

They DO want foreclosure and the reasons are copius, complicated, far reaching and most of all HIGHLY PROFITABLE!!!

They do want to foreclose, they do, they are, and they will!!!! I was not behind on my payments but was required by Ocwen to be behind in payment to apply for HAMP. (thanks for your help Obama et al, keep tryng to figure out what to do…..until then, another gravy train for the poor banks shoud do it, huh?)

What will you say when everyone but YOU knows the banks didn’t lose, the investors and home owners did. I know the truth and have been both!

I did ALL I was told exactly as instructed, preapproved for HAMP followed all steps…OVER and OVER and OVER, (with help used to convince us of the actual intent and reasonig for ‘bail out’ / making homes affordable).

From there, count on this, if there is equity in your home; INTENTIONAL delay coupled with calculated, multiple and various lies, tricks and back door tactics. OCWEN stole my home of 34 years and I am insulted when I hear ‘it’s just a house, move on.” I’m now widowed, without family, 100% disabled and additional, serious illness is what the stress of fighting for justice against being wrongly victimized costs. Much more than money or things, as I’ve heard it phrased by the uninformed, uneffected and cruel who couldn’t possibly imagine, let alone empathize.

I worked my entire life and paid for home in 2001. Same company now marketing home for sale also ripped off my late husbands entire retirement and insurance payment invested in stock annuities. (what a coensidence, huh?)

Do NOT assume the whole, greedy, stupid, toy buying cause of massive loss across the country by long term home owners. Yes, some of course but it does not represent real stastistics. It is media spin by the planners and participators and is intended to cover massive, far reaching, and appalling fraud. Yes, FRAUD, FRAUD, FRAUD.

Citi created the foreclosure after my nest egg was stolen using unbelievable tactics that only the most educated would believe. The risk assessment (think cross-marketing, that’s what they call it), companies that are now being touted is only ONE of the vehicles used to TARGET the vunerable. With large amounts of equity and little recourse if kicked while doing all you can to keep what is YOURS, although it cost a lifetime to acquire, there is little chance you could posture in time to fight back even if you had the means or knowledge.

Blame the victim. Go ahead, but I hope you are not a homeowner and God forbid, you ether get in a wreck, get sick, become a widow, etc. None of the devices used to steal my home had to do with little more than calculated fraud by those who are now assisted and rewarded instead of exposed and jailed.

Here’s a summary, that’s all I can stand…..

To begin with the hint is this, all the following occurred over several years in which I used my education and career as a budget and research analyst to put together a major theme of puzzle; ALL the following participants, (except broker who was paid to stear me to them), are owned or have been acquired by ONE too large to fail entity……ONE!!

Short story version: Original Insurance payout from late husbands death + 6% 30 year fixed loan on home of entire life + wrecked auto and delayed payment by insurance company, (dare I say it, AIG subsidary) + rental car expense on AMEX preapproved and charged during delay of payout of destroyed vehicle + demand to return rental car after charged up during wait for payment + high limit card with execellent pay record over nine years was preapproved for rental, charged over months of waiting, then UNAPPROVED + pay for rental car now included optional insurance that would have been paid by credit card co. + created money flow issue as rental car payment came out of pocket + aggressive collection requests for a credit payment to another account, (housing related expenses, not vacations or toys), were then requested in advance + bank of nine years posting checks before auto deposited retirement pay on same day which create auto house payment to be returned for being two cents short + request to cancel advance payment refused by both store and bank. (yep, same owners here too) I closed bank account and they processed the payment anyway………………it goes on and on, but you get the idea.

Here’s the primary punch line. ALL OF THE ABOVE PARTICIPANTS ARE THE SAME COMPANY!!! Home mortgage, Dept Store, Rental Car Co, Auto Insurance, Home Insurance, (did I mention the forced placed Home Insurance after mortgage company didn’t pay and I wasn’t told by either of them…..yep, same owners of hazard insurance company I had for nine years).

Believe it or don’t. It’s absolutely 100% true. You are just hearing of Equity lines of credit being jerked for no reason, EXCEPT it guarantees losing house if you are retired, disabled or widowed. Well, it wasn’t just equity lines or business loans, it was however they could get to you. It just hasn’t come out yet, just like taking HAMP money then foreclosing anyway. (ON PEOPLE WHO HADN’T MISSED PAYMENTS or in my case were foreclosed on as a result of the HELP programs created for our benefit)

Forget about new house purchases and job loss, that’s 20%, the other 80%, (my entire neighborhood), owned homes for entire life but with retirement brings little margin to stay standing if you fall and are kicked on the way down.

The home owners part, aside from what was coming at you from all sides was need for a roof, repairs, maintenance or hospital bills or medicine which would be fine EXCEPT you were told your home was worth twice it’s real value, talked into something (special loan product just for you), you never received, and used the credit rating companies to make sure you couldn’t get away.

If you tried, like I did, they had a table co. or unlicensed broker sell you a lie, withhold all the legally required disclosure documents then add a bait and switch into an ARM you don’t know about untiil it’s too late.

If you get that far, spend the rest of your life savings hiring loan modification companies that pose behind law firms. I’ve paid five different times, the procedure was delayed, (NOT BY ME), long enough to add 25K+ which added me to most of the entire neighborhood becoming REO, all that is left is now to apply for HAMP.

Mind you, still not missed any payments, until Ocwen confirms you are pre approved, makes you with hold payment to submit application then drags it out long enough to eat up all your equity, all your money, then a few more well timed tricks, foreclose on your house while telling and doing otherwise. By the time the deed goes back to the original (although hidden players), you have nothing.

As far as this FREE HOUSE verbage, it’s an outrage because if you do get to the court house, the attorney fees have completed this process of bleeding you dry. At the request for emergency TRO, the judge didn’t allow any speaking because, ‘if 17 months have past already, how can it be an emergency?” (other than they already broke into house and were stealing my ornate front door and have since been in front of my house on several occasions) On morning I went to the scheduled auction to serve my papers they were already out front ready to come in illegally and if you think the worry stops at losing home, think again. If you are caught unaware, you risk loss of all your belongings as well!

ASK OCWEN customers, they know. In California however the judges don’t seem to ask the one’s hurt the most profoundly and in my case I had no chance to speak. Now as I wait for the court hearing, (UD and summary process appears the biggest joke for all my research evidence, preparation, and proof of fraud I spent my life during these last 6+ years collecting became boxes of garbage) Although I have paid for and deserve my day in court, the back door swoop used for taking my home back robs me of the opportunity to even be heard!

After this next step, (I’m anticipating it should take around 15 seconds), which although the sudden free fall into the Summary Process is truly impressive intellect, it is nothing less that an outrage. Obviously they know once you are forced out, there is no way to move, pay to fight, and now rent….and THEY KNOW IT, THAT’S WHY YOU WERE SINGLED OUT. Now that the equity was slowly stripped until far gone, the lack of choice kept the payments coming and when there was nothing left to give but the lawsuit, once handed over, BAM, they own your home…..just as planned.

Get over it? Sure, I’ll just go back 35 years, to college, military, government career of 27 years, and 17 years of working two jobs. Now widowed disabled and sicker than when the fight started, I get to hear how it’s my fault and the judges don’t get it quite yet.

Yeah, when I was 12, a woman kidnapped me from a gas station bathroom and I was held for three days of torture beyond belief. I truly believe I wasn’t killed in the end because I happened to mention ‘friends’ which angered the five perverts holding me captive that my kidnapper may have been seen. So I was allowed to live.

Later at the police station my mom was told, in my presence,”It would be a waste to take them to court because it would only make it worse for her.” “You / she would never prevail in court BECAUSE your twelve year old daughter is “TOO PRETTY, TOO SOPHISTICATED, MATURE FOR HER AGE / translation articulate and smart, and no jury will ever be on her side. Creepy?

Fiction? Maybe…..or not. Not too far out when speaking of hard core criminals, not bankers, judges, polititions or professionals. Why does it feel I’ve been raped them? Because there is no empathy when you are humiliated and somehow made to feel at fault and judged harshly. It doesn’t matter that you know inside what has been done to you as over time the element of judgement, ignorance, and climate of the times you feel humiliation.

After all, I lost my home I lived in my entire life because I was, a) greedy, b) stupid, c) irresponsible, d) using home as ATM, d) living beyond means or bought house I couldn’t afford AND / OR most of all “deserves what she gets for not paying her bills / house payment. Make sense?

Now that I have had to pay in ways that cannot be understood unless you have lived it, I / we must suffer cruel and ignorant assessment of our ordeal. Such judgement and disregard come by way of harsh conclusions and insulting labels. Defamed, blamed, and deserving, I watch the news reports of the ‘shake out’ of those that shouldn’t have purchased homes they couldn’t afford.

Attorneys will help us educate the judges offer hope that soon they will get it. My local representative ignored my pleas to visit her district / my neighborhood whic started long before my home was gone. Instead she keeps me up to date on health care reform.

Ocwen reports the numbers of successful modifications absent all connection with reality and the growing numbers of angry Americans. Financial news broadcasts committee members and their earnest effort to figure it all out with the help of the banks lawyers and the like. For all the efforts, ideas, compromise, and reports of the ways the economy has been helped and future consumers will be protected, there is no mention of justice or equity for me. My contribution to loan mod scammers that have led to prosecution of two that took my money and allowed Ocwen to collect more fees has uncovered millions in cash and assets without mention of my loss.

I was also told I had been approved and all I had to do was dismiss the Chapter 13 (filed because there was nothing I could do once unable to turn back what had been done). A conference call between us three, (fourth modificaton attorney, Ocwen, & self), is stored on my computer, the words and assurances making me feel glad to agree to do so. That led to $1000 more added onto the charges for the paperwork that was less than a week old. While I have seen the money and assets collected from the two companies that have been prosecuted with some assistance from my information about them, there is nothing for those efforts.

This morning, the financial committee that I used to watch for every morning to gage their progress was on long enough to hear, “I have a great deal of respect for the job the banking execs are doing…….”

It seems from my view, (which doesn’t include EVERY ONE, of course), for the most part I’m hearing that, JUDGES don’t get it, most ATTORNEYS don’t get it, the BANK’S presidents, ceo’s, their auditors don’t get it, the ELECTED OFFICIALS / REGULATORS don’t get it. The special fianancial investigation Committee continue TRYING to get it and as of this a.m. they continue asking.

It seems over all difficult to understand and as this same person was saying how complicated it all was that nobody gets it, he respects the efforts of those smiling faces standing before him, it hit me:

Why don’t you ask me or countless others like me what happened? Perhaps I wouldn’t keep tuning into so many smiling faces or expressions of respect if someone like me were asked. Maybe if they were to hear a larger truth, it would help everyone finally “get it” in time for others to have hope although I doubt that will come in time for me.

I hope they all get it soon……………….but then on the othe hand, I’m just an idiot living in the low rent district, what do I know? Just because this sounds like an idiot’s conclusion maybe it’s because I don’t get it either and it’s true that it’s all too hard to understand………..hmmmmm

get it?

Nimesh,

You have to remember that CHEAP U.S. DOLLARS cease to buy quality anymore. You want to live in a quality town, it will still cost up. Unlike the last downturn, we are stuck with cheap dollars. I bet you could buy a nice 2,500 sq. ft. house in Lancaster for less than 150K! Sure, when interest rates rise, it will put the skids on, but strong foreign money will pick up the slack for the good properties in NICE areas. If you just look around, there is not a huge supply of homes in quality areas available. South Pasadena, Arcadia, Sierra Madre, etc. are quality areas that won’t drop much if any. Almost one year ago, I bought a house in a predominately Asian area. I just applied for a 15 year loan refinance, and the appraisal came back slightly higher than what I paid for it. Why? Superior schools and a conservative culture that saves. People who pay 550K for a 1300 sq. ft. house want a quality city with culture. Areas where there are mass disclosures attracted the no money down crowd. Silly couples who were attracted to 3 to 4 thousand sq. ft. homes in the middle of nowhere couldn’t figure out these houses cost a fortune to heat up and cool down, much less furnish or commute from. Instead, they couldn’t wait to fill the garage and house up with boats and toys with HELOC’s and 2nd mortgages. Just plain insanity! Of course, you could probably find a nice craftsman Pasadena house located in the N/E area for a lot less, but watch out for gangsters……..

Wake me up in 2012!

The good Doctor says: “A random Vegas style lottery would have better results.”

FYI, Doc, lotteries are so illegal in Nevada, their prohibition is set forth in the Nevada Constitution.

Article 4, Section 24 of the Nevada Constitution provides that “. . . no lottery shall be authorized by this State, nor may lottery tickets be sold.â€

Other than that minor quibble, we love your posts here in the Silver State.

Sorry, no jobs. This is California

Small- to medium-sized companies need more than economic cues to boost payrolls, Kyser said: “They’re having trouble accessing bank lending and are concerned about health-care reform and about environmental regulations out of Sacramento.”

They’re also waiting on consumers who have been stashing cash and paying off debt in a hurry instead of fueling job growth at shops, distribution centers, offices and factories.

That doesn’t bode well for Los Angeles County, California’s most populous county. Kyser sees its jobless rate next year averaging 12.8 percent — or worse. “That may be a conservative forecast because it’s already at 12.3 percent,” he said.

Nick,

What you are saying may be true ( I really don’t know) but I have a problem with the govt targeting 31% of gross income. The fact that they call the program Home AFFORDABLE Modification Program does not sit well with me. I just don’t see how spending nearly 50% of net income on shelter alone is affordable. Certainly it depends on how much someone makes, but looking at median incomes, 31% is too high a target.

The way the gross is calculated is frustrating too. For example, I get “paid” ~ $15,000 a year in flex dollars which are used to cover things like medical and dental insurance for my family. Even though this is not money I would otherwise receive (if I had coverage from my wife’s job), it would be included in my gross income. Employer 401k contributions count as gross. This is another item I don’t have the option of accepting as monthly cash flow. So as this program would view my situation, I should pay ~$650 a month of this gross income towards my mortgage even though I can’t use a dime of it on a monthly basis. I think a much more reasonable way to calculate what amount should be spent on a mortgage is to use net income.

In my particular situation, 31% of my gross = ~ 55% of my net. Can very many people afford to spend 55% of their net income on housing? This is why I think that HAMP is just another way to suck people in to being house poor at best, and dead broke at worst. Just say no to HAMP.

Actually if a 2nd is used a purchase money it is still non-recourse in CA(ie 80/20 piggy). At least according to everything I’ve ever read. I’m just quoting what it says directly on the IRS web site. They say the rules are completely different regarding debt for recourse versus non-recourse. Maybe the IRS is lying about their own policies. I also didn’t realize until today that my adjust basis in the house is probably fairly high since my purchase price was $372k… though I don’t know exactly how to figure that out. I read something like purchase price + repairs/improvements??

Rising Debt a Threat to Japanese Economy

Gross public debt mushroomed during years of stimulus spending on expensive dams and roads, and this year it passed 187 percent of Japan’s economy.

That debt could soon reach twice the size of the $5 trillion economy — by far the highest debt-to-G.D.P. ratio in recent memory — and the biggest, in real terms, the world has seen. Japan’s outstanding debt is as big as the economies of Britain, France and Germany combined.

Comment by D1

A neighbor refied his house, a model exactly like mine but I had about 40K more in upgrades than him. His appraisal came in about the time my house closed. His “appraisal” was 580K while I finally sold after on the market for 1 year at the following list prices..739K, 699K, 649K,599K,515K. After 2 months at 515K I sold for asking.

I really doubt the “appraisal” is the same as what it might sell for.

Other than that, I agree with your statement about the dollar and quality completely.

Martin,

It depends on where the house is located. Currently, banks are quite conservative about lending money out on a refi. In my neighborhood, a comparable is taking back up offers after being on the market for one month. It sounds like your house was recently built and or is surrounded by a newer development which can be a victim of collapsing prices because of possible surrounding foreclosures. Many newer developments were subject to sale right at the peak or close to it which spells big trouble. I am generally speaking of older stable areas. Even in stable areas, there was always a dip shit or two, that paid a horrendous price for a property with no money down and drove it into the ground. I have a neighbor that bought one of these for a 300K discount. After he gets done fixing it up, He’ll be in the property for just about par for the neighborhood.

Hi Dan,

I’m mad as hell, and I’m not going to take it anymore. Unfortunately, this will not change anything. What can be done? Are we ever going to see the house prices seriously comming down in the south bay area of Los Angeles?

Excellent post, I feel that I’m 1 steep from being homeless. I hope things pick up soon

I was approved for the Home Affortable Modification Program ( HAMP ) I was on a 3 month trial which ended on Feb, 01 2010. My lender or servicer send two copies of the final contract with all the details of my modification and I needed to sign both and send them back, if we agree to the terms. We signed both contracts ( me and my wifw), and send it back. With these contracts came a letter stating that this Contract was not going to be valid until they sign one copy and retun it to us. Well; we received the Contract back signed by my lender. We made already 5 payments on time with the new amount agreed on the Modificatio Contract. And now we received a letter last week telling me that that contract is no longer valid. They said that the owner of my loan did not want to sign the contract. But in the contract clearly says that it will be a finalized Contract when they sign and send it back to me. It does not said anything about a investor needed to sign. It does not even mantion any investor or owner of my loan. They should get everything together before they sign anything. Everybody knows that. Not after… I think thats not my problem… They are just backing up… And I think thats a Breach of Contract… Before sending me this last letter, I received another letter telling me to send some forms and a new application. I called them and ask them what was thw problem. That I already have send those forms a the application. They said that it was only for their files, that I should not worry about it, that my modification was already finalized. They said that my inital application had a pen mark on top my signature and that the government was very strict and they want it everything to be very clean… I even ask them if this was not a new application, and they said NO: DONT WORRY>>> Please HELP US on this. We dont want to lose our home… THANK YOU…

Leave a Reply to JimAtLaw