California baby boomers and the golden real estate handcuffs: Examining the real numbers behind generational real estate wealth.

Americans tend to shun generational transfers in wealth especially when they are unwarranted and not based on individual merit. Heck, revolutions were fought with much bloodletting to rid the heavy chains of an aristocratic class that handed down the baton of wealth to future heirs. The question of baby boomers and real estate is an important one because you have one generation with much of their wealth tied up in one asset class while younger generations struggle to get by. In California, Prop 13 has been the subject of much debate and was at the hub of a rallying cry back in 1978 for tax reform, a rally many baby boomers remember (the older baby boomers were already in their early 30s at this point). One issue that constantly comes up with Prop 13 is that you don’t want grandma thrown out to roam around the streets of L.A. Of course, this assumption is that most people stay put in one home for 30-years (this is factually not the case). People move. A lot. The figures for California highlight a mobile class which flies in the face of Prop 13 justifications since properties are typically reassessed when they transfer hands.

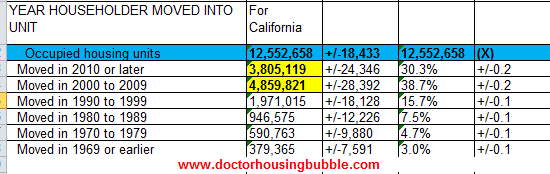

When did California home owners move into their current house?

The data is easily accessible if you dig into Census databases. Not pretty but it does shed the real story behind people and their actual behavior. People tend to argue about housing benefits as if they lived in one place and never moved. If this were the case, it would make sense to subsidize the living daylights out of real estate. Instead, subsidies in housing have created perverse incentives that have now caused the market to go bananas and where a large majority of recent sales are now going to real estate investors. That is another perspective of the story and caused by another form of subsidization of Wall Street from the Fed. Let us look at the figures:

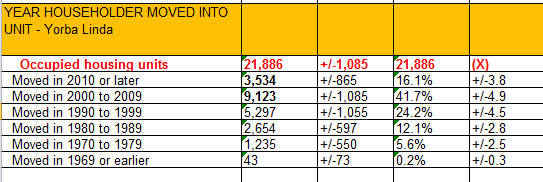

A large majority of Californians moved into their properties from 2000 to the present, roughly 69 percent. That is a sizeable number. Even if we look at 2010 to the present, we find that 30 percent of current households moved into their current shelter. For California, 54 percent of households own and 46 percent rent. So naturally, it is likely that renting households move more often (the data isn’t broken down between groups). So it might be useful to look at an area dominated by home owners. Let us look at Yorba Linda where 80 percent of households own property and there are few rentals:

The statistics change a bit here as expected. Close to 58 percent of households moved into their property from 2000 to the present. So much for those lifers staying put for an entire generation. Given that the bubble started raging when Wall Street got fully involved in housing in the late 1990s and our good friend Alan Greenspan started blowing mega-Fed bubbles, this is a good starting point of when those juicy golden real estate handcuffs started being purchased.

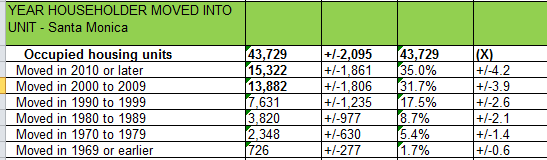

What we find in Yorba Linda is likely the case in more owner-occupied regions. Santa Monica is the opposite of Yorba Linda with few owner-occupied places and tons of rentals:

Recent data shows that 70 percent of households in Santa Monica rent. This is a much higher figure than statewide data but reflects a similar moving dynamic. Nearly 67 percent of households moved into their property from 2000 to the present. You have a small portion of single-family properties for sale so the battle for these properties is fierce.

What is more interesting and the data may have a tough time tracking, is that from 2008 to the present roughly 30 percent of all properties bought up have come at the hands of investors. Run a thought experiment here. Someone buys a property in Santa Monica and converts it to a rental. The investor then rents the place out. The Census data registers a new household moving in. Now assume this investor bought five places. Five new households move in but one is truly the controller here. No grandma being kicked out onto Skid Row because of rising tax rates.

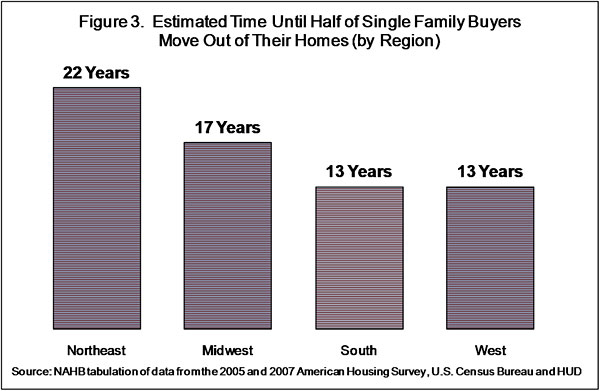

One thing is very clear here though, people move a lot regardless of owner or renter status. In fact, people in the west move the most:

Within 13 years, half of the people that purchased a property in the west flat out are gone from their homes. If they play the property ladder game then they basically purchase another property at the newly assessed price. You can see why the state would enjoy more housing transactions.

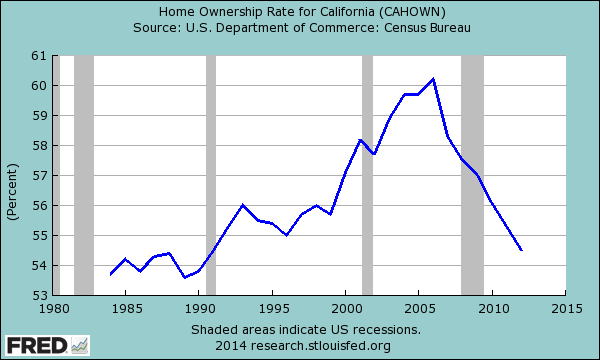

Ironically, one of the consequences of the real estate mania stew in California is that a larger portion of the voting public is now becoming renters:

The California home ownership rate is back to where it was in the early 1990s. The homeownership rate took a dramatic shift from the top and now with investors driving a large number of sales, fewer California households can actually afford to purchase a home. It is human nature (a biological imperative no doubt) to think that you had some hand in your own success, even if it is largely a luck of the draw when it comes to timing the real estate market. Many of us drew a solid hand by being born into the United States instead of some despotic nation. There is no denying that. Just like many boomers had the luck of the draw to purchase during relatively affordable times in California with limited global competition in terms of employment, steady growing income streams, and less speculation in the overall housing market.

23 percent of the California population is 55 or over. Throw in those 45 and older and you are talking about 37 percent of the population. Without a doubt, you have many households enjoying those golden real estate handcuffs but how big of a difference is this? Take this house in Culver City for example:

11201 Segrell Way, Culver City, CA 90230

3 beds, 3 baths – 2,343 square feet

The place is listed for sale at $974,900. The place sold for $750,000 on August of 2013 for $750,000. Nearly a $200,000 gain in a couple of months. Sounds perfectly non-bubbly to me! Previously, the place sold back in 1991 for $356,363. The place had property taxes of $4,398 a year until this recent flip. Now the current investor/buyer is looking at a $750,000 tax assessment but if they get their target list price, the new buyer will have to fork over taxes on a $974,900 property. How in the world do you go from paying property taxes at a $350,000 rate to suddenly going to nearly $1 million in less than a year? Surely the roads didn’t get that much better in this time. Are they suddenly building a new awesome school for your kids? Maybe the air over this piece of land will be cleaner once you ink that new mega-mortgage. Clearly grandma isn’t being put out on the cold streets of Culver City to roam around looking over her shoulders for those tax collecting zombies while snacking on Slim Jims.

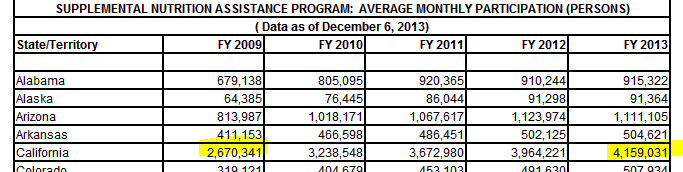

It should come as no surprise that a state with some of the most restrictions and red tape also has some of the most expensive real estate. Some seem to welcome this new favela versus Park Avenue version of the future yet fail to examine what this does to younger generations. It was interesting to read some comments from readers that were shocked that San Jose actually had some, get this, ghetto areas. Of course! Only 1 out of 3 California households can afford to purchase a home but people need to live somewhere. People don’t even realize that food stamp usage is up 55 percent in California for the recovery:

Source:Â SNAP

As I have mentioned before, many of the people that bought in more affordable times and enjoy those grandfathered in Prop 13 rates are largely house rich and cash poor. They peek out of their windows and see young professional couples move in with multiple degrees and flashy cars sporting juicy incomes while they pinch pennies living in their million dollar California granite countertop laden sarcophagus. They complain and hem and haw but never cash in that golden ticket. At least the data shows that the majority don’t do this for a variety of reasons, mainly that it really is expensive to live here. Yet there are plenty that enjoy those golden real estate handcuffs. While one household is shopping at Wal-Mart the next door neighbor is unloading the SUV with Whole Foods grocery bags. A very interesting dichotomy. People seem to forget about the flood of foreclosures that ravaged the state only a few years ago – no need to dwell on that and California is notorious for economic amnesia.

Any other stories of golden real estate handcuffs and mega real estate handoffs trying to pass on those Prop 13 rates to family members?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

80 Responses to “California baby boomers and the golden real estate handcuffs: Examining the real numbers behind generational real estate wealth.”

Great insights. Though, I’m surprised there has been no discussion here of the current or potential trends in reverse mortgages.

The heirs get stiffed.

Other than that, the process is identical to retirees staying on to the very end.

It can’t move the market, then.

We are seeing a huge influx of reverse mortgage sales from Homeowners stuck with their lowball reversals where the bank gave them a line of credit on their outright owned home, only to yank it in 2012 and bite into a juicy low price house, just in time for the retirees to have a stroke and need care. They are trying to sell the house at what they now owe (after paying for repairs, taxes and medical bills) which has resulted in a pile of homes on the market for 2008 prices (none selling for that) and desperate retirees being swindled out of their equity and real estate. In a typical case, the family would simply sell the home at whatever they could get (allowing the market forces to play out) and take care of Grandma at the nursing or retirement property. Now, the bankers swoop in after 1 year and just take the house free and clear. Grandma has lost everything and the relatives are stuck holding the bills. If Grandma dies, they don’t even get a month (but they are supposed to get a year and an offer of 95% the current value price to buy the house.) We have a TON of these on the market right now, with panic in the market by the baby boomers trying to re-establish their aging parents while still getting enough to pay the realtor. It is sad and destructive. Lots of vacant homes that we can’t buy because the price is not in the range of reality, and lots of people living in crapshacks while homeowners are duped into thinking that happy days are here again. Only…they aren’t and the homes that are actually selling are 1/3rd of the price the average listing shows. When will people learn that bubbles ALWAYS pop? Just wait and see. The tumble will happen, and the banks will insist it was all the irresponsible retirees who leveraged their homes at the expense of their kids. Find another scapegoat, count the money. It is pure evil. Fortunately, this life is not all there is. I am looking forward to sticking my tongue out at them in the next life. (No, I’m not bitter.)

At some point, you’d think that the homeowner would choose the tax free equity over the golden handcuffs.

I agree. However, most people tend to fear change, no matter how positive it could be, especially as they age. Also I’d guess quite a few Boomers have adult kids/adult grandkids who have moved back into the family house; likely everybody sits tight until the day the family bank account no longer can support the taxes, maintenance, fees/etc.

We did that in 2007, sold our house, and cleared a tidy sum which is being used to pay for kids’ college, a new car when needed (not for a while I hope, the current ones are 10 and 11 years old right now), medical bills, etc. Which means we have given up home ownership in CA to be able to afford renting here and living decently. And, as expected, we have been way priced out from neighborhoods that we look to for renting. But it is a trade-off. We picked one that would allow the kids to leave college debt-free like we are right now. But we gave up being able to buy a home. At this point, I am overall happy with the decision. It wasn’t a great alternative (my wife is really tired of landlords, not being able to “nest” and fix a house up the way we like it, etc.), but of the two choices available for staying in CA, selling the house was the winner. I don’t foresee those boomers selling me one of their houses for a good value any time soon, unless there is a big crash in the economy of some type.

What’s keeping you in CA? If the cuffs are off, why not consider AZ, NM or some other more affordable state or country?

Unless you have a state pension. I know people who have the golden handcuffs and a tidy CalPERS retirement. Too bad the property they live in looks like a 1970s time warp.

California taxes ALL capital gains at ordinary income rates. You’d better have capital loss carry-forwards in magnum quantity if you cash in your chips.

If you’re not trading up — and cashing out — then you’re paying FULL FREIGHT.

The proceeds then become available to invest at ZIRP rates. PERFECT.

When you get old enough, you don’t have even the intellectual energy to trade stocks.

To sell out is to lose out every way you figure it.

No wonder there is such a unanimity of inaction.

You make some other good points (ZIRP, etc.) but are wrong on capital gains tax. Home sellers are exempt for any capital gains up to $250k for single and $500k for joint filers.

“…As I have mentioned before, many of the people that bought in more affordable times and enjoy those grandfathered in Prop 13 rates are largely house rich and cash poor….”

What I have noticed (at least here in the OC) are house rich homeowners renting out rooms to raise cash. Such practice is remarkably common. I have personally visited what amounts to lots of little rooming houses in some very fancy neighborhoods.

(Irvine, Corona Del Mar), simply because that is were some of myfriends happen to live.

These room renters are not blue-collar either. In all the situations that I know about the renters are all professionals [single] with pretty darn good incomes.

Such activity is quite stealthy. With the possible exception of extra cars parked outside, its pretty difficult to tell whats going on inside just by looking.

What you’re seeing is mere repetition of Hawaii trends going back two generations.

On Oahu, such rentals are pervasive.

To detect such rentals — and trim the ‘landlords’ of G.E.T. (General Excise Tax — 4% of GROSS proceeds) the legislature long ago passed a ‘renters credit’ — whose sole import was, and is, to betray unreported (tax-wise) transactions.

[Hawaii has some very weird taxation. The GET is applied at the retail level: 4% of gross proceeds AND all other prior levels. (deemed wholesale ) The latter GET STACKS and is compounded through the economy.

Retail GET is applied to everything in sight — and most things invisible, too.

When re-calibrated to Mainland norms, the Hawaii GET equates to a 19% sales tax. (!)

This how — and why — Hawaii’s state government can support 25% of the labor force.

BTW, the Japanese Americans in Hawaii approximate 24% of the population. They compose 100% of the secretaries across all state government civil service positions. (!) Go ahead, visit any office. This stat even made the local papers.

As you can see, the Federal diversity laws are absolutely void when they reach Hawaii.

The bizarro economics of Hawaii is nationally relevant BECAUSE our President gets most of his seat-of-the-pants economic nostrums from what he picked up while at Punahou.

Stranger yet: I lived in the same condo as his tutu — circa 1983 — and thus came into direct contact with Barry. (Yes, his Grandmother ALWAYS addressed him as Barry. The Barack bit had just been started — back at Columbia.)

In Dreams he writes/ ghosts of being stared at in an elevator: that’d be me, of course.

His Grandmother would be chewing him out something fierce — her voice booming down from the top floor. (16th) So that when I entered (15th) the rage was still spewing forth.

Barry didn’t ever say a peep, BTW.

What an ODD couple. He was handsome, young, tall; she was loud, nasty, short — and not ready for a photo-shoot.

I stared at him because hapa-popolo Hawaiians were not rare — kids without parents during the holidays WERE. And it was plain as day that she was his Grandmother! I’d never seen a really mean, foul-mouthed, grandmother before. She was a real harridan.

This dynamic goes a LONG way to explaining why Barry has so many strong women in his administration — yet has issues with them. This latter point is particularly glaring when caught by WH photographers.

I’ve seen pictures of him zoning off while his female aids are practically mounting his oval office desk — fingers wagging! That snapshot is a PERFECT echo of his elevator moment — thirty-years ago.

As various tell-all books relate: none of the gals have figured the dynamic out. He likes to have strong women around. He also likes to see them frustrated. They become echoes of his teenage campaign against his Grandmother.

It’s also evident that his Mother, Stanley Ann, had similar run ins with HER Mother — of course, the very same woman.

She is NEVER much discussed by the MSM. It’s as if she doesn’t exist. She only attended to Barry when he was an infant — and his Mother was off in Seattle — at school. She only raised him through his teen years and sent him off to college.

So, there’s no story here, folks.

…

For those wanting the address:

The Condo is still standing. You can see it with Google Earth. It’s just north of the H-1 Freeway to the West of Punahou — on MAKAI Street. It’s the only major structure on that street north of the freeway. (It’s on the east side of Makai Street.)

Barry’s Grandmother owned the Penthouse unit, facing the freeway, at the top east corner of the building.

It’s so close to the H-1 that it was possible to see President Reagan’s motorcade rolling by all those years ago.

What does your brush with Obama have to do with this blog? Good grief, you sure do like to listen to yourself talk – or type.

You’ve jumped the Shark blert.

Write a novel to yourself that no one wants to read.

It’s good to know that I am not the only one that thinks that blert is having trouble with his meds…

Some of us like Blert and the insights that only Bert can bring. That was an interesting story about Barry’s early life in Hawaii and why he now surrounds himself with shrill, mean, hard core communist women like Valerie Jarrett.

That’s nice, sonar. Perhaps you can help blert start a blog and therefore provide an appropriate forum for his or her ramblings.

Could be why Barry cherished having Hillary (the winged granny from Hell) shoved out of the way on his way to his imperial presidency.

Roscoe…

I missed that.

Hillary really IS much like his grandmother. There are plenty of stories about her autocratic impulses and shrill outbursts.

There was, and is, a real reason why the Democrat Party insiders dropped her like a lead balloon.

I suspect that eyes are already casting around for a better presidential candidate.

She is a terrible stump speaker… the exact opposite of Barry.

Hello Doc. I have written this before but since you specifically asked about golden handcuffs.

My granparents purchased a 3bd 1 ba house North of Montana Avenue in 1955 for $16K. It was a house that my grandparents (both skilled laborers) could barely afford but stretched to buy the house when they arrived from Montana. They did not know the area would end up so prestigious, they simply liked all the palm trees and ocean breezes. As my grandparents slowly passed on, my parents inherited the house and we moved into it in 1975. At that time the house was worth about $60K. I do remember my parents complaining that the taxes were high but dont recall exactly when Prop13 kicked in. In any case my mother still lives in the house and plans to pass it on to me and her 2 other children if she dies. Amazingly enough, she could sell it for dirt value for about $2.2M and buy a condo for a half mil and pocket the money herself, but perhaps as a child during the depression she insists on living out her years in the house and scrimp on everything else to live there. Further amazing is that owing to Howard Jarvis and Prop13, her taxes are only $1900 per year. Imagine a new buyer for $2.2 Million would then pay more than 10 times the taxes!

“Hello Doc. I have written this before”…

Oh, Dear; yes, you have!

Coming from a “nice” area of the South Bay, I’ve actually noticed that most of my friends who are able to enjoy Prop. 13 property transfers don’t…or at least, not for their primary residence. One I know rents it out. The rest don’t want to live in L.A. anymore…some are in nice areas of San Diego, others have freely chosen to move out of state.

New mortgage rules go into effect today (Friday):

http://money.cnn.com/2014/01/10/real_estate/mortgage-rules/index.html

Still no minimum downpayment requirement?

I have lived in my current house for 26 years. It is worth a little over $900k but pay prop tax on an assessed value of $300k. I considered moving about 10 years ago, but when I looked at my new Prop tax bill, I said no way. Prop taxes in Calif are a total rip off. Lower those rates and you would see a lot more houses change hands.

Comparing to other states I think you’ll find CA’s property tax *rates* are actually pretty reasonable (1.0 – 1.25% of assessed value). What’s unreasonable are the outsized home valuations leading to commensurately large tax payments upon reassessment to market value.

PS. Your example serves to illustrate how much of a bubble was occurring back in the late 1980’s. I too have an assessed value of ~$300K, but have only owned my home for 22 years – so my current market value is only around $500K 🙁 .

“only” half a million!

California property taxes are the money conduit for California’s civil service labor unions. Their take has simply exploded. A friendly press has suppressed the statistics as best can be.

While average wages have gone no-where in twenty-years… wages paid to school teachers and other civil service employees have experienced at least a clean doubling.

(!)

In the case of school teachers’ unions: you would not believe the number of non-teachers that have been stuffed into their ‘bargaining’ unit.

In major school districts there are just about one non-teacher for every teaching post. While some are janitors and guards — the big money goes to highly degreed mandarins sitting on their butts down-town — pushing Federal surveys around and arguing over next year’s textbooks; as if arithmetic and spelling have changed in the last six-months.

The vast bulk of DC funding goes to staffing out self-reflective reportage about how well DC has spent money — surveying its results. Think: No-Child-Left-Unreported&Left-Untallied.

The resulting stats pile up in data warehouses that would’ve done the Stasi proud — rather like the terminal scene in: ‘Raiders of the Lost Ark.’

The jokers working this scheme are paid huge bucks — since they went back and got highly advanced, politicized, degrees — so that they can more ably shuffle paperwork.

Think of them as the diversity mavens.

You can’t get too much diversity — until the schools riot.

Then a soft-peddled pogrom fires up, and the vastly out-gunned African-Americans head east — to greater Atlanta. (This trend has been noted in the 1990, 2000, and 2010 US Census. I’ve had Black associates tell me they didn’t even recognize their old stomping grounds: Watts.)

The taxpayers of California have been paying for a mass migration up out of the south — going back generations. It’s only accelerating.

Unlike prior immigrants, the moderns are being gifted wealth on a grand basis. This wealth transfer suppresses native birth rates — as kids become unaffordable. The tale is different when you’re being paid for each additional tyke.

As Milton Friedman said: “You can’t have open borders AND a welfare state.”

The numbers must blow up.

BTW, Jerry is trying to figure out how to spend EVEN MORE MONEY to help out.

Perfect.

Love the Milton Friedman quote; I hadn’t heard that one before. Clearly, Friedman must have been racist… 😉

Clearly u can tell who the racists are. Their minds immediately go to a race war when none has been prompted. Rorschach test for KR perhaps? More than likely…

What teachers do you know getting double their salaries in 2000? Out here, they get just slightly above the median income ($60K) and we have been losing teachers to boot (although the idiot administrators have doubled their salaries, so you may have a point, though not via the teacher’s union.) We have a huge influx of Chinese buyers in the nicer neighborhoods, but they don’t like the rural locations, so those areas are depressed (at least in NorCal.) This market is haywire. I would be happy with just a little stability. The open houses are the ones typically done for 2008 prices. We avoid them now.

I say hats off for generational home transfers. The taxes we pay here by percentage is not large compared to other states but when you take in account that it is three to four times more expensive to buy here than other states, the taxes we pay is oppressive. We do not get more for the money here either. California govt. rakes it in and wastes our tax dollars more than almost any other state. Why people complain about someone paying less in taxes astounds me…life is not fair. Let the lucky few alone. Focus on taxes as a whole entirely too much.

Amen to that. Why people would want to feed more money to this state to waste? Incredible! Prop. 13 came into being because the state was raising property taxes exponentially every year and many people were being priced out of their homes. I work in government. The waste and indifference is unbelievable.

Christie, “Let the lucky few alone”, yeah, that’s how laws and tax code should be written. Sounds like a winning formula. What other legislative areas would you like to see this philosophy applied to? Maybe we tell the courts to do the same thing. Shall we just flip a coin anytime somebody goes on trial?

Christie, c’mon. Nice try.

BTW: I’m a little short on cash right now to pay my property taxes so I need your home address so I can take the money from you. By force if I have to, cuz afterall “life is not fair”.

Prop 13 is a joke. Plain and simple.

Prop 13 sucks. I think it will forever limit natural housing turnover in any desirable CA areas. But if you can’t beat them, join them. I’ll be voting with my pocketbook now. Prop 13 stays forever!

@Lord Blankfein,

Prop 13 doesn’t need to be repealed. Prop 13 can be amended into irrelevance. For most California cities, public safety (i.e. police and fire firefighters) consumes 50% to 75% of the budget. This spike in costs occurred primarily after 9/11/2001. This implies a massive pension shortfall in the not to distant future.

Therefore, Prop 13 will be amended and amended and amended (i.e. death by a thousand cuts). You should be okay. The amendments will likely be keyed to the inheritance and generational transfer components of Prop 13. Ancestors expecting to pick up properties on the cheap will likely be in for tax sticker shock.

Ernst, I’d be all for overhauling Prop 13. Primary residences only, no tax basis passed to heirs, getting corporate welfare out of the picture, etc. I just don’t see it happening. The power, money and influence that the corporations and special interests bring to the table are not to be underestimated. Time will tell…

We pay too much in property taxes here but it is easier to get those green eyed jealous monsters all wound up over what someone is not paying.

I tell you, as an easterner, I’m always stunned when the Doc shows a picture of what goes for nearly a million dollars in some places in California. I mean, wtf? What a screwed up market. I mean, I live in one of the wealthiest areas of NYC metro, and, a million dollars will certainly buy much much more. We’re talking a small pseudo estate.

It’s a case by case situation…

But the absolute craziest figures come from locales that are fed big bucks by:

Hollywood

Big Government (Fed & State)

particularly:

DoD contractors

NSA contractors

Mega-employers such as the above can elevate an entire area. When they leave the area utterly implodes. I give you: Vallejo, California. The USN pulled out — and the city went over the cliff.

http://www.sfgate.com/bayarea/article/Vallejo-votes-to-declare-Chapter-9-bankruptcy-3285168.php

When you dig into the Chapter Nine filings you find astounding payroll outlays for classic blue collar civil service positions. Firemen were getting $250,000 per annum — all up; wages, overtime, benefits, retirement… the works.

“Vallejo spends 74 percent of its $80 million general fund budget on public safety salaries, “

This bizarro payout scale is replicated across the State of California. The unions use each others extortions as the basis for their next threshold of the absurd.

BTW, many of those overpaid firemen held down second CAREERS — as in — had their own businesses on the side. (!)

They were being paid, basically, to sleep. Trouble calls in Vallejo had collapsed after the Navy left. The city was staffed for an industry that simply left.

Union contracts, union logic, makes no provision for the demand for their talent to go backwards, let alone evaporate.

This is at the heart of modern unionization blues. Truly dirty, dangerous, jobs are now performed by machines. The crusade has won, so it’s devolved into a racket.

Vallejo is truly fucked, but it has very little to do with the city’s expenses or the bankrupcty. Definitely more to do with the Navy pulling out and the closure of Mare Island (now a copper thief’s paradise.) There is almost no economy in Vallejo. This despite a slot on the Bay, a few miles from Napa, Carneros, Marin, Sonoma, SF, Berkeley, Coco. Not too far from Sacramento. Docks at the gateway to California. Next door to the original state capitol. Such amazing old buildings, Deco, Victorian, hilltop water views. Yet the cops have shot at least a half dozen people dead there in the last year or so and it doesn’t even make the SF news. (Look it up). Ah, good old Vallejo.

I keep thinking about how much the greater San Diego area is held up by the Navy and Marines. Otherwise, you’d have another Los Angeles.

I live in Southern Calif and I go WTF continuously!

Mike:

Which wealthiest areas of NYC metro are you talking about? Is it in Manhattan, Westchester, Rockland, L. I. or Bergen County?

I just moved to San Diego from lower Rockland County in 2012. In my experience, the average home prices in these NY wealthiest areas are not lower than those in San Diego. And the property taxes in my experience are much higher in New York metro.

I am very happy that I moved in 2012 especially I know my property tax is now protected by Prop 13.

My last residence in Rockland NY had property tax $7.5k in 1998 raised to $22k in 2012 – nearly three times in 14 years!

Property taxes exhibit downward pressure on the price level. This is one of the reasons why certain CA RE is priced higher than its peers in other states. Of course, there are many inputs and it’s difficult to make regional comparisons, but this shouldn’t be ignored.

Inflated prices are an unintended byproduct of the Prop 13 related measures. Yet another example of you can’t get something for nothing. Two main problems have manifested from the Prop 13 related measures: 1) in real terms, some people are paying less for more services while others are paying more for the same amount of services by extremely wide margins, and 2) some land speculators and real estate investors are being subsidized by the remaining taxpayers outside of their small cohort.

At some level this distortion could backfire. There is a breaking point where for the masses, the sunshine tax is no longer worth it relative to the alternatives. Those with the most productive capability are likely the first and most able to act on the alternatives. We want those people here, but if it’s an uphill struggle and they can do better elsewhere in the aggregate, why stay here? Foreign entities hedging in dealings with the same assets we choose as our homes is not a healthy alternative for like minded neighbors in a similar boat. The “I got mine and screw everyone else” mentality is short sighted. Long term, this is going to bite us in the ass.

Anon thinks that inflated prices are an unintended byproduct of the Prop 13 related measures and one of the reasons why certain CA RE is priced higher than its peers in other states? Huh?

So are homes prices in inland California areas with depressed economies like San Bernardino, Stockton or Fresno priced any higher than peers in other states because of Proposition 13? Probably not?

Maybe home prices are inflated in some wealthier coastal California areas because of extremely high demand and very limited supply?

California is a high-tax state, with some of the steepest sales tax, personal income tax and corporate tax rates in the nation along with enumerable fees that are also levied. California has:

Highest state sales tax paid in the nation!

Highest gasoline taxes paid in the nation!

Highest personal income taxes paid in the nation!

Property taxes in California were $1,458 per capita in 2012 and ranked 15th highest nationally. No doubt without Proposition 13, the Democrats who control California would soon make sure that California ranked the highest in property taxes?

Many California property owners also are required to pay costly parcel taxes such as Mello Roos fees which are annual property taxes imposed by many school districts, special districts and other jurisdictions and that are not based upon the value of the property.

With all the taxes and fees that the State of California collects, then why is the state still perennially broke?

Apparently also: Highest use of exclamation points in the nation!!!

PS. Last I looked CA has a $3+ Billion budget surplus in the current year. Dang those pesky Democrats.

“Maybe home prices are inflated in some wealthier coastal California areas because of extremely high demand and very limited supply?”

Yes, that’s also a reason. I didn’t state that Prop 13 related measures were the only reason.

“So are homes prices in inland California areas with depressed economies like San Bernardino, Stockton or Fresno priced any higher than peers in other states because of Proposition 13? Probably not?”

I stated that “certain” CA RE had this input as an inflating influence. It’s not a one size fits all equation.

You obviously have some sort of axe to grind in regard to CA taxation in general. Understood, but let’s not have that get in the way of honest assessment of the topic at hand.

AS-congrats on CA having a temporary surplus and then somehow equating that ‘success’ to the ‘pro-business’ policies of the dems. Keep relying on a useless piece of tech crap going public to boost your state revenues and you may get burned. CA has a temporary surplus due to the bubble in tech. See facebook, twitter, etc. Basically QE has been a boon to NY (wall street) and CA the most of any two states. QE is the reason behind the real estate surge throughout Cali and the tech bubble in No Cal as people need a place to put their money. Lets see how a completely artificial pumped up Cali does without QE (aka ARTIFICIAL STIMULUS-read those words three times if you have to. Focus on artificial. Focus on stimulus. Either way, it ain’t good long-term for those relying on such a thing to balance a budget, no? The run of pets.com going public is gonna run its course. Then its less revenues and all the dems policies in CA of higher taxes/less services bc pensions must be paid or CA will implode too.

Poli-Scientist:

The goosed figures out of Sacramento are juiced by:

1) Barry picking up 100% of Medi-Call from Jan-1 through Dec-31, 2014. Half of that has been factored into fiscal 2014.

(Sacramento runs a July – June fiscal year, typical of many states.) (Think of the school year and part-year legislative sessions.)

2) Front loading of Barry’s rail road to nowhere grifting. That’s ‘found money’ running into the billions. The bleeding is scheduled for later.

3) Sacramento is, like DC, benefiting from bizarrely low interest expenses against its staggering pile of old, and rolled over, debt. Now that the worm has turned, Jerry is staring straight at the abyss — and is determined to spend EVEN MORE.

Yes, that’s the official line, pitched in the house organ: The Sacramento Bee.

!

Housing To Tank Hard in 2014!

I feel that Prop 13 actually depresses values. We looked at a house in SM, which had dilapidated “huts” on both sides of it. I thought it would be depressing to live there because of the surroundings..

If people don’t have money to take care of their house, maybe living in an upscale area is not for them..

Could be some of those golden handcuff folks that Doc writes about.

Maybe those two dilapidated huts on either side of the house you looked in the peoples republic of Santa Monica were rent controlled? Landlords in Santa Monica have to incentive to fix up or maintain their properties when their income is limited by the city government.

http://www.smgov.net/Overview.aspx

Sonar pinged it first. ^^^^

Rent control destroys the economic value of rental property. Wealth is simply shifted from the property owner to his tenants. Naturally enough, with this additional wealth, the tenants don’t spend a slim dime on their own living quarters. Instead, the money goes to up scale tastes in wine, cheese, and the good life.

This is also in full bloom in Berkeley, California. It also looks like a time warp. That little burg is protecting tenured professors for the University of California at Berkeley. That’s why Berkeley still has that small town feel — if you can get past the Maoists, Islamists, and Marxists. Boutiques dedicated to fine living have had stellar success since Berkeley adopted rent control.

You’ll see the same dynamic in San Francisco, too.

http://www.npr.org/2013/12/03/247531636/as-rent-soars-longtime-san-francisco-tenants-fight-to-stay

The Ellis Act ‘out’ is not normally available to SM landlords. They are simply not zoned for commerce — and too far away to even make the attempt.

…

Lesson for landlords: never plunk down in elite, rental neighborhoods, as in near universities. Your target community is going to be only one-step away from City Hall.

You lose.

That might apply to the LL with just one SFR but it doesn’t apply to multi units. What happens is that the rent price level becomes inflated for the remaining renters who don’t get the rent control benefit. The wealth transfer is from the later market entrants to the early market entrants. Same thing that happens with home purchasers and Prop 13 measures.

Actually blert, something tells me that you’re not an experienced landlord. Rentals near universities can be a good bet if you know what you’re doing. Usually the parents are on the hook for the rent and party to the lease agreement. Sometimes the students are getting rent assistance through loans which is stable revenue like sec 8 without the nightmare that typically accompanies sec 8. It can make for very reliable payments and predictable turnovers.

Anon…

1) Come up with some other pseudonym — anything — really. Otherwise this blog — like others — becomes impossible to follow… for obvious reasons.

2) The recent blog topic has been SFH rentals. I have to say, in my personal experience, college towns DON’T attract apartment landlords. They can usually figure on too much lost rent each Summer. The slug of students each Fall overloads management. The immaturity of the tenants is a chronic bane. University sponsored dorm housing is always a threat against an asset that takes decades to cash out. I will give you that turnover within the units pretty much eliminates rent control as an issue… as long as the tenants are students.

No, the best rental properties are those that can’t get tripped up by politics and that are not dedicated to a one-industry economic base. In that regard, a university is much too close to a company town; which must be shunned.

An exception can be made for locations that have a quasi-steady military payroll. Such a location would have to have both military (adjunct civilian support employment) and straight civilian demand. (military spending not a factor at all)

Because of the Fedsury’s hyper-inflation of the currency, ALL rental properties are at elevated risk.

Due to the addicting policy proscriptions that kick in during early hyper-inflation, it normally progresses — like a cancer — to the full embodiment of the affliction.

At some point along the progression, the currency is rejected overseas.

(Happening now: Russia, Iran, Red China, et. al.)

Next the currency is repatriated — with a vengeance. This flood is mistaken for a surge in exports and good times right around the corner.

(The California property mania sweeping Asia is the leading edge of this.)

Next, the natives FINALLY figure out that the currency is a hot potato. This also happens in waves, with the financially savvy taking huge short positions against the currency.

(This is what the hedge funds are doing in SFH. Their real angle is to establish mega-shorts against the US Dollar — away from the exchanges. The very structure of their investment pools permits them to attain astonishing leverage for a one-way bet. The proles mistake this grand move as faith in real estate.)

Even selling off rents replicates the structure of stripping US Treasuries — to sell the coupons.

(This stripping was a companion to CATS, et. al. before STRIPS were issued directly by the US Treasury. The corpus of the Treasury was sold to the proles back in the early 1980’s — as the ‘CAT’ — while the broker (Salomon Brothers, initiator) shunted the coupon stream to institutional accounts.)

(Pension funds loved them for their annuities portfolios)

In the case at hand, the big boys are floating paper in magnum size that pays a ZIRP world 1.5% — even less — while the Fedsury is grossly debasing the currency. The short side profit is going to be epic. The only serious concern is if the proles can keep making their rents. With any luck, the entire price structure will begin to levitate, and rents can be lifted. The lenders/ pension funds get stuck silly.

When this is done on a massive scale, the concentrated profits focus the mind.

In the meantime, there is that management fee to collect.

Exiting this trade figures to be dicy. At some point the proles lose the ability to cover their rents — and the government is sure to intervene. (Such is the historical record.) Then you get tied up in knots. Cash flow is arrested and market values simply collapse. No-one is extending mortgage paper in such an environment. If they could and would then the proles wouldn’t be that pinched.

Like an overcrowded bed, all of these things turn together… and everyone’s sweating.

blert…

1) No. Last I checked, no one else is posting here with my name.

2) Could you get to the point, please?

Great scenario posted by Blert RE: Vallejo. It still amazes me that these stories are sidstepped by MS Media. Base closures are more forthcoming to a town near you.

Relax and enjoy the show!

“Americans tend to shun generational transfers in wealth especially when they are unwarranted and not based on individual merit. Heck, revolutions were fought with much bloodletting to rid the heavy chains of an aristocratic class that handed down the baton of wealth to future heirs.”

What nonsense! The leaders of the American Revolution were mostly wealthy men (Washington and Jefferson were VERY wealthy). What they weren’t were members of the peerage. Remember that in England, only about 10% of the adult male population could vote for members of the lower house of Parliament. The upper house was full of hereditary members (the peerage). By the late 18th century, the House of Commons was more powerful, but even so, there were “rotten boroughs” where votes could be bought and sold. In Britain, the vote was mostly limited to freeholders. Because freeholders were much more common in America, the British could not give the Americans seats in Parliament without upsetting the social class applecart. “No taxation without representation” was the slogan. So it was more of a tax revolt than an inheritance revolt. The current inheritance tax at the Federal level was enacted in 1916.

The Stamp Act of 1797 did pass a levy on inheritance documents and small taxes on large estates, but it was repealed in 1802. (Adams administration vs Jefferson administration.) Estate taxes were also passed to fund the Civil War and the Spanish-American war. The Civil War taxes were repealed by 1872. This is not a history of anti-inheritance sentiment at all!

I am all for giving my wealth (whatever it may wind up being) to my children as opposed to giving it to our government (i.e. taxed away).

On another point, Oregon has a limitation on Real Estate taxes somewhat similar to California’s, but Real Estate values aren’t particularly high there. My Wife and I both inherited estates largely made up of Real Estate, and the larger size of her inheritance was in part due to higher values of California vs Oregon Real Estate.

“I am all for giving my wealth (whatever it may wind up being) to my children as opposed to giving it to our government (i.e. taxed away).”

End result of this policy applied to the nation at large is you eventually end up with a tiny elite of Waltons owning almost everything, while the bottom 90% own nothing. Think Nigeria. Steeply progressive tax on capital, inheritance and income is the only way to counter this. Too bad we’ve been doing the exact opposite of this for 35 years –and it shows.

prop13 working just fine. by the way,how much of ones property tax is voted for in additional fees? and if any thing is wrong with 13 it is the fact that commercial property is not reaccessed with the larger corporations.now that sucks.

“working just fine”

At the end of the day, those who stand to benefit at the expense of those who don’t will likely want to keep the Prop 13 status quo. Although there are some who are willing to look the other way if the commercial interests take it in the rear. How nice of them to acknowledge that something is broken.

Just as long as I got mine, screw everyone else. How predictable. The feels good now approach.

Of course there are mello roos and various other municipal schemes. It’s like pushing down on one area of the waterbed and not expecting the other areas to compensate in return. Yep, it’s working just fine.

No doubt Anon is a hypocritical Democrat who has his but wants to takes yours to give to someone else. How typical.

No doubt sonar resorts to name calling and categorization tactics when he or she has no good rebuttal to make. How sad.

I don’t subscribe to any political party’s ideology.

@blert – that’s a non-sensical argument. Every policy creates winners and losers, or looked at another way, it creates a set of market forces with pros and cons that lead to one group benefiting and another being penalized.

The questions ultimately are who benefits, and what is the net/gain or loss. One can certainly make the case that one of the functions of prop 13 has been to ‘subsidize’ home sales. It’s functionally a transfer from one set of market participants to another.

It benefits sellers greatly, because the prop. tax certainty creates perceived ‘value’ which can be passed along to the buyer in the form of a higher sales price. But it’s not entirely clear what the long-term benefit to the buyer, except perhaps for the subset who are on a fixed income and intend to reside in the home until death.

@bler…

Prop 13 benefits NON-sellers.

Sales extinguish all Prop 13 economic benefits.

If there is any skew, it’s that new entrants (real estate buyers) have to price their acquisition in full knowledge that they will pay property tax upon the latest market transaction — theirs.

As the Doctor has previously posted, due to the economic dynamics of California, only a minority even benefit from Prop 13… those of long ownership… basically the retired citizens. Property tax is primarily used to fund services that are lightly used by the elderly. (Education and the crime blotter are famously light on seniors.)

The PRIMARY purpose behind Prop 13 was, and remains, to thwart Jerry Brown.

He, and the rest of his Silent Generation crew, were growing state government like topsy. It’s this huge bleeding that’s ruining California real estate — and the larger state economy.

From Bell to Vallejo to Oakland to … everywhere you turn, state and local government civil servants have seen their wages double in real terms over the last decade.

The average Joe has actually seen wage reductions over the same period.

Amazing wage gains in a private industry drive up real estate values and advantage all of society. Private industry does not fund itself through coercion.

Big government does.

This bulge in civil servant wages is of a piece with the bulge in the MPIC. Wages in the Medical-Pharma-Insurance Cartel have also stepped right along.

Not surprisingly, this drain has reached such an epic distortion that 0-care has been invoked. Plainly written by teams of committees, the mega-statute is internally conflicted.

The crews even forgot about America’s territories. (!) 0-care actually makes it illegal to sell health insurance in Guam, the Virgin Islands, and Puerto Rico. (Whoops!)

The reason Speaker Pelosi said that Congress would have to pass it to find out what’s in it was because they/She was still winging it. She didn’t dare commit to anything — even within her own caucus. (!)

Ranking Democrats admitted that they weren’t even permitted to get in to her office to see the bill as it was being marked up! We’re talking about her own committee chairmen.

K Street was faxing over pages from every player. So it’s no wonder that the MPIC signed on. Only now are the players realizing that they’ve crafted a beast stranger than those haunting the “Forbidden Planet.”

These follies are huge economic drags on the American economy.

Businesses get tripped up by CASH FLOW.

The same thing figures to trip up Jerry. Strangely, he seems more determined than ever to spend large.

And then, and then, mother nature throws Sacramento a ringer: no rain, no snow.

Taken all together, this is the perfect storm for Jerry.

There are a number of different “Californias” in California. We are diverse. There are the new immigrants that love all the government benefits, such as food stamps that allows one to own a home and a car. This is considered an “entitlement” which will never go away. California is a rich state, thanks to the “San Jose” area. The Tech Industry pays a lot of taxes on the stock options and the high salaries(this is why the companies import the Indians on the H-1 visas and more will come with the Senate’s immigration “reform” bill).

The “West Side” of Santa Monica and etc. is a different world than the Inland Empire. Speaking of California as one is not as relevant as speaking about the different Californias that exist.

Don’t think that it is just the Mexicans that take advantage of government benefits, in Irvine, I know some Chinese that also take advantage of their “entitlements”.

True, it’s not just Mexicans.

I’ve seen Russian Jewish immigrants in New York City (my hometown) paying for stuff with food stamps. Wealthy-looking, too. (That is, one of them wore a fur coat, which I assume means she’s not dirt poor.)

Prop 13 is what allows half of California population to rent at decent prices.

It has nothing to do with ownership. Sure, grandma would be on the streets etc. etc.

No, grandma would sell her cool 1 million $ home and move to Arizona where she could buy 3 properties, one to live in, and two to rent out.

So, no, the grandma myth is just a myth.

The real issue is that without Prop 13 rents would skyrocket. Good chunk of rentals in CA are affordable (much more affordable than buying!) because taxes stay in the past.

If not, rents would go about 15-20% up overnight. It would be a catastrophe for CA economy because less money would be spent elsewhere. And extra money CA would get would be blown like a fatty in the back alley.

If you look at taxes in other states, like Arizona or Oregon, seemingly very different states, things are different, but the more different, the more they stay the same. Just like with California, there is a subtle dance of taxes. Which one goes up, in order to some other to stay low? How to tweak more money out of our pockets for the class of our overseers (pardon me, “public servants”) to enjoy their guaranteed lives and pensions? If Prop 13 isn’t it, then perhaps blowing bubbles is the way to go.

Ultimately, that’s what Prop 13 was all about.

Grandma would have to pay capital gains taxes to Sacramento at FULL ordinary income tax rates when she cashes out. Since her tax basis is going to be a joke, and there is no income-averaging, figure Grandma to lose the 6% commission AND another 10% to Jerry AND another bump to Barry. His cut is hard to know without punching the numbers — but let’s assume it’s 15%. (Can go to 20%)

So, Grandma has been clipped 31% of the proceeds. (Assuming a trivial tax basis.)

THEN she buys a replacement home. That should cost 30% of her gross selling price… could be more, could be less. They’re not giving the stuff away in Scottsdale any more.

Let’s throw in the cost of the move and balance that against my crude tax assumptions. ^^^^

So Grandma is left without her old neighborhood, doctors, etc. and gets to invest 39% of her gross proceeds at ZIRP — and watches as her receipts crater — as her Treasuries go south — forever, and ever, and ever.

Yep. I can certainly see the big appeal that cashing out holds for California grandmothers, north and south. NOT.

You talk of a 6% realtor’s commission. Does it HAVE to be that high?

Assume a house in a desirable area, in a seller’s market (houses selling within a week of listing) — then it seems that sellers can easily negotiate down the realtor’s commission.

If a house will likely sell in a week or two, how much work, really, is the realtor doing? Anything to earn a whole 6%?

Someone once posted on this site that he insisted on paying no more than 2%, and the realtor accepted it.

Son of a…

I’ve NEVER heard of SFH commissions ever being negotiated down that low.

It’s the kind of rate seen in mega-deals, though. ( $1,000,000,000 x 0.02 = fat city )

The typical broker is going to come back with: “You won’t see the highest bidders, ma’am.”

“The brokers representing the buyers (schelpping them around) split the 6%. NO WAY will they accept such a ‘commission-dectomy’. You’ll be, de facto, boycotted.”

“You are in no position to dictate terms even in a hot market, for it’s REALLY the buyer that’s paying the commission — via the highest bid. That reality trumps your parsimony. It’s the reason that EVERY OTHER SELLER has been paying the full boat for years on end. No-one beats the market. Selling a house is not like taking a wire order for stocks or bonds!”

BTW, aged grandmothers are not your typical hard bargainers.

Blert, it seems to me that many buyers seek houses on Trulia, Redfn, Zillow, Realtor.com, etc. Thus, realtors aren’t doing all that much schleping.

All realtors do is put me on their email lists — which contain the same listings that I’ve already found on Zillow, etc.

In fact, I’ve seen some nice properties that are offered directly by the seller. For instance, this house in Culver City (which, I’m told, is already sold):

http://www.owners.com/ca/culver-city/5030-rhoda-way/wjg4555?src=odf

Why can’t I just list a property on those sites, and avoid working with a realtor — thus, ZERO commission? If I own property in a hot market, the buyers will see my listing, and come. Then I can hire an attorney to handle the closing for only a few thousand.

I bought my current condo in Santa Monica directly from the seller. I hired an attorney to represent me, for a few thousand. No commission was paid to any realtor.

Not the usual procedure, but it happens.

Son of a…

Which is to say that you’re w a a a y above normal for real estate savvy.

The typical grandmother doesn’t even know that she can handle the escrow process via an attorney.

I must say, though, that even trimming the broker down does not greatly change the calculus: moving away from established doctors, friends, grocery clerks, et. al. — to pay Jerry full boat — and then having to turn around and invest in absolutely rotten financial instruments.

The better move is to play a pat hand. The house has been going up in value for years — most years. That appreciation is not ravaged because of Prop 13. The retired don’t feel the impact of Sacramento’s taxation — not spending large, not earning large.

And the sunshine feels fine.

All of my parents generation are dying in place. There is no talk of moving, whatsoever.

BTW, this is amplified in Hawaii. The retired in that state pay practically no income taxes at all. (Pensions, SS, are exempt) I fully expect Barry to retire to the Islands.

(BTW, Carter, Ford, etc. all had un-publicised retreats on Maui. The Secret Service in Honolulu gave me the dope — decades ago. The secluded quietude is a huge draw.)

Let me set the record straight here.

Yes, there’s cost associated with this strategy. But there is no need to go Scottsdale. There are great facilities in south Gilbert and Queen Creek. For example, Trilogy is one of the best retirement communities nationwide. If you haven’t been there and haven’t seen the facilities they have (they and other like them), then you might not be aware of what’s available.

Nice retirement home there will set you back about 220K. If you come with 700K (that’s 30% off the 1M that grandma sold), you can buy this home and two investment homes for cash, and be done with it. Forget meager government help, you’ve got real income.

YES, it is doable, and people do it EVERY SINGLE DAY. I know quite a few people like that who now bask in the cheap and welcoming Arizona sun (especially if you’re old, nothing feels better).

The fact that many people simply don’t know what they can do, and how far a dollar can go in Arizona, and the fact that many seniors are set in their ways isn’t a reason not to consider such a move.

For those who want to stay in California and have 1M or more, I recommend Murrieta/Temecula area. It’s likely the best climate in SoCal (wine country!), and yes it beats the beach, and prices are still much lower than the rest of SoCal. Houses are big and new, and Murrieta is the the leader in health care in Riverside county. Both towns are consistently among 10 top safest in the nation (according to the FBI).

FYI: I am a real estate investor & landlord with properties across CA and AZ. I have retired using strategies like the above when I was 48.

Blert is simply wrong with his calculations here. First off, there’s a $500k (joint filers) and $250k (single) capital gains exclusion for people selling their primary residence. And that’s *after* deducting selling/closing costs and the tax basis of the house from the sale price. Will that mean zero tax for someone who bought 40 years ago @100k and is selling for a $million today? No, but the tax bill will still be far, far lower than he is suggesting.

An experienced LL would tell you that their input prices don’t determine the rent, the market does. It’s a myth that any costs can be simply passed through to the tenant. In the aggregate, rental and purchase demand tend to counterbalance each other.

” It’s a myth that any costs can be simply passed through to the tenant. In the aggregate, rental and purchase demand tend to counterbalance each other.”

Over the course of history that’s generally true. But over the past few years it does seem there’s a group of very active investors intent on manipulating both the purchase and rental markets in certain areas. They do, in fact, seem quite able to pass along costs as higher rent, thus why the ratio has shifted from rents being 1/3 of income to 1/2, and landlords pushing 5-10-15% annual increases in some complexes and market categories.

If the estimates that 30% of current sales are going to speculators is correct (and anecdotally, that seems about right in my area), they have enough weight to significantly influence both rental prices and sales prices, especially if they focus in specific price ranges, which seems to be their strategy.

Leave a Reply to Chris D.