Of bidding wars and foolish bets: Small time investors attempt to cash out equity to play the market.

There is some foolish money swirling in the real estate market.  In particular, there is a growing flood of small time investors trying to enter the market at a turning point and others are simply looking for a quick way to make a buck.  It is amazing how many people are waiving inspections just so they can win a property.  Some people are going to get a dark reality check when they are hit with major unexpected repair bills.  To bring this back to frothy California, the euphoria of 2005 and 2006 is back in the air.  People are trying to tap out equity to leverage into additional real estate.  Keep in mind many of these people have no idea about real estate investing and many wouldn’t know how to use a tape measure or a hammer if it hit them over the head.  Emotions are stronger than fundamentals in the current marketplace.  Take a look at some shifting trends.

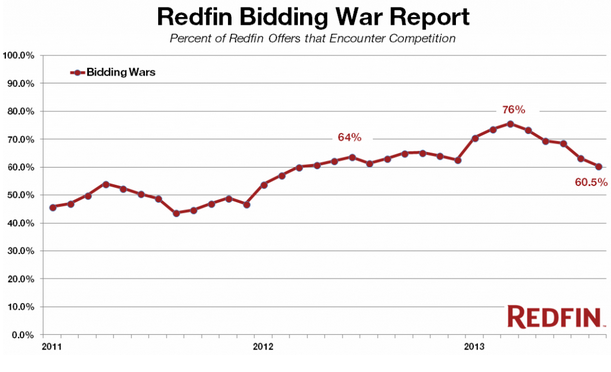

Bidding wars pulling back

Source: Â Redfin

It looks like earlier this year the asylum was fully open for real estate mania. Â Some 76 percent of those receiving offers through Redfin stated they were facing competition. Â Thanks to inventory increasing and prices soaring because of investors diving in, there has been a cooling off. Â Yet this is only the start of this trend. Â Recently, the spike in higher rates has cooled down the regular home buyer market. Â For investors, not so much.

You know things are frothy when people are willing to drop hundreds of thousands of dollars on something they really have little understanding on (outside of the luck of buying at a certain point in the trend cycle). Â This is like betting on 21 on roulette every single time just because you hit the number four times in a row. Â Take a look at this post over in the Redfin Los Angeles forum:

“I just got my first place two years ago – luckily just when prices were starting to change. My banker told me that the current market price of my property allows me to borrow an equity line of credit or get a loan. I am told either way I can do whatever I want with the money. Mainly am interested in getting an investment property. However, I am not sure what or how to figure out the numbers and whether this is something I can get into. My current salary pays off my mortgage very comfortably and then some chunk including equity line/loan. What my concern is: paying off the main mortgage of the investment property. Since this is a rental, it would be relying on the rental income and making payments on a monthly basis would be depending on whether or not the renter decided to move out or pay. How do I make a decision – whether to forge ahead or chicken out and stay behind. I am hesitating because I am concerned that I may be missing something… I am interested in 2-4 in glendale, burbank or places with no rent control.â€

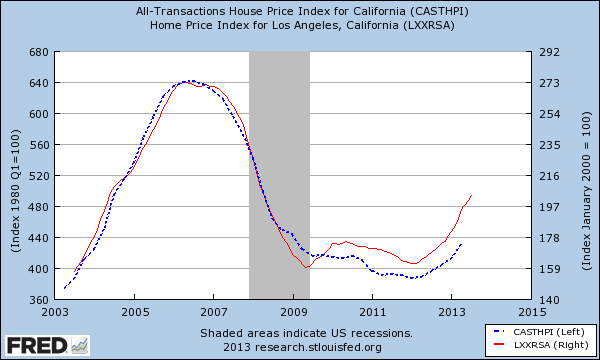

The emphasis above is mine. Â This pretty much sums it up. Â First, even this buyer acknowledges that they lucked out when they bought. Â Next, you begin to see that banks are getting that bubble itch to lend out money at any cost. Â This person then goes on to say they want an investment property yet in the next sentence, acknowledges they have little clue on calculating the numbers. Â This is not a one-off case. Â This is a rather typical mindset in California. Â Ride the bubble up. Â Milk the equity. Â Rinse and repeat. Â Of course, this person will have a hard time finding places that produce any reasonable yield on rents in California since the market has done this since they bought:

That is to say, the market has ballooned back up and much of this rise is because of an extraordinary amount of investor buying. Â I must admit that some free good advice was given to this person on the same post:

“the guy we just bought a condo from had a tenant in there who after one thing and another, didn’t pay rent for over 7 months plus she forced him to repair stuff before she stopped paying rent AND she trashed the carpets and smashed the tile floor in the kitchen.  there’s a guy on one of the forums who had a tenant who accidentally flooded the place they just moved into, and it cost a good chunk of money to get the floors dried out – i could be wrong, but i believe around $15,000.

my point is if you can’t afford to do without rent for several months or to make major repairs, you may run into trouble with rentals.â€

California is notoriously a renter friendly state.  That isn’t necessarily a bad thing but good luck if you get that horrible tenant.  Given how everything is inflated here, good luck trying to fix any repairs at reasonable prices if you are not handy.  As the post above highlights, a simple issue such as someone flooding out your floor (it does happen) can wipe out an entire year (or more) of profits.  Can you carry a mortgage for six to twelve months while pushing out a bad tenant?  I’m not sure if people really think these things through.  When you buy a property as a rental, you are buying a mini-business.  You have expenses.  You have fixed costs.  You have ups and downs.  You have tax issues.  This is no simple matter of buying a place and pretending you are Donald Trump and putting the place on auto-pilot.  If you want good property management, expect 8 to 10 percent off any gross rents.  Make sure to build in costs for vacancies.  I think many people see the big price increases and simply dive in yet rents do not respond quickly because they are based on more underlying economic fundamentals. This person is looking to buy in bubbly Glendale and is aiming for a 2 to 4 units place.  The market for these will be small and the ability to get a decent cap rate is even more remote.

I’m sure some readers have some stories of newbie investors ready to dive into the market as the froth spills over the Pacific Ocean.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

28 Responses to “Of bidding wars and foolish bets: Small time investors attempt to cash out equity to play the market.”

Waiving inspection? Like playing Russian Roulette.Unless you can flip you over priced home to another buyer willing to waive inspection.

After all it’s real estate and it always goes up defects and all!

It is common practice to limit your due diligence to 10 days, not waive it. You are still competitive then. You can also allow the seller to not take the property off the market until you have removed that contingency.

In Soviet Russia, inspections waive investors! Sorry, but had to throw that in there in reference to just how silly this is getting. I have noticed for a few months now that in the Glendora, La Verne et. al. areas that there are more and more for sale signs going up. We all know the recent upward move in prices is The Bernank purchasing $45 billion a month in MBS a la QE (whatever number this is). If you are lucky enough to catch the top and brave enough to short this, you will have a nice early retirement.

And how exactly are you able to short real estate? Unless you are Hank Paulson, Goldman Sachs et al. and you can create put options on mortgage backed securities or whatever fancy maneuvers it takes to bet against real estate, mortgages, etc.

The place we rent was recently purchased by an “investor.” Tell me if you think he’s an idiot. He bought at peak pricing, and:

1) He plans to demolish the house and build a 4-unit condo.

2) He then plans to immediately sell that condo for a big profit.

3) He just realized that due to a recent city ordinance he can’t build close enough to the property line to build the condo.

4) Just a couple months in he’s already had to pay hundreds of dollars in repairs since the building is old and the prior owner slacked in maintenance.

5) Our rent is crazy low but we’re month-to-month with a solid lease and there’s little he can do about it. The prior owner lied to him about rents it seems.

6) He’s shared every detail of his plans with seemingly little clue on the ramifications of trying to kick myself and my family out of the building. Yes, we have an attorney. 🙂

What does “month-to-month with a solid lease” mean?

If you are month-to-month he can terminate your lease with 30 day notice, or raise your rent with 30 day notice.

If you have a lease, he can terminate your lease upon expiration, or raise your rent.

I dunno… Sounds like there may be idiots on both sides of the table haha

Haha. You guys are cruel. But what should I expect? It’s actually 60 days in our case, and we’re fine with that. Our lease is solid in the sense there a lot the landlord has to cover (gardening, trash, water etc). The new owner came in with a brilliant plan, and has a long road ahead.

Pwned – if you’re on the good end of the deal I hope you’re wise enough to treat your landlord with extra kindness and respect. Don’t motivate him/her to force your hand, otherwise you may find that 60 days from now your rent has been tripled…

Pwned, given everything you mentioned, that giant rent increase is almost guaranteed in the next two months. Since your lease is up soon, you’ll either get a notice to vacate or sign lease at a much higher price. I don’t think an attorney can do anything about it.

Welcome to why renting sucks 101.

Good story, thanks! BTW, Redfin forums are heavily censored, often without any notice or explanation, and NOT for good reason (like someone trolling, using profanity, being abusive, etc.) in many cases so I gave up on them long ago as there is no telling what has been deleted from a given thread.

U.S. third quarter earnings warning ratio is 2nd worst since 2001:

http://mobilebeta.reuters.com/us-third-quarter-earnings-warning-ratio-is-2nd

Here’s one that I didn’t see coming. Retiree loans lead to FHA cash crunch:

http://blogs.marketwatch.com/encore/2013/09/27/retiree-loans-trigger-fha-cash-crunch/

I wonder how many people are trying to tap out equity to leverage into additional real estate as the doc says. I see some tapping out in the San Diego area, but I think it’s to get out of the bad deals they made – absentee landlords and flippers are feeling the pinch IMHO. I think this is a good sign for us regular folks who just want to buy a home to live in for a decade or two. Maybe the doc is right about some greedy newbies but I’m not seeing that in the SD area I’ve been watching for the past few years.

“I think this is a good sign for us regular folks who just want to buy a home to live in for a decade or two”

Damn right! Please, specuvestors and would be moguls, continue to leverage up. There will be know bailouts for you after the next crash. Maybe then we can get back to an economy of providing REAL services (non-financial), producing consumer goods and a housing that is a natural extension of that real economy.

A fool and his money are soon parted.

Hey Doc. I thought this would interest you…. talk about ‘the have and have-nots’ in LA, LA, LAnd. LA county has highest percent of poverty in Californication

http://www.latimes.com/local/politics/la-me-poverty-20131001,0,60926.story

Here is a story of a fixer upper that turned into a disaster for the owners.

In today’s LA Times.

http://www.latimes.com/local/la-me-hollywood-fixer-20130930,0,7331935.story

As they say real estate is local but along the east coast 10/1/2013 is a big day due to something called Biggert-Waters which phases out the subsidy many homeowners have received on their Federal flood insurance. This is no small thing for hundreds of thousands of property owners in Florida as flood insurance can now easily exceed $10,000 per year. While existing homeowners will have the new rates phased in over 5 years anyone buying a home gets the new rates all at once. Needless to say this is going to affect property values from Long Island to Galveston and not in a good way.

I was always puzzled by the fact you can buy a home in California and not be required to have earthquake insurance but you must have hurricane insurance along the Gulf Coast. Here is why. Tampa, e.g. has not been struck by a hurricane since 1921. Almost a century. Is it due? No, not really, while it is at risk of a hurricane strike there are some meteorological reasons the SW coast of Florida is not hit as often as the Atlantic coast or panhandle. OTOH geologists will tell you, e.g. there is a 50% chance of a major earthquake on the eastern side of San Francisco Bay within the next 25 years. We know that WHEN this quake hits many thousands of homes will be destroyed or severely damaged by the quake. Few will be insured ( and quake insurance typically has very high deductibles so even the insured may not have the money to rebuild). So who is subsidizing whom. We know that the Federal government will have to step in when California is next hit with a major quake and the devastation to infrastructure will be far more extensive as hurricanes do not knock down bridges or destroy freeways.

Euphoria of 2005 and 2006, you say? Seems like it. Also starting to see little Price Reductions here and there, $5k to $10k.

Adds up to the big crash in late 2014 if you ask me. This winter season will be quite telling.

In my zip code of Eastern outer suburbs of Sacramento, I am seeing multiple price reductions, mostly $10,000 per time, a lot of $19,000 reductions, stuff like that.

I haven’t seen this much inventory in my zip code for about 5 years 🙂

Yep, same here in S. Reno.

Typical drop is 15-20K, but also up to 40K.

Price per foot before coming in at 135-175/sqft, now coming in at 110-120/sqft. Or less.

No price raised posting, only New, Back on Market and Price Reduced.

@PapaNow, the trend watching period begins in now in mid-October. This is when the preliminary September sales data comes out. Since it can take 60 days from when an offer is accepted until escrow closes on a mortgage, September sales would be for transactions that were initiated as early as July when interest rates stabilized at the higher rates (+4.5%).

As the pool of available buyers draws down (mortgage applications plunged 60% when interest rates went from 3.25% to 4.5%) it will be interesting to watch the trends in November, December and January 2014 sales figures.

I have only been doing this multi-unit investing for about 13 years so take it with a grain of salt.

For an individual to operate 4 to 12 units, they are probably not going to generate much cash flow unless they have excellent maintenance skills, they operate the property directly and keep LTV welll under 50%.

To get some scale to afford property management (not kidding yourself that your value added can be costed out at zero or that buyer won’t add the real cost back in), you need 20+ units. Until you get to 30+ units, you better plan on being hand’s on – almost daily participation in all aspects – even with a manager.

A decent property (good rent roll, audited roof of high occupancy, low turn over with record of increasing rents above inflation in the neighborhood) in need of minor maintenance, several years from comprehensive re-model – i.e new carpets, complete painting including ceilings, new fixtures and appliances in bath and kitchen) may generate about 8%-10% in operating income before financing costs. You have 5% to 7% for you as investor and the bank. You should budget at least 3% for capital expenditures and improvements. Over time, you win by re-investing and improving a good property. If you try to milk it, you need to have good fortune upon exit and hope to sell to a greater fool.

Waiving an inspection does sound crazy but I now wonder if the inspection game is a scam. I just bought a condo in Boulder. It’s nice and I am so far happy but the inspector’s report was a joke. He claimed nothing except the sink leaked bit which the seller had already disclosed. After every paragraph there was a disclaimer that he could only inspect by eye balling the appliance, plumbing, roof. I already had to replace 2 appliances which did not function properly because he could only make a sight judgement on them. What is the point of the inspection if the inspector opts out of all responsibility. On the other hand an inspector who wrote up 25 page reports, crawling under the house, climbed on the roof saved me from buying 2 houses in Portland. Here it the inspections seem a joke. A friend of mine used to own an inspection company and he said Colorado was not at all serious about them but then that’s no surprise since CO has very few consumer protection laws and the cities tax food. I haven’t bought a house in California since 1997 so I don’t know how things are there now.

@ Bobi. Here in LA, I hired a home inspector when I purchased my home in Baldwin Hills in 2012, and he did a terrific job. He was at the house for several hours and I received a 58 page report, with photos of attic, foundation, piping, circuit box, report on mainline water pressure, etc. For peace of mind, I also hired a mold inspector, sewer inspector and chimney inspector. Mainly for peace of mind, but at least I found out that the chimney had no cracks, the foundation was over-built for its time, the sewerline was broken which the seller promptly fixed (that was about a $5K job). Because it was my first time purchasing and I wanted to have a working fireplace (many chimneys in LA houses are cracked due to earthquakes and cannot safely be used to burn wood). and also a mold inspection because I have allergies (although black mold is not common). I invested about $1,000 for all 4 inspectors and they were professional, showed up on time and had pdf reports emailed to me 2 days later with their comments and concerns clearly stated. it was well worth it. Hope this helps.

You got lucky in Portland and dealt with inspectors who acted ethically and responsibly. I think that pretty much everywhere their reports remove any legal responsibility for things that they don’t find. So if you get a good inspector, you’re getting some value from them. A bad one, worse than worthless.

I never believed in haunted houses but in 2011 my father became ill and died at home in the house he had lived in next to his golf club for over 40 years. He maintained it very well but, I swear, that house got sick and died with him. While he was still alive the air conditioner and water heater decided they could not live without him and they expired. I expected the A/C to go as it expired was 15 years old ( he had a file cabinet documenting every repair, service work or replaced appliance ever done on the house) and the water heater was not very new either. Then other things began to conk out as soon as he did. Kitchen sink faucet had to be replaced, then a bathtub drain, the front door decided it would no longer close as if there had been an earthquake, toilet flush mechanisms refused to go on any longer. On it on it went as I put the house on the market. It sold quickly and, on the day of escrow, as I was removing the last items from the home I went to get a coke from the refrigerator… it was only 5 years old. There was no ice from the ice dispenser! I opened the door and grabbed a coke. It was barely cool to the touch. Called my broker and said I’d give the buyers a $1000 credit towards the purchase of a new one. They agreed being happy that they already had a brand new A/C , HWH and other recent repairs done to their ‘new’ home. I hope the house got over its grief and calmed down but I will tell you this, if I ever am looking to buy a home I am going to ask how long the prior owner lived there and did they die in the house. If the answer is yes and they lived their for more than 20 years I’m going to pass on it. Call me superstitious but after that experience… I believe!

weird question – but how can I short the housing market and retire early? I do not own any real estate at all so I have nothing to sell. I am a renter and have money to “invest” – but not in the stock market because it’s rigged and not in real estate because it’s not the right time.

My brother’s girlfriend works for a smaller version of the same type of company as Blackstone – in south Florida. In a brief text msg convo he mentioned that her boss said housing is about to start going down in 90 days and a lot of foreclosure’s are being “hidden”.

I don’t like having cash sitting in the bank, but at the same time if I trade all of my cash for something like gold/silver then I have all of my eggs in one basket. What to diversify with that produces a return in these wild times is my question…oh, and how to short the housing market?

Leave a Reply to QE abyss