Beverly Hills short sale – A lost decade condo story. Median price for condo sales in 90210 for may above $7 million?

The condo market in Southern California continues to show some interesting behavior. For the last year there has been a steady stream of short sales particularly in the condo segment of the housing market. You might expect that a steady stream of condos would only impact lower priced areas but the type of property entering the market is diverse. This is why I found it interesting that in May five condos were sold in the 90210 zip code for a median price above $7 million. Obviously this is too small of a sample size and if we look at the single family market, we find that 29 homes sold at a median price of $2.5 million. Beverly Hills is prime luxury market. Even here however, we are seeing some aggressive pricing when it comes to moving short sales.

Falling from millionaire status

There is a psychological threshold when a property crosses into the million dollar range. Beverly Hills has plenty of high priced properties. In the midst of it all, there are some high priced condos as well:

458 N Oakhurst Dr #301 Beverly Hills, CA 90210

2 bedroom, 2 bathroom, 1 partial bath, 1,962 square feet, Condo

This is an interesting condo. It was listed on the MLS in April as a short sale. If we take a look it looks like a common condo:

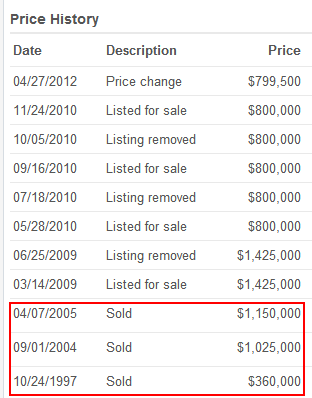

Not much out of the ordinary outside of the location. The current list price is $799,500. For those not in the area they might be looking at the pictures for a 2 bedroom condo and are wondering how it is priced at $799,500. This is simply a prime area in Southern California. If you want to see a property lose the millionaire status you will need to dig into the sales history:

In 1997 this place sold for $360,000 arguably at the genesis of the housing bubble. It sold again in 2004 for $1,025,000 and then again in 2005 for $1,150,000. It sold in the millions twice. So here we are nearly 8 years later from the condo selling for the first million and the list price is $799,500. The place is listed as a short sale.

I was looking at the listing and the current HOA dues are listed at $641. Let us just hypothetically run the numbers here:

20% down payment:Â Â Â Â Â $159,900

PITI:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $4,462

For $4,462 per month and over $150,000 down you can be the proud owner of a condo in Beverly Hills. The listing states the place is currently occupied. While the monthly payment might seem high to many, a rental in this area with this square footage and 2 bedrooms and 2 baths would likely rent from $3,500 to $3,800. The incredibly low interest rate understates the monthly payment by over $1,000.

The fact of the matter is this property has faced a lost decade in price and is located in one of the most prime areas in the country, Beverly Hills.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

23 Responses to “Beverly Hills short sale – A lost decade condo story. Median price for condo sales in 90210 for may above $7 million?”

Still hugely overpriced, if payment and condo fee comes to $1500 over what a comparable unit rents for, and that’s a falsely low number due to interest rates. Plus maintenance and insurance… no bargain! Prices still have a long way to go down in this area.

Just a bit of history for this Saturday morning: Directly across this jacaranda-lined street at 457 N. Oakhurst stands the last home of 2-time Oscar winner Shelley Winters (“Diary of Anne Frank” and “A Patch of Blue”. A 2-story Spanish-style duplex surviving from the ’30s, the now renovated property just sold for $2.1 million on 7/11/12, up from the $1.95 million on 8/22/06 several months after Winters died. Apparently plans are available for a 5-unit/4-story condo building on this corner lot which is now framed by a nice, tiny “urban forest.” See it before it’s gone.

Oh, and more on topic, foreclosed Unit 204 at 458 Oakhurst sold for $641,000 on 8/22/11 (while 2 bedrooms like Unit 301, it is 527 sqft smaller.) It previously sold for $780,000 on 3/20/07. Thanks, Dr. Housing Bubble, for highlighting various areas in greater L.A. As you know, Beverly Hills prefers to keep things close to the chest and close to the vest, and does not really like to talk about unfortunate real estate transactions.

Hangers on of yesterday’s bubble prices. Tough to let go of the easy dream loot. With a lost decade happening look to prices in 2000 or so for an indicator of realistic prices. A condo is still just an apartment, no matter how dolled up it gets.

I see properties going with more than one unit(R2). Just as the above BH condo, they do not cash flow. Is this another mini bubble forming? With an HOA like that, I’d expect house keeping, ironing and valet. Im guessing you get a gate with a buzzer. Funny thing about the HOA’s they just keep going up, along with the property maintenance of an aging property. Seems kinda reckless!

A PITI of about $4500/month. Or $54,000/year. Not sure if you included $7200/year in HOA. Still a formidable sum for a condo.

Unless there is constant appreciation, “owning” properties like the ones featured makes absolutely no sense. This property will likely be dead money for the next decade. Buyer beware in a big ass way!

A median price of $7 million seems to be a mistake. Did you mean $700k?

This looks like an older building. I wonder what the “special assessment” will be when the roof or HACV system needs to be replaced.

I always wonder what makes a 2-bedroom condo worth ~$800K. Like the post mentions, it looks like an ordinary condo/apartment/whatever. Decent digs, IMHO, and well worth ~$750 a month if it’s close to work, a park, a library, and a grocery store, has a nice pool area, and allows cats or dogs.

My point is that a $3K to $4.5K monthly payment + repairs demands a $3K to $4.5K bump in lifestyle. Maybe there’s famous people around, but paying the rent doesn’t mean they’ll be your friends. Even if they were your friends, chances are you’ll find they’re just like any other random group–some smart, some not, some nice, some not…what’s the difference?

I just don’t get the value proposition. Is the area burgeoning with economic opportunity? Academic opportunity? Free parties or foot massages?

Spend all the money on a domicile you want, because life will still be what you make of it.

I would like to submit to you the following questions:

1, what will the price of your house be in 5 years?

A, the same as today

B, up 10%

C, Down 5-10%.

2, What will your rent be in 5 years?

A, the same as today

B, up 10%

C, down 5-10%

3, What will the unemployment be in CA in 5 years?

A, The same as today

B, Up

C, Down.

4, What will your income be in 5 years?

A, THe same as today

B, Up. 5-10%

C, Down 5-10%.

I sure would like to know the answers to all those questions!

Answer: Look at Japan over the last twenty years.

If the markets were not being manipulated, we would know the answers to those questions and the recession would be long gone.

I’ll take a stab:

1, what will the price of your house be in 5 years?

A, the same as today (still too much pressure on inflated housing prices)

2, What will your rent be in 5 years?

B, up 10% (the powers that be are turning the crank on renters)

3, What will the unemployment be in CA in 5 years?

A, The same as today (the nominal number will be lower, real number same or higher)

4, What will your income be in 5 years?

C, Down 5-10%. (nominal number will be higher, real number much lower due to massive inflation…that 2% raise won’t keep up with 5+% inflation)

You will have to have a view on all these questions before you make a sound decision to buy or to rent.

If you measure by the value of gold and silver, everything is deflated. But we live in a nominal world. Japan remains to be the most expensive place to live (at least the big cities). Government told you that they will not let the system fail, and they will print a lot money to inflate the asset prices. They told you that, and they have been doing it all along, and in a openly fashion. They screw the savers and anyone prudent in their finances. The renters were screwed long before the crisis. Otherwise, how do you think those debt to be repaid?

Is Torrance still over priced? I have been hoping to purchase a house (3 bed 2 bath 1500-1800 sq feet) in 90505 90503 and 90501 area code. Whenever I put an offer, there are so many others bidding on the same property. I was told that there are a lots of foreign buyers in the market and the market is only going to hit up. Should I just give up living in Torrance?

Keep saving for your down payment. I personally know of 4 90505 places that have just sold for right around $500K to Chinese “investors”. Immediately, for-rent signs went up. It seems they’d rather have their $500K generate $2800/month than sit in the bank. It matters little to them if they are using N-Korean counterfeited dollars or not. I have spoken (attempted to in English) with these new owners, and they are completely ignorant of the specifics of the area, but like everyone else, are trying to find a “safer†place for their dollars, as world currencies, including the Yuan, come crashing down. Even though this frustrates someone in your position, trying to fight over the MLS properties, I don’t think they will “drive†prices up over the long-term. There is many (7?) times as much shadow inventory waiting in the wings. My strong opinion is prices MUST be supported by equivalent RENTS over time, and we aint there yet, not even close. How much rent do you currently pay? Will your(new) house payment including taxes be same/similar number?

The luxury markets in general have not taken the hit that most of the rest of the markets have.

The housing bubble also made a muscle car bubble as well. I guess the same goes for ATV’s, RV’s, etc…but I don’t pay attention to those markets. I have, however, been driving muscle cars for 15 years and the same rules are currently applying to them as houses.

2005 – any old car was worth twice what it is now. People were scrambling for projects, drivers, show cars, and trailer queens. Now everyone is broke. Long story short, 2012 you can go on eBay or CCTOL and find nice old cars with big blocks (Chargers, Chevelles, etc) for $15k or less all day long. These cars are most likely non-numbers matching, have bondo, mid/high cutouts in the door panels, etc. But they are still great fun to drive and can look good. You could not get them this cheap in 2005. However…

The best of the best have not fallen in value, kinda like housing. A numbers matching Hemi Cuda 4 speed is still $150k and up, meaning the 1% are still rich, and the rest are not.

I watched the Barret Jackson auction and was seeing 69 Mustang Mach 1 (428 CJ cars) selling for near 100K. I remember back in high school (1980s), I had the chance to buy an original owner, great condition, stock ’69 Mach 1 (351, 4 speed car) from an older guy down the street for 5K. Would have, should have, could have….

My parents also had the chance to buy 20 acres of land in Santa Barbara county back in the 1960s for a reasonable price that a middle class family could afford back then. It was just farmland at the time. Today that 20 acres is premium land next to vineyards and horse ranches near Buellton/Solvang. I would guess it wouuld be worth millions today. Would have, could have, should have…..

You speak my language. Hard assets, not as liquid as cash, but more fun & noise to enjoy. Lots of stuff available right now for less than cost to build/restore. I just ran out of room to store them. Need a property, but everything is still un-affordable, so my collection can-not, will not expand….upkeep and maintenance can whittle away at your wallet though.

Beverly Hills is a successful brand. Folks will pay a premium for a successful brand. That’s why companies invest so much money in marketing. The high priced goods sold on Rodeo drive are the prefect example of that. You can pay bucks to buy a pair of Jimmi Choo shoes, or buy no names at Target. The fact that both are functional and suitable for walking is irrelevant. That’s why style is free money to companies. For no additional cost of goods, you can get folks to pay a premium marketing to their impressions. You can wag your finger all you like, but in spite of Harvard continuing to turn out moron after moron, Harvard is still a successful brand. That is the way the human animal works. Once you have it, it takes an awful lot to lose it.

Leave a Reply to Facts and Feelings