Beverly Hills real estate selling for 1989 price levels – Southern California two bubbles. Home sold for $920,000 in June of 1989 and has a pending sale at $920,000 today. 1 MLS foreclosure versus 100 in the shadow inventory.

The negative year-over-year price trend in Southern California is not surprising. The overall market is still inflated and delusion still runs rampant. If you follow previous historical manias the true bottom is usually reached when most of the public concurs that said object of mania is rejected nearly at all price levels. We are nowhere near that level of capitulation. The next phase is bottom investors picking up homes in lower priced markets. 30 percent of sales last month in SoCal involved all cash buyers picking up homes for a median price of $190,000. Yet a fascinating thing that is now occurring is the places to hide are getting smaller and smaller. There are many psychological trends that have hit in this bubble and the one that seems to remain is the one of selectivity in niche markets. There are only a handful of people that now say “well that isn’t the best part of the 90210 or San Marino will not go down.â€Â Well it will go down but nothing that you will be able to afford! The other 98 percent of areas where people live prices are adjusting and in many mid-tier markets. These delusional folks somehow think they are going to buy a million dollar home on a low six-figure salary (or even less). Champagne taste with a beer budget. Today we see a home in the 90210 zip code that is now back to 1989 price levels.

Beverly Hills revisiting the peak of 1989

9586 SHIRLEY Ln

Beverly Hills, CA 90210

BEDS:Â Â Â 3

BATHS: 2.75

SQ. FT.: 2,290

$/SQ. FT.:Â Â Â Â Â Â Â Â Â Â Â $402

LOT SIZE:Â Â Â Â Â Â Â Â Â Â Â Â Â 0.33 Acres

PROPERTY TYPE:Â Â Â Â Â Â Â Â Â Â Â Â Â Residential, Single Family

STYLE:Â Â One Level, Traditional

YEAR BUILT:Â Â Â Â Â Â 1956

COMMUNITY:Â Â Beverly Hills Post Office

This home is in the Beverly Hills Post Office area and we’ve seen some sharp corrections in this market (ht to reader for finding this gem). We’ve been highlighting this area because we are now sorting out the super prime from the prime. Prices are coming down. This home is a nice place so let us look at the sales history here:

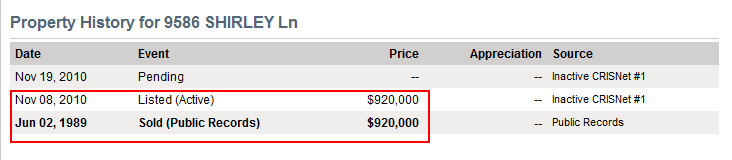

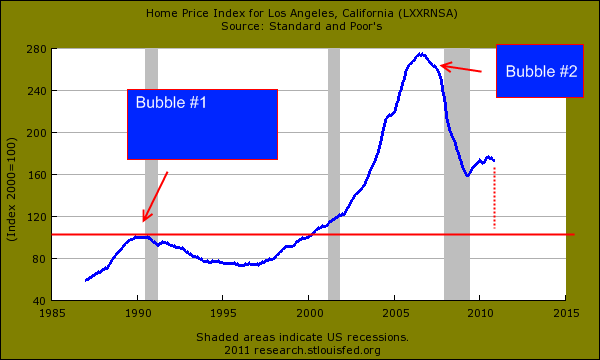

This home sold for $920,000 in June of 1989, a previous peak in Southern California housing. The home was listed on the MLS on November 8th, 2010 for $920,000 and now has a pending home sale. Over two decades and the price remained the same in Beverly Hills. At this price it now has a pending sale which signifies homes are moving if priced right. If you want to look at what happened in the LA/OC market overall this is the chart:

After the bubble peak of the late 1980s prices went under their inflation adjusted baseline for an entire decade. We haven’t even hit the inflation adjusted baseline! And we have unemployment and underemployment at 23 percent which is much worse than what we experienced in the 1990s. We did not have the depth of the current budget problems at that time either. If you also recall California benefitted greatly from the 1990s technology boom yet real estate prices remained under the baseline for this entire time. This bubble has no comparable in the history of our region. If you look above you realize home prices are still inflated.

The home above is actually a very nice place:

I’m sure you will have your typical handful of delusional folks commenting on how they can’t land a La Jolla home for $200,000 but the overall trend is abundantly clear. Prices are correcting in virtually all areas of Southern California. This is expected. The amount of toxic junk floating out in the market is immense.

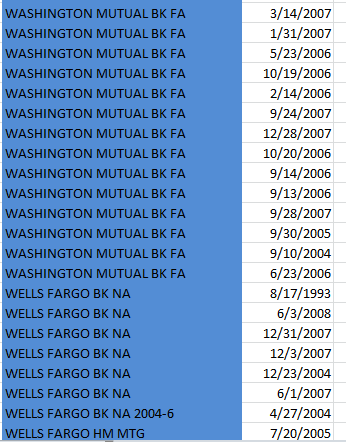

I’ve also noticed some people down playing the Alt-A and option ARM fiasco. Ironically the people saying it is a problem that has gone away forget that much of this bubble was created by a corrupt and unethical investment banking and housing industry. Yet they now trust their data? Not sure what to think here but maybe they are just naïve. For example; 1 foreclosure is listed in the 90210 via the MLS. Yet 100 are part of the shadow inventory. Banks seemed to have moved on lower priced Alt-A and option ARM loans but are not sure what to do with the mega defaults. WaMu and Wells Fargo (from the Wachovia branch) were notorious at making giant crap loans and look at how many of the 100 loan are from WaMu and Wells Fargo:

These are for active foreclosures. Loan amounts range from $600,000 to over $6 million (many are in the millions of dollars). Yet the Alt-A and option ARM problem is largely gone because some trust banking data. Sure. Keep on believing what you want to believe. This correction is far from over.

Are you noticing any other trends like that in the 90210?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

57 Responses to “Beverly Hills real estate selling for 1989 price levels – Southern California two bubbles. Home sold for $920,000 in June of 1989 and has a pending sale at $920,000 today. 1 MLS foreclosure versus 100 in the shadow inventory.”

“Don’t stop believin’, hold on to that feeling yeah yeah!” ~ Journey

Hey Dr. H.B., here’s another real winner for you. I was perusing today’s Coldwell Banker “View” rag that covers their open houses for LA, Santa Barbara and Ventura Counties that comes with the Saturday LA Times, when the full page listing on page 26 caught my eye.

It’s a listing for the “Robert Taylor Ranch”, a 112 acre ranch located up Mandeville Canyon in Brentwood. I noticed in small print under the picture the word “FORECLOSURE”. Original asking price according to the ad is $65,000,000, now “only” $38,000,000.

Now there’s a real ranch of genius. How’s that for a residential foreclosure?

Here’s the listing for it, although it isn’t listed/marked as a foreclosure in the listing:

http://www.redfin.com/CA/Los-Angeles/3099-Mandeville-Canyon-Rd-90049/home/6859565

Pondering sticker shock for a moment.

While the sale price number on the brick ranch house is nominally the same, the value of those dollars has…what….about halved?…since 1989.

http://www.dollartimes.com/calculators/inflation.htm

So maybe one can buy a 1950s Cleaverhaus in Botoxland for the equivalent of…what, $500K in Poppy Bush Bucks.

But I have to wonder about the costs the RealTor fluff sheet evades in favor of the stripped-down model of price/value that NAR has established in everyone’s minds.

Such as where the jobs are relative to this “desirable” area…and what it costs, and will cost over the next 20 years, to commute. Houses may get cheaper. You can bet energy will not.

Single-pane windows; that should cost a penny or two as heat and cold get more extreme.

I’d want to know whether there are deeper infrastructure issues with that 55 yo rancher. Like, you know, it needs to be completely re-plumbed, whutup with the heating/cooling system/s, and the gas main on the street is set to blow up in 3, 2, 1….

While the interior looks cosmetically conventionally-nice with all the accoutrements of comfort, the brick pointing on the face of the house near the entryway looks dodgy, and the moss on the sidewalk indicates it’s perpetually damp there.

And I’d like a look at that roof. I don’t see any rain gutters. Does the water just, like, pour off the roof as is the case in trailer houses in our rainforests around here? Has it been doing that since 1956? I’d like a look at the foundation, please.

Where weather/climate are concerned, when you buy a house, you are also buying your primary source of adaptive technology for the increasingly erratic weather we all will have to live with.

So “the same price” is true…but I’m betting that this house is much more costly in terms of hidden factors, and that that–more than market correction–is what accounts for this “low” price. I’m guessing that any money put into the house were for cosmetic things.

I may be completely wrong about all of this…but it’s part of my own thinking about price versus cost versus value. It’s not just the sticker price. What needs to be part of every house buyer’s mental landscape is whether the house they are buying will work in the future, not in the past. And as with buying a horse or a sailboat, the initial purchase is just the beginning.

heh, heh, heh… you and I are the technically savvy hyper-discerning buyers who banks and Realtards FEAR the most. That 20-year soil termite treatment gave out during the Carter Administration, lol.

I let the lender send their lame-o “inspector”, then MY guy shows up, wearing knee-pads, and and armed with a drill, and a flexible BORESCOPE!… and a piece of electrical test equipment called a ‘Ground Bond Tester’… the “list” grows so long.

Oh yeah, I’ll balk right there in the closing, force 5-figure give-backs at the last minute, make those cosmetic flippers CRY… or WALK out… heh, heh, heh… FULL DISCLOSURE is good for society… where’s my medal? ;’)

Thank you. What you said is very illuminating.

Excellent points and analysis. Us humans are more emotional than we gives ourselves credit. So, in conclusion, we must give ourselves more credit, and banks should give us less.

It’s all true, then again it’s not like your going to have fancy double paned windows on a rental either and when the stock of affordable houses in decent shape in Los Angeles is few and far between …. You will of course have tons of money in the bank with the rental.

Developers are still trying to push out option ARMs for new construction, and taking advantage of FHA loans as best they can. I see more of these instances on the westside than northern areas like burbank/glendale/pasadena. Given the prices in the westside, this is likely the only way they can keep pushing large loans and keep home prices high.

Also, I’ve been shopping around since last year, and it seems prices in the burbank/glendale area are adjusting at a faster pace. While the quality of homes are still subpar, the prices have come down enough to make living in those neighborhoods accessible. I’d still wait for the nicer homes to decline in value, but at least it’s a good sign.

The question is whether banks/government can keep propping up homes effective enough to make this a long slide vs market fundamentals taking over and deflate home prices enough for an effective bottom within the next several years.

Homes in prime areas (ocean view, status address) will alway carry a premium. Even after all the downward adjustments, they will still be out of reach for the average person.

However, the current trend is very healty for the economy and for the future homebuyers.

They just have to be patient for another year or two, and let the slow motion avalance of housing prices take hold.

90266 is immune, at least that is what my MB realtard told me.

So is 90274!

ha ha ha

very funny

I used to live up in the SF bay area during the peak. One of my friends bought a condo in the east bay for 800k- a nice, big condo . But a condo neverthless and that too in the east bay-she was worried she would be forever priced out. To think a few years down the road and 100k more, you can get ahouse in beverly hills !

It just goes to show how big the 1988-1990 bubble was. I’ be willing to bet that house wouldn’t have fetched more than $500k in the mid 90’s.

For example…

In 1996 (the bottom) for $495,000 you could have had this…

http://www.zillow.com/homedetails/2289-Betty-Ln-Beverly-Hills-CA-90210/20533784_zpid/

http://www.redfin.com/CA/Beverly-Hills/2289-Betty-Ln-90210/home/6834282

Speaking of cheap RE. Yesterday I was given an original mimeograph from 1972 for Hancock Park, Windsor Square and the adjacent streets. The bulk of the homes were $40,000 – $150,000 and would *now* sell for $1,000,000 – $3,000,000.

Crazy.

$100 000 in 1972 is about $525 000 now, but that still leaves more than doubled price, inflation adjusted.

“For what?” is a hard question. 😉

Shows how big the bubble was in 1989.

In 1996 that house probably would have been closer to $500,000 like this one…

http://www.redfin.com/CA/Beverly-Hills/2289-Betty-Ln-90210/home/6834282

Speaking of cheap. I was given an original mimeograph of all the listings in Hancock Park for 1972. The bulk of them were between $50,000 and $150,000. At the 2005-2007 peak, the same homes would have gone for $1,500,000 to $4,000,000.

That house would have sold for $500k (or less) in the mid 90’s.

http://www.redfin.com/CA/Beverly-Hills/2289-Betty-Ln-90210/home/6834282

Today, I saw a mimeograph of listings for Hancock Park from 1972.

The bulk of the homes were listed from $50,000 – $150,000.

We have the same trend up here in the San Francisco – East Bay Area, 1990’s numbers. http://bmjr.me/ee1f2S

As long as aggregate pay levels are still in the 2002 range, this will keep homes from slipping too far below that time level. Unemployment is a killer for real estate prices. And we’ve got uncharted waters for unemployment in CA. And if the state and local govts cant get more money, we’ll see higher unemployment from their lay-offs as well.

2002 wages did not support 2002 home prices in Ca. Teaser rates caused prices to surge far more than wages would support, but I don’t need to rehash the entire history of the bubble, do I?

Martin, excellent input, I totally agree. 2002 prices in So Cal were already inflated. The run up seemed to be right about 1999. After the corrections in the government sector (lay off’s, cancelled development efforts ect) and the return of realistic interest rates, prices dropping to 1999 levels is not unrealistic at all…may go even lower.

Good point, and really, it’s not the weather that people move anywhere for–it’s good jobs. Nobody really wants to live in Minnesota, Wisconsin, Chicago, Detroit, Cleveland. They moved there for jobs. Califonia had jobs and climate, as well as happy cows. Sorry, but no jobs means death for any city or state. Mexican’s don’t come here because they think Taco Bell is great–they come for jobs. People will endure bad weather for good paychecks. Jamaica is real nice, but not many jobs, people want out-not in.

Burbank is stuck. Not moving at all. Fixers going for 450 to 500K. Need to put 50K in before the moving van hits the drive. Who can afford that? In Burbank?

There is a general observation in all things: delusional people say this or that is going to happen without any analysis or reasoning–maybe inserting some cliche; while, realists tend to support their arguments with data, facts, analysis, reasoning and conclusions. Doc’s been accurate for years now, and obviously quite a few people have been thirsting for truth–don’t give me a pep talk, give me the truth. Many will never believe, but obviously many have been spared financial disaster. Anyone here admit to ‘bottom feeding in 2009,2010? How’s that working out?

Americans in general are not that good at math–it’s rather obvious…

I tried to bottom feed last week. Failed. Multiple bids on property I tried to buy. Realtor called mine and asked how high I was willing to bid above my initial offer since there were other bidders. I said exactly zero cents higher.

you guys will LOVE this posting, check this one out doctor

http://www.zillow.com/homedetails/439-S-Spalding-Dr-Beverly-Hills-CA-90212/20511023_zpid/

I love it, Jason. Just keep bottom feeding if you’re out to buy. Lowball the hell out of these delusional sellers and idiot real-turds/real-tards/agents.

Do what I do at open houses – write down a number that’s half the asking price and tell the agent (or even better, the seller if they are there) that you’d be happy to draw up the paperwork immediately as well as pay cash. Then when they balk, tell them that’s fine, take it or leave it, and you’ll get an offer for half the previous offer in 6 months!

@Burbank

While I do believe prices there will fall enough to settle in the $300-350K range for the fixers(significantly I DO NOT believe Burbank will fall below 2001 pricing due to a variety of factors), I do not see why it would be unreasonable that one buying a fixer in Burbank @500K would not have the following:

-20% down

-Closing costs

-Savings

-$50K for repairs.

And if one does not have the above items, why would one even consider that they could spend half a million dollars?

I say this not really as a commentary on just Burbank, but rather as commentary on the folly with which people CONTINUE to engage in when making the single largest purchase they will ever make. Its rather frustrating that desperate to buy people continue to keep housing prices from sliding into the abyss.

Compass Rose – you made me laugh. “I’d want to know whether there are deeper infrastructure issues with that 55 yo rancher…..and the gas main on the street is set to blow up in 3, 2, 1….” I don’t think we’d miss it if ALL of Hollywood got “taken off the map.”

You bring up some great points. And yeah, even though I personally think this house is overpiced at $920,000, it is really selling at half the 1989 price when inflation is taken into consideration!

Oh man, it would be hilarious! You sign the papers on the sucker (the house) and the next day – KA BOOM! Well, what did u expect from a 55 year old house?

This is bad news for me. I bought at the peak (2007) in Brooklyn, NY, so it could be worth the same amount in 21 years!

It appears that this home in Beverly Hills is down some 42% from the peak. But is it?

As we all are aware of, we live in a global economic world. Let’s examine how much the US dollar has been devalued since the peak versus other currencies (Euro dollar, British Pound, Swiss Franc, Australian dollar, Canadian Dollar, Chinese Yuan, Japan Yen, and etc.); vs precious metals (Gold, silver, Platinum, and even yes copper); vs food commodities; and how much inflation we have had and is on its way. I have not performed a detailed study and research regarding this but it seems like the 42% figure may not represent a true figure and it may very well be much much less than 42%.

Any input and thoughts from the Doctor and the readers?

Hey, I’ve lived in South Pasadena since 1976…hi neighbor!

Hi neighbor. Great town. No place like it in Southern California. Save the trees. No 710 extension!

I heard yesterday that the Federal Reserve will keep the currency (US dollar) the way it is for the next 10 years for our exports = more jobs for us.

Hey, I also have been living in South Pas for last 13 years….

jw

Yea, and don’t forget the issue about MERs not having legal standing to foreclose on homes as courts are begining to find out. Broken Title Chains, Option Arm loans secured by fraud through mistated incomes, inflated appraisals, loose underwriting, and greed through profits made from Collateralized Debt Obligations (loans sold to investors). According to online sources and evidence, these loans were structured to fail from the outset ……the intent, to make lots of money.

Add this to the whole equation and you will begin to realize that THIS IS GOING TO BLOW UP…..

The home on Shirley Lane is in the 90210 zip code but it’s actually in the City of Los Angeles. 90210 zip traverses the City of Beverly Hills and the City of Los Angeles. You would not get Beverly Hills schools, police or other amenities, but apparently you would get a nice house on Shirley Lane with the 90210 cache.

In zip code 90212 within Beverly Hills, here’s an interesting listing:

439 S. Spalding, 3/3, 1911/9100 lot, ask $950,000, $497 p/s/f.

Listed 6/30/10, went pending 8/13/10. Previously sold 12/2/05 for $1,852,000.

Will be interesting to see the final price per square foot…if this short ever completes.

Has anyone done a misery index for LA lately? High rents, high unemployment, falling wages, road rage, gas prices up, food prices up, crime rising, etc. etc.

In my building in “desirable” WeHo there are about 8 units vacant that have been so since 2008. Owner reluctant to lower rents due to enormous loan she took out against the property.

Some landlords in apartment-heavy WEHO, where every other building seems to have a “for rent” sign displayed, are lowering rents. They’ve seen the light; the others are being enveloped by darkness.

The mixed-use project at Hancock and Santa Monica Blvd now has one or two businesses at street level but the bungled auction of the “lofts'” above has resulted in the property going rental with unrealistic prices starting around $3,300. Go by it. See if you see any lights on — that are not staged. What a joke!

Looks like this mixed-use concept is not going across very well in WEHO where folks were told it was the next greatest thing. Some good did result though — along the Hancock Ave. side of the property sit 7 studios that the city required the developer to include as affordable housing units. These are occupied.

Given the age and the apparent 8′ ceilings, my bet is that this house will end up in the landfill and that the sales price included only the value of the lot. $920K for .33 acres may be “rich”.

I can tell you how they are postponing the Alt-A disaster. They’ve given bad in-house loan mods to the homeowners that will put them in debt even more, while Wells Fargo pockets the money on a 3 month forebearance agreement.

When buying a 2000 sq ft homes over 1MM you are paying for the zip code. Most homes in Bev Hills are old junk. I was not born in the ’30s and ’40s but I bet the same builder built them as they did the 2000 sq ft homes in “Los Angeles” a few miles south.

That said, you are paying for prestige. Not land value as you have the same land a few miles south in LA. So yes, the rich like to keep the others out.

So back to the other 98% of us…we just sit and wait for the prices to continue to fall. But as they fall, I am having issues finding work in LA. The economic slow down hurts the consulting business and I have to travel out of state for jobs. Maybe one day I will decide that the other state might make a good home. (Ok, probably not.)

So I agree we need to hang in there as prices fall. But maybe we should evaluate why we want a home in SoCal? I want to say because of the weather, great food, and the work when available. But I also realize I am missing out on life waiting.

With that said…I need to factor in everything when picking a price. I admit I know these homes are not worth 1MM as the exact same home in Vegas is $100,000. So I need to decide if weather, great food, and a job is worth the extra $900K. Hmmm, not an easy decision.

We’re up in th Castaic/Valencia area. This place was booming between 2005 and 2007. People that bought the homes new in 2000 for $300,000 turned around and sold the in 2003 for around $450,000. Those buyers then turned around and sold the homes for $700,000 in 2006 and 2007. All told by brokers that the values continued to be on the rise and you could turn around and refinance that interest-only loan (the only loan you qualified for). Guess what…all the kids who thought they would be life long friends are all gone. About 60% of the homes have been foreclosed and most hidden in shadow inventory (not on the MLS). The HOA community looks like CRAP! It’s very sad for all the displaced kids. These foreclosures have got to stop and there needs to be a principle correction to those fraudulant appraisels done between 2005 and 2007.

By the way, they’re STILL offering these BS loans with promises of re-financing. Check it out. This same company has gathered investors to purchase foreclosed homes and do a ridiculous Rent-To-Own program with terms that are impossible to pay off. It’s the same scheme all over again. When will we ever have a middle class again? When this all ends and those responsible are put in jail.

@ Phil

Rents are not high in Los Angeles.

In fact, steals can be had if you have good credit and employment. I’m literally renting a unit for $1200/mo less than it would cost to purchase. And they give me a gym membership AND a $1000 gift card at move in.

In fact, I make a solidly middle class income, yet could easily afford to rent @ 1/3 takehome in upper middle class and wealthy areas. Furthermore, if I was not single, and my spouse made even 1/3 of what I made, we could afford to rent a small home in an upper middle class to wealthy neighborhood like Sherman Oaks or Studio City.

Buying OTOH is near impossible and would likely require moving into a lower middle class neighborhood.

ditto- my wife and i are in the exact same situation. renting makes way more financial sense at this point.

My friend recently bought a house for 150K (foreclosure) in Central California. Put 30K down and did some repair. She rents it for 1050$ a month. Her mortgage payment is 600$ a month. So, her renters are paying her mortgage + 400$ a month. So, buying does not make sense now. Does renting make sense? Paying somebody’s mortgage?

In my area (central NC) a 150K house would never rent for 1050. It would probably rent for about $600.

It would make sense. I wonder who is renting that house when you can buy it. Folks with bad credit?

@ Kat

It depends. Down in Los Angeles county, many areas are still priced at crazy unrealistic prices. Imagine paying $450,000 for a house that sold for $180,000 in 1999. What if the price of that $450,000 house declines to 1999 levels. If you needed to move and sell that house, you would be unable to sell it for what you paid for it. You’d be stuck. So, do you think it is worth taking on that $450,000 loan with the bank when you could have rented for a while until prices adjusted to normal levels.

The example you showed may actually be a good purchase because the rent covers the mortgage and provides profit. Sometimes renting is better and safer. Paying someone else’s mortgage is a good think if it means you are not paying unnecessary money to a bank every month and you are not stuck with a house that is depreciating in value.

[Informed sideliner wrote]

Imagine paying $450,000 for a house that sold for $180,000 in 1999. What if the price of that $450,000 house declines to 1999 levels.

—————-

I think this is a good example for making your point. I know people who bought back in the mid to late 90s for $180,000 and their homes are now valued roughly at $400,000 – $450,000.

But it gets me to thinking. If prices were to ever drop to their 1999 levels… what a catastrophe that would be! The U.S. dollar in 2011 is worth roughly 60% of what it was worth in 1999. So even if the housing bubble never occurred that house would be valued at $300,000 today.

Sorry about the thread hijack, but does anybody here think that So. Cal prices in Ventura County/LA County could ever drop down to there 1999 levels?

Just curious to hear what the experts think.

@Phil

I agree with you about landlords in LA. Many people bought properties in the runup and now have to cover them somehow. Rents on a lot of places haven’t come down because the landlord can’t cover the mortgage or reach a target return on investment at market rental rates. I was looking for a place a few years ago and the prices were ridiculous because so many units were not on the market – either trying to be sold as condos or priced absurdly high. Many landlords have deep pockets and can keep paying so as not to lock themselves into lower rents paid for the next few years. They think the rental market will come back but I don’t think it will.

Rents in LA are too high for the average renter to afford. This is why you have some families doubling up in 1 bdrm apts. Younger non-married couples live together in higher rates in LA just to be able to survive – this was very common among my group of friends. Roommates are the norm. It was not uncommon to see people spending 50% or more of income on rent.

During the bubble, rents went crazy. My landlady would tell me how much her building was worth and would often think about raising the rents. The reason? She thought that if her building was worth $2 million, then cash flows from the building should be reflective of the value of the building. Her fellow landlords felt the same way and jacked up rents up and down our street. Rentals going for $700-$1000 were now priced at a minimum of $1500. This happened in every neighborhood in LA it seems like. The end result was that a bunch of younger workers left LA.

My husband and I rent a duplex in Redondo Beach, and I have not seen housing prices go down significantly in the past two years. I really haven’t. I keep hearing prices won’t fall in this area because it is a highly desirable area, and people will pay a premium price to live here. I’ve heard this from several people: homeowners, other renters, and, of course, realtors. Do any of you believe prices will go down in the Redondo Beach, Hermosa Beach, or Manhattan Beach areas? I don’t feel badly about renting, but I would like to be able to stay in one place longer than a few years.

In 1985, my uncle and aunt bought a house in Los Feliz, on the top of the hill with a wonderful view, for $200K. Their non-real estate net worth before the purchase was about $600K, or roughly three times the price of the house. I think it would sell today for at least $1.5M, which means a buyer in equivalent financial position would need to have about $4.5M in non-real estate net worth. I know very few people in that position, but I know a lot of people willing to buy a house for that price.

“Rents in LA are too high for the average renter to afford.”

That’s true, and so is your point about debt-laden landlords facing impossible choices. In my neighborhood I’m seeing the same absurd phenomenon in both commercial and residential situations: empty spaces going unrented for many months. The previous tenants driven out by absurd rent increases. Several neighborhood businesses went under in the past couple of years because their landlords demanded more even as they had to slash prices to attract customers.

@ Facts and Feelings

I’ve seen some lowering, but not fast enough to fill all those empty units in the neighborhood and empty storefronts up and down SM. A friend of mine manages a building in another “desirable area” and says that he’s had no problem getting his bosses to lower rents as needed. The reason is that this ownership group is stable, has owned the property for many years and didn’t succumb to the temptations of the cash-out refi boom.

Maybe WeHo just has a higher than average proportion of both bubble-era landlords and established ones who encumbered their properties with lots of debt.

Now, what are the chances that the proposed “mixed use” monstrosity will see the light of day at SM and Crescent Heights? I mean, now that they’ve chucked out most of the longstanding, paying commercial tenants from that corner.

@What

I can see how your situation is advantageous, but I also think it’s somewhat unique. Most of the renters we rely on to bring fresh energy, ideas and spirit into LA are young people lacking both great credit scores or solid incomes. For them, it’s still too frigging expensive.

In fact, today’s 20-somethings are coming into the game more loaded down with student debt than ever before, and entering a job market that’s dodgy at best.

But I see your point: there are lots of nice dwellings in nice places desperate to rent out at rates far, far below the cost of buying. If you can take advantage of this more power to you.

@ Trail rider

Home prices are already declining to 1999 levels in other areas outside LA/Ventura County, so one has to ask himself or herself if prices can decline to those levels in LA/ Ventura County as well. I’ve seen some homes in LA/Ventura County priced at 1999 levels, but they were in “undesirable” areas. I’m no expert, but I believe we are going to see prices decrease to 1999 levels in most parts of LA/Ventura County. Who’s to say prices will not fall to lower levels than we saw in 1999. When wages start increasing at drastic rates and the unemployment rate decreases to a normal level, then we can start talking about home prices bottoming out or increasing. Many people are going to be in for a big surprise as home prices continue to decline.

Leave a Reply to KPPI2U