Real Homes of Genius – The search for the biggest California foreclosures. Missing the housing peak in Beverly Hills. From $9.8 million to $7.25 million and counting. From $2.4 million to $1.3 million.

Historically foreclosure has been a rather simple process. Banks would move quickly on missed payments and proceed with the typical timeline of foreclosure. As a bank, it was likely that the home you were taking over had some amount of equity so the quicker you were able to take over the property the faster you could check off a troubled loan from your books. This mechanism allowed for a smoother process to deal with expected events in society like job losses or divorce. As an owner it also allowed many borrowers to sell if they were unable to make their payments for whatever reason. There were inherent checks and balances that made sense and the pressure was on building equity. When historians and erudite economists look at this crisis years down the road they will wonder why in the world did the system encourage equity dilution? Foreclosure isn’t a new thing obviously. Yet the magnitude and size of foreclosures is astounding. Last week we featured a multi-million dollar foreclosure in wealthy Newport Coast. Today we will examine the Beverly Hills market and see how a nationwide housing bubble is unraveling right before our eyes even in posh zip codes.

Beverly Hills – Any takers at $10 million?

2700 BENEDICT CANYON DR, Beverly Hills, CA 90210

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 5

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 8

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 11,000

The above is a gorgeous home in the famous 90210 zip code. It is located in the Beverly Glen neighborhood and is considered prime by any measure. Yet even the very wealthy need access to debt in order to leverage up to make big purchases. The market for mega jumbo loans is virtually non-existent or comes with hefty rates. Actually, banks will lend but now that they need to verify income the pool of potential buyers has magically shrunk. The above home is listed as a foreclosure and was originally built in 1984 but with these kind of homes, it is likely that much of the work is fairly new:

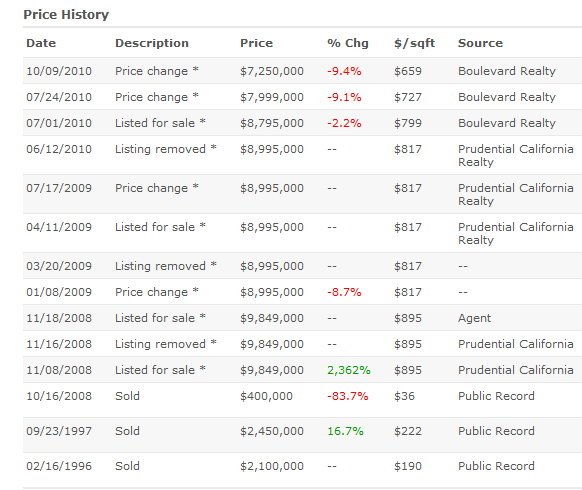

The home was first listed for sale back in November of 2008. Without a doubt, there is demand for this home. But of course wanting a place and being able to afford it is a different story as millions have learned in this housing debacle. Back in November of 2008 this place was first listed for sale at $9,849,000. As we track the listing history, we realize that they missed the peak of the market by one or two years:

Just look at the history here. There was no significant movement until January of 2009 when the price was dropped by $854,000. This price remained for all of 2009 stubbornly. Then in July of 2010 it had a $200,000 price drop. Three weeks later, a $795,000 drop. Finally, the price was dropped to the current listing price of $7,250,000. Is this a good price? Well obviously the market isn’t snapping up the current price so either the current owners drop the price further until a buyer is found or it is likely to sit on the market for a lot longer. What these homes show is that even the very rich are unable to purchase elite properties at whimsical prices. There has to be some deeper underlying value here and even in very elite areas we are seeing some significant adjustments. It is interesting that the ad for this place also sells the financing options:

“Reduced! Priced to sell! Magnificent, secluded celebrity-style gated compound on highly desirable benedict cyn. Private driveway leads to circular motor court and this fabulous mediterranean estate! Expansive living spaces, huge kitchen, grand terraces overlooking hotel-style pool, panel den/library with coffered ceilings, high end appointments throughout. Championship tennis court. Corporate owned! Seller financing avail oac, 20% down, 5.99%, 3 years i/o. What an opportunity! **agents please see private remarks for showings!â€

If you are pinching pennies to squeeze into this place you clearly cannot afford it.

Beverly Hills Foreclosure #2

3074 FRANKLIN CANYON DR, Beverly Hills, CA 90210

Beds:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Baths:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 3

Square feet:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 2,632

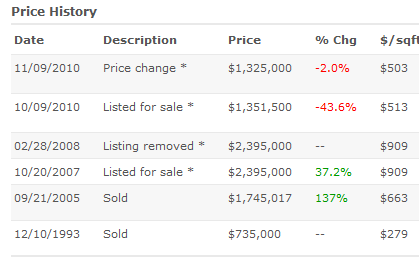

This is a very nice home as well but definitely much smaller and less extravagant than the first one. If we look at the listing history we see a similar pattern to the previous Beverly Hills home:

The home was purchased in 2005 for $1.7 million and the owner put the place up for sale in October of 2007 for $2.39 million. The listing was taken down in February of 2008 only to reappear over two years later with a price listing of $1,351,500 million and it being listed as a foreclosure. Banks and private owners that are taking these places back realize that they need to price homes correctly in order to move them. Privately some might be betting that things will get worse before they get better and are trying to unload properties. What is also important to note is that someone needs to pay taxes here. For this home, the 2009 and 2010 yearly tax assessment came in at $22,745. The 2010 tax assessment values the home at $1,020,000.

The MLS lists 10 properties as foreclosures in Beverly Hills. Yet the shadow inventory lists the following:

Bank owned:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 18

Auction scheduled:Â Â Â Â Â Â Â 71

Notice of defaults:Â Â Â Â Â Â Â Â Â 81

In other words, the pipeline has many million dollar properties lined up for foreclosure. This is occurring in one of the prime zip codes in Los Angeles. What this tells us is that a large number of people are still hoping that somehow, some pricing miracle happens. This is doubtful and the above two foreclosures are signs of market capitulation, albeit very slowly even in very prime neighborhoods.

Today we salute you Beverly Hills with our Real Homes of Genius Award.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

31 Responses to “Real Homes of Genius – The search for the biggest California foreclosures. Missing the housing peak in Beverly Hills. From $9.8 million to $7.25 million and counting. From $2.4 million to $1.3 million.”

Once a downward trend is in effect, even the stupid money is hesitant to get involved. The only homes selling right now in CA are the ones at the low-end where investors can rationalize cash-flow from renting even though the prices may go lower.

I don’t believe investors can even rationalize positive cash-flow in low-end markets. There are many vacancies and rents are dropping in low-end areas. On top of that, even if you get a tenant, good luck on getting them to pay on time every month.

Two comments. First of all, would you pay almost 10 million dollars for a house that has a “hotel-style pool?” If you want a “hotel-style pool” you can go to a Motel 6 for the weekend. The advertising for that home seems a little lame.

My second comment is that there are many people who can afford any house they want, it’s just that there are way more multimillion dollar houses than there are people who can afford them. There was a time when Beverly Hills was “Beverly Hills.” Now you have many parts of Los Angeles county that have million dollar homes.

@ NickHandle

Perhaps you haven’t noticed, but there is a WORLD of difference between a Hotel and a Motel. Besides the spelling, a MOTEL came to be as the influx of auto~MObiles hit the USA. MOtor HoTELS were erected to cater to families and couples driving through America. You drive your car up without the need of a bellhop and park right by your room. A Motel 6 is such a place. It is a place to sleep and not much more. A Hotel, on the other hand can be a destination on it’s own. The Beverly Hills Hotel, the Bel Air Hotel, The Lake Palace Hotel in Udaipur. These are not just places to sleep, but they are also destinations.

Owners of mansions and estates, often design their pools to have the feel of swimming pools as those found on the grounds of great Hotels. But no one, save you (perhaps), would envision their home, dreamily, with a MOTEL pool.

Regarding your other point: there is ONLY one Beverly Hills. You might have multi million dollar houses in Glendale, Burbank and Tustin but Beverly Hills is a world class neighborhood. Of course, I’m speaking of Beverly Hills, NORTH of the boulevard and NOT in the Post Office. Beverly Hills is a WORLD CLASS city. You can be in New York, Paris, Tokyo, Buenos Aires and people know what you are all about when you give out your fabled Beverly Hills address.

And as the (over inflated) prices of Beverly Hills real~estate continue to slump, just ask yourself what that does to housing prices in other parts of Los Angeles County. Would you rather pay $2.5M for a house in the city of Beverly Hills, with its beautiful weather and excellent shopping and dining destination, or would you prefer to spend your $2.5M in Burbank with it’s air you can bite into? As Beverly Hills/Holmby Hills/ Bel Air continue to be hit by foreclosures you can rest assured that prices in less tony neighborhoods will be affected accordingly.

I just came back from an open house. The realtor was very straight forward. Said they just went to a meeting that had reps from three of the largest banks. One of the first questions the banker asked was “are there any members of the media present?” When he was confident none were in attendance he went on to share that they see the market being in very rough shape for the next three years. You know it is scary when the realtors tell you things are not going to improve in the near term. Also, the banker shared that they will try and control the market as long as they can to prevent a massive price drop.

Bankers can try to control as much as they want. There will come a time when they are low on cash or the carrying costs of the foreclosures are such that they need to unload these properties to get cash in the door. Then you will see a flood of banks trying to beat the others to see who can unload their properties first before prices drop even more. Once the downward trend starts, its hard to stop a train until you reach the bottom.

Actually, I think the banks can hold out for a long, LONG time. Our financial overlords keep getting access to cheap (basically free) money from the Fed. I believe they’re allowed to keep houses on their books valued at the bubble assessment, so they don’t show tremendous losses. Maybe Dr Housing Bubble can confirm that, or do a post on the specific shenanigans that are keeping the shady banksters afloat and receiving record bonuses.

Either way, banksters will lose more money pushing these houses through foreclosure than they will using Fed money to prop up their balance sheets. Losing $22k a year in property taxes vs taking a $1 million dollar loss upfront? Banks can hold onto a losing asset for what, 40 years before the break even point?

Inflation will have us paying $50 for a loaf of bread by that point.

@Eric nailed it. NOTHING scares the banksters and their cronies at the Fed like DEflation, and Housing is the Hoover Dam of DEflation. They’ve got all kinds of tricks to deal with INflation, even hyperinflation (incl., if necessary, troops in the streets), but only these lame and limited QE and FASB tricks to deal with the big D…

Remember: every person that loses their job/income is DEflationary… as is every piece of RE that sells for less than its previous transaction price (FORECLOSURES most of all)… as is every bond downgrade and/or default, etc.

Gotta hand it to the banksters on propping up world commodity prices, while playing massive extend-and-pretend in RE… perhaps never in history have the fates of so many nations been juggled so precariously. =:O

What carrying costs would a bank have? All I can think of is that they might have to pay property tax. They’re probably not going to maintain the place, they’ll have few if any renovation costs, no utilities to pay, and most of all, no mortgage payment.

In fact, if the market is rapidly declining, the opportunity costs of holding onto a large number of properties in decline would be extremely high. Except for a perhaps unknown factor in just how much they’re getting through quantitative easing, the only way I can see benefit in a long term holding position on REO’s is if they’re trying to maintain a certain cross section of quality in the active inventory at any given time, and even then, I can’t see it doing a whole lot of good.

The anecdote just doesn’t pass the sniff test. It sounds like a creative high pressure sales tactic. The “banker” was probably just another realtor buddy.

I too agree the banks can extend and pretend for A LOT longer. But, in the interest of completeness re: “what carrying costs would a bank have?” – while hard to calculate, Fannie and Freddie have estimated carrying costs on their foreclosures of $2B annually. So it’s not $0. In addition to taxes, banks are required to pay HOA fees, Mello-Roos, and general upkeep (though, nobody is enforcing this last one).

According to the NAR, the national median house price is around 173,000 and according to the Census Bureau, the national median property tax is 2.85%. If the carrying costs are tax alone, this would imply approximately 400,000 REO’s in the possession of the GSE’s. Now according to Freddie and Fannie, at the end of Q3’10, their combined holdings were approximately 240,000 REO’s. Given the crudeness of my estimation and coastal bias in the housing bubble, I think my assumption that the vast majority of the carrying costs would be nothing more than the property taxes isn’t too far off. It’s certainly not 0, but it’s hardly substantial compared to mortgage, operating, and maintenance costs associated with actual habitation of the homes.

How come the system encouraged equity dilution? The answer is simple…there wasn’t any incentive to encourage equity or its dilution! Thankfully you really don’t need an equity calculation…it’s really all about risk/reward.

Everybody gets paid upfront in the real estate business…except the SUV, CDO, bond, stock holders….and those chumps have NOTHING to do with the engineering of the deal. They are passive investors who foolishly believe that some one is going to pay them interest for 30 years….well the game has changed there too (societal ethical devolution) but let’s just focus on the deal.

Everybody on the selling end is looking to close the deal ASAP…they get paid 100% upfront no matter how swarmy the buyer is. So they naturally get swarmy buyers. So two things have to happen, that haven’t happened, to fix this default situation.

1) Commisisons/fees paid/points etc. need to be paid out over the life of the loan. If the loan goes sour the monies all have to be refunded to the original deal. As much as possible, the deal needs unwound to the original start point. These payments can’t be sold either….but only willed to a trust that will hold them for a beneficiary until paid in full.

That gets the plethora of real estate agents/brokers/title companies etc reduced to a responsible few who will all have skin in the game (There are more real estate agents in Kahleeforneeha than houses for sale…even after the melt-down!). Now there will be an incentive to sell to those who can pay their loan off.

2) The original lender must be on the hook for 100% of potential losses….so PMI has to be for 100% of the loan….not 30%…THAT’s the biggest scam in this game. PMI failed to cover the losses! AIG got bailed out…spit.

It’s interesting that they do this in the life insurance biz already… all life and annuity policies pay “trailing commissions” typically 5-7 years worth. This is so that the agent has an incentive to not have the policy lapse… Typically 40-50% on sale and 50-60% paid out over the remainder of the trailing commission period.

The first house is a nice home. But why, oh why does it say on 10/16/2008 “sold” and list $400,000 as the price? Did it really sell for $400,000? Doctor Housing Bubble, can you clarify this? Please!

Line of credit

The price the first house sold for in 1996 – $2,100,000 – is, in my opinion, the fair market value of that house. It is a gorgeous house, and the owner could have made out like a first-class bandit if he had sold it in 1995, or 1996. However, it is MASSIVELY overpriced, and even for a rich person, it’s a $2 million dollar house, not a $7 or $10 million dollar house.

Governments are broke! Banks are broke! Bankers were broke! (but got bailed out with taxpayer money!). Many business are broke! Millions of families are broke. We are entering a depression. This is a gorgeous $2 million dollar house, but the housing bubble days of insanity are over!

Right– most rich people didn’t get that way buy overpaying for stuff. There are a lot of arrogant kids right out of college that think they know everything, but it’s pretty hard to swindle someone that’s got a couple million net, I would think–particularly after the Madoff thing.

I’m afraid I can’t agree with you. Lots of high earners and millionaires have lost a fortune in real estate, buying at the peak and riding it down. I know more than a handful who built from scratch nice places, put millions in, all cash. Now they complain that the bank won’t even give them an equity loan–brand new multi-million dollar homes in the best neighborhoods. Can’t get 200k out? This thing hit everyone. Everyone.

In 2008, the first house sold for 400k? Is there a missing zero or some hanky , panky on the lender/seller/whoever’s part?

Maybe it was “sold” to a relative or family member at that time.

None of this will seem real to me until one of the characters from Real Housewives of Beverly Hills lose their home. I’m secretly hoping that Kelsey Grammar’s arrogant wife feels some pain, but I think Kelsey works enough to keep the wolves away. The other characters will probably make it through okay.

Maybe they can put old Duke out front with a sing that says “Varmints Chased”. Bet that’d bring in the buyers. There are real estate bubbles all over the world right now: Spain, China, Dubai…there’s probably someone from C21 giving an open house on Taliban caves in Afghanistan: “Comes with stainless steel grenade launcher and hammered copper IED”. And Fed squirts out another trillion in hot money which ends up…trying to inflate another bubble while the natural markets are trying to correct…something much more sinister is at work here.

This website lists the 2009 property taxes for the first home as $72,069! Ha! There’s a whopper for ya.

http://www.redfin.com/CA/Beverly-Hills/2700-Benedict-Canyon-Dr-90210/home/832516

Beautiful pictures! The architect and the builder did a fine job!

There are literally hundreds of homes scheduled to go to foreclosure sale here in The Platinum Triangle, I follow them as I am a REO agent, the second house above is my listing.

Each month the lenders postpone the sales, a very small few go to sale, and they keep postponing. During this time the folks who are not paying their mortgage are also not paying their property taxes, in a state with a $25,000,000,000 shortfall that means we get to close libraries and parks, cut teachers and firemen to balance a budget that cannot be balanced until lenders flush the toilet on these loans and get rid of them to new owners.

New owners, unlike the deadbeats in the house for free, hire contractors, buy carpet and paint and go to Home Depot for all sorts of things for the house-about 17 people benefit from this. What a great way to improve unemployment and stimulate the economy instead of sweeping the mess under the rug for a few months.

If the lenders are right and we are in for a rough time then I would have thought being the first to sell at better pricing levels was the best policy instead of waiting for another drop. look for the lenders to stampede eachother like a crowd in a burning theater once this becomes clear.

Right now a non performing asset is on the books as an asset and at full bubble price until they foreclose. If they all had to write down the loans to market value there would only be 4 solvent banks in this country. Not good.

So Obamacare extends to Wall Street and we try everything to “keep these folks in their homes” and curry favor with the voters. The reality is there are more folks looking to get into the market with a downpayment than are not paying their mortgage and they are livid prices are being propped up for deadbeats. And they vote too!!!

More like the big banks swapped MBS for treasuries and mark to market disappeared with FASB changes. None of you people were complaining when Real Estate went psycho, but now you’ve got truckloads of buyers at the right price and want to blame something stupid like Orhamacare. Please, he’s a stooge that inherited the biggest mess in world history. Any thinking person knows the ratings agencies facilitated this disaster, how else could huge money have gotten involved?

Huh? I was screaming like a wounded animal as one place after another was priced ever further away from me. I looked at condos substantially inferior to my rental apartment that were priced at points where I would have paid twice as much to buy a tiny studio as rent my large 4 room 1 bed.

When the market began to break down, I was greatly relieved. The world started to make sense again, and it makes more sense every day prices drop more.

I can now buy a lovely 5 room 2 bed for less than the price of a studio during the Great Rampage.

If only we were not paying with our very blood for the immense tower of unrepayable debt that was racked up in the Rampage years, I’d be in heaven. Unfortunately, the toll for those heady years that profited very few people very much, is being extracted from everyone, including those who were cut out of the opportunity to buy a reasonably priced home.

Hey genius.

In case you haven’t noticed, nicer homes (much nicer) are currently pending for 300k less.

Lower the price another 500k and you just might get it sold.

Second house above, according to the listing, has no heating, no cooling, and no parking — that’s gotta bring the value down quite a bit, no?

I saw the crash coming early in the decade. I predicted it would hit the “upper middle” market first, because that’s what was most overpriced and underfinanced (meaning, the thinnest equity cushions and the most speculative). Then it would hit the low end. Then it would hit the high end, the reason being that the rich usually have a bigger financial cushion and could wait it out longer.

But the tide eventually reaches everyone. The houses depicted here are still overpriced. I think the magic number will be $250 to $350 per square foot. It’s going to depend on how catastrophic California’s state government finances wind up being. Eventually the s*** rolls up hill. When the little people run out of money, the businesses that serve them fold. And eventually the owners of those businesses run out of luck too.

A lot of pretensions are yet to be deflated.

Christian stevens, I agree on the banks holding on to it so they can declare it as an asset and due to recent regulations, they don’t even have to mark it at market rates-just mark to fantasy.

When I worked in the corporate world, many projects were done in a similar way. Depending on how you account for it, you can mark it as a liability or an asset- I have no faith in a corporate balance sheets-mostly because I worked on those darn things for so long. its why companies that look so good on paper can go belly up in months-one has to look real close at what is an asset and what is a liability.

Meanwhile the top management keeps getting their darn bonuses.

Saw on CNN today (12/7) that activists are encouraging homeless people (nation wide) to squat in foreclosed homes that are empty, ala Randay Quaid style. If this comes to fruitition, look for the banks to make a move to get rid of properties as quickly as possible. The banks do not want to be holding on to homes that are being lived in by homeless people. Hence, major slashes in price reduction will be coming. No in the really wealthy areas, this will not be the norm so the lower prices will be held off for a bit longer. No matter if it’s the poor, middle income, or wealthy, all classes are going to feel major pain. It will just depend on were people are in the income levels. This will all end ugly for everyone.

Leave a Reply to JC