Banks cherry picking individual foreclosures that show up on the MLS in Culver City and Pasadena with proof: Southern California lenders pushing out properties in Culver City with an average price tag of $300,000. Median sale price for city is $600,000. Shadow inventory average price is $443,000 with loans at an average of $552,000. 141,000 homes in Southern California are distressed yet MLS only reflects 83,000 total properties.

Party like its 1999. The U.S. homeownership rate is now down to levels last seen in 1999. In essence, every effort to push homeownership rates upwards with absurd Wall Street gimmicks (the entire toxic mortgage disaster) but also the government backed implosions of Fannie Mae and Freddie Mac have basically been one giant waste of time and money for the public (many became filthy rich). Why? These efforts focused on quick and easy money at the expense of long-term sustainability. For many decades, we were doing well with large down payments and the vanilla flavored 30 year fixed mortgage. It is no coincidence that the entire game collapsed when Wall Street lobbyist bought out government plutocrats and turned our entire economy into one giant housing casino. Southern California is still very much in a housing bubble phase. Prices even today are disconnected from market fundamentals. Inventory is still growing and the shadow inventory figures remain elevated. Why? The government took a bazooka of easy money, tax credit gimmicks, and other financial shenanigans to hide the fact that people don’t have stronger wages to support current prices. We went into bubble 2.0 here in SoCal in many areas. That bubble will burst.

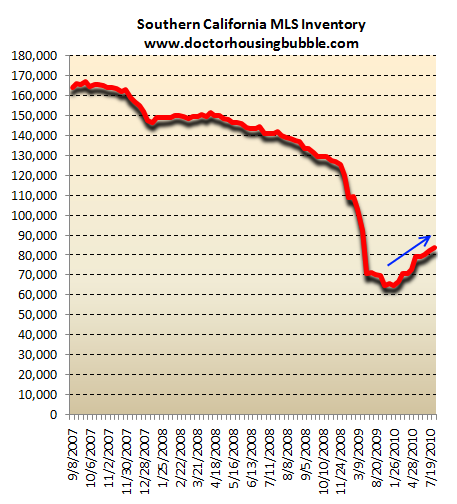

Inventory in Southern California is still growing:

Source:Â MLS

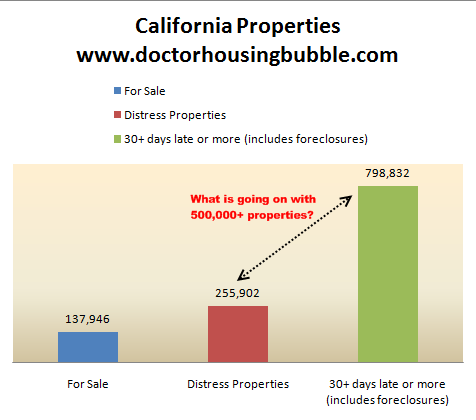

Now this growth in the MLS inventory is only in the subset of properties that the public can see. The bulk of properties are sitting hidden in bank balance sheets and are part of the shadow inventory. I wanted to show you how big of a difference this discrepancy can become when you include these additional properties:

Source:Â MLS, MBA

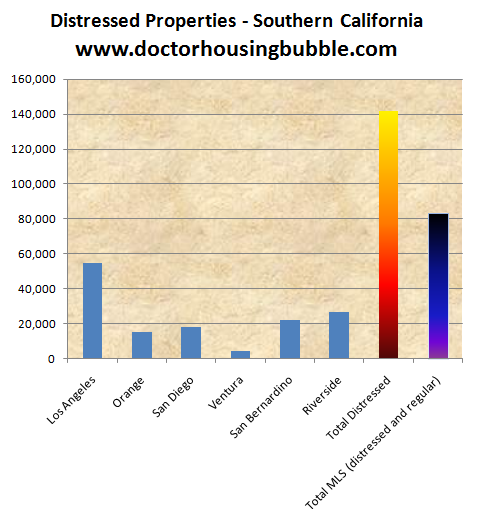

The above chart is looking at MLS and MBA data for the entire state. For Southern California, the actual breakdown of distressed properties looks like this:

The above chart is probably one of the most telling in regards to where things stand today. Over 140,000 properties in Southern California have at least a notice of default, are scheduled for auction, or are now bank owned. The amount of these properties that show up on the MLS is sparse. We are seeing virtually a 2 to 1 ratio here. For every one property on the MLS we will likely find two properties being distressed. In mid-tier areas, it is higher as we will show.

Let us run an experiment to test this out. We’ve covered Culver City and Pasadena many times in the past so let us use those two areas here again.

MLS Pasadena

Total Listed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 678

Short sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 71

Foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 44

Total distressed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 115

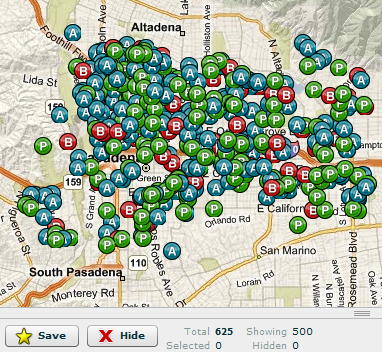

Foreclosure Data Pasadena

NODs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 225

Scheduled for Auction or Bank Owned:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 400

Total distressed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 625

For Pasadena, for every one listed foreclosure or short sale, you can be assured that there are 5 other properties sitting in the depths of a bank balance sheet. Keep in mind this is for a highly desirable area. But if you look at the data closely it wouldn’t appear that way:

Let us run this data now for Culver City:

MLS Culver City

Total Listed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 148

Short sales:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 25

Foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 7

Total distressed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â 32

Foreclosure Data Culver City

NODs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 74

Scheduled for Auction or Bank Owned:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 98

Total distressed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 172

Well what do you know? It turns out that the numbers look nearly the same in Culver City. For every one distressed property on the MLS, you have 5 others hidden in some bank balance sheet. Now when I look at this data what I see is a façade in Southern California real estate. Prices in these areas are still extremely high relative to household incomes. Unless you go out there and buy with an Alt-A or option ARM (no longer available) you will have to show a decent income. But let us dig deeper a bit. How much are those foreclosures selling for in Culver City versus what is off the balance sheet?

This is incredibly important.  Banks are listing (what appears) the bottom barrel homes here. The average listed foreclosure price for Culver City is $330,000. This is interesting given the median sale price for Culver City in zip code 90230 is $605,000 and in 90232 is $775,000. Seems like a tiny bit of a discrepancy don’t you think?

I decided to jump deep into the data for this area and pulled up 19 bank owned homes in the area. This is where you actually see bank behavior stand out. The “estimated value†of the 19 bank owned homes in Culver City are $443,281 and the average estimated loan balance on each place is $552,159. These places are massively underwater yet banks seen to be cherry picking which homes they funnel out to the MLS. So right now you see a trickle at the bottom end but make no mistake, the bigger suckers are only a few months away and are already falling massively behind on payments. Banks are basically trying to avoid facing the music and realizing the reality that these properties are overpriced (people can’t even keep up with their payments). Does any of this data look like a healthy market?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

46 Responses to “Banks cherry picking individual foreclosures that show up on the MLS in Culver City and Pasadena with proof: Southern California lenders pushing out properties in Culver City with an average price tag of $300,000. Median sale price for city is $600,000. Shadow inventory average price is $443,000 with loans at an average of $552,000. 141,000 homes in Southern California are distressed yet MLS only reflects 83,000 total properties.”

The banks may believe that the higher quality residents can go for a decent price, or they can give the current resident a new loan with a reduction in principle and 3% interest for 30 years. Don’t underestimate the banks and their friends in the government for creativity.

Another point, don’t just look at reported income in an area. Many immigrants from China and India invest money from back home. They also have a tendency to not report much of their income for tax purposes and other purposes. So in communities with a lot of these immigrants, things may not be as they appear.

140,000 in distress, and what, another 300,000 late on mortage payments?

Dr HB- I’ve appreciated your blog for quite some time. I think it’s a fair statement to say that the RE market is under heavy manipulation by various parties. The question I have is – what is the solution?

People cannot keep their mortgages because they don’t have jobs, but they can’t find jobs because they can’t sell and move. Let’s say we force the banks to list their assets at market value – they dump them, RE market tanks, people still don’t have jobs, more homes fail…

Is the only solution to let the RE market completely tank, everyone who owns RE today becomes financially insolvent (anyone who bought after the 80s loses substantial equity), and then we wait 10 – 20 years for a recovery?

A friend’s son is getting ready to stop making payments on an FHA loan in a full recourse state. To get FHA to short sale he is told he has to prove he can’t make payments by not making them. Swag is that FHA will accept short sale at no less than 88 percent of appraised value. He has already moved out of state for job.

Word is that in that state, foreclosures are taking 12 months or more.

Should he just bag it and declare bankruptcy?

Does anyone have any experience with what is going to happen?

He bought in 2008 and doesnt have the cash for more than a token loss.

Eric,

I lived through this in Portland Oregon circa 1985.

Your average house fell from 50K to about 35K back then. (side note…..minimum wage is 100% higher than 1985 yet housing is 6 to 8 times higher…..THINK ABOUT THAT!)

What happens is things move from the weak hands to the strong hands which creates a very strong economic base in which to launch a recovery. The prudent are rewarded and the stupid punished.

The federal government is spending trillions trying to thwart market forces. The fed is trying to actually punish the prudent and trying to keep realestate and wealth in the hands of the weak.

How can an economic recovery occur when the foundation is being jackhammered by the federal government on a daily basis?

Ok so the banks might be able to sucker people into buying now by dribbling houses onto the market. What happens when these buyers want to sell further down the road? I see people with savings rushing to buy now or they bought in 2007 when prices dropped by $10K. The well of these people is running dry since they rushed like a herd to get slightly below bubble pricing. When they try to sell, they will not be selling into manipulated market, they will be selling into a market dictated by fundamentals. No matter how you slice it, the outlook for house prices over a 5-10 period going forward doesn’t look pretty. Kids graduating college in this recession will not have the same prosperous financial situation as previous generations and won’t be able to bail current buyers out of their mistakes. The negative equity situation for today’s buyers will keep money out of the market as well. Add that to boomers retiring/passing away, low economic growth reducing immigration and lack of available financing, and you get prices going back to historical or below historical norms.

One more comment, I live in an area that is considered one of the wealthiest areas in the nation and features high priced housing. However, in the past few years, many of the larger companies have left or are on skeleton staff. Many of the smaller companies and small businesses are closing or laying off. Every week, an acquaintance of mine tells me that they’re getting laid off or know someone who is. This is scary.

Since the majority of people in the US our home owners, the banks and the government know they have the masses on their side. Not until all the home owners give into the fact that the party is over, we are all in the same boat and they are going to have to take one for the team, will this madness end. Let it all burn to the ground and start over.

Ouch. If all that shadow inventory will result in that many future homes for sale, California is going to see home prices come down a whole lot more.

The banks simply cannot take the losses on their balance sheets. Extend and pretend, until the FDIC shuts your a** down.

“Banks are listing (what appears) the bottom barrel homes here.” I wonder why they do this. Are these homes gutted? Are they fixer-uppers? They must be. A $180,000 house in Culver City is very cheap.Even a fixer-upper at this price sounds good.

I agree 100% with you Everett, and top that tax hike coming 2011 OUCH!

On that Pasadena area map, what do the letters mean? B, P, etc….

Yes, the government should not prop up housing prices, and in fact, I would like to see Fannie and Freddie disappear. Since 90 some percent of housing is financed through the GSE’s, if you eliminated them from taking on the toxic debts of banks, and then prices would drop as they need to. Then we could start over, but not with the present cronyism, double dealing, and lies. I think this would reveal the situation for what it is, and it is simple policy prescription……

Does El Segundo have a large shadow inventory like Culver City and Pasadena or does not exist like in Manhattan Beach? I’m really interested in the El Segundo market. Thanks

When I look up distressed properties in Pasadena on redloc.com I get:

NODs – 178

Scheduled for auction – 218

Bank owned – 80

for a total of 476.

Anyone have any idea why this source would list nearly 150 fewer distressed properties than Dr. HB’s source?

we moved to Riverside/ Corona/ Norco area 2 years ago and are sitting out the craziness to buy. meanwhile we have been renting and our landlord defaulted on her mortgage, it was an ARM she was a realtor same story you hear over and over again in these parts.

so in looking to find a new rental we’ve come across landlords that have told us that they’re getting 70 calls, maybe some of those are multiple calls by the same household (I know my husband and I have called some landlords or emailed them from the both of us). a couple of the landlords have said they’re getting lots of people who are walking away from their homes, want to rent and then plan on doing something in 2 years to fix their credit and then jump back in and buy the same house they defaulted on.

my point is down here on the lowly streets of renting it is pretty obvious that people are using the summer break to walk away from their homes, from the stories we hear from landlords, the prices people are asking for rentals right now (high) and the few rentals we see available are evidence imo. i also see that people are renting out rooms in their houses a lot to make ends meet.

on the bright side we found out our credit score was 893! we thought 850 was the highest anyone can get. what kind of benefit does having a high credit score get me when it comes to buying a house? we’ve owned and sold before, but out of state.

Suggest friend’s son (and everyone) read this and follow up with martin Mandelson’s REST advice. Briefly, because many loans were securitised the original docs may not be found and any foreclosure can be challenged.

Martin will always advise.

Bankcruptcy is a very last resort….don’t let the banksters win!

I have a news flash for you: There are market forces capable of punishing both the “prudent” AND the “stupid”. Not everyone who is in danger of losing their home during the worst recession since the 1930’s is “stupid”.

If you still have your job, and you can still afford to live where you’re living, and you can still support your family without any sort of assistance, you’re not being punished — you’re LUCKY.

As a former Santa Barbara County resident, I have tried to keep up with Central Coast prices during this crash:

1. During a visit to Santa Barbara in March, I picked up a few real estate magazines and counted some 160 properties openly for sale in the county at more than 2 million dollars (some of them are for rent in the $3000/mo. range). I didn’t even try to count the over 1 million (too many TLC and starter homes among them).

2. Goleta homes are still listing for 700-800,000. A three bedroom house in Goleta rents for about 2500. A look at homes.com shows considerable price softening among NOD and REO properties. Still, it looks like southern SB County still has 40-50% to fall.

3. Bubble still unpunctured in San Luis Obispo-Morro Bay, but Santa Maria and Lompoc are taking their hits. Recently listed properties in Santa Maria-Orcutt are 30-35% ($100,000 and more) cheaper than homes in the same neighborhoods listed only a few months ago. Foreclosure activity is very nearly frantic. Homes. com lists twice as many NOD and foreclosure sales as listings.

Even a couple of years ago, a drive through Western LA showed a thicket of for sale signs; Beverly Canyon looked like a real estate convention. I can only imagine that sellers are growing ever more desperate even in the most desirable areas.

The first graph shows inventory prices fell in March ’09. The is the same month that Obama introduced the “American Recovery and Investment Act” and it disappointed everyone.

The first graph shows inventory prices fell in March ’09. The is the same month that Obama introduced the “American Recovery and Investment Act”.

The listing for $189k is a 1-BR/1-BA 697 square foot condo – looks dark. Built in 1973. No mention of condo association dues on that list, but elsewhere I found that they are $291/month.

Per the payment calculator on realtor.com, monthly payment assuming 20% down would be $790. + taxes (1%/year = $160/month? ) + 291 = maybe $1250/year. Rental parity? I don’t know the area, but that seems pretty high for a crappy 1-bedroom apartment that you had to pay $38k down to move into! Granite countertops, though.

Eric, the solution is the same as during the Depression. Kill the livestock and plow under the crops to drive up the prices due to the perceived oversupply.

In these neighborhoods where the builders overbuilt, remove the excess housing stock. We have an oversupply of housing. Much of the Mexicans have left due to lack of construction jobs so they are leaving their keys and leaving. I know that Chinese investors have been buying up some of the housing, but not enough.

A quick search on Trulia will find 665 filings in Pasadena:

http://www.doctorhousingbubble.com/forum/viewtopic.php?p=547#547

Keep in mind these are actual filings from banks. We can only imagine how many people are not making payments with not even a NOD filed.

The change in FASB allows the mortgage holders to keep the mortgage on their books at face value, not market. The only way most of these mortgage holders can survive is to slowly parse out and sell the homes they think they can sell the easiest and with the least loss. This is their only chance for survival and why we’re seeing such small inventory on the market. And this is why the bubble could slowly deflate rather than pop from here on out.

I was looking at the site and saw this from 2007.

http://www.doctorhousingbubble.com/forum/viewtopic.php?t=77

Jay

El K

That’s about what you can rent a one bedroom in the area for. It has been falling though. And of course, personally I would rather rent a one bedroom apartment than own it for the same price when you factor in the transactional costs, the hassle of selling when you need to move, the hassle with the condo board, the “special assesments” when they decide to put in new solar panels etc., and the spectre of rising taxes unless I knew that I could make some money renting it out or selling it down the road…both of which scenarios seem to be ever less-likely with each passing month of deflation.

Re: notjonathon’s comments:

We have been visiting the central coast for about 10 years,love the area, but prices are still bubble pricing in San Luis Obispo, and the coastal towns south of there.

Prices in Santa Maria are falling like a rock for a good reason- gangs are out of control there, and some of the areas are quite dangerous.

Lompoc has alway been a military town, lots of people moving in and out, and a lot of lower paid jobs-never has been a great place to live, even in the good years.

Just think if all the bubble money went to solar energy, mass transit, water and resource management. On top of the hopeless destruction of our society we have a more dysfunctional infrastructure and more wasted resources to maintain larger, less efficient homes. We might as well have put up Easter Island monuments in our front yards because we are as stupid as they were in creating our own demise.

Huge piece in MSM finally admitting the continued collapse of housing bubble and unsustainable local gov debt problem, more layoffs, more price drops, less tax base, and the vicious cycle going down the maelstrom. Guess reporters check in here from time to time. Ben’s going to need a big f’n helicopter to bail out all the states, territories and DC.

True dat! I’m working, not laid off, saving, and renting in Pasadena. Why? Cuz I’m not one of the laid off, not working, collecting unemployment, non-mortgage paying squaters living in a nice house they couldn’t afford. Why am I being punished for knowing I can’t afford the $700k house when it’s really only worth $300? Let it come down and let me buy it! I make $100k/yr and a 10 yr Sr. Engineering veteran and can’t afford to live here! What gives? I’d gladly let the stupid rent from me while I teach them about basic economics. But i guess right now they’re teaching me about working the system.

I hear ya, ow!

ow, I’m in your same position. And even looking in Culver City, so the statistics quoted above just irk me beyond belief. Let the market come down so responsible people like me (solid wage-earner, huge down payment, great credit score) can actually get into the market, instead of protecting the irresponsible gamblers who put down bad bets. Please!!

Martin- Thanks for chiming in.

I suppose in a true free market that this would happen, but I don’t see that as a possibility with our country. I think the political class is too concerned about getting voted out if everyone loses their homes. What is good for the country long term is of secondary importance against re-election efforts in 2 or 6 years.

If homeowners as a group tend to be wealthier than renters, and wealthier people are more politically active, then this group will be served to the detriment of the next generation or those who played it safe. There will be collateral damage (honest people who cannot afford houses, dis-honest people who get to stay in their houses), but I suppose that is an acceptable loss.

Right now we’re stalling, hoping that something new comes around to generate jobs and fix the housing oversupply issue. Which will come first – financial reckoning or this new jobtopia?

You can always do the FHA, 3.5% down! 😉

@Eric – “Which will come first – financial reckoning or this new jobtopia?”

I have two ideas 1. instead of a job, start a trade school, no, I don’t mean enroll in trade school, (I have done this twice with no luck) I mean Start one! The parking lot is constantly filled at West Valley Occupational Center.

2. Buy cheap land in the desert, several acres if possible, build some concrete pads, get water rights, and then cater to the ever-growing number who will have to live in their cars, or trucks or campers or vans, etc. Charge them rent for the pad and water. Make it very Steinbeckian, for the art of it. The last contribution I will make is this, get used to the taste of cat food. Another idea is to invent “catfood on a stick”. It will be huge, and come in handy in the future..

catfood on a stick – LOL:)

I know some people wanted to discuss the distressed map in more detail. I have posted the details at:

http://doctorhousingbubble.com/forumnew/viewtopic.php?f=8&t=3

I’ve updated the message board – I’ll be adding specific cities so if you want to see a city up for discussion, just let me know.

Dr. I would love to see a breakdown of Irvine.

“Another point, don’t just look at reported income in an area. Many immigrants from China and India invest money from back home. They also have a tendency to not report much of their income for tax purposes and other purposes. So in communities with a lot of these immigrants, things may not be as they appear.”

~

What does that matter? Average wages are a lot lower in those countries and their economies are an order of magnitude smaller. They’re not coming here with bucketloads of cash unless they’re Japanese.

~

WAGES WAGES WAGES are what affect prices in the long run.

PRCalDude, the wealthy Chinese and Indians that I am referring to are obviously not average. Rich Taiwan Chinese come here to invest because the Peoples Republic threatens war and other nasty things. India is next to nuclear Pakistan who, on occasions, has committed acts of war(at least that is what they tell me). Don’t forget the South Koreans. Been getting some of that money coming here recently. California is safety to many rich people of the world.

For those of you wanting to purchase now in Pasadena, I would be very very cautious. Especially you out of towners who don’t know too much about the city of Pasadena. For one, houses are still way over priced. You may say that’s my opinion, but I believe it is fact. Do the research. Second, watch out what neighborhood you buy your home in because Pasadena has some rough areas. This is true for Altadena as well. I have heard stories of people who relocated their families and purchased their homes in Pasadena around the 2006 and 2007 timeframe. Not only did these people overpay for their homes, but they moved into the “hood” and didn’t even know it. Pasadena has some of the worst areas you could imagine. Gangs, housing projects, drug sales, high crime. Yes, Pasadena also has some of the nicest areas you could imagine and everything in between. I am just saying before you buy your overpriced home in Pasadena do some research. Even the homes in the “hood” are overpriced. Oh, I’ve mentioned this before, the school district is terrible. Stop watching American Idol people and do the research. Buyer beware.

Back in late 1991 when I lived in San Diego, the housing market was in trouble but not to this extent. I knew of people who raffled their house because there were no buyers.

“PRCalDude, the wealthy Chinese and Indians that I am referring to are obviously not average. Rich Taiwan Chinese come here to invest because the Peoples Republic threatens war and other nasty things. India is next to nuclear Pakistan who, on occasions, has committed acts of war(at least that is what they tell me). Don’t forget the South Koreans. Been getting some of that money coming here recently. California is safety to many rich people of the world.”

~

California is starting to look like the first Mad Max movie. You know what they say about fools and their money….

Re: 7/27. You’re saying, DHB, that banks are selectively putting only lower value distressed properties on the market. Which means that the banks themselves don’t want to let the upper tier stuff on the market, so that that sector can adjust. But they can’t sit on that inventory forever, so are just deferring the inevitable.

~

What else needs to be said about this whole mess? This is the single biggest, simplest, most profound and telling indicator in this entire flustercluck.

~

Add what PRCalDude said, and it’s all really that simple.

~

sigh

rose

I tried that catfood on a stick. you know, a little allegro and it tastes just like chicken.

Once again, the best blog around, housing or otherwise, and the best comments to boot! Almost all the responses are insightful, intelligent, and much appreciated and on top of that a bunch of them are hilarious.

That said, the banks are certainly dumping the bottom of the barrel trash onto the market only, but also remember that some might be intentionally underpriced in order to generate a “bidding war”. Most likely not that crappy 1 bed/1 bath condo (with granite countertops WOOHOO!) for $180K or whatever it was, but the banks have been notorious under and over pricers. And on the underpricers, it will get bid up to “market value” by the horde of suckers, errr I mean buyers. But fewer and fewer of those every day, as we run out of knife catchers.

I’ve been running inventory reports daily, and sure enough, it’s going up in the quality areas (although so are asking prices, my God these sellers are delusional). Fewer and fewer homes going into escrow, under contract, closing. Hang in there everyone…

Leave a Reply to Eric