The arrival of housing purgatory – Why is housing experiencing one of its worst sales years even with the 30 year fixed rate mortgage breaking into the 3 percent range? A case as to why housing will remain a poor investment deep into 2015.

This week the 30 year fixed rate mortgage entered into supernatural territory breaking the 3 percent barrier. The Federal Reserve is getting its desired result of pushing mortgage rates into the absurd. Yet rates have been low throughout the entire housing crisis and for most of the last decade. Access to cheap debt is not some kind of Holy Grail of housing. This year we have seen mortgage rates break records almost on a weekly basis. So why is the housing market not reviving? In spite of all this cheap debt households in large measures have lost their insatiable appetite for housing but more importantly, with consumer debt. Some are simply trying to make ends meet. For the past five years the obsession has been on banking policy and forcing mortgage rates low. The only true winners with this policy move are the banks who continue to hoard millions of properties in the shadow inventory so they can inflate their gluttonous balance sheets. Housing is likely to experience weak performance deep into 2015 for a variety of reasons. Let us lay the case out and you be the judge.

Artificial demand can only hide so much

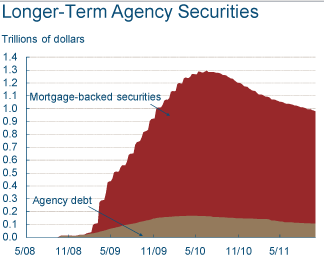

The housing market is largely being held up on the back of the Federal Reserve. Since the crisis hit, the Fed has bought up over one trillion dollars in mortgage backed securities:

Why would the Fed do this? To keep mortgage rates artificially low. At the same time, it also inflates home prices since it allows home buyers to leverage without taking on the true risk of their purchase. The most disturbing thing here is the Fed is setting up a disastrous future. Markets become accustomed to low rates. The initial injections and programs were meant to be temporary. Clearly it is more than temporary as we have gone from TARP, TALF, Maiden Lane, QE1, QE2, Operation Twist, and a multitude of other programs to essentially bail out banks. Banks have a front row seat as to what they have in their gloriously inflated balance sheets. The fact that the shadow inventory is still over 6,000,000 properties tells us a lot. Even with mortgage rates at comical lows, there are still over 10,000,000 properties with negative equity. A Pinto with a zero percent loan is still a Pinto.

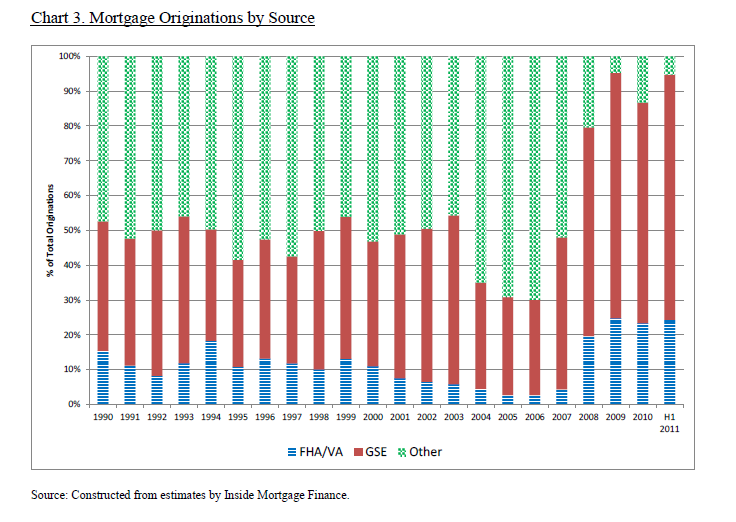

Another telling sign that banks know things are worse than expected from their nicely printed and collated 10-Ks is the amount of mortgages that are now government backed:

This is a fascinating and telling chart. In 1990 FHA/VA and GSE loans made up roughly 50 percent of all loan originations. This remained the story for the entire decade. The private sector got incredibly hungry with their toxic loans in 2004, 2005, 2006, and 2007. But look at 2008 up until today. For the last three full years, government backed loans made up over 90 percent of all loan originations. This is simply unsustainable. We saw what happened when banks took on too much risk in the housing market. Since banks are still originating these loans yet pushing them off to the government balance sheet, why are we suppose to feel comfortable? At the same time, what use is there having these middlemen when virtually the entire market is cannibalized by government loans? Banks for the last three years have been absent in the mortgage market. So what were all those bailouts for?

The bottom line is that banks do have loans to offer if you have excellent credit, solid household income, and a sizeable down payment. Yet the vast majority of Americans do not have this and need to be enticed with low down government backed loans with artificially low mortgage rates just to buy a home. This is like offering a coupon to buy a Mercedes. Even with this inspiration home sales continue to languish.

The lack of construction jobs and new home growth

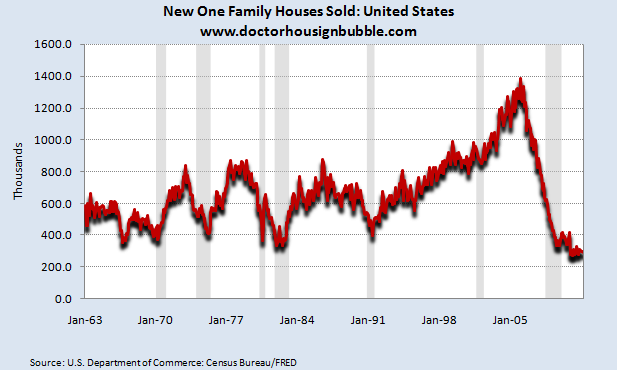

There isn’t exactly a good or bad time to have an economic bubble. Yet having this massive housing bubble on the cusp of millions of baby boomers downsizing has been a recipe for disaster. There isn’t the large new household formation demand that some would have expected. We also built out for a trend that never came:

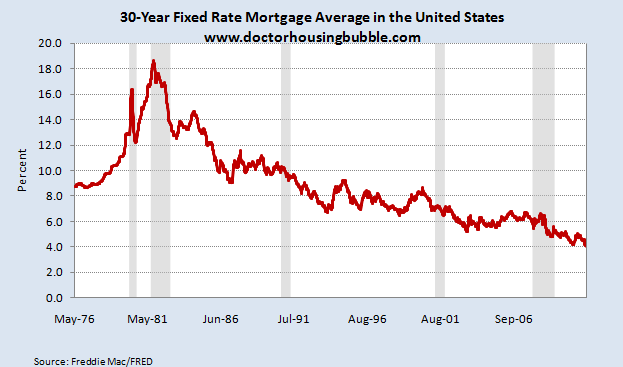

The new home market has completely imploded. Even with all the above intervention from the Fed and banks storing shadow inventory in their taxpayer funded pockets to make it look like supply is really smaller, there is little demand for new homes. Why? First, new homes tend to be more expensive and right now buyers are price conscious and demand is coming from the distressed side of things. Distressed properties sell for much cheaper. As the chart above highlights, things have gone south from 2006 and haven’t turned back for new home sales. It certainly isn’t because of high interest rates:

The 30 year fixed rate mortgage broke into the 3 percent range this week. Great news right? Well as we all know there is no free lunch. The Federal Reserve makes no secret that they are artificially pushing rates lower. Rates have been negative, meaning they are under pricing true market risk, since the crisis hit in 2007. For five years they claim that this is to help home buyers and home sellers but the data only shows that this has gone to help the largest banks. Why? What has this done for the over 10,000,000 underwater homeowners? Millions have already lost their homes. These policy measures don’t help because they don’t create better jobs or larger paychecks. That is the bottom line. It also keeps banks from facing the ills of their decade long bad bets on the housing market. Markets run well when transparency is open. Today, the housing market is very asymmetrical. What you see on the MLS for example, is not the true supply of housing on the market. Psychology is a big player here since many potential buyers realize this.

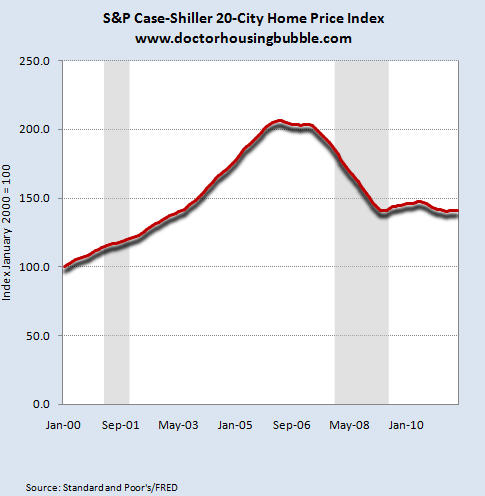

Home prices are pretty much stuck and may make a move lower:

There has been some recent movement on the shadow inventory front. Home prices have been moving sideways for nearly three years and are getting closer to an official lost decade. It is safe to say that home prices will either go lower or move sideways deep into 2015. Why? First, household formation hasn’t been as high as one would expect. The recent Census data shows that between 2007 and 2010 household formation has been running at roughly 500,000 units per year. This is much lower than the 1.3 million average per year from 2000 to 2010. The recession has shifted people into doubling up or simply from forming new households. In the 1990s this rate was at 1 million.

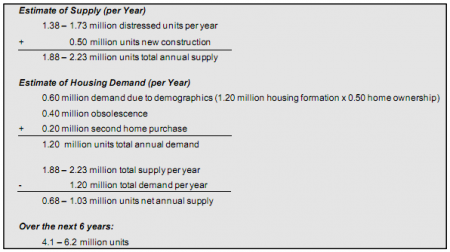

Someone sent over a great analysis by Laurie Goodman with Amherst Securities. Ms. Goodman testified to Congress on September 20 and has excellent data on the shadow inventory:

In essence, because of the slow household formation, distressed inventory, and construction figures we are looking at adding 680,000 to 1 million properties to overall inventory each year. In basic economics this means we have more supply compared to demand. When this occurs prices get pushed lower. Given the size of the shadow inventory I simply do not see us clearing out the 6,000,000 distressed properties over the next four years without prices taking a hit.

Affordability versus denial

The added jobs came as a positive although digging deep in the report, we find a couple of continuing problems. The bulk of jobs come from lower paying fields and you have many people simply entering the part-time labor market but looking for full-time work. Will these people pick up the jumbo shadow inventory properties of $500,000 to $1.5 million? Of course not. Even low rates on debt are not enough to make up for weak household income. That is why in some markets prices are simply entering their next major correction phase while prices for the overall country may move lower but not so dramatically since prices have already cratered. In other words markets in Nevada and Arizona that are selling at a blistering pace but with 60 and 70 percent price cuts may reach an affordability bottom much quicker while places like California and New York are in solid bubbles still. For example, I’ve seen condos and even some homes in Nevada going for $50,000 or $60,000 and even with a retail job and a 3 percent mortgage this is doable.

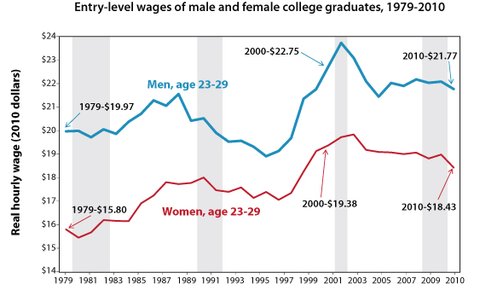

What about our educated work force? As a nation we are more college educated but deeper in debt as well. In the past boomers were able to enter a healthier workforce with virtually no college debt and simply buy a home that was already moderately priced because no insane bubble was in place. Today the next generation is buying homes with giant student loan debt and home prices that are still inflated in many places. And the return on education in terms of salary isn’t really carrying the power it once did:

Source:Â NY Times

You can see that the hourly wage peaked somewhere around 2000 for college graduates. And we expect these people to pay top dollar for homes? Even if they wanted to they couldn’t. All these factors combined point to a weak housing market for years to come. I wrote an article over three years ago talking about the coming lost decade for California real estate. Back in August of 2008 I wrote an article stating that Los Angeles and Orange County would not reach bottoms until May of 2011. At the time there was still no vision that the shadow inventory would balloon to such an incredible level and we were also looking at those very popular reset/recast charts for toxic loans. All of that happened except behind closed doors with banks. But guess what? Prices are at the post-bubble bottom as we write. Yet in these markets prices will go lower while nationwide prices may only move slightly lower. When we wrote those articles the unemployment rate in California was 7 percent! Today it is above 12 percent.

Banks will try to leak out properties as the grim realization that no bubble era part two will emerge even with three percent mortgage rates. Ultimately jobs and good pay will revitalize home prices but what evidence do we have of that? Instead we have those in the 25 to 34 age group moving back home many times with large student debt! This is the peak household formation years. For all these reasons I really see housing as a drag on the overall economy deep into 2015. As it turns out, my analysis over three years ago turned out to be optimistic. How will things look in 2015?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

84 Responses to “The arrival of housing purgatory – Why is housing experiencing one of its worst sales years even with the 30 year fixed rate mortgage breaking into the 3 percent range? A case as to why housing will remain a poor investment deep into 2015.”

The Fed’s insane program to push interest rates to zero, without worrying about other consequences, is destroying the economy. Retired people now get zero interest on their savings- there is no “extra” money to spend or invest. Young people do not see the sense in saving, since their money will not grow in a bank, a 401k, or any type of retirement account. With mortgages at 3%, houses should be flying off the market. Instead, no one with an ounce of sense wants to buy with the uncertainty in the economy.

No President in modern times has ever been re elected if unemployment is over 7.5%. The best we can hope for is some change in 2012.

I’m frustrated with the intereset rates, too. I have a bit saved up and I’m waiting on the sidelines to buy a house. It makes me mad that I get chump change for my savings at the bank –and now the big banks are changing their fees requirement. I”m already in the process of switching banks –from large mega bank to community bank because the mega bank is changing the requirements to avoid a monthly fee. I have to have at least $7500 thousand in a variety of acounts to avoid a fee. So… they want me to deposit more money in their bank -getting chump change for interest to avoid a $15 monthly suck. And now Bank of America wants to charge fees for ATM use. The community bank I’m switching to pays better interest, and all I have to do is have a small monthly minimum or use my check card 15 times a month to avoid a $5 fee. I wonder if these extra fees are going to end up backfiring on the maga banks?

Obama is too much of a socialist for me, but I’m not convinced that high unemployment is going to prevent him from another term. We need a really strong candidate to beat him, and I’m not sure the right has anyone strong enough.

Amen Brother! Anybody But Obama for 2012!!!!!

55% unemployment exists for age group 18-29

Try ages 50 -75 ? now look at 80 percent unable or unavailible work after being raped of your savings. We played by the rules payed everything off, then they continue to steal from us, nothing to be made while the use of our money an assets for their ill gotten gains goes on and on. Tax us inadvertently while the cost of living is stratosphere. Then we see that occupy wall street is granny and gramps protesting too. Folks I give this one year to reach mass riots in the USA ! As Gerald Celente says : ” When people lose everything and have nothing left to lose they lose it ” The plan to make us so dependent on gov programs has backfired.

totally with you good neighbor, my wife and i worked all our lives and have done with out and saved, now our interest is .75% lucky we have some rentals or we would be on the street. We still have three years till we will get SS and it wont be much, with no chance of ever getting work again. We get nothing from the government and are too proud to ask.

Hi Goodneighbor, Don’t worry you will get some good interest rates once the dollar collapses, which will definitely happen just a matter of when. The fed printing money and flooding the market temporarily props up the stock market but the result is unavoidable inflation. Inflation will start to hit about two years after the last round of printing…can we say QE3? Once the money is out there you can’t reel it back in. So just know the stock market will crash again and this time won’t rebound like the last few years. Make your money and get it out before inflation starts to hit and the dollar crashes. Good to have cash. Interest rates will go up and if the housing market looks bad now, wait till interest rates go up and the fed won’t be able to hold them down so property values will once again take a hit. Sell your house if you want to retain your investment otherwise get ready to ride home prices/equity even lower. You will get more interest on your savings but you are looking at inflation of around 10%. Get ready for total chaos. Banks will go under, interest rates will go up, inflation will hit. This is no joke. I’m pretty depressed about all this. Boomer greed killed our economy.

It is not good to be holding cash in an inflationary period. You want to be in non dollar denominated assets or commodities. Unfortunately, this time around a lot of other currencies will probably be strongly inflationary at the same time, in a race to the bottom to be competitive. These probably will be the countries with debt problems now.

We’re not in an inflationary period. The Fed just shot somewhere between $3-23+ Trillion, and housing is still going down.

We’re in a credit destruction phase, which is not inflationary. Unless you understand that, you’ll never understand what’s going on in the market.

This statistic is completely misleading without backup information.

The full definition is 18-29 year old job seekers (actively looking, but not currently employed) with only a high school diploma.

Key words – “with only a high school diploma”.

What did you expect? To not have any advanced education and go out and find a job? Get a clue.

Want a better statistic? Try this:

Unemployment rate for 25 years and over w/ bachelors degree or higher: 4.2%

How about we actually define statistics before posting them.

Employment is what matters. Even with interest rates in the basement, one cannot pay a mortgage without a job. The U-6 for people under 30 is in the 25% range. Even if family formation was at ‘normal’ levels, these people will not be buying homes. Without first-time buyers, there’s no move-up buyers. The downward spiral continues on……

Correction, without income. Job is the hypnosis trick.

Excellent read Dr.

I remember your analysis from over three years ago. I thought you were optimistic then. As much as I’d like to see good times, I have to say your outlook for 2015 is optimistic.

In 2008 I closed the doors of my new home construction firm. I made the right decision.

I have no intention of spending what is left of my life fighting with the dogs over a bone with no meat on it.

I agree with Ronnie, I too think you are being optimistic. I was a mortgage banker in 2005 when Option ARMs were introduced. Brokers in my office were excited about the possibilities and potential earnings with 2% rebate being offered on these loans. When I penciled it out and realized in 5 years my clients may be in for a rude awakening I refused to sell them. I cost myself a lot of money, but at least I could sleep at night. Talk about a “perfect storm”, this is it.

Factor in that the politicians in California are doing nothing but driving businesses (aka, jobs) out of the state with their insane policies and regulations. I truly fear what my children will be having to deal with going forward.

Prepare your children to run for Congress. The gravy train is just around the corner.

Guaranteed pay even when no longer a congressman, Social security that’s different from all the rest of us, health insurance that is separate from the ordinary people, etc, etc.

Give it a rest. Congress pay packages are a hair on the flea on the dog compared to everything else. You could require Congress work for free and it wouldn’t make any difference to the federal budget.

I’m right there with Ronnie and Bluerollout…2015 too optimistic. I’m So. O.C. coastal and still sooo many foreclosures and short sales. Incredibly, after booting the owners the banks let them sit for a year, perform no maintenance other than the mow and blow crew then sell many as fixers. Amazingly the banks still try and get mid 6’s or 7’s dropping the price month by month for another year till they find a sucker.

By federal law, student loan debt is not allowed to be absolved at BK. This is becoming hindrance to growth in the larger economy. The banks in their greed to protect themselves from defaults on the student loan side are destroying consumption going forward.

That assumes consumption is the solution, and not the problem. Production is the solution. Tough to employ idle unskilled folks with no practical skillset today.

It is very tough to argue that saddling young folks with a mountain of debt is good for anybody. I don’t know why expenses are through the roof for so many things like medical care and college education. I do know that we didn’t need to pay so much 30 years ago and one wonders why we need to pay so much today.

Sorry, but I don’t think most boomers intend to downsize – If they were serious about having to do this they wouldn’t be so resistant (at least here in CA) to lowering the price for their overvalued homes.

I think these boomers will be DIPs – Die In Place.

~Misstrial

Boomers in CA will die in place, especially true due to Prop 13. When you are paying a fraction of true market value property taxes, why would anybody move? You can always rent the place out or leave it to your heirs. I imagine lots of boomer offspring will be inheriting CA houses during the next 20 years, rent them out and pay next to nothing in taxes…a win, win situation all the way!

My bro and I are boomers who inherited rental property. Neither of us has kids…oh well!

CA collects a boatload of taxes already. Why advoacate for more? They just waste more. Are you wastefull? Why steal from me, and give to some wastefull behemuth who then decides how to allocate it? No accountablliity, no efficiency? Envy is actually same as “covet”. Moses had a tablet that mentions covet at least twice, are you familiar with that?

I’m not talking about more taxes, California can collect the same amount as they do now. New buyers pay less and baby boomers pay more so everybody pays the SAME amount for a similar home. Not really hard to figure out and fair to everyone…no more free rides for anybody!

Careful, i think you are still lost. You are advocating RAISING taxes on who? Older owners? and lowering on “younger” owners. Who decides that? YOU? At what age? This all shakes-out as the prices decline, because tax assesment is based upon purchase price. You are allowing your envy, and mis-guided longing for “Fairness” to cloud your judgement. I have to remind my 8 year old CONSTANTLY, that life isnt fair, and whoever told him that is full of crap.

Surfaddict, your reasoning is ludicrous. Regarding fairness, anybody with an IQ greater than 50 will agree that Prop 13 is UNFAIR to new buyers, so let’s change it to make it fair! Just because something is unfair doesn’t mean you have accept the status quo and take it. The baby boomers decided back in the day (late 70s to be exact) that THEY would be insulated from further property tax increases, future generations be damned! They have already made their decision with their wallet, sounds like you have too since you are benefitting from Prop. 13, why the hell would you want it changed!

Again, this all goes back to common sense. Property taxes pay for services, why the hell should new buyers of equal properties pay 5x what older buyers pay? Please answer this question for me…and please don’t bring up the life isn’t fair crap!

LB, I’m totally with you on this. It’s been a sore point with me for many years, for exactly the reasons you stated. When I bought my first home in La Habra back in 1986, I was paying right at $1000/yr in property taxes, while most of the neighbors on my street had lived there since the 1960s’, and I was shocked when I learned they were paying $100 a YEAR in property tax!! I was outraged and still am, to think they get the same services I got but I had to pay 10X the amount they did. Where is the fairness in this? How can any fair-minded person justify this? No, maybe life isn’t fair, but this is beyond a fairness issue. Prop 13 is one of the most one-sided issues to ever be enacted in the state of CA. It is literally stealing from the younger, more recent homeowners to pay for mostly well-off seniors free ride. It has to stop eventually, when younger people say enough is enough.

The only reason this rape has gone on this long is 13 is considered the “third rail” of politics here, and even Warren Buffet got the slap-down when he commented on the inequity of this. Just for the record, I have benefitted from the lower tax rate too, but to be honest, I would rather pay my fair share and see all the fat-cat well off seniors with their paid off houses and ponzi-enabled SS checks pay their fair share and end their free ride at every else’s expense. This does not happen in any other state, that must tell you something. The issue here is FAIRNESS. To tax identical property at 10X the amount as the house next door is just plain wrong. End of story. Anyone arguing otherwise is lying to themselves, as they are benefitting from this scam and don’t wish to see it end. But end it must, and the sooner the better, I say.

Prop 13 caps the annual amount tax can be raised. 20 years x 3% property tax increases per year, evolves into boatload of tax. Should the cap be 10% per year? How about 0%?? What is fair? How much property tax do YOU pay? I pay same as my parents pay, who bought 9 years before me. I’m sure I pay 500 times more than my neighbor next door, but I certainly don’t get jealous or envious of her.

They wont be down sizing with most of them having to provide housing for their kids that cannot find jobs.

Many of us boomers never even bought in the first place, Missy!

Rhiannon, Misstrial is correct…as I recall your parents (WWII gen?) are the ones who purchased the property you now reside in and rent out as income property; and it appears you intend to keep the place and not sell

True Dfresh, we never bought houses is what I meant. We have commercial property…

Rhiannon:

This is the second time you have referred to me as “Missy” however, please no “Missy,” “honey,” “dear” -type of adjectives. Not cute.

Guess its my generation, but we don’t care for these sorts of descriptors.

~Misstrial

We’re downsizing to 1/2 our last home’s sq ft and going one-story w/ no HOA. Who the h*ll needs 5+4, and only use 1/2 the house. I’m the mistress, not the maid. LOL

Besides, life’s vicissitudes crept up on us.

Along with distressed home owners there is a large pool of small business owners that are on the edge of bankruptcy. I work in the Chapter 11 bankrutpcy field and many are hanging on by not paying their payroll, property, and income taxes. Local cities are trying to work with this situation along with the public pensions burden that needs large gains from the stock market to remain solvent.

Pacer,

Beaverton, OR

In California neither payroll tax, personal property tax, property tax on real estate, nor income tax are forgiven in a bankruptcy. Someone correct me if I am wrong but local government does not have clout in these areas. Perhaps the state can forgive some state related taxes but normally payroll taxes are never forgiven in any way.

This is an excellent article. I’d like to add some news which recently appeared:

“Fitch Predicts Half of All Prime Mortgages Will be Underwater”

http://nationalmortgageprofessional.com/news26821/fitch-predicts-half-all-prime-mortgages-will-be-underwater

That’s going to have an impact. This is in line with a recent Zerohedge article whereby the markets were acting as if half of the prime mortgages were underwater already, similar to what the subprime markets did back around 2007-2008, if I recall the article correctly.

We, this economy is doomed.

Can’t remember where now but I read a recent article on how the retired are now struggling and having to go back to work because their nest eggs are producing next to nothing due to the FEDS assault on savers.

Maybe 10% of the posts were sympathetic to those being screwed by Republican Ben Bernanke.

The responses from readers were not what I expected but were of the type of mindset you’d expect from those who think that everything is the fault of yourself and liberals and you have no one to blame but your self for your current situation.

Anyway the responses ranged from……They should work and pay their way…and…These elderly want to hang on to their crystal and china worth tens of thousands when they could sell it for income but instead want to complain when consumers get a break in the going interest rates………to………These people need to sell their houses and live off of that money and stop complaining.

I don’t think it was your average liberal leaving those comments.

This article correctly pointed out that low interests hold prices high. Why would I want to buy at the peak? Interest rates will go up eventually driving prices down…AGAIN! Lowing interest rates is just another patch. My wife and I looked at a few bank owned homes. They were full of black mold and had a grotesque smell. The pools were dark green. Who actually owns the house is disputed with all the illegal MERS transactions. What a mess! I think we’ll continue to lease.

100% agreed…

Well, the post is devastating and a thank you as well to the comment pointing out the Fitch rating service saying that half prime mortgages will be on underwater property…but the article goes on to say that Fitch then downgraded pools of mortgages dependent on low defaults, prompt payment, etc. That’s not helping Wall Street, thus Wall Street may demand some new insane policy to fix that. And they get their way with what we call our Government. As to the key question, where do all the buyers come from? Last year there were still almost five million homes sold, so there are lots of buyers, just not quite enough buyers. Rentals have tightened, though, which is good for housing price stability in most markets. But are most of those people buying in the last year already owners? First time buyers? And how many houses end up in a sales contract but buyer can’t get out of their present home? That may be the biggest problem is the “stuck” owner. Anyone have experience with contracts excessively falling out of escrow for this reason, and is it rampant?

Well listened to you 2011 prediction and bought in June 2011…. Thanks Alot Dr! When cost to own reached rental parity for me… I jumped. Now 4 months later it kinda sucks that things took such a turn for the worse economically. But i still think my reasons buying may prove wise. If things stay stagnant til 2015 i will have paid off $25k of my mortgage by then… And collected $25k in tax deductions… A little better than renting.

Lets not kid ourselves… Interest rates will be below 4% or maybe pushing 2% by 2015! Thats my prediction! You liked to compare this market to Japan in the past… Well prepare for 2% loans… Basically free money! Houses will be cheaper, but most that bought now will be able to refinance to 2% because rates that low will bring out buyers.

No, they won’t be able to refinance because they will be underwater with negative equity.

And if we do have 2% rates, that would mean jaw crushing deflation all around. That means 80 on the Case Shiller Index, and 25% unemployment. We are NOT Japan, as the majority of their debt is held internally. Deflation would crush tax revenues, meaning crippling government cuts, or massive money printing to pay for expenditures. Either way, housing goes into the toilet.

Yes, especially since they bought the home with FHA/VA financing with 0 to 3.5% down payment…

Spartan, you took the words right out of my mouth. Although they could refi if they come to the table with (another) 20%.

@Kevin:

Let me get this straight. You bet on things staying stagnant until 2015. But in the next paragraph you’re expecting housing to be cheaper in 2015. Clearly one of us is confused here.

Hi Kevin–I doubt that interest rates will still be dropping as of 2015. We just started the Federal 2012 Fiscal Year Budget period ten days ago, 10/01/2011. This will make the 4th consecutive budget year with a federal deficit of around $1.4 trillion, which is about 95% of GDP.

Greece is in the same boat, and look at what is happening there. We can run these kinds of deficits a bit longer, since the USA dollar is the world’s reserve currency, and countries like China and Saudi Arabia don’t want to shout out that he dollar is worthless, while holding a bunch of same.

But there are limits. Maybe one more year of this. Maybe two. But certainly before 2015 interest rates will be skyrocketing.

The Banks could keep conceivably hold on to shadow inventory for years to come. They could keep millions of homes off the market in order to prop up the housing market. Can Banks be forced to unload the shadow inventory?

Isn’t BofA being forced to bring their foreclosures to market in a way? All of their recent announcements point to cash flow problems. Owners (legal squatters) who don’t make mortgage payments don’t bring in bank cash, and neither do idle foreclosures. Here are BofA’s recent announcements:

– Speeding up foreclosing

– Speeding up selling foreclosures

– Layoff 30,000 workers

– New bank fees for customers

This cash flow problem was caused/encouraged by the suspension of Mark to Market, which has enabled banks to outright lie about their financial positions. If you hold stock in any major bank, sell before it’s worthless. BofA could be starting a bloodbath, but they have no choice. They need cash.

The last chart is the most illustrative IMO.

The early 90’s is when the great hollowing out began. You can see the low plateau/trough that existed before the dotcom bubble and subsequent housing bubble began. That little downward trend at the end indicates where we’re probably headed in that level in terms of income, if we’re not already there.

Yes, incomes were stagnant from year 2000, but I don’t think we should be crying about that because the year 2000, wages were in a massive bubble. We should thank our lucky stars that we stayed around the same level for so long and didn’t revert quickly to early 90’s wage levels because that’s really where we should be. Now, if prices for food, transport, energy and shelter went back down to early 90’s levels, we’d be in fine shape.

Asset price inflation is a great way to make asset holders feel wealthy if you can ignore the stickiness of prices when wages decrease at the tail end.

Prices are too high relative to wages. Housing and real estate should never be an investment. It is a place to live. The economy started going bad when what was called the transition to a service economy started. It was really a transition to an economy of salesboys. Inflating the price of houses is not the way to prosperity. Each of us buying stuff from Thailand and China, inflating the price and selling it to one another is not the path to prosperity. Swapping pieces of paper, whether called ,stocks, bonds, derivatives or anything else does not produce wealth.

The economy has become twisted to the schemes of the marketeering and salestrash. It will not heal till it is returned to a productive base. The small handful of producing people cannot support the hug overhead of speculators claiming to be investors, salesboy trash and marketeering con artistes we have been burdened with.

We put a CASH offer in on an REO yesterday. We also had to supply FICO’s- 820’s.Talk about chutzpah! Oh, and we had to have reserves. That’s double chutzpah! Who do theses sob’s think they are.

“Who do theses sob’s think they are”

The Masters of the Universe that can make you, a buyer paying CA$H, jump through ALL the hoops THEY want…

Personally, I would have told them BITE me!

You are paying 100% cash on a house? What do they need a fico score for if you’re not using credit?

I think it’s because of multiple offers. Our area is light on listings in the $300K-$425K range.I guess they don’t want a tax lien sale, a home to compete with their 6M other REO’s and SS’s.

I’m less excitied as the minutes pass. The home is only 50% of my bullet list, and I think it’s not what we really want in so many ways. Besides, I think our offer was too high. The house was “fixed up” with all tile floors. Man, is that cold and fugly. The pool is a $10K fix, it needs work, and that’s even before the inspection.

I think we took the BPO too seriously. The REO Agent involved always lists high.

We’re not a Bank or The Treasury. Print- Repeat

Unless this is a rental, it sounds like you need to get out of the offer. I hope that isn’t expensive.

Oh, one more thing, we had to prove reserves. (In case I didn’t mention it in my prior post-mental pause and busy or it doesn’t post). So, let’s see…CASH, Good Credit, Reserves, for a CASH REO purchase. F’ing nuts if you ask me.

I don’t understand, Speed It Up. How can the bank ask for credit and reserves if you’re paying cash? Don’t you just pay for the house and that’s that?

You don’t understand. The banks have a plan to change the rules yet again with the help of that socialist Obummer. Since it’s a short sale when the market recovers fully to 2006 levels next summer (and it will cause the election is coming) they plan to rewrite his contract so that he now owes a mortgage for what the house was worth in 06. Simple but in-genius.

My guess — and it really is just that — would be that they might want to validate the source of the cash to take the offer seriously. i.e. if someone with a 420 score has hundreds of G’s laying around, it might arouse suspicion. Of course, it also seem that there wouldn’t be a whole lot of liabilities once they’re satisfied that the cash is legitimate.

They do need to do some checking to make sure that the cash you say you have on hand wasn’t borrowed from a bank yesterday with the loan due tomorrow. When we bought a house for cash, we had to do a credit report and such. It wasn’t even a short sale. ‘t were just buying from a older couple downsizing. They had had one sale fall through. They were happy to just see a fully funded escrow account and figured once they got the cash, it was theirs to keep! I hope they are enjoying Hawaii.

In many ways, life would be simpler if borrowing was uncommon.

How long will banks sit on this shadow inventory? I completed my DIL on my house in the IE in early June. The house had absolutely nothing wrong with it(built at the end of 2006) and was ready to be listed immediately. It had actually been listed as a short sale for quite a while, but the bank refused all offers. What I have got to wonder is how my old place is listed on their balance sheets? Is it still listed at the 430k Bank of America claimed I owed them for the place or the 150k that it is actually worth? Will it be years before they finally decide to list this property?

“Is it still listed at the 430k Bank of America claimed I owed them for the place or the 150k that it is actually worth? Will it be years before they finally decide to list this property?”

The Ivy League banksters are waiting for their fraternal brethren politeers to pass some midnight legislation, probably during holiday session, to create another U$ Tax Sucker event where the Mark-To-Model on their books will be realized…

Why do you think Obummer was se-lected in the first place!

Most likely the homes will be bulldozed, all on the sheepster’s dime, all will be okey dokey once again with the TBTF/TPTB balance sheets, once again returning to Mark-To-Market (except for those derivative side bets that *wink* *wink*, the .GOV know nothing about…

In case you all didn’t notice, in just three (3) years Obummer has created more .GOV debt than ALL POTUS fraud before him, even including Dumya!

If you think things are bad yet, or that things will get better in our lifetimes, you ain’t seen nothin’ yet…

“If you think things are bad yet, or that things will get better in our lifetimes, you ain’t seen nothin’ yet…”

I think you’re right about that. Growing up my parents always told me that I had it easy –they grew up in Poland during WWII and immigrated as refuges. And really my generation did have it easy. I push my kids much harder at school than my parents did because I really think it’s going to be more difficult and more competative to succeed when they graduate.

It’s considered 430K on the balance sheets. At the current rate, it may take anywhere from 12~24 months to foreclose on your property if the bank doesn’t think it’s worth the short sale.

They have it listed on their books at the amount that the Note was. For example the NOte was for a 400k home back in lets say 2005. If the NOte was for a 30 year fixed rate the value of the NOte would be approx. 1 million dollars over the course of the 30 years. Thats what the NOte is worth. Thats what they have the NOte listed for as the value of the Note based on a home with a value of 400k that is now worth at least half that amount. This is the problem. The underlying asset will not even come close to the value of the NOte at the CMV. If the banks write these off or sell them at todays CMV then the reality is they are bankrupt. They are zombie banks being held up by air.

Great post, and 100% correct. I think housing has declined by roughly $3 trillion in value since the bubble collapsed (somebody correct me?). But it’s not just the hit the banks will take from declining home values through defaulting borrowers, it’s all that future compounding interest that they’ve got riding on their balance sheets. The last thing that banks want are a bunch of cash only buyers sucking up inventory at fire sale prices because not only will they lose on the default they will lose out on future income, with both losses knocking massive holes in their reserves. This is exactly what happened in Japan in the early nineties, and the actions taken by the Japanese govt/central bank are being copied wholesale by both the US and Europe (with some minor differences). It ‘worked’ for Japan because that country had a gigantic pool of domestic savings that the banksters could steal to extend and pretend up until the present time. I’m a mite sceptical that the same story will play out elsewhere.

BTW I’m from Australia, and have only recently discovered Dr. Housing Bubble, great blog. Oh and if you want to view a housing market in full retard bubble mode come take a trip down under. Average family home in Melbourne going for $650,000 of your American dollars.

Re:borsabil

Welcome to the blog. I’ve been passively interested in the Australian housing market. Can you tell me what you think the triggers for this bubble are? My guess is that exotic mortgages are behind the ausi boom as well. It just seems so odd that ausi consumers can get involved in a hyped market, when we all know what can happen in the U.S. Market.

Based on what you know, what are your plans to deal with the inevitable fall of the ausi market?

Doc, with all the respect of your arguments I disagree with your conclusion for coming catastrophe. It is not coming what is coming is more of the same until they destroy the dollar and then inflation comes as a rinse to clean this mess. When inflation comes I don’t think anybody needs advise to throw all the money into something tangible. This tangible after the gold bubble will be houses again. Good luck changing the game. We will play the same game until the end.

The banks have so utterly destroyed the housing market that it will never became an inflation protector. We will/are experiencing a hyper inflationary depression.

america is capitalism where supply and demand dictates prices.so what happen? he who has the gold makes the rules,wall street,as long as wall street has the money they will dictate to our government the rules and the laws are all in wall streets favor.as for the rest of us we are going to have to use ours wits to survive.

We rescinded our offer this morning. Like so many things in life, we rationalized the h*ll out of the caveats. Even if the home was cheaper, and it was less of a fixer, the location was really a deal breaker. With multiple rents, and other issues, we need a home, but this isn’t it.

I was thinking about the quality of people in the r e business, and I think it’s ashame that the biggest purchase of your life is facilitated by the level of people who gravitate to realturdhood. Scary.

Might be good timing on your part to pull your bid.

http://www.zerohedge.com/news/primex-update-its-donkey-kong

Looks like Prime is in trouble like subprime was back in 2008. Hope you don’t mind me linking to an external site, Dr., but the topic is super relevant. Prime might be in BIG trouble, as you have been espousing.

Graviturds. For RE shuck and jive douches, sucking is the norm not the anomaly. Even the “bank rep” REturd/Loan broker was skeezeball in my dealings with him, but the independents and shlubs sitting on listings and making cold calls send shivers up my spine. Just say no or go to the darkside and deal with the devil by ethically compromising the sellers agent. Listen to the Freakonomics boyz:

Want to Jump-Start the Housing Market? Get Rid of the Realtors!

http://www.freakonomics.com/?s=real+estate+agent&x=0&y=0

But whose buying even with 3%. The Obama machine isn’t bringing another round of $10k tax credit carrots. There is no fiscal ammunition to save the housing market.

video:

http://www.freakonomics.com/2011/07/22/want-to-jump-start-the-housing-market-get-rid-of-the-realtors/

I am really curious to see that “chart 3” in terms of inflation-normalized dollar values and absolute number of loans closed. While FHA/GSA mortgages are most of what’s written today and I do suspect that they have been writing more and larger loans, I have a feeling the apparent drop-off in ’04-’06 was likely still a period of growth, and that the prominence today might be exaggerated in lieu of the almost complete seizure of the private mortgage market. The most interesting figures to drop out of restatements of the data would be to form comparisons of how the growth of GSA/FHA financing has tracked against the economy as a whole. The way it’s presented above, we can only see the relative prominence of the the public funding sources and confirmation that the private lending market has, in fact, stalled out.

I was reading somewhere that the total cost of the bailout was about 9 trillion dollars. I was also reading somewhere that the total value ofoutstanding mortgages was around 9 rillion. Even if it was a trillion or two off-if the govt paid off the mortgages to every owner and elt the banks collapse-we would be in much better shape. But they chose to do the opposite-sigh.

A viable response would have been to protect the economy first, the financial system second and specific financial firms (whose recklessness caused the trouble in the first place) last. Thanks to the total corrpution of our political system by corporate money and prevalence of corporate whore politicians, they did the opposite.

“Thanks to the total corrpution of our political system by corporate money and prevalence of corporate whore politicians, they did the opposite.”

Unfortunately, for the adults in the room, the sheepster culture is dumber than a box of rocks!

Just take a look at that group of GOPhers in the last “debate”…

And with Obummer and DemoRATs like ol’ Gov Moonbeam going full retard (is that an act to cover for their Ivy League masters?), it don’t look like the future is shaping up none-to-good for the ol’ USofA.

Good luck all, I think I’m going to make wise use of my time to prepare for whatever scenario TEOTWAWKI brings…no use talking about TRUTH anymore, their isn’t enough to make a diff!

IQ Out!

Doc, I think that you are too optimistic to think that 2015 will be the bottom. I think that we will scrape the bottom for years to come. May be in 2020 prices may start to keep up with inflation at 2 or 3 %. But nobody knows what the future will bring.

The new normal is that every job that can be shipped overseas will be. Creative ways will be thought of to ship even more jobs overseas using the technology that Silicon Valley dreams up. The S&P 500 corporations will do OK because they get a large portion of their profit internationally. The politicians are out of touch with Main Street businesses because they can’t afford the political contributions like the big businesses. .

A coworker of mine said it quite well today – “Who wants to buy a house today when they don’t even know if they’ll be working tomorrow?” I though about this on my ride home. Exactly! Well said! I think housing is going DOWN, DOWN, DOWN. I hate to say it, but it’s like a big rock dropped from an aeroplane – there’s only ONE direction it can go – DOWN.

Also to Karen – 2nd response above – YES, THERE IS A CANDIDATE WHO WILL SAVE OUR NATION, and OUR FREEDOMS – he is RON PAUL. Ron Paul has always defended the U.S. Constitution (and therfore the freedoms they represent). In his 3 decades in Congress, he has NEVER ONCE VOTED FOR A TAX INCREASE. He will end the wars in the Middle East on his FIRST DAY IN OFFICE. He has promised to ABOLISH THE FEDERAL INCOME TAX (note – the U.S. had NO income tax from 1776 until 1913). He will abolish the IRS and the Federal Reserve which has destroyed our economy. Ron Paul WILL STOP THE RAPING OF U.S. CITIZENS in our aeroports by the TSA (unconstitutional pat-downs and full body scans). Ron Paul is the only canditate who WILL NOT SERVE THE BANKERS. Ron Paul for President 2012 !!!

I couldn’t agree more. But sadly, he has no chance of winning so the red/blue makes green, will continue the raping and fleecing of the sheeple.

Leave a Reply to Karen