A question of affordability: A rise to ARMs. Adjustable rate mortgage usage at multi-year highs and the increase in jumbo mortgages.

The housing market and rally has been sustained largely by investor demand. This demand is showing some signs of weakening as the fast money crowd is now chasing yields in the raging stock market and with rates now increasing and prices much higher, good deals are harder to come by. Of course the general crowd is always late to the party. In California, only 1 out of 3 families can actually afford to buy a home based on their current incomes. For the last few years many have been outbid by investors coming in with alternative financing detached from the regular mortgage market (aka the Fed mortgage market). Signs of froth are everywhere including the rise in adjustable rate mortgage (ARM) usage and large numbers going with jumbo mortgages. The last time jumbo mortgage usage peaked was in August of 2007, right at the apex of the bubble. Does the jump in ARM usage and jumbo loans signify a late arrival of the public to this housing rally?

A crushing blow to refinancing

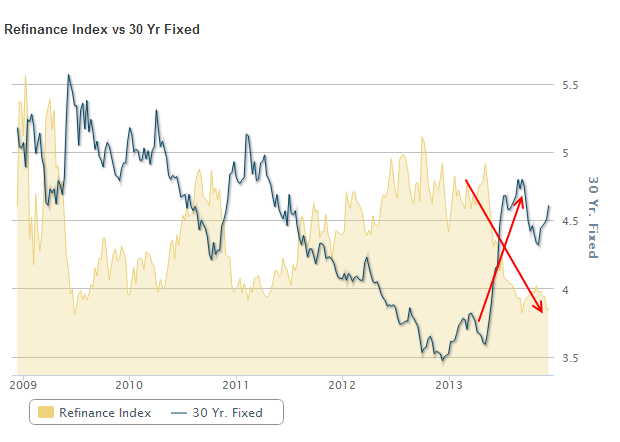

The market has been conditioned to lower and lower rates. So with rates up by more than 100 basis points in the last year, a quick shock was introduced into the refinancing party:

Keep in mind that a 4.5 percent mortgage rate is still incredibly low courtesy of the Fed basically owning the mortgage market. In spite of the Fed’s efforts via QE, rates still jumped. At a certain point you reach a saturation situation and the outcome of the Fed’s activities with QE was largely to divert big money from Wall Street onto Main Street in the form of investors buying up single family homes. So much for aiding the 5,000,000 that lost their homes. The chart above is very telling. That rise in rates crushed refinancing activity.

One thing that is very telling is the rise in the usage of ARMs and jumbo mortgages as regular households need to lever up just to play in this current low inventory game with manipulated mortgage rates. Since incomes are stagnant, the only way to squeeze into a home is by lowering the payment. You have a few options here:

-1. Lower rates (rates are trending higher)

-2. Varying mortgage structures (i.e., ARMs)

So what we are now seeing is a rise in ARMs simply to squeeze into real estate:

“(Mortgage News Daily) The share of applications for adjustable rate mortgages (ARMs) has been slowing rising from the 3 percent range where it has languished for years. Last week ARMs received 8.1 percent of applications, the largest share since July 2008. The average rate for a 5/1 ARM increased to 3.11 percent from 3.09 percent and points increased to 0.35 from 0.28.â€

This becomes a chicken and egg type argument: did ARMs peak right before the last bubble popped as a symptom or as a cause. In retrospect, we know this answer. ARMs peaked and so did jumbo mortgage usage because the masses jumped head first into buying homes they could not afford based on their incomes. While many try to hype up toxic mortgages as the full reason for the crash people forget that a large part of the foreclosures came from those in vanilla traditional 30-year fixed rate mortgages. The system was predicated on prices continually going up. Once the mantra of “real estate never goes down†broke the entire edifice collapsed.

Yet here we are again. ARM usage is at multi-year highs and so is jumbo mortgage usage. In Southern California this is the data (of all purchases):

October 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 12 percent ARMs (highest since July of 2008 when it was 12.6 percent)

October 2013:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 26.3 percent jumbo mortgages

August 2007:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 40 percent jumbo mortgages (previous peak)

These changes also create giant wealth effects. People feel richer because of stocks and real estate and spend more and this trickles down. However, the opposite also happens when prices reverse or stall out. Savvier investors have been pigging out at this trough since 2008. Now you have the public coming in near a top having to leverage up with ARMs and jumbo mortgages. Why would you get an ARM when rates are still at historically low levels and the Fed is already signaling at higher rates via tapering?

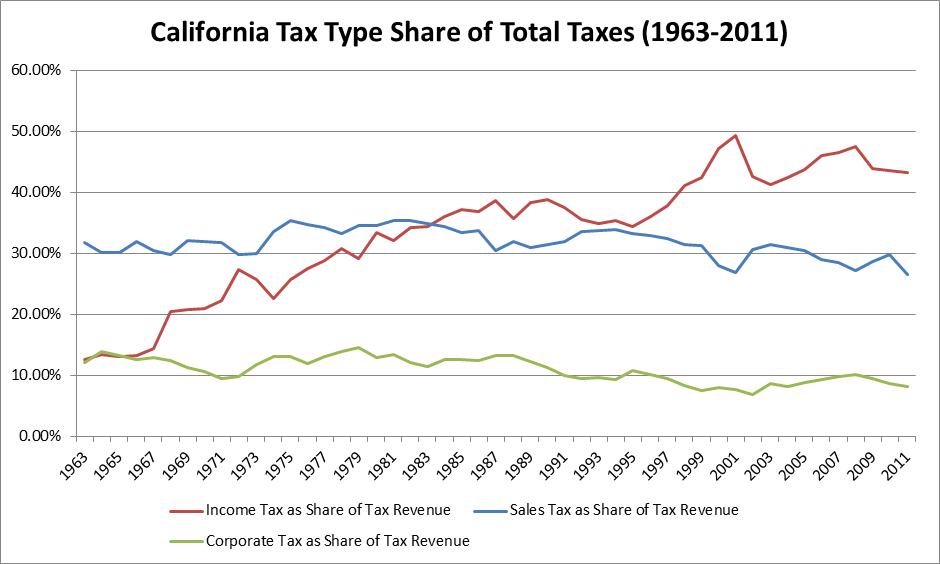

Keep in mind that California is built to be a boom and bust state. A large part of tax collections come from volatile sources:

Source: Advancing Free Society

So you have income, sales, and corporate taxes that rise and fall with the whims of the economy. When the next recession hits, you can expect all three sources to take a hit. This is why it makes more sense to use property taxes as a bigger source of revenues because they are less volatile and cut back on regressive taxes like those with sales or try to make it more lucrative for businesses in the state by cutting back on corporate taxes. Instead, there is a massive subsidy via Prop 13 and guess what?  You have these golden legacy handcuffs and many are going to go into their grave with their granite countertop sarcophagus. Do we really need to subsidize housing anymore?

The rise in ARMs and jumbo mortgages looks to be more of a symbol of froth. Also, FHA loan limits are going to make it tougher for high-end properties (FHA was never intended for wealthy home buyers but here we go again subsidizing the folks that least need it). You also have the Volker rule coming online shortly and the Fed’s supposed taper. This likely means higher rates which will make it more unaffordable to stagnant income households. The fact that places like Las Vegas are seeing major jumps in inventory and investors pulling back tells us that the investors are probably looking for greener pastures elsewhere. The public on the other hand is lured in near or close to the top.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

70 Responses to “A question of affordability: A rise to ARMs. Adjustable rate mortgage usage at multi-year highs and the increase in jumbo mortgages.”

A relevant data. Mortgage Equity Withdrawal is still negative, but looks like it will turn positive in the near future.

http://www.calculatedriskblog.com/2013/12/mortgage-equity-withdrawal-slightly.html

“While many try to hype up toxic mortgages as the full reason for the crash people forget that a large part of the foreclosures came from those in vanilla traditional 30-year fixed rate mortgages.”

I’m glad you make this revision to the political propaganda of the last few years. We know the housing crisis was due more to people who did have the wherewithal to buy a home but were buying 20% too much house. It was convenient for politicians to put all the blame on NINJA buyers, who should have been renting, because the first rule of American politics is to always flatter the middle class. The NINJA buyers were just lower-class backfill for all the overpriced, crappy starter homes that were being vacated by upwardly-mobile middle class buyers. NINJA buyers were just another government subsidy for housing-crazy buyers whose votes politicians were seeking to buy.

Another way to look at it is that NINJA loans are a gift to the banking industry. These types of loans screw the middle class in the end, but the banks can slice and dice them and sell them as AAA rated to suckers all over the world.

Finally someone with some sense.

Central banks will move goal posts to keep QE forever:

http://www.marketwatch.com/story/central-banks-will-move-goal-posts-to-keep-qe-forever-2013-12-11

You’re witnessing the political-financial addiction of hyperinflating the money supply.

Historically, the PTB just can’t wean themselves off of fiat abuse.

They’ve got everything backwards, of course. ZIRP KILLS Angel Investors: the fulcrum of new businesses, of new jobs formation.

So society ends up with neither chicken nor egg.

ZIRP environments are ruinous for anyone trying to launch a new firm/ new idea.

They make the real cost of investment capital brutally high — because they increase the perception of risk — in the eyes of elderly investors.

No elderly investor (Angle Investors are always older than the budding entrepreneur, and not uncommonly are blood relatives.) dares risk the cash flow that is REQUIRED to sustain themselves. They can invest only such funds as are surplus to obvious needs.

In an environment of ZIRP the elderly are seized with a liquidity panic. EVERY time they need cash they have to sell an investment asset — as money rents have been destroyed. (Interest, dividends, royalties, net rents, etc.) Such cash flows now represent only trivial values compared to the market values of the various assets.

So, the psychology is all wrong.

Shutting down the cross-generational wealth backing causes a brutal, slow, and erosive decline in business formation, employment and wage growth.

The brainiacs at the Fed don’t see any of this. It doesn’t affect anyone they know. They have absolutely no contact with the business establishing segment of our society. In every sense, they are clueless.

This effect has been extremely pronounced in Tokyo — where business innovation is but slight to begin with. Japan has a ‘daughter economy’ — namely, it’s totally dependent upon America to come up with the New.

Red China is Japan on steroids.

Apple is an exemplar: without Jobs the firm has stopped innovating. All that is left is tweaking the master’s touch.

Obama loves high tech. His problem is that he’s never destined to ever run into a genuinely viable start-up. His fate, as President, is to only ever meet cronyists — and their rotten speculations. It can be no surprise that every single one of his high tech bets has been a bust. Any really viable gambit will have been jumped on long before it came to his attention. After all, a million eyeballs would see it before it ever made its way to his desk. The Venture Capitalists of Sand Hill Road will only ever leave the dregs.

Beyond that, the Federal Government is not prepared in any way shape or fashion to hook up turn around artists or marketing experts when an inventor with great ideas gets into a rough patch. Back in the real world, serious management decisions have to be made on the fly — often in minutes — without any committee meetings at all.

It’s notable that the entire VC community has had a relapse in performance during recent years. Now that intellectual property is leaking to Red China like a sieve — or to the NSA-crony crowd (Google, et. al.) — it’s no surprise.

===

This harsh environment for start-ups bodes ill, for what will Asia do when there are no more solved business franchises for them to mimic?

If anyone can name a world ranking innovation that started in Asia in the last century — please post of it.

====

And on the military-technology front: it ought to be sobering if every weapon you build is a knockoff!

>> If anyone can name a world ranking innovation that started in Asia in the last century — please post of it. <<

Didn't Sony invent the VCR (Beta), to be copied and improved by JVC's VHS?

There's a story that Sony's CEO tossed a paperback book to one of his engineers, and said he wanted a video cassette the size of that book.

Sony also invented the Walkman. And was the CD one of theirs?

You might dispute that the VCR was an innovation, since videotape itself was an American invention (by 3M?), but I consider Sony's contributions to be innovations worthy of the name.

I think you basically outlined the big picture. But one thing you forgot to mention about japan. Nothing is made in japan. Just like here in the good old U.S.A. when cost of production went up the jobs left. So when all the froth was over and the economy settled down the jobs that sustained us were gone, this first happened in japan and is a big part of their 20 stagnant economy and will be ours.

Bernanke’s attempt to lift the economy by flooding it with money has proved a failure so now we see Obama beating the drum for a raise in the minimum wage there by creating the much needed inflation to paper over the mess.

This has been the game for a long time, devalue the currency, pay off the bills with cheap paper. Never fix the problem just cover it with paper and flush the toilet.

What about the Toyota Prius hybrid drive technology (or the game plan to make that a viable commercial product) that all the American manufactures are now copying?

China steals a lot, but in the case of thorium reactor and the fast reactor tech that eats spent radioactive fuel from older reactors, at least they’ll use the ideas, instead of letting them sit on the shelf, like we do with our nuclear waste.

Ok, so Asia developed a couple of technologies. I worked in Asia for a while, the risk-taking, go against the grain mentality just isn’t part of the culture. You need this mindset to innovate. Despite our flaws as Americans, we have this in spades.

Americans invented the airplane, internet, computer, transistors, microchips, the motion picture, television, all manner of industrial machinery, social networking, most computer programming languages, most medical devices, most medicines we currently use, and on and on. We did these things not just to get rich, but because we wanted to explore the possibilities and push boundaries.

“Americans invented the airplane, internet, computer, transistors, microchips, the motion picture, television, all manner of industrial machinery, social networking, most computer programming languages, most medical devices, most medicines we currently use, and on and on.”

Egotripping, eh?

Airplane is described as far in history as in Da Vinci papers, definitely not an US invention. Le Bris had controlled flight 50 years before Wright brothers (but he didn’t have suitable engine). Adding an engine, when suitable is tehnically possible, isn’t “invention”, but engineering.

Internet it isn’t “invention” as itself at all, just a bunch of standard ways to do things and anyway, modern version of internet is “invented” (actually specified) by Berners-Lee, in Switzerland.

TCP/IP is defined/invented by Kahn and Cerf but even then Cerf credits Zimmerman and Poutin, frenchmen for ‘important influences’. How much is questionable so I’ll leave this open.

Computer definitely isn’t an US invention, but UK, by Babbage.

Transistor and microchips: OK, I’ll give you a point on that.

Motion picture isn’t invented by any single person as it has been existing since at least 1021, earliest document found for camera obscura. Film, camera and projector were crated by different people around the world too but those aren’t the idea of moving picture.

Television was invented by Nipkow, in Germany and even he wasn’t the first to think about the idea. Farnsworth blatantly copied the fully electronic version from a japanese (Takayanagi) who didn’t patent it. No dice here either: A patent and an invention haven’t much in common.

Most medical devices and medicins have existed longer than US has been existing as a country. Almost any “new” medicin now is a molecular level modification and re-patented version of classic ones, definitely not “an invention”.

Some are, but what is the real business in US is to invent new diseases. In that US medical industry is very good in that and happily they have a already patented medicine ready for the disease they just invented. But no no, not about money at all.

Summa summarum: Either the level of knowledge (and fact-checking) is alarmingly low or people in US really believe they’ve invented everything, against any factual reality.

Propaganda has been done well: the Soviet Union people had/has exactly same beliefs about inventions. Obviously for the same reason.

Thomas (from EU)

“Americans invented the airplane, internet, computer, transistors, microchips, the motion picture, television, all manner of industrial machinery, social networking, most computer programming languages, most medical devices, most medicines we currently use, and on and on.â€

Egotripping, eh?

Airplane is described as far in history as in Da Vinci papers, definitely not an US invention.

… To INVENT is to reduce to practice… So the Wright brothers invented the heavier than air flight machine. We still have wholly impractical flight machines – such as inter-stellar ram jets – that exist only on paper – but which can not be realized… so they haven’t been invented yet…

Le Bris had controlled flight 50 years before Wright brothers (but he didn’t have suitable engine). Adding an engine, when suitable is tehnically possible, isn’t “inventionâ€, but engineering.

… The engine – and its propeller – were of the essence… Patents were issued… You stand alone. The Wright Flyer was an epic breakthrough recognized by everyone right then and there…

Internet it isn’t “invention†as itself at all, just a bunch of standard ways to do things and anyway, modern version of internet is “invented†(actually specified) by Berners-Lee, in Switzerland.

… You’re conflating the World Wide Web with the Internet. Don’t…. packet switching protocols WERE new back then…

TCP/IP is defined/invented by Kahn and Cerf but even then Cerf credits Zimmerman and Poutin, frenchmen for ‘important influences’. How much is questionable so I’ll leave this open.

Computer definitely isn’t an US invention, but UK, by Babbage.

… Historians date the digital logical adder, etc. to 1938 – and J.V. Atanasoff – in Iowa, America. The very first adder is in the Smithsonian. Babbage had a totally unworkable design that, even now, can’t be reduced to practice… Inventions HAVE to work, high concept doesn’t cut it.

Transistor and microchips: OK, I’ll give you a point on that.

Motion picture isn’t invented by any single person as it has been existing since at least 1021, earliest document found for camera obscura. Film, camera and projector were crated by different people around the world too but those aren’t the idea of moving picture.

… The motion picture – as a realized invention – is American – especially the modern designs (talkies) – which have evolved…

Television was invented by Nipkow, in Germany and even he wasn’t the first to think about the idea. Farnsworth blatantly copied the fully electronic version from a japanese (Takayanagi) who didn’t patent it. No dice here either: A patent and an invention haven’t much in common.

… For purposes of claiming, patents decide it every time… It’s where the rubber meets the road…

TV appears to be one of the inventions that had parallel developments all over. The British re-invented the digital adder – independently – not knowing that Atanasoff had already developed a working adder five years earlier. (It was kept under wraps.) The ENIAC was entirely derivative of the ABC machine – with Atanasoff being queried when the ‘inventors’ ran into troubles! Said letters of advice were entered into Federal Court, circa 1970. They ruined the ENIAC patents, which were revoked as a result of the most expensive civil litigation until that time.

Most medical devices and medicins have existed longer than US has been existing as a country. Almost any “new†medicin now is a molecular level modification and re-patented version of classic ones, definitely not “an inventionâ€.

… Until recognized as having beneficial properties, nothing qualifies as a drug… DNA research is driving drug discoveries into totally unforeseen lines of inquiry… Most all of the shamanic medicines of antiquity have been driven from the market: they didn’t work/ were dangerous. So, you’re insanely far off on this assertion.

Some are, but what is the real business in US is to invent new diseases. In that US medical industry is very good in that and happily they have a already patented medicine ready for the disease they just invented. But no no, not about money at all.

…Heh…

Medical researchers are just about the most selfless individuals on the planet… banking is where the lucre is…

… By definition, a disease CAN’T be invented… maladies can only be discovered and resolved… it’s the doctor’s art… not one of invention at all…

Re-patenting is a non sequitur… each is unique… while the term of protection can be extended (rare) you are still dealing with just the one patent..

Summa summarum: Either the level of knowledge (and fact-checking) is alarmingly low or people in US really believe they’ve invented everything, against any factual reality.

Propaganda has been done well: the Soviet Union people had/has exactly same beliefs about inventions. Obviously for the same reason.

…Heh… Heh…

You don’t need any fancy statistics or mathematical mumbo-jumbo here. Common sense and history state taht whenever things get “creative”, they end in disaster.

Go back to the way it used to be.

“What, sir? You would make a ship sail against the wind and currents by lighting a bonfire under her decks? I pray you excuse me. I have no time to listen to such nonsense.”

-Napoleon Bonaparte

Idiot.

We are at the event horizon, no going back.

Rather than crossing swords with Prop 13…

It’s the better part of policy to merely cap the interest rate deduction.

At a time of seriously low (rigged) interest rates, a window of practicality is to hand.

The ability to deduct (owner-occupied) mortgage interest is hugely distortive — not something that’s done in Canada — and which has been a big part of over-hyping real estate.

This should be balanced by backing off on the higher tax brackets, 35% is plenty stiff.

=====

ARM are almost always abused.

They smack of Carleton Sheeting one’s way to the poor house.

Since nominal interest rates can only trend higher from here, ARM are time bombs.

The only crowd that benefits from ARM: flippers — perhaps.

Because the Fedsury is hyperinflating the money supply, I would contend that real interest rates are actually in negative territory.

This means that it’s impossible for most entrepreneurs to start a business by using credit card advances. The vig is too much — by far — even if you’re not borrowing much.

There is actually 3 options (not 2) to “lowering the payment”. The doctor mention 2, which are as follow:

-1. Lower rates (rates are trending higher)

-2. Varying mortgage structures (i.e., ARMs)

He forgot the 3 option, which is the probably most important, and will at the end be control by “the invisible hand” like Adam Smith, who once said that changes will occur spontaneously and don’t need the help of government intervention.

-3. Home price must FALL!!!

Option 3. Housing to tank hard in 2014! You better blerting believe it 🙂

Never gets old…

I still think we have a higher chance for a drop in the stock market but I am not willing to bet on (short) it other than my current stock position is now down to less than 15%…

Know a guy in Palm Springs who underwater by about 400K. He got a loan modification to present value, but over a forty year term with a balloon payment of 400K at the end of the loan. He is gonna be dead by then, so what does he care?

Sounds like a renter to me except he can’t move out…

That’s hilarious, almost as funny as the fake sign language interpreter at Nelson Mandela’s memorial. Guy was on stage with world leaders, seems he just made up hand gestures as he went along. Who hired him, George Costanza?

http://news.yahoo.com/outrage-over-sign-language-interpreter-madiba-memorial-082056835.html

Fake, but accurate.

Blert, I’m not sure how something can be “fake, but accurate” but I believe the Fed should get this guy on a plane stat, hire him to accompany Yellen to all her public appearances and interpret. It’s perfect, really.

Drinks – Be thankful you did not get a 200 word essay on the history of American sign language and its economic significance. I am always thankful when blert blerts a single digit word count response. Who cares if it makes sense at least it doesn’t take up a lot of real estate…

The “Fake, but accurate,” quip is a paraphrase of Dan Rather inre the TANG fiasco.

When confronted with the blatant reality that his TANG memo was a total fraud — he contended that his broadcast was still essentially true, anyway.

He was canned over it. Then he lost his lawsuit — and finally, his reputation.

BTW, he’s never backed of that assertion — to this very day.

We can stop subsidizing housing and the banks by eliminating the interest deduction and property tax deduction like most of the developed world. We are no longer a third world republic(Republic of California).

Doctor – I have learned some really important lessons these past few weeks

1 Money creation and destruction;

Bank makes loan and holds the loan. Loan fails and collateral does not cover the loan. That would be money creation and then destruction.

Bank makes loan sells loan. Loan fails and collateral does not cover the loan. That would be money creation without destruction.

Non bank originates loan and sells loan. Loan fails and collateral does not cover the loan. That would be no money created and none destroyed…

2 Oil & Gold same same

Precious metals and fossil fuels have the same/similar impact on an economy.

Proof is that someone might throw a laptop in a landfill that has microscopic amount of silver therefor we have the same consumption of silver as oil. Also because of “technology” we no longer need to worry about China’s 1.36 billion and India’s 1.27 billion living the same lifestyle as the US’s .32 billion. There is plenty of oil for all for at least another 200 years…

3 Blowing versus Sucking…

And most important is that a propellor does not push a plane forward rather it creates lift/vacuum which sucks the plane forward. And speaking of sucks…

Heh.

debt to income too high

liability to income too high

Instead, there is a massive subsidy via Prop 13 and guess what? You have these golden legacy handcuffs and many are going to go into their grave with their granite countertop sarcophagus. Do we really need to subsidize housing anymore?

Guess what, the Right wing in California that loves Texas doesn’t want to do this. Texas is the oppose extreme, no state income tax but high property taxes but try to get a conservative Republican in California to reduce income tax and increase property taxes you can’t.

This reminds me of that left wing socialist whack job communist Ronald Reagan who raised the capital gains tax because it wasn’t fair that his secretary (now known as an administrative assistant) paid a higher effective tax rate than he did. What a nut job bleeding heart liberal. Typical California Hollywood liberal… 🙂

Ronald Reagan? you mean the right wing conservatives hero they love? Where the heck did you get left wing communist from? I Think that’s the first time i ever heArd the republicans hero Reagan referred to in this manner. By the way it was Warren Buffett who said that his secretary paid a higher tax rate then he did. It wasn’t Ronald Reagan just an f.y.i.

See income tax rate section on capital gains tax the same as ordinary income…

http://en.wikipedia.org/wiki/Tax_Reform_Act_of_1986

Reagan the job killer!!!

“The bills didn’t raise more revenue by hiking individual income tax rates though. Instead they did it largely through making it tougher to evade taxes, and through “base broadening” — that is, reducing various federal tax breaks and closing tax loopholes.

For instance, more asset sales became taxable…â€

http://money.cnn.com/2010/09/08/news/economy/reagan_years_taxes/

Let me know if I can stop now or do you need more proof before you drink the Kool-Aid?

I can go on forever…

http://www.nytimes.com/2012/11/23/business/a-starting-point-for-tax-reform-what-reagan-did.html?_r=0

One more time who said what and when?

Reagan

http://www.youtube.com/watch?v=clyq0ZdHubM

Buffet

http://www.youtube.com/watch?v=zB1FXvYvcaI

Okay… I am done…

http://www.npr.org/2011/10/17/141407285/times-have-changed-since-reagans-1986-tax-reform

Lynn – Please research before you make a statement about that socialist left wing whack job Reagan. I think Warren got it from Reagan. For all those who don’t understand, this is a sarcastic remark.

http://www.youtube.com/watch?v=clyq0ZdHubM

http://www.window.state.tx.us/taxinfo/crude/

Texas gets tax revenues from oil extraction. These are so great versus the state budget that state income taxes never got off the ground. ( Ditto for Alaska, BTW )

Likewise, Nevada lives off of gaming revenues — and associated taxes.

====

The courts long ago ruled against California’s system whereby all school districts were funded by local property taxes. It was obvious that the kids in the sticks and in the inner city were getting stiffed — remarkably so.

As it now stands, property taxes have to be vectored up to Sacramento — and then shuttled back down to the various school districts… per court mandates. This loopy scheme causes financial headaches every year since the funds are front loaded. (Sacramento is expected to put the bulk of the cash in the till before the beginning of the school year. — Don’t get me started about the way big government manages cash flow.)

This means that every district has ‘mad money’ at the beginning of every school season. Then things get tight on the other end. To stop that tightness, every district bumps up its budget, year by year; but the ‘mad money’ effect never goes away. New books are purchased — with the ‘mad money’, of course.

California’s problem is purely one of spending — and open borders. The drain on the state budget from illegals is through the roof. Naturally, it’s taboo to broach the topic.

There are, by now, at least 5,000 felony warrants for MURDER pending against illegal immigrants — just from Mexico alone. The vast bulk of these crimes were committed against yet other illegal Mexicans — while inside the US. A hefty fraction are mob and gang hits associated with the drug trade. It doesn’t take Sherlock to dope them out.

California now has entire prisons dedicated to Mexicans (court ordered separations) of whom the majority are here illegally. (Mule Creek State Prison, Ione, California)

It’s expenditures like these that are blowing up Sacramento’s budget. Many of these drains are dictated by Federal policies. Governor Schwarzenegger, by the end, just gave up: Sacramento’s finances are being driven by Washington’s policies. Everyone sees it, but no-one is going to shift their positions.

Providing more tax revenue in this case is like providing extra booze to an alcoholic/ more smack to an addict.

In every way, more revenue just makes the pathologies even worse. It’s never a case of low tax revenue. Quite the reverse is true.

I am a housing bear intermediate term, but follow me here…

If home ownership is at/near an all time low, that means a lot of people on the sidelines (potential buyers) who are renting. And if rents are “too damn high,” all of the renters who are tired of paying high rent, will be lured in by the ARMS and buy an expensive home. That’s what sheeple do (buy high, sell low.)

Couple this with the fact that many homeowners locked in unbelievably low rates the past couple years (sub 4%) who will not sell because their mortgage payment is cheaper than renting an apartment.

If I’m correct, there will be more buyers than sellers (short-term) and if that’s the case then it seems this bubble may not pop for another year or two or three.

Your conditions result in real estate CHURN.

Most of the time markets really don’t have a direction… unless going nowhere counts as a direction.

We’ve reached the end of nominal interest rate declines — going back to September 1, 1981. That puts a cap on any macro-bull move.

Yet, the Fedsury is spewing out astounding amounts of fiat. So, it’s hard to see how prices can fade off — particularly when Fedsury is also issuing mortgages like they’re Chicklets.

It does seem that the pensions of America are being dislocated from the US Treasury market — and into rental properties previously never considered: Single Family Homes.

It’s an oddity because SFH have been traditionally priced based upon their tax character — of which pensions don’t benefit.

The same holds true for oil and gas royalty trusts. They don’t make any tax sense for pension funds, either.

It’s just that the Fedsury has driven pension assets out of the debt markets. They are now too small to handle the retirement assets of the Boomer generation.

Or, as Bernanke would put it, there are excess savings in the system.

The best ‘out’ would be to raise the retirement age — ASAP.

Such a shift would solve all manner of problems: Medicare outlays, the SS Trust Fund, the Federal cash flow… on down the line.

Of course, such an obvious solution is a third-rail of American politics.

I expect that we’ll back into it: Boomers will find that they can’t retire because the cash flow is not there.

I don’t believe what I’m discussing is churn. But regardless of what you want to call it…if there are more buyers than sellers, then prices should not go down. Should the prices get high enough that the homeowner decides that cashing out the home equity and locking in a capital gain, is more important than holding onto the 2% mortgage, then i think we begin to see many more sellers enter the market, and that is when it could all come crashing down.

BTW, this is a discussion board, not a university lecture hall. Please try to focus on one issue at a time, and spare us the unwarranted ramblings of a nutty professor.

You should look at bubble homeownership rates vs. non-bubble homeownership rates. What’s the natural level? Then see if we’re near it or not. Despite ARM’s and other weird loans, there is an upper limit to people interested in or able to buy a home.

Keep in mind a lot of inventory is being held off the market. Might not be by banks, but by people that want to sell but expect huge prices and therefore aren’t selling right now. But, they may be forced to sell within the next 5-10 years.

“Inventory is being held off the market by people that want to sell but expect huge prices and therefore aren’t selling right now. But, they may be forced to sell within the next 5-10 years.”

Yes, I agree. That is why i said in the short run, there are very few sellers. Nobody wants to trade their ultra low interest rate mortgage for a higher rate mortgage. Eventually they will begin to focus less on the rate, and more on capital gains they can lock in, but not until they have built up some equity.

The problem with your logic is that it is based on incorrect premises.

First, “home ownership is at/near an all time low†is factually incorrect.

http://www.freeby50.com/2009/04/history-of-homeownership-rates.html

Even if that was correct you still cannot jump to “that means a lot of people on the sidelines (potential buyers) who are rentingâ€. We are currently in the 60% range which means that less than 40% are “on the sidelinesâ€. BTW this was the mean for a long time after WWII

http://www.census.gov/housing/hvs/files/currenthvspress.pdf

We are in a bubble that started around 1987 due to the savings and loan crisis. That is why looking at any chart that starts after 1987 is not really demonstrating the mean.

“And if rents are “too damn high,†all of the renters who are tired of paying high rent, will be lured in by the ARMS and buy an expensive home. “ This makes many assumptions about ability to qualify for a loan in today’s market. First, how do you come up with even 3.5 – 5 percent if you spent all your money on rent? Second what kind of job security do these sideliners have or anyone else for that matter? How many of these sideliners have any credit never mind the 800 fico requirement for a loan from a bank? How many of these sideliners even want the headache of a home? How many of these sideliners are not already racked up with debt and college loans?

I do agree that supply is constrained and that in my mind is the real culprit of the price increase along with the artificial demand caused by the artificially low rates. This is where I would start to agree with the ramblings of our friend blert. There are at least two forces at work here. First, is the availability of relatively free money to the large investment banks that allows them to go on the open market, purchase SFR’s and securitize them into funds. The second factor is that bonds, treasuries, money markets, etc. no longer pay enough returns to support pension funds, 401k’s, etc. These funds along with normal savers are seeking higher returns at the cost of higher risk.

What?, ok, instead of “all time low”, I should have said 18 year low…is that better?

The point is, there are a lot of potential buyers out there who are stuck paying high rent. And if they can find a way to step into a mortgage payment which is less than their rent payment, then they will do it. The link below confirms my suspicions…the home ownership rate bounced up this past quarter, from 65.0% to 65.3%.

http://www.bloomberg.com/news/2013-11-05/homeownership-rate-climbs-from-lowest-level-since-1995.html

As for how each person qualifies for specific mortgages or down payments, I don’t know, that is a case by case situation. The methodology will probably resemble the run up to bubble 1.0…creative financing. Home ownership is still heavily engrained in this society, renters are still looked down upon, people still like to save money on a monthly basis. If they can get out from under their landlord while saving a little money each month, they will, especially if their loan broker cousin or real estate agent uncle is telling them to.

Remember that banks and hedge funds don’t want to own SFRs forever. The Fed is buying time so their member banks can offload all of these RE portfolios onto the sheeple. The only way to do that is ARMs, NINJAs, HELOCs, subprime, etc. This is why i believe we a have a couple more years before bubble 2.0 pops. Then again, I could be wrong.

A couple of clarifications, first is that 65% home ownership rate is historically high as is 4.5% fix 30 year mortgage is historically low. Now lets count backwards from 2013 18 years. That gets us back to 1995. 1987 was the original banking (savings and loan) crisis. The result of this crisis was actions by the Fed to artificially lower interest rates to sweep all the nasties under the carpet. Yup the crisis of 2007 was not the fist time. So, lower interest rates makes two things happen. More affordable mortgage rates more folks become home owners and housing values go up. Second thing is money chases higher returns at the cost of higher risk (the other side of the equation). Tada, the dot com boondoggle. Two towers fall, two wars yadda yadda yadda interest are forced even lower and we really never had a break from the prior bubble…

Let’s keep in mind where the money is and where it isn’t. The last time around the money was in MBS/CDOs. This meant that the money was chasing down folks to mortgage a property or refinance. That is so 2005. Now the money is in buying properties, renting them out and securitizing the “revenue streamâ€. These revenue streams will make it into pension funds, 401ks, mutual funds, etc. Same game different angle only this time you don’t get to play until the bill comes…

@Todd, yes there are lots of wanna be buyers. However, a 10% or 20% cash down payment means most of them will not qualify, as does their sub-700 FICO score.

I don’t expect the current Housing Bubble 3.0 to pop anytime soon as the inventory is way too low. I expect 3 to 7 years of flat stagnation in the housing market if interest rates stay in the 4% to 5% range. The housing market will collapse in SoCal if interest rates on a 30 year fixed mortgage goes above 6.5%.

“Keep in mind that a 4.5 percent mortgage rate is still incredibly low courtesy of the Fed basically owning the mortgage market. In spite of the Fed’s efforts via QE, rates still jumped.”

How much influence is just plain old lack of demand having on pressuring interest rates lower? Regarding financial markets, there is acknowledgement that lack of demand for borrowing is influencing interest rates.

Rates are going up as the US needs some indirect buyers of treasuries and MBS paper when fed tapers….if they taper…this kondratieff wave is still in play..

http://en.wikipedia.org/wiki/File:Kondratieff_Wave.svg

I would think we are near top in Housing bubble 2 as most tops are always retested, we are there..

the wild car being inflation…if it catches fire with everyone caught in debt, it will be ugly, a home will be very good investment

Its rolling over and will tank end of 2014

Mr. Taylor – you are sounding like you are starting to hedge… end of 2014? Be bold! Housing to tank July 27th 2014 at 8:37am PDT.

The pool of FICO qualified borrowers has collapsed, hence the drop in loan originations across the economy.

Nominal interest rates below 4.5% must surely be below the tempo of dollar debasement. In such times, the real cost of funds is negative. Of course, this is but one part of official policy, torn from the Keynesian play book. (See: MMT)

Rates have shifted because the Primary Dealers (& Hedge Funds) are no longer so ready to soak up the Treasuries immediately ahead of Bernanke’s SOMA buying circus.

Picking up nickels in front of that steam roller is now weighted with enhanced risk: Bernanke just might break the psychology of the credit markets faster than one might hedge or unwind. To my mind this shift in sentiment is exactly what Bernanke wanted to impress upon the players. The animal spirits had to be chilled out — a modicum of deleveraging is overdue for those too big to fail.

Does anyone know where I can get a blertanise to english translation dictionary? I looked on amazon and there were 0 hits…

Google is your friend:

MMT = Modern Monetary Theory

SOMA= Special Open Market Account — the Fed’s market intervention book

FICO = Fair Isaac Company = retail credit score

“buying circus” = the Fed pre-announces it’s timing and volume to the Primary Dealers

Primary Dealers = that tight crowd that is permitted to directly bid at the Dutch auction of US Treasury instruments.

Dutch Auction = the offer starts high and descends… Treasuries are auctioned on a variation… The PDs send in a multitude of sealed bids (using the When Issued, pre-auction trading action) — which are filled from the highest price on down until the issue is distributed. (The smaller, general public, bids are given the best pricing — after the fact. Visit the Treasury literature for all the specifics.

In all of my postings, I assume that this readership is savvy; and will troll Google or Bing to dope out unknown terms.

I further assume that readers will avail themselves of web links provided by posters so as to become as perceptive as the hedge fund crowd; for it’s no different for the big boys.

Market study can never end. It’s the nature of the beast.

I too never know what Blert is talking about. That’s why I just skim through his posts. Maybe I’m dense, but Blert’s posts are just a stream of jibberish to me.

blert – you are completely missing my point. Spewing lots of facts, findings and ideas are a great exercise inside the brain. Usually if someone has a point to make, they would present their point, then present facts to support their point and then maybe reiterate their point one more time at the conclusion. This is basic thesis building. What I find from you is a brain dump and I am never really sure what your point is. You appear to have a large amount of knowledge but never really seem to make a coherent point. I am always open to open discussion but it seems to breakdown every time. Point in case was with my comment about the destruction of money supply and then you respond why is gold going down to counter my statement. I counter that gold is not really an important commodity as oil is for our economy and you want to argue about how gold is consumed the same way as oil. Then later you state that gold is one of the most recycled metals… I really see no point to your input which is unfortunate because I do believe you have a great deal of knowledge. The dictionary point was not about the acronyms rather a better statement would be does anyone have a blert map to get me from point “A†to point “B†AKA blert.

What?…

“gold going down”…

This is merely the latest example of your posts putting your words into my expositions…

…As for crossed up logic…

Some of your expositions are so hard to follow that I’m not sure if you’re being sarcastic, or whether you wish to be taken literally.

None-the-less, I don’t expect or request that you, or anyone, draft responses to clear up my own confusion/ lack of wit.

As for my style: it’s as common as dust in the Hedge Fund community. Read Hendry, et. al.

Serious money wants to know market history and your underlying reasoning.

Snappy banter is for the proles. At the edge of the market, knowledge is fuzzy; everything is in contention. Euclidian verities — proofs — are not to be had.

Many of my contentions are at severe variance with widely accepted dogma: Keynesianism and Monatarism. My definitions of economic terms does not conform to the fuzzy, sloppy, notions tossed around by ‘popular economics.’

My track record is too good to help my cause: even those who’ve witnessed it in real time — with their own monies on the line — can’t accept that what’s happening is anything beyond mere good luck.

Understanding is not a popularity contest.

My nephew spent his Peace Corps years in South Africa. He left dazed and confused. He found out that he was out voted on all matters of worldview. His protests against permitting the living room to be used as sty for the livestock were ridiculed. All agreed that bathing and hand washing were alien rites, and that local culture was the best on the planet. It didn’t help his cause that he’d fingered the big woman of the clan for stealing Western aid by the truck load. ($9 for her, $1 for everyone else) — But, at the end, it was widely agreed that the wealth of the White Man was due entirely to some evil conspiracy to keep them at the bottom… To resist that cultural scheme, they were determined to hang onto their own local traditions!

Einstein commanded all to explain things simply — but not any simpler than they had to be.

=========

I’ve laid out the differing sources and types of common, modern, monies now in use.

This truth is omitted from ALL of the popular economic theories that I’m aware of.

In the popular conception, these monies are all one and the same — having one unified dynamic.

If this supposition is still valid for you, then none of my contentions is ever going to make sense.

I’ve not opined on the gold and silver markets other than to observe that the price in the pits is determined by paper trades. These values are so heavily gamed by the PTB that their economic indications are completely corrupted. You do know something’s off when the biggest players are hoovering up every physical ounce to be had. Near as I can tell, Red China is producing more than ever — none of which is being traded through the open markets. It’s just going straight to the vault from the refiners.

===

When Ronald Reagan is jibed as being Left Wing… are we being trolled?

For me, I just let it pass.

===

Any true student of the market ought to flag these threads as favorites — and come back later to research the cited Web links.

I don’t link to jokes, funny images, or quips — just highly reasoned, deeply informative, expositions by some of the smartest analysts out there. Some should reasonably take you all week-end to comprehend. They challenge orthodox/ popular economics.

Some are an open window into the thought processes of those who’re managing billions of dollars.

You’re to be forgiven if these writers are taking you in over your head. Their IQs are high, their understandings are often profound… certainly better than the shoe-shine boy.

Do NOT expect the markets to validate your own theories and egos.

Given enough time, everyone gets to dine on ground up crystal balls.

Isaac Newton and Groucho Marx were some of the brightest minds ever… and both lost their shirts in the markets… famously so.

My single, wealthiest, client died a billionaire — starting with mere wage savings. He was just smart enough to make one fundamental bet: that inflation would rule the world (and the time) that he lived in. It did.

We are of a time when the markets are destined to whip-saw from one theme to another.

So, yeah, it’s confusing now … and going to get even worse as the PTB make a hash out of all investment logic.

I don’t think that there’s a trend to jump onto.

The one trend that is surely under way is the general bleeding of the middle class.

I’ve yet to see a way to profit from its emaciation.

son – landlord…

I don’t know just how young you really are… but my style is TYPICAL of Wall Street types…

Read ZeroHedge… you’ll see the same terse writing style pretty much across the board.

No-one is going to slow down and work with you at your own pace…

Wall Street doesn’t play that game.

You should go out of your way to follow any public presentations offered by the leading figures of our time: Hendry is a great place to start.

One simply CANNOT comprehend the California real estate scene without getting a handle on the macro-economic scene. Further, the evident debasement of government statistics, high and low, is very relevant to anyone who has to plunge-invest into rental properties. (Easy to buy, tough to liquidate.)

The single wealthiest client I ever knew made it on one thesis: inflation, and real estate, would rise and rise for the rest of his life. He won. He’s dead now.

His one-way betting would’ve destroyed him over the last five-years. He’d had the ‘Sam Zell’ experience, for Zell is just a younger version of my billionaire client.

Both spent their entire lives pyramiding up compounded commercial real estate portfolios. Unwinding his under duress would’ve done my man in, too.

These one-trick Charlies naturally gave themselves vast, vast, credit for being brilliant deal makers.

Instead, they’d have been much the wiser if they’d understood that their acumen was — like a quick-draw artist — confined to pulling the trigger quickly. Speed of execution is what carried them to the top. Balls beat brains. Both jumped into deals that required more Pepto-Bismol than savvy. Luck of the draw bailed them out, time and again.

If ZeroHedge, Hendry, Keen, et. al. (and blert) are tiresome for you… stay in your comfort zone.

You can still make it to millionaire acres. Just don’t admit to the world that you can’t keep up — ’cause most everyone else can — or is at least circumspect enough to not defame themselves across the Internet.

When I find “Why?” confusing — I just assume that he’s being witty — in a trollish sort of way. I make no attempt to grade his papers/ give him praise or damnation. If he expounds an alternate theory — I’m all ears. I look upon the Doctor’s blog as a collegiate debate society. Everybody has a shot at the soapbox.

If I thought I had it all nailed down — I’d be contacting a publisher.

Cheers.

http://www.oftwominds.com/blog.html

(December 13, 2013 posting)

Here is a CLASSIC case of a smart analyst utterly missing the picture.

The credit expansion chart reflects COMMERCIAL bank credit/ ordinary money creation — which is not tracking the Dow-Jones at all.

He’s omitted the Federal debt/ money being created and spewed through the Primary Dealers — which is the rocket fuel that’s driving the market to new highs.

The four types of modern money:

1) Specie: silver and gold coins… the classics… re-weighing, re-assay not required.

2) Warehouse receipts… the first banknotes… claims on specie, later bullion, held in unallocated vaults. Fraudulent issuance thereof initiating fractional reserve banking as we know it today. (The vaulter started out with 100% backing — then couldn’t resist loading out ‘extra’ banknotes — as no-one would be the wiser.)

2c) Warehouse receipts… as claims on non-metallic commodities… the Dutch invention. Instead of vaults, ‘bonded’ warehouses were used. Like bullion receipts, these were nominated in round figures and in every other way functioned as banknotes — except that the Dutch didn’t trade them until they’d been counter-signed/ endorsed by at least three top rank, ultra wealthy, local merchants. Everything from pepper to salt to spices could collateralize these widely negotiable, bearer forms of ownership. The endorsers stood legally liable for the value/ quality of the goods — always stored ‘in bond.’

This was the mechanism for funding the tulip bulb mania. Even the tulips, themselves, became collateral for receipts. In doing so, they pre-peated the American real estate bubble of recent vintage.

What sets both apart from CDO syndications is that highly illiquid non-financial assets are collateralized generating extremely liquid and uniform forms of tradeable wealth… essentially banknotes. This time, it’s a commodity-warehouse ‘bank.’ Unlike bullion backed warehouse receipts, it was common practice for such instruments to be presented for prompt delivery of the goods. The top three endorsers were held liable for quantity and quality of said goods.

Under the Dutch rules, these instruments traded very much like endorsed checks — in this case Fifth-Party Checks! Each endorser was liable in the order of endorsement. As you might imagine, this liquidity scheme scarcely left the city. (Rotterdam) It was also greatly confined to the merchant class — which just happened to be expanding like topsy. The tulip craze became the bell weather for all the manias that the West has come to experience. ( Kindleberger’s : Manias, Panics, and Crashes ISBN 0-465-04402-6 is essential reading… and ownership.)

3) Commercial bank initiated debt backed money. For modern Americans, this is the utterly dominant source of money that we’ve all known — right up until the QE#1.

It is this kind of credit/ money that Smith is posting of in the plot afore mentioned.

This money is naturally generated by the animal spirits of individual enterprise. Our emotions and gregarious herding cause all of us to follow momentum — and run with the pack. This is reflected in the ‘business cycle’ and Elliott Wave dynamics. The trading action always follows our emotional cycles.

4) Federal debt backed money. While it looks and trades like Money #3… this money gushes from only one debtor, one spigot. Consequently, it does not enter the bidding in the manner of other modern monies.

Like all new money, those first to take it out ‘for a spin’ are advantaged at auction. Such lucre provides a Trump Hand that can Overcall the market’s clearing price — typically shutting down bid escalation altogether.

Today’s pre-leveraged hedge fund bidders prove that this gambit is afoot. The players are surfing the Fedsury’s slush, closing deals before the market vaults to a new normal.

The crony crews sweep-up the cake, leaving but crumbs. Their group-think builds momentum in thin markets. A confidence addiction takes hold — risk tolerance builds up quickly.

Type #4 money generation is missing from most econometric price scaffolds. (Cf. Hughes Smith, ob. cit.) Even trillions in US Treasury debt-money have been omitted from his tallies. (!)

He is truly lost, but at least he has plenty of company,

At another remove, he doesn’t comprehend that corporate debt is being artfully debased, while the profit engine survives largely intact. (Firms dependent upon discretionary spending will suffer in their top line (revenue) as the middle class retrenches to solvency and survival.)

This last point is a strong reason for owning dull as dust electric utilities. Such staid debtors come out of hyperinflation smelling like a rose. No matter what, the power bill just has to be paid. The true merit of the utility dividend can survive a total re-boot of the currency — once you get to the other side.

One question, what happens to money supply when debt is destroyed?

Debt based money vanishes as the debt is paid down. It’s for this exact reason that the Federal Reserve Bank tracks said figures within the ‘M’s.

You get the same effect if bonding warehouses empty out. Evaporating collateral kills its associated liquid instrument.

To have the same dynamic in specie, the coins have to be sunk at sea; which happened so often that the intercontinental rail road was put in motion.

( A gold shipment was lost off of Crescent City, California in 1865 — it was intended to pay off official debts and land deals associated with the Washington Territory It had been held up for years, pending civil peace. It was only re-discovered — and recovered — in the last generation.).

Of course, defaulting really harshes one’s mellow. The prospect that no specie would be to hand was the driving force behind bank runs in the 19th Century.

So, are you telling me that if someone takes a nonrecourse loan out for a house from your neighborhood major bank for $1,000,000. Let’s say that due to fractional reserve banking this action created $900,000 new money (just making up a number for demonstration purposes only). Then let’s pretend the housing market crashes and the outstanding loan balance is $999,000 and let’s say that the house is now worth $400,000. Let us further say that this loan was not insured. Next, let’s say that the homeowner defaults on the note, the bank takes control of the property and sells the property at auction for $400,000. Now there is one caveat. The bank actually sold the loan to a MBS and is just a servicer of the loan. Did we or did we not just loose money supply as you stated in your response above?

Plainly, you have not, will not read Steve Keen.

I’m not going to plagiarize his work… nor attempt to craft a hyper-condensed version.

Your queries are best directed to that blog post.

http://www.debtdeflation.com/blogs/2009/01/31/therovingcavaliersofcredit/

With study, this Web Log should provide real understanding.

You’re still using Milton Friedman’s money creation math: it’s wrong.

Keen explains why.

Your ire is best directed towards bad theories.

Ok, let’s walk through this step by step and tell me where I go off the rails.

There is something called debt based money correct? You just stated “Debt based money vanishes as the debt is paid down. It’s for this exact reason that the Federal Reserve Bank tracks said figures within the ‘M’s.“

So, is debt based money created if someone takes a nonrecourse loan out for a house from your neighborhood major bank?

http://www.zerohedge.com/news/2013-12-14/guest-post-chinas-shadow-currency

^^^ BANs in Red China have mimicked the Dutch warehouse receipt scheme to an astonishing degree.

It’s worth a read… and it’s evidence that Red China is NOT deflating. Were it not for Beijing’s Capital Controls — their liquidity engine would be flooding the planet. The Yuan is worse than the Yen when it comes to flooding the market.

I must highlight that Tokyo is hyperinflating the Yen — as ALL of the borrowing is by the central government — whereas Beijing is inflating the Yuan — as new money/ debt is being ginned up all across Red China.

The differences are easier to see from afar. In both cases, they’re ‘out printing’ / out expanding America. This goes quite a ways to explaining why the US Dollar is trading strong vs the Yen and rigid to the Yuan… even though it’s being fulsomely debased, itself.

For me personally, a nice crash in SoCal RE prices would be just fine. We could buy another house for a low price now that we’ve gotten our Daughter and her family into a nice 4 BR house not too far from us and out of the townhouse with high HOA fees. They got a fixed rate with less than a $400K balance, and if a crash is accompanied by a drop in rates, they probably will be able to refinance. Buying the house before selling the townhouse proved to be a good move as the prices went up in the two months between two deals. Plus they bought us out with a refinance during the drop in rates after the 2013 highs on Dr B’s 30 year Fixed rate graph in today’s article.

The heart of the matter is that cash lets you move quickly when opportunity comes along. Real Estate is always a good thing, but it isn’t always a bargain. I’m hoping to get out of the doghouse with my Wife for insisting that we get our Daughter taken care of first. So crash away, Real Estate!

Are you suggesting that interest rates will go lower? I think the real issue is that we kinda hit a bottom with 3.5% on a 30 year mortgage. This is actually a negative real interest rate. The components of interest include loan risk, interest rate risk, anticipated inflation and cost of money. Explain to me how those four components add up to 3.5 while keeping the cost of money positive. Risk really can not be a negative number. Now if you believe we are in a deflationary era then the anticipated inflation can be negative. That would mean that your dollars would buy you more house tomorrow than it could today. I think it is safe to say for the time being the cost of money is actually negative and this is why the Fed has to buy up all the mortgages because holding mortgages is a losing proposition…

http://www.nomadiccapitalpartners.com/short-us-housing-market/

I read often but rarely post. I am a bear who took advantage of the recent run up by engaging in an owner occupied flip which was quite profitable. However, this market (housing and equities so I guess i should say markets) has become such a manipulated lie that I can no longer ascertain which way things are going to go. I’ve been fortunate enough to time it right during the last couple bubbles but now it’s just plain weird and I am about to throw in the towel and capitulate to the bull camp just like Hendry.

Dr. HB, this one is for you. I have yet to read anything on here about the QRM (qualified residential mortgage) rules that are coming into play this January as part of the Dodd Frank nightmare. Reductions in max loan amount (esp. large reductions for SB and RVSD counties), LTV, DTI, and fee restrictions should definitely impact the organic market (so I guess around 70% of buyers). I would love to read comments on these upcoming changes, as well as those of the bloggers on this site.

Leave a Reply to Variance Doc