Alt-A Loans and Option ARMs meet Strategic Defaults: The Perfect Recipe for a Toxic California Housing Market in 2010. Behavioral Economics of Housing and Top 7 California Regions with Active Alt-A Loans.

The last week for whatever reason saw the resurgence in mainstream articles covering the option ARM fiasco. Even those who are purported to be financial experts still miss the bigger picture. That is, they fail to understand that the category of Alt-A loans covers the vast majority of option ARMs and Alt-A is basically a category assigned to loans that were no-doc or low doc, had weaker credit scores, and low to zero down payment. In other words, mortgages that make Medusa look like the next Miss USA. Some of the confusion also arises from the difference between a reset and a recast. This is like saying dogs and cats are all the same because they are pets. Resets are no problem in this artificially low interest rate environment (the future is another story). Recasts are a gigantic problem. Another issue being ignored is the fact that current owners of Alt-A infested homes have a selling environment that lacks these maximum leverage products. That is, they bought at a time when leverage was flush in the market. When I look at current reporting I would ask reporters this – think more like a criminal crony banker.

On the other side, I would ask reporters to also think like a California HGTV granite countertop obsessed housing speculator. That is why even as far back as February of 2008 it was easy to see that people would be strategically defaulting on their mortgage. People at the time thought that there would be no way that people would actually stop paying their mortgage if they had the money to do so because people in general were responsible. Yeah right! And option ARMs were only for high income actors and doctors that didn’t want to disclose the amount of boob jobs they did in the last year on their tax return. But the no money down world essentially gave buyers a call option on their home with these craptastic mortgages. If prices go up, you sell and keep the difference between the sale price and the premium. If the price tanks, then you are out the premium. But guess what? Some didn’t pay a penny! These were basically free call options. The only incentive is a bad credit history but with 1 out of 10 mortgages in the U.S. being delinquent this isn’t such a tiny group anymore. Many saw the chance of a foreclosure as a small price to pay to ride the easy appreciation gravy train if the market shifted into mania part two.

One of the popular articles sent in the last few days was from the San Francisco Chronicle highlighting the option ARM mess in the Bay Area:

“People think option ARMs (will be) a national crisis,” he said. “That’s not really true. It’s just in higher-cost areas like California where you see their prevalence.”

Of the 10 metro areas nationwide with the most option ARMs, three are in the Bay Area, according to Fitch Ratings, a New York research firm. They are the East Bay counties of Alameda and Contra Costa, the South Bay area of Santa Clara and San Benito counties, and the counties of San Francisco, Marin and San Mateo.

Together, these areas account for the second-most option ARMs in the country, although they are still far behind the greater Los Angeles area (including Los Angeles, Riverside, San Bernardino and Orange counties), according to Fitch data.

Understated data

First American shows more than 54,000 option ARMs issued here with a value of about $30.9 billion. Fitch shows more than 47,000 option ARMs here with a value of about $28 billion. Both say their data underestimate the totals.â€

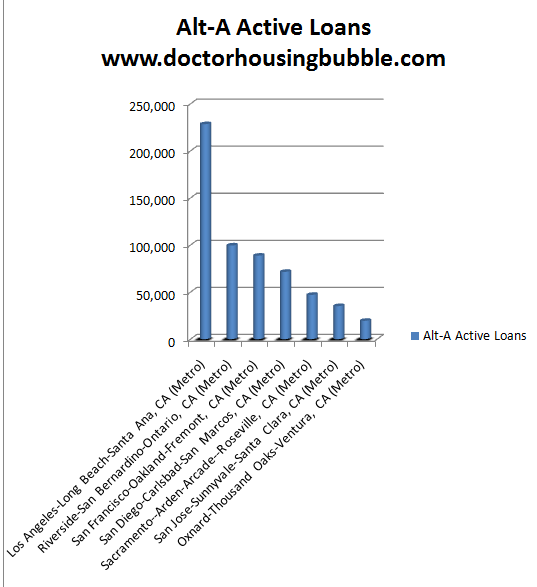

$30 billion of option ARMs are sitting like ugly ducks in the Bay Area. But we do things bigger here in Southern California. We aren’t given the actual data regarding the LA/OC area but we can extrapolate from the Alt-A loans that we are in a world of hurt in Southern California:

Thankfully, I have some data on this. Â We can try and get a figure for Southern California by looking at the Bay Area data.

Bay Area

Alt-A active loans:Â Â Â Â Â Â Â Â Â Â Â 136,000

Options ARMs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 47,000

Ratio Alt-A/Option ARMs:Â Â Â Â Â Â Â Â Â Â Â 34.5%

Southern California

Alt-A active loans:Â Â Â Â Â Â Â Â Â Â Â 400,000

Option ARMs:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 138,000 (appx)

Now given that Southern California is the birth place of the option ARM, I would venture to say that the ratio would hold for Southern California. We have various estimates on this data. Some will say that option ARMs are not that bad, but given that 80 percent of option ARMs were low doc loans, they qualify as Alt-A loans. Plus, we are only looking at one item and many of these loans can go from current to non-paying over night. How many were zero down 80/20 loans? 100 percent loans? So at the low range we know 80 percent will fall under the Alt-A category umbrella. Bottom line is California is going to have a smack down with these mortgages. Not only because these mortgages have no shine like Glitter, but we have a 23 percent unemployment and underemployment rate.

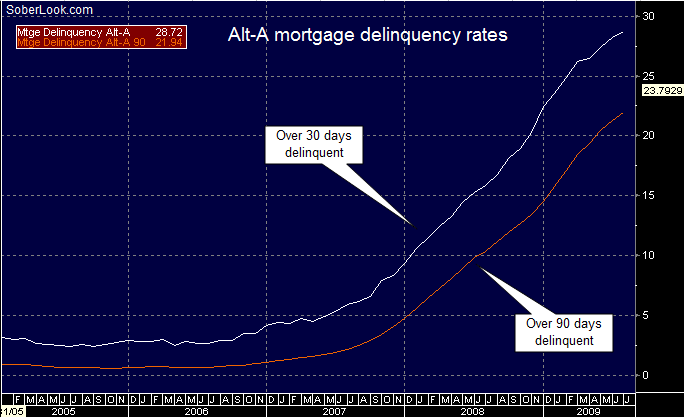

And Alt-A loan defaults are spreading like the plague:

Source:Â Bloomberg, Seeking Alpha

Keep in mind the Alt-A universe covers over 2 million active mortgages. And with 2 million mortgages nearly 30 percent are already at the 30 days late mark. 22 percent are already 90 days late. Given the size of these mortgage balances, you can rest assured those 90 days late are going to turn into foreclosures assuming banks move on shadow inventory. If they don’t they are going to contend with negative cash flow issues. But as we know negative cash flow hasn’t stopped the crony banking industry!

I want to go back to something that I have been kicking around in my head. Much of this information has been out there for years. This option ARM wave isn’t any surprise, certainly not to those that follow the housing market closely. But why is the media suddenly catching on at a point where it really is too late to do anything? My feeling is the lack of understanding in behavioral economics. This is an area that I have studied extensively. A field that also combines the psychology and sociology of human nature into the mix. Neo-classical economists don’t want to hear about this because it interferes with their free market ideology of letting Wall Street do what it wants and the market will right everything.  The only problem is, when the abyss stares at them in the face they quake and suddenly become corporate welfare recipients. Holding your values is about staying true in the toughest of times. In good times everyone is a saint.

This would also explain a lot of behavior in the current market with Alt-A loans. Of course people leveraged to the max on these loans. It was a premium free call option on the biggest housing bubble in the world. It was like buying a lottery ticket. You won’t feel so hurt if you lose $5 but if you win, you better believe you’ll be running in the streets in your underwear. But what if you had to pay $500 for that lottery ticket? Or $1,000? With housing, it is so vital to have a down payment because it makes the borrower take a place at the gambling table. That is why anyone that even spends time with friends and family in California and talks about homeownership realized that if things imploded, many would simply walkaway. This was the psychology.

Also, I’m not sure I like the term walkaway. It is more like “stop making payments, save the cash, let the moronic banks sit back for more bailouts, and wait months until they even pay attention to your file†since that is a more accurate description. Many aren’t walking away. They are not paying and playing chicken with banks. Those who are paying and want a modification usually find an incompetent boob who really has no idea what to do and can only follow the “higher crony†orders if you are 3 months behind. Alt-A loans and option ARMs are the mortgage version of Russian Roulette.

Now some people might think strategic defaults are only a minor problem. 588,000 strategically defaulted in 2008 and most happened in you guessed it, California and Florida:

“(LA Times)

* The number of strategic defaults is far beyond most industry estimates — 588,000 nationwide during 2008, more than double the total in 2007. They represented 18% of all serious delinquencies that extended for more than 60 days in last year’s fourth quarter…

* Strategic defaults are heavily concentrated in negative-equity markets where home values zoomed during the boom and have cratered since 2006. In California last year, the number of strategic defaults was 68 times higher than it was in 2005. In Florida it was 46 times higher. In most other parts of the country, defaults were about nine times higher in 2008 than in 2005.

* Two-thirds of strategic defaulters have only one mortgage — the one they’re walking away from on their primary homes. Individuals who have mortgages on multiple houses also have a higher likelihood of strategic default, but researchers believe that many of these walkaways are from investment properties or second homes.â€

I bet if we drilled down deeper into the data, you would find that most of these strategic defaults are attached to Alt-A loans. The problem (and rest assured there are many) with option ARMs isn’t the interest rate. Resets are no problems here. The issue is the recast. The rate can be rock bottom and it is, but this doesn’t help someone making a $1,500 teaser payment on a $500,000 mortgage. Even at the 5 year mark with a 5 percent interest rate the payment will virtually double because of negative amortization (90% made the minimum payment only) and the fact that you now have a 25 year time horizon to pay off your mortgage with no negative amortization option. Basically the option ARM becomes a no option mortgage. These mortgages are the absolute epitome of the crisis we find ourselves in. Financially reprehensible mortgages that had no checks and played upon the greed and cynicism of Wall Street and the herd mentality of the get rich quick population. Didn’t we learn any lessons from the Great Depression?

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

60 Responses to “Alt-A Loans and Option ARMs meet Strategic Defaults: The Perfect Recipe for a Toxic California Housing Market in 2010. Behavioral Economics of Housing and Top 7 California Regions with Active Alt-A Loans.”

Option ARM is not feasible. It may facilitate low payments in the initial months, but later the repayment amount simply shoots up. The end accumulated repayment amount is much, much higher.Efforts to modify home loans have been slow and easily outpaced by the number of new delinquencies. In the first quarter, loan companies modified 185,156 mortgages, up 55 percent from the previous quarter. But the number of foreclosures in process increased to 844,389, up 22 percent.

Read more.

http://www.housingnewslive.com/us-housing-news-articles.php

I used to have faith in the mainstream media, but now I realize that those writers are merely experts in writing nice, easy to understand sentences, but they are not experts in the content they write about. This blog might have some grammatical errors, but the arguments are well thought out and supported by data. Whatever I learn from this blog my friends will learn in about one year from mainstream media.

I would take it a step further as to the risk on the Option ARMs. It is not only the Alt-A borrowers with their no doc loans that are at risk of default but also the prime borrowers who documented their incomes.

>>

The VP at my little local bank and I have discussed the whole mortgage debacle extensively. Now that little bank didn’t do teaser 2/28s or 3/27s (subprime) or Option ARMs but he paid close attention to what the other banks were doing. He told me that the lenders on those too-scary-for-words loans were

>>

(1) lending where the mortgage payment was up to 65% of gross income – not includiing insurance and taxes: and

>>

(2) qualifying borrowers on the teaser rate – that minimum payment that did not even cover the accrung interest.

>>

So put those 2 factors into the equation and even a prime borrower is looking at default when they have to start repaying ALL the interest AND the principal when they only qualified for the loan to start with because the less-accruing-interest payment was 35, 40, 50 or more of their gross income.

>>

BTW it is a lot of hogwash that no doc loans were ‘necessary’ for self-employed to be able to get a mortgage. Someone who is self-employed could always qualify for mortgage where they have to document their income by simply producing 2-3 years of tax returns showing a stable income. Of course the lender would use their net income to calculate the ability to pay and not the gross income before business expenses were deducted. It can be done quite easily – we did it several times.

Thanks DHB!!! I been following your blogs for while and many ppl still don’t get it…. I’ll wait for few years to buy my 1st house and I’ll be patient. I’ll really appreciate your hard work!

Take Care!

**”These mortgages are the absolute epitome of the crisis we find ourselves in.”**

Bingo. That’s absolutely correct.

You know around election time how you see all those campaign signs stuck in peoples’ front yards? It’ll look exactly like that, but with “for sale” signs, on the westside by 2011.

If you own a home that is seriously underwater – maybe 30-50%, even if you can still make the payments under a reset/recast, you still have the problem of what to do when/if you need to sell. You wont be getting back to zero for over a decade, and maybe you can’t wait that long.

I’m beginning to think strategic default will be the new popular short-sale negotiating technique with the bank. “I want to do a short sale”. “We’ll think about it.” “Ok, while you do that, I’ll think about paying the mortgage, but not actually pay it, and I’ll live rent-free while I get my stuff ready for the eviction one or two years later. Now, how about that short-sale?”

That’s why I tend to take the latest “who strategically defaults” credit-report study with a grain of salt. How many of those “strategic defaults” are actually a responsive tactic being used because the bank wouldn’t approve a short-sale? We know how hard it can be to deal with a loss-mitigation department.

I wouldn’t default if I still lived in the house and could still make the payments – but I would if I had to leave all of a sudden and the bank was playing hardball with me. How many folks, especially since they are looking to move where the jobs are (not California!), are in this exact position?

The USDA is currently holding seminars for real estate agents and mortgage brokers,explaining how they are making loans for 100% of value, no money down, on ‘Rural” properties.

Many fringe suburbs in San Francisco and L.A. qualify as ‘rural ” areas.

Next year is an election year. The only thing that you can conclude is that the gov’t. is trying to keep the bubble going until after Nov.2010 elections. After that, everything can collapse.

I think the gov is just setting up another Fannie and Freddie fiasco.

The Mortgage problems continue today according to this Reuters article http://www.reuters.com/article/ousivMolt/idUSTRE58K29E20090921

And I would suggest that they are going to increase to an even higher rate because of the unemployment rates that continue to rise across the country. Remember the “good news†that the gov keeps feeding is us that less people were laid off, not that more people were hired. So the job loss is increasing not decreasing.

Add to all this a dollar that continues to bleed and inflation is not far behind as gold – an inflationary leading indicator – shows us.

Consider too how banks are leveraged. Check out this article on the FHLB which is leveraged close to 25 to 1. http://www.caseyresearch.com/displayCdd.php?id=227

I’d be interested to see the hard statistics of what loan are defaulting. I think I would classify as a strategic default (mostly) even though I’d eventually lose my house either way because of a balloon payment. My first is a 40 year fixed at 6.5%, but the problems comes in with my 2nd which is 7.5% with a balloon. Obviously I put no money down. How many other people in my situation are throwing in the towel now. Even if they offered a loan mod that lowered my payment significantly I doubt I’d take it.

These types of loans were pedaled heavily even in the prime full documentation market in 2006/2007. Very few people who bought in this time period put money down because the banks told them there was no reason to. Even in the prime FRM market how many of these loans do you expect to not go bad? When you brought nothing to the table and can walk away so easily from $250,000 worth of upside down mortgage you’d have to be a complete idiot not to. This is why you are seeing people with 800+ FICO scores(like I had) go from a perfect payment history to never receiving another payment again overnight with no other delinquency. Chances are if our credit score was that high we can do some pretty simple math.

I find it interesting that there were two big waves of resets. The first was the subprime and now it’s the alt-a loans. Why did they stop issuing subprime loans and move to alt-a loans? What explains the lull in the middle of the two reset histograms?

I sold my “overprice” San Diego house in July, 2005 because of the common sense news from some great internet sites who called this bubble perfectly! I tried several times calling and writing newspapers about this bubble and Why it was happening? They were not interested. Negative attitudes. Also real estate adversting was big bucks for the newspapers. They put that first before honest forewarding independent news for their readers. They could have warn readers and perhaps a few would have seen the light and made the right decisions. We will never know now.

DG. Seeing that you picked a 40 year first mortgage and a 2nd with a balloon payment PROVES that FICO scores have NOTHING to do with being smart or good at math.

And you pedal a bike, not a loan.

Moron.

THIS DATA SHOULD BE MADE PUBLIC AND PART OF FD. I’M TALKING ABOUT LOAN DEFAULTS, FORECLOSURES, ALT-A CRAP, ETC.

E,

I have to disagree with your comments regarding DG. I am a bit biased because the case he laid out is virtually identical to my own. When I bought my house in late 2006 I was presented with a variety of loan options. I had ~ $50,000 to use as a down payment but was given the option of putting nothing down. To me, this was a no-brainer. If I used the money I had for a down payment and then the value dropped or I had to move for some reason, I would not have been able to recover the $50,000. If I put nothing down and had to leave, I would have the option to come out of pocket to close or just walk away and still have the $50,000. It’s not like I was losing the $50,000. I could put that money towards the principal at any time so why would I limit my options by locking it up right up front? The bank should have required it but they didn’t. Bad decision for them, fortunate for me. As it turned out, the house plummeted in value over the next two years and after trying to work out something better with the lender, I walked away. I saved up ~$35,000 more before leaving and now rent for less that half what I was paying before. To your point that someone who got this type of loan and then walked away is a moron, I think that a more accurate way to describe it is one bad decision that was not followed up by another. I feel like even though I could have continued to pay on my home, I would just be making the worst out of a bad situation. Judge if you want, but if you want to have an opinion worth anyone’s consideration, make an arguement and avoid childish name-calling.

Delusional homebuilders just can’t seem to catch a break: http://www.marketwatch.com/story/toll-incentives-insider-sales-raise-eyebrows-2009-09-23?siteid=yahoomy

Serves ’em right. We’ll see if their lobbying efforts through the NAHB along with their cronies at NAR can get the 1st time tax credit extended (and even increased to $15,000). Why should we be bailing out these fools?

Be brave Comrades!

Ok, why are prices not crashing in San Diego? I live in Chicago and I always dreamed of living in San Diego. Perfect weather and no more terrible, cold, snowy winters.

I check for housing prices in San Diego and they still want 750K for an average American house (three bedrooms, two baths and a two car garage sounds pretty average to me). What gives? Why haven’t prices declined to more reasonable levels?

There’s the problem. Can’t get those bubble appraisers drunk again…Don’t cry for me, NAR.

By Les Christie, CNNMoney.com staff writer

Last Updated: September 23, 2009: 3:04 PM ET

“But realtors, mortgage brokers and builders have charged that one result of the code has been an increase in below-market valuations that have killed sales and further slowed already moribund housing markets. A recent survey from the National Association of Realtors reported that 20% of its members claimed to have lost at least one deal due to low valuations.”

Hey, Partyboy. You are the poster child of childishness.

You gamed the system by saving up $35,000. not paying

your mortgage and then walked away from your house debt.

What we need immediately in this country is retro

law requiring you to pay the tax on the windfall for

the note (including accumulated non-payments).

This needs to be strongly reinforced by liens

on all your bank accounts and properties.

Garnishment if necessary.

Let me finish off with a little name calling. It’s

sh-t like you who are destroying the economic fabric

of this country. If the damn house had made you a

buck you expected to keep it all. But if you lose, you

expect the American taxpaper to pay the bill for

your greed and stupidity in making the purchase

and then for what you stole living there, mortgage free.

Saw this on another blog. Is this for real? Am I starting to believe in the recovery?

http://www.youtube.com/watch?v=0yeWknZm81k

Just a update from the real economy – my small business that serves the semiconductor industry has seen a surge in business over the past weeks. I guess all the corporate insiders selling $95/1 into the stock market will produce positive GDP. I know once the bubble bursts again (how much f*cking longer?) it will all go to shit again. I am an uber-bear but maybe we can print our way to prosperity?

I’d go even further, original thinker. Partyboy is a f’ing thief. He absolutely should be on the hook for entire amount he stole. Don’t want to pay? Declare bankruptcy. There should be laws that a$$holes that intentionally fail to pay have their bankruptcies on the books for 20 years.

I don’t know, Partyboy’s actions ARE pretty disgusting, but I don’t really blame him for expertly gaming a system that was set up for him (and many others) to do just that. I place the real blame on the politicians and despicable “chairmen” who blew the bubble in the first place and set up all the moral hazards that we are now living with.

I would love to hear Dr. HBB’s thoughts on this terrifying article:

http://www.opednews.com/articles/LANDMARK-DECISION-PROMISES-by-Ellen-Brown-090921-894.html

Incredibly, the Kansas Supreme Court has legitimized the idea that a securitezed home loan CANNOT legally be foreclosed upon, because one of the interested parties to the original contract is no longer present. (The originating bank) So what, basically there will now be FREE houses for 60 million stupid morons who bought at the peak? Is this how the foreclosure wave will be averted? FREE HOUSES, just stop paying, no one can legally foreclose on you!!!!!!! Please tell me I’m completely misunderstanding the aticle.

original thinker,

Don’t forget, a lot of real estate professionals and financiers also made a lot of money of selling these toxic loans.

Prices will go down in San Diego. The Alta’s and Interest only loans for the higher level homes will start 2010 . We will see how many can keep up with the “new “increase payments as their equity further declines. Add this with the job market/unemployment declines the sun shine, great climate, might not mean that much. Paying on a under water, upside down house on a sunny or wet day makes little sense. Give the market time for these realities to reveal themselves and see what the prices are a year from now?

Referring to my earlier comment, I think San Diego might be largely unaffected by the housing crisis. The problem in the economy lies with private sector employment, i.e., that which has to compete globally. All the military, defense, healthcare, etc. down there is simply not affected. They are all plugged into the Fed’s printing press whereas the rest of us have to compete against China and the like. So if housing is hot down there I guess it doesn’t surprise me. When the dollar collapses (6-24 mo.) it might be a different story altogether.

Waiting for 2011, I had the exact same reaction to that article you did. I’m afraid you’ve got it right. Just quit paying your mortgage and if the bank can’t come up with the proper paperwork you’re home free – literally.

I enjoy reading your speculation on the market and am impressed on your insight with this real estate market fiasco. I just have one question on one of your graphs. In one of the graphs it shows a source from Seeking Alpha. I believe you may have accidentally mistaken this graph. This graph isn’t related to California or even the US. If I read correctly, it actually is a graph for the Dutch government in retrospect of the ING Alt A crisis. Nonetheless, thank you for all your continued hard work in this subject and I look forward to reading your articles.

Bob Toll’s Impeccably Timed Insider Sales

The Pragmatic Capitalist|Sep. 24, 2009

http://www.businessinsider.com/bob-toll-has-impeccable-timing-with-his-insider-sales-2009-9

Origional Thinker stole $85000.

It would be different if he had gone broke making payments he could not afford. But he chose to deadbeat a loan, to not pay back the money HE borrowed out of greed even though he was not out of money.

This is the moral hazard that will ruin the country. The Greatest Generation raised Boomers who raised deadbeats.

spit

You are not a moron, partyboy, though you are no genius, either. What you are, exactly, is scamming scum the likes of whom were enabled by our corrupt government and crony financial leaders in wrecking our financial system by fraudulent borrowing.

You borrowed in bad faith, with no intention of paying back if it became too difficult. Granted, your lender was the greater fool in requiring no down payment but the core guilt here is yours.

You can thank those of us at all levels who did not take part in this rampage that we have enough of a financial system and economy left for you and me both to be able to exchange U.S. currency for things like food, train fare, clothes, and electricity. If we had all done what you did, we wouldn’t even be able to do that much. Those who think we are in a state of collapse now don’t know what real collapse is, and let’s hope that the wave of future defaults now setting up thanks to the current wave of badly underwritten FHA loans being generated, doesn’t take us there, because our huge systems and oversized infrastructure are all very fragile, and very costly to operate. These systems are very necessary to our lives and daily well being, and they’ve been extremely neglected. Worse, we don’t have the money to repair them- the money that could repair every dangerously deficient hydro dam and bridge in the country is instead being committed to propping up the housing market. Oh, yeah, and for corporate welfare for our dying auto makers to build more trash cars.

And we will have another bubble, because that’s the only way our leaders know how to drive the economy. That’s why the people who drove this rampage, like you and like the top money men who took home millions of dollars a year in bonuses, are not being pursued and prosecuted.

But the next time we have an interstate bridge collapse or catastrophic dam failure that results in a Biblical flood and body count in the thousands- I’ll think of all the people like you , whose schemes and thievery has drained us of the last of our wealth.

Original Thinker/Steve,

Well fellas, I can understand where you are coming from. I just think that you are classifying the effects of the problem as the actual problem. It seems to me that you both think that people who are walking away are people who gamed the system and caused this mess when in actuality (my opinion), the lax lending standards and no-money down loans created this mess. Either way, it doesn’t really matter. What’s done is done and cannot be undone.

To the point that I “stole” $35,000, that is ridiculous. I told the lender that if we couldn’t work something out that I was going to stop paying. I told them that I would be willing to transfer the house back to them as soon as they wanted. They refused and said that they would not take the house back (deed in lieu) and that foreclosure would run the normal course. Now why would I leave the house sooner than I had to at that point? If you got sentenced to prision starting on the 1st of next month, would you go to prision sooner because you will be there inevitably? Or would you “steal” as many days freedom that you could? The terms of a mortgage contract clearly lay out two options, pay and stay or don’t pay and be foreclosed on. I chose option two because it was clear that I would be unnecessarily burdening myself and my family if we stayed and paid. The fact that the foreclosure process took so long was just a nice benefit for us.

I don’t disagree that there should be garnishments, liens, etc. to cover the balance of the foreclosure which is not recovered in a foreclosure auction. However if those laws were in place before the housing bubble started, I don’t think that the bubble would have gotten so far out of hand in the first place. Making rules like that retroactive is a ridiculous idea and would be grossly unfair. Everyone went into these mortgage contracts with a set of rules which had to be abided by, it just so happened that the rules favor the buyers in a lot of cases. Perhaps changes will be made to correct this in the future but you can’t change the past.

If the taxpayers are paying for the losses that the banks are taking, don’t blame the people who bought too much. They have suffered. And don’t blame the banks. They have suffered as well. Blame the government because they are the enablers here. Banks and buyers made their beds and now they should have to lie in them. It should have nothing to do with the rest of the country and the government should stay the hell out of it. Feel free to be angry, but you really should direct your anger in the right direction.

Best of luck to all in these hard times.

Torabora,

I am trying to decipher your post…are you saying that people are a-holes unless they go broke trying to keep their house? Enough with the “The captain should go down with the ship” mentality. When you recognize something is going wrong, stop. Period. Be adjustable, continuously re-evaluate situations, look forward and try make good decisions.

Morals do not apply to business. Law applies to business, morals apply to relationships. If this were the 1950s, where you get your home loan from your neighbor who works at the local bank, it might be a bit different. But we live in a much more dog-eat-dog world where banks look at customers as numbers, not as people. Why should we look at the banks any differently?

I would never condone doing anything illegal. What I did was well within my legal rights to do. What I don’t understand is why there are people out there who argue that people should follow up a bad decision with an even worse one and drive themselves in to the ground financially in a futile effort to save a sinking ship. I just don’t get it. Perhaps one of you can formulate a sentence or two into a coherent and logical thought to convience me that you are right. I am all ears…

Unemployment is a leading indicator for real estate prices. With real unemployment pushing over 20% in CA, there’s no way any kind of rise can be sustained. It’s govt intervention on a massive level. Smoke and mirrors. Lenders not recognizing defaulting home loans is a very bad sign. This will cause them to be zombies. Credit is contracting. Who buys a home with cash? It’s a highly leveraged purchase by the average person. And the average person is in a world of hurt these days.

My loan looks pretty dumb now, but at the time this is almost all that was going on. Few people did conventional loans between 2004 and 2007. Hindsight is 20/20 and now I feel pretty dumb for making such a bad loan, but I was assured when I took it out that I would have no issues refinancing because housing could never go down in Southern CA. These were the words of the loan officer not mine. Obviously a little simple math would have told me people didn’t make enough money to afford the houses they were buying, but I didn’t do it. Lesson learned and I will probably have to stay out of the market until we get through the next bubble(15 years?) Good thing I’m still young. Nothing has changed with financial regulation so I am sure there will be another bubble soon enough. If you are so pissed about people getting off the hook write your congressmen and make CA change the non-recourse laws, but banks did these deals knowing full well if the values every dropped people could freely walk away from them.

As partyboy stated I’d love to give the lender my house back now and start the credit healing process. The lender not only refuses to take the house back but hasn’t even filed a notice of default after 9 months of non-payment. What am I supposed to do? They refuse to make a deal that will allow me to stay in the house longer term, and at the same time they refuse to take the house. I am keeping the place up, but I’m not going to pay them for something I will eventually lose anyway. So I’d like to hear what all the judgmental intellectuals on this site think I should do? If you were 250k underwater in a place with a balloon payment coming in a few years what would you do? I am sure you are all perfect and would never have taken such a stupid loan, but imagine I guess that you didn’t know it had a balloon until after you signed the loan. I’m saving my money of which I also have around $30,000 and waiting for them to take the home. I don’t really see any other choice. I won’t argue that I was a moron for taking the loan that I took, but are the actions I’m taking to correct my own stupidity now irrational?

I back partyboy 100%. Nobody is expecting the taxpayer to cover the loss. The fact that the taxpayer is on the hook is the consequence of the bankers and both Bush and Obama admins colluding to lay the burden of all the bad loans squarely on the shoulders of the homeowner. The lender made a bad loan, and the borrower signed on to a bad deal. Both parties should be compelled to make a deal. The lenders WILL NOT make a deal. So, gratis to partyboy and everyone like him for turning the loss over and shoving it back in the banks face.

I just found out Reno home values are down by approximately 50%. (Reno is often considered to be an extension of California, with its close proximity to Tahoe).

The government and individual buyers did not make this mess. They may have gone along for the ride and been swept up in the enthusiasm of easy money but they are not the ones who created this mess. The Criminals are the banking and finance industry. A lack of government oversight can be credited as well, but after thirty years of pursing an ideology of “the market is always right and can police itself, business knows best” b u l l s h i t we are left with the current economic situation.

Laura,

I think that you are lumping everyone who defaults on their mortgage into the same category which is quite unfair. To classify someone as “scamming scum” would be appropriate if they were a first-payment defaulter. But to assume that I had no intention of paying back the loan or borrowed the money in bad faith is incorrect. What is correct is that I didn’t accurately estimate the costs of my commute to my new job, car repairs, CA taxes, Mello-Roos, etc. These miscalculations were my own fault and I blame no one but myself for them.

One of the major reason for us walking away is that we had a balloon payment on our second mortgage due at the 5-year point. The balloon payment was ~ $100k. When we bought the house I didn’t have any intention of moving until my kids are out of high school. I have a very good job and wanted to stay in one place for the next several years. My plan was to refi the second into a 30-year fixed at about the 3-5 point and just ride out the storm. But when the values dropped by 50%, there was no chance of refi on the second and I knew that it was unlikely that I would be able to make the $100k payment. I called the lender and asked if we could go to a 30-year fixed at that time (about 18 months ago). They said that they would not refi the loan at all because of the LTV, which was ~ 125% at the time. I asked if they would be willing to settle the loan for a lesser amount and they said no. For us, the writing was on the wall. We would lose the house at the 5-year point when the balloon payment was due so why continue to pay ~ $3500 a month to essentially rent our house for another couple of years when we could foreclose, start the healing process and rent for $1500? It just didn’t make any sense. If you think that you would have acted differently in my situation then more power to you. I am not willing to sacrafice my family’s well-being for the bank who was unwilling to compromise on a contract that was bound to screw both of us. I came to the table with several solutions that would have been less painful than the end result and was uniformily rejected. If you want to hang that on me, so be it.

As far as who will be to blame for the next catastrophy, that is just silly. There is plenty of blame to go around for that. Don’t be so naive to think that the end of the world will be the fault of the overextended home-buyers…you are obviously smarter than that.

After reading the posts here for several months there is a clear dislike of something called “the free market” (along with HGTV). What would your suggested “improvement” consist of? Should we move, as the current administration clearly wishes, to a more centrally planned economy? Is the problem that the Imperial Federal Government most of us now try to hide from is simply not yet big and intrusive enough? Inquiring minds are curious. BTW The nauseatingly snide remarks about the free market aside, I visit here often and always appreciate the useful information about the housing market.

Partyboy;

There is something called “Business Ethics” that you don’t seem to grasp. Those BE’s apply to both sides of a legal transaction, not just the bank. I’m not faulting you for your situation other than your greed and stupidity at the time you signed your loan(s). However, being that the US Taxpayer is going to foot the bill for your gross negligence in finance, I think you owe us ALL a little more than “in your face I’m right” attitude. No one twisted your arms to sign that piece of paper (a couple of times over since you apparently had also a HELOC?) and if you can’t be held to your word than what good are you? What good are the rest of these types in America other than a drain on the rest of us? If you were poor, bought in low, and fixed up the place, and were struggling to hold onto it, I’d have a lot more sympathy as to your plight. As it is, I have ZERO sympathy for someone riding the system despite the circumstances. That money you are saving? That’s the lending institutions – you should at the time of actual foreclosure surrender those funds to them. Its theirs by the fact you signed an agreement agreeing to pay. In the meantime, its rightful place is in escrow. Collecting interest for the BANK.

freemarketeer–

Most of us here are not necessarily opposed to a free market economy; we would prefer, however, that our government for once side with those who work for a living, rather than defer to a handful of corporate monetarists bent on profit for sloth. The market has proven repeatedly that it is simply incapable of self-regulation. The repeal of the Glass-Steagall Act, beginning with the Depository Institutions Deregulation and Monetary Control Act of 1980, the Garn-St. Germain Depository Institutions Act of 1982, and finally the Gramm-Leach-Bliley Act of 1999, saw an unregulated market collapse much as it did in 1929. Unfortunately, government regulation appears to be the only available solution.

What I am fearing is a complete collapse of the moral sense which has, foolishly or not, kept this country afloat for so many years. Sense of decency, sense of shame, moral responsiblity–this is what kept so many millions of people trying to pay off their loans and their mortgages. But if indeed there is a financial advantage to not doing so, and if there is very little societal castigation or ostracism on the downside, more and more people are going to do it. And it’s not just going to be mortgages they will default on.

Our government is so desperate to make things look better, even very temporarily, that they are throwing trillions around to fix up the banks’ balance sheets, and to keep all these delinquent borrowers in their homes, or to let t hem leave but with a nice cushion, courtesy of a rent-free year or two. But I don’t think it will work for too long economically. And morally, it will be an absolute disaster, as there will be at least half a nation of people who will have no intention of making good on any of their obligations unless it profits them. And when the potential suckers–the honest and hardworking people–refuse to play along with another cooked-up Ponzi scheme I wonder whom the banks will find to lend to. Of course the suckers could get ‘smart,” and decide not to pay anything back, either, thus entirely sinking this corrupt financial system.

If I ran the government, I’d have done everything I could to encourage the savers, the prudent, the responsible, by allowing the housing markets to fall to sustainable prices. But they’d much rather put the pretty bandaids on, rather than go through the pain of a long but meaningful recovery process.

Partyboy, sounds like you made wise decisions. You didn’t _make_ the rules, you simply based your $ decisions on the rules that the banks had at the time. Doesn’t sound to me like you planned on bailing on the loans from the get go, but by not putting a high down payment you left that option in case something went wrong. Smart! And as much as my tax dollars are bailing you out, that’s not YOUR problem or YOUR fault. The banks that allowed high risk loans to be completed should have been allowed to fail, as they were in a game of high stakes gambling, and not making sound business decisions.

If you took the loans out with the definite intention of not paying, that’s wrong. If you choose to put as little of your own cash as allowed to limit your risk/exposure, that’s smart.

Always put as little of your own money as possible into any biz, home, etc…that’s common sense.

Tony

And no, for all the haters, I haven’t defaulted on any loans/credit lines, etc…

My suggested improvement would be to return to a time when financial institutions at least acted like they were responsible for their own business decisions. They made bad loans and asked for no collateral from the borrower. Then others bought these loans without performing the necessary due diligence. A free market means companies are free to fail from stupid decisions.

I also think the government should regulate enough to prevent the “too big to fail” syndrone that seems to come from no regulation.

No.

Another edition of simple answers to simple questions.

Hey E, attacking someone because they mis-spelled a word? That’s weak. Wanna take some more and smoke it in your pipe? I *AM* a strategic walk-away and I’m proud to be. Walking away is very smart if you are in a bad position. This very website will echo that.

The people bitching about morals and ethics…..where the f were you when the government and financial institutions created this sh1tstorm of fraud? I’m not bound by a damn thing to pay my mortgage…other than the agreement with the bank. They have their security in the home…their security should *NOT* come from the usury charges. Take the bank Chase…and suck on it. Too bad our US government will give them OUR hard earned taxes to subsidize the losses.

You are wrong. I don’t owe any of you a DAMN thing. The whole situation was fraud from the top down, but you pick on the victims, not the banks. How mighty generous of you. I’m telling you with the posts like the one above me, this country needs a revolution….we need to chlorinate the gene pool.

@ms –

Help me understand why the jobs picture in SD should be the main driver of the market? The real estate crash began with unemployment at half the rate it is now. If you think it’s connected that tightly with unemployment rates, you’re simply not paying attention. In fact, b/c there are so many military personnel down there, the bust should be even worse b/c, at its core, the issue is one of affordability. No one is getting rich on a military salary. Talk to me when home prices:household income approaches reasonable levels again. Please pay attention.

William:

I am not worried if Americans lose their moral fabric, at least not in the financial sense. In fact it may be a moot point because I think most already have. If people en masse become perpetual deadbeats/scammers, the banks and lenders (the market) will eventually figure it out and ALL transactions will be made with an assurance that both parties have A LOT of “skin in the game”. (Down payments, high interest for losers) That way, being a deadbeat would become a painful thing to be. (The way God intended) If that world came to be, it would also greatly benefit the non-deadbeats like me, because with less credit being extended to countless morons/deadbeats, our “more reliable” business will be all the more sought after by the lenders, and the ball will always be in our court. Prices on everything will decline too, because there won’t be mountains of credit laden morons stupidly bidding up the price of EVERYTHING.

Chipchick,

I appreciate what you have to say, but you are wrong on several points. I understand the concept of business ethics and don’t feel that I violated them at any point. I did not take out any HELOCs, I did not intend on defaulting at all, and when I saw the writing on the wall, I made several efforts to work something out with the bank. I felt (and I was correct) that the home would sell in the low $200k at auction but offered to pay $50k down if the lender would reduce the principal to $300k. They would essentially sell me the house for almost $100k more than they eventually sold it for and get $50k upfront. They refused. I understand that this would have been a $200k haircut for them, but isn’t that better than $300k? And I would have been essentially buying the house for $300k when it was really worth ~ $250k. If you think that this was a disgusting idea, so be it. I felt that it was a reasonable middle ground in which the bank and I both share the pain of the declining housing market. The bank ended up losing much more after the cost of foreclosing and then selling the house at auction for $212k. I don’t begrudge the bank for what they decided to do. It was well within their rights per the mortgage contract, just as walking away was within mine.

I think the enormity of this fiasco will end in all mortgages being non dischargeable and where “jingle mail” will be concept from the distant past.

You make a deal and you’re stuck w/ it. Period.

I sat on the sidelines watching all the pigs eat at the trough of greed, and I still can’t believe all of you losers in the end got to dig into my pockets and just walk away from all the mess you caused.

Now we are all paying the price. Thanks a bunch, losers.

Partyboy, you still don’t get ‘it’. You signed a legal agreement, and you broke it. That makes you out to be a liar. Plain and simple. No matter what the extenuating circumstances are, from the lending institutions perspective, you “agreed to pay’ on that original loan by your signature. As for the market, who here hasn’t lost a lot with the downturn? Does that make it right for you and others to just skip when the going gets rough? In my parents generation, that was considered a deadbeat and those people were not highly regarded. We have deteriorated so far from what should be an ethical standard in this country. Just like its OK to not be responsible and blame others, it also OK to go bankrupt or skip out on a debt that you profitted from. This is primarily why I don’t think a solution to this mess is to further regulate. There is going to be a continuing wave of corrupt people who do these things and take down the rest of us without regard. The good people will be further penalized. The bad will continue to take advantage and walk.

Well Chipchick, I think that you and I are just going to have to agree to disagree. I can see why you think that the contract was broken, but in actuality I exercised one of the two options in the contract. Option one, pay as agreed and someday own the house. Option two, don’t pay and the bank will foreclose. It’s really that simple.

You, along with many others, feel that all buyers who have since defaulted were buying out of greed. That is not necessarily true. The same could be said about the banks. They should not have bent rules and abandoned all sensible lending practices in an effort to push through as many loans as possible. But they were making money and getting huge bonuses, even for the crappy loans. They were completely overexposed in their lending practices and left themselves open to huge liabilities if the value of the houses went down.

When a home is purchased (unless a buyer pays cash) there are really two sales taking place. The bank buys the home for cash and then sells it to the buyer on credit. Since the house is the only collateral on the loan, it is foolish for the bank to allow zero money down. Without value apprecation on the house, the bank is immediately overextended and potentially stuck with an asset worth less than the money paid for it. This is the primary reason for requiring a downpayment and the primary reason, IMO, for the massive defaults.

Every decision a person makes has consequences. Walking away is no different. Your feelings are well founded and somewhat justified, but your anger is misdirected. There are no laws against walking away from a mortgage. It is perfectly legal and every single lender knows the risks when they make the loan. If two educated parties enter a contract and the contract is upheld in the eyes of the law, why the bitterness? You are not bitter because of what I have done, you are bitter because the governement has stepped in and protected the banks from massive losses, perhaps at your (and my and every taxpayer’s) expense. If I had continued to pay until I was dead broke, would anyone have helped me? Of course not. That is why I had to help myself while I still could. I hope you never make a bad decision which puts your “morals” to the test because you would be quite the hypocrite when you do what is best for you and/or your family. Walk in someone else’s shoes before being the judge of all that is right and wrong and try to take a look at the world through something other than your rose-colored glasses.

This from Pru Bear sums up the whole situation. The question is do you know how long before the music stops and accounts are settled. Will it unwind all at once or gradually. From a mathematical background, not economic pseudo-economic-science, these things are parabolic and change suddenly, like the way the Dow moves:

“in 2007, when the U.S. housing bubble collapsed, the satirical magazine The Onion demanded that the American people be given another bubble to speculate in. Their wish now appears to have granted. Actions to stabilize the global economy seem only to have created new bubbles – in government debt and emerging markets. Government actions seem to be primarily designed to ensuring continuation of the Ponzi scheme. The only lesson learned is that no Ponzi scheme can ever be allowed to stop.

There is broad agreement that a key component of the GFC was the problem of global capital imbalances. A central feature was debt-funded consumption in the United States that allowed 5% of the global population to constitute 25% of its GDP, 15% of consumption and 48% of global current account deficit. Japan, China, Germany and the other savers funded the consumption. At its peak, the United States was absorbing about 85% of total global capital flows to fund its government and private debt”

I think we have to consider a more widespread reason for this problem. Lenders tell you that you can refinance in a few years. The buyer knows there’s a risk of higher interest rates, but the current lower rate offsets this and the buyer figures they could just sell if the rate is too high. The problem is that there’s an underlying assumption, spread by the media and housing industry – you will always have positive equity.

Also, housing prices would be affordable if these lending practices were not allowed.

Partyboy agreed to pay “under the terms of a contract”. He did not agree to pay, period, the end, without conditions. Corporations are the capitalistic version of individuals without any moral stricture and they use contract terms to insulate thenselves and customers from the hindraces of moral agency. Customers are free to operate as autonomous agents within the agreed upon terms without moral consequence. Both parties are. It’s business, not ethics.

E – You are a prick. Plenty of smart people got caught up in the housing mania. Young first-time buyers don’t have the background knowledge to know when a broker they have know for 10 years is selling them on a bad loan. Don’t be so full of yourself.

What if PartyBoy can’t work anymore? What if his wife lost her job? There are lots of extenuating circumstances one might not be able to uphold their end of the bargain. I’ll bet most people defaulting on their mortgage aren’t happy about it.

As a bank shareholder and customer, I don’t want to hear that the bank was giving out loans that wouldn’t at least break even if the customer defaulted on the terms. The bank should have never loaned PartyBoy the money. When I couldn’t come up with 20% down on my first house, the bank required me to carry Private Mortgage Insurance until I got to a point of 20% equity. And I had to put up 10% anyway.

What happened to all those good lending practices? There should never been an opportunity for PartyBoy to mess over the bank.

I’m not going to make any judgmental comments about PartyBoy, since I’ve never been in his shoes. I think many people would do the same, rather than simply bankrupting themselves to satisfy some huge corporate bank, which probably sold the mortgage to someone else anyway. Just assume, anytime you lend, someone exactly like him is signing the paperwork. And protect yourself.

Leave a Reply