5 reasons to rent in California for the next 12 months – Glut of vacancies, decreasing home sizes, banks get serious about short sales, and uncommon financial headwinds.

Buying a home in the next 12 months seems to be a highly speculative move especially in California even with lower home prices. It is amazing (although not surprising) that none of the potential options for a housing recovery include renting. You will not hear the NAR or CAR echoing to families that renting actually will make sense for a large number of people. The median home price in California was $264,000 in December of 2009 and in September of 2010 it was $265,000. Prices have moved sideways for the year and are likely to move lower in 2011. I would argue that a large reason for the movement was the homebuyer tax credit but also the numerous fence sitters that thought 2010 was the year to buy. Yet as the median price demonstrates, there is little reason to buy because you think you will be priced out. In fact, if you have the itch to buy right now I would say lock yourself into a 12 month lease to protect yourself from impulsive moves like the large herd that went to condo bidding wars. There is no rental lobby but there are many reasons why renting in California for the next 12 months makes absolute economic sense.

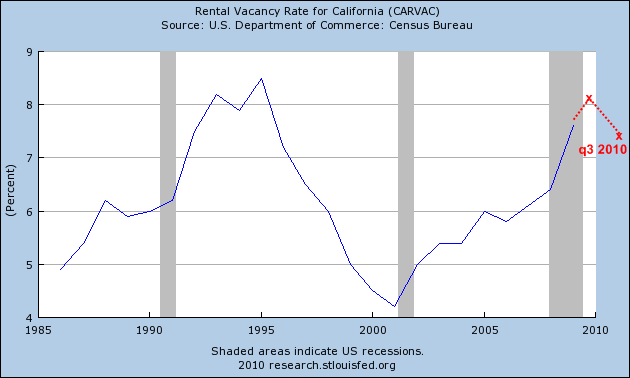

Reason #1 – Glut of vacant homes

The housing market in California is full of empty houses. The pressure for lower prices for both homes and rentals is evident. The above chart highlights the rental vacancy rate for the state. If we add in the massive amount of shadow inventory likely to come online in the next few years, it is likely that there will be more cheaply priced homes hitting the market soon. We are already seeing this trend in many markets with banks getting serious about short sales. In the last few months it looks like banks are targeting the 30 percent price cut range as their starting point.

The vacancy rate has provided an added benefit to finding good rentals throughout the state at an excellent price. Why would you buy today if you know prices won’t be up in 12 months and there is strong chance prices will be lower? Those arguing that inflation will happen in home values clearly don’t realize that the California median home price has fallen by nearly 50 percent. I’m not saying that potential inflation isn’t a big concern and we are already seeing it in oil and other commodities. Yet this doesn’t mean that we will see housing inflation. What this reflects more than anything is a weak dollar. Some will point to the 1970s as an example of inflation and rising home values. But what these people fail to mention is the subsequent wage inflation that occurred as well. This isn’t remotely in the books today and wages have actually fallen for the decade!

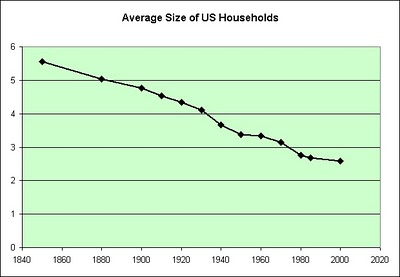

Reason #2 – Decreasing family size

Source:Â Census data, chart IllusionofProsperity

Many families now include two working professionals. Given the volatility of the California housing market many people need the flexibility to move to find better career opportunities. We also have a growing number of DINKS (dual income, no kids) that can make due with a nice loft close to work or an apartment closer to their employment. The above chart shows the obvious trend of decreasing family size. If anything, there should be less demand for bigger homes moving forward. This is one of those odd trends where families have gotten smaller but homes have gotten bigger.

Some argued that the bubble price rise was due to family formation. This flies in the face of all the available data. In California, a working professional family should be renting for the next year so they can see how things play out in the next year with a real estate market that is largely going to need to stand on its own feet. Otherwise, the shadow inventory just gets bigger and bigger and we push problems further into the future. The only people I see that are desperate to buy are those with children of school going age and want to plant roots. Yet this group isn’t the majority like it was in the 1950 and 1960s for example.

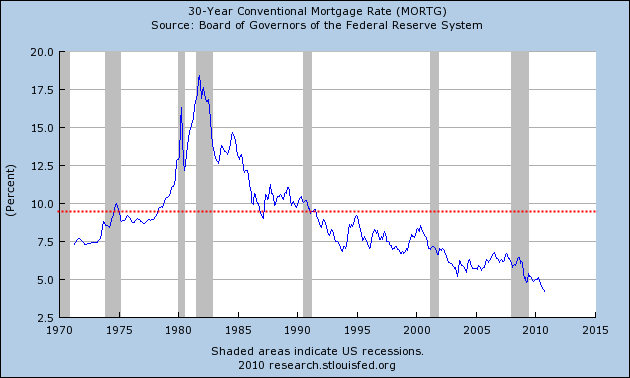

Reason #3 – Interest rates have only one way to move

Take a close look at the chart above. Interest rates have only one direction to move. The red line highlights the 40 year average and we are way below that critical point. One argument that people fail to grasp is that it is better to have a higher interest rate and a lower home price than having a low interest rate and a higher home price. For example, say you are a prudent individual and want to pay your mortgage down quicker. What you want is a lower interest rate because every additional $100 you throw at your payment will save you tens of thousands of dollars down the line on a typical mortgage. Plus, if rates were to move down in the future you would have more pricing power to sell.

Today, the interest rate is at a rock bottom levels. So if rates even return to their historical average, you are left with a smaller pool of potential buyers. Unless you plan on staying put for 30 years and are happy with that, then go for it. Otherwise it would be smart to rent for the next year with so much uncertainty in the California housing market.

Reason #4 – Unemployment

The more glaring and disturbing reason for weak housing prices and a large number of vacancies is the economy. California has an unemployment and underemployment rate of 23 percent. Not only is this not healthy, it brings into question whether people can even pay their mortgage. Without employment wage growth there is little reason to believe home prices will go up. In general the public has a hard time looking deep into the future. Psychology has a cruel way of clouding our vision when it comes to finance (just go into any casino to see this in action). Even during the Crash of 1929 you had many people saying things would be getting better just in a few months. Until this trend reverses, the pressure on home values is going to be on the downside.

Take a look at this data for example:

California MLS listings (non-distressed):Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 178,046

California MLS + distressed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 470,846

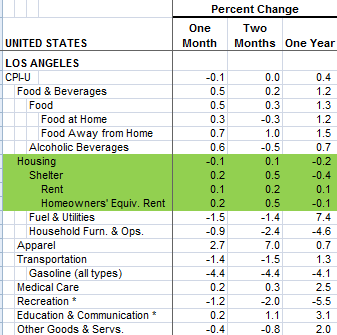

The majority of the distressed inventory is there because of the economy. Sure, we have a large number of people who are strategically defaulting but this isn’t the majority. The vast majority in California and across the country can’t pay their mortgage because of the economy (aka no jobs or weak wages). Just look at the vast difference between MLS inventory and shadow inventory. Renting provides a buffer especially given how volatile the market is right now.  It is also the case that there is little pressure on the cost of housing at least for California:

Anyone arguing that the market isn’t volatile right now is sleeping under a rock because the Federal Reserve just entered unchartered territory part two and is taking the country down an uncertain path. They’ll probably end up doing another big movement to complete the rubber match of financial irresponsibility.

Reasons #5 – California budget uncertainty

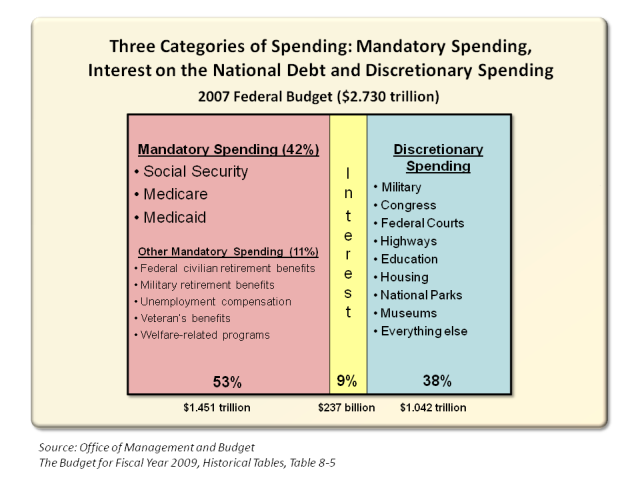

California is borrowing $40 million per day just to pay for unemployment benefits from the Federal government. This is borrowed, as in we have to pay it back. And let us not even talk about the budget gimmicks that were used to plug the $20 billion gap. These things will be back next year. All we did was push the problems down the road. So two things are on the table; either taxes go up or deeper spending cuts will hit. Both will hurt the wallets of Californians. It is amazing seeing the politicians squirm like worms on a hook when asked where they will cut. They don’t want to touch Social Security, Medicare, or Defense Spending. Well that is where most of the money is!

Source:Â Perot Charts

Given these headwinds, renting makes complete sense just to provide you flexibility for another year. People then ask “well can I buy after that?â€Â You can buy now if you want. No one will stop you but looking at the marcoeconomic picture it is likely home prices will be lower by November of 2011 and those who want more financial options and houses to choose from are likely to rent for the next year. The drop in sales shows that more people are starting to get it.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

71 Responses to “5 reasons to rent in California for the next 12 months – Glut of vacancies, decreasing home sizes, banks get serious about short sales, and uncommon financial headwinds.”

“…either taxes go up or deeper spending cuts will hit. Both will hurt the wallets of Californians. ”

I can not fully agree with this. Closing the library every other Friday dont hurt my wallet a bit. I concede it might affect the overpaid librarians wallet a little, but they were napping the last time I returned my late book I had to ring the bell. How about we TRY cutting spending MORE. Spending MORE every year and borrowing to do it hasnt worked out so well.

What are you talking about, “over paid librarians”?

In San Diego a librarian recently retired and is get a pension of over $200K

http://www.foxandhoundsdaily.com/blog/richard-rider/8160-billboard-comparing-head-san-diego-city-librarians-pension-with-4-star-gener

In Sacramento there was a scam about the overpaid librarian overpaying her relative to do contracting work for the library that he then subbed out….money for nothing. Nobody had their corneas and kidneys removed to pay for this rape of the taxpayer.

It will effect your wallet. As more people lose work and income they will make fewer purchases, stop paying mortgages, stop paying bills and taxes, go on unemployment or assistance requiring the government to raise your taxes and fees. More private businesses will suffer as a result and be forced to lay off workers or go out of business. It’s called a deflationary spiral. We are all interconnected no matter how much some may like to delude themselves into thinking we are not. Anyone cheerleading people losing work or pay is a fool.

True there may be some benefit to paying people to be librarians as opposed to paying them to be unemployed.

It never goes well when Surf Addicts strive to talk about libraries.

Err….that’s probably because they were in the back doing all the restocking and clerical that their coworkers who where laid off or forced into early retirement used to do. Every librarian I know is just working double-time and glad to have a job these days.

I don’t see rising interest rates as a huge concern in the immediate term. Rates will stay low for at least the next several years, if not the next decade or two (just like Japan).

Rising inventory, high unemployment as well as large disparity between incomes to home prices will likely be the big 3 topics as we enter into 2011.

In my 60 years on this planet, there has never been a time with so much uncertaintly about the financial future. In the past 2 years, we have considered buying some rental property, to take advantage of the low rates and declining values. Fortunately, we did not take that route.

Today, the future is up in the air for many, many Americans. The meager jobs creation is not even able to keep up with new high school, and college graduates, looking for a job, and the immigrants looking for the first rung on a ladder. This is simply not the time to take on any long term financial committments.

I truely wish that younger people had the type of opportunity that we had in decades past. The reality, however, is dismally grim.

Bob:

I was in San Francisco when you could buy a two flat for less than $40,000.00 and while San Francisco is perhaps now the most overpriced real estate in the nation I disagree with your conclusion about not buying investment property. The right property at a positive cash flow is a good buy in a the right market and/or with a long term hold strategy. If you can make 4 -5 % on your investment on an annualized basis you will be well ahead of “safe” investments (CD’s, etc). There are people actually buying on court house steps and making a bundle here in southern ca. Take a look at this site. http://www.bubbleinfo.com/2010/11/05/200000-flippers/#comments. The all cash buyer himself is intending to develop the property perhaps into condos. He has a decent house for cash flow and if his plans to develop succeed he will make good money. Yes he is taking a risk but one would assume he did some diligence on pulling permits from the city. With 3/4 ths of an acre to work with he may actually have made a good investment. If you really want rental property to create income and have money to buy in you just have to find the right location. I doubt it’s in San Fran.

My family has been renting property in the San Francisco Bay Area for over 40 years. We have not bought anything within 30 miles of SF for over 15 years but we are starting to look as prices keep falling. My one word of advice is to stay away from even looking at SF, Berkeley and EPA due to rent control (and liberal politicians that will make owning property a nightmare)…

A little anecdote about EPA… Back 25 years ago I rented a crappy little studio in EPA during grad school. $350/month the first year – and because of rent control it actually dropped down to $315 three years later when I left. My landlady would vent at me all the time about how rent control was driving her to the poorhouse.

Sold both my houses in early 2007. Been renting ever since. One of the best financial moves I ever made.

I know I get it! The inventory out there is absolute GARBAGE…the worst picked over, leftover trash of the past 5+ years, or delusionally priced nonsense where insane sellers are asking twice the real market value (often they are asking OVER peak prices!).

Thanks again Dr. HB!

First off – this is great information. Secondly, we sold our house in June and decided to rent to shop for a better deal and to give prices time to go down. We live in the Long Beach, CA area and I have seen listing prices drop in the last 30 days. We still want to buy for family purposes but will only do so at a price that factors in the future drops I see coming. Somebody on this site had the best advice if you are buying … think of a low price for the home and knock of another 10% … if they say no walk away and wait for the next one. Things are not getting better. Open houses look like scenes from Ghost Adventures. No living souls allowed.

If you look at the average mortgage rate before 1970 and go back 100 years it is 3% I think.

…that is in the early 1960’s a VA loan was 3% maybe the average back 100 years was 5% for non VETS.

I noted that spike in the rates in the 80s on the docs chart from which he deduces the 9% average. I wondered if that is a healthy average. I sure would rather pay less for money than more. Duh. My Mom said her grandmother advised to never pay more than 10% for a mortgage. I hinted at my age in an above post so you can imagine how long ago my great grandmother was buying property. I still took that advice to lean toward paying as well below 10% as I can. That said as the dr says paying a high dollar for real estate that is financed in a falling market sounds like a bad strategy. I do however recall properties marketed with those assumable VA loans in the 90s when prices were rising and rates were higher. I would think if your property is not underwater and you have a low interest assumable it will sell readily in a market when rates do go up.

Now that Californian’s have elected a liberal Governor, approved 50% +1 to pass the budget, and still a majority Democratic legislature, tax increases and spending will easily go up, to resolve the State budget. On top of that, Californians said no to Prop 23, and now we will see energy costs skyrocket, while unemployment is sky high. California will never recover but become a cesspool of rich environmentalists and activist liberal entertainment executives/stars pushing their save the world agendas on poor dumb Californians.

Arizona looks to me better every day.

You’re right. In ten years CA will be primarily wealthy libs who don’t mind high taxes, government/union workers and the working poor that require lots of subsidies (free lunches, Section 8, MediCal). The wealthy hoods will be fine; middle class hoods will see more multigenerational households as families are forced to consolidate as they attempt to hang onto the California Dream. Middle class exodus will continue as companies exit CA; retirees on fixed incomes will exit as they can no longer afford increased taxes and cost of living in CA as inflation creeps in. No doubt about it.

Learned how to live without water, eh?

http://finance.yahoo.com/real-estate/article/111186/the-ten-biggest-american-cities-that-are-running-out-of-water

This drivel about Prop 25 resulting in massive tax increases HAS TO END. Have any of you actually READ the prop? There is still a 2/3 supermajority vote required for any tax or fee increases.

Not that I think CA is in a great fiscal position, but c’mon people, get your facts straight on propositions that JUST HAPPENED.

In the one saving grace of the election, prop 26 passed. This will extend the 2/3 requirement to all taxes, closing the loophole of calling new taxes ‘fees’ to sidestep the 2/3 requirement. This may even slow down the horrendously ill-concieved AB32 sanctions that are set to ramp up in the coming years.

However, the loss of the 2/3 requirement for setting the budget, while it doesn’t extend simple majority rules for taxation, does put in place a power structure with next to no oversight on spending and no requirement for a truly balanced budget. My own prediction is that we’ll see deficits of $20-30 billion each year for the next few, and while higher taxes are not an immediate consequence of the referendum’s language, it is a foreseeable and perhaps even likely ultimate outcome.

Arizona is a burning hellhole. No way can it be better. Go to AZ…. good riddance!

Please go.

Unemployment will ultimately sink this market. It will remain stubbornly high around 10% for the next few years. Just how long will the banks be able to extend and pretend? A disturbing figure published in the LA Times after last weeeks election said, 34% of all voters in California had been laid off within the last 2 years. If that is true, the housing market is in for a big decline.

http://www.westsideremeltdown.blogspot.com

I think the single most important graph to understand is this one:

http://research.stlouisfed.org/fred2/graph/?s%5B1%5D%5Bid%5D=EMRATIO

This shows the employment ratio vs population. It is a much better gauge of employment than weekly jobless claims.

What it says is we’re headed back towards the days of single-earner households. When viewed this way, the fact that we’re hitting early 2000 prices – at the peak of being a dual-earner society – is not that impressive. It means homes are still too expensive for the average household.

This is a major secular change, and my opinion is that families will slowly come to grips that they only have one income to rely on, make adjustments, and find out it’s not that bad for the family and stress having one parent at home. I think 2011 will be the year that people remember that $1M is actually a lot of money.

actually $1M is not really a lot of money, really its just a single unit and QE2 is rolling 500,000 of these units off the presses over a couple of months with no strain at all, the reality is they can produce millions of these units at will , whereas nice houses that people want to own are much harder to produce ……

The Dr. hit the nail right on the head regarding the numerous reasons not to buy currently. I could only think of one make believe scenario to buy: your family is expanding and you want to settle down, you find the perfect forever house at a steep discount…and you know you will have job security for the forseeable future. Good luck with that one. For people in the real world, keep renting and saving money. Plan B can always be to move out of California. Living elsewhere is so much easier. That’s my plan in a few years if sanity doesn’t return.

When are we all going to get our Dr. Housing Bubble signs and walk the streets chanting about the impending doom! The world as we know it is coming to an end. And NEXT year will be the worst year ever. If not, then the year after that. And if not that year certainly the year after that. Repeat until numb.

I have been hearing this since 2007-2008. Wait wait wait, here comes the big drop. Yet any of the nice areas are still plugging along doing fine.

Most people here have a computer and are college educated. So our unemployment rate is a little under 5%. It’s business as usual for us. If you are our of work and High School educated you aren’t here on this blog trying to time the housing market bottom. You are filling out applications at Target-Mart.

So I ask the upper middle class who plan to live in a nice area (West Side BevHills, Bel Air, San Marino, etc.) what are you seeing? For me, I found a good deal on a home and it had multiple offers and went for asking price in about 90 days. I offered the 10% less but the agent laughed. Now I am stuck even longer in a rental while I wait for the the gult of homes.

2007-2008-2009-2010-2011-2012

Those are not just numbers, they are years of your life. 5 years putting off a family, 5 years without my own garage, 5 years without a surround-sound system I can enjoy, 5 years dealing with loud neighbors, 5 years of smells coming through the floorboards, 5 years of waiting. But on the positive side, yes, 5 years of savings.

Wat what point do we say – this isn’t going to happen. Housing isn’t going to drop in areas we want to live. The homes the bank is holding on to are in the undesirable areas we won’t live anyway. At what point do we get on with our lives and pay the premium? As we have seen the nice area do not have auctions and foreclosures. Are you ready to move to victimville and get that run down home at an auction?

I would be happy to eat my words in 2011, but I will search this post next year when we are talking about the impending doom in 2012.

“So I ask the upper middle class who plan to live in a nice area (West Side BevHills, Bel Air, San Marino, etc.) what are you seeing?”

Sean, not sure if you’ve been paying attention but prices have been coming down. Look at some of the areas you mentioned. Beverly Hills, Bel Air, San Marino. Are you a moron? These areas will always be expensive. We’re talking about Culver City, Pasadena, or Cerritos for example. These areas are falling and seeing double digit price declines. If you want, why not rent in the above areas?

The median home price in Southern California has fallen by over 40 percent. That is doom for most. Stop whining and hoping that Bel Air or San Marino is going to cost a few dollars. You are looking at 1 percent of the California market through a delusional lens. Most people want to buy in middle-class areas. You are hand picking the most elite of the elite areas.

Marc,

The home I was looking at was actually a Pasadena home and I lump that ares in with San Marino and Beverly Hills. Pasadena is not dropping in price in the nice area either. Unless you travel to the rough area in NW Pasadena. So to answer your question, nope not a moron. I have been watching the home prices like a hawk. They may have dropped 10% from the peek but only after jumping 2-3 times in price since 2002 time frame.

Gambling on another 10% drop on these homes amounts to very little. That is my point. You are still at 1.9 to 2.9 times the price in 2002. If you miss out on a home you like to save 50-100K is it really worth it?

What we need is an entire crash of the housing market in these areas like what happened in the Inland Empire. I want it to happen but I don’t know how much time I have to wait. Which was the point of my thread. How long is to long to wait?

Areas where home prices were > 600~700K back in 00′ are probably going to stay million dollar homes. Areas where 200~400K homes became 500K~1M homes still have room to fall. Areas where homes were < 150K back then have already fallen significantly, and decreases in those homes will be marginal. (Disclaimer: Just a generalization)

It's up to you to decide where you fall in and how you want to go about your home purchase. I don't see buying as a bad thing in the current environment if you have the money and don't plan on using the home as any sort of financial investment in the near future. Stay in it for a long time and I'm sure you'll be a happy owner, and so will your family as well. The Idea is that there's only so many 'premium' areas that can be upper and upper-middle class. The rest are just very nice areas available for dying population of middle class residents.

Speaking of 'upper-middle class,' the areas you list are stereotypically upper class areas (million dollar homes) that have middle-upper class residences ( 500K) surrounding it. If you’re more interested in the latter, it may be worthwhile just to wait one more year and take the plunge in winter of 2011. Sure, there is the emotional burden of waiting, but personally, the emotional burden is a small price to pay for potential of saving an extra 50~100K to put into a greater quality of life. I’ve decided this to be a better investment in my family’s future than to settle just 1 or 2 years sooner. (I’m sure you’ve thought the same since you haven’t bought yet)

Sadly those 500K homes are complete garbage. Junk! Trash! I am ready to give up on housing. I fear that 500K homes is really a 100K home in a good area a new paint.

“Those are not just numbers, they are years of your life. 5 years putting off a family, 5 years without my own garage, 5 years without a surround-sound system I can enjoy, 5 years dealing with loud neighbors, 5 years of smells coming through the floorboards, 5 years of waiting. But on the positive side, yes, 5 years of savings.”

I feel like you, Sean. The past ten years have been ten more years with crummy rental kitchens and no equity built.

But the last decade has been a lost decade for nearly everyone but the bankster scum who’ve enriched themselves on our destruction. We have, most of us, lost equity, income, and often our livelihoods. And worse may be on the way.

Just think… would you be in better shape now if you’d bought some overpriced house and were now watching your equity vanish? The trend in your area is down, as it is in nearly every locale in the U.S., and we will spend the next 10 years, if not longer, liquidating the bad debt we accumulated in the 00s.

We still have boatloads of bad debt to liquidate, so you might want to sit tight and maybe move to a better rental. I’m sick of waiting, too, and scope out the MLS every day with baited breath. But given my area has the highest foreclosure rates in Illinois, it will pay me to sit on my hands awhile longer.

We’ve waited this long.. .we can wait a few minutes longer.

dead on. I actually laughed at your post because it is so true! year after year we hear about the “BIG DROP” in price…hahahaha.

Sanderson, we’ll probably never encounter any single instance where home prices drop significantly, but I’d consider the loss of 20~50% equity from 2006 to 2009 a big drop.

Also, if you take into consideration the winding down of subprime resets in 09, QE1, home tax credits, FHA loans and very, very low rates, it’s understandable why deflation slowed down since 09.

Whether there will be another significant drop depends on how the next wave of defaults from option arms resets play out, whether the Fed intends to stop QE2 at its introductory limit, unemployment rate (and number of people who can still receive it) and other possible interference from the Fed. I think there’s tremendous downside that cannot be ignored. If the drops do come, I think q3 and q4 of 2011 will be the most likely time we’ll start seeing further drops. If we don’t see any significant drop into q2 or q3 of 2012, I think there is less risk of deflation and higher risk of stagnant home prices. They’ll simply hold or decrease marginally until the end of the decade.

Just my 2 cents

Sean, are you joking? Give me ANY, ANY zip code and I will show you and enormous amount of bank owned homes and NTS not on the market relative to what is actively on the MLS. Beverly Hills, Bel Air, Malibu, San Marino, La Canada take your pick. Throw me some zip codes! 91011, 90210-90212? Hell, go to realtytrac and type in any zip code you prefer and see what pops up. The homes are bank owned and they are not on the market – they are the shadow inventory and they are not in the ghetto.

Even funnier, you say these areas haven’t dropped, well check the median price per square foot or even median sales price from 2005/2006/2007 versus 2009 and 2010! 2009 in any of those areas was most likely around 33% off peak sold prices/ppsf, 2010 thanks to the credit bump it’s probably 25% off peak on average! Just because you still can’t afford it or it’s too high in your mind doesn’t mean it hasn’t come down significantly, even in the best neighborhoods, in the past 5 years.

As for how long to wait, that’s your choice. Put your money where your mouth is and buy

91108 – Go. Show me actual sales of homes lower then previous selling prices. Find me anything near a 2006 level price.

No followup Noobz? Where is the info you said you would provide?

Sean, I’m with you for the most part. At some point you’ve got to jump in if home ownership is your goal. We waited on the sidelines for several years as we saved for a 20% down payment. We closed on a house last month. We (really my wife) was tired of apartment living and we plan to have more kids so we wanted more room. Was it the best financial decision? Only time will tell. But it was absolutely a quality of life decision.

All the stars seemed to align: We had 20% down, comp rentals were as much as a house payment plus maintenance, a short-sale was available very close to a great elementary school, and the two most important things, PI is 20% of gross income and I’m confident in that income for the next several years.

Excellent post, thank you. You can’t get years of life back.

This High School Graduate is sitting on 600K profit from my house sale in 2005, waiting for prices to fall.

The FED wants me and everyone to capitulate. Why earn 1% on 600K 550 a month or so, and fork over 2500 a month in rent? It would seem as though that would not make sense, but it does when you calculate taxes, ins, maintenance and likely rice declines.

As the months go by it can be depressing but times are uh changin”. The last 3 months I have seen massive price drops in the nhoods I have been watching.

Banks will not be lending as freely as they did for many many years to come and average wages just don’t support the current price level. I am very encouraged with what I am currently seeing in the local San Diego housing market.

Sean, I hear – and feel – your pain.

I’ve been wanting to buy a house since – worst timing EVER – the mid 2000’s. Or in other words, just about the time housing started to go ballistic.

Here’s the most personal example I can give: The house I’m currently renting – an 800 sqft 2bed/1bath tract home built in 1950 with a converted garage – was valued at about $200K in 2000. At the peak of the housing insanity, houses just like this in the neighborhood were going for 750K!

That’s more than TRIPLE in far less than 10 years time.

And now? People in the neighborhood are still asking 500-600K (or more) for these little shoeboxes.

My point is, everybody whines and moans about the 30-40% decline in real estate prices in SoCal, but never in relation to the 200-300% INCREASE that preceded it.

Cry me a freaking river – you’re still 200+% ahead in under 10 years!

I, too, am beginning to believe median home prices will never reflect median income reality here in SoCal. The government will literally destroy the entire economic health of the country before they let free market forces rule.

And I’ll continue to have to rent.

Sean, let me tell you a little anecdote…

In 2001, my girlfriend bought a house. We were getting serious, but hadn’t gotten married yet, and I wasn’t ready to buy a house. But, she made a lot more than I did, and really wanted to buy. I was wary about it, but I was young and stupid so I moved in with her into HER house, and just paid rent to her which she put towards the mortgage. She soon got all HGTV on me, going on about the house and spending every waking hour doing some b.s. improvement on it. Meanwhile, our relationship went south due to me making less than her, and not even having the good sense to be ashamed of it! She worked some high-pressure job she hated, and was a miserable person who tried to make up for it by buying stuff. I actually liked my job even though I made less than her, and as you can imagine there was conflict. Well, long story short: we broke up, I moved out, and she had the yard mowing to herself.

I moved into a little apartment, which I thought would just be a temporary thing. But, thanks to the housing bubble, I am still there today. As I looked around at the craziness of the housing market, I figured that I had been “priced out forever” and decided not to worry so much about making money or buying a place of my own. While my ex continued to live her materialistic lifestyle, I was a musician and toured the world. Then, when that got old, I went to grad school in a subject that interested me. (I also got another girlfriend who is younger, more attractive, and most importantly NICER than my ex).

As I look back on the last decade, I would have had a lot less fun had I taken the plunge and bought a house myself. If I had worried so much about what society dictated, I would probably have married my miserable ex-gf, would have pooped out a kid or two, and today would either be in a miserable marriage in an overpriced house, or divorced and living in a little apartment. So, just like I am now, but with alimony! So, hey, it coulda been much worse. Boo hoo, you didn’t buy a house or start a family. Sounds like you came out on top to me!

But, if you are really serious about starting a family, I hear recent findings by scientists have shown that kids can grow up just fine living in rented property. Really.

Thanks for that. It is a good perspective. I did have fun and I really don’t have many worries about being tied to an anchor of a home.

Interest will increase as the US keeps printing dollars. The affects might take awhile, but it’s coming.

Miriam-Webster: “Except when your topic is psychology, you will seldom need the noun affect.”

affects means changes in

I agree with 12:03

One interesting thing about this recession is the benefit it has given to some business owners. The business owners I know have almost all been able to upgrade their employees and / or lower wages for employees. The labor market is such that they can take the bottom 40% of their performers, terminate them, and then hire better newer people for less money.

That is the point of a recession – the people who own businesses get more power vs the employees and the employees get less power.

This is true even if you just speak about Southern California. But when you factor in the fact that the internet makes it really easy to shift jobs to places like Texas, you get even more downward pressure on wages. Lower wages CAN for many businesses mean higher profits for the business owner.

Be aware of the fact that in the exurbs of Dallas and Houston, your employees can buy beautiful new houses for $150 thousand dollars. What that means is that employees who are very reliable and smart can be hired there for much lower wages than what you have to pay people here in Southern California. I don’t have to tell you that the costs of insurance and benefits are lower in Texas as well.

So among business owners I know, the recession lets them pay lower wages to californians and also the internet allows them to move jobs to Texas and other more reasonable places.

Many of the best houses in my neighborhood are being purchased by business owners. I would encourage everyone here to speak to the people buying nice houes in your own neighborhood see if you see the same pattern.

If anything, business owners are looking to buy multiple lots and merge them

And I love visiting Manhattan Beach on the weekends – if you spend any time around 8th and the Strand you will see the family that bought three houses on the strand and tore them down to build a large house on three lots. The family is super friendly with the mom active in the PTA and the dad often seen surfing in front of his house or BBQing on his covered front porch which borders the Strand. This family told me that after they built their house the rules were changed to encourage other families to buy two lots and merge them, but to forbid other families from buying three lots and merging them. As a result you see other double lot houses going up but no other triple lot houses.

Again, the people are usually super super friendly and will tell you that they are business owners. Talk to them and they will tell you that they are doing their hiring outside California.

So I agree that people in California who are employees are in trouble, especially if they have skills that can be replicated in Texas. And in many neighborhoods that means house prices going way way down.

But there are rays of sunshine for the high end

And in Manhattan Beach, if you spend any time around 8th and the Strand you will see the family that bought three houses on the strand and tore them down to build a large house on three lots. The family is super friendly with the mom active in the PTA and the dad often seen surfing in front of his house or BBQing on his covered front porch which borders the Strand. This family told me that after they built their house the rules were changed to encourage other families to buy two lots and merge them, but to forbid other families from buying three lots and merging them. As a result you see other double lot houses going up but no other triple lot houses.

“That is the point of a recession – the people who own businesses get more power vs the employees and the employees get less power.”

That really depends on the business. I’ve known some that do upgrade their staff, and I’ve known some that simply closed down due to the recession. Businesses generally decrease in revenue (and profit) during recessions. Replacing workers with better ones at lower wages increase efficiency, and therefore help some companies do even better. However, that does not always fix the bottom line of a business in decline. A business’ purchasing power into the talent pool is ultimately decided upon by whatever resources it has.

My sense is that DHB is absolutely correct regarding CA–I’m betting that the time frame might even extend out to 24 months. Or more.

It essential for people to stand back from the usual NAR drumbeating of “act now or be priced out forever!” A strategy of pressure and extortion that no one should capitulate to ever.

CA housing insanity didn’t stop at the state’s borders, either. Where we live, pension-and-house-sale-millionaire Boomer Californians reshaped many rural and upper middle class areas with their consumerist dreams of Puget Sound Lifestyle, to be secured through bailing on their home state after making their bundle, and flipping houses for the rest of time. They never envisioned that the people back home might not be able to afford an exponentially escalating tax burden, or might politically reject that. Nor did they envision that those of us who don’t speculate might not appreciate the hardening class divide they aimed to import into our communities…for THEIR benefit.

There are tons of distressed properties sitting on the market here, but their owners–many of whom have blown town already for what they hope will be greener pastures elsewhere (meaning somewhere they can feel like the richest people around, compared to their new neighbors)–still won’t cut the prices to what local incomes can support. They actually believe it will someday be 2006 again.

Doc, the growth of house size is in part due to expectations and luxury. But it also is accounted for by the restructuring of American personal and social life since Reagan. That too was tied to access to easy/consumer/revolving debt.

What evidence is there that banks are getting serious about short sales? I’ve had my place listed as a short sale for 4 months with 4 offers and the bank declining every single one. Our last offer was easily more than the home was worth. Same model selling for 15k less within the past 6 months. At 2 years delinquent I can’t get them to take a short sale or foreclose the place for that matter. I guess I’m sort of a strategic defaulter, but at the same time I was going to lose the place to a balloon payment in a few years anyway so I’m choosing the time, but the house was gonna be lost either way. I’ve already moved(5 months ago) and informed the bank that the house is vacant and still they won’t accept a short sale or foreclose the place.

Sorry for the double post, but on a side note I’d really like to see the number of people that have large balloon payments coming up over the next 5 to even 10 years. None of these people will never have the equity to be able to refinance and most are barely paying the interest on their homes. How many homes will be lost to 80/20 financing with 5-15 year balloon when the values are down 60%. I asked the bank about it and they assured me I’d be able to refinance because the value of the house would go up. I wonder how many people don’t even know they have a balloon payment that is a ticking timebomb?

Banks probably want to avoid short selling as much as possible. They’ll let owners consider the possibility to leave some options open, but depending on the status of all the other short sales and the effect they will have on the balance sheets, they’ll hold back as long as they can while signing as few as possible.

So, if you currently own (using the term loosely) an overpriced home in a still bubbly area of California and have little to no equity….should you sell it and rent?

I was a believer interest rates, currently at artificial rates in the last 12-14months would rise eventually atleast to a historic level of 7-9% . When rates go up, home prices do the opposite. But why EXACTLY would interest rates rise? Inflation? Bond Investors? No more stimulus? We keep preaching interest rates have “only one direction” to go and that is up, but when and how this occurs seems to be more of a mystery to me as these aritifical rates stay where they are at. If these artificial interest rates stay where they are at for the next 5 years, there will be other reasons why housing prices remain flat or decline, such as unemployment and home equity, but interest rates won’t be a reason.

I too believe that higher interest rates are a plus. This brings home prices down saving CA home buyers from paying too much property tax, forces banks to get back to functioning as Banks were designed to. Making money by loaning money, providing savings accounts that paid competitive rates helping the retired to pay thier monthly bills and possibly opening up a few more jobs for young people that these retired folks took to make ends meet. Banks can then flush out thier bad assets in lower valued properties while not depending on the tax payer’s dollars to keep them afloat. How do we force the Banks to step up and reject government control and start learning about customer service again, Customers – The people who’s hard work and money that built the Banks.

We are still deep in a Bubble here in Ventura county with many Home owners still trying to become over-night Millionaires by priceing thier homes at over 100% profit. Hard to believe but plenty of proof. How stupid do they think we are? Many of these numbers are not hard to find and are well worth the effort to protect our wallets!

Thanks Doc for another great Article!Â

Â

Observations from someone who has been envolved in every phase of RE. Now I would be very concerned about the documentation of title. We are going to wake up and find that the titles of hundreds of thousands of homes have been clouded by the careless and botched handling of recording of loans as they have been re-assigned from one lender to another. This whole MERS fiasco of electronic assignment and skipping documentation in county recording offices can come back to haunt you. A property without a clear title is a zombie. It can’t be resold or financed because you can’t get title insurance. This is a nightmare waiting to happen. Another reason not to buy at this time

Sean,

Like the rest of us Gen X and Yuppy larva (or whatever they call the Boomer spawn), it’s time to stop pining for the life that the Boomers had, and adjust our reality for what’s actually happening. In short- don’t blame the housing market for your own refusal to start a family. There is rarely a “perfect time” for anything in this life, and there’s no shame in renting (especially with landlords getting more and more desperate for good renters). One of the most financially stable families I know rented for YEARS in not-so-fashionable areas with good schools, and only bought a home when they found a good home for the right price (after their youngest left for college, no less). Now they live in a home that’s almost paid off in a more fashionable neighborhood than my parents (who over extended to buy when we were young, and are now over-mortgaged and under water). And their kids both went from extremely good public schools to amazing universities.

So in short, there is NO real downside to starting a family while renting in your neighborhood of choice. We’ve just been brainwashed to think there is.

We do live in interesting times. Some play the same game-liberal this blah, blah. But conservative Texas now has a bigger budget deficit problem than us(proportionally). AZ is not that far behind us proportionally. So much for low taxes and business friendly policies . I think this one transcends philosophy-both conservative/liberal politicians have shown they don’t have a clue on what to do.

I think we are facing a major problem. It is very hard to read the tea leaves now. I was looking to buy investment property for cash flow-but right now just decided to wait and get a clearer picture. Are we going to follow the path of Japan and long term deflation of assets/stocks etc. Or will we face a sudden collapse and face massive chaos-not entirely out of the picture. Nobody knows.

I think the doctor is right, best to wait and see. if you have cash-you can always get in later-not like property prices are shooting up. But the winds are blowing in multiple directions and the ship is being tossed around.

RE: 11/9–caboy, I agree with you overall about a “state’s business climate”–reflected often as politics–is irrelevant in how this all is playing out.

The question isn’t whether a state is liberal or conservative, Democratic or Republican, Column A or Column B.

What’s at issue is how hard and far each state and area or region bought into the globalized speculative fiat currency magic inflating debt balloon consumerist model. I call it Reaganismo for shorthand, since its uber-rise allied with the burgeoning telecommunications sector at that time. But Clinton was a key practitioner and preacher of the model as well.

Sadly it seems the best American voters can come up with is either voting for bums or “throwing them all out” even when it’s stupid (Russ Feingold comes to mind).

As far as the global power interests are concerned, we’re all migrant labor to be exploited at whim and automated will, to harvest maximum profits with minimum sharing. It’s feudalism, but with robots.

Interesting thing about wages, the work that I do, which is Unix systems administration and programming, I found a unusual phenomenon about California wages regarding my career. I specialize in Linux and Solaris large, high performance systems and found that Los Angeles salaries despite the derth of people with my skill set are low for the cost of living. Now salaries in the Bay Area, Chicago, New York and DC actually reflect the supply and demand for my skills but not LA.

And above, an interesting comment about Texas and lower salaries. I found that in Dallas and Houston, for what I do, my salary is the same or HIGHER! I had an interview with a firm in Houston that will pay me much more then what I make here in LA and the cost of living in Houston is 40% less.

My wife loves the idea of being able to buy a nice home in a nice area with good schools (Kingwood) for the cost of a run down 1 bedroom condo in Pasadena.

But it would be a hard choice to move, weather not being the main concern, I lived in Japan which has the same dreaded summer time humidity/dew point combo. But the lack of good Japanese grocery stores (wife is Japanese) and the small Korean stores can’t really compare to the good Korean stores here in LA.

It is tempting though….

I’d actually feel ‘rich’ in Texas.

I am in a similar line of work and have been contemplating an out of state move as well for the same reasons. For $700k you can by a really nice house in a nice part of Texas or Colorado. And some parts of Texas, like Austin, are fairly progressive – although they’re definitely still very much Texas; no mistaking it for CA.

If the lack of Asian grocery stores is the only thing holding you back, I’ll say this:

WTF??? Make the move!

Dallas, Houston, Austin, etc. aren’t exactly backwaters – I’m sure you can find something to suit your tastes there. Besides, with the money you’ll be saving, you can afford to airmail food from the country of your choice.

Seriously, go to Realtor.com and take a look at some of the houses you can get for the same amount of money you’d spend on a ratty 1-bed condo in Pasadena. For a couple hundred grand, you can literally get a 5 bedroom house on ACREAGE with all the granite/marble/stainless bells and whistles you want.

Yee-hah, indeed!

Move away from CA, don’t look back. Feel rich. We are forced to live in SoCal, Pasadena, as my husband has a very specialized PhD. We are just poor renters, unable to have a family for the cost (I free lance and would have to quit for a while given the nature of my job). His $100k salary is not enough for a family IF we think ahead to the necessity of a good school, in neighborhoods we just can’t afford, and never will. So go. Go for us, go for me. Order your special food over the internet – open a store in texas to service everyone else who is leaving.

None of us reading this blog have experienced RE deflation only short corrections during a long periods of housing asset inflation. It seems that most view Calif RE as increasing in price which justifies current pricing along with improvements but this viewpoint may be based solely on the false belief that long term deflation is not possible but if household income does return to single incomes and unemployment stays elevated then longterm housing price deflation could be the new normal.

Here is one example: A home at 114 Roosevelt St, Napa Calif custom built in 1961 for about $16K is on the market @$299K. The insides are worn and need replacing and the neighborhood is now mostly Latino with most homes in the $250K to $300K. This home on an inflation adjusted basis should be offered @ 125K and that is if it was in new condition ! So does this home head back towards its longterm inflation adjusted price or is it a buy at 299K putting in the needed maintenance of 25K?

Hi ron,

How much does the property need to decrease in price before it counts as deflation? If you mean a long extended period of deflation I agree.

There a LOTS of things that factor into any properties price. But 2 things to are good indicators are how much do people make in the area and how much are people willing to pay to live in the property. How much do the people living in the area make and how much are similar houses in the same area renting for?

We are already in a dirty ass depression. The Republicans are going to axe the unemployment benefits for 3 million Americans by the end of December…and the whole housing house of cards is going to come crashing down. House prices in California will crash like nothing we have ever seen in the history of this nation. Californians will be kicked out of their houses and will be walking the streets like homeless American dead zombies.

Meredith Whitney says decades of mortgage problems

and hosuing to go down starting now 2010.

http://www.youtube.com/user/TheNewWaveSlave#p/a/u/0/IdUPErXvtoI

Leave a Reply to FormerAptBroker