California budget means lean times for the state – 5 reasons why the California economy will lag for years to come. High paying jobs gone, shadow inventory, state taxes, and re-writing history.

It appears that the longest stalemate in California’s circus like budget process is now coming to an end. Before you throw up your arms in glorious celebration, a large part of the proposal seems to rely on cuts and more financial gimmicks. Yet with no actual financial reform since the real economy flew off the overpass, it is likely that California is in for a long drawn out decade. Of course all of this can change if we can find another bubble or another Enron-scheme to trade worthless contracts to enrich the state at the expense of others but the game of easy money seems to be coming to an end. We still need to plug the $19 billion gap and merely having the budget is the first step. The hard part is enacting the proposal. Anyone was able to sign on the dotted line for a $750,000 toxic mortgage but keeping up with the payments for the long haul was a losing proposition. Housing cannot recover without the real economy recovering first. Today we are going to look at 5 reasons why it appears that California is going to face austerity for the next decade.

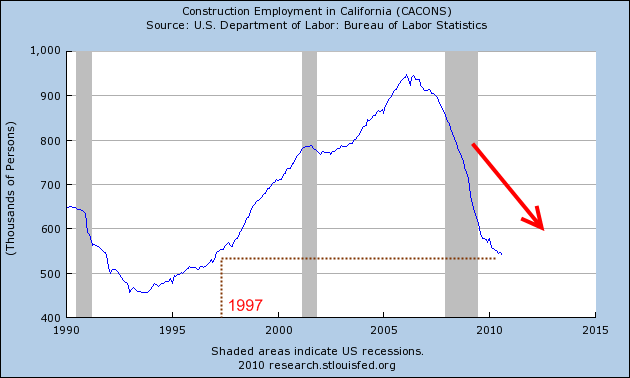

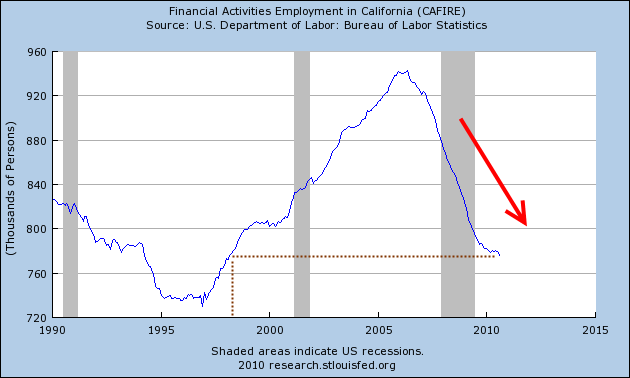

Construction and finance jobs back to 1997 levels

We have the same number of people working in construction as we did in 1997. Of course the state has added over 5,000,000 people since that time. The contraction in construction has been incredibly severe. And the issue here can’t be resolved overnight. We basically built enough housing to keep us going until 2015 and ate up the money during the good times. Another industry that is tied to the hip to housing was the financial industry:

I can’t tell you how many people were making large incomes during the heyday of the housing bubble by pushing people into toxic mortgages but it was a good number of people. What was interesting psychologically is many of these people in the industry believed their own rhetoric and went out and bought incredibly expensive homes with the toxic mortgages they were selling. This was fine when $200,000 a year was flowing in but it was unsustainable. Just go on Craigslist and take a look at the used auto sections. You’ll find a large number of foreign luxury vehicles being sold at fire sale prices. Like the California budget, the issue is always around sustainable cash-flow. The state didn’t mind because it was winning on:

-Higher property tax assessments from home sales (reassessed value)

-Big state income tax collections from commissions

-Sales tax revenues from people spending this money

It was a game of musical chairs for the state and those in these industries. And make no mistake, these were good paying jobs. Yet in today’s market where the only game in town is government backed loans, many of these industries are gone for good. You tell me what other industry is going to pay people six-figures pushing people into inflated assets? Even good entry level jobs in healthcare don’t come close to what some people were making. So it is very doubtful that California will see this revenue stream comeback from this group anytime soon.

Shadow inventory will provide lower priced distressed properties for years

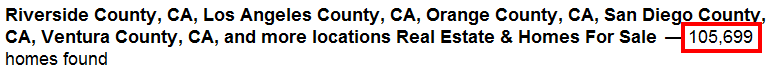

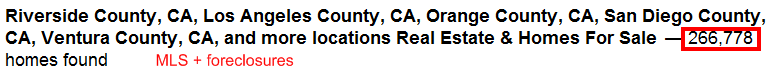

I’m not sure if the public fully understand the magnitude of shadow inventory on bank balance sheets. I suppose if they did, it wouldn’t be called shadow inventory. But take a look at the above snapshot. Currently in Southern California we have approximately 105,000 homes on the MLS. But if we include foreclosures (not necessarily on the MLS) the figure just flies off the charts:

What do you think is going to happen with the 160,000+ properties in the foreclosure pipeline? Do you really think these will cure and suddenly become current? The troubling fact is California is littered with many Alt-A and option ARM foreclosures that are now hitting the market. We’ve now shown a steady flow of high priced foreclosures selling for hundreds of thousands off their peak price.

You can run this data for up North as well:

San Francisco County, Marin County, and Sacramento County MLS:Â Â Â Â Â Â Â Â 8,314

Plus foreclosures:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 27,656

The banks are merely hiding the junk. They’ve been slowly sweeping the toxic inventory under the taxpayer rug for the last three years hoping miraculously the market would recover. If they flood the market we’ll have a crazy few years. If they decide to leak properties out, you can rest assured we will have a lost decade in housing that will also serve as a drag on the real economy (i.e., Japan’s lost decades). The market will adapt to this hoarding behavior and eventually folks will start assuming holding out patterns waiting for the steady leak to hit.

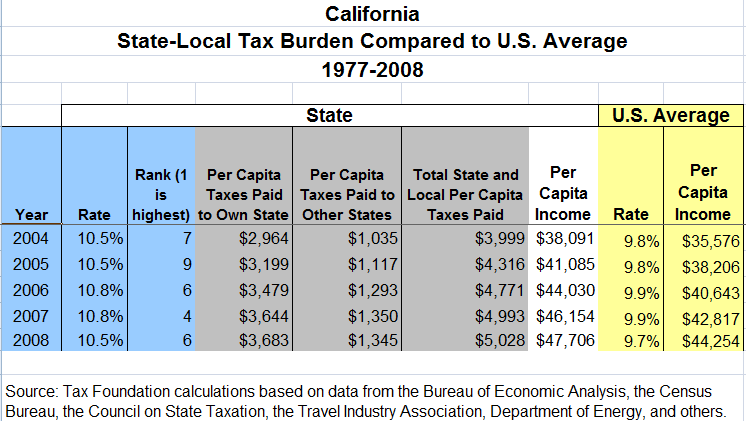

State tax burden

The California tax burden is relatively high compared to other states. However the counter to this is the low property taxes as we will show shortly. In California, a large part of the state budget (over 50 percent) comes from personal income taxes. Other taxes include sales taxes which hit consumers yet again on the buying end. As much as people don’t want to hear it, there is only two ways to balance a budget; you either cut or you raise revenues (i.e.,taxes). I haven’t seen any solid argument showing an industry that will step in and employ 2 million unemployed Californians. So the new adjusted reality has to reflect this new structure. It doesn’t matter who is elected the next Governor, we have structural problems in the state.

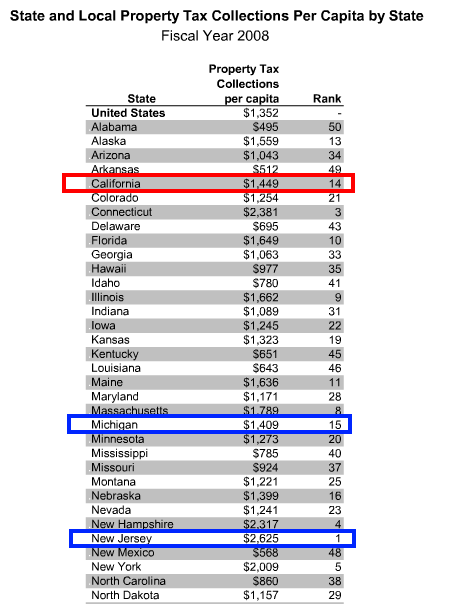

Property taxes in California on par with Michigan

Because of Prop 13 property taxes in California are relatively low even though property prices are some of the highest around. California ranks near Michigan in terms of property tax rates per capita. Yet I’m not sure why so many people are confident that no one will ever change this in the future. We are beyond arguing economics anymore. The new changes will be politically motivated and states around the country are hurting for cash. The Federal Reserve is merely monetizing debt to help out their crony banker friends but the rest of the country doesn’t have access to this money machine.

Yet things haven’t changed here so we can only go by current law. Take a county like Riverside that has seen property prices fall from the mid-$400,000 range to $200,000. In this large area when people buy these homes taxes will be assessed on half the value. So these local governments are going to have to cut back on services. You can see why boom and busts are horrible for planning out financial strategy. This is like your family income being $250,000 one year and $35,000 the next year. How will you plan for the next year? California has basically used the strategy of spend everything as it comes in.

History nostalgia and jobs

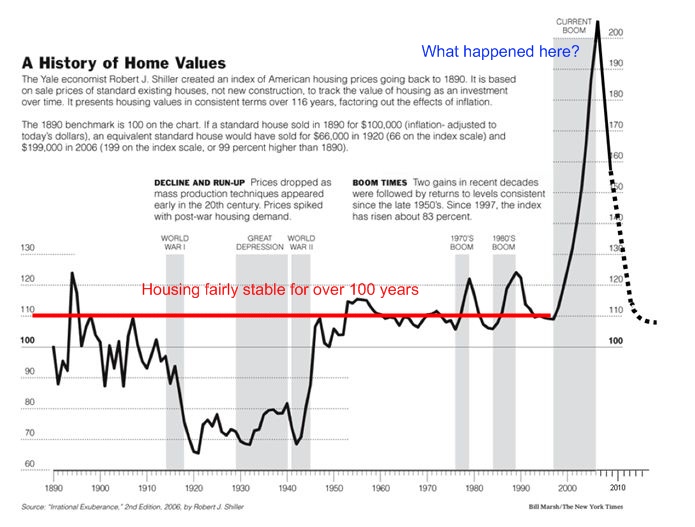

I was listening to the radio driving on one of these oddly hot fall summer days and a radio guest said something that made me laugh out loud. The topic was people walking away from their debt. The person was trying to make a moral argument about how “bad†these people were and how they were hurting their neighbor’s home values. Of course, this myopic guest didn’t talk about how big banks were walking away from their bad debt and how immoral that was but that is another story. Yet the line that stuck in my head was, “it is sad because our parent’s generation would have never walked away from their mortgage.â€Â Well no crap Sherlock! The past generations had to go in with 20 percent down payments and stick it out with either 15 year or 30 year mortgages. They didn’t have paper mill mortgage factories tossing out options ARMs, interest only loans, and other no-doc crap on their platter. They also didn’t operate against robo-signers and flat out criminal like behavior in the mortgage market. It is also the case that we’ve never seen a housing bubble like this thanks to a completely de-regulated Wild West Wall Street:

So to make the moral argument is nonsense. See, in the past if you walked away everyone would look at you like a financial newbie because you had to put 20 percent into your home (frankly, it was very unlikely except in extreme cases that a strategic default would occur). Today, if you bought a home for $500,000 with zero down and the home is now worth $250,000 why in the world would you stay in the place? It just doesn’t make economic sense. Banks have robbed the country blind and they are only standing because the public has bailed them out. Now there is this propaganda that TARP is nearly paid back. Well let us all do a happy dance! This is like someone betting $50,000 on one hand of blackjack and busting. They reach into their neighbor’s pocket, take out $50,000, make a bet again and win and then pay the money back. What good investor they are. And all we had to pay for their gambling was with our real economy:

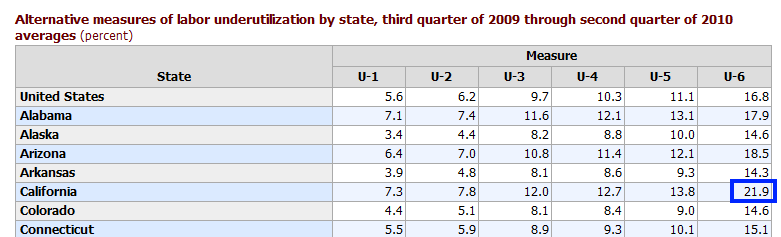

This is straight from the BLS website. California’s U6 rate is close to 22 percent from the 3rd quarter of 2009 to the 2nd quarter in 2010. So in fact, this actually understates the true underemployment going on. We are now three years into the bailouts and Wall Street shenanigans and most Americans are now poorer than they have ever been. And someone is arguing that typical Americans should pay their mortgage no matter what? Give me a break. This is exactly why you have large down payment requirements to begin with.

If these history revisionists want to preach about something why don’t they talk about the 20 percent down payment that was typical in the past? Why don’t they argue for bringing back the separation of investment and commercial banking? It seems like their parent’s generation did well under this system. Of course they won’t argue this because they would rather argue a narrow focused ideological battle that has nothing to do with historical economic facts.

California is in for a long haul. I hope wiser heads will prevail going forward. It is rather clear what works and what doesn’t and now we need the actual reformation of the system to be implemented. I’ll believe it when I see it.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

51 Responses to “California budget means lean times for the state – 5 reasons why the California economy will lag for years to come. High paying jobs gone, shadow inventory, state taxes, and re-writing history.”

Average pay for teachers in CA. is $70,430, per NEA. In some cities, over half of the public employees make over $100,000. a year. No wonder property prices are high.

When you pay someone $100,000. a year to cut the grass on baseball fields, you are going to distort the value of a house.

Nice job completely ignoring all the painstaking fact gathering, data monitoring, nuanced reasoning, deep reflecting, and careful writing that Dr. Housing Bubble did in this entry…in favor of a knee-jerk anti-labor/anti-teacher/anti-union rant.

Yeah, teachers getting paid one standard deviation over median income after 20 years of service doing a job you couldn’t get me to do for seven figures–that is entirely responsible for all of California’s problems.

Keep telling yourself that as BoA and the rest of the Free Bling Circus run roughshod over everyone and their bought-and-paid-for politicians pander to them, while the quant boys evade responsibility by setting up computers that run Wall Street and the Economy.

http://en.wikipedia.org/wiki/Colossus:_The_Forbin_Project

rose

Yeah, you’ve got to love the speed at which these nonsensical comments get posted. The “cadillac welfare queens” canard has now become the “$100K/year gub-mint lawn mowers” and “$70K/year entry-level ‘union’ teachers.” None of these really exists, of course. But you will never win an argument or even come to any compromise when the other person is nothing but a doctrinaire.

Solution to our government malaise: Arms length transactions, no more Quid pro quo, by elected representatives and corporate or union bosses; Transparency, full public discloser and debate, competitive bidding minimum 3 qualified bidders, or have contract put to a full vote of all registered voters not just the government workers or union card check to be able to vote. It all just a shame on the tax paying public, can anyone say disenfranchised?

Steve

Since when is $70,000 considered a large income ( esp. in CA)? What do you think of the billions the banksters are raking in? Why can’t teachers get a break, they are taking up the slack from the idiot parents not doing their jobs!

It’s only a peripheral issue.

But, remember, getting paid $70,000 for, essentially 3/4 the work year of an average person (about 180 days versus about 240) is equivalent rate of pay of someone making $93,000 per year.

I think to call parents idiots is alittle rude. I think anyone that has children, loves their children and does want them to get a good education. The parents are busy working so that they can have food and shelter, that’s why the teachers are paid well, so that they can teach our children. I get that parents are supposed to help, and most do help, but don’t put down the parents that are unable to help due to time restraints and just busy trying to keep a roof over everyones heads. We do help our children, but I still feel sorry for the parents that don’t have time.

James T in MA wrote: “But, remember, getting paid $70,000 for, essentially 3/4 the work year of an average person (about 180 days versus about 240) is equivalent rate of pay of someone making $93,000 per year.”

This is a specious argument. There is no equivalent. Teachers actually must take the summer off. And not all of them can find other work and those that do may not be paid at the same rate. The truth is that most teachers must spread that $70,000.00 over the twelve months. I have a teacher friend making close to that but she cannot afford to buy a decent home anywhere near where she works in the San Gabriel valley. She is also like the students referred to in a prior posting saddled with a lifetime of student debt.

uclalien wrote: “I agree that most teacher’s aren’t necessarily “raking it in.†But what you don’t mention is that your father now enjoys a lifetime of taxpayer funded retirement.

In other words, he was guaranteed a lifetime job that was practically impossible to be fired from (something that doesn’t exist in the private sector). In addition to his tenure, he received very generous benefits and annual salary increases (regardless of performance).

The fact is that due to the combination of salaries and fringe benefits, most teachers live comfortably, while only working 9 months out of the year.”

On your last point, yes teachers may live comfortably but that is certainly not getting wealthy as this anti-teacher ranting implies.

While taxes (mostly from property taxes) pay teachers salaries they by no means are 100% responsible for pensions. Teachers like most civil servants contribute a portion of wages into retirement funds that are then invested to cover those pensions. So in point of fact much of teacher pensions are dependent on the private sector. By the way most teachers are denied salary increases in the current economy, have been required to increase pension contributions, had wages cut and even been laid off. Stop bashing them.

Idiot parents? What a crock. But you grip at home schoolers too. Teachers get paid for what they do NOT because parents shrug their responsibilty but because we have a public school system… which btw is a joke of another color when most seriously home schooled kids can test circles around pulbic schooled kids

When I looked into it a few years ago, starting wages for a new teacher in LAUSD, with a masters degree, were around $40,000/year. When my father retired from LAUSD three years ago, he was making $75,000/year, after 25 years of service. Given that his real hours were 7:30-6 (at least, for grading AP English papers, preparing lessons) and that he was at the end of his career, I wouldn’t exactly argue he was raking it in. And given that $40,000 barely leaves you with any savings after rent, food, and car expenses in Los Angeles, I gave up on my dream of becoming a teacher for economic reasons. Instead, I make about $75,000 five years into my career, with definite room for growth, meaning I have a lot more money and opportunity in the private sector (though I’d love some of the public employee benefits, which is how they entice anyone of value to enter public service in the first place). My mother managed a department of 4,000 employees and earned about $150,000/year in public service, working 12 hour days. So I don’t know where you’re getting your information, but teachers and public employees aren’t exactly rolling in dough compared to private counterparts of equivalent education or responsibility.

I have a follow-up question: How much does your father make now to do absolutely nothing?

I agree that most teacher’s aren’t necessarily “raking it in.” But what you don’t mention is that your father now enjoys a lifetime of taxpayer funded retirement. And during his 25 years, he was likely tenured. In other words, he was guaranteed a lifetime job that was practically impossible to be fired from (something that doesn’t exist in the private sector). In addition to his tenure, he received very generous benefits and annual salary increases (regardless of performance).

I’m not sure how long ago “a few years ago” is, but my sister looked into teaching in LAUSD in 2002. At the time, she would have made over $50,000 as a first year teacher with simply a BA. Although my sister ultimately chose to teach in a school district closer to her family, she still made out quite well, starting out at over $40,000 per year. On top of her salary, the district also paid off all of her student loans and she received her tenure after only 2 years on the job.

So let’s face it, teachers enjoy a level of non-monetary benefits that simply don’t exist in the private sector. The entire salary package (including benefits) should be taken into account when having any discussion on pay. The fact is that due to the combination of salaries and fringe benefits, most teachers live comfortably, while only working 9 months out of the year.

This person’s father PAID INTO a pension system which the state of California then INVESTED to put more money into the system.

Anyone who wanted one of these “jobs for life” could have chosen one. Let’s face it, most of us would rather wrangle maggots with our tonsils than teach in public schools. I have plenty of gripes with public education–I worked in it long enough myself (though not as a teacher and not at the K-12 level). But it’s like transit drivers. If you want those “big bucks,” then go ahead and apply for one of the jobs–and keep it.

But this is all torquing from Doc’s outstanding piece. This is the last I’ll say on this here.

rose

@compass rose

Whether or not this person’s father paid into the pension program is pointless in a world where: (1) he only pays in a small portion of the total pension contributions and (2) is guaranteed a certain level of return. If that guaranteed return isn’t met, it falls on taxpayers to make up the difference. That’s the reason for all the talk of the CA teacher’s retirement fund having a current unfunded liability of approximately $100 billion (and the state public pension program having a current unfunded liability of over half a trillion dollars).

As Governor Schwarzenegger put it recently, “Few Californians in the private sector have $1 million in savings, but that’s effectively the retirement account they guarantee to public employees who opt to retire at age 55 and are entitled to a monthly, inflation-protected check of $3,000 for the rest of their lives.”

In many cases, if not most, retirement actually last longer than time served as a public employee. And the fact that these pensions are inflation adjusted actually makes them equal to a $2 million retirement fund.

Nobody is getting paid $100000 year to cut grass on baseball fields….those folks get paid little to offset the $100000+ salaries for rafts of Administrators with no callouses on their hands. The UC Bizerkeley head coach gets $2.4 million/yr. That’s not a typo.

A majority of that salary is categorized as a talent fee and is paid by Nike, so not a good example.

@beson

coincidentally…

http://www.baycitizen.org/sports/story/uc-berkely-cuts-baseball-gymnastics-and/

Amen.

The state of CA has a hefty payroll to meet. I’m starting to hear a lot of people saying that property taxes are infair to the people that have bought in the last 10 years. They’re paying way more than those who’ve been in their homes 20 or more years. I NEVER used to hear this. Prop 13 may be in trouble.

Yes, Prob 13 is bad. It should be equal for all, based on the current appraisal of your home. Texas survives very well, because they evaluate each year the home values, and then property tax is derived from those amounts. It’s unfair to have the old lady across the street paying substantially lower then the new home buyer, completely unfair. Plus, it limits the ability or desire for home owners to upgrade to larger or better homes, because they cannot afford the current property tax value on the newer home, and are forced to stay in a home that they wish to sell. It should be fair for all, use the Texas Tax way, eliminate prop 13, which is totally unfair to new buyers, and all schools, etc.. will do better.

I’m not saying that Prop 13 is good. It definitely has its problems, the worst of which took control of property taxes from counties and gave it to the state. This process has turned out to be not only inefficient and costly, but financially painful for counties. This has become even more of an issue as a result of the state’s budget crisis, where the state essentially issued IOUs to counties rather than distributing actual property taxes.

While I understand the argument against having neighbors in similar homes pay drastically different property tax rates, the argument doesn’t address the fact that some people use a home as a place to live, rather than the more recent phenomenon of hoping one’s home value appreciates exponentially in an attempt to turn a profit. In other words, some hypothetical assessed or market value means very little, if anything, to many homeowners. Paying higher taxes simply because some arbitrary value has increased wouldn’t seem to be fair either.

With regard to how property taxes are collected in Texas, that model might not work effectively in a state with large fluctuations in home values like CA. For instance, in my home town, total property taxes and fees could have easily increased from 1.25% of value to 2.5% of value in a matter of 3 years under Texas’ system simply because values dropped by 50%. This can happen because, to the best of my knowledge, there are no limits to how property taxes are levied in Texas. Counties simply levy what they “need.”

Prior to Prop 13 (and since, despite Prop 13), the state and counties showed a propensity to spend simply for the sake of spending. This was one of the reasons for 13 in the first place. Public agencies were increasing spending to keep up with rising home values. While Prop 13 didn’t stop these public agencies from doing this anyway, it probably didn’t happened to the same extent it would have in a world absent Prop 13.

So to summarize, there are both good and bad aspects to Prop 13.

So someone like my parents who bought their house in the 1970’s for $80K should pay taxes on the same house now appraised at $700K? Because a bunch of idiots pumped up the housing bubble way past wage growth? What retiree could afford that? How about we cut the ludicrous $130B CA budget instead? You libs are unbelievable thieves. You won’t be happy until you steal every last dollar to waste on the unproductive.

There’s going to be another tax revolution in CA alright – but not against Prop 13. It’s going to be the one on CA cap gains tax when people start cashing in their retirements.

Idaho needs a prop 13.

Retiring Californians sold their over inflated homes and moved to Idaho. All the folks moving in with their crazy money inflated the price of homes in the Treasure Valley to the point that Idahoans who lived and worked there couldn’t afford the homes. They couldn’t afford to live in the towns they were born in.

Homes in the Boise Metro area inflated to $360,000 for the average. Half what californias homes sold for. NO working class Idahoan can afford that.

Yes Idaho was a great deal. It’s a better deal now that you all left. Your mc mansions are selling for $100K. Subdivision after subdivision of now empty mc mansions. You screwed up alot of peoples lives all over the west by trying to get away from your own miserable

situation.

California is the worlds 8th or 9th largest economy. The rest of us in the nation feel like when we are bailing out the nation, we are actualy bailing out California.

Maybe we should consider terminating the Treaty of Hidalgo and letting the La Raza people have California back for Mexico. Then see how what is left of the nation pencils out ?

Then there are some people who did put down decent down payments, not everyone came in zero or 3 percent. These folks most likely are in some of the nicer locations, but still more than 50 percent upside down now.

The deflation of assets vs the inflation of cost of living.

Thanks gov for the bank bailout.

Doc again you use this example of ” Today, if you bought a home for $500,000 with zero down and the home is now worth $250,000 why in the world would you stay in the place?” Yep – that is pretty typical of prices which are now easily 50% of peak in the boiling-over bubble area. (My personal favorite in my area is the $2,600,000 peak price beach house where the buyers put down $500,000 and it has now been listed for $999,999 for over 15 months and not even a looker. That is 62% off peak and still no buyer. The beach house buyers here DID put down that 20%. And they WALKED AWAY nearly 2 years ago – or at least quit making payments and the bank is trying to short sell it without foreclosing. )

And Doc? It wouldn’t have mattered squat if your hypothetical buyer had put down 20% on that $500,000 house that is now worth $250,000. They would have put down $100,000 and owed $400,000 — and the house would be now worth $250,000. That means they are in the hole a total of $250,000 – $150,000 owed on the mortage and their never-to-be-seen-again-in-our-lifetime downpayment of $100,000. For them to ever have a hope recouping that downpayment, the house would have to get back to $100,000. (Or they could pay off the $400,000 + interest of another $300,000+/- and sell it an walk away with $250,000 in hand. LOL!) WHy on earth would they keep making payments when with a $400,000 mortgage on a now-$250,000 house they owe 60% more than it is worth and their $100K downpayment is gone with the wind?

It is not the amount down that makes the difference between 1950,60,70s etc and now. It is the following factors:

(a) House prices then were in proportion to incomes

(b) House prices then were nor inflated beyond belief relative to real incomes

(c) Employment was stable and paid well. Those were the days of

(1) going to work for a company and staying for life and

(2) getting paid enought that one income could support a middle class life and

(3) getting regular raises that were equal to or more than inflation

(4) and having health insurance that didn’t cost so much that the employer and employee couldn’t really afford it

(5) and having pensions when you retired from whatever company you had wored for all those years. Real pensions with guaranteed amounts paid out in retirement – not having to gamble on the stock market and pray.

WHole different world where people didn’t get downsized, outsourced and otherwise lose their employment or have their wages fail to keep up with inflation. And a stable income means being able to actually pay those debts that a household took on. A 20 or 30 year mortgage was a reasonable plan in 1965 since it was reasonable to expect a steady and reliable income. Now taking on a 30 year mortgage is doing so on hope, a wish and a prayer that income will be reliable enough to pay for it.

You’re kidding right?? Somebody made ur dumb ass neighbors buy at the peak?? Oh wait they weren’t speculating then?? Then they should be fine with the fluctuations because they were long term home owners and want a home. Butt wait they were speculating. Pigs get slaughtered!!!

Ann, while you are correct that putting 20% down would still leave many buyers deeply under water in a 50-60% downdraft, what you are missing is that 20% down requirement would have never let housing get so out of hand on the upside. That 20% down requirement forces people to exercise fiscal prudence and save a portion of their income over some period. Since that 20% savings must come from their income, it also ties housing more closely to people’s real take home income preventing the income/valuation dislocation.

That’s really the issue in CA. Income from jobs vs. price of housing. Figure a $750K house requires an income of $250K at a 3x multiple (which used to a considered a maximum multiple). 250K household incomes aren’t all the common in CA or anywhere else and yet 750K housing valuations are a dime a dozen (many look like crap too). What made those valuations possible was long-time owners trading phantom equity back/forth resetting prices higher and consistently declining savings/increasing debt from the generation below. Music stopped and now its back to being about incomes. Even long-time home owners took a major hit to net worth with a large equity draw down. Stinks but that’s reality.

Nope. Whether it is 20% or 10% or 4% down is NOT what caused the problem. Nice fantasy that it did but when put to the test and compared to the lending practices of little conservative local banks here, it falls flat on its face.

My 2 little banks here in town are both 5-star in all ratings. Neither has loan defaults of any kind that are more than 95/100ths of 1%. They did -and still do – routinely do FHA (3 1/2%), USDA (3%), VA (still and always ‘0’ down loans), 10% down etc. They even do all the loans for the 2-county housing program (subsidized purchase price where the buyers have to met certain income requirements, put down maybe 1-2% in closing costs and can’t sell the home except through the county program.) Their default rates on the County Program = 0. Their default rates on all the other mortgages (from 30% down to 0% down on those VA loans) = LESS than 1%.

The difference is that those little community banks :

(a) do NOT use FICO scores. They do it the old-fashioned way by looking at the credit report and looking the applicant’s bank account records for a couple years to see the flow of money and that bills are paid on time.

(b) verfiy and re-verify income. Someone who is a wage salve has to produce 3 years of W-2s and their tax returns and they call the employer. Someone who is self-employed has to produce 3 years of tax returns and a verified audit of their business records.

(c) never ever ever lend where the house will be more than 30% of gross income for all of PITI (and they prefer not more than 25- 27% of gross)

(d) never ever lend lend where total debt (house, car, student loans, credit cards etc) will be more than 40% of income – and they prefer it really be not more than 35% of gross. (Called back-end DTI)

(e) if it is a 2nd home (and we have a lot) they want to see 25-30% down plus 2-3 years of carrying costs in the bank and in escrow

So it doesn’t matter if the buyer using FHA or VA or the County Program are putting down 0 -4%. They KNOW the person can pay the loan based upon income.

Three things were really the cause of the inflated house prices:

(a) not verifying incomes AND cash flow AND actual expenses and/or

(b) allowing PITI to be more than 25-28% of gross and going as high as 65% of income. Bill Gates can afford to spend 65% of gross on a house and not miss a meal. The average household with their $50,000 income can NOT affor to even really spend 30% of income on PITI.

By raising and raising the maount of gross income that could be committed to PITI, buyers where encouraged to spend more and more – and more than they could really afford – and that drove up prices. Rather than prices coming down to incomes, lending criteira got loose as a goose and allowed prices to rise.

(c) eliminating any requirement of a cap on the backend DTI (mortgage, insurance, taxes, credit cards, car loan, student loan etc.)

Ann:

1) In the other comment you’ve moved from down payment to solid underwriting standards from banks that likely hold the loan from origination to payoff/prepayment. I don’t think anyone, certainly not I, ever made the case that money down alone would have prevented everything. It was a contributing factor and would have made a significant difference but certainly not the entire deal. Underwriting, ratings agencies, government policies, securitization/passing risk off after origination all played a part as well as the purchaser’s rampant speculation and willingness to ignore the facts and financially overextend. All are there, all would have made a difference but letting each factor go wild we ended up with a mess. I’ll also say that the biggest issue in this was government in forcing lending to lower demographics/promoting homeownership, removing leverage requirements from banks, and giving mortgage securities (i.e. securitization) vastly preferential treatment via Basel over equivalent whole loans. Remove that web and honestly, I don’t think this could have gone nearly as bad.

2) On the comment above you seem to equate the middle-1900s with a sustainable lifestyle. Looking back over history, that may well have been the height of the common man. Not often that one relatively unskilled and uneducated male with no assets of his own could work, support a home and family, and retirement while the wife essentially took care of the kids/home. Further back you had whole families working together, passing houses down, taking care of kids and elders. The 20-30 years following WWII was pretty much the height of US industry and wealth creation. Through broader history this is a tough standard to hold.

Hi Doc,

Thank you so much for including data for NorCal. You have a lot of readers up here in the bloated and overpriced SF Bay Area, and we appreciate the data!

x2!!

Robert Shiller and Dr.Bubble here keep talking about home price appreciation needing to be the same as inflation. If they truely believe in that, the vast majority of America, including all of the MidWest, has severely trailed inflation for the past 20 years. Home prices have not even DOUBLED in 25 years in the MidWest, and now even in Los Angeles, the median home price now, after the decline in the past few years, is not even double of what it was 20 years ago. So answer this Shiller and Dr.Bubble, with inflation at 3% per year for the majority of the past 20-25 years, are not home prices UNDERVALUED even by your own analysis, regardless of its merit?

I can’t comment on Doc and Schiller’s opinions are on the issue, but the truth is that inflation is only one factor that helps determine home values, others include supply and demand. A ton of supply has been added to the CA housing market in recent years, yet demand has plummeted. Not to mention that there is a huge supply of unbuilt lots held by developers waiting for the market to turn around.

Ignoring all other contributing factors, home values should increase significantly less than inflation. After all, what other asset gains value as it ages and becomes more and more outdated?

Depends on what parts of “the” “Midwest” you’re talking about. I can assure you that prices in the metropolitan areas and cities of Madison (WI), Chicago, Duluth, Minneapolis/St. Paul, Ann Arbor, and many others indeed doubled from 1980 to 2005! Maybe they didn’t double in Podunkus or Dingleberry (fine towns, truly, but try finding work there). But that’s not where people live…or where gentrifiers speculate.

The gentrification in the abovementioned cities has been staggering. And the sprawl as people try desperately to keep their jobs by driving more and more miles out of town for the cheaper houses that pull the average downwards and create the myth of affordability. In fact all it has done is externalize the costs of sprawl.

rose

I had one of those Archimedes Moments looking at the Case Shiller chart back to 1890. (Though we must bear in mind that that index is not inflation adjusted, it starts in and *standardizes to* 1890–a distorted market just prior to the terrible financial cataclysm of the 1890s–and it lumps in together pre- and post-Jekyll-Island currency regimes. This doesn’t make it a wrong metric, we just have to remember what it is and isn’t measuring.)

The depression of the 1890s was a terrible financial cataclysm–though we don’t hear much about it. Notice the spiky progress of house values in that decade. It’d be interesting to take a closer look at that, DHB, as well as at what Case Shiller would look like if restandardized to three or four other starting points.

Could it be that the “boom” of the Aughts was in fact a debt-plated Depression after all?

Some of us were suggesting that, back then. I’m of the view that our Lost Decade began in 2000, as the Fed papered over the dot-bust, the race to the bottom for workers, and the gutting of American productive capacity with Ayn Rand Asshole fantasies erected atop a thick meaty layer of Reaganismo.

http://www.dangerousminds.net/index.php/site/comments/ayn_rand_assholes/

When I bought in 2001, rents were very high here. And Left Coast housing has always looked ridiculously high to me, buy or rent. I looked at Case Shiller and other metrics, as well as our own fundamentals. My view was that the market was already overvalued. But bearing in mind the 1970s and 1980s spikes and longer trends, I figured that prices could be overvalued by about 10%, and anyway we’d save much more on that on energy. (Our house location lets us earn a living with feet.) I got the seller down to 8% over what I was willing to pay (down from 20-22%) because it had sat on the market for months at his asking price. That 8% we quickly recouped in the first year of not needing a car, and amounted to more as we paid the mortgage ahead with that.

This is all of course predicated on what we might one day sell the house/land for. We have no idea, but anyway plan to be here till we croak n rot.

1970s house price spike was all those first Boomers hitting the market; 1980s was the first Generation Jonesers getting smacked in the gob by inflation. By the ’80s the construction boom had begun. The ’70s spike in house prices owed to too-low inventory. The ’80s was due to builders pricing houses at what they thought they could get, and people were willing to take 18% mortgages or 20% inflation house prices.

The Aughts “boom”/bubble had different underpinnings, as Doc has laid out so well. Most notably cheap and effectively unsecured/revolving debt. It was the era of mortgages becoming credit cards. Thanks, Wilmington, Delaware.

rose

Robert Schiller adjusted for inflation home chart has been out for years. Everybody is always commenting that it will take a 40% drop in the median prices to get back to normal. What writers never write about is the location of the graph during the thirties. What happens if we go down to the 70% level. That would mean a drop of almost 60%. Could it happen? A derivative blowup by a few of the top four banks should really stop bank lending. Which would ruin the economy for a few years and another 20% drop to 60%.

Apologies, worm, I misspoke. And blame my aging eyes–I misread the tiny fine pale grey print as this particular chart not being inflation adjusted. (Which was news to me, i.e., a non IA CS chart…but what the heck, numbers are for crunching this way and that.)

In any case my point was not to slam the index but just point out that any set of data measures only what it measures, and it’s hard to get a sense of an N dimensional history of a trend from just one snapshot. Something I know that DHB is well aware of. Thanks for the clarification, and again, my apologies.

Regulatory requirements are such that banks are suppose to sell their REO’s 12 months after acquisition. Since the banks can see that California real estate is not going to go up anytime soon, their only course of action is to dispose of the REO’s within the statutory time period at the best possible price. Of course, the banks can be slow in their repossessions, but that excuse is only good for a period of time. This problem is enormous. Even selling a billion dollars in REO a month, the FDIC is going to take four years to dispose of the REO it currently has, and since they are getting more REO through failed bank takeovers, the actual inventory they will need to dispose of is much larger.

Most people don’t understand absorption rates. Buyers at various price points are limited by their incomes. Once the available buyers at a certain income level are satisfied, the only way to move more product is to lower prices and expand the buyer pool. When absorption rates are as low as they are now, lenders will either hold properties forever, or they will need to lower prices to get rid of it.

Doc, please don’t make false arguments like the one that the real estate bubble was the result of a degegulated wild west mortgage market.

There’s plenty of blame to go around, from unscrupulous mortgage issuers and mortgage backed securities creaters to buyers lying on applications and thinking that the ride would never end to the Fed and congress.

To ignore the “Greenspan put” and congressional and agency actions is to ingnore a necessary but not sufficient part of creating the problem.

All of this pain and suffering brought to you by the private Federal Reserve Banking Cartel. There is a solution…

http://thecivillibertarian.blogspot.com/

I have noticed two homes in my area with price decreases this week alone. MLS# 10011711(DHB focused this home in Sept) $599,000 to 550,000. A spec home on a hill. With two other spec homes on the same property.

Also MLS # 12141115 Orig priced 589,999 to 569,000 Now 519,000. Does this mean the Shadow Inventory has finally hit the market? Does this mean the banks have realized that they finally have to lower prices?

Another good article, doc. I remember sometime around the height of the real estate bubble, I was home visiting my parents and caught an episode of The Real Housewives of Orange County on television. What struck me about the show, other than the vapidness of everyone involved, was that all of the families’ income seemed to come from the residential real estate industry. Several wives seemed to be real estate agents and several of the husbands were developers. All of them lived in enormous, multi-million dollar homes that they could no longer afford after the bubble burst.

I think all of the people complaining about teachers making too much money are being ridiculous. While I agree that we should hold them to higher standards — I’ve had my share of incompetent and uncaring teachers while I was growing up — I don’t agree that teachers, in general, are overpaid. The bad teachers, the ones who have given up on their students or simply don’t care, are certainly overpaid. However, the good teachers are grossly underpaid.

Higher % down payments are not the answer or even income to loan ratios, since peoples income drops to 0 if they lose their job. The size of the loan should be based on the income stream that the asset can generate ie the rental value of the home. Obviously rental rates also vary but at least it ties the value of the debt to a potential income stream. If mortgages were limited to say x120 monthly rental value the whole system would be a lot more stable.

The most ABSURD real estate bubbles have been going on in India and China for the past 20-30 years, where homes have appreciated about a THOUSAND times. A one thousand US dollar investment in India’s metro real estate in the 1970s is now worth more than a million US dollars. Home owners in India and China are unbelievably rich and are far more wealthy than their Western counterparts. Despite the ABSURD appreciation in the past 30 years, the mentality in India and China is that real estate is the easiest and best form of investment, with values doubling every 2-3 years. Note that these so called homes in India and China are small, with little features, very low quality, have no good infrastructure and so filthy that no sensible person would spend even a 100 bucks on, yet are being sold and bought for millions of dollars each in the greatest PONZI game ever played. You read that right, an apartment will cost you USD 500,000 and a small independent house will cost you at least USD 1 million in the cities of India and China. Note also that the median income in these places is still just a few thousand dollars per year, yet the median home prices are about a million dollars. Very few of the local population can afford to buy homes and so live in makeshift huts. This PONZI game has created inflation, which then fuels the PONZI game even more and you get the idea. Compare all of this to the United States. Homes have hardly even tripled in value in the last 30 years, and yet, we are quick to point this out as a bubble. We are playing the reverse PONZI here, where we want to destroy absolutely fabulous homes to complete worthlessness. A regular 2000 sqft 4-BR American home would cost several million dollars everywhere in the world except in the USA, where it costs a measly USD 200000. Yep, Americans want everything for free. If it is not free, it has to be a bubble.

James T. That is the point of deregulation. Greenspan, Bush et al were supposed to be regulators. Instead all of them started to buy into this kumbayah fairy tale philosophy that the market is some enlightened place where everything works in perfect harmony and no interference was needed.

Enron was the canary in the coal mine-the feds refused to step in then and refused to step in for quite a while.

Blame it on buyers all you want-but if regulations were in place and properly enforced-that strawberry picker in Gilroy earning 14k a year would not have qualified for a 700k+ loan. No way on earth. That is not the only case-there are so many like him.

Now I am not arguing for some government controlled Soviet Union style economy. Just that over and over, it has been proven that extremes on either side can be extremely dangerous.

Why do I keep bringing up the topic of the extreme and absurd housing bubble in India and China? The middle class and upper classes in those countries have been riding this absurd bubble for 20-30 years and are now sitting pretty with each family in those classes having net worths of USD 1 million or more. The size of the middle and the upper class in these 2 countries is close to a billion people. International investors who are pouring more and more money into such emerging economies to get better returns on their investements are fuelling a hyperinflationary bubble in those countries. The double irony is that the currencies in these countries are not falling against the US dollar, but gaining, so this makes it a double benefit to invest in emerging economies – you get better returns even in the local currency, and then you gain even more in dollar terms when those currencies strengthen against the dollar. Why is all this relevant? This billion people in India and China that have net worth of USD 1 million or more in their own countries can now buy many homes in the United States, since vastly superior housing is very cheap here in America compared to Asia. Think about the pros and cons of that possibility.

SR, you must be dreaming. There wasn’t even a million millionaires at the beginning of the year. Check out the hurun report here: http://www.hurun.net/listreleaseen451.aspx

I can’t imagine the other 999 million millionaires reside in India either. That’s just absurd.

Furthermore, I doubt most of those chinese individuals are going to buy up overpriced housing in the states, especially if they are planning on re-investing that money into something more productive than a nice summer home outside of the prime areas.

I don’t know why you keep bringing up India and China but you sure sound deperate. ARM reset coming up?

P.S. Your facts are wrong. All of them.

A 250,000 home can be worth millions if the dollar is destroyed by hyperinflation.

Yeah, and the person who tries to sell only has to find someone

who can pay those millions of dollars!!!

California is simply too huge to remain as one state.

During the Civil War, Virginia, then the 2nd largest state in the union(after Texas of course), broke into two because the NW counties stayed loyal to the Feds.

It’s time to break California into at least 4 states, east (the agricultural area), west (San francisco and all that), south (LA, OC, San Diego) and north (the backwoods).

x3 🙂

Leave a Reply