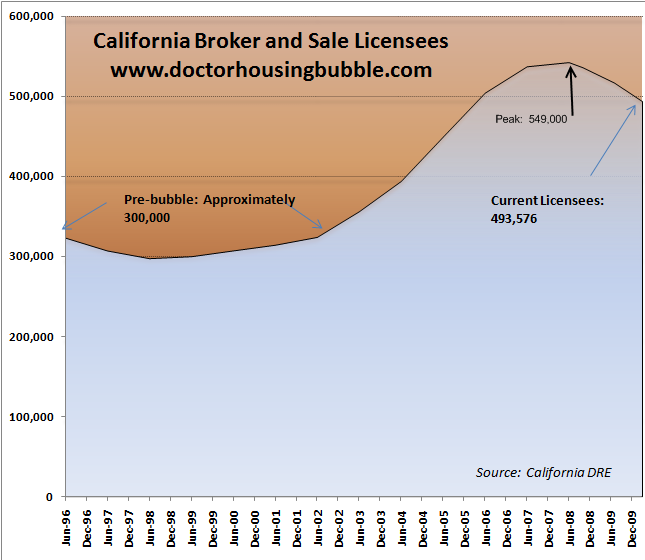

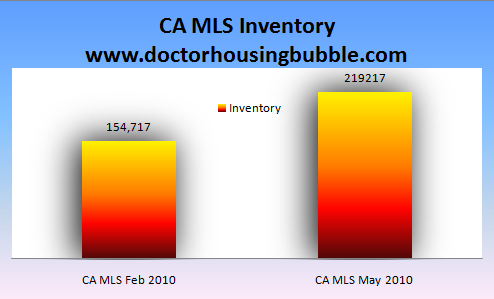

5 reasons why California will face another lost decade in housing – 493,000 real estate agents and brokers for 219,000 homes listed on the MLS. 7 percent of 90+ day late loans in California have no foreclosure filed. State budget depended on real estate bubble jobs for revenues.

How many real estate agents and brokers does it take to sell a California home? 2 ¼ if we look at current inventory levels and the amount of Californians with a real estate or broker’s license. One of the early observations of the housing bubble was how much money was being spent in the economy because of high wage California housing bubble jobs. Toxic loan after toxic loan provided wonderful commission checks but also provided the state with a nice chunk of tax revenue. Year after year this went on. Our fate has been intertwined with real estate and since real estate has busted so has our state economy. I remember a few colleagues that were pulling in high six-figure incomes as mortgage brokers and real estate agents and were spending every dime as quickly as it came in. Many have downsized drastically and don’t have a penny to their name. Ironically many of these people drank their own Kool-Aid and bought million dollar homes with the same mortgage sewage they were passing onto their clients. A few are now in bankruptcy and many have lost or will lose their homes.

California is likely to face a lost decade in housing. Do I mean from 2000 to 2010? In some areas we have already reached a lost decade. Yet many areas will face their lost decade from 2010 to 2020. Here are 5 reasons why California real estate will have a decade of slow or no growth ahead:

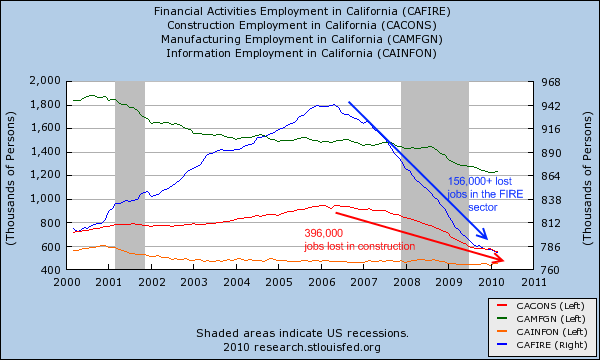

Reason #1 – High paying finance and real estate jobs are gone

I went ahead and compiled 14 years of license and broker data for California above. From 1996 to 2002 we averaged approximately 300,000 active licensees in the state. This was before the bubble ramped up. We reached a peak in 2008 of 549,000 active licensees. Today that number is down to 493,000 and is continuing to fall as many simply let their license expire. Even with recent sales increases we are still close to half the volume of the bubble years. Plus, home prices are half of what their peak values were. So even basic math will tell you that at the very least, half of income in this industry is gone (for example the 5 to 6 percent agent cut is based on the sale price). Then on the lending side you have 96.5% of loans being government backed and these don’t provide the nice kickbacks that the option ARMs did for example. In other words, high income no GED required jobs are now gone. Even those with industry specific degrees and training are finding it hard to get good jobs in today’s economy.

And many other jobs tied to the FIRE side of California employment and construction took big hits:

These were good paying jobs that are now gone. Many of these jobs depended on the perpetual growth of the housing bubble. But even as we will see with inventory levels, do we still have a bubble in this industry?

Reason #2 – Too little inventory and sales for the amount of workers

I went ahead and took a major snapshot of how much MLS inventory is currently listed for public view in California. Although inventory is spiking, you start seeing issues that are plaguing the industry:

Since February of this year California has added 64,500 homes to the MLS, an increase of 41 percent. This is a massive jump. Part of this jump aligns perfectly with the failure of HAMP and more banks pushing inventory onto the market.

But let us use that current inventory number and run a quick analysis:

493,576 real estate agents and brokers / 219,217 homes on the CA MLS = 2 ¼ agents and brokers for each home

I find the above fascinating. We have close to 500,000 licensed agents and brokers for 219,000 homes on the market. And you wonder why we have a problem? This is like going to a used car lot with 20 cars and finding 50 sales representatives. However like many things in life, I believe that the Pareto principle applies here as well. That is, 80 percent of sales is likely to come from 20 percent of those with active licenses.

Although the shadow inventory is much larger than the 219,000 homes on the MLS, agents and brokers only make money when they sell. And banks don’t seem in a big hurry to move the entire inventory out at once. In other words, we have years of junk built up in the pipeline with wages slashed.

Reason #3 – California budget and revenues shattered

If you want to see a problem in the making look at this:

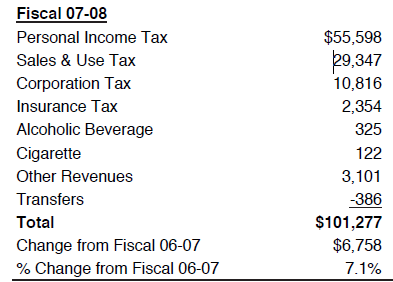

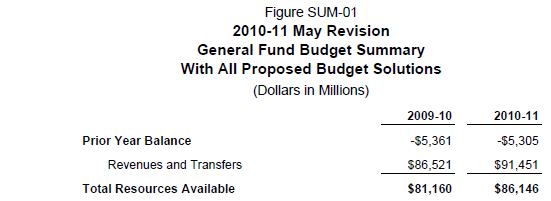

The state for the fiscal year of 2007-08 collected over $101 billion. How do things look today?

For the fiscal year that is coming to an end, we are projected to bring in $81 billion. We are short by $20 billion and this includes every kind of tax increase you can imagine. This does little considering half of the state revenues come from personal income taxes and many of those high paying bubble jobs (see above) are now gone. Yet the state kept spending more and more assuming that a Ponzi like income stream was going to come in forever. That is not the case as we are now painfully finding out so we must adjust.

The Legislative Analyst Office (LAO) is projecting problems well into 2015. Another issue that the state will have to contend with is high pension costs of soon to retire baby boomers. Recently CalPERs announced that the state will need to pitch in $700 million to cover its poor bets. They are pulling back for the moment:

“(LA Times) Facing political fire, the state’s largest public pension fund Wednesday retreated for a month from a plan to approve a $700-million increase in taxpayer contributions it gets from the state and about 1,000 school districts.

State Treasurer Bill Lockyer, a member of the California Public Employees’ Retirement System board, said the fund needs to assess the consequences of the huge hike on California at a time when the state faces an estimated $19-billion budget deficit.â€

You can rest assured that there will be some serious battles on this front for years to come.

Reason #4 – Shadow inventory

The Wall Street Journal put together data regarding shadow inventory that we already knew about. California ranks near the top of shady banks and home squatters that are simply staying put and not paying their mortgage:

Source:Â WSJ

This is just nuts. In California 7 percent of loans that are 90 days overdue are not in foreclosure! What is even more stunning is the nationwide amount of people living in homes with no payment and foreclosure for 2 years! This is a slap in the face of every prudent middle class American. And the idea of poor homeowners is nonsense here in California. You have folks living in prime locations not paying their mortgage who can easily afford a nice rental. But they’ll sit it out while banks sit back and suck on the taxpayer gravy train. This data merely confirms what we already know. The state is plagued with delinquent loans. In fact, 15 percent of all California loans are 30+ days late or worse.

Reason #5 – Consumer psychology and jobs

The mantra that real estate prices never fall is completely shattered for an entire generation of Americans. Those who lived through the Great Depression are largely absent from our current economy and can’t share their wisdom. And given the preference of Americans to watch Dancing with the Stars instead of reading some history, many have forgotten that real estate can crash and crash hard. But if history is any guide, we will have a generation of Americans who are more cautious and thus will put a lid on any mega jumps in appreciation for the next decade.

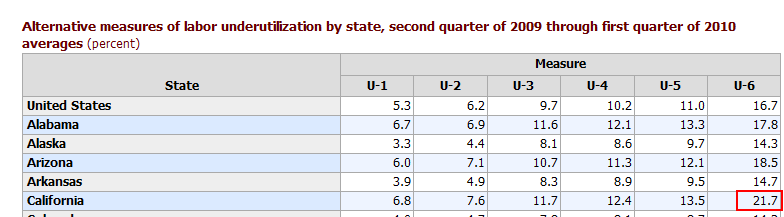

On Friday the California unemployment rate came out and we are still at a record high of 12.6 percent. Adjusted for the underemployment rate we are closer to 23 percent. Even the running average at the BLS shows us over 21 percent:

Keep in mind this is a one year rolling average so this will only move higher as we have been at peak levels for many months. This also goes back to my earlier reasons for a lost decade in home prices. Those high paying jobs are gone. You can only purchase a home by what your income can support. A large number of those depended on toxic mortgages that were easy to churn on a short notice. After all, giving NINJA loans with no verification allowed seedy mortgage brokers to turn out loan after loan. Now even with lax lending in FHA insured loans, at least they have to verify income. As it turns out, there simply isn’t that many that can qualify in California.

I see a sideways moving decade for California real estate. And for the next one or two years prices will start trending lower again as the Alt-A and option ARM waves hit and the gimmick parade starts running out. You can only keep a lid on corruption for so long. The “once in a century†problems now seem to be hitting every month. A near 1,000 point drop in the Dow, the trillion dollar Euro bailout, and other mega events will come quicker as a reckoning day will hit. All it takes is a failed Treasury auction and you can kiss cheap mortgage rates goodbye.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information. Subscribe to feed

Subscribe to feed

35 Responses to “5 reasons why California will face another lost decade in housing – 493,000 real estate agents and brokers for 219,000 homes listed on the MLS. 7 percent of 90+ day late loans in California have no foreclosure filed. State budget depended on real estate bubble jobs for revenues.”

(Question and Comment)..Commercial Vacancy rate in San Bernardino now is at 57 percent…..Why would the City of SB rezone commercial properties to residencial… causing business owners to loose even more value as they have done recently? Can you shed any light on this? I am not involved in this but know business owners who consider their properties retirement and now it is gone.

Thx…Californian

I wonder how many of the 14% of mortgagees are strategically defaulting? The ones that still have incomes will be facing a much higher tax bill when they cant use their interest payment deductions to lower their tax bill….becuase they never paid any. Although the lender may look the other way on nonpaying mortgages, they wont be sending them a 1099 for interest paid either.

I find the Borrowed Time chart helpful.

Nevada has a higher percentage than California. I imagine that a lot of the borrowed time is in higher FICO neighborhoods where the properties have two mortgages from the same lender; rather than in lower FICO neighborhoods, where different banks have rights.

One neighborhood of squatters for sure is Paradise Valley. What a name! I never knew there was such a place until I read the Melinda Fulmer MSN Real Estate article Hard Times In Paradise. I then went to Redfin and found the average priced home at 1.7 Million, like the one at 7131 E Berneil Ln, Paradise Valley, AZ 85253. I think many are living at no expense, courtesy of the bank’s FASB 157 entitlement to value real estate at manager’s best estimate rather than at market. Contrast this neighborhood to Englewood, IL, 60621. Wow what a difference. The lower one goes on the home price scale, the greater variability in house prices in the same area. In Englewood prices are all over the board! I think social chaos is coming to Illinois. Alan Greenspan should have required 20% down on all housing sales, but then again, I believe his goal was an eventual transfer of wealth to the hands of a few; which is something Ben Bernanke accomplished.

Like you say, all it takes is a failed Treasury auction and you can kiss cheap mortgage rates goodbye. This is coming soon as the National Debt Ceiling is about to be hit in October or November or even sooner if the US conducts a military strike on Iran which is very likely.

Yes, all it takes is a failed Treasury auction and you can kiss cheap mortgage rates goodbye. In fact I see a cut off of mortgages, shortly after a liquidity evaporation/stock crash/failed auction occurs, as funding to the GSE is likely to be abruptly terminated. Wow, that will cause prices to fall. Then the age of mortgage lending will end and the age of property leasing will begin.

U6 Unemployment is the true rate of unemployment and it is a leading reason why California is going to go from insolvency into bankruptcy. The other being that the Legislature cannot agree on a budget. Illinois may go bust before California as its been decimated by subprime lending more than California.

High salaries and cadillac pension benefits paid to govt. employees in CA. is not sustainable. Average firefighter in Long Beach costs the city $200,000.,EACH, in pay, overtime and benefits. Average teacher salary in CA. is $70,430, per NEA, with retirement benefits of $40,000. to $50,000. per year at age 55.

The likely winner of the election for govenor will not touch these “third rail” items.

Nearly 10,000. retired state workers get $100,000.or more,per year. see

pensiontsunami.com

Only 55 percent of taxpayers in CA. pay any Federal income tax. The number of people who get paid in cash and pay NO tax of any kind in CA. is huge- just go to any home improvement store parking lot in the morning and see people lined up to participate in the underground economy.

A recent drunk driving checkpoint in our area netted 5 drunk drivers, but 40 people who have NO driver’s license. The social activists in our area say that sobriety checkpoints should be stopped, as it “unfairly” affects people who do not have a license.

Political correctness is alive and well in CA. Means bigger tax burden for us fools who go to work, pay taxes, and are trying to raise a family.

Most of the garage sales in my area are done by people who are on unemployment, welfare, or disability.

All transactions are in cash, no paper trail, and income does not disturb the delivery of their weekly checks.

The entire economy was traded for a paper economy when JFK was shot. Now it is a virtual economy where there are just long-integers and doubles in ledger subroutines–an electron economy, if you will. This is the end-game we’re in. Everyone knows Sam is bluffing, but they’re all in a vault and only Sam knows the cipher lock combination.

This is not a rabbit trail–it is germain to this topic, and if you don’t understand what is going on you will continue to be frustrated by the inability to resolve the surface logic. Prices will not go down on fundamentals alone. The will go down in the collapse.

Most of you are probably to know what the ‘kool aid’ idom is about. Jim Jones was a phsycho evangelist (I actually heard him in 1966) and took his flock to South America. When everyone started to figure out he was a phony. he poisoned everyone with cycanide-flavored kool-aid. The man-hatter bankers are Jim Jones–they control the media, the banks, the governments, the Fed, and they make you think it makes sense to buy a house for $600,000. It doesn’t and it won’t. Don’t drink the kool-aid. It’s the wrong kind of vitamin-C…wait until the collapse is finished. We’re just a year or two from the abyss, although no one knows how long it takes to pull out of that.

With all said and done. When is a good time to buy a house. Interest rates are all now and expected to go up…. When this happens, home values will go down. I have 1 house that I can rent for $750 income and hope to buy another to move into. When is a good time to buy.. when interest rates go up? I am a teacher with a modest salary in Sacramento. Any hints?

Eventually these homes will foreclose and the strategic defaulters will have ruined credit scores for at least 7 years. They will then find it nearly impossible to get a home loan and will have to rent. This will cause house prices to go even lower as there will be fewer buyers in the years to come..

I really enjoy your articles…

First I was in the automotive business for about 20 years… downsized in 2002 and the corporation folded and discontinued selling vehicles in the US a few years later

Then, decided to become a real estate appraiser… did all the training but couldn’t get anyone to mentor me for the 2000 hours needed to obtain a license

Becamer a realtor in 2004… and you KNOW where that has left me

now at 53 yo, trying to just find a decent paying job for income… and with a 12+% unemployment rate… impossible…

hmmm, what do I want to be when I grow up??? What is left? What will be around for awhile?

oh… and a p.s. my husband and I are among the very few (stupid?) people who are still current on our mortgage, have not applied for a remod, pay our bills on time, do not owe credit card money on any extravagent purchases made, declare an honest taxable income and our children do not get free lunches at school… MAYBE that is what we are doing wrong!

@ Mickey.

“When is a good time to buy” depends only on YOUR present and expected circumstances and life needs, not on any specific economic data point.

If you can make it work out on paper and you want to buy a particular house in a particular neighborhood at a particular price, then go for it. Just don’t freak out if the RE market continues to go down. If you’re only counting on $750 rent to help with your cash-flow, I don’t see that being in danger looking forward. Just prepared to possibly see your new home lose another 10-25% in value, or at best not appreciate materially, over the next 2-5 years. Of course, if that were to happen, you’ll have some friends on this blog encouraging you to walk away as long as your family benefits from such a decision.

If you want to play the speculator game (like most of us here), then you should take umbrage that most of the things discussed on this blog for years have come to pass. So, you can expect things to get worse or at the best not get any better for quite some time.

P.S., I actually love you strategic defaulters out there. Sure, we foolish bag-holders and side-liners (and the progeny for generations) will bear the brunt of your selfish act (I realize we’re all selfish at our core, but, face it, let’s call a spade a spade) through higher taxes, but at least your home, once the banks are forced to eventually re-list it, will lower the comps in the neighborhood to likewise force prices down. Bad for your neighbors and taxpayers and banks, but good for us on the sidelines waiting for the best opportunity to buy again and enjoy the fruits of the ATM bonanza left in the wake…..ahhhh, to realize the dream of granite counter-tops!!!

Another excellent article. That was downright scary to read. I think everybody is in agreement that it will hit the fan…the question is when. Tough decisions will have to be made in the near future, spending (federal, state, local, individual) at all levels will have to be curtailed. The U6 rate in CA is mind blowing, the prime areas will be affected by this sooner or later.

On another note. Someone on the Irvine Housing Blog mentioned one of the theories regarding buying at current prices with a 3.5% down and squatting if it comes down to it. If prices rise, you win. If prices drop, you can quit paying and probably squat for 1 to 2 years…you win again (those two years free rent will be much greater than the 3.5% down). This is not a bad strategy to have given the current conditions. And if shit REALLY hits the fan, there might be no limit on squatting.

Interesting….. Englewood, IL 60621 is actually the Englewood neighborhood in the City of Chicago, and is one of the poorest neighborhoods in the city. The prices you see “all over the map” are on properties not selling. In truth, the average Englewood cottage would be lucky to fetch $35000.

But people are trying to sell them because they are being hit with monster property tax bills, often 10% of the market value. I’m surprised there has not been a public outcry here in Chicago over the sheer injustice and inequity in the property taxes. where $1,000,000 condos in the ritzy Streeterville neighborhood downtown pay as little as $6000, while $57,000 condos in West Ridge are taxed for $3500… and shanties in the cities poorest areas, like Englewood, Gage Park, and Garfield Park are taxed nearly as much as the fairly nice $57K condos and lavish downtown condos.

We have become a viciously unjust society, where the responsible and prudent pay for the sins of the delusional and greedy, and where the top 1% are legally empowered to ruthlessly asset-strip the rest of us.

Again, wonderful insight to what is to come. One point though on the real estate license issue. Not all real estate agent/brokers use their license to list real estate. Some simply use their license to buy and sell their own portfolio properties, some use it for loan services, property management, etc. Keep in mind that there are two sides to each transaction, buying and selling agent. Yes under CA dual agency this can be the same person but most often we are looking at a co-op transaction so the number of MLS sides is more like 3.4-4.4 and with only 170,000 or so REALTORS in CA the number of transactions per agent is probably a bit higher as they are more likely to use MLS than non REALTOR licensees. The foreclosure spike WILL hit later this year and those that are not in a position to either list REO’s or list buyers will be left out in the cold as this will be the majority of transactions. If you think HAMP was a disaster wait unitl you see how much of a failure HAFA will be that was supposed to save us all.

The tone of these posts has really shifted against the homedebtors as of late. I don’t understand what you expect people to do if the banks refuse to foreclose. Find a rental while you are still liable for the home the bank won’t foreclose? I’m pretty irritated because I already purchased another much smaller place for cash, but I can’t really move until the bank forecloses. If I did I’d still have to check up on the place because I am liable. I still have to pay HOA\water\sewer\trash whether or not I live here. I’m sure most people would move out and move on if the banks would foreclose. I certainly haven’t put up a fight and its been nearly 18 months.

I think it’s interesting that banks are taking so long to foreclose. I moved out of my house over 3 months ago and the same month I stopped paying. The bank denied my short sale offer that was presented in March saying it was too low even though it was supported be the recent comparables. I would like for them to foreclose on the house but I still haven’t received a notice of default. The house is in Inglewood. They claim the house is worth 70,000 more than the offer that was submitted which is ridiculous. Anyhow, I put over a 100,000 down on my house and the house went from $500,000 down to $290,000 (bank wants $355,000 good luck). The neighborhood was bad and the I moved because I refused to pay for a house that I lost all my investment but the bank keeps getting paid. I would have never purchased this home if I knew the banks were basically giving people homes for free and with no proof of income. I now rent in Studio City in a place almost as big as my house and for $500 less than my mortgage +taxes and ins.

DG, your post is absolutely astonishing. Are you telling us that you really cannot understand why we are so critical of defaulting homedebtors, when you confess that you have the money to buy a second house for cash, but still are not paying for the house you bought previously, presumably because it is now worth substantially less than what you agreed to pay?

If you have the cash to pay cash upfront for another house, why can’t you pay the mortgage on the original house? Can you not see that you and people like you are what caused this problem?

The only reason you are getting off so easy is that we are letting the elite do the same thing, which is to strategically default on a previous obligation. If you want out of the obligation of caring for the original home, why not just sell it for whatever you can get?

The fact that we’ve enabled our moneyed elites in this kind of behavior doesn’t make it any better. All we’ve done is make our society more unjust than ever. If you didn’t have the wherewithal to pay, I’d be sympathetic. I surely understand about loss of income and being in a horrible economic situation where you can’t pay for anything. But that is not the case with you. While a number of friends of mine who are “buried” in houses that they are continuing to pay for because they agreed to pay a given price, you are deciding you shouldn’t have to pay merely because your investment didn’t pan out as you hoped.

No Laura, what is astonishing is the inability of some people in these blogs to view things objectively without their emotions clouding their judgment. People have to look at things with a black and white perspective. Is this legal or illegal? Does it make sense? What are the pros and cons of staying vs. walking? Do I care about the bank’s well being more than my family’s?…okay, that last one is a bit on the emotional side but the point is valid.

Just because DG walked from his house even though he seemingly could have afforded to stay doesn’t mean he should have. This seems to have been a better move for him so I have no problem with what he did.

What is interesting to me is that the bank is probably frustrated with his actions because he acted in his own self-interest, and now he is frustrated with the bank’s non-action because it may be in their best interest. That is hypocritial. But to get all bent out of shape because someone made a decision to better their situation is arrogant and illogical. Are you mad because you feel like you will be paying for his house through taxes? This is something I have read countless times and couldn’t disagree with more. The walkaways are not raising your taxes, your government is. Are you mad because the walkaways are lowering your property value? It’s value was completely out of whack to begin with. Are you mad because you think it is irreponsible to exercise the option to walkaway? That doesn’t make sense since the party feeling the pain of that decision is the same one who put the provision in the contract, ie. the bank.

Whether you or I feel the pain of his foreclosure via taxes is completely dependent upon the decisions of the lawmakers. It doesn’t say in any mortgage contract ever written that the losses steming from a foreclosure will be paid by John Q Taxpayer, that is an amendment added by our elected officials…anyways, I will be getting off my soapbox now. You just struck a nerve with me by misplacing your frustrations on someone with the foresight and balls to say enough is enough

Partyboy:

Put a period on that. Yeah.

I have no problem with people walking away from their mortgages EVEN if they can pay for them! That’s the risk the banks take for giving you the loan in the first place… If the banks hadn’t lended money to anyone with a pulse for the last 10 years.. Then home prices wouldn’t have risen as high as they did. I believe those that do default should be punished with a horrible credit score for longer than 7 years though… And to be perfectly honest.. I think alot of these people will be punished more than 7 years. They’ll get crappy rates on any loans they try to get for years to come at the very least. If I’m a bank and i see a foreclosure on your record.. No way in hell are you getting a low interest rate… get used to it!

The stupid person is the person who would consider loaning money to someone that has a foreclosure on their record…. Information is everywhere.. They can’t hide their credit score from borrowers. I like the fact that my 770 blemish free credit score will look that much better now. I still get 0% credit card offers every single day.. I got a 0% 5 year loan on my new car.. all of these are valuable perks.

Weekly we get a RE newsletter 12 pages self cover over sized color showing the wine and cheese lifestyle in Sonoma along with various listings and industry writers.

The regular writer in the latest issue actually wrote an article telling local sellers to lower their price that the market wasn’t going to get better later this year or next year if they wanted to sell it would be necessary to lower their price down to the level of willing buyers!

The number of 450K plus listings in Sonoma both the city and county have skyrocketed of late and the sales velocity is like watching paint dry. Open houses are attended by neighbors and other Realtors.

We have a large percentage of Realtors in this market and if the current sales velocity continues much longer many with be added to the foreclosure/short sale crowd as they have been significant flippers and short term investors.

People who walk away are simply exercising one of the options in their contract with the bank. Both parties agree that if the borrower stops paying the bank takes the house and the buyer loses his down and whatever payments he may have made, as well as his ability to obtain credit easily or cheaply. In the past this worked well for the bank because having the bank take the house was the worst thing that could happen to most people. That has changed, but the contract hasn’t. So now it’s working a little less well for the bank. I for one am not breaking out any violins – or judging the people who walk away. I’m a happy renter who sold the one investment property I owned in 2007 and put the money in the bank. I got out. Others weren’t so lucky. I can’t say what I would do in their shoes and I certainly don’t blame them for exercising an option clearly spelled out in their contract

> And for the next one or two years prices will start trending lower again as the Alt-A and option ARM waves hit and the gimmick parade starts running out

Except for a few with true teaser rates, these loans have been getting better for the borrowers rather than worse. I’ve spoken with two people in the last week who have had their resets and are at under 4%. These loans are NOT a problem and will not become a problem until interest rates start increasing.

FinestExpert.com

Crazy thing is that a lot of homes are selling for bubble era pricing. In LA and SF, they are selling like hotcakes. Even rents in a lot of places are not coming down even with increased rental inventory in most cities. Either the few that benefited from the last 10 years are rearing their heads in the housing market or something we haven’t seen before is happening.

I remember the early 2000’s recession and how cautious everyone was about money, hiring, buying homes and even renting. No one wanted to spend more than they could afford. Landlords dropped rental prices to entice would-be renters and in the condo/home market, at least condo prices were cut dramatically. And everybody was talking about how hard it was to find work. Nowadays, people are shopping, buying bubble priced houses, renting studio apartments for $2500/month without abating. You hear that there is no work out there but then the next day, someone drops 100K on a destination wedding. Where is the $$$ coming from and where can I get some? It’s been 2 years since the bubble burst but somehow, we’re still in a bubble. At least the whole Escalade trend is over with, when was the last time anyone saw one of those?

LAer,

People in Los Angeles county don’t live in reality. What you’re probably seeing is evidence that the only people remaining in that county are the upper class and the poor. The upper class wasn’t as affected by recession and shops in entirely different areas and stores than the poor.

~

I just moved out of that county after living there a total of 8 years off and on not counting the time I lived there as an infant. Will the last person in the middle class from Los Angeles county please turn out the lights?

@Happy Renter

I agree with you. It’s a financial contract–not a solemn oath. The Man-hatters try to guilt us into throwing our life away after they sucked is into a usury death trap. We have to fight back somehow. We have to reckognize this was not a mistake–after the S&L bailout the Manhatters knew Sam would steal from the poor and give the the criminal bankers, so they just ramped the stakes up 100 times and pulled the same trick again. Amazing how few saw this coming, and how those that did we’re mocked. Ben Stien, have you seen the truth?

Regarding reason 4,

7 percent of all mortgages are over 90 days delinquent and not in foreclosure.

Not 7 percent of mortgages 90 days delinquent are not in foreclosure.

This is beyond nuts, 1 in 15 mortgages nationwide are in this boat.

LAer we live in extordinary times. The FED is essentially loaning out money at 0% and banks and hedge funds get that and use it to invest in all sorts of crappy assets all over the world. Bubbles that took years to form , now inflate and deflate within a year or less. It is simply mindboggling to look at what is going on. Then of course you have the strategic defaulters who now have anywhere from 2000-4000 a month in extra disposable income.

I have no problem with strategic default. What is good for the goose is good for the gander. If AIG can walk away from 100s of billions without a single criminal charge, then why not your average joe homeowner. Keep in mind it was the FED Chairman Greenspan that encouraged people to get adjustable rate mortgages at the height of the boom and he and Bernake did not see the housing bubble.

However all good things must come to an end. It may be a few years from now-but prices always adjust to reality. Look at what happened to Detroit when the industries moved out. My complex just lowered the rent the second time after I moved in. You can only sit with empty apartments for so long. I think the Dow is ripe for a massive crash, judging the P/E ratios which. So we could end up with a long deflationary trend with no money left for future rounds of bailouts or stimulus. Now that will be interesting.

You people a smokin crack if you think people who default on a home will have bad credit and high interest rates for 7 years or more….hahahha. The average time is 2 years and you can buy another home with reasonable interest rates. This is the problem people. There is just no punishments for anyone any more. Put on your seatbelts life is headed down a bumpy road. SAVE your money!

@A&M good point. This is why I left my home to the bank because the government and banks are bailing out people who shouldn’t have been able to buy a home to begin with and because I can afford to pay a mortgage on a house that is worth half the price then people think I should? That’s a joke. I have several friends who bought homes they couldn’t afford with no money down. Then when they couldn’t pay they got reduced payments, one got 2% interest for the life of loan. She didn’t have the income when they gave her the house to begin with. Anyhow, my point is fortunately we live in a state that you can give the bank the house back and only end up with a bad credit score. Quite frankly I could careless because I have cash so I don’t need credit anyway. At this point I don’t ever want to own an home again. But I’m sure the bank will want my money again in 5 yrs and try to figure out a way to take it. lol too funnie..

@A&M good point. This is why I left my home to the bank because the government and banks are bailing out people who shouldn’t have been able to buy a home to begin with and because I can afford to pay a mortgage on a house that is worth half the price then people think I should? That’s a joke. I have several friends who bought homes they couldn’t afford with no money down. Then when they couldn’t pay they got reduced payments, one got 2% interest for the life of loan. She didn’t have the income when they gave her the house to begin with. Anyhow, my point is fortunately we live in a state that you can give the bank the house back and only end up with a bad credit score. Quite frankly I could careless because I have cash so I don’t need credit anyway. At this point I don’t ever want to own an home again. But I’m sure the bank will want my money again in 5 yrs and try to figure out a way to take it. lol too funnie..

I’m going to call severe bullshi1t on this post of yours Laura. YOU are part of the problem by not pulling your head out and looking at the problem from the top down. If you honestly think the hard working PEASANTS in this country were the ones responsible for this mess, I’ll lump you in with the other republicans who see no wrong in allowing the plutocracy of America to continue. Posts like yours only further enrage me to do the right thing for me and my family and not cling to propaganda that falls from ignorant mouths.

Blaming DG and people who lost thousands if not hundreds of thousands of dollars pisses me off. I would bet you are *NOT* one of the people actually financially hurting…..yea yea, we know, because your so smart and fiscally sound….that and you got LUCKY to time things well.

DG, live there for as long as possible and take every single thing you can sell LEGALLY (remember this is all LEGAL from your cronies LAURA elected!), just replace anything you take with something that is the absolute bottom shelf cheapest Chinese made CRAP, I recommend Wal-Mart, they have the worst garbage.

You see, when the law does what a single person wants…the law is good. When the law conflicts with their (Laura’s) personal morality and ethics, well then, you’re a piece of excrement if you don’t follow through on THEIR (Laura’s) ethics and morals.

Laura, I’m sure you would keep a company in business even though it was losing money right? Even though you would lose EVERYTHING, or even if you were working for 10 years to break even, you would keep going because you signed the obligation on the contracts for credit…right? Yea, I thought so, you would default and declare bankruptcy because that’s SOUND business ethics. Why the difference for your fellow man?

Another hypocrite….next hypocrite please.

Almost a half million licensed agents? That is beyond amazing. The DRE should be disbanded.

Trying to locate a real estate agent/broker in the State of California named LAWRENCE COWEN. Can you help?

Leave a Reply to PRCalDude