1.8 Million California Mortgages Underwater. In 2008 100,000 Renters were added. 2010 California Housing Market Trends. How Banks Hoodwinked the Public into Believing the Bailouts were to help the Housing Market.

As we wind the year down the California housing market is entering a new chapter in its bubble saga. 2009 brought many new factors to consider in how the housing correction will play out. One major trend was the growing number of moratoriums. These programs largely failed at preventing foreclosure and only pushed the inevitable down the road creating a cryogenic toxic mortgage. The growing number of shadow inventory has been mounting as well. A few articles appeared in the L.A. Times and O.C. Register discussing this topic. Hopefully we’ll see some opinion pieces discussing how shady bank practices are when banks claim housing numbers look good when they know that the numbers on the books state otherwise. As of today, on the eve of a new year, roughly 1,800,000 mortgages in California sit underwater. That is, the home backing the mortgage is not even worth the current balance.

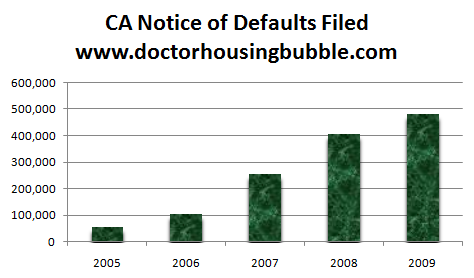

This is hard for people to imagine. Recent annual data from 2008 showed that California added 100,000+ new renters in 2008. When the 2009 data is released late in 2010 we should expect a similar trend. 2009 saw a record number of notice of defaults filed:

So 2009 was the worst year for California housing if we consider people not paying their mortgage as a significant criteria. And the above chart is largely responsible for the growing number of shadow inventory. In a typical foreclosure process, after a notice of default is filed a home will be taken back in 3 to 6 months. Take for example the 135,000 notice of defaults filed in Q1 of 2009. With a cure rate of 3 to 5 percent according to recent reports we would expect 128,000+ of these homes to be taken back in Q3 of 2009 by the bank. How many foreclosures occurred? 50,000. Now this isn’t a new trend or something that is shocking. In fact, with the HAMP initiative it has become a formalized process. Yet HAMP has only converted some 4 percent of trial modifications to permanent status (they have extended the deadline to the end of January as if this was going to miraculously boost the numbers). Plus, we have yet to see drilled down statewide data. California also has toxic mortgages like option ARMs and Alt-A products that largely do not qualify for HAMP. Many of the option ARMs recast in 2010.

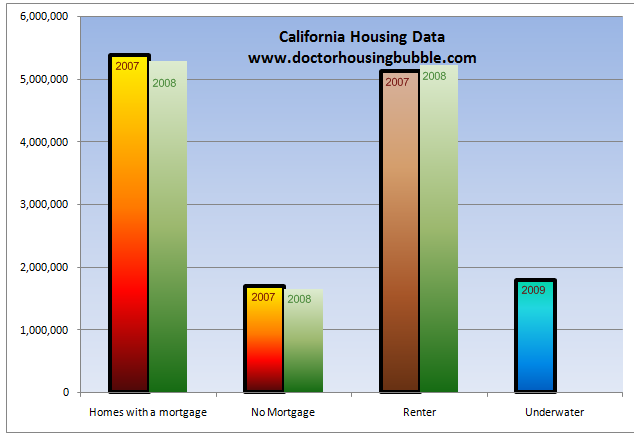

But let us look at the overall California market:

California has an extremely large renting population. In 2008 we saw a massive shift of 100,000 additional renters. This number almost perfectly correlates with the 91,000+ drop of homes with a mortgage. In 2008 California had almost the same number of renters as homeowners with a mortgage. It is a safe bet that in 2009 we have more renters than homeowners with a mortgage. I hesitate to call someone with massive negative equity a homeowner. Of those with a mortgage, nearly 2 million owe more than what their home is worth. They are worse off than a renter.

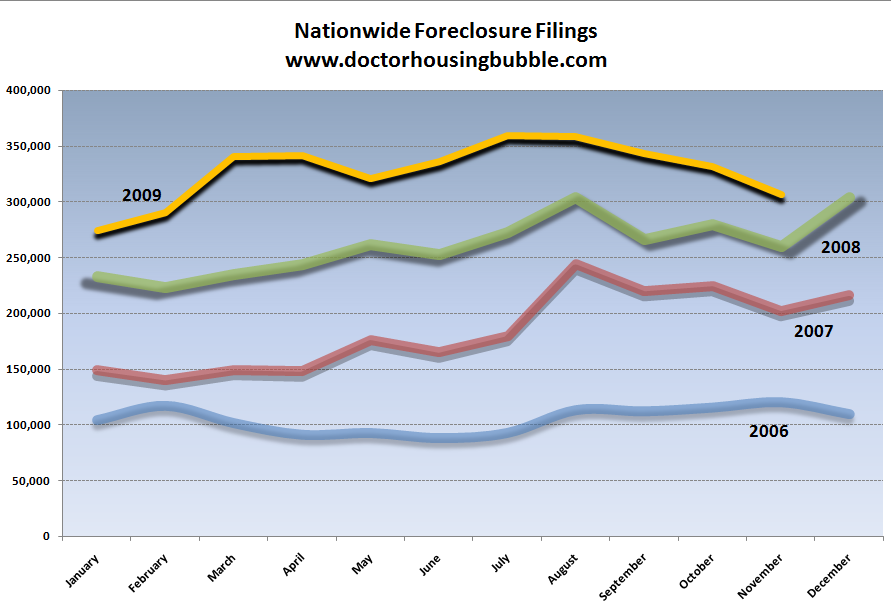

Banks have been playing this absurd game with taxpayer money. Since the recession started we have seen trillions of banking subsidies and direct bailouts. Yet here we are with foreclosures still near their peak and the economy still in the dumps:

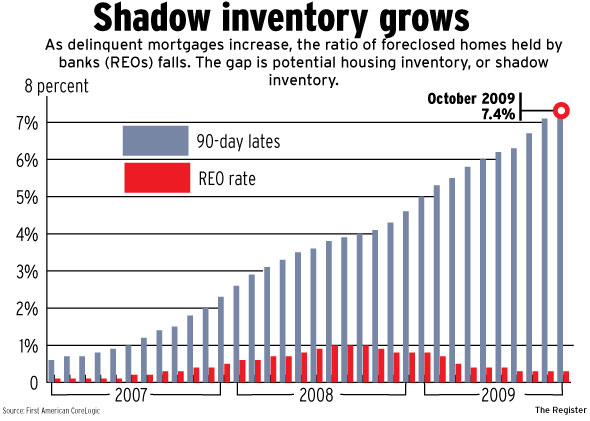

Matthew Padilla at the O.C. Register has a chart showing the growth of the shadow inventory:

Source:Â OC Register

So what are we looking at above? While foreclosures in Orange County have been steadily dropping loans that are 90+ days late are now at a record high! In other words, banks have been covering up their eyes and pretending everything is okay. This is the nonsense that is called a “solution†to the current problem. If ignoring a serious issue like this is good news then a gambler should keep on gambling even if he is in the hole for millions. This is the shadow inventory. We have never been in a situation like this. It is the height of stupidity to give banks the authority to resolve this mess when they are largely the culprits of bringing down our economy. With the trillions banks have received we could have paid off every single mortgage in the U.S. But as you have figured out by now the bailouts were never about helping the public. The bailouts were to protect the entrenched crony interests of Wall Street.

It is amazing that government policy is only now starting to connect the fact that the employment situation is so dismal and that may be a reason for the continued problems with housing. I tend to believe that D.C. and Wall Street are now one in the same so they already knew this and sold the bailouts as assistance for the people. That has been a major sham. Early reports on HAMP show that the process is laborious and painstaking for those trying to get a modification. You mean the same people that made $500,000 mortgages with your cat as a co-signer in 24 hours are no longer able to rush through paperwork? The banks are largely lagging because they already have taxpayer money so what is the big rush? They can simply go back to gambling on Wall Street while the real economy looks like this:

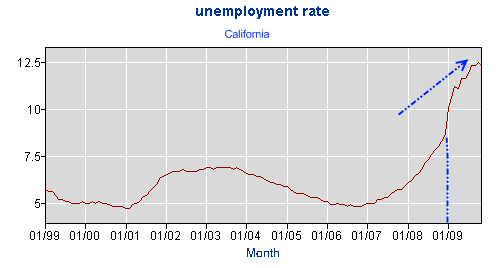

The California unemployment rate went from 8.7 percent in December of 2008 to 12.3 percent today. Without a doubt this has something to do with the 90+ days late jumping off the charts. What use is modifying a mortgage if you have no job? Yet this has been the tunnel vision policy of our government since December of 2007 and we continue to allow Wall Street to write the path forward. The PR machine is going heavy that things are now dandy because the stock market is up 60+ percent but the reality is much different. Foreclosures are still sky high and hiring is still anemic.

Is it any wonder why so many loans are underwater in California? Maybe the market is trying to say something that prices are still too high given the current economy of the state. We are going to start the year off with a $21 billion budget deficit. How is this good for housing but more importantly the economy? Banks will continue to rip people off and drain taxpayer money because nothing has come in the way of solid reform. There is a commission that is finally going to look into the causes of this crisis but findings won’t be out until late in 2010! First, banks and Wall Street are the primary causes of this crisis thanks to their bedfellow the Federal Reserve which serves as a pseudo-government agency to funnel money into the banking and financial sector. Alan Greenspan dropping rates to 1 percent juiced the housing market completely. Would people be buying homes if mortgages were 10 percent? They’d think twice. Plus, the easy interest free money was more a gift to Wall Street to gamble in the global stock markets. One argument goes “well people should know better than to borrow $500,000 from a bank.â€Â Poor bank. How about we only allow the bank to lend their money and let us see if they still make those loans with zero government backing. Something tells me lending standards would change overnight.

Are people to blame as well? Absolutely. But many are paying the price with job losses and foreclosures. They are taking their knocks. Yet Wall Street has siphoned off every penny from the taxpayer to ensure that they don’t lose any money in this downturn. They talk about moral hazard when it comes to the public but when it comes time for their punishment they like to pull the hypocrite card out.

And things are going so good that Fannie Mae and Freddie Mac are having their caps pushed upwards. Turns out losses are just pouring in. Do you remember the gall of these people telling us we were somehow going to turn a profit on this? This was the ultimate sucker play. If banks had to make mortgages with their own money you can rest assured the interest rate would be somewhere between 8 and 10 percent and they would be limiting who they lend money too (I would assume a more sizeable down payment as well). But instead, banks with their horrible underwriting standards are actually dishing out government backed loans with artificially low rates. These are the loans that are now imploding. Banks don’t give a crap since they don’t hold the note. So if this is the case, why do we even need the bank? Why not have the government make the loan directly to the public? Because banks want to suck every nickel out of your wallet.

So until we get any real reform we can expect to live in a 1984 like world where we hear propaganda that the economy is fine and housing is recovering. Don’t worry, after all banks were in charge this decade and look how well things went.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information.

Subscribe to feed

Subscribe to feed

41 Responses to “1.8 Million California Mortgages Underwater. In 2008 100,000 Renters were added. 2010 California Housing Market Trends. How Banks Hoodwinked the Public into Believing the Bailouts were to help the Housing Market.”

Housing evangelist back to Scary Gary

– Since 2008, the U.S. government has engaged in a series of “botched†efforts to rescue the housing market.

– The core problem in local (Orange County) real estate is a lack of move-up buyers.

– While demand for homes selling for under $500,000 is hot, sellers of those homes no longer have any equity. They end up with nothing to invest in a bigger house. As a result, sales of homes for more than $500,000 are “dead in the water.â€

– Foreclosures and “short sales†— sales of homes for less than is owed on the mortgage — continue to dominate. Other homes must compete with those properties by lowering their prices.

– High unemployment, tight credit and a new wave of foreclosures on Option ARMs and other creative loans likewise are combining to depress the market.

Watts has seen his own share of bad luck this year. The Mission Viejo broker was required to default on a loan for a rental home he owned as a condition for selling the home as a short sale. In his latest outlook, he said:

“To add to the housing woes, the Treasury is issuing a lot of money. The market is beginning to wonder who is going to buy all these notes and bonds. This will force interest rates upwards, putting more pressure on our already weak housing market.â€

Hey, Doc, Oceania has won the war! you can relax.

OUCH

I am so glad I was able to see and leave CA in July of 09.

Hold on to your hats, this will be a very crazy 2010!

We stayed on the Central Calif. coast recently. There is a 3 unit condo,built in 2007, granite, stainless, etc., one block from the beach, with great views of the ocean. In Jan.09, one of the units was on the market for $1,300,000.

No takers.

In Dec.09, it is on the market at $795,000.

Unsold.

Housing prices have a long way to come down, at the upper levels.

This will probably be one of the stories of 2010.

1.8 million seems awfully low to me. I assume that every single mortgage made between 2004 and 2007 has to be underwater unless the person put 50% down. Then you have all the people who used their home as an ATM that are underwater…. The modification program is a huge joke and waste of money. Most of the people are much worse off with a modification than they are strategically defaulting. Why would I be a renter in my own home and pay double the price and not have the ability to ever move?

Dr. HB,

As the year draws to a close (good riddance!) I wanted to thank you for helping me understand and come to grips with the financial crisis in general, and my own family’s losses in particular. I don’t live in CA, but in a sense all Americans do, as the bubble that inflated there arguably contributed to everything that happened nationwide this decade (in particular, the creative loans introduced there but then spread everywhere else). I think people outside CA did not understand how interconnected we all are. We do now.

I think voices like yours have been critical to creating an informed vanguard among non-professionals like myself. Now your message has gone mainstream and people who would never have considered letting their underwater house go before it takes them under are on the verge of doing so. I think you will save lives, literally, with your message and information, if you have not already done so. Please keep up the good work.

Many Americans still don’t understand that they have been had, and that they should not let their mistakes (which they were mostly–not completely, there is still free will–but mostly conned into making) ruin the rest of their lives. Government and bankers are colluding against the people. People need to recognize this and stand together against them. We need to free ourselves and save the country. It is just like being on the Christmas flight to Detroit–we have to save each other. No one is coming to our rescue.

Great research on exposing the truth our govt doesn’t want us to know. These days, what else is new. But WE have a choice in deciding to play the game or not. The future definitely has more downside risk than upside. Why not RENT a beautiful place that is twice what you could afford to buy and half of what other “homeowners” or homedebtors are paying, WITHOUT the risk of losing your hard earned down payment and credit history?

Let me see, a North of Montana rental in Santa Monica or a starter house in Venice? Hmmmm, that’s a tough one..

http://www.westsideremeltdown.blogspot.com

http://www.santamonicameltdownthe90402.blogspot.com

Thanks Doc. Nice work. I just keep wondering how long all these govt fingers in the dyke will keep the dam from collapsing?

Not much longer, CAE. The scent of loan/note default is making its way around the globe. The whole world knows we are broke, but our Congress and gov’t keeps behaving as if the faucett will not shut off.

Nationally, we are now in a very unenviable position of now having to run to stay ahead of the fire, because the fire is right behind us ready to consume us. That marathon can only go on so long.

The revenue $’s aren’t there to prop us up any longer across the whole economy, with no jobs and the declining job market.

What happens now is anyone’s guess on how big the final collapse will be, and what it will mean to the USA.

In inflationary times, its best to be renting, especially if the interest rate goes up. If you have savings, your yields will go up. The current note holder is either going to have to hang on for a long long time and weather the storm, or default.

I think we are witnessing the last, greatest, breakdown of America. And it didn’t happen overnight. I’m in the process of paying off my mortgage. I see no alternative other than to take cash and pay it out, and cross my fingers that the cost of living doesn’t go so high that I can’t make my taxes on my farm.

If you are not able to do this, its going to be a very bumpy 2010.

I’ve got a question for the board.

Is U.S. economic “growth” coming to an end?

What economic forces will support sustainable growth, as opposed to speculative, bubble-driven growth?

What is happening in this country is very sad and yet the public is just sitting around and not organizing massive protests to demand resignations of public offlicials. It is beyond comprehension on how we can stand what is going on and the government continuing falsifying unemployment statistics, revising the positive GDP number lower twice, bailing out banks with $9.7 trillion guarantees, allowing banks to not write down the true value of their loans, Federal Reserve buying most of the of treasury bills, FHA conducting sub-prime lending again, Obama accepting a Nobel Peace Prize and then expanding the pointless war in Afghan, government borrowing $1.8 trillion for the operating federal budget, and meanwhile here in California the increase of the sales tax, taking more out of your paycheck in advance, increasing traffic and court fines, and hoodwinking the public with accounting gimmicks.

We can take back our country if each of us moves our money to smaller local and regional banks! Just think about it… what would happen if thousands of us relocate our savings and checking out of the big money center banks!! We can take back our country by using the money system to OUR ADVANTAGE!! It’s time for us to take back our country!!

See this site to learn the details and find a local or regional bank in your area

http://www.moveyourmoney.info

Still boils down to the flawed HNP2009. (human nature program). People will do anything for money and until there are swift ramifications exacted on the perpatrators, they will continue in their ways. Donald Fagan had the solution: “Just machines to make big decisions, programmed by fellows with compassion and vision.” (IGY-The Nightfly) but that’s just a dream. Unfetterred cronyism and oglipolies (SP) will define our future as they have our past. Folks, this elevator is still going down.

Great article and spot on, now the question is how long will it be before Australia follows suit?.

Over here they say it is different, in the US they just hand the keys back no problem over here people want to fight harder to keep thier homes since you can`t do that haha oh yes you can by going bankrupt!.

It is no different at all it will implode this year, and to my mind it will be worse than America if that is possible.

Aussies have much higher debt in thier homes and values are far more inflated than the US ever was, right across the board.

@nine yarder

Still lots of growth industries:

Military

Goldman executive compensation

Health Industry

Staff at unemployment offices

Identity Theft is still going up

Parents still paying for kids cell phones

Scammers of the unemployed

Debt scammers, especially mortgage

Bank charges

Government Lobbying

Education Union

Prison Staff as more desperate folks resort to crime to survive

Petroleum futures, in spite of declining demand

Gold as more people capitulate that things may never get better

Price fixing has food at insane levels.

Government intervention in everything

Lots of growth industries–just destructive ones.

In the 2010 congressional elections, vote for a 3rd party candidate. We have seen that Repubs and Dems are at their core the same (just a different group of crony swine at the troth). Wall Street has the current game locked down, but a strong 3rd or 4th party showing would be an epic wake up call.

The US has been sending production out-of-country for many years now. This has created wage arbitration which has allowed inflation to appear lower…along with very misleading CPI calculations. The GDP calculation has been completely manipulated to hide the fact that we produce far less goods today than 20 years ago. And the BLS puts out utterly garbage unemployment figures. Add this all up and one can see that the good news is massively over stated and the bad news is massively understated. The next 5 years are going to be really hard.

Matt, Move you money, potestus, and everyone reading this:

<

IT IS TIME FOR A REVOLUTION !

<

This new year, When you make your new years resolution, lets all say: " 2010 is the year we Americans take our country back".

<

When I say take our country back I mean, take it back from the banks that looted our treasury.

<

It is a simple truth that the bail-outs by Congress and the Federal Reserve was a confiscation of our treasury by the major banks, pure and simple. The recapitalization of those banks was the only goal.

That means vote out of office any politician that voted for the bail-outs, the foreclosure moratoriums and the gifts to the banking industry. In California that means we get rid of Barbara Boxer and Diane Fienstein. Nationaly that means Barney Frank, Nancy Pelosi, Geithner, Chris Dodd, John McCain and the looter in chief Barak Obama. If George Bush/ Paulson was in office I would include them too.

<

Folks, the revolution has already started, it began with the Tea Parties. Those traitors that gave the trillions to the Wall St. banks are going to pay with their offices in 2010. Then we are going to go after the chairmen and CEO's of those banks that think that they own this country!

Join in the Tea Party revolution everyone, we have nothing to loose and everything to gain.

Join the teaparty bigots and delusional paranoid misinformed freaks? Yeah, that will solve the problem.

I’d have to agree that if ever there was a chance that a 3rd or 4th party had a real shot at getting into the US political process, it’s in the next few years. The hurt is on for many people now, and it aint getting better soon.

Well written Doc, and thanks for standing up with us homeowners who make a mistake paying too much, but are doing our best to weather the storm without completely rejecting the system.

@ DG – I agree with almost every one of your posts, but then again, you and I are in very similar circumstances, try not to get too angry, I know I battle with anger every day about what is happening to me personally, and what is happening to our country. They have us blaming each other for it and we are just trying to succeed.

It’s going to get much worse before it gets better here in CA, CHP got me the other day for tinted windows and talking on the phone, the fine was a tad over $300, good Lord I bet a stop light violation is probably soon going to be over $1000 and from a CAMERA at that!

@swiller

Police state here in the east too. Cops, lawyers, judges–you’re more likely to be ‘legally’ swindeled than have a conventional crime perpetrated upon you.

Anyone with an honest opinion knows we are about to go down the next ramp, but who can say just when? Thing is, do we ever recover from this? Can we reflate this? How did the last Depression end, W II? Is it just a state of mind or is it general systemic failure? Personally, I see this as the Dark Ages II. Once this thing breaks it will not be repaired in our lifetime.

Hope I’m wrong.

From what I’ve seen, here is my prediction.

The January HAMP deadline is extended

Just as home buying season (summer) comes, a new 90 day moratorium

More bizarre government inaction

Round out 2010 with a “holiday” November, December feel good moratorium

See you in 2011, wash/rinse/repeat…

Um Greg in LA….

Don’t get all wee-wee’ed up over this so called revolution. It’s a handful of people relative to the voting public (AKA Boobus Americanus) & as right as they may be Boobus will vote for the same old retreads they always vote for who will be barking to the pack (telling them what they want to hear) to get elected. Bank on it. This has been happening since the country was founded. If FDR can confiscate gold in the ’30s and not incite a revolution then the teabaggers don’t stand a chance. Look around you….all these people vote and most are fools and idiots. They voted for Barrack Obama for God’s sake. It ain’t happening dude.

Democracy is the idea that the common man knows what he wants and deserves to get it good and hard.

H. L. Mencken

U.S. Loan Effort Is Seen as Adding to Housing Woes

Some economists contend that the Obama administration’s $75 billion program to prevent foreclosures has done more harm than good.

Greg,

Obama calls the gifts from us to Wall Street,

“Redistributive Justice”

His voters figured that meant stealing from the rich to give to the poor.

His voters were mistaken!

Hope and Change train wreck.

Robert,Was that condo at Lovers Point in Pacific Grove ?

Kudos to the Doctor again.

What is happening is that the bubble is being erased. We saw 6+ years of increasingly nonsensical underwriting which went to the extreme of sub 600 FICO borrowers with no money down and no income documentation getting 700k loans. This allowed realtors to raid every rental throughout the land telling people that they were losers for not owning a home and that buying a house was easier than they thought. So off they went. Oooh, a perfect house just came on the market. Let’s go get you into a bidding war on some piece a crap in Riverside before you get completely priced out of the market; isn’t that great! Hey, I thought bumfights were illegal, but the realtors had no problem playing cornerman with multiple offer hysteria. How many of those people who were scared into buying would like to roast their realtors and loan agents over a spit right now?

At the onset of this fiasco, we saw institutions take over the hard money lending market. I had been active in hard money since the 80’s and then these institutions began writing loans they called subprime, which my private hard money investors rightly called trash. They would question me as to who would buy such garbage and we would wonder how such deep pockets could be so stupid, but the money train never ended they just kept getting dumber and dumber with their so called underwriting. It was absolutely perplexing because we knew it would result in horrific losses. How come they couldn’t see that?

Well, the truth finally came out that these mortgages were being mislabeled and disguised as AAA investments to be sold all over the world. This is classic misrepresentation and do you see anyone being prosecuted? Wall Street’s MBS investors simply bought a rating, while real trust deed investors scoffed at these suicide loans. Subprime… should be called Kamikaze loans. No thank you.

Now the market is just returning to where it was supposed to be all along and people see this as some kind of tragedy. The tragedy was that home prices were distorted by lending conduits that acted more like crack dealers in the first place. Then our “Dear Leaders” bailed them out instead of letting them be buried in this crap avalanche of their own making. You do something stupid and the market is supposed to mete out the punishment and bury you; but instead America failed and bailed them out. Extend and pretend etc etc. Now we live in a Politburo society where you’re only successful if you can get close to the government hacks and get some sycophant sugar. Absolutely abominable,,, or should I say, an Obamination. We are obviously no longer a nation of laws but a nation of men, like every other banana republic.

When will people realize that these politicians do not represent us. Whether we are ruled through some dufus sock puppet who has no business speaking with a Texas accent or ruled by the latest politically correct looking Barbie who has no business using the word “Change” – we are ruled.

The only way out is to abandon party politics and only vote for independents who have the capacity to craft their own campaign platform and stick to it when elected; not beholden to the party who manufactured their candidacy. In my opinion, political parties are nothing more than money laundering operations who put on a show to gain control over the levers of power using whichever frontman suits their needs. Voting for frontmen or frontwomen leads to disingenuous “leaders” by design. We are owned. Vote only for independents. We need real people running this country, not flak catchers for the overlords.

Doug N. Yeah. I read the same New York Times article you reference. It’s always nice to see the mainstream media actually acknowledge that all this “help” is actually harmful in the long run. The more people catch on to what is really happening, the more they will pressure the politicians to stop all this money give-away to the banks.

@ohiogal – when inflation increases, isn’t it better to own a house with a mortgage? Inflation will push up rents, and if you have a fixed rate mortgage, your monthly payment will drop below the local rents.

The only caveat is that we can’t be assured that inflation will rise. Everyone in power is old enough to remember the 1970s inflation, and know the cure: raise the lending rate, kill growth and reduce inflation. This wasn’t Reaganomics’ fiscal austerity: even Keynes was anti-inflationary.

jk2001, in THIS situation, it will be better to rent. Where we are at financially in this country, is totally unlike anywhere we’ve been before. We are completely broke, from the consumer level to the gov’t – no way around that!

The last bastion of income “re-distribution” will be taxpayers with -any- equity as the target – they will be “the new rich”. Just like they are going to take the 401K’s to float already insolvent programs like SS – any money that Congress can pass a law to seize is going to be a target.

The heathcare legislation is another entitlement that has to be funded in the near and distant future. That hasn’t kicked in yet, and its another big drag on the economy.

When this house of cards really starts caving in, you are going to be better off not owning a home if you have a note on it. And if you count on the property tax “discount” each year to file your taxes, kiss that goodbye.

Rents will only be forced upwards as much as people can pay for them. With this market (no jobs) rents can’t go up – and when inflation hits, they won’t be able to go up, or they will be vacant because there will be no way for people to pay. Look at what happened in the last Great Depression. 3-4 families living in a single home because they had no options. No jobs!

As for sheltering money, its always best to own a home on a fixed note, at a lower interest rate, when the interest rates go up. That note does protect you somewhat as you pay for that home with cheaper dollars..but there is no way to stop them from calling that note if things get bad enough…and the assumption is that you are going to KEEP your job to pay for it.

Responding to “ohiogal” regarding healthcare legislation.

The United States is the only major industrialized nation which:

1. Permits medical insurance corporations to be exempt from anti-trust regulation.

2. Forbids doctors from owning the hospital

3. Price fixes the cost of physician services instead of permitting cash basis transactions with the doctor.

4. Permits drug companies to hold extensive patent rights on certain drugs

Taken together these four items touch on the real reasons for rapidly escalating costs of healthcare.

But, the single most important reason for the escalation of healthcare costs in GDP is due to the lousy US Dollar valuation. Since the hospitals and doctors are locked into procedure-specific “allowable” charges, the hospitals and doctors begin to anticipate the future buy-power of the money reimbursed. Because the insurers can take up to a year to reimburse for services, you can see hospitals and doctors inflating their service costs in order to compensate for the credit extended by the service provider to the insurers.

ohiogal writes “As for sheltering money, its always best to own a home on a fixed note, at a lower interest rate, when the interest rates go up. ”

>>

You pretty much got everything right until that point. YOu are dead wrong that it is better to pay $100,000 for the house and have a 4% interest rate (or whatever is ‘low’) when the time comes and interest rates rise. When you go to sell that house for which you have a 4% loan when interst rates are back up to a more normal 6-7%, you are in BIG TROUBLE.

>>

Incomes have not only stayed flat but are going in reverse when time periods are adjusted for inflation to compare them. (This has been going on for 30 years.) Ergo your buyer in 3, 5 or 7 years won’t be able to pay anymore a month than you can. Difference is that more of their payment will be going to interest than does yours. This means that they have to pay LESS for the house than you did so that the principal part of the payment is lower . That means you have to sell the house for LESS than you paid.

>>>

Your only other choice is to find a buyer whose income is 10-30% more than yours so that they can make the payment at the higher interest rate for the house at the same price you paid. Good luck. Everyone else will be looking for that same buyer too – and for houses nicer than yours were they cut the price.

>>

You can ALWAYS refinance from a high rate to a lower one if rates drop. You can not reduce the price you paid for the house without losing money.

>>

And sellers price houses aiming at potential buyers who can pay XX$$$ a month. So if rates are low, the sticker price can go up. (Duh…..that is why the Fed forced the rates down.) If rates are high, the sticker price has to fall.

>>

Bottom line on house prices is that they can NOT go beyond what households can pay per month and that means looking at household income.

>>

BTW, jk2001 have to say all this nonsense about ‘inflation’ jumping up and getting you is way overblown. If you are worried about price inflation, that can only happen to the extent that there are more people with enough money to buy the good or service than there is an amount of the good or service. With the falling incomes in the US and the lack of disposable household income it is hardly likely that there will be more buyers who can afford a higher price than there will be houses. (And that goes for cars, plasma TVs, vacations in Hawaii etc etc etc.)

AnnS, my assumption is that you are buying the home to be in it long term – as a place to shelter first – not as a direct investment – and certainly not as a cash savings account as most people now view their homes. What used to happen in the past was that people bought, stayed put, paid it off and then had money for retirement or had a lot less expense for retirement. They did not cycle their income through their real estate using second mortgages as the vehicle. In fact, having a second mortgate was considered poor budgeting and living above one’s means….

We’ve become accustomed to the idea that we can work both ends for profit where real estate is concerned, and that is just not true historically. The model has been to pay interest and pay it off, which is an expense of owning that home.

In the case where you are turning over this home due to relocation or job issues, then is is going to be based on the consumer market- which is shrinking daily on eligible buyers due to the debt level everyone is carrying.

As for inflation, we need to consider the massive printing press that’s been rolling for months now…we are NOT going to miss the inflationary spiral that is coming. As soon as the Federal Reserve tries to remove all that money, inflation will kick in and since we are already at 1% or so on the interest rate..there’s not much wiggle room to “stimulate” anything.

Unfortunately, history WILL repeat itself and the sad part is, that those who perpetrated this cycle are too young to have experienced the last GD. I grew up with someone who did – and its looking like we are on the same path and doing the same things (protectionist trade policies and monetary policies) that not only deepened the problem but made it longer lasting last time.

‘Aughts were a lost decade for U.S. economy, workers’

http://www.washingtonpost.com/wp-dyn/content/article/2010/01/01/AR2010010101196.html?wprss=rss_print/asection

(excerpts):

For most of the past 70 years, the U.S. economy has grown at a steady clip, generating perpetually higher incomes and wealth for American households. But since 2000, the story is starkly different.

There has been zero net job creation since December 1999. No previous decade going back to the 1940s had job growth of less than 20 percent. Economic output rose at its slowest rate of any decade since the 1930s as well.

Middle-income households made less in 2008, when adjusted for inflation, than they did in 1999 — and the number is sure to have declined further during a difficult 2009. The Aughts were the first decade of falling median incomes since figures were first compiled in the 1960s.

Job growth: (percent change in payroll employment)*

1940’s: 38%

1950’s: 24%

1960’s: 31%

1970’s: 27%

1980’s: 20%

1990’s: 20%

2000’s: 0%

Percent change in household net worth*

(by decade, inflation-adjusted)

1940’s: Not available

1950’s: Not available

1960’s: + 44%

1970’s: + 28%

1980’s: + 42%

1990’s: + 58%

2000’s: – 4%

(2000’s extends only through November 2009)*

ohiogal

>>

(1) The average length of residence in a single-family homes is around 7 years. People move. They more for work, for school, because of divorce, because they planned on 2 kids and whoops there are 3 and they need more bedrooms, because they need to move closer to fmaily to help elderly parents, becasue of job losses……

>>

Any recommedation that relies upon an unrealistic assumption is utter nonsense.

>>

(2) The inflation nonsense is an internet fringe theory. Utter silliness. The money the Fed Res has put into the system is NOT CIRCULATING. The banks stuffed it in their vaults. And when and if they do circulate it, the borrowers will NOT be Tilly and Jake but right back into estoeric financial instruments. No aditional money circulating among the majority (70%) of buyer (households) = no inflation. No serious economic commentator is even considering inflation a problem. For the foreseeable future, that is a bugaboo like being worried about things hiding under the bed or in the closet.

>>

(3) You grew up with someone who lived through the GD. Good. My grandparents were all young adults in 1929, my 2 great-grandfathers were in their 40s in 1929 — and they all lived until I was at least 18 and many until I was in my 30s. Due to their influence, my one degree is a triple play in economics, and social and poltiical history………specializing in the 1930s!!!!

>>

Didn’t have inflation then from the money the US Government put into the economy and won’t have it now.

ohhiogirl

–

>>

I forgot to add that you are DEAD WRONG on the impact of tariffs (if imposed) on the US economy as it exists. Way too simplistic.

>

Tariffs are bad if one is an exporting county. (US in the 1930s.)

>>

Tariffs are good if one is an importing country and domestic production is collapsing ie: import more than export while domestic production collapses. (Great Britain in the 1930s and US now.)

>>

Great Britain was among the first countries in the 1930s to impose extremely stiff tariffs on imported goods – huge tariffs. Great Britain did not suffer anywhere near the extent the US did in the 1930s — and recovered far far faster as domestic production (and thus employment) increased to produce goods which were now prohibitively expensvie due to the tariffs.

>>

In case you hadn’t noticed, the US imports billions upon billions more in goods than it exports. Money flows out of the US like Niagra Falls. And all the while domestic production dies….and jobs are lost…..

>>

There are names for societies that import more than they export. They are called ‘third world’ and ‘colonies.’

AnnSsssssssss…..

Well good on you! Multiple degree’s do NOT mean common sense! LOL!!!!

You might want to check out the latest from Ben Bernacke. There definetely is going to be inflation, they are publicly stating that they are about to increase the base interest rates now to control it (inflation). That wouldn’t be happening if they didn’t think this was going to start blowing up. They have to deal with the money supply issues…that’s a given. Especially since the Fed is buying its own debt, which is a Ponzi scheme of the first order.

In my area, (NOT California) we have had a low turnover in housing (other than a horrific foreclosure rate in “city” areas due to lost jobs) and because I live in a rural area, people generally buy and hold, they do not buy and sell. You’d lose your shirt expecting to do so as most of the properties are land intensive and not that easy to market except for big developers and my area is sufficiently remote from an interstate to keep people out unless they really want to live here.

Given that, its perfectly reasonable to look at real estate as a long term prospect if you expect to BUY AND HOLD and LIVE there. Depends on the goal, no?

Of course, there is always the “rules don’t apply to me” dude who makes stupid decisions. People have to live somewhere and patience was never an American virtue. 😉

Great work on the shadow inventory. Just wonder what your research shows you about zip code 91344 (granada hills) and 91326 (Porter Ranch). What is the total shadow inventory(NOD, NTS, REO) vs MLS listing. Thanks

1930’s: “Didn’t have inflation then from the money the US Government put into the economy and won’t have it now.”

Haha; another conclusion on the part of an edu-maton. So many factors were so completely different then vs. now that such a conclusion is invalid. FWIW, in terms of money itself, the US had a swiftly-administered type of “inflation” with respect to the then-foundational underpinning of US currency when FDR outlawed most forms of private gold ownership in 1933, called a bank holiday, and then revalued gold from $20.00/oz to $35.00/oz with a stroke of the pen.

Those who rely upon textbooks, professors, and the so-called “education” obtained thereby cannot see the forest for the trees. They’ll be stuck in the inflation vs. deflation debate, on one side or the other, relying upon their textbook definitions and Certificates of Indoctrination (i.e., college degrees – yeah, I have a few of them, too, and they don’t mean jack when it comes to street smarts) to “explain” things. All “explanations” rely upon mental models, which remain valid only within limited boundary conditions, and which progressively become less useful and eventually break down once boundary conditions are violated.

As a result, the edu-matons, as well as their “teachers,” will be unable to comprehend episodes of simultaneous “bothflation,” which will affect particular types of asset, currency, and goods classes differently in a quasi-synchronous manner, and which will lead to a currency crisis that unfolds right under their noses. The next 7 – 10 years shall give their zero-common-sense high-IQ’s a good enema or three.

Ah, edu-matons…”What you often find is that intellectuals are the most indoctrinated part of the population…First, as the literate part of the population, they are the ones most susceptible to propaganda. Second, they are the ideological managers, so they have to internalize propaganda. They have to believe it.†Noam Chomsky interview, “Noam is an Island “ – Mother Jones, Oct. 1988.

Chomsky unfortunately cannot perceive his own self-indoctrination; he and the multitudes of today’s edu-matons should perhaps defer to Jacques Ellul for a bit of insight.

I love these articles. Makes me feel better about my decision to attempt a short sale and if that doesn’t work foreclosure is my only option. I will be loosing my $100,000 down payment but getting this monkey off my back is way more important. I doing a strategic walk away unfortunately.

Information on this site just has confirmed I’m making the best decision now my house in Inglewood is worth $200,000 less than what I paid for it and continuing to slide. I appreciate the information I just wish more people would listen, but you can’t save everyone from themselves. I’m just happy I seen the light and am no longer depressed about being in a mountain of debt with no light at the end of the tunnnel. I feel like such a fool that I even bought into this whole mess. Now I realize I’m not alone, but among my friends I am the only person making an exit from this bad investment. My friends think the market is going to back to normal in 5 years and I’m the crazy person. But I will settle for being alone in my happiness of not throwing money down the toilet.

Leave a Reply to CAE