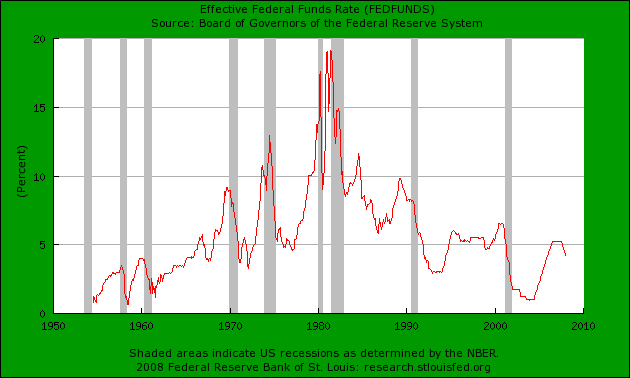

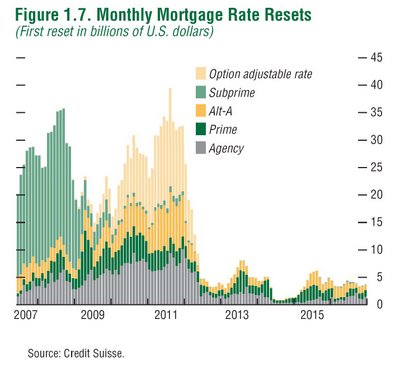

Now that was an interesting start to the week. Can you believe that we are only 3 weeks into the year? Anyone that can tell you they predicted this playing out exactly this way is flat out lying to you or should be given some sort of award for forecasting. As many hyper global vigilantes were watching the market last night, seeing two days of worldwide financial carnage many were expecting that the U.S. markets would wake up to much of the same. The DOW futures were pointing to a 670 point loss before the opening bell. It seemed that nothing would be able to stop the decline, that is until Boom Boom Bernanke stepped in with his wonderful Fed speak. Haven’t we already heard this story? The market initially plunged 464 points and gyrated all over the place like a go-go dancer finally coming to rest at a 128 point loss. Not exactly the best outcome given that Ben Bernanke did an emergency liquidity injection to the likes that have not been seen in over 25 years. And by the way, they are still meeting next week and will probably cut again. Take a look at the chart below:

The magnitude of the Fed cut only tells us one thing. They are scared. Not only did Ben Bernanke tip his hand, we are now becoming increasingly aware at how little power the Fed has over market conditions. Even during the Greenspan tenure, any hint of a rate cut would send the markets rallying into some form of credit bubble euphoria. This time, the cut as deep as it was, after all .75 was a 17 percent cut from 4.25 just did enough from keeping the markets from collapsing. And there is legitimate reasons for concern. The credit bubble is unwinding and we just realized how intertwined we are as a global economy. Some folks want to believe that we are all operating in these independent silos talking about decoupling but the fact of the matter is many metro areas around the world from Sydney to London to Los Angeles, we are in a global credit and real estate bubble tied at the hip. This credit and debt is floating everywhere and finally the gig is up.

People have reached peak consumerism and will now have to scale back not because they do not want to buy anymore, but because they cannot buy anymore. Many people woke up this morning and I hope you had the opportunity to catch a glimpse of CNBC; as they all were praying at the church of the Fed, and the market didn’t really respond exactly how they envisioned. In fact, Jim Cramer was yelling for the Fed to take over insurers and cut rates deeper and faster. I think if the Fed could cut rates to -100,000 Jim Cramer would be asking for it. This on the back of his rant last week at saying how corrupt things have gotten in Wall Street. You either think they are corrupt and should bring them down or you subsidize this Ponzi Scheme for a few more months and let a few more folks jump out with golden parachutes. You can’t have it both ways.

I mean how in the hell does this cut create jobs or help the ailing economy? Did you see what was in the green today? Financials and insurers. We all know there is no way in god’s green Earth that they can afford what is going to happen in 2008 so thinking they are going to create jobs is absolutely ludicrous. Thinking we can have a strong competitive economy by simply trading homes and issuing paper is simply incomprehensible. And the bulk of investors on main street hold most of their wealth in the equity in their homes, not some high flying insurer that essentially wrote protection that might as well be written on Monopoly money. Home was a store of wealth and not some speculation vehicle.

Whatever the market does, the eventual trajectory is to a major correction and all these little diversions will only make the endgame that much more painful. When things were starting to get out of hand in 2003 and 2004, someone should of stepped in. Error after error was compounded to the point that this game got everyone involved and now it seems everyone is trying to keep the illusion up. Someone on CNBC was openly arguing, “we aren’t in no recession and we won’t be in a recession. The fundamentals are strong.†To these delusional folks I offer the foreclosure capital of the world, California.

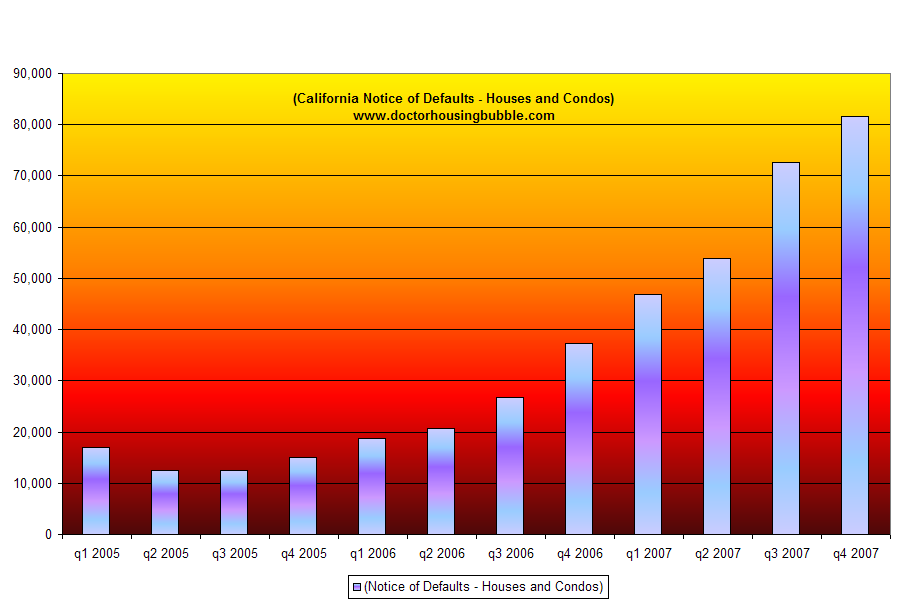

California in Uncharted Foreclosure Territory

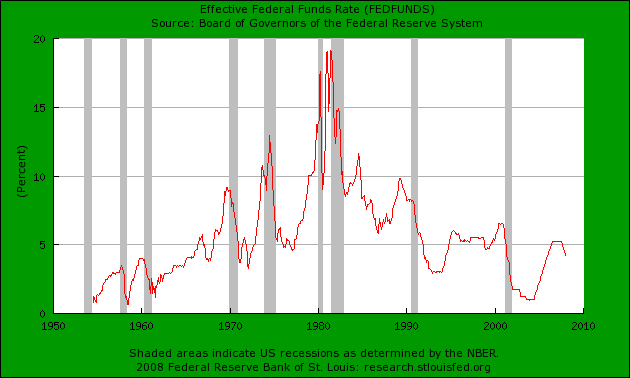

DataQuick just released their updated numbers for the forth quarter of 2007 and the numbers look absolutely abysmal for California. Take a look at the notice of defaults:

This is the highest rate of notice of defaults since DataQuick started tracking numbers for California. Now I don’t know if it was a coincidence that they released these numbers on the day that the market was raining Fed cuts and everyone was smoking the credit peyote, but I sure as hell noticed how significant this was. Not only that, it would seem other folks like Bank of America with poor earnings numbers were rallying simply because the market was in another credit stupor forgetting that mind boggling Real Homes of Genius are all over the freaking map sprouting up like weeds in an abandoned parking lot. Yet this is a symptom of the global nature of housing in the current era. How is someone in Japan, China, or England going to know about homes in Compton, Paramount, Lawndale, Carson, Chula Vista, Palmdale, Downey, and other areas that are poor to working class neighborhoods where homes were selling for $500,000 to $600,000?! To them, Hawaiian Gardens seems like an area that should go for $500,000. It is absolutely bananas and again, I would love to take Ben Bernanke and his buddy Hank on a weekend trip on the 105 through some of these areas to see if they think dropping rates further is a smart idea.

Yet if you need any more evidence that they can give a damn about lower to middle class America today essentially puts a nail in the coffin. They do not have the guts to come right out and tell you what truly is going on. They have to play some Ministry of Truth Orwellian game where you need a translator to understand their basic tenets. An astonishing 49 percent of the 2007 jumbo market was because of California. One-third of all subprime loans found their home here in California. Make no mistake, we are the model citizen of conspicuous consumption and the poster child of the housing bubble. The sheer amount of credit dependent on this state is enough to put someone into a mental asylum but given how we have a $14 billion budget deficit and Arnold is looking to let thousands of inmates out, you might as well strap a straightjacket on yourself and run around in some public park (that is before he closes those too). Another major issue jumping out at us is how many of these notice of defaults are actually going into foreclosure. Take a look at these numbers:

|

Quarter Recorded Trustees Deeds % of Notice of Defaults

|

|

Q2 2006: 1,936 9%

|

|

Q3 2006: 3,435 12%

|

|

Q4 2006: 6,078 16%

|

|

Q1 2007: 11,033 23%

|

|

Q2 2007: 17,408 32%

|

|

Q3 2007: 24,209 33%

|

|

Q4 2007: 31,676 38%

|

What this signifies is more and more people are unable to save their homes from foreclosure. And as Wachovia is now finding out, many people are simply saying “screw it†and sending their keys in the mail. And how else should they react? They are a product of the financial institution’s own greed and mortgage alchemy. All of a sudden they act “shocked” that people aren’t trying to save their house with all they got. In an economic sense of poetic justice, they are screwing them back. Here’s another shocking piece of evidence, housing is expensive. News flash amigos. There is such a disconnect from D.C. to Wall Street to main street that when I drive around many cities here in my beloved Los Angeles County, I can’t help but wonder how many of these mortgage holders actually know how close to the edge we are treading here? I doubt they even know or even cared so long as someone was buying the mortgages and they had nothing to do with the buyers once the escrow closed. Now that the buck has to stop somewhere, no one really wants to admit the brutal facts confronting us.

All make believe aside, we have two options. First, we’ve spent way beyond our means and their needs to be a correction in the credit markets. What that means is retailers will suffer and the economy will shrink because 70 percent of our economy is based on spending. Doesn’t it shock you that politicians aren’t saying, “please save the $800 and pay off some of your debt?” You should spend a twenty and get a basic finance book to begin with but the underlying theme is perplexing and disturbing. It reminds me of experiments done with rats where they are given the ability to feed themselves cocaine via a button that they activate. After a few days, these rats are so addicted on the cocaine that they ignore food and basic necessities for a quick high and eventually perish. The basic needs of this country are being completely ignored. The administration is content on keeping a mass population in the dark about the most basic of financial rules and giving them enough credit crack to keep them appeased. But looking back at history this seems to always be the case. Herbert Hoover was quoted as saying:

“Economic depression cannot be cured by legislative action or executive pronouncement. Economic wounds must be healed by the action of the cells of the economic body – the producers and consumers themselves.“

Amazingly, we are trying to cure these ailments with stimulus packages and rate cuts. Is this really the free market at work? Of course Hoover couldn’t do a damn thing about the Depression since the 1920s bubble was built in. A lot of the blame was put on him and rightfully so, but some of it came because of the Coolidge Prosperity.

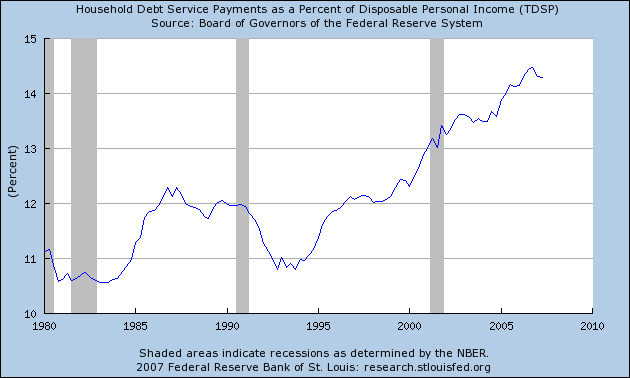

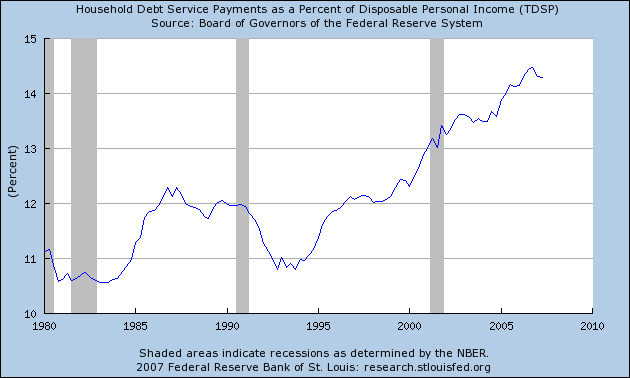

The second choice is taking the medicine and living within our means. As reluctant as Americans are to do the latter choice they are being forced to do so. The household debt load is becoming unsupportable even given the “amazing” housing boom:

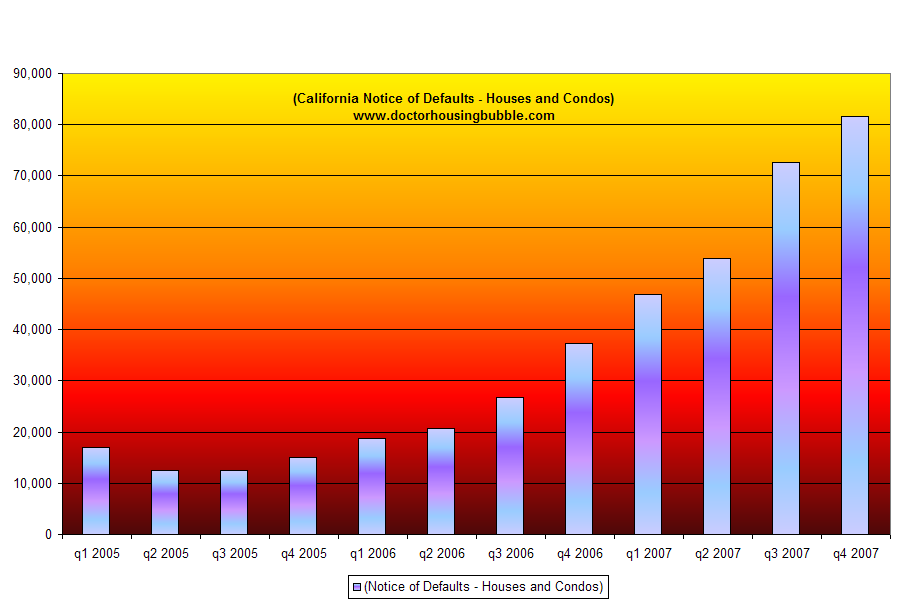

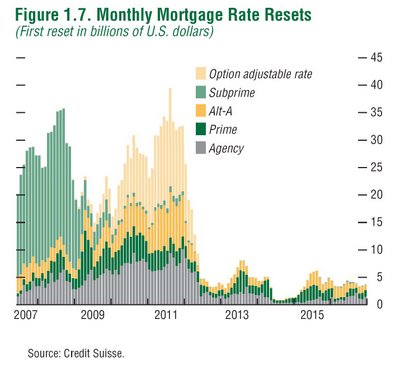

What does this mean? It means people are going to have to spend within limits. You would not believe the insanity that was going on out there. We had people making $14,000 a year getting $720,000 loans or a cat named Messiah getting a $4,200 credit card. That is how insane this thing got. Some poorer nations don’t even have per capita incomes of $4,200 per year and here we have a feline getting a credit line. If this is global arbitrage we have some serious rethinking to do. Housing prices are already coming down hard as we have shown in this report where every single county in Southern California is now down in double-digits on a year over year basis. The numbers that came out today do not point to a bottom or anything close to it. We haven’t even seen the worst of the resets yet:

The peak will hit this March. And then we have more to expect with the Pay Option ARM fiasco:

That won’t start unwinding until 2010 – 2012. The fact of the matter is the only way we are going to avoid a recession is if we go back to no documentation, no income, no job, no money, no friends, no nothing loans, with artificially low rates and start doing mortgage equity withdrawals and spending like Messiah the cat. This isn’t going to happen. We’ve reached the capitulation point. I was hearing a few CNBC pundits talking about “this is great because people are now going to refinance and all will be well.” Small caveat there Einstein. You need equity to refinance! What of the massive amount of homes that are now underwater? If they want to refinance they won’t be able to because of the overall declining prices in housing unless they come up to the table with cash. Now if they had cash would they be borrowing? And let’s not kid ourselves, rates have been at rock bottom for many years so people have already taken advantage of this “window” and many are now paying off their home equity lines because of that granite countertop addition or the French corridor they added.

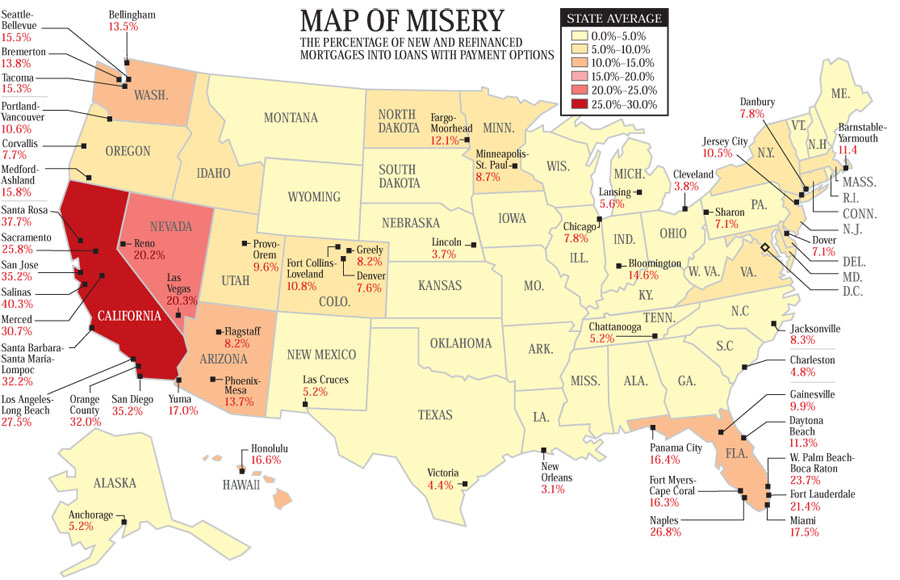

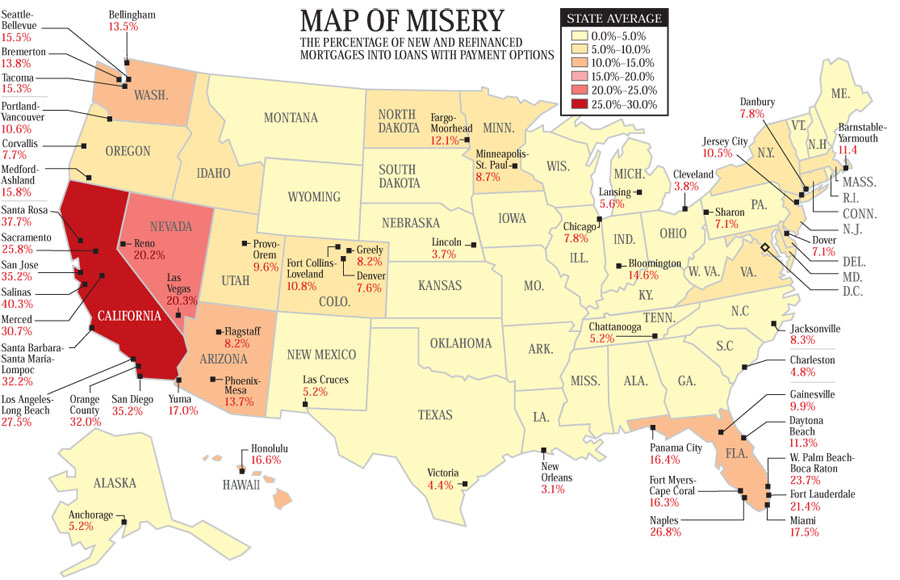

I had a smirk while I was listening to this flat out distortion of the financial truth. In reality, these cuts were to shore up the main perpetrators of the bubble, the financial lenders and insurers that created this entire mess in the first place. Show me a study where this type of action will create jobs. I assure you it will not and we will continue to see this mess unfold while posh severance packages are given to the people that screwed this nation. When you go out and vote this February 5th (for Californians) or your own primary date, keep this in mind when choosing your next potential President. Whoever inherits the White House is going to have to deal with an absolute mess. At least we know where the red state is:

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

25 Responses to “Who Cut the Rates? California Dreaming and Double-Speak Housing.”

Man, the longer this goes on, the more I want to see just, like, one frigging week without the Fed either lowering rates or everyone believing they’re going to (all last week). Free market, my left foot.

Cutting interest rates will translate in a weaker dollar from which many of our mighty corporations who have business overseas will benefit. Many of them already announced big profits in 2007. But the average American citizen will suffer the consequences of this, e.g. higher oil prices since oil is our biggest import, which would have a big impact on their spendings and availability to make a real estate purchase

Sorry to be first to comment again but your blog has become must reading while I’m on vacation and ‘vacation’ these days is not so restful as my stock portfolio is

under attack ( down 20% from the first of the year) and now Bernanke is going after my CD’s where I put twice as much of my assets).

Reading Financial Times columnist Martin Wolf this morning. Available here.

http://www.ft.com/cms/s/0/18083bfa-c8f8-11dc-b14b-0000779fd2ac.html

Its not so much what Martin says as a chart he posts that was prepared by UBS.

Entitled “US Credit Intensity of GDP Growth” it purports to show the $ credit change per $ of GDP. Not sure of what this means but it is very disturbing for it

shows there was a one to one relationship back in 1957 that gradually reached 2 to 1 around 1985, thence 3 to1 in 1997 and has since soared to almost 5 to 1.

If I’m reading this right it would seem to imply we have reached the point where it

takes an additional $5 of credit/debt to add $1 dollar to GDP! Perhaps you or someone else with a better foundation in economics than I could look at Martin’s

column and see I am interpreting this right.

To me the Bernanke move seems obvious. Drive down bank rates to the point where, instead of home prices being underwater, cash holdings/CD’s are. Chase

money from safe havens and force those looking for any sort of return to take their money out of FDIC insured deposits and purchase bank shares instead. Wachovia’s dividend is near or at 8%,e.g. Alternatively if you don’t like equities

anymore, go and buy and house. Great buying opportunity right ?

The big institutional investors are similiarly being chased out of their sanctuaries

and perhaps being told to give another look at those discounted CDOs the banks

want to off load. They can’t be worth nothing especially if inflation and government

bailouts keep the bottom from dropping out of the real estate market.

I am being paranoid?

Dr.,

I enjoy reading your insights, but a few more paragraph returns could go a long way.

I asked for your thoughts last week on the impact of the writer’s strike on Los Angeles housing. It seems MSNBC was pondering the same question. From today:

http://www.msnbc.msn.com/id/22791780/

About 18 years ago I left the great sunny state of Callifornia to attend college out of state. Everytime I returned I noticed what a herd mentality Californians have, need bigger houses, bigger cars, bigger implants. Friends in California would look down on me because I didn’t have the latest leather jacket, drove a car that is older (and paid for), not buying a first house for 400K and filling it with leather couches. I watched this happen as an outsider with the unique view of knowing the inside. I say suffer California, no amount of Fed cuts will pull the state and its inhabitants out of this mess. California will go into a deep recession due to its own stupidity and arrogance. Pay in blood and tears.

All I want to know is where is the check I’m supposed to get in the mail from Mr. Bush? My savings is building up pretty quick, so if I get those $500-$800 soon I can start saving even more.

Great article, as always. I was thinking about the $150 billion “stimulus package” being proposed by Bush. It clicked for me that we had a massive stimulus package following 9-11 that makes this pale in comparison. Essentially, the artificial increase in the price of housing in the U.S. made us spend as if we were vastly richer than we actually were. (I say “artificial because we had artificially low interest rates and artificially low or non-existent loan qualification standards that caused most of the apparent increase in wealth.)

Here are some rough numbers.

. There are around 100 Million Households in the United States.

. 69% of Americans “own” their own home.

. In 1999, the average house price was around $175,000

. In 2007, the average house price was around $300,000

So we get 69 million homes increasing an average of $125,000 each, with total appreciation giving us net appreciation of 8,625,000,000,000 or 8.6 Trillion dollars.

Since about 20% of this is accounted for by inflation, we get 6,900,000,000,000 or about 7 Trillion dollars of artificial wealth. Now *that* is a stimulus package. Maybe we needed it after 9-11, but we certainly didn’t pay for it. We are now.

People truly believed they were far richer than they really were and spent vast amounts of money because of it. How many times have you heard that “the consumer drives the U.S. economy?” Well, we certainly did during the heady days of the first half of this decade. But that ultimately was all borrowed money, and we will inevitably have to tighten our belts and pay it back, dragging down our economy while we’re at it.

Bush’s plan for stimulating the economy back into shape is an insignificant 2% of that number. And we’ll have to pay that one back too.

I’m not sure where we go from here, but it does look pretty grim.

It is great for someone else to say what I have been saying for the last year.

As a foreigner I can not go around saying what you’re saying because I will surely be told to go back to my country if I hate America so much. I don’t, I came here because I believed and still believe that America and Americans are the smartest and most generous people in the world, as my friend used to say: “They will not give you any money but they will give you a job and welcome you into their neighborhood” but Iately I see too many living beyond their means and thinking good times will last forever believing that God is looking out for them and that they deserve more than any one else just because they are Americans. I am a worrier by nature, and I hope I’m wrong, but I think this will end badly.

Well stated! I am losing my home in nevada, 30 year fixed had to relocate for work after job was downsized. I was one of 7 that lived on my street of 18 homes all owned mostly by the red crested, double breasted california investafinch. My mail man lived across the street in a 500k dollar gaurd gated community, he owned 2 of them by the way, and it was common for many LasVegans to own 6 or more. The problem for me was that the subprime mess dropped our value so much(58% at the moment for the short sale listing) that there was no way out and no job to stay in the community with. I think a lot of fixed rate people are going to be in for an awful time as their life situation changes and they come to find that there is no way out of the home unless the have owned it since the 80’s and good luck to them trying to get a new mortgage. My father is a lender and he said they will not lend at all on jumbo’s and they are looking for any excuse to turn down qualified applicants. His last one was rejected because the home had a coal fired furnace which is smart and common in the high country of Colorado. I believe they are trying to create a backlog for the looming return of 18% rates which will have to happen unless they are planning to completely dismantle The United States…..Good luck to all of You

Every time I think your articles couldn’t be any better, you show me.

I read this site not only for your keen insight but for the writing itself- nobody wants to hear the truths you tell, but your writing is so pithy, witty, and entertaining that people have to read it anyway. I’ve passed your link around to numerous housing Koolaid junkies of my acquaintance and they hate eveerything you say but they are greedy to hear it, and have become addicted to your site.

Maybe they will soon get hooked on the wisdom it imparts.

wow…great post! thank you for taking the time to create this blog…it’s fabulous! i’ve been reading this for about 6 months now and it has really inspired me to be more than just a “credit crack drone” and really educate myself about finance.

bush & company barely mask their contempt for the average american and i believe that people aren’t paying attention because of the credit “crack” as well. sometimes really bad events like this are wonderful opportunities for people to start getting educated and interested in what’s going on in the world (people like me!)

thank you!

Great article as usual, Doc.

What a big mess this red state is in … makes our choice on Feb 5 all the more important. May be the decision for a generation!

For now, the political game seems to be one of pandering. All the press that I see seems to call for bailing out the derilict versus rewarding the prudent.

This may play out like Japan … a long dribble of lower median prices. I’m told by my Japanese friend that you’re just about at the point of break even for the apartment in Tokyo purchased in the late 80s — And this is in a nation of savers!

Very Well said,

Anyone want to by my home in Escondio, I’ll sell it to you for the same price I paid four years ago? Oh wait, my next door neighbor’s is on sale right now for $100k less.

I get all of this, makes perfect sense in retrospect – wish I’d have learned all of this four years ago.

Doesn’t change the fact that this still sucks and I’ll be homeless soon.

GREAT ARTICLE!

Right on cue folks, we are now hearing rumors of bailout for insurers and get this, even some of the builders. I wish I was making this stuff up. However the odds of boosting this economy are nearly as likely as seeing your stimulus check anytime soon:

“Testifying before the Senate Finance Committee, the official, Peter Orszag, said workload issues at the Internal Revenue Service would prevent the mailing of rebate checks until after the peak tax filing in late May or early June. And then it could take 8 to 10 weeks to distribute the checks, meaning the impact of the action might not be felt until the second half of 2008 or early 2009.”

http://www.iht.com/articles/2008/01/22/business/econ.php?page=2

Dose anyone remember super duper SIV not to be confused with super duper incredible fantastic Tuesday in February? With the writers strike and no $800 until May, what will folks do to stimulate themselves? Before you answer, this is a PG-13 rated site.

Hi Doc and AnnScott,

This news just in. Does this change the picture at all for those with no equity / underwater on their current loans? Is there a minimum equity / downpayment requirement for Freddy / Fanny? Or is this to simply line up a new batch of pigeons to buy their homes, basically a bailout for the current lenders?

Thanks

Tentative Deal Reached on Tax Rebates

http://biz.yahoo.com/ap/080124/economy_stimulus.html

To address the mortgage crisis, the package also raises the limits on Federal Housing Administration loans and home mortgages that Fannie Mae and Freddie Mac can purchase to as high as $725,000 in high-cost areas. Those are considerable boosts over the current FHA limit of $362,000 and the $417,000 cap for Fannie Mae and Freddie Mac’s loan purchases

THIS JUST IN, it’s finally happened…

http://money.cnn.com/2008/01/24/news/economy/housing_prices/index.htm

Homes see first annual price drop on record

The median price for a homes dropped 1.3 percent to $219,000 in 2007, while total home sales plunged by 13 percent for the year

My stimulus check will go directly to arousing the balance in my savings account.

Or would blowing it on hookers and crack help the economy?

from the “stimulating” package just announced…”To address the mortgage crisis, the package also raises the limits on Federal Housing Administration loans and home mortgages that Fannie Mae and Freddie Mac can purchase to as high as $725,000 in high-cost areas. Those are considerable boosts over the current FHA limit of $362,000 and the $417,000 cap for Fannie Mae and Freddie Mac’s loan purchases.”

Question for DHB.

What do you expect to happen if Fannie Mae and Freddie Mac can purchase loans as high as $725,000?

Just got off the phone with a recently downsized AE for an A-paper (not Alt-A or sub-prime guy), who is one of the good guys in the industry. While on the phone he read me an email from an underwriter he got 2 minutes earlier declining a loan based on (1) review appraisal lower by $15k and (2) 5% drop in LTV due to the loan being in a distressed area (as defined by FNMA).

To answer Bartman’s question – no – this does NOTHING to help people whose house’s values have dropped, or who need stated income to qualify. It will prop up jumbo prices in OC for a while as realtors and sellers drink kool-aid and think the $600 lower monthly payment on that $600k loan (conforming vs. jumbo rates) will suddenly make the house more attractive to a knife-catcher.

Uh, good luck with that. You still need about a $12k monthly income to qualify for that $600k loan – and that’s with 10% down. The $600 stimulus package (can we get Beavis to say that?) needs to be about 100 times bigger.

I’m curious about all the foreclosures and REO’s that are taking place and will continue to take place. Are these transactions counted as a sale by the NAR when they release their monthly figures? Also, is that different than the local sales numbers that are released for communities and cities each month (i.e. if Los Angeles has 3,000 sales and 400 foreclosures or REO’s, is the 400 included as a sale in the 3,000 number because ownership has changed?).

Excellent article. Love your insight. One of my favorite bubble blogs that I visit daily!

I am so sick of the Fed which is so influenced by the financial industry they they might as well be wiping their butt and cleaning their nose for them. I am so sick of politicians who think they can pass a law to fix every problem when what they are really doing is creating more of a mess than they realize. What a power trip.

Maybe they can pass a law to fix stupid politicians and get rid of the Fed.

If Alan Greenspan, Wall Street’s hero, and Ben Bernanke, who is ultimately one of the most influential people in the financial system, couldn’t see this housing bubble coming, while many, many laypeople all over cyberspace could see this coming from a mile a way, what does this do for you confidence in the leadership of this country?

I think they need to read this blog.

This is an insight as to how the UK mortgage and housing market will be in 12 months time. People over here are still in denial they think the market will bouce back. Feel sorry for the guy that cant sell his house for what he paid 4 years ago.

Leave a Reply