When $100,000 makes you Go Broke: The Invisible Hand Forces Americans Into Debt.

Many people reading this blog from states with moderate housing prices have a very hard time understanding how a family earning $100,000 a year is having a challenging time staying in the middle class ranks. The idea of a six-figure income certainly doesn’t connote the same wealthy status as it did a decade ago. But where is all the money going then? Now that we are quickly approaching the great Wal-Mart voucher stimulus revolution and will see our accounts increase by $600 to $2,400 depending on our family situation, once we look at the cost of monthly items we realize that this money is a drop in the bucket for most Americans. In fact, there is so much debt out there that many are now saying they’ll use the money to pay off current debt or save; certainly not the intention of what the current government has in mind. They would love nothing more if you went and blew your stimulus check on a new laptop or stove and one month later, are back in the same spot.

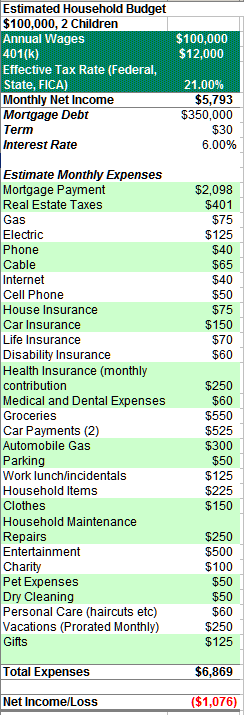

This is the problem with deficit spending on many levels. At a certain point debt will crush an economy if it is not handled properly. We have done an abysmal job managing debt over the past few decades and now we are seeing the after effects of this. Today I want to put out a hypothetical budget for a family with 2 kids earning $100,000 a year and show you how easily it is to go into debt. This data is conservative and I will talk about a few of major line items later in the article. So now I present to you going broke on $100,000 a year:

We’ll go into detail on a few line items. First, I want to show you that the above family is running a deficit of $1,076 per month. Nothing unusual from the above profile. Family bought a modest home in Southern California, has 2 cars, and has many of the items we would associate with middle class living. They also save a modest amount for retirement in their 401(k) and pay taxes unlike Blade. They have additional expenses with healthcare, feel the pinch of higher gasoline, and are seeing their grocery bill increase.

We are assuming that the above family purchased a $385,000 home here in Southern California with a down payment of $35,000. As many of you may know, over the past decade many families bought with zero, 3, or 5 percent down so we are in fact being conservative with the above number. If we were to use a smaller down payment the actual monthly debt would increase. $385,000 does not buy much home in Southern California. In fact, only until 2008 and the ongoing correction in prices, was $385,000 considered chump change and you’d be lucky to get a condo for this price in a safe neighborhood with good schools, something a family with kids would be concerned about. Where did I get this $385,000 number? I simply pulled it out of data from March 2008 sales:

“The median price paid for a Southland home was $385,000 last month, the lowest since $380,000 in April 2004. Last month’s median was down 5.6 percent from February’s $408,000, and down a record 23.8 percent from $505,000 in February 2007. That peak median of $505,000 was reached several times last spring and summer.”

You’ll also notice that prices for Southern California are now back down to April 2004 levels. Of course prices at this point were in a bubble so assuming we are at a bottom is naïve and ignoring the actual foreclosures and trends that we will be seeing for another few years. California property taxes are capped at 1 percent of the assessed value of the home plus local area bonded indebtedness:

“In 1978, California voters passed Proposition 13, which substantially reduced property tax rates. As a result, the maximum levy cannot exceed 1% of a property’s assessed value (plus bonded indebtedness and direct assessment taxes). Increases in assessed value are limited to 2% annually.”

In the above we are using a 1.25% tax rate which includes local area bonds, again a somewhat conservative assessment. I want to point out that I’ve been hearing on the radio companies looking to help you reassess your property to lower your rate. Through Proposition 8 (not to be confused with Preparation H) you can do this on your own:

“· You must demonstrate that on January 1, the market value of your property was less than its current assessed value.

- You must file a claim form for a Decline-in-Value Reassessment Application (Prop.8)with the Assessor between January 1 and December 31 for the fiscal year beginning on July 1. If December 31 falls on a Saturday, Sunday, or a legal holiday, an application is valid if either filed or mailed and postmarked by the next business day.”

So save yourself some money and do it yourself. Just run the numbers, in the end you are probably saving a few hundred dollars to maybe a thousand a year. Why not use your rebate check to reassess your property! The ironic fact about this is you are still going to pay an appraiser to tell you your property is worth less which if you own a home in Southern California and bought in recent years, is probably the reality.

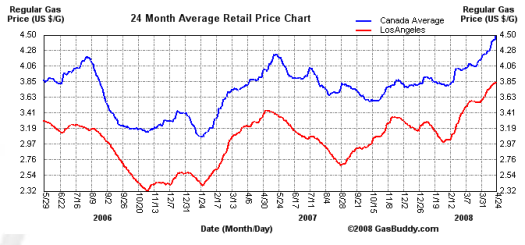

The next item we are looking at closely is fuel prices. People drive around a lot in Southern California especially in Los Angeles. The current Los Angeles average is $3.85 a gallon:

We’ll assume that you tack on 15,000 miles per year per car. I put on a bit over this and your numbers of course will vary. We’ll assume that both cars get 25 miles per gallon. So how much money are you spending a year on fuel?

(15,000/25mpg) = 600 gallons x $3.85 = $2,310 per car X 2 = $4,620 per year or $385 per month

I’ll leave the $300 per month fuel cost since you may have more economical vehicles and may also drive less but the above equation is simply to give you an idea that we are being extremely conservative here. Plus, how many mega gas guzzlers do you see on the freeway or streets in your neighborhood? Clearly the price can go much higher.

You know many people forget to include the additional costs of owning a home. When plumbing goes bad you have to pay to get it fixed. If your roof needs to be replaced, that comes out of your wallet. What about lawn services? Garbage pickup? There are many other unforeseen costs associated with owning a home which many people simply do not factor into their budget. They simply assume the principal and interest is all they’ll need to worry about. Also, which impacts both homeowner and renter, is the rise in energy costs for homes. Again this eats away at your bottom line. That rebate check makes no impact for the average American because the above line items seem like they are here to stay for the foreseeable future.

What if you want to send your kids to college?

*Source: State Farm Insurance

Where are you going to save for that given that the above hypothetical family is already running a $1,076 deficit? If you pull back on say cable that will create job losses in certain areas connected to this field. Maybe you cut back on clothing. Retailers are already seeing this pain. And in fact, that is what we are seeing even with the recent announcement that Target is seeing an increase in their charge-off rate:

Calculated Risk: “Target Corp., the second-largest U.S. discount chain, said it wrote off 8.1 percent of its credit-card loans in March as consumers grappled with job losses and the biggest housing slump in a quarter century.

Defaults during the month totaled $55.5 million, the Minneapolis-based retailer said in a regulatory filing today. The charge-off rate was 6.8 percent in February.”

And there you have it. Going broke with a $100,000 income. And these people aren’t the folks leasing BMWs or Lexus cars but living a more modest middle class lifestyle. The fact of the matter is, life just got a whole lot more expensive because your green dollar in your wallet is magically disappearing and we don’t need David Blaine for that kind of magic. You can thank the true magicians on Wall Street and Washington D.C. for that.

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Did You Enjoy The Post? Subscribe to Dr. Housing Bubble’s Blog to get updated housing commentary, analysis, and information

Subscribe to feed

Subscribe to feed

110 Responses to “When $100,000 makes you Go Broke: The Invisible Hand Forces Americans Into Debt.”

I think a few of your expences were pretty low too boot. $125 for electric? Perhaps, if they never turned the lights on. $50 for cell phone – maybe if the whole family has one – not likely.

$500 entertainment might be a bit high for a family that runs out of money each month, and I would expect that they would cut back on their 401K contribution to help make ends meet – though, of course that has its own long term consequences.

The reason your hypothetical family is running a deficit is because they’re making poor decisions. Buying a house more than 2.5x annual salary…not a good idea. Buying with less than 10% down…not a good idea. They could simply rent longer and save more. Also the 6% interest rate on the mortgage seems high. This would denote less than stellar credit.

Also, it’s ridiculous to have two car payments at the same time. Buy mom a nice late-model used car and let dad drive the beater. Lather, rinse, repeat. There should be one car payment at most and preferably no car payment.

Your budget also doesn’t show any savings other than the 401k. So they have no emergency fund? What happens when a car needs repairs? Goes on the credit card, I suppose. So living check to check or ‘going broke’ as you put it, because of not making wise decisions. I can’t say I’m too sympathetic.

Perhaps but the point of the article is a middle class lifestyle. Driving a beater isnt a middle class lifestyle. Sure you can live below your means but thats not middle class, thats working poor.

Yeah, but the $600 voucher will help. Wait- waddya mean it’s not coming every month? Huh?

Considering that the average American’s credit card bill is $9k, the payment for that debt isn’t even factored in. Yikes…

This family is also only donating 1.2% of their income to charity.

It looks like this family has overstretched on what they can afford in a home. If they can’t get a decent home for less then this in California then they just need to realize that they are going to have to rent or move to the midwest. Also they are spending $250 a month on vacations. If they are operating in a deficit then they have no business going on a vacation. That’s tough but that’s life. Some people cannot afford vacations and this is clearly one. They will probably unfortunately have to cut back on thier 401k contributions also.

I think alot of these people making $100k a year getting into money trouble are overstretching thier budgets. My wife and I make about 80k a year and just recently bought a house. We follow a monthly budget and knew exactly what we could afford. Since we live in the midwest, buying a house was a possibility for us. If we lived where housing was more expensive we would unfortunately have to say goodbye to the dream of owning and keep renting.

I agree with Savvy. They have made poor decisions. Also to Jon, this family should be donating 0% to charity. They don’t have the money to give away. I know you want to be nice and donate but if you don’t have the money then you don’t have the money. If you are going broke and possibly going to get forclosed on but you still are giving money to charity then I don’t feel bad for you.

For those of you who say The Hypotheticals are spending too much on housing: that’s the POINT OF THIS WEBSITE.

The Hypotheticals earning $100k puts them in the top 15% or so of households (as this site points out). Given the Real Homes of Genius (900 sq ft in crime-ridden Compton for $500k), $385k in Southern California is hardly lavish, but rather about half of a “starter home.”

And to those who say “put down a bigger down payment,” where would they magically get that money? People with the education to earn $100k are almost certain to have graduated with student loans. Before the children, The Hypotheticals were working entry-level recent-grad type jobs and making significantly less money: even if they were renting, they still had rent, food, utilities, and transportation.

Remember this is a hypothetical family, but one who’s decisions are probably not to different than a large number of Americans, and probably better than some. Most likely of course to make things meet the family would get rid of 401k savings. But then would go out and buy a boat or add an addition to the house and still not be able to make things work. Finally of course they would blame it all on someone else and then wait for the government to bail them out.

Long time reader, first time poster. Excellent post. It really conveys a sense of how precarious many people’s lives are.

There’s no point in being a scold with fictional characters, it’s just a description of conditions.

When these super-consumers stop buying their share (i.e. >100%) it’s going to affect some of the more prudent as well. If every family like this drops the cable, and the cell phones, and cuts out the vacations, and gets more wear out of their clothes, and go out less often and bring their lunch to work, and many families will make all these adjustments and more, it just might have a little impact on the rest of us. Sure, the way the economy values certain “services”, like cell phone ring tones, is ridiculous; it does need to adjust to more sober minded consumers. Still, it looks like there will be plenty of pain for more than just the spendthrift.

The problem isn’t the salary; it’s where it’s being earned. It costs about 30% less to live in Minneapolis compared to Los Angeles, so that 100,000 only needs to be about 70,000 in Minneapolis. I don’t know how salaries work in your neck of the woods, but it took me about 12-13 years in the work world to earn that kind of cash, and I was a frickin’ English major.

“what we associate with middle class living”

This is the crux of the problem. Things that in bygone days were luxuries are considered entitlements. Cell phones and Landline (pick one), Digital Cable vs Basic, highspeed internet vs. dialup, 2 FINANCED cars, 30 YR mortgage on a (relatively) expensive house for this family without substantial down payment-not to mention the monthly carrying costs at $2824 are roughly half (49%) of take home pay!

NOTE: These are generally the same people that want a federal bail out for home borrowers that will keep housing overpriced for the foreseeable future and make mortgages more expensive for those that have been saving for a down payment.

We all make choices in this world and this hypothetical rundown is a good exapmle of a family making very poor ones.

The sooner we realize that it is not acceptable to live beyond our means and blame the ‘system’ for the consequences, the better off we’ll all be.

Sadly that will not come until some start to actually repay their accumulated debts.

“Balance budget for Dummies”

Items I have experience with:

– Phone – discontinue service completely – you have cell after all. +40$ savings

– Cable – get “rabbit ears” and discontinue cable service +65$ savings

– Entertainment – 500$ – get a netflix or blockbuster unlimited plans, play monopoly (free), get out to play – 50$ – +450$ savings

– Charity – whaa??? – +100$ savings

– Vacations – look at charity – +250$ savings

Items I’m not sure about:

– Disability Insurance – 60$ seems to high, considering some of the Life Insurance Plans include this, plus you probably will have SSDI. I’d say 25$ or nothing at all – +35$ savings

Everything else is hard to argue about, it depends heavy on personal circumstances. So, we’re at +940$ at overall savings, rest of the balance act (1076-940 = 136$) should come from 401K savings.

People should learn to live by their means!

These people could be living within there means. EASY.

First off $500 for entertaimement. Gone. There are lots of free things to do with a family.

Charity $100. Gone. If you are broke, don’t give to charity.

Vacation locally, Free. Camping is a good one. $250 Gone.

So thats $850 a month right there saved.

Packing your own lunch for work can save another 100, Cheaper gifts per month, another 100 Then switch internet to bacis DSL. There you go, no more deficite each month……

Can you imagine what the budget of a family who bought the same house with a 60K yearly salary. I guess you would have to add sling shots to that budget because they will be hunting pigeons for dinner. So if the middle class is the new lower class, what do you call the current lower class?

Where Dreamer and Savvy see somebody who made poor choices, I see somebody in pursuit of the “American Dream” who is being forced to make choices betweeen a series of bad options by a shrinking real income, a regressive tax system and skyrocketing inflation.

Sure. They could rent. But isn’t the middle class “American Dream” a modest 3 bed, 2 bath house in a safe neighborhood, two kids, a a dog? Since when was the American dream to make a six-figure income, but still have to share a duplex with the college students next door?

Sure. They could move to the Midwest. To … what job exactly?

Sure. They could save less for retirement. And a real life family in this situation probably would. But that’s a risky proposition in a world where very few people earn pensions, and social security may not exist in any meaningful form in 40 years. So much for the golden years.

Also, don’t depend on Suzy and Jimmy to take care of you when you’re old. They probably won’t have very good jobs, since this budget doesn’t even take into account saving for college.

And god forbid this family have an expensive medical crisis. Better hope all that health insurance you’ve been paying for actually pays. Even the better plans only pay about 90%. Don’t get sick!

And god forbid this family still have elderly parents that need care for. Hurry up and die Grandma!

Honestly, the point wasn’t to show a familiy making good or bad choices. The point was to show how easily a $100,000 salary get’s eaten up very quickly in the pursuit of the modest “American Dream.”

What would have been considered a solidly upper middle class income 15 years ago, is now barely hanging on, in a lot of places.

Wages have not kept pace with inflation, nor with housing prices. And that is creating a dilemna for a lot of families. Get a heart, why don’t you?

This budget is basically right on the money for a family with 2 kids, although I’d definitely up the gas and electric bill costs. Also, clothing for 150 dollars a month? My kids outgrow clothing and shoes very fast and even with hand-me-downs we still spend more than 150 a month on clothes for all four of us. I have a job which requires professional attire and that can be pricey. 525 a month for groceries also means that they aren’t eating steak or even chicken every night.

Oh, and savvy clearly does not have children. When buying a home, you HAVE to factor in school district. If you buy a cheaper home with a bad school district, plan on factoring in the cost of private school. When we bought a home, we wanted a place our kids could play outside without getting shot. Sometimes a cheaper home is NOT a good idea. And two car payments totalling 525? Again, given the current high cost of cars, they are not driving anything super-nice. With kids, TWO reliable cars are an absolute necessity or your schedule turns into chaos.

This family hasn’t made bad choices overall, their financial fate is being dictated by the current ridiculousness of the economy.

Why would a family with a deficit donate any money to charity? I’m all for being charitable, but if that money started coming out of my savings every month, I’d have to stop giving.

I agree with some of the other posters on the cell phone being too low.

I’m in New York – Specifically Long Island and I’d just about kill to only pay $400/month in property taxes. On a $415,000 home, I pay $8400/year and that is before we vote on the school budget which adds at least 3% every year.

Good article otherwise.

Re: Dreamer:

Moving to the Midwest would lower their expenses, it’s true, but then they wouldn’t be making $100k per year either, so they’d probably still be doing the same dance. I mean, sure, you can buy a nice house in Michigan for under $100,000, but the unemployment rate is half again the national average. It’s hard to make even a small mortgage payment if you don’t have a job.

Saving $850 a month still leaves them in a deficit situation. Cutting out the fun stuff doesn’t cut it. Serious changes have to be made.

No state or local income tax here, so that’s a help. That’s a little over $400 more to play with.

$75 in gas? Are you kidding? I’m spending twice that, and I’m a stay at home dad. Wife isn’t around TO drive.

$150 in cell phone bill. 4 phones. With texting for all an absolute necessity (the daughter could not get it in her head that texting US cust US even if t was free from her point of view)

$300 in electricity here average. That’s a little high for last year, but I know better. You have to have AC here.

$100/mo Real Estate taxes. Yeah, that’s a bargain. Maybe.

Car insurance is about right, but I’ve got not one but two new drivers soon.

So I find some of those categories actually light.

Where this family saves it’s money is only paying less than $1000 for it’s mortgage. We refi’ed 5 years ago, and only took out $5k in equity to get a new roof. We’ve been here 16 years too. Houses are trying to go for about $250,0000 around us, I don’t think they’re getting it. Also, we only carry one car payment ever. And we’ve cut the length of our car payment from the original 60 months to 48 months by making bigger payments. And we own three vehicles (two are actually in joint names and belong to our kids, and another is currently under pursuit)

$500 in entertainment is probably a little high too.

Work lunches and dry cleaning are expensed.

The wife works out of country 3 weeks every month, so we don’t need two cars. And that also explains why we don’t have some of the above expenses.

So yes, my family is living within it’s means.

About the charity, it’s only $100/month. Removing it wouldn’t drastically change the picture.

And I have no children, but I saw nothing in the budget for:

Piano / music lessons

Soccer uniforms

Soccer shoes

Roller Blades

Bicycles

Summer Science Camp

Basketball Clinic

Karate Lessons

Etc.

And to those who pick on “luxuries” like high speed Internet: I personally get all my DVD’s from the Public Library and watch them on the computer I need for my job, but is your arithmetic so poor that you put more attention to the the $10 Netflix bill than the $400,000 house?*

Healthcare and education are also not cheap.

The same hyperinflated housing costs that the government is dedicated to preserving.are what’s killing them. If they could get a decent 3 bedroom house in a low-crime neighborhood with good schools, then they could probably afford as many overpriced coffees as they want.

*Having said that, I do agree that many people significantly overspend on gadgets, eating out, and entertainment. Unlike market-driven things like housing, this really is a “keeping up with the Jones” aspect where going to the movies 1x/month makes you look like John the Baptist.

But run the numbers for the median California family at about $60k and nothing is left even with entertainment at $0.

That $100 a month amounts to about $20 a week in the collection plate.

That’s too much for a family making $100,000 a year?

We live in a f-ed up country.

Dr. HB didn’t say that they family finances were perfect – he said they were typical. This hypothetical family could cut somewhere (entertainment), but somewhere else would take the money (anybody got a gas bill in Southern California over the past month?? Didn’t look like $40 I betcha.)

The point is – THE EXORBINANTLY HIGH COST OF HOUSING – can make the most modest of budgets look like wide overspending. It is not. This is a $350K mortgage, folks, unheard of for a livable residence in SoCal until very recently.

This is the country/state we live in. This IS reality.

Lets look at the biggest expense in this hypothetical families income. TAXES. OK, they have a 21% tax rate at the payroll deduction level but it doesn’t end there. They are nickel and dimed to death at every expense along the way. They Gore tax on their land line telephone? $5 per month every month to wire schools for the internet. Hasn’t that been accomplished yet? Look at your cell phone bill. I don’t. Its auto debited and I throw mine away but its loaded with this that and the other tax. Cable or satellite TV? Ditto. Sales taxes, utility taxes, gasoline taxes. At the end of the day this family is probably being stripped of 1/3 or more of their income and this is a family with two kids. If you are single and at this income level you are not only stripped, you are bent over and sodomized and your ‘rebate’ check will not buy you dinner for two at anyplace that doesn’t have formica tables! This country has created an enormous parasite class that leaches off the middle class. Native born parasites. Immigrant parasites, transgender parasites, they are everywhere and they are crushing the middle class. Any wonder why the birth rate is so low amongst the productive citizens in this country and so high amongst those along for the ride?

GREAT article.

amen scott. funny enough though, i was licking my chops at their 21% eff tax rate. i had to check my paystub, as they net 1700 more than me a month when i make almost the same gross income, and that doesnt include the fact that i pay an extra 3-5k come aprils.

we should celebrate the tax free day a couple days ago, where we’ve been working for the man from jan1-apr23! not.

i agree with others though, entertainment much too high. charity, no. car payments are not permanent.

no sympathy here, they’re living above their means

also didnt even notice a dining out expense, maybe that is part of entertainment..

I live in So Cal, I have a $310,000 mortage, two kids, and I make $110,000 a year with a stay at home wife, so this is basically my scenario, except I save about $1500 to $2000 a month. I have a few items of clarification:

First, taxes are not 21% if you have that mortgage. It would be around 12%-15% with deductions. There is no need for a car payment, I’m only 30, but I’ve never had one. My wife drives a new 2008 Toyota Minivan, I drive a 2007 Ford truck. We pay cash. Life insurance runs only $50 a month for both of us, which gives us a little over $1 million in combined coverage. Our grocery bill rarely tops $300 a month. Entertainment expenses are at $60 a month. Vacations are a two week camping trip for $250 every year, so about $20 a month. Auto gas is only $100 a month, but then my wife doesn’t work. I don’t know of anyone that pays parking fees in So Cal, there is plenty of land here. I bring my own lunch to work. Clothing is $50 a month.

Really, this seems like a very over inflated budget. I’ve been living with this salary and mortgage for 4 years now, and I’ve got $45,000 sitting in an online savings account. When I bought the house I only had $5,000. (You might notice that my per month savings doesn’t add up to $45,000 after 4 years. We bought an RV and other “luxuries” that could have been passed on if things were tight.)

For those saying that this family should rent rather than live in a house they can’t afford, consider that their mortgage+property taxes+insurance are about $1,874 after considering tax advantages. So they would have to find a 2 or 3 bedroom place for $1,875/month or so to match the housing costs, as the $699 cost difference would show up as additional taxes. In all but the sketchiest places in Southern California, that’s not particularly realistic. And 6% mortgage? That’s a great rate…current 30-year fixed conforming mortgages are hovering around 5.875%…if their house cost more than $470K (actually a more realistic amount), the going rate is 7%+.

As for internet, for many jobs (especially those that pay $100,000/year), this is a necessity. And the two cars? To make $100,000, both parents often have to work. If they work in different places, you need two cars to get there.

For those waving the “public transportation” flag, that’s only practical if your office is near a bus stop or train station. As an example, it would take me two hours to get to my office on public transportation, when the drive takes 12 minutes. That 4 hours of transit time translates to hundreds of dollars a month of my time.

So sure, cut the vacations and entertainment, but that leaves you $300 short. Cut charity? Well, then those charities will need more money from elsewhere to operate, which will end up costing the government more and lead to higher taxes in the long run. Cut 401k? Well, with social security predicted to implode long before these new homeowners retire, it’s not an optional expense. And remember that each dollar pulled out of the 401k only saves $0.75 after taxes.

I wish I had a solution, but hopefully this adds some perspective…

poor family

So, the Basic American Lifestyle costs $100,000/yr. Raise your hand if you make less.

Really, it’s the area. 100,000 and change will not get you far with kids, student loans and daycare (1800 a month for two.) Even if you cut out all extraneous expenditures and pack a lunch each day. That is why buying a home for many is simply out of the question.

Interesting article. For years my wife and I were living on about $50k (or less–when we were in the Midwest I think one year we had about $25k), and this was in Portland, OR, with 1 kid and then later 2. I was always frustrated with books telling me places I could cut expenses because they were things I wasn’t buying anyway: broadband, cell phone, coffee, lunch out … We lived within our means AND contributed to our IRAs and gave to charity.

Just last fall we moved to the Midwest and had an income jump–my wife just started her doctoring job and so now our gross is around $170k, a huge jump. I finally decided we could afford broadband Internet for the first time in our married life, though we still don’t have cable. We figured with the decreased cost of living here and increased income, we could just about afford to pay cash for a house in a couple years if we continued the same standard of living.

But somehow, as I sat down and started looking at our budget, I noticed that we were saving much much less than I thought we would be. Worse, when I looked for things to cut, I wasn’t finding a lot of easy stuff to remove.

I’m not looking for sympathy here–I’m just pointing out that I finally have at least a little sympathy for people who make more money not meeting their expenses. I’ve always been frugal and I thought we could finally be a little less careful, but apparently not–even with a much bigger income, I have to keep a pretty tight rein on things if we want to stay within our means.

And one other note: I’ve noticed a lot of people scoffing at the idea of giving to charity; as a Christian I try really hard to tithe–that’s 10%–even when we were making $25k a year (and that’s just to church, not other charities). Sure, if you’re not living within your means you shouldn’t be spending $500 a month on entertainment. But if charity is one of the first things you cut when things are tight, you’re never going to give at all. And let’s face it–1.2% is tiny.

Oh yea I can see a 100k family in Los Angeles struggling (and yes it’s either a house in a decent school district or private schooling (which is thousands a year!)). If they live in a bad school district this family is likely to end up with kids who graduate high school and can’t read or do basic math! What family wants that for their kids?

And yes most housing in decent school districts are still costing more than the hypothetical family paid. So those housing costs are still low for current reality.

I have entertainment income and save and live in L.A., but no kids, higher than 50k income, no debt, and of course, it goes without saying: RENTING!!!!! Oh and taxes, taxes are outrageous, and I don’t see them going down with the state being bankrupt!

Hello,

Very interesting and spot on.

I think the one thing that people can’t grasp, or dont’ want to grasp is the magnitude of what is going on. The numbers are so large that they almost start losing meaning, because we have no reference point to compare this too.

The scale of what is going on is off the chart, there is no infrastructure to deal with this size of economic disaster. Katrina and the Tsunami sort of come to mind, compare it to a economic nuclear bomb going off in Florida and California. One can argue that this economic disaster is going to have the same end result as if a Nuclear weapon went off in LA county, etc. I would also argue that this may be even more difficult to deal with because this is happening over 18 plus month period vs. a nanosecond. Sure, what I am saying can be dismissed as so much hyperbole… but when you begin to think of what is happening now, and try to plot possible event futures you begin to see that the future is very scary. We are in a “System of a Downâ€, or a negative spiral…. the energy needed to pull us out of this is so massive that it is beyond comprehension, and most likely beyond possibility. One almost can come to the logical conclusion, “well I better get mine, before the whole @@@@house goes up in flamesâ€â€¦ thank you Jim Morrison…

Doubt me.. Just look at the chart…. then think of possible scenarios of what could pull us out… $600 rebate check… Bear Stearns bail out… The chinese gov’t buying every foreclosed upon house, and creating the worlds largest property management company… a small investment of 1 to 2 trillion dollars would do that…

Good article

Dutchtraders first solution

F the 401k plan and keep your standard of living. Take a cheaper vacation

Dutchtraders second solution

Work more hours, second job, grow your own vegetables, ride a bike to work etc etc.

Dutchtraders conclusion

Life sucks and then you die

Lose the following:

Cell phone $50

Work Lunch $125

Take it from home

Entertainment $500

Use the library and read a book

Go on a picnic

Go for a hike (most Americans could use the exercise)

Vacations $250

Learn to love camping with a tent

Gifts $125

Bake cookies and bread for gifts

Cable $65

Go rent movies at the library or read a book. TV is mindless dreck that poluutes the soul. Haven’t had it in the house in 17 years.

There – I just saved them $1115 a month or $13,380 a year.

And food can go down some. I only spend $220 a month on food AND all the household supplies (cleaning stuff, shampoo etc) for 2 people. We eat very well. (If anyone wants the recipe for Wild Mushroom and Dill Soufflé with Mousseline Sauce or Potatoes with Dill and Mushrooms Poached in Wine let me know.)You give them $550 for food and $225 for household items or $775 a month. They can do it on $450-500 if they cut out the frou-frou specialty shampoos, bath oils and similar stuff AND learn to cook and stop eating meat. Just saved another $275-325 a month.

Clothes at $150 is nuts. They can learn to shop on Ebay (Brooks Bro men’s shirts New Without Tag for $5-10 plus $5-7 to ship instead of $80.) I dress very well – just bought a New With Tags Lilly Pulitzer sundress I have been coveting since the fabric design came out 2 years ago – retail was $320 and I paid $40 including shipping on Ebay. It is particularly good for kids who outgrow everything. They can get acquainted with resale shops. Cut the clothes budget down to $75-100. Now they have saved $300 on food and household plus $75 on clothes. That is another $375 a month saved on food, household and clothes or $4,500 a year.

Annual total savings thus far = $13,380 + $4,500. That is a grand total of $17,880 ($1490 a month.)

Such spending is inexplicable. My parents had an income comparable to 2008 $100,000 – and I grew up spending all summer onboard the 38 ft boat at the yacht club, a car for my 16th birthday and my parents were self-employed and retired at the age of 55. Of course I had to mow the yard and clean the house when I got home from school; they did their own home repairs (unless you are thick as two bricks, you can learn how. I just finished painting every room in the house) and I heard the word ‘no’ a lot as in ‘no you want it, you do not need it.’

BTW, my electric is $65. Open the windows and turn on a fan and/or add a swamp cooler (and I have lived in the humid swamp of DC without AC.) Propane is $100 (hot water and heat here in the far north) Hot water is supplied by the tankless Bosch hot water heater that cut the hot water bill by 68% and the overall gas bill by 33%. No car payments – and I just love our his ‘n her matching little Escort wagons that get 32 mpg city and 36 mpg hwy and both handle 800 mile road trips.

Bottom line is that house is killing them – way too much house on their income so all the ‘stuff’ and ‘gotta haves since the nieghbors have it’ have gotta go.

Fascinating article. I’d like to add that all those economies people are talking about could work for this family right now. But with medical costs going up every year, they’ll be just as screwed next year. The really essential stuff – food, energy, education, health care – is going through the roof. You can’t save enough on DSL and cell phones to make it up any more.

The vacation budget, I agree with. That may not even be Disney World or something that can be replaced by “going camping for free”. That could be vacations to see relatives for holidays. $2500 would probably get us one holiday with each family if we caught ridiculous airfare sales and used our credit card reward miles to boot. And yeah, we could slash our cable and cell phones and broadband back, but I at least need the broadband & MY phone for work (I tax-deduct non-reimbursed expenses)…and cable isn’t all THAT much.

And it’d be GREAT to move someplace with cheaper housing, but our jobs are HERE. People with long-term experience and a vested interest in the companies they work for are not easily able to pack up and move to the Midwest. We could probably pack up and move to a slightly cheaper city with decent public schools, and STILL pay $385K for a nice house in a good school district that wasn’t going to require us to spend two hours each way commuting to work. Where the hell do you even get a $385K house in Los Angeles that doesn’t require you to waste hours a day in a car if you work in the city?

I don’t think these people have made bad decisions. I think they’ve done what they can to provide a decent life for their kids, one in which the kids have the creature comforts and access to pop culture, without spoiling them or being excessive. They’re not doing badly. They could certainly slash some things like entertainment, but if we pretend “entertainment” includes lessons and organizations and things like that, then maybe not. I think it’s a great look at how difficult things are for people who are doing well. All the more reason to keep giving to charity for the sakes of those people who are NOT.

I see few big problems with this budget. First of all if you care for your children there is no place with desent schools in LA metro where house cost lest than $500K ( which will add some $700 for morgage). In the cities where is the borderline between the “big money” and the gheto like Torrance, Glendale, Huntington Beach there is still no house less than $500K. (there is cities much worse deals if you look schools) Second if both parents work there is usually tuituion for after school – YMCA/Salvation Army – $300 ( so $600 for 2), if one of the children is at child care – minimum $600. Expences for 2 children run at min $600 to max $1200. The other option is single salary income, which rearly makes $100K.

My case is both working and making $130K still renting at least till next sping.

Mi Primavera, mi primavera blanca,

let me see your prices…

Yes, this hypothetical family needs to cut back and yes, it will be hard. And no, neither they nor anyone else should get a single dime from any other taxpayer.

Under which category in this budget of expenses would I include the $179.70 I spend monthly for the cheap Gallo Chardonnay at Albertson’s? Cause really, the hooch is only thing keeping me from a total nervous breakdown at this point.

Great blog, as always.

I have to admit, I don’t see how anyone can possibly feed a family of four on $550 a month without eating Hamburger Helper four days a week and dog food the other three. The two of us can barely get by on $500 a month, and that doesn’t include expensive food or restaurant food, which we don’t eat. (I’d also like to see where anyone can get one haircut for $60, let alone two a month for the working adults who (admittedly) need to look professional and one every two or three months for the kids. I have a feeling some things are remarkably more expensive in Alberta than in California.) I also know that in some cities dial-up internet isn’t available – it isn’t in mine, and if you have school-aged kids internet service may be essential. The utilities are unavoidable. But the rest?

Are these hypothetical people insane? I own a house. In no year has my maintenance cost me $3,000. The average is about $350 per year! And what consecrated idiot spends $6,000 a year on entertainment?!?

Argh. If you find yourself falling behind, stop paying money for entertainment. Stop buying all but the most necessary gifts (which should only be to the kids and could be under $200 a year total). Stop buying lunches and going to restaurants – completely! Sell your expensive cars and buy cheaper used ones. Stop wasting and wasting and wasting on ‘essentials’ that are in reality extreme luxuries.

Also, why is this family in SOUTHERN CALIFORNIA paying $75 a month for gas? I don’t pay that much, and I live in an actual cold climate.

I agree with the article as I feel this in my life. I earn approximately 80000 with just me and my son on weekends.

Take home 4300

Rent 1500 Nice but not great.

Car 600 My only real luxury paid off soon.

CC 200 a month at 1.9%.

Food 250

Utilities 200

Basic cable vonage and internet. 150

Health ins 150 cheap

Car ins 150 no tickets accidents

gas 200

Always brown bag.

Vacation 100

Roth 330

Misc 400 tires ,cloths, unexpected expenses.

Rarely eat out 50

No cell

No charity

4350

Broke with no real extravegence.

Great article Doc!

Many of you missed the entire point. These are “average” people… OK, I get it, you would do your budgeting differently, but these figures are average for California.

Don’t even get me started on all of those saying “move to the midwest” – where do you think all us Californians came from? MOST of us came here for a job… and it seemed like a high salary. The real estate prices in CA, AZ, FL and NV have outstripped the the average wage…. the Doctor’s point is to show us the ramifications if the prices do not drop to historic norms.

THINK: The banks and government are doing everything in their power to keep prices HIGH. The end result will be the destruction of the “middle class.”

Wake up America… the rug is being pulled out from under honest hard working people. I cannot believe there are not marches and protests about the situation… THIS is why unions popped up in the first place. Did we learn NOTHING in the 20th century?

This is the strangest post, and responses.

$100k should be OK even in California, with $350k mortgage, though it would be pretty tight, a lot of the expenses are not neccessary or too high.

Assuming home related taxes and insurance cancel out the tax savings of the mortgage:

Gas + Electricity = 100

Water + garbage = 60

Phone + Cable + cell = 150

Car insurance = 150 (on the high side already)

Medical and dental = 60 (Health insurance should have been deducted in the paycheck if you work for a good company)

Grocery = 600 (still on the low side, i have no idea how some can survive with under 300)

Entertainment + dine out = 300 (on the low side)

Household maintenance = 250

Auto gas = 300 (on the low side)

Auto maintenance + expenses = 150

That leaves quite a few dollars for clothing + household expense + vacation. If you still need to pay for 2 cars, forget about buying a house, or forget about vacation and other life enjoyment.

By the way, 150 dollars doesn’t even cover my wife’s clothing.

What Dan said is definitely true, there is no way in the Bay Area you can buy a decent property with good school with 350k, not even in 1998.

So 100k income is not impossible, but it will be tight and you will need to make some tough decisions (like no after school for kids and a lot of budget cut for kids, they can be damn expensive)

Being a realtor I see that in a-lot of cases playing true. Greg Moser

“And there you have it. Going broke with a $100,000 income. And these people aren’t the folks leasing BMWs or Lexus cars but living a more modest middle class lifestyle.”

Modest? WTF? Cell phones, cable, 2 unpaid cars, “entertainment” ($500! — and I don’t even know what this means, since it’s separate from “cable” and “vacation” — lap dances for the whole family?), pets, “haircuts etc” (ha!), vacations, gifts, dry cleaning, and $550 in food for 4 people? I grew up in the 1990’s and if this is “modest” middle class then we need a new word to describe the middle class of just 10 years ago. We didn’t have cell phones or cable or a microwave or half of these things.

If you want to know why your dollar isn’t going as far as it was a decade or two ago, it’s because you’re finding dozens of new and creative ways to waste it. News flash: more stuff costs more money!

Southern California isn’t a cheap place to live. If you can’t afford to live there, then don’t. There are plenty of cheaper (and more pleasant!) places to live.

If your kids want to go to college, take out loans and have them pay it back when they graduate. Worked fine for me. Face it: if your kids can’t pay it back themselves, their degree wasn’t worth it.

Nobody’s forcing Americans into debt. Their inability to make sound financial decisions is pushing them into debt.

Can you explain me why do you need all those insurances ? Are those really necessary ? And dont you people have all-in-one packages for phone-cable-internet ? We do here in Estonia (look it up from the map) – cost 50 $. And there are many other weird expenses…

They are in debt due to their own choices and living outside of their means. The largest choice was their house. Why do they have a phone if they have a cell-phone? A number of the expenses listed are classic examples of living outside their means, vacactions, dry cleaning (unless its work related then may be able to claim it on taxes), entertainment, pets, cable.

You have to budget your money, once basic needs are covered with the insurance and retirement savings are complete then they can use the extra for meals out, cable tv and vacations.

All the above showed me was that family had issues with wants vs needs.

If you have a home that cost $385k in Southern California, you are living in the fuckin’ hood no doubt about that. I lived in Irvine and you won’t get any home there for less than $500k and that is in the worst part, probably a very old fixer upper townhome. For $385 that must be up in South Central or the hood of Santa Ana.

Let’s see – spouse and make more than $100k each. Her specialty has her on contract in Orange Co. at $109k. A 750 sq ft apt – near Cal State Fullerton is $30k/yr. Our home is in the midwest and we are 17 tears into the 30 year 3.5% mortgage – a 3 BR $105k purchase in ’91. Power has gone from $125/mo to 150 to 250 to 175 with insulation and setback thermometer, double glazed windows, etc. Monthly water, gas and waste ~150.

My office rent $1,800 – other office costs bring monthly nut to $7k. Wife owns SAAB I own Volvo – no payments. We have about 280k in TIAA-CREF – but medicals (we are both in our 50s – one diabetic) run $2k over ins a month.

I fly to see spouse as often as I have enough travel points on AMEX – I pay as much office expense on AMEX as possible ~ $3.5k out of the 7.

We gross well over 240k and there are no real shortages – VOIP telephone and cell – office phone lines are only $260/mo + another $200/mo Internet.

OH, yeah – an 82 year old ataxic physician (mother) in nursing home $7k/mo and 89 year old COPD spouse’s father in structured living at $33k/yr (that HE has, but we have to beat out of him – his deceased spouse’s investments generate $30k/mo – she was a Rhodes Scholar – he wasn’t and expects to be taken care of) and our son is in college – scholarship – but $20k/yr is normal for East Cost costs….

So, a failure? Turn the 89 year old over to a public administrator (we don’t live in the same state)? Allow the 82 year old physician to go onto Medicaid? We pay the AMA co-pay for Medicare for the nursing facility. You tax payers want to cover the doc?

Son will graduate in a year – will he have a job – yes – CAD design and film school. No debt – all scholarship at private school.

Day-to-day it is tough – I’m self employed and my cash flow changes – a lot.

If 89-year old doesn’t go batshit crazy, there is an inheritance. Our Tiaa-Cref will be over $1.4 meg by the time I reach 67 – 15 years out. House will be paid for … but living hemi-costal is expensive.

Yeah, I think I could do better with $100k per year…

Great post!

That is my life with a wife and three children living outside of Boston. Home prices in good school districts are a killer. To find good schools at affordable prices you have to drive west, and the gas for the commute is a killer.

Not to mention I save $50 for each child for college each month – another $150 monthly. We have just one car payment at a time as we drive the other car into the ground, but it’s about $500 a month even with just the one.

And some of you commenters don’t get the purpose of the post. The purpose of the post is to say that $100,000 isn’t upper middle class anymore. When you commenters keep writing “who needs a cell phone or a vacation?” you are PROVING the purpose of the post. Removing all those type of items from the budget makes it a decidedly NON-upper middle class life style.

Hehe. You should try London. We earn about GBP80k (that’s about US$160k). No kids. No chance of buying either. “Huh?” you ask.

We remember that on the top rate of my income I pay 40%. We pay around 30% on the rest. No tax breaks, we’re unmarried with no kids, both in full time employment.

Our rented one bed flat (at a good rate from my brother) costs GBP$2000 in rent a month (not including electric, water, or council tax [like local taxes]. It’s tiny, with the kitchen/living area smaller than the bedroom alone I had when I lived in Philly. And on the market? It costs over GBP200k (that’s US$400k). And there’s no way I’d pay that much for something I literally cannot walk around in.

We do live in a nice area, but if we moved somewhere in London cheaper it would be further out, further from both our jobs and any savings (or increase in space) would be severely mitigated by extra transport costs (the girlfriend can walk to work, I have half an hour on the underground into the City) and by a corresponding dramatic decrease in the ‘niceness’ of the area. Which means something in London, when neither of us drive and we need to walk home at night.

The bills are roughly equivalent to the above example, but in pounds sterling. EXCEPT – groceries. The grocery bill is just for two of us, remember. And we don’t buy clothes, we go out rarely, and neither of us has a serious drug habit (yet).

Why no car? Even second hand for something that isn’t going to fall apart when the wind blows you need at least $2000. And this would be a crappy car. Insurance of let’s say $500 a year. Congestion charge in London of $16 a day! And traffic means you can’t move faster than 5 miles per hour anyway. No way Jose.

So my salary is GBP50k – that’s about $100k. I’m 28, and should be entitled to think I’m doing pretty well. My girlfriend has a good job also. We worked bloody had to get here. Yet we cannot afford to buy a house, a car, and indeed are still paying back student debt and personal loans from when we were younger and considerably poorer. And moving outside London would mean both hours of commute and very expensive transport costs (you wouldn’t believe what an hour-long train journey in the UK costs). And not working in London? Neither of us have careers that are possible outside London.

South California sounds like a dream.

Why do you need two cars, a 350K house, and $500 in entertainment? I spend less than $50 a month in entertainment and feel pretty comfortable about it. Also, why do you need to spend $150 a month in clothing? Are you changing your whole wardrobe every single month?

I think that what people need is to realize that luxuries are not necessities, and are forbidden if you can’t afford them. It is not all the government’s fault. I mean, here in the US, “poor” is making less than $35K a year. Where I come from, $35K a year is 5 times more than the average income. In fact, a family of four making $35K a year are considered “middle class”. This is even more outstanding when you consider I come from Mexico, and because of NAFTA, prices in the US are similar to prices in my country…

So, if Mexicans can live like wealthy at $35K a year, there is absolutely no reason why Americans can’t live comfortably at $100K a year.

And sure, all those insurances are really necessary, but some of them are paid by the employer, so, don’t exaggerate, please.

If they bought used cars then they would break even without the car payments.

Here’s what I would reconsider if I was in your shoes: Sell the house and rent- savings of $2824, Get rid of the home phone and use your cell phone- save $40, Sell your gas guzzler and buy something more economical- save $200(approx), spend $150 every 6 months on clothes- save $1500(per year), lose the pet- save $50, Quit worshipping your materialistic lifestyle- save: Your dignity.

Total Savings:$3282/month ($39,384/year).. Sh|t man.. What’s wrong with you?

Moving to a cheaper market like to Midwest sounds great but remember salaries are lower in a cheaper market than a more expensive one like So. California. So net gain from such a move is usually 0

Not contributing to a 401(k)? sure let Social security take care of retirement if it still exists in another 20 years. Debt now or no income later..hmmm, let me think!

No entertainment? ok so now we have depression setting in and add in the cost of treating that so you can continue earning.

Not donating to charity? well that is an option so what it you want to live a selfish life and hope the mighty Government helps out the homeless and troubled kids in your neighborhood so that you don’t get mugged carrying your groceries into your home.

If you want to talk about fiscal responsibility, lets start with the Federal Government and have them set an example for other Americans. Lets tax those more who earn more and give a break to those who deserve it. This applies to both income, sales and real estate taxes.

$350K for a house on $100K income?

That’s the problem. Sell the house and move into something a little more reasonable. Problem solved.

If you cannot buy something in cash, you CANNOT AFFORD IT. What are they doing buying two cars when they can’t even afford one? Make the kids walk to school or learn to ride a bike–you are in a city, not a rural area. $500/mo in entertainment? I don’t even know where to begin with this, are they going to a theme park every week? $150 a month in clothes? $125 in “gifts”? $100 in “charity?” No, I’m sorry, this is not a typical family.

Don’t even get me started on the house itself.

Also, if you can’t afford children, don’t have them.

Sorry, Matt. I don’t buy your food numbers at all. I ain’t saying you’re lying but $300 / month for 4 people? In SoCal?!? Please.

That’s $300 / roughly 30 days per month = $10 per day.

Which is $10 / 3 meals per day = $3.33 per meal.

Which is $3.33 / 4 = 83 CENTS per person per meal.

Unless you’re eating nothing but bulk dried beans and rice, EVER, you’re not even in the ballpark.

And seriously, if you are managing to keep your food bill that low in SoCal for real, lay out your meal plans so the rest of us can learn from you. I’d love to know what you’re doing that I’m missing.

I think the numbers are very realistic. This is what leads to the sad decline of families and becoming sadly European. No mom at home, and no families being created in the first place. The exponential increase of Mrs. Mom professional Doc, lawyer etc. and stupid dad staying home is pathetic.

Sorry, smart gals but there are many educated women who set aside ego to lead a traditional normal family life. And yes, live on less.

and, never cut the tithe, first, that is pathetic. You give out of need, not the lie that when you’re a Rockefeller, you’ll become the great philanthropist. Joke.

Matthew Sage said: “Our grocery bill rarely tops $300 a month.”

Matthew, I’d really appreciate you laying out your meal plans. I have no idea how you can feed a family of 4 for $300 a month in SoCal. Please share your secret with the rest of us.

$300 per month / roughly 30 days per month = $10 per day

$10 per day / 3 meals per day = $3.33 per meal

$3.33 per meal / 4 people = 83 CENTS per meal per person.

I’m presuming the following:

– You eat a LOT of dried bulk beans and rice.

– You never buy any meat other than whole chicken or 5-pound hamburger “tubes”.

– Eggs, milk, flour, sugar, pasta, fruits, veggies, taters, and oil in bulk.

– Zero snacks. Zero junk food. Zero sodas. Zero prepared food of any kind, including bread. Zero alcohol.

– Home-made lunches; they’re usually leftovers.

Even with those presumptions, $300 a month sounds pretty low for SoCal.

Reading through all the comments on this board I think people are missing the point. One hundred thousand dollars a year is or used to be ALOT of money! When you do the break down of expenses these people aren’t living “la vida loca”. These are reasonable expenses not associated with being a spend thrift and are frankly sobering. I think the main take away thought from this is, what the heck happened to the purchasing power of money? Easy credit, intractable government unions, over regulation and a contemporary silliness about everything from the environment to morality is the answer. The real estate bubble is merely one component of an even larger more disquieting bubble and that is a REALITY bubble.

As an European, I read this article and I feel really glad of living at this side of the Atlantic… 😀

I work as an information technology consultant in Madrid and my monthly net wave after taxes is 2800€; my wife works in a call center, but she only makes 900€ every month. We live in a flat in Madrid which cost just 125.000 € in 1998 and probably right now with the housing bubble, it would cost more or less 280.000 €.

We have two sons, but in Europe you don’t usually pay anything for schools (well, there are private schools, but they are intended for the sons of politics, bankers, etc). Also, we don’t need to pay anything for medical assistance: if we are sick, we go to the hospital, and that’s all (The doctors, the nurses and the school teachers are paid by the government, with our taxes).

Our house is heated with gas, and we pay 120€ every two months, but only in winter and fall; in spring and summer, we just pay 30€ to the gas company. We also use electricity, and we pay 40€ every two months.

We go to the work in tube; for 30€ a month, you have a flat rate that you can use to travel to everywhere (using bus or tube) in the city.

We don’t pay any mortgage now, because the 70.000 € mortgage we started in 1998 has been finished yet ( I mean, last year, we paid the last bill). The tax of the house is just 200 € a year.

We have two mobile phones, but we only pay for one of them (my wife’s) because mine is paid by my company. My wife pays more or less 12 € every month for her mobile. We have also a fixed line telephone at home with ADSL and we just pay 30€ every month (flat rate for city calls).

We have a car, and we pay a full-risk insurance of 700€ every year. The tax for the car is 120€ a year.

Why do you pay 150€ of clothing every month? Do you throw your clothes to the garbage as you take off them? Don’t you wash your clothes and try to reuse them for at least two or three years? With 150€ in Spain, you can buy tree pair of shoes, or a suit, or 5 business shirts, or two coats, or 40 pair of socks, or 30 slips … maybe once a year, just after Christmas or after the summer in the bargain hunting, we can spend 200€ in clothes, but only once or twice a year !!

Pet expenses, 50$ a month ? I have a cat, and its food is just 6€ a month, and my cat is very refined, as he only likes cat show and whiskas. Do you give caviar to your pets? And the veterinarian expenses are minimal… I think that in five years, he has been sick just one or two times (and I paid 30€ to the veterinarian).

Hair cuts 60$. Have you tried to buy a hair cutting machine? You pay 40€ for this machines, and you can cut your hair every time you want. A girl hair cut is more expensive, but maybe just 20 or 30 € (and of course, my wife don’t go every two weeks to the hair dresser).

Why do you pay 500€ every month in entertainment. What do you understand about entertainment? If every weekend for entertainment you rent a airplane for example, and go for dinner to the most expensive restaurant in the city, then… maybe 500€ is too low, but I think that the typical family don’t need to pay such a huge amount of money to get some amusement in the weekend. Have you tried to go just twice a month to the cinema theater, and maybe once a month for dinned with the kids? The tickets for a cinema theater are 6€ each, and a typical dinner in a Italian fast food restaurant is 20€ for each one. And of course, we don’t go dinning every week with the kids.

Biggest mistake that is pushing them into the red?

2 kids.

No kids? $100,000 suddenly is a lot more. And don’t act like that’s not a decision you make.

I’m not sure what is more concerning: the fact that you are stating that $100k is now considered middle-class, or the real fact that $100k/year is the top 10% of house-holds in the US?

http://felfoldi.wordpress.com/2007/04/05/does-your-family-make-100000yr/

Want to see how your family matches up? Then check out this handy-dandy chart. Something that should surprise you: the “average” household income — or 50% of Americans, make less than $48k/year. That is a family of two adults and 2 kids. $48k/year. They probably aren’t living in $350k houses in Southern California.

http://felfoldi.wordpress.com/2008/02/01/top-us-household-incomes/

The bigger problem is that we all seem to be feel so damn entitled. A cell phone, a home phone, house ownership, dry-cleaning, cable, cars (2!), exotic $3k annual vacations.

Thank you for breaking down how “quickly” $100k can go, but rather than seeing a problem of too little, I saw a problem of too much.

I live in L.A. My rent for nothing flash (3 bed, 2 bath house) $2800 per month. Health Insurance (which we never use luckily) is $850 per month for a crappy Blue Cross HMO. School fees for a catholic school for 2 kids are $900 per month. Food costs (not including eating out) are at least $700 per month. Car Insurance for two cars (nothing flash) $200 per month.

Oh, and we are paying $4.00 per GALLON AND Food costs are going up considerably. Living in L.A. is damn expensive. The biggest drain has been the dramatic increase in housing costs. We’re holding out to buy something, yet rent is still expensive compared to what it cost five years ago.

Yeah those people can eliminate a lot of junk, like others said, but that’s not my point. I’m definitely going to put the rebate check towards debt. I bought 4 houses with credit cards and now I can’t refinance because my FICO is too low. But remember, it’s better to pay back debt with inflated money. If you had bought a house 30 years ago for $50k, your payments would be minuscule with today’s dollars. $2098/m will be lunch money 30 years from now.

The comments about ‘children’ are the most worrisome. If educated middle class

people do not have children, and many now don’t, just what is to become of this country? Will we end up like Europe? The smug comments from the person in Spain ignore the fate of that country and it will be coming soon. In 2011 the work force of the EU will begin an inexorable decline. How a shrinking labor force can pay for a growing population of pensioners is their dilemma and the collapse of the welfare state is the likely solution! We have a different problem in the US in that it is the poor who are bearing the children. This will have a growing dysgenic

effect on our population. Already we are having to import our scientists and engineers as not enough of our own children enter college with the academic wherewithal to pursue degrees in these fields. Further, amongst those who do, too many prefer the potentially more lucrative MBA and LLD degrees. So housing costs are not just a financial dilemma they are a mortal threat to our society. When my father graduated from college in 1950 he did two years in the army then began work as a civil engineer. Married at 23 he had two children and a stay at home wife when he bought his first house in 1956 for $16,500. FHA loan I believe. That house btw, in Fairfax County, Virginia, improved only by the carport my father enclosed to make a ‘family room’ for us, sold in 2006 for $400,000! Tell me a 27 year old with a stay at home wife and two kids could afford to buy that house today. This is the real ‘cost’ of housing inflation. Young couples today must both work and postpone having children to achieve the income and or savings necessary to buy a home in a decent neighborhood with good schools. By the time they can afford it it maybe too late. Our biological clocks are not synchronized any longer with our financial and social ones. If we don’t change that we face cultural extinction by third world hordes already pouring over our borders and the feral children of our own underclass.

It fascinates me how some people – living in areas that don’t have such economic factors at play – instantly think that canceling the cable will solve all your problems. Further, the earlier comment about not having a cell phone is downright silly. Having endured the complete shutdown of the DC area on September 11, 2001 – I will never be without a cell phone again. I don’t consider it a luxury in this dangerous world, but a means of self-defense and security.

Moving to the Midwest – where I grew up from 1970 – 1988 is not some magic solution to financial problems either. I recall vividly while living in Central Illinois that the entire region was held hostage to the economic fortunes of either Caterpillar or corn/soybeans. Should one or both have a bad year – everyone paid for it – harshly.

Lionizing such minor cost cost cutting or playing “my region is better than your region” games as some panacea to debt management and economic woes is downright childish. Stop treating the symptoms while pretending it is the disease.

Larger economic forces are at work beyond the decision whether to go to a movie or stop by Blockbuster instead.

The reason this family is going broke is they can’t calculate their taxes properly!

Let’s first assume they owe $8000 in Social Security and Medicare taxes (8%) – we can’t reduce that. They have monthly deductions for mortgage interest (at least $1600), health insurance ($250), real estate taxes ($401), charity ($100), and state income tax ($149 – see why in a bit). That’s $2500/month in deductions, or $30000 per year. Add their exemptions ($3400 * 4 for a family of 4 filing jointly), and you’ve got another $13600 per year, for a total of $43600 knocked off their gross income. That leaves gross income (after 401k contributions) at just $44400, for a tax of $5881. But wait – they have two kids, so they get a child tax credit of another $2000, for a total federal tax of $3881. In MA, they’d pay a state tax of about $4134, but in CA, it’d be about $1400 ($59800 income after deductions, married filing jointly, $394 in exemptions). Total federal and state tax for the CA family is about $5300. Their take-home pay is then $6225, not $5793. They just found $425 per month! Knock entertainment expenses down to $200 per month (learn to use parks and the outdoors – not difficult in CA), and they’ve found another $300 per month. The gap is now $350 per month, not the $1076 per month you’ve listed. While it’s not a wise idea long-term, they could certainly reduce their 401k contributions to $6000 per year for a few years until their income catches up. Doing so would make them pretty much break even.

Yeah, anonymous, make kids walk to school so they can get abducted.

Estimated are low, that is not enough for food or electric.

The reason this country is going down the tubes is excessive late fees, taxes, school taxes, and government waste.

Move to Canada. Rent in decent suburb of Vancouver (small two bedroom for 3 people) $900. Health, Life, Disability Insurance $0, paid for by employer. Medical expenses including ALL wife’s diabetic drugs $150 a month (rest paid for by work insurance and the province). One car, payments were $300 a month (now paid for) gas $200 a month (2003 Honda Civic, about one tank a week). I only contribute about $220 a month to my RSP, but that should go up now the car is paid for, and I have a company/union pension and CPP to look forward to. That leaves more for a good vacation every year, and we pretty much break even.

Great article. People are you getting it? First of all where can you find something decent in the $300’s not in L.A. Dr. Housing bubble’s number are extremely conservative. The point is our money is disappearing and worth nothing. Housing got overly inflated and sucked people into a vicious cycle of debt and more debt. Until housing becomes stable with incomes we are all in for a very bumpy ride. You can pinch pennies for so long, but there comes a time when you realize. Something is not right with this picture.

Don’t any of you see what’s happening here. You all are in the same boat. Now with bush spending $6 trillion to kill people and you saying S Cal people are living too luxuriously and that we shouldn’t have a cell phone or text messages is insane. In California and anywhere in the USA cell phones are a necessity and especially if you have children. I used to live by Compton and I wouldn’t go out at night without a phone. But I’ve lived it Iowa too and things are cheaper and the foods better quality, or it was, but they don’t make as much income. My point is we shouldn’t have to live like we don’t deserve a vacation when those people in Congress sitting up there making $200,000 a year of our money and all they do is nod their heads, take money from big business and have a meeting twice a year. And yup you’re right I am over spending and I think what needs to be done is about what getting for my tax dollar. Oh that’s right if you don’t pay their salaries they lock you up. Hmmmmmm……..sumthins messed up. think about it. The figures are low I would say and cherity is a write off so it’s smart as it comes out of tax money. I would gladly move but my business is here and it would cost me more to move. I’m going to anysoldier to pick a name of a soldier and send them a package of necessities like soap and toothpaste. Nice post!

those college expenses are too low. Its more like 25000 for public and 55,000 fro private today.

It all gets down to the fact that the loan should not exceed 3 times your annual gross income. This is something that most Californians have abandoned long ago. Either houses have to drop to that affordable level or people from other countries that our corporations and government sold out the middle class to will buy them.

I don’t think this hypo family is making poor decisions at all. This budget does not seem unreasonable at all to me. Perhaps they could cut some here and there, but as the article states, that has consequences for the entire economy. The fact is this budget is very conservative because it doesn’t even include pre-existing debt and student loan debt, which are common. Even if the family didn’t buy a home and rented, they would easily be paying $1,700 or so for that. The premise of this article is quite valid. The middle class is struggling to survive even with two incomes and one of the biggest expenditures is housing and its associated costs. I don’t think this hypothetical family is living high on the hog by any stretch of the imagination and to say they are to somehow to blame is misguided at best.

I would like to make a bold statement that IN MANAGING FINANCES, IT’S STRESS THAT REALLY COUNTS.

Let me make that simple: all the calculations that one can make are meaningless if you stress about it. INEVITABLY, if you stress about it, you will get sick eventually and all your ‘savings’ and ‘wealth’ will flush down that sink hole of ‘health care’.

$1,000 in the hole? Do I hear cancer or heart attack coming soon?

Brother, you must be at least $1000 on the plus side to sleep well at night.

People don’t understand that earning ‘respect’ from neighbors and family, and being a big guy (or girl) means nothing if your life is a FEAR HELL (fear from losing home, car, health, wife, children’s love or you name it).

I am not going to mention dollar figures, or what one needs to do. But people, do WHATEVER YOU HAVE TO DO (legally) to sleep well at night. Downsize, rightsize, sidesize, drop it all – you figure out what change in your life will bring some sense and peace.

Comment by Blurgle “I have to admit, I don’t see how anyone can possibly feed a family of four on $550 a month without eating Hamburger Helper four days a week and dog food the other three. The two of us can barely get by on $500 a month, and that doesn’t include expensive food or restaurant food, which we don’t eat. ”

******How on earth 2 people can consume $500+ worth of food at home completely eludes me. As I said, I honestly do not spend more than $200-225 a month on food for 2 people. Double the amount of food and you blow up like a blimp. (I’m still a size 0-2 in my mid-50s.)

****Define “expensive” food. I call it a waste of money to buy anything that is prepared or ‘just add water’ – and that includes the deli, frozen dinners or pizza or waffles or Snackables or any of the rest of that junk. Lose the junk food (chips, pretzels, Doritos etc) and the pop and the energy drinks (66% of Americans are fat or obese and should give up that crap on those grounds alone.) Quit eating so much meat – that is a heart attack on a plate. Quit sucking down the cookies and pastries. (Again, if only to lose the excess around the gut and hips.)

****Instead of the processed junk, buy whole grain bread (or better yet learn to bake it – much much better over anything in the store.) Cook with vegetables, rice and pastas (but skip the cream sauces for the sake of your waistline.) Have fruit salad for dessert instead of sugary garbage. Buy generic – the store brand of corn tastes the same as Delmonte. Try eating less – 66% of the US consumes far far more than they need.

****Yes – we eat very well. Dinner last night was Broccoli Risso (Gruyere and Blue Castello cheese make up the sauce with the broccoli and arborio rice) with a spinach salad and a fruit salad of apples, pears, bananna, walnuts, celery and raisins in a dressing of yogurt, orange juice, & lemon juice with touch of honey, cinnamon and allspice . Tonight it is Vegetable Pot Pie with a Swiss Grean Beans (green beans & onions with yogurt, honey and swiss cheese) and finishing off the fruit salad

There are a lot of comments that are related to the idea that in you country, there are “decent neighborhoods with good schools†and “not as decent neighborhoods with bad schoolsâ€.

From the perspective of a person living in EU, this sounds very strange. I mean… if I think in Sao Paulo, I can imagine a lot of very bad neighborhoods with poor children asking money to tourists and so on, but when I see your Hollywood movies in the TV, I can’t believe that you can have such terrible neighborhoods and schools that you are afraid of raising your children there.

In Madrid for example, we live more than three million people, and there are only some specific districts – Villaverde, Vallecas, etc – that have very small areas with lots of gypsies (we call then ‘gitanos’), but the only problem in these small areas, is that in the classrooms, for every 30 children, maybe 5 or 6 are gypsies, but still regular people lives in this neighborhoods, and life is nice there.

If you detect a school with problematic children, why don’t you just report it to the police? It’s clearly cheaper than moving all your family to a different neighborhood, isn’t it ? If a boy has stolen a watch or a cell phone to other boy, report it to the police, but don’t sold your house !